Introduction

At least since James Tobin (Reference Tobin1974) posed the question “What is permanent endowment income?”, the endowment of a college/university has been understood to be the instrument of financial input that will indefinitely sustain the institution’s rate of consumption needed to support its output. This is particularly important given the endogeneity and volatility of the other revenues (e.g., student tuition, grants) that can finance consumption and production. While Henry Hansmann (Reference Hansmann1990) points out the limitations of Tobin’s intergenerational equity motivation for the existence of endowments, Caroline M. Hoxby (Reference Hoxby2012, Reference Hoxby, Brown and Hoxby2014) provides a compelling venture capital framework in which college/university endowments are necessary if they are to finance welfare-enhancing intellectual capital—human capital and research—to society. In particular, similar to venture capital projects, investments in human capital and research—or intellectual capital—has properties that cannot rely on conventional financing, and endowments emerge as an optimal financing mechanism.Footnote 1 Viewing colleges/universities as intellectual capital venture projects that contribute to society’s welfare, the number of such projects with benefits that exceed their costs can have a proportional relationship to social welfare. It is in this context that endowment inequality among colleges/universities can be harmful for social welfare. Venture capital firms are heterogeneous with respect to what they identify as worthwhile investment projects, and can reduce the informational asymmetries associated with particular investments, given they can attract financing (Amit et al., Reference Amit, Brander and Zott1998; Gompers and Lerner, Reference Gompers and Lerner2001). Thus, relative to colleges/universities with higher endowments, those with lower endowments can be constrained in scaling up intellectual capital investments with potential net benefits to society that colleges/universities with higher endowments do not identify and/or choose not to make.

The success that Historically Black Colleges/Universities (HBCUs) achieve relative to non-HBCUs in educational and intellectual outcomes (Koch and Swinton, Reference Koch and Swinton2023; Price and Viceisza, Reference Price and Viceisza2023) for its students suggests that relative to non-HBCUs, they are better able to identify and invest in welfare-enhancing human capital investments among their traditional constituency—Black Americans—which has been historically excluded from non-HBCUs.Footnote 2 Frankki Bevins and colleagues (Reference Bevins, Fox, Pinder, Sarakatsannis and Stewart2021) report on several dimensions in which HBCUs seem to be able to to achieve this. Roland G. Fryer and Michael Greenstone (Reference Fryer and Greenstone2010) estimated that with respect to Black Americans, HBCUs have graduated 40% of all congressmen, 12.5% of chief executive officers (CEOs), 50% of professors at non-HBCUs, 50% of lawyers, and 80% of judges.Footnote 3 Perhaps even more impressive, the mean economic mobility rate—the probability that a college graduate reaches the top fifth of the income distribution given his/her household is in the bottom fifth (Chetty et al., Reference Chetty, Hendren, Kline and Saez2015)—of HBCU graduates is more than twice that of non-HBCUs (Hammond et al., Reference Hammond, Owens and Gulko2021).

HBCUs appear to have an advantage relative to non-HBCUs in educational and economic/social mobility outcomes for its graduates (Elu et al., Reference Elu, Ireland, Jeffries, Johnson, Jones, Long, Price, Sam, Simons, Slaughter and Trotman2019; Hammond et al., Reference Hammond, Owens and Gulko2021; Hardy et al., Reference Hardy, Kaganda and Aruguete2019, Koch and Swinton, Reference Koch and Swinton2023). However, this advantage is not complemented by a favorable endowment disparity, as on average―even though there is evidence HBCUs are not less capable stewards of endowment resources relative to non-HBCUs (Drezner and Gupta, Reference Drezner and Gupta2012), and use their endowment more efficiently relative to non-HBCUs (Coupet and Barnum, Reference Coupet and Barnum2010)―HBCU endowments are dramatically lower than those of non-HBCUs. William Darity Jr. (Reference Darity2019) reveals the starkness of the endowment disparity between HBCUs and non-HBCUs. In 2018, the ten HBCUs with the largest endowments had a total that approached $2 billion. The largest was held by Howard University at about $689 million, followed by Spelman College at $387 million. The sum total of the top ten HBCU endowments was less than that of state-supported non-HBCUs such as University of Michigan ($12 billion), University of Virginia ($8.6 billion), Ohio State University ($5.2 billion), University of North Carolina at Chapel Hill ($5 billion), and private non-HBCUs such as Harvard ($38 billion), Stanford ($27 billion), Yale ($29.4 billion), Princeton ($26 billion) and Smith ($2 billion). Such a misalignment between HBCU relative success in producing intellectual capital and their relatively smaller endowments suggests that society would be better off if the endowment disparities between HBCUs and non-HBCUs were closed. A recent analysis by the Association of Black Foundation Executives (2023) suggests that philanthropic foundations contribute to the endowment disparities, as between 2015– 2019 Ivy League colleges/universities received $5.5 billion relative to $303 million for HBCUs. Marybeth Gasman and colleagues (Reference Gasman, Samayoa, Benyehudah and Fowlkes2022) report a downward trend in foundation giving to HBCUs over the past twenty years. This of course raises the question as to why there are endowment disparities between HBCUs and non-HBCUs.

This article considers both the consequences and causes of the endowment disparity between HBCUs and non-HBCUs. As a historical institutional racial identity distinguishes the difference between HBCUs and non-HBCUs, the endowment disparity between them constitutes a component of racial inequality in the United States, and is a likely driver of other race-based inequalities and inequality in general (Cheslock and Shamekhi, Reference Cheslock and Shamekhi2020; Christensen and Rankin, Reference Christensen and Rankin2011; Eaton et al., Reference Eaton, Habinek, Goldstein, Dioun, Garcia, Godoy and Osley-Thomas2016; Meyer and Zhou, Reference Meyer and Zhou2017), as college/university endowments fund welfare enhancing intellectual capital that improve the economic well-being of college graduates. With recent cross section data on college/university financial health and endowments, we estimate the parameters of a failure model specification, a treatment effect specification, and an endowment distribution decomposition specification. The central aim is to determine if the endowment disparities between HBCUs and non-HBCUs has consequences for the viability of HBCUs to continuously exist, and if institutional racial identity is a causal driver of endowment disparities between HBCUs and non-HBCUs. If institutional racial identity does matter, this would be consistent with racial discrimination in the market for philanthropic contributions/gifts, providing at least a partial explanation for the endowment disparities between HBCUs and non-HBCUs.

While the endowment disparity between HBCUs and non-HBCUs can be explained by a variety of historical factors (Harris Reference Harris2021; Smith Reference Smith2021), our inquiry focuses exclusively on the role of the racial distinctiveness of HBCUs as a driver of endowment disparities.Footnote 4 The historical persistence of racial inequality (Collins and Wannamaker, Reference Collins and Wanamaker2022; Darity and Mullen, Reference Darity and Mullen2022; Jung Reference Jung2023; Margo Reference Margo2016; Williams et al., Reference Williams, Logan and Hardy2021), particularly as it relates to educational financing (Loubert Reference Loubert2004) and HBCUs (Sharpe Reference Sharpe2004), permits one to treat the racial distinctiveness of HBCUs as an analog of a sufficient statistic for at least two reasons. First, the persistence of racial inequality in the United States suggests that observable and identifiable racial characteristics convey more information about the parameters of interest—the effects of race on college/university endowments—relative to any other parameters based on non-racial phenomena. Second, the findings of Denise Smith (Reference Smith2021)—that relative to a random sample of colleges/universities, the variablility in educational outcomes of students at HBCUs is different—suggest that HBCUs are racially distinct institutions.

The remainder of the article is organized as follows. The second section provides an overview of relevant extant literature. The third section describes the data and methodology. Our empirical methodology considers estimating the parameters of two outcomes within a treatment effect framework—the probability of a college/university failing as function of its financial health which is conditioned on its endowment, and its endowment level—across two specifications. We appeal to a potential outcomes causal framework to determine if being an HBCU has a causal effect on endowment, and an endowment decomposition framework to determine if the the endowment distribution of HBCUs, differs from that of non-HBCUs as a result of HBCUs being racially distinct. Parameter estimates are reported in section four. The last section concludes.

Overview of Relevant Extant Literature

There is, as far as we can determine, an extant but limited literature on the causes and consequences of HBCU endowment disparities relative to non-HBCUs related to our inquiry. In his book, The History of Higher Education, James D. Anderson (Reference Anderson, Goodchild and Weschsler1997) provides several insights that offer a historical context for our inquiry. Anderson’s analysis implicates the racial distinctiveness of HBCUs as a factor in their relative disadvantage is attracting philanthropic gifts along two dimensions. First, from the genesis of their founding after the Civil War, wealthy philanthropists were biased toward HBCUs that offered industrial training deemed appropriate and suitable for the formerly enslaved by many industrialists. As these were a subset of all HBCUs, and non-industrial training was not considered taboo for non-Blacks, the bias for Black industrial training in college was a plausible driver of disparities in endowments between HBCUs and non-HBCUs. Lastly, by 1900 the missionary societies that perhaps disproportionately funded HBCUs not specialized in industrial education, were largely diminished in their capacity to raise funds. Thus, it is plausible that private HBCUs offering non-industrial education lost a reliable source of endowment funds, contributing to endowment disparities between them and their non-HBCU peers.

In more recent times, Sara Straubel (Reference Straubel2024) finds evidence that grantmaking professionals at private foundations are prone to implicit racial bias in their grantmaking. This can reduce the likelihood of non-White individuals and institutions receiving grants and endowment gifts and engender racial disparities in philanthropic grants and endowment gifts. Marybeth Gasman and Noah D. Drezner (Reference Gasman and Drezner2008) report evidence for the post-1960 period suggesting HBCUs experience discrimination with respect to donations from White Churches, as HBCUs received some sixty percent less relative to non-HBCUs. Gasman and Drezner (Reference Gasman and Drezner2008) also summarize the findings of Trent (Reference Trent1971) and Votaw and Sethi (Reference Votaw and Sethi1970), who found racial disparities in corporate philanthropic gifts to colleges/universities, suggestive of racial bias in corporate giving to both private and public HBCUs.

The limited extant literature on HBCU endowment disparities does not explicitly test for racial bias in philanthropy that support endowments. As such, our inquiry aims to consider if the endowment disparities between HBCU and non-HBCUs are driven by the racial distinctiveness of HBCUs―or discrimination. In this context, our contribution is in the spirit of Christina M. Fong and Erzo FP Luttmer (Reference Fong and Luttmer2011) who find experimental evidence of racial bias in perceptions of gift worthiness. In particular, they found that for donors, knowing the recipient was Black lowered perceived recipient worthiness significantly more among non-Black respondents than among Black respondents.

Data and Methodology

Our data were obtained from six sources: (1) Forbes 2021 Financial Health Data for private colleges/universities, (2) National Association of College and University Business Officers (NABCU) fiscal year 2021 endowment data, (3) TP-insights-The Plug, (4) National Science Foundation (NSF) Higher Education Research and Development Expenditures for 2021, (5) Wikipedia, and (6) U.S. Department of Education College Scorecard. Our initial source for the colleges/universities in our endowment sample was the NSF data, as it included a key an indicator of the type of intellectual capital produced by colleges/universities—research and development expenditures.Footnote 5

As not all colleges/universities participate in the NABCU analysis of endowments, supplementing it with additional sources such as TP-insights-The Plug was a practical necessity. The supplemental endowment data enabled enhancing our sample by matching with institutional research and development expenditures reported by the NSF—as these expenditures are important for the venture-like outcomes enabled by endowments. Supplementing the NABCU endowment data with that provided by TP-insights also enabled more observations on HBCUs, which likely enhances the statistical power of inferences on the HBCU effect in our parameter estimates (Norton and Strube, Reference Norton and Strube2001).

The Forbes Financial Data are utilized to enable an inquiry into a particular possible consequence of endowment disparities between HBCUs and non-HBCUs—the likelihood of failing. Of the nine components that determine the financial health of college/university, the majority of the weights are on components that are a function of the endowment.Footnote 6As such, a consideration of the probability of a private college/university failing as a result of its measured financial health can inform the extent to which endowment disparities between HBCUs and non-HBCUs have consequences for relative survival likelihoods. Two of the components in the Financial GPA also capture the extent to which graduates/alumni of an institution provide donations that could be allocated to the endowment—the Core Operating Margin, and Tuition as a percentage of Core Revenues—with a total weight of twenty-five percent. As such, matching HBCUs and non-HBCUs on the Financial GPA allows for some control on the wealth/income of an institution, graduate/alumni, and their effects on endowment gifts by graduates/alumni to a given institution.

Following the lead of others, (Elu et al., Reference Elu, Ireland, Jeffries, Johnson, Jones, Long, Price, Sam, Simons, Slaughter and Trotman2019; Price and Robinson, Reference Price and Robinson2023; Price and Surprenant, Reference Price and Surprenant2022), we first parameterize and estimate the treatment effect of being an HBCU within a Rubin potential outcomes causal framework (Rubin Reference Rubin2005). Suppose a sample is characterized by (

![]() $ {Y}_i $

,

$ {Y}_i $

,

![]() $ {X}_i $

,

$ {X}_i $

,

![]() $ {T}_i $

), where the

$ {T}_i $

), where the

![]() $ {Y}_i $

are continuous or discrete scalar outcomes for the treated and untreated states of Y(1) and Y(0) respectively, the

$ {Y}_i $

are continuous or discrete scalar outcomes for the treated and untreated states of Y(1) and Y(0) respectively, the

![]() $ {X}_i $

are covariates measuring pre-treatment characteristics of observational units, and the

$ {X}_i $

are covariates measuring pre-treatment characteristics of observational units, and the

![]() $ {T}_i $

are treatment indicators for whether an observational unit is an HBCU. For

$ {T}_i $

are treatment indicators for whether an observational unit is an HBCU. For

![]() $ M $

potential matches on treated observations, the imputed potential outcomes are

$ M $

potential matches on treated observations, the imputed potential outcomes are

![]() $ {\hat{Y}}_i $

(0) =

$ {\hat{Y}}_i $

(0) =

![]() $ {Y}_i $

if

$ {Y}_i $

if

![]() $ {T}_i $

= 0,

$ {T}_i $

= 0,

![]() $ {\hat{Y}}_i $

(0) =

$ {\hat{Y}}_i $

(0) =

![]() $ \frac{1}{M}{\sum}_{j\in {l}_{m\left(\mathrm{i}\right)}}{Y}_j $

if

$ \frac{1}{M}{\sum}_{j\in {l}_{m\left(\mathrm{i}\right)}}{Y}_j $

if

![]() $ {T}_i $

= 1,

$ {T}_i $

= 1,

![]() $ {\hat{Y}}_i $

(1) =

$ {\hat{Y}}_i $

(1) =

![]() $ \frac{1}{M}{\sum}_{j\in {l}_{m\left(\mathrm{i}\right)}}{Y}_j $

if

$ \frac{1}{M}{\sum}_{j\in {l}_{m\left(\mathrm{i}\right)}}{Y}_j $

if

![]() $ {T}_i $

= 0, and

$ {T}_i $

= 0, and

![]() $ {\hat{Y}}_i $

(1) =

$ {\hat{Y}}_i $

(1) =

![]() $ {Y}_i $

if

$ {Y}_i $

if

![]() $ {T}_i $

= 1, where

$ {T}_i $

= 1, where

![]() $ {l}_mi $

is an index

$ {l}_mi $

is an index

![]() $ l $

for

$ l $

for

![]() $ {T}_l $

$ {T}_l $

![]() $ \ne $

$ \ne $

![]() $ {T}_i $

that satisfies

$ {T}_i $

that satisfies

![]() $ {\sum}_{j\mid {T}_j\ne {T}_i}1\left[\left\Vert {X}_j-{X}_i\right\Vert \le \left\Vert {X}_l-{X}_i\right\Vert \right] $

= m

$ {\sum}_{j\mid {T}_j\ne {T}_i}1\left[\left\Vert {X}_j-{X}_i\right\Vert \le \left\Vert {X}_l-{X}_i\right\Vert \right] $

= m

![]() $ \in $

M. The indicator function

$ \in $

M. The indicator function

![]() $ l\left(\cdot \right) $

selects and matches observational units in the control group—with index

$ l\left(\cdot \right) $

selects and matches observational units in the control group—with index

![]() $ j $

—that are the

$ j $

—that are the

![]() $ {m}^{th} $

closest with respect to the distance norm

$ {m}^{th} $

closest with respect to the distance norm

![]() $ \Big\Vert $

$ \Big\Vert $

![]() $ \cdot $

$ \cdot $

![]() $ \Big\Vert $

.

$ \Big\Vert $

.

For a sample of N observational units with N

![]() $ _1 $

treated and N

$ _1 $

treated and N

![]() $ _0 $

controls, we consider three treatment effect parameters (Abadie et al., Reference Abadie, Drukker, Herr and Imbens2004):

$ _0 $

controls, we consider three treatment effect parameters (Abadie et al., Reference Abadie, Drukker, Herr and Imbens2004):

where

![]() $ {\tau}^P $

is the treatment effect for a randomly assigned observational unit of the population,

$ {\tau}^P $

is the treatment effect for a randomly assigned observational unit of the population,

![]() $ {\tau}_T^P $

is the treatment effect for observation units that actually received the treatment, and

$ {\tau}_T^P $

is the treatment effect for observation units that actually received the treatment, and

![]() $ {\tau}_C^P $

is the treatment effect for observation units in the control group, if they were exposed to the treatment.

$ {\tau}_C^P $

is the treatment effect for observation units in the control group, if they were exposed to the treatment.

For a given observational unit exposed to treatment, the treatment effect parameters enable causal inference with the use of so-called counterfactuals—the alternative state outcomes in which an observational unit is not actually exposed to the treatment (Shadish Reference Shadish2010). With matching, an estimate is made of outcomes had the observational unit not experienced exposure to the treatment under consideration. Thus, the causal effect of the treatment is conceptualized as a comparison of an observational unit in two possible states of the world; one in which there is exposure to treatment, and one in which there is no exposure to treatment—the counterfactual state. When estimating the treatment effects, we use two approaches. The generation of the counterfactual to estimate the treatment effect is enabled by a matching distance function which compares treated units with untreated units on the basis of: (1) a propensity score and (2) covariates.Footnote 7

The alternative state outcome is an empirical operationalization of David Hume’s (Reference Hume2000) counterfactual notion of causality (Lewis Reference Lewis1973, Reference Lewis2000).Footnote 8 In our empirical and econometric framework, we view the HBCU treatment as making a difference from what would have happened without it. Our estimate of the treatment effect of being an HBCU constitutes an exercise in viewing causality in a Humean sense whereby counterfactual dependence between certain types of outcomes and their absence establishes a causal relationship (Harbecke Reference Harbecke2021).

The three treatment parameters capture three different counterfactuals that can be estimated to determine the causal effects of a particular treatment. From a counterfactual causal perspective,

![]() $ {\tau}^P $

is the average counterfactual treatment effect for a random draw from the entire population of observational units,

$ {\tau}^P $

is the average counterfactual treatment effect for a random draw from the entire population of observational units,

![]() $ {\tau}_T^P $

is the average counterfactual treatment effect for a random draw from the subpopulation of observational units assigned to the treatment, and

$ {\tau}_T^P $

is the average counterfactual treatment effect for a random draw from the subpopulation of observational units assigned to the treatment, and

![]() $ {\tau}_C^P $

is the average counterfactual treatment effect for a random draw from the subpopulation of observational units not assigned to treatment. For each counterfactual causal parameter, a Rubin Causal matching estimator imputes the missing potential outcomes—the treated and untreated state—by using average outcomes for observational units with similar values for the matching covariates in the relevant population and subpopulation.

$ {\tau}_C^P $

is the average counterfactual treatment effect for a random draw from the subpopulation of observational units not assigned to treatment. For each counterfactual causal parameter, a Rubin Causal matching estimator imputes the missing potential outcomes—the treated and untreated state—by using average outcomes for observational units with similar values for the matching covariates in the relevant population and subpopulation.

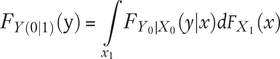

Our second parameterization of the treatment effect of being an HBCU deploys the counterfactual distribution decomposition framework of Victor Chernozhukov and colleagues (Reference Chernozhukov, Fernandez-Val and Melly2013). For the entire distribution of potential outcomes Y*

![]() $ _j $

and vector of characteristics X

$ _j $

and vector of characteristics X

![]() $ _j $

, let 0 be the population of non-HBCUs and 1 the population of HBCUs. For

$ _j $

, let 0 be the population of non-HBCUs and 1 the population of HBCUs. For

![]() $ j $

= 0 and

$ j $

= 0 and

![]() $ j $

= 1, and where the potential outcomes are realized (Y*

$ j $

= 1, and where the potential outcomes are realized (Y*

![]() $ _j $

= Y

$ _j $

= Y

![]() $ _j $

,

$ _j $

,

![]() $ \forall $

$ \forall $

![]() $ j $

), the conditional distribution functions that characterize the stochastic assignment of outcomes

$ j $

), the conditional distribution functions that characterize the stochastic assignment of outcomes

![]() $ y $

$ y $

![]() $ \in $

$ \in $

![]() $ Y $

to non-HBCUs and HBCUs with characteristics

$ Y $

to non-HBCUs and HBCUs with characteristics

![]() $ x $

$ x $

![]() $ \in $

$ \in $

![]() $ X $

is F

$ X $

is F

![]() $ _{Y_0\mid {X}_0} $

(y

$ _{Y_0\mid {X}_0} $

(y

![]() $ \mid $

x) and F

$ \mid $

x) and F

![]() $ _{Y_1\mid {X}_1} $

(y

$ _{Y_1\mid {X}_1} $

(y

![]() $ \mid $

x) respectively. The counterfactual distribution of outcomes that would have prevailed for HBCUs if they faced the non-HBCU distribution is:

$ \mid $

x) respectively. The counterfactual distribution of outcomes that would have prevailed for HBCUs if they faced the non-HBCU distribution is:

$$ {F}_{Y\left(0|1\right)}\left(\mathrm{y}\right)=\underset{x_1}{\int }{F}_{Y_0\mid {X}_0}\left(y|x\right){dF}_{X_1}(x) $$

$$ {F}_{Y\left(0|1\right)}\left(\mathrm{y}\right)=\underset{x_1}{\int }{F}_{Y_0\mid {X}_0}\left(y|x\right){dF}_{X_1}(x) $$

The difference in the observed outcome distribution between non-HBCUs and HBCUs, can be decomposed similar to the approaches of Ronald Oaxaca (Reference Oaxaca1973) and Alan S. Blinder (Reference Blinder1973) as:

where the first expression on the right is the difference in the outcome distribution due to differences in outcome structure and the second expression is due to differences in characteristics. The first expression is a measure of discrimination against HBCUs, as it captures any differences in outcomes, when HBCUs face the same outcome distribution as non-HBCUs.

Following Chernozhukov and colleagues (Reference Chernozhukov, Fernandez-Val and Melly2013), for a link function

![]() $ \Lambda $

, and location function for the conditional mean

$ \Lambda $

, and location function for the conditional mean

![]() $ P{(x)}^{\prime}\beta (y) $

we estimate the relevant parameters of the differences in the observed outcome distribution with a distribution regression specified as

$ P{(x)}^{\prime}\beta (y) $

we estimate the relevant parameters of the differences in the observed outcome distribution with a distribution regression specified as

![]() $ {F}_{Y\mid X}\left(y|x\right) $

=

$ {F}_{Y\mid X}\left(y|x\right) $

=

![]() $ \Lambda \left[P{(x)}^{\prime}\beta (y)\right] $

. The choice of a distribution regression specification is pragmatic, as relative to alternative specifications (e.g. quantile) does not require smoothness of the conditional density functions.

$ \Lambda \left[P{(x)}^{\prime}\beta (y)\right] $

. The choice of a distribution regression specification is pragmatic, as relative to alternative specifications (e.g. quantile) does not require smoothness of the conditional density functions.

Similar to the counterfactual Humean causal interpretations of the treatment parameters estimated in the Rubin Causal framework, the counterfactual decomposition parameters also permit a causal interpretation. The value-added of a counterfactual distribution decomposition framework is that when the potential outcomes equal the actual outcomes in the distribution, one can determine explicitly how much, if any, of the differences in the distribution of outcomes between HBCUs and non-HBCUs is due to differential treatment—perhaps as a result of discrimination.

Results

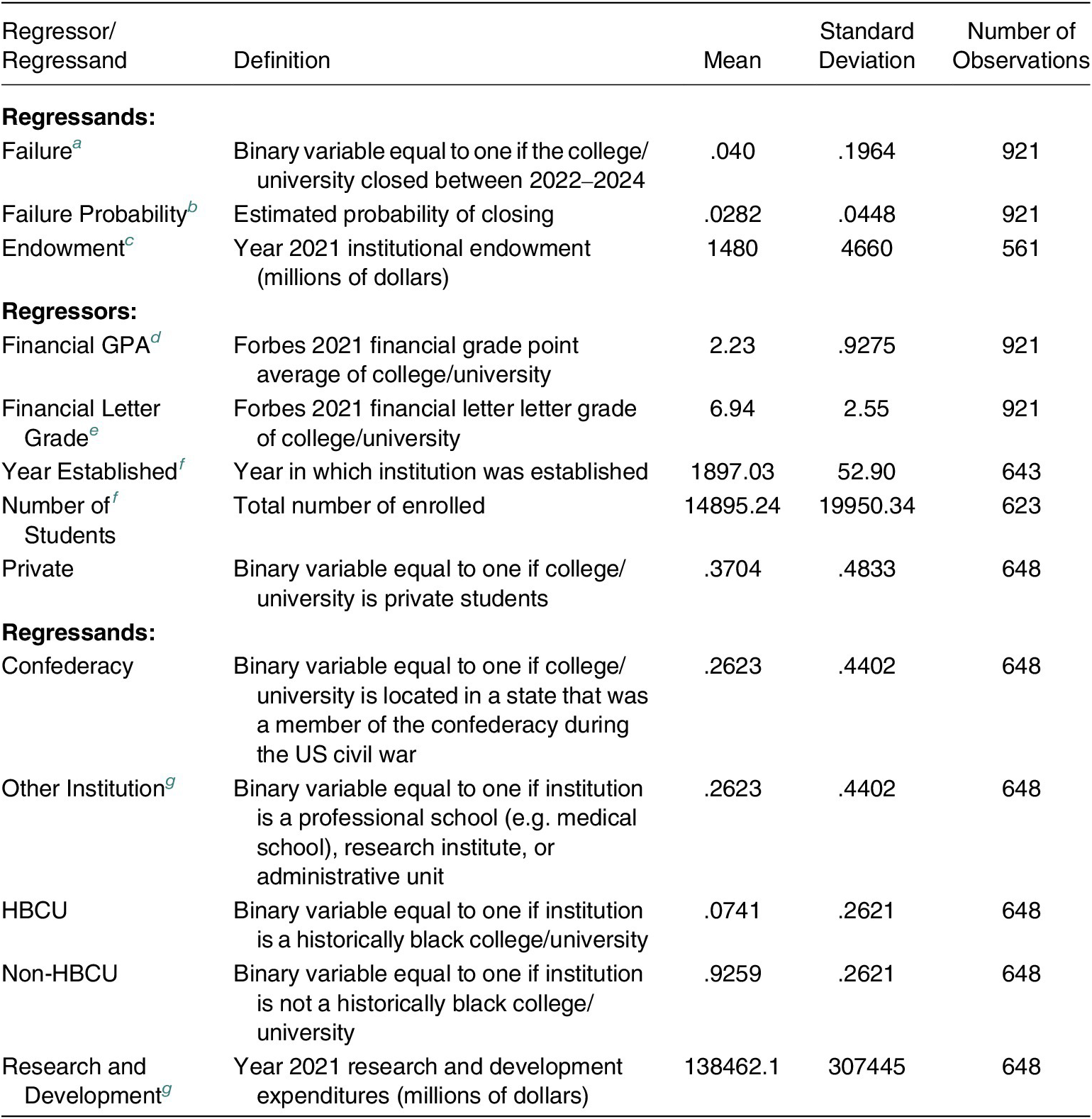

Table 1 reports a statistical summary, description, and source notes for all regressors and regressands utilized. All estimated Rubin Causal treatment parameter estimates use four matches with replacement, as there is evidence that four matches produces the lowest mean-squared error of treatment parameters (Abadie and Imbens, Reference Abadie and Imbens2002).Footnote 9 As matching parameter estimates can be biased if the matching is not exact, our matching parameter estimates use bias adjustment on the matching covariates (Abadie et al., Reference Abadie, Drukker, Herr and Imbens2004). For the failure probabilities, we match on two covariates derived from the data on private colleges/universities to enable the counterfactuals of the treated and untreated observations: (1) The standardized value of the financial GPA and (2) The encoded numeric value of the financial letter grade. We use six matching covariates derived from the data to enable the counterfactual endowment outcomes of the treated and untreated observations: (1) The quartile for the year a college/year was established to account for the possibility the endowment can accrue over time; (2) The quartile of total student enrollment; (3) The quartile for total research and development expenditures; (4) A binary variable for an college/university being private; (5) A binary variable indicating whether an institution is a professional school (e.g. medical school), research institute, or administrative unit for a system of state colleges/universities; and (6) A binary variable indicating whether the college/university is located in one of the former States of the U.S. Confederacy. To allow for the possibility that the conditional variance of the treatment effect to varies with the matching covariates and treatment, the parameter estimates are estimated with heteroskedasticity robust standard errors—also with four matches. In general, the matching covariates are derived from the data, and are motivated to enable a comparison of similar counterfactual treated and untreated observations, particularly within the context of financial and endowment stratification among colleges/universities (Lee Reference Lee2008).

Table 1. Description and Statistical Summary of Regressands and Regressors

Sources/Notes:

a The failure rate is based upon the private colleges/universities in the Forbes Magazine 2021 College Financial Health Grades, that closed—ceased operations—in years 2022–2024. The 2021 Forbes data reports for each college/university both a letter grade, and an overall financial grade point average. Closed colleges/universities were identified in the publicly available U.S. Department of Education College Scorecard data. See: https://www.forbes.com/sites/schifrin/2021/02/22/college-financial-grades-2021-will-your-alma-mater-survive-covid/?sh=f8199149163f; https://collegescorecard.ed.gov/

b Estimated from a logit specification where the binary dependent regressand is Failure, and the regressor is the college/university 2021 Forbes Financial Grade Point Average.

c Endowment as reported by the National Association of College and University Business Officers (NACUBO) for fiscal year 2021. For HBCUs that did not have reported values in the NACUBO data, publicly endowment data from TPinsights-The Plug for fiscal year 2021 are utilized. See: https://www.nacubo.org/Research/2022/Historic-Endowment-Study-Data; https://tpinsights.com/data-sets/hbcu-endowments/

e The letter value of the ten distinct financial health letter grades were numerically encoded into ten distinct number values.

f For each college/university, the data reported in Wikipedia as of June 1, 2022.

g Research and Development expenditures by college/university in 2021 as reported by the National Science Foundation based on on the National Center for Science and Engineering Statistics, Higher Education Research and Development Survey, Table 21: Higher education R&D expenditures, ranked by FY 2021 R&D expenditures: FYs 2010–21. See: https://ncses.nsf.gov/pubs/nsf23304

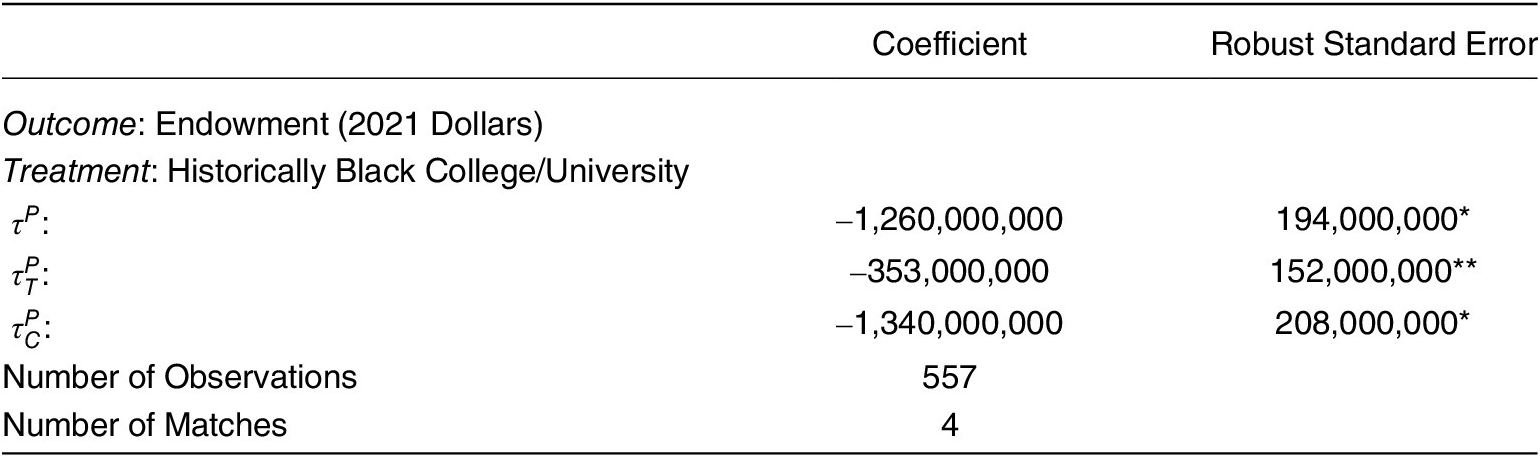

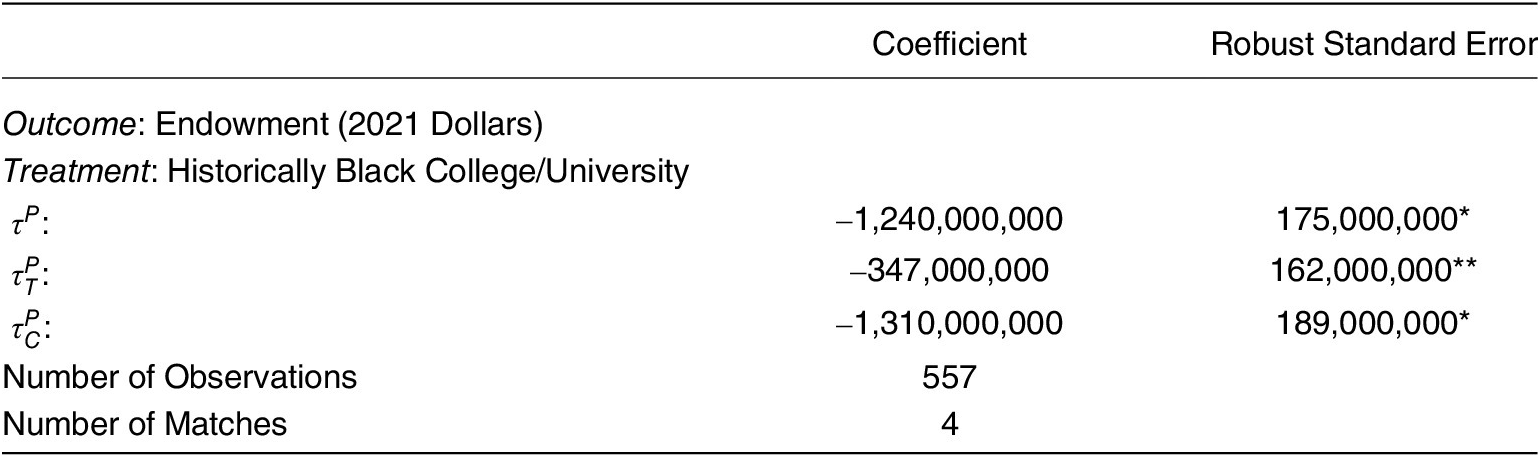

Tables 2 and 3 report Rubin Causal propensity score and covariate matching parameter estimates for the treatment effect of being an HBCU on the college/university endowment.Footnote

10 For both matching approaches, the parameter estimates are similar in sign, magnitude, and statistical significance, suggesting precision in our estimates of the treatment effects, and affording interpretation with the covariate matching parameter estimates, which are more robust to model specification (Imai et al., Reference Imai, King and Nall2009; Imai et al., Reference Imai, King and Stuart2008). The average treatment effect (

![]() $ {\tau}^P $

) is statistically significant, suggesting that for a randomly selected private college/university, being an HBCU decreases the endowment by approximately $1.2 billion. The statistically significant estimated average treatment effect on the treated (

$ {\tau}^P $

) is statistically significant, suggesting that for a randomly selected private college/university, being an HBCU decreases the endowment by approximately $1.2 billion. The statistically significant estimated average treatment effect on the treated (

![]() $ {\tau}_T^P $

) suggests that actually being an HBCU, relative and counterfactually to being a non-HBCU, has the effect of decreasing the endowment by approximately $340 million. If non-HBCUs were HBCUs, the statistically significant estimated average treatment effect on the controls (

$ {\tau}_T^P $

) suggests that actually being an HBCU, relative and counterfactually to being a non-HBCU, has the effect of decreasing the endowment by approximately $340 million. If non-HBCUs were HBCUs, the statistically significant estimated average treatment effect on the controls (

![]() $ {\tau}_C^P $

) suggests that there endowment would be lowered by approximately $1.3 billion. In tandem, the two estimated counterfactuals of not being an HBCU provided by

$ {\tau}_C^P $

) suggests that there endowment would be lowered by approximately $1.3 billion. In tandem, the two estimated counterfactuals of not being an HBCU provided by

![]() $ {\tau}_T^P $

and

$ {\tau}_T^P $

and

![]() $ {\tau}_C^P $

suggest that being an HBCU causes the endowment to be lower.

$ {\tau}_C^P $

suggest that being an HBCU causes the endowment to be lower.

Table 2. Rubin Causal Treatment Propensity Score Matching Parameter Estimates: The Effect of Being an HBCU on Endowment

*p

![]() $ < $

.01, **p < .05

$ < $

.01, **p < .05

Table 3. Rubin Causal Treatment Covariate Matching Parameter Estimates: The Effect of Being an HBCU on Endowment

*p

![]() $ < $

.01, **p

$ < $

.01, **p

![]() $ < $

.05

$ < $

.05

Parameter estimates for the counterfactual decomposition of the endowment distribution are reported in Table 4. All three of the estimated distributional decompositions parameters are positive and statistically significant. The magnitude of the effects of being a non-HBCU on endowment (

![]() $ {F}_{Y\left(1|1\right)} $

-

$ {F}_{Y\left(1|1\right)} $

-

![]() $ {F}_{Y\left(0|1\right)} $

) suggests that counterfactually, being a non-HBCU relative to being an HBCU, causes the endowment to increase by approximately $255 million. The estimated coefficient implies that if HBCUs were non-HBCUs, there endowment would been higher by $255 million, on average. Given the observed total distributional endowment differences (

$ {F}_{Y\left(0|1\right)} $

) suggests that counterfactually, being a non-HBCU relative to being an HBCU, causes the endowment to increase by approximately $255 million. The estimated coefficient implies that if HBCUs were non-HBCUs, there endowment would been higher by $255 million, on average. Given the observed total distributional endowment differences (

![]() $ {F}_{Y\left(1|1\right)} $

-

$ {F}_{Y\left(1|1\right)} $

-

![]() $ {F}_{Y\left(0|0\right)} $

) between HBCUs and non-HBCUs of approximately $1.7 billion, this suggests that approximately 15% of the endowment disparity ($255 million) between HBCUs and non-HBCUs is explained by discrimination—in the market for philanthropic endowment contributions/gifts—against HBCUs.

$ {F}_{Y\left(0|0\right)} $

) between HBCUs and non-HBCUs of approximately $1.7 billion, this suggests that approximately 15% of the endowment disparity ($255 million) between HBCUs and non-HBCUs is explained by discrimination—in the market for philanthropic endowment contributions/gifts—against HBCUs.

Table 4. Endowment Distribution Decomposition Parameter Estimates: The Effect of Being a Non-HBCU on Endowment

* p

![]() $ < $

.01

$ < $

.01

a Bootstrapped error based on fifty replications.

Overall, the parameter estimates reported in Tables 2–4 suggest that the racial distinctiveness of HBCUs is a cause of the endowment disparities between HBCUs and non-HBCUs. Our variety of estimated counterfactuals reveal that being an HBCU relative to being a non-HBCU has an adverse effect on surviving as an ongoing institution—which is a function of endowment—and on the amount of the endowment. Given the range of endowment losses caused by being an HBCU implied by the various counterfactual causal estimates in Tables 2–4, the statistically significant estimate of

![]() $ {F}_{Y\left(1|1\right)} $

-

$ {F}_{Y\left(1|1\right)} $

-

![]() $ {F}_{Y\left(0|1\right)} $

can inform a lower bound conservative estimate. As there are forty-five HBCUs in the endowment sample, the estimate of

$ {F}_{Y\left(0|1\right)} $

can inform a lower bound conservative estimate. As there are forty-five HBCUs in the endowment sample, the estimate of

![]() $ {F}_{Y\left(1|1\right)} $

-

$ {F}_{Y\left(1|1\right)} $

-

![]() $ {F}_{Y\left(0|1\right)} $

in Table 4 suggests that cumulatively, racial discrimination in philanthropic endowment contribution/gifts lowered the value of endowments for all HBCUs by approximately $11.5 billion. A less conservative, and perhaps upper bound estimate can be informed by the causal counterfactual parameter estimate of

$ {F}_{Y\left(0|1\right)} $

in Table 4 suggests that cumulatively, racial discrimination in philanthropic endowment contribution/gifts lowered the value of endowments for all HBCUs by approximately $11.5 billion. A less conservative, and perhaps upper bound estimate can be informed by the causal counterfactual parameter estimate of

![]() $ {\tau}_C^P $

—the endowment effects of non-HBCUs becoming counterfactually HBCUs in Table 4. In this instance racial discrimination in philanthropic endowment contribution/gifts has the effect of cumulatively reducing HBCU endowments by approximately $58.9 billion.

$ {\tau}_C^P $

—the endowment effects of non-HBCUs becoming counterfactually HBCUs in Table 4. In this instance racial discrimination in philanthropic endowment contribution/gifts has the effect of cumulatively reducing HBCU endowments by approximately $58.9 billion.

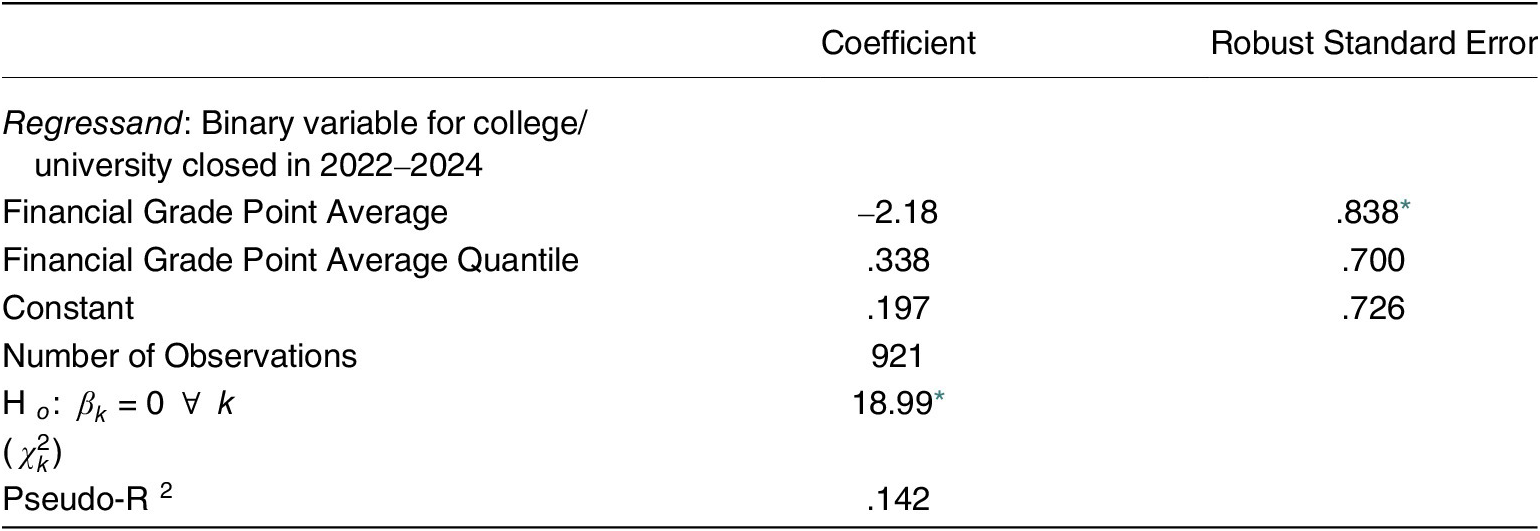

In Table 5, we report the Logit parameter estimates for the failure probability of the private colleges/universities—which is reported on as a regressand in Table 1.Footnote 11 We specify the failure probability as a function of the 2021 Forbes financial GPA, and the quartile in which the GPA falls—to capture possible unobserved distributional effects. As the failure is rare in a particular year for colleges/universities (Eide Reference Eide2018), and the adverse effects of a college/university’s balance sheet can plausibly take time, we measure failure for the private colleges/universities in our sample for the three year period of 2022–2024.Footnote 12 For the Logit parameter estimates in Table 5, while the probability of failure is decreasing with respect to increases in financial health, not all of the regressors are statistically significant. However, as the aim is to predict private college/university failure as a function of financial health—which is a function of endowment, this is satisfactory. Adeline Lo and colleagues (Reference Lo, Chernoff, Zheng and Lo2015) find that the presence or absence of statistical significance for a predictor regressor is not necessarily an optimal criterion for good or bad prediction—and they provide evidence of instances where statistically insignificant predictors generate accurate predictions. In general, classical hypothesis tests can lack sufficient power for detecting the predictive power for sets and subsets—which can include a number of unknown interactions—of regressors. Sara Shugars and Nicholas Beauchamp (Reference Shugars and Beauchamp2019) find that this is particularly true for out-of-sample predictive accuracy. As such, we retain the statistically insignificant regressors for predicting the probability that a private/college university will fail—which we use as a regressand in our treatment and distribution decomposition specifications to determine how HBCU status affects the probability of failure for a private college/university.Footnote 13

Table 5. Logit Parameter Estimates of Private College/University Failure as a Function of Financial Grade Point Average

* p

![]() $ < $

.01

$ < $

.01

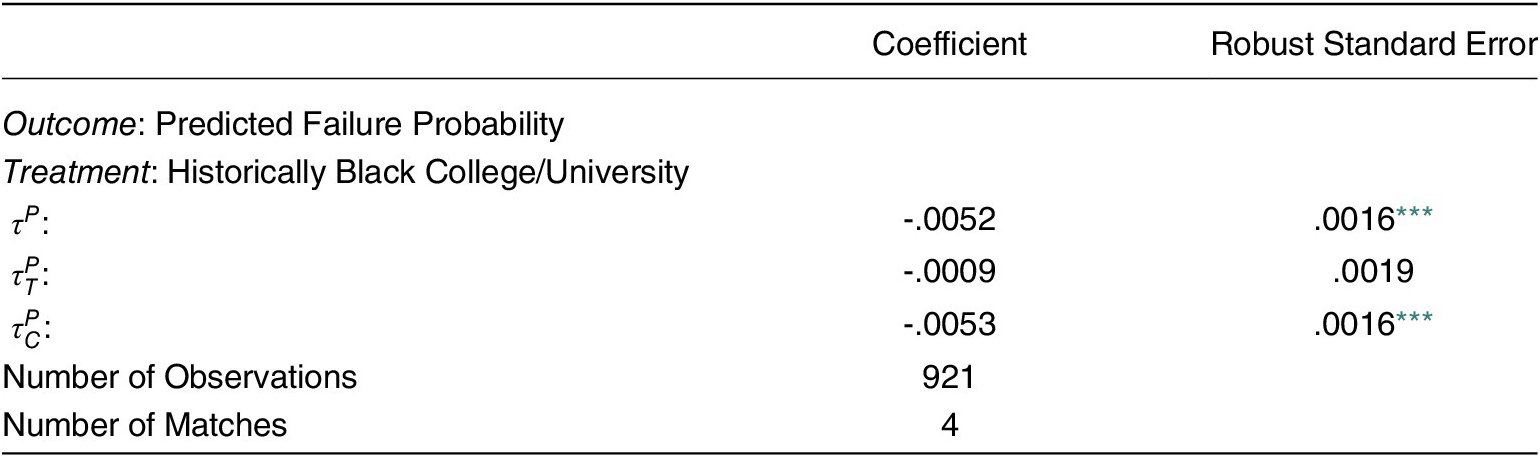

Tables 6 and 7 report Rubin Causal propensity score and covariate matching parameter estimates for the treatment effect of being an HBCU on probability of a private college/university failing.Footnote

14 For both matching approaches, the parameter estimates are similar in sign, magnitude, and statistical significance, suggesting precision in our estimates of the treatment effects, and affording interpretation with the covariate matching parameter estimates in Table 7, which are more robust to model specification (Imai et al., Reference Imai, King and Nall2009; Imai et al., Reference Imai, King and Stuart2008). The average treatment effect (

![]() $ {\tau}^P $

) is negative and statistically significant, suggesting that for a randomly selected private college/university, being an HBCU decreases the probability of failure. However as selection into the HBCU treatment is not random across the entire population of colleges/universities, the average treatment effect on the treated (

$ {\tau}^P $

) is negative and statistically significant, suggesting that for a randomly selected private college/university, being an HBCU decreases the probability of failure. However as selection into the HBCU treatment is not random across the entire population of colleges/universities, the average treatment effect on the treated (

![]() $ {\tau}_T^P $

) is perhaps more informative and relevant, and it is statistically insignificant. This suggests that actually being an HBCU, relative and counterfactually to being a non-HBCU, does not increase the likelihood of failure. In the sample, the financial GPAs of HBCUs relative to non-HBCUs is lower.Footnote

15 The negative sign and statistical significance of the average treatment effect on the controls (

$ {\tau}_T^P $

) is perhaps more informative and relevant, and it is statistically insignificant. This suggests that actually being an HBCU, relative and counterfactually to being a non-HBCU, does not increase the likelihood of failure. In the sample, the financial GPAs of HBCUs relative to non-HBCUs is lower.Footnote

15 The negative sign and statistical significance of the average treatment effect on the controls (

![]() $ {\tau}_C^P $

) informs the third causal counterfactual. If non-HBCUs were HBCUs, their failure probabilities would be lower, suggestive again, of HBCU endowments being more productive relative to non-HBCUs. Based upon covariate matching results in Table 7, this implies that relative to their mean sample failure rate, the counterfactual reduction in non-HBCU failure probability would be approximately twenty-one percent.Footnote

16 As this counterfactual is based on private colleges/universities with similar financial GPAs, an implication is that if non-HBCUs had HBCU status, they would have lower failure probabilities.

$ {\tau}_C^P $

) informs the third causal counterfactual. If non-HBCUs were HBCUs, their failure probabilities would be lower, suggestive again, of HBCU endowments being more productive relative to non-HBCUs. Based upon covariate matching results in Table 7, this implies that relative to their mean sample failure rate, the counterfactual reduction in non-HBCU failure probability would be approximately twenty-one percent.Footnote

16 As this counterfactual is based on private colleges/universities with similar financial GPAs, an implication is that if non-HBCUs had HBCU status, they would have lower failure probabilities.

Table 6. Rubin Causal Treatment Propensity Score Matching Parameter Estimates: The Effect of Being an HBCU on the Probability of Private College/University Failing

*** p

![]() $ < $

.10

$ < $

.10

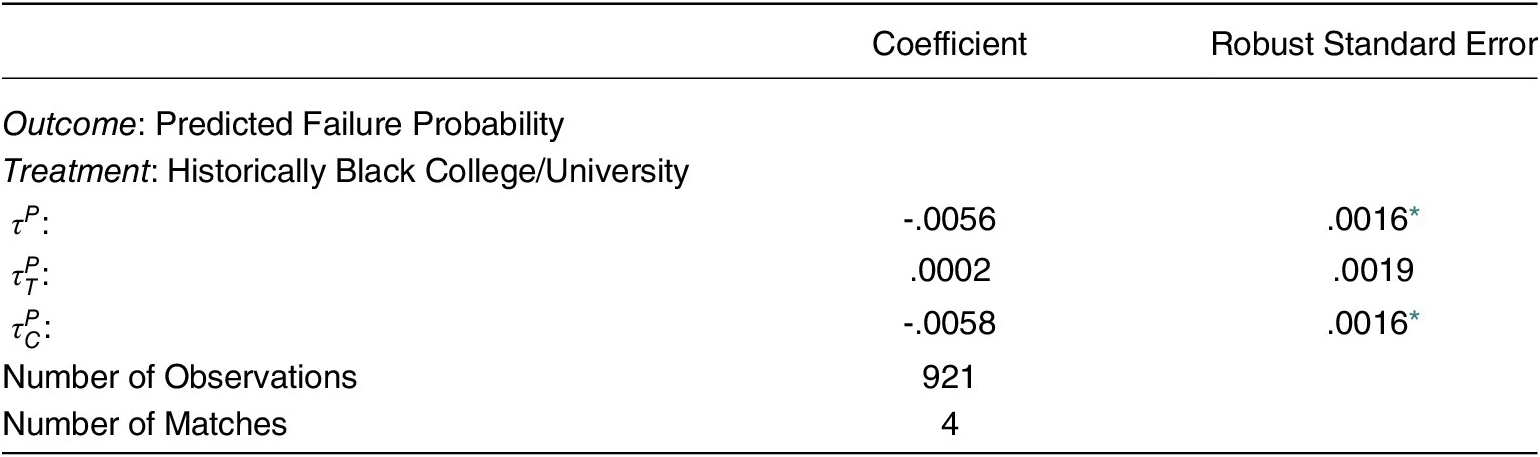

Table 7. Rubin Causal Treatment Covariate Matching Parameter Estimates: The Effect of Being an HBCU on the Probability of Private College/University Failing

* p

![]() $ < $

.01

$ < $

.01

As college/university financial health is proportional to its endowment (Bare 2024), the treatment effect parameter estimates in Tables 6 and 7 suggest that the lower relative endowments of HBCUs does not translate into financial insolvency that leads to failure. This also suggests that endowments at HBCUs are more productive relative to non-HBCUs, as per dollar of endowment, HBCU failure probabilities are lower.

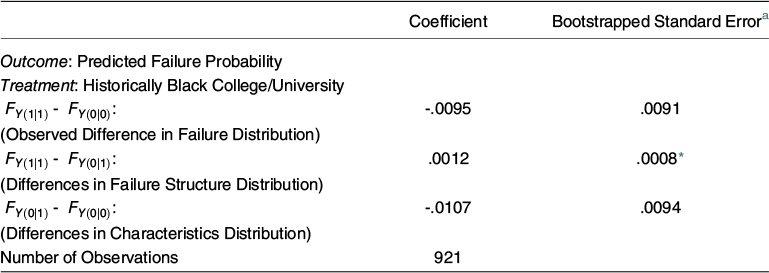

As the estimates in Tables 6 and 7 do not explicitly account for the possibility that HBCUs are treated differently relative to non-HBCUs, parameter estimates for the counterfactual decomposition of the failure probability distribution are reported in Table 8.Footnote

17 The overall observed distribution in failure probabilities (

![]() $ {F}_{Y\left(1|1\right)} $

-

$ {F}_{Y\left(1|1\right)} $

-

![]() $ {F}_{Y\left(0|0\right)} $

) and the component explained by different characteristics (

$ {F}_{Y\left(0|0\right)} $

) and the component explained by different characteristics (

![]() $ {F}_{Y\left(0|1\right)} $

-

$ {F}_{Y\left(0|1\right)} $

-

![]() $ {F}_{Y\left(0|0\right)} $

) is statistically insignificant. However, the distributional component explained by the racial distinctiveness of HBCUs (

$ {F}_{Y\left(0|0\right)} $

) is statistically insignificant. However, the distributional component explained by the racial distinctiveness of HBCUs (

![]() $ {F}_{Y\left(1|1\right)} $

-

$ {F}_{Y\left(1|1\right)} $

-

![]() $ {F}_{Y\left(0|1\right)} $

) is positive and statistically significant. This suggests that while for the overall distribution of failure probabilities, there are no differences between HBCUs and non-HBCUs, the racial distinctiveness of HBCUs appears to matter. The positive sign and statistical significance of (

$ {F}_{Y\left(0|1\right)} $

) is positive and statistically significant. This suggests that while for the overall distribution of failure probabilities, there are no differences between HBCUs and non-HBCUs, the racial distinctiveness of HBCUs appears to matter. The positive sign and statistical significance of (

![]() $ {F}_{Y\left(1|1\right)} $

-

$ {F}_{Y\left(1|1\right)} $

-

![]() $ {F}_{Y\left(0|1\right)} $

) suggests that, all things being equal, if non-HBCUs were counterfactually HBCUs in the sense of facing the HBCU failure distribution, the non-HBCU failure probability would be higher. The failure probability of a college/university reflects, at least in part, an inability to service existing and/or long-term operating expenses. As such, the positive sign and statistical significance of (

$ {F}_{Y\left(0|1\right)} $

) suggests that, all things being equal, if non-HBCUs were counterfactually HBCUs in the sense of facing the HBCU failure distribution, the non-HBCU failure probability would be higher. The failure probability of a college/university reflects, at least in part, an inability to service existing and/or long-term operating expenses. As such, the positive sign and statistical significance of (

![]() $ {F}_{Y\left(1|1\right)} $

-

$ {F}_{Y\left(1|1\right)} $

-

![]() $ {F}_{Y\left(0|1\right)} $

) suggests that HBCUs, with their higher failure probabilities relative to non-HBCUs, face discrimination from philanthropic donors who could provide endowment gifts to shore up balance sheets, and/or from lenders in financial markets who could refinance/restructure debt.Footnote

18

$ {F}_{Y\left(0|1\right)} $

) suggests that HBCUs, with their higher failure probabilities relative to non-HBCUs, face discrimination from philanthropic donors who could provide endowment gifts to shore up balance sheets, and/or from lenders in financial markets who could refinance/restructure debt.Footnote

18

Table 8. Failure Distribution Decomposition Parameter Estimates: The Effect of Being a Non-HBCU on the Probability of Private College/University Closing/Failing

* p

![]() $ < $

.01

$ < $

.01

a Bootstrapped error based on fifty replications.

Conclusion

This article considered both the consequences and causes of the endowment disparity between HBCUs and non-HBCUs. Historic and persistent inequality in the endowments between HBCUs and non-HBCUs is one component of racial inequality in the United States. This disparity in endowments is a likely consequential driver of racial inequality in general, that if closed, could enable some convergence, if not elimination of, racial disparities in income and wealth. With recent cross-section data, we estimate several causal counterfactual parameters, that estimate the impact of being an HBCU has on failure probability of a college/university failing, and on the endowment levels. The posited counterfactuals permit alternative states of the world in which HBCUs are non-HBCUs and vice versa, as a way to identify the causal effects of being a racially distinct HBCU.

We first estimated the parameters of HBCU treatment effect endowment specifications to identify the effects of HBCU status on a college/univerity endowments likelihood of failure as a function of its endowment-dependent financial health, and the extent to which it is explained by the racial distinctivness of HBCUs. Lastly, we estimated the parameters of an HBCU treatment effect and endowment distribution decomposition to determine if HBCU status mattered for a college/university endowment. Similar to the estimates of Thomas Sav (Reference Sav2000), and historical findings and conclusions of Adam Harris (Reference Harris2021), Gasman and Drezner (Reference Gasman and Drezner2008), Laura T. Hamilton and colleagues (Reference Hamilton, Dawson, Armstrong and Waller-Bey2024), Samuel M. Nabrit (Reference Nabrit1971), Charles V. Willie (Reference Willie, Willie, Garibaldi and Reed1990), and Melissa E. Wooten (Reference Wooten2015), our treatment effect parameter estimates suggest that the endowment disparities between HBCUs and non-HBCUs is caused, at least in part, by racial discrimination in philanthropic endowment contributions/gifts. With respect to a college/university failing as a function of its financial health―which is proportional to endowment―our failure decomposition parameter estimates suggest that the racial distinctiveness of HBCUs, all things being equal, has the effect of increasing their probability of failure relative to non-HBCUs.

Closing the endowment HBCU/non-HBCU disparity would be beneficial, as the endowments of colleges/universities finance human and intellectual capital that improve well-being—and HBCUs appear to have a comparative advantage in this regard. As HBCU status contributes to higher failure probabilities that are a function of college/university financial health, reducing the HBCU/non-HBCU endowment disparity would also enhance the ability of HBCUs to continuously exist. We find that if non-HBCUs were HBCUs, their failure probabilities would be higher. With respect to the endowment disparities, our various counterfactual causal parameter estimates suggest that the racial distinctiveness of HBCUs causes, and can account for, cumulative endowment disparities between HBCUs and non-HBCUs between $11.5 billion and $58.9 billion for the HBCUs in our estimating sample.

The top end of our estimated HBCU/non-HBCU cumulative endowment disparity of $58.9 billion provides a stark insight of the overall endowment inequality that exists, and would possibly persist between these two types of institutions. The nine generously endowed non-HBCUs considered in this article’s introduction have a cumulative endowment of approximately $153 billion. Our top end estimate of $58.9 billion in HBCU/non-HBCU endowment disparities constitues approximately 38% of the cumulative endowment of just nine generously endowed non-HBCUs. In this context, remedying the endowment shortfalls of HBCUs due to their differential treatment philanthropic would still result in a status quo of stark endowment inequality between HBCUs and non-HBCUs.

As our results implicate racial discrimination in philanthropic endowment contributions/gifts as a source of the endowment disparities between HBCUs and non-HBCUs, policy interventions that can induce philanthropic institutions move away from their existing racially inegalitarian practices (Beer et al., Reference Beer, Patrizi and Coffman2021; Cunningham et al., Reference Cunningham, Avner and Justilien2014), could increase HBCU endowments relative to non-HBCUs. One such policy intervention could be to increase the tax subsidy for contributions to HBCUs relative to non-HBCUs, as a way to incentivize more gifts to HBCUs from wealthy foundations. Of course, private philanthropic foundations are not the only source of endowment gifts to colleges/universities—alumni are also. In this case, a modest public policy intervention would be to also tax-subsidize individual gifts to HBCUs relative to non-HBCUs. However given long-standing persistent Black-White wealth disparities (Derenoncourt et al., Reference Derenoncourt, Kim, Kuhn and Schularick2022) HBCU alumni have less wealth to provision gifts to their HBCU alma mater, and there is evidence that HBCU alumni give back to their alma mater at a higher rate relative to relative to their non-HBCU peers (Stokes Reference Stokes2023). As such, two policy interventions warrant consideration. First, a public policy that distributes reparations to the descendants of Black American Slaves (Brooks Reference Brooks2004; Darity and Mullen, Reference Darity and Mullen2022) that closes Black-White wealth disparities could translate into larger endowment contributions/gifts from HBCU alumni. Second, to the extent that chattel slavery constrained the wealth accumulation trajectory of Black Americans (Craemer et al., Reference Craemer, Smith, Harrison, Logan, Bellamy and Darity2020), which constrained their ability to make gifts to HBCUs, private corporations who benefitted from chattel slavery could directly provide reparations to HBCUs in the form of endowment gifts (Marks Reference Marks2023).

While our findings implicate differential treatment of HBCUs relative to non-HBCUs in philanthropic donations, it provides no explicit insights into how the relative financial disadvantages of state-supported HBCUs are driven by historic and ongoing state-level underfunding (Ortega and Swinton, Reference Ortega and Swinton2018; Rose Reference Rose2022; U.S. Department of Education 2023). Extending our analysis to consider this is perhaps a worthwhile research effort, as this may be an important determinant of how endowments in publicly funded colleges/universities evolve over time. Our estimates do however control for whether an institution is private or public, which may capture, however imprecise, the role of state-level appropriations of state-supported colleges/universities. However, to the extent that relative to public non-HBCUs, public HBCUs are subject to discriminatory treatment in state appropriations, and our matching methodology captures this imprecisely, the estimates provided here on the effects of being an HBCU on failure probabilities and endowment levels could be downwardly biased.

Acknowledgment

The author acknowledges and is grateful for financial support from the Samuel DuBois Cook Center at Duke University and the Southern Reconstruction Fund.