I

This article investigates whether the Bank of Japan followed the rules of the game of the gold standard from October 1897 to July 1914. Japan adopted the gold standard twice: (i) from 1 October 1897 to 12 September 1917 and (ii) from 11 January 1930 to 13 December 1931. It was among the last countries to do so during the classical period (Bryan Reference Bryan2010; Mitchener et al. Reference Mitchener, Shizume and Weidenmier2010; Schiltz Reference Schiltz2012). It was also among the last to return to gold – though only briefly – following the end of World War I. Our focus is on the classical period. The outbreak of hostilities in Europe led to a suspension of gold exports by major countries, causing the yen–sterling exchange rate routinely to move outside the gold import point. This explains the choice of July 1914 as the terminal date, even though Japan remained on gold for three more years.

The Coinage Law of 1897 defined one yen as 0.75 grams of pure gold. The British pound was the reference currency and, as such, the yen–pound rate was used as the benchmark. The Yokohama Specie Bank (YSB), a semi-public bank responsible for conducting foreign exchange operations on behalf of the ministry of finance and the Bank of Japan, quoted the yen's exchange rates against other currencies, including the US dollar, on the basis of their cross rates against the pound in foreign markets (Fukai Reference Fukai1941, pp. 119–21; Bank of Tokyo 1981, p. 184). Contemporary observers reported a range of estimates for the gold points (e.g. Kimura Reference Kimura and Keizaigakubu Kai1926; Fujita Reference Fujita1929; Mimata Reference Mimata1929). Against the US dollar, the estimates ranged between $50.1875 and $50.375 per ¥100 for the import point and between $49.3125 and $49.5 for the export point, suggesting a margin of up to 1 per cent on either side. A somewhat wider margin of around 1.2 per cent was reported against the British pound, reflecting the longer time required for gold to travel to and from London.

Stipulated by the Convertible Banknotes Ordinance of 1884, the money supply rule was called the ‘elastic fiduciary issuance limit method’. The supply of banknotes consisted of (i) ‘specie issues’, (ii) ‘fiduciary issues’ and (iii) ‘extra issues’. The Bank of Japan was, first and foremost, required to hold specie equivalent in value to the balance of banknotes outstanding. Second, fiduciary issues, unbacked by specie, were permitted up to a statutory limit against the security of government or high-quality commercial securities in order to accommodate the public's variable demand for currency. The initial fiduciary limit of ¥85 m, inherited from the silver-standard era, was raised to ¥120 m in March 1899. This amount remained unchanged during the rest of the classical period of the gold standard.

Third and finally, the central bank, under extraordinary circumstances, could issue additional banknotes by obtaining approval from the minister of finance and by paying a tax of not less than 5 per cent per year, as determined in each instance by the minister. The purpose of the extra issue tax was to serve as a warning signal to prompt the central bank to take remedial action (Tanaka Reference Tanaka1929). Implicit was the idea that the supply of banknotes must ideally be anchored in the stock of specie, so that extra issues should be withdrawn as soon as practical. As a joint stock company with a profit motive, the Bank of Japan was expected to raise the discount rate whenever the government raised the extra issue tax in order to reduce the public's demand for currency.

II

This study draws its motivation from a subset of the large literature on the gold standard that quantitatively tests whether central banks followed the rules of the game. The presumed rules are an invention of the interwar period to describe an idealized working of the classical gold standard. As generally interpreted (Keynes Reference Keynes1931; Bloomfield Reference Bloomfield1959), central banks were supposed to amplify the impact of a gold flow on the monetary base so as to subordinate domestic stability to external balance. In order to facilitate external adjustment, it was assumed that a central bank losing (gaining) gold (i) raised (cut) the discount rate to encourage a capital inflow (outflow) or (ii) sold (purchased) domestic securities to contract (expand) the monetary base further.

Arthur Bloomfield (Reference Bloomfield1959) most likely played a decisive role in the early formation of the semi-consensual view that violations of the rules were pervasive under the classical gold standard. Following the methodology Ragnar Nurkse had developed for the interwar period (League of Nations 1944), Bloomfield came to this conclusion by finding a negative correlation, in annual data for 1880–1914, between foreign and domestic assets in the balance sheets of 11 central banks about 60 per cent of the time. A replication by Teranishi and Uchino (Reference Teranishi, Uchino, Kaizuka and Ono1986) yields a similar finding for Japan during 1897–1914, namely, foreign and domestic assets were negatively correlated 65 per cent of the time.

Some have questioned why a negative correlation between foreign and domestic assets should be taken as conclusive evidence of central bank intention (Yeager Reference Yeager1966). When a loss of gold leads to a contraction of currency, it is difficult to imagine that the central bank would be so unwilling to accommodate at least part of the existing demand for currency that it would not allow domestic assets to increase even by a small amount. In view of the likely endogeneity of domestic assets, the present study focuses on the discount rate as a more transparent measure of central bank intention.

Bloomfield notes that when the rules of the game are expressed in terms of a discount rate reaction function, a robust inverse relationship between the discount rate and the ratio of gold reserves to banknotes (abbreviated as the ‘reserve ratio’ hereafter) was observed in annual average data for six out of the 11 countries examined, including Austria–Hungary, a non-gold-standard country whose currency was stabilized against the gold parity. On the other hand, no inverse relationship was found in the remaining five countries. Failing to find a consistently inverse relationship, Bloomfield concludes that central banks had objectives other than maintaining gold convertibility and employed instruments other than the discount rate.

Recent empirical literature, by utilizing higher-frequency data to estimate a discount rate reaction function, has shown that country experience with the rules of the game was varied. Overwhelming evidence comes from the so-called ‘core’ countries of Britain, France and Germany. While most central banks often raised the discount rate when there was a fall in the reserve ratio or an outflow of gold, the response was not automatic or mechanical. Both in the core and in the periphery, the policy response was nuanced, country-specific and informed by competing objectives.

For example, the Bank of France adjusted the discount rate only 30 times between 1880 and 1913, compared to 194 times for the Bank of England and 116 times for the German Reichsbank. It was a heavy user of non-market instruments (‘gold devices’) to influence the direction of gold flows, including by varying the premium it charged on gold. The bank was permitted to honour convertibility in either silver or gold. This allowed it to redeem banknotes in silver while charging a premium on gold in order to discourage a gold outflow. When a reaction function is estimated, the discount rate was found to respond negatively to the reserve ratio (Tullio and Wolters Reference Tullio and Wolters2003a), but the bank's large gold stock, use of gold devices and absence of a minimum reserve ratio created room for discretion by allowing a large gold outflow to be tolerated (Bazot et al. Reference Bazot, Bordo and Monnet2016).

While the German Reichsbank was likewise found to adjust the discount rate negatively to the reserve ratio, it also responded to the Bank of England's Bank Rate and a deviation of the sterling exchange rate from the mint parity. When the sample is divided into 1876–95 and 1896–1913, the impact of Bank Rate disappears almost entirely in the latter period (Tullio and Wolters Reference Tullio and Wolters2003c). Moreover, the share of discount rate increases attributable to gold outflows declines from more than 50 per cent during 1879–83 to about 20 per cent during 1884–98. Mandeng (Reference Mandeng2019) interprets these findings to mean that the Reichsbank, having established its credibility as a gold standard defender, used this reputation to exercise discretion in pursuit of domestic objectives.

Because the Bank of England did not maintain a large stock of gold, it frequently countered gold movements by adjusting Bank Rate. When a reaction function is estimated for 1893–1913, Bank Rate responded negatively to the reserve ratio and positively to domestic interest rates (Pippenger Reference Pippenger, Bordo and Schwartz1984). Tullio and Wolters (Reference Tullio and Wolters2003b), by estimating a reaction function separately for 1876–95 and 1896–1913, find that Bank Rate responded more strongly to the reserve ratio but less strongly to the German discount rate in the latter period, which they interpret as evidence of an increasing influence of short-term capital flows. Bank Rate responded countercyclically to domestic activity (Dutton Reference Dutton, Bordo and Schwartz1984), but Davutyan and Parke (Reference Davutyan and Parke1995) show that domestic activity mattered only when Bank Rate was above 5 per cent.

As one of the few quantitative studies on the experience of peripheral countries, Morys (Reference Morys2013) finds that all central banks in the European periphery followed the British or German discount rate and that all but one responded to the reserve ratio. Bazot et al. (Reference Bazot, Monnet and Morys2022), covering all gold-standard central banks from 1891–1913 (of which all but one were in Europe), find that the passthrough from an exogenous Bank Rate increase to the discount rates was on average around 20 per cent. The authors interpret the low-interest-rate passthrough as evidence of monetary autonomy created by central bank operations that stabilized domestic interest rates (in contrast, the passthrough in the United States, where no central bank existed, was two to four times larger).

Belgium and Portugal are among the few peripheral countries that have received dedicated attention in recent empirical literature. The National Bank of Belgium was bound by an informal agreement with the government to keep the interest rates low (Ugolini Reference Ugolini2012). The bank therefore used daily foreign exchange intervention – open market operations in foreign exchange bills, including with repurchase agreements – as the primary instrument to stabilize the level of excess reserves. This made it possible to delay the need to align the discount rate with the level of foreign interest rates, creating a measure of short-run monetary autonomy.

The Bank of Portugal was similarly constrained in its use of the discount rate (Reis Reference Reis2007; Esteves et al. Reference Esteves, Reis and Ferramosca2009). Raising the rate above 5 per cent required a government decree, which was seldom granted. The bank could charge less than 5 per cent but rarely did so out of profitability concerns. When a discount rate reaction function is estimated, the coefficient of the reserve ratio is negative and significant at 1 per cent, but the discount rate is positively correlated with the reserve ratio (with a correlation of 0.17). When the exchange rate approached the gold export point, the central bank imported sovereigns from London or intervened in the market for exchange bills on London as a ‘gold device’.

In sum, the recent quantitative literature suggests that central banks under the classical gold standard did not follow the rules of the game in the sense of not using the discount rate solely for the purpose of preserving gold convertibility. Central banks ‘were less alike in their behaviour than was presumed’ and their ‘ample disregard … for the “rules of the game” has come to be accepted as a fact of life of the classical gold standard’ (Reis Reference Reis2007, p. 713). This consensus was obtained in Europe, where short-term capital mobility was high and the discount rates of virtually all central banks tended to rise or fall together (Bloomfield Reference Bloomfield1959). The question is whether this understanding of the operation of the classical gold standard equally applies to Japan, a gold-standard country physically separated from the rest of the gold-standard world and most likely not financially integrated with the European core.

III

Japan's experience with the gold standard was not a textbook case. Internally, gold coinage did not circulate widely within Japan, owing, at least in part, to the relatively large minimum denomination of ¥5 (when per capita GNP in 1900 was around ¥55). Almost all cash transactions took place by means of banknotes. Externally, the monetary authorities (i.e. the ministry of finance and the Bank of Japan) did not exclusively maintain the gold parity through the free private movements of gold. Instead, during much of the period, they managed the system largely by selling and buying foreign exchange held abroad at a fixed rate, which they typically set below the parity but above the presumed gold export point, ostensibly to encourage exports and discourage imports (Furuya Reference Furuya1928). As noted, actual market operations were delegated to the YSB because the Bank of Japan was not permitted by law to engage directly in foreign exchange transactions (Tamaki Reference Tamaki1995).

This practice proved to be an efficient arrangement for traders and financiers located far away from each other. It took gold at least 20 days to travel to and from London or New York. On top of the costs of transportation and insurance, an annual interest of 6–7 per cent, typically, was charged during the transshipment (Inouye Reference Inouye1931). Central bank pegging of the yen with the use of foreign exchange deliverable in London or New York made sense, both for the authorities who wanted to avoid a physical outflow of gold, and for market participants who wanted to minimize transactions costs. The system itself was established in 1904 but the practice of setting the selling rate in relation to the gold export point may have started in 1909 (Kojima Reference Kojima1981).

Japan was not unique in this regard. Under the classical gold standard, little gold movement took place generally (Cassel Reference Cassel1936). Instead of shipping gold, bills of exchange drawn on London were widely used as a means of international payment. Even Japanese export bills drawn against American, Chinese or Indian importers were made payable in London, and Japanese importers paid for their imports in sterling bills drawn against them payable in London (Furuya Reference Furuya1928). For example, the receipts for silk exports to the United States might be made in sterling in London, which might then be used to pay for the imports of machinery and chemical products from Germany (Fukai Reference Fukai1929).

The official overseas balances of interest-bearing assets denominated in gold-convertible currencies played a central role. They were simply referred to by the authorities as ‘specie’ because of their ready gold-convertibility, though strictly they were not. The reason for this is that, for accounting purposes, gold held at home and foreign exchange held abroad were considered totally fungible and no distinction was made between the two (e.g. specie issues were backed by their combined total from December 1903 to August 1922; see below). Initially, these foreign currency assets were held by the government, with the Bank of Japan acting as a custodian. In early 1903, the central bank for the first time acquired its own foreign assets when it purchased part of the ¥50 m proceeds the government had obtained from selling bonds in London. In June 1904, it signed a formal agreement with the ministry of finance, authorizing it to own foreign balances.

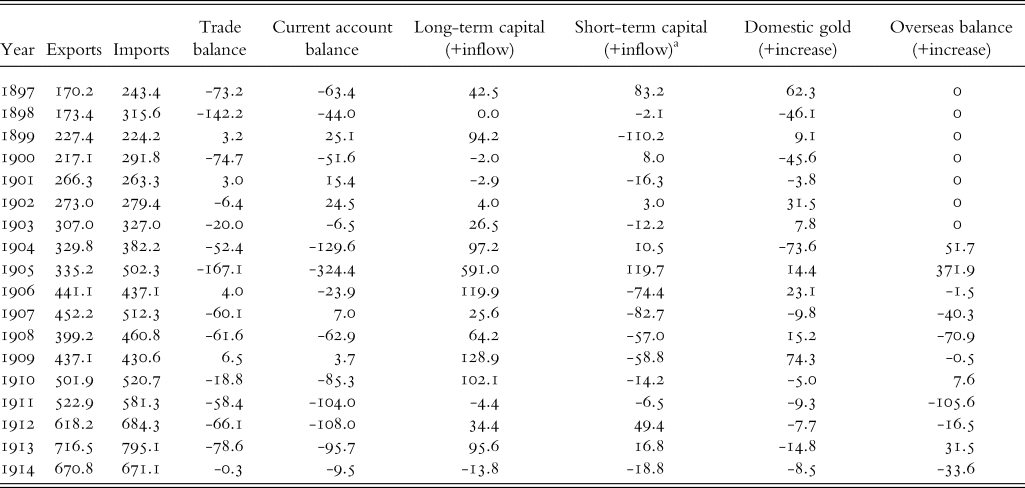

Overseas ‘specie’ balances became a distinguishing feature of Japan's classical gold standard, in part necessitated by the need to earmark a portion of the foreign exchange for purchases of weaponry (Nochi Reference Nochi1981). Given Japan's persistent current account deficits, the balances needed to be replenished by long-term foreign borrowing, which continued until the outbreak of World War I (Table 1). The loss of gold following the start of the Russo-Japanese War was so great that, without the Anglo-American loan of May 1904, Japan's gold standard may not have survived (Ito Reference Ito, Fujise and Yoshioka1987; Suzuki Reference Suzuki1994; Metzler Reference Metzler2006). Japan kept a portion of the proceeds in London and other financial centres in the form of foreign government securities, central bank deposits, or deposits with private banks of high credit standing.

Table 1. Japan's annual balance of payments, 1897–1914 (in millions of yen)

a Includes errors and omissions.

Source: Bank of Japan (1986), pp. 340-3.

A change was introduced to the money supply rule in December 1903, when the government authorized the central bank to count part of its sterling deposits in London as the backing for specie issues. Additional assets, including British, American and French government securities, were counted as eligible for backing specie issues in subsequent years (Kitsukawa Reference Kitsukawa1969; Kojima Reference Kojima1981). From 1904, the official overseas ‘specie’ balances therefore consisted of three components: (i) assets held in the government account; (ii) assets counted as part of the Bank of Japan's monetary gold reserve; and (iii) assets held in the Bank of Japan's nonmonetary account.

It is important to understand that operations in the government account did not affect the monetary base, unless part of the funds was sold to the central bank. When the government purchased foreign goods with funds raised abroad, for example, it acted like any private agent, with no impact on the monetary base or the overall balance of payments. On the other hand, operations in the Bank of Japan accounts directly affected the monetary base. Normally, when ‘specie’ was acquired from the government, it was entered in the nonmonetary account, that is, to back fiduciary issues. Counting it as part of the monetary gold account required explicit authorization from the government.

The overseas balances were held predominantly in London, with small balances in Berlin, New York, and Paris. At the end of fiscal year 1914, for example, the majority (63.1 per cent) was owned by the Bank of Japan, with the predominant portion of it (90.3 per cent) in London; no foreign exchange in the monetary gold account was held outside London (Matsuoka Reference Matsuoka1936). The government deposits outside London were meant to facilitate the payment of interest on bonds raised in those markets or to pay for the import of weapons from those countries (Nochi Reference Nochi1981). Between 1916 and 1917, the war in Europe prompted the Japanese authorities to shift more of the foreign balances to New York, while consolidating in London the small balances held in Berlin and Paris (Tomaru Reference Tomaru1932).

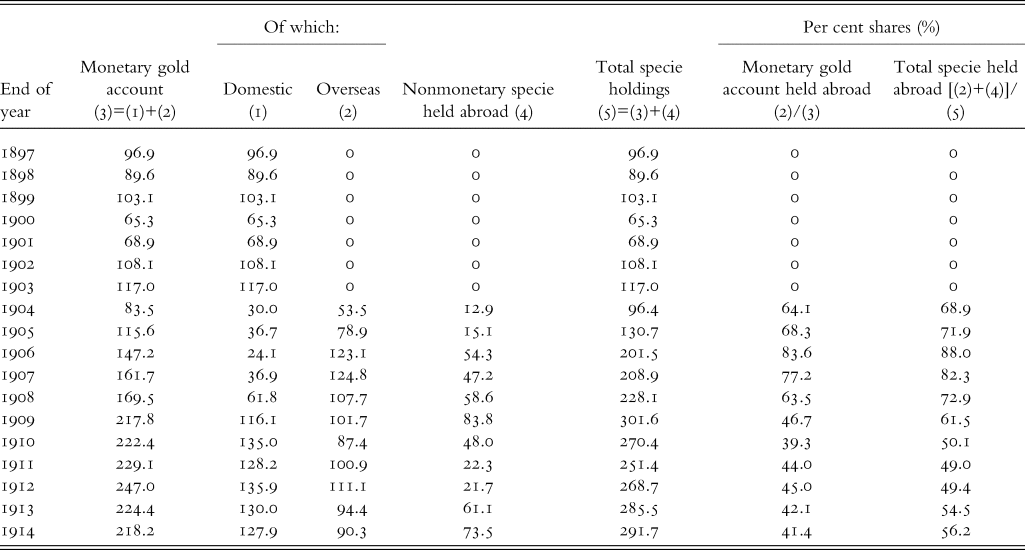

League of Nations (1944) noted that, in 1913, 15 European central banks held about 12 per cent of gold reserves in the form of foreign exchange. If there was any sense in which the Japanese system was unique, it was the much higher share of foreign exchange in Japan's ‘gold’ reserves (Table 2). At its peak in 1906, the share was as much as 83.6 per cent. The League of Nations classified Japan, along with Argentina, India and Russia, as practising a sterling exchange system. Keynes (Reference Keynes1913) likewise characterized the Japanese system as ‘virtually the same’ as India's gold-exchange standard (p. 33). The Japanese authorities, conscious of the strongly held view that the gold standard must be backed by gold, did not take such a characterization kindly.

Table 2. The composition of central bank specie holdings, 1897–1914 (in millions of yen)

Note: In the terminology used here, ‘specie’ includes ‘domestic’ reserves held in gold bullion and coins and ‘overseas’ reserves held in gold-convertible foreign exchange.

Sources: Bank of Japan (1986), pp. 332-3, for 1897–1903; Bank of Japan internal documents, as cited in Ito (Reference Ito, Fujise and Yoshioka1987), p. 389, for 1904–14.

Japanese central bankers stressed that they honoured convertibility by maintaining an adequate domestic stock of gold, which they used freely to accommodate any request for conversion, and that setting the exchange rate in relation to the gold points presumed a shipment of gold (Fukai Reference Fukai1941). The system of overseas balances was a target of constant criticism as a violation of the spirit of the Coinage Law (Ishibashi Reference Ishibashi and Keizai Shuppanbu1932), causing the authorities to become opaque about its operations (Kitsukawa Reference Kitsukawa1969). In part to conceal the volatility of ‘specie’ movements, the central bank predominantly transacted using the nonmonetary balance, the amount of which was not disclosed even to the Diet (Kojima Reference Kojima1981). In 1913, the government accused the Bank of Japan of a lack of transparency about the breakdown of assets in the monetary gold account (in order, presumably, to keep more of them abroad to earn interest), insisting that the assets in the monetary account should be converted into gold and shipped home (Ito Reference Ito, Fujise and Yoshioka1987). With effect from 30 August 1922, the government removed foreign-currency assets from the monetary gold account, ending Japan's gold-exchange-standard-like system, even as much of the post-Genoa world was moving towards such an arrangement (Clarke Reference Clarke1973).

IV

According to the Bank of Japan's official documents, as reviewed in its centennial history (Bank of Japan 1983), the overriding objective of monetary policy under the classical gold standard was to preserve gold convertibility. In June 1897, the Bank of Japan was instructed by the minister of finance to take various measures, including an increase in the discount rate, ‘when an adverse turnaround in the trade balance leads to an outflow of gold’ (pp. 24–5). In 1913, the government reiterated its position that the Bank of Japan's discount rate policy should be conducted with the primary objective of defending gold convertibility (Bank of Japan 1983; Ito Reference Ito, Fujise and Yoshioka1987). Junnosuke Inouye (Reference Inouye1925, Reference Inouye and Keizaigakubu Kai1926), a two-time governor whose central bank career had begun in 1896, stated that monetary policy had the twin objectives of (i) preserving gold convertibility and (ii) facilitating domestic finance and that the discount rate was the only available tool.

Rarely did the two objectives conflict with each other, given Japan's perennial trade deficit. An overheating economy was associated with easy money, which caused imports to rise and gold to flow out. A typical response was to raise the discount rate. If there was any conflict, Governor Tatsuo Yamamoto stated in 1902, priority was given to preserving gold convertibility (Sato Reference Sato1984). There is no evidence that the discount rate was cut in response to a gold inflow (which seldom occurred), but a reversal of tight policy was sufficient to generate a systematic relationship between the discount rate and gold movements. An episode-by-episode analysis (e.g. Takizawa Reference Takizawa1912; Ishibashi Reference Ishibashi1936) shows that the Bank of Japan typically raised the discount rate when a trade deficit led to an outflow of gold and reversed the policy when the outflow dissipated. Sato (Reference Sato1984) states that the central bank followed the rules of the game when it raised the discount rate six times from November 1899 to July 1900.

To test the hypothesis that the Bank of Japan followed the rules of the game, we estimate the following 4-variable vector autoregressive (VAR) model:

where Nt = [DRt, RRt, TBt, ERt]’ is a column vector of four endogenous variables; Ct is a column vector of constants, BR is an exogenous variable; Vt is a column vector of error terms; Fj and Hj are, respectively, 4 by 4 and 4 by 1 matrices of coefficients; q is lag length; t is a time subscript; and the five variables are defined as follows: DR = discount rate, RR = reserve ratio (monetary gold/banknotes), TB = trade balance, ER = exchange rate, and BR=(Bank of England) Bank Rate. Equation (1) is estimated in terms of 12-month per cent changes or logarithmic differences to ensure stationarity, where the log of the trade balance is obtained by adding a constant to make the minimum equal to +1. We use economic logic to select the lag length (q) of 3 by overriding the Swartz’ information criterion, which calls for q = 2. It is unreasonable to assume that trade flows fully respond to a shock within two months.

An explanation of the specification of equation (1) is in order. First, as an operational definition of ‘gold’ movements, we choose the reserve ratio (RR) based only on monetary gold (which, for accounting purposes, includes foreign exchange held abroad in the monetary gold account), not total official specie (which includes government-owned foreign exchange) or total central bank specie (which includes foreign exchange held abroad in the nonmonetary account). We rule out the government-held balance because government operations in foreign exchange did not affect the monetary base, except when a part of the funds was sold to the central bank (in which case it is reflected in one of the other measures). The government otherwise acted like any private agent.

As to the choice between total central bank specie and monetary gold, it is largely academic. We have no choice but to use monetary gold because the timeseries data on the central bank's nonmonetary balance are available only annually (see Table 2), but not monthly. Even so, one can make a case for using monetary gold, which the central bank regarded as the permanent component of specie reserves. In contrast, Ito (Reference Ito, Fujise and Yoshioka1987) describes the nonmonetary balance as a buffer it used to protect monetary gold. Between June 1909 and July 1914, for example, the standard deviation of specie issues (backed by monetary gold) was 0.039 in log and 0.117 in log difference, compared to 0.248 and 0.253, respectively, for fiduciary plus extra issues (part of which was backed by nonmonetary gold). It is reasonable to assume that the Bank of Japan was ultimately interested in preserving monetary gold as the second line of defence.

Second, we include the trade balance (TB) as an additional or alternative determinant of discount rate policy, in view of the instruction given by the minister of finance in 1897, as noted above. Inouye (Reference Inouye and Keizaigakubu Kai1926) emphasized that when the Bank of Japan raised the discount rate, it did not expect to retain, much less attract, short-term foreign capital; rather, it believed that the impact of the higher discount rate worked through discouraging imports (see also Bank of Japan 1983). Inouye (Reference Inouye1925) went so far as to say that the bank raised the discount rate whenever imports surged. It is therefore reasonable to consider that the Bank of Japan was viewing movements in the trade balance as proximate gold movements.

Third, the inclusion of the exchange rate (ER) follows the specifications frequently encountered in the recent literature. The exchange rate is defined as units of yen per pound. Given the binding gold points, the exchange rate never changed in one direction by more than 2.9 per cent. The timeseries, obtained from Tōyō Keizai Shinpōsha (1931), contain the monthly averages of what was then known as the ‘Specie Bank posted rate (Shōkin tatene)’, which the YSB quoted almost continuously from 1 October 1897 to 13 December 1931. The posted rate, reflecting the official policy stance, was regarded as a semi-official rate by the market, given the YSB's dominant share (70–90 per cent) in the foreign exchange market (Bank of Tokyo 1969, 1980). The posted rate was adjusted on the basis of market conditions but could be fixed for a period of time. It is reasonable to assume that the YSB knew in real time the net specie flows into and out of Japan and set the exchange rate accordingly. To this extent, adjustments in the exchange rate reflected the direction and strength of underlying specie flows.

Finally, the inclusion of Bank Rate (BR) also follows the recent empirical literature. By including Bank Rate, we are not suggesting that Japan was financially integrated with Europe. Separated by distance, Japan was virtually closed to autonomous short-term capital flows. Any such flows most likely took place primarily through trade (e.g. leads and lags, over-invoicing and under-invoicing) or through merchants and financiers engaged in trade. The precise amount of short-term capital flows cannot be known because ‘short-term capital’ in the balance of payments (see Table 1) was a residual item that included errors and omissions.

There is no episodic evidence that the Bank of Japan systematically responded to Bank Rate changes. The Japanese discount rate was perennially higher, on average by 3.1 percentage points, than Bank Rate, suggesting that Japanese and British assets were highly imperfect substitutes and that Japan most likely enjoyed nearly full monetary autonomy. Some have suggested that the discount rate was purposely kept high to preserve gold convertibility (Tamaki Reference Tamaki1995). Whereas Bank Rate changed 79 times between 1897 and 1911, the Japanese discount rate changed only 33 times. The coefficient of correlation between the discount rate and Bank Rate was -0.140 in level and -0.295 in annual percentage change between 1897 and 1914.

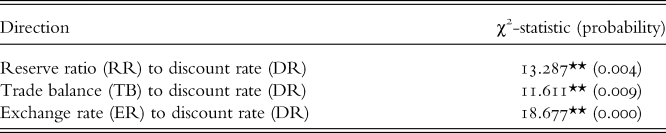

Focusing on the reaction of DR, Granger causality tests confirm that causality indeed ran from RR, TB and ER to DR (Table 3), meaning that the past values of RR, TB and ER contained information useful in predicting the future values of DR. In the DR equation (not formally reported here), the coefficients of both the current and the lagged BR are found to be statistically not significant, and the hypothesis that the long-run multiplier (estimated as 0.035) is zero cannot be rejected. Just for the sake of comparison, however, given that DR and BR are of the same dimensionality (that is, 12-month percentage change), the long-run multiplier of 0.035 can be compared with the estimated average passthrough, from Bank Rate to domestic discount rates, of about 0.2 found in the literature for gold-standard countries in Europe; the passthrough for the United States was two to four times larger (Bazot et al. Reference Bazot, Monnet and Morys2022). This confirms our earlier conjecture that Japan's financial link with the European core was rather limited.

Table 3. VAR-based Granger causality tests, October 1898 – July 1914 (lag length = 3)

Note: ** indicates that the null hypothesis of no causality is rejected at the 1 per cent level.

Source: author's estimates based on Asakura and Nishiyama (Reference Asakura and Nishiyama1974); Bank of Japan (1986); Tōyō Keizai Shinpōsha (1931, 1935); Federal Reserve Bank of St Louis (https://fred.stlouisfed.org).

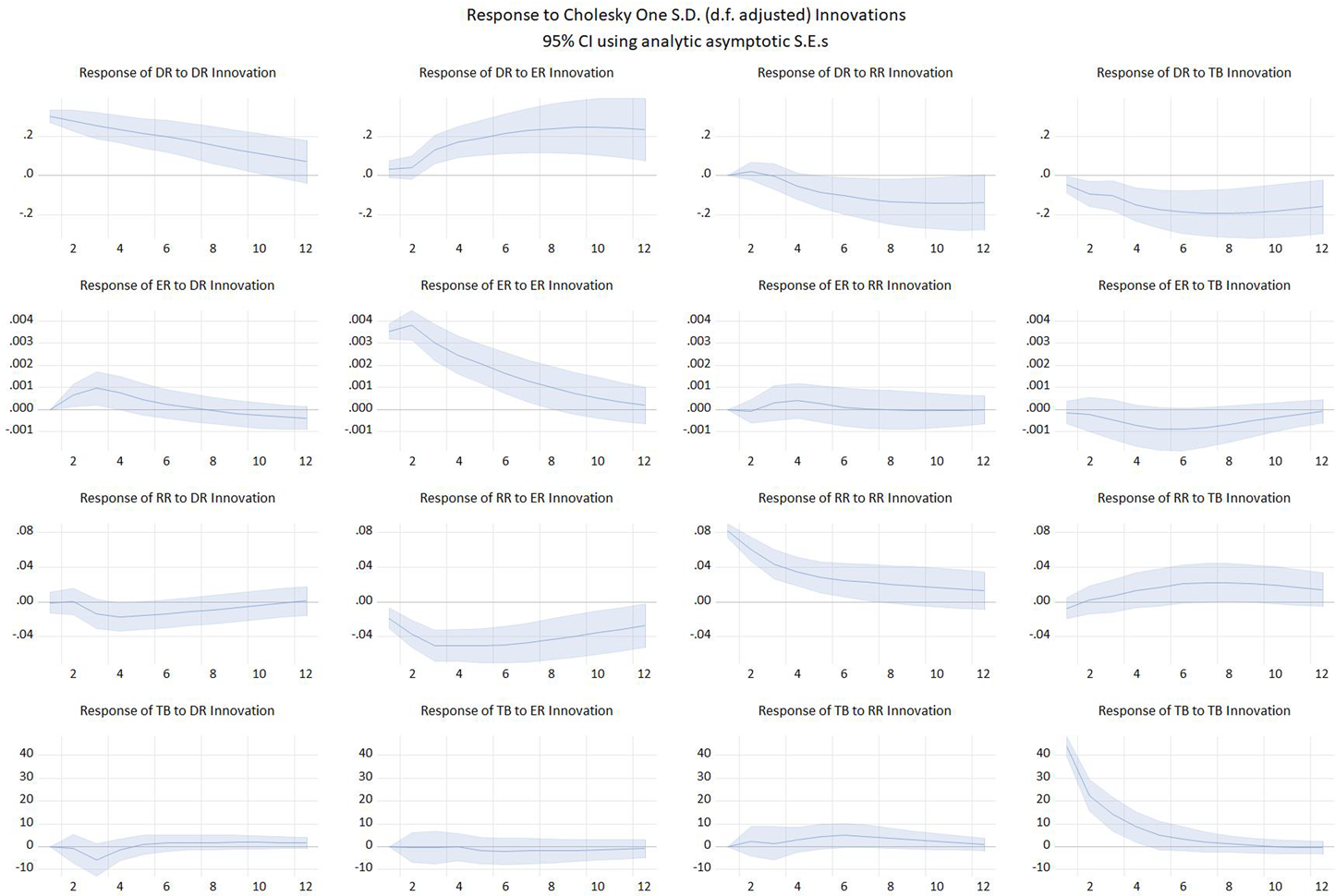

As it turns out, the impulse responses of DR to one-standard-deviation innovations to RR, ER and TB (based on the Cholesky decomposition) are robust to the ordering of the variables. Here, we report the results obtained from the two most sensible orderings, that is, TB→DR→ER→RR (Figure 1) and TB→ER→DR→RR (Figure 2). In both cases, the first variable is TB and the last variable is RR. TB is considered not contemporaneously responsive to innovations in other endogenous variables. The denominator of RR (banknotes), on the other hand, is considered contemporaneously responsive, while its numerator (monetary gold) includes a domestic component that moves with transactions at the gold window. In contrast, the middle two variables, DR and ER, can both adjust over time but, in the short run, have a strong discretionary component: DR was a policy interest rate and ER, as the YSB's posted rate, could remain fixed for a period of time.

Figure 1. Impulse responses to a one-standard-deviation innovation (Cholesky ordering: TB → DR → ER → RR)

Notes: DR = discount rate; RR = reserve ratio; TB = trade balance; ER = exchange rate. The shaded areas represent a 5-per cent confidence interval.

Source: same as Table 3.

Figure 2. Impulse responses to a one-standard-deviation innovation (Cholesky ordering: TB → ER → DR → RR)

Notes: DR = discount rate; RR = reserve ratio; TB = trade balance; ER = exchange rate. The shaded areas represent a 5-per cent confidence interval.

Source: same as Table 3.

Regardless of which ordering we adopt (Figure 1 or 2), we observe from the top row that the Bank of Japan raised the discount rate in response to (i) a depreciation of the yen against the British pound (second from left); (ii) a fall in the reserve cover ratio (second from right); or (iii) a worsening of the trade balance (far right). Moreover, DR's positive response to ER and negative response to TB are significant (at the 5 per cent level) and persist into future months. The weaker response to RR may mean that the choice of the monetary gold balance, dictated by data availability, was less than ideal. The fact that the Bank of Japan was ultimately interested in protecting the monetary gold balance does not mean that it did not respond to changes in the nonmonetary balance from time to time.

We find from the first column that the responses of ER, RR and TB to DR are broadly consistent with the channel of monetary policy transmission Japan's central bankers had in mind. The response of ER to DR changes to the negative range (second from top), suggesting that the yen's depreciation was reversed as the discount rate was raised. The responses of RR and TB to DR increase in algebraic value (bottom two), suggesting that a higher discount rate invited gold inflows and improved the trade balance. Moreover, as TB improves, RR is seen to recover (right column, third from top). Thus, the impact of a higher discount rate on the monetary gold account works both directly and indirectly through trade. Admittedly, the response of RR to a change in DR or TB is weak. Again, this may in part be due to the choice of the monetary gold balance, necessitated by data availability. Total central bank specie might have responded more strongly to factors that affected cross-border specie flows because it was through the nonmonetary balance that the central bank transacted in foreign exchange as the first line of defence.

V

By estimating a vector autoregressive model of monthly timeseries data for October 1897 – July 1914, we have found that the Bank of Japan systematically raised the discount rate in response to a fall in the reserve cover ratio, a worsening of the trade balance, or a depreciation of the yen against the British pound. To the extent that trade balance or exchange rate movements reflected proximate or prospective movements in monetary gold, these findings suggest that the Bank of Japan pursued the preservation of gold convertibility as the primary objective of monetary policy. In contrast, the discount rate hardly responded to Bank Rate, suggesting that Japan's financial integration with the European core was limited. It may be that this high degree of monetary autonomy permitted the Japanese central bank, unlike its European peers, to seek singlehandedly to preserve gold convertibility. The Bank of Japan's rules-of-the-game-like behaviour was consistent and robust, challenging the semi-consensual view in the literature that violations of the rules were frequent and pervasive under the classical gold standard.