I. Introduction

Tokenised assets are cyborgs of technology and law, born out of paradox. On the one hand, tokens can be exchanged globally and continuously on permissionless blockchains.Footnote 1 They minimise the need for trust between parties using technology.Footnote 2 On the other hand, assets such as claims, financial instruments, money and property rights, derive their economic value from institutionalised trust anchored in delimited jurisdictions and supported by legal enforcement mechanisms.

Interest in tokenising assets continues to grow,Footnote 3 and so does the heterogeneity of projects.Footnote 4 This proliferation heightens the tension between borderless exchangeable digital tokens and jurisdictionally bound assets. The lack of legal clarity remains among the most cited concerns regarding tokenisation. Legal literature has explored the property of the digital assets,Footnote 5 the legal effects of token transfers,Footnote 6 and the possibility to use tokens to represent property rights in assets.Footnote 7 Some approaches start from first principles to offer theoretical frameworks, while others focus on offering practical legal solutions.

However, the diversity of jurisdictions and the overlaps of property, commercial and financial laws complicate these efforts to bring intelligibility.Footnote 8 Existing literature shows gaps, particularly in addressing jointly legal, technical and operational aspects. Therefore, this paper establishes a high-level categorisation of the strategies employed to tokenise assets regarding the link between the token and the asset. This categorisation aims to facilitate legal and financial analysis, risks assessment and regulatory responses.

Tension between technologies and legal objects can be resolved in two ways. First, by adapting technical objects to match legal norms. Laws and regulations may recognise the usage of new technologies while maintaining processes and roles of intermediaries. Technologists then transcribe legal requirements in the functioning of digital systems.Footnote 9 This has been the predominant approach since the digitisation of financial assets in the past century. Some tokenisation projects have taken this approach. For example, regulatory requirements restricting asset transfers to qualified investors can be enforced through whitelist mechanisms at the smart contract level.

Second, by identifying or creating the legal constructions that provide legal certainty given a set of practices and technologies. This approach seems to have found some traction among the industry and regulators alike in the case of blockchains. This may be due to the historical development of digital assets in a relative grey area,Footnote 10 its political background,Footnote 11 or the particular constraints of the technology.Footnote 12 Market participants have progressively adopted some form of compliance with trends such as “Security Tokens,”Footnote 13 registered “Decentralised Autonomous Organizations”Footnote 14 and “Real World Assets.”Footnote 15 In parallel, major jurisdictions have issued frameworks attempting to accommodate these technical and commercial innovations legally. A notable example is the European Union’s Markets in Crypto-assets regulation (MiCA) which include provisions specific to tokenised assets: asset-referenced tokens and e-money tokens.Footnote 16

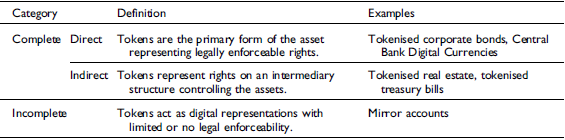

These two approaches have led to diverse legal structures for tokenised assets. This article identifies high level categories and compares them. We take the teleological view of categorising according to the level of legal certainty between tokens and their corresponding assets (Table 1). As a result, we identify three categories: Direct tokenisation, where tokens are the primary form of the asset; Indirect tokenisation, where tokens represent rights or claims through an intermediary structure; and incomplete forms where the token serves only as “digital twin” with limited or no legal value. Then, we discuss the impact of these categories on the key features of tokenisation regarding asset transferability, legal certainty, technical efficiency and composability. This analysis provides foundational categories for understanding the legal structures of tokenisation with practical insights for practitioners, policymakers, and scholars. It draws examples from various jurisdictions to illustrate and prepare further comparative analysis.

Table 1. Taxonomy of Legal Structures of Tokenisation

II. Direct Tokenisation

Direct tokenisation represents the purest form of asset tokenisation, but its feasibility is deeply tied to regulatory and technical constraints.

1. Nature of the token

In direct tokenisation, tokens are the primary form of the asset. Similarly to paper shares or digital register entries, tokens embody a legal instrument. The token is the instrumentum, while the asset is the negotium. Laws, or contracts, bind this piece of digital information with the legal right. In practice, this link can be established from the token to the legal documentation, conversely, or through mutual reference. The resulting assets are native to this tokenised form.

The legal nature of tokens and their treatment derives from the underlying legal instrument and applicable law:

-

• Financial instruments: When tokens represent financial instruments such as fund shares or bonds, financial laws and regulations generally provide a suitable framework to manage token transfers, public and private offers, and other parts of the asset lifecycle.Footnote 17 However, regulatory compliance requirements can create operational costs. For example, entities involved in dealing with such assets may have to obtain a licence and apply anti-money laundering measures.

-

• Money: As money is by definition an exchangeable and fungible asset, tokens are suited to represent forms of money. Central Bank Digital Currencies (CBDC) and deposits are considered under a token form.Footnote 18 However, as the response to the project Libra highlighted in 2019, monetary instruments remain subject to stringent oversight and politically sensitive.

-

• Property rights: Tokens can represent property rights on moveable assets as a “title” in English law for chattels.Footnote 19 However, this application presents practical challenges, such as maintaining an accurate and up-to-date record of the physical asset’s status, ensuring the uniqueness of the token representation, and handling situations where the physical asset is lost, damaged or modified.Footnote 20

-

• Digital deeds: Pushing that idea further, tokens could even be envisioned as an official document representing property in real estate. They would serve as digital deeds or “acte notarié.”

-

• Contractual rights: Tokens can represent a private contract or claim, such as ownership of assets, participation in revenue, or usage rights. In this case, possessing the token equates to being a party to the contract. The rights and obligations can be specified within the token itself or in separate oral or written arrangements.

-

• New instrument: Tokenisation can also be an opportunity for legal innovation or facilitating uncommon practices. For example, the tokenisation of account receivables or tokens offering perks when using particular services.

Conversely, some jurisdictions have adopted laws that aim to provide a similar treatment to different asset types. For example, Liechtenstein’s Token and Trustworthy Technology Service Provider ActFootnote 21 introduces the concept of a “token container model.” This model allows tokens to represent various kinds of rights, including ownership, membership rights, and other absolute or relative rights. The token acts as a container for these rights, facilitating their transfer.

2. Conditions for direct tokenisation

The feasibility of direct tokenisation is contingent upon several regulatory, technical and procedural conditions. These conditions may concern the full lifecycle of the asset, from its initial issuance to its destruction.

a. Issuance in a tokenised form

The legal framework must allow novel forms of asset representation. In some cases, assets can be represented freely. However, for financial instruments, many jurisdictions have historically mandated specific forms, such as paper-based registers or a database maintained by a specific actor. For example, in the European Union, transferable securities traded on a regulated trading venue must be recorded by a central securities depository (CSD).Footnote 22 In such cases, direct tokenisation is not possible without significant regulatory changes or exemptions.

To facilitate the development of new paradigms, several jurisdictions have enacted legislation explicitly allowing tokenised forms of financial assets. For instance, the French executive ordinance of 2017 permitted the representation of unlisted company shares via distributed ledger technology (DLT).Footnote 23 The ordinance gives information in the DLT the same legal value as traditional registers. The German Electronic Securities Act of 2021 implements similar adaptations with a much broader scope, allowing the issuance of electronic bearer bonds.Footnote 24

Projects have issued financial instruments directly on chain,Footnote 25 including sovereign bondsFootnote 26 or Money Market Funds,Footnote 27 but adoption remains limited. The European DLT Pilot Regime aims to foster these experiments by offering a form of regulatory sandbox for regulated institutions and challengers.Footnote 28 However, as noted by the European Securities and Markets Authority (ESMA) the pilot regime presents challenges, such as the lack of suitable form of money, limited interoperability with existing infrastructures, and “low thresholds for the DLT financial instruments.”Footnote 29 As a result, considering upfront costs, direct issuance remains unattractive except for specific use cases.

These token-specific efforts accompany a broader trend towards accepting the functional equivalence of digital forms of legal documents and digital signatures. The concept of functional equivalence, as recognised by United Nations Commission on International Trade Law in its Model Laws on signatures and on Electronic Transferable Records,Footnote 30 establishes that the legal effect of a digital representation should be equivalent to its paper-based counterpart, provided it fulfils the same essential functions. These principles have found their transcription into EU laws on electronic commerce and signatures.Footnote 31

b. Asset transferability

The practical utility of tokenised assets depends on their legal transferability, which may be constrained by statutory requirements or contractual limitations. Transferable securities and other types of financial instruments are generally designed for simple transfers. More generally, as highlighted by Garcia-Teruel and Simón-Moreno,Footnote 32 “In a number of countries, the mere consent of the parties is enough to transfer property ( e.g. art. 1196 French Civil Code, art. 1376 Italian Civil Code and s. 18(1) English Sale of Goods Act of 1979, which does not apply to real estate).” Additionally, some jurisdictions have specifically designed bearer debt or shares to facilitate trading.Footnote 33

However, even if individual transfers are valid through party consent, irregularities could occur in the transfer chain. As a result, the possessor of the token may not be its legal owner. Moreover, certain assets or rights require additional procedures. German corporate law, for example, necessitates that share transfers are reported to the commercial register.Footnote 34 This requirement could potentially delay or complicate the real-time transfer of tokenised shares and necessitate a mechanism to synchronise blockchain transactions with the commercial register. Similarly, French corporate practice often incorporates contractual preemption rights, requiring shareholder notification prior to share transfers. In such cases, direct tokenisation requires legal or contractual adaptations, or the implementation of appropriate mechanisms of programmed compliance. For instance, smart contracts could be designed to notify relevant parties and enforce preemption rights before finalising a token transfer.

c. Adequate digital infrastructures

In some cases, the technical feasibility of tokenisation is contingent upon the digitisation of associated processes. Real estate, for example, presents an intriguing case for tokenisation as legal documents such as deeds or their digitised form already represent property. However, real estate transactions involve multi-faceted processes and interactions with public registers. The tokenisation of such assets necessitates a complete digitisation of these processes in an interoperable and trust-minimised form. Therefore, not only should the regulatory framework be adapted, but also publicly operated services.Footnote 35 Efforts in Slovenia, Estonia and Georgia, implementing digital land registers, provide instructive case studies in this regard.Footnote 36

Similarly, identification and identity mechanisms are necessary for the integrity of tokenised systems. The pseudonymous nature of blockchain systems presents challenges in meeting regulatory requirements for party identification. Potential technical solutions include the integration of Know Your Customer (KYC) protocols on chain or the involvement of third-party custodians. Recent developments in decentralised identity (DID) and verifiable credentials, and usage of Zero-Knowledge Proofs could provide a solution that balances privacy concerns with regulatory compliance. However, implementations remain limited.

III. Indirect tokenisation

Tokenisation is indirect when a new financial instrument is issued as a token, backed by the original asset. The products of indirect tokenisation are asset-backed tokens. This process involves the creation of an intermediary layer for the purpose of tokenising the original asset, followed by the direct tokenisation of this layer. The resulting tokens derive their value exclusively from their link with the underlying original asset. Both assets will coexist, with different forms.

Indirect tokenisation can be used when the initial asset cannot be directly tokenised, necessitating the creation of an intermediary financial asset, or as a strategic choice of the issuer. Indirect tokenisation provides several benefits, including flexibility by allowing for the creation of customised investment products to represent an asset class and facilitating fractional ownership, enabling division of ownership rights among multiple investors. This approach is the continuation of traditional securitisation, where assets are pooled and repackaged into new securities, with the added technological dimension facilitating operations.

1. Intermediary legal structures

The holding structure can be a private company, designated as a Special Purpose Vehicle (SPV). The shares of this holding structure are issued as tokens. For example, in tokenising real estate, a company can be formed that owns the property. Retail investors can buy and own shares of this company as tokens. This approach is utilised by companies like RealT, which uses Delaware LLC series to create SPVs for real estate tokenisation. A new company is created for each real estate property. Their shares are native digital assets, but the property of the real estate itself is not directly tokenised.Footnote 37

A regulated fund can also be used as a holding structure.Footnote 38 The fund invests in a portfolio of assets, including stocks, bonds, and real estate, and its shares are tokenised. Depending on the jurisdiction, funds may provide additional guarantees to investors, as they can be subject to more precise regulations. For example in the European Union, under the Undertakings for Collective Investment in Transferable Securities (UCITS) Directive,Footnote 39 funds must appoint custodians for asset safekeeping and adhere to robust risk management practices. This regulatory framework can provide additional investor protection and potentially increase trust in tokenised fund shares.

In practice, the choice of a particular intermediary structure is guided by multiple parameters, such as taxation, flexibility, and registration costs. Other intermediary legal structures considered include trusts in common law countries, American Depository Receipts (ADRs), custodial relationships, or simple contractual claims.Footnote 40 The choice of structure has implications for investor rights and protections. For example, an SPV could be used to tokenize a luxury watch. The SPV would own the watch and each share represents a portion of the value of the watch. However, the SPV could contract other liabilities during its lifetime that reduces the value of each share. Projects are not always perfectly transparent on these consequences.

2. Particular cases of indirect tokenisation

Money represents ad hoc cases of tokenisation as units are fungible among different forms of money. Stablecoins aim at tokenising money, providing a stable asset in a fiat currency. Most stablecoins are backed by other forms of money, such as deposits or central bank reserves, along with safe assets, such as treasury bills. As a result, stablecoins can be categorised as a form of indirect tokenisation, using a novel intermediary legal structure. However, they are also perceived as native assets with money-like properties. Similarly, tokenised deposits or central bank reserves-backed stablecoins could also constitute hybrid tokenisation of money.Footnote 41 Only CBDCs are by definition an unambiguous product of direct tokenisation.

The intermediary legal structure can also be created through bespoke arrangements that combine existing legal forms and contractual mechanisms. For instance, a trustee might hold the assets and issue tokens onchain representing ownership. Alternatively, a registrar might maintain a register of ownership in a conventional legal format and guarantee bilateral synchronization of onchain and offchain records. Such arrangements require careful design to ensure data coherence and legal enforceability of the tokens. Without such measures, the arrangement might be a form of incomplete tokenisation.

A variant of this approach can be seen in the concept of open contractualisation. Vouchers are issued openly, enabling the holder of this voucher to engage with the emitting entity. It is a de facto bearer instrument. One example under German law is the “Auslobung,” a public announcement of a reward for the fulfilment of a specific performance or action.Footnote 42 This legal concept has been innovatively applied to tokenise shares of companies seeking to raise funds.Footnote 43 Each company promises economic participation rights to holders of its token. This approach enables possession and transferability of a form of economic ownership.

3. Underlying assets

In the case of indirect tokenisation, while the token itself is a financial asset, the initial asset continues to exist independently. Therefore, indirectly tokenised assets can be distinguished further depending on the nature of the link between the representation and the underlying asset. The asset’s original conservation, valuation, and claim strength significantly impact the token’s quality. The legal intermediary structure and operational arrangements must be analysed to evaluate the risks.

In the strongest cases, custodial arrangements can maintain a strong segregation of the underlying assets, kept by an intermediary distinct from the token issuers.Footnote 44 This is the case for stablecoins under MiCA, where they represent a claim on a segregated reserve.Footnote 45 In weaker cases, the underlying assets are part of the balance sheet of a company or a financial institution without guarantees in case of bankruptcy.

In some situations, we can distinguish the target asset from the backing asset. The target asset is the asset that the token aims to replicate financially, while the backing asset guarantees the token’s value. For example, in the case of a tokenised treasury bill, the target and backing assets are identical. In contrast, stablecoins such as USDC target a value of one dollar but are backed by a basket of monetary products to support their value. In some cases, the asset can be synthetic, mimicking the financial properties of the target asset or creating a new profile of asset. In such cases, there is no direct link with the backing assets.

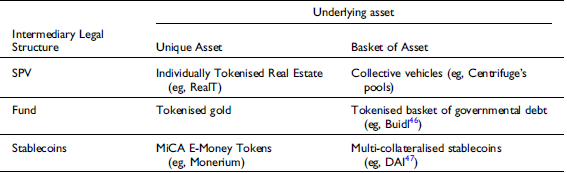

The table below summarises different possible links between tokens and their backing assets (Table 2). Claims rely exclusively on contracts. SPV and Funds rely on existing corporate and financial laws. MiCA provides a specific way to back a tokenised form of money, as “e-money tokens” with substantial financial guarantees.

Table 2. Examples of indirect tokenisations

IV. Incomplete tokenisation

While complete tokenisation creates digital assets that are legally enforceable, incomplete forms of tokenisation do not fully embody the legal rights of the underlying asset. These tokens can serve as an instrument to share information, manage assets, or prove facts.

1. Contractual Evidence

In the context of a contractual relationship, parties can select any source of information as the basis for their claims. For example, a contract for providing electricity designates the metre machine used to count usage. Payment is adjusted according to its readings. Similarly, the organisers of a festival can create vouchers sold at the entrance that can be redeemed for food and beverages.

A token can be used as such a evidentiary mechanism. An illustrative example is the HSBC Gold Token offering.Footnote 48 As outlined in the legal documentation, the tokens do not represent rights or value directly. As a result, holding a token does not equate to direct ownership of the underlying financial instrument. Thus, the term “HSBC Gold Token” refers exclusively to a pure financial instrument, the ownership of which is only evidenced by a token.Footnote 49

When evaluating such proof mechanisms, two questions emerge. First, the technical quality to account precisely for the claims. An electricity meter must be robust, audited, and sealed. Similarly, the reliability of the token as proof depends on the technical robustness, governance, transparency, and auditability of the DLT system used. Second, the strength of the legal claim and ultimately users’ confidence in their ability to obtain a good, a service or value by redeeming the token or a voucher. The information provided within the token, in the accompanying documentation, operational redemption mechanisms, and the relevant jurisdiction may have an impact on this guarantee.

2. Mirroring assets

In the case of mirroring, the token is merely information with limited legal value. This token can facilitate the identification of ownership. The claim is, by law or by contract, primarily represented in another system. This is common in traditional financial infrastructures, where multiple systems may represent views of the same underlying information.

For example, in the context of securities markets, CSDs and custodians maintain duplicate systems that reflect the same ownership information. However, the legal claim resides in one primary system, with others serving as mirrors for operational purposes.Footnote 50

While these incomplete forms of tokenisation may not carry full legal rights, they can still serve valuable purposes in terms of information sharing and process optimisation. These tokenised forms function as interfaces to the underlying systems. However, they also present challenges in ensuring consistency across all mirrored systems, managing permissions, and safeguarding confidentiality. Users and investors must be clearly informed about the limitations of these tokens to avoid misunderstandings about their legal status and enforceability.

V. Comparative risk analysis

The fundamental challenge of tokenisation is ensuring that the holder of a token is effectively the legal owner of the asset. Ideally, the possession of the tokens should equate to, or closely approximate, asset ownership. A strong bond provides legal certainty, facilitates exchanges, and allows more advanced operations. The token is a practical element of a legal chain linking a natural or legal person with economic value. The length and quality of this chain depend on the type of legal structure used for tokenisation.

1. Model of possession

The first link of this chain is the possession of the token. Cryptoassets can be possessed through the knowledge of a cryptographic private key.Footnote 51 Possessing a token means that the holder of this token can “control”Footnote 52 its movements. Moreover, the holder can prove possession, without moving the token, by signing an arbitrary message with the private key. The possession of private keys contributes to proving ownership.

However, token possession and legal ownership are not always equivalent, technically and legally. For example, tokens can be temporarily deposited in another smart contract to leverage Decentralised Finance (DeFi) protocols.Footnote 53 Moreover, private keys can be controlled by an intermediary, a custodianFootnote 54 or even a trust. The relationship between the custodian and the ultimate owner adds a new link to our chain. In cases of irregularity, such as error or fraud, the holder of the token may not be the rightful owner.

The remedies for mismatches between token possession and legal ownership depend on the model of ownership. In a bearer model, whoever possesses the asset is its owner. The bar to reclaim assets is high as the plaintiff must prove the irregularity in an action in rectification. In a registrar model, an intermediary manages a register that keeps track of ownership, often on behalf of the issuer. In such cases, the claimant may obtain rectification from this intermediary.Footnote 55

Token smart contracts can technically accommodate both bearer and registrar models.Footnote 56 In practice, the distinction is attenuated by several factors. When the underlying infrastructure is easily accessible, users may directly access information and initiate transfers, reducing the role of the registrar. Conversely, when tokenising assets, the registrar often retains control to validate particular transactions, force the reattribution of assets, or pause all transfers. However, such controls introduce new risks at odds with the design philosophy of digital assets on permissionless blockchains.

In the case of direct tokenisation, the possession model is generally determined by the asset. When a company issues shares, it is commonly required to know the ultimate owner of the shares and to control their transfers.Footnote 57 Therefore, registrar models are favoured. For projects conducting an indirect tokenisation, this strategic decision may influence the choice of a particular intermediary legal structure. In both cases, operational and legal details can have consequences on the responsibilities of the intermediaries and the type of action in rectification available. Incomplete forms of tokenisation, not bound by these models, have more flexibility.

2. Transfers and legal scope

Transfer of the token should also transfer ownership in cases of complete tokenisation. Such transfer can operate without additional formality in some legal systems or by simply adding metadata to the transaction.Footnote 58 For example, when preparing to adapt its legislation, the Swiss Federal Council identified that blockchains present properties well-suited to be used as digital registers.Footnote 59 The integrity and reliability resulting from trust-minimisation ensure a reasonable quality of recorded information. As a result, tokens may serve as proof for the parties involved without legislative changes.

Moreover, as DLTs necessarily involve multiple participants, information remains accessible, if not fully public. As a result, tokens can also serve as a source of information to third parties. When tokenisation is complete, this publicity could facilitate erga omnes effects.Footnote 60 A transfer of property is publicly known, and thus, rights and obligations could be enforceable by anyone. However, it is not uncommon that property transfers must be formally registered to be enforceable by third parties.Footnote 61 This can be circumvented with indirect tokenisation, as only the token and its associated instrument are transferred, while the underlying asset remains the property of the intermediary structure.

In contrast, incomplete tokenisation typically results in inter partes effects only. Here, the token transfer represents indicative information or a contractual arrangement between the parties involved. Third parties are generally not bound by or entitled to rely on this information.

3. Technical composability

In cases of direct tokenisation, our chain is shorter by one link as the token constitutes the asset directly. Conversely, the chain is almost broken in cases of incomplete tokenisation. Cases of indirect tokenisation offer the highest variability in terms of legal robustness.

Blockchains offer the possibility of adding new links to our chain, guaranteed by technology. A new token can represent another tokenised asset in a secure manner. The original tokenised asset is locked by a smart contract and in exchange a new asset is issued representing it. The resulting asset is a “wrapped” version of the original asset. For example, Ether, the base crypto asset of the Ethereum network,Footnote 62 can be wrapped into ERC20Footnote 63 tokens (WETH)Footnote 64 for easier interoperability.

Wrapped assets can also represent tokens from another platform, locked in a trust-minimised bridge, or a basket of assets, or “Pool.” Furthermore, synthetic assets can be used to combine different functions. For example, yield-bearing tokens combine the representation of an underlying asset with an automatic yield-generating strategy.Footnote 65

While the primary backing mechanism for wrapped assets is technological trust-minimisation, a legal claim can complement this trust-minimised link. This claim can be either explicitly stated in the token’s documentation or inferred from the parties’ intentions.

The ability to use such possibilities with tokenised assets is contingent on strong legal foundations. Incomplete tokenisations may have limited uses. For complete forms of tokenisation, the quality of the legal link, and the underlying assets may have cascading effects. Legal ambiguities in the base layer of tokenisation, such as cross-jurisdictional conflicts or insolvency proceedings on the underlying asset, can propagate through the entire chain of composed solutions. Composability increases the challenges of unwinding complex situations in case of disputes or technical failures.

For instance, tokenised assets are being used in DeFi protocols. They serve to generate yield and as collateral to collateralised loans. In case of a crisis, the liquidity of these assets is critical. It is expected that immediate liquidity will come from secondary markets. However, this liquidity depends on the ability to eventually obtain the underlying economic value. The legal enforceability of some legal structures may be challenging, especially in cross-border scenarios.

4. Securitizing further

The intersection of tokenisation, composability, and securities law offers further interesting opportunities. For example, mortgages or pledges can be automated with the tokenised representation of the asset. This could potentially reduce the time and cost associated with securing loans, particularly in cross-border situations.

Moreover, the blockchain can provide a transparent register of property rights and their securities. This increased transparency could help prevent issues like the “double-pledging” of collateral that contributed to the 2008 financial crisis.Footnote 66

Several jurisdictions have begun to adapt their legal frameworks to accommodate these possibilities. For instance, Luxembourg, which has established a framework to allow the issuance and transfer of tokenised assets, has carved out the appropriate measures to facilitate collateralisation.Footnote 67

Tokens resulting from direct and indirect tokenisation could be used as collateral. However, indirect tokenisation, as a form of securitisation, and secondary collateralisations may opacify assets. Underlying risks may be hidden from traders of higher level assets and such positions present systemic risks.Footnote 68

VI. Conclusion

Tokenisation represents a change in how we represent and transfer assets. This change of medium introduces new possibilities for financial innovation, but the exact nature of the tokenised right should remain clear. This work establishes a framework for categorising legal structures of tokenisation and demonstrates that the effectiveness of these new infrastructures depends on the robustness of their legal foundations.

When tokenisation is complete, tokens embody legal assets. Transferring the token is generally equivalent to transferring the asset. Token information serves as a source of legal information for involved parties and third parties. This category comprises two subcategories: direct and indirect tokenisation.

Direct tokenisation, where tokens are the primary form of targeted assets, offer the most straightforward legal structure. However, the possibility to tokenise directly is subject to various conditions, including regulatory requirements, technical feasibility, and the availability of identity mechanisms. Depending on the instrument that is tokenised and jurisdiction, the legal nature of tokenised assets varies.

Indirect tokenisation is the issuance as tokens of new financial assets backed by the initial assets. This approach can involve intermediary legal constructs, such as SPVs, funds or trusts. While offering flexibility, it introduces one, if not several, layers with potential associated risks. Projects presenting the underlying asset as simply “tokenised” without specifying the legal structure may obscure legal and operational risks from investors.

In incomplete tokenisation, tokens do not fully embody legal rights, acting as “digital twins.” These representations can serve as digital interfaces that facilitate information sharing and asset management while providing reliable evidence. However, incomplete tokenisation requires maintaining existing infrastructures and processes for the assets.

Our analysis reveals that current regulatory frameworks present fragilities and variability across jurisdictions. The robustness of the chain of rights linking a natural or legal person with the asset is a critical factor in the benefits of tokenisation. Indeed, tokenisation allows the composability of financial functions. Assets and financial services can be combined and recombined to offer new services in a trust-minimised manner, amplifying opportunities and risks. Therefore, each additional link in the chain of rights demands strong legal foundations to maintain system integrity.

This foundational work opens several areas for future research: to identify obstacles to direct and indirect forms of tokenisation, to assess risks for different legal structures, and to establish appropriate disclosure requirements to investors. Another area concerns the practical challenges that arise when digital token systems need to work alongside traditional systems, including duplicate and heterogeneous title forms. Finally, we could examine how tokenisation works across different jurisdictions and consider paths for harmonisation or, at least, predictable dispute resolution.

Since Bitcoin’s inception, blockchains and DLTs have demonstrated their potential as global infrastructures for asset exchange. However, the development of appropriate legal structures and regulatory frameworks remains a limiting factor in their broader adoption as a backbone for financial infrastructures. The challenge ahead lies in aligning technological capabilities with legal certainty and regulatory compliance. Success in this endeavor will determine whether tokenisation can fulfill its promises.

Acknowledgment

The author would like to thank Michel Rauchs, Victor Charpiat, Val Lee, Ciarán McGonagle, and Alexis Bourdillat for their comments on initial versions of this work. Paper initially presented at the Blockchain and Digital Assets Conference at HEC Paris in November 2023 and accepted for publication in the European Journal of Risk Regulation in October 2024.