1 Introduction

This Element investigates the tension between innovation and financialisation in the global pharmaceutical industry, with a focus on two leading UK companies – AstraZeneca (AZN) and GlaxoSmithKline (GSK) – from the time of the mergers that created them (1999 and 2000, respectively) to the present. The tension between innovation and financialisation is central to modern capitalism and its capacity to deliver sustainable prosperity. Overall, financialisation reflects the rise of shareholder-value ideology and the resulting shift from a ‘retain-and-reinvest’ to a ‘downsize-and-distribute’ resource-allocation regime. Financialisation manifests differently across enterprises, industries, and economies.

Against this backdrop, and drawing on other empirical works conducted by various authors over the years, we place the study of these two UK-based companies in the context of innovation and competition among twenty Big Pharma companies based in Europe and the United States. We argue that companies that mitigate financialisation and support innovation perform better in global competition. This conclusion may seem obvious to those who understand the critical importance of dynamic capabilities for competitive performance, but it is not at all obvious to those financial economists, corporate executives, and hedge-fund managers who argue that ‘maximising shareholder value’ (MSV) promotes superior economic performance. In our view, a critique of this flawed ideology through industry studies is central to ‘reinventing capitalism’, especially in the context of the health industry and its impact on human well-being.

Our comparative study of AZN and GSK is part of that research agenda and provides new evidence for informing concrete sets of corporate-governance reforms. Using ‘the theory of innovative enterprise’ framework, through empirical studies such as the ones offered in this Element, we analyse the interaction of strategy, organisation, and finance at each of the companies. The evidence we collect is new and updated to early 2022. Our analysis speaks to recent discussions on ‘stakeholder capitalism’ and ‘rethinking the purpose of the corporation’, especially in key industries such as health.

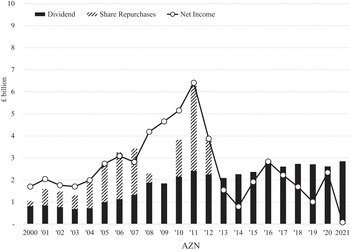

We have found that in the decade after their mergers both companies adopted US-style governance models, manifested by stock buybacks, in addition to dividends, and US-style stock-based pay, which rewarded senior executives for boosting the company’s stock price, even if the price increases were driven by manipulation (via buybacks) and speculation rather than innovation. In the aftermath of the 2008–9 financial crisis, however, key directors and shareholders in both companies began to rethink their business models, with AZN decisively shifting from financialisation to innovation in 2013 with the appointment of Pascal Soriot as CEO. Central to this transition was the cessation of buybacks in order to focus as many resources as possible, including executive attention, on investing in the drugs pipeline. This process continues at AZN and is a prime reason why it was chosen to partner with Oxford University in the development, manufacture, and delivery of the COVID-19 vaccine. It took GSK a few years longer to begin transitioning from financialisation to innovation, with the reorientation of the company’s focus towards innovation becoming more evident when Emma Walmsley replaced Andrew Witty as CEO in March 2017, with buybacks ceasing completely in 2018.

Our study also uncovers important differences in corporate-governance institutions in the United Kingdom from those which prevail in the United States. The UK institutions, expressed in part in the UK Corporate Governance Code, ultimately provided support to AZN and GSK in shifting from financialisation to innovation. Like the United States, the United Kingdom has a shareholder model of capitalism, but, in part because of British business reactions to the extreme US orientation towards MSV from the late 1980s, the UK governance institutions include defences against financialisation that are not present in the United States. We raise these issues in the conclusion of the study to argue that, despite globalisation, ‘reinventing capitalism’ still needs to recognise the importance of national institutions.

2 Innovation and Competition in the Global Pharmaceutical Industry

Within any business firm, there is a resource-allocation tension between innovation and financialisation. Innovation entails the generation of a product that is of higher quality and lower cost than the previously available one (Reference Lazonick, Clarke, O’Brien and O’KelleyLazonick 2019a). In the pharmaceutical industry, the measures of higher quality are the safety and effectiveness of a medicine. The availability of a safer and more effective medicine enables the pharmaceutical company to access a large extent of the market (i.e., patients whose health can be improved by taking the drug), thus transforming the high fixed cost of developing the safer and more effective drug into a low unit cost. The lower unit cost is the result of ‘economies of scale’, which means that the drug has been made more accessible to patients. A lower unit cost can also permit lower pricing of the medicine to make it more affordable to patients. Alternatively, a higher drug price can provide the pharmaceutical company with higher profits that can be reinvested in drug innovation (Reference Collington and LazonickCollington and Lazonick 2022).

Given existing and new medical needs, the development of a safe and effective medicine requires investment in the productive capabilities of people who can engage in organisational learning within research labs operated by government, business, and civil society organisations. For a drug developer, the implementation of an innovation strategy requires investment in teams of researchers who have specialised knowledge, acquired much more through work experience than through advanced formal education (as necessary as higher education is in this industry). This accumulation of unique knowledge occurs at the discovery stage, through clinical trials, in the drug manufacturing process, and from data collected of an approved medicine in use.

A pharmaceutical firm’s innovative capabilities reside largely in its human resources. With the rapid advancement of technology within the pharmaceutical industry, drug development using novel methods has tended to be done by start-ups, the most successful of which are highly focused on new areas of specialised learning. Once an innovative company has a successful product, its senior executives may allocate the firm’s resources to further investments in organisational learning that, for the sake of developing a new round of innovative products, builds on the specialised knowledge that it has accumulated. Key to the success of these investments in human capabilities is ‘organisational integration’: the enabling, coordinating, and incentivising of large numbers of people with different functional specialties and hierarchical responsibilities to devote their skills and efforts to the innovation process.

Through sustained innovation across generations of products, a small pharmaceutical company can grow to be large as a distinct business firm, or what can be called a unit of strategic control. Alternatively, by selling itself or merging with another company, its further growth may occur as part of another unit of strategic control. The success or failure of a merger or acquisition will depend on the organisational integration of the employees of the two business units into the unified firm that now exercises strategic control.

The growth of the pharmaceutical firm requires sustained commitment of financial resources to an innovation process that is collective, cumulative, and uncertain. It is collective because it entails the organisational integration of large teams of people. It is cumulative because what the organisation learned yesterday provides a foundation for what it is capable of learning today. It is uncertain because the investments in organisational learning may fail to develop a safe and effective medicine.

Hence, in exercising strategic control, the abilities and incentives of senior pharmaceutical executives are of critical importance to the allocation of resources to the innovation process. They bear the responsibility to make decisions to invest in certain types of medicines in the face of the uncertainty of whether the firm will be able to develop a higher-quality, lower-cost drug than is currently available. To implement the innovation strategy, they make investments in productive capabilities, largely embodied in people engaged in collective and cumulative learning, that, through organisational integration, can enable these capabilities to generate an innovative product. The most high-powered means of organisational integration is provision of personnel with the sustained employment through which they can accumulate productive capabilities, attain incomes commensurate with those capabilities, and build rewarding careers.

This organisational-learning process unfolds over time from the point at which investments in innovation are made to the point at which a commercial product, if it is indeed generated, can result in financial returns. Early drug development has three distinct stages: target identification, lead identification, and lead optimisation. During the target-identification stage, scientists engage in extensive learning to gain insight into the biology and mechanism of a disease of interest. Enhanced understanding of the disease mechanism enables drug discovery efforts to focus on lead identification of potential targets in the disease mechanism. In this stage, drug discovery efforts also concentrate on identifying the number of potential leads (chemical compounds) to pursue as effective pharmaceutical interventions (Figure 1).

Figure 1 Drug discovery process.

Drug safety is a paramount concern for scientists to address in the lead-optimisation stage when designing compounds that are intended for long-term use. Scientists may choose to bring several variations of a lead compound as backups to be further examined during preclinical studies outside (in vitro) or inside (in vivo) living organisms. Engaging in deep learning to better understand a disease during the early discovery stages has major implications for preclinical and clinical stages of the drug-development process. Any increase in the number of lead compounds advancing into the preclinical stage can potentially undermine the productivity of the entire drug-development effort and result in an increased compound failure rate in the preclinical or first-in-human toxicology testing phases.

To sustain this innovation process until it results in financial returns, executives who exercise strategic control mobilise funds that provide financial commitment. In the pharmaceutical industry, start-ups are typically financed by venture capital, which can ‘exit’ from its investment (often before the firm has even generated a commercial product) through a listing on a stock exchange (of which NASDAQ is the most important) or through the sale of the company to an established firm (Reference Lazonick and TulumLazonick and Tulum 2011). In pharmaceuticals, as in any other industry, once the firm has generated profitable products, the net income that it retains becomes the foundation of financial commitment.

Through this process of retaining profits and reinvesting in productive capabilities, both internally and through strategic acquisitions, it is possible for an innovative enterprise to grow to become a multi-product pharmaceutical company, with the capability of developing more complex drugs. The most successful companies also invest in manufacturing and marketing capabilities, including committing resources to specialised productive assets and facilities (Reference Chang and AndreoniChang and Andreoni 2020). A fully integrated pharmaceutical company can grow to employ tens of thousands of highly qualified and well-paid personnel, who then, through stable employment and promotion opportunities, can become more experienced and productive over the course of their careers. In the global medicinal drug industry, these types of firms, many of them dating back a century or more, have become known as ‘Big Pharma’.Footnote 1

There is always the possibility, however, that the executives who exercise strategic control over a firm that has become profitable through innovation may decide to allocate its enhanced cash flow to a process that we call ‘financialisation’: the extraction of value from the firm for the benefit of certain parties above and beyond rewards justified by the contributions that these parties have made to the value-creating processes that have resulted in innovation and profits (Reference Lazonick and ShinLazonick and Shin 2020). It can be the case that certain groups of powerful employees are the beneficiaries of financialisation; historically, across a range of industries, trade unions have often been blamed (whether deservedly or not) for using their collective power to bargain for pay and benefits that exceed their value-creating contributions.

In the twenty-first century, however, these ‘value-extracting’ employees are more likely to be senior corporate executives, enriched by stock-based pay and lavish pensions. In the name of MSV, these value-extracting executives bestow benefits on shareholders, including themselves, in the form of cash dividends and share repurchases. In addition, stock traders, who acquire corporate shares on the stock market, may be able to assert their power over corporate resource allocation for the sake of value extraction, achieved by timing the selling of the shares that they previously purchased (Reference LazonickLazonick 2019b; Reference Lazonick and ShinLazonick and Shin 2020). The value extracted by these executives and traders is often far in excess of any contributions that they have made to the firm’s value-creating process.

This value extraction takes the form of the yields on the company’s stock, enhanced by cash dividends and share repurchases (aka stock buybacks). As we explain in this Element, stock buybacks done as open-market repurchases are a much more deleterious mode of financialisation than dividends. All shareholders of a class of stock benefit from dividends by holding shares. In contrast, the purpose of buybacks done as open-market repurchases is generally to manipulate the company’s stock price to reward well-positioned stock traders for selling, not holding, shares in the company.

In the extreme, when the company downsizes its labour force, divests production capacity, and takes on debt for the sake of increasing payouts to shareholders, corporate resource allocation becomes what Reference Lazonick and ShinLazonick and Shin (2020) call ‘predatory value extraction’. In their analysis, based on recent US experience, predatory value extraction results from the combined power of corporate managers as value-extracting insiders, asset managers as value-extracting enablers, and hedge-fund managers as value-extracting outsiders, operating in a national institutional environment that permits, and even encourages, this value-extracting activity (Reference Lazonick, Driver and ThompsonLazonick 2018; Reference Lazonick and ShinLazonick and Shin 2020; Reference Lazonick and JacobsonLazonick and Jacobson 2022).

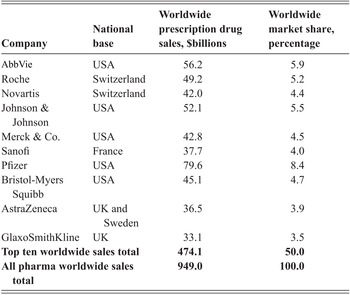

In the world of Big Pharma, extreme financialisation undermines the processes of drug innovation and the sustainability of the firm as an innovative enterprise. By the same token, those major pharmaceutical companies that have resisted financialisation have emerged as or remained global leaders in drug innovation (Reference Lazonick and TulumLazonick and Tulum 2011; Reference TulumTulum 2018; Reference Tulum and LazonickTulum and Lazonick 2018; Reference Lazonick, Tulum, Hopkins, Sakınç and JacobsonLazonick et al. 2019). As shown in Table 1, in 2020, the world’s ten largest companies in the global pharmaceutical industry generated 50 per cent of the industry’s revenues. The two leaders, Roche and Novartis, both based in Switzerland, are, like most Europe-based pharmaceutical firms, less-financialised companies than their US-based competitors such as Merck and Pfizer. Nevertheless, Novartis is much more financialised than Roche. Less-financialised companies have gained market share in global pharmaceuticals (Reference Tulum and LazonickTulum and Lazonick 2018; Reference Lazonick, Tulum, Hopkins, Sakınç and JacobsonLazonick et al. 2019).

Table 1 Worldwide prescription drug sales, top ten companies, and national bases, 2021

| Company | National base | Worldwide prescription drug sales, $billions | Worldwide market share, percentage |

|---|---|---|---|

AbbVie | USA | 56.2 | 5.9 |

| Roche | Switzerland | 49.2 | 5.2 |

| Novartis | Switzerland | 42.0 | 4.4 |

| Johnson & Johnson | USA | 52.1 | 5.5 |

| Merck & Co. | USA | 42.8 | 4.5 |

| Sanofi | France | 37.7 | 4.0 |

| Pfizer | USA | 79.6 | 8.4 |

| Bristol-Myers Squibb | USA | 45.1 | 4.7 |

| AstraZeneca | UK and Sweden | 36.5 | 3.9 |

| GlaxoSmithKline | UK | 33.1 | 3.5 |

| Top ten worldwide sales total | 474.1 | 50.0 | |

| All pharma worldwide sales total | 949.0 | 100.0 | |

In this Element, we focus on the two UK-based companies in the top ten: AZN and GSK. Given the extreme financialisation of US Big Pharma companies (Reference Tulum and LazonickTulum and Lazonick 2018; Reference Lazonick, Tulum, Hopkins, Sakınç and JacobsonLazonick et al. 2019), which make up 50 per cent of the world’s top ten, it is of great importance to the global pharmaceutical industry as well as to the innovative capability of the UK economy that these two UK-based companies avoid the adoption of the US business model. This Element provides an in-depth analysis of the evolving tension between innovation and financialisation at AZN and GSK from the time of the mergers in 1999 and 2000, respectively, to the present.

The key findings of our study, which we document in detail in this Element, are that, influenced by US-style corporate governance, both AZN and GSK became more financialised in the decade after the mergers that formed them, but, then, over the course of the following decade both companies altered their resource-allocation strategies to shift away from financialisation towards innovation. Our analysis of the processes of corporate-governance transformation at AZN and GSK provides unique insights into the UK institutional environment relevant to corporate governance. It also sheds light on the ways in which UK corporate-governance institutions differ from those in the United States, where, as we have shown, predatory value extraction has become the norm (Reference Tulum and LazonickTulum and Lazonick 2018; Reference Lazonick, Tulum, Hopkins, Sakınç and JacobsonLazonick et al. 2019; Reference Lazonick and ShinLazonick and Shin 2020; Reference LazonickLazonick 2022a).

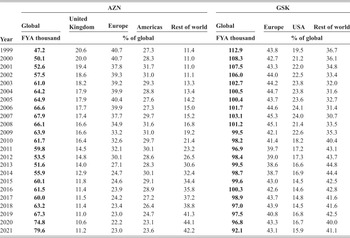

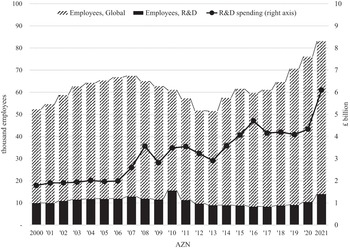

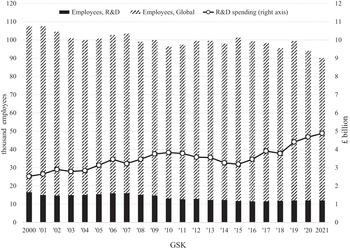

The United Kingdom derives several benefits from the existence and persistence of these two UK-based companies as innovative competitors in the global pharmaceutical industry. According to the most recent data, AZN employs 8,300 people from seventy nations at its UK sites (AstraZeneca 2021). As can be seen in Table 2, AZN has been increasing the number of UK employees since 2017 as part of its global expansion. In 2021, GSK employed 16,000 people at eighteen UK sites (GSK 2021). Table 2 also shows GSK’s total employment from 1997 to 2021.

Table 2 AZN and GSK employees, by geographic area, 1997–2021

| Year | AZN | GSK | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Global | United Kingdom | Europe | Americas | Rest of world | Global | Europe | USA | Rest of world | |

| FYA thousand | % of global | FYA thousand | % of global | ||||||

| 1999 | 47.2 | 20.6 | 40.7 | 27.3 | 11.4 | 112.9 | 43.8 | 19.5 | 36.7 |

| 2000 | 50.1 | 20.0 | 40.7 | 28.3 | 11.0 | 108.3 | 42.7 | 21.2 | 36.1 |

| 2001 | 52.6 | 19.4 | 37.8 | 31.7 | 11.0 | 107.5 | 43.3 | 22.0 | 34.8 |

| 2002 | 57.5 | 18.6 | 39.3 | 31.0 | 11.1 | 106.0 | 44.0 | 22.5 | 33.4 |

| 2003 | 61.0 | 18.2 | 39.2 | 29.3 | 13.3 | 102.7 | 44.2 | 23.8 | 32.0 |

| 2004 | 64.2 | 17.9 | 39.9 | 28.8 | 13.4 | 100.5 | 44.7 | 23.8 | 31.6 |

| 2005 | 64.9 | 17.9 | 40.4 | 27.6 | 14.2 | 100.4 | 43.7 | 23.6 | 32.7 |

| 2006 | 66.6 | 17.7 | 39.9 | 27.3 | 15.0 | 101.7 | 44.6 | 24.1 | 31.4 |

| 2007 | 67.9 | 17.4 | 37.7 | 29.7 | 15.2 | 103.1 | 45.3 | 24.0 | 30.7 |

| 2008 | 66.1 | 16.6 | 34.9 | 31.6 | 16.8 | 101.2 | 45.1 | 21.4 | 33.5 |

| 2009 | 63.9 | 16.6 | 33.2 | 31.0 | 19.2 | 99.5 | 42.1 | 22.6 | 35.3 |

| 2010 | 61.7 | 16.4 | 32.6 | 29.7 | 21.4 | 98.2 | 41.4 | 18.2 | 40.4 |

| 2011 | 59.8 | 14.5 | 32.1 | 30.1 | 23.2 | 96.9 | 39.7 | 17.2 | 43.1 |

| 2012 | 53.5 | 14.8 | 30.1 | 28.6 | 26.5 | 98.4 | 39.0 | 17.3 | 43.7 |

| 2013 | 51.6 | 14.0 | 27.1 | 28.3 | 30.6 | 99.5 | 38.6 | 16.6 | 44.8 |

| 2014 | 55.9 | 12.9 | 24.7 | 30.1 | 32.4 | 98.7 | 38.7 | 16.9 | 44.4 |

| 2015 | 60.1 | 11.8 | 24.6 | 29.1 | 34.4 | 99.6 | 43.0 | 14.5 | 42.5 |

| 2016 | 61.5 | 11.4 | 23.9 | 28.9 | 35.8 | 100.3 | 42.6 | 14.6 | 42.8 |

| 2017 | 60.0 | 11.5 | 24.2 | 27.2 | 37.2 | 98.9 | 43.7 | 14.8 | 41.6 |

| 2018 | 63.2 | 11.4 | 23.4 | 26.4 | 38.8 | 97.0 | 43.9 | 14.5 | 41.6 |

| 2019 | 67.3 | 11.0 | 23.0 | 24.7 | 41.3 | 97.5 | 40.8 | 16.8 | 42.5 |

| 2020 | 74.8 | 10.6 | 22.2 | 23.1 | 44.1 | 96.8 | 43.3 | 16.7 | 40.0 |

| 2021 | 79.6 | 11.2 | 23.0 | 23.6 | 42.2 | 92.1 | 43.1 | 15.9 | 41.1 |

Note: Fiscal year average (FYA).

The presence of major global competitors in the United Kingdom provides the government with a rationale for investing in the advanced-technology knowledge base (Reference O’Sullivan, Andreoni, Lopez-Gomez and GregoryO’Sullivan et al. 2013; BEIS 2017; BEIS 2021). Some of the scientists who gain experience at these large companies leave to form new ventures, and we can assume that those who gain career experience and establish social connections while working in the United Kingdom are more likely to seek out entrepreneurial opportunities there. The COVID-19 pandemic has demonstrated the importance of both AZN and GSK to the United Kingdom’s participation in the global vaccine response. GSK is one of only four Big Pharma companies (along with Merck, Pfizer, and Sanofi) that possessed vaccine capabilities coming into the pandemic. Even though AZN does not have vaccine capabilities, Oxford University chose AZN to manage the manufacture and distribution of its COVID-19 vaccine, in large part because it is UK-based (Reference Tulum, Lazonick, Jacobson and ChappelkaTulum et al. 2021).

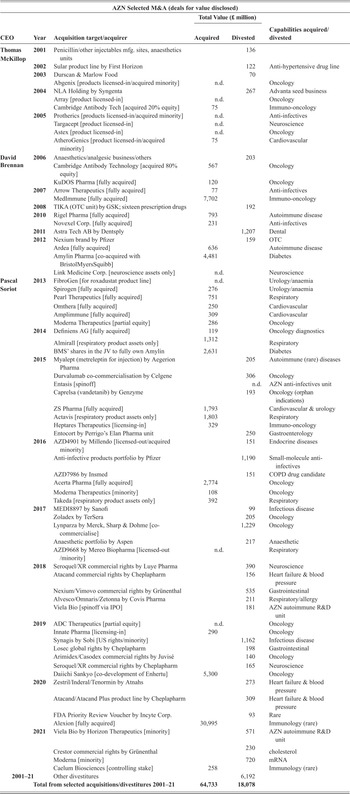

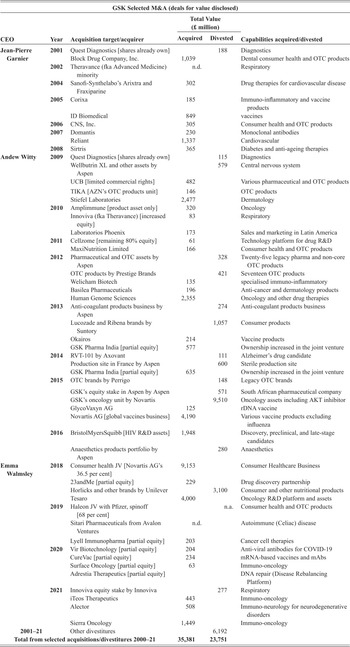

Given the centrality of mergers and acquisitions (M&A) in the global pharmaceutical industry over the past few decades, the survival of AZN and GSK as UK-based companies was not inevitable. As we document in this Element, complex and intersecting social factors in the global pharmaceutical industry paved the way for the ‘merger mania’ of the 1990s and early 2000s, and the movements for absorption and concentration continue to have major impacts on the industry (Reference Gagnon and VoleskyGagnon and Volesky 2017; Reference LiuLiu 2021). Whether as an attempt to reduce costs or to develop new revenue sources, a proliferation of mergers has transformed the corporate identities, including the national home bases, of leading companies in the global pharmaceutical industry.

The fact is that in 2021 these two UK-based companies were major competitors in the consolidated industry. The merger of Zeneca with Astra occurred in 1999 and that of Glaxo Wellcome with SmithKline Beecham (SKB) in 2000 (Reference Heracleous and MurrayHeracleous and Murray 2001; Reference Quirke, Slinn, Quirke and SlinnQuirke and Slinn 2010). At the time, the field for developing novel medicines was becoming crowded as fledgling biotech start-ups raced to capture the seemingly lucrative, and rapidly expanding, market for immunotherapies and other specialty drugs (Reference PisanoPisano 2006, chapters 2 and 3; Reference Lazonick and TulumLazonick and Tulum 2011; Reference Owen and HopkinsOwen and Hopkins 2016).

Big Pharma was at a competitive disadvantage in terms of possessing the necessary capabilities for developing novel medicines that could address the varied and complex health challenges of the twenty-first century. In particular, the established companies failed to recognise and engage in new learning in the fields of molecular biology during the last three decades of the twentieth century.Footnote 2 With the expansion of the start-up sector in the 1980s and 1990s, Big Pharma saw the new ventures as competitors that were luring away key scientists and securing valuable intellectual-property protection.

The flow of human resources and intellectual property to start-ups dissipated Big Pharma’s once-formidable capabilities for new drug development. Struggling to overcome this dilemma, in the late 1990s Big Pharma engaged in unprecedented M&A activity that could potentially transform their lacklustre drug-development capabilities (Reference Rafols, Hopkins and HoekmanRafols et al. 2014). Over the past two decades, the financial support and possibility of acquiring innovative new ventures by the established pharmaceutical companies have created a synergistic dynamic between Big Pharma and the start-up sector for drug development and delivery. As we shall see, AZN and GSK have both been able to enhance their drug-development capabilities by the acquisition of young companies located in both the United Kingdom and abroad.

Large numbers of these biopharma start-ups are based in the United States, which is by far the world leader in venture-backed companies (Reference MurpheyMurphey 2020). Given the proliferation of these start-ups and unregulated drug prices as well as subsidies and market incentives available in the United States, the US pharmaceutical ecosystem provides an ideal environment for a non-financialised company that is willing to reinvest its profits in drug development to generate innovation. As Reference Lazonick, Hopkins, Jacobson, Sakınç, Tulum, Tyfield, Lave, Randalls and ThorpeLazonick et al. (2017) argue, however, many US-based pharmaceutical companies have been failing to take advantage of these opportunities because they are highly financialised. Indeed, as a result of their focus on value extraction at the expense of value creation, financialised companies are facing a deep productivity crisis in terms of bringing innovative new therapies to the drug market (Reference Tulum and LazonickTulum and Lazonick 2018; Reference Lazonick, Tulum, Hopkins, Sakınç and JacobsonLazonick et al. 2019).

Major European pharmaceutical companies, including those based in the United Kingdom, which are subject to price regulation in their home markets, have positioned themselves to tap into the immense knowledge base in the United States and sell innovative products there at high, unregulated prices. The higher profits that they gain from sales in the US market can then be used to develop the next generation of innovative products. Through a listing on the US stock market, pharmaceutical companies can also use their shares as an acquisition currency, in addition to or instead of cash, to gain control of innovative new ventures. As they recruit executives in the United States, these companies might adopt US-style executive compensation systems, emphasising the inflation of stock-based pay through distributions to shareholders, and especially through stock buybacks, which give manipulative boosts to stock prices (Reference LazonickLazonick 2014a, Reference Lazonick2015). While expanding their research & development and commercial infrastructures to take advantage of the US innovation system and its large pharmaceutical market, the very participation of these companies in the US pharmaceutical industry may result in their adoption of governance norms and managerial cultures that encourage a shift from innovation to financialisation.Footnote 3

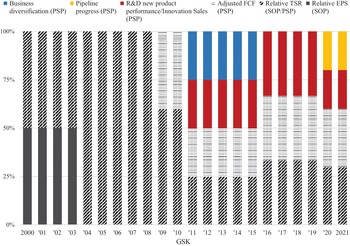

Section 3 of this Element provides our general framework for analysing the tension between innovation and financialisation, based on the theory of innovative enterprise, which focuses on three social conditions: strategic control, organisational integration, and financial commitment. As an empirical point of departure for the analysis of the tension between innovation and financialisation, we provide basic indicators – distributions to shareholders in the form of dividends and buybacks as well as drugs in the pipeline relative to R&D expenditures – for the eight largest US-based and eight largest Europe-based pharmaceutical companies by revenues in 2021. Included among the Europe-based companies are AZN and GSK.

Sections 4 and 5 analyse the evolution of the innovation-financialisation tension at AZN and GSK, respectively, highlighting the different trajectories of the two companies. As in previous work (Reference TulumTulum 2018; Reference Tulum and LazonickTulum and Lazonick 2018), the research summarised in this Element shows the importance of in-depth company-level studies of the relation between resource allocation and economic performance, using the ‘social conditions of innovative enterprise’ framework. The analysis of the dynamic interactions of firm-level strategy, organisation, and finance enables us to comprehend the evolving relation between investment in a firm’s productive capabilities and its competitive performance as an historical process, brought up to the present.

During the first decade or so after their formation in 1999 and 2000, both AZN and GSK engaged in corporate resource-allocation strategies that entailed financialisation and undermined innovation. If these trajectories had continued over the following decade, it is highly unlikely that either AZN or GSK would still be independent UK-based companies. Especially in the aftermath of the financial crisis of 2008–9, these companies became potential takeover targets – as continues to be the case. In 2014, US-based Pfizer sought to take over AZN, and AZN’s successful response in fending off the merger reinforced the resolve of the leadership of the UK company to move from financialisation to innovation. As a UK-based company, AZN has played a central, although at times contentious, role in the COVID-19 vaccine rollout. Beginning in April 2021, GSK, with its stock price down, came under attack from US hedge-fund activist Elliott Management, run by Paul Singer, one of the world’s most notorious ‘vulture capitalists’ (Reference StoneStone 2013; Reference KolhatkarKolhatkar 2018).

The final section of this Element takes stock of the evolution of the tension between innovation and financialisation at AZN and GSK, summarising our views of why each of the companies moved towards financialisation in the 2000s but shifted towards innovation in the 2010s. The answers to these questions have policy implications for the design of UK corporate-governance institutions to support innovation and mitigate financialisation. This Element shows, for example, the importance of the UK Corporate Governance Code (formerly known as the Combined Code on Corporate Governance), which in the 1990s emerged in part as a reaction to the extreme shareholder-primacy movement emanating from the United States. The Code empowers corporate executives, board directors, and public shareholders who want to shift corporate resource-allocation decisions towards innovation and away from financialisation.

In the recent experiences of AZN and GSK, we see the promise of redesigning executive pay to include explicit rewards for superior innovative performance that are not based on stock-market yields. Our analysis of the social conditions of innovative enterprise provides a rationale for UK government policy to limit the influence on corporate governance of ‘predatory value extractors’ (Reference Lazonick and ShinLazonick and Shin 2020). By ensuring that the United Kingdom remains the home base of major companies in the global pharmaceutical industry, the UK government can support businesses in providing careers to teams of scientists, thus enhancing drug-development capabilities in the United Kingdom. Finally, UK government policy must address the issue of the allocation of corporate profits to investment in innovation versus distributions to shareholders, even if the latter only take the form of cash dividends.

3 The Innovation-Financialisation Tension in the Global Pharmaceutical Industry

The innovation process is uncertain, collective, and cumulative. Innovation requires strategy to confront uncertainty by investing in the learning processes to transform technologies and access markets in the attempt to generate a higher-quality, lower-cost product. Innovation requires organisation to engage in collective learning, which is the essence of the innovation process. And innovation requires finance to sustain cumulative learning until, by transforming technologies and accessing markets, product revenues and, possibly, profits result.

Signifying relationships and behaviour that result in productive activity, the social conditions of innovative enterprise are strategic control, organisational integration, and financial commitment. Strategic control endows senior executives with the power to allocate the firm’s resources to particular products and processes. The critical questions are whether those executives who exercise strategic control have the abilities and incentives to allocate the firm’s resources to inherently uncertain innovation processes. Organisational integration mobilises and incentivises the skills and efforts of people in the firm’s hierarchical and functional division of labour, its local ecosystem, and global network to engage in collective learning (Reference AndreoniAndreoni 2018; Reference Andreoni, Lazonick, Oqubay and LinAndreoni and Lazonick 2020). Financial commitment provides the funding that can sustain the transformation of the collective learning process into the cumulative learning process required to generate, over time, a higher-quality, lower-cost product.

For an established corporation, the foundation of financial commitment is the portion of profits that a company retains after distributing cash to shareholders in the form of dividends and buybacks. The company can, if need be, leverage retained profit with debt for the purpose of investing in innovation. Conversely, a company can deplete its profits through distributions to shareholders. Indeed, by taking on debt, selling assets, laying off employees, or drawing on cash reserves, a company can even distribute more than 100 per cent of profits to shareholders over a sustained period of time.

A high payout ratio – dividends plus buybacks as a percentage of profits – is an indicator of financialisation (see Reference Lazonick, Tulum, Hopkins, Sakınç and JacobsonLazonick et al. 2019). But the impact of financialisation on innovation is not simply, or even primarily, because distributions to shareholders erode financial commitment. A company that has profited, and may continue to profit, from successful innovation undertaken in the past often has access to accumulated financial reserves that can sustain high payout ratios for years on end (Reference Lazonick, Hopkins, Jacobson, Sakınç, Tulum, Tyfield, Lave, Randalls and ThorpeLazonick et al. 2017).

Hence, it is possible for a cash-rich company to simultaneously, for a period of time, have both a high payout ratio and sufficient internal funds available for investment in innovation (measured in terms of R&D expenditure, for example). Our research has found, however, many cases of companies that have done large-scale buybacks over a period of years, when the cash flow is available, only to find themselves financially strapped when technological, market, or competitive conditions change (see, e.g., Reference Carpenter and LazonickCarpenter and Lazonick 2017; Reference LazonickLazonick 2022a). It is well established, moreover, that a publicly listed company is reluctant to cut its dividends, so that, when industrial conditions reduce its cash flow, the attempt to maintain its level of dividend payments may cut into the financial resources that it has for operations.

Even when, in the presence of a high shareholder payout ratio, cash flow for reinvestment in productive capabilities remains adequate, a more immediate deleterious impact of financialised behaviour on the innovative capability of a once-successful company is the undermining of strategic control and organisational integration – which will eventually have a negative impact on profits. Senior executives who, with their stock-based remuneration, are incentivised to make use of their power to allocate the firm’s resources to do distributions to shareholders for the sake of improving the company’s stock-price performance, tend to lack the incentives to allocate the firm’s resources to innovative investment strategies. Indeed, once this shift in the incentive structure occurs and these executives go down the path of financialised resource allocation, they may lose the ability, even if they once possessed it, to envision and implement the types of investments in organisational learning required for the next round of innovation. Pressure on management from shareholders to increase distributions may also undermine the social conditions of innovative enterprise.

An innovation strategy requires a firm to retain-and-reinvest (Reference LazonickLazonick 2015, Reference Lazonick, Clarke, O’Brien and O’Kelley2019a): it retains profits to reinvest in employees’ productive capabilities. In contrast, a financialised firm tends to engage in downsize-and-distribute: it lays off workers and depresses wages, outsources production, and sells off assets while using some or all of the extra cash flow to increase distributions to shareholders. As a result of downsize-and-distribute, employees are deprived of the opportunity to engage in collective and cumulative learning, and the company is deprived of the innovative products that organisational learning can generate.

In between retain-and-reinvest and downsize-and-distribute is a resource-allocation regime that we call dominate-and-distribute: a firm that has secured a stream of profits by establishing a dominant position in a product market – for example, a patented blockbuster pharmaceutical drug – can avoid downsizing even as it focuses on distributing these profits to shareholders. At some point, however, that dominant position may disappear. Unless the firm engages in a renewed retain-and-reinvest strategy (if it is not too late to do so), it will eventually enter the realm of downsize-and-distribute.

With financialisation undermining strategic control and organisational integration, at some point the financialised company will lack the funding to engage in financial commitment. Our research shows, however, that the injurious impacts on strategic control and organisational integration tend to be more severe when the form of distributions to shareholders consists of buybacks in addition to, or instead of, dividends. Stock buybacks done as open-market repurchases tend to reward sharesellers who are in the business of timing the buying and selling of shares, with insider knowledge of when open-market repurchases are actually taking place. These well-positioned sharesellers include corporate executives themselves with their stock-based pay as well as hedge-fund managers (Reference Lazonick and ShinLazonick and Shin 2020).

In contrast, dividends provide an income stream to shareholders for, as the name says, holding shares. While corporations are reluctant to cut dividends even when profits decline, satisfying stable shareholders with a consistent income stream, buybacks are much more volatile, typically soaring when profits and stock prices are high and declining in downturns when profits and stock prices are depressed. All other things equal, the resource-allocation strategy of a company with a high payout ratio based on dividends will tend to be less financialised than a company with a high payout ratio based largely on buybacks. A high dividend payout ratio may constrain financial commitment, but it will tend to do less damage to strategic control and organisational integration than a high buyback payout ratio.

As we shall see in this Element, this analysis of the different impacts of dividends and buybacks on the social conditions of innovative enterprise is of prime importance for understanding the evolution of the tension between innovation and financialisation at AZN and GSK. Both companies are highly active in developing, manufacturing, and selling drugs in the United States, and hence have had exposure to the extreme adherence to the shareholder-value ideology that pervades US corporate governance.

As an indicator of the tension between innovation and financialisation, we examine relative shareholder payouts and the innovative productivity performance of the eight largest global pharmaceutical companies by revenues based in the United States and six of the eight top companies in Europe, which include the two UK-based pharmaceutical companies, AZN and GSK. (Data on innovative productivity are not available for Merck Group, based in Germany, and Novo Nordisk, based in Denmark.)

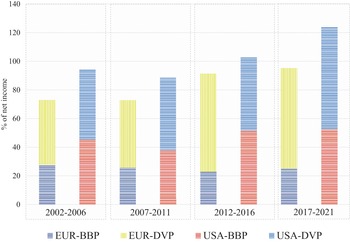

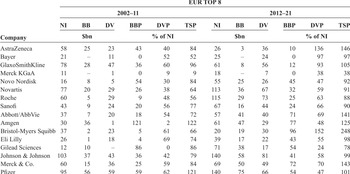

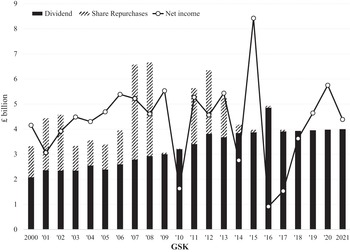

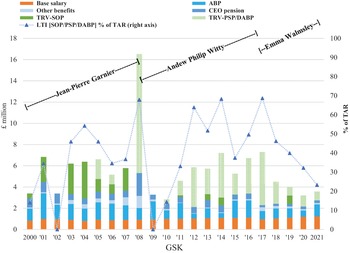

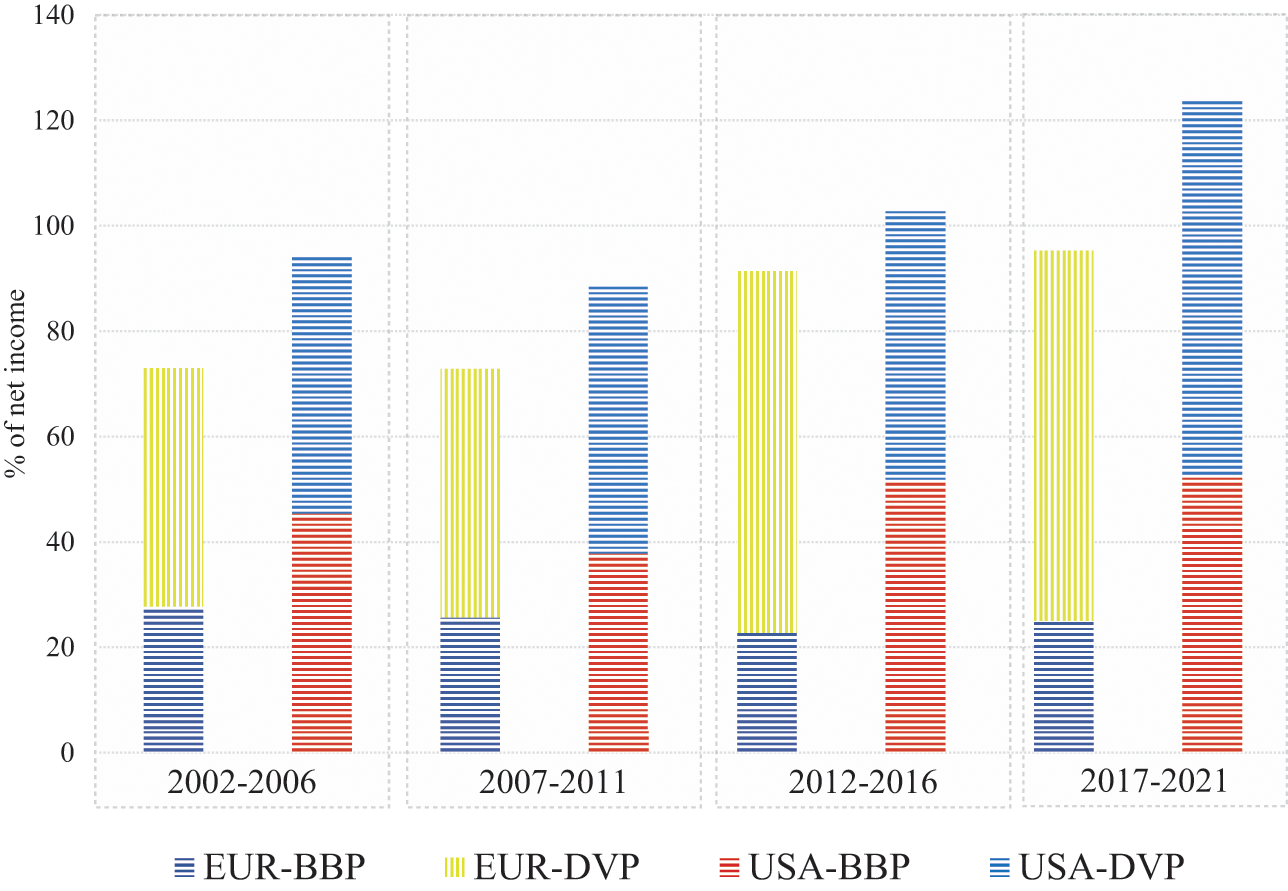

Figure 2 graphs the changing total shareholder payouts – dividends and buybacks combined – as percentages of net income (TSP) by the eight Europe-based pharmaceutical companies (EUR) and the eight US-based pharmaceutical companies (USA) that had the highest revenues in their regions in 2021. The columns in the graph break down TSP into percentages of net income in the form of cash dividends (DVP) and stock buybacks (BBP) by these eight EUR and eight USA companies for the four five-year subperiods from 2002 through 2021. In all four subperiods, both TSP and BBP were higher for the USA than for EUR companies. Although USA did relatively more buybacks than EUR, USA distributed substantial dividends in all four periods. In both EUR and USA, TSP fell in 2007–11 compared with 2002–6 because of the impact of the 2008–9 financial crisis. In the period 2012–16, BBP rose sharply in USA, while buybacks fell to their lowest proportion of net income for the four time periods in EUR. These data suggest that throughout the two decades, USA was more financialised than EUR and that after 2012 financialisation became even more extreme in USA while the opposite was the case in EUR.

Figure 2 Percentages of net income distributed to shareholders in the form of stock buybacks (BBP) and cash dividends (DVP), 2002–21, by the eight largest Europe-based (EUR) and eight largest US-based (USA) pharmaceutical companies by revenues, 2002–21

Note: The eight largest US-based (USA) companies are ABT/ABB: Abbott Pharmaceuticals, 2002 to 2009 and AbbVie, 2010 to 2021; AMGN: Amgen; BMY: Bristol-Myers Squibb; GILD: Gilead; JNJ: Johnson and Johnson; LLY: Eli Lilly; MRK: Merck; PFE: Pfizer. The eight largest European (EUR) companies are AZN: AstraZeneca (UK); BAYN: Bayer (GER); GSK: GlaxoSmithKline (UK); NVS: Novartis (CH); ROG: Roche (CH); SAN: Sanofi (FRA); NOVO’B: Novo Nordisk (DEN); MRK.DE: Merck KGaA (GER).

By the TSP measure, USA was much more financialised than EUR throughout 2002–21, with a far higher percentage of net income being absorbed by stock buybacks. EUR TSP was by no means low, but its focus was on dividends, especially in the 2010s. USA distributions were more focused on buybacks throughout the two decades, with the predilection for buybacks increasing in the 2010s.

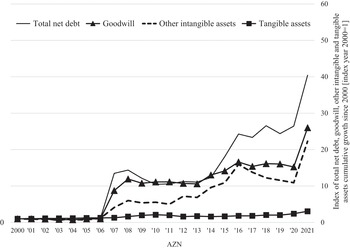

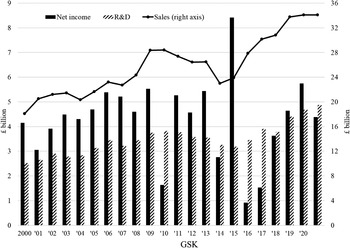

Among the companies that constitute EUR and USA, distributions to shareholders differed. Table 3 shows net income, dividends, and buybacks as well as TSP, DVP, and BBP for each of the EUR companies for 2002–11 and 2012–21, listed in order of net income (in US dollars) for the decade 2002–11. In the first decade, GSK had the highest net income, dividends, buybacks, and TSP of the eight companies. Its DVP was first and BBP was second to AZN.Footnote 4 In 2012–21, GSK’s net income was almost $17 billion less than the previous decade, but it paid out about $9 billion more in dividends. The decline of AZN’s net income from 2002–11 to 2012–21 was $15 billion greater than that of GSK’s decline, but its DVP more than tripled. In the period 2012–21, GSK and AZN had by far the highest TSP of the Europe-based companies. But as their profits declined, each company reduced their buybacks significantly, both in absolute terms and as a percentage of net income.

Table 3 Net income (NI), dividends (DV), buybacks (BB), and payout ratios (TSP, DVP, BBP), by the eight largest Europe-based (EUR) and eight largest US-based (USA) pharmaceutical companies by revenues, 2002–11 and 2012–21

| Company | EUR TOP 8 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2002–11 | 2012–21 | |||||||||||

| NI | BB | DV | BBP | DVP | TSP | NI | BB | DV | BBP | DVP | TSP | |

| $bn | % of NI | $bn | % of NI | |||||||||

| AstraZeneca | 58 | 25 | 23 | 43 | 40 | 84 | 26 | 3 | 36 | 10 | 136 | 146 |

| Bayer | 21 | – | 11 | 0 | 52 | 52 | 25 | – | 24 | 0 | 97 | 97 |

| GlaxoSmithKline | 78 | 28 | 47 | 36 | 60 | 96 | 61 | 8 | 56 | 12 | 93 | 105 |

| Merck KGaA | 11 | – | 1 | 0 | 9 | 9 | 18 | – | 7 | 0 | 38 | 38 |

| Novo Nordisk | 16 | 8 | 5 | 54 | 30 | 84 | 55 | 25 | 26 | 45 | 47 | 92 |

| Novartis | 77 | 20 | 29 | 26 | 38 | 64 | 113 | 36 | 67 | 32 | 59 | 91 |

| Roche | 60 | 5 | 29 | 9 | 48 | 56 | 115 | 29 | 73 | 25 | 63 | 88 |

| Sanofi | 43 | 9 | 24 | 20 | 56 | 77 | 67 | 16 | 44 | 24 | 66 | 90 |

| Abbott/AbbVie | 37 | 7 | 20 | 18 | 54 | 72 | 57 | 41 | 40 | 71 | 69 | 141 |

| Amgen | 30 | 36 | 1 | 121 | 2 | 122 | 61 | 47 | 29 | 77 | 48 | 125 |

| Bristol-Myers Squibb | 37 | 2 | 23 | 5 | 61 | 66 | 20 | 19 | 30 | 96 | 152 | 248 |

| Eli Lilly | 26 | 1 | 18 | 4 | 69 | 74 | 39 | 17 | 22 | 43 | 55 | 98 |

| Gilead Sciences | 12 | 10 | – | 86 | 0 | 86 | 71 | 38 | 17 | 54 | 24 | 78 |

| Johnson & Johnson | 103 | 37 | 43 | 36 | 42 | 79 | 140 | 58 | 81 | 41 | 58 | 99 |

| Merck & Co. | 60 | 15 | 36 | 25 | 59 | 84 | 69 | 50 | 49 | 72 | 70 | 143 |

| Pfizer | 95 | 56 | 59 | 59 | 62 | 121 | 140 | 75 | 66 | 54 | 47 | 101 |

Later in this Element, we argue that, while the high levels of DVP of AZN and GSK in 2012–21 deprived these companies of internal finance for innovation, of significance for their transitions from financialisation to innovation over the decade was the sharp shift of each UK company away from buybacks compared with the 2000s. Indeed, as we shall see, since 2013 AZN has done no buybacks, while GSK reduced its buybacks sharply in 2014 and subsequently its buybacks have been minimal or zero.

Table 3 also shows that among the USA companies, TSP ranged from 66 per cent to 122 per cent in 2002–11 and from 78 per cent to 248 per cent in 2012–21. Indeed, in the latter decade five of the eight companies had TSP of 100 per cent or more. At 78 per cent, the TSP of Gilead Sciences was the lowest in the group in the second decade, but only because its nearly six-fold increase in profits from 2002–11 to 2012–21 – inflated by price-gouging (Reference Lazonick, Hopkins, Jacobson, Sakınç, Tulum, Tyfield, Lave, Randalls and ThorpeLazonick et al. 2017) – outstripped its dividends of $17 billion, which it only started paying in 2015, and its over four-fold increase in buybacks.

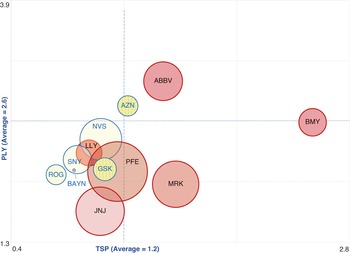

Figure 3 provides an initial indication of where twelve of these global pharmaceutical companies stood in 2011–20 in terms of the tension between innovation and financialisation. The size of the bubble measures the dollar value of buybacks that each company did over the ten-year period. The yellow bubbles represent the Europe-based pharmaceutical companies and the pink bubbles the USA companies. Note that, as mentioned previously, we lack innovative-productivity data for Germany’s Merck and Denmark’s Novo Nordisk, so they are not included in the analysis illustrated in Figure 3. In addition, since we lack historical pipeline data for Amgen and Gilead, only the top six USA companies are included in the analysis in Figure 3.

Figure 3 Mapping the pipeline yield (PLY) in 2021 and total shareholder payout (TSP) for six US-based and six Europe-based pharmaceutical companies, 2011–20

Note: For corporate ticker codes used in the graphic, see the note to Figure 2. PLY is the number of products under development in the pipeline as of December 2021 per billion dollars spent on R&D, 2011–20; TSP is (buybacks + dividends)/net income, 2011–20. The size of the bubbles reflects the value of buybacks done by the company, 2011–20. Yellow bubbles are Europe-based companies; pink bubbles are US-based companies.

We caution that this comparative analysis is only a starting point for in-depth company-level studies, rooted in the theory of innovative enterprise, of the tension between innovation and financialisation. Each point on the horizontal axis in Figure 3 is a proxy for the prevalent allocative regime in a company, indicating to what extent a company is oriented towards innovation or financialisation. While point ‘0’ (not displayed) on the horizontal axis refers to a company that has fully retained its net income (TSP = 0), point ‘1’ on the horizontal axis refers to a company which has distributed 100 per cent of net income to shareholders in the form of buybacks and dividends. Point ‘2’ at the far-right end of the horizontal axis refers to a situation where a company’s total shareholder payout is two times greater than its net income. When the value of TSP is greater than the value of net income, buybacks and dividends tend to be financed through cash reserves, the liquidation of certain assets, laying off employees, or incurring debt.

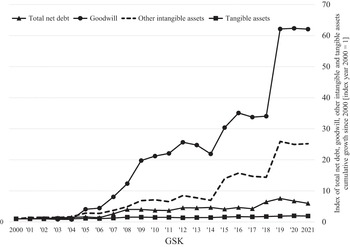

If the TSP ratio is less than 1, it indicates that the company has retained a portion of its profits, having these funds available for the development of innovative products or rewarding employees for prior productive contributions. It is through such investments in productive capabilities that pharmaceutical companies develop innovative drugs to address unmet medical needs. A financialised pharmaceutical company which is willing to deplete its cash through distributions to shareholders tends to downsize its productive resources in an attempt to generate even more cash to distribute to shareholders. As discussed more extensively in the case analyses of AZN and GSK, such downsizing efforts often entail reduction of the workforce and disposal of tangible and intangible assets. The key analytical challenge is to determine the effect of downsize-and-distribute on productivity through its influence on the social conditions of innovative enterprise: strategic control, organisational integration, and financial commitment.

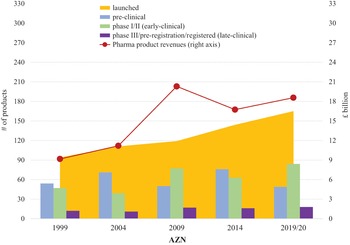

To view the correlation between TSP and innovative productivity, each point on the vertical axis in Figure 3 refers to pipeline yield (PLY): the number of products under development in 2021 per $billion that each of the fourteen pharmaceutical companies spent on R&D from 2011 to 2020. We should caution that simply because a company records R&D expenditure does not necessarily mean that those expenditures will be productive. But given that the purpose of R&D is organisational learning and given that organisational learning is the essence of innovation, documentation of the relation between R&D spending and the drug pipeline is a useful preliminary metric for comparative purposes as well as for delving into the innovation processes as they occur in particular companies.

In Figure 3, any point on the vertical axis indicates a distinct productivity level in terms of PLY. In 2021, after having spent $914 billion on R&D from 2011 through 2020, the twelve pharmaceutical companies had 1,949 potential drug candidates under development, including projects in phases ranging from discovery to late-stage clinical trials. The average PLY for investments of the twelve companies was 2.6 product candidates under development. Companies in the upper section of the graph indicate levels of innovative performance above the group average, while the companies in the lower end have underperformed.

By the metrics in Figure 3, the companies located in the bottom-right corner of the box (Pfizer, Bristol-Myers Squibb, Merck) are the most highly financialised of all the companies because their PLY is below the group average while their TSP is higher than that of the companies in the group. Of the twelve companies included in the analysis, the two UK companies, AZN and GSK, have the highest PLY. At the same time, GSK has the highest TSP of the six Europe-based companies, slightly greater than that of AZN. The other European companies are all lower than GSK and AZN in terms of both TSP and PLY.

The analysis illustrated in Figure 3 does not tell us why these companies are distributed across the plot area based on their PLY and TSP. Because the transformation from innovation to financialisation, or vice versa, is a dynamic process that depends on the social conditions of innovative enterprise, the distribution of these companies in the plot area may vary at different points in time as the relation between innovation and financialisation changes. It is therefore necessary to analyse the companies individually to understand their changing product pipelines relative to the historical evolution of shifting resource-allocation regimes. For the purposes of this Element, Sections 4 and 5 analyse the two major UK-based competitors in the global pharmaceutical industry: AZN and GSK.

The company-level analyses explore to what extent the R&D productivity of the two UK drug companies over the past decade has provided each one with a competitive advantage over its global rivals as well as relative to each other. Our study raises important questions about the evolving relation between resource-allocation strategies and innovative performance at each of the companies. In carrying out this empirical research, we identify the ways in which, through investment in innovation, a company accumulates productive capabilities. From this perspective, we can then seek to explain how financialisation undermines the development and utilisation of innovative capabilities within the firm.

There are a number of ways, all of them potentially complementary, by which a company can accumulate innovative capabilities. It can invest in-house, engage another company in an R&D contract or a joint venture, license another company’s intellectual property, or execute an M&A deal. In-house development provides strategic managers with knowledge of the types of productive capabilities that it needs but lacks and the potential for filling that gap through collaboration, licensing, or acquisition. Indeed, without in-house development, a company will be unable to absorb the capabilities of another company or research entity with which it has partnered. Once a company has taken strategic control of productive capabilities through an acquisition, it must engage in organisational integration of those capabilities. Moreover, the company that is now exercising strategic control must make further in-house investments to generate innovative products on a sustainable basis.

At any point in time, the capabilities that a company has accumulated represent its assets. From an accounting standpoint, these assets are divided into tangibles and intangibles. Tangible assets include property, plant, equipment, and cash, while intangible assets include ‘goodwill’, copyrights, and patents, with the latter two representing ‘intellectual property’. Goodwill is an accounting measure of the value that a company pays for an acquisition that is in excess of the ‘net fair value’ of the acquired assets. Goodwill looms large on the balance sheets of a company that does numerous acquisitions of other companies with organisational capabilities that the acquirer must further develop. A high valuation of goodwill may reflect market speculation in the value of acquisitions, which may turn out to be a reflection of a company’s financialised strategy rather than its acquisition of innovative capability. As with any asset, tangible or intangible, whether its cost generates profits for the company of which it is now a part depends on the effectiveness of management in developing and utilising its productive capabilities to generate competitive products.

An acquisition may contribute to the innovative capabilities of the acquirer through further in-house investments. Alternatively, the acquisition may be used by the acquirer as an instrument for value extraction, and hence contribute to financialisation. An acquisition is a way for a firm to take strategic control of productive capabilities that were originally developed by another firm as a distinct unit of strategic control. In pharmaceuticals, acquisitions are often done because, for drug development that entails a new technology, a start-up has an advantage in integrating strategy and learning. Once, through investment in productive capabilities, a young company can show that it has innovative potential, it may be acquired by a more established company that wants access to that potential. Whether, subsequent to an acquisition, its assets support innovation or financialisation depends on whether the acquirer seeks to further develop the acquisition (retain-and-reinvest) or milk it for profits that can be distributed to shareholders (downsize-and-distribute).

The ideology that a company should be run to MSV lacks a theory of the business enterprise as a learning organisation (Reference LazonickLazonick 2022b). Legitimised by MSV ideology, financialisation essentially amounts to reneging on obligations to reward employees for their prior contributions to value creation and reducing reinvestment in organisational learning. If, as is particularly the case in the United States, senior executives who exercise strategic control increase their own stock-based remuneration through manipulative boosts in the company’s stock price, they have a strong incentive to do stock buybacks as open-market repurchases (Reference LazonickLazonick 2014a; Reference Lazonick and HopkinsLazonick and Hopkins 2016).

Stock-based pay, as it emerged in the United States in the 1980s and 1990s, reflected a shift of the business corporation from innovation to financialisation (Reference Hopkins and LazonickHopkins and Lazonick 2016). Academic proponents of MSV such as Reference Jensen and MurphyMichael Jensen and Kevin Murphy (1990) advocate using stock-based pay to align the incentives of senior executives with shareholders. The purpose of this alignment is, in Jensen’s words, to ‘disgorge’ the ‘free cash flow’ from companies, based on the assumption that these executives have been simply wasting resources by investing in productive capabilities (Reference JensenJensen 1986). As Reference JensenJensen (1986, p. 323) puts it:

Free cash flow is cash flow in excess of that required to fund all projects that have positive net present values when discounted at the relevant cost of capital. Conflicts of interest between shareholders and managers over payout policies are especially severe when the organization generates substantial free cash flow. The problem is how to motivate managers to disgorge the cash rather than investing it at below cost or wasting it on organization inefficiencies.

There are several problems with this statement that reflect a bias towards financialisation and the absence of an understanding of the social conditions of innovative enterprise. First, innovation is an uncertain process and hence the notion that one can calculate the ‘net present value’ (NPV) of an investment in innovation is absurd – which, however, has not kept it from becoming a standard ‘tool’ of mainstream financial economics. Students of innovation have recognised the damage that NPV measures can do when they become a basis for managerial decision-making (Reference Baldwin and ClarkBaldwin and Clark 1992; Reference Christensen, Kaufman and ShihChristensen, et al. 2008). Indeed, Christensen, Kaufman, and Shih label these financial tools ‘innovation killers’.

Second, the definition of how much cash flow is ‘free’ depends on one’s view of how the corporation’s resources should be allocated. If one ignores the need to attract, retain, motivate, and reward large numbers of employees to engage in the organisational learning that is the essence of innovation, a substantially greater portion of cash flow can be deemed to be ‘free’ to be distributed to shareholders. Yet, organisational learning is the foundation of an innovative enterprise and a productive economy, all the more so in the pharmaceutical industry.

Third, the very term ‘disgorge’ implies that the retained earnings that a profitable company has accumulated were somehow ill-gotten, and hence it is necessary to distribute these funds to shareholders to reallocate the funds to their best alternative uses. Sustained profits are, however, the results of successful investments in organisational learning, in which the firm’s employees are the prime participants. As such, they must be motivated and rewarded. Shareholders of publicly listed companies are simply households as savers, either through their direct purchases of shares on the market or indirectly through asset managers. It is business firms, not financial markets, which, by investing in productive capabilities that can generate competitive products, determine ‘best alternative uses’ (Reference Lazonick and ShinLazonick and Shin 2020, ch. 7).

Since the mid-1980s, Jensenite ‘agency theory’ has legitimised the growing tendency in US publicly listed companies to do stock buybacks. In this looting of the US business corporation, US-based Big Pharma companies have played a leading role. For the decade 2011–20, seventeen US pharmaceutical companies in the S&P 500 Index spent $387.3 billion on buybacks and $341.8 billion on dividends. The combined distributions to shareholders of $620.8 billion represented 116 per cent of the net income of these seventeen companies over the decade and were 17.4 per cent more than the $620.8 billion that these companies spent on R&D.

As we have noted, incentivising these distributions to shareholders has been the stock-based pay of US pharmaceutical executives. Over the decade, 2010–19, total remuneration of pharmaceutical executives named in company proxy statements who were among the 500 highest-paid executives in the United States ranged from a low average of $20.7 million in 2010 (twenty-three executives), with 73 per cent stock-based, to a high average of $45.1 million in 2015 (thirty-three executives), with 88 per cent stock-based. In the United States, the design of stock options and stock awards permits executives to realise gains from stock-price increases that result from stock-market speculation and manipulation. Stock buybacks done as open-market repurchases give US senior executives a powerful means of manipulating the stock prices of the companies that they head. By creating or accentuating upward momentum of a company’s stock price, open-market repurchases in turn foment further speculative increases in the company’s stock price (Reference Lazonick, Tulum, Hopkins, Sakınç and JacobsonLazonick et al. 2019; see also Reference Tulum and LazonickTulum and Lazonick 2018).

As documented by Reference Hopkins and LazonickHopkins and Lazonick (2016), the use of stock options as a mode of executive remuneration in the United States from the 1950s to the 1970s did not incentivise stock buybacks because the Securities and Exchange Commission (SEC) could have charged a company that did large-scale buybacks with stock-price manipulation. The adoption of SEC Rule 10b-18 in November 1982 gave corporate executives a ‘safe harbour’ to do buybacks on a scale that would previously have been viewed as manipulative (Reference PalladinoPalladino 2018; Reference Jacobson and LazonickJacobson and Lazonick 2022). Reference Jacobson and LazonickJacobson and Lazonick (2022) call Rule 10b-18 a ‘license to loot’.

In the United States, the explicit purpose of stock options for senior executives in the period 1950–76 was to provide the recipients with a tax dodge to avoid ordinary personal marginal tax rates that were as high as 91 per cent in the 1950s and were still at 70 per cent in 1980 by having the realised gains from stock options taxed at the much lower capital-gains tax rate (25 per cent during most of this period). To be eligible for this favourable tax treatment, an executive had to hold the shares for at least one year after exercising the option, thus risking a decline in before-tax realised gains. From the late 1950s, a political backlash occurred in the United States against this special tax treatment for corporate executives’ stock-based pay, and in 1976 the US Congress abolished this tax dodge (Reference Hopkins and LazonickHopkins and Lazonick 2016).

All this changed in the 1980s with the rise of the New Economy business model, a characteristic feature of which was the use of broad-based stock-option plans to recruit large numbers of professional, technical, and administrative personnel from secure ‘lifetime’ employment at established Old Economy companies such as IBM, Hewlett-Packard, Motorola, Merck, Pfizer, and Johnson & Johnson, among others, to inherently insecure employment in young start-up companies whose future growth was highly uncertain (Reference LazonickLazonick 2009, ch. 2). During the 1980s, large numbers of relatively young employees at New Economy companies became very rich when their companies did initial public offerings (IPOs) on NASDAQ. The senior executives of established companies demanded stock-based pay, now taxed at top marginal personal rates that were as low as 28 per cent in the late 1980s, on which they would reap realised gains from stock-price movements.

Until May 1991, these senior executives, as ‘insiders’ had to wait six months after exercising an option before they could realise the gains for themselves. That changed in May 1991 when, after considerable lobbying by corporate executives, the SEC ruled that the six-month waiting period would begin on the grant date of the option rather than the exercise date, and since the minimum period for an option to vest after a grant is one year, the executives were now permitted to realise the gains on the options immediately upon exercise. This rule change in turn enabled senior executives to coordinate option exercises with stock buyback activity, the execution of which they controlled.

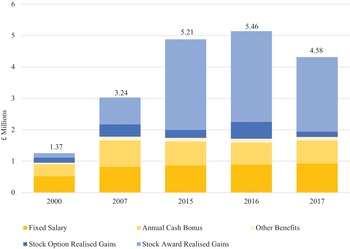

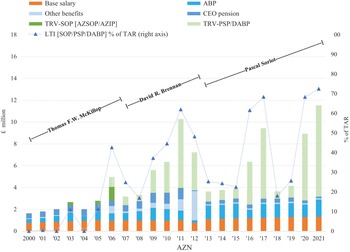

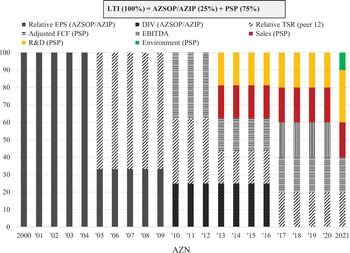

Our analysis of the changing balance between innovation and financialisation at AZN and GSK, therefore, pays close attention to value extraction as dividends versus value extraction as buybacks as well as to the stock-based components of total CEO remuneration. Currently, at major UK corporations, the CEO remuneration scheme includes many different components of pay including salary, bonus, pension, stock options, and stock awards. Figure 4 shows the components of CEO pay averaged across the same seventy-two large UK companies for the fiscal years 2000, 2007, 2015, 2016, and 2017. Total compensation averaged £1.37 million in 2000 and was as high as (for the years for which we collected the data) £5.46 million in 2016.

Figure 4 Salary, bonus, stock options, and other components of CEO total remuneration (£ million), seventy-two UK companies, 2000, 2007, 2015, 2016, and 2017.

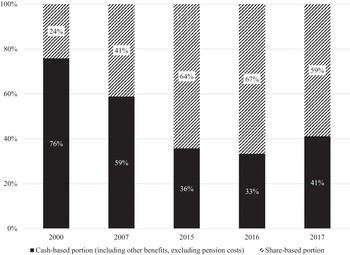

Figure 5 transforms these data into percentages of total remuneration that are cash-based and stock-based. In 2000, the stock-based portion of CEO pay averaged 24 per cent but was as high as 66 per cent in 2016. In all five years, the higher the percentage of compensation that was stock-based, the higher the total average CEO remuneration.

Figure 5 Proportions of cash-based and share-based components of CEO total remuneration, seventy-two UK companies, 2000, 2007, 2015, 2016, and 2017.

Ostensibly, the various components of CEO pay and their specific conditions for realising gains reflect attempts by the board’s remuneration committee to attract, retain, motivate, and reward the CEO for doing her job of investing in the productive capabilities of the company to generate competitive products. Whether the components of pay, and particularly those that are stock-based, perform this function is, however, a question that requires both close scrutiny of the schemes implemented by the company concerned – in this study AZN and GSK – and the institutional environment in the nation in which it is headquartered.

At the national institutional level, the extent to which senior corporate executives should be able to realise gains on stock-based pay has received far more discussion in the United Kingdom than in the United States. As recognised by the Reference GreenburyGreenbury Report (1995, p. 10), issued by a committee of the UK Confederation of British Industry in 1995:

We also believe there to be a key issue about performance which has received too little attention in the public discussion. The UK’s industrial performance has greatly improved in recent years. It is vital that this improvement should continue. But the performance of our companies depends to an important extent on the Directors and senior executives who lead them. The remuneration packages UK companies offer must, therefore, be sufficient to attract, retain and motivate Directors and managers of the highest quality.

By the early 1990s, as documented in the book, In Search of Excess: The Overcompensation of American Executives (1991), the prominent compensation consultant Graef S. Crystal sketched out what is called the ‘ratchet job’ for boosting average CEO pay over time (Reference Murphy, Ashenfelter and CardMurphy 1999; Reference LazonickLazonick 2014b). Using corporate funds, the CEO of a US business corporation hires a compensation consultant to recommend a remuneration package to the board’s compensation committee. The consultant’s report benchmarks other corporate CEOs and tends to place the CEOs who have hired the consultant in the 75th percentile in terms of performance and, hence, pay. CEOs of other companies dominate the board’s compensation committee, and this process of ratcheting up CEO pay is in their own personal interest. Moreover, with the realised gains from stock-based pay becoming an increasing portion of total remuneration, sharp increases in CEO pay in stock-market booms set new norms for total CEO remuneration. When the stock-market declines and, with it, CEO pay, the compensation committee recommends that the CEO should be granted more stock options, which are now at low exercise prices, and/or stock awards, with an MSV mandate to do whatever it takes to boost the company’s stock prices, at which point stock buybacks greatly augment the power of the remuneration ratchet.

By the mid-1990s, this detachment of US-style CEO pay from the productive performance of a company was apparent to the UK Confederation of British Industry in its promulgation of the Greenbury Report, which focused on executive remuneration in articulating its ‘code of best practice’. The Greenbury Report emphasised structuring the remuneration packages of UK managers and directors to incentivise them to focus on improvements in industrial performance – that is, value creation – rather than the value extraction incentivised by US-style stock-based pay. As we will see in Sections 4 and 5, the changing modes of CEO remuneration at AZN and GSK can be understood as integral to the changing tension between innovation and financialisation within the company. Specifically, the more US-style stock-based pay has been prevalent in the remuneration packages of the CEOs, the more financialised the company, whereas restrictions on CEO stock-based pay to conform with a UK-style ‘code of good practice’ have reflected an attempt by the board to move the corporate orientation away from financialisation towards innovation.

4 AstraZeneca

4.1 Strategy and Learning

In the 1990s, global pharmaceutical companies began to develop highly sophisticated drugs, using new scientific insights from molecular biology, including cutting-edge recombinant DNA (rDNA) technologies. Developed by young biotechnology companies in collaboration with leading scientists, these novel biologics were the products of prolonged learning efforts, invariably rooted in government-funded projects. As new drugs entered the global market, major producers of traditional pharmaceuticals strategised how to transition into this booming segment.

Zeneca PLC was incorporated as an independent pharmaceutical company in 1993 following the demerger of Imperial Chemical Industries (ICI) and the spinoff of the company’s pharmaceutical division. Changing conditions of global drug markets and biomedical technologies posed a challenge to the demerged company’s top executives, as they sought new ways to boost its innovative productivity. Given the scale of, and the risk associated with, the investment necessary to expand into the biologics market, many established companies chose to enter into mergers.

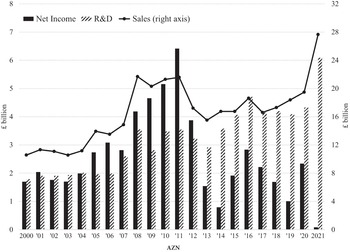

In the late 1990s, Zeneca embarked upon discussions with Astra AB, based in Sweden. The senior executives of both companies were aware that neither Astra nor Zeneca possessed the productive capabilities necessary to transition into biologics. Both companies were searching for the ideal partner with which to pursue a merger-of-equals before becoming a takeover target amidst rising consolidation in the global pharmaceutical industry. Their merger into AZN in late 1999 created the world’s fourth-largest pharmaceutical company and the UK’s fifth-largest industrial organisation (see Figure 6).

Figure 6 Pre-merger evolution of AZN.

Investor AB played a key role in the merger and further development of AZN. Founded in 1916, Investor is a Swedish investment company that has been tightly controlled by the country’s most influential industrialists, the Wallenberg family, through a governance mode known in the Nordic countries as the industrial foundation. Strategic control within industrial foundations has tended to be secured through a dual-class share structure. In the early 1920s, Astra, which had been founded as a Swedish pharmaceutical company in 1913 but was nationalised in 1920 after its bankruptcy, was acquired from the Swedish government by a consortium of Swedish industrialists and bankers, including Jacob Wallenberg. Subsequently, Investor held a controlling interest in Astra through a dual-class share structure, and at the end of 1998, preceding the merger with Zeneca, was still the pharmaceutical company’s most influential shareholder.

Over the past two decades, Investor has been a significant shareholder in other global companies, based in Sweden and abroad. However, prior to the merger, Astra was the largest holding in Investor’s investment portfolio. Reflecting the family’s ‘buy-to-build’ philosophy, Investor’s business strategy entails a long-term investment horizon with no timeline to exit. Investor favours involvement in companies with a dual-class share structure, which enables it to have active representation on corporate boards, with two or more directors including the board chairman.

Following the merger, AZN’s newly issued ordinary shares with one class of voting and dividend rights replaced the voting and non-voting shares of Astra, bringing the company’s dual-class share structure to an end. In AZN’s new single-class share structure, the majority of shares were owned by the former Zeneca shareholders. Following the merger, however, the Wallenberg family managed to acquire significant board representation, with former Astra executives filling seven of fourteen director seats. AZN’s board chairman was Percy Barnevik, CEO of the Swiss-Swedish power company ABB, in which Investor was the largest shareholder. He was also non-executive chairman of Investor. Marcus Wallenberg, CEO of Investor, was a director of AZN. Other former Astra executives became AZN’s non-executive chairman, executive deputy chairman, executive director of R&D, chair of the remuneration committee, and executive director of business development.

During the first five-year period following the merger, the directors with strong ties to the Wallenberg family were involved in major strategic decisions. During 2004, a series of events unfolded that reduced Investor’s influence on AZN’s board. It began with the pivotal ruling by the European Commission that required Volvo to sell its stake in Scania. With major stakes in both AZN and Scania, Investor reduced its shareholding in AZN from 5.0 per cent to 3.75 per cent to raise nearly $1 billion to purchase the vote-heavy A-shares of Scania (Reference Brown-HumesBrown-Humes 2004).

Investor’s downsizing of its shareholding in AZN resulted in a major transformation of the company’s board and senior executive team in 2004 and 2005. Barnevik, who had resigned from his chairmanship of Investor in 2002 in the wake of a scandal concerning the pension he had been awarded when he had retired as CEO of ABB (Reference WoodruffWoodruff 2002), stepped down from his post as AZN chairman in 2004. He was replaced by Louis Schweitzer, former chairman of French automobile maker Renault, who had no prior ties to Investor. In 2005, Schweitzer removed AZN’s first CEO, Thomas McKillop, filling the position with the head of the company’s US operations, David Brennan. Although Brennan was not the frontrunner among candidates to replace McKillop, the board promoted him from president of the company’s North American operations to lead AZN’s global operations as the new CEO.

During Schweitzer’s tenure, the AZN board continued to undergo major transformation, in part to address a movement that had been occurring since the 1990s within the UK business community to increase the number of independent directors of UK companies. Prior to Schweitzer’s arrival, major plans to amend the company’s corporate-governance policies were underway, including the appointment in 2003 of Michele Hooper, a corporate-governance expert, as an independent director.

AZN’s status as the world’s fourth largest pharmaceutical company following the merger was based largely on sales of the company’s flagship ulcer drug Losec/Prilosec and blood-pressure drug Zestril. AZN generated a steady flow of revenues from these drugs, which accounted for nearly 50 per cent of the company’s total revenues. With both drugs set to lose patent protection in major markets over the next few years, however, AZN struggled to come up with new replacements.