I. Introduction

In recent decades, the economic literature has increasingly focused on the significance of firms’ export behavior and the markups they realize. According to current theories, firms with higher product quality and/or lower marginal costs are more likely to enter the export market and adjust their prices based on the competitive environment in the destination country (Bernard et al., Reference Bernard, Eaton, Jensen and Kortum2003; Melitz and Ottaviano, Reference Melitz and Ottaviano2008). Moreover, firms that have been exporting for a while may experience changes in their markups due to learning by exporting (Bernard et al., Reference Bernard, Jensen and Lawrence1995).

This topic has become increasingly important in the food industry with the decline of protection against competition from foreign trade (Curzi et al., Reference Curzi, Raimondi and Olper2015). This shift presents an opportunity to scrutinize the relationship between export behavior and markups, an area that lacks sufficient empirical evidence due to its recent emergence, methodological complexities, and limited availability of data. Current knowledge indicates that higher markups enhance export market participation and intensity, that exporting firms achieve higher markups, and that exporters generally have higher markups than non-exporters (Jafari et al., Reference Jafari, Koppenberg, Hirsch and Heckelei2023). Specific evidence from the wine industry suggests that while tariffs are heterogenous across export destinations, the effect on markups is smaller for higher quality exports (Chen and Juvenal, Reference Chen and Juvenal2022). Additionally, export behavior positively impacts financial performance (Lessoua et al., Reference Lessoua, Mutascu and Turcu2020).

In this paper, we specifically focus on wine exports. Recent studies have investigated dimensions of wine exports, adding depth to our understanding of this complex market. Back et al. (Reference Back, Liu, Niklas, Storchmann and Vink2019) examined how the additional production costs associated with Fair Trade certification are reflected in wholesale and retail prices in the context of South African wine exports to the United States, with a particular focus on price margins and asymmetries along the supply chain. Bargain (Reference Bargain2020) analyzed French wine exports to China, emphasizing regional diversification and competition within France and highlighting the strategic responses of various French regions to the Chinese market. Thomé et al. (Reference Thomé, Paiva and Gois2023) examined the structure and competitiveness of the international wine market, providing insights into market dynamics and competitive strategies. Puga et al. (Reference Puga, Sharafeyeva and Anderson2022) explored bilateral patterns of global wine trade over a historical period, shedding light on the evolving nature of international wine trade relationships.

Additional studies have focused on country-specific contexts. Lessoua et al. (Reference Lessoua, Mutascu and Turcu2020) investigated the Romanian wine industry, revealing that firms’ financial performance is positively linked to export activities. Landazuri-Tveteraas et al. (Reference Landazuri-Tveteraas, Asche and Straume2021) examined the dynamics of buyer–seller relationships in Norwegian wine imports, highlighting the importance of these relationships in shaping trade flows. Depetris Chauvin and Villanueva (Reference Depetris Chauvin and Villanueva2024) provided a detailed analysis of exporting wineries in Argentina, offering insights into the characteristics and strategies of these firms. Dearden et al. (Reference Dearden, Guo and Meyerhoefer2021) examined how offering wine by the glass influences bottle markups in New York City restaurants, finding that glass offerings are associated with higher retail and wholesale markups, particularly for lower-priced wines.

Our study explores the relationship between markups and the export activities of Hungarian wine exporting firms, providing new insights in the process. Hungary's wine industry differs significantly from Western European markets due to its structural heterogeneity, varying scales of production, and distinct policy environment. These characteristics offer a compelling context to examine how markups influence firms’ decisions to engage in export markets and the extent of their export activities. By focusing on this sector, the study provides insights into how economic liberalization and EU integration have influenced firm performance in a traditionally fragmented market.

We will discuss the following research questions: What is the impact of markups on a firm’s decision to export and, further, the export intensity in the wine industry? Does participating and sustaining presence in the export market have an impact on the markups of firms? Do exporters and non-exporters have different markups?

We contribute to the literature in several ways. First, to our knowledge, this is the most comprehensive study examining the relationship between export behavior and markups in the wine industry. Second, the Hungarian wine industry offers a unique post-EU accession context, providing insights distinct from markets with longer export traditions. Third, we employ a robust methodological approach, following Jafari et al. (Reference Jafari, Koppenberg, Hirsch and Heckelei2023), utilizing a double hurdle model with instrumental variables to address endogeneity concerns and distinguish between export participation and intensity. Additionally, we control for productivity differences that may influence the relationship between markups and export behavior (De Loecker and Goldberg, Reference De Loecker and Goldberg2014).

This article is structured as follows: we first present the background to the research, the literature, and our hypotheses. Second, we outline our empirical approach for examining markups and export connections, then provide details about our data, and ultimately, present and analyze our findings and conclusions.

II. Background, literature, and hypotheses

The relationship between trade, firm markups, and export behavior has been a significant topic of research, particularly since the emergence of trade models with monopolistic competition assumption (Behrens and Murata, Reference Behrens and Murata2007). There has been an increase in this interest in parallel with the development of intra-industry trade models with a distinction between domestic and export markets (Jafari et al., Reference Jafari, Koppenberg, Hirsch and Heckelei2023). Rich micro-level datasets since the mid-1990s have revealed that markups affect firms’ export behavior, that entering or remaining in export markets can alter firm markups, and that notable differences exist between exporters and non-exporters (De Loecker and Warzynski, Reference De Loecker and Warzynski2012). Significant attention has been directed toward understanding how markups—defined as the ratio of a product’s price to its marginal cost—affect both the decision to export and the degree of export engagement. Since a firm’s productivity shapes its marginal cost, it serves as a key factor in determining whether the firm opts to enter export markets and thrive within them (Koppenberg, Reference Koppenberg2023). Melitz (Reference Melitz2003) illustrates that firms with higher productivity are more likely to engage in multiple foreign markets due to their ability to cover fixed export entry costs. Models by Chaney (Reference Chaney2008) and Helpman et al. (Reference Helpman, Melitz and Rubinstein2008) suggest that lower bilateral trade frictions result in a higher expected export share for firms. Despite extensive exploration of the relationship between individual markup components and export decisions, empirical studies directly linking firm markups to export participation and intensity are lacking except Jafari et al. (Reference Jafari, Koppenberg, Hirsch and Heckelei2023). Based on the theory, the first two hypotheses are:

Hypothesis 1: Higher markups increase the probability of exporting.

Hypothesis 2: Higher markups result in greater export intensity.

Theoretical models propose that engaging into exporting and retaining export markets have an impact on a firm’s pricing, marginal costs, and consequently its markups. Exporters can modify their prices to align with the prices in the export market, which is influenced by the marginal costs of their competitors (Melitz and Ottaviano, Reference Melitz and Ottaviano2008). The market size and level of competition in the export destination are important factors that have a significant impact. Firms may strategically lower their markups to enter new markets or take advantage of economies of scale and enhanced product quality, which can have a positive effect on their markups (De Loecker et al., Reference De Loecker, Goldberg, Khandelwal and Pavcnik2016). Thus, we postulate:

Hypothesis 3a: Markups of firms increase once they start exporting.

Hypothesis 3b: Markups of firms increase once they start exporting even when we control for productivity.

Moreover, firms that continue to operate in foreign markets often gain advantages from the process of learning through exporting, resulting in enhanced effectiveness, technological progress, and overall enhancements in productivity. As a result, firms that continue to export usually have decreasing additional costs and increasing profit margins over time. We test the following:

Hypothesis 4a: Markups increase with continued involvement in exporting.

Hypothesis 4b: Markups increase with continued involvement in exporting even when we control for productivity.

Exporters tend to have higher markups than non-exporters, partly due to the learning effects and productivity improvements gained through export participation. Bellone et al. (Reference Bellone, Musso, Nesta and Warzynski2016) found that exporters in the French manufacturing industry had higher markups compared to non-exporters, attributing this to the quality-enhancing impact of productivity outweighing the competitive price pressures in export markets. However, this study did not control for the simultaneity of markups and export participation, potentially biasing the estimates (Koppenberg, Reference Koppenberg2023). Jaumandreu and Lopez (Reference Jaumandreu and Lopez2024) extend this discussion by examining markups in U.S. food manufacturing accounting for non-neutral productivity. They find that exporters generally exhibit higher markups than non-exporters. Therefore, the final group of hypotheses is:

Hypothesis 5a: Exporters have higher markups than non-exporters.

Hypothesis 5b: Exporters have higher markups than non-exporters, even when we control for productivity.

III. Methodology

We employ a two-stage approach. First, we estimate markups by adopting the approach of De Loecker and Warzynski (Reference De Loecker and Warzynski2012) and augment it to account for input market power in order to recover markups of price over marginal cost. Production functions are estimated using Cobb–Douglas specifications (Ackerberg et al., Reference Ackerberg, Caves and Frazer2015). To estimate markups, we use firms’ net turnovers as output, fixed assets as capital, the number of employees as labor, and intermediate inputs as inventories. As in earlier studies, we do not estimate a separate markup for domestic and export turnover, rather we differentiate firms based on export activity. In second stage, to address the three research questions posed by our study, we have constructed three models in accordance with the methodology proposed by Koppenberg (Reference Koppenberg2023) and Jafari et al. (Reference Jafari, Koppenberg, Hirsch and Heckelei2023).

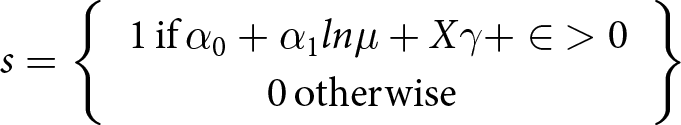

We begin with the estimation of the regressions meant to test Hypotheses 1 and 2, that is, the effect of markups on firms’ decision to export and the extent of their export activities. Because only a relatively small fraction of firms participates in export activities, the dataset contains many zero trade values. Nevertheless, these zeros must be treated as meaningful observations as they represent the optimal choice for these firms. Therefore, we employ the Cragg hurdle regression as estimator. The hurdle model is based on ![]() $E{I_{}} = {s_{}} + EI_{}^{}$where

$E{I_{}} = {s_{}} + EI_{}^{}$where ![]() $E{I_{}}$is the export intensity and

$E{I_{}}$is the export intensity and ![]() ${s_{}}$is a latent variable capturing the participation in exports, defined as Equation (1), as follows:

${s_{}}$is a latent variable capturing the participation in exports, defined as Equation (1), as follows:

\begin{equation}

s = \left\{ {\begin{array}{*{20}{l}}

{1\,{\text{if}}\,{\alpha _0} + {\alpha _1}ln\mu + X\gamma + \in\ \gt 0} \\

{\quad \quad \quad \,\,0\,{\text{otherwise}}}

\end{array}} \right\}\end{equation}

\begin{equation}

s = \left\{ {\begin{array}{*{20}{l}}

{1\,{\text{if}}\,{\alpha _0} + {\alpha _1}ln\mu + X\gamma + \in\ \gt 0} \\

{\quad \quad \quad \,\,0\,{\text{otherwise}}}

\end{array}} \right\}\end{equation} where ![]() ${\mu _{}}$are the markups previously estimated by Cobb–Douglas production function,

${\mu _{}}$are the markups previously estimated by Cobb–Douglas production function, ![]() ${X_{}}$is the vector of control variables,

${X_{}}$is the vector of control variables, ![]() ${\alpha _1}$and

${\alpha _1}$and ![]() $\gamma $are their associated coefficients, respectively. The controls are labor, capital, and material (all in logarithmic form) and lagged export intensity. Furthermore, year dummies are included to account for the trend.

$\gamma $are their associated coefficients, respectively. The controls are labor, capital, and material (all in logarithmic form) and lagged export intensity. Furthermore, year dummies are included to account for the trend. ![]() $ \in $is a standard normally distributed error.

$ \in $is a standard normally distributed error. ![]() $EI_{}^{}$is a continuous latent variable that is observed only when

$EI_{}^{}$is a continuous latent variable that is observed only when ![]() ${s_{}} = 1$; in exponential form it is the following (Equation (2)):

${s_{}} = 1$; in exponential form it is the following (Equation (2)):

where ![]() $E{I_{ - 1}}$is the lag of export intensity, employed to control for potential dynamic effects of export intensity. Because the hurdle model makes it possible to explore a firm's two-step decision process—whether to export and how intensively—we rely on the same explanatory variables for both stages, except for

$E{I_{ - 1}}$is the lag of export intensity, employed to control for potential dynamic effects of export intensity. Because the hurdle model makes it possible to explore a firm's two-step decision process—whether to export and how intensively—we rely on the same explanatory variables for both stages, except for ![]() $E{I_{ - 1}}$. As Jafari et al. (Reference Jafari, Koppenberg, Hirsch and Heckelei2023) noted, the markups are potentially endogenous to export behavior due to simultaneity in Equations (1) and (2). In addressing endogeneity, several instrumental variables are employed. This involves the utilization of instruments such as the lagged values of labor and capital, and years. It has been observed that the former are significantly correlated with productivity, i.e. markup (De Loecker, Reference De Loecker2007), and markup exhibits variability across firms of varying ages (Peters, Reference Peters2020).

$E{I_{ - 1}}$. As Jafari et al. (Reference Jafari, Koppenberg, Hirsch and Heckelei2023) noted, the markups are potentially endogenous to export behavior due to simultaneity in Equations (1) and (2). In addressing endogeneity, several instrumental variables are employed. This involves the utilization of instruments such as the lagged values of labor and capital, and years. It has been observed that the former are significantly correlated with productivity, i.e. markup (De Loecker, Reference De Loecker2007), and markup exhibits variability across firms of varying ages (Peters, Reference Peters2020).

Equation (3) is estimated next, to test Hypotheses 3 and 4 on learning by exporting:

where ![]() $Entr{y_{}}$ is a dummy variable that equals one if the firm is an exporter in time t, and

$Entr{y_{}}$ is a dummy variable that equals one if the firm is an exporter in time t, and ![]() $Continu{e_{}}$is a dummy variable that equals one if the firm exports in time t and t − 1. To capture the genuine markup gap between newly entering firms and those already active in the export market, we also incorporate the lagged dependent variable (

$Continu{e_{}}$is a dummy variable that equals one if the firm exports in time t and t − 1. To capture the genuine markup gap between newly entering firms and those already active in the export market, we also incorporate the lagged dependent variable (![]() $ln{\mu _{ - 1}}$) on the right-hand side. We use the lags of capital and labor as instrumental variables for export status, both of which are highly correlated with the productivity, and hence with markups. The coefficients of our interest are

$ln{\mu _{ - 1}}$) on the right-hand side. We use the lags of capital and labor as instrumental variables for export status, both of which are highly correlated with the productivity, and hence with markups. The coefficients of our interest are ![]() ${\lambda _0}$and

${\lambda _0}$and ![]() ${\lambda _1}$, which measure the differences in markups between starters and those firms that continue exporting, in comparison to the firms without export activity.

${\lambda _1}$, which measure the differences in markups between starters and those firms that continue exporting, in comparison to the firms without export activity.

Finally, for Hypothesis 5, stating that exporters will have higher profit markups than non-exporters we estimate Equation (4):

where the ![]() $Export$ variable is a binary indicator, taking the value of one if firm i is an exporter in period t and zero otherwise. The same instrumental variables are used. The associated coefficient

$Export$ variable is a binary indicator, taking the value of one if firm i is an exporter in period t and zero otherwise. The same instrumental variables are used. The associated coefficient ![]() ${\delta _1}$ indicates the percentage markup advantage enjoyed by exporting firms.

${\delta _1}$ indicates the percentage markup advantage enjoyed by exporting firms.

For regressions (2) and (3), we also assess the robustness of our results by controlling for firms’ productivity. This procedure entails regressing markups on productivity estimates, so that the residuals capture the component of markups not explained by productivity. These adjusted markups are then substituted into Equations (2) and (3) in place of the original markups, while the estimation methods remain unchanged.

IV. Data

We use a detailed Hungarian firm-level database. Our unit of analysis is the Hungarian wine exporting firms with more than five employees between 2004 and 2019. We merged data from the firms’ balance sheets and earnings statements with detailed export and import data from the Hungarian Customs Statistics (HCS). The corporate financial statements hosted by the National Tax and Customs Administration for the primary purpose of tax collection. The data cover enterprises using the double-entry bookkeeping system as defined by Act LXXXI of 1996 on corporate and dividend taxes. All such enterprises contribute data, resulting in a sample size ranging from 150,000 to 400,000 firms each year between 2000 and 2022. The main topics include the region, headcount, and sector of the enterprises, along with selected financial statement information.

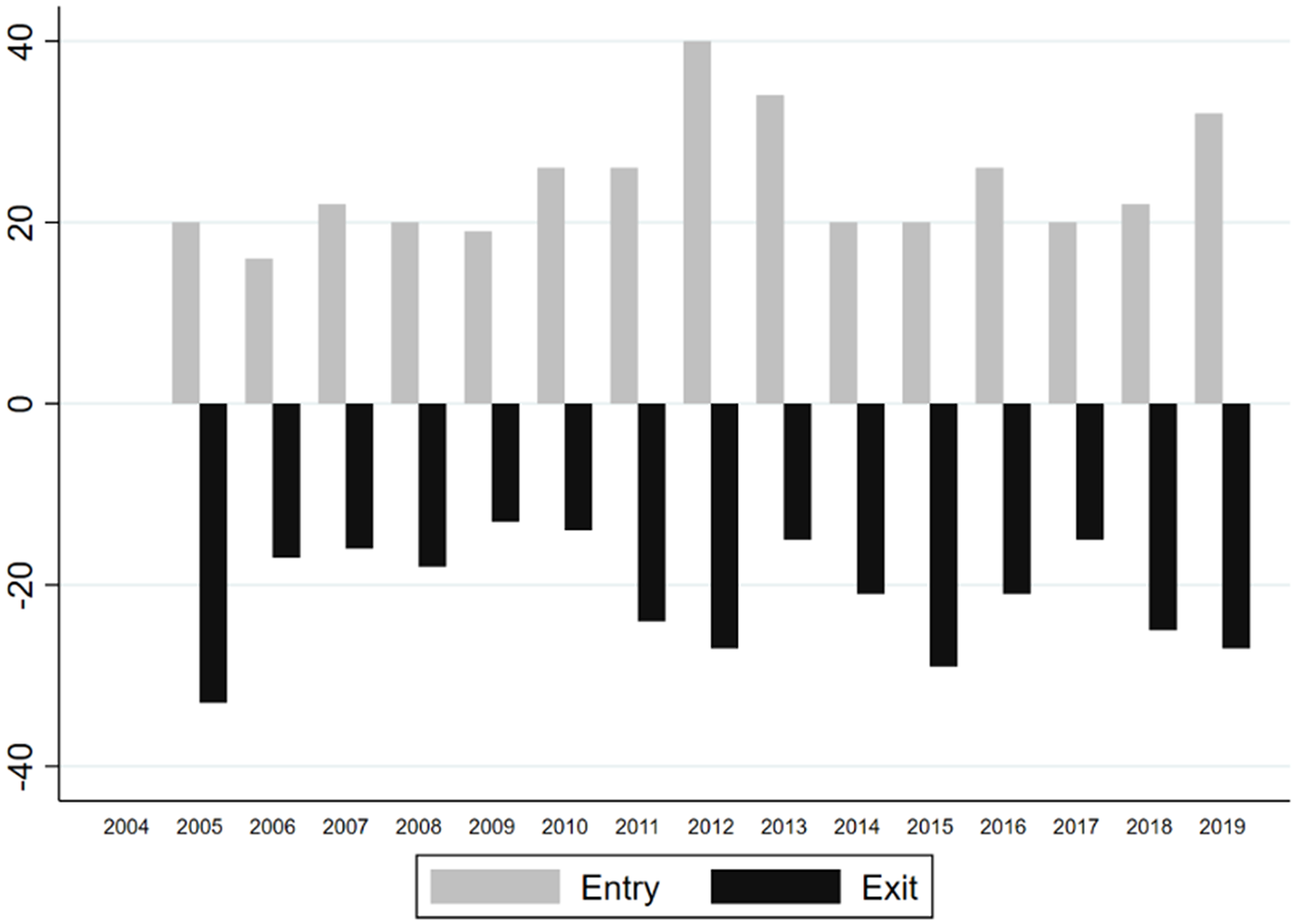

We have observations for roughly 200 companies each year. The number of new exporters varies between 17 and 40 per year, while about the same number of firms exits the export market. Considering that more than 10% of all firms start exporting each year (with even higher numbers exporting) this represents a notable proportion.

From the balance sheet and earnings statements, we use sales, employment, fixed assets, and various cost measures including expenditures on labor and materials, as well as ownership structure (foreign-owned, domestic state-owned, domestic privately owned). HCS reports data on essentially all export and import flows, both as value and quantity, for each firm by six-digit HS (harmonized system) product category, partner country, and year.

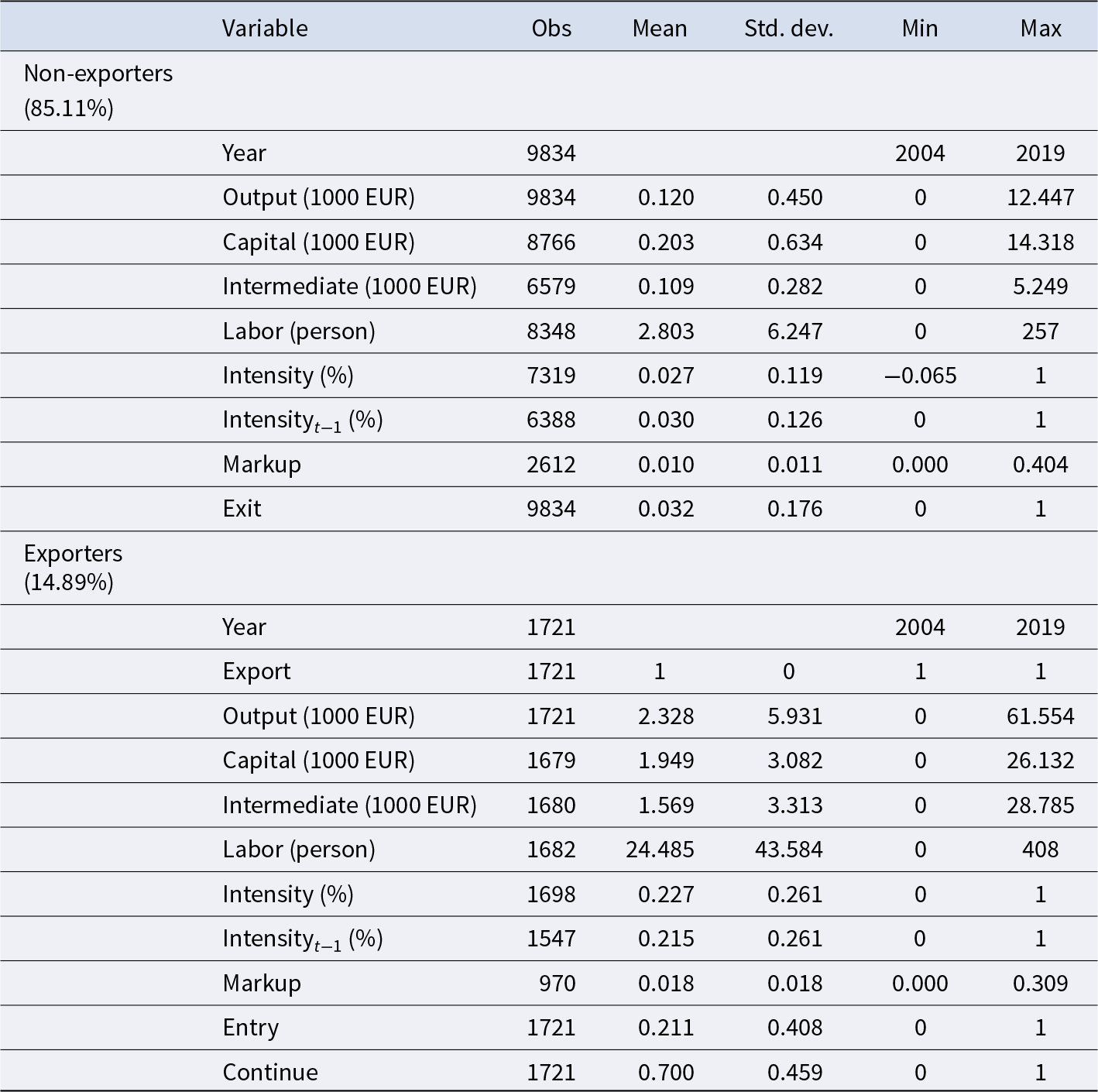

Table 1 presents the descriptive statistics of firms in the Hungarian wine industry that either do not export or do export, covering the period from 2004 to 2019. The summary includes key variables such as output (Output), capital (Capital), intermediate inputs (Intermediate), and labor (Labor). Furthermore, it demonstrates export intensity (Intensity and Intensityt −1), markup (Markup), and indicators for market entry, continuation, and exit. It is evident that non-exporters exhibit markedly low average export intensity, while exporters demonstrate higher average intensity values. Additionally, exporters tend to have higher labor inputs (Labor) but slightly lower markups (Markup) relative to non-exporters. These observations underscore the potential link between exporting behavior and firm performance. In the estimations, we used the logarithmic specification of these variables.

Table 1. Summary statistics

Results are presented in the following structure. First, we present the number of firms entering and exiting the export markets, followed by estimation of the impact of markup upon the export entry and the resulting export intensity. Next, we assess whether firms that enter (or continue in) the export markets have higher markups (learning by exporting). We use two dummy variables, Entry (takes the value 1 if the firm was not exporting in the previous period but it is exporting in the current year) and Continue (takes the value 1 if the firm was exporting in the previous year and continues to do so in the current year). Lastly, we compare the markups of exporting firms to those that are not exporting using a dummy variable Export (takes the value of 1 if the firm is exporting and 0 otherwise).

Figure 1 shows the number of firms starting and ending export activity. The number of exporting firms fluctuated widely during the period under investigation. During the analyzed period, new firms entered the export market, while many firms exited.

Figure 1. Firms entering and exiting the export market—Hungarian wine industry.

V. Results

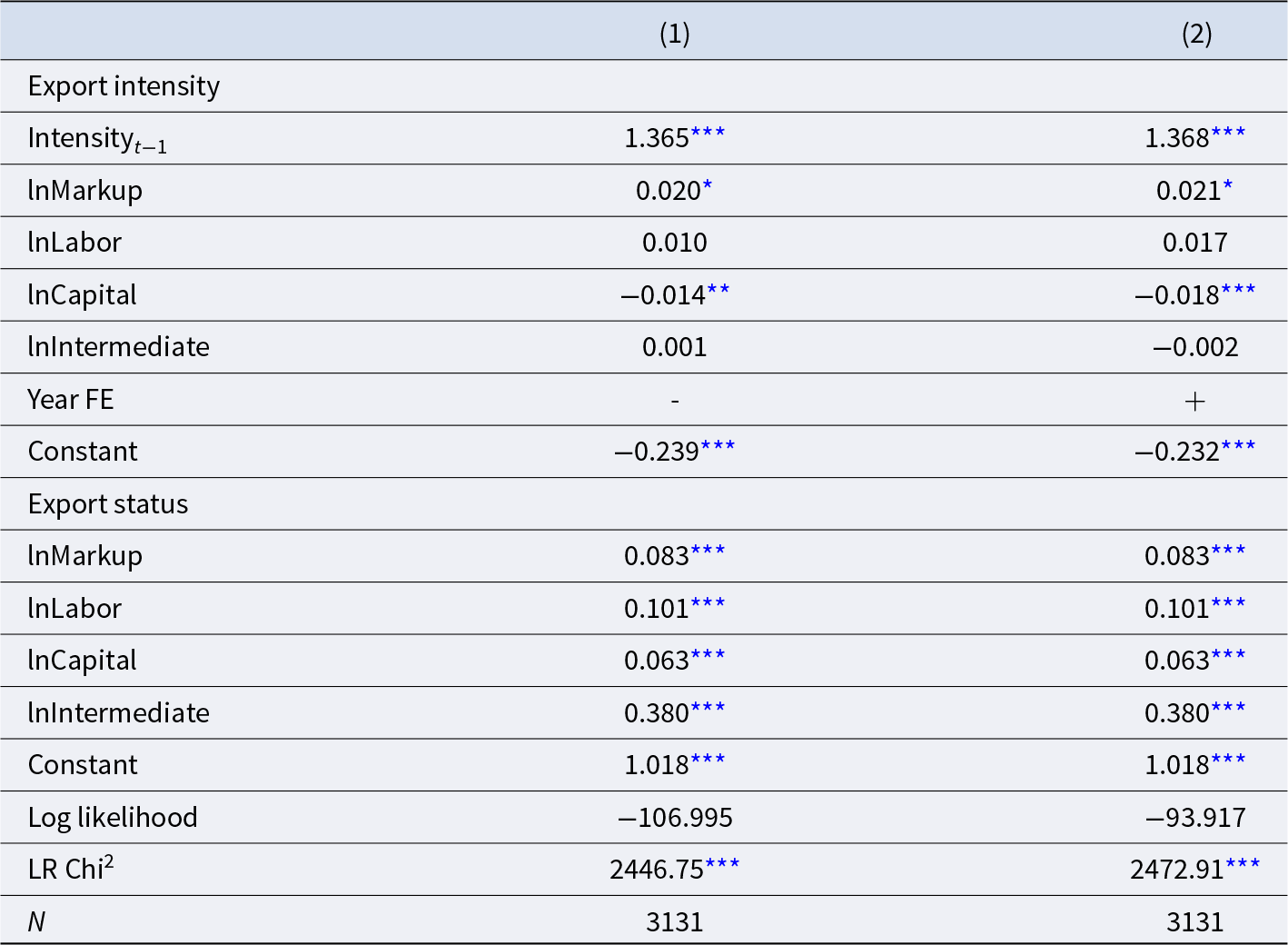

The results emphasizing the impact of markups on wine export intensity (Equations (1) and (2)) are presented in Table 2. For all models, markups were derived using the Cobb–Douglas production function. Year fixed effects were incorporated into model (2) to account for heterogeneity between years.

Table 2. Impact of markups on export intensity

Note:

* p < 0.10,

** p < 0.05,

*** p < 0.01.

Markups have a significant impact on both export participation and export intensity in the structural model. The consistency of these results across all model specifications highlights the reliability of the findings. Albeit only significant at 10%, firms with higher markups demonstrate an increased propensity toward engaging in export activities. This empirical evidence confirms the validity of Hypotheses 1 and 2 being consistent with existing research (Jafari et al., Reference Jafari, Koppenberg, Hirsch and Heckelei2023; Melitz and Ottaviano, Reference Melitz and Ottaviano2008).

Table 3 presents the results on learning by exporting within the Hungarian wine industry. However, for model (2), the results are adjusted using residuals from the reduced form equation, and year fixed effects are incorporated across all models.

Table 3. Learning by exporting

Note:

* p < 0.10,

** p < 0.05,

*** p < 0.01.

The results imply that entering export markets does result in higher markups and does favor continued export activity. Adjusting the results by residuals confirms that the impact of beginning and continuing export activities on markups is detectable across all cases. The coefficient of the Entry variable for models implies that entry into export markets is associated with a 16.4–19.9% increase in markups. Similarly, according to the models where the coefficients of the Continue variable are obtained, firms that export for at least two consecutive years apply markups that are approximately 19–19.2% higher than those charged by firms that have exited the export market or have never exported. The coefficients for Entry and Continue variables are much higher comparing results by Jafari et al. (Reference Jafari, Koppenberg, Hirsch and Heckelei2023) suggesting a higher role of export on the markup in Hungarian wine sectors. Overall, these findings confirm Hypotheses 3a and 3b, which propose that firm markups increase after beginning to export, and this effect remains significant when considering productivity. Additionally, Hypotheses 4a and 4b are supported, indicating that sustained export activity increases firm markups.

The final question to addresses whether there is a difference in markups between exporters and non-exporters, attributable to learning effects and productivity gains from export participation (Equation (4)). The results are presented in Table 4, following the same formatting as Table 2. There is a correlation between export activity and higher markups. The results support Hypotheses 5, which propose a difference in markups between firms that export and firms that do not export. The observed difference remains statistically significant even when taking into consideration the productivity of the firm. The coefficient of the binary Export variable suggests the markup premium ranges between 18.8% and 19.2% for exporters compared to non-exporters. These numbers are significantly higher comparing the results by Jafari et al. (Reference Jafari, Koppenberg, Hirsch and Heckelei2023) suggesting the export status has remarkable higher importance in the Hungarian wine sector.

Table 4. Markup differences between exporters and non-exporters

Note:

** p < 0.05,

*** p < 0.01.

VI. Conclusion

This study examines the relationship between markups and export activity in the Hungarian wine sector. The results provide valuable knowledge for managers of the industry and add to the current body of research on the export decisions made by individual firms.

The results of our study show a strong and positive impact of markups on both the likelihood of engaging in exports and increasing export intensity. This is consistent with the results of Jafari et al. (Reference Jafari, Koppenberg, Hirsch and Heckelei2023) in the French food processing sector. This result emphasizes that firms with greater profitability (as indicated by markups) have a higher probability of engaging in export activities.

The examination of the learning-by-exporting hypothesis uncovers important findings. The estimations show significant and positive influence of exporting on markups. Accounting for productivity enhances the correlation, providing further evidence that exporting results in higher markups (Hypotheses 3a, 3b, 4a, and 4b). This is consistent with the idea of learning through exporting, possibly because it leads to improved efficiency or the acquisition of knowledge in foreign markets.

The final stage of the investigation analyses the difference in markup between firms that export and those that do not export (Table 3). We find that exporters consistently have higher markups than non-exporters, even when productivity is considered (Hypotheses 5a and 5b). The markup premium in the Hungarian wine industry is higher compared to French food processing sector, see Jafari et al. (Reference Jafari, Koppenberg, Hirsch and Heckelei2023), suggesting a significant impact specific to this industry.

To summarize, this research presents strong evidence that markups have a substantial impact on export decisions and performance within the Hungarian wine industry. Firms with higher profit margins are more willing to engage in international trade and achieve higher levels of export activity. The practice of exporting appears to result in higher markups, possibly because of learning-by-exporting. The utilization of a double hurdle control function methodology helps to separate the valuable insights into these relationships.

These findings have substantial implications. Policymakers can establish conditions that promote higher prices (e.g. tax breaks) for firms, which in turn stimulates the exportation of goods and contributes to economic expansion within the wine industry. Firms should prioritize enhancing productivity and implementing strategic pricing strategies to attain higher profit margins and achieve success in exporting. Further research could investigate similar dynamics in different nations and sectors to gain a deeper understanding of the intricate relationship between price markups and export patterns in the worldwide wine industry.

Acknowledgments

We are grateful to the anonymous reviewer whose insightful comments helped improve the quality of the manuscript. This study has been prepared using the data sets of the Hungarian Central Statistical Office Külkereskedelmi adatok 1992-2018, Ipari termékek és szolgáltatások árjeletése 2000-2019, Teljes vállalati mérlegállomány (92-19), Ipari termelés és értékesítés 92-22, Teljes GSZR 12-22. The calculations contained in this document and the conclusions drawn from them are the exclusive intellectual property of Gergely Csurilla, Zoltán Bakucs, and Imre Fertő. This study has received funding from the European Union’s Horizon 2020 research and innovation program under grant agreement No. 861932 (BatModel). The views expressed here are solely those of the authors’ and may not in any circumstances be regarded as stating an official position of the European Commission (the funding agency).

Competing interests

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.