Book contents

- Better Money

- Better Money

- Copyright page

- Dedication

- Contents

- Figures

- Acknowledgments

- Introduction

- 1 Markets and Governments in the History of Money

- 2 How a Gold Standard Works

- 3 Common Misconceptions about the Gold Standard

- 4 How a Fiat Standard Works

- 5 How a Bitcoin Standard Works

- 6 Comparing and Contrasting Gold and Bitcoin Standards

- References

- Index

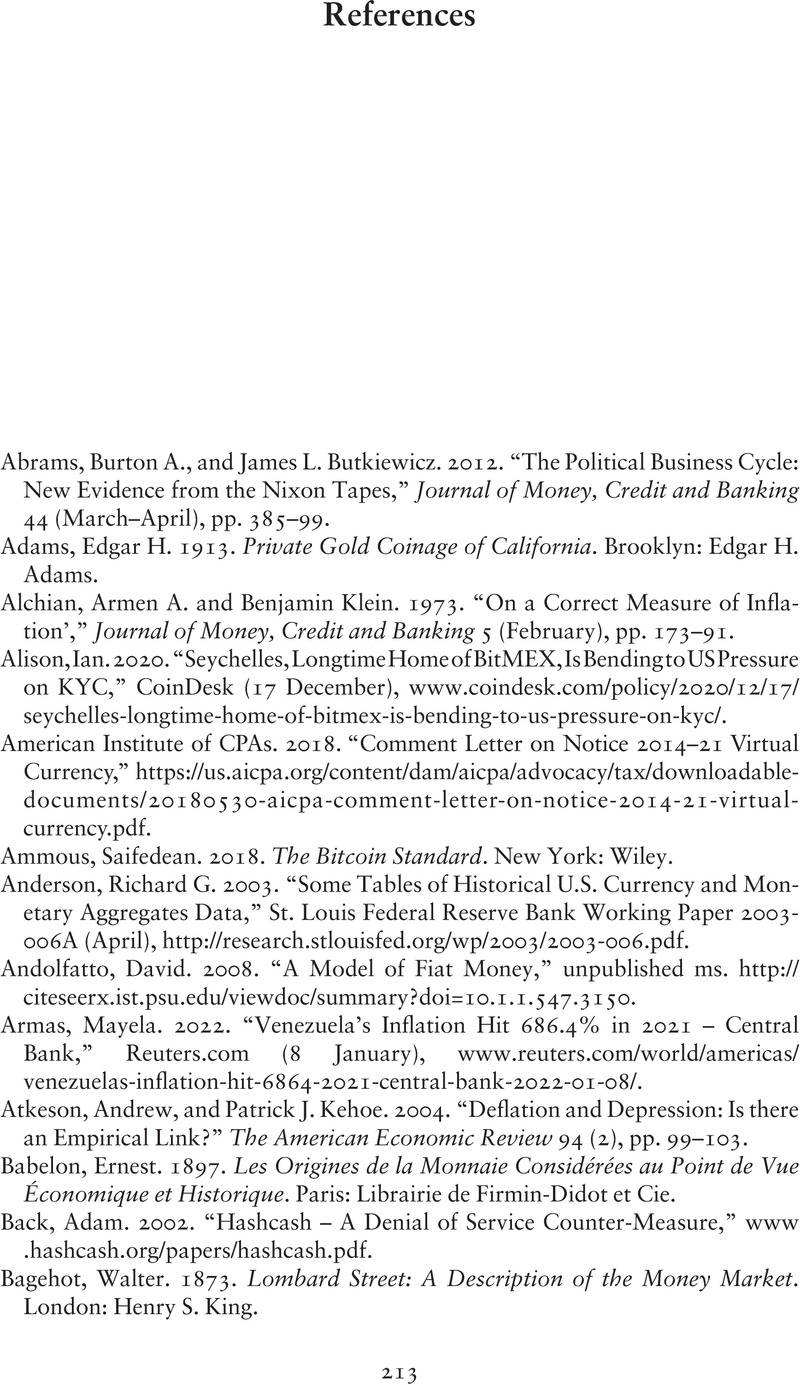

- References

References

Published online by Cambridge University Press: 16 March 2023

- Better Money

- Better Money

- Copyright page

- Dedication

- Contents

- Figures

- Acknowledgments

- Introduction

- 1 Markets and Governments in the History of Money

- 2 How a Gold Standard Works

- 3 Common Misconceptions about the Gold Standard

- 4 How a Fiat Standard Works

- 5 How a Bitcoin Standard Works

- 6 Comparing and Contrasting Gold and Bitcoin Standards

- References

- Index

- References

Summary

- Type

- Chapter

- Information

- Better MoneyGold, Fiat, or Bitcoin?, pp. 213 - 232Publisher: Cambridge University PressPrint publication year: 2023