Introduction

The connections between economics, stability and security are particularly obvious at the macro level. Essentially, macroeconomic stabilization is a foundation for growth, leading to economic and social stability and ultimately bolstering the state’s security. The economic security of each country acquires particular importance in the context of the increasing number of interstate conflicts and contradictions at the macroeconomic level (Ouedraogo et al. Reference Ouedraogo, Mlachila, Sourouema and Compaoré2022). The concept of ‘economic security’ refers to the condition of a country’s economy, capable of withstanding internal and external challenges (Jankovska et al. Reference Jankovska, Tylchyk and Khomyshyn2018). This includes global conflicts and sudden plunges in financial and economic activity, such as the ones observed during the COVID-19 pandemic (Adrian et al. Reference Adrian, Natalucci and Qureshi2023) or crises, the scale of which can be compared with the 2008–2009 financial crisis (Borio et al. Reference Borio, Shim, Shin, Borio, Robinson and Shin2023). Economic security is vital to national security, representing a country’s capacity to withstand global crises, foster stable growth, and maintain competitiveness within the international financial and economic system (Gryshova et al. Reference Gryshova, Kyzym, Hubarieva, Khaustova, Livinskyi and Koroshenko2020). The level of economic stability is impacted by various factors such as macroeconomic conditions, international relations and cooperation between states, domestic policies, economic status, growth trends, and global financial and economic stability.

As a fundamental prerequisite for maintaining economic security at a high level, financial stability implies a state in which macro-financial risks are unlikely. At the same time, macro-financial risks are integral determinants of the economic environment (Ábel and Siklos Reference Ábel and Siklos2023). Potentially, they affect the state of macroeconomic and macro-financial indicators and, as a result, can provoke a decrease in the state’s economic security level. The impact they have is mainly negative. The macroeconomic conditions that prevailed during the global financial crisis significantly impacted the behaviour of economic entities within national systems, causing a shift in the effectiveness of their operations. The capital structure of any economic entity (which includes the state as an integrated system of financial and economic processes and a separate company as a representative of the national business sector) is quite sensitive to macroeconomic and financial shocks. Therefore, the government’s early deployment and implementation of appropriate policies are essential in the response system to global financial imbalances (Homapour et al. Reference Homapour, Su, Caraffini and Chiclana2022). The 2007–2009 financial crisis confirmed the importance of financial destabilization and changes in the level of economic security of countries that are members of the global community and emphasized the need to support financial stability at all levels. Developed economies have effectively used macroprudential and monetary policies to support national financial systems and protect them from the destructive impact of risks caused by destabilization. Developing countries have combined a variety of tactical moves, including using interest rate instruments with currency interventions, macroprudential policies, and sometimes capital flow management measures to address capital flow and exchange rate volatility (Borio et al. Reference Borio, Shim, Shin, Borio, Robinson and Shin2023). To achieve financial stability, it is crucial to recognize how changes in the global financial system are interconnected with economic indicators representing the state of individual national economies.

The member states’ accession to the EU has bolstered economic and financial integration in the region, facilitating the establishment of a robust framework for macroeconomic and financial stability among new EU members. However, the influence of macro-financial stability carries inherent risks, particularly in the face of global financial crises. Therefore, as Cihak and Fonteyne (Reference Cihak and Fonteyne2009) highlighted, implementing more prudent policies and reinforcing macro-financial stability at the EU level are deemed necessary.

In EU countries, financial stability is ensured by the guiding influence of the European Central Bank (henceforth – the ECB) and common EU methods (Morgan and Pontines Reference Morgan and Pontines2014). Stability in the European financial market is only relative and quite vulnerable because there are factors that indicate a potential deterioration of the macro-financial situation (European Central Bank 2023b):

-

• first, financial markets remain dependent on adverse macro-financial and geopolitical developments, potentially exacerbated by the high vulnerability of non-bank financial institutions and investment funds;

-

• second, the high costs of borrowing and debt servicing will only further test the stability of households, companies and governments of the Eurozone countries in the long run, which will cause economic danger for them;

-

• third, as a vital element of the financial system, the banking sector in Eurozone countries has specific advantages, particularly in the context of interest rate growth. However, it faces increased funding costs, lower credit volumes, and reduced asset quality. These challenges pose a risk to macro-financial stability in the global landscape.

According to an analysis of current trends related to the economic security of EU countries, the macro-financial conditions are being tightened due to increasing geopolitical risks. That is causing a ripple effect on the real economy of member states, which are already struggling with weak growth, high inflation, and rising geopolitical tensions (European Central Bank 2023b).

Considering these aspects, the search for interdependencies between financial stability and economic security of individual states does not lose its relevance. It becomes especially valuable in the urgent need to protect national economies. The conditions for ensuring a stable state of macro-financial indicators are using efficient financial process management tools selected considering the current macroeconomic situation. It also applies to the optimal choice of political steps to prevent the aggravation of crises, the emergence of which is caused by massive economic and geopolitical conflicts, as well as the increased volatility and vulnerability of the global financial system against the background of current trends.

Financial stability plays the role of the main prerequisite for sustainable economic development. The presence of volatility complicates the conditions for economic activity, negatively affects growth, and worsens financial and economic indicators, collectively creating threats to national economies (Le Fort Varela et al. Reference Le Fort Varela, Gallardo and Bustamante2020). Eliminating and preventing macro-financial imbalances creates a robust basis for each country’s economic security, preventing critical situations and potentially reducing the likelihood of threats that can have a destructive effect on national economies.

Considering these aspects, this article aims to research the influence of macro-financial stability on economic security among EU member states with different levels of development.

To achieve the aim, the following hypotheses were formulated and examined:

H1: The EU’s financial stability affects the economic security of EU members.

H2: The EU’s financial stability impacts economic security regardless of the development level of EU members.

Literature Review

The stability of financial processes at the macro level, in a general sense, reflects the ability of the financial system, in particular financial institutions, intermediaries, financial markets and the corresponding infrastructure, to withstand financial imbalances and shocks (Nosheen and Rashid Reference Rashid2021), and internal and external problems. Financial stability is a side effect of stable conditions in the banking, the financial market, and the real economy sectors (Wan Reference Wan2022). It is studied as a primary condition for maintaining the economic security of countries at the proper level. In this context, it was noted that this is a state of the financial system in which it can simultaneously effectively perform its three key functions. First, ensure a rational distribution of resources to maintain their smooth movement from depositors to investors and ensure a general redistribution of economic resources. Second, assess the expected financial risks accurately and manage them effectively. Third, to be characterized by being such a state that it can comfortably or even smoothly absorb financial and real economic surprises, shocks and threats, preventing their impact on the economic and financial security of the state in advance. Failure to perform at least one of the abovementioned functions indicates instability, creating real threats to reducing economic and financial security (Schinasi Reference Schinasi2005). The lack of financial stability hinders economic activity. When financial markets are not functioning correctly or significant financial institutions face pressure, it can adversely affect businesses and households. In the long run, this can harm the real economy, as capital cannot flow freely into deserving investments. That, in turn, can lead to threats to economic stability and security, such as the credit crisis and other related issues (Nelson and Perli Reference Nelson and Perli2007).

The uninterrupted operation of the financial sector ensures efficient financial resource redistribution, as stated in the work of Verheliuk et al. (Reference Verheliuk, Koverninska, Korneev and Kononets2019). The effective interaction between the real and financial sectors of the economy is based on continuous flows of investment resources. Manta et al. (Reference Manta, Badareu, Florea, Staicu and Lepădat2023) stated that a reliable financial system is a prerequisite for increasing investment flows and promoting entrepreneurship and general economic growth, making the state of the national economy less vulnerable to risks and strengthening the system’s resilience to external threats. A close interdependence between the concepts of ‘financial stability’, ‘financial development’, and ‘financial and economic security’ is observed, where each category implies the growth, modernization and stability of the financial sector. Development in this context is directly related to improving and expanding the network of financial institutions such as banks, stock markets, etc., and the financial services they offer. At the same time, stability results from efficient resource allocation and capital mobilization. Together, stability and sustainable development reduce the likelihood of unforeseen crises and protect the economy from threats. Regardless, under certain conditions, they can contribute to increasing income inequality among the population, focusing attention on another side of the problem that is no longer related to the topic of our study (Manta et al. Reference Manta, Badareu, Florea, Staicu and Lepădat2023). Studies by Olokoyo et al. (Reference Olokoyo, Ibhagui, Babajide and Yinka-Banjo2021) and Mabkhot and Al-Wesabi (Reference Mabkhot and Al-Wesabi2022) suggest a correlation between slowing down economic development and growth, decreasing stability, and destabilizing trends in the financial sector’s structure. Specifically, these findings indicate that the efficiency of banks or other financial institutions’ work has declined and contributed to these trends. Considerable attention to the connection between financial stability and external imbalances, particularly the net international investment position and the country’s external debt, was investigated in the works of Andrieş et al. (Reference Andrieş, Chiper, Ongena and Sprincean2023) and Alberola et al. (Reference Alberola, Estrada and Viani2020). The researchers have demonstrated that the financial system’s destabilizing tendencies can be the primary reason behind a country’s economic indicators’ decline and destabilizing events in nations. This highlights the interconnectedness of the categories under study. The results of Kalyuzhna et al. (Reference Kalyuzhna, Khodzhaian and Baron2023) confirm that macro-financial stability and other external factors can have a destructive effect on economic security at the national level.

Economic security has come to the forefront of current political discussions. The essence of the category is often considered in the context of national security, an element of world trade, and a political determinant, focusing on the state’s geopolitical goals. The rise in interstate conflicts, such as the ongoing war in Ukraine, has led many countries to seek ways to protect their national economies from the risks posed by increasing geopolitical tensions, fragmentation of the global economy, disturbance to world trade, and the worsening state of global supply chains (Ossa Reference Ossa2023). It is worth noting that economic security requires a balance between the state’s financial, socioeconomic, and political interests. This balance creates stability and helps ensure the system can withstand potential threats. In this context, Shigeaki (Reference Shigeaki2022) notes that economic security is ‘establishing a balance between economic and political logic from the perspective of maximising national interests’. One of the significant obstacles in carrying out this task is that stability is a subjective notion, and the approaches of politics and economics in unstable conditions differ significantly. While economics aims to restore and enhance economic and financial efficacy through market-based principles, politics prioritizes values that may deviate from economic efficiency (Shigeaki Reference Shigeaki2022). Głowacki (Reference Głowacki2022) analyses the category precisely from the standpoint of economic interests and even equates it with the ‘economic stability’ or ‘macroeconomic stability’ concepts. The scholar claims that signs of instability can disrupt the entire state’s socio-political system.

However, in developed countries, the triad of economy, stability, and security is less evident than in the economies of Central and Eastern European countries (Khan et al. Reference Khan, Khurshid and Cifuentes-Faura2023). Macro-financial stability is becoming more and more relative. Considerable attention is focused on managing short-term macroeconomic risks, and stabilization of financial conditions occurs due to supplementing monetary and fiscal policy with macro-prudential regulation instruments (Bank for International Settlement 2022). The study of imbalances is increasingly becoming a crucial step in countering threats of destabilization. One of the diagnostic methods – Macroeconomic Imbalances Procedure (henceforth – MIP), which is based precisely on the early warning of imbalances in macroeconomic and macrofinancial indicators, allows early detection of the preconditions for exacerbating crisis trends. The level of economic security is significantly reduced in the conditions of imbalances. Their accumulation can not only lead to critical vulnerability of the national economy and the financial sector, in particular, in individual member states, it can also negatively impact the systems of other EU member states due to the spread of the crisis (Dany-Knedlik et al. Reference Dany-Knedlik, Kämpfe and Knedlik2021; Bacchinia et al. Reference Bacchinia, Cannatab and Donà2020). In this context, stabilization is the monitoring of imbalances, which allows the early formation of a request for reforming certain processes (Bricongne et al. Reference Bricongne, Mata Garcia and Turrini2019).

Examining ways to protect a country’s economic interests during times of potential instability and implementing measures to maintain economic security coincide with pursuing strategies to ensure financial stability and overcome financial uncertainty. Some researchers emphasize the role of globalization and integration processes. According to Apergis (Reference Apergis2019), expanding the financial market through globalization and integration processes has led to new risk channels. As a consequence, there is a growing need to maintain stability in order to reduce financial vulnerability. In this context, we can conclude that financial stability and financial and economic security are mutually dependent. On the one hand, financial stability plays a crucial role in ensuring economic security, fostering sustainable growth, and promoting overall well-being. On the other hand, control of the level of financial and economic security is the primary step toward achieving macroeconomic and macro-financial stability (Vaitkus and Vasiliauskaitė Reference Vaitkus and Vasiliauskaitė2022).

The study’s relevance lies in exploring the impact of financial stability on the macroeconomic level and its association with the economic security of EU members. This topic has been under-explored by previous researchers, particularly considering the varying levels of development among these countries. By delving into this area, the research aims to contribute valuable insights into the dynamics between financial stability and economic security, shedding light on aspects that have received limited attention in existing literature.

Methodology

Following the aim and the proposed hypotheses for assessing the EU members’ economic security level, the MIP indicators (Appendix B) were chosen as the primary data source, which became the dependent factors. This is a set of indicators reflecting the presence of imbalances in the structure of economic and financial processes. In 2011, the MIP assessment methodology was introduced to respond to the worsening of crisis phenomena. Bacchinia et al. (Reference Bacchinia, Cannatab and Donà2020) suggest that this method still serves as a helpful tool for efficiently detecting potential threats to the economic security of EU members. The assessment outcomes are then employed to support subsequent reforms. The procedure for assessing imbalances involves the determination of 14 indicators indicating the presence of imbalances in financial and economic processes. In fact, the indicated set of indicators is a unique source of data for a comprehensive assessment of the economic security level and the country’s development and well-being within its borders (Verrinder Reference Verrinder2017).

As indicators that affect the economic security of EU countries and reflect the stability level of the financial system, a set of indicators was chosen that most clearly describe the trends in the functioning of the financial sector:

-

• deficit/surplus of the general government sector (%),

-

• government debt (% of GDP),

-

• the inflation rate indicator (Harmonized Index of Consumer Prices, HICP) (% deviation),

-

• composite indicator of systemic stress (Composite Indicator of Systemic Stress – CISS) (%) (Appendix A).

Several highly developed EU states (Germany, France and Italy), as well as several developing EU states (Poland, Romania and Hungary), were chosen as the basis for the study of the interdependence between macro-financial stability and economic security. The IMF proposed this method of dividing the country by development level (IMF 2023). The reason for selecting two groups of countries with varying levels of development was to establish a correlation between the selected factors and to demonstrate that the indicators are interlinked irrespective of a country’s development level. Considering the factor of the country’s development during the study enables us to speak about the relatively unconditional dependence of the economic security of the EU members on the EU’s financial stability. The ten years from 2012 to 2021 were chosen for the study.

Using these indicators, a multifactor regression analysis was conducted using Microsoft Excel software, correlation indicators between factors (Multiple R) were found, and the quality of the regression line was displayed, which is shown in Tables 4 and 5 in the form of the corresponding coefficients of determination (R-square).

Results

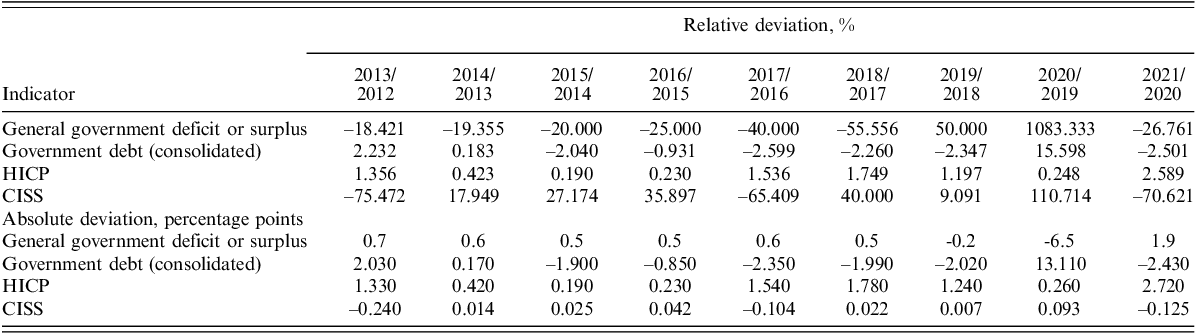

The general dynamics of EU macro-financial indicators during 2012–2021 and deviations in their values are demonstrated in Table 1.

Table 1. Relative and absolute deviation in EU macro-financial indicators, 2012–2021 (general values for the EU) (adapted from European Central Bank 2023a, Eurostat 2023).

The data in Table 1 attest to the general stability in the EU during the years studied. However, the COVID-19 pandemic emerged as the most significant disruptive factor for the EU financial system. During this period, the deficit of the general government sector increased by 6.5 percentage points, public debt rose by 13.1 percentage points, and the inflation rate grew by 0.26 percentage points. The Composite Indicator of Systemic Stress (CISS) confirmed the pandemic’s negative impact on financial processes, with systemic stress levels increasing by 0.093 percentage points in 2019–2020.

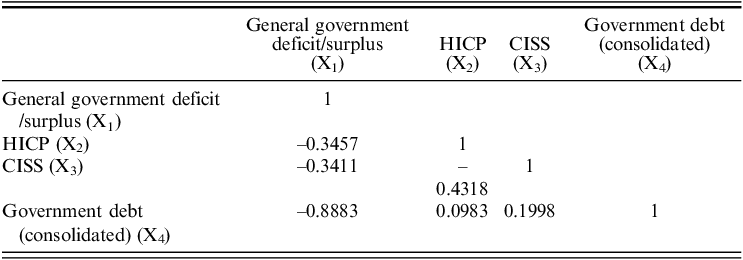

A correlation matrix was constructed to check the independence of the variables (Table 2).

Table 2. Correlation matrix of independent variables.

A strong correlation (0.8883) between variables X1 and X4 allows one of the indicators to be removed from further research. Since the correlation between X1 and other selected factors is stronger than the correlation between X4 and other selected factors, removing the indicator X1 – the level of deficit/surplus of the general government sector – is appropriate.

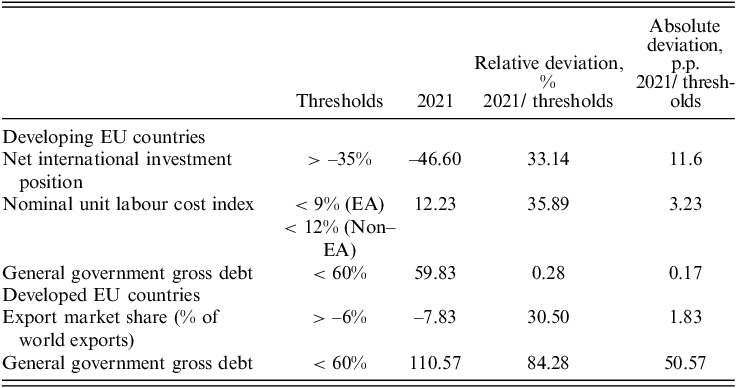

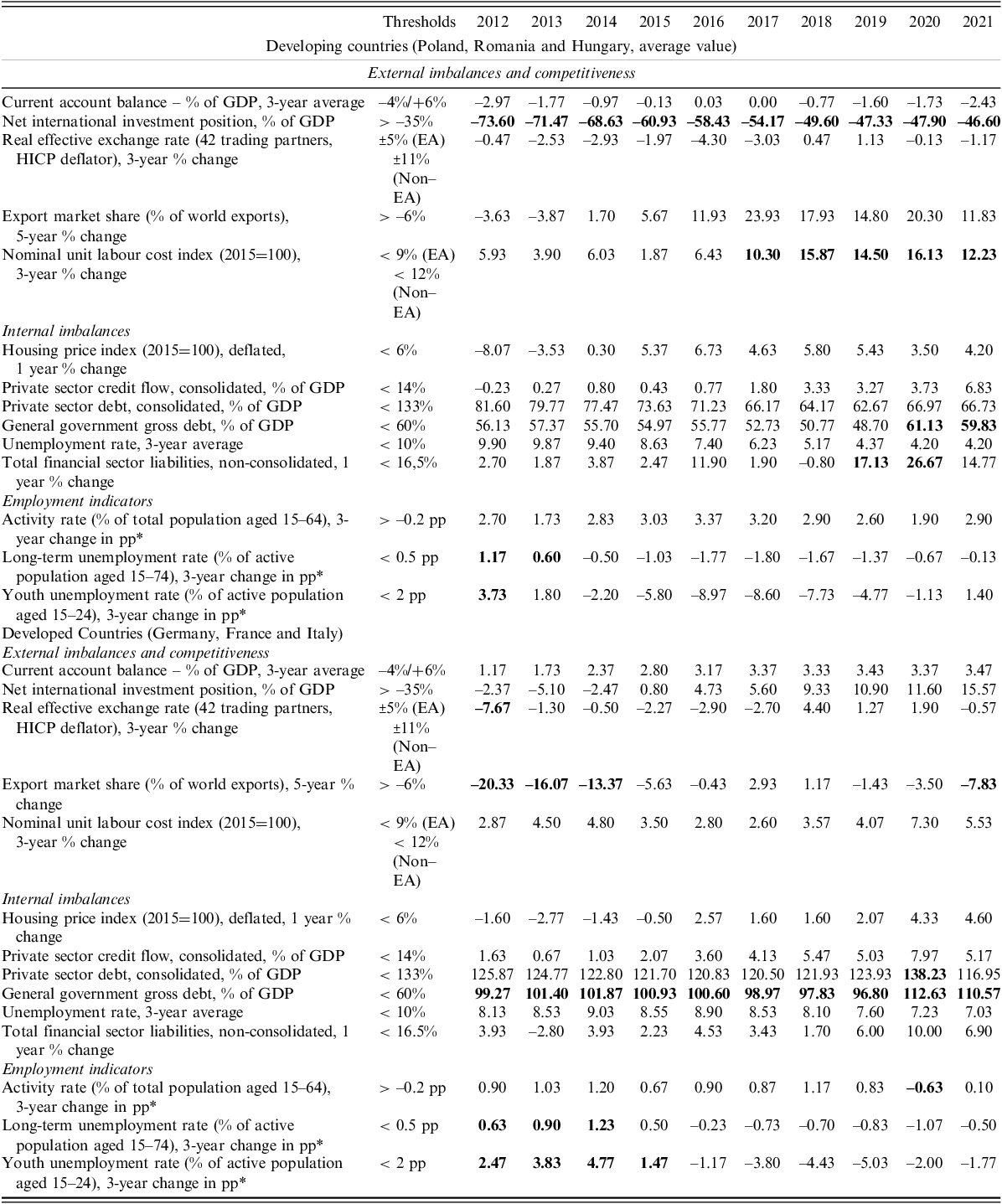

As of 2021, significant imbalances were characteristic of the net international investment position, general government gross debt, nominal unit labour cost, and export market share (Table 3).

Table 3. The absolute and relative deviation of MIP indicators in 2021 from normative values (average calculated data for developing and developed countries) (adapted from European Commission 2022).

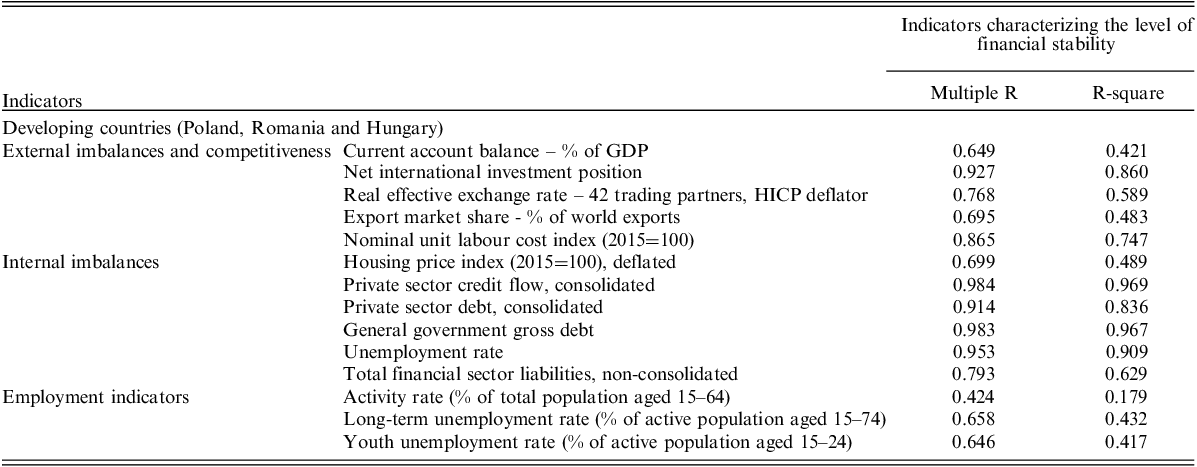

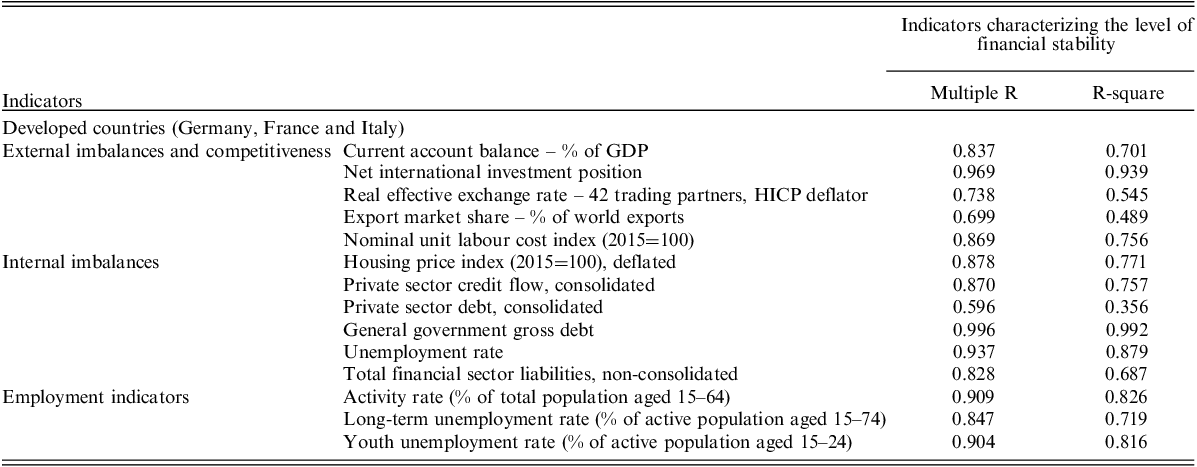

The impact of macro-financial stability on the MIP indicators of developing countries was studied using regression analysis, the results of which are demonstrated in Table 4.

Table 4. Results of regression analysis.

The results for developing countries demonstrate:

-

• Strong dependencies for internal imbalances (e.g., private sector credit flow, private sector debt, general government gross debt, and unemployment rate) and partially for external imbalances and competitiveness (e.g., net international investment position and nominal unit labour cost index).

-

• Moderate dependencies for external imbalances and competitiveness indicators (e.g., current account balance, real effective exchange rate, and export market share), as well as certain internal imbalances (housing price index and total financial sector liabilities) and employment indicators (long-term and youth unemployment rates).

-

• Weak correlations between financial stability and general economic activity indicators.

These findings confirm Hypothesis H1, demonstrating that the EU’s financial stability significantly impacts the economic security of its member states. The strong relationships between financial stability metrics and key economic security indicators highlight the critical role of macro-financial stability in developing countries.

The regression analysis results for the developed countries are shown in Table 5.

Table 5. Results of regression analysis.

The results for developed countries indicate:

-

• Strong dependencies for internal imbalances (e.g., housing price index, private sector credit flow, general government gross debt, unemployment rate, and total financial sector liabilities) and external imbalances and competitiveness (e.g., current account balance, net international investment position, and nominal unit labour cost index). Employment indicators also consistently show strong dependencies.

-

• Moderate dependencies for certain external imbalances and competitiveness indicators (e.g., real effective exchange rate and export market share) and internal imbalances (e.g., housing price index and private sector debt).

These results support Hypothesis H2, confirming that financial stability impacts economic security consistently across both developed and developing countries. However, nuances in sensitivity are evident: employment indicators exhibit stronger dependencies in developed countries, whereas external imbalances, such as the net international investment position, have a more pronounced effect in developing countries.

Hence, it can be claimed that the EU’s financial stability plays a vital role in shaping economic processes and influencing key indicators across both studied groups of countries. While financial destabilization negatively impacts economies regardless of their development level, developed countries exhibit a greater ability to mitigate imbalances due to their advanced financial systems. Nevertheless, even these economies cannot fully shield themselves from the pressures of destabilization, as demonstrated during systemic shocks such as the COVID-19 pandemic.

The analysis confirms both hypotheses:

H1: The EU’s financial stability significantly impacts the economic security of its members through robust and consistent relationships with key indicators such as government debt, private sector credit flow, and employment rates.

H2: Financial stability affects economic security consistently across development levels, although variations in indicator sensitivity reflect structural differences between developed and developing countries.

The EU’s financial stability plays a pivotal role in influencing macroeconomic processes across its member states. Developed countries show greater resilience in managing imbalances due to their sophisticated economic structures, yet they remain vulnerable to systemic shocks. Developing countries, on the other hand, face heightened risks from external imbalances, underscoring the need for targeted financial reforms to strengthen their economic foundations.

These results validate the hypotheses and provide valuable insights into the macro-financial dynamics within the EU. They underscore the importance of tailored policy interventions to address specific vulnerabilities, ensuring sustainable economic security for all member states in the long term.

Discussion

The research proved a connection between macro-financial stability and the state of economic security of the EU members, and this dependence is characteristic of both developing and developed countries. The corresponding R-squared values shown in Tables 4 and 5 reflect the quality of the regression line, expressed by the compliance level between the original data and the regression model. Considering the proximity of the values of most indicators to 1, one can argue about the high quality of the regression line. It is possible to infer that a present correlation may lead to a rise in imbalances and a decline in economic stability if destabilizing trends affect the overall pan-European financial and economic landscape.

Tables 4 and 5 show that there is a strong correlation between the indicators revealed and the weighted average amount of debt within the EU (X4), inflation (X2), and the composite indicator of systemic stress (X3), regardless of the state’s development.

The correlation between stability factors and the country’s international investment position is strong (for developing countries, R = 0.927; for developed countries, R = 0.969). Several risks are associated with a decline in the net international investment position. These include a potential rise in external debt or an increase in the cost of servicing it, a decrease in the value of the national currency due to reduced investor interest, a decline in investment flows in the real sector of the economy, a general deterioration of the investment climate, and a potential decrease in the country’s rating on the global stage. According to Andrieş et al. (Reference Andrieş, Chiper, Ongena and Sprincean2023), trends in external imbalances cause further shocks. That confirms the conclusions obtained in our study about the correlation between financial stability and the country’s external imbalances and agrees with the study of Vaitkus and Vasiliauskaitė (Reference Vaitkus and Vasiliauskaitė2022) and Alberola et al. (Reference Alberola, Estrada and Viani2020).

These findings highlight the direct influence of financial stability on the economic resilience of developing countries, particularly through internal imbalances, supporting Hypothesis 1. This aligns with the conclusions of prior studies (e.g., Kasal, Reference Kasal2023; Alberola et al., Reference Alberola, Estrada and Viani2020), which emphasize the interconnectedness of financial systems and economic outcomes.

The correlation between indicators of financial stability and the level of gross debt of the general government sector confirmed in our study (for developing countries, R = 0.983; for developed countries, R = 0.996) proves the opinion that the economic security of the country cannot be at a high level in conditions of destabilization. The lack of stability in financial processes will hinder balancing the debt. It will only worsen the economic situation, creating additional risks for the system and its sectors. Such a conclusion was also obtained in the work of Kasal (Reference Kasal2023) – a positive financial stress shock harms economic activity as it increases public debt. However, some researchers (Afonso et al. Reference Afonso, Baxa and Slavík2018) focus on the fact that production responds positively to an increase in the debt ratio in low and high-financial stress regimes. Nevertheless, this conclusion may not be applicable universally. The level of a country’s development is a crucial factor in this context, and this assertion is the outcome of a research study that analysed the correlation in highly developed nations.

These findings align with research by Borio et al. (Reference Borio, Shim, Shin, Borio, Robinson and Shin2023) and Alberola et al. (Reference Alberola, Estrada and Viani2020), which emphasize that systemic risks affect advanced and emerging economies similarly but with varying degrees of exposure. This supports Hypothesis 2, which underscores the consistency of financial stability’s influence across different development levels. The observed differences underline the need for differentiated policy approaches to strengthen economic security across regions.

A destabilized state among the studied developing EU countries characterizes the indicator of the nominal value of a unit of labour force. The strength of the correlation between financial stability and the specified indicator is 0.865 (for developing countries) and 0.869 (for developed countries). In the case of a decrease in the macro-financial stability level of the EU for member countries, the risk of reducing the cost of labour, which is determined by wages, increases. The consequences of this trend can have various effects. On the one hand, the declining wages of employees have decreased their socio-economic status and ability to maintain economic comfort. This could potentially hinder the growth of migration processes and impact the overall quality of life of the population. Nonetheless, on the other hand, an increase in the cost of a unit of labour force can lead to a rise in inflation. Financial destabilization is strongly correlated with the cost of a unit of labour force. However, it can have both a direct and an inverse effect on the indicator, depending on the presence and strength of influence of other factors. To objectively evaluate the impact of a change in labour cost per unit, one must consider various factors such as state development level, innovative potential and technologies, production automation, unemployment rate, inflation level, and enterprise efficiency. Our study in this part only partially correlates with the previous findings. Zoaka and Güngör (Reference Zoaka and Güngör2023) claim that the efficient, stable functioning of the financial system will inevitably lead to an increase in labour productivity, which does not consider the factor of changes in labour costs and its impact on other economic processes.

Another indicator beyond the normative values among developed EU countries is the export market share. The strength of the correlation between this indicator and financial stability indicators is 0.695 (for developing countries) and 0.699 (for developed countries). The correlation is moderately strong. The coefficient of determination is 0.483 and 0.489, respectively, which proves the importance of other factors influencing the indicator because only 48.3% of the model built for developing countries and 48.9% of the model built for developed countries are explained by the impact factor financial stability. Among the studied countries, the export market share is lower than its normative value by 30.5%. Such a trend may indicate the presence of competitive pressure on the studied countries, a decrease in international demand, or a post-pandemic consequence. The moderate correlation between the indicators is actively studied in the example of different countries and was previously confirmed in the Chinese province of Jiangsu (Xinzhong Reference Xinzhong2022). Financial development has been observed to have a relatively weak influence on the province’s growth and structure of export trade. The stable development of international activity and the transformation and improvement of export activity results from various external and internal factors working in coordination. This suggests that financial stability cannot be given priority in achieving these goals. In this context, our study complements the previously obtained conclusions of Xinzhong (Reference Xinzhong2022) and confirms that they are also valid for EU countries.

Thus, the interdependence between financial stability and the level of economic indicators of the studied states confirms the importance of maintaining constant stability of financial processes and the system in general. This conclusion entirely correlates with the results of studies by Manta et al. (Reference Manta, Badareu, Florea, Staicu and Lepădat2023), Olokoyo et al. (Reference Olokoyo, Ibhagui, Babajide and Yinka-Banjo2021), and Mabkhot and Al-Wesabi (Reference Mabkhot and Al-Wesabi2022). A stable system is crucial for ensuring uninterrupted financial investments. That, in turn, enables effective management of public debt, maintaining an optimal exchange rate for the country, and balancing economic activity and unemployment through regular reviews of wage levels. Our research findings complement the conclusions of Manta et al. (Reference Manta, Badareu, Florea, Staicu and Lepădat2023) regarding the crucial role of financial resources in preventing internal and external imbalances, sustaining competitiveness, and protecting employment from adverse trends. Also, it contributes to the works of Olokoyo et al. (Reference Olokoyo, Ibhagui, Babajide and Yinka-Banjo2021) and Mabkhot and Al-Wesabi (Reference Mabkhot and Al-Wesabi2022), which emphasize the significance of financial stability in promoting economic security and development across countries.

Conclusions

The study concluded that macro-financial stability refers to the ability of the financial system, including all its components, participants, processes, and intermediaries, to function effectively, withstand both global and national shocks, facilitate efficient distribution of financial resources, and maintain optimal conditions to prevent economic imbalances of varying degrees. In assessing the stability of the macro-financial system, one of the basic requirements is to consider the role of financial stability indicators in the economic processes of the state. Specific harmful patterns can cause instability and disrupt the economy. These patterns can affect the redistribution of finances, contribute to inflation, create problems in the labour market, worsen the investment climate, increase public debt, and result in additional costs. Collectively, these factors can pose a threat to the overall economic security of a country.

Correlation-regression analysis on the example of developed and developing EU countries confirmed such dependence between factors. Particular fluctuations in indicators of financial stability can cause external and internal imbalances because correlation indicators between factors are at a high level.

Practical Implications

The results can be used to form economic development plans and management tactics for external and internal imbalances under increased risk of financial destabilization. The study is a conclusion on the influence of financial stability on the state of MIP indicators, the use of which is an original approach to measuring the state’s economic security. The conclusions obtained reflect how external imbalances and competitiveness of the economy, internal imbalances, and employment indicators can change under the impact of financial destabilization, which is an essential element in the formation of tactics for managing economic and financial processes in the state. Understanding the relationship between the financial stability of the EU and the economic security of its member countries can be highly beneficial for candidate countries and potential candidates for the EU. This knowledge can help predict possible changes in economic imbalances upon acquiring EU membership status.

Limitations

The conducted research has some limitations. First is the data used. Several developing and developed EU countries were selected for analysis. Considering the differentiation in the levels of countries’ development from different continents and the difference in the management policies of financial and economic processes, the conclusions obtained may not be confirmed for other countries. Second, there were time limitations. The analysis was carried out based on data from 2012–2021. Therefore, results obtained during the study implementation based on the indicators of another period may differ. Third, these are the indicators selected for the study. It was proposed to use MIP indicators across EU countries as dependent factors and some EU financial indicators as influencing factors. The study’s results may have new conclusions by choosing other indicators to measure financial stability or the economic security level.

Future Research Directions

To manage the economic security of EU countries during times of high vulnerability in financial stability indicators, future research should focus on finding ways and tactics to balance external and internal imbalances. Future studies can be conducted not only on the example of EU member states but also on candidate countries or potential candidates because such countries will be able to assess how indicators of external and internal imbalances will change under the influence of the European financial system.

Appendix B. The average value of the MIP scoreboard for developing (Poland, Romania, Hungary) and developed countries (Germany, France and Italy), 2012–2021 (adapted from European Commission 2022)

Note: Figures in bold are the ones at or beyond the threshold.

About the Authors

Volodymyr Korneev, Doctor of Economic Sciences, Professor of the Department of Finance named after Viktor Fedosov, Kyiv National Economic University named after Vadym Hetman. His research interests include finance, financial stability, financial services and technologies, banks, non-bank financial institutions, capital markets, digitalization, lending, and investment.

Alina Khodzhaian, Doctor of Economic Sciences, is a professor, Head of the Department of Economic Theory, Macro- and Microeconomics at Taras Shevchenko National University of Kyiv. Her research interests include the problems of economic theory and economic policy, macroeconomics and macroeconomics regulation of the economy, economic security and sustainability of the national economy.

Oleksandr Dziubliuk, Doctor of Economic Sciences, is a full professor in the Department of Finance at the Western Ukrainian National University. His research interests include the problems of organization of money circulation, functioning of the banking system, peculiarities of monetary policy, monetary and currency regulation of the economy.

Natalia Kozmuk, PhD, is an assistant professor in the Department of Social Welfare and Personnel Management, Faculty of Economics, Ivan Franko National University of Lviv. Her research interests include social responsibility of business, corporate social responsibility, entrepreneurship development in extreme conditions, liquidity of the banking system in the face of financial instability.

Nataliia Shehynska, PhD, is an associate professor in the Department of Social Welfare and Personnel Management, Faculty of Economics, Ivan Franko National University of Lviv. Her research interests include the peculiarities of social security in conditions of turbulence, development of company personnel (mentoring, training, adaptation, and professional development programmes).