The foundations of economic statecraft

We have witnessed a recent surge in state interventions targeting strategic industries and technologies, reflecting a new era of economic statecraft amid intensifying geoeconomic competition.Footnote 1 High-profile examples—from current trade wars and semiconductor export controls to foreign investment screening—highlight how governments are increasingly leveraging economic tools to pursue national security and techno-industrial goals.

These actions mark a stark departure from the late-20th-century orthodoxy that assumed ever-freer markets and global supply chains would persistently advance efficiency and interdependence. Instead, concerns over technological leadership, supply chain vulnerabilities, and the dual-use nature of innovations have prompted states to assert greater control over markets. This phenomenon, “new economic statecraft,”Footnote 2 centers on government measures that deliberately reshape market outcomes for strategic ends, particularly in sectors like advanced manufacturing, computing, and telecommunications that are critical to economic and military power. The result is a series of global technology conflicts, as major powers compete to secure advantages in key technologies while managing interdependence and security externalities. And for middle powers,Footnote 3 the tensions between the United States and China are particularly acute, given American pressure on these countries in the second Trump administration.

Scholars have long studied why and how states intervene in markets, especially for strategic industries. Classic work in international political economy noted that economic gains in pivotal sectors can translate into security capabilities—a concept Gowa and Mansfield (Reference Gowa and Mansfield1993) termed “security externalities.” These external effects mean that trading freely with a potential adversary could ultimately jeopardize one’s own security by augmenting the other state’s power. Earlier analyses by Albert Hirschman (Reference Hirschman1945) and others similarly argued that asymmetric trade dependencies give states leverage for coercion, an observation that the current Trump administration has taken to heart. In response to such dynamics, states may adopt protectionist or interventionist measures; Laura Tyson (Reference Tyson1992), for example, observed that governments often intervene to manage the competitive and security externalities arising from high-technology industries. Marc Busch (Reference Busch1999) further posited that intervention is especially likely when the benefits of a new technology are largely internalized within the national economy rather than widely shared. Put simply, if a breakthrough chiefly advantages one country’s firms, that state has a strong incentive to shield and support those gains.

Building on these foundations, recent scholarship has zeroed in on the nexus of technological innovation and state power. Andrew Kennedy and Darren Lim (Reference Kennedy and Lim2018) advance the notion of an “innovation imperative,” arguing that when a rising power’s technological advancements threaten a dominant state’s military edge or undermine the prevailing international order, the dominant state is driven to intervene aggressively. This dynamic is evident in contemporary U.S.-China technology rivalry, where China’s rapid progress in areas including artificial intelligence (AI) and 5G has spurred U.S. policy responses ranging from export bans to industrial subsidies – all aimed at maintaining the United States’ strategic advantage. The dual-use nature of many emerging technologies (i.e. their ability to serve both civilian and military purposes) complicates these competitions.

Despite these important scholarly insights, there remains a need for a comprehensive framework to understand new economic statecraft in a systematic manner. Existing theories tend to emphasize one dimension—be it security externalities, domestic politics, or technological factors. We argue that a more integrated approach is required to capture the full complexity of state interventions in the current geopolitical and geoeconomic context to explain how and under what conditions states use the varying tools of economic statecraft.

This article builds on our earlier work focusing on a framework to first categorize the main types of trade and investment policies that states deploy in strategic technology sectors, which we identify as “at-the-border,” “behind-the-border,” and “beyond-the-border” measures.Footnote 4 We then elaborate on our five-factor model encompassing market conditions, domestic politics, technological characteristics, international regimes, and systemic geopolitics.Footnote 5 Our goal is to shed light on how and why states engage in economic statecraft around critical technologies, thereby offering a nuanced lens through which to view unfolding global technology conflicts. The articles included in this special issue variously draw on these factors in their analysis of economic statecraft among middle powers in sectors as varied as space technology, climate technology, and semiconductor supply chains.

In the following sections, we begin by contextualizing the concept of new economic statecraft within the broader literature. We next define and justify our typology of state intervention strategies and then discuss each of the five determinants in turn. Finally, we summarize the key arguments by the contributors to this special issue on new economic statecraft and middle powers.

Conceptual background: state intervention in strategic industries

Governments have always played a role in shaping markets, whether through regulation, subsidies, or direct ownership—despite the claims of neoliberal economics. As Vogel (Reference Vogel2018) notes, market governance (“marketcraft”) is an inherent function of the state, implying that markets are “embedded” in a web of rules and policies rather than truly free. However, what distinguishes strategic state interventionism is the deliberate targeting of industries and technologies deemed crucial for national security, wealth, or geopolitical influence. In such cases, states move beyond routine market regulation aimed at efficiency or consumer protection and instead adopt policies explicitly designed to secure strategic advantages or mitigate strategic risks.

One classic context for strategic intervention is the development of dual-use technologies, which have both civilian and military applications. Almost all technologies lie on a spectrum of dual-use potential, but those at the high end (e.g. nuclear energy, aerospace, cryptography, artificial intelligence) pose particular dilemmas. As noted above, Volpe (Reference Volpe2019) illustrates this with the advent of 3D-printing in nuclear technology, where the inability to distinguish civilian from weapons-related printing activities exacerbates mistrust between states, each fearing that commercial advances could stealthily boost another state’s military programs. In such scenarios, cooperative regimes struggle. As Vaynman and Volpe (Reference Vaynman and Volpe2023) note, dual-use ambiguities can lead to “dual-use deception,” undermining arms control efforts—and states fall back on unilateral or bloc-based interventions to control the diffusion of the technology. Thus, dual-use characteristics often spur tighter export controls, investment screeningFootnote 6 or R&D restrictions as states seek to prevent adversaries from gaining equal access to cutting-edge innovations.

Another driver of strategic intervention is the perception of a looming or ongoing power transition fueled by technology. Kennedy and Lim’s (Reference Kennedy and Lim2018) “innovation imperative” encapsulates this: when a rising state’s technological strides create “negative order externalities”—that is, they threaten to upset the military or economic balance underpinning the current order—the hegemon or dominant state is incentivized to respond with interventionist measures. For example, as China’s technology sector has climbed the value chain, U.S. policymakers have increasingly treated leadership in areas like AI and quantum computing as zero-sum—prompting export bans on advanced chips visa restrictions on scientists, and efforts to undercut Chinese firms like Huawei in international markets. These actions represent economic statecraft deployed in service of maintaining systemic primacy. This behavior aligns with Organski’s theory from the historical international relations canon that hegemonic states will use all instruments at their disposal (including economic) to forestall relative decline, updating it to the contemporary arena of high technology.

Beyond great-power rivalry, strategic intervention is also a feature of how states engage with the global economic system and supply chains. The late 20th century saw the emergence of complex transnational production networks, which in many cases diffused technology and prosperity. Yet these global value chains have now become sites of vulnerability and leverage in international politics. Recent events—from the 2020 pandemic to sanctions in the wake of Russia’s invasion of UkraineFootnote 7 —exposed how dependence on foreign suppliers for critical goods (medical equipment, semiconductors, energy technology, etc.) can be a strategic liability. States have responded by reasserting control: pursuing reshoring or “friend-shoring” of supply chains, stockpiling key materials, and using export controls as leverage. This reflects what Farrell and Newman (Reference Farrell and Newman2019) term “weaponized interdependence,” wherein states exploit positions in global networks to pressure rivals. The broader point is that deep economic integration has not eliminated state power: rather, it has given states new avenues to exercise power via economic linkages. Our framework accounts for this by incorporating geo-economic strategies, which we have termed new economic statecraft, to shape the flow of goods, capital, and technology to enhance their geopolitical standing.

Crucially, strategic interventionism is not confined to traditionally “interventionist” states. While East Asian developmental states (e.g. South Korea, Taiwan, Singapore) have long practiced overt industrial policy, even liberal market economies like the United States and Germany engage in what might be called covert industrial policy. Mariana Mazzucato’s work on the Entrepreneurial State documents how the U.S. government, often through defense and space agencies, heavily funded and guided the development of the internet, GPS, biotech, and other innovations—all while officially espousing free-market principles. Germany similarly supports its high-tech manufacturing base through vocational training systems, public R&D institutes, and strategic EU-level initiatives, albeit without labeling it protectionism. Recognizing this continuum is important: the difference lies in degrees of explicitness and mechanism rather than a binary of interventionist vs. laissez-faire. In short, virtually all major states intervene in markets when vital interests are at stake; what varies is how and to what extent, as we see in this special issue.

Against this backdrop, we aim to provide a structured approach to analyze the forms that state intervention takes and the factors that lead to it. In the next section, we outline a typology of policy instruments of economic statecraft, dividing them into at-the-border, behind-the-border, and beyond-the-border categories. This typology serves as an organizing device to capture the multifaceted nature of state measures—from tariffs to treaties—in technology conflicts. We then delve into the determinants of intervention, identifying five key dimensions (market, domestic, technological, international, systemic) that collectively explain why a state might choose one type of intervention or another, and why some technologies or contexts see more intensive state involvement than others.

A typology of state intervention strategies: at, behind, and beyond the border

To grasp the range of policies that constitute new economic statecraft, we classify state interventions into three broad categories based on where and how they impose constraints or provide support: at-the-border, behind-the-border, and beyond-the-border. This schema builds on distinctions used in trade policy analysis while adapting them to the context of strategic industries. Each category represents an ideal-typical mode of intervention, and together they are intended to be collectively exhaustive. However, as we discuss, real-world measures can blur the boundaries between these categories.

At-the-Border Policies: These are measures applied at a country’s point of entry or exit for goods, services, capital, and technology. They directly discriminate between domestic and foreign economic actors.Footnote 8 Traditional examples include tariffs, quotas, and export bans, which explicitly tax or restrict imports and exports, and which we have now seen being actively used by both the United States and China. In the realm of technology conflicts, at-the-border tools have expanded to encompass export controls on sensitive technologies (for instance, banning the export of advanced semiconductors or surveillance software to rival states) and foreign investment screening mechanisms that vet or block inbound investments (such as mergers or acquisitions) on national security grounds. For example, in the United States, the Foreign Investment Risk Review Modernization Act of 2018 expanded the jurisdiction of the Committee on Foreign Investment in the United States to address mandatory filing requirements for investments involving foreign governments, as well as foreign investment in firms deemed to represent critical infrastructure.Footnote 9 The unifying feature is that at-the-border interventions take place “at the water’s edge” of the state’s jurisdiction – they are outward-facing barriers or filters. As Baldwin and Evenett (Reference Baldwin and Evenett2009) describe, at-the-border measures “discriminate against foreign goods, companies, workers, and investors” by conditioning their entry into the domestic market. In essence, the state uses its control over market access as leverage, either to protect domestic industries from foreign competition or to deny rivals the benefits of one’s own market and technologies.

Behind-the-Border Policies: These refer to domestic measures within a state’s own territory that affect economic activity and can confer competitive advantages (or disadvantages) in international terms. Unlike at-the-border tools, behind-the-border interventions do not explicitly target foreign actors at the point of entry; instead, they operate “in the backdoor” of the economy.Footnote 10 Examples include government subsidies to domestic industries (such as grants, tax breaks, or preferential loans), domestic content requirements and regulations favoring local firms, public procurement policies that buy only from domestic sources, and investments in national infrastructure or R&D (e.g. funding for broadband networks, innovation hubs, or workforce training in critical fields).

Industrial policy broadly falls in this category—the state bolsters its own producers so they can out-compete foreign counterparts or achieve self-sufficiency. Such behind-the-border measures are often less visible in international trade statistics but can have a profound impact on trade and investment outcomes by indirectly shaping comparative advantages. For instance, a government’s heavy investment in domestic semiconductor fabrication (as seen in recent U.S., EU, and Chinese chip initiatives) might not violate any trade rule at the border, yet it alters the competitive landscape by expanding domestic capacity and potentially creating surpluses that affect global markets. We consider behind-the-border actions to be part of economic statecraft when they are deployed with an explicit strategic intent to influence international economic positions or national security, beyond the normal scope of market regulation.

Beyond-the-Border Policies: States also act to shape trade policy beyond their border. Policies could include the creation of explicit agreements on a bilateral, minilateral, or multilateral basis but also unilateral measures such as trade or investment promotion.Footnote 11 International regimes or bilateral accords can influence policies member states are expected to adopt or comply with and which actions they are expected to avoid. A pertinent example is the development of plurilateral digital trade agreements and data governance frameworks (such as the Digital Economy Partnership Agreement) aimed at setting norms for cross-border data flows and digital commerce.

A key approach to beyond-the-border efforts includes the extraterritorial application of domestic laws. In such cases, states can use their jurisdiction over globally active firms or financial systems to impact behavior abroad—for instance, the U.S. leveraging the dollar-based financial system to enforce sanctions on third countries or using export control jurisdiction over foreign-produced items that contain U.S. technology (the so-called “foreign direct product” rule) to restrict China’s access to chips. Such measures are unilateral yet beyond-the-border in effect. Other recent efforts to internationalize policies include the General Data Protection Regulation (GDPR) (in force), EU Artificial Intelligence Act (in force August 1, 2024), and the EU Supply Chain Act (in force). There are dangers associated with this approach, however. Beyond-the-border interventions can lead to the domestic market becoming unattractive for third-country actors. Thus, there is a risk that excessive regulatory efforts will lead private actors not wanting to operate in the EU, for example, owing to its efforts to project regulatory power.

The inclusion of beyond-the-border policies in our typology recognizes that states do not only act alone; they also shape and exploit international systems as a means of statecraft. This goes beyond traditional definitions of economic statecraft (which often focus on bilateral sanctions or aid) by encompassing the strategic dimension of regime-making. For example, creating a new international standard for 5G security or AI ethics can be as much an instrument of advantage as imposing a tariff, even though it operates through consensus rather than coercion.

We have sought to make these categories as analytically distinct as possible but recognize potential overlaps. In principle, these are mutually exclusive loci of intervention. In practice, however, specific policies can intersect multiple domains. A domestic subsidy (behind-the-border) might have the effect of altering trade flows, thus functioning like an at-the-border barrier by making imports less attractive and goods for export cheaper. Regulations enacted ostensibly for domestic reasons—such as health and safety standards—can be repurposed as covert trade barriers or geopolitical tools. For example, China’s use of stringent import inspections on foreign food products has been interpreted as retaliation against countries that displeased Beijing; Sung Eun Kim, Rebecca Perlman, and Grace Zeng (Reference Kim, Perlman and Zeng2025) demonstrate that Chinese regulators have systematically used health standards to “punish states that act against China’s interest,” rejecting imports on dubious grounds. Such tactics straddle behind-the-border (a domestic regulatory measure), at-the-border (blocking foreign goods), and beyond-the-border (signaling foreign policy leverage) all at once. Similarly, foreign investment screening—which we classify as at-the-border—has ramifications for domestic industry development (behind-the-border) and can be coordinated across allies (beyond-the-border). These overlaps mean that our typology should be applied with an understanding of primary vs. secondary effects: a policy is categorized by its primary mechanism, while secondary impacts may cut across categories.

Why adopt this typology at all, given the potential for overlap? The value lies in highlighting different mechanisms of influence. At-the-border policies work by blocking or filtering flows (they are about access). Behind-the-border policies work by shaping domestic capacities and incentives (they are about internal development or regulation). Beyond-the-border policies work by altering the external rules of the game (they are about structuring the environment or partnerships in which economic activity occurs). By parsing interventions this way, we can better analyze how states choose among tools: e.g., when do they favor unilateral barriers versus building coalitions, or when do they rely on boosting their own firms at home versus impeding others abroad?

Each approach has different advantages, legal implications, and long-term effects. For instance, a country facing a technological rival might impose export controls (at-the-border) for immediate security protection and invest in its domestic industry (behind-the-border) for longer-term competitiveness and try to form an international coalition to set standards (beyond-the-border) – addressing the challenge on multiple fronts. Our framework allows these to be considered both separately and in tandem.

The determinants of state intervention: a five-factor model

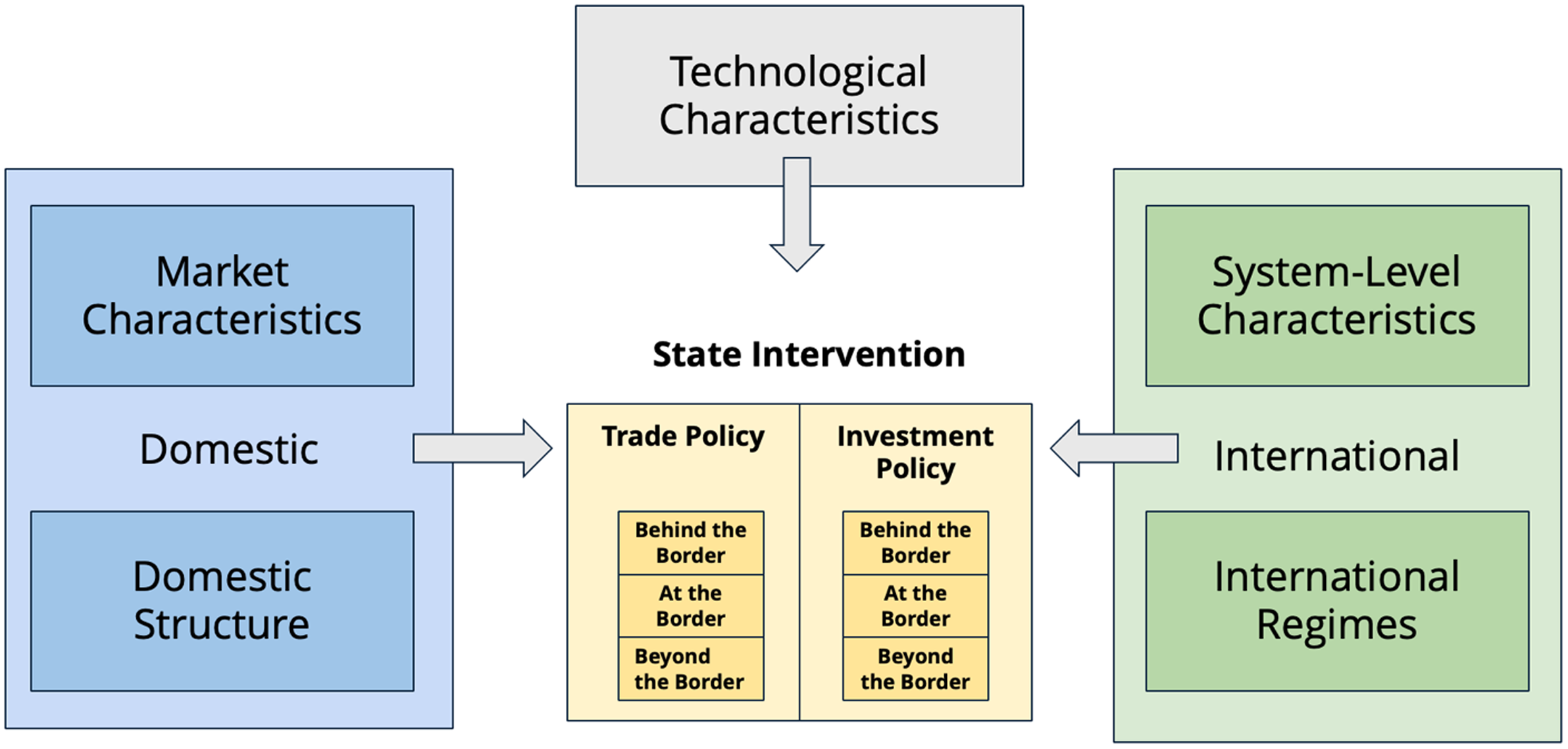

Having outlined the variety of ways in which governments might intervene for strategic purposes, we show how factors across five levels of analysis affect the type and magnitude of state intervention in markets. We illustrate this five factor model in Figure 1. These five factors serve as the basis of a conceptual framework to examine both the likelihood and character of government intervention.Footnote 12

Figure 1. A five-factor model of state intervention in high technology sectors.

Across each of the determinants, we point to the importance of the factor and its elements, then turn to how actors have conceptualized and measured these elements, and finally develop some propositions about their likely impact.

Market characteristics

The first set of determinants relates to the structure of markets and the nature of economic interdependence. What dimensions of a specific industry are likely to influence state intervention? Several elements that Michael Porter analyzes based on the industrial organization literature are relevant to perceptions and decisions about state intervention.Footnote 13 While the number is potentially vast, given this article’s focus on strategic technologies, our discussion centers on what we believe to be the three most important relevant variables: barriers to entry, the number of competitors in the market, and the vulnerability of the supply chain.

The literature on industrial organization has long emphasized the importance of barriers to entry.Footnote 14 If entry barriers are low, then incumbent firms face continuous threats of entry. At one level, one can consider barriers to entry as a master variable in the following sense. If barriers to entry are very low, then governments have little to worry about since firms either on their own or with government encouragement can rapidly ramp up production. Still, understanding how barriers come up about is of critical theoretical importance. What leads to higher or lower barriers to entry in high-technology sectors?

For ease of presentation, we thus look at driving factors with barriers to entry in mind. Barriers to entry can be based on scale economies, brand loyalty, and technical barriers, but also on regulations that prevent easy entry (for example, taxi medallions or trade restrictions).

With respect to scale economies, industries such as aircraft production, auto production, and steel production have significant economies of scale given the capital requirements for production. Such scale economies are linked to the number of competitors, as high economies of scale are likely to favor industry concentration. However, the presence or absence of economies of scale in various high-technology industries are likely to have an independent effect on decision-making on state intervention.

In terms of likely state intervention for strategic purposes, we might expect that if barriers to entry for domestic and foreign firms are low in a given industry, there should be little incentive for the state to assist such firms from a security standpoint. By contrast, states are tempted to intervene to protect industries with significant economies of scale as this allows firms in these industries to have lower production costs. For example, a defense industry’s cost of production of fighter jets and bombers are highly dependent on the number of units that are produced, often leading states to promote foreign sales. In another example, the start-up costs in terms of human capital and compute in AI technologies are significant, with the potential for the technology to scale once built—particularly if a particular algorithm is for a given use case is first to market.Footnote 15 Indeed, the potential application of large language models or computer vision tools across numerous contexts has led to government support for the nascent industry across the globe.

The second variable we consider is the number of competitors in a given industry. A focus on competitors provides the touchstone of work in industrial organization. Scholars have long focused on the pros and cons of different market structures. To examine market power, economists have created standard measures such as the Herfindahl–Hirschman Index that measures concentration. For the most part, neoliberal economists discourage state intervention to bolster specific firms or industries, focusing instead on an array of antitrust tools to ensure that firms do not unfairly secure an oligopolistic or monopolistic position in the market. In contrast to neoliberal orthodoxy where the expectation is that the market provides solutions on the supply side, a wide variety of states have promoted specific firms in a number of industries, seeking to create economies of scale that would create “national champions” in these countries to compete with large American or other countries’ firms. There are many examples of how this has played out in Europe (i.e., France) and, more recently, in China.

Finally, we are interested in the security of supply for strategic goods and technologies. States are concerned about dependence on foreign sources for this critical input or technology that could create vulnerabilities.Footnote 16 In essence, asymmetric interdependence translates into power: the side that can afford to sever ties (or has alternatives) can coerce the side that cannot.Footnote 17 These insights imply that states will strive to minimize critical dependencies on potential adversaries—or conversely, to create dependencies that give them leverage. For example, a country like China, after experiencing supply pressure (e.g. U.S. export restrictions on high-end photolithography equipment and chips), has doubled down on efforts to indigenize its semiconductor supply chain. Likewise, Western nations have grown wary of their reliance on China for rare earth minerals and have intervened via stockpiling and encouraging alternative sources. As Joanne Gowa and Edward Mansfield (Reference Gowa and Mansfield1993) argued, states cannot ignore such security externalities stemming from commerce: trading freely with adversaries may jeopardize one’s security by enriching the other’s war-making potential. They concluded that states prefer to trade with allies where gains are shared within a coalition and restrict trade with foes. This logic, drawn from the Cold War context, is resurfacing in today’s techno-security climate, where allies are coordinating on supply chain security (for instance, the U.S., Japan, and EU aligning on semiconductor controls) and adversaries face selective decoupling.

To summarize our expectations, in markets with low barriers to entry, many competitors, and where security of supply is not a major concern, we would expect little intervention for strategic purposes. By contrast, governments facing vulnerability on one or more of these dimensions will be likely to use a panoply of measures to bolster their own firms.

Domestic political structures and state capacity

Even when facing similar market conditions or external threats, states vary in their propensity and ability to intervene, based on their domestic political structures and institutions. This factor examines how domestic politics—the interplay of the state, interest groups, and institutional capacity—shapes strategic economic intervention.

A key concept here is the distinction between “strong” and “weak” states in relation to societal actors. By strong state, we mean a state apparatus that is relatively autonomous from narrow interest group pressures and that has coherent, capable institutions (bureaucracies) to formulate and implement policy. A weak state, conversely, is one where government policy is easily captured or influenced by powerful private interests (business lobbies, oligarchs, etc.), or where institutional fragmentation and lack of capacity hinder coordinated action.Footnote 18 From our perspective, a strong state is better positioned to carry out long-term strategic interventions in technology sectors and avoid regulatory capture—even if certain firms or consumers might prefer laissez-faire—because it can resist lobbying for short-term gains and invest in broader national goals.Footnote 19 A weak state might instead bend to the immediate interests of corporations (for example, protecting an uncompetitive industry due to lobbying, or refraining from regulating Big Tech due to its influence), thereby undermining a strategic approach.

Of course, domestic dynamics are more complex than just a binary of strong/weak state. State–business relations can be adversarial or symbiotic in different contexts. Ling Chen and Miles Evers (Reference Chen and Evers2023) provide a nuanced view: how firms respond to state intervention can depend on the international context and the incentives at play. If a government pushes for decoupling from an international partner (say, State A tells its companies to stop selling to State B), firms that heavily profit from the status quo may resist—they might lobby against the restriction or find ways around it—thus constraining the state’s policy effectiveness. We have seen this when the U.S. government restricted trade with China: some American tech companies warned of lost revenues and argued against overly broad bans. Conversely, if the state offers an attractive alternative—e.g., subsidies to relocate supply chains domestically, or protection in the home market if companies comply—firms might align with the state’s directive because it promises mutual benefit. Chen and Evers (Reference Chen and Evers2023) term this a “Wars without Gun Smoke” scenario where the outcome (cooperation or resistance) hinges on whether firms see the state’s move as aligning with their economic interests. This interplay suggests that a state’s capacity to intervene effectively is partly a function of coalition-building at home: successful interventions often involve creating coalitions with industry (or segments of industry) that stand to gain from the intervention, thereby neutralizing opposition.

Another domestic factor is the form of government and legal constraints. In democracies, public opinion and electoral politics can influence strategic economic decisions. If voters fear job losses from trade, governments might impose tariffs; if consumers fear unsafe products or data misuse, governments might regulate tech firms. Democratic institutions also mean that interventions often need broader justification (national security arguments, for example) to gain support. In authoritarian systems, decision-makers might face fewer public constraints but could be more influenced by elite interests or the regime’s survival calculus. For instance, an authoritarian regime may heavily invest in surveillance tech both for geopolitical gain and for domestic control—the lines blur between external and internal motivations. Furthermore, legal frameworks (antitrust laws, procurement rules, budget processes) affect what tools the state can use behind its borders. The United States, for instance, has strong anti-trust and state-aid laws that historically limited certain types of industrial policy—yet it found workarounds via defense contracts and research grants to achieve similar ends.Footnote 20 In the 2020s, even the US has started to relax its stance, passing acts like the CHIPS and Science Act, indicating a political shift in what is domestically acceptable to counter strategic competitors.

Importantly, domestic political orientation—whether a leadership is more market-liberal or state-interventionist in ideology—will color its approach. The past consensus leaning toward neoliberalism often constrained overt industrial policy in many countries (labeling it as inefficient or distortive). Now, with that consensus weakening in the face of geo-economic realities, a bipartisan or cross-ideological recognition of strategic intervention is emerging in places like the US and EU.Footnote 21 This makes possible a suite of policies that might have been politically taboo two decades ago. Thus, shifts in domestic economic thought (influenced by academic ideas, interest group lobbying, or external shocks like financial crises) are also part of the story.

In summary, domestic factors determine who drives the bus of economic statecraft and how effectively it is driven. Does the state have a clear strategic vision and insulated institutions to carry it out? Are domestic firms and societal groups supportive or obstructionist regarding a given intervention? Are there institutional channels for the state to mobilize resources (like state-owned enterprises, sovereign wealth funds, development banks)? All these questions influence outcomes. Our framework highlights that even if two states face the same external threat—say a disruptive new technology in a rival’s hands—one might respond with a bold industrial strategy while another dithers or leaves it to the private sector, largely because of differences in domestic state capacity and politics. Put simply, state intervention is ultimately a political process shaped at home.

Technological characteristics and dual-use externalities

Not all technologies are alike, and the particular characteristics of a technology or industry can heavily influence the likelihood and form of state intervention. In our framework, technological characteristics include attributes such as dual-use potential, externalities, required investment (fixed costs), stage of development, and breadth of application. These traits affect how governments perceive the technology’s strategic value and risk, and thus how they formulate policy towards it.

The capacity for both civilian and military use—is arguably the most significant technological trigger for state intervention. When a technology can enhance military or security capabilities, states become acutely attentive to its development and distribution. This has been evident historically: from machine tools to cryptography to space launch vehicles, dual-use technologies have prompted export controls and monitoring. The logic is grounded in the security dilemma and the arms race dynamic. Volpe (Reference Volpe2019) underscores that when it is difficult to differentiate between civilian vs. military applications, states err on the side of caution by assuming a rival’s civilian advancements could translate into military gains. Thus, they may intervene to restrict access (preventing transfers to the rival) or to accelerate their own progress (funding military R&D). Nuclear technology is the classic case—ostensibly for energy but tightly controlled due to weaponization potential.

Currently, we see similar concerns apply to artificial intelligence algorithms (which could be used for civilian automation or military autonomous weapons), quantum computing (with civilian uses but also the potential to break encryption), and biotechnology (CRISPR could revolutionize medicine or create biological weapons). Technologies with high dual-use stakes often see a web of state interventions: export licensing, classification of research, vetting of foreign students in sensitive fields, to name only a few. In our typology, dual-use controls are predominantly at-the-border (export restrictions) and beyond-the-border (multilateral regimes), though they also influence behind-the-border decisions (how much to invest in domestic innovation to reduce reliance).

Another feature concerns the externalities of strategic technologies. On the positive side, innovations can yield spillover benefits to other industries or to overall productivity. A state aware of such positive externalities might intervene to support and accelerate those benefits, for instance by funding basic research or providing innovation incentives, reasoning that the social gains exceed what private firms could capture. However, positive externalities could also argue against heavy-handed intervention in some cases: if a technology is rapidly proliferating beneficially across borders, a state might prefer to allow spillovers and reap gains from global innovation rather than restrict the technology.

On the negative side, technologies can have external costs—for example, artificial intelligence might displace jobs or undermine privacy, while relying on fossil-fuels that contribute to climate change. These negative externalities tend to prompt regulatory intervention (such as safety standards, data protection laws, or environmental regulations). For the most part, emergent externalities associated with specific technologies are likely to increase the likelihood of state intervention, in general, and of regulatory barriers, in particular. In principle, this seems intuitive: if new technology causes public fear or cross-border spillovers (like misinformation from social media, or surveillance capabilities with human rights implications), governments respond by putting up guardrails. The COVID-19 pandemic’s effect on medical supply chains, for example, raised externality concerns (public health security), leading many states to intervene in pharmaceutical and medical supply markets. However, the relationship is not automatic—it depends on whether the state perceives the externality as manageable through openness or requiring restriction. For example, the substantial positive externalities of AI (e.g., productivity gains) might incentivize states to permit broad experimentation and diffusion, rather than clamp down, at least until negative externalities loom larger. Thus, states perform a balancing act: maximizing positive spillovers (often by staying open to international knowledge flows) while minimizing negative spillovers (possibly by limiting or shaping certain uses of technology).

A related aspect is the degree to which technological and economic gains are captured domestically versus abroad. If breakthroughs in a sector primarily benefit foreign firms or economies (for instance, if a country is a net importer of high-tech products, thus funding R&D abroad), its government might intervene to try to internalize more of those gains at home (through industrial policy or by enticing investments from abroad into local production). Conversely, if a nation leads in a technology and its firms reap profits globally, it has a stake in keeping markets open but also might use selective protection to hold that lead. Busch (Reference Busch1999) emphasized that state interventions are more politically viable when the winners are domestic—policymakers are more likely to step in if they believe their intervention will nurture a home-grown industry that keeps wealth onshore. This ties into the concept of global value chains: whether a country’s role in a value chain is one of high value-added (design, innovation) or low value-added (assembly) can influence its government’s strategy. Countries stuck in low value-added positions often implement policies to move up the value chain (e.g., encouraging technology transfer, imposing local content rules, or protecting infant industries). Meanwhile, those at the technological frontier may intervene to prevent erosion of their position (like enforcing intellectual property rights globally, screening foreign acquisitions of domestic tech firms, etc.).

Another critical characteristic is the cost structure and required scale of investment for a technology—essentially, whether a technology has high fixed costs or low entry barriers. Drezner (Reference Drezner2019) provides useful insights here: he differentiates technologies by whether they demand large up-front investment (for instance, semiconductor fabs or aircraft carriers) or relatively small start-up costs (like software development or small-scale 3D printing. He also considers whether the private sector or public sector is the primary driver of the technology. This yields a 2×2 matrix: (a) high fixed cost, public-led (“big science” projects like nuclear, space)—Public-High; (b) high fixed cost, private-led (perhaps commercial aerospace or pharmaceuticals, where companies invest billions)—Private-High; (c) low fixed cost, public-led (niche cases where tech is cheap but government dominated, maybe some basic research endeavors)—Public-Low; and (d) low fixed cost, private-led (e.g. consumer software apps)—Private-Low.

Each quadrant tends to see different forms of state intervention. In Public-High cases, the state is inherently deeply involved (as with the Manhattan Project or the Apollo program—massive state-funded efforts). Even today, cutting-edge sectors like quantum computing or fusion energy have very high costs and see governments forming public-private partnerships or direct programs because the market left to its own devices might not mobilize the capital required to innovate. In Private-High cases, like pharmaceuticals or large civilian aircraft, the state often steps in to regulate (to ensure competition or prevent dependency, given a few firms hold much power) or to provide support where market failures occur (like subsidizing early-stage drug research). For Private-Low techs, government might let the market lead and intervene only to regulate externalities (social media is a good example: low cost to innovate, so lots of private activity, with the state now trying to set some rules after the fact). Technologies in the Public-Low category are rare and usually not strategic (by definition, if costs are low, private actors often jump in too, unless it’s something like basic science research).

For us, the key takeaway from Drezner’s analysis is that high fixed-cost, strategic technologies nearly always involve state intervention by necessity, and their strategic nature reinforces that involvement. For example, advanced semiconductor manufacturing requires enormous capital expenditure and technical know-how—historically, this was led by private firms in places like the United States and then Taiwan and South Korea, but with heavy tacit state backing (infrastructure, education, subsidies). Now, other states, recognizing the strategic importance, are directly intervening to build domestic fabs. Conversely, a technology like mobile app development has low barriers to entry; states did not need to invest to have that industry, though now they may regulate it for data security reasons.

Another attribute is whether a technology is a General Purpose Technology (GPT)—meaning it has broad applications across the economy (like electricity, information technology, AI)—or a more specialized technology. GPTs often induce widespread change and create new industries: states are interested in capturing the lead in GPTs to gain broad economic growth and possibly standards-setting power. The broad applicability means large positive externalities, which might justify government support. It also means a security lag in one GPT could permeate many sectors (e.g., lagging in AI could affect military, finance, healthcare, all at once). Therefore, states are keen to be at the forefront of GPTs, evidenced by national AI strategies, quantum initiatives, etc., around the world. In contrast, a niche technology (say a specific type of machine tool) might only get state attention if it’s a bottleneck or chokepoint in a supply chain.

The stage of technological development matters too. Early in the innovation cycle, uncertainty is high, and private investment may be tentative, so governments often intervene to ensure progress (fundamental research grants, DARPA-style programs). Once a technology matures and commercializes, state roles might shift to referee (setting standards, preventing monopolies) or to protector (shielding domestic firms from predatory practices). For instance, the U.S. government’s role in the internet shifted from initial creator through ARPA to regulator through bodies setting standards and regulating telecom aspects, and now to partial protector with concerns over foreign cyber threats and tech company acquisitions.

Finally, technological interdependence—the extent to which a tech ecosystem is globally dispersed—will influence interventions. If a technology’s supply chain crosses many countries (like electronics), states might focus on chokepoints (Japan controlling semiconductor chemicals, or the Netherlands with lithography machines) and intervene specifically around those, recognizing where leverage lies.

In our five-factor model, technological characteristics thus serve as a lens for risk and opportunity assessment. Does this technology pose a security risk if uncontrolled? Does it offer huge economic upside if mastered? Is it something our private sector will do on its own, or does it need a push? By answering these questions, states decide on interventions. Our framework assimilates these insights, asserting that technological features shape the strategic landscape in which states operate. States calibrate their economic statecraft according to what the technology is and does. A prudent analysis of any case of tech conflict should therefore include an appraisal of these features: How dual use is it? Who can develop it, at what cost? How widely will its effects spread? The answers will often predict the intensity and form of state intervention.

International regimes and governance frameworks

International regimes are defined as the agreed-upon principles, norms, rules, and decision-making procedures among states in a given issue area.Footnote 22 These form the external context that can either restrain or enable economic statecraft. In our framework, international regimes are considered as an institutional factor that shapes state interventions from the outside in. This includes formal international organizations (IOs) and treaties, as well as less formal norms and arrangements. It is important to be more conceptually clear with respect to international regimes: Aggarwal (Reference Aggarwal1983) distinguishes between principles and norms, which he labels the meta-regime vs. rules and procedures (the regime). Our interest is in how these institutions influence state behavior in technology conflicts.

Historically, the post-WWII liberal international economic order—epitomized by GATT/WTO and the Bretton Woods institutions—sought to curb beggar-thy-neighbor policies and promote open markets. In many ways, that approach constrained classic economic statecraft: high tariffs, quotas, and discriminatory industrial subsidies were disciplined by international agreements (see Aggarwal and Reddie Reference Aggarwal and Reddie2021). For instance, WTO rules put limits on tariffs and outlaw many types of export subsidies. However, states carved out exceptions, notably the national security exception (Article XXI of GATT), which allows countries to take measures “necessary for the protection of essential security interests.” This clause has been invoked to justify actions like export controls or sanctions that would otherwise breach trade commitments. With current tech conflicts, some countries began stretching this exception – the U.S. cited national security to justify tariffs on steel and tech export bans; China declared tech self-reliance a security imperative. This trend tests the strength of the trade regime: if overused, the exception can swallow the rule, effectively weakening regime constraints.

Most emerging technologies largely fall into governance gaps—there is no WTO agreement specific to digital trade (negotiations stalled in the Doha Round and have moved to plurilateral regimes), no binding global treaty on AI, and existing regimes like the WTO or WIPO (World Intellectual Property Organization) address pieces (trade, IP) but not the strategic whole. This means that for now, states operate in a somewhat institution-light environment when it comes to new tech, giving them freer rein for unilateral statecraft. We do, however, see a growing number of international initiatives and nascent regimes focusing on technology and digital issues including the nascent Digital Economy Partnership Agreement among a few countries, the OECD’s AI Principles (a non-binding normative framework adopted by many states), UNESCO’s recommendation on AI ethics, the establishment of the Global Partnership on AI, and various summits such as REAIM (Responsible AI in the Military Domain) and the Global AI Summit. Moreover, longstanding regimes are adapting—for instance, the Wassenaar Arrangement added new categories for cyber tools, and the WHO and others are looking at health data governance.

The rise of these regimes suggests that states recognize a need to jointly address some facets of the tech revolution. Why would states bind themselves through regimes? Often to solve cooperation problems: setting common standards (so that, say, autonomous vehicles or 5G equipment have interoperable and safe protocols), preventing dangerous arms races (e.g. potential future agreements on autonomous weapon systems or norms against cyber-attacks on civilian infrastructure), or managing trade tensions (like agreements on semiconductor supply chain security). For our framework, the presence of a robust international regime can constrain unilateral interventions by raising their costs (legal challenges, diplomatic fallout) and by providing alternative avenues to achieve goals. For example, if a multilateral export control regime is effective, states may work through it rather than imposing purely unilateral controls; if a trade agreement covers digital products, states will be wary of violating it with new restrictions. Conversely, in areas with regime voids or weak regimes, states feel more justified to act on their own or in ad-hoc coalitions. The cyberspace domain is telling: with no comprehensive regime governing state behavior in cyberspace, we see rampant economic cyber-espionage, unilateral sanctions for cyber operations, and countries erecting their own digital barriers (data localization, etc.)—all forms of uncoordinated statecraft.

International regimes not only constrain but also can be instruments of statecraft themselves. Powerful states often try to shape regimes in their favor as with TPP and RCEP.Footnote 23 The U.S., EU, and China are currently vying to set global standards in fields like AI ethics and digital trade. The EU’s General Data Protection Regulation (GDPR) has in effect externalized EU privacy norms globally (companies worldwide adjusted practices to comply if they handle EU data), an example of a unilateral-but-global regulatory intervention sometimes called the “Brussels effect.”Footnote 24 The U.S. and like-minded nations formed initiatives like the Trade and Technology Council and the Quadrilateral Security Dialogue (Quad) working group on tech, aiming to create a unified front on standards and secure supply chains—essentially mini-regimes or alliances for tech governance. China has its own efforts (standard-setting in the ITU, the Digital Silk Road initiative exporting its tech infrastructure along with norms). Thus, beyond-the-border statecraft can occur via forum-shifting and regime-shaping: choosing friendly venues to advance rules that align with one’s interests.

In sum, our framework views international regimes as a contextual constraint and opportunity. When an international regime is strong (e.g., trade rules in goods), states must get creative to intervene (using exceptions or shifting to behind-the-border measures that are regime-compliant). When regimes are weak or nascent (e.g., in AI or cyberspace), states face fewer constraints but also more uncertainty, which can lead to a “race to the bottom” or confusion that eventually spurs regime creation. To illustrate, consider export controls on cutting-edge chips: The WTO has no specific rules against export bans (especially if national security is cited), and the multilateral export control regime (Wassenaar) sets only broad lists and relies on national implementation. So, the U.S. and allies could coordinate new chip export controls outside of any formal global institution. They faced minimal formal constraints—only diplomatic coordination issues. Had there been a strong regime (say a treaty banning certain tech restrictions), their calculus might differ. On the other hand, for something like subsidizing industry, WTO does have an Agreement on Subsidies and Countervailing Measures that limits export subsidies and allows retaliation on subsidies that harm others. Thus, countries crafting new chip subsidy programs have to ensure they don’t violate those rules (hence framing them as domestic capacity building, not explicit export promotion). This shows how regimes channel state intervention choices.

In short, we contend that international regimes remain a vital piece of the puzzle: they are evolving rapidly in the face of tech upheavals, and they will determine whether the future is one of fragmented unilateral interventions or somewhat harmonized approaches. For scholars, this means closely watching forums like the WTO (e.g., e-commerce negotiations), the G20 tech discussions, or new treaties in areas like AI or cyber, as these will shape the “rules of the road” for economic statecraft.

Systemic geopolitical structure

The final factor we consider is the broad international system structure and geopolitical environment in which states operate. This speaks to the distribution of power (polarity), the level of rivalry or cooperation among great powers, and the overarching strategic narratives of an era. Systemic characteristics serve as a backdrop that can amplify or dampen the other factors.

During the Cold War bipolar era (1945–1990), the world was essentially divided into two blocs led by the United States and the Soviet Union. In that context, economic statecraft (trade policy, aid, sanctions) was frequently employed along bloc lines—allies traded freely with each other (as encouraged by institutions like the OECD and GATT for the Western bloc), but economic relations across blocs were restricted (CoCom controls on Western exports to the Soviet sphere, Soviet autarky in some areas). Bipolarity meant a high level of security competition, which justified extraordinary economic interventions by invoking the existential threat of the rival. For example, the U.S. subsidized and protected certain industries (like aerospace via defense contracts) not only for economic reasons but to ensure the West maintained technological supremacy over the Soviets. Likewise, the Soviets heavily directed their economy to compete militarily. The systemic pressure of bipolar rivalry thus made states view technology through a security lens and take actions they might not take in a less tense system.

After the Cold War, we entered what many considered a unipolar or hegemonic era under U.S. dominance. This period saw a strong push for globalization and liberalization, partly driven by the belief that security competition had receded, and major powers were converging on a liberal order. In systemic terms, one could say the system was unipolar. During this time, economic statecraft did not disappear—the U.S. still used sanctions on rogue states, for example—but great-power tech competition was muted. The American attitude was confident: it led in most advanced tech, and interdependence was seen as benign (the Clinton administration allowed encryption tech to be exported, the internet to grow globally open, etc., calculating that openness served U.S. interests). Other powers, like the EU, focused more on regulatory standard-setting (the EU’s single market and expansion was a form of beyond-the-border integration, not aimed at rivalry). One could argue that under unipolarity, the U.S. underwrote openness because it was not significantly threatened economically or militarily by allies or second-tier powers. However, some scholars caution that even in this period there were undercurrents of competition—for instance, Japan’s rise in the 1980s (though an ally, it prompted U.S. interventions like the Plaza Accord and semiconductor agreement) and later China’s rise starting in the 2000s (which by the late 2000s was causing concern).

Some scholars such as Milner and Ulvund Solstad., (Reference Milner and Ulvund Solstad2021) offer a critique relevant here: focusing purely on polarity (counting superpowers) can mask important shifts in the concentration of capabilities over time. Polarity is a blunt measure; while the world might have been formally unipolar after 1991, China’s rapid growth from a poor country to a tech-manufacturing powerhouse by 2010 was a major change in capability distribution that polarity didn’t register (until China became big enough to be considered a pole). Milner and Solstad argue one should also look at how power is distributed among many countries, not just the top one or two. A highly concentrated system (one or two states hold most power) vs. a more distributed system (several significant powers) can influence patterns of cooperation and conflict. A system tending towards multipolarity—say the emergence of U.S., China, EU, India all as major players—might lead to more fluid alignments and selective interventions, leading to a situation where some states might band together on certain tech norms but compete elsewhere.

The current environment of the mid-2020s is widely described as a return to great-power competition, often likened to a bipolar competition between the U.S. and China.Footnote 25 While U.S.-China is the dominant strategic axis, the global picture is more nuanced: Russia’s confrontation with the West, Europe’s quest for “strategic autonomy,” India’s nonaligned tech development, and other factors mean the world has not neatly split into two all-encompassing camps as it was in the Cold War. Nevertheless, the spirit of the age has undoubtedly shifted from the cooperative globalization of the 1990s–2000s to a more fragmented and competitive order. Trump’s policies are also likely to make a bipolar economic order a reality.

Power transitions also matter: the fact that one rising power (China) might overtake the incumbent (U.S.) in economic size and perhaps technological prowess is itself a systemic driver of intervention. Power transition theoryFootnote 26 posits that such junctures are prone to conflict. The difference in our era is that conflict is unfolding significantly in the economic and technological realm rather than outright military clash. Thus, economic statecraft is the weapon of choice in this power transition phase—trade restrictions, tech alliances, etc., are being used to slow or channel China’s rise and for China to push back against U.S. dominance. This is theme in Andrew Kennedy and Darren Lim’s analysis: they describe how a dominant state facing a tech challenge from a rising state experiences “negative order externalities” and ramps up interventions.Footnote 27 We have seen the U.S. coordinate an international response (e.g. forming the “Chip 4” alliance with Taiwan, Japan, Korea, and convincing the Netherlands to join chip equipment bans)—essentially leveraging its systemic position to rally others, which is reminiscent of Cold War bloc-building, albeit issue-specific.

In our framework, we include systemic structure to capture these overarching pressures. Are we in a cooperative or conflictual international environment? Is there a hegemon enforcing rules or a vacuum of leadership? Is there a clear rival that concentrates minds in capitals around the world? When systemic rivalry is high, even states that are not superpowers have to respond—e.g., European states choosing whether to allow Chinese 5G vendors had to weigh alliance pressure from the U.S. versus economic ties with China. Many chose to restrict Huawei, aligning with the systemic Western camp’s security preference. In a less confrontational system, they might have purely economic criteria for such decisions. Thus, systemic factors can sway the balance: they can make security considerations trump economic ones more often (in a rivalry scenario), or they can make states comfortable prioritizing economic gains (in a cooperative scenario).

To summarize: Systemic geopolitical factors set the stage upon which all these policies play out. They don’t dictate specific interventions, but they provide the strategic imperative or caution that guides policymakers’ mindsets. Our analysis acknowledges that a framework of state intervention would be incomplete without accounting for whether we are in a Cold War-like scenario or a liberal peace scenario, or something in between. The current trend toward rivalry increases the salience of the other four factors (markets are seen through a security lens, domestic politics rally around national champions, tech characteristics are judged for their warfighting utility, regimes may split into rival blocs). Conversely, in a hypothetical future where U.S.-China tensions cool and some cooperative equilibrium emerges, we might expect a dialing back of the most severe interventions (perhaps easing of some export controls in exchange for mutual assurances, etc.). Systemic context, therefore, is our broadest lens, ensuring we remember the adage that state actions in the economic realm do not happen in a vacuum.

Having detailed each of the five factors—market structure, domestic structure, technological traits, international regimes, and systemic geopolitics—we can see that they are deeply interconnected. For example, a systemic rivalry (Factor 5) heightens the significance of dual-use tech (Factor 3) and may weaken international regimes (Factor 4), while a strong domestic coalition (Factor 2) is needed to respond to market vulnerabilities (Factor 1). Our framework’s utility lies in disaggregating influences yet allowing analysis of their interactions in any given case of state intervention.

Middle power and technological competition

The articles that follow in this special issue examine the tools of new economic statecraft outlined here from the perspective of middle powers. Caught between rivalry between the U.S. and China, these countries must maneuver carefully to avoid confrontation while attempting to preserve their interests through technology policies.

Kun-Chin Lin, William Matthews, and Sam Olsen explore the efforts of Taiwan and Thailand in the space industry, a sector with high barriers to entry. Surprisingly, these middle powers are increasingly involved in the space domain, viewing it as a sector for economic and security competition. These countries are guided by the opportunities provided by technological innovation and market globalization, as well as the catch-up industrialization pressures. The authors argue that the Asian developmental state model is adapting in response to the US-dominated global supply chain for commercial space activities. Though both are middle space powers, Taiwan and Thailand differ in the management of their space and industrial policies, which will likely impact their national security and lead to diverging technological trajectories. Their long-term achievements also rely on the United States and People’s Republic of China space race. Taiwan, drawing inspiration from its successful semiconductor market, is taking a state-led path towards a linear progression of space manufacturing that emphasizes domestic satellite development and manufacturing. This includes behind-the-border measures to promote the space industry. In addition, the government has encouraged its firms to move beyond the border to become a reliable, lower-cost component provider to leading US firms like SpaceX. In contrast, Thailand has adopted a broad beyond-the-border strategy of international collaboration—partnering with Europe, the United States, and China—to improve its space capabilities and fulfill its national security needs while balancing relations with major powers.

The extent to which Taiwanese and Thai firms can navigate the political landscape and U.S. regulations will be crucial for their success as suppliers in the global space industry. Taiwan’s corporatist, highly centralist style, a key component of success as we have noted in our framework, has led to more public investment, domestic firm engagement, and intensified ties with the US, but it is limited in its ability to expand satellite capabilities globally. The Thai strategy has focused on beyond the border measures to expand bilateral and multilateral collaboration, including international treaties and inter-agency cooperation agreements. Its goal has been to pursue integration into the international space supply chain. Yet as a middle space power, its r long-term prospects will be decided by their strategic choices in the great power competition context and their ability to establish sustainable niches in a rapidly evolving industry.

Next, in focusing on materials–parts–equipment products, Min Gyo Koo turns to the South Korea–Japan whitelist conflict (2019–2023). This case is a revealing example of the use of new economic statecraft and the securitization of high-tech industries. Triggered by Japanese export restrictions on three crucial semiconductor materials, the conflict was the consequence of a South Korean Supreme Court ruling to seek reparations for wartime forced labor. Japan cited “essential security interests” under GATT Article 21 to justify its action, causing a political and legal confrontation. South Korea responded with an ambitious localization policy of materials, parts, and equipment to reduce its dependence on imports from Japan.

Koo argues that the localization policies of South Korea were largely ideologically motivated and devoid of rigorous economic planning, despite being well-intentioned. Although the Ministry of Trade, Industry, and Energy was capable, it was politically captured, and the policy implementation did not meet many of the standards we have discussed on government intervention behind the border, such as including clear success milestones, adequate institutional autonomy, and adaptation and feedback mechanisms. The policy led to inefficient allocation of resources and the emergence of “zombie” firms, which raised concerns about moral hazard and the costs of over-securitization.

He also warns that while trade and security become increasingly interconnected in global politics, policymakers ought to be prudent and cautious when pursuing industrial policy for national security claims. Rather than politically motivated and reactive measures, economic statecraft must be rooted in a coherent and flexible approach to ensure long-term competitiveness and resilience.

Chung-in Moon and Wonho Yeon focus on South Korea’s efforts to maneuver in the context of US-China technology rivalry. They focus on techno-statecraft that goes beyond geopolitical contestation. Tracing longer-term tensions over technology, they examine how in the 1980s, the United States faced a perceived threat from Japan. Similarly, in a different geopolitical context, they examine how both the U.S. and China have pursued a set of similar policies. As they detail, these policies reflect the full panoply of measures discussed in this introduction. These include behind-the-border measures such as government-directed promotion of indigenous cutting-edge technology, using at the border measures to regulate investment, and efforts to set global standards.

For its part, they note that as tensions have increased between the U.S. and China, middle powers like South Korea face what they term a “sandwich dilemma.” With a relatively strong state, Korea has been able to promote home-grown technology and use behind-the-border measures to promote high-tech industries. This effort includes tax incentives, R&D investments, and other forms of government support. At the beyond the border level, while it may make sense for Korea to align with the technologically superior United States, it is heavily dependent on China, which is not only its largest trading partner overall but is also the primary market for Korean chipmakers. One strategy has been for South Korea to join the American-led Chip 4 alliance, as well as collaborating with the United States on multilateral export controls and economic security measures. At the same time, Korea is muddling through given the dual-track approach of the corporate sector, with some firms investing in the United States while others (especially in the semiconductor and automotive industries) expanding investments in China. Techno-geopolitical conflict limits the strategies available to middle powers like Korea, forcing it turn toward techno-statecraft policies that we have discussed in our framework.

In a companion piece on South Korea, Seungjoo Lee shows how US-China strategic competition has caused South Korea to develop its own economic statecraft and cope with coercion. Traditionally, Korea’s approach to navigating the tricky dynamics of US-China technological competition has been reactive, aiming to respond to economic coercion by the great powers. Until recently, its policy of strategic ambiguity to maintain this delicate balance has served it well. But while strategic ambiguity has its advantages, it has arguably made Korea more vulnerable to coercion by the United States and China, especially in recent times when each great power has demanded more extensive cooperation at the expense of the other. Overlapping partnership commitments and complex webs of interdependence have opened Korea up to repeated economic coercion, from China’s retaliation for THAAD deployment to Japan’s export restrictions on semiconductor materials.

To cope with the new global environment, Korea has shifted its strategy to be more proactive and more forthright in embracing new economic statecraft. Its new economic statecraft reflects both behind-the-border and beyond-the-border efforts. With respect to supply chain diversification both firms and the government have engaged in both beyond-the-border measures to diversify away from China to the US, and also to increase investments in Vietnam. At the same time, the government has encouraged reshoring as a key behind the border measures that include subsidies, indicative planning, and governance reforms. He notes two key features of Korea’s techno-economic statecraft. First, it uses high technology as a nexus between the economy and security. China has been known to manipulate asymmetric interdependence and can exert leverage through trade in materials, intermediate components, and capital goods like equipment. Korea is reducing its dependence on imports and developing self-sufficient indigenous production capacity, in semiconductors, for instance, through reshoring, investment, and tax support through the K-CHIPS Act. Second, Korea uses high technology as a bridge between domestic and foreign policies, complementing external-facing economic statecraft with domestic industrial policy. From a political implementation standpoint, international considerations like the need to maintain global semiconductor competitiveness in the face of US and EU industrial policies and recent disruptions in semiconductor supply chains have facilitated the enactment of domestic industrial policies that would otherwise face more intense resistance. As Lee notes, while these international considerations have largely united Korean policymakers, domestic politics has influenced the form those measures have taken. Compromises among the government, legislators, and private companies resulted in tax credit measures that fell short of initial ambitions but nevertheless empowered Korea to engage in proactive techno-economic statecraft.

The rise of geoeconomics

The landscape of global technology competition is complex and rapidly evolving. We argue that by breaking down state intervention into clear categories and explanatory factors, we can better understand the patterns and anticipate future developments. The world is witnessing a reassertion of state agency in markets—a trend that challenges the neoliberal assumptions of previous decades. New economic statecraft, especially in strategic technologies, has become a primary arena of great-power competition and a key concern for businesses and governments worldwide. Our analytical framework provides a structured way to analyze this phenomenon. It helps distinguish whether a given conflict is primarily about market failure or security externalities, driven by domestic lobbying or by geopolitical rivalry, and enabled by weak international norms or constrained by strong ones.

For policymakers, recognizing these dimensions can improve strategy: for example, appreciating that allies share one’s security externality concerns (systemic factor) might encourage a beyond-the-border cooperative solution rather than a unilateral one. Or understanding that an adversary’s domestic political constraints might limit their ability to reciprocate an agreement could temper expectations in negotiations. For scholars, this framework invites further research on how regime formation in new tech domains succeeds or fails. The framework’s integrative nature aims to ensure that such inquiries remain connected, so that economic, political, and technological analyses inform one another.

Ultimately, the new economic statecraft is about the blending of economics with power politics in the age of technology. It requires analysts to be attentive to trade theory, security studies, and innovation policy and charts a path forward for analyzing and navigating the emerging era of global technology conflicts—an era where microchips can be as strategically salient as battleships, and where the competitors wield supply chains and standards as weapons alongside, or even instead of, guns and missiles. The stakes of getting this right are high: global peace and prosperity will depend in part on whether states can manage their techno-economic conflicts through savvy statecraft rather than allowing them to escalate into open confrontation. Our framework offers a tool to aid in that management, by illuminating the choices and trade-offs that define the new economic statecraft.