“May you live in interesting times”

Attributed to Joseph Chamberlain1. Introduction

Technology is changing our lives. The pace of change is daunting – the first smartphone (the iPhone) was introduced only in 2007 and is now ubiquitous. The types of sensor already available in miniature packages mean that the “quantified self” revolution is well established. Many measures that were previously only available in laboratory or clinical settings are now readily accessible to anyone prepared to spend £100 on wearable technology and load up the relevant apps on said smartphones. We are well on the way to a time when the tools required to measure many facets of human health and behaviour will be completely invisible to the user – woven into everyday clothing and the apparatus of daily life.

The Wearables and Internet of Things Working Party was set up in 2016 by the Health and Care Research Sub-committee to explore the potential role and application of wearables and the broader “Internet of Things” (IoT) to the world of insurance. Those involved come from a range of backgrounds and experience but are united by a passion for, and interest in, the evolving world of digital health. The core focus has been on the health and care sector, although our findings have inevitably drawn us to applications of the technology in other areas.

While attempting to be thorough in explorations and analysis, this subject is peculiar in that the rate of growth of the wearable technology, and perhaps even more so the IoT, means that even through the duration of this Working Party, its members have had to change our notions of what can and cannot be done. The Working Party concluded that it is futile to present the environment with any kind of formal or fixed view – any such opinions will be obsolete within a few years, if not by the publication of this paper! Rather the reader is offered an introduction to the journey that we’re all on, and a broad insight into the current and potential future influences of the technology sector on the world of insurance.

The first part of this paper explores the current technology and how it is used. Access to huge amounts of personal biometric data is not without risks and challenges, and these issues are explored in the heart of the paper. The content deliberately steers clear of discussion about big data, confidentiality and related issues, as this is being covered by other working parties. The final sections engage in some low-tech crystal ball gazing with some perspectives of what the future might reveal in terms of new technology and the potential implications (and risks!) for the insurance industry.

This paper explores just some of the products and solutions currently available.Footnote 1 It is in no way meant to be an exhaustive review of all the digital health tools and in a constantly evolving market can only reflect current times. However, it aims to provide a valuable overview of the current digital health space.

“I do not fear computers. I fear lack of them.”

Isaac Asimov2. Overview of Wearable Devices and the Internet of Things

The Working Party was commissioned to look at both wearable technology and the IoT. As wearable technology often feeds the IoT, the distinction between the two is not always clear and perhaps unimportant. In general terms, this paper investigates technology that can be the source of additional information that might be useful in the world of health and care insurance. Anything that provides relevant data for the risk-taking community is therefore deemed to be in scope for our review.

With that in mind, the technology of interest falls into five categories:

Wrist-borne wearables

Medical devices

Clothing and shoes

Other wearables, including jewellery

IoT

These are explored in more detail here.

2.1. Wrist-Borne Wearable Technology

When commencing this project, the Working Party naturally started with wrist-borne devices, not least because most members of the Working Party were users of such technology or had made use of it in the past. The reader should, however, think more broadly as the limitations of the wrist-borne devices will become apparent later. Examples of manufacturers and their current products at the time of drafting are listed in Annexure A1.1.

The larger providers (Fitbit, Garmin, Jawbone, Xiaomi) offer a range of products to meet various needs and budgets, although most measure fundamentally the same things (see section 3). Doubtless this market will see the emergence of large numbers of Chinese imitators, like Xiaomi, which will drive down the price and make the technology more affordable. Currently, basic devices are available at £40–50, with top-end devices ranging from £100 to over £200 for the Apple Watch.

2.2. Medical Devices

The commercial device market offers a range of technology that meets the basic needs of consumers with limited need for highly accurate readings. When used in clinical settings, greater accuracy and reliability is required, and clinical tests will need to have been undertaken on the device to prove that recorded data are sufficiently accurate for its use in that particular setting. Consequently, the considerations are more for accuracy than for aesthetics and convenience. Nevertheless, technology in medical devices is expected to graduate towards commercially viable products consistently over time, at least while demand for self-diagnosis from the “quantified self” community remains high.

Examples of devices that are marketed for clinical use are set out in Annex A1.2 and demonstrate the wide range of conditions that can be supported by tracking technology, such as diabetes, Parkinson’s disease and heart conditions.

While wrist-borne technology is generally offered to promote general health and well-being, medical devices are used by clinicians to support either diagnosis or monitoring of specific conditions. Furthermore, whilst wrist-borne devices will be worn for long periods of time to pick up trends, the clinical devices will tend to be used for shorter duration spells.

However, this distinction is narrowing over time as health is marketed to users outside of the clinic setting. Makers of general well-being wearables are on a mission to become more accurate and reliable, while clinical devices are becoming smaller and more wearable. A time is sure to come that the general wearable device will become more accepted and widely used by the clinical community as the information derived from it increases in accuracy and relevance.

2.3. Technology Embedded into Clothing and Shoes

One of the challenges for wrist-borne devices is that many are supplementary, in the sense that people need to choose to wear them. Some of the manufacturers have set up their devices to replace others – the best example being Withings (now part of Nokia) who have chosen to mimic watch functionality in their designs. Apple have gone to another level with a watch that is destined to replicate many functionalities of the iPhone.

For this reason, even traditional fitness wearables such as Garmin running watches are evolving to include features such as being able to send/receive texts by syncing with your smart phone, contactless payment functionality and downloading music.

Where devices are indeed supplementary, users typically become bored of the devices after the initial novelty wears off, and engagement wanes. Some manufacturers have therefore turned to integrating the measuring technology into items of clothing and shoes that people wear. In this way the device itself becomes invisible to us, and we don’t have to choose to wear it for the data to be generated. While the user does not need to do anything with the data (which will typically be sent to an app voluntarily accessible by the user), the data will exist and be available to anyone with rights to access it.

A few examples of the types of “integrated” technology that are currently available are set out in Table 1.

Table 1. Examples of Technology Integrated into Day-to-Day Clothing Items

2.4. Other Wearables, Including Jewellery

There are a wide range of other commercially available devices which are selectively wearable for specific purposes, without typically meeting clinical standards (although some claim to). Many of these centre around the newfound ability to more accurately measure the quantity and quality of sleep using heart rate (ECG) and brainwave (EEG) data. Sleep has been promoted in the wearables market as one of the main drivers of improved health, well-being and performance. In addition, there are devices for measuring blood sugar, which may be useful for diabetic patients, and headbands for monitoring the quality of your meditation!

Some of the devices identified are detailed in Table 2.

Table 2. Examples of Other Wearable Technology

2.5. Internet of Things

The IoT is a vast and growing source of data potentially useful for evaluating relative risk in an insurance environment. A complete analysis of this space has not been attempted, and this paper rather highlights some examples of the types of data that might prove interesting.

2.5.1. Behaviour monitoring

One of the most interesting potential sources of data is mobile phones. Our smartphones carry a range of sensors which track motion and location, making collection of such data “frictionless” in the sense that users do not need to do anything different from what they would normally do on a day-to-day basis.

One Belgian company, Sentiance, has created a tool for collecting smartphone data to monitor what people are doing, and then uses AI to attribute certain behavioural characteristics to them. For instance, the data it collects allows the user to be categorised as a dog walker or restaurant goer, a fast or safe driver and a commuter or homeworker, among many others. It can also provide real-time nudges based on context at a time when the user is in a particular place or behaving in a specific way.

SmartPlate TopView is an Intelligent Nutrition Platform that uses photo recognition and AI technology to identify, analyse and track everything you eat, and has a wide range of applications. The AI technology is capable of recognising individual food items on a plate, combining that information from the weight information from the SmartPlate and can hence derive calories and nutrients consumed.

2.5.2. Support for the elderly and infirm

The search for active uses of the IoT revealed many examples where the data were being used to support the health and safety of the elderly and infirm, particularly for those with dementia. The IoT allows carers to be made aware more quickly of circumstances that might be dangerous, unhealthy or unpleasant for those in care. Some examples have been included in Annex A1.3.

2.5.3. Health and safety in the workplace

Solutions designed to address health and safety in the workplace include the following:

Sensor clips (which can be attached to clothing or machinery) that monitor trips and falls, and identify the location of workers in risky workplaces, for example, the Spot-r clip

Smart glasses which allow remote managers and experts to monitor activity and offer advice and support to workers on the ground, for example, XOeye

Movement sensors that can detect when workers move in a way that is likely to cause injury including poor lifting technique or bending, lifting excessively heavy weights and doing activity close to dangerous equipment, for example, Human Condition Safety.

2.5.4. Other technologies

Among the other technological developments identified are scales that monitor an individual’s hydration levels, smart wallets that track how many pills have been removed from a blister pack, bottles that dispense the correct dose of medication at the correct time and can send reminders to smartphones, avatars to guide people through care routines and even sensors that can be attached to chairs to monitor how long someone has been sitting.

The NHS (National Health Service) runs a variety of “test beds.” At the time of drafting there are two specifically related to maximising the availability of data from the IoT:

Technology Integrated Health Management: Individuals living with dementia and their carers are being provided with sensors, wearables, monitors and other devices, which will combine into an “IoT” to monitor their health at home. The aim is to reduce the need for GP visits and unplanned admissions to hospital, prevent or delay the need for costly long-term care in nursing homes and reduce demands on carers.

Diabetes Digital Coach: Providing people with type one and type two diabetes with a selection of integrated digital tools to manage their condition.

Other examples include:

AliveCor Kardia Mobile Platform, which allows doctors to monitor patients for atrial fibrillation;

MySignals, which is a development platform for medical devices and eHealth applications; and

TZOA which offers environmental monitoring include air quality and UV.

2.5.5. Data aggregators

Because the range and quantity of data now available is already beyond human comprehension, firms have sprung up to collect data and provide usable information in managed data bundles. These providers are referred to as data aggregators, and they exist in a variety of forms.

Data aggregators are explored in more detail in section 5.3.

“What gets measured gets managed”

Peter Drucker3. Types of Measurements Available from Technology

3.1. Sensor Data

Wearable technology uses sensors to collect data from the individual user. Sensors currently available include:

These sensors collect base information which can be interpreted by various software analytical tools. For instance, distance travelled is often calculated based on an individual’s number of steps (based on accelerometer data) and average stride length. Sleep quality is derived from a few different sources depending on the device, but if ECG or EEG sensors are installed, then the corresponding ECG/EEG data are used to define various sleep quality phases.

3.2. Measurements Available

A list of all the potential measures available from current technology that the Working Party is aware of is included in Table 3.

Table 3. Measurements Available from Current Technology

Many of these are unlikely to be useful for insurers, at least not for a while. Rather this list is presented to raise awareness of the range of potential measures that are already available, with the promise of further and more accurate sensors and data to come.

3.3. Accuracy and Consistency of Measurements

At the current stage of evolution of the technology, there are still significant discrepancies between the measurements collected from different devices and sensors, and even between the same brand and make of device. For accurate measurements, users would typically need to turn to the medical-grade devices in section 2.2, although as noted the distinction is blurring.

Inaccuracies occur for a variety of reasons and vary according to what is being measured. As mentioned earlier, to count even basic steps, software needs to convert data on three-dimensional motion, usually from an accelerometer, to an assumed number of steps. Device software is becoming better at this, and a 2015 meta-analysis (Evenson et al., Reference Evenson, Goto and Furberg2015) concluded that in a laboratory setting, there is a reasonably high level of accuracy (errors of 15% or so) and consistency of measurement of steps. However, the devices will not be worn in the laboratory, and informal research (Chemi, Reference Chemi2016) suggests that real-world experience is likely to produce errors of much greater magnitude (100% or more).

Devices are required to make assumptions, for example, about stride length, metabolism and so on, in order to determine sleep, energy expenditure or distance travelled. Consequently, research suggests that errors from derived measures are greater than those from direct measures. For example, one study shows that while steps are measured reasonably accurately (+/−10% in a laboratory setting), derived estimates of energy expenditure could be up to 60% different from actual levels measured (Stackpool, Reference Stackpool2013). A Stanford study concluded that none of the devices investigated gave accurate energy expenditure readings, whereas six out of seven devices determined heart rate within 5% of the true value, where heart rate is usually measured directly by device sensors (Shcherbina et al., Reference Shcherbina, Mikael Mattsson, Waggott, Salisbury, Christle, Hastie, Wheeler and Ashley2017).

The requirement for accurate data is greater in clinical settings and for medical devices, and where data are being used to compare between users with different devices (the inter-rater reliability). The way in which most wearable devices, like wrist-borne devices, are currently being used is to monitor longitudinal change in the same individual, in which case the accuracy is less important.

In conclusion, insurers should look at the purpose of the device used to collect data and review how the measurements of interest are determined – are they derived by software based on assumptions or determined directly from sensor readings? Ideally the devices used to deliver measurements should be matched in purpose and be relatively easy for the individual to wear correctly.

“It has become appallingly obvious that our technology has exceeded our humanity.”

Albert Einstein4. Current Examples of Use

Wearables and IoT technologies are already being used across life insurance, health insurance, general insurance, as well as in other fields such as corporate well-being and sports coaching. This section draws on current examples of use across these sectors to bring out the key themes of how the technology supports insurance and related areas. Consideration of potential future uses will be addressed later in the paper.

4.1. Examples of Use in Life and Health Insurance

Wearable technology and IoT is currently being used in life and health insurance to gather non-traditional data, engage with customers, provide rewards to incentivise customers to live a healthier lifestyle, help educate users to improve their health and assist with underwriting.

4.1.1. Engaging with customers

Insurers are incentivising customers to use wearables and lifestyle apps in order to increase engagement in a traditionally passive space. There are already several health and life insurers partnering with wearable tech companies to offer discounted physical activity trackers to their customers.

An early adopter in this space is Vitality, which has partnered with Apple to offer discounts on the Apple Watch to customers (Vitality, 2018). There are other insurers already on this journey or cited to be in talks with wearable providers, for example; United Healthcare in the US are adding the Apple watch to its United Healthcare motion program which already includes multiple activity tracker buy-up options (United Healthcare, 2018); in South Africa ABSA Instant life offers a discount on life customer premiums for wearing an activity- and sleep-tracking device and engaging in the Instant Life FitLife programme (ABSA Instant Life, 2018). The offering of wearables to insurance customers can help to boost customer engagement through more regular contact with policyholders and by helping the insurer to play a positive role in the lives of their policyholders.

The investment that insurers are making in subsidising the use of wearables by their customers could be as part of a marketing campaign designed to boost engagement, or to create product differentiation. Also, where data regulations permit, there may be the opportunity to leverage data from mobile apps to better understand the needs and behaviours of customers. In Japan, Sompo Japan Nipponkoa Himawari Life Insurance Inc. has given customers free Fitbits and is using the data from these devices in conjunction with the results of health check-ups to help provide better insights into the causal relationships between disease and various lifestyle habits (The Japan Times, 2017).

4.1.2. Rewarding healthier behaviours

Some health and life insurers are using wearables in conjunction with external motivators such as rewards vouchers, monetary discounts and digital badgesFootnote 2 to incentivise customers to lead a healthier lifestyle. Some examples of how wearable technology and IoT has been used to reward healthier behaviours are set out in Table 4, but this is by no means an exhaustive list.

Table 4 Rewarding Healthy Behaviour using Tracking Technology

Although there are widespread examples of rewards and financial incentives being used in conjunction with wearables and IoT connected devices, the use of behaviour-linked incentives in this way appeals to extrinsic motivation. At the time of writing, peer-reviewed research does not support the use of extrinsic motivators such as money and rewards to bring about long-term behaviour change, even when used as part of a clinician-led health intervention programme. Study of the science of motivation and behaviour change is beyond the scope of this paper, but interested readers should read Daniel Pink’s (2009).

4.1.3. Well-being-led use of wearables and IoT

Increasingly, health and life insurers are recognising that wearables and IoT themselves are unlikely to create significant change on their own. To address this, they are integrating wearables into a broader “healthy lifestyle” proposition which, among other things, educates customers about the underlying virtues of improving their lifestyle.

Health insurers are using health and lifestyle apps to assist customers in developing more positive health-related behaviours. For example, in 2015 Punter Southall Health & Protection partnered with Aviva to provide an insurance product that offered an onsite health kiosk enabling employees to measure key health stats, a health app and corporate challenges (Punter Southall, 2015). Another example is the Bupa Boost app which incorporates wearables into a more comprehensive mobile app-based well-being platform to enable customers to develop more positive nutrition, mindfulness and relaxation habits (Bupa, 2018).

A continuing move towards integrating wearables into broader well-being strategies is likely. Wearables provide a relatively quick feedback loop for individuals looking to target improvements in health through behaviour change. As behaviour becomes the focus of well-being programmes seeking to drive health improvements, wearables can provide valuable data for the user and the change agents (like coaches, the insurer, AI-led learning) seeking to guide the user through lifestyle changes.

4.1.4. Continuous underwriting

An area more associated with traditional actuarial thinking is the use of wearables and IoT as part of a continuous underwriting process to improve risk selection and pricing. Several products have recently been launched where ongoing customer premiums depend on the medically measurable health status of customers.

The Royal London, the Exeter and Vitality have all launched products aimed at diabetics, with ongoing tracking of their blood sugar measurements. The Exeter has also launched a product with ongoing measurements of BMI.

For some products, premiums are based on customer measurements. Certain products offer reduced premiums for achieving better risk measures, for example, fasting blood sugar below 6.0 mmol/L. Wearable technology is often used as an objective means to track the measurements, and it has the additional benefit of offering continuous rather than spot measurements. This is particularly useful, for example, for blood sugar, where the speed with which glucose is processed by the body is at least as important as the absolute figures.

There is scope to both increase and substitute existing market share with continuous underwriting products. Diabetes products increase total market share by enabling acceptance of customers who would otherwise be declined. In addition, diabetes and BMI products substitute market share for lives who otherwise would be rated.

4.1.5. Health condition and case management

Existing technology can help to manage acute and chronic conditions.

App-based solutions are available to help support mental well-being. They cover many areas providing tools such as breathing and relaxation techniques, mindfulness, educational information and “nudges” on managing stress, good sleep practice and resilience. They can also gather information from users on how they are feeling, for example, using established mental health assessment-based question sets, as well as simple mood diaries. One of the strengths is that the journey can be personalised, providing content, help and support based on how a user is responding. They can also signpost to telephone-based or face-to-face support at the time of need, for example, to employee assistance programmes, where data collected by the app can be shared with counsellors. Thrive and Unmind are examples of app-based solutions in this area.

Physiotherapy apps are being used to help case-manage the recovery of patients. For example, QBE Business Insurance has recently partnered with IPRS Health to launch a new innovative physiotherapy service for its customers, which uses an app to treat and monitor patients remotely.

These and other similar technologies may lend themselves well to the claims management in the life and health space, notably for income protection and private medical insurance plans.

4.2. Examples of Use in General Insurance

Uptake of wearables and IoT technology in general insurance (GI) has been faster and wider-reaching than in life and health insurance, perhaps because the current technology lends itself better for use in the GI sector. General insurers are using wearables and IoT to gather data on and engage with customers, implement behaviour-linked incentives and assist with underwriting. For example, RSA has introduced the PitPatPet activity monitor for dogs to boost customer engagement in pet insurance (RSA Group, 2017).

We’ve included examples in this section not necessarily because they have direct relevance to the health and care sector, but rather to illustrate the innovative ways in which technology can be woven into insurance product design.

4.2.1. Motor insurance

In motor insurance, black boxes and smartphone apps are being widely used to monitor the habits of insured drivers using GPS and accelerometer sensors. Good driving behaviour (driving styles associated with fewer accidents) is rewarded with lower premiums and other benefits. For example, Insure The Box provides an online portal which rates a customer’s driving and offers the opportunity to earn up to 100 “Bonus Miles” each month of safe driving (Insure The Box, 2018).

4.2.2. Risk management

Technology companies are working with manufacturers of sensors, collecting fire, flood and other preventable risk-related measurements, to develop analytical tools which aggregate and draw conclusions about risk from the measures collected. General insurers are partnering with these companies to utilise this novel data for both the short-term prevention and prediction of risk.

In the home insurance space, smart-home technology can monitor and protect insured spaces and act as a theft deterrent. For example, Neos offers smarter home insurance with a 3-year no-claim fixed-price guarantee to customers who install Neos sensors and an indoor security camera (Neos, 2018).

4.2.3. Cover as you need it

Technology (including payments technology) is also being used to help tailor insurance cover to the customer’s need on an ongoing basis. Some lines of general insurance (e.g. motor, travel, contents) are well suited to the “cover as you need it” model. For example, Cuvva offers motor insurance cover on the go with cover from 1 hour to 1 month on any car, and Back Me Up provides contents cover for 1–4 items on a monthly basis (Cuvva, 2018; Back Me Up, 2018). Using IoT technology it may be possible to build on the cover as you need it service model to automatically recognise when a vehicle is in use or to insure items automatically at the point of purchase or leaving the house.

However, this model is less well suited to health and other forms of long-term insurance, as it could lead to anti-selection, with people turning on cover only when they experience early symptoms of illness.

4.2.4. Claims process management

Claims process management is being made easier through the use of app-based solutions that help customers gain authorisation or pay-outs for claims and to help direct customers to the most cost-effective remediation solution.

Tech company Rightindem has produced a claims process management app that allows insurers to carry out virtual damage assessment (e.g. for motor insurance claims it can incorporate the use of video, photo, GPS and weather conditions) (Rightindem, 2018). The app can also help insurers with fraud detection, easier scheduling of repairs and enhanced cost control through repair tendering.

4.2.5. Social media

There may be application for this type of IoT technology within the health insurance space. Apps could be developed to facilitate the contracting of and payments to providers for a given claim by helping to recommend suitable physicians (based on geography, cost-effectiveness, waiting time and condition) to customers on open referral.

Social media data can in theory be used for tailoring insurance product recommendations, but there are risks. The company Digital Fineprint is using machine learning technology to make smart insurance policy recommendations to users based on their social media data – LinkedIn data can be used as an indicator of income and Facebook data can give an indication of a user’s appetite for risk when it comes to a life insurance policy (Digital Fineprint, 2018). However, there is resistance from some consumers to the use of social media data by insurers. For example, in 2016 Admiral hastily withdrew plans to use Facebook posts to set insurance rates for car owners, and more recently, Facebook’s data privacy protocols have been questioned after Cambridge Analytica reportedly accessed the information of millions of Facebook users without their knowledge (NY Times, 2018).

The data privacy challenge is considered further in section 6.4.2.

4.3. Other Examples of Use

Beyond insurance, wearables and IoT have many potential implications. This section considers just three examples of these with links to health: sports coaching; home medical applications; and mental health treatment, but there are many others.

4.3.1. Sports coaching

Globally, sport is a multibillion-dollar industry, and organisations that are linked to sport are often at the forefront of technology uptake, be that looking for the extra edge that will give them an advantage over their competitors or improving the spectator experience. Consideration of the use of wearables linked to sport – such as in football (Gadgets & Wearables, 2018) – can give us an indication of new uses for existing technology, or high-end technology that may eventually become mainstream and more widely available for use in insurance.

Wearables offer the opportunity for real-time coaching across a range of sports, including skiing, cycling, swimming, running, weightlifting and basketball. Rather than rely on video interpretations, or wait for laboratory tests, the contemporary wearable offers a range of objective and instantaneous data for the sportsperson looking to improve performance. As discussed in section 2, sensors are now being embedded into clothing, footwear and eyewear in addition to the more familiar wrist-borne devices. New techniques and methods can be tried by sportspeople looking to improve performance, with feedback on impact obtained immediately improving the efficiency of evaluation. Over the longer term, trends in cardiovascular fitness, strength and flexibility can be monitored continuously and linked to training activities, diet and sleep.

The risk that the technology will be used inappropriately is ever present. Last year, the Boston Red Sox, a US baseball team, used the Apple Watch to gain an unfair advantage by surreptitiously relaying information to its players (NY Times, 2017). The willingness and ability to cheat is not limited to professional sports, and the challenges for insurers seeking to be sure that users are not “gaming” the system must be addressed in any product design.

4.3.2. Medical monitoring and diagnostics

Wearables and IoT also have the potential to transform medicine, allowing an increasing proportion of diagnostic and health monitoring processes to be carried out virtually by individuals from the comfort of their own homes, rather than with medical professionals in a clinical setting.

Wearable tech entering the market to facilitate this includes a flexible patch that can track a user’s temperature over time and a wearable for continual foetal heart rate monitoring and physiological data recording for pregnant women.

Moreover, autonomously functioning AI consumer medical devices, such as the DxtER prototype, are being developed to diagnose conditions, including diabetes, atrial fibrillation, chronic obstructive pulmonary disease (COPD), tuberculosis and stroke, from a user’s own home by using non-invasive sensors and integration with their medical records and healthcare providers (Basil Leaf Techonolgies, 2018). AI can also be used to help support the decision-making processes of healthcare professionals. For example, IBM Watson is helping to incorporate AI into healthcare models through the development of tools to support medical and research professionals in areas such as oncology, drug discovery, genomics and care management (IBM, 2018). Devices such as these will need to undergo rigorous testing but serve as examples that medical diagnostic techniques, previously the realm of science fiction, are already within our grasp.

4.3.3. Mental health treatment

Another promising area is the treatment of mental health disorders. One promising technology uses virtual reality (VR) for exposure-based treatment by simulating real-life situations. A systematic review of 285 empirical studies into VR to treat mental health conditions found evidence that VR can reduce anxiety disorders. VR has also generated positive outcomes for treatment of other conditions such as eating disorders and schizophrenia (Freeman et al., Reference Freeman, Reeve, Robinson, Ehlers, Clark, Spanlang and Slater2017). The authors of the study suggest that VR treatment programmes should become increasingly user-centred to maximise efficacy.

“It is a capital mistake to theorize before one has data.”

Arthur Conan Doyle5. Data Considerations

5.1. Making the Data Meaningful

Converting data to information has been a challenge that the profession has addressed since Edmond Halley produced the first mortality table. Although we have moved on from the days of manually processing raw mortality data and generating handwritten tables for pricing life assurance, the profession is now faced with a challenge on an altogether different scale. The data available from a single smartphone are so abundant as to render it virtually meaningless unless processed by one of the myriad of apps or other software packages that exist for making sense of the data.

Even after processing, the data can be hard to decipher and interpret. This section explores the challenge for insurers in making use of the data, the mechanisms available to support data acquisition and some of the concerns about data privacy.

5.2. Data Reliability

In sections 2.3 and 2.5.1, the concept of frictionless tracking was introduced. There is a big difference between data that has been collected because someone has chosen to wear a “supplementary” tracking device for a declared purpose, like a pedometer for tracking steps, and data from a mobile phone that is going to be collected whether it is used or not.

The risk of anti-selection is ever present where users can exercise choice over what and when data are collected, and this should be borne in mind when choosing a data source. Wearable technology attracts a particular risk that, if the users know the purpose of the device and how data are likely to be used, then they are able to “game” the system. Tales abound of users needing to raise their step counts handing the device to an active friend or even attaching it to their dog! Where device data are used, insurers will need to be comfortable that the data are objective and relating to the insured.

For this reason, data collected in a frictionless way might be regarded as more reliable. You would typically expect to collect more data, and more representative data, as people do not need to make a special effort to capture it and do not accidentally (or otherwise) forget to wear the device. People also will not usually hand their smartphones over to others to get better results due to their dependency on these devices. Before insurers collect this data, robust customer disclosure agreements that are compliant with data protection legislation would need to be put in place allowing customers to consent to sharing their smartphone data with their insurer. Data regulation is considered further in section 6.4.2.

Insurers will also need to know whether the data are fit for purpose. Many devices have been developed specially to collect a specific piece of data, whereas generic devices like smartphones, for example, have been designed for another purpose, and the data are just a by-product of that functionality. So while the data from a smartphone regarding, say, driving will be reasonably accurate – drivers will almost always have their phone in the car, and the GPS and accelerometer reading can provide accurate readings about the motion of the vehicle – smartphones are generally less accurate when tracking steps, as the phone is not always taken on every walk and the software is not optimised for accuracy of this measure.

Evidently, data from wearables and the IoT need to be treated with some respect and circumspection. As explained in section 3.3, unless they are clinically tested, accuracy of measurements is not a given even among devices designed specifically for a purpose; there is inconsistency between devices on even something as rudimentary as steps. However, if it is changes over time that matters, the results are more reassuring – there is far greater reliability in the consistency of the measure.

Before embarking on using any of these novel data, the actuary should consider the potential systematic errors from:

The device itself, and changes in the device during the data collection period

How the device is used when collecting the data of interest, and how that affects the readings

How the device is worn – if the device is worn incorrectly, how will it affect readings?

For truly accurate data, at least to the level required by clinicians, insurers would need to turn to medical devices. Data from medical devices remain in the minority, with medical-grade devices being both expensive and usually cumbersome to wear.

Furthermore, much of the analysis done by actuaries is at the aggregate level – looking at the multivariate experiences of homogeneous cohorts. By grouping data across larger populations, some of the random volatility in the experience between individuals and devices will average out, meaning that relative risk, and trend analysis, could be reasonably reliable. Of course, if the resulting risk ratings are then applied to individuals based on the measurements coming from their devices, the specifics of the insured’s circumstances matter once more.

5.3. Aggregators

There are already a wide variety of wearable devices and apps, both of which are rapidly evolving. Engagement is enhanced where individuals have choice over the app and wearable they use, and many want to upgrade the latest version as soon as it is issued, or the newest technology as it is launched. Some people wear multiple wearable devices. Users will therefore change their devices and apps over time. Any market that wants to make use of this data will need to be prepared for and have a methodology for handling this evolution.

For the moment, it will be much more practical for insurers to obtain data from a single source. Partnering with multiple providers will be challenging, but partnering with a single provider will be restricting.

The solution to this challenge exists in the form of data aggregators. Like the technology they are still relatively new and are building their databases, but they exist to collect and process data from multiple devices and partners using API integration. Some aggregators will hold data for their own purposes, seeking to extract value from the information available from the processed data, while others exist solely to pass that data on in a cleaned-up format for use by their clients. Aggregators are mostly device-agnostic and collate data from a broad range of health, lifestyle and wearable apps into one platform.

Examples of aggregators include the following:

Dacadoo collates people’s health data from multiple sources and uses it to calculate an individual health score, which is based on their body, feelings and lifestyle. The Dacadoo Health Score is compared to a benchmark, providing a reference point for relative health of the user in the dimensions measured (Dacadoo, 2018).

WeSavvy adopts a similar approach. WeSavvy has a Customer Lifestyle scoring engine, where customers receive points for everyday activities such as exercising and obtaining enough sleep. It has partnered with AdInsure, and the AdInsure core system can now interpret the lifestyle data provided through WeSavvy and provide customer-specific ratings, while enabling the insurer to manage risk more accurately (Adacta, 2018).

Sentiance gathers data from mobile phones loaded with its app. The software gathers data from all the sensors, providing information about movement, acceleration, location and so on. Sentiance then processes this into segmented chunks of anonymised information about the user which can be invaluable to the retail sector, restaurants and insurers (Sentiance, 2018).

Intel’s COVALENCE platform can be used by insurers to collect data from wearables and structure it in a way that can better meet insurers’ needs (Intel, 2017).

Insurers are also partnering with health data aggregator start-ups, such as Tictrac and Fitsense, who are helping to streamline, interpret and synthesise data from wearables to generate more actionable insights (Breteau, Reference Breteau2017).

5.4. The Value of Data

This section covers briefly the value that might be obtained from new data. Other working parties will provide a much deeper and more insightful view on the value of plentiful novel (‘big’) data. Nevertheless, this review would be incomplete without some reference.

Collecting any data comes with a price tag. Whether it is the resource investment of time, energy and programming to do the job in house, alongside any device costs, or the cost of acquiring data from a data aggregator, the insurer will need a business case for the spend.

The greatest challenge currently appears to be knowing what to do with the data. There are no equivalents of the multiple decrement table that interpret even steps, the most ubiquitous of the measures available from devices. Knowing how to extract value from heart rate, blood pressure, blood sugar and cholesterol data is a major challenge for traditional insurers and the profession looking to make the most from this new data-rich world.

Although knowing precisely how various measures or trends impact the experience of a population cohort is likely to be beyond most of the insurance communities for some time, there is no doubt that the measures listed in section 3.2 are reliable indicators of health and future experience. The data are inherently valuable, in the sense that it tells us something about the prospective risk for an individual. The problem is that there is no way yet to graduate experience to adjust for the relative risk revealed by the data.

The challenge runs deeper. While intuitively most actuaries will see that collecting the data will ultimately be valuable, in the sense that it will improve the sector’s ability to underwrite accurately, nobody yet knows which data will prove most useful when explaining risk. Thus, a forward-thinking insurer might choose to invest millions of pounds in developing a system to collect step data, only to find 2 years down the line that the most important data are blood sugar.

It is unlikely that the insurance community can ignore these developments. Any insurer looking to survive will have to engage in this space – there are many market disruptors looking to innovate and create new markets for insurance. However, it should probably do so based on a long-term business plan, with the flexibility to adjust and modify the direction of travel as data and knowledge improves.

Improved underwriting is not the only source of value. Where devices are provided directly to customers (so data are not obtained from an aggregator), device users are easier to communicate with and, if they are providing data directly to the insurer, they are offering an opportunity for personalised communication based on the customer’s profile and characteristics. The life and health insurance community has historically struggled to build relationships with their customers (McKinsey & Company, 2016). Insurance is a grudge purchase, and you need it only in unhappy situations – hardly the foundation for a fulfilling relationship. Devices offer the opportunity for a revolution in this space allowing insurers to build a closer and “stickier” relationship with customers, taking a role in customers’ lives not previously envisaged, while also collecting the data. This will be hard and counter-cultural in many ways, but the opportunity is there based on the technology.

“Technology … is a queer thing. It brings you great gifts with one hand, and it stabs you in the back with the other.”

C. P. Snow6. Risks and Challenges

6.1. Overview

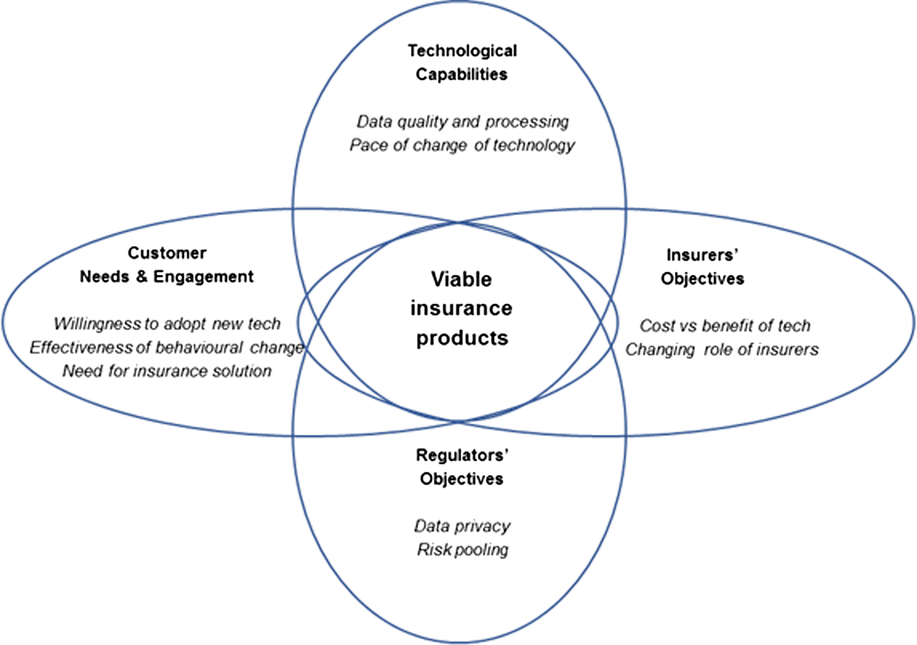

Preceding sections have described the features of wearable technology and the IoT. Many of these features give rise to risks and challenges that insurers will have to navigate to see benefit. Multiple stakeholders are involved in the development of insurance products (see Figure 1). For insurers to successfully incorporate wearables and IoT technology into their insurance propositions, they should ensure that:

they have the technological capabilities and integration required to service the enhanced product,

the product helps them to meet their corporate objectives and is aligned with the business vision,

the enhanced proposition helps them to engage more effectively with customers and meet their needs and

the proposition is acceptable to the regulators.

Figure 1 Risks and challenges faced by key stakeholders when integrating wearables and IoT technology into insurance products

For viable products to exist, the risks and challenges associated with each of these areas need to be addressed; otherwise there is a risk that one or more of the stakeholders’ objectives will not be met. What follows is an examination of some of the risks and challenges that have been identified by this Working Party.

6.2. Technological Capabilities

6.2.1. Data quality and processing

The quality of data obtained from wearables, as discussed in section 5.2, is a key consideration for insurance companies for two main reasons. First, historically obtained data will be required to help design and price insurance products that make use of wearable technology. Second, data will have to be continually collected going forward in a consistent manner to ensure that any assumed benefits of the wearable-integrated product (beyond the collection of data itself) are materialising, and if not, then to understand why and whether any changes are needed.

Sections 3.3 and 5.2 address accuracy and reliability limitations of data from wearable technology, respectively. These limitations mean there is a risk that, even if an insurance product could be developed that makes use of data from wearable technology or tracking apps, the validity of the conclusions drawn may be questionable. This could lead to inconsistencies between product design and reality, with potential-associated financial consequences. If products are to progress, consistent and reliable historical data will be needed, or insurers will be forced to make leaps of faith based on unreliable information and research.

Insurers are likely to face challenges in collecting, aggregating and processing the real-time data from wearables and IoT as these data are different from the static databases that insurers currently use for underwriting and claims processing. Most health and life insurers do not currently have the capability for mining and interpreting large dynamic datasets in near real-time. Insurers may look to build these capabilities in time or work with data aggregators (see section 5.3) who can assist in data analytics, but this could require significant investment for them to meet changing future demands and, as discussed in section 6.4.2, data security requirements.

6.2.2. Pace of technological change

As alluded to in the introduction to this paper, technology in this area, as in many others, is advancing at a staggering rate. The pace of this change is a source of challenge and risk for insurers, as is the fact that the insurance sector lags behind sectors like banking and retail in making use of the technology. There is already a danger that the insurance industry has not reacted quickly enough to new opportunities, but equally it should not now act too hastily.

Gartner’s Hype Cycle (Gartner, 2018) provides a good visualisation that illustrates the evolution of technology.

To act before the benefits of any given technological advance are clear will open an established insurer to risk, especially if it is acting under the “peak of inflated expectations.” Time, effort and money could be spent developing products where expected benefits fail to materialise or are not maximised due to the infancy and understanding of the technology at the point it is adopted. That said, there is likely to be at least an element of first mover and early adopter advantage in this sphere.

Conversely, to not seize opportunities as they arise may leave a company behind the curve and struggling to catch up with competitors, or at risk from external innovators. Impacts from this could be loss of market share, being seen as “behind the times” or being left with a sub-standard risk pool as better risks choose to be covered by competitors.

The key way for insurers to mitigate this risk is not to just focus on what is available now or in the short term, but to ensure there is a good understanding of what may be developed in the future and continually review and refine strategies to maximise benefits stemming from technological advances. Building products that can seamlessly integrate as-yet undeveloped technologies will help create a sustainable product structure. This is especially important given product development cycles can be lengthy, resulting in technological changes by the time the product is launched.

6.3. Insurers’ Objectives

6.3.1. Role of the insurer

A long-term risk is that the technology developed becomes too good at risk identification, undermining the essential principle of cross-subsidisation. For example, lower-risk individuals may be able to opt out of insurance purchase as they better understand their risk level and perceive insurance as poor value for money. While this may intuitively feel like it is a long way off, given the pace of change and unexpected developments in the technology over the years there is a possibility that this sort of risk crystallises sooner than expected.

Moreover, with the difference between mass market consumer technology and medical-grade devices becoming ever smaller, there is a risk that there could be a shift in the perceived role of the insurer. An insurer might consider providing technology that will manage or prevent medical conditions to reduce risk and claims costs. At this point, care needs to be taken that insurers do not overstep the mark from being a financial safety net to being medical advisors, and creating a much higher level of duty of care, as this could expose the insurer to risk of litigation for inappropriate medical advice.

Improved customer engagement and deeper information about the nature of an individual’s condition provided by technology might open other markets. Affinity groups making use of the technology might be able to secure better terms by demonstrating a relatively low-risk profile compared to the general population, for example, sports clubs and dog walkers. Opportunities for other product types, such as critical illness and income protection, where continuous monitoring and careful medical management are valuable, should be self-evident.

6.3.2. New competitors taking insurance market share

As connected health and insurance blend together, insurance companies may face additional competition from non-traditional companies seeking to enter the insurance market. Technology companies such as Apple, Google and Amazon increasingly have the analytical resources, access to consumer data, strongly developed customer relationships and, in some cases, the desire to enter the insurance market.Footnote 3 This new insurance cross-selling model by non-traditional competitors may change the competitive landscape in drastic ways as market share moves from the traditional insurance carriers.

6.3.3. Cost versus Benefit

The cost versus benefit challenge is key – there must be a business case for insurers incorporating wearables and IoT into their propositions. If the economics of incorporating technology from either the insurer’s or the customer’s point of view do not stack up, then there is unlikely to be significant market change.

The beneficial health outcomes from many portable consumer medical devices are becoming clearer, such as the use of glucose monitors and insulin pumps. Also, in terms of diabetes prevention, US health insurer Cigna launched a pilot programme in 2016 where it distributed a wearable armband device to thousands of employees at one of its large corporate customers. Cigna has indicated that early results showed that several employees on the verge of contracting diabetes have improved their risk profiles (Caprice, 2017). Another apparent indication of the success of wearables comes from a 3-year long study of employees of US health insurer Humana. Humana has indicated that those who participated in the HumanaVitality rewards-based wearable insurance scheme and remained engaged throughout the 3 years have, on average, an 18% increase in healthcare savings and a 44% reduction in sickness absence compared to those who did not engage in the programme (Finnegan, Reference Finnegan2016).

However, as the following section on behavioural change shows, the independent peer-reviewed research in this area is less conclusive. Caution should be exercised when interpreting any “research” published where the findings are clearly in the interests of the publisher. Where there is evidence of increased activity levels among the users of wearables, these are often short-lived as customer engagement wears off. An insurer will also need to adapt and interpret any existing research into the context that technology will be used within their proposition. For example, results from the use of technology as a standalone offering will differ from the use of technology embedded in a wider incentive programme.

This poses an issue for insurers as for any tangible benefit to be gained then long-term engagement is needed. If data are to be collected in the long term, alternate solutions that make tracking frictionless are likely to be required, such as the incorporation of sensors in clothes or using data from devices with other purposes such as mobile phones.

The use of sensors in this way could help to solve a secondary challenge, that of who pays for the technology. If users are expected to pay for something solely to gain cheaper premiums (or access to insurance), they will need to see a good return to be motivated to do so. Likewise, if the insurers are expected to pay, then they will expect a similar level of benefit. However, by leveraging technology that a consumer is likely to already have purchased, such as a smartphone, there is relatively little additional cost for insurers or consumers.

6.4. Customer Needs and Engagements

Insurers incorporating wearable and IoT technologies into their insurance propositions should do so in a way that facilitates engagement with and meets the needs of customers.

6.4.1. Behavioural change

There is a risk that insurers embark on this journey believing that technology will change customers’ behaviour for the better. The evidence about behaviour change remains mixed (Hajat, 2016).

One of the largest reviews that included more than 200 individual studies of internet and mobile interventions found that internet interventions improved diet, physical activity, adiposity, tobacco use and excess alcohol, and mobile interventions improved physical activity and adiposity. However, the authors also concluded that future studies are required with longer durations of follow-up beyond 12 months to evaluate sustainability, as well as greater consistency of the intervention content and intensity. (Mozaffarian et al., Reference Afshin, Babalola, Mclean, Yu, Ma, Chen, Arabi and Mozaffarian2016)

A recent meta-analysis (Noah & Keller, Reference Noah, Keller, Mosadeghi, Stein, Johl, Delshad and Spiegel2018) revealed that despite growing interest in the use of technology to monitor patients, they could find limited evidence of its ability to improve outcomes.

Some smaller studies on 800 and 500 patients, respectively, have showed negative results, finding that wearing physical activity trackers for 12 months increased their step count, but did not contribute to weight loss, lower blood pressure or improve cardiorespiratory fitness (Finkelstein et al., Reference Finkelstein, Haaland, Bilger, Sahasranaman, Sloan, Khaing Nang and Evenson2016) or were even less effective than traditional weight loss techniques of diet and exercise in assisting with weight loss (Jakicic et al., Reference Jakicic, Davis, Rogers, King, Marcus, Helsel, Rickman, Wahed and Belle2016).

Sustained behaviour change, or healthy habit adoption in customers, is complex and beyond the scope of this paper. However, based on the current evidence, insurers should not pursue wearable health technology with the primary aim of driving change towards healthier behaviours. There is currently insufficient evidence that technology alone can create desirable outcomes in customers or patients. This is not to say that behaviour change is impossible, and that technology does not have a role to play. There is evidence that the novel experience of wearing a device and seeing the personal data for the first time can be motivating and can lead an individual to short-term efforts for healthy change. The challenge is converting these short-term efforts into new healthy habits. Collaboration with a wide range of stakeholders including health professionals, behavioural psychologists and policy makers may be necessary in order to deploy wearable and IoT health technologies to try to more effectively bring about long-term, sustained behavioural change.

6.4.2. Data privacy and willingness of customers to adopt new technologies

Under the General Data Protection Regulation (GDPR), which came into effect in the UK from 25 May 2018 to replace the Data Protection Act 1998, firms will only be able to collect information that is relevant, adequate and not excessive, meaning they will not be allowed to collect categories of data that are not strictly necessary to perform the functions of an insurer. In an environment where insurers and reinsurers need to gather data, but the reasons for doing so might not be clear at outset and might only become clear after behaviours and outcomes are correlated, there are likely to be problems. In practice, insurers will have to build products that require the data without necessarily having the confidence that the impact is fully understood – and then adjust terms as the data become available.

Due to the sensitivity of some of the data associated with wearable tech and IoT-connected devices this will be an area of concern for insurers. While insurers will already have teams and procedures in place to ensure their existing processes comply with all relevant legislation, there may need to be more investment to ensure that new dynamic datasets gathered from wearables are not misused. This will increase the costs of launching and maintaining products that make use of this sensitive and rapidly changing data.

The other key challenge surrounding data privacy is the attitude of consumers. Many customers will be uncomfortable about insurers having access to such a wealth of information about them. A recent YouGov survey found just one in five 18–24-year-olds said they would feel comfortable sharing their date of birth with an organisation they didn’t know. For 45–54-year-olds, this figure was just 8% (ODI, 2018). Findings such as these raise concerns that people may be uncomfortable with allowing access to data points such as GPS data from a wearable tech item, smartphone or black box. Novel product design, higher levels of communication and integrated use of wearables into product design are potential avenues to greater levels of trust and sharing, but this may be a long road requiring the breakdown of multiple paradigms.

Consequently, not only do insurers need to ensure they have tight controls and meet all data privacy regulation, but they also need to communicate and create relationships and trust. To mitigate data privacy risks, they need to ensure that customers are comfortable with what data they are sharing and how it is used. This is likely to be achievable only through reasonable disclosure to consumers to ensure they do not feel deceived about the use of their personal data. Insurers also need to restrict themselves to collecting data they can demonstrate has a link to the product they are providing, is adequate, and not excessive.

6.5. Regulators’ Objectives

To build trust and accommodate the rapidly changing environment, insurers should build products that meet both the letter and spirit of the regulatory environment. In addition to data protection, insurers must consider the requirement to Treat Customers Fairly and comply with the Equality Act. This regulatory environment is likely to tighten as the data available become more prevalent, relevant and accessible.

As regulatory scrutiny increases there may be some limitation on the use of wearable devices or the data gathered from them, in the worst case making them economically unviable. The risk from future regulation should form part of any business case for technology.

“Here’s to the crazy ones. The misfits. The rebels. The troublemakers. The round pegs in the square holes. The ones who see things differently. They’re not fond of rules. And they have no respect for the status quo. You can quote them, disagree with them, glorify or vilify them. About the only thing you can’t do is ignore them. Because they change things. They push the human race forward. And while some may see them as the crazy ones, we see genius. Because the people who are crazy enough to think they can change the world, are the ones who do.”

Apple Inc.7. Future Technological Developments

To give a glimpse as to what the future might bring, this section considers several potential technological developments – both cutting-edge technology that is available now that could become mainstream and widespread in future and new technology still in the research phase. It also considers the potential risks and opportunities that future developments could bring for insurers.

7.1. New Types of Device, Measurement and Engagement

As previously discussed in section 3, the wearable device market has, to date, been largely focused on devices that capture physical and biometric information such as activity levels, sleep metrics, heart-related information and blood sugar levels.

The future, however, holds even greater promise and more profound health metric availability with the potential to:

a. Track and analyse emotional states, via;

Voice patterns (Beyond Verbal)

Brainwave activity (Emotiv)

Electrodermal activity (The Pip)

Breath analysis (Spire)

b. Obtain information about physiological performance and dysfunction from analysis of molecular biomarkers from sweat – derived from eccrine glands in human skin. These measures can be directly correlated with blood biomarkers (Eccrine Systems)

c. Brain–computer interfaces that will potentially allow brain signals to be directly merged with computers.

7.2. Tracking Emotional States

Affective computing (also known as artificial emotional intelligence) attempts to recognise and interpret human emotional states. Companies such as Beyond Verbal do this via the voice, whereas companies such as Affectiva, Realeyes and Sticky use camera-based systems to deliver consumer emotional responses to digital content.

Although Realeyes’s system has been used by household names such as Heineken, LG and Twix for advertising and marketing purposes, the technology is not yet mainstream. However, the ability to track facial expressions using a suitable camera is easily demonstrated via the iPhone X animoji, and Facebook (with some 1.56 billion daily active users on average for March 2019 (Facebook, 2018)) has patented technology that would allow user emotions to be tracked using cameras, keyboard movement and touchpad gestures (Silver, Reference Silver2017). It is easy to imagine how this technology could be widespread in future.

7.3. Brain–Computer Interface

Facebook also has plans to go beyond tracking emotional states and has announced its aim to develop technology that directly reads users’ thoughts (Constine, Reference Constine2017). Details on how Facebook plans to achieve this are scant, but brain–computer interfaces already exist in some forms. For example, prosthetic limbs with movement controlled by thought have been available since at least 2015 (Murphy, Reference Murphy2015).

Facebook is not the only company looking to achieve this. Companies such as Kernal, Openwater, CTRL-labs and Elon Musk’s Neuralink are all looking to build technology to interface with the human brain.

Modius Health claims to aid weight loss via stimulation of the brain’s hypothalamus. There are also various start-ups involved in this area at present. Perhaps the most high-profile company is Elon Musk’s neurotechnology company, Neuralink, which has the stated aim to make devices to treat serious brain diseases in the short term, with the eventual goal of human enhancement.

7.4. Exoskeletons

One potential use case for a brain–computer interface is to control a bionic suit using thought, which among other things could restore the ability to walk in patients with spinal cord injury.

There are “exoskeletons” without the brain–computer interface that is already available from companies such as SuitX, Hyundai, Ekso Bionics, ReWalk Robotics and others.

One company, Cyberdyne, maker of a lower-body exoskeleton that works by detecting bioelectric signals sent from the brain to the muscles – a form of brain–computer interface – has just received FDA marketing approval in the US.

Other developments in “wearable” technology that aim to support human physical capabilities include:

smart underwear that is being developed as a potential solution to back pain, a major cause of work-related sickness absence; and

a “chairless chair” that has been developed by noonee that aims to provide support to anyone required to stand for prolonged periods of time in an environment (e.g. manufacturing) where using a traditional chair may not be possible.

7.5. Nano Implants for Humans

It sounds like science fiction and indeed has been used in many a Sci-Fi film; however, implants for humans are already a reality. The ability of chip implants to start tracking and measuring health stats on a large scale is closer than we think, potentially within the next 10 years.

Similar to micro chipping your cat or dog, a tiny implant is embedded under the skin. A digital hub in Sweden has already offered microchips to employees of the start-up companies based there, and people did volunteer. The chips allow employees to unlock doors, operate printers, open storage lockers and even buy smoothies with the wave of a hand (McGregor, Reference McGregor2017).

The evolution of this type of technology to capture biometric data provides endless possibilities in the health and medical space which, because it is involuntary and therefore frictionless, will be more accurate and reliable than say wearables. (Williams, Reference Williams2017)

“Everything is designed. Few things are designed well.”

Brian Reed8. Considerations for the Future of Insurance

How might developments in wearable technology affect the future of insurance? Consider three questions:

How might future innovations affect insurers?

What could this mean for the future of insurance?

Will we see evolution or revolution due to the quantified self?

8.1. How Might Future Innovations Affect Insurers?

From the consumer’s perspective, future innovations in wearable technology may appeal to groups that do not currently use wearables, thereby expanding the potential insurance applicant pool with wearable data available.

Future innovations make it more likely that a health condition may be discovered by the individual, potentially increasing information asymmetries between the individual and an insurer. If the individual is currently uninsured, the discovery of this information may lead to the purchase of insurance to cover that condition, particularly if the insurer’s disclosure requirements do not cover wearable data. In this way, future innovations have the potential to increase anti-selection risk, especially for living benefits products making payments on diagnosis of specified conditions.

Alternatively, future innovations may have the potential to have a positive impact on experience from currently insured individuals. If an innovation makes it more likely that an unknown health condition is discovered, the individual may be less likely to behave in a way that would be detrimental to that condition. Indeed, the individual may go further and may seek medical treatment or actively manage his or her condition, both of which could have a beneficial impact on the experience of an insured group, although there is limited evidence that this would be the case.

From the insurer’s perspective, future innovations may make it more attractive to incorporate wearable data into marketing, underwriting and claims processes, as well as bringing pricing and product development opportunities, tipping the balance between benefits these data may bring compared to the associated costs and expertise required to source and analyse the data. Insurers can also combine these new data with traditional data sources to build a richer picture of the customer that can benefit both parties in multiples ways.

There may be potential for new marketing opportunities, distribution channels and rating factors by tapping into innovations that generate new wearable ecosystems linked to a particular device, be-it sensors, social networks or an algorithm for turning sensor-level data into actionable insights. It also may allow the possibility of writing new products that provide insurance where conditions need to be demonstrably managed. The opportunities for post-issue underwriting and the identification of non-disclosure could also expand.

Even if an insurer is not actively selling or planning to sell wearable-linked insurance, it would do well to monitor developments in the wearable space to keep abreast of what conditions can and cannot be identified with reasonable accuracy by both consumer-grade and medical-grade wearables. As this space develops, and an increasing number of conditions can be identified with increasing accuracy using wearables, such insurers would benefit from considering:

how each innovation may affect anti-selection risk;

how information asymmetries could be minimised by incorporating wearable-linked questions into their application process;

the costs and benefits of promoting the uptake of wearable innovations among their current insured portfolio, together with the behavioural expertise required to do so successfully.

Wearables offer increased knowledge and understanding about biometric risks and behaviour, enhancing insurers insight of the individual beyond reported conditions and claims. The relationship between biometric risks and claims is already reasonably well understood, as risk indicators are valued by the medical community as markers and precursors of the onset of disease.

Behaviour is an emerging area of interest and is now understood to be a driver of rising rates of non-communicable diseases. As it stands today, insurers have limited skills in changing behaviours, and customers would feel unease if their insurer started overtly engaging with a view to modifying their daily actions. However, it is in the interests of both parties that this be resolved, and it is possible that evolution along these lines will happen over the next few years.

8.2. What Could This Mean for the Future of Insurance?

The insurance industry is unlikely to drive the widespread adoption of wearable technology, but is increasingly likely to be the user of such wearable data, metrics and insights.

Insurers are likely to eventually find themselves in a position where sufficiently accurate and reliable wearable data are available for analysis as part of writing insurance policies, and the unknown is whether the insurer will be able to make use of this information. If some insurers can and others cannot, what will be the impact on the insurers that cannot?

The insurers best placed to use wearables within their businesses will have:

access to substantial volumes of sensor-level data, with long follow-up periods,

rich phenotypic information on their customers,

detailed data on health outcomes and

possibly even a social network.

They will also have access to the skills and expertise required to analyse these data and convert it to actionable insights and will be device agnostic. They will probably make use of behavioural science expertise. Each of these is a non-trivial requirement that may require substantial investment to achieve.

Looking to the future, what is the best way of obtaining these data and expertise? Some insurers have already obtained access to data directly through offering wearable-linked insurance. These policies may offer evidence-backed reductions on risk premiums for demonstrating healthy behaviours, or they may simply offer a nominal reduction because the primary purpose is data acquisition.

Some insurers are investing in their research and data analytics capabilities and bringing the expertise to analyse wearable data in-house.

For insurers doing neither of these things, there is the option to partner with third parties – such as device manufacturers, data aggregators and analytics companies – to obtain access to the necessary data and expertise.

It is important to recognise that those best placed to use wearable data successfully may lie outside of the current insurance industry. We may see new technology and data analytics companies enter the insurance industry: companies that are more agile than traditional insurers and who think about risk in a different way, and who may already have the data and expertise in wearables. Would it be easier for a tech-savvy aggregator of data to learn about insurance, or for an insurer to learn about wearable data? It is likely that the successful insurers of the future will be able to do both.

8.3. Revolution or Evolution Due to the Quantified Self?

Wearable technology in some form has been available for many years, although most commentators would say that it was not until around 2013 that the wearable market really took off with the explosion in wrist-borne wearable devices.

While there had been a lot written during this time about the potential for wearable technology to revolutionise the insurance industry, it is fair to say that progress so far has been evolutionary rather than revolutionary. The metrics available from wearable devices to date, maybe due to a lack of accuracy or actionable insight, have failed to live up to the hype.

What would be the game-changing innovation – what metric or actionable insight would lead to a revolution in the insurance industry? Automatically monitoring food intake? Detecting serious illness and disease before traditional symptoms appear? Monitoring emotions?

Who knows?

Until then, perhaps the most likely scenario is a continuation of the slow evolution, maybe until a game-changing innovation is developed, either of the technology itself or of the models that are used to interpret the data. This would doubtless be followed by a scramble not to be left behind as forward-thinking insurers and innovative tech-savvy new entrants take advantage.

But it is on the horizon. The mainstream take-up of increasingly accurate and innovative wearable devices will be driven by forces outside of the insurance industry. It may take some time yet, but it will come eventually. Insurers need to monitor this space and, when the time comes, be ready, willing and able to incorporate wearable data into all aspects of their businesses.

“Technological progress has merely provided us with more efficient means for going backwards.”

Aldous Huxley9. Conclusion