Introduction

Chief Executive Officers' (CEO) human capital specificity (generalist vs. specialist CEOs) is one of the most explored phenomena in management literature, given the fundamental significance associated with CEOs influence on firms' strategic decisions, performance, and survival (Brockman et al., Reference Brockman, Lee and Salas2016; Chen, Huang, Meyer-Doyle, & Mindruta, Reference Chen, Huang, Meyer-Doyle and Mindruta2020). Although extant research has explored implications for generalist versus specialist CEOs on firms' strategic outcomes, studies regarding their impact on firms' strategic actions such as R&D investment has been explored to a limited extent and that too with mixed results (Custódio, Ferreira, & Matos, Reference Custódio, Ferreira and Matos2017; Koo, Reference Koo2019).

Research subscribing to the generalist view of human capital asserts that the accumulation of broad, general career experience results in better strategic decisions (Mueller, Georgakakis, Greve, Peck, & Ruigrok, Reference Mueller, Georgakakis, Greve, Peck and Ruigrok2020). Due to their diverse career experience, generalist CEOs could resolve a diverse range of problems (Lazear, Reference Lazear2012). In contrast, the specialist view of human capital emphasizes the significance of understanding firms’ internal capabilities that make specialist CEOs more apt to devise effective strategic actions (Li & Patel, Reference Li and Patel2019). On the contrary, more generalist CEOs may find it challenging to combine diverse inter-industry experience while making R&D investment decisions with focal firms’ specific resources (Powell, Reference Powell1992).

One reason for these inconsistent findings could be that literature has disregarded the fact that CEOs do not make strategically important resource allocations such as R&D investment decisions as isolated agents but in consultation with the top management team (TMT), commonly referred to as the CEO–TMT interface (Arendt, Priem, & Ndofor, Reference Arendt, Priem and Ndofor2005; Hambrick & Mason, Reference Hambrick and Mason1984; Heyden, Reimer, & Van Doorn, Reference Heyden, Reimer and Van Doorn2017). Upper-echelons scholars have reported that demographic traits of TMTs (e.g., functional experience, education, etc.) influence R&D decisions (Finkelstein, Cannella, & Hambrick, Reference Finkelstein, Cannella, Hambrick and Cannella2009; Hambrick & Mason, Reference Hambrick and Mason1984). However, the interaction between CEOs’ generalist versus specialist industry experience and TMT demographic traits for influencing resource allocation decisions have not been explored, even though CEOs make such decisions in congruence with TMT. Thus, demographic traits of TMT may influence generalist versus specialist CEOs differently in their R&D allocation decisions.

Furthermore, evidence from emerging markets like India is also lacking. For example, R&D investment is specifically riskier for emerging market firms (EMFs) as they suffer from resource constraints, such as under-developed capital markets (Khanna & Palepu, Reference Khanna and Palepu2000). In such a resource constraint environment, making resource allocation decisions for R&D that have uncertain outcomes (Webb, Khoury, & Hitt, Reference Webb, Khoury and Hitt2020) could be even more challenging for CEOs, and their generalist or specialist experience could influence the decision.

CEOs are the most valuable intellectual capital sources who make strategic resource allocation decisions for firms (Hambrick & Mason, Reference Hambrick and Mason1984). Consequently, their human capital specificity will most likely influence their commitment to R&D as driven by their experience in the same or related industry. Given this significance of CEOs and resource constraints of emerging markets, it is vital to explore whether human capital specificity in the form of generalist versus specialist skills of CEOs could influence R&D commitment under the moderating influence of demographic traits of TMT (Heyden, Reimer, & Van Doorn, Reference Heyden, Reimer and Van Doorn2017). Moreover, as in the extant R&D literature, the interaction of a CEO and the rest of the TMT members' demographic traits has been scantly explored, scholars have called for more research on this stream (Bolinger, Brookman, & Thistle, Reference Bolinger, Brookman and Thistle2019; Custódio, Ferreira, & Matos, Reference Custódio, Ferreira and Matos2017). We intend to fill these gaps in the literature.

Our research has two objectives. The first is to explore if human capital specificity, i.e., whether generalist or specialist CEOs would have a higher R&D commitment. Second, to explore how TMT demographic traits influence generalist–specialist CEO and R&D investment relationship, i.e., TMT demographic traits’ moderating effect on CEO human capital specificity and R&D commitment relationship. We explore these research objectives in the context of a scantly explored emerging market, namely, India.

Leveraging human capital theory, we assert that specialist CEOs, i.e., CEOs who work in the same industry throughout their careers (Custódio & Metzger, Reference Custódio and Metzger2013), are likely to have a higher R&D commitment compared to generalist CEOs. This is because specialist CEOs have more industry-specific human capital, such as technical expertise, which enhances their ability to identify appropriate R&D opportunities and make resource allocation decisions. In contrast to developed market generalist CEOs, who may switch jobs easily after R&D failures and therefore take risks in R&D investments (Custódio, Ferreira, & Matos, Reference Custódio, Ferreira and Matos2017), in a resource scant market such as India, R&D failures would impede a generalist CEO's ability to secure jobs at any firm. This is because failed R&D efforts would reflect the CEO's inability to manage scant resources judiciously (Chen, Heng, Tan, & Lin, Reference Chen, Heng, Tan and Lin2018; Scharfstein & Stein, Reference Scharfstein and Stein2000).

Next, we explain how TMT educational and functional demographic diversity moderates the human capital (i.e., generalist vs. specialist CEOs) and R&D commitment relationship. We assert that although generalist and specialist CEOs differ in their strategic choices, such as R&D decisions, TMT members influence these decisions through their knowledge and experience (Alessandri & Pattit, Reference Alessandri and Pattit2014). Thus, we propose that TMT's education and functional diversity present an important boundary condition in a generalist versus specialist CEO and R&D commitment relationship.

Our study contributes to human capital management literature in multiple ways. The study examines how CEOs' human capital specificity (i.e., generalist vs. specialist CEOs) influences R&D commitment. Although CEOs' human capital specificity has been explored in depth in compensation studies, firms' strategic investment decisions, such as R&D commitment, have not been explored (Datta & Datta, Reference Datta and Iskandar-Datta2014; Peng, Sun, & Markóczy, Reference Peng, Sun and Markóczy2015). Furthermore, studies examining the CEO's human capital defined generalist versus specialist CEOs based on CEOs’ firm-level experience and not industry-level experience (Koo, Reference Koo2019).

We extend the literature on human capital by exploring CEOs' generalist and specialist nature at the industry level rather than at the firm level. R&D opportunities do not differ much for firms belonging to the same industry, enabling CEOs to transfer knowledge across firms belonging to the same industry, but not different industries (Li & Patel, Reference Li and Patel2019).

Furthermore, research that explored the influence of CEOs on R&D commitment considered CEOs as part of the TMT (Chen, Hsu, & Huang, Reference Chen, Hsu and Huang2010). However, scholars studying CEO–TMT interface research have asserted that CEOs are key decision makers in the organization. The rest of the TMT members only influence CEOs' decisions through an advisory role (Cao, Simsek, & Zhang, Reference Cao, Simsek and Zhang2010). For instance, output-oriented TMT members reduce the negative influence of CEOs' career horizon on the R&D commitment decisions. We extend this CEO–TMT interface research by exploring the effect of yet another CEO trait, i.e., generalist versus specialist CEO, on R&D commitment, under the moderating influence of TMT members’ demographic traits. We thus link CEO human capital and TMT traits literature to explore their joint influence on R&D commitment. Our study empirically examines the critical role that TMT education and functional diversity play in diminishing generalist CEOs' negative influence on R&D commitment.

Finally, Hamori and Koyuncu (Reference Hamori and Koyuncu2015) asserted that managerial discretion is a function of the institutional context in which a firm operates and called for more CEO-specific research in the different institutional contexts. Our study responds to this call by exploring the impact of CEO generalist versus specialist skills on the R&D commitment of a firm in the context of emerging markets, where CEO human capital and R&D relationship has not been explored. Finally, our research reconciles the mixed findings of prior studies on the association between CEO's human capital specificity and R&D commitment by broadening the country context and examining factors reflecting the internal context, i.e., the CEO–TMT interface (Custódio & Metzger, Reference Custódio and Metzger2013; Koo, Reference Koo2019).

Theoretical background and hypothesis

Human capital theory (Becker, Reference Becker1964) distinguishes human capital to reflect the degree of transferability of human skills between firms. Castanias and Helfat (Reference Castanias and Helfat1991, Reference Castanias and Helfat1992) extended this theory to the context of CEOs and asserted that CEOs possess differing qualities of generic, industry-specific, and firm-specific skills. Similarly, Custódio, Ferreira, and Matos (Reference Custódio, Ferreira and Matos2013) classified specialist CEOs as those who were occupied in only one industry throughout their professional careers to have a depth of industry experience. On the other hand, CEOs are generalists when they have experience across several industries. Consequently, their skill sets are not confined to any one industry but reflect different industries. On a continuum scale of generalist CEOs, the fewer industries in which CEOs have worked, the higher the specificity of the CEOs, hence making them specialist CEOs.

CEOs' human capital specificity plays a vital role in shaping firms' R&D commitment as it requires industry-specific knowledge expertise. For example, a specialist CEO is more likely to know which industry-specific R&D opportunities are more important, which new technology development could enhance their process efficiency, how technology can be exploited to solve customers' problems (West & Iansiti, Reference West and Iansiti2003), and how to increase the overall R&D commitment of a firm. The industry-specific expertise of a specialist CEO can help to channelize appropriate R&D investments by virtue of the CEO's knowledge of industry characteristics, strategic opportunities, and industry connections (Faleye, Hoitash, & Hoitash, Reference Faleye, Hoitash and Hoitash2018). Specialist CEOs are also more likely to be better connected with industry networks, thus facilitating information exchange with relevant actors in the R&D process (Bell, Reference Bell2005). Compared to generalist CEOs, specialist CEOs are also better able to estimate the costs and benefits associated with R&D investments in pursuing such technologies (Park & Tzabbar, Reference Park and Tzabbar2016). They are also better equipped than generalist CEOs to resolve underlying challenges associated with technology implementation.

On the contrary, generalist CEOs may find it challenging to transfer their knowledge across different industries and may not find their skills relevant in new contexts (Reuber & Fischer, Reference Reuber and Fischer1997). Generalists are also able to ‘unlearn’ at a slower rate (Morrison & Brantner, Reference Morrison and Brantner1992) due to greater reliance on past cognitive maps (Hamori & Koyuncu, Reference Hamori and Koyuncu2015), thus making it difficult for them to explore R&D opportunities in new industries. Based on these many factors, CEO generalist experience is likely to be negatively associated with R&D commitment.

Furthermore, innovation is risky, and outcomes are uncertain. Failure can occur at any stage between the concepts to the realization of actual profits. Scholars favoring generalist CEOs over specialists have explained that generalist CEOs are more likely to invest in R&D as they are less sensitive to the risk of termination. This is because their diverse work experience allows them to have skills appropriate for any industry even if terminated (Custódio, Ferreira, & Matos, Reference Custódio, Ferreira and Matos2017); however, termination has a social cost as terminated executives are likely to be perceived as less competent than others, thereby decreasing their chances of selection for new jobs (Connelly, Ketchen Jr, Gangloff, & Shook, Reference Connelly, Ketchen, Gangloff and Shook2016). This is likely to be even more true in emerging markets, where resources are scant and failed R&D expenditures are likely to be perceived as a wastage of these scant resources, thus placing executives in an even more negative limelight.

In resource-constrained markets, such as India, if the CEO is unsure about R&D outcomes or perceives high chances of failure of R&D efforts, the CEO may not pursue the technology (Kraiczy, Hack, & Kellermanns, Reference Kraiczy, Hack and Kellermanns2015). Due to a lack of expert industry knowledge, a generalist CEO is more likely to be unsure about positive outcomes or to appropriately gauge the technology challenges and is more likely to behave in a risk conservative manner and to avoid investments in R&D. Stevens and Burley (Reference Stevens and Burley1997) asserted that of 125 funded R&D projects, one project achieves commercial success. Under these contingencies, an emerging market CEO may not invest in R&D if he/she lacks industry-specific technical knowledge. Similarly, Cummings and Knott (Reference Cummings and Knott2018) found that for CEOs who did not have industry-specific technology expertise, R&D productivity fell by 65%. Emerging market CEOs are less likely to take the risk of investing in R&D projects, which are likely to fail due to a lack of specific knowledge.

Although generalist CEOs' knowledge in different technological domains is likely to be valuable, given that technological requirements are unique to each industry, a dominant technology and innovation path is likely to be highly specific in an industry (Herstad, Aslesen, & Ebersberger, Reference Herstad, Aslesen and Ebersberger2014; Malerba, Reference Malerba2004). Thus, the experience of generalist CEOs from different industries may not be readily transferable to a new industry due to the idiosyncratic discrepancy among industries (Ayerst, Reference Ayerst2016; Becker, Reference Becker1964). Furthermore, ‘more generalist CEOs also face ambiguity when attempting to align the external environment and the available resources at their current firm’ (Li & Patel, Reference Li and Patel2019, p. 321), implying the situation to be specifically risky for R&D commitment in resource-scant emerging markets.

Driven by their varied accomplishments within different industries, generalist CEOs might be better able to combine diverse inter-industry experiences; however, they may have only limited success in efficiently utilizing firm-specific resources as generic CEOs have a shallower knowledge of organizational resources at hand, which can make them stretch organizational resources into more distant strategic realms (Powell, Reference Powell1992; Sirén & Kohtamäki, Reference Sirén and Kohtamäki2016). Therefore, generalist CEOs' limited understanding of the interrelationships among firm capabilities related to product development, resource bundles, or technology (Li & Patel, Reference Li and Patel2019; Wooldridge, Schmid, & Floyd, Reference Wooldridge, Schmid and Floyd2008) would diminish their R&D commitment ability. Overall, despite being capable of developing diverse and innovative strategic solutions (Crossland, Zyung, Hiller, & Hambrick, Reference Crossland, Zyung, Hiller and Hambrick2014), due to their limited ability related to the effective integration of internal resources, generalist CEOs would refrain from making intensive R&D investments in resource-scant emerging markets.

Overall, due to the better knowledge and risk conservativeness of CEOs in emerging markets, firms with specialist CEOs can be expected to have a higher commitment to R&D as their decisions are likely to be more informed by deeper and more refined knowledge of the industry. Hence, we hypothesize:

Hypothesis 1: Generalist CEOs are less likely to be committed to R&D investments.

CEO–TMT interface: role of TMT diversity

CEOs and the TMT do not possess equal decision-making power. Arendt, Priem, and Ndofor (Reference Arendt, Priem and Ndofor2005) even advocated for a CEO-advisor model to study the CEO–TMT interface, where strategic decisions are taken by a CEO (Simsek, Heavey, & Veiga, Reference Simsek, Heavey and Veiga2010) and the TMT plays an advisory role in influencing CEOs' preferences and investment behaviors (Cao, Simsek, & Zhang, Reference Cao, Simsek and Zhang2010; Stoker, Grutterink & Kolk, Reference Stoker, Grutterink and Kolk2012). Different definitions of TMT have been proposed, and controversy exists regarding the boundaries for the inclusion of members in the TMT (Nielsen, Reference Nielsen2010). More traditional definitions of TMT include senior executives, whereas a broader definition, known as supra-TMT, incorporates the board of directors along with executives (Finkelstein & Hambrick, Reference Finkelstein and Hambrick1996; Jensen & Zajac, Reference Jensen and Zajac2004). The board of directors is incorporated into the TMT as they oversee and control several strategic decisions from a corporate governance perspective, such as acquisitions, mergers, and internationalization (Chen, Chang, & Hsu, Reference Chen, Chang and Hsu2017; Man Zhang & Greve, Reference Man Zhang and Greve2019). Though senior executives often interact with the board of directors, in reality, they have very different roles; where boards monitor and control strategies taken by a CEO, information related to different strategic choices, prevailing opportunities, and challenges is often provided by senior executives and rarely by the board of directors (Tuncdogan, Boon, Mom, Van Den Bosch, & Volberda, Reference Tuncdogan, Boon, Mom, Van Den Bosch and Volberda2017). As we focus on the information sharing role of the TMT in the present study, we proceed with the traditional and not the supra-TMT perspective of senior management.

Due to bounded rationality, a CEO may not be able to fully address the contradictory information and knowledge inputs that R&D investment demands. Indeed, more frequent and intense communication between CEOs and their team members can improve the information exchange required for R&D decisions (Hoffmann & Meusburger, Reference Hoffmann and Meusburger2018). TMT members are closer to the firm's existing competencies and are also knowledgeable about when and how to exploit them. Depending on their functional expertise, they are also more likely to be closer to the markets and knowledgeable about market trends and emerging customer needs/wants, among other exploratory opportunities (Cao, Gedajlovic, & Zhang, Reference Cao, Gedajlovic and Zhang2009). Thus, a CEO's information network extensiveness provided by the CEO–TMT interactional interface can assist them in making appropriate R&D decisions.

For appropriate R&D investments, CEOs' industry-specific skills are required; however, given that a R&D investment is an iterative process, the significance of a heterogeneous knowledge base cannot be ignored. In organizational top management, there are likely two sources of heterogeneous knowledge: TMT functional and educational diversity (Barkema & Shvyrkov, Reference Barkema and Shvyrkov2007). Diverse teams with a variety of knowledge and functional expertise contribute towards knowledge creation in a complex environment (Bendoly, Bharadwaj, & Bharadwaj, Reference Bendoly, Bharadwaj and Bharadwaj2012). For instance, engineering TMT members can render technical insights into new product development, and marketing or sales members may propose innovation opportunities pertaining to new markets and new customer segments, while those in finance or operations may call for more efficiency in processes. This diversity in their backgrounds can further enhance the ability of a CEO to process information on a wider perspective and to invest more in R&D such that it has a wider scope. For instance, product and process R&D complement each other (Hullova, Simms, Trott, & Laczko, Reference Hullova, Simms, Trott and Laczko2019).

Similarly, educational diversity brings diversity in the knowledge bases of the TMT, which is vital to create and to integrate multiple streams of knowledge for effective R&D commitment. Cognitive heterogeneity arising from the educational heterogeneity of the TMT within the same organization also strengthens assimilative power so that more R&D opportunities are recognized. A TMT with a diverse knowledge base arising from differences in education can explore a wide range of technologies that have organizational problem-solving capabilities in their technological and broader search activities (Nelson & Winter, Reference Nelson and Winter1982; Talke, Salomo, & Rost, Reference Talke, Salomo and Rost2010). The significance of knowledge diversity in enhancing firms' ability to create new knowledge combinations has been well established by the knowledge-based view of a firm (Kengatharan, Reference Kengatharan2019). This implies that TMT diversity in terms of their skills and knowledge that they develop by virtue of educational qualification and functional specialization facilitates a favorable generation of new ideas (Quintana-García & Benavides-Velasco, Reference Quintana-García and Benavides-Velasco2008), therefore increasing the possibilities of new R&D avenues to be explored by CEOs.

Moderating the role of TMT educational and functional diversity on the generalist CEO and R&D investment relationship

As explained, TMT education and functional diversity influences CEOs' ability to make appropriate R&D investment decisions. When confronted with diverse ideas from team members with different backgrounds, CEOs are compelled to rethink their points of view, critically discuss alternatives, and consider factors not previously considered (Heyden, Reimer, & Van Doorn, Reference Heyden, Reimer and Van Doorn2017). CEOs interfacing with more diverse TMTs should therefore be able to identify more creative and novel solutions to the problem at hand, thus resulting in a higher R&D commitment (García-Granero, Fernández-Mesa, Jansen, & Vega-Jurado, Reference García-Granero, Fernández-Mesa, Jansen and Vega-Jurado2018).

A generalist CEO is more likely to benefit from a diverse TMT than an expert CEO. This is due to their ability to integrate diverse streams of information (Buyl et al., Reference Buyl, Boone, Hendriks and Matthyssens2011). As generalist CEOs have experience working in diverse areas, they are more likely to be skilled at assimilating firm-specific diverse information provided by the TMT and thus making more informed R&D decisions. In contrast, specialist CEOs may lack this ability of making sense of diverse information. Hamori and Koyuncu (Reference Hamori and Koyuncu2015) referred to this inability as ‘knowledge corridors’ that make it difficult for specialist CEOs to adjust to new contexts and thus limit their R&D investments.

Furthermore, as specialist CEOs have a lower career variety, they tend to prefer stable rather than complex and chaotic strategic decisions (Crossland et al., Reference Crossland, Zyung, Hiller and Hambrick2014), implying their hesitation to assimilate any diverse information provided by a heterogeneous TMT. This would limit their scope of R&D investments.

Extant research suggests that career variety influences the cognitive breadth of executives (Crossland et al., Reference Crossland, Zyung, Hiller and Hambrick2014). High career variety executives can conduct a multifaceted diagnosis of a problem. As generalist CEOs have a higher career variety than specialist CEOs, by processing diverse information from TMT executives, they would be better able to conduct this multidimensional analysis of a problem and to develop more novel solutions (Mueller et al., Reference Mueller, Georgakakis, Greve, Peck and Ruigrok2020). Thus, based on the diverse information provided by a TMT pertaining to the immediate organizational environment, generalist CEOs would be more capable of developing creative and innovative solutions, implying more R&D, in the presence of an educational and functionally diverse TMT. Hence, we hypothesize:

Hypothesis 2a: The relationship between generalist CEOs and R&D commitment is moderated by the educational diversity of the TMT such that generalist CEOs have a higher R&D commitment when TMT educational diversity is high.

Hypothesis 2b: The relationship between generalist CEOs and R&D commitment is moderated by the functional diversity of the TMT such that generalist CEOs have a higher commitment to R&D when TMT functional diversity is high.

Method

We conducted our study in the Indian context as the R&D ecosystem of India has been growing, accounting for 40% of global engineering and R&D investment (IBEF, 2017). Rather, the R&D market in India is expected to grow at a CAGR of 14% and reach US$ 42 billion by 2020 (IBEF, 2017). We focused on A&B category Bombay Stock Exchange listed manufacturing firms in India for the year 2010–2016. We focused on manufacturing firms as they are more research intensive compared to service firms. A&B group listed firms have more liquid stock and the chances that their financials, TMT information, and annual reports be publicly available are relatively high.

Data on firms, CEO and TMT, were collected from multiple sources, including Prowess (the Centre for Monitoring Indian Economy financial database of Indian firms), company website, annual reports, Bloomberg, and marketscreener.com among other online sources. Following previous studies, we did not include public sector or foreign sector firms (Stucchi, Pedersen, & Kumar, Reference Stucchi, Pedersen and Kumar2015). A key criterion for selecting firms was data availability on CEO and TMT demographics and financials of the firm. After using all these filtering criteria, we were finally left with a sample of 253 firms and 253*6 = 1,698 firm-year observations.

Dependent variable

R&D intensity: Over the years, R&D intensity has been primarily measured through the ratio of firms' R&D investment to sales (Alam, Uddin, Yazdifar, Reference Alam, Uddin and Yazdifar2019; Heyden, Reimer, & Van Doorn, Reference Heyden, Reimer and Van Doorn2017). Thus, we also operationalized R&D intensity as the ratio of R&D investment to sales. The operationalization suggests the relative importance ascertained to R&D in the firm's strategy. We lagged R&D intensity by 1 year in the panel structure to allow for temporal demonstration of our theorized effects.

Independent variables

General versus specialist CEO

Custódio, Ferreira, and Matos (Reference Custódio, Ferreira and Matos2013) suggested a formative measure of the CEO general ability index based on five components: the number of top five executive positions held, the number of firms at which a CEO has worked, the number of the four-digit industries in which a CEO has worked, a past CEO experience dummy, and a conglomerate experience dummy. However, scholars in the organizational research field questioned the general validity of such formative constructs as it treated indicators as causes of constructs (Edwards, Reference Edwards2011; Rönkkö, McIntosh, Antonakis, & Edwards, Reference Rönkkö, McIntosh, Antonakis and Edwards2016). We thus follow Li and Patel (Reference Li and Patel2019) and use the direct measures of CEO general ability that is rooted in the strategic management discourse of conceptualization of general human capital (Finkelstein, Cannella, Hambrick, & Cannella, Reference Finkelstein, Cannella, Hambrick and Cannella2009), i.e., the number of industries in which a CEO has worked.

Furthermore, as we focus on the industry-specific work experience of a CEO to categorize the CEO as a generalist versus specialist, following (Li & Patel, Reference Li and Patel2019), we defined CEO as a generalist based on the number of industries the CEO worked, where firms having the same four-digit NIC codes were considered as belonging to the same industry (Bailey & Helfat, Reference Bailey and Helfat2003; Buchholtz, Ribbens, & Houle, Reference Buchholtz, Ribbens and Houle2003). Thus, more the different industries in which the CEO has worked, more generalist is the CEO.

TMT functional diversity

TMT included executives as mentioned in the TMT of the firm, information on which is available on firms' websites or annual reports (Bantel & Jackson, Reference Bantel and Jackson1989; Wiersema & Bantel, Reference Wiersema and Bantel1992). For functional diversity, finance, human resources, general management, marketing, operations, research, and development, or strategic planning were considered as different functions. Using Blau's index (1−∑Si 2), where i is the proportion of TMT members in the ith category, functional diversity was calculated (Simons, Pelled, & Smith, Reference Simons, Pelled and Smith1999).

TMT educational diversity

For education diversity, the same formula was used, and Si represented the proportion of executives with the same education degree. Degrees considered were engineering, science, business administration, economics, law, commerce, and other subjects (Barkema & Shvyrkov, Reference Barkema and Shvyrkov2007).

Interaction terms

TMT functional diversity*generalist CEO

Two variables were mean-centered and multiplied to get the interaction term. The mean centering technique was adopted to reduce the chances of multicollinearity (McClelland et al., Reference McClelland, Irwin, Disatnik and Sivan2017).

TMT educational diversity*generalist CEO

Again, the two variables were mean-centered and multiplied with each other.

Control variables

Past research suggests that several corporate governance and firm-level variables could influence a firm's R&D intensity. Thus, to control for governance aspects of a CEO's behavior, we controlled for board outsider representation (Krause & Semadeni, Reference Krause and Semadeni2014). We also controlled for CEO-chairman duality as it indicates the CEO's discretion over the allocation of company resources (Mousa, Chowdhury, & Gallagher, Reference Mousa, Chowdhury and Gallagher2017; Westphal & Zajac, Reference Westphal and Zajac1995). Thus, when the CEO was also board chairman, it was dummy coded as 1, else zero. Similarly, we also controlled for CEOs age.

For firm-level variables, we controlled for firm age, firm size, cash-in-hand, and prior performance (Heyden, Reimer, & Van Doorn, Reference Heyden, Reimer and Van Doorn2017). Firm size was operationalized with the total number of employees, and prior performance was measured as return on assets. Again, the natural log of firm age, firm size, and cash-in-hand, were taken.

We also included year dummies to account for unobserved heterogeneity arising from historical events and industry dummies at two-digit NIC level to account for specific industry environment.

Data analysis

Data analysis happened by employing the generalized estimating equations (GEE) approach. GEE is a multivariate regression technique, which is suitable for non-independent observations, such as longitudinal datasets (Hanley, Negassa, Edwardes, & Forrester, Reference Hanley, Negassa, Edwardes and Forrester2003), as its estimates account for both time-invariant effects (‘subject effect’) and autocorrelated, time-varying, ‘within-subject’ effects (Ballinger, Reference Ballinger2004). GEE has been commonly used in studies on executive influences on firms' outcomes (Chatterjee & Hambrick, Reference Chatterjee and Hambrick2007; Quigley & Hambrick, Reference Quigley and Hambrick2012). For regression analysis, variables were entered in three steps. The first step included only the control variables (Model 1). In the second step, we included all the independent variables (Model 2), followed by adding the interaction effects in the third step (Model 3).

Results

Table 1 presents the descriptive and correlations for the variables used in the regression. As can be observed from Table 1, there is a negative and significant correlation between generalist CEO and R&D intensity, thus giving preliminary evidence in support of our first hypothesis.

Table 1. Descriptive statistics and correlation (n = 1,698)

***p < .01, **p < .05, *p < .10.

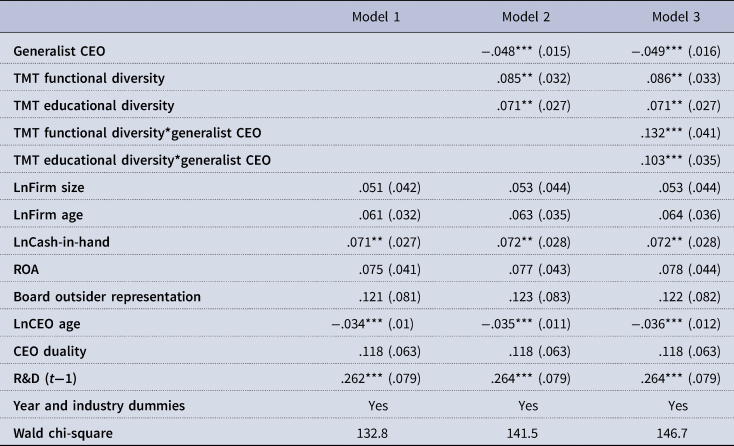

Model 1 of Table 2 presents the results for the control variables. Model 2 presents the results of main and independent effects and Model 3 presents the results of moderating effects. Among control variables, LnCEO age (β = −.034, p < .01) and LnCash-in-hand (β = .071, p < .05) were found to be significant. In Model 2 of Table 2, since the beta coefficient of the generalist CEO is negative and significant (β = −.048, p < .01), we receive evidence in support of Hypothesis 1, which predicts there will be a negative association between more generalist CEO experience and firm's R&D investment.

Table 2. Generalized estimating equations (D.V. = R&D intensity) (n = 1,698)

***p < .01, **p < .05, *p < .10; SE in parenthesis.

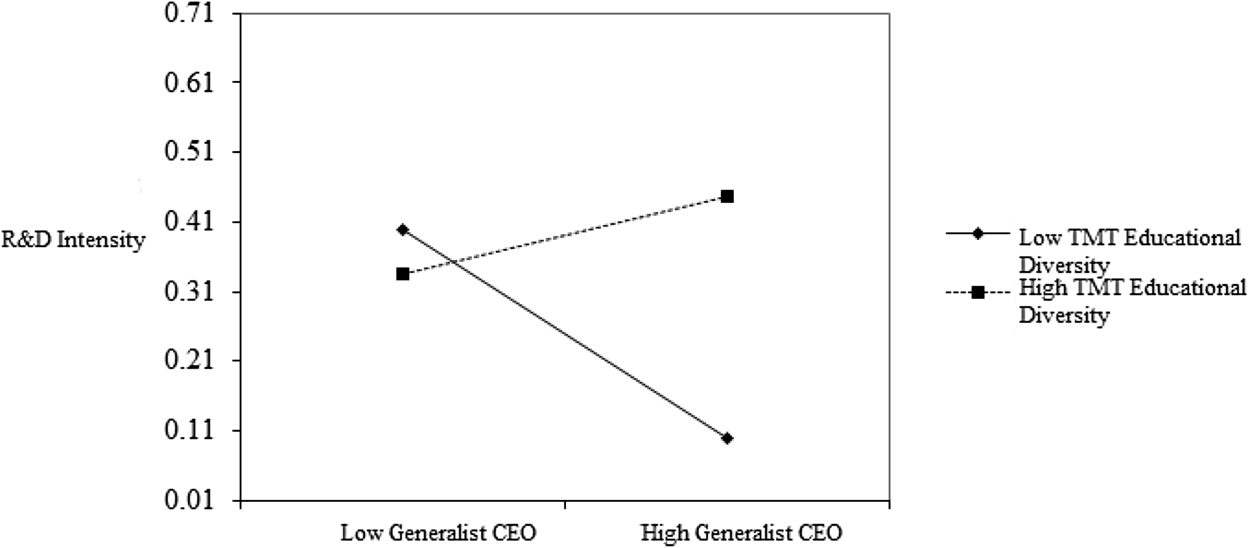

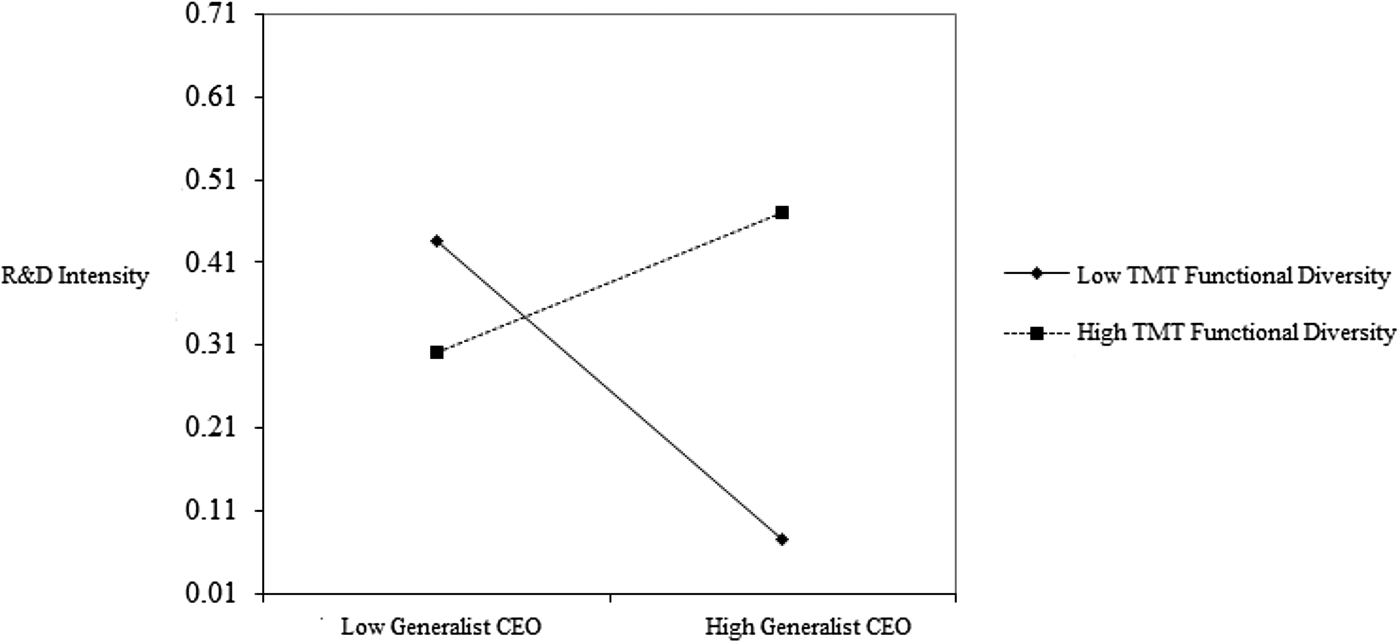

Hypothesis 2 predicts that the negative association between more generalist CEO experience and firm R&D intensity will weaken with functionally diverse TMT. Model 3 of Table 2 provides support for Hypothesis 2 (β = .132, p < .01), indicating that the CEO general ability index effect on R&D intensity is influenced by TMT functional diversity and validating visual inspection of the corresponding interaction plot. Figure 1 reveals that as the functional diversity of TMT increased, the impact of generalist CEO on R&D intensity also increased. Similarly, the beta coefficient of the interaction effect of educational diversity of TMT and generalist CEO was positive and significant (β = .103, p < .01), warranting for graphical inspection. Again, as we can observe, in Figure 2, when educational diversity is high, R&D intensity increases as CEO becomes more generic in his ability, while for low educational diversity, general CEOs' investment in R&D decreases.

Figure 1. Moderating plot with TMT functional diversity as a moderator of R&D intensity and generalist CEO relationship.

Figure 2. Moderating plot with TMT educational diversity as a moderator of R&D intensity and generalist CEO relationship.

Robustness test

We also checked industry-specific human capital, with firms classified under the same three-digit NIC code (e.g., Harris & Helfat, Reference Harris and Helfat1997), and two-digit NIC code (Hatfield, Liebeskind, & Opler, Reference Hatfield, Liebeskind and Opler1996). Although beta coefficient values changed, results remained statistically significant following our hypothesis.

Discussion

In this paper, we reexamined the differences between specialist and generalist CEOs concerning R&D commitment. Our first hypothesis was motivated by human capital theory. We have asserted that unless CEOs have in-depth expertise in the industry, they will not identify appropriate R&D opportunities. Moreover, drawing from the CEO–TMT interface as a boundary condition, for hypotheses 2a and 2b, we found that this lack of industry-specific expertise can be overcome by a functionally and educationally heterogeneous TMT. Thus, the generalist CEO tends to invest more in R&D when surrounded by a functionally and educationally diverse TMT. This CEO–TMT interface has been a key conceptual omission in previous R&D commitment studies. We also advance the literature by suggesting and investigating the idea that R&D commitments made in the executive suite depend on specific TMT characteristics.

Overall, relying on human capital theory, we have asserted that industry-specific expertise is more likely to make a CEO committed to R&D, at least in emerging markets, such as India. Although due to their broader industry experiences, generalist CEOs might be more willing to take R&D risks, in the context of resource-constrained emerging markets (Khanna & Palepu, Reference Khanna and Palepu2000); this possibility is lower as a lack of industry-specific knowledge is likely to make CEOs less confident in investing in R&D. Our findings are in congruence with the notion that industry-specific knowledge, adherence to industry R&D trends, and informal arrangements are relatively more vital to enhancing firms' R&D commitment (Cummings & Knott, Reference Cummings and Knott2016). Faleye, Hoitash, and Hoitash (Reference Faleye, Hoitash and Hoitash2018) also asserted that firms with industry expert directors invested more in R&D as well as received more patents than generalists. Our findings are consistent with prior studies where industry-specific human capital was also found associated with successful acquisitions (Custódio & Metzger, Reference Custódio and Metzger2013), firms' higher performance (Masulis, Ruzzier, Xiao, & Zhao, Reference Masulis, Ruzzier, Xiao and Zhao2012), and a divesture of unrelated business (Huang, Reference Huang2014).

This study's results imply that human capital theory should be explored on a broader view of top management's influence on CEO decisions: by examining their moderating effect on CEO-strategic decision relationship rather than attributing R&D commitment only to generalist or specialist CEOs.

Theoretical implications

Our findings extend the implications of human capital theory for generalist versus specialist CEOs. Extant literature suggests that general human capital, i.e., generalist CEOs, are more beneficial for firms compared to specific-human capital, i.e., specialist CEOs (Custódio, Ferreira, & Matos, Reference Custódio, Ferreira and Matos2017; Li & Patel, Reference Li and Patel2019); however, in the context of emerging markets, we found that specialist CEOs show a higher R&D commitment. This is due to the lack of the industry-specific human capital of generalist CEOs, resulting in a shallower knowledge of the industry. This limitation of generalist CEOs accompanied by the limited organizational resources of EMFs, unlike developed market firms, inhibits the generalist CEO's ability to extend organizational resources into more appropriate industry-specific strategic realms. We thus specifically add to industry-specific human capital literature, where broader human capital is considered beneficial for firms, though in emerging markets, such as India, the depth of human capital gained through experience in the same industry is more beneficial for a firm, at least in context of R&D.

Our study thus advances a reinterpretation of CEOs' human capital and firms' strategic behavior relationship. By exploring the moderating role of TMT diversity, our study further extends human capital theory as driven by TMT-diversity enabled behavioral inclinations. Our findings suggest that TMT demographic diversity plays a significant role in enabling or constraining CEOs' strategic decisions as a function of their general or specialist human capital. Previous researchers have emphasized the role of the CEO–TMT interface in determining the strategic behavior of firms (Heyden, Reimer, & Van Doorn, Reference Heyden, Reimer and Van Doorn2017), including organizational ambidexterity (Cao, Gedajlovic, & Zhang, Reference Cao, Gedajlovic and Zhang2009) or corporate entrepreneurship (Ling, Simsek, Lubatkin, & Veiga, Reference Ling, Simsek, Lubatkin and Veiga2008). Our findings add to this CEO–TMT interface literature by exploring the role of CEO–TMT interface in the context of R&D commitment.

By exploring the CEO–TMT interface, we respond to the call for more attention on studies that highlight the importance of the CEO–TMT interface (Cao, Simsek, & Zhang, Reference Cao, Simsek and Zhang2010; Stoker, Grutterink, & Kolk, Reference Stoker, Grutterink and Kolk2012). In our context of a relatively risky and long-term R&D commitment, it seemed particularly useful for analyzing the behavioral tension of generalist versus specialist CEOs through the TMT diversity lens. By introducing the TMT diversity interface, we were also able to reconcile inconsistent findings in the R&D commitment literature pertaining to generalist versus specialist CEOs (Blagoeva, Mom, Jansen, & George, Reference Blagoeva, Mom, Jansen and George2020; Koo, Reference Koo2019; Liu, Reference Liu2017; Nagle & Teodoridis, Reference Nagle and Teodoridis2019). Generalist CEOs are able to overcome their limitations for enhanced R&D investment by interacting with functionally and educationally diverse TMT. We have thus provided some preliminary answers by focusing on how TMT functional and educational diversity may influence generalist versus specialist CEOs' decisions related to R&D intensity.

We also extend the R&D literature in emerging markets, such as India, where in contrast to developed nations, specialist CEOs are more likely to be committed to R&D. We have argued that typically, R&D investment draws on the industry knowledge base, and hence R&D commitment requires a high degree of asset specificity, making the inter-industry transfer of skills difficult (Van Horne & Dutot, Reference Van Horne and Dutot2017). Thus, specialist CEOs are more likely to be committed to R&D.

Managerial implications

The decision of whether to hire a generalist or specialist CEO is considered among scholars as well as practitioners as highly influential for subsequent firm R&D commitment. In recent years, due to the increasing uncertainty and organizational complexity accompanied by a shortage of executive talent, generalist CEOs have been in higher demand (Gerhart & Rynes, Reference Gerhart and Rynes2003; Kaplan & Rauh, Reference Kaplan and Rauh2010). Boards are increasingly hiring CEOs with diverse experience to enhance firms' strategic repertoire as well as to increase competitiveness.

Custódio, Ferreira, and Matos (Reference Custódio, Ferreira and Matos2013) found that one standard deviation increase in general ability led to a 12% increase in CEO pay. Other studies have also reported significant pay premiums for more generalist CEOs (Kaplan & Rauh, Reference Kaplan and Rauh2010). Our findings call into question whether such pay premiums are justified. At least in context of emerging markets, generalist CEOs are less committed to R&D, especially when TMT education and functional diversity is low.

As higher industry-specific knowledge might outweigh the potential benefits of broader industry experience, firms that specifically intend to enhance R&D commitment may take our findings into account when they appoint the CEO. Overall, despite a widespread preference of generalist CEOs in enhancing firms' performance, such practices may be harmful for R&D commitment, at least in emerging markets. Our findings suggest that when the CEO is a generalist, firms should encourage the educational and functionally diverse TMT for promoting R&D commitment.

Thus, a generalist CEO is likely to be beneficial when TMT educational and functional diversity is high. Overall, boards of directors might benefit from considering the dynamics of the CEO's industry background and TMT diversity when considering R&D commitment. If the board believes that a firm needs to invest more in R&D, they may benefit from hiring a generalist CEO when TMT functional and educational diversity is high. When TMT diversity is low, a specialist CEO is likely to make more R&D investments than a generalist CEO. TMT diversity as firm-specific human capital is a vital source of competitive advantage for a firm as it is tacit, specific to the firm, and path dependent and thus valuable and inimitable (Barney, Reference Barney2001). Thus, a CEO's functions should be explored in light of the TMT members that set the boundary condition for a CEO's investment in R&D.

Limitations and directions for future research

This study is not without limitations. First, like most CEO studies, ours relies on secondary data, which is the most feasible way to obtain information from CEOs who are less likely to reply to surveys. Surveys or field observations would have allowed for measuring the effect of intervening variables between generalist and specialist CEOs and R&D commitment (e.g., risk taking propensity, industry knowledge, etc.), which we were unable to do. Second, we drew from a sample of large firms that were publicly traded and did not cover small firms. Because a CEO's managerial discretion varies with firm size, the relationship between CEO expertise and R&D commitment may become more pronounced in small organizations as they are less constrained by organizational inertia (Vinokurova & Kapoor, Reference Vinokurova and Kapoor2020). We also measured CEO expertise based on the number of industries the CEO was associated with; however, previous studies have used several other measures, such as years of CEO experience (Bragaw & Misangyi, Reference Bragaw and Misangyi2017; Hamori & Koyuncu, Reference Hamori and Koyuncu2015) or the formative index of five indicators (Custódio, Ferreira, & Matos, Reference Custódio, Ferreira and Matos2013), including firm, industry, and functional areas, as measures of generalists' skills. We chose different operationalizations of the number of industries as our hypothesis pertained to explaining CEO expertise based on industry differences. We explored only two TMT traits, i.e., educational and functional diversity. Future research could explore the impact of other TMT diversity traits as well.

Conclusion

The human capital of CEOs has played a significant role in organizational theories of a firm's strategic choices; however, the debate still exists regarding whether generalist CEOs are more effective than specialist CEOs. In this study, we extended and reconciled the findings by viewing human capital theory under the lens of an emerging market that suffers from resource constraints and within the CEO–TMT interface's boundary conditions. Our results suggest that generalist CEOs in emerging markets, such as India, are less likely to invest in R&D compared to specialist CEOs. Also, TMT dynamics influence this relationship. TMT educational and functional heterogeneity in particular moderates the impact of generalist CEOs on R&D investment. Thus, they tend to invest more in R&D if the TMT is educationally and functionally diverse. This paper thus extends human capital theory and CEO–TMT interface theories in the context of R&D in emerging markets.

Acknowledgements

We would like to thank the Associate Editor: Dr. Conor O'Kane and the two anonymous reviewers for their excellent insights and feedback that tremendously helped us to improve the paper.

Arpita Agnihotri is an Assistant Professor of Business at Penn State Harrisburg. Arpita's teaching and research interest lies with international business and strategic management. She has published research papers in reputed national and international journals, such as Journal of World Business, Management International Review, Group and Organization Management and International Journal of Human Resource Management.

Saurabh Bhattacharya is a Senior Lecturer in Marketing at Newcastle University Business School, Newcastle Upon Tyne, UK. The teaching and research interest of Saurabh lies with research methods and digital marketing. In academic publications, Saurabh has published research papers in leading national and international journals such as Journal of World Business, Journal of Advertising Research, Psychology & Marketing, and Journal of International Consumer Marketing.