1. Introduction

Around the world, including in wealthy countries, a significant proportion of households face chronic financial struggles. According to a survey based on a representative sample of working adults in the US (PwC, 2020), in 2020 58% of workers would not be able to meet basic expenses if they were out of work for an extended period. Women are at even greater risk than men, since only 29% of them would be able to make ends meet during a period of prolonged unemployment. Furthermore, many households are increasingly having to cope with limited savings and accumulated debts. Of US workers, 42% lack the ability to absorb even a minor shock: they have less than $1,000 saved to deal with unexpected expenses (PwC, 2020). In a financial emergency, these households might resort to extreme measures such as pawning their possessions, selling their home or taking out a payday loan (Lusardi et al., Reference Lusardi, Schneider and Tufano2011).

In this paper, we use a large original dataset to explore whether the experience of financial challenges affects the extent to which individuals are concerned about their future financial security and their propensity to plan for retirement. We define ‘experience of financial challenges’ as a self-assessed instance in which individuals were unable to save part of their income in the past 12 months.

Having to cope with an inability to save could either increase or decrease people's concerns about, and propensity to plan for, their retirement. On one hand, when facing adverse financial circumstances, many people tend to neglect issues related to their lifelong financial security such as well-being in retirement. Previous research has shown that financial constraints impede people's capacity to consider less imminent problems (Shah et al., Reference Shah, Mullainathan and Shafir2012; Mani et al., Reference Mani, Mullainathan, Shafir and Zhao2013; Mullainathan and Shafir, Reference Mullainathan and Shafir2013; Haushofer and Fehr, Reference Haushofer and Fehr2014): resource scarcity translates into myopic behaviour and thinking.

Conversely, people could develop stronger concerns about their future financial well-being if they have first-hand experience of financial challenges. Past negative incidents might improve people's ability to assess financial risk (Nisbett and Ross, Reference Nisbett and Ross1980) and make them more aware of the need to plan for the future. This is because experience carries valuable information and thus can be considered ‘a great teacher’ (Marx et al., Reference Marx, Weber, Orlove, Leiserowitz, Krantz, Roncoli and Phillips2007). In previous studies, experience has been found to affect people's intention to adopt precautionary measures such as purchasing insurance to prevent the risk of future financial losses (Kunreuther, Reference Kunreuther1996; Michel-Kerjan, Reference Michel-Kerjan2010; Innocenti et al., Reference Innocenti, Clark, McGill and Cuñado2019).

The direction of the effect of experience of financial challenges on people's concerns about their financial security and their propensity to plan for retirement has important implications for the long-run governance of pension systems. If the experience of financial challenges makes people more inclined to worry about their retirement and plan for it, the long-run viability of defined contribution arrangements is at lower risk. By contrast, if an inability to save makes people less inclined to thinking about and planning for retirement, this suggests a renewed need for governments and other pension providers to intervene and support those in need.

Using original survey data from a sample of 18,000 workers across 16 countries, we present evidence of the effect of financial challenges on people's propensity to plan for retirement and to recognise future financial security as an important concern. We show that individuals who could not save part of their income in the past 12 months are less likely to consider well-being in retirement as their major financial concern. They are also less likely to hold private pension products than those who could save in the past. This suggests that when people face important budget constraints, they have a limited capacity to worry about multiple issues at any one time (Linville and Fischer, Reference Linville and Fischer1991); short-term financial constraints can take on enhanced salience, eliciting greater engagement with some problems while leading to the neglect of others (Shah et al., Reference Shah, Mullainathan and Shafir2012; Mani et al., Reference Mani, Mullainathan, Shafir and Zhao2013; Mullainathan and Shafir, Reference Mullainathan and Shafir2013; Haushofer and Fehr, Reference Haushofer and Fehr2014), and notably resulting in a lower propensity to plan for or worry about their well-being in retirement.

While exploring the channels through which the experience of financial challenges can affect our respondents' propensity to plan for retirement or recognise future financial security as an important concern, we examine whether the effects of an inability to save are dependent on respondents' risk tolerance, their self-assessment of their current economic circumstances, and expectations about their future income. We show that the effect might partially operate through people's perceived future income prospects and assessment of their current financial situation.

We also evaluate the heterogeneity of effects. First, the negative effect of experiencing financial challenges on people's propensity to plan or worry for retirement could be driven by individuals' time preferences. If this were the case, we would expect the effect to be stronger for those who are more present biased. Equally, having to provide for a spouse might increase the threat posed by past financial challenges and thus increase the effect these factors might have on retirement planning. Work arrangements might also alter the extent to which past experience of financial challenges affects concerns and planning for retirement. We show that experience of financial challenges remains a key determinant of retirement planning, no matter the respondents' present bias, marital status or work arrangements, suggesting that the estimates do not show more general differences in family and work arrangements or time preferences across respondents.

Moreover, we examine the sensitivity of our results to alternative measures of financial challenges. We also control for the adequacy of the country pension system. This analysis mitigates the possibility that our findings are driven by the overall robustness of the social security systems, which might directly influence the extent to which people are affected by periods in which they were unable to save.

2. Related literature

This paper is part of a growing literature which focuses on understanding the factors that can either inhibit or encourage effective financial planning for retirement. Multiple studies indicate an association between retirement savings and gender, with men being more likely to plan and save for retirement than women (Agnew et al., Reference Agnew, Balduzzi and Sunden2003; Lusardi and Mitchell, Reference Lusardi and Mitchell2007, Reference Lusardi and Mitchell2008, Reference Lusardi and Mitchell2011). Age and the duration of an individual's job tenure are also positively associated with retirement planning (Agnew et al., Reference Agnew, Anderson, Gerlach and Szykman2008; Clark et al., Reference Clark, Knox-Hayes and Strauss2009; Hershey et al., Reference Hershey, Henkens and Van Dalen2010), suggesting that younger individuals just stepping onto the career ladder are less likely to think about their future financial well-being. Income is also a key determinant, with higher earners more inclined to plan for their financial well-being in retirement. Financially knowledgeable and educated individuals are also much more likely to have thought about retirement and plan for it (Lusardi and Mitchell, Reference Lusardi and Mitchell2011; Brown and Weisbenner, Reference Brown and Weisbenner2014). Family structure and marital status (Szinovacz et al., Reference Szinovacz, DeViney and Davey2001; Clark and Strauss, Reference Clark and Strauss2008; Chatterjee and Zahirovic-Herbert, Reference Chatterjee and Zahirovic-Herbert2010) also affect positively people's propensity to plan for and be concerned about their financial security in retirement. More recently, studies have shown that numerous systematic, and often predictable, behavioural tendencies, such as present bias, procrastination, and adherence to the status quo, can act as barriers to individuals saving for retirement (Thaler and Benartzi, Reference Thaler and Benartzi2004; Venti, Reference Venti, Clark, Munnell and Orszag2006; Benartzi and Thaler, Reference Benartzi and Thaler2007).

We contribute to this literature by providing an analysis of the effect of having too few financial resources, i.e., lower savings, on individuals' propensity to plan for the future or recognise retirement as their major financial concern. Previous studies have shown that financial challenges affect people's subjective well-being and mental health (Shafir, Reference Shafir2017). However, with the exception of de Bruijn and Antonides (Reference de Bruijn and Antonides2020), few studies have systematically explored the relationship between people's inability to save and their preoccupation with their financial future, or with their propensity to plan for it. After including a large battery of controls that previous studies have identified as determinants of retirement planning and concerns, we show that people who could not save part of their income in the past 12 months are less likely to consider well-being in retirement as their major financial concern or plan for their retirement years, a task that ‘is left for some hopefully easier future time’ (Shafir, Reference Shafir2017, p. 133). One can afford to pay attention to asset building and long-term welfare only when short-term needs can be met, or are so well understood that they can be managed.

More generally, we complement the growing literature on the effects of life experience on belief formation, and the adoption of self-protective behaviour. People base their concerns about the future on their current feelings combined with past experience (Loewenstein et al., Reference Loewenstein, O'Donoghue and Rabin2003). Past experience affects individuals' mental imagery, which in turn affects cognitive evaluations and anticipatory emotions – that is, future visceral and affective reactions to risk and uncertainty (Loewenstein et al., Reference Loewenstein, Weber, Hsee and Welch2001; Slovic et al., Reference Slovic, Finucane, Peters and MacGregor2002; Marx et al., Reference Marx, Weber, Orlove, Leiserowitz, Krantz, Roncoli and Phillips2007). In the economics literature, these findings have been used to explain the adoption of precautionary measures in a wide variety of areas. It has been shown that having experienced substantial damage to one's property due to a flood, hurricane or earthquake increases people's interest in purchasing an insurance policy against these risks (Kunreuther, Reference Kunreuther1996). Equally, experience informs people's intentions to purchase safety devices and insurance policies which could prevent theft and thus the risk of financial losses (Maguire, Reference Maguire1980; Yechiam et al., Reference Yechiam, Erev and Barron2006). In the domain of health, it has been shown that people who have suffered from ill health in the past worry more about their health, update their beliefs concerning the prevalence of that illness and its seriousness, and ultimately revise their behaviour accordingly. Innocenti et al. (Reference Innocenti, Clark, McGill and Cuñado2019) also show that people who have personally experienced a negative health event that temporarily prevented them from earning an income are 25% more likely to state an intention to purchase income protection insurance than those who have not had such an experience.

While controlling for most factors that previous studies have identified as key determinants of retirement planning decisions, our paper contributes to this literature by focusing on the relationship between people's ability to save part of their income over the last 12 months and their propensity to recognise well-being in retirement as their major financial concern and plan for it. We conduct robustness exercises and explore possible underlining mechanisms. Additionally, unlike some studies that use data from just one country or a handful of advanced Western economies (Lusardi and Mitchell, Reference Lusardi and Mitchell2014), our data reach beyond the US, the UK, and Western Europe to Australasia and Latin America. Like Gruber and Wise (Reference Gruber, Wise, Gruber and Wise1999) and others, we anticipated that there would be variations in our empirical findings by country given persistent and significant institutional differences in social security and welfare systems around the world. Yet we provide a consistent set of results across the 16 jurisdictions, enriching our understanding of retirement concerns and planning around the world and making a key contribution to the literature.

The remainder of the paper is structured as follows. Section 3 describes the data and our main measurements. Section 4 describes our empirical strategy and key results. We explore possible mechanisms in section 5, followed by robustness checks in section 6 and the heterogeneity analysis in section 7. Section 8 synthesises our results and implications for future research.

3. Data

3.1 Data source

Our analysis relies upon a large international survey implemented between February and March 2019. The data were collected as part of a multi-country study for Zurich Insurance Group, a large multi-national insurer. The countries included in the survey were Finland, Germany, Ireland, Italy, Spain, Switzerland, and the UK (Europe); Brazil, Mexico, and the US (the Americas); Australia, Hong Kong, Japan, and Malaysia (Asia); and the United Arab Emirates (UAE). In each country, the survey sample was selected to be representative in terms of age, gender, and sub-national region. In all but one country (UAE), the numbers of respondents who completed the survey ranged from 900 through to 1,600 people, matching other cross-country studies including Dohmen et al. (Reference Dohmen, Falk, Huffman and Sunde2010) and Innocenti et al. (Reference Innocenti, Clark, McGill and Cuñado2019).

The survey was implemented by a private research firm which has experience with consumer panels and the collation of survey data across multiple jurisdictions and in different languages.Footnote 1 The providers' panel management practices were compliant with jurisdiction-specific data protection and privacy laws. Only respondents who completed the survey received rewards. These rewards depended on the panel providers' customary compensation schemes and included points programmes, gift cards, vouchers, charitable contributions, and prize draws.

Respondents were asked to provide detailed information about several aspects of their work lives and financial circumstances, including their work contract, their perceptions of job security and the changes in their financial situations, and their health history. Their cognitive skills and attitudes towards risk were also tested. Socio-demographic data were also collected at the individual and household level. Our survey includes 18,019 observations across 16 countries.

3.2 Retirement concerns and planning: measurement and descriptives

Our main dependent variables identify whether individuals are mostly concerned about or plan for their financial security in retirement.

First, we measure people's concern about their future financial security in retirement by asking respondents to report on their major financial concerns. Respondents were given the opportunity to choose between the following options: paying monthly bills; having enough money for a comfortable retirement; burdening their family and friends if they were to die prematurely; paying off/reducing credit card debts; other.Footnote 2 We construct a binary indicator that takes the value 1 if the respondent has identified their financial well-being in retirement as their major financial concern and zero if they are mostly concerned about other financial matters. In what follows, we interpret this binary variable as capturing the respondents' ‘concerns for retirement’ or their ‘worry for retirement’.

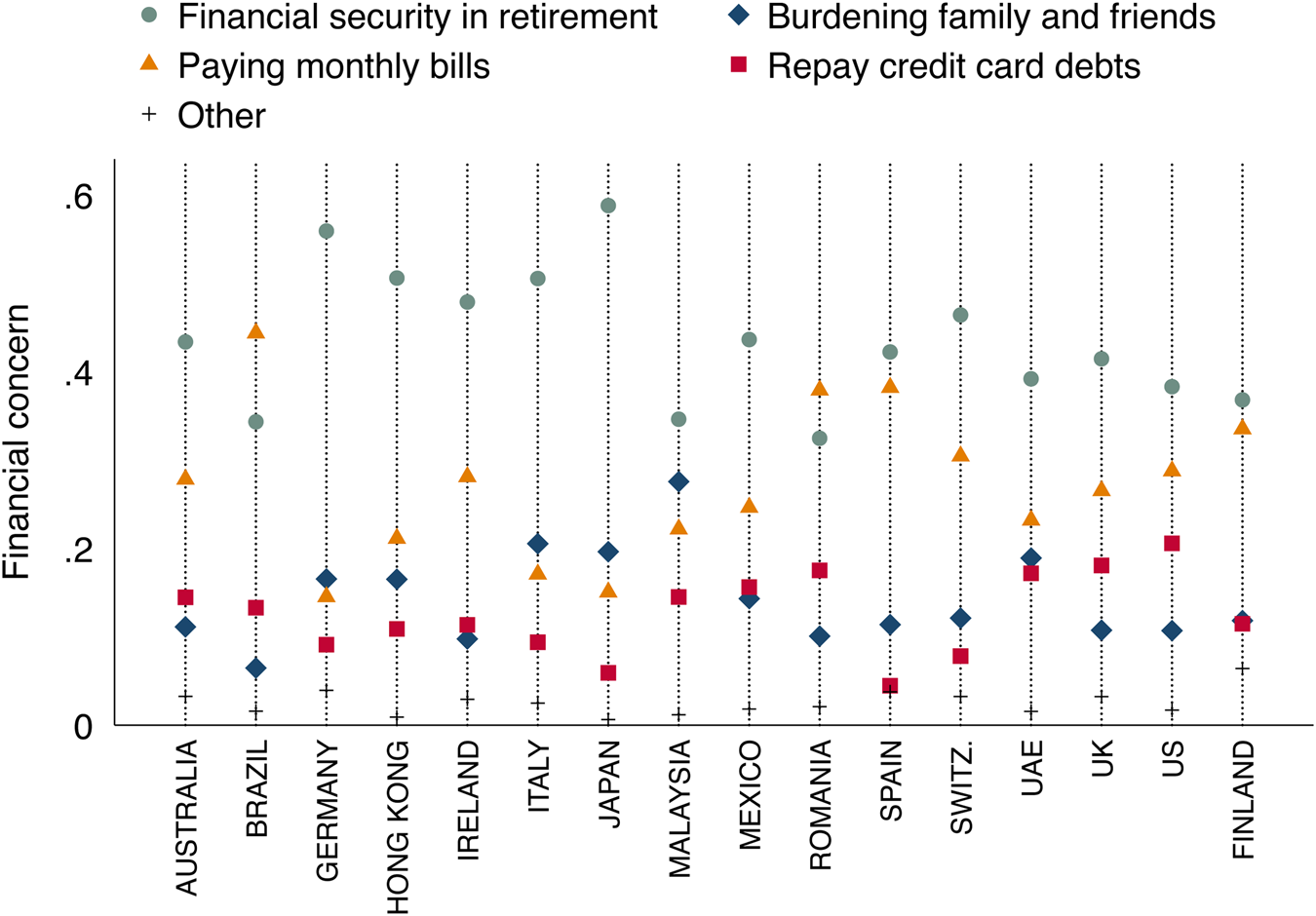

In our sample, 43% of workers recognise financial security in retirement as their primary financial concern. We note that there is some heterogeneity in the extent to which people are concerned about their retirement financial well-being across the countries in our dataset. Figure 1 documents the rankings of financial concerns across countries. The answer option ‘having enough money for a comfortable retirement’ was ranked as the number one concern in 14 of the 16 countries under scrutiny, the exceptions being Brazil and Romania. In Japan and Germany, financial security during retirement was more important than all other answer options combined and was about equal to all other options combined in Finland, Hong Kong, and Italy.

Figure 1. Ranking of financial concerns by country.

Notes: Fraction of respondents who are concerned about their financial security in retirement (grey circles), being a burden to their family or friends (blue diamonds), paying monthly bills (orange triangles), repaying credit card debts (red squares), and other concerns (black +), for each country in our sample.

Second, we measure the extent to which people are planning for retirement by asking respondents to answer a binary question indicating whether they own private pension products that are meant to increase financial security in retirement. We asked respondents ‘Do you personally hold a personal pension product, i.e., long-term savings product that helps you save extra for your pension? This private insurance supplements pensions provided by the state or your workplace’. We take positive answers to this question as an indication of the respondents greater propensity to plan for retirement. Hereafter, we refer to this variable as ‘planning for retirement’ in this paper. Our dataset contains this information for all countries, expect for Australia, where the data provider did not collect this information.Footnote 3 As a consequence, for this question, our sample counts 16,912 observations.

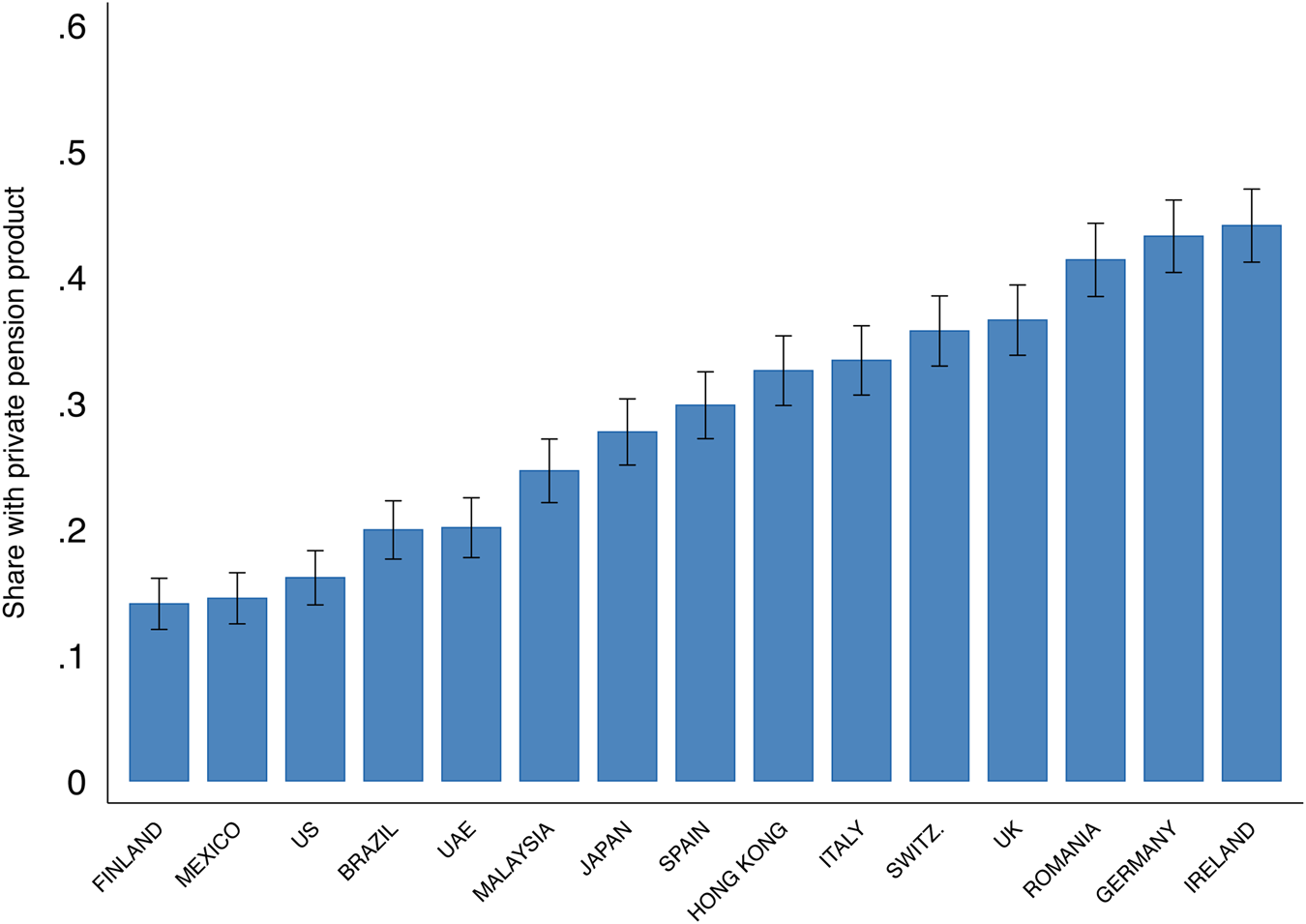

In our sample which excludes Australian respondents, 29% of workers own private insurance products to supplement their retirement income. However, contributions to private pension funds vary across jurisdictions. As can be seen in Figure 2, the uptake of these financial products appears to be highest in Ireland, where 44% of respondents own a private pension product, and lowest in Finland (14%). This heterogeneity is possibly due to tax regimes and other country-specific institutions which incentivise or discourage the acquisition of these financial products.

Figure 2. Share of respondents who own private pension products by country.

Notes: Fraction of respondents who own a private pension product, for each country in our sample.

We pool together survey participants across all countries to identify which individual characteristics are correlated with retirement concerns and plans. We present this information in Table 3 in the Supplementary material. Respondents who worry about their retirement or own a private pension product are on average older than individuals who do not have one, and they are significantly less likely to be engaged in atypical work. We define an atypical work arrangement as any employment contract other than full-time, permanent employment. A similar definition has been adopted by Eurofound (2017) and used in recent work on atypical work arrangements – see for example Datta et al. (Reference Datta, Giupponi and Machin2019). Further, those who identify financial security in retirement as their major concern or plan for it are on average more educated and have higher monthly earnings. Interestingly, on an unconditional basis, individuals who identify financial security in retirement as their major concern or plan for it display higher cognitive skills. In line with previous literature which showed that men have a stronger tendency to purchase pension savings-related investment products than women (Agnew et al., Reference Agnew, Anderson, Gerlach and Szykman2008), in our sample those who worry about and plan for their retirement are significantly more likely to be men. This is also in line with Lusardi and Mitchell (Reference Lusardi and Mitchell2008), who show that the majority of women undertake no retirement planning.

3.3 Experience of financial challenges: measurement and descriptives

As mentioned, our main independent variable is the ‘experience of financial challenges’, which we measure by asking respondents to report whether or not they were able to save part of their income in the 12-month period before the survey was administered. In what follows, we interpret negative answers to this binary question as capturing respondents' ‘experience of financial challenges’ or as an indication of whether they ‘have lived through financial hardship over the last 12 months’.

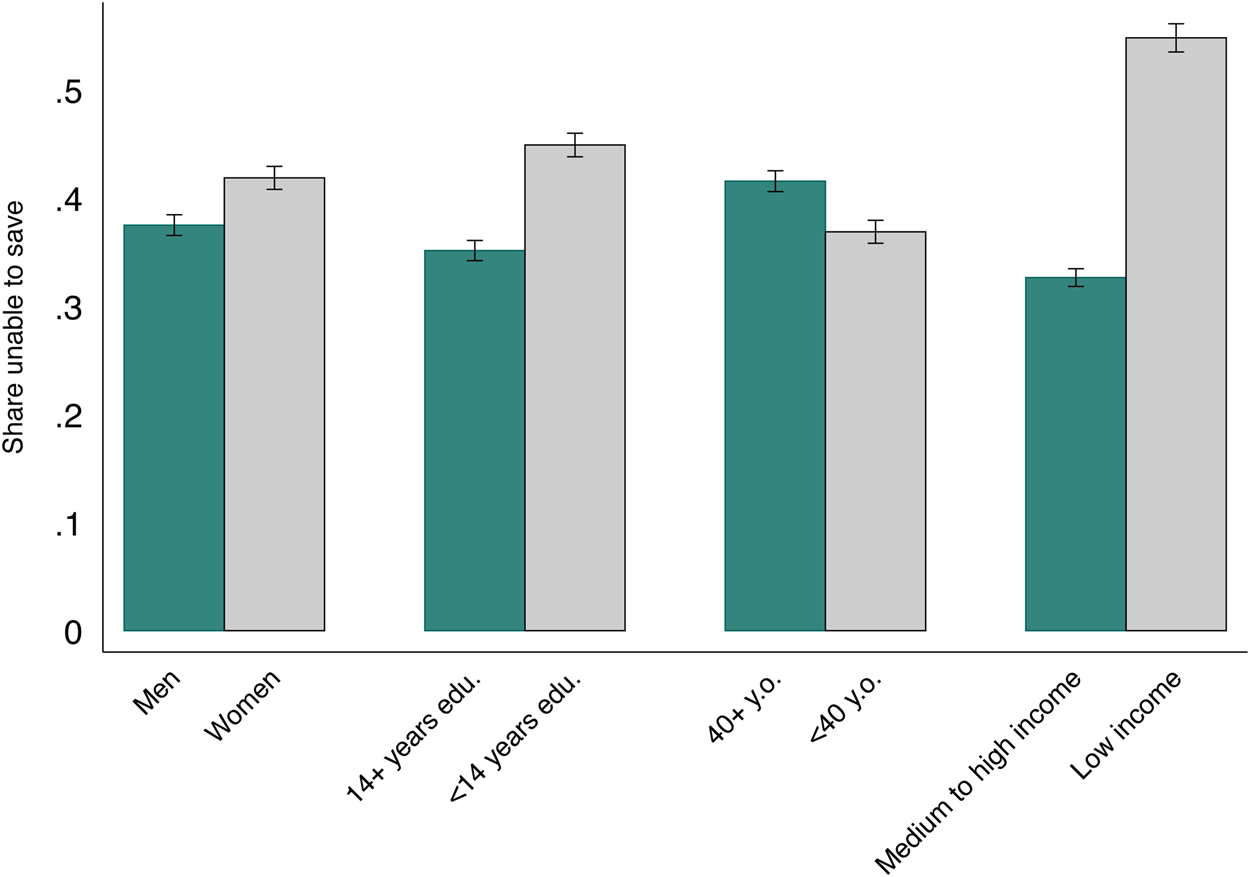

Around 39% of people in our sample were not able to save part of their income in 2018. As can be seen from Figure 3, on an unconditional basis, women, less educated, older workers and those earning lower incomes are significantly less likely to have been able to save part of their income in the year prior to the survey.

Figure 3. Experience of financial challenges by individual characteristics.

Notes: Fraction of respondents who experienced financial challenges in the 12-month period prior to the survey by individual characteristics.

4. Empirical strategy and results

4.1 Empirical specification

Our basic logit specification is presented in Equation (1).

where Y i,c, our binary dependent variable, indicates either whether a respondent declared that her financial well-being in retirement represents her major financial concern or not, or whether she plans for retirement by contributing to a supplementary pension fund. i indicates the respondent, c her country of residence. The term u c stands for country fixed effects to control for jurisdictional factors that could drive differences in retirement concerns and planning. Since we specify a logit model to represent choice behaviour, Λ( ⋅ ) refers to the cumulative distribution function of the logistic distribution.

As noted above, FC i,c stands for the key regressors of our analysis. As mentioned above, we measure experience of financial challenges by means of a dummy variable indicating whether the respondent was able to save part of her income or not during the year prior to the survey.

The variable ${\bf X}_{i, c, j}$![]() identifies a vector of controls, i.e., a set of individual and employment characteristics. We assume that whether people identify retirement as their major financial concern and plan for it depends on the demographic and economic characteristics of the respondent, including gender, education, individual income, age, and a binary variable for the presence of children in the family. We also include a dummy to identify whether the respondent has an atypical work arrangement or a ‘standard’ full-time open-ended employment contract. Additionally, we consider people's level of financial literacy, which in the past has been identified as a key predictor of deliberative decision-making and financial behaviour (Lusardi and Mitchell, Reference Lusardi and Mitchell2007, Reference Lusardi and Mitchell2014; Alessie et al., Reference Alessie, Van Rooij and Lusardi2011). Although our survey does not contain a test of financial knowledge, we use the Cognitive Reflection Test (CRT) (Frederick, Reference Frederick2005) as a proxy. In fact, cognitive abilities, as measured by this test, have been found to be highly correlated with financial literacy (Skagerlund et al., Reference Skagerlund, Lind, Strömbäck, Tinghög and Västfjäll2018; Muñoz-Murillo et al., Reference Muñoz-Murillo, Álvarez-Franco and Restrepo-Tobón2020) and mathematical abilities (Campitelli and Gerrans, Reference Campitelli and Gerrans2014). We include in our regressions the number of correct answers individuals were able to provide to the three questions which the CRT comprises.

identifies a vector of controls, i.e., a set of individual and employment characteristics. We assume that whether people identify retirement as their major financial concern and plan for it depends on the demographic and economic characteristics of the respondent, including gender, education, individual income, age, and a binary variable for the presence of children in the family. We also include a dummy to identify whether the respondent has an atypical work arrangement or a ‘standard’ full-time open-ended employment contract. Additionally, we consider people's level of financial literacy, which in the past has been identified as a key predictor of deliberative decision-making and financial behaviour (Lusardi and Mitchell, Reference Lusardi and Mitchell2007, Reference Lusardi and Mitchell2014; Alessie et al., Reference Alessie, Van Rooij and Lusardi2011). Although our survey does not contain a test of financial knowledge, we use the Cognitive Reflection Test (CRT) (Frederick, Reference Frederick2005) as a proxy. In fact, cognitive abilities, as measured by this test, have been found to be highly correlated with financial literacy (Skagerlund et al., Reference Skagerlund, Lind, Strömbäck, Tinghög and Västfjäll2018; Muñoz-Murillo et al., Reference Muñoz-Murillo, Álvarez-Franco and Restrepo-Tobón2020) and mathematical abilities (Campitelli and Gerrans, Reference Campitelli and Gerrans2014). We include in our regressions the number of correct answers individuals were able to provide to the three questions which the CRT comprises.

Two potential identification issues arise when carrying out this analysis. First, the extent to which individuals are concerned about their well-being in retirement depends on the institutional measures in place to offset the negative effects of financial challenges. This can a priori shape their inclination to take action to augment their retirement income or simply be concerned about it. We address this issue by including country fixed effects in all our model specifications. Additionally, in a robustness check, we also explore whether the adequacy of the pension system alters the association between our variables of interest (see section 6.2).

A second issue to consider regards omitted variables. Our main regressor records whether individuals were able to save part of their income during the 12 months prior to the survey. Yet we have no measure of the amount of savings. Equally, we have no information as to whether respondents own a house or have accumulated other forms of equity that might help with their retirement well-being and thus reduce people's propensity to worry about their financial security in retirement or propensity to plan for it. We acknowledge that previous literature has shown that assets are generally considered tools to reduce exposure to risk and shield oneself against shocks (Lusardi et al., Reference Lusardi, Schneider and Tufano2011). Although we have no means to alleviate these concerns directly, we always control for income in our specifications. Additionally, in section 5, we use the interaction between the experience of financial challenges and broad income levels as a proxy for wealth and examine whether the effect of past experience of financial challenges on retirement concerns or planning changes along the income distribution. We also explore whether perceptions of one's current financial situation mediate the effect that financial challenges exert on retirement concerns and planning.

For these reasons, although we control for a large number of observables, we cannot make causal claims about the effect of financial challenges on people's propensity to identify financial security in retirement as their major financial concern and their propensity to plan for their retirement years.

4.2 Results

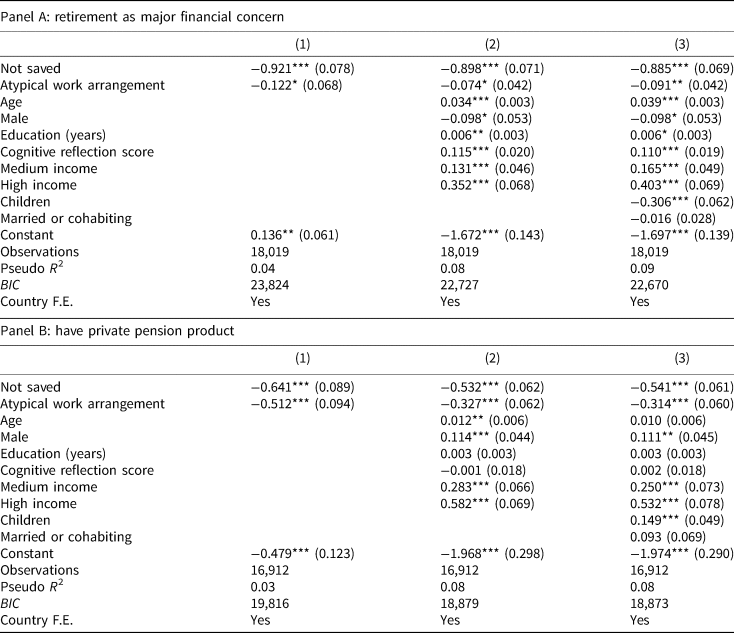

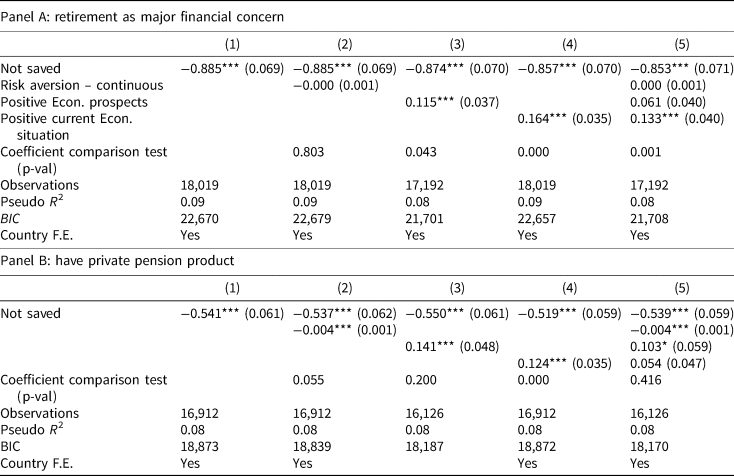

We report our main results in Table 1. In panel A, our dependent variable is a dummy indicating whether people have identified financial well-being in retirement as their major financial concern. In panel B, we consider whether respondents own a private pension product or not as the dependent variable. All estimates display the log-odds resulting from pooled logit regression models with country fixed effects and standard errors clustered at the country level to account for country heterogeneity.

Table 1. Financial challenges, concerns for retirement, and ownership of private pension product

Notes: Panel A shows results for logit regressions where the dependent variable is a binary indicator for whether respondents identify retirement as their major concern. Panel B shows the same sets of results for regressions where the dependent variable is a binary indicator identifying whether the respondents have a private pension insurance product. Coefficients of logit regressions expressed in log-odds metrics. All regressions include controls for age, gender, having children, education (in years), cognitive reflection test score, indicators for having a medium or high income, and binary variables for having an atypical work arrangement and being married or cohabiting. Standard errors clustered at the country level. *p < 0.1, **p < 0.05, ***p < 0.01.

Table 1 shows that having been unable to save income over the past 12-month period is inversely related to individuals' propensity to worry and plan for retirement, conditional on individual and employment characteristics. In particular, panel A shows that, all else being equal, an individual who could not save part of her income is less likely to consider retirement as her major financial concern compared to someone who accumulated savings in the year prior to the survey. Panel B confirms that financial challenges are at least one factor that discourages the acquisition of private pension products. Individuals who could not save part of their income in the year prior to the survey are significantly less likely to own private pension products compared to those who were able to accumulate some savings.

Additionally, Table 1 shows that educational attainment increases the estimated probability of being concerned about retirement. However, it does not exert a significant effect on people's decision to purchase private pension products. Table 1 also confirms that, all else being equal, people with higher cognitive abilities are also more likely to identify financial security in retirement as their major financial concern. This finding is in line with previous behavioural studies which uncovered a positive correlation between cognitive capacities and the handling of scarce financial resources (Mani et al., Reference Mani, Mullainathan, Shafir and Zhao2013; Mullainathan and Shafir, Reference Mullainathan and Shafir2013; Shah et al., Reference Shah, Mullainathan and Shafir2012). Working arrangements also seem to play a significant role. Although it could be argued that those in atypical contracts are more concerned about their future well-being, given that they often have lower social security entitlements, Table 1 shows that, conditional on all other socio-economic characteristics, atypical workers are less likely to be concerned about and plan for their retirement than those who have more stable working arrangements. Overall, older individuals are more likely to be concerned about their well-being in retirement than their younger counterparts, a finding which confirms that retirement becomes salient as one grows older.

5. Potential explanatory channels

There are several ways to rationalise the effect of people's inability to save and their concerns and propensity to plan for retirement. We test two behavioural mechanisms: risk tolerance and expectations about future income. In line with previous studies (Pei et al., Reference Pei, Pischke and Schwandt2019; Adams-Prassl et al., Reference Adams-Prassl, Boneva, Golin and Rauh2022), we perform a coefficient comparison test and check whether our estimates are insensitive to the inclusion of these factors in our model. We also test the role of a more direct mechanism by exploring whether people's assessment of their current financial situation mediates the effect of financial challenges on their propensity to plan for retirement or to be concerned by it. We also explore the role of wealth holdings, which might attenuate the effect of one's inability to save for 12 months on concerns and planning.

5.1 Risk aversion

The first mechanism stems from risk aversion. Multiple studies in the economics literature have shown that people's willingness to take risks lessens significantly as a result of negative experience such as natural disasters, wars, and economic crises (Malmendier and Nagel, Reference Malmendier and Nagel2011; Callen et al., Reference Callen, Isaqzadeh, Long and Sprenger2014; Kim and Lee, Reference Kim and Lee2014; Cameron and Shah, Reference Cameron and Shah2015; Bernile et al., Reference Bernile, Bhagwat and Rau2017; Cassar et al., Reference Cassar, Healy and Von Kessler2017), or individual-specific negative life events (Bucciol and Zarri, Reference Bucciol and Zarri2015). Equally, having experienced financial hardship lowers people's risk tolerance through stress and negative affective states (Haushofer and Fehr, Reference Haushofer and Fehr2014). In the context of our study, this might in turn affect people's propensity to plan for or be concerned about their future financial well-being.

To elicit an individual's degree of risk aversion, the survey adapted the experimentally validated method elaborated by Charness and Gneezy (Reference Charness and Gneezy2010) and Charness and Villeval (Reference Charness and Villeval2009). This consisted of a simple investment task where each participant was asked how much of a hypothetical equivalent of $100 of savings they would want to invest in a risky asset that paid 2.5 times the amount invested with 50% probability, and zero otherwise. The lower the amount invested in the risky asset, the higher the degree of risk aversion. Conversely, risk-tolerant or risk-neutral individuals will invest the whole $100. We construct a variable that captures the difference between 100 and the amount the individual would be willing to invest. The variable ranges from 0 to 100, with 100 indicating the highest degree of risk aversion.Footnote 4 We include this measure on the right-hand side of our main model specification.

Table 2 shows our results. At first glance, the estimated effect of past financial challenges does not appear to move when risk tolerance is considered. Following Pei et al. (Reference Pei, Pischke and Schwandt2019), below the estimates in column 2, we display the p-values comparing each of the estimated effect of past financial challenges to the one from column 1 where risk tolerance is not accounted for. The results confirm that risk tolerance does not mediate the negative relationship linking financial challenges and people's propensity to plan for or be concerned about their financial well-being in retirement.

Table 2. Potential mechanisms: risk aversion, future income prospects, and current financial perceptions

Notes: Panel A shows results for logit regressions where the dependent variable is a binary indicator for whether respondents identify retirement as their major concern. Panel B shows the same sets of results for regressions where the dependent variable is a binary indicator identifying whether the respondents have a private pension insurance product. Coefficients of logit regressions expressed in log-odds metrics. All regressions include controls for age, gender, having children, education (in years), cognitive reflection test score, indicators for having a medium or high income, and binary variables for having an atypical work arrangement and being married or cohabiting. Standard errors clustered at the country level. *p < 0.1, **p < 0.05, ***p < 0.01.

5.2 Future income prospects

The second mechanism stems from people's uncertainty regarding their future income. Experience of financial challenges could skew expectations about economic prospects. Specifically, due to some form of negativity bias (Baumeister et al., Reference Baumeister, Bratslavsky, Finkenauer and Vohs2001), people could project their financial experience into their future economic prospects. Since the literature has established a link between income expectations and planning for retirement (Thaler and Benartzi, Reference Thaler and Benartzi2004), it may be that part of the negative effect linking people's inability to save and their concerns and plans for retirement operates through future income prospects.

We investigate this possible channel by controlling for people's expectations of future income in our model specification. We measure income expectations through a survey question which asked respondents whether they believe their financial situation is going to deteriorate, remain stable, or improve in the 12 months following the survey. We construct a variable that takes value 1 if the respondent expects a positive improvement in their financial circumstances and zero otherwise.

Column 3 in Table 2 shows that when expectations of future income are included in the model, the coefficient linking financial challenges and people's concerns and propensity to plan for retirement marginally reduces in size. The coefficient comparison test presented in column 3 indicates that expectations of future income attenuate the estimated effect of past financial challenges in panel A, but not in panel B. This suggests that the effect that past financial challenges exert on retirement concerns is mediated by future income prospects. In particular, the negative effect that financial challenges exert on retirement concerns is lessened if people expect their income to increase in the next 12 months.

5.3 Current financial perceptions

A more direct mechanism might also be at work. People's propensity to plan for retirement or simply to be concerned about it could be directly affected by perceptions that their current financial situation has not ameliorated compared to the past. Equally, people's saving abilities might cause a change in their perceptions about their current financial situation. In fact, being able to save can intrinsically bias personal assessments of one's current financial situation.

We investigate this direct channel by including in our model a measure of perceived changes in one's current financial situation. We asked respondents to declare whether they believe that their financial situation has changed over the last year (compared to the previous 12 months). Answer options were given on a 5-point Likert scale ranging from 1 ‘It got a lot worse’ to 5 ‘It improved a lot’. We construct a binary indicator that takes value 1 if the respondent reckons that her finances improved considerably or mildly, and 0 otherwise.

Column 4 in Table 2 shows that when a binary variable depicting whether one's current financial situation has improved or not is included in the model, the negative effect that financial challenges exert on both retirement concerns and planning drops significantly. This is confirmed by the coefficient comparison test presented at the bottom of the table. It suggests the effect that episodes of financial challenges exert on people's propensity to plan for or be concerned about retirement is stronger when the perceived deterioration in their finances extends into the present.

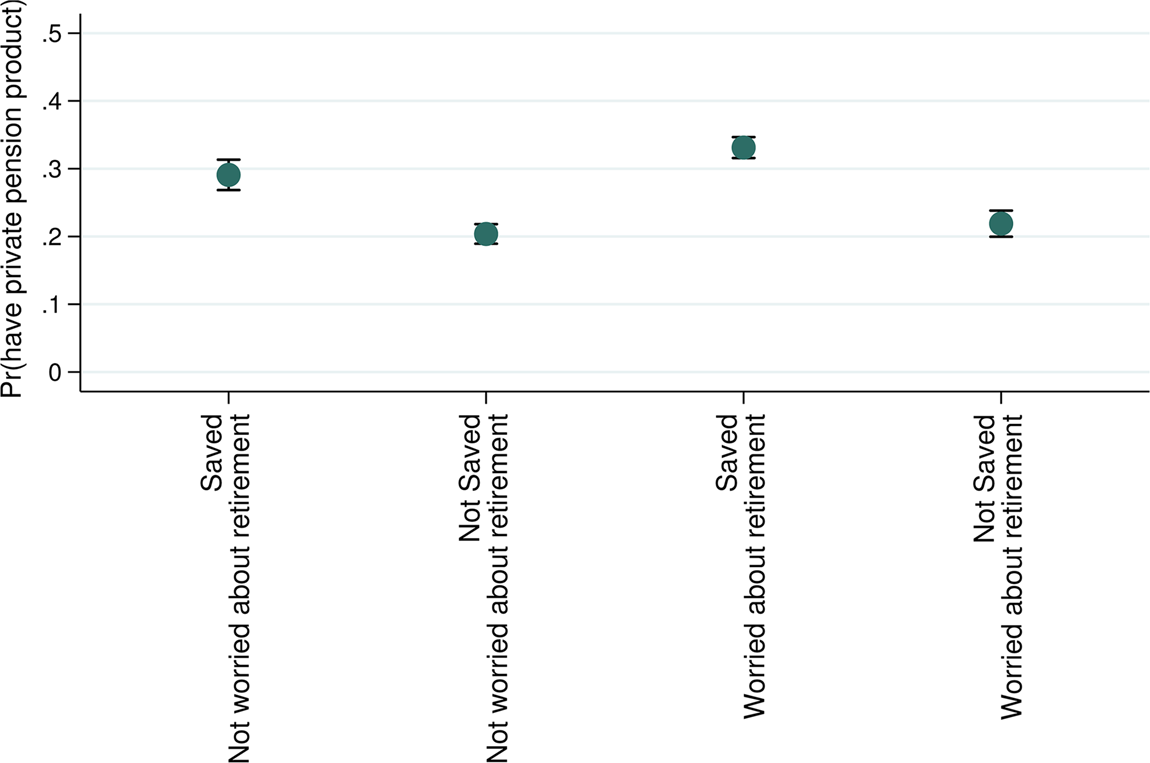

It can also be argued that concerns for retirement are the conditio sine qua non for individuals to purchase a pension product. This would suggest that both an inability to save and concerns about retirement security could affect individuals' decisions to contribute to a pension plan either positively or negatively. To explore the relative importance of these two opposing factors, we run a simple logit regression with an interaction term to estimate the joint effect of retirement concerns and financial challenges on planning. The coefficients of the interaction term yield interesting insights, summarised graphically in Figure 4. The effect of retirement concerns on planning is significant if and only if participants were able to save in the 12-month period prior to the survey. Differently, concerns for retirement exert no significant effect on people's decision to purchase retirement products if individuals could not save part of their income. People who could save and are worried about their well-being in retirement are ceteris paribus significantly more likely to think about investing in pension products compared to those who could not save and are not worried about well-being in retirement, with the predicted probability increasing from 0.20 in baseline to 0.33.Footnote 5

Figure 4. Predicted probability of holding a private pension product by concern for retirement.

Notes: Predicted probability of holding a private pension product for the four possible combinations of retirement concerns and saving. The dots represent marginal effects from the interaction variable, and the bars show 95% confidence intervals. All regressions include the full set of controls.

5.4 Wealth holdings

An alternative mechanism to explain the observed relationship could reside in the fact that people with lower wealth holdings are also more likely to be exposed to episodes of financial challenges. Assets are in fact generally considered tools to reduce exposure to risk and shield oneself against shocks. Clark et al. (Reference Clark, Durán-Fernández and Strauss2010, Reference Clark, Almond and Strauss2012) showed that, in some countries, some individuals, typically young and with relatively low income, rely heavily upon investment in the property market for their future retirement incomes. Lusardi and Mitchell (Reference Lusardi and Mitchell2007) found the existence of a strong positive association between retirement planning and wealth.

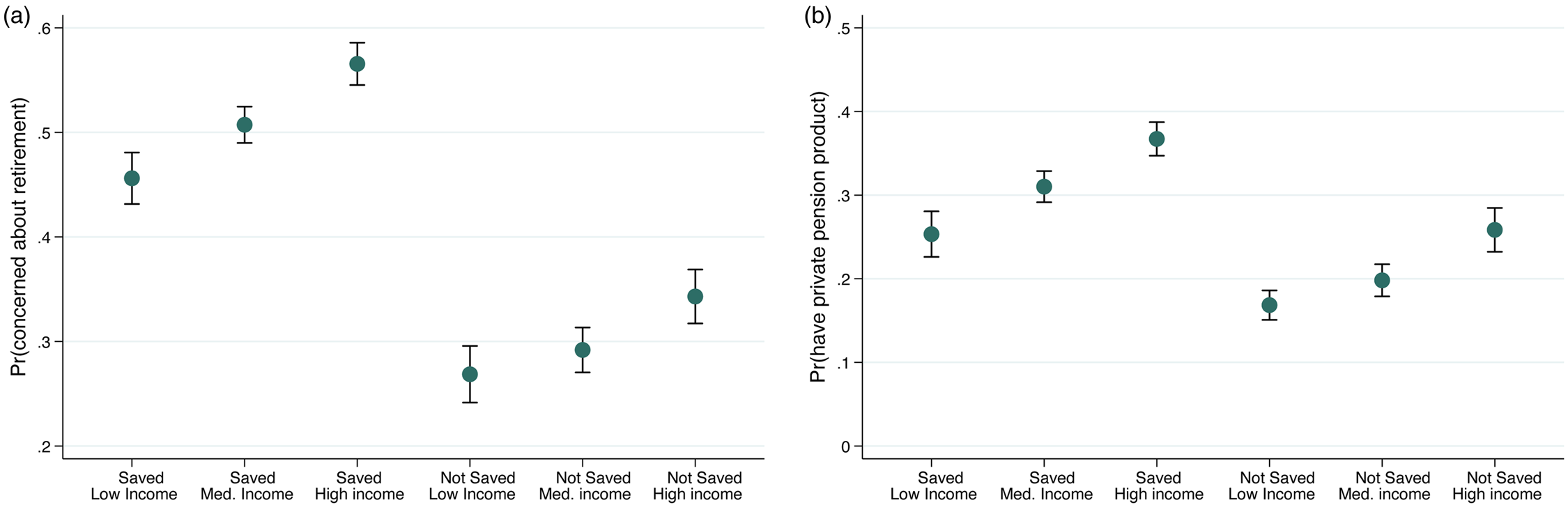

In all our model specifications, we control for income, as our dataset does not contain information on respondents' equity. However, to explore this mechanism further, we interact our main regressor with broad income categories calculated on the basis of each country's income distribution. In doing so, we implicitly assume that wealth holdings are directly proportional to one's income.

Figure 5 plots the predicted probability of retirement planning or concerns for the six possible combinations of income as a proxy for wealth and financial challenges. The results show that the effect of financial challenges varies along the income distribution. However, the predicted probability that people identify retirement as their major financial concern or plan for it is significantly lower if people could not save, no matter their wealth holdings. For instance, as shown in Figure 5a, high-income people who could not save are significantly less likely to be concerned about retirement than low-income household who could save part of their income.

Figure 5. Predicted probability retirement planning and concerns by broad income categories.

Notes: Predicted probability of worry for retirement (panel a) or planning for it (panel b) for the six possible combinations of wealth holdings and financial challenges. The dots represent marginal effects from the interaction variable, and the bars show 95% confidence intervals. All regressions include the full set of controls.

6. Robustness

Our results are robust to using a different definition of experience of financial challenges based on past episodes of a shortfall in earned income due to ill health which prevented our respondents from working. In addition, we show that our results remain unchanged when we control for the specific characteristics of the pension system of the countries scrutinised in the study.

6.1 Alternative measures of financial challenges

In our main specifications, we have focused on the inability to save as the main manifestation of financial challenges. In this section, we assess whether defining the experience of financial challenges as the result of negative health events undermines our results. While people's ability to save conceals some discretionary spending, episodes of ill health are largely beyond workers' control. This definition allows us to explore whether an exogenous experience of financial challenges can still exert an effect on individuals' propensity to plan for retirement or see future financial security as their major concern. In the survey, respondents were asked whether or not they had suffered from ill health which prevented them from working in the past. We use this binary indicator as an alternative measure of past experience of financial challenges.

We re-estimate our main model using the same set of controls but employing this alternative measure to proxy experience financial hardship over the past 12 months. We obtain similar results in terms of sign and statistical significance (see Supplementary material Table 4). The effect size changes slightly, with negative health events exerting a smaller effect on retirement concerns and no effect on planning.Footnote 6 However, this evidence corroborates our finding that experience of financial challenges is a particularly important predictor of people's concerns for retirement and ability to plan for it, even beyond their capacity to save.

6.2 Institutional arrangements and country-level regressions

We included country fixed effects in all our models to remove the impact on retirement concerns and planning of fixed country characteristics, which are potentially correlated with financial challenges. Yet these country dummies run the risk of absorbing differences in institutional contexts. The perceived adequacy of retirement income systems might well affect individuals' inclination to plan for retirement or to be concerned by it.

Therefore, as an additional check of the robustness of our result, we use the 2019 Melbourne Mercer Global Pension Index to control for country-specific characteristics of the pension system of the countries scrutinised. This index provides a comprehensive measure of pension welfare, taking into account national social security systems, private or employer-sponsored pension benefits, and other related institutions. The index attributes an overall score to each country which is the weighted sum of scores measuring the adequacy, sustainability, and integrity of pension systems found in three sub-indices. The index, which was retrieved from Mercer (2019), is only available for 14 out of our 16 countries; Romania and the UAE are not included in the analysis.

The results are presented in the Supplementary material Table 5. Column 1 controls for the three sub-indices which make up the Mercer Global Pension Index. Finally, in columns 2 and 3, we split the sample depending on whether individuals reside in a country whose overall score on the index is above (i.e., Australia, Germany, Hong Kong, Ireland, Switzerland, Finland, and the UK) or below or equal to (i.e., Brazil, Italy, Japan, Malaysia, Mexico, Spain, and the US) the median sample value. This allows us to verify whether the effect of financial challenges on retirement varies depending on the overall pension system performance. Table 5 in the Suppelementary material shows that the effect of financial challenges on people's propensity to plan for retirement or to recognise future financial security as a concern remains relatively stable even after controlling for the differences in retirement income schemes across countries.

We also ran country-level regressions to identify any further country heterogeneity. We report the coefficient of our main measure of the experience of financial challenges on retirement concerns and planning for each country in our sample in Figure 7 in the Supplementary material. All regressions include the full battery of controls. No matter their country of residence, respondents who were unable to save part of their income are significantly less likely to recognise their well-being in retirement as a concern (see Supplementary material Figure 7a). Similarly, lacking savings significantly reduces the probability of holding private pension products. This effect is significant at the 5% level for most countries in our sample (see Supplementary material Figure 7b).

7. Heterogeneity in effects

In this section, we explore possible heterogeneity. In particular, we wish to ascertain that the effect that past financial challenges exert on people's concerns and plans for retirement is not guided by individual differences in time preferences, family, or work characteristics.

7.1 Impatience

Eisenhauer and Ventura (Reference Eisenhauer and Ventura2006) established a significant relationship between present-biased preferences and a dichotomous variable for whether or not the person has contributed to a pension. According to the psychology of poverty literature, households with a smaller budget are faced with more difficult trade-offs, which in turn affect their willpower and time-discounting behaviour (Haushofer and Fehr, Reference Haushofer and Fehr2014; Carvalho et al., Reference Carvalho, Meier and Wang2016). Thus, the negative effect of experience of financial hardship over the last 12 months on retirement concerns or planning could be driven by individuals' time preferences. If this was the case, we would expect the effect to be stronger for those who are more present biased. To shed light on this, we examine the heterogeneous effects of financial challenges and time preferences. In line with numerous studies (Benjamin et al., Reference Benjamin, Brown and Shapiro2006; Lusardi et al., Reference Lusardi, Mitchell and Curto2010; Scharff and Viscusi, Reference Scharff and Viscusi2011), we use smoking as a proxy for present preferences and self-control limitations.Footnote 7 In Table 6 (columns 1 and 2) in the Supplementary material, we show that the overall effect is not driven by individuals who are impatient and thus have strong preferences for the present.

7.2 Family circumstances

Marital status has been found to play an important role in retirement income adequacy (Bajtelsmit, Reference Bajtelsmit, Clark, Munnell and Orszag2006). Even and Turner (Reference Even and Turner1999) show that the pension coverage rate for two-person households is greater than that for singles of either gender. Equally, however, having to provide for a spouse or a partner might increase the threat posed by past financial challenges and thus increase the effect these factors might have on retirement concerns and planning. In Table 6 (columns 3 and 4) in the Supplementary material, we test whether the experience of financial challenges exerts a differentiated effect depending on whether individuals are married or cohabiting, or single or widowed. We show that an inability to save does not exert a stronger effect on retirement concerns or planning for those individuals who are married or cohabiting, and might have to provide for their spouse or partner, compared to those who are single or widowed.

7.3 Work arrangements

On the one hand, pension systems suffer from an intrinsic inertia and do not account for occupational labour mobility (Engelen, Reference Engelen, Clark, Munnell and Orszag2006). At the same time, recent changes in the world of work have seen a growing share of the workforce employed in atypical working arrangements and thus enjoying fewer pension benefits. These two concurrent phenomena suggest that the effect that financial challenges exert on people's concerns and planning for retirement could vary with their employment status, with atypical workers being more exposed to financial challenges and possibly also more likely to identify well-being in retirement as their major financial concern and to have a supplementary private pension. In Table 6 (columns 5 and 6) in the Supplementary material we show that atypical workers are less likely to worry about and plan for retirement than full-time employees. Yet, financial challenges generate a symmetric and quite comparable decline in the predicted probability to acquire private pension products for both groups of workers.

8. Conclusion and discussion

The accumulated effects of population ageing, low economic growth, and more recently reduced financial returns have accentuated the problems of paying for workers' retirement in many countries. Thus, now more than ever before, workers are faced with the need to plan for their retirement. At the same time, many households, even in developed countries, are living on the financial edge and are increasingly less able to handle financial shocks.

Using an original survey based upon representative samples of working individuals in 16 countries, we show that individuals who were not able to save part of their income over the last 12-month period are less likely to consider well-being in retirement as their major financial concern. They are also less likely to contribute to private pension funds to replenish their retirement income than those who could accumulate savings. Put differently, episodes of financial turmoil exert a negative effect on people's propensity to identify financial security in retirement as their major financial concern and act in the interest of their long-term well-being. We provide evidence that this effect is stable across countries. Additionally, we show that the importance of financial challenges does not vary significantly with work arrangements, family circumstances, or time preferences.

Taken together, these findings demonstrate a feedback loop in which the experience of financial challenges can become engrained and may then lead to lower levels of concern and a greater tendency not to plan for retirement. This feedback loop may prolong a state of distress and undermine the prospects of achieving financial security in retirement. If this feedback loop holds true, efforts to help households to weather financial turbulence should be key to ensuring their long-term financial well-being. When saving shortfalls loom large, an individual's future financial well-being is not salient to them. This might seriously undermine people's efforts and ability to accumulate assets, putting the retirement system under strain in turn. In these circumstances, establishing minimum income levels could be beneficial to counteract the psychological distress that resource scarcity brings about (Haushofer and Fehr, Reference Haushofer and Fehr2014). A second possibility for breaking the cycle and improving welfare consists of targeting retirement planning directly. In this respect, small nudges, such as commitment saving accounts, reminders, or opt-out mechanisms might stabilise contributions and produce tangible benefits. These strategies are not mutually exclusive. They should be considered in isolation as well as in combination to properly assess their long-run effect.

Our analysis is robust to using alternative measures of financial challenges and controlling for differences in countries' pension systems. However, future research might wish to eliminate the bias in our estimates that is plausibly generated by omitted variables. In particular, collecting information on the amount of savings and possibly equity holdings for each respondent appears to be a promising way to advance our analysis. Additionally, longitudinal studies might be well suited to evaluating whether financial challenges alter people's propensity to think about and plan for retirement in a sustainable manner or whether the effect fades away with an amelioration of workers' financial situations. Equally, in our set-up, perceived income prospects, together with assessments of one's financial situation, appear to at least partially mediate the effect that financial challenges exert on retirement concerns. However, to properly assess the potential of these mechanisms, future studies might wish to collect data on income expectations before and after the experience of financial challenges. This would be key to assessing whether the effect of financial hardship over the last 12-month period on retirement planning and concerns acts through a decline in income expectations.

Supplementary material

The supplementary material for this article can be found at https://doi.org/10.1017/S1474747223000082.

Acknowledgements

We thank Zurich Insurance for providing access to the data. Ethics approval was obtained from the Central University Research Ethics Committee (CUREC) of the University of Oxford: SOGE1A-19-21. We are grateful to the Smith School of Enterprise and the Environment for institutional support and access to facilities in the implementation of our research programme. We also wish to thank Paolo Bordalo, Stephen Brown, Paul Gerrans, Peter Tufano, Noel Whiteside, and H. Peyton Young for their suggestions and advice. Marta Golin provided excellent research assistance. We also appreciate the insightful comments of the journal's editors and an anonymous referee. None of the above should be held responsible for any errors or omissions.