1. INTRODUCTION

The United States (US) and Germany are both constitutional nation-states with long, centuries-old federal traditions.Footnote 1 Comparative federalism scholarship has identified not only commonalities, but also significant differences in the structural relations between the federal government and the states in both legal orders.Footnote 2 In the energy sector, over the course of the 20th century both countries developed similar patterns of energy generation and supply with a mix of energy sources dominated by fossil fuels such as coal, mineral oil, and natural gas, as well as nuclear energy. Moreover, both countries were early movers in promoting renewable energy (RE) generation. In the US, federal laws promoting RE were enacted as early as 1978. In Germany, the Federal Electricity Feed-in Act of 1990 established a nationwide support system to give incentives for RE technologies and guarantee access to the electricity grid.

Despite these important historic parallels in the early promotion of renewable sources of energy, the general division of authority in Germany and the US between federal and sub-federal governments differs significantly. While Germany's federalist system has strong unitary features and delegates legislative authority mostly to the federal government,Footnote 3 the US (despite many aspects of centralizationFootnote 4) has retained many features of ‘dual federalism’Footnote 5 with much broader legislative authority for the states.

Against this backdrop, this article explores and compares the relevance of federal legal structures for RE expansion in Germany and the US. Following this introduction, Section 2 sets out the legal and factual foundations of energy federalism in Germany and the US, including the constitutional framework (particularly the basic principles of federal jurisdiction over the energy sector), the core statutes, and important structures of energy infrastructure – namely, the electricity grids. Section 3 explores in detail the legal and empirical dimensions of the processes of RE expansion in Germany and the US at both the federal and the state levels. Based upon the varying national experiences with RE expansion, Section 4 draws five comparative lessons about the significance of federal structures for energy transition processes in federal legal orders.

2. ENERGY FEDERALISM IN GERMANY AND THE UNITED STATES

The Federal Constitution of Germany (Grundgesetz) grants broad federal authority for legislation in the energy sector. Historically, the most important title is Article 74.1.11, which authorizes federal legislation on ‘matters of the energy industry’ (Energiewirtschaft). Since the early days of the Grundgesetz of 1949, this title has served as the basis for the Federal Energy Industry Act (Energiewirtschaftsgesetz (EnWG)).Footnote 6 The EnWG consists of rules on very different aspects of the energy sector, including the foundation of energy supply as a service of public interest, regulation of energy prices, and planning and realization of grid lines.

The EnWG also sets the legal framework for the German electricity grid. The national high-voltage grid is run by four transmission system operators, which are formally companies under private law. Each of these four companies operates the extra-high-voltage grid in a particular territory of Germany: 50Hertz operates in a plurality of states in the German east; TenneT in a north-south corridor from the shoreline bordering the North Sea through Hesse to Bavaria; Amprion in Rhineland-Palatinate and large parts of North-Rhine-Westfalia in the German west; and Transnet BW in the German southwest.

The Grundgesetz also grants exclusive federal jurisdiction for legislation on the civil deployment of nuclear energy (Article 73.1.14) and authorizes federal legislation on air pollution control (Article 74.1.24). Thus, the federal legislature is responsible for choosing between different energy sources and the basic structures of energy generation and supply. A particularly significant emanation of the federal prerogative over the states was the decision to phase out nuclear energy in 2000–02, which was based on negotiations between the government and enterprises (the so-called ‘nuclear consensus’). The German Federal Constitutional Court dismissed a challenge to the exclusion of states from the negotiations.Footnote 7 The gradual phasing out of coal over the next two decades – negotiated by the federal government in 2019 in a political process that involved the states with significant representation from the mining industryFootnote 8 – will be implemented by federal legislation (at the time of writing the legislative process is still ongoing).

In addition to the ‘internal’ federal structure of the Federal Republic of Germany, there are the ‘external’ supranational legal structures of the European Union (EU).Footnote 9 Germany is the largest Member State of the EU and thus is subject to a multitude of relevant EU laws. Member States have granted broad powers to the EU to legislate in the energy sector, as confirmed in Article 194 of the Treaty on the Functioning of the European Union (TFEU).Footnote 10 Since the early 1990s, the EU has enacted several packages of directives which have heavily influenced and (to various degrees) reshaped the energy sectors in the Member States, such as through the liberalization of energy markets and the unbundling of utility companies and grid operators.Footnote 11 Since 2015, the EU has pursued the concept of the ‘EU Energy Union’, which aims towards a plurality of goals, including decarbonization of energy sources, in light of international efforts on climate change mitigation, energy security, efficiency, affordability, and economic competitiveness.Footnote 12 This concept informed a series of far-reaching legal acts in the energy and climate change sectors, including an overhaul of the EU Directive on the Emissions Trading System (EU ETS Directive),Footnote 13 the new RE Directive (RED),Footnote 14 the new Effort Sharing Regulation (which allocates decarbonization commitments of EU Member States in non-ETS sectors),Footnote 15 and the new Governance Regulation for the Energy Union and Climate Action. The last enactment establishes additional procedural duties for Member States including a requirement that 10-year ‘integrated national energy and climate plans’ be submitted to the EU Commission.Footnote 16

In contrast to the centralized approach to energy governance in Germany, state governments in the US have primary jurisdiction over many aspects of energy production and delivery. Congress derives its authority to govern energy production and delivery from the Commerce Clause in Article I.8.3 of the US Constitution. This provision states that Congress may ‘regulate commerce … among the several states’,Footnote 17 which the US Supreme Court has recognized applies to multistate electricity systems.Footnote 18 In theory, therefore, Congress could be the sole decision maker for many aspects of the electricity system but it has chosen to respect the historical role of state governments in electricity governance.Footnote 19

Federal oversight of the electricity sector focused initially on hydroelectric facilities pursuant to the jurisdiction of Congress over navigable waterways.Footnote 20 In 1927, the US Supreme Court determined that the Commerce Clause prohibits states from regulating interstate electricity sales.Footnote 21 Because the federal government had not enacted laws governing such transactions and the Constitution prevented states from doing so, these interstate sales were not subject to government oversight.Footnote 22 Congress responded in 1935 by enacting the Federal Power Act (FPA), which continues to define federal and state jurisdiction over electricity sales.

The FPA requires the Federal Energy Regulation Commission, or FERC (originally named the Federal Power Commission), to ensure that interstate wholesale electricity transactions are ‘just and reasonable’.Footnote 23 Congress later granted FERC limited authority to site interstate electricity transmission lines, but courts have interpreted FERC's authority so narrowly that the federal government rarely plays a role in transmission siting.Footnote 24

With a few notable exceptions, the federal government does not directly control electricity generation.Footnote 25 States retain their historical authority over the siting of power plants and in-state transmission, local distribution, and retail electricity rates.Footnote 26 States may use their ratemaking authority, siting and permitting laws, tax laws, and environmental and public health laws to directly influence the state's energy mix. State governments may also ban the construction of certain types of electricity generation (such as California's ban on new nuclear power plants or North Carolina's recently expired ban on new utility-scale wind farms), and certain types of energy production (such as New York's ban on hydraulic fracturing to extract natural gas and oil).

Other federal energy laws strike a different balance between federal and state authority. The Natural Gas Act, for example, grants FERC authority to site interstate natural gas pipelines.Footnote 27 States may incentivize the construction and operation of nuclear power plants, but the federal Nuclear Regulatory Commission issues operating licences and governs nuclear reactor operations.Footnote 28 There are also numerous federal and state policies to incentivize energy technologies through grants, tax credits, and government-funded research.Footnote 29 US Congress has debated implementing a federal renewable portfolio standard pursuant to its Commerce Clause authority, but thus far federal legislators have not adopted the proposals.Footnote 30

Federalism in the electricity sector, then, has different impacts across the country depending upon three factors: (i) whether a state's electricity system is connected to a multistate grid; (ii) the makeup of a state's electricity generation mix; and (iii) the structure of a state's electricity market. Firstly, the US has three large electricity grids. Two of these grids – the Eastern Interconnect and the Western Interconnect – are multistate networks.Footnote 31 Wholesale transactions in these states are therefore subject to FERC oversight. The third – ERCOT– is located entirely within Texas and thus is not subject to FERC oversight as a result of limited interstate connections.Footnote 32

Secondly, the electricity generation mix differs among the states, depending in part on the resources available and in part on state energy policies. Utilities in many states in the eastern and midwestern US depended heavily on coal-fired generation. States in the Pacific Northwest continue to rely heavily on hydropower. The majority of utility-scale wind generation is located in the Midwest. Nuclear generation is located primarily in the eastern US but support for nuclear power is not uniform. Over half of the states have enacted renewable portfolio standards (RPSs) to require utilities to include specific percentages of RE in their respective electricity mixes, but these also vary by state. Federal policies affecting a particular energy resource, such as coal or wind generation, therefore have different impacts across the country.

Thirdly, the majority of US states rely on vertically integrated monopoly utilities to manage their own system operations. State agencies set retail electricity rates for the monopoly utilities and oversee the utilities’ long-term planning. In other states the monopoly utilities and other power plant owners participate in organized regional electricity markets that are managed by independent operators – known as regional transmission organizations (RTOs). State utilities commissions in these states may oversee retail sales, but the wholesale transactions are governed by the RTO rules and subject to federal oversight. Opting into an RTO can help to manage wholesale electricity prices and take advantage of economies of scale for reserve capacity and new transmission investments, but it also requires state governments to cede some control over transmission investments and related cost allocation.

The ‘bright line’ between federal and state jurisdiction remains relatively intact in states which maintain traditional electric utilities that control electricity generation, transmission, and retail sales within their territories. State energy policies for utilities that do not participate in RTO markets are relatively immune from federal interference. Conflicts over federal and state authority are increasing in RTO markets, however, as FERC and some RTOs consider changing their auction rules to reduce the impact of state energy subsidies on the RTO markets.Footnote 33

Two recent US Supreme Court cases demonstrate the challenges with the Federal Power Act's distinction between retail and wholesale markets. In FERC v. EPSA, the Court considered whether ‘demand response’ (compensating certain customers for reducing energy consumption during periods of high demand) qualified as wholesale or retail transactions, and thus whether FERC had authority to specify compensation for demand response products in RTO markets.Footnote 34 The Supreme Court concluded that FERC's authority over practices that ‘directly affect’ wholesale markets was sufficient to establish jurisdiction over RTO demand response transactions.Footnote 35 In Hughes v. Talen, the Court considered a Maryland law that subsidized the construction of a new natural gas-fired power plant in the state.Footnote 36 Maryland's electricity sector is restructured and the state's electricity providers participate in an RTO. The state law determined the amount of the subsidy based on the RTO capacity market clearing prices.Footnote 37 The Supreme Court found that this direct link amounted to Maryland attempting to govern interstate wholesale electricity transactions – a realm exclusively reserved for FERC.Footnote 38

Interpreted broadly, these two cases could allow a significant expansion of federal jurisdiction under the existing Federal Power Act, potentially having an impact upon state RE policies. Subsequent decisions by lower courts have limited the reach of the cases by upholding new state subsidies for nuclear power plants that are at risk of early retirement because they are uncompetitive in RTO markets.Footnote 39 Jurisdictional uncertainty remains, however, and it is unclear whether FERC will exert more influence over RTO market rules.

3. RENEWABLE ENERGY EXPANSION IN GERMANY AND THE UNITED STATES

3.1. Germany

Federal renewable energy policies

Just as the Constitution assigned far-reaching legislative authority in the energy sector to the federal level, the core legislation of RE expansion was enacted as federal legislation. The first federal statute with a national support scheme for RE was the 1990 Electricity Feed-in Act (Stromeinspeisungsgesetz (StrEG)), based on Articles 74.1.11 and 74.1.24 of the Grundgesetz.Footnote 40 In the German electricity mix at that time, hard and brown coal (mostly extracted from domestic sites) accounted for about 50%, nuclear energy for about 30%.Footnote 41 Hydropower, the only relevant RE technology at the time, accounted for under 5.4% of electricity production. The US Public Utilities Regulatory Policy Act (PURPA) of 1978Footnote 42 served as a source of inspiration for deliberations on RE support legislation in the German Federal Parliament in the 1980s, although the instruments eventually implemented in the StrEG were different.Footnote 43 The StrEG 1990 established a model of technology-specific feed-in tariffs (FITs) for renewable energies and an obligation to purchase for the corporate energy providers. The StrEG established a unitary support scheme with equal support conditions for all of Germany.Footnote 44 Statistically, the 1990s witnessed a moderate expansion of RE: in 2000 it contributed about 6.5% (including hydropower) of national electricity production.Footnote 45

Renewable energy expansion under the Renewable Energy Sources Act (EEG) 2000

The StrEG paved the way for the Renewable Energy Sources Act (Erneuerbare-Energien-Gesetz (EEG)), which was enacted as a federal statute in 2000, again based on Articles 74.1.11 and 74.1.24 of the Grundgesetz.Footnote 46 At the time, the goal of RE expansion gained broad political support based on the need to replace the fading capacities of nuclear energy in the German electricity mix. Since then, the EEG has remained the core statute of RE policy in Germany, despite many textual and conceptual changes.

As a legal instrument of technology promotion in the RE sector, the EEG 2000 aimed to stimulate private investment in RE installations through long-term price guarantees that would compensate for the gap between the generation cost of RE and actual electricity market prices. Thus, the EEG combined several investment-oriented features, including technology-specific FITs, long-term (20 years) compensation periods, guaranteed access to the electricity grid, and priority grid access over conventional (fossil) fuels.Footnote 47

The EEG established a specific surcharge mechanism to refinance the payments guaranteed to the investors in RE. Each year the amount of the EEG surcharge is determined on the basis of the difference between the overall amount of the guaranteed FITs and the relative market price at the energy exchange, and passed along to energy consumers as a surcharge to each unit of electricity (ct/kwH). With the expansion of RE the EEG surcharge increased to 3.59 ct/kwH in 2012 and about 6.5 ct/kwH in 2014 and the following years.Footnote 48 The EEG grants broad exemptions from the EEG surcharge to energy-intensive industries; these exemptions address the international competitiveness of the German economy and the problem of carbon leakage.

Conceptual changes: From FITs to market premiums and bidding processes

The 2014 and 2017 revisions of the EEG brought far-reaching conceptual changes.Footnote 49 With these revisions the German federal legislature aimed to limit the rising costs of energy transition, reflected in the increasing EEG surcharge, in the interests of both consumer electricity bills and the international competitiveness of German industries.Footnote 50 An additional goal was adjustment to changing market dynamics. The enormous scale of global investment in RE, technological progress in the efficiency of RE installations, and the emergence of mass production capacities in Asia have led to massive reductions in RE production and installation costs. The cost of each kwH of wind and photovoltaic energy is significantly lower than in the early 2000s. Perhaps most significantly, the production cost of electricity from freestanding photovoltaic installations has dropped by almost 80% between the early 2000s and 2016.Footnote 51

Moreover, the 2014/2017 reforms of the EEG answered to increased pressure in EU competition law in favour of a more market-oriented system of RE support. The EU Commission conceived of the German RE support scheme as a national subsidy with negative protectionist effects on the EU energy market which had to be justified under the rules of EU state aid law according to Articles 107–109 TFEU. The Commission Guidelines on State Aid for Environmental Protection and Energy 2014–20Footnote 52 articulated a set of market-oriented conditions for RE aid schemes in EU Member States. A de minimis rule applies for smaller installations. The EU judiciary has sent mixed signals. In 2016, the European General Court – formerly the Court of First Instance – sided with the EU Commission.Footnote 53 In 2019, the European Court of Justice reversed the judgment and held that the support scheme of the EEG 2012 did not constitute state aid in the sense of Articles 107–109 TFEU.Footnote 54 The 2019 judgment clearly increases the leeway for Member States in the design of national RE support systems as a matter of EU primary law. The practical effects, however, remain limited, because the generally market-oriented approach of EU law has more recently also been entrenched in EU secondary law, which is equally binding on Member States. The recently enacted EU Renewable Energy Directive requires that RE support schemes in Member States ‘shall provide incentives for the integration of electricity from renewable sources in the electricity market in a market-based and market-responsive way’.Footnote 55

The influence of EU RE policy is clearly visible in the 2014/2017 EEG amendments. The former standard instrument of RE support, long-term FITs, was largely replaced. As an instrument of market integration, electricity from RE sources was generally to be sold directly on the electricity market.Footnote 56 The support scheme changed to a system of bidding processes and market premiums. As confirmed in § 2 Sec. 3 Sent. 1 EEG 2017: ‘The level of payments for electricity from renewable energy is to be determined by auctions’. At such auctions the competent authority (the Federal Network Agency) would propose the payment of market premiums in return for the production of a certain quantity of RE electricity. The market premiums would then be awarded to the lowest bids until the quantity is met. Guaranteed FITs became the exception to the rule and were limited to the support of small RE installations, such as rooftop solar panels on private homes.Footnote 57 A similar market-oriented support scheme has been introduced into the legal framework for offshore wind energy.

For future RE expansion the EEG 2017 contains ambitious goals. The share of RE in gross electricity consumption will be increased to 40–45% by 2025, to 55–60% by 2035, and to at least 80% by 2050.Footnote 58 For the key RE technologies, § 4 EEG 2017 establishes a so-called ‘development corridor’:

1. an annual gross new-build of onshore wind energy installations with an installed capacity of a) 2,800 megawatts [(MW)] in 2017 to 2019 and b) 2,900 MW from 2020;

2. a rise in the installed capacity of the offshore wind energy installations to a) 6,500 MW in 2020 and b) 15,000 MW in 2030;

3. an annual gross new-build of solar installations with an installed capacity of 2,500 MW; and

4. an annual gross new-build of biomass installations with an installed capacity of 150 MW in 2017 to 2019.Footnote 59

The different amounts also express a ranking of the RE technologies. In effect, the EEG 2014/2017 narrowed the focus of RE expansion on wind and solar energy and left only a minor role for biomass.

Interim results: Renewables rise to almost 40% of overall electricity consumption (2018)

From an overarching perspective the RE expansion strategy of the EEG 2000 was very successful. From 2000 to 2010 the share of RE in overall electricity consumption tripled from about 6% to 17%; by 2018 it had increased steadily to 37.8%.Footnote 60 The various RE technologies contribute very differently to the overall amount. The single most important technology is onshore wind energy (40.9%). Offshore wind contributes 8.6%; photovoltaics 20.5%; and biogas/biomethane 14.2%.Footnote 61

Differentiation at the state level: A significant north-south divide

However, there is very significant differentiation at the state level. This is particularly true for onshore wind energy, the single most important RE technology. In absolute quantity of installed wind energy capacity the leading states (as of 2017) are located in the north, northwest and northeast of Germany – namely, Lower Saxony, Schleswig-Holstein, Brandenburg, North Rhine-Westfalia, and Saxony-Anhalt (Figure 1). The dominance of the north is bolstered by the increasing wind energy offshore capacities in the North Sea and in the Baltic Sea. A southwestern state with a voluminous quantity of installed wind energy capacity – given the relatively small territory of the state – is Rhineland-Palatinate. The large territorial states in the south, Baden-Württemberg and Bavaria, lag significantly behind (Figure 1).

Figure 1 Renewable Energy Installations in the German States

Sources: Bundesverband WindEnergie, ‘Die deutschen Bundesländer im Vergleich’, 31 Dec. 2019, available at: https://www.wind-energie.de/themen/zahlen-und-fakten/bundeslaender; Agentur für Erneuerbare Energien e.V. (ed.), ‘Bundesländer mit Neuer Energie: Statusreport Föderal Erneuerbar 2019/2020’, Dec. 2019, p. 197.

Bavaria and Baden-Württemberg, however, are the leading German states in solar energy installation and RE from biomass facilities. Bavaria and Baden-Württemberg account for almost half of the photovoltaic installations in the whole of Germany (Figure 1). Still, given the significantly higher overall amount of wind energy, the endeavours of the southern states in photovoltaics do not make up for the overall lead of the northern states in RE expansion because of the onshore wind energy installations in those states. As a consequence, southern Germany was hit particularly badly by the retirement of nuclear power plants (and will similarly be hit in the 2020s and 2030s by the closure of coal-fired plantsFootnote 62) because of the lack of immediate regional RE electricity capacities to substitute for the emerging gap in electricity supply.

The gap between north and south in RE generation is particularly obvious on a per capita basis. In 2018, the leading states in per capita electricity generation were Schleswig-Holstein (7,818.3 kWh), Brandenburg (7,338.6 kWh) and Mecklenburg West Pomerania (7,067.5 kWh). Given that the overall annual per capita electricity consumption in Germany levels at around 7,000 kWh per year,Footnote 63 RE generation in these states already exceeds the average German per capita consumption rate. To the contrary, states with much lower annual per capita generation like North Rhine Westfalia (1,104 kWh), Baden-Württemberg (1,487.9 kWh), and Bavaria (2,871.7 kWh) are far from self-sustaining RE production.Footnote 64

Reasons for state differences

There are several reasons why RE production varies across the 16 German states.

Firstly, geographical conditions play an important role. This is particularly true for wind energy on land. In the urban environment of the three German ‘city states’ (Berlin, Hamburg, and Bremen) there is insufficient territory available to build wind energy facilities in significant quantity, regardless of the regional wind conditions.

For the 13 German ‘territory states’ (Flächenstaaten) the regional wind conditions are a relevant factor. Wind energy experts divide Germany into four wind zones. Wind zone IV – the zone with the best wind conditions – covers only a small fraction of German territory, mostly along the shoreline bordering the North Sea.Footnote 65 Wind zone III covers ‘sites near the coast’ (also only a small fraction of the German territory at large) located in Schleswig-Holstein, Lower Saxony, Mecklenburg-West Pomarania, and Brandenburg). Wind zone II (‘typical inland sites’) and wind zone I (‘low profile wind energy sites’) make up most German territory, particularly in the German south and southwest (Hesse, Bavaria, Baden-Württemberg).Footnote 66 All else being equal, wind energy investments are more lucrative in the German north and northeast than in other parts of Germany. This ‘natural advantage’ explains the leading role of Schleswig-Holstein, Lower Saxony, Mecklenburg-West Pomarania, and Brandenburg in wind energy.

Secondly, law and policy at the state level also play a significant role. A particularly important tool is land designation for RE (which prioritizes RE land use over competing interests). The state approaches vary and express different degrees of favourability vis-à-vis RE. For example, while some states require a minimum distance of only 800 metres between a wind energy facility and the nearest residence in a specific type of planning zone (Rhineland-Palatinate),Footnote 67 the minimum distances in other states are significantly greater. In 2014, the state of Bavaria implemented the so called ‘10 H Rule’ in the Bavarian building code. It requires a minimum distance of ten times the height of the wind turbine to the next residence.Footnote 68 Because the average height of effective wind turbines in Bavaria is about 200 metres, the practical effect of this rule has been an almost complete end to new wind turbines in Bavaria.Footnote 69 In 2018, the state government of North Rhine-Westfalia introduced a regular minimum distance of 1,500 metres between wind energy facilities and housing areas.Footnote 70

Political science research has examined the motives of state governments in enacting minimum distance rules at the lower end of the range. On the one hand, there are economic motives.Footnote 71 Local governments in the states with large shares of RE/wind-energy tend to emphasize the economic benefits of RE in terms of local RE industries, job growth, and similar. In states in which the economy is developing below the average gross domestic product (GDP) of German states, state governments tend to promote RE as a tool of economic modernizationFootnote 72 as, for example, in Mecklenburg-West Pomerania, Brandenburg, and Lower Saxony. On the other hand, there are examples of ecologically driven wind energy expansion at the state level. In the state of Rhineland-Palatinate, for example, the involvement of the Green Party in the state government could be identified as the main cause of a particular significant period of wind energy expansion after 2011.Footnote 73

Thirdly, the 2014/2017 changes in the RE support system from FITs towards market-orientation and auctioning has widened the gap between RE in north/northeast Germany and the south, as a result of the particular design of auctioning conditions. Between 2010 and 2017 about 20% of new wind energy capacity had been installed in the south (south of the river Main), and about 80% in the north. However, in the first four bidding procedures for wind energy conducted by the BNetzA in 2017 and 2018 the share of EEG-supported wind energy installations from northern Germany increased to about 90%, while the share of the south dropped to about 10%.Footnote 74

3.2. United States

Federal renewable energy policies

There is no coordinated national RE policy in the US, and the future trajectory of RE growth will depend on a complex interaction between various state policies, electricity market rules, and shifting federal priorities. Divergent views about the role of RE in the US electricity sector are on stark display with the diametrically opposed approaches to energy and environmental protection between the Obama and Trump administrations. President Trump famously supported subsidies for coal and claimed that climate change is a hoax. Nonetheless, generation from renewable resources is projected to expand in the coming years and numerous US states announced that they will take steps to contribute to the US commitments under the Paris AgreementFootnote 75 despite the Trump administration's withdrawal plans.Footnote 76

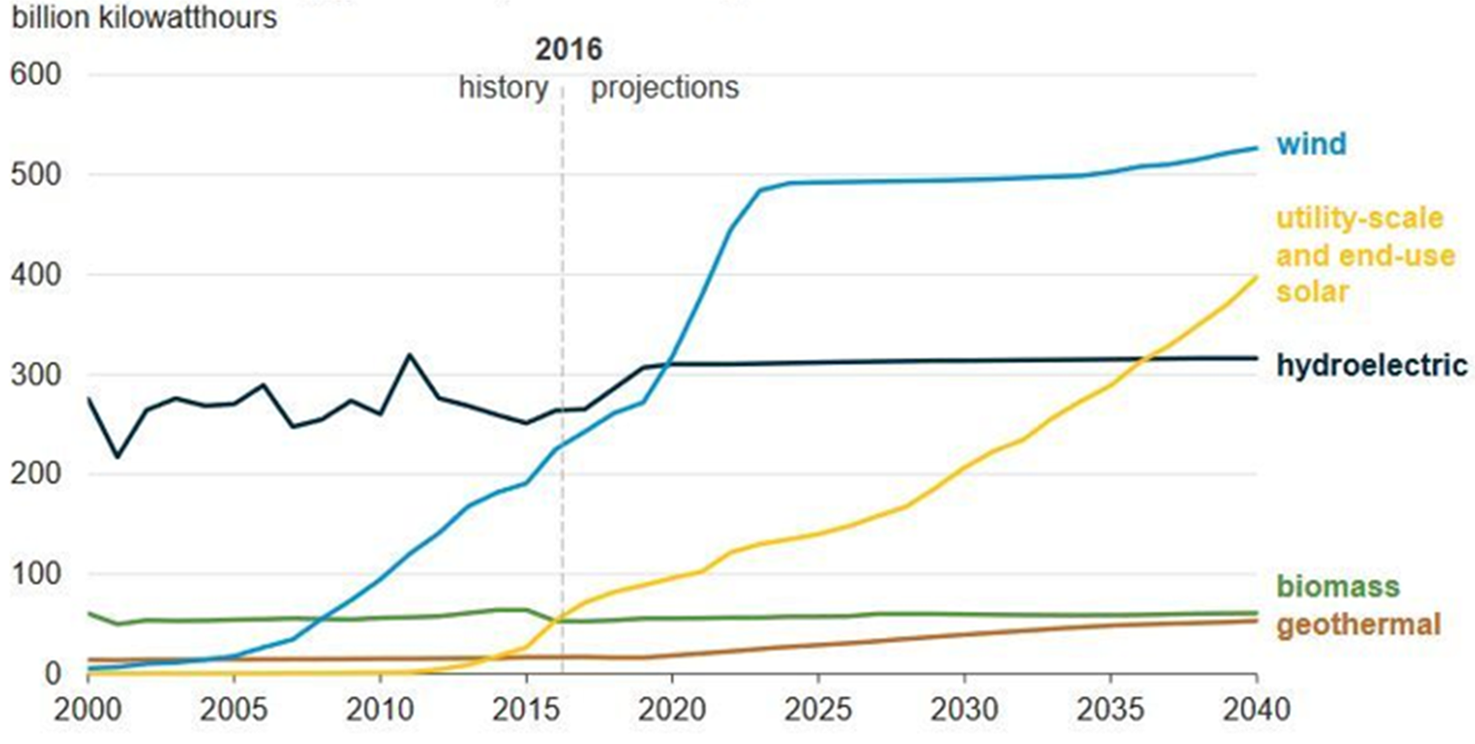

Like Germany, RE in the US has increased rapidly since 2010 as a result of a combination of favourable policies and falling prices. RE resources accounted for 18% of total electricity generation in 2018, up from 10% in 2010.Footnote 77 Hydropower accounts for approximately 7% of the total US energy mix.Footnote 78 The remainder of US electricity generation was provided by natural gas (34%), coal (28%), and nuclear (19%).Footnote 79 As Figure 2 demonstrates, hydroelectric power was the dominant RE resource historically, but generation from hydro is not expected to increase. In contrast, wind and solar energy have increased steadily, and the US Energy Information Administration projects that wind will be the dominant RE resource between 2020 and 2050. In April 2019, RE generation surpassed coal-fired generation for the first time.Footnote 80

Figure 2 US Renewable Energy Generation (History and Projections)

Source: US Energy Information Administration, ‘Annual Energy Outlook 2017’, available at: https://www.eia.gov/aeo.

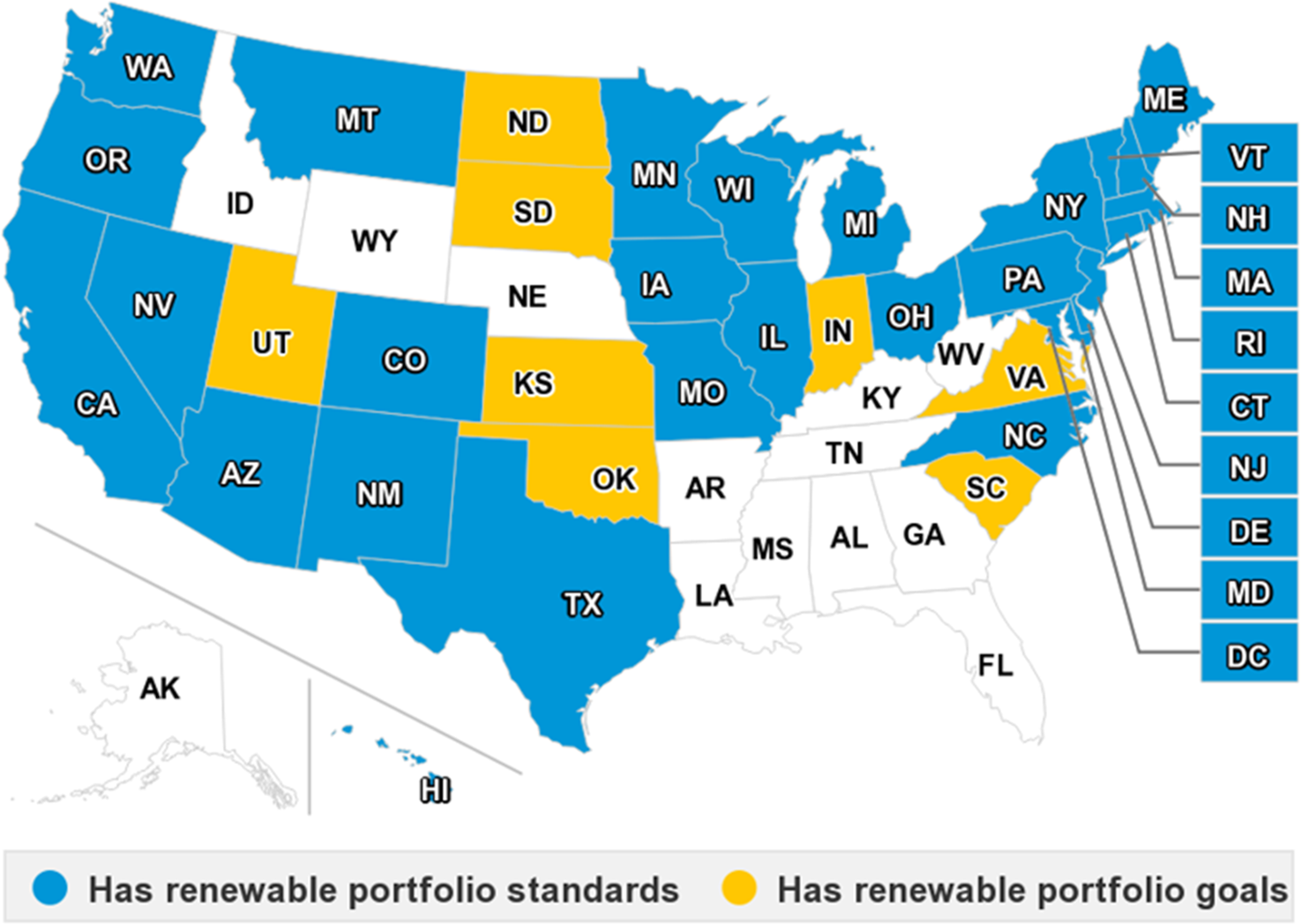

Figure 3 States with Renewable Portfolio Standards and Goals

Source: US Energy Information Administration, n. 98 below.

Federal involvement in RE deployment has focused primarily on removing barriers to market access for non-utility power generators, incentivizing RE investment through tax credits, and funding for research and development. The US Congress enacted a suite of new energy laws in the late 1970s in response to the Organization of the Petroleum Exporting Countries (OPEC) oil embargo, the resulting energy crisis, and an economic recession. PURPA was an early effort to create opportunities for RE to compete in the electricity sector.Footnote 81 The law requires electric utilities to purchase power from certain small ‘qualifying facilities’ (80 MW or less), including most types of RE generation. The qualifying facilities are compensated based on the utility's ‘avoided cost’ (namely, the amount the utility would otherwise spend to generate or procure the same amount of power).Footnote 82 PURPA allows state utility commissions to determine the avoided cost rates for their respective states, which may vary significantly.Footnote 83

Federal efforts since the enactment of PURPA generally have relied on financial incentives and market rules to facilitate investment in RE. The 1992 Energy Policy Act established federal tax credits to encourage investment in RE generation.Footnote 84 The law provided a credit for each kilowatt/hour generated by a qualifying RE resource (referred to as a production tax credit or PTC).Footnote 85 The amount of the credit has fluctuated since 1992.Footnote 86 Congress subsequently allowed RE developers to choose a one-time 30% investment tax credit (ITC) when the project entered service in lieu of the ongoing PTC.Footnote 87 The initial PTC tax credits expired in 1999 and Congress has intermittently extended the credits for short periods at a time, creating lapses in credit availability and contributing to boom-and-bust investment cycles.Footnote 88 Lawmakers reached a compromise in 2016 to extend the RE tax credits for utility scale generation with a specified schedule to phase out credits after 2019, but again adopted a limited, temporary extension in 2020.Footnote 89

The 1992 Energy Policy Act also simplified rules for independent (non-utility) wholesale generators to engage in interstate electricity transactions and allowed these generators to petition FERC for access to a utility's transmission system. FERC subsequently enacted new rules to help to remove barriers facing new electricity generators, including RE, by requiring open access for interstate transmission lines, encouraging regional planning, and establishing rules to facilitate the creation of regional electricity markets.Footnote 90

State renewable energy policies

RE generation varies widely across the US states as a result of differences in energy resources and policies. Texas has the highest amount of wind capacity, far surpassing other states, from a combination of steady winds and state policy to construct new transmission lines to deliver the wind power to large urban areas.Footnote 91 Many of the other states with large amounts of installed wind generation capacity are located in the Midwestern US, with favourable wind resources. While the states with the highest amounts of installed wind energy each have favourable wind resources, the states with high amounts of solar are not necessarily those with the highest amounts of solar irradiance.Footnote 92 California is among the states with the most consistent solar resource and has numerous policies to incentivize solar energy generation.Footnote 93 The state boasts the highest amount of installed solar generation, surpassing 26,000 MW in 2019.Footnote 94 North Carolina ranks second, with approximately 5,600 MW installed.Footnote 95 Other states ranking high in installed capacity include Massachusetts and New Jersey (3,000 and 2,500 MW installed, respectively), which have less favourable solar irradiance than most other states but rank among the highest in installed solar because of their state policies.Footnote 96

Many state governments have implemented RE policies that supplement federal policies. Twenty-nine states and the District of Columbia have implemented RPSs which create mandatory RE targets, thus guaranteeing market demand for qualifying RE generation.Footnote 97 RPS policies identify a minimum amount of RE that electric utilities or other retail electricity providers must include in their respective generation mix.Footnote 98 Utilities may comply by investing directly in qualifying renewable facilities or purchasing renewable energy credits (RECs) which represent one MW-hour of qualifying RE generation.Footnote 99 These state policies vary significantly over which resources qualify as ‘renewable’ and how REC markets function, but together they have been a significant factor contributing to the growth of RE in the US. According to a report from the Lawrence Berkeley National Laboratory, ‘[r]oughly half of all growth in US renewable electricity generation and capacity since 2000 is associated with state RPS requirements’.Footnote 100

Many state governments are increasing RE requirements and implementing new clean energy mandates. For example, the California legislature has recently extended its carbon market beyond 2020 and increased the state's RPS to require public utilities to procure 50% of their electricity from renewable sources by 2030. Seven states (including California) and the District of Columbia have committed to achieving a 100% carbon-free electricity sector within their respective borders between 2040 and 2050.Footnote 101

Support for RE is not universal among the states. In 2017, for example, North Carolina implemented an 18-month ban on new utility-scale wind generation. The Ohio legislature adopted a new law that subsidizes nuclear power plants and coal-fired power plants in the state and weakens the state's RPS.Footnote 102 Some states are also re-evaluating their incentives for residential solar out of concern that payments to homeowners and businesses with solar panels may shift the costs of maintaining grid infrastructure to ratepayers who do not have on-site solar.Footnote 103

States that continue to rely on vertically integrated utilities to operate their respective electricity systems (namely, utilities that do not participate in wholesale markets managed by an RTO) are experimenting with competitive procurement as a method for engaging third parties in the power generation space. Competitive procurement is contributing to falling RE costs globally and could play a broader role in US states with vertically integrated utilities.Footnote 104 For example, a recent North Carolina law sets a target of an additional 2,600 MW of solar capacity within 45 months, and establishes a competitive process to achieve the public policy goal.Footnote 105 The law allows utilities and independent power companies to submit bids to construct new solar facilities and ensures that the utility does not exert undue market power over the auction process. This approach provides a mechanism to achieve the public policy goal of increased investment in utility-scale solar energy, allows rate payers to benefit if independent (non-utility) companies can meet the goal at a lower cost than the utility, and does not otherwise interfere with the traditional monopoly model for electric utilities.

3.3. Recent Developments in US Energy Federalism

Retreat at the federal level

There has been a retreat in federal RE policy since 2016. As noted above, federal tax credits will phase out between 2019 and 2022. The Trump administration sought to reduce funding for RE research and development in 2018 and 2019, but thus far Congress has maintained existing funding levels.Footnote 106 The Trump administration's ongoing rollback of federal environmental policies also has an impact on RE deployment, particularly the repeal of the Obama administration's Clean Power Plan, which limited carbon dioxide emissions from existing coal-fired and natural gas-fired power plants. Federal environmental law does not determine specific electricity generation choices, although the increasing stringency of air quality regulations may incentivize investment in low- or zero-emitting options. The Clean Power Plan went a step further in considering the carbon reduction potential of RE generation when setting emissions targets for each state.Footnote 107 The Trump administration's proposed replacement for the Clean Power Plan focuses exclusively on coal-fired power plants, ignoring the emissions reduction potential of RE and other options beyond the sources explicitly covered by the policy. The federal Clean Air Act allows state governments to implement more stringent air quality requirements than under the federal rules, and the repeal of the Clean Power Plan does not affect state-level RE or climate change policies. It does, however, demonstrate the ongoing importance of state policy decisions regarding RE deployment.

Federal and state conflicts in wholesale electricity markets

RTO market rules create preferences for certain energy resources over others. Some RTOs, for example, rely on capacity markets – auctions for the commitment to provide electricity in the future if needed – to help in ensuring that enough electricity generation will be available to ensure system reliability. When the rules favour dispatchable generation – such as a requirement by the largest RTO that participants in capacity markets must offer dispatchable generation that can provide power for 10 hours at a time – it can disqualify RE and short-term battery storage.Footnote 108

A growing number of states with restructured electricity markets are responding to the threat of early retirement of nuclear power plants by implementing new requirements that distribution companies (monopolies operating local electricity grids) purchase ‘zero emission credits’ (ZECs) from nuclear power plants that are unable to out-compete other generation sources in competitive wholesale markets.Footnote 109 These programmes seek to achieve state environmental policy goals as well as protect jobs at the existing facilities, and they operate in parallel with state RPS requirements.Footnote 110

The US Department of Energy took a different approach to the nuclear retirement issue, proposing subsidies for nuclear and coal-fired power plants.Footnote 111 The Department of Energy's 2017 Proposed Grid Resiliency Rule instructed FERC to consider compensating these two categories of facility for their reliability and ‘resiliency’ attributes.Footnote 112 The proposal defined resiliency attributes as the ability to store fuel on site, thus excluding natural gas and RE facilities.Footnote 113 FERC rejected the Department of Energy's proposal, but in December 2019 issued an order that could allow the largest RTO in the US to prioritize existing coal and nuclear plants and counteract many state clean-energy policies.Footnote 114 FERC justifies the new order as necessary to address concerns about power plant retirements as a result of state energy subsidies, but a dissenting commissioner claims that the action diminishes the state role in choosing electricity generation and ‘fundamentally upends the public power model’.Footnote 115 It is likely to take years to assess the impact of the new FERC order, assuming courts do not overturn the action, but it highlights the ongoing disputes between state and federal energy policies.

4. COMPARATIVE OBSERVATIONS

Germany and the US have adopted different models for energy federalism, with Germany allocating more authority to the federal government and the US relying on a more decentralized cooperative federalism model that preserves key roles for state actors. This section examines how these divisions of authority between federal and state governments impact on the trajectory of RE in each country. The section focuses on five aspects. Firstly, the impacts of federalism have differed as RE generation has expanded. Secondly, the choice of federalism model may help to mitigate the impact of changes in political leadership or, alternatively, may expose the electricity sector to sudden policy shifts. Thirdly, federalism can create policy path dependencies at the federal and state levels. Fourthly, allocating authority between federal and state actors may create cooperation challenges for RE policies. Finally, energy law and policy within the federal state is influenced tremendously by the outer obligation of the state under international law, such as through membership of a regional international organization like the EU or the North American Free Trade Agreement (NAFTA),Footnote 116 or through international treaties and protocols as in the case of the Paris Agreement.Footnote 117

4.1. Emergence of Federalism Conflicts over Time

Federalism plays out differently in various phases of RE expansion, and federalism conflicts have become more pronounced as RE prices have fallen and technology has improved.Footnote 118

The impacts of energy federalism in Germany and the US have evolved over time. Early federal RE policies in both countries created market incentives for RE investment, provided funding for research and development, and removed some market barriers. These policies helped to lay the foundation for the RE growth that both countries are experiencing today, but the early measures did not have significant impacts on traditional electricity generation sources. Similarly, RE policy choices by one state had minimal effects on electricity generation choices in neighbouring states. There were political disagreements over the value of RE and the economic impact on energy users. However, these disagreements did not centre on the division of authority between the federal and state governments.

In the US, the low costs of RE and natural gas are causing rapid retirements of coal-fired power plants and, in some areas, nuclear power plants.Footnote 119 Some states are seeking to continue this trend to support their respective greenhouse gas (GHG) reduction goals, while other states are creating new subsidies to prevent retirement of existing power plants. Both strategies have an impact on the broader regional electricity grids, and the state-by-state conflicts are taking place at the same time that the federal government is scaling back support for RE, considering changes to RTO markets to minimize the impact of state RE subsidies, and promoting fossil fuel-fired electricity generation. These divergent priorities point to the growing importance of divisions of authority under governance systems. As technology and cost barriers fall, decisions about which level of government sets the rules will have a growing impact on the role of RE as the electricity sector evolves.

In Germany, the early federal legislation on RE promotion in the 1990s did not meet significant opposition at the state level. The modest increase in RE did not substantially challenge the prevailing structure of energy generation and supply, and thus gave no cause for serious federalism conflicts.

Over time, however, this picture changed. With the constant rise of RE and ever more visible impacts – such as land-use conflicts, problems of social acceptance, necessity of grid expansion and so on – state interests and federal interest came increasingly into structural conflict. For example, the increasing number of RE facilities in German landscapes brought the problem of negative environmental and social impacts of RE facilities to the forefront of state politics. As a result, several states imposed restrictions on land use for RE facilities which conflicted with the federal plans for RE expansion in Germany.Footnote 120 The shrinking availability of adequate territory for wind energy facilities is a key reason for the wind energy expansion crisis that unfolded in Germany in 2018 and 2019.Footnote 121 While in 2017 a historical record of 4,169.6 MW new capacity in onshore wind energy was added, the new capacity added in 2018 dropped to 2,073 MW and to only 514 MW in the first three quarters of 2019. Thus, in 2018 and 2019 the ‘development corridor’ for new onshore wind energy envisioned in the EEG 2014/2017 remained clearly undersubscribed.Footnote 122

4.2. Exposure to Sudden Policy Shifts

Federalism theory posits that one important function of federalism is to limit and control the potentially far-reaching legislative and executive capacity of central government.Footnote 123 The idea of checks and balances, projected horizontally between the legislature, executive, and judiciary, is extended vertically to the relation between the federal and state governments. In effect, this ‘vertical separation of powers’Footnote 124 tends to limit political change to incremental reform and to reduce sudden policy shifts. In RE federalism in Germany and the US the ‘vertical separation of powers’ plays out very differently.

In the US, the long-standing state jurisdiction over electricity generation and in-state energy policies enables ambitious RE legislation in the states, regardless of the political stance on the issue at central government. As a result, state RE policies have remained in place despite major policy shifts at the federal level. For example, states enacted RPS policies in the 1990s and early 2000s despite the different policies of the Clinton and Bush administrations.Footnote 125 Generation from renewable resources is projected to expand in the coming years even though the Trump administration is focused on supporting coal, withdrawing from the Paris Agreement, and rolling back environmental regulations that incentivized investment in RE. In fact, many states have increased their RE mandates during the Trump presidency. Some have announced that they will take steps to contribute to the US commitments under the Paris Agreement despite the Trump administration's announced withdrawal.Footnote 126

In the more centralized system of renewable expansion in Germany, the influence of sudden policy shifts is more heavily felt. In particular, the exposure of states to changes in RE support systems at the German federal level or under EU law is far more significant than is the case in the US. As seen above, the 2014/2017 changes to the federal Renewable Energy Sources Act (EEG), concerning the RE support system, from long-term technology specific FITs to market-oriented bidding processes immediately affected all German states. The nationwide application of uniform auctioning conditions favoured wind energy investment in the German north, which contributed to the widening gap in wind energy generation between north and south Germany,Footnote 127 and a related demand for capacity increase in interstate electricity transportation.Footnote 128 This outcome led to policy proposals for the introduction of ‘regionalization bonuses’ for wind energy investments in geographically disadvantaged regions, including in the federal government's Climate Action Programme 2030.Footnote 129

4.3. Path Dependencies

Path dependence is a concept that is itself subject to broad methodological debate.Footnote 130 In this article we draw on an encompassing understanding of path dependence as a property ‘of a system whose motion remains under influence of conditions that are themselves the contingent legacies of events and actions in its history’.Footnote 131

In the legal analysis of RE federalism the concept of path dependence helps to identify causes of federal conflicts and possibilities for avoiding similar conflicts in the future.

In Germany, the predominance of the north in RE generation creates a path dependence for the organization of German electricity infrastructure. The industrially powerful states with large populations in the south, Bavaria and Baden-Württemberg, as well as North-Rhine-Westfalia in the northwest have found it far more difficult to replace fading coal and nuclear power capacities with domestic RE sources than have the northern states.Footnote 132

As a result, the expansion of interstate electricity grids has become an integral element of the German energy transition. Hundreds of kilometres of new electricity grid lines are planned and under construction, particularly in the north-south direction. The RE-related interstate grid line expansion again has impacts on federal structures.

Firstly, the process amplified the role of federal administration in the energy sector. The administrative authority for the planning and construction of new grid lines for grid connection to wind turbines offshore is the Federal Maritime and Hydrographic Agency (Bundesamt für Seeschifffahrt und Hydrographie). Moreover, the corresponding authority for several of the most important new land grid lines in north-south directions was assigned to the Federal Network Agency (Bundesnetzagentur), whereas traditionally the authority for electricity infrastructure lay exclusively with state authorities. In light of the constitutional prerogative for state implementation of federal statutes (Articles 83 and 84 of the Grundgesetz),Footnote 133 the expanded role for federal agencies raised political and constitutional concerns.Footnote 134

Secondly, the construction of new grid lines regularly meets with local opposition in the affected communities across Germany. Thus, state governments come under political pressure to take a critical stance, which creates potential barriers for efficient federal grid line expansion. For example, motivated by local opposition against new overhead power lines, the state government of Bavaria succeeded with a legislative proposal to amend the relevant federal statute to prioritize buried cables for many new grid lines.Footnote 135

The prominence of state energy policies in the US mitigates some concern about path dependencies in federal agencies. States retain their jurisdiction over electricity generation and retail sales, and the US Supreme Court has recognized that states have a number of policy options to ‘encourage development of new or clean generation, including tax incentives, land grants, direct subsidies, construction of state-owned generation facilities, or re-regulation of the energy sector’.Footnote 136 Unless Congress enacts new statutes pre-empting these state choices, states can utilize these options to incentivize RE. Not only may this exacerbate disputes between federal and state energy policies, but it may also prevent ossification of federal decisions. As noted at Section 3.2 above, numerous states are adopting more stringent RE and clean-energy policies even as the federal government decreases RE tax credits and prioritizes fossil fuel generation.

4.4. Cooperation Challenges

While federalism is often conceptualized as distinct spheres of federal and state responsibility, practical social problems often require intrafederal cooperation.Footnote 137 In addition, often legal and political interconnections prevent federal and state governments from attaining their respective policy goals on their own.Footnote 138 RE federalism provides additional, more recent examples of such challenges to intergovernmental cooperation.

In Germany, the availability of adequate sites for new onshore wind energy capacity has emerged as a key problem for the continuation of the German energy transition. Realizing the ambitious federal goals of wind energy expansion with the ‘development corridor’ of the EEG 2014/2017 depends on land-planning policies at the state level. However, the legal and political practice of federal cooperation in RE expansion is underdeveloped.Footnote 139 Rather, several states have significantly limited the territory available for wind energy facilities in recent years through the enactment of state rules on strict minimum distances between housing areas and establishment sites for wind turbines.

Against this background, the German federal government in October 2019 issued a strategy paper on the ‘stabilization of expansion of onshore wind energy’.Footnote 140 It proposed measures for (i) nationwide harmonization of rules on minimum distances between wind energy facilities, housing areas, and habitats of endangered species; (ii) enhancement of wind energy site development in areas close to air traffic control facilities; and (iii) acceleration of administrative licensing procedures for new wind energy facilities.

Multiple entities have a role in US electricity planning and operations. For example, the North American Electric Reliability Corporation establishes national reliability standards.Footnote 141 RTOs or imbalance markets may coordinate wholesale electricity markets. RTOs also facilitate interstate transmission planning within their territories, but these entities do not have transmission siting authority. For states that do not participate in RTOs, individual electric utilities coordinate with one another through wholesale markets, although not on resource planning. The lack of coordination for new electricity transmission, and the ability of states to deny construction of interstate transmission, create barriers to connecting load centres with cheap RE resources.

Conflicts between federal and state energy priorities also present challenges.Footnote 142 Federal or state subsidies for older coal and nuclear plants may limit the market opportunities for RE, for example. Different state RPS mandates and conflicting state energy subsidies within a connected regional grid may also complicate system planning. As noted in Section 3, some RTOs are considering new market rules to reduce the impact of a single state's energy policies on other states participating in the market, angering some stakeholders and potentially limiting the ability of RE resources to compete.

4.5. Renewable Energy Federalism and International Law

The federal states of Germany and the US are members of international organizations and are subject to obligations flowing from international treaties affecting the energy sector. However, the juxtaposition of German and US energy federalism shows that the influence of international law varies significantly.

RE law and policy in Germany is heavily influenced by the supranational federal order of the EU. Article 3.1 of the Renewable Energy Directive (RED)Footnote 143 sets a binding target for RE expansion in all EU Member States combined: ‘Member States shall collectively ensure that the share of energy from renewable sources in the Union's gross final consumption of energy in 2030 is at least 32%’. All individual Member States, including Germany, are required to contribute towards that goal (Article 3.2 RED), but national RE-support schemes must consider EU law again (Article 4 RED). EU climate change law also bears on the transition from fossil fuels to RE resources. The EU Effort Sharing Regulation requires Germany to reduce GHG emissions in the non-emissions trading sector (which covers transportation and housing) by 38% from 2005 levels by the year 2030.Footnote 144 In 2019, the European Commission announced the ‘European Green Deal’ as a top political priority for the coming years to make Europe a climate-neutral continent by 2050.Footnote 145 As an intermediate goal the programme aims to increase the EU's overall GHG emissions reduction target for 2030, currently set at 40%, to ‘at least 50% and towards 55%’ below 1990 levels. Should the European Parliament and the Council follow the Commission's proposal, it is likely that Member States will be required to further expand RE.Footnote 146

International law has little impact on RE federalism in the US. Had the US remained in the Paris Agreement, additional federal policies could have accelerated RE growth.Footnote 147 Yet, as noted above, the Trump administration's withdrawal has not diminished RE policies at state level. Similarly, federal tariffs on solar panels have had an impact on the economics of some states’ RE mandates, but the federal decision has not caused states to weaken their commitments. In 2019, the World Trade Organization (WTO) ruled against the US in a challenge to the ‘buy local’ provisions in the RPS laws of some states.Footnote 148 If upheld on appeal, this could result in federal action to pre-empt these provisions, but this potential action would not necessarily affect other aspects of state RE policy.

5. CONCLUSION

In both Germany and the US, federal legal structures play an important role in the transition of the energy sectors towards renewable energies. However, RE federalism has different features in the two countries. The division between federal and state authority differs significantly. German laws grant the federal government broad authority over the energy sector, whereas US laws grant a larger share of energy decision making to state governments. Because of its membership of the EU and the Paris Agreement, Germany is more greatly influenced by international RE policies than is the US. There are important trade-offs between these approaches to federalism. Germany's emphasis on federal authority provides a greater degree of policy certainty and uniform RE investment conditions, but may fail adequately to address regional geographic differences. By contrast, energy federalism in the US allows states to experiment with energy policies that reflect their respective resources and goals. The decentralized approach not only makes state energy policies more resilient to sudden policy shifts at the federal level, but it also complicates interstate energy markets and fails to provide clear guidance for the evolving electricity sector.

Despite these differences, there are common observations for energy transitions in federal systems. The impact of federalism has changed in both countries as RE technologies have evolved from niche resources to economically viable energy options, and state and federal energy goals have changed. Conflicts between state and federal authorities are more prevalent as RE competes with traditional fossil fuel generation. Cooperation challenges also persist in both countries, particularly with transmission siting and competing policy priorities between federal governments and some state governments.