The Chairman (Mr S. K. Reid, F.F.A.): Welcome to this sessional research event about the hot topics in health and care. We have three papers.

The first paper is Digital Health and Disability Claims. It is written by Adele Groyer and Ross Campbell from Gen Re. Groyer heads up the Gen Re London branch pricing and research team. She is responsible for general research and client-specific quotations for income protection as well as life, long-term care and critical illness business sold in the UK and Ireland. She is currently a member of the IFoA Health and Care Board and the CMI Assurances Committee.

Adele holds a bachelor of business science degree from the University of Cape Town and became a fellow of the IFoA in 2005.

Campbell is Chief Underwriter in Research and Development at Gen Re Health and Care based in London. His role involves medical and non-medical research including digital innovation. For 10 years Ross was chief underwriter for Gen Re UK, responsible for claims and underwriting client services. Ross has worked in reinsurance for more than 30 years in the UK and overseas markets. He is a chartered insurer and holds the Insurance Medical Society’s Diploma in Medical Underwriting. He is a senior examiner for the Chartered Insurance Institute in London.

Mrs A. N. Groyer, F.I.A.: Ross and I would like to present research into using digital technology in disability claims. There has been a great deal of research and many presentations about how digital technology can improve many aspects of the insurance industry.

We felt that this area has, perhaps, been explored in less detail. It is something that we spend a lot of time working with in my role of pricing and designing disability products, working with claims managers, and in Ross’s role, underwriters. Now we have day-to-day interactions with digital start-ups looking to expand into this space.

Tonight, we thought that there were four key questions that would set out the key messages we would like to leave with you.

The first one is, “What is digital health?” Many landscapes rely on having common terminology. We would like to share with you what the key features of this environment are. Then we will turn our attention specifically to the disability claims space and describe how there are many parallels with the health and care space, and where this technology is also being considered. There are many strategic initiatives there.

The next question is: “What are the disability claims problems we are trying to solve?” There is always a danger in trying to find a problem to use your technology to solve. We are conscious that we need to think carefully about what the problems are in the disability claims space for which a solution may involve digital technology. So, the third question is, “Which digital solutions are available?” We then touch on some specific examples where we see this technology going. The last question is, “How do we implement these solutions?” It is very early days. Many countries are looking to others thinking that everyone else is ahead of them. How do we get this over the line?

So what are the disciplines in digital health? What digital health is trying to do is to use information and communication technologies in order to improve health and care outcomes. There are five ways that I am going to describe. I am going to focus on four of them.

First, what is health information technology? It is all about having a system where you can transfer data from one domain to another. For instance, you can exchange information between doctors or between patients. We have all heard about the aspiration to have good electronic health records – obviously with all the complications around data security and privacy.

The second discipline many of us will be familiar with is mobile health (mHealth). This is where we are able to use mobile phones in order to have medical interaction. There could be something as simple as an appointment reminder from your doctor coming to your mobile phone, or it could be that you are accessing health advice via your phone.

The third, Telehealth, is a broad area. That is specifically looking at remote interactions. There are subsets of Telehealth. One of them is Telemedicine. That is where you have a clinical consultation in a remote setting. The doctor is somewhere other than where the patient is.

Another is Telecare, which is instead of clinical consultation care. Somebody is, for example, in their home. They need someone to know when they have a problem. It is sending information to another place.

Telehealth also includes broader ideas like online learning for doctors.

Finally, many of us will be aware of wearables. Many of you may be wearing wearables. The obvious idea is that there will be an activity tracker. That is not the only wearable. The idea is that it is transmitting health information from something that you are wearing on your body. A nice example that I found was glucose monitoring. That is something that a diabetic would wear on their skin. We could continually look at the skin and from that be able to determine glucose levels and advise the patient to take an appropriate intervention.

Fall alarms are another example. A person who is at risk of falling may be able to wear a pendant around their neck. That has an accelerometer in it. That could again alert the person to the danger of falling. I saw one that involved airbags in a belt around the waist. It would alert somebody that they needed help.

All of this is in the health space. The fifth one is personalised medicine. That is to do with using genetic information in order to personalise treatment. I could not see an obvious parallel to what we would do in disability care, so I am not going to go into the detail of that tonight.

These are all ideas in the health and care space. There are obvious parallels. When someone is putting in a claim for disability, by definition they have a medical problem of some kind. They will be receiving care. What the claims manager is trying to do is work in partnership with the medical professionals to try to get this person back to work. There is a slightly different focus but you are dealing with the same person and there could then be opportunities to use similar technologies and solutions to improve outcomes for everyone.

What do we mean by improving outcomes? One of the institutes looking at digital health identified five objectives to achieve digital health. I have drawn up the parallels that I see with digital disability claims.

The first objective is to increase the quality of care. If you assume the National Health Service (NHS) has a strategy for how it can use this technology to improve outcomes for people, the parallel that I see is improving the claims decisions and interventions that somebody receives. If somebody has put in a disability claim, they want to know that they are going to be treated promptly and they also want support from the insurer.

There could be a bias if somebody has a condition that is variable from day to day and they happen to go for an assessment on a good day and then they get the claim declined. The claims manager is also looking to get the person back into work. Again, if there is a good information flow, are there opportunities that could encourage a person to focus on something that will help rehabilitate them back to work?

In the health and care space and in the disability claims space, everyone is looking to reduce costs (the second objective). Costs come in the form of the actual claims payments as well as the cost of administering the claim. There could be delays in getting a medical appointment. With resources constrained in the health environment, we sometimes see that somebody needs to go for a physio appointment, but they have an 18-week delay before they can get one, at which point the opportunity to rehabilitate them is much diminished. Again, is there a way that we can interact better and use technology to get some treatments in place?

The third objective is improving access. In the healthcare space, this would be the ability to get to a doctor in a convenient way. If somebody is trying to put in a disability claim, they want to be able to do that in an easy way, to be able to reach the insurer and have the appropriate interactions at the right time.

As an example, I have had some personal experience in the PMI space where I was, as a customer, on hold for a long time trying to get authorisation to get an appointment with the doctor. When someone’s health is compromised like that, is there not a better way of interacting with the insurer to notify them what has gone on and get some initial indication back from the insurer about what the next steps are going to be?

Another objective is reducing inefficiencies in delivery. Again, there are stories of why the medical system may not be operating efficiently. My claims colleagues could have talked for hours about the numbers of times that they have had to do things that were not utilising their skills in rehabilitation. That was taking up administrative time and making the whole process inefficient and unpleasant for all.

A key example is they are still using a lot of paper-based communications with doctors. Papers go off in the post, taking a long time to get back. Someone then must manually enter it into a system. It seems like that there is a solution which could be found to make the experience more efficient for all.

The final objective of digital health would be to make services more person-centred. Can we make this a nicer experience for everyone? If you are a disability claimant and you get a phone call from your claims manager a few days before you have gone for your medical appointment asking you what happened at your medical appointment, that is not a very good intervention. Whereas, if you had the call the day after with a sympathetic, “How did it go yesterday?” it feels like a more positive person-centred approach.

Coming back to the disciplines in digital health and how those relate to disability claims: how could health information technology help? We have seen in group business that electronic absence records made available to the group insurer make it faster for the disability claim to go through; the insurer was alerted much earlier in the process that someone was at risk of needing to put in a claim.

The other thing that could help is dashboards. This is a path issue between multiple stakeholders. Could the doctor, the insurer, the claimant and the employer all have access to a dashboard underpinned by an electronic system where everybody knows what they are expected to do and what is going to happen next?

In terms of mobile health (mHealth), most people do have access to a mobile phone. In fact, some of the providers we are working with have approval to be on the NHS’s website. There are apps available in many areas, such as mental health, muscular skeletal areas and cancer. Someone gets access to the app on their phone and starts to get some therapy that, perhaps, is more difficult to arrange face-to-face. Even something like a reminder to attend an appointment, or a reminder to contact the insurer as soon as an appointment has happened, is enabled by mobile technology.

An example that we saw using mobile technology was when someone had a fracture. They went to hospital. They took a photograph of their hospital discharge note and a photograph of the injury and sent them to the insurer. The disability claim was admitted on the basis of that evidence.

Telehealth is all about everyone being remote. The idea here is a better way that doctors, patients and insurers can interact using communication technology. If you could get the insurer able to talk to the doctor or the customer able to talk to the insurer remotely, perhaps by a Chatbot, it would feel like a potential solution.

I spoke of the example of wearables where you get inconsistencies between somebody having a good day or a bad day depending on their claims assessment. If somebody with a variable condition can have a piece of wearable technology that they are then willing to share with the insurer, that may lead to a much fairer assessment with the insurer, who can see the patterns of what is going on with their health.

With that, I am going to hand over to Campbell, who will show more on the examples and some interesting challenges.

Mr Campbell: I have been talking to start-ups and investigating the potential for digital for around 3 years. One of the first questions that people ask me is which of these solutions is actually used anywhere. That is always a difficult question to answer because very few are being used, which is unusual. If I asked for a show of hands from those who do not have a mobile phone, I guarantee no one ever puts their hand up. But everyone has a phone, we all use apps and we are all listening to this idea about digital solutions and how seductive they are.

Why is it not happening? I thought that it will be interesting to round off our presentation thinking about some of the things that get in the way. With start-ups I think it is just the sheer complexity of insurance. They see it as an opportunity. They understand that it is an industry that is ripe for some change. We have been saying that ourselves. But it is bafflingly difficult. The products that we sell are not familiar to many of the people that I am encountering. Even the languages that we use to describe the things that we do are not familiar.

It is a heavily regulated industry. There are barriers to entry. There are certain things that we have to do to comply with rules and laws. These are all different in different domains. That is baffling to people who are encountering insurance for the first time.

Generally speaking, start-ups are not being created by people who have left the insurance industry thinking that they might make a start-up to serve the insurance industry. I have found a few people who worked in insurance. Typically, entrepreneurs are not furnished with that kind of background. Their insurance knowledge is low. We have to help them to understand what it is that we do and how they can help us.

Start-ups are obsessed with raising money. They are spending their own money, their parents’ money, their friends’ money. They are constantly on the lookout for investment and are driven by that. A lot of the material that they present is aimed at attracting investors and does not often answer our questions. I understand why they are interested in raising money because building software and testing ideas is not cheap.

Therefore, when you encounter an entrepreneur who has a decent idea and you ask for a demo, you often see a half-finished product. They build only what is minimally viable to demonstrate their technology idea. It is therefore impractical for us to expect to be able to buy these things off the shelf and plug them into our systems without any customisation, and that is something that we must get used to. Normally, if we buy a product, it is ready.

They are also easily distracted by other shiny things. They work in a different environment to us. People go through a 3-month incubation process. They have spent all their money; an angel investor gives them more. Then they encounter insurance, which has not changed for 300 years. It has a special momentum all of its own.

On the insurance and reinsurance side, which of these companies do you choose to work with? There are so many of them. More than 550,000 start-ups were launched each month on average last year. Of those 30,000 identified themselves as InsurTech companies.

The insurers are concerned about the sustainability. First of all, they are all exploiting available technology. They are talking about wearables and digital data on phones that are unlikely to look the same in the future. Do we want to hitch ourselves to a technology that might change? There will be a seamless development of apps; the software and the hardware will go with it, but it is a concern.

We are also worried about scalability. We meet a company that has little money, few staff and no customers, and we are going to plug it right into our important insurance business that has long-term guarantees of managing risk. Again, that is something that we have to rationalise.

Then there is the technical validation of the ideas. Do they work? What about the algorithms that they say they have that are proprietary? They do not want to give too much away yet we want to understand how they work.

We must decide whether we are integrating these ideas to make our current processes better, more user-friendly or simpler; or whether we are going to eliminate all those processes and just go completely digital.

We are intrigued by this. There is a fear of missing out. There is a great deal of interest and that is good because we are getting some dialogue and some momentum behind this idea. The more powerful force is a fear of a better offer, so no one wants to commit.

We are all concerned about the data. What is the data? Do we need it all? Is it just nice to have? How do we look after it? Will people share it with us? Can we use it sensibly?

I also want to talk about some of the solutions that are on offer. We are interested in therapeutic apps, things that are built along clinical pathways. For example, Thrive is a mental health app that embodies National Institute for Health and Care Excellence (NICE) guidelines. It has diagnostic criteria that we understand. Monsenso is a good example. We are interested in things that work.

Prescription exercise apps can get people moving again quickly. People can personalise them and get involved in video-based exercises to rebuild their physical strength. TrackActive is a good example. Injurymap is another.

We are also interested in those companies that are exploiting the technology still further, such as the 3-D cameras that will soon be in our phones, which can be used to analyse motion to see where people’s limitations are occurring. This could be used at an underwriting stage or at a claims stage. AIMO is a company that is involved in this kind of technology. It is waiting for the technology to catch up with it.

For the consumer, these ideas are convenient and easy to use. People want to be involved. They do not want to wait for 6 months for an appointment to see someone in health services when they can download an app and get on with it.

Consumers want things that are personalised to them. If the app does not work for them or an exercise, for example, that is prescribed hurts or that does not help them get better, they can feed that back and it can change almost immediately.

For insurers, I think it is all about the data. We do not know how much of the data is useful, but we know we want it. We are not sure how we are going to use it, but we are going to use it for something. Seriously, the data are different to the data that dwell in claims disability files. Disability claims files are beautifully manicured. They tend to be analogue and it is hard to extract meaningful insights from them.

We also hope that this will lead to some savings. Savings could be found in the processes, the cost of the analysis and the management of disability claims. We could allow customers access to an app before they claim to help them build resilience, to avoid that injury or to prevent the inevitable happening. We hope that we will improve our experience over time, that we can reflect that in our pricing, perhaps, or the experience of our customers.

People only appreciate insurance when they make a disability claim. Then they think it is fabulous. Few people encounter us in that way. There is a lot of anti-news about what insurance does and does not do, which is slightly irking for us. However, we know that it does provide strong benefits for people.

Finally, there are some things that we can do. First, engage: meet start-ups or people who are meeting start-ups; think about how these ideas might work for you.

Another is to collaborate. Many entrepreneurs work in shared working spaces. They collaborate just as a way of life. They are all making discrete solutions and are concerned about not collaborating. Sometimes they want to join up to create a better solution. Then they need to get into doing some project work or some pilots.

The last thing is to implement some of the solutions, initially in a parallel environment, perhaps with a test group.

The Chairman: There is an opportunity to ask questions now.

Dr G. Woo: Is the idea to do for the human population what is being done for automobiles? You have various types of monitoring instrumentation inside your car. Essentially, the insurer can know exactly how you are driving.

Is the idea to check on whether you have done your 10 minutes of brisk walking every day, and that kind of thing? There is a question in my mind about how intrusive this might be.

It is one thing to have somebody checking on how you are driving. That is fair enough. But to have someone checking on whether you are going to the gym or not … have you thought about this?

Mr Campbell: In terms of a disability claims scenario, if I were claiming and I wanted to get back to work, I would be keen to engage in a modern way. The NHS is providing apps; why should not insurers provide them? Why do I have to wait 6 weeks to see the consultant about my bad back when I can download an app and begin some exercises now that might help?

You are right. It is untested whether people will or will not share data in that way. I suppose we are willingly sharing data in many other ways. We all share data just by having a phone in our pockets, giving data points about where you are, where you have been and what you do, what apps you have had and how many calls you have had, whether you want it to or not.

The only way to not have it is to disconnect from the digital world. I cannot believe there are many people who are willing to do that.

A member of the audience: In terms of income protection, with certain providers there are clauses to help people get better. Some policy providers will pay for treatment, physiotherapy or even getting a cab to work if you cannot get to work. Do you feel that people, customers, are aware of how insurers can help them? And do you think that the way that income protection is sold means that people are not aware of these things?

Mrs Groyer: I think a lot of the marketing for disability insurance is about the money. I think that the real value comes in those added services: someone who is helping you through the process, guiding you through some ideas of how to work with an injury or disability. I have seen an example from New Zealand where they did not market it as a disability insurance product but a rehabilitation benefit.

Once somebody gets to the claims stage and they have had a positive experience, and there is a good reciprocal relationship with the insurer that is the point at which they value it.

I think the low disability or income protection sales tell us how much people value it at this stage.

Mr I. C. Collier, F.I.A.: I am interested particularly in the interaction between insurers – it could be the NHS but the insurers in particular – and the start-up high-tech companies. There are many clever people looking for start-ups out there but do not know where to start, because they do not know what the problems are.

Campbell suggested that you need to help them. Do insurers, or perhaps other people, go to the start-up hubs around the world where there are many bright young people looking for high-tech start-up companies but do not really know where to go or where to start?

Mr Campbell: I think typically within incubators and organisations, insurers are encouraged to invest their time and money. The motivation might be that they are looking for the next best thing or the motivation might be altruistic: to create something that is useful for everyone.

Reinsurers have an important role to play in selecting some of the more promising from the thousands of available start-ups. Typically, we see quite good quality thinking. We have a checklist of things that we look for in start-ups that help us.

As I said in my presentation, I think it is unrealistic to expect a 20-year-old person who is a whizz kid with data to come up with a solution that fits with my problem on income protection claims, unless I speak to them about it.

I should like to think that there is enough dialogue. Out of the thousands of these companies, so few of them make enough money to make it through.

Eventually it will happen. But I think that it will happen through collaboration, and I think insurers and reinsurers need to engage with it.

A member of the audience: I have a comment to add in response to the last question. I work for BUPA. We bring start-ups into the organisation. It is becoming an annual exercise. We will pose several business questions and invite start-ups to apply to spend 3 months with us, thereby leveraging the resources within the firm and bringing in fresh young talent to work in an innovative way on these ideas. That is an example of how insurers can practically interact.

I also have a question. We know that a couple of the key determinants of recovery from disabilities are the underlying motivation of the individual claimant to recover and to get back to work and, second, early intervention on the part of the insurers. I was wondering whether you had come across any examples of the use of the technology to make that assessment of motivation, perhaps to engage in a motivational way with the claimants, and therefore to help an insurer to direct its activity to the claims that are most likely to be amenable to intervention.

Mr Campbell: You are right. Many companies are taking entrepreneurs under their wings and putting them through their own incubation processes, which is useful.

In the context of disability claims, it is untested, to answer your question directly. Where I look for evidence is where these things are working in a clinical world. Does it help people get better? Do people continue to engage with it?

Where engagement is high and success in treatment is high, then I am encouraged that the question you are asking would be answered. I am not sure that there is currently enough to show that it works in an insurance setting.

Obviously there is a concern. Insurers are not trusted in the same way that perhaps other services are. We must address that in some way and show that we can help people and use the data that they are prepared to share with us in a constructive way to help them get better more quickly.

But until we can show that, we must fall back on the published evidence or the clinical outcomes that these companies are already delivering in their other business. Many are involved in delivering clinical solutions to pensions. We are talking about delivering semi-clinical solutions to claimants. So we are not that far apart. But the motivations of those two population groups are quite distinct.

Mrs Groyer: I have not seen a tool that assesses motivation. At the moment it is down to the claims managers, who try to use economic techniques to generate reciprocity or something positive. If we could find an app, it would be great to collaborate on it.

Mr Campbell: There is something in the feedback. With instant feedback you can drive through a digital solution. Someone in a claims setting is going to be seen episodically, whereas if they are going to see the app every day, if they choose to, they might say “I want you to talk to me only every week”. They can manage that and get rewards, feedback or encouragement or whatever it is they need. That is something the traditional way of looking after disability claims cannot offer. You cannot see people on a daily basis, even if you would like to do so.

Mr S. McCarthy: Some of the focus seem to be on claims management. I was wondering whether there were any inroads made with the mitigation of disability claims arising in the first place – a managed life approach. Has there been much collaboration with start-ups at that end of it?

Mr Campbell: I think that there is definitely a role for resilience building in policyholders, but whether the motivation is there to engage with the insurer, I do not know. Some of the therapeutic apps are about keeping you well. They are not only designed for people who are unwell.

I completely agree that there is an opportunity to build a model that facilitates that. It is just a changed way of thinking.

The Chairman: Our next speaker, Dr Gordon Woo, is the chief architect of the RMS LifeRisks pandemic model which was developed in 2005, at the time of the emergence of a lethal strain of avian flu. Among his articles on endemic risk is a contribution to the pandemic edition of the 2015 IFoA Longevity Bulletin.

Educated at Cambridge, MIT and Harvard, he is a visiting professor at UCL and an adjunct professor of Nan Yang Technological University, Singapore. He is an author of two books on catastrophe risks published by Imperial College Press.

Dr Woo: My talk is important not just for your professional work as an actuary or underwriter, but for you as a person, for your family, your friends, your colleagues.

It is 100 years since the great 1918 pandemic. Quite remarkably, it is only in the past 2 years that the true understanding of the age dependence of that pandemic has been revealed through diligent science. That is what I am going to tell you about today.

It is the first strain of flu to which you were exposed as a child. When you get home you can call your mothers or your grandmothers to try to find out what was the first flu. Scott [Reid] told me he was born in 1969. Most likely he is exposed to the Hong Kong flu of 1968. But more of that later.

I was thinking about the centenary of the 1918 pandemic. Normally with anniversaries the general way of thinking is to suppose that pandemic were to occur this year. Suppose the 1918 pandemic were to occur in 2018? But I thought in a different way. Last year I wrote the report for Lloyds called “Reimagining History: Counterfactual Risk Analysis”. It came out in October last year with publicity in The Economist magazine.

My alternative way of looking at the 1918 pandemic was this: how could the 1918 pandemic have been different from what it was?

The answer is it could have been different if the previous pandemic in 1890 had occurred a little earlier or a little later. That was the start of this journey into exploring the age dependence of 1918.

Let me start with some basic virology. The two main players in this cast of thousands are the two proteins Neuraminidase and Hemagglutinin. Neuraminidase is the protein that attaches to your throat or your chest. Hemagglutinin is what governs the release of the virus from the host cell.

The five most recent influenza pandemics are Russian flu (1889), Spanish flu (1918), Asian flu (1957), Hong Kong flu (1968) and Mexican flu (2009). Most likely in your recollection of pandemics you only knew the date and the name of the flu, Spanish flu, Asian flu, etc. You probably did not pay too much attention to what strain it was.

In fact, the strain turns out to be crucial. H3N8 in 1889–1890; H1N1 in the great pandemic; H2N2, the Asian flu; H3N2, the Hong Kong flu; and most recently, H1N1, the Mexican flu.

Before I talk about how lethal viruses are, I should say a few words about contagion. The degree to which the virus is contagious depends partly on the characteristics of the virus itself. The virus can attach to the throat or deeper in the chest. What is crucial is the way in which the virus causes you to either cough or sneeze. If it attaches to your throat, you might be coughing more, and so on. You might spread the virus more easily to people around you.

That is not all that matters in contagion. What also matters is your social network through which you can spread the contagion. That is crucial in terms of trying to figure out what the overall spread of the virus will be.

I should like to say a few words about the 1918 pandemic in terms of its contagion. It killed more people than the Great War. There was a Chinese connection to this; namely, the Chinese government of the day sent 95,000 labourers to the Western Front to do menial jobs: cooking, digging trenches, laundry, and so on. They brought the contagion with them from China across to Vancouver and then by rail across Canada to Nova Scotia and then by boat to Britain and Europe.

For historical interest, the reason why the Chinese government decided to do this was they wanted to try to get Shandong province back from the Japanese, who were occupying it at the time. That is just by way of explaining how contagious the 1918 pandemic was. When you have large fluxes of population such as the 95,000 Chinese labour corps, that is dangerous.

In our own time, in 2015, when we had one million refugees from Syria going to Germany, that was also a very dangerous situation. Fortunately, there was no pandemic outbreak in 2015. Think of the Ebola outbreak in 2014 and if there had been a civil war in West Africa at the time. That would have been a dangerous situation for the whole world.

Much attention has been given to the aspects of the virus itself that might be contributing to its lethality.

First of all, with reference to the traditional way of looking at the 1918 pandemic, we gave a lot of attention to cytokines. These cytokines are proteins that govern and regulate the immune system and influence the inflammatory response of a person. The phrase “cytokine storm” was coined at the same time as the “Desert Storm” in the first Iraq war. That is how the term came about. It is an overreaction of the immune system to attack by an external virus.

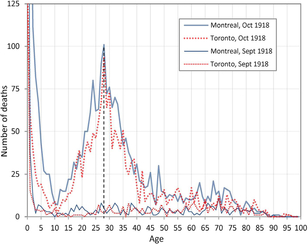

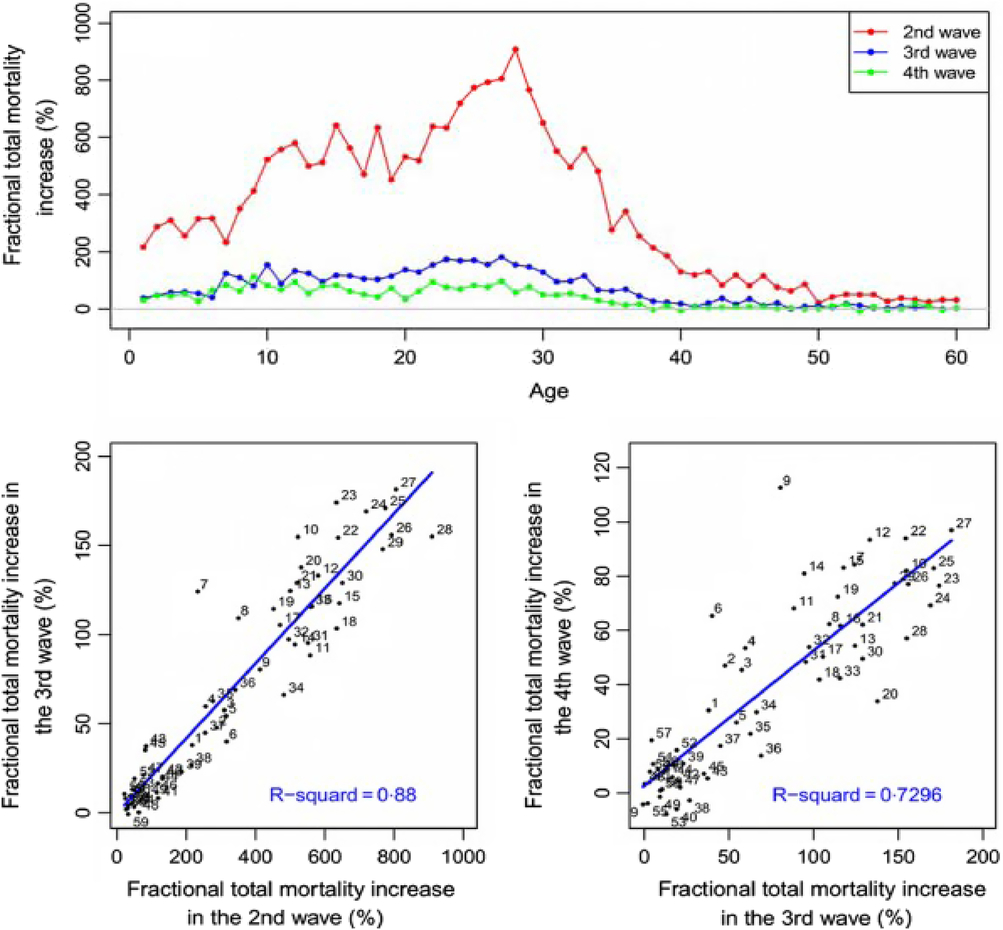

It has always been thought that the age profile of the victims of the 1918 pandemic was explainable by the cytokine storm. The level of the immune system is pretty much flat once you get past infancy and before you get into old age. This flatness does not explain the following data, which is the age profile of victims in Canada (Montreal and Toronto).

Figure 1. Recorded deaths (from all causes) by age in Montreal and Toronto in September and October 1918 (Gagnon et al., 2013).

We were astonished by the peak age at death of 28.

If we look at New York City, which is also good data, we also see this spike about age 28.

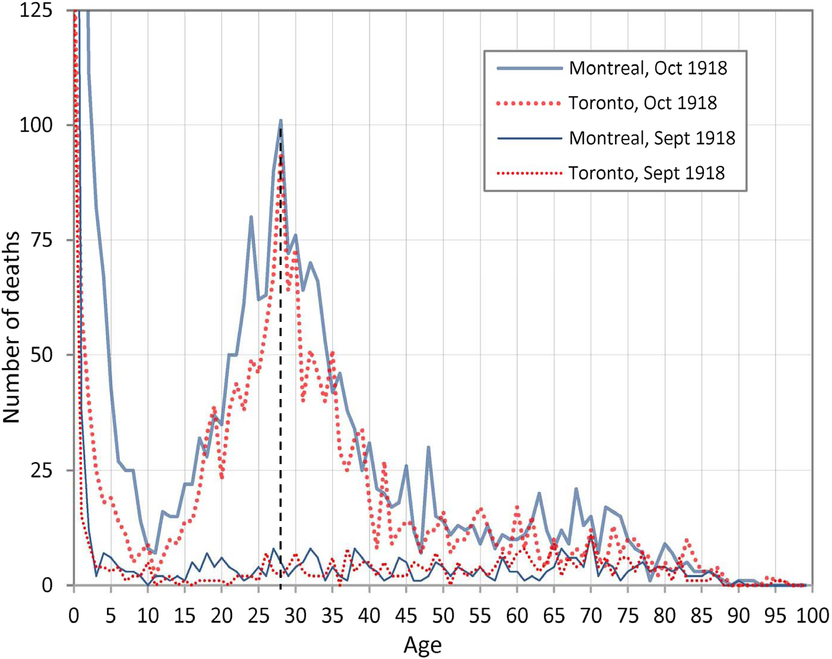

Figure 2. Pandemic impact in New York City. Correlations of age specific mortality patterns in the final three pandemic episodes (Yang et al., 2013).

Everyone here can subtract 28 from 1918 and get 1890. 1890 was the date of the last pandemic. The most famous 28-year old who died in the 1918 pandemic was the Viennese expressionist artist Egon Schiele. Those who were exposed to H3N8, the Russian flu, were in trouble when the 1918 pandemic came about, because it was of a different group of viruses. I will describe the differences in a moment. Those who were unfortunate enough to have been born around 1890 and caught the Russian flu were vulnerable to the virus that came in 1918.

This leads to the concept of antigenic seniority, which is that the strongest response of your immune system to any type of flu is that specific strain of flu to which you were first exposed as a child. This is a discovery which has just been reinforced by recent data and observation. The basic concept of it goes back to the Welsh American, Thomas Francis, who came up with the idea, which was first called “original antigenic sin”. The original antigenic sin was that the virus to which you are first exposed is what you are most vulnerable to.

It has taken a long time for the ideas of Thomas Francis to be validated by real data in terms of experience in subsequent influenza outbreaks.

There are two phylogenetic groups of influenza. Essentially, these two groups (Group 1 and Group 2) encompass the range of types of Haemagglutinin variations of flu.

If you happen to have been exposed in childhood to a strain of flu in one of the groups, then you are covered if a strain of flu in the same group occurs.

This grouping of strains of flu goes by the name “antigenic imprinting”. The principle of antigenic imprinting is that your immune system is imprinted with a response to the first flu to which you were exposed. The first flu to which you were exposed leaves a permanent imprint on you.

That is why, in terms of insurance, it is not just a question of how old you are, your vulnerability, it is your date of birth that is crucial. Your date of birth tells you about what first flu to which you would have been exposed.

Our chairman, Scott [Reid], is a marked man. He was born in 1969 – just after the 1968 Hong Kong flu. What does this tell you? It tells you that if the next pandemic happens to be like the 1918 H1N1, then my advice to our chairman is to get vaccinated. Do not leave it to chance. However, if the next pandemic happened to be H3N1, then he is all right. This is the principle of antigenic imprinting.

A paper was published in the premier scientific journal Science, the American journal, in October 2016 called “First Flu is Forever”. The reason why science has taken so long to surface and to be validated is it has taken time to gather the data for two major flu outbreaks in the past several decades. H5N1, which was the bird flu, started in about 2004–2005.

In the case of bird flu, the age profile of the victim was young and middle aged. The watershed is 1968. Basically, those who were born afterwards were most likely first exposed to the other group, Group 2. Most of the victims were in the age group young to middle aged.

However, if you take H7N9, which is another highly lethal strain of flu, where the lethality rate was something like one third of all those who caught it died from it, the age profile was different. It was the older people who mainly died. Instead of the kind of pattern we might have expected, where if you have serious flu it is going to be young and middle-aged people who will be dying, in the case of H5N1 and H7N9, it was the older people who are dying. That is because the first flu they were exposed to was essentially H1N1. When H7N9 turned up as a Group 2, they were in a bad situation. So they were vulnerable.

From the basic information that I am giving you, you can work out many things about past experience of mortality and morbidity in flu. That is just from reading the paper. A great deal can be explained. The cohort born between 1880 and 1900 was strongly impacted by the 1957 pandemic. That was H2N2, which was the same grouping as in 1918. Interestingly, when H3N2, Hong Kong flu, turned up in 1968, they were all right simply because they had been first exposed to H3N2, from Russian flu.

If you consider the mortality of the Hong Kong flu in 1968, you would probably find that at the peak were those born around the time of the great pandemic of 1918. Those who were born around then were first exposed to H1N1. When this pandemic occurred, the other group, Group 2, was in trouble.

You may say what I am talking about is only of relevance every 20 or 30 years when there is a pandemic. That is not correct. It tells you a lot about the mortality in seasonal flu. If you take the 2013–2014 flu season, which was predominantly H1N1, there was severe illness among young and middle-aged adults. But older people were not badly affected.

The excess deaths were actually quite low in 2013–2014. However, if we move on to the following year, 2014–2015, when H3N2 was the predominant flu virus, we have a different situation. The excess number of people who died was of the order of 28,000, a huge number of people. This was because of the different age vulnerability of H3N2.

If we look at the chart of excess winter deaths, we see the spike at 2014–2015.

This new science explains variations in excess deaths from one year to another. I was doing this kind of work in the early part of this year when Australian flu was causing problems both in Europe and in North America. The Australian flu was H3N2. It was tragic to see young children, pre-teens, dying from Australian flu. Almost certainly they were first exposed to the other group of flu, the 2009 H1N1 Mexican pandemic. Someone who was exposed to the Mexican pandemic H1N1 would be only eight or nine years old now. They were more vulnerable to this seasonal flu.

This principle that the first flu to which you are exposed governs your vulnerability to flu is something that everyone can take home with them. If you can track what kind of flu you might have been exposed to as a child, that would be a good thing to tell your GP about.

I should like to emphasise the remarkable fact that what I have been telling you today I could not have said 2 years ago. This paper was published in October 2016. This is the wonderful thing about science. You wait 100 years to try to understand something and at year 98 you are close to understanding what happened in 1918.

If the next pandemic turns out to be Group 1, which will affect the older cohort of insurers, the life insurance implications of this kind of pandemic are potentially significant. If you take a Group 2 pandemic, H2N2, then people born before 1968 would be especially vulnerable. This might have implications, for example, for long-term care insurance (LTCI).

For the first time it is possible to have a good idea of the age profile of the victims of future pandemics just from the information about the type of group of flu which is coming around. In particular, if you were to go to your GP with the Australian flu of this past winter, almost certainly the GP would not be offering you any special information just because you were born before or after 1968. That is because this is new science. It is something that you know now so you can quiz your GP about antigenic imprinting and looking at seniority. I hope that he will not be too bemused by that.

The Chairman: The floor is open for questions for Woo.

Mr W. M. Chishti, F.F.A.: It feels like we have found a piece of the puzzle that explains the 1918 pandemic where younger people were exposed, particularly 28 year olds.

I wonder if similar science could be applied to other kinds of population cohort effects that we have seen in the insurance industry.

For example, in the late 1990s and early 2000s, there was a cohort of pensioners who seemed to have particularly good mortality improvement experience. I wonder if there could be something that they were exposed to when they were younger which affected their immune system, which meant that they were healthier?

Do you know any research or science about that?

Dr Woo: This begs the question to have more focus on the vulnerability of a cohort of the population and to ask questions about what special amenities they might have from the exposure to different types of diseases.

If you take the so-called cohort effect on longevity, then it has been speculated that those who might have been born before the war might have had some increased immunity because of the circumstances in which they were growing up at the time.

The fact that what I have explained to you is so recent does provide food for thought in terms of expanding horizons and understanding the environment.

The key thing about what I have been explaining to you is it has all been data driven by the analysis of these two major flu outbreaks H5N1 and H7N9, which had very high mortality rates. Essentially, it is by diligent collection of the data on the mortality of the population that that conclusion has been obtained.

A member of the audience: I have three questions. The first one is why do children not die from the first flu they are exposed to? Second, would it be possible to expose children to both strains of flu very early on in a safe way to give them immunity? Third, could we all save our money or our NHS money and immunise the people against the group of flu to which they have not been exposed?

Dr Woo: To reply to your last question first, yes. The Holy Grail of influenza virology is, of course, to create the universal flu vaccine for any type of flu. In fact, the kind of learning that I have outlined to you is precisely the kind of understanding that is needed to develop a universal vaccine and to better understand the way that people respond to vaccines.

The current situation is that it seems like exposure to a vaccine is not the same thing as exposure to the real flu. If you are vaccinated against a particular strain of flu, that does not have the same impact as actually catching it directly. This is being researched all the time.

Turning to your first question about why children do not die from it, it is because children are tough. They cope with all kinds of diseases. I think the mortality among young children is still high, but it is not extraordinarily high.

Mr C. Suthersan: Is there a relationship? You said there was a 28-year gap between Russian flu and the Spanish flu. That was the spike. Is there a relationship between the severity of your first flu? If you catch normal seasonal flu, in the case of Russian flu, is it because they caught very severe flu in 1918 that the effect was worse?

Dr Woo: It was a pandemic flu. In the years after 1890, the predominant strain would have been the Group 2 type of virus. If you were born in 1895, then most likely the first flu to which you were exposed was the Russian flu. We get the spike at age 28 simply because you have this particular cohort of people who got the pandemic flu in 1890–1891. Essentially they would have been imprinted with this. When the other type of flu turned up, they would have had difficulty.

There is enough data to conclude, as I have shown you, exactly what the age profile is the cohorts of people following each of these pandemics. In the paper “First Flu Is Forever” we had this watershed of 1968, which was the Hong Kong flu. There would be some special distinction made if it was the pandemic.

Having said that, if you caught the strain a few years later, that would be imprinted on your immune system.

Mr E. J. Stipp, F.I.A.: In practice, is there enough time when the seasonal flu emerges to know what type it is to take action? If it is called Australian flu, does that mean that the first people who go down with it were born in the wrong year?

Dr Woo: This is something that the NHS did not do but could have done. Everyone knew that Australian flu was H3N2. There was the suggestion that everyone should get vaccinated. But there was no age distinction. The key point was, because it was H3N2, we knew exactly what the most vulnerable parts of the population were: young people who might have been exposed in the pandemic in 2009, and people born before 1968, older people, whose first flu exposure would have been to Group 1.

The NHS, in principle, could have been more targeted in terms of advice to people, but it was not. However, this knowledge can be used to improve public health.

Mrs Y. Cho, F.I.A.: You talked about the fatality for the 28 year old from the 1918 flu. I was wondering how much it played a role. People argue that because of different behaviour by different age groups we may have had a different instance experience. Old age people, if they knew there was flu outside, may stay at home. Younger people had to go to work, so that is why they might experience instances. I wonder how much instances played a role.

Dr Woo: Essentially the question was about how much human behaviour has some effect on the age dependence. If you look at the data on the ages of the victims, you see a clear spike at certain ages in different parts of the world, like in New York and in Canada, and so on.

You saw the markedly different age profiles of the victims from H5N1 and H7N9. The studies undertaken by the virologists have been rigorous and diligent. That is the reason why it has taken so long to get to these conclusions. It has taken a lot of hard work by the scientists to unravel the data to give us this information.

It is a combination of data observations and basic virological understanding of why it is that this vulnerability to the first group should have come about. It is really a disciplinary type of investigation involving those out in the field who collect the data on the victims and also some fascinating serological studies of the virus itself in people’s blood, which has led to this understanding.

I would not be standing here now if it were not for the fact that there is a mountain of evidence now supporting this.

The Chairman: Now it is time to move on to the final presentation. It is about a paper written by Sabrina Link, called “Long-term care reform in Germany – at long last.”

Tim Eppert works for Gen Re and is a senior actuary with more than 10 years’ experience as a product specialist for long-term care and critical illness products and has experience as an account manager for Germany and Singapore. Tim holds a degree in economic mathematics at the Bielefeld University and is a member of the German Actuarial Society.

Mr T. Eppert: Sabrina Link did all the work for the presentation, but she is unable to be here tonight. I will be talking about German LTCI. I would like, first, to give you a small introduction to the German social security system and what the German LTCI system looked like before I explain the changes. Then, at the end, we will see what this means for private insurance and I hope that also will give some interesting insights for the UK.

Germany is proud to have one of the first social security systems in the world. The newest member is long-term care, which joined in 1995. This was seen as essential reform and a big step forward due to changing demographics. However, ever since the introduction of this system, there was a lot of criticism on how the assessment was designed, and it took some time before it was changed.

What does this structure look like? In Germany, at first, there was compulsory LTCI. Every person in Germany has some kind of LTCI. This follows the German health insurance system. As our health insurance system is a little unusual, our LTCI structure is also a little unusual. Ninety per cent of the population are covered under the public sickness funds. The compulsory LTCI is also under this public sickness fund. Then the other 10%, roughly, have private LTCI with health insurance. If you earn a lot of money, or are in certain occupations, you can choose to opt out of the public health system into the private health system.

The benefits for LTCI are identical. It is just that the sickness funds are pay-as-you-go funds; otherwise it is a funded system with medical underwriting.

The private LTCI is divided into the health insurance branch and the life insurance branch. There are more policies for health insurance. This is because the compulsory LTCI scheme follows the health insurance system, because it can offer the premiums a lot more cheaply, because it does not have to give guarantees and it can use different interest rates, which for long-term care is quite an important factor. However, the life insurance products are much more stable in pricing and can offer different features.

There are two principles for compulsory LTCI. The first one is “home health care over nursing home care”. I guess that there are two motivations. The first one is that most people prefer to stay at home as long as they can. This means some benefits are paid to people who stay at home, not only nursing home care is paid for.

Obviously, it is cheaper to offer some professional help at home than to offer a nursing home place. From the consumer perspective, and from the government perspective, it is a good thing to do.

The other one is “partial coverage insurance”. It was never intended to cover all of the costs. Roughly, it is covering half of the costs. We will see this later on. That means there is always room for additional private LTCI. This is one of the first lessons that we learnt. Long-term care is also a niche market in Germany and it is still one of the biggest top-up long-term care markets in the world.

The contribution rate has increased over time and is likely to increase in future. The major driver for this is demographics, but this is not the only reason. There have been new benefits added so the scheme has become more generous and inflation adjusted. We will see how this develops over time. The people from the private part of the compulsory LTCI say, “You had better come to us. We have the fund that is more stable”. But with decreasing interest rates over the last years, this is now a more even discussion.

How did the old system work? They mainly investigated the activities of daily living (ADL): personal hygiene, nutrition, mobility and how much household help was needed. Then, it depended on how often you needed the care. Do you need it at least once per day to get into the lowest care level with the lowest benefits? Or do you need it permanently even at night? You could go into Care Level I, II or III. It was a system with levels of care.

They also looked at the minutes that you need for care per day. They also said that most of these minutes must come from the ADL and only a limited number of that time is calculated for household help.

Under these conditions, you would be able to receive money from the old system.

As an example, for washing, they split the whole body up into upper body, lower body and hands and face washing. They asked how much time a layperson would need to help the dependent person to get the care level that they need to be appropriately clean.

Our definition was criticised from the beginning. This was mainly for two reasons. One reason was that it is clearly ADL focused. With old age, many people may be physically able to perform these ADLs but if they develop Alzheimer’s or other forms of dementia, they may need constant supervision. People with severe dementia after some time would get a care level, but under this scheme it would take them quite a long time. So this was thought to be not adequate.

The other reason is the minute keeping. There were two issues. The first one is that people criticised: “If I pay for only these minutes, then the caregivers will only have time to use this number of minutes and there is no time for more holistic care”. There is no talking to the people and maybe listening to them. You may argue that this is more a question of funding than how this is measured. But, still, this was a major criticism.

The second point was they measured how much care was needed, which seems fair at first. But it happened, for example, that a person would need help in climbing the stairs. So we write down, for example, 10–15 minutes a day for climbing stairs.

Later, this person was bed-ridden when the condition worsened. You do not need time to help them climb the stairs. There were some cases where, when the physical abilities declined, they received a lower care level. That was perceived as unfair, as you can imagine, by the families, even though you could argue that on a technical point this was correct.

We have seen quite a number of changes over time, but these were all smaller changes to the system: adding small benefits for people with dementia or with other mental illnesses or maybe increasing the benefits a bit and things like that. The major change was to define a new assessment. As I said, the discussion started in 1995. In 2006, there was the first commission to discuss with all the experts the best achievable definition of people needing care. This took until 2015 to be passed.

In 2017, it was implemented. So, this is why we have called it the ‘new’ long-term care reform in Germany. It took three ministers of health to bring it through. It is a complex measure; and it is expensive if you want to give better care to a lot of people and not just say, “Let us change the pot from the physical disabilities to the mental disabilities”.

What were the key changes for the new definition? The minute-taking was abolished. Instead we find a degree of independence. In the second step they wanted to get away from deficit orientation to resource orientation.

If you want to encourage people to stay with their strengths, then, from an assessment point, this makes sense, even though the question of how much money is not different whether you say these are the levels which can still be met or these are the levels which cannot be met any more.

So, they moved away from the ADLs to a much more comprehensive understanding of care. The three care levels moved to five care grades. The aim was to have some more differentiation. Care levels and care grades are more or less the same. They just wanted to use a new name under the new system so that you do not get confused with the old one.

The lowest care level would definitely include people who did not receive any benefits in the past or were not identified as being in need of care. Then there was the extra “given care need”, which we discussed in the example with the ADL failure. Now it is the theoretical abilities of the person. So, no matter whether the house has stairs or does not have stairs, it is just whether the person could use their legs.

They developed eight modules including two modules that are not used for defining the grades but are for additional information.

The top two modules, self-supply and mobility, are still based on physical abilities and the ADL. They form 50%. Then we have dealing with requirements due to illness or therapy, the organisation of daily life, cognitive and communicative abilities, and behaviour and psychiatric problems. There is a strong focus on non-physical abilities and disabilities.

This does not add up to 100%. This is one example of the complexity when you talk to many people and must come up with a compromise. There is 115% in total for the lowest level, with 15% each for Module 2 and Module 3. It is the higher value of the two that is taken into the ranking.

The six modules are used for level two and three. You take the higher one and you use weighting. Then you come up with a points system. If you have 90–100 points you are in Care Grade 5. If you have zero points, then you are active.

The points system with the thresholds allowed the politicians to say, “Let us define good levels of care first and then when we have a pot of money to share and we see that there would be too many people getting into Grade 2 or 3, we could just rearrange the points for the thresholds and adjust this to the money that we have”.

There is a special rule for the highest care grade (Grade 5). It is either above 90 points or it is the loss of use of both legs and both arms. You can see some people, in the end, had the feeling that maybe this is not stressing the ADLs enough anymore. Somebody losing the use of both arms and both legs can get intensive care, and in this case should be graded on Grade 5, which would not necessarily be the case with the system as described before.

One question that arose was Germany had a system implemented with more than 2 million people in need of care already and what to do with the people in that care. Would you like to reassess everyone? That would be a first step. There were two reasons why they decided not to do that. The first one was that it was a lot of work. If you want to implement the system quickly, you have to have a simple rule.

The other one is that the two systems are not aligned very well because we have the ADL focus in the old scheme and we have stronger focus on dementia in the new system. It might be that people who were in the highest care grade before would get only a lower care level in the new system. That would be a political catastrophe.

There was one published paper, where you could clearly see that these effects would have occurred, so they just said no at the beginning and everybody who is now on Care Level I becomes at least Care Grade 2, and so on. You can see that there is a clear, easy rule and the politicians could say nobody is worse off than before.

People with limited ability to cope with daily life would be shifted even higher.

I have an example of the benefits that you can get. There are benefits for home health care and for nursing home care. The benefits clearly increase with the care grades. There is a tiered system. This tiered system is also adopted typically by private insurance.

The extra costs are much higher for you for professional home health care. There is still a gap of about €1000, maybe. Still there is a clear need for additional insurance cover.

It is interesting now that in the new system, nursing homes can only charge a fixed amount from dependants independent of the level of care. That was completely different in the past, where this level increased.

Now for new business, that means life insurers must ask, “Does it still make sense to offer step benefits, which increase with the care level, or are people better off just getting a flat amount?”

That was the situation for the government system. Now we take a look at life insurance. For health insurance it is easy because everything is adjusted. But, on the other hand, they must follow the new system. They had to do some actuarial calculations as well. But for them it was less of a strategic question.

For life insurance, in the past, there was typically an ADL figure. They had copied the social system, the old one, but said they do not follow automatically any changes. They were aware that some changes were coming and that would not fit the guarantees.

They had a dementia trigger, because otherwise dementia was not well covered. As there were the three care levels by the social system, this was then split up into a tiered benefit context. So, for example, you would receive 100% if you paid for six ADLs; 50% if you paid for six ADLs in Care Level II or had dementia, and you would maybe get 25% on some products if you are in Care Level I or failing three out of six ADLs.

As I mentioned before, Germany has been successful in selling private LTCI. It is still a niche market. Long-term care is not so easy to sell, but we have more than 3ν million sold policies for the non-compulsory part, so it is quite a large market.

As I told you before, health insurance is in a better position due to cheaper rates and it being the natural partner to the compulsory scheme. But even for life insurance we can see, on a small base, there was quite strong growth in the years up to 2015 with a 27% per annum increase.

Many big life insurers either did not care or they said, “We have to have it in a portfolio, but it is not of strategic importance”. But there are some small players for whom this is a major driver and they are quite happy with having this product.

Now the question arises: What do we do with this new situation? How do the old and the new definitions compare? It was clear when the new definition was taken into the market, the players, at least the ones for whom this business is important, wanted to have the pricing ready so we had to come up with some pricing ideas in the market. But what do we do with the in-force business? Do we want to change it from the old world to the new world or should we keep it with the old world?

As I said, for health this is not a question, but for life insurance, as this was something which was dawning for ages, a few years ago marketing people were afraid that they could not sell the old definitions anymore because it was apparent that the new definition was going to come. So they added clauses like, “If we are going to offer a new tariff then you will have the chance to change”.

How do you transfer this to the new system? Would you say to somebody “You can change as long as you do not get benefits from the old system”. Consider a person with some early dementia signs. They could say, “Yes, of course I want to change”. Then under the new scheme they would be able to directly benefit. Or how do they react?

This is why, as the new system was not just adding one top layer or one bottom layer, it was quite difficult for them to decide and this is why on so many of the old blocks of business they are using the old definitions today.

We had some information on pricing from the studies because the government wanted to know how much it costs. We can see the distribution of the old definition and you can also see the distribution of the new definition. In this publication you could not see how this interacted. But there was a second publication, where you could see cases under the new system and under the old system with the three levels. Some people are worse off than before and some are better off than before. Some people receive roughly the same benefits. There are 27%, for example, for current Care Level I who would be worse off if there was not this rule from the ministry for automatic transfer.

Now, if you think of long-term care, you have not only the incidence rates, but you have to check what it means for mortality as well.

Another question would be: “For the future, how do we deal with the old cases which used the old definition?” For dementia we are fine because this is covered in the new assessment. For the ADLs we think we can also derive this from the old assessment. In 10 or 20 years’ time, there may be nobody left who is used to the old system, so will it become easier or will it become more difficult to assess these people and will there be claims where we do not treat them fairly?

We had also to think about the fact that the new definition is more generous than before. There are people that we did not see. They would not try to claim under the old care system but now they were going to because they know they have a better chance.

The government guessed it would be around 500,000 people. The actuaries said it should be around 800,000 people. In the first year after the implementation we saw 550,000 extra people. We guess that there will be some extra people coming in. It takes something like 2 or 3 years to see the full picture. The truth is probably somewhere in the middle already.

What does it mean for Germany, and for the UK? First, the compulsory LTCI does more good than harm to the private LTCI market. If you are now awaiting a green paper on how things could go on in Great Britain, it is a good thing not only for society but also for the actuarial insurance industry to participate and actively accompany this process.

Second, Gut Ding will Weile haben – it takes a long while for things to ripen especially if you talk about long-term care because it is so complex. If this stage is included and you do not reckon that this is a change within 1 year, it may be worth being prepared.

Also, care needs seem to be reflected more appropriately than under the old scheme. Better assessment is not the same as better care. Now we have the next discussion in Germany. It is our big topic because still there are people missing who can give care. There is still a similar need. You still need money to get care and use only people who can give the care. This is not going away no matter how good or bad your definition is.

Last, care touches the whole society. That means it is complex and political. If you have something that you need to decide, do you make something which is independent of the state system in the end? Or do you want to lean on that with all the changes that are included?

The Chairman: Are there any questions?

Mr P. G. Brett, F.I.A.: Have you any idea what the 3.5% contribution rate will go up to ultimately for the state system?

Mr Eppert: Now the discussion is to increase the contribution rate by another 0.5% because they want to give more money to the care-givers because they are seeing that we have quite a lot of people in need of care but not enough people giving care. We need to give them more money and so the contribution rate is likely to go up by 0.5% soon.

There are projections. In 10 or 20 years’ time, there will be many more people when the baby boomers get to the age where they need care. That will get problematic. Then, as always, there is discussion in social society about how much do you want to pay. You could, say, reduce the amount of benefit and people will have to increase the share that they pay for themselves. Or you could say we take all this and it will go more than 1% higher than now.

The Chairman: In your market, 90% is covered by the state and 10% is covered privately. Do people have to take up the private cover? And how sustainable is that cost into the future? It is paid on a yearly basis as well, is it not?

Mr Eppert: The 90% and 10%: as I said, we have a strange system. Either you are covered in the one or in the other. For example, I am covered by a local sickness fund. I do not have any private LTCI. If I were a teacher, there would be a more than 90% chance I would have private health insurance and I would also have private LTCI.

They face different problems. One is facing problems from the pay-as-you-go system with different demographics. The other one is facing challenges when we see a decline in interest rates, for example.

The Chairman: Any other questions?

A member of the audience: The paper is particularly relevant here in the UK where we are having a green paper to talk about how we tackle the demographic problem of long-term care. Indeed, it is true around the developed world, of course, and not just here in the UK or in Germany.

I think that there will be a debate here in the UK, as there is on a number of things, on hypothecated taxes, by which I mean taxes designed specifically to provide a particular benefit rather than having taxes which go into the whole pot and the government chooses how to spend them.

Clearly, in this case Germany has come up with, or feels it is necessary to have, a hypothecated tax. Do you believe that is a better system than just putting everything into a big pot and letting the government decide how it should be spent?

Mr Eppert: This is a political question. The question is how much you trust the government to keep enough money, and maybe you are in a better position to judge the UK government than I am.

Having said that, Germany has a system, where taxes, Social Security and all the money are included. There is a discussion whether it would be better to use part of the taxes for that. Everybody has to pay. You are not only using income taxes but money generated from other sources of income as well. That might make it more stable.

Apart from who can change the amount of money and use it for other purposes, how can you generate a constant stream of income in an ageing population when there is a shift between people who are retired and people who are still working?

The Chairman: To summarise the talk we have had, we started off with Campbell and Groyer talking about digital technology and disability claims and how that can be used to help to manage claims, and some of the issues that insurers will have trying to engage start-ups.

In the second talk from Woo, I learnt that I have got to go to the doctor and work out exactly what I have been exposed to. And, if there is another flu epidemic coming along, I have got to get the right vaccination. The first flu is the one that lasts for ever. That is the key strapline.

Finally, “Long-term Care” is a timely paper. The UK government is going to launch a green paper soon on social care in the UK. It is an interesting example of how the German market works. It will be good to pick up some of the lessons there and feed that back into the consultation when it comes up.

It just remains for me to express my thanks to all the contributors, the audience tonight and all the presenters.