1. Introduction

Human preferences for rare and endangered species have an important role in wildlife conservation. On the one hand, these preferences can be monetized and channeled toward conservation initiatives in the public sphere (Becker et al., Reference Becker, Choresh, Bahat and Inbar2009; Lew and Wallmo, Reference Lew and Wallmo2011; Johnston et al., Reference Johnston, Jarvis, Wallmo and Lew2015). The ‘flagship species’ approach, which involves identification of charismatic and threatened species followed by implementation of conservation programs for the associated ecosystems, rests upon the notion of positive human preferences toward certain wild species (Kontoleon and Swanson, Reference Kontoleon and Swanson2003; Belbachir et al., Reference Belbachir, Pettorelli, Wacher, Belbachir-Bazi, Durant and Hofreiter2015; Cisneros-Montemayor and Vincent, Reference Cisneros-Montemayor and Vincent2016). On the other hand, human preferences could also lead to species exploitation (Coltman et al., Reference Coltman, O'Donoghue, Jorgenson, Hogg, Strobeck and Festa-Bianchet2003; Wilson-Wilde, Reference Wilson-Wilde2010). In the private good regime, humans derive direct use values from certain wild species that could lead to unsustainable extraction; for example, poaching for ivory (Wittemyer et al., Reference Wittemyer, Northrup, Blanc, Douglas-Hamilton, Omondi and Burnham2014) and rhinoceros horn (Hanley et al., Reference Hanley, Sheremet, Bozzola and MacMillan2018).

In this paper, we examine consumer preferences for species rarity in caged-bird markets in Indonesia and implications for species extraction from the wild. The demand for birds as pets is high in Indonesia, as bird keeping has an important cultural value for many Indonesian households (Jepson and Ladle, Reference Jepson and Ladle2005; Symes et al., Reference Symes, Edwards, Miettinen, Rheindt and Carrasco2018). In fact, Indonesia has one of the most vibrant bird markets in the world (Harris et al., Reference Harris, Tingley, Hua, Yong, Adeney, Lee, Marthy, Prawiradilaga, Sekercioglu, Suyadi, Winarni and Wilcove2016). As most of these birds are captured from the wild, the trade poses a significant threat to avian diversity (Burivalova et al., Reference Burivalova, Lee, Hua, Lee, Prawiradilaga and Wilcove2017).

Does species extraction from the wild, as observed for birds in Indonesia, result in species extinction? The conventional theory of resource extraction suggests that this may not be the case, because increasing harvesting costs make the process of extraction economically less beneficial when population size declines (Gordon, Reference Gordon1991). Species exploitation ceases, and population recovery follows. However, for species with rarity value, that is, when desirability of a species in the market increases with rarity in the wild, the market price increases with rarity (Gault et al., Reference Gault, Meinard and Courchamp2008; Angulo et al., Reference Angulo, Deves, Saint Jalmes and Courchamp2009; Dalerum et al., Reference Dalerum, Miranda, Muñiz and Rodríguez2018). This in turn is an incentive for more harvesting efforts (Gault et al., Reference Gault, Meinard and Courchamp2008; Su et al., Reference Su, Cassey, Vall-Llosera and Blackburn2015). Beyond a given threshold of exploitation, population size drops to such a level that the loss of species becomes irreversible, with population growth becoming a negative function of density (Brook and Sodhi, Reference Brook and Sodhi2006). Below this critical level, the rare species precipitate into an overexploitation vortex until eventual extinction occurs. Driving a species population to this threshold is called the anthropogenic Allee effect (Berec et al., Reference Berec, Angulo and Courchamp2007; Courchamp et al., Reference Courchamp, Berec and Gascoigne2008; Angulo and Courchamp, Reference Angulo and Courchamp2009), which is prominent in trophy hunting and in markets for exotic pets (Coltman et al., Reference Coltman, O'Donoghue, Jorgenson, Hogg, Strobeck and Festa-Bianchet2003; Hall et al., Reference Hall, Milner-Gulland and Courchamp2008; Palazy et al., Reference Palazy, Bonenfant, Gaillard and Courchamp2012; Harris et al., Reference Harris, Green, Prawiradilaga, Giam, Giyanto, Hikmatullah, Putra and Wilcove2015).

A growing body of literature suggests that anthropogenic pressures affect wildlife populations across the world (Lee et al., Reference Lee, Gorog, Dwiyahreni, Siwu, Riley, Alexander, Paoli and Ramono2005; Clavero, Reference Clavero2016; Hanley et al., Reference Hanley, Sheremet, Bozzola and MacMillan2018; Symes et al., Reference Symes, Edwards, Miettinen, Rheindt and Carrasco2018). The possibility of anthropogenic Allee effects has been detected with respect to certain insect (Slone et al., Reference Slone, Orsak and Malver1997; Tournant et al., Reference Tournant, Joseph, Goka and Courchamp2012), fish (Gault et al., Reference Gault, Meinard and Courchamp2008), and reptile (Lyons and Natusch, Reference Lyons and Natusch2013) populations. These studies employed a diverse set of methods to identify the presence of Allee effects. However, the relationship between rarity value and species extraction, which could vary depending on the end use of the species (e.g., pets, trophies) and other market conditions, has not been systematically examined in the past.

In this paper, we examine consumer preferences for species rarity in the market for caged birds in Sumatra, Indonesia. The empirical analysis is guided by three research questions. Do Indonesian consumers prefer species that are rare in the wild? If the answer is yes, are these preferences dependent on other species attributes? Suppose there is a rarity value, does it affect the rate of extraction from the wild? To address the first two questions, a choice experiment was conducted among urban households in Sumatra in 2016. Participants were potential buyers of caged birds. The third question is addressed by analyzing market transaction data collected from bird traders in Sumatra during 2013–2015. These data were complemented by a set of ecological surveys, which indicated the rarity status of bird species. By combining data on consumer preferences, actual market transactions, and region-specific species rarity, we are able to identify the association between consumer preferences and the rate of species extraction from the wild.

The paper is structured as follows. In section 2, we elaborate the potential conservation effects of rarity value and potential scenarios for the occurrence of a trade-induced Allee effect. Based on this, we develop three testable hypotheses. Section 3 presents the data sources and section 4 the analytical frame. The empirical results are presented in section 5, whereas section 6 concludes with a few policy implications.

2. Rarity value and species extraction from the wild

In this section, we examine the conditions under which wildlife trade can generate an anthropogenic Allee effect. Based on this, three testable hypotheses are developed. The literature on the effect of consumer preference for species rarity on the rate of extraction is scant. There are a few studies demonstrating that consumer preference for species rarity retains the level of consumption even at exaggerated market prices (Gault et al., Reference Gault, Meinard and Courchamp2008; Sun et al., Reference Sun, Chiang, Guillotreau, Squires, Webster and Owens2017). However, a strong preference for rarity alone is not sufficient to generate an anthropogenic Allee effect (Harris et al., Reference Harris, Cooney and Leader-Williams2013). Population dynamics of the species, nature of market demand, and constraints in wildlife supply chains also matter, and these factors vary significantly across species and markets.

An Allee effect or ‘a causal positive relationship between the number of individuals in a population and their fitness’ (Courchamp et al., Reference Courchamp, Berec and Gascoigne2008) arises through a variety of mechanisms; for example, by reducing the mating encounters as a population becomes scarce in the wild. Whether an Allee effect occurs at a given rate of extraction is hence determined by density dependence of the species; that is, how the population growth rate changes with decreasing population density. A population might exhibit either strong or weak density dependence. The risk of Allee effect is relatively low for a species population with weak density dependence.

The potential risk of the anthropogenic Allee effect also depends on certain economic attributes of wildlife markets. The supply and demand factors shaping the effect of wildlife trade on species extraction are discussed in detail by Courchamp et al., (Reference Courchamp, Angulo, Rivalan, Hall, Signoret, Bull and Meinard2006), Berec et al., (Reference Berec, Angulo and Courchamp2007), and Harris et al., (Reference Harris, Cooney and Leader-Williams2013). Wildlife products such as caged birds are often marketed by a few small-scale vendors, and entry barriers for new suppliers are low. In such markets (described as ‘polyopoly’ by Slone et al., (Reference Slone, Orsak and Malver1997)), each vendor considers that other vendors in the market do not care about the actions that he/she undertakes. The optimal market price is set at the point where the demand curve intersects with the average cost of the harvesting curve. The average cost of harvesting wild birds is expected to increase with hunting effort, and hence is a positive function of rarity. When rarity value is present, however, the price increment for rarity allows for positive economic returns from harvesting even at lower population densities. To make this happen, the market price should increase more steeply than the cost of extraction with increasing rarity. One could expect a less detrimental outcome if the cost of collection of a species is higher than the market price at lower population densities and the cost increases more steeply than its price. Regulatory policies effective at conserving rare species could result in similar cost curves. As the slope of the price curve is determined by market demand for rarity, our analysis starts with identifying consumer preferences for species rarity. The following hypothesis is developed.

Hypothesis 1: There is a positive consumer preference for species that are rare in the wild.

We now examine two scenarios in which wildlife trade occurs but without an Allee effect. The first scenario deals with incomplete information that consumers have on species rarity in the wild. Many of the existing studies on the anthropogenic Allee effects inherently assume perfect information. However, if the species is rare in the wild and not very charismatic, only a few consumers would be familiar with its attributes, and the demand for rarity would be low. On the other hand, consumers might derive their rarity perception from the marketplace, and not from the field. If so, perceived rarity may differ from actual rarity in the wild.

In the second scenario, we examine the preference heterogeneity. Does market demand for rarity vary across different rare species? If the preference for rarity is restricted only to a smaller set of species or only a small share of households have an effective demand (that is, willingness to pay above the cost of harvesting), many species will be spared from the trade-induced Allee effect. Uniformity of preferences across different rare species and consumers is examined to assess whether wildlife trade leads to overexploitation. Our second hypothesis can be stated as follows.

Hypothesis 2: Consumer demand for rarity remains positive irrespective of other attributes of the species.

Finally, even if the demand for rarity is strong and uniform across different bird species, trade would not lead to overexploitation if price transmission in the wildlife supply chain is inefficient to connect sales price and market arrivals, or if the cost of harvesting is greater than the market price and is increasing steeply with scarcity. This warrants an examination of the markets for wildlife products. Due to inefficient conservation measures, species extraction from the wild is taking place under a de facto open-access regime in many developing countries. In the absence of enforced access rights over the resource, costs of harvesting and returns from harvesting jointly determine the harvesting rate (Ostrom et al., Reference Ostrom, Burger, Field, Norgaard and Policansky1999). Decreasing the harvesting rate to sustain the resource base would be a financially inferior strategy for the individual supplier.

Hypothesis 3: Market arrivals of rare species increase with an increase in their market price.

Non-rejection of hypotheses 1 and 2 would suggest a strong consumer preference for most rare species. However, rejection of hypothesis 3 would indicate that an increase in the market demand does not lead to an increase in the harvest rate, and this could be due to either a steeply increasing harvesting cost with a declining population (an inelastic supply function), or inefficient price transmission in the wildlife supply chains. If the existing supply chains impede efficient price transmission, the market arrivals of abundant species should also not respond positively to the changes in the sales prices. However, if this does not hold, rejection of hypothesis 3 would suggest a diminishing population or rare species in the wild. This could occur due to over-extraction for the market or habitat loss from deforestation and land use changes.

3. Experimental design and data sources

We now discuss the data sources used for the empirical analysis. Data were collected in Jambi Province on the island of Sumatra (Indonesia). The study area is characterized not only by a vibrant caged-bird market, but also by rich wild-bird diversity. Studying local bird markets to identify the factors that determine demand and supply is highly relevant, as the bulk of the bird trade in Indonesia takes place in the domestic markets (Shepherd et al., Reference Shepherd, Sukumaran and Wich2004). This study uses two sets of primary data, namely an urban household survey that included a choice experiment and a repeated trader survey, both implemented in Jambi City.

3.1. Choice experiment design

Consumers develop their preferences for particular types of birds based on various attributes, such as bird size, color, origin, rarity, singing ability, and price, among others. Choice experiments can only focus on a few key attributes in order not to overburden respondents and ensure high data quality. We selected the attributes that consumers consider most relevant in the local context based on various discussions that we had with bird-keeping households, bird shop owners, traders and other key informants in Jambi prior to designing the choice experiment. The attributes selected and other details of the choice experiment are explained below.

3.1.1. Bird species selection

The first task was selection of species to include in the choice experiment. The 77 bird species that are native to Sumatra and traded in the local market were categorized into eight groups based on three attributes: rarity in the wild (S 1 rare, S 0 abundant), trading frequency (T 1 frequently traded, T 0 not traded frequently), and relative position of the species in the local bird market with respect to general price level (H 1 high-end, H 0 low-end). Trading frequency and relative position of the species were assessed by the number of birds sold in the market and the average sales price, based on data from the trader survey conducted in 2013 (see below).

The rarity attribute was assessed based on different data sources. The main source was the distribution area of bird species in Sumatra based on the BirdLife International Global Species Program.Footnote 1 A species was categorized as rare or abundant in relative terms, based on whether the distribution area was below or above the median value of all 77 species. This categorization was verified using data from own field observations conducted in 112 plots in rural Jambi (Batanghari and Sarolangun regencies; across four major land use systems, namely tropical lowland rainforest, oil palm and rubber plantations, and shrub/bushland).Footnote 2 After assigning the frequently observed birds to the ‘abundant’ and unobserved and scantly-observed birds to the ‘rare’ groups, the categorization made based on BirdLife data was modified. Five species of birds were observed frequently in the field even though their recorded distribution area was small in the BirdLife database. These species were re-categorized as abundant. One possible reason for the difference between the BirdLife database and field observations is the invasion of escaped birds from local markets. Another reason could be regional variations within Sumatra, which are not reflected in the aggregated BirdLife database. Since our rarity index is generated from Jambi Province, only those species native to the region (but present in the caged-bird market) were included in the choice experiment. The list of bird species included is provided in online appendix A1.

Each bird species has a particular combination of the three binary bird attributes, even though the same combination of attributes may occur in several species. We developed four species groups, each containing eight H i S i T i(i = 0, 1) combinations represented by eight distinct species. For example, the combination H 0 S 0 T 0 (a low-end, abundant bird, which is not frequently traded) was represented by Aegithina tiphia; its common names (Sertu or Sirpu) along with a picture and information on whether or not the species can be trained to sing were included on the choice card in the first species group. In the second group, H 0 S 0 T 0 was represented by a different species, Ploceus manyar (commonly known as Manyar). Thus, across the four groups, 32 species would actually have to be included. However, for the combinations H 0 S 1 T 1 and H 1 S 1 T 1, only three representative species were available, so we had to repeat two species (Acridotheres javanicus and Alophoixus ochraceus). Hence, in total 30 distinct species were included in the choice experiment.

3.1.2. Selection of other attributes and levels

In addition to the bird species that represent one of the H i S i T i combinations, two other attributes were randomly assigned in the experiment, namely market price and origin of the birds. For each species, we used five different price levels. The average species-specific price was estimated from the 2013 trader survey data. As significant intra-species price variation was observed, we used the median price (expressed in thousand Indonesian rupiah (IDR) per bird), based on which the other price levels were generated, namely 0.75 (1st level), 0.90 (2nd level), 1.00 (3rd level), 1.10 (4th level) and 1.25 (5th level) times the median price (online appendix A2).

For the bird origin attribute, we used three levels – wild capture, captive breeding and no information. As observed by Hanley et al., (Reference Hanley, Sheremet, Bozzola and MacMillan2018) in a study of rhinoceros horn markets in Vietnam, information on the origin of the product might influence consumer demand for wildlife products. With the three origin categories, a full factorial design would result in 120 combinations (8 species in each species group × 5 price levels × 3 origin alternatives), which would have been difficult to implement in the field. To simplify the experiment without losing information, a fractional factorial design was derived. The final experimental design was selected using Stata 13.0, which employs the modified Fedorov algorithm to maximize the D-efficiency of the design (Carlsson and Martinsson, Reference Carlsson and Martinsson2003).

The final design consisted of 24 choice sets, which were randomly allocated to three different blocks of eight choice sets. Each set contained two birds of different species, each representing different combinations of H i S i T i. Each combination was represented by four different species, and hence, in effect there were 96 different choice cards (3 blocks × 8 choice sets × 4 species groups). These cards were organized in 12 books, each containing eight choice cards. As is common for choice experiments, we used a between-subject design. A single book was used per interview, meaning that each respondent was asked to make only eight choices.Footnote 3 The choice cards also had an option not to choose either of the two birds shown. This ‘opt-out’ option is instrumental for achieving welfare measures consistent with demand theory. The respondents' familiarity and perceptions on different characteristics of the selected species were elicited through an interview conducted before the experiment. The choice sets were presented and explained sequentially by trained enumerators. The attributes and attribute levels used are summarized in table 1, and choice cards are shown in online appendix A3. For the actual experiment and survey, all materials were translated into Bahasa Indonesia.

Table 1. Choice experiment attributes, levels, and descriptive statistics

Notes: Number of choices = 8,064.

aWhen the number of birds of a given species sold per year exceeded its median value (in the 2013 trade data set), that species was classified as ‘frequently traded’. Following the same procedure, species were put into ‘high-end’ (species price above median value) and ‘rare’ (with the species distribution area below or equal to the median value) categories.

bFor about one-third of the cases, we indicated in the choice cards that no information is available on whether the bird was captured from the wild or bred in captivity.

3.2. Household survey

The household survey was designed to identify the presence of consumer preference for species rarity, and was conducted between February and May 2016 in Jambi City. Only households that either kept caged birds at the time of interview or during the previous three years were included in the sample.Footnote 4 Based on this criterion, 504 households from 26 neighborhoods were randomly selected.Footnote 5 Interviews were conducted with the household member who made (or would make) the purchase decision for caged birds. Due to the strong spatial patterns in the distribution of households actively involved in caged-bird keeping, the number of respondents per neighborhood varied widely. A map of the study area is provided in the online appendix A4.

The household survey was carried out by a team of six trained enumerators who were supervised by the researchers. Computer assisted personal interviews (CAPI) were conducted over a period of three months, employing the software Surveybe TM after translating the questionnaire to Bahasa Indonesia. The questionnaire contained five major parts: (1) respondent and household identification, (2) respondent familiarity with different bird species and preference for different bird attributes, (3) choice experiment, (4) perceptions on environmental conservation, and (5) socio-economic characteristics. In part (2), respondents' perceptions on eight different bird species were elicited with the help of pictures. These questions referred to opinions on different attributes of the species, including quality of the sound, beauty of the plumage, whether or not the bird is native to Jambi, and rarity in the market as well as in the wild. Questions in this part did not ask whether or not respondents would want to purchase a particular species, nor were additional explanations provided at this stage. These questions were in fact meant to stimulate the thought process related to bird preferences without directly interfering with the choice experiment. In part (3) of the questionnaire, respondents were introduced to the hypothetical market scenario in which he/she had the option to buy one of the two birds shown on each choice card.Footnote 6 Further details of the experimental design were explained above.

3.3. Trader survey

A consumer preference for species rarity, if present, is expected to result in higher market prices of rare species. How does the rarity preference affect the rate of species extraction from the wild? To answer this question, a market survey was conducted among bird traders in Jambi City in three rounds: Jan.–Dec. 2013 (12 months), Sept.–Dec. 2014 (4 months), and Sept.–Dec. 2015 (4 months). For each of the rounds, existing bird traders were identified. The researchers visited the traders before the survey in order to explain the scope of the research project and to build a trustful relationship. A small remuneration was provided for organized book-keeping on individual transaction details. At an interval of 30 days, research assistants collected the book-keeping data – such as the number of birds bought and sold, purchase and sales prices, and other characteristics of individual birds like sex, age and voice maturity. Several of the traders who were selected in the first round (2013) did not continue with caged-bird trade during subsequent rounds (2014 and 2015), which points at frequent market entry and exit. Nevertheless, we could develop panel data at the species level combining data from different traders. Altogether, about 38,000 transactions involving 113 bird species were recorded during the study period. Because we intend to model the effect of consumer preferences for species rarity in the wild, our analysis includes only the subset of 77 species that are native to the study area.

4. Analytical framework

4.1. Testing hypothesis 1

The consumer preference for species rarity is identified using a choice experiment, details of which were explained above. The choice experimental data were analyzed using a random parameters logit (RPL) model, also known as mixed logit (Train, Reference Train2009). The mixed logit is frequently used in choice modeling, as it allows for preference heterogeneity and relaxes some of the other potentially unrealistic assumptions of the standard logit (Lew and Wallmo, Reference Lew and Wallmo2011; Lew and Wallmo, Reference Lew and Wallmo2017; Johnston et al., Reference Johnston, Jarvis, Wallmo and Lew2015; Pallante et al., Reference Pallante, Drucker and Sthapit2016). The mixed logit fixes household-specific attributes so that it also controls for any observed and unobserved heterogeneity (Hensher and Greene, Reference Hensher and Greene2003).Footnote 7

Following the general framework of mixed logit models, we modeled a sample of N respondents with a choice of J alternatives on K choice occasions. The attributes other than market price were not assumed to have a fixed coefficient. The utility a person n derives from choosing a bird j in choice situation k was specified as a function of market price (p njk), species rarity (S njk), and other non-monetary attributes (x njk).

where α n, β n, and γ n are respondent-specific coefficients, and ε njk is a random error term. We assume that ε njk is an extreme value distributed with variance ![]() $\mu _{n}^{2} \lpar {\pi^{2}/6} \rpar $, where μ n is a respondent-specific scale parameter that can be estimated through a simulated maximum likelihood procedure (Train, Reference Train2009). Dividing equation (1) by μ n does not affect behavior and results in a new error term that is an independently and identically distributed (IID) extreme value with variance π 2/6:

$\mu _{n}^{2} \lpar {\pi^{2}/6} \rpar $, where μ n is a respondent-specific scale parameter that can be estimated through a simulated maximum likelihood procedure (Train, Reference Train2009). Dividing equation (1) by μ n does not affect behavior and results in a new error term that is an independently and identically distributed (IID) extreme value with variance π 2/6:

where λ n = α n/μ n, θ n = β n/μ n and σ n = γ n/μ n. This specification models the choices in the preference space. Here a positive θ n value in the mean function would denote consumer preference for rare species. The statistical significance of θ n in the standard deviation function would denote heterogeneity of preferences for rarity across respondents.

4.2. Testing hypothesis 2

The hypothesis on preference heterogeneity was constructed in two parts. In the first part, we aimed to examine the species- and respondent-specific factors determining the strength of consumer preference for rarity. The second part was on testing whether potential consumer preferences for rarity remain positive across different market scenarios involving different sets of bird species. To examine the species-specific factors determining the strength of consumer preferences for rarity, a provision was made in the choice experiment design, allowing for interactions between the three key variables – relative market position, rarity, and trading frequency. Statistical significance of the interaction terms would suggest that rarity preference varies with species price levels and/or trading frequency. There could also be respondent-specific factors determining the strength of consumer preferences. This was tested by including respondents' familiarity with the species, their perceptions on species rarity in the wild, and popularity of the given species in the choice models. Two binary variables were created from the perceived species rarity: ‘augmented rarity perception’ and ‘negated rarity perception’. The former took the value of one when the perception on rarity status matched with the rarity status in the choice card. When the respondent's perception and information provided did not match, the negated perception variable took a value of one. Inclusion of both augmented and negated perceptions in the estimation did not lead to a dummy variable trap, as there were many respondents unaware of the rarity status.

4.3. Testing hypothesis 3

While the first two hypotheses were framed to test the presence and prevalence of market demand for species rarity, the third hypothesis connects market demand with the rate of species extraction from the wild. This was tested analyzing the trader survey data. Although we cannot directly link the household and trader data, rejection of hypothesis 3 for species preferred in the choice experiment would indicate that their wild population is declining drastically. As a first step of the analysis, trends in sales prices and market arrivals (number of birds reaching the market in a given month) were examined. Then, market arrivals were regressed on sales prices to see whether an increase in the sales price could increase the extraction rate of rare birds.

For the trend analysis, we used multivariate regression models. The time variable, which was measured in months, was allowed to interact with the rarity dummy. A positive trend in sales price and a negative trend in market arrivals would be indicative of a scenario in which rising financial returns are unable to induce increases in harvesting from the wild. One reason could be the increasing costs of harvesting wild species because of the declining population density. Yet, such a decline could also be due to multiple factors unrelated to caged-bird markets, especially habitat loss due to deforestation and associated land use changes.

In the second step, we examined the pattern of market arrivals of different species and modelled it using sales price. To begin with, simple fixed-effects models at the species level were estimated. The dependent variable was market arrivals and the explanatory variables included sales price and its interaction with rarity and trainability (the possibility that a bird can be trained to sing) dummy variables.

where A i, t and P i, t are the number of birds that arrived in the market and the sales price respectively, for species i in month t. Among the explanatory variables, S i stands for rarity and T i for trainability; both are species-specific and hence time-invariant binary variables. u i and ν t represent unobserved individual and time-specific effects, and a 0 to a 3 are coefficients to be estimated. We are particularly interested in the coefficient sum, a 1 + a 2, which is the price effect for rare species. The interaction term allows for differentiation between the effect of sales prices for rare and non-rare species, while a 1 is the price effect for abundant species. A positive relationship between sales price and market arrivals occurs when many of the rare species are still available in the wild. On the other hand, if the coefficient sum is small and insignificant, it would mean that an increase in market price does not result in increased harvesting of rare species.

Because the supply chain of wild birds in Indonesia is informal and unorganized, changes in demand and sales price might affect market arrivals only after a time lag. The few studies that have modeled the relationship between market price and sale of caged birds (e.g., Su et al., Reference Su, Cassey, Vall-Llosera and Blackburn2015) do not consider possible lags. We address this issue by employing dynamic panel data models. While such models were used in various other contexts (Capitanio et al., Reference Capitanio, Gatto and Millemaci2016; Njikam, Reference Njikam2016), they have rarely been employed to study the implications of wildlife trade. We used the following linearized expressions to test for lagged effects:

where m ≥ 1 is the number of lags, and b 0 to b 7 are the coefficients to be estimated. The species-specific unobservable fixed effects (ϑ i) are correlated with the lagged dependent variables, making the standard regression estimators inconsistent. To overcome this, the Arellano-Bond dynamic panel data model (Arellano and Bond, Reference Arellano and Bond1991), which includes m lags of the dependent variable as covariates and certain unobserved panel-level effects, was estimated. The model specification implies a transformation of the regressors and the use of lagged values of the dependent variable as instruments. A positive coefficient sum b 3 + b 5 denotes that an increase in the sales price in the bird supply chain would lead to an increase in market arrivals of rare species with a time lag of m months. If b 3 is positive and b 3 + b 5 not, that would indicate that the market arrivals of abundant species only respond to the changes in market prices, which to a great extent would rule out the possibility of inefficient price transmission in the supply chains, and the supply inelasticity for rare species can be attributed to the increasing population scarcity in the wild. More information is required on the Allee threshold or extinction threshold in order to understand whether the increasing cost of harvesting prevents further extraction, or whether the trade in conjunction with the land use changes already resulted in an extinction vortex.

5. Results

5.1. Consumer preference for species rarity

We identify consumer preference for species rarity in a hypothetical bird market scenario and examine whether rarity preference is consistently positive irrespective of other bird species characteristics. As the first step, a mixed logit model with attributes shown in the choice cards was estimated (table 2a). The model was significant at the 1 per cent level, indicating that consumer preferences are attribute-dependent. Market price affected demand positively, indicating a possible Veblen good status of caged birds.Footnote 8 However, the square term of price was negative, indicating a weakening of the positive price-demand relationship at higher prices. While respondents generally preferred high-end species, their willingness to purchase increased at a slower rate with increasing market price.

Table 2. Determinants of consumer preference for bird attributes: basic models

Notes: Number of observations = 5,812***: p ≤ 0.01; *: p ≤ 0.10. Figures in parentheses show standard errors of the estimates.

Notes: Number of observations = 5,812. ***: p ≤ 0.01.

aRarity perception variables (dummy), and the reference is ‘no idea about rarity status’. Figures in parentheses show standard errors of the estimates.

Species rarity was found to be statistically insignificant in the mean function with high preference heterogeneity, as depicted by significance of rarity in the standard deviation function. One possible reason could be that respondents' perception on rarity status of a species differed from the information provided in the choice cards. To test this, another model was estimated with subjective rarity perceptions that were elicited before the choice experiment. Those who considered a species rare, with reference to the ones with no information on the rarity status, showed a greater willingness to purchase (table 2b). Nonetheless, a similar pattern was also observed for subjective abundance (those who considered a species abundant). Rather than perceptions on rarity, respondents' familiarity with the species might be contributing to the market demand. We will test the role of familiarity for demand enhancement in subsequent models.

Because the respondents resided in urban areas, their perceptions of rarity might be derived from local bird markets rather than from the wild. To test this, a dummy variable on trading frequency was included in the estimation. While this variable was not included in the choice cards, 50 per cent of the species selected for the choice experiment were frequently traded in Jambi markets, and the other 50 per cent were rarely traded. The estimates are shown in table 3 (Model 1). In addition to trade frequency, the attributes presented in the choice cards (market price, rarity, origin of birds, and trainability of species to sing) were included. The trade dummy was positive and significant in the mean function. The rarity dummy alongside origin of birds (bred/captured) remained insignificant. A strong consumer preference was observed for trainability, that is, for the species that can be trained to sing.

Table 3. Determinants of consumer preference for bird attributes: extended models

Notes: Number of observations = 5,812. ***: p ≤ 0.01; **: p ≤ 0.05; *: p ≤ 0.10. Figures in parentheses show standard errors of the estimates. Model 3 includes respondent-specific variables in addition, which are shown in online appendix A5.

There exists significant preference heterogeneity with respect to rarity as observed in the estimated standard deviation function of Model 1. In order to examine the source of this heterogeneity, we estimated another model with interaction terms (Model 2, table 3). Coefficients of both the rarity dummy and its interaction with the trade dummy turned statistically significant in this specification. Positive rarity value (positive willingness to pay for species that were rare in the wild) existed only for species that are scant in the market. Following Chen, (Reference Chen2016), a possible reason for the negative interaction between rarity and trade frequency could be a snob effect, the desire to own and consume unique goods. In other words, buyers who value rarity lose their interest when rare species become easily available in the market place.

In order to examine whether respondents' preference for rarity depended on their familiarity with the species alongside subjective perceptions on species rarity, we estimated Model 3 (table 3 and online appendix A5). While inclusion of respondents' perceptions led to better empirical fit, it did not significantly alter the coefficients of other variables in the mean function. Respondents' familiarity strongly determined preferences (online appendix A5). On the other hand, subjective perceptions on species rarity, in contrast to information provided in the choice cards, were not statistically significant. As in Model 2, positive rarity value was present only for species that were scant in the local market. Significant preference heterogeneity was present with respect to most variables included the model. This indicates that respondent attributes might also be playing a key role in determining market demand.

The mixed logit model controls for both observed and unobserved household-specific attributes. To learn more about the potential role of socio-demographic factors in determining preference heterogeneity, we divided the sample into subgroups with respect to household wealth, respondent education, age, and marital status, estimating separate mixed logit models for each of the subgroups (online appendix A5). Across the different wealth groups, most coefficients in the standard deviation function turn statistically insignificant, indicating that household wealth is one of the major sources of preference heterogeneity. We also observe that the preference for species rarity is higher among younger and unmarried than among older and married respondents.

5.2. Effect of species rarity on market price and market arrivals

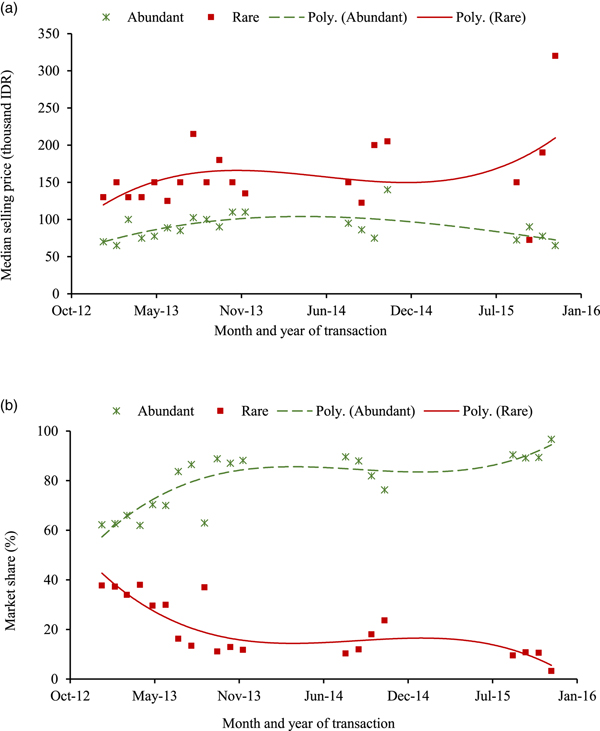

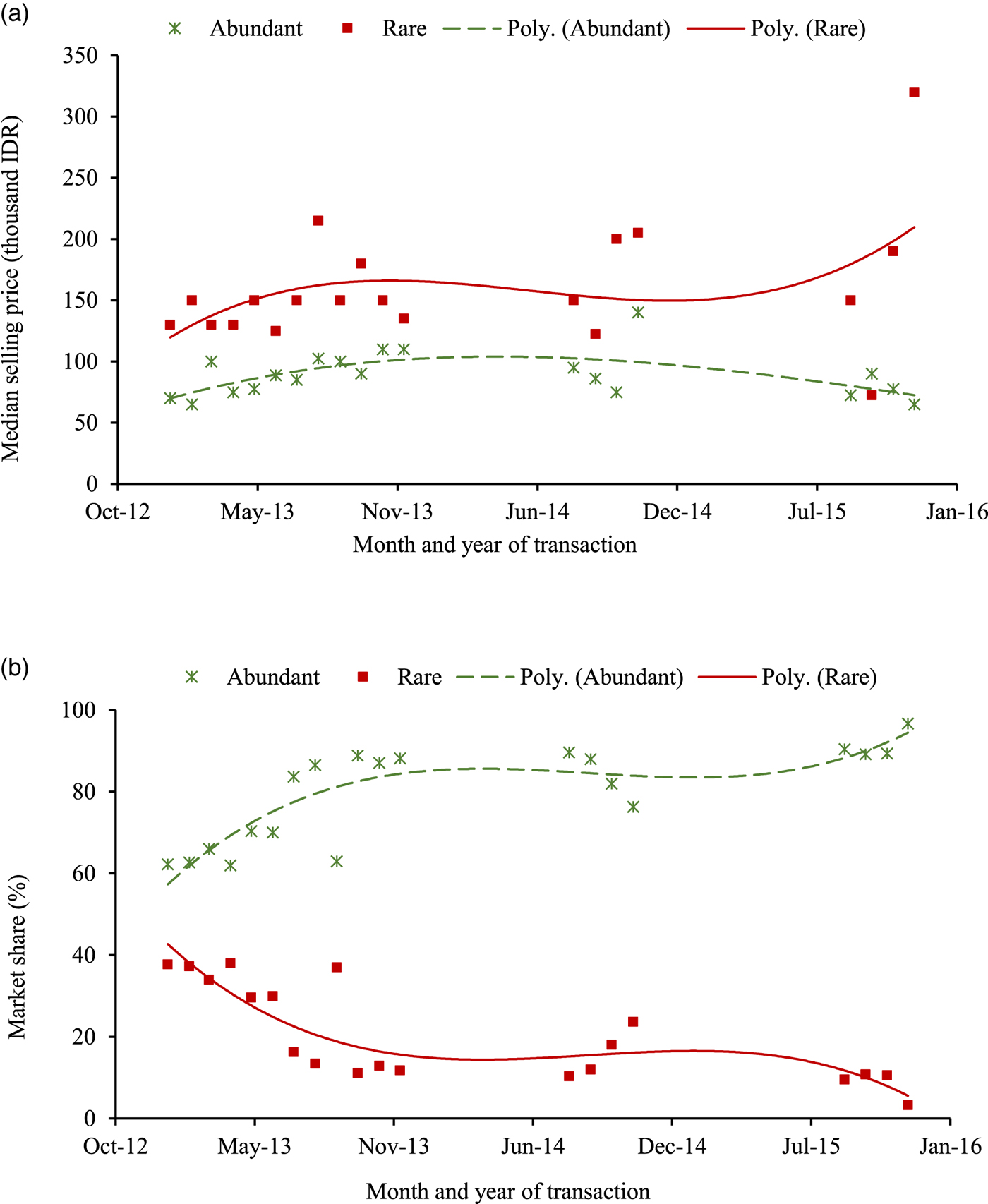

We now address hypothesis 3 linking the rarity attribute and market arrivals of birds, using the time-series data from the trader survey. Market price is found to be high for rare species (figure 1), which is one of the necessary conditions for encountering an anthropogenic Allee effect (Lyons and Natusch, Reference Lyons and Natusch2013). The price increment observed for rare species corresponds to the positive value that consumers attributed to species rarity in our choice experiment. However, the trade data suggest that higher prices do not lead to an increase in the trade volume of rare species. The species abundant in the wild formed more than 60 per cent of the total transaction volume, with their share increasing over time. During August-November 2015, only 5 per cent of all marketed birds were rare.

Figure 1. Market price and sales of caged birds with respect to rarity status. (a) Market price (thousand IDR/bird). (b) Market share (% share of total number of birds sold/month).

A trend analysis indicates that while sales price remained unchanged over the study period, the number of birds arriving in the Jambi market declined drastically.Footnote 9 These patterns do not differ significantly with respect to the rarity status of birds (online appendix A6). There could be a number of factors influencing the market shrinkage, including diversion of birds to bigger neighboring markets. However, there is no evidence for such a geographical shift in the literature, nor was anything along these lines mentioned by traders or other key informants in Jambi during our discussions. Hence, a declining harvest rate in the presence of unchanged economic incentives could indicate declining population sizes in the wild. Significant inter-species differences exist. For some rare species, a significant reduction in market arrivals was associated with a sharp increase in the market price, implying the possibility of a declining population in the wild.

To test hypothesis 3, we examined the role of sales price on market arrivals. If the species is abundant in the wild, the number of birds arriving in the market will increase with an increase in the sales price. Species-level fixed-effects models were estimated and are presented in table 4. The analysis was carried out by including the time-invariant rarity attribute interacted with sales price as the key explanatory variable. Indeed, for the species abundant in the wild, an increase in price is associated with an increase in market arrivals. This effect is not observed for rare species.

Table 4. Panel datamodels onmarket arrivals of caged birds

Notes: Dependent variable is the number of birds entered the market in a month. Number of observations: 880. Number of groups: 77. ***: p ≤ 0.01; **: p ≤ 0.05; *: p ≤ 0.1. Figures in parentheses show std. errors.

aAdjusted for inflation between 2013 and 2015.

To understand the possible lagged effect of sales price on market arrivals, Arellano-Bond dynamic panel data models were estimated (table 4). The specification passed the goodness-of-fit test based on the Wald Chi-squared statistic. The Arellano-Bond tests for serial correlation in panel errors suggest that, while the first-differentiated errors were correlated, the second-order errors were not. Serially uncorrelated errors were obtained by including a sufficient number of lags of the dependent variable in model estimation (Capitanio et al., Reference Capitanio, Gatto and Millemaci2016). An increase in market arrivals with the sales price is observed only for abundant species with a time lag of two months, while market arrivals are insensitive to price variations for rare species. The inelastic supply function of rare species could possibly be due to a declining stock of rare species in the wild, which in turn could be due to either over-extraction for the market or general habitat loss from rapid deforestation and associated land use changes (Symes et al., Reference Symes, Edwards, Miettinen, Rheindt and Carrasco2018). However, not all rare species seem to be equally affected. For six species in particular (Alophoixus bres, Alophoixus ochraceus, Cissa chinensis, Copsychus saularis, Heterophasia picaoides, Platylophus galericulatus), the trend in sales price was positive, while the trend in market arrivals was negative. As the steady increase in market price is expected to provide the catchers with economic incentives to focus on these birds, these species could be the ones most severely affected by the trade and/or land use change in Sumatra. We conclude that a positive relation between market arrivals and sales price does not exist for rare species, possibly due to declining population. To quantify how much trade contributes to the population decline, more interdisciplinary research is required on functioning of bird supply chains and population density-dependence functions of the selected species.

6. Discussion and policy implications

Deforestation, climate change and unregulated wildlife trade are threatening a large number of species in developing countries. In this paper, we have examined the conservation effects of caged-bird markets using a choice experiment among urban households and time-series data collected from local traders in Jambi Province on the island of Sumatra, Indonesia. We have tested whether species rarity is preferred by consumers, and whether a price increment for rarity fosters the rate of harvesting from the wild. While rare species are indeed preferred by participants in the choice experiment, the strength of preference also depends on other species-specific attributes. For instance, the rarity value is low for species that are transacted frequently in the market. This can effectively restrict the expansion of niche markets for rare species.

These findings do not imply that all bird species of commercial interest are unaffected by trade. At least for six rare species, market price was observed to increase considerably over time, with a simultaneous decline in market arrivals. For these species, market supply was inadequate to meet demand, suggesting a drastic population decline in the wild. However, the observed inelastic supply could also be due to bird habitat loss. Jambi has been experiencing drastic land use changes, with forests being converted to rubber and oil palm plantations (Clough et al., Reference Clough, Krishna, Corre, Darras, Denmead, Meijide, Moser, Musshoff, Steinebach, Veldkamp, Allen, Barnes, Breidenbach, Brose, Buchori, Daniel, Finkeldey, Harahap, Hertel, Holtkamp, Hörandl, Irawan, Jaya, Jochum, Klarner, Knohl, Kotowska, Krashevska, Kreft, Kurniawan, Leuschner, Maraun, Melati, Opfermann, Pérez-Cruzado, Prabowo, Rembold, Rizali, Rubiana, Schneider, Tjitrosoedirdjo, Tjoa, Tscharntke and Scheu2016; Krishna et al., Reference Krishna, Kubitza, Pascual and Qaim2017; Kubitza et al., Reference Kubitza, Krishna, Urban, Alamsyah and Qaim2018). Such land use change might affect some bird species more than the others. While the present study points toward a significant population decline for several species in the wild and a potential of caged-bird markets to overexploit the wild population, more interdisciplinary research is required in order to understand whether the current rate of extraction for the markets is indeed leading to an Allee effect for the rare birds.

In theory, a tough government stance against wildlife collection when the population falls below a threshold could eliminate extinction equilibria (Kremer and Morcom, Reference Kremer and Morcom2000). In practice, however, the popular regulatory mechanisms involving trade restrictions and quota imposition are often inadequate to address overexploitation of wild birds. Being a signatory of the Convention on International Trade in Endangered Species of Wild Fauna and Flora and the Convention on Biological Diversity, Indonesia has made significant progress with respect to creating a legal base for the protection of wildlife (Chng et al., Reference Chng, Eaton, Krishnasamy, Shepherd and Nijman2015). Nonetheless, the governance of domestic wildlife trade remains weak (Lee et al., Reference Lee, Gorog, Dwiyahreni, Siwu, Riley, Alexander, Paoli and Ramono2005). Without an effective governance system in place, hunting and other forms of wildlife exploitation occur under a de facto open access regime (Harris et al., Reference Harris, Cooney and Leader-Williams2013). With new regulatory institutions (e.g., Wildlife Crimes Unit) to curtail illegal wildlife trade and hunting, there is a need for more empirical evidence of their actual impact on conservation.

Another limitation of trade restrictions and quota imposition is that, in the absence of effective local regulatory institutions, these initiatives could be merely ‘publishing the plight of vulnerable plants and animals’ (Brook and Sodhi, Reference Brook and Sodhi2006: 556). This could induce consumer demand and illegal markets in which rare and attractive bird species command higher prices (Robinson, Reference Robinson2001; Guttery et al., Reference Guttery, Messmer, Brunson, Robinson and Dahlgren2016). Indeed, we observed that there is only limited information on species rarity among bird-keeping households, and that provision of additional information on rarity actually increased consumer demand. This is in line with Hanley et al., (Reference Hanley, Sheremet, Bozzola and MacMillan2018), who observed that consumers in Vietnam are willing to pay more for rhinoceros horn in illegal markets.

However, the role of additional information for consumers is not unambiguous. In a recent study, Moorhouse et al., (Reference Moorhouse, Balaskas, D'Cruze and Macdonald2017) showed that providing consumers with information on the legal consequences of trade in exotic pets reduced the purchase probability, while providing information on the conservation effects did not. Furthermore, it can be expected that the effects of information on public attitudes toward wildlife conservation can differ geographically (Vogdrup-Schmidt et al., Reference Vogdrup-Schmidt, Abatayo, Shogren, Strange and Thorsen2019). The nature of the information provided, the incentive structures used in experiments, the type of wildlife product considered, the strength of the existing regulatory institutions, and several other factors may all influence the effects of information provision, so that policy recommendations can only be given for a particular context.

Another economically viable and effective intervention to conserve wildlife could be the substitution of wild-caught birds with commercially-bred alternatives. Jepson and Ladle, (Reference Jepson and Ladle2005) suggested that substitution between captive-bred and wild-captured birds was taking place in many Indonesian markets, while Burivalova et al., (Reference Burivalova, Lee, Hua, Lee, Prawiradilaga and Wilcove2017) indicated that consumers may prefer wild-captured birds for superior song quality. Our choice experiment indicated that respondents were rather indifferent about the birds' origin (captive-bred or wild-captured). While captive breeding of many species is technically difficult, the potential financial returns are high for certain rare species, which could attract investors. Providing economic incentives for captive breeding could reduce wild capture, enhancing the supply of rare species and avoiding price hikes. As indicated by Kremer and Morcom, (Reference Kremer and Morcom2000), anticipated future abundance of wildlife products could reduce current prices and economic incentives for illegal collection. However, there should be strong market institutions (e.g., certification of birds' origin) in place to distinguish the products of captive breeding from wild capture (Shepherd et al., Reference Shepherd, Sukumaran and Wich2004). In the absence of such institutions, partial legalization of banned wildlife products may not impede black market activity, as empirically shown by Hsiang and Sekar, (Reference Hsiang and Sekar2016).

Further research is required in two directions in order to frame effective regulatory interventions. First, to explore the nature and determinants of market demand for wildlife forms, and second, to better understand the wildlife supply chains. We have seen that market demand for rarity does not necessarily align completely with demand for rare species. Certain species characteristics other than rarity could also increase the risk of an anthropogenic Allee effect. For example, buyers have a higher preference for species that can be trained to sing in captivity. Singing competitions for caged-birds are prevalent in Indonesia, sometimes with remarkable prizes, which continue to raise the demand for certain rare species (Chng et al., Reference Chng, Eaton, Krishnasamy, Shepherd and Nijman2015). Certain rare bird species (e.g., Gracula religiosa) are preferred due to their ability to sing, which could lead to overexploitation of the species even in the absence of a direct preference for rarity. More interdisciplinary research is warranted at the species level to explore the conservation effects of relevant attribute interactions.

A greater research focus is required also on wildlife supply chains. Markets for wildlife products in developing countries are characterized by low entry barriers, participation of several small-scale vendors, and strong market differentiation for different species transacted. Due to limited employment opportunities in rural villages, the labor costs associated with collecting wildlife are low when compared to the market price for rare species (Lyons and Natusch, Reference Lyons and Natusch2013). While there are some recent research attempts to estimate the labor requirement for capturing wild birds, the data available are still insufficient. For example, simply counting the hours needed to catch one bird will underestimate the total labor requirement if unsuccessful missions are not considered. More systematic studies are needed to examine the economic and social motivation for rural households to engage in the collection and trade of wildlife products.

Supplementary material

The supplementary material for this article can be found at https://doi.org/10.1017/S1355770X19000081.

Author ORCIDs

Vijesh V. Krishna, 0000-0003-2191-4736.

Acknowledgements

We gratefully acknowledge the willingness of the sample households to participate in the survey. We also thank Patrick Diaz for his inputs during the fieldwork, and Christoph Kubitza, Dennis Ochieng, Sreejith Aravindakshan, and the two anonymous reviewers of this journal for their valuable comments on earlier versions of this manuscript. This study was funded by the Deutsche Forschungsgemeinschaft (DFG, German Research Foundation) – project number 192626868 – in the framework of the collaborative German-Indonesian research project CRC990.