1. Introduction

In the early 1990s, central banks of New Zealand, Canada, and the United Kingdom officially adopted an inflation-targeting regime, which was later followed by numerous other countries. Since then, determining the optimal inflation target has become a central focus in monetary policy research.Footnote 1 The existing literature presents a wide range of estimates for the optimal inflation target. Early studies proposed negative optimal inflation rates mainly based on Friedman rule (Cooley and Hansen, Reference Cooley and Hansen1989; Chari et al. Reference Chari, Christiano and Kehoe1996; Schmitt-Grohé and Uribe, Reference Schmitt-Grohé and Uribe2004), whereas more recent papers suggest positive inflation rates (Kim and Ruge-Murcia, Reference Kim and Ruge-Murcia2011; Blanco, Reference Blanco2021; Adam and Weber, Reference Adam and Weber2023), with some advocating for rates as high as 5% (Fagan and Messina, Reference Fagan and Messina2009).

An important motivation for targeting a high inflation rate is the friction in the labor market called downward nominal wage rigidity (DNWR)–the inability of firms to reduce nominal wages.Footnote 2 A higher inflation rate provides firms with the flexibility to reduce wages in real terms while keeping nominal wages constant. So, higher inflation relaxes this constraint but at the same time increases the welfare cost associated with price dispersion.Footnote 3 Since DNWR is a friction at the worker level and affects the cross-section of individual wage changes, a representative agent economy cannot fully capture its effects. A constraint on aggregate wages fails to account for micro-level frictions, leading to an underestimation of the impact of this labor market friction and, consequently, the benefits of higher inflation. For DNWR to play a significant role, it is crucial to fully account for worker heterogeneity (Daly and Hobijn, Reference Daly and Hobijn2014). Accordingly, this study uses a heterogeneous-agent New Keynesian model to quantify the trade-offs and identify the welfare-maximizing steady-state inflation rate. Second, the quantitative importance of DNWR depends heavily on how the nominal friction is specified and calibrated. To address this, different wage-setting models have been considered to capture the DNWR constraint, and key parameters are calibrated based on recent empirical evidence on DNWR.Footnote 4 The findings reveal that DNWR significantly influences the economy, with the optimal steady-state inflation rate estimated to be as high as 9%, yielding welfare gains of approximately 3.60%. Although the optimal inflation target is sensitive to parameter choices, it consistently exceeds 3% across a broad range of calibrations.

Data on annual wage changes reveal that nominal wages exhibit downward rigidity, as nominal wage cuts are rare and a substantial proportion of employees experience no change in their nominal wage. This phenomenon, known as downward nominal wage rigidity, generates a trade-off between inflation and unemployment at low inflation rates. Specifically, some firms may need to reduce real wages due to the stochastic nature of productivity, but in a low inflation regime, this necessitates nominal wage cuts, which are not commonly practiced by convention. Thus, if the inflation rate is low and nominal wage cuts are not feasible, firms resort to layoffs instead. As a result, positive shocks result in wage increases, while negative shocks lead to increased unemployment. To put it differently, the long-run Phillips curve approaches verticality at high inflation and flattens out at low inflation, indicating a progressive increase in the output cost of reducing inflation (Daly and Hobijn, Reference Daly and Hobijn2014).

According to Tobin (Reference Tobin1972), when DNWR is pronounced, positive inflation acts as a lubricant (“greases the wheels”) for the economy by promoting wage flexibility. A positive inflation rate allows for greater downward real wage adjustments in response to shocks, as it provides more leeway for real wage cuts while keeping nominal wages constant. Hence, a higher inflation rate may be desirable to accommodate a wider range of real wage reductions.

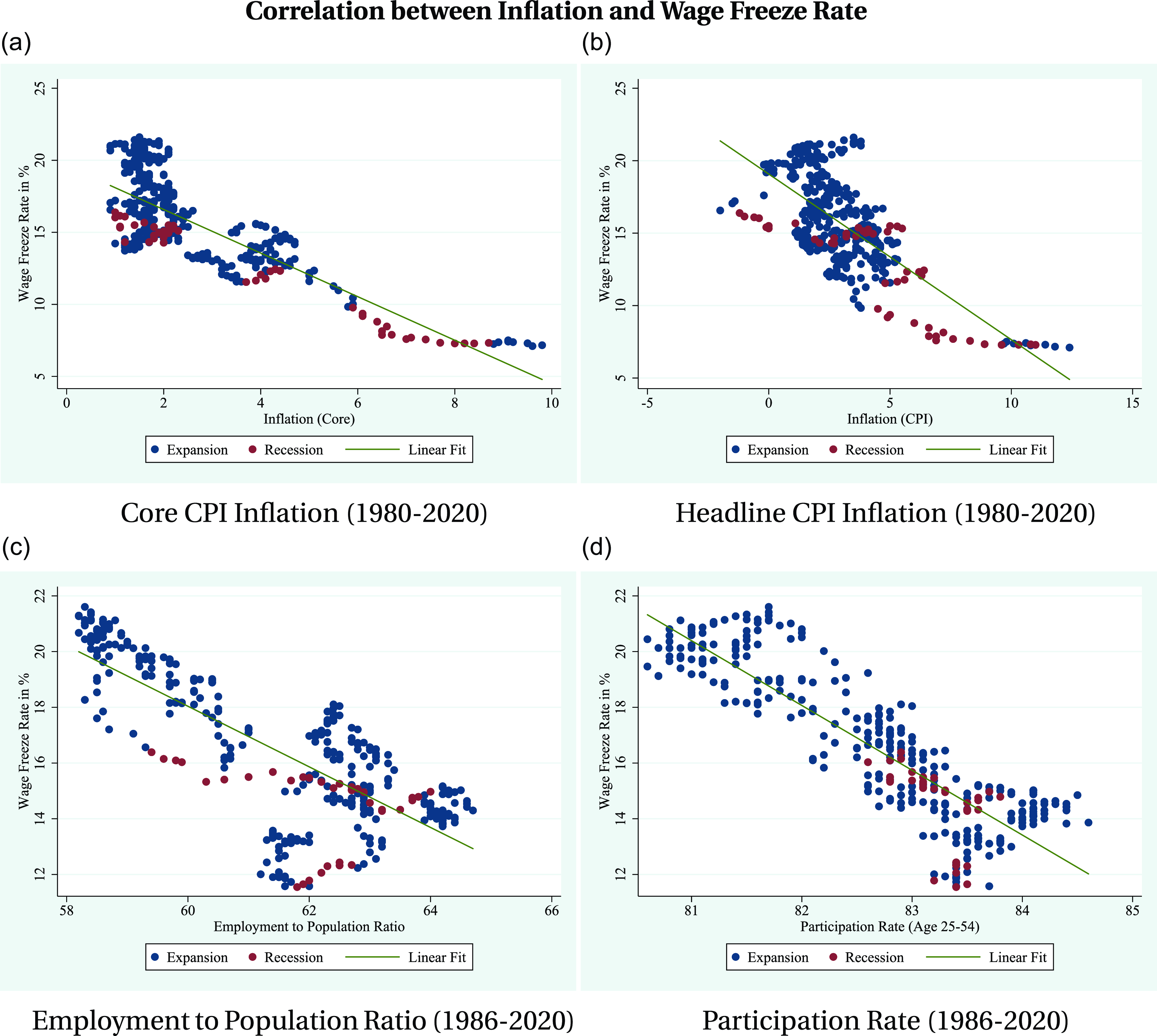

Both survey data (Akerlof et al. Reference Akerlof, Dickens, Perry, Gordon and Mankiw1996; Daly and Hobijn, Reference Daly and Hobijn2014; Fallick et al. Reference Fallick, Lettau and Wascher2016) and administrative data (Kurmann and Mcentarfer, Reference Kurmann and Mcentarfer2019; Jardim et al. Reference Jardim, Solon and Vigdor2019; Grigsby et al. Reference Grigsby, Hurst and Yildirmaz2021) indicate that DNWR is empirically valid in the U.S. This phenomenon has also been observed in other countries as shown by Dickens et al. (Reference Dickens, Goette, Groshen, Holden, Messina, Schweitzer, Turunen and Ward2007), who document the empirical wage change distribution based on cross-country datasets. In the U.S., the rate of no wage change–defined as the proportion of employees experiencing no nominal wage adjustment within a year–has ranged from 5% to 25% since 1980 and can reach up to 35% when considering only base wage changes, as documented by Grigsby et al. (Reference Grigsby, Hurst and Yildirmaz2021).Footnote 5 Furthermore, the correlation between the inflation rate and the rate of no wage change from 1980 to 2020 is −0.65 (see Figure-C2), supporting Tobin’s original idea that higher inflation should result in fewer nominal wage freezes.

While nominal wage freezes are common in the data, a non-negligible proportion of nominal wage cuts is also observed. According to Grigsby et al. (Reference Grigsby, Hurst and Yildirmaz2021), the rate of wage cuts is 15.7% when bonuses are included and 2.5% when only base wages are considered.Footnote 6 Given the high level of wage freezes and missing cuts in the empirical distribution, a model with a DNWR constraint imposed on aggregate wages within a representative agent framework–restricting aggregate wages from falling below a certain threshold–may fail to accurately capture empirical findings. In reality, DNWR is binding for a subset of households in each period. To effectively analyze the welfare costs of DNWR, a model must replicate the empirical wage change distribution, which necessitates the use of a heterogeneous-agent framework. That is, to address DNWR more accurately, one needs to consider the heterogeneity in productivity at the household level. Firms seek to decrease the real wages of workers who receive negative idiosyncratic productivity shocks in a period. In a low inflation environment, real wage cuts are limited, leading to significant welfare costs due to the inability to adjust wages optimally. However, this is offset to some extent by the lower welfare cost of price dispersion in a low-inflation environment.

I incorporate the DNWR constraint into an otherwise standard New Keynesian model, and then analyze the welfare costs at various steady-state inflation rates in order to determine the optimal inflation rate in this standard model to make the results comparable to the previous literature. It examines the trade-off between the “grease” effect of inflation, which alleviates the DNWR constraint, and the “sand” effect of inflation, which captures the costs of price dispersion and inefficient price setting. In a low-inflation environment, the grease effect dominates, whereas at higher inflation rates, the sand effect becomes more pronounced. In other words, while a higher inflation target reduces the welfare cost associated with DNWR, it simultaneously increases the welfare cost of price dispersion. This trade-off is central to the welfare analysis and enables the identification of the economy’s optimal inflation rate. Here, the model abstracts from other potential costs of higher inflation, such as increased macroeconomic volatility, higher markups, and dispersed inflation expectations (Ascari and Sbordone, Reference Ascari and Sbordone2014), and instead focuses solely on the trade-off between DNWR and the distortion in relative prices caused by inflation, which represents the standard cost of inflation in sticky price models.

I match the wage change distribution using a simple heterogeneous-agent model with an asymmetrically staggered wage-setting mechanism, as proposed by Daly and Hobijn (Reference Daly and Hobijn2014). After calibrating the model, I solve it for different steady-state inflation rates and conduct a welfare comparison. According to the steady-state welfare analysis, the optimal steady-state inflation rate is approximately 7%, rather than the current target of 2%, and could be as high as 9% when considering only changes in base wages. Even under extreme levels of price stickiness and the resulting cost of inflation, the model suggests an optimal rate above 3%. In a standard New Keynesian framework, with only minor modifications to the wage-setting mechanism to imitate the DNWR constraint, I find that the optimal inflation rate is considerably higher than the 2% benchmark set by the Federal Reserve or the slightly positive rates typically regarded as ”normal.” This finding is quite robust to changes in the nearly all parameters in a standard model. By accounting for the nonlinearity introduced by DNWR in the labor market, the result inferred from a very standard model is significantly different from previous literature.

The paper is structured as follows: In Section 2, I review the relevant literature and outline my contribution. Section 3 presents the model, a heterogeneous-agent New Keynesian framework incorporating the DNWR constraint at the household level. Section 4 presents the steady-state results and Section 5 includes a sensitivity analysis of the steady-state results. Section 6 presents the results obtained from the model with asymmetric menu cost wage setting as an alternative to the benchmark model with asymmetric Calvo-type wage setting. Finally, Section 7 concludes the paper.

2. Related literature

Downward nominal wage rigidity has become an important research topic that can leverage recent increases in computational capabilities. Elsby (Reference Elsby2009) analyzes the distribution of wage changes using a partial equilibrium model that incorporates DNWR and evaluate its implications for aggregate wage growth. Their main finding is that while DNWR prevents wage cuts, it also suppresses wage increases, leading to the conclusion that the macroeconomic effects of DNWR are limited.

Kim and Ruge-Murcia (Reference Kim and Ruge-Murcia2009) and Kim and Ruge-Murcia (Reference Kim and Ruge-Murcia2011) introduce an asymmetric cost to wage adjustments and analyze the effect of DNWR on the optimal level of “grease” inflation, in a representative agent model. They conclude that the optimal inflation target should be near 1 percent. Benigno and Ricci (Reference Benigno and Ricci2011), on the other hand, incorporate a DNWR constraint into individual wage-setting problems in a heterogeneous-sector model, accounting for both idiosyncratic and aggregate shocks. They explore the implications of DNWR for the shape of the Phillips curve and conclude that positive inflation can facilitate both intratemporal and intertemporal relative price adjustments, although they do not provide an estimate for the optimal inflation rate.

Fagan and Messina (Reference Fagan and Messina2009) utilize a modified menu cost model for wage setting and conduct a welfare analysis, determining that the optimal inflation target under DNWR is 2 percent but can vary up to 5 percent based on estimates for the probability of menu costs within the model.Footnote 7 If half of households are exempt from menu cost constraints annually, the optimal rate is estimated at 2 percent, increasing to 5 percent if the binding frequency of menu costs rises to 80 percent. Daly and Hobijn (Reference Daly and Hobijn2014) employ a discrete-time model to analyze the mechanism behind the flattening of the Phillips curve by incorporating the DNWR constraint, similar to Benigno and Ricci (Reference Benigno and Ricci2011), and they solve for transition dynamics in response to demand and supply shocks to analyze the bending of the Phillips curve. They examine the relationship between the unemployment rate and the degree of downward nominal wage rigidity. Schmitt-Grohe and Uribe (Reference Schmitt-Grohe and Uribe2016) introduce a DNWR constraint for the aggregate wage in a standard representative agent model and analyze the impact of currency peg in this setting. Amano and Gnocchi (Reference Amano and Gnocchi2023) and Billi and Galí (Reference Billi and Galí2020) document that wage rigidity reduces the severity of demand-driven recessions, particularly during zero lower bound periods, in a representative agent setting. In this context, the aggregate DNWR constraint is binding in a demand-driven recession, distorting the labor market but making marginal costs rigid, thereby decreasing the volatility of inflation and the zero lower bound binding frequency. Consequently, wage flexibility might decrease welfare in such recessions.Footnote 8 Jo (Reference Jo2021) analyzes different wage-setting schemes in the literature and shows that a model with a downward nominal wage rigidity constraint is the most consistent with empirical findings regarding the wage change distributions.

Mineyama (Reference Mineyama2022) employs a wage-setting framework with asymmetric adjustment costs, similar to Fagan and Messina (Reference Fagan and Messina2009), to match the empirical distribution of wage changes and estimates an optimal inflation target between 1.4 percent and 2.6 percent. The model’s parameterization plays a significant role in producing a relatively low welfare cost associated with the downward nominal wage rigidity constraint. Additionally, the assumption of wage flexibility for job switchers further reduces the welfare cost; however, Hazell and Taska (Reference Hazell and Taska2020) document that wages for new hires are also downwardly rigid. The paper discusses the differences between the model presented here and Mineyama (Reference Mineyama2022) in a dedicated section, comparing the results accordingly.

The present model adopts a simpler wage-setting mechanism that deviates slightly from the standard New Keynesian model to match the annual wage change distribution, thereby enhancing its comparability to prior literature. A simplified DNWR constraint, widely used in recent studies, is employed to capture labor market dynamics and explain the flattening of the Phillips Curve in a straightforward manner. The primary contribution of this study lies in implementing the DNWR constraint, as utilized in recent papers (Guerrieri et al. (Reference Guerrieri, Lorenzoni, Straub and Werning2021, Reference Guerrieri, Lorenzoni, Straub and Werning2022); Schmitt-Grohe and Uribe (Reference Schmitt-Grohe and Uribe2016); Shen and Yang (Reference Shen and Yang2018); Dupraz et al. (Reference Dupraz, Nakamura and Steinsson2025); Jo and Zubairy (Reference Jo and Zubairy2025); Rouillard (Reference Rouillard2023)) and demonstrating its welfare implications. While this approach has become standard in macroeconomic modeling, its welfare implications have not been thoroughly explored. This study highlights that the DNWR constraint, when calibrated to match the empirical wage change distribution, generates substantial welfare costs and should be incorporated cautiously into standard models.Footnote 9 In summary, this study employs a widely adopted version of the DNWR constraint and conducts a steady-state welfare analysis across various trend inflation rates to evaluate the welfare costs associated with DNWR.Footnote 10

I match the annual wage change distribution by using the most recent empirical data based on the estimates of Grigsby et al. (Reference Grigsby, Hurst and Yildirmaz2021), derived from administrative data, and the San Francisco Fed’s wage rigidity estimates, which are based on the Current Population Survey (CPS) data.Footnote 11 The empirical match is crucial for the welfare analysis because the significance of the DNWR channel depends on the wage freeze rate in the annual wage change distribution.Footnote 12 The model assumes no aggregate uncertainty and focuses on this cross-sectional heterogeneity. To the best of my knowledge, Coibion et al. (Reference Coibion, Gorodnichenko and Wieland2012) - which analyzes optimal steady-state inflation using a standard representative-agent New Keynesian model without heterogeneity - is the closest paper, in terms of the main research idea. They find that the optimal inflation may range from 1% to 3% depending on assumptions related to price stickiness, DNWR, zero lower bound, and uncertainty. To facilitate a meaningful comparison with their findings, I calibrate my model by closely following their approach. This allows me to document how the DNWR constraint influences the optimal inflation rate in a heterogeneous-agent model within a standard New Keynesian framework. The main finding is that the optimal inflation rate is approximately 7%, with its level shaped to some extent by the parameterization and the modeling approach. However, the conclusion of a higher optimal inflation rate–significantly above the conventional 2% target–remains robust across alternative calibrations and wage-setting mechanisms. Importantly, this study quantifies the welfare impact of the DNWR constraint and estimates the optimal inflation target while also accounting for the “sand” effect of price dispersion in the economy.

3. Model

I employ a New Keynesian model, which includes a standard Calvo pricing friction but an asymmetric wage setting friction, following Daly and Hobijn (Reference Daly and Hobijn2014) and Jo (Reference Jo2021). The households are heterogeneous in their productivity levels. Basically, I introduce a downward wage rigidity setting into an otherwise standard New Keynesian model without capital accumulation.

3.1 Households

In this economy, there is a continuum of households, indexed by i on the unit interval and they supply differentiated labor input to the labor packer. Households differ in their productivity due to idiosyncratic productivity shocks they receive each period. The labor packer combines labor into aggregate labor with the following Dixit-Stiglitz technology:

where idiosyncratic shock

![]() $q_t(i)$

follows AR(1) process:

$q_t(i)$

follows AR(1) process:

The idiosyncratic productivity process is assumed to be persistent, unlike Daly and Hobijn (Reference Daly and Hobijn2014), and the persistency is calibrated based on Guvenen (Reference Guvenen2009) to make it as standard as possible.Footnote 13

The maximization problem of the competitive labor packer is

The first-order condition of the cost minimization problem of labor packer implies

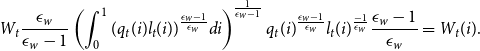

\begin{equation*} W_t \frac {\epsilon _w}{\epsilon _w-1} \left (\int _{0}^{1} (q_t(i) l_{t}(i))^{\frac {\epsilon _{w}-1}{\epsilon _{w}}} d i\right)^{\frac {1}{\epsilon _ w-1}} q_t(i)^\frac {\epsilon _w-1}{\epsilon _w} l_t(i)^\frac {-1}{\epsilon _w} \frac {\epsilon _w-1}{\epsilon _w} = W_t(i). \end{equation*}

\begin{equation*} W_t \frac {\epsilon _w}{\epsilon _w-1} \left (\int _{0}^{1} (q_t(i) l_{t}(i))^{\frac {\epsilon _{w}-1}{\epsilon _{w}}} d i\right)^{\frac {1}{\epsilon _ w-1}} q_t(i)^\frac {\epsilon _w-1}{\epsilon _w} l_t(i)^\frac {-1}{\epsilon _w} \frac {\epsilon _w-1}{\epsilon _w} = W_t(i). \end{equation*}

Then, I can get the labor demand as

The relative demand for labor of type i is a function of its relative wage, productivity, and the elasticity

![]() $\epsilon _{w}$

. Using the demand, I can find aggregate wage as

$\epsilon _{w}$

. Using the demand, I can find aggregate wage as

\begin{equation*} W_{t}=\left [\int _{0}^{1}\left (\frac {W_{t}(i)}{q_{t}(i)}\right)^{1-\epsilon _{w}} d i \right]^{\frac {1}{1-\epsilon _{w}}}, \end{equation*}

\begin{equation*} W_{t}=\left [\int _{0}^{1}\left (\frac {W_{t}(i)}{q_{t}(i)}\right)^{1-\epsilon _{w}} d i \right]^{\frac {1}{1-\epsilon _{w}}}, \end{equation*}

which can be written in terms of real wage as well.

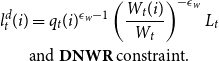

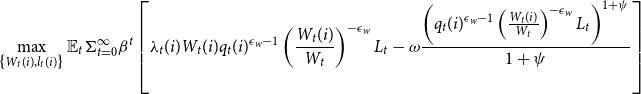

Households have CRRA utility and their preferences are additively separable in consumption and labor. They choose consumption, saving as nominal stock of bonds, nominal wage, and labor supply to maximize the expected lifetime utility. The following is the maximization problem of households

subject to

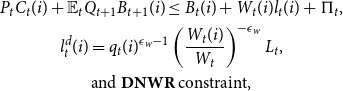

\begin{gather*} P_{t} C_{t}(i)+ \mathbb{E}_t Q_{t+1} B_{t+1}(i) \leq B_{t}(i)+W_{t}(i) l_{t}(i)+\Pi _{t}, \\ l_{t}^{d}(i)=q_{t}(i)^{\epsilon _w-1}\left (\frac {W_{t}(i)}{W_{t}}\right)^{-\epsilon _w} L_{t}, \\ \text{and }\textbf {DNWR}\text{ constraint,} \end{gather*}

\begin{gather*} P_{t} C_{t}(i)+ \mathbb{E}_t Q_{t+1} B_{t+1}(i) \leq B_{t}(i)+W_{t}(i) l_{t}(i)+\Pi _{t}, \\ l_{t}^{d}(i)=q_{t}(i)^{\epsilon _w-1}\left (\frac {W_{t}(i)}{W_{t}}\right)^{-\epsilon _w} L_{t}, \\ \text{and }\textbf {DNWR}\text{ constraint,} \end{gather*}

where price of consumption good

![]() $P_t$

, unique stochastic discount factor

$P_t$

, unique stochastic discount factor

![]() $Q_{t+1}$

and aggregate labor supply

$Q_{t+1}$

and aggregate labor supply

![]() $L_t$

are taken as given by households.

$L_t$

are taken as given by households.

![]() $\Pi _t$

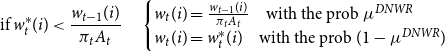

is profit distributed lump sum to households. Here, the downward nominal wage rigidity (DNWR) constraint is defined as

$\Pi _t$

is profit distributed lump sum to households. Here, the downward nominal wage rigidity (DNWR) constraint is defined as

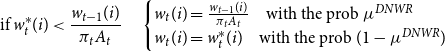

\begin{equation*} \text{if } w_t^*(i) \lt \frac {w_{t-1}(i)}{\pi _t A_t} \quad \begin{cases} w_t(i)=\frac {w_{t-1}(i)}{\pi _t A_t} \quad \text{with the prob } \mu ^{DNWR} \\ w_t(i)=w_t^*(i) \quad \text{with the prob } (1-\mu ^{DNWR}) \end{cases} \end{equation*}

\begin{equation*} \text{if } w_t^*(i) \lt \frac {w_{t-1}(i)}{\pi _t A_t} \quad \begin{cases} w_t(i)=\frac {w_{t-1}(i)}{\pi _t A_t} \quad \text{with the prob } \mu ^{DNWR} \\ w_t(i)=w_t^*(i) \quad \text{with the prob } (1-\mu ^{DNWR}) \end{cases} \end{equation*}

where

![]() $w_t^*$

is the optimal real wage of households if the constraint does not bind and solution to the maximization problem presented below. Here, households adjust their nominal wages upwards without restriction, but they are only able to decrease their nominal wages with a probability of

$w_t^*$

is the optimal real wage of households if the constraint does not bind and solution to the maximization problem presented below. Here, households adjust their nominal wages upwards without restriction, but they are only able to decrease their nominal wages with a probability of

![]() $1-\mu ^{DNWR}$

. Otherwise, if they are unable to decrease their nominal wages, they must keep them constant. This does not eliminate real wage cuts completely because if inflation is positive, keeping the nominal wage constant is simply a real wage cut. There is also aggregate productivity growth factor

$1-\mu ^{DNWR}$

. Otherwise, if they are unable to decrease their nominal wages, they must keep them constant. This does not eliminate real wage cuts completely because if inflation is positive, keeping the nominal wage constant is simply a real wage cut. There is also aggregate productivity growth factor

![]() $A_t$

, which provides additional scope for real wage reductions.Footnote

14

$A_t$

, which provides additional scope for real wage reductions.Footnote

14

The DNWR constraint simply implies an asymmetric Calvo wage setting scheme, where households have flexibility in increasing their wages but are restricted from decreasing them with some probability. Due to idiosyncratic productivity shocks, some households each period may wish to decrease their wages, but the DNWR constraint may prevent them from doing so, causing a spike in the wage freeze rate in the wage change distribution. Depending on the value of

![]() $\mu ^{DNWR}$

, some households may be able to decrease their wages, which constitutes wage cuts in the wage change distribution. This friction leads to differences in wages across households and, therefore, differences in the labor hours supplied by each household.

$\mu ^{DNWR}$

, some households may be able to decrease their wages, which constitutes wage cuts in the wage change distribution. This friction leads to differences in wages across households and, therefore, differences in the labor hours supplied by each household.

In this framework, I assume that households have access to complete state-contingent assets, allowing for complete consumption insurance and uniformity of consumption across households (Benigno and Ricci, Reference Benigno and Ricci2011), as a result of their separable utility functions.

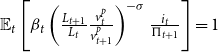

Market completeness ensures that there is a unique stochastic discount factor that prices any asset. The first-order condition for households with respect to nominal bond holdings

where the nominal discount factor is

![]() $Q_{t+1} = \beta \frac {u^{\prime}(C_{t+1})}{u^{\prime}(C_t)} \frac {P_t}{P_{t+1}}$

and

$Q_{t+1} = \beta \frac {u^{\prime}(C_{t+1})}{u^{\prime}(C_t)} \frac {P_t}{P_{t+1}}$

and

![]() $i_t$

denotes the gross nominal interest rate. The Euler equation can be derived from the first-order conditions for consumption and nominal bond holdings.

$i_t$

denotes the gross nominal interest rate. The Euler equation can be derived from the first-order conditions for consumption and nominal bond holdings.

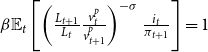

Since there is no capital in this economy, all production is consumed. Output is equal to consumption and I can rewrite the Euler equation as

\begin{equation*} \begin{array}{c} \beta \mathbb{E}_{t}\left [\left (\frac {L_{t+1}}{L_{t}}\frac {v_{t}^p}{v_{t+1}^p}\right)^{-\sigma } \frac {i_{t}}{\pi _{t+1}}\right]=1 \end{array} \end{equation*}

\begin{equation*} \begin{array}{c} \beta \mathbb{E}_{t}\left [\left (\frac {L_{t+1}}{L_{t}}\frac {v_{t}^p}{v_{t+1}^p}\right)^{-\sigma } \frac {i_{t}}{\pi _{t+1}}\right]=1 \end{array} \end{equation*}

where

![]() $\pi _t$

is inflation rate,

$\pi _t$

is inflation rate,

![]() $v_t^p$

is price dispersion, and

$v_t^p$

is price dispersion, and

![]() $i_t$

is nominal interest rate.

$i_t$

is nominal interest rate.

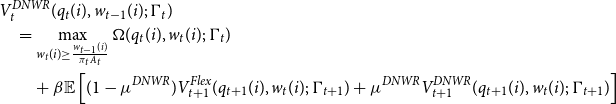

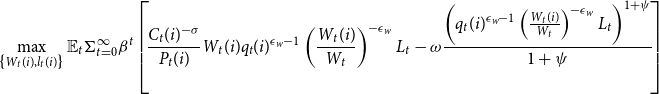

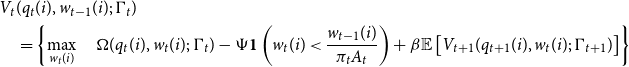

Due to heterogeneity in productivity (as a result of uninsurable idiosyncratic productivity shocks), the labor supply differs across households, and leisure is not fully insured. Two Bellman equations characterize the dynamic planning problem of a household. Given the aggregates

![]() $\Gamma _t \equiv \{ L_t,\pi _t,v_t^p \}$

, the value function for constrained households, who cannot nominally decrease their wages, can be written as

$\Gamma _t \equiv \{ L_t,\pi _t,v_t^p \}$

, the value function for constrained households, who cannot nominally decrease their wages, can be written as

\begin{align*} & V^{DNWR}_t(q_t(i),w_{t-1}(i);\;\Gamma _t) \\ &\quad = \max _{w_t(i) \geq \frac {w_{t-1}(i)}{\pi _t A_t} } \Omega (q_t(i),w_t(i);\;\Gamma _t)\\ &\qquad + \beta \mathbb{E} \left [ (1-\mu ^{DNWR}) V^{Flex}_{t+1} (q_{t+1}(i),w_{t}(i);\;\Gamma _{t+1}) + \mu ^{DNWR} V^{DNWR}_{t+1} (q_{t+1}(i),w_{t}(i);\;\Gamma _{t+1})\right] \end{align*}

\begin{align*} & V^{DNWR}_t(q_t(i),w_{t-1}(i);\;\Gamma _t) \\ &\quad = \max _{w_t(i) \geq \frac {w_{t-1}(i)}{\pi _t A_t} } \Omega (q_t(i),w_t(i);\;\Gamma _t)\\ &\qquad + \beta \mathbb{E} \left [ (1-\mu ^{DNWR}) V^{Flex}_{t+1} (q_{t+1}(i),w_{t}(i);\;\Gamma _{t+1}) + \mu ^{DNWR} V^{DNWR}_{t+1} (q_{t+1}(i),w_{t}(i);\;\Gamma _{t+1})\right] \end{align*}

And the value function for households that can change their wages flexibly is

\begin{align*} &V^{Flex}_t(q_t(i),w_{t-1}(i);\;\Gamma _t)\\ &\quad = \max _{w_t(i)} \quad \Omega (q_t(i),w_t(i);\;\Gamma _t)\\ & \qquad + \beta \mathbb{E} \left [ (1-\mu ^{DNWR}) V^{Flex}_{t+1} (q_{t+1}(i),w_{t}(i);\;\Gamma _{t+1}) + \mu ^{DNWR} V^{DNWR}_{t+1} (q_{t+1}(i),w_{t}(i);\;\Gamma _{t+1})\right] \end{align*}

\begin{align*} &V^{Flex}_t(q_t(i),w_{t-1}(i);\;\Gamma _t)\\ &\quad = \max _{w_t(i)} \quad \Omega (q_t(i),w_t(i);\;\Gamma _t)\\ & \qquad + \beta \mathbb{E} \left [ (1-\mu ^{DNWR}) V^{Flex}_{t+1} (q_{t+1}(i),w_{t}(i);\;\Gamma _{t+1}) + \mu ^{DNWR} V^{DNWR}_{t+1} (q_{t+1}(i),w_{t}(i);\;\Gamma _{t+1})\right] \end{align*}

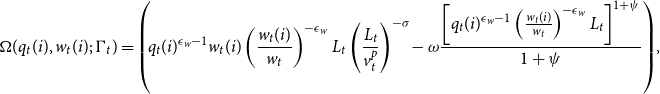

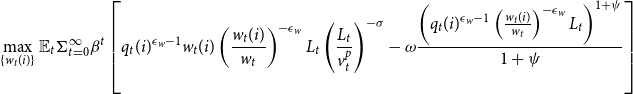

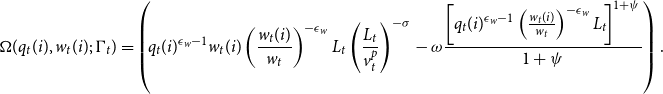

where

\begin{equation*} \Omega (q_t(i),w_t(i);\;\Gamma _t)= \left (\! q_{t}(i)^{\epsilon _w-1}w_{t}(i)\left (\frac {w_{t}(i)}{w_{t}}\right)^{-\epsilon _w} L_{t} \left (\frac {L_t}{v_t^p}\right)^{-\sigma }\!-\omega \frac {\left [q_{t}(i)^{\epsilon _w-1}\left (\frac {w_{t}(i)}{w_{t}}\right)^{-\epsilon _w} L_{t}\right]^{1+\psi }}{1+\psi } \right)\!, \end{equation*}

\begin{equation*} \Omega (q_t(i),w_t(i);\;\Gamma _t)= \left (\! q_{t}(i)^{\epsilon _w-1}w_{t}(i)\left (\frac {w_{t}(i)}{w_{t}}\right)^{-\epsilon _w} L_{t} \left (\frac {L_t}{v_t^p}\right)^{-\sigma }\!-\omega \frac {\left [q_{t}(i)^{\epsilon _w-1}\left (\frac {w_{t}(i)}{w_{t}}\right)^{-\epsilon _w} L_{t}\right]^{1+\psi }}{1+\psi } \right)\!, \end{equation*}

and

![]() $w_t$

is real detrended aggregate wage,

$w_t$

is real detrended aggregate wage,

![]() $L_t$

is aggregate labor supply,

$L_t$

is aggregate labor supply,

![]() $v_t^p$

is price dispersion, and

$v_t^p$

is price dispersion, and

![]() $A_t$

is trend productivity growth, which is assumed to be constant.Footnote

15

$A_t$

is trend productivity growth, which is assumed to be constant.Footnote

15

For constrained households, wages in the current period cannot go below nominal wages set in the previous period. Households, who are allowed to change, are free to set their nominal wages flexibly, but they know the DNWR constraint might bind in the future.Footnote

16

Daly and Hobijn (Reference Daly and Hobijn2014) analytically prove that the ones who are subject to DNWR constraint keep their nominal wages constant (a real wage cut), which creates the wage freeze rate in the wage change distribution. The parameter

![]() $\mu ^{DNWR}$

and the idiosyncratic productivity process affect the wage freeze and cut rates, and the model can be calibrated using this degree of freedom.

$\mu ^{DNWR}$

and the idiosyncratic productivity process affect the wage freeze and cut rates, and the model can be calibrated using this degree of freedom.

3.2 Firms

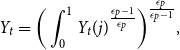

There are two types of firms: final good and intermediate good firms. The final good

![]() $Y_t$

is produced as a combination of a continuum of intermediate goods

$Y_t$

is produced as a combination of a continuum of intermediate goods

![]() $Y_{t}(j)$

with j

$Y_{t}(j)$

with j

![]() $\in$

(0,1).

$\in$

(0,1).

\begin{equation*} Y_{t} = \bigg ( \int _{0}^{1} Y_{t}(j)^\frac {\epsilon _p-1}{\epsilon _p} \bigg)^\frac {\epsilon _p}{\epsilon _p-1}, \end{equation*}

\begin{equation*} Y_{t} = \bigg ( \int _{0}^{1} Y_{t}(j)^\frac {\epsilon _p-1}{\epsilon _p} \bigg)^\frac {\epsilon _p}{\epsilon _p-1}, \end{equation*}

where

![]() $\epsilon _p$

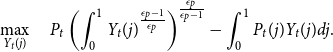

is greater than 1. The profit maximization problem of the final goods firm is

$\epsilon _p$

is greater than 1. The profit maximization problem of the final goods firm is

\begin{align*} \max _{Y_{t}(j)} \quad P_{t}\left (\int _{0}^{1} Y_{t}(j)^{\frac {\epsilon _p-1}{\epsilon _p}}\right)^{\frac {\epsilon _p}{\epsilon _p-1}}-\int _{0}^{1} P_{t}(j) Y_{t}(j) d j. \end{align*}

\begin{align*} \max _{Y_{t}(j)} \quad P_{t}\left (\int _{0}^{1} Y_{t}(j)^{\frac {\epsilon _p-1}{\epsilon _p}}\right)^{\frac {\epsilon _p}{\epsilon _p-1}}-\int _{0}^{1} P_{t}(j) Y_{t}(j) d j. \end{align*}

As a result, I can write the output of firm j as

Then, it is straightforward to derive the price as

Monopolist intermediate goods producer

![]() $j$

produces according to a constant return to scale technology.

$j$

produces according to a constant return to scale technology.

There is a single sector in this economy and firms are identical (representative firm). Intermediate goods firms rent labor in a perfectly competitive market. Each period, they try to minimize their cost by solving the following problem

Then, the first-order condition is

where

![]() $MC_t$

is nominal marginal cost and identical across intermediate goods firms due to facing common wage in the market. Then, I can define real marginal cost as

$MC_t$

is nominal marginal cost and identical across intermediate goods firms due to facing common wage in the market. Then, I can define real marginal cost as

![]() $mc_t = \frac {MC_t}{P_t}$

.

$mc_t = \frac {MC_t}{P_t}$

.

Firms set prices through the Calvo mechanism. Every period, with some probability (1-

![]() $\mu _p$

), firms are able to reset their prices optimally. In this setting, the dynamic problem of a firm is the following:

$\mu _p$

), firms are able to reset their prices optimally. In this setting, the dynamic problem of a firm is the following:

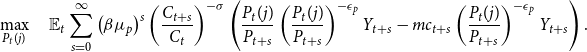

\begin{align*} \max _{P_{t}(j)} \quad \mathbb{E}_{t} \sum _{s=0}^{\infty }\left (\beta \mu _{p}\right)^{s} \left (\frac {C_{t+s}}{C_t}\right)^{-\sigma }\left (\frac {P_{t}(j)}{P_{t+s}}\left (\frac {P_{t}(j)}{P_{t+s}}\right)^{-\epsilon _{p}} Y_{t+s}-m c_{t+s}\left (\frac {P_{t}(j)}{P_{t+s}}\right)^{-\epsilon _{p}} Y_{t+s}\right). \end{align*}

\begin{align*} \max _{P_{t}(j)} \quad \mathbb{E}_{t} \sum _{s=0}^{\infty }\left (\beta \mu _{p}\right)^{s} \left (\frac {C_{t+s}}{C_t}\right)^{-\sigma }\left (\frac {P_{t}(j)}{P_{t+s}}\left (\frac {P_{t}(j)}{P_{t+s}}\right)^{-\epsilon _{p}} Y_{t+s}-m c_{t+s}\left (\frac {P_{t}(j)}{P_{t+s}}\right)^{-\epsilon _{p}} Y_{t+s}\right). \end{align*}

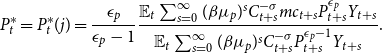

Firms solve the profit maximization problem and choose the optimal price. After getting FOC, it can be simplified into

\begin{align*} P_t^* = P_{t}^*(j)=\frac {\epsilon _p}{\epsilon _p-1} \frac {\mathbb{E}_{t} \sum _{s=0}^{\infty }(\beta \mu _p)^{s} C_{t+s}^{-\sigma } m c_{t+s} P_{t+s}^{\epsilon _p} Y_{t+s}}{\mathbb{E}_{t} \sum _{s=0}^{\infty }(\beta \mu _p)^{s} C_{t+s}^{-\sigma } P_{t+s}^{\epsilon _p-1} Y_{t+s}}. \end{align*}

\begin{align*} P_t^* = P_{t}^*(j)=\frac {\epsilon _p}{\epsilon _p-1} \frac {\mathbb{E}_{t} \sum _{s=0}^{\infty }(\beta \mu _p)^{s} C_{t+s}^{-\sigma } m c_{t+s} P_{t+s}^{\epsilon _p} Y_{t+s}}{\mathbb{E}_{t} \sum _{s=0}^{\infty }(\beta \mu _p)^{s} C_{t+s}^{-\sigma } P_{t+s}^{\epsilon _p-1} Y_{t+s}}. \end{align*}

The optimal reset price

![]() $P_t^*$

is the same for every firm that is not allowed to change its prices. Finally, as shown in the literature, the price dispersion evolves according to a recursive formula

$P_t^*$

is the same for every firm that is not allowed to change its prices. Finally, as shown in the literature, the price dispersion evolves according to a recursive formula

3.3 Monetary policy

Since both prices and wages in the economy are sticky, monetary policy has an effect on the allocation of resources. Monetary policy is given by a standard Taylor (Reference Taylor1993) rule, and the interest rate is bounded by zero.

where the central bank targets the inflation rate,

![]() $\overline {\pi }$

, but also tries to stabilize the output gap.

$\overline {\pi }$

, but also tries to stabilize the output gap.

![]() $\overline {y}$

is the steady state output and

$\overline {y}$

is the steady state output and

![]() $\overline {A}$

is the steady-state productivity growth.

$\overline {A}$

is the steady-state productivity growth.

3.4 Market clearing

Market clearing requires that the good market, asset market, and labor market clear.

Because of fully insured consumption, the asset market trivially clears. In addition, the nominal output is equal to nominal wage payment in this economy.

Using (1) and (2), I can write

By integrating over j, I get

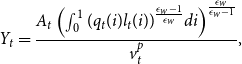

So, the aggregation gives the output at time t

\begin{equation} Y_t = \frac {A_{t} \left (\int _{0}^{1} (q_t(i) l_{t}(i))^{\frac {\epsilon _{w}-1}{\epsilon _{w}}} d i\right)^{\frac {\epsilon _{w}}{\epsilon _ w-1}}}{v_t^p}, \end{equation}

\begin{equation} Y_t = \frac {A_{t} \left (\int _{0}^{1} (q_t(i) l_{t}(i))^{\frac {\epsilon _{w}-1}{\epsilon _{w}}} d i\right)^{\frac {\epsilon _{w}}{\epsilon _ w-1}}}{v_t^p}, \end{equation}

where price dispersion is

![]() $v_{t}^{p}=\int _{0}^{1}\left (\frac {P_{t}(j)}{P_{t}}\right)^{-\epsilon } d j$

. The trade-off is mainly stemming from equation (3). If inflation is positive, due to staggered price setting, there is going to be price dispersion and

$v_{t}^{p}=\int _{0}^{1}\left (\frac {P_{t}(j)}{P_{t}}\right)^{-\epsilon } d j$

. The trade-off is mainly stemming from equation (3). If inflation is positive, due to staggered price setting, there is going to be price dispersion and

![]() $v_t^p$

becomes higher than 1, which leads to a decrease in output at time

$v_t^p$

becomes higher than 1, which leads to a decrease in output at time

![]() $t$

. However, an increase in inflation reduces the wage freeze rate (less binding DNWR constraint), enabling households to optimize their wage setting and supply more labor, resulting in higher output. This trade-off makes the welfare analysis in this paper particularly intriguing.

$t$

. However, an increase in inflation reduces the wage freeze rate (less binding DNWR constraint), enabling households to optimize their wage setting and supply more labor, resulting in higher output. This trade-off makes the welfare analysis in this paper particularly intriguing.

3.5 Equilibrium

An equilibrium of this economy consists of a path {

![]() $C_t,L_t,Y_t,i_t,\pi _t,v_t^p,W_t$

} that satisfies (i) the production function, (ii) the Euler equation, and (iii) the Taylor rule. Given the aggregates, households’ decision rule solves the wage setting problem. Goods, labor, and bond markets clear in equilibrium.

$C_t,L_t,Y_t,i_t,\pi _t,v_t^p,W_t$

} that satisfies (i) the production function, (ii) the Euler equation, and (iii) the Taylor rule. Given the aggregates, households’ decision rule solves the wage setting problem. Goods, labor, and bond markets clear in equilibrium.

Since the wage setting decision of households depends on past wage-setting decisions on top of current aggregate economic conditions and expectations, it is not possible to analytically solve the model. Thus, the steady-state equilibrium (and transition dynamics in appendix) are solved numerically. For that, I utilize a supercomputer to parallelize the computation process, which is grid-based and suffers from the curse of dimensionality.Footnote 17

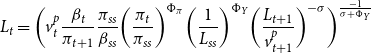

4. Steady-state and calibration

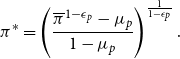

In steady-state, equation (3) becomes

where the price dispersion can be written in terms of inflation, and at the steady-state it is straightforward to show that it becomes

where

![]() $\pi ^*=\frac {P_t^*}{P_{t-1}}$

is the reset price inflation and

$\pi ^*=\frac {P_t^*}{P_{t-1}}$

is the reset price inflation and

![]() $\overline {\pi }$

is the trend inflation rate. Firms that are allowed to update prices in a given period will set their prices to a common reset price, denoted as

$\overline {\pi }$

is the trend inflation rate. Firms that are allowed to update prices in a given period will set their prices to a common reset price, denoted as

![]() $P_t^*$

. Since not all prices can adjust, some remain fixed at their previous-period levels. However, the ability of some firms to adjust their prices creates price dispersion. When a firm has the opportunity to reset its price, it must overadjust to account for trend inflation during the expected duration for which it will be unable to change the price. This overadjustment becomes more pronounced with greater price stickiness (higher

$P_t^*$

. Since not all prices can adjust, some remain fixed at their previous-period levels. However, the ability of some firms to adjust their prices creates price dispersion. When a firm has the opportunity to reset its price, it must overadjust to account for trend inflation during the expected duration for which it will be unable to change the price. This overadjustment becomes more pronounced with greater price stickiness (higher

![]() $\mu _{p}$

) and higher trend inflation. The reset price inflation can be written as

$\mu _{p}$

) and higher trend inflation. The reset price inflation can be written as

\begin{equation} \pi ^{*}=\left (\frac {\overline {\pi }^{1-\epsilon _{p}}-\mu _{p}}{1-\mu _{p}}\right)^{\frac {1}{1-\epsilon _{p}}}. \end{equation}

\begin{equation} \pi ^{*}=\left (\frac {\overline {\pi }^{1-\epsilon _{p}}-\mu _{p}}{1-\mu _{p}}\right)^{\frac {1}{1-\epsilon _{p}}}. \end{equation}

In this setting, if there is no trend inflation, then

![]() $\pi ^{*} = 1$

, which implies

$\pi ^{*} = 1$

, which implies

![]() $v_p = 1$

. As inflation increases, the price dispersion also increases, and this dispersion becomes larger when prices are stickier. Finally, I can write the output as

$v_p = 1$

. As inflation increases, the price dispersion also increases, and this dispersion becomes larger when prices are stickier. Finally, I can write the output as

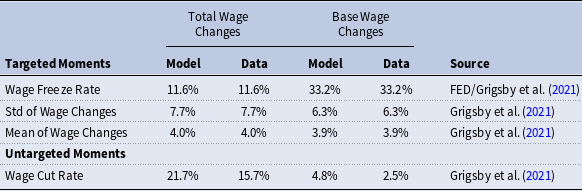

\begin{equation} Y = \frac {A \left (\int _{0}^{1} (q(i) l(i))^{\frac {\epsilon _{w}-1}{\epsilon _{w}}} d i\right)^{\frac {\epsilon _{w}}{\epsilon _ w-1}}}{v^p}, \end{equation}

\begin{equation} Y = \frac {A \left (\int _{0}^{1} (q(i) l(i))^{\frac {\epsilon _{w}-1}{\epsilon _{w}}} d i\right)^{\frac {\epsilon _{w}}{\epsilon _ w-1}}}{v^p}, \end{equation}

where the integral in the nominator is non-trivial because of the asymmetric Calvo wage setting mechanism. In the standard NK setting (Andrade et al. Reference Andrade, Gali, Bihan and Matheron2019), the output is

![]() $Y=\frac {AL}{v^p v^w}$

, where both price dispersion and wage dispersion create inefficiencies. In my model, the impact of wage dispersion is implicitly captured in the aggregation of labor supply.

$Y=\frac {AL}{v^p v^w}$

, where both price dispersion and wage dispersion create inefficiencies. In my model, the impact of wage dispersion is implicitly captured in the aggregation of labor supply.

The model will be calibrated to replicate the empirical wage change distribution, which exhibits a spike at zero nominal wage change. The model is calibrated and solved at a quarterly frequency but is then aggregated to an annual frequency, matching the frequency at which wage changes are observed in the data. Empirical studies show that the annual freeze rate changes between 5 to 33 percent. In this study, I followed the wage rigidity estimates of Grigsby et al. (Reference Grigsby, Hurst and Yildirmaz2021) and the San Francisco Fed, which is updated quarterly based on the CPS data. To calibrate the model, first, I aim to achieve a wage freeze rate of 11.6%, which represents the average value observed during the Great Recession,Footnote

18

by setting the DNWR parameter

![]() $\mu ^{DNWR}$

to 0.75. For this specification, only first and second moments of the annual wage change distribution are retrieved from Grigsby et al. (Reference Grigsby, Hurst and Yildirmaz2021). However, in a separate specification, I match the base wage change distribution (instead of total wage change) presented in Grigsby et al. (Reference Grigsby, Hurst and Yildirmaz2021), where the wage freeze rate is extremely high, 33.2% compared to other estimates in the literature, which is matched by setting

$\mu ^{DNWR}$

to 0.75. For this specification, only first and second moments of the annual wage change distribution are retrieved from Grigsby et al. (Reference Grigsby, Hurst and Yildirmaz2021). However, in a separate specification, I match the base wage change distribution (instead of total wage change) presented in Grigsby et al. (Reference Grigsby, Hurst and Yildirmaz2021), where the wage freeze rate is extremely high, 33.2% compared to other estimates in the literature, which is matched by setting

![]() $\mu ^{DNWR}$

to 0.95. Then, I compare these two specifications to understand how sensitive results are to various empirical distributions.

$\mu ^{DNWR}$

to 0.95. Then, I compare these two specifications to understand how sensitive results are to various empirical distributions.

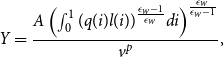

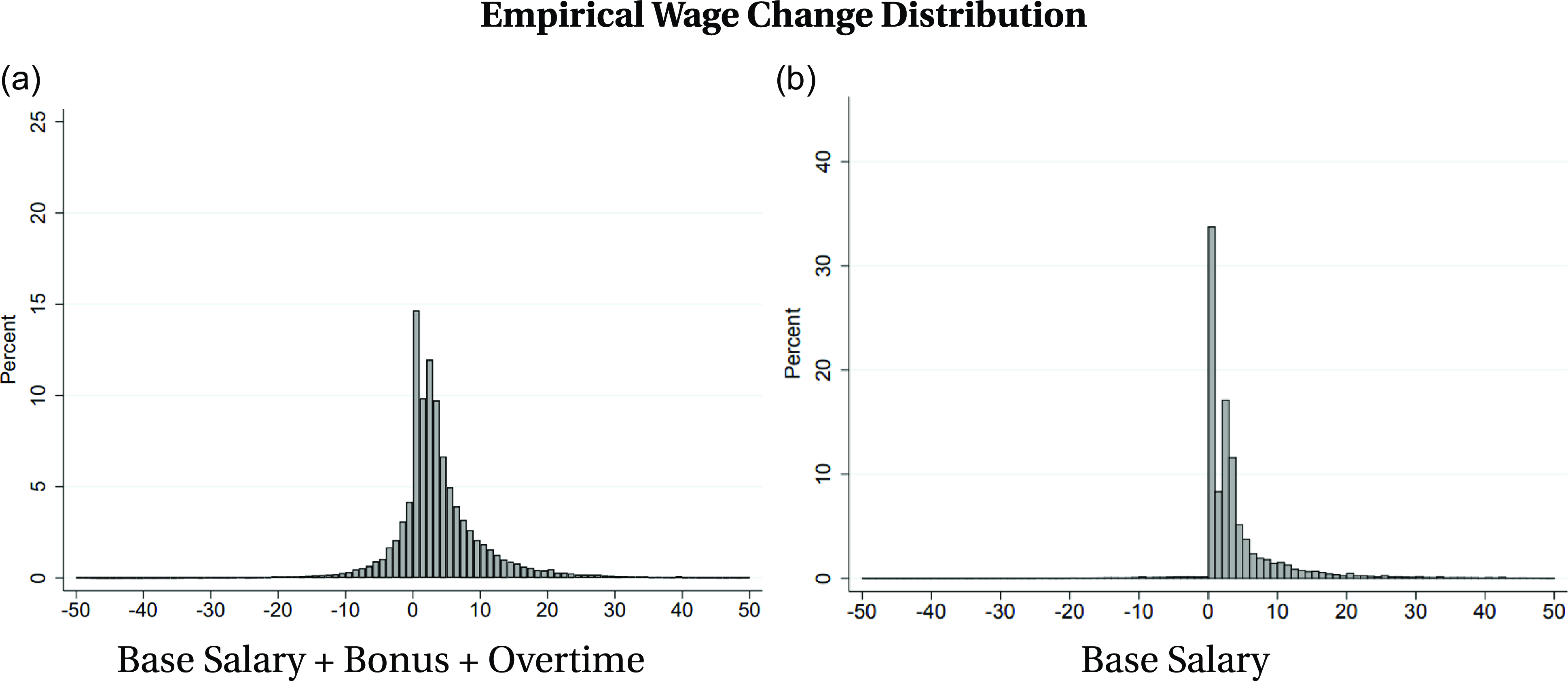

Figure 1. Distribution of annual wage changes under DNWR at 2% trend inflation.

Notes: The figure plots the annual wage change distribution for two specifications considered in the paper. The first specification includes total wage changes and has a lower freeze rate, while the second specification includes base wage changes and has a higher freeze rate. See Table-1 for details about the distributions. The model is run at a quarterly frequency, and the distributions are then annualized to match the empirical distribution. The wage freeze rate, mean, and standard deviation of wage changes are the targeted moments. See Figure-C10 for the quarterly distributions.

The annual empirical wage change distribution closely resembles the one depicted in Figure-1a, particularly when annual bonus payments are included alongside base earnings, as in Grigsby et al. (Reference Grigsby, Hurst and Yildirmaz2021).Footnote 19 In Figure-1b, the base wage change distribution reported in the same paper is matched, representing the extreme example of the wage freeze rate, since bonuses and overtime payments are excluded. The paper presents results for both of these specifications. Due to data limitations, evaluating the accuracy of the models for quarterly wage change distributions can be challenging. Consequently, this study focuses on the distribution of annual wage changes, and the model accurately fits this distribution by adopting an asymmetric wage-setting mechanism and assuming an idiosyncratic productivity process calibrated to match the standard deviation of the observed distribution.Footnote 20

Since the idiosyncratic productivity process is assumed to follow an AR(1) process, the wage change distribution is normally distributed in the absence of rigidity in wage setting. However, as the DNWR parameter increases, the wage freeze rate in the distribution rises, as some wages cannot adjust nominally downward.Footnote 21 With higher values of the DNWR parameter, a spike at zero nominal wage change becomes evident in the annual wage change distribution, as shown in Figure-1.

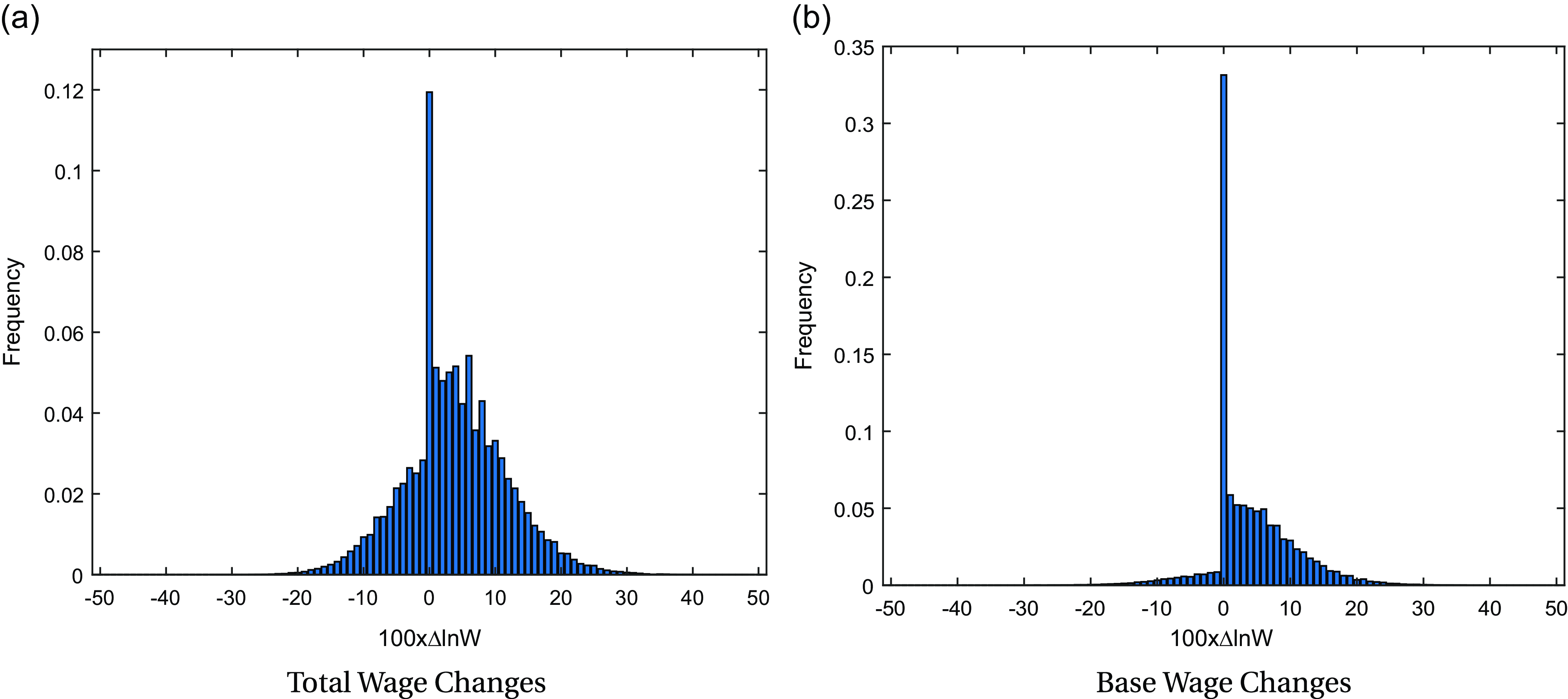

Table 1. Targeted and untargeted moments

Notes: The table presents moments for two empirical wage change distributions. The first uses the wage freeze rate from the wage rigidity meter of the San Francisco FED, along with other moments derived from the annual total wage change distribution in Grigsby et al. (Reference Grigsby, Hurst and Yildirmaz2021). The second uses the moments from the annual base wage change distribution in Grigsby et al. (Reference Grigsby, Hurst and Yildirmaz2021). The parameters

![]() $\mu ^{DNWR}, A, \sigma _q$

are calibrated to match these moments.

$\mu ^{DNWR}, A, \sigma _q$

are calibrated to match these moments.

As documented in Table-1, the model accurately captures the targeted moments of the distribution, including the freeze rate and the first and second moments. In an effort to be more conservative regarding welfare costs, I first match a slightly more flexible wage change distribution, which has a lower freeze rate and more wage cuts. This provides a lower bound for the cost of DNWR. Subsequently, the model is calibrated to match the high freeze rate of 33.2% observed in base wage change distributions documented by Grigsby et al. (Reference Grigsby, Hurst and Yildirmaz2021) using administrative data, which is considered more reliable than CPS data due to the absence of reporting and measurement errors. By focusing on base wages, matching this freeze rate–one of the highest reported in the literature–provides an upper bound for the cost of DNWR in this setting.Footnote 22

4.1 Welfare analysis

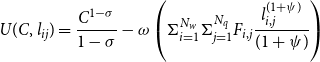

I define the welfare at the steady-state as the sum of household utilities using the invariant distribution by following Fagan and Messina (Reference Fagan and Messina2009):

\begin{align*} U(C,\boldsymbol {l}_{ij})=\frac {C^{1-\sigma }}{1-\sigma }-\omega \left (\Sigma _{i=1}^{N_w} \Sigma _{j=1}^{N_{q}} F_{i, j} \frac {l_{i, j}^{(1+\psi)}}{(1+\psi)}\right) \end{align*}

\begin{align*} U(C,\boldsymbol {l}_{ij})=\frac {C^{1-\sigma }}{1-\sigma }-\omega \left (\Sigma _{i=1}^{N_w} \Sigma _{j=1}^{N_{q}} F_{i, j} \frac {l_{i, j}^{(1+\psi)}}{(1+\psi)}\right) \end{align*}

where

![]() $N_w$

and

$N_w$

and

![]() $N_q$

are the size of finite real wage and productivity grids, respectively. Since I use a non-stochastic simulation method and I approximate the distribution of real wage with a histogram composed of equally spaced bins for each value of productivity, I can map this distribution into labor supply one-to-one and get the labor supply distribution

$N_q$

are the size of finite real wage and productivity grids, respectively. Since I use a non-stochastic simulation method and I approximate the distribution of real wage with a histogram composed of equally spaced bins for each value of productivity, I can map this distribution into labor supply one-to-one and get the labor supply distribution

![]() $\boldsymbol {l}_{ij}$

.

$\boldsymbol {l}_{ij}$

.

![]() $F_{w,q}$

is the invariant joint distribution of the model and the aggregate utility is calculated by using the invariant distribution of the model as a counting scheme. The parameters used in the analysis can be found in Table-2.

$F_{w,q}$

is the invariant joint distribution of the model and the aggregate utility is calculated by using the invariant distribution of the model as a counting scheme. The parameters used in the analysis can be found in Table-2.

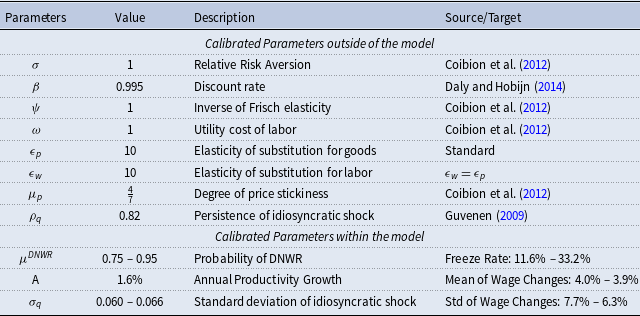

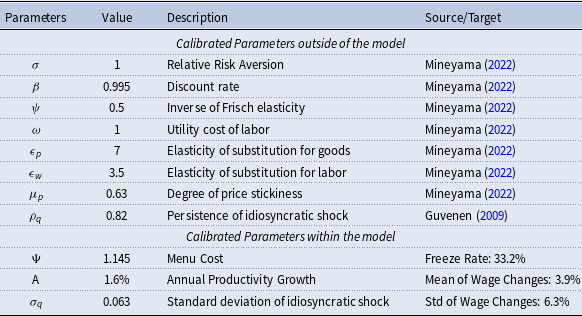

Table 2. Parameterization of the model

Notes: The table presents the calibration of the model. Parameters are chosen to be as standard as possible to ensure the results are comparable to the existing literature. Three parameters are calibrated to match the empirical wage change distributions; this table presents the calibration for both specifications used in the paper.

Bils and Klenow (Reference Bils and Klenow2004) estimate that firms reset prices every 4 to 5 months and Nakamura and Steinsson (Reference Nakamura and Steinsson2008) find that firms change prices every 9 to 11 months.Footnote 23 In accordance with Coibion et al. (Reference Coibion, Gorodnichenko and Wieland2012), I choose the middle of this range (7 months) and set the degree of price stickiness accordingly. In fact, this parameter is crucial to the analysis, as its impact on the cost of inflation is highlighted in Nakamura et al. (Reference Nakamura, Steinsson, Sun and Villar2018). Consequently, one side of the trade-off (sand-effect) in the paper depends on the choice of this parameter. To address this, I provide a robustness exercise examining the impact of this side.

I calibrate the model using two different specifications. In the first specification, to match the wage freeze rate of 11.6% in the annual total wage change distribution,

![]() $\mu ^{\text{DNWR}}$

is calibrated to 0.75, and to match the second moment of the distribution,

$\mu ^{\text{DNWR}}$

is calibrated to 0.75, and to match the second moment of the distribution,

![]() $\sigma _q$

is set to 0.06. In the second specification, to match the wage freeze rate of 33.2% in the base wage change distribution,

$\sigma _q$

is set to 0.06. In the second specification, to match the wage freeze rate of 33.2% in the base wage change distribution,

![]() $\mu ^{\text{DNWR}}$

is calibrated to 0.95, and

$\mu ^{\text{DNWR}}$

is calibrated to 0.95, and

![]() $\sigma _q$

is set to 0.066. To accurately match the mean of wage changes, the productivity growth rate is set to 1.6% per year, which is approximately the average annualized labor productivity growth over 2008–2019.Footnote

24

To facilitate comparison with Coibion et al. (Reference Coibion, Gorodnichenko and Wieland2012), all parameters except for productivity growth are taken directly from that paper, including the use of log utility for consumption. The Frisch elasticity parameter is set to 1.Footnote

25

The elasticity of substitution between goods and labor is assumed to be equal and set to 10, implying a markup of 11%. The persistence of idiosyncratic productivity shock is taken from Guvenen (Reference Guvenen2009).Footnote

26

The standard deviation of idiosyncratic shocks is calibrated to match the standard deviation of the wage change distribution.Footnote

27

The annual discounting in the model is assumed to be 2%, following Daly and Hobijn (Reference Daly and Hobijn2014). Therefore, the quarterly discount rate is set to 0.995.

$\sigma _q$

is set to 0.066. To accurately match the mean of wage changes, the productivity growth rate is set to 1.6% per year, which is approximately the average annualized labor productivity growth over 2008–2019.Footnote

24

To facilitate comparison with Coibion et al. (Reference Coibion, Gorodnichenko and Wieland2012), all parameters except for productivity growth are taken directly from that paper, including the use of log utility for consumption. The Frisch elasticity parameter is set to 1.Footnote

25

The elasticity of substitution between goods and labor is assumed to be equal and set to 10, implying a markup of 11%. The persistence of idiosyncratic productivity shock is taken from Guvenen (Reference Guvenen2009).Footnote

26

The standard deviation of idiosyncratic shocks is calibrated to match the standard deviation of the wage change distribution.Footnote

27

The annual discounting in the model is assumed to be 2%, following Daly and Hobijn (Reference Daly and Hobijn2014). Therefore, the quarterly discount rate is set to 0.995.

Using this set of parameters, I calculate welfare for various steady-state inflation rates. Two primary channels significantly influence welfare in this analysis: (1) the presence of DNWR, which reduces labor supply and is mitigated by a higher inflation target (the “greasing” effect), and (2) price stickiness, which creates economic distortions through increased price dispersion at higher inflation rates (the “sand” effect).Footnote 28

To facilitate welfare comparisons, I first calculate welfare for a flex-price economy–where prices and wages are fully flexible–as the benchmark case. I then measure welfare losses in economies with DNWR constraints and/or price rigidity as deviations from the benchmark economy across different trend inflation rates. These welfare losses are expressed in terms of consumption equivalence.

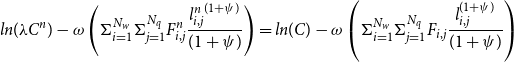

\begin{align*} ln(\lambda C^n)-\omega \left (\Sigma _{i=1}^{N_w} \Sigma _{j=1}^{N_{q}} F_{i, j}^n \frac {{l_{i, j}^n}^{(1+\psi)}}{(1+\psi)}\right) = ln( C)-\omega \left (\Sigma _{i=1}^{N_w} \Sigma _{j=1}^{N_{q}} F_{i, j} \frac {l_{i, j}^{(1+\psi)}}{(1+\psi)}\right) \end{align*}

\begin{align*} ln(\lambda C^n)-\omega \left (\Sigma _{i=1}^{N_w} \Sigma _{j=1}^{N_{q}} F_{i, j}^n \frac {{l_{i, j}^n}^{(1+\psi)}}{(1+\psi)}\right) = ln( C)-\omega \left (\Sigma _{i=1}^{N_w} \Sigma _{j=1}^{N_{q}} F_{i, j} \frac {l_{i, j}^{(1+\psi)}}{(1+\psi)}\right) \end{align*}

In this equation, the benchmark scenario is indicated with a superscript “n” (natural level), and “F” represents the stationary distribution over the wage and productivity space, which act as state variables in the model. I calculate the values of

![]() $\lambda$

(consumption equivalence), which reflect the welfare cost of deviations from the flex-price and flex-wage case, for various model specifications.

$\lambda$

(consumption equivalence), which reflect the welfare cost of deviations from the flex-price and flex-wage case, for various model specifications.

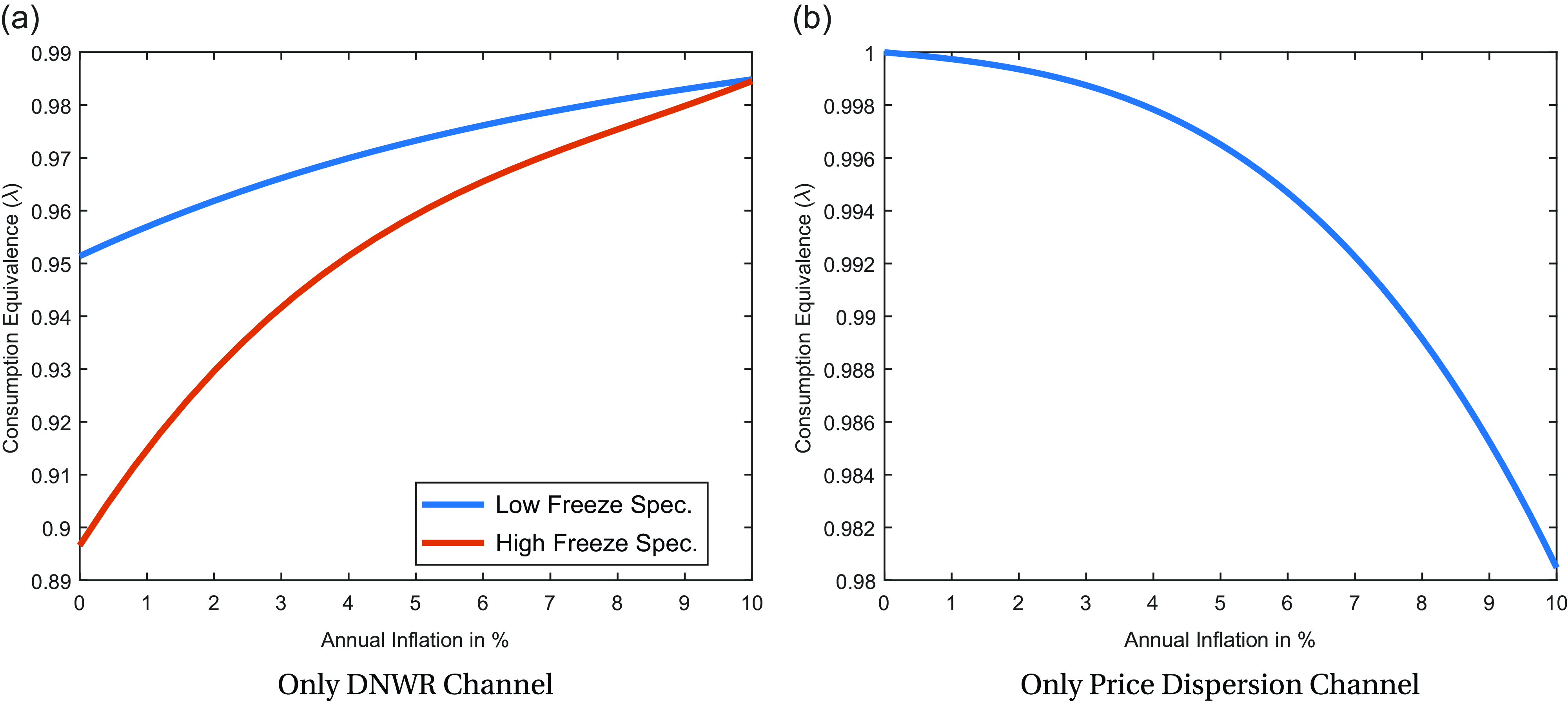

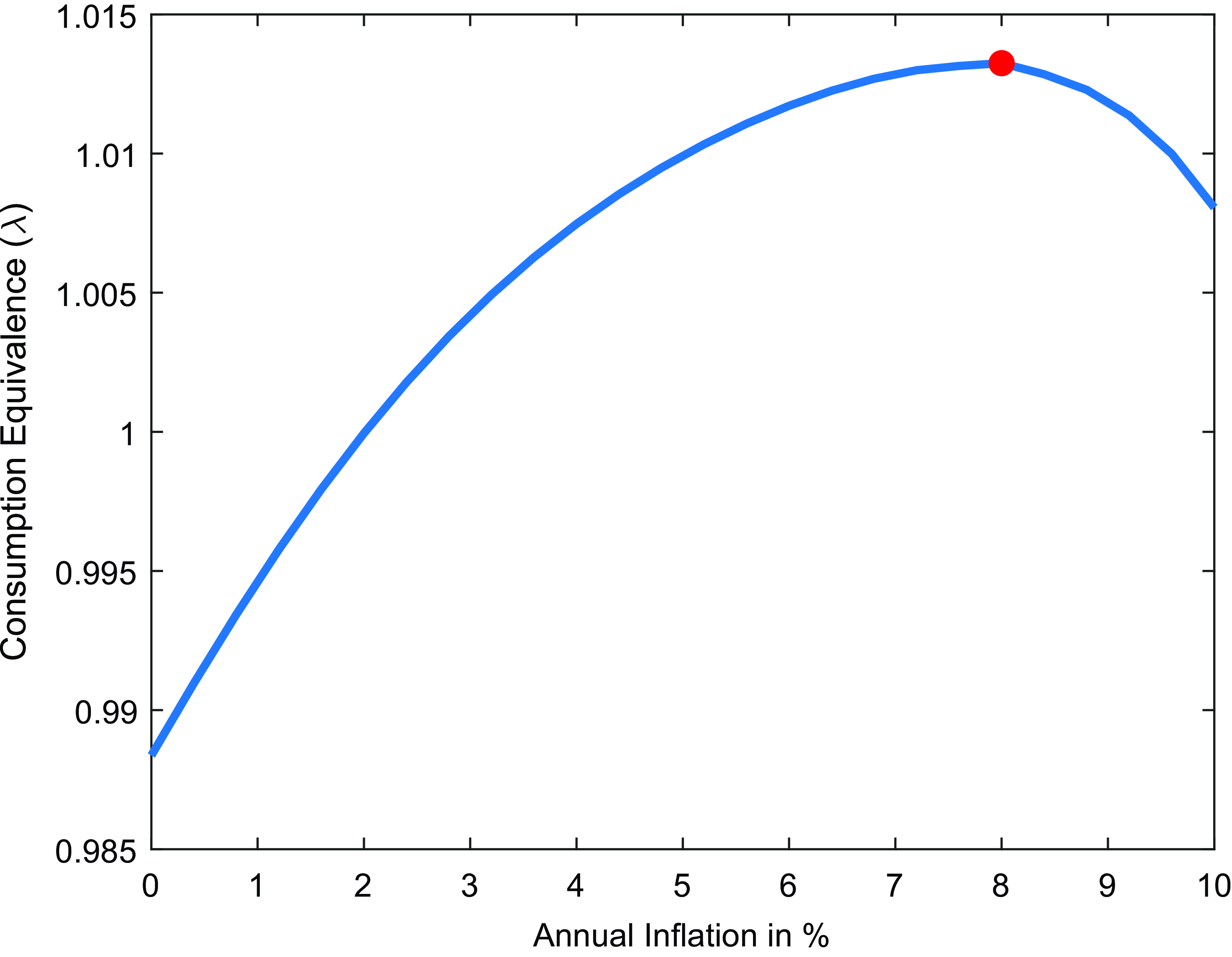

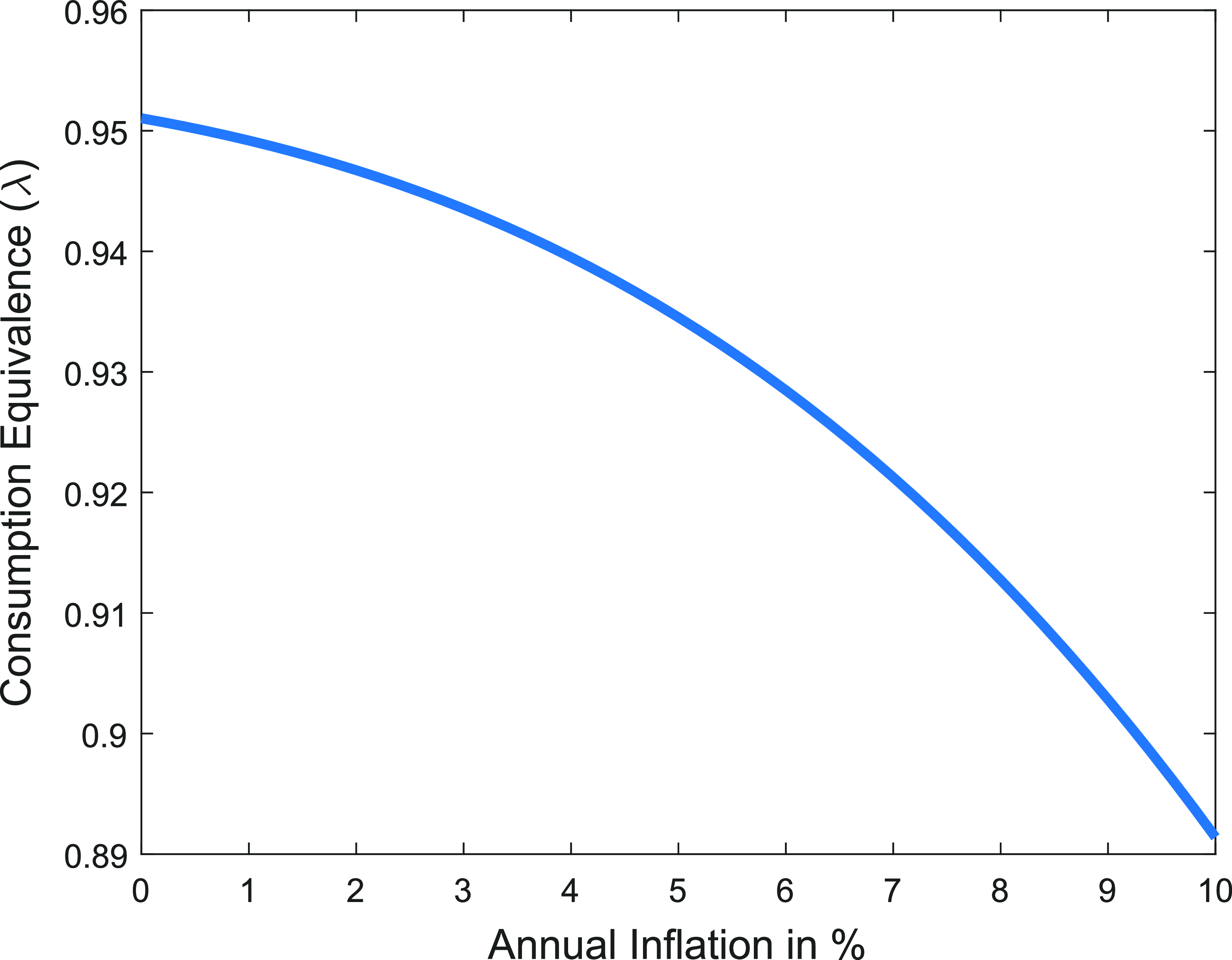

Figure 2. Welfare costs of DNWR and sticky prices, separately.

Notes: The figure plots consumption-equivalent welfare for each specification as a function of the inflation rate, relative to welfare in a fully flexible price and wage setting. It quantifies distortions in the labor market and goods market separately, highlighting the trade-off between these two key channels. At inflation rates close to zero, the welfare cost of DNWR is approximately 5% when the low freeze rate is matched and 10% when the high freeze rate is matched.

As documented in Figure-2a, the DNWR constraint becomes less costly as the inflation rate increases, due to the decreasing wage freeze rate (also known as the “grease effect”). Although the relationship is not perfectly linear, increasing trend inflation by 1 percentage point improves consumption-equivalent welfare by approximately 0.3 percentage points. Under the high freeze rate specification, this improvement is more pronounced, reaching nearly 0.8 percentage points. This finding indicates that raising the inflation target alleviates the welfare cost of DNWR by reducing distortions in the labor market. In standard models, staggered wage contracts are very costly under positive trend inflation (Ascari et al. Reference Ascari, Phaneuf and Sims2018).Footnote 29 In my model, the asymmetry in staggered wage contracts–where wages are flexible upward but rigid downward–leads to a reduction in welfare costs as inflation increases.

Under flexible wages, the wage change distribution would follow a normal distribution, as the idiosyncratic productivity shock is modeled as a Gaussian process, with wages adjusting to reflect productivity. In this scenario, there are no distortions in the labor market, and deviations from the flexible price-wage benchmark arise solely due to increased price stickiness at positive trend inflation rates. The associated welfare cost is depicted in Figure-2b. Furthermore, in the absence of heterogeneity and aggregate uncertainty, DNWR would not bind for representative agents, resulting in no costs associated with DNWR. The same graph would be obtained in such a setting, as inefficiencies would arise exclusively from the “sand effect.”

In short, Figure-2b shows that welfare costs increase with higher inflation under price stickiness due to greater price dispersion and inefficient price allocation, with no distortions originating from the labor market. The distortive impact of price dispersion arises because, when a firm has the opportunity to reset its price, it must overadjust to account for trend inflation over the expected duration during which it cannot change the price again. This overadjustment becomes increasingly pronounced with greater price stickiness and higher trend inflation. If price stickiness is the only friction, without a DNWR constraint, the optimal inflation rate would be 0%, consistent with the standard implication of a New Keynesian model.

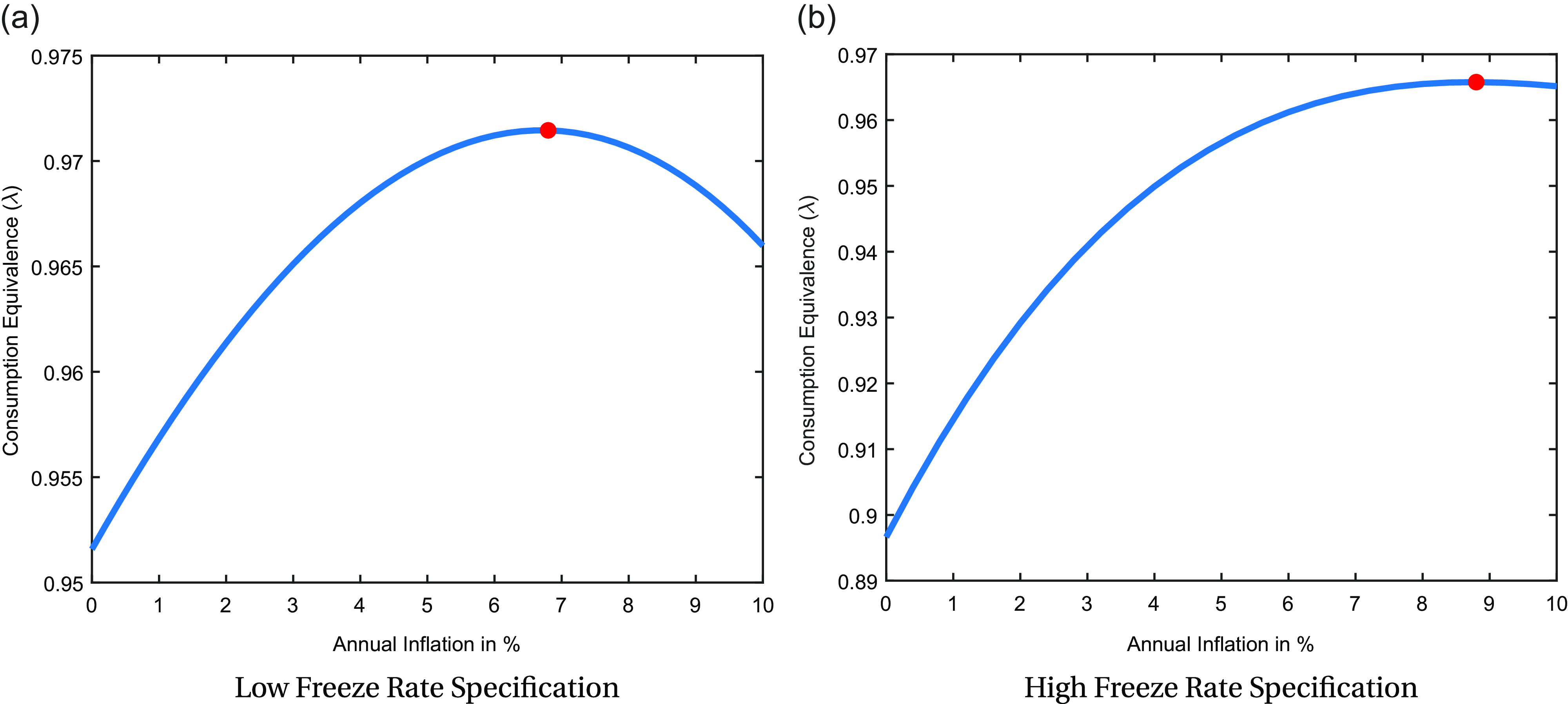

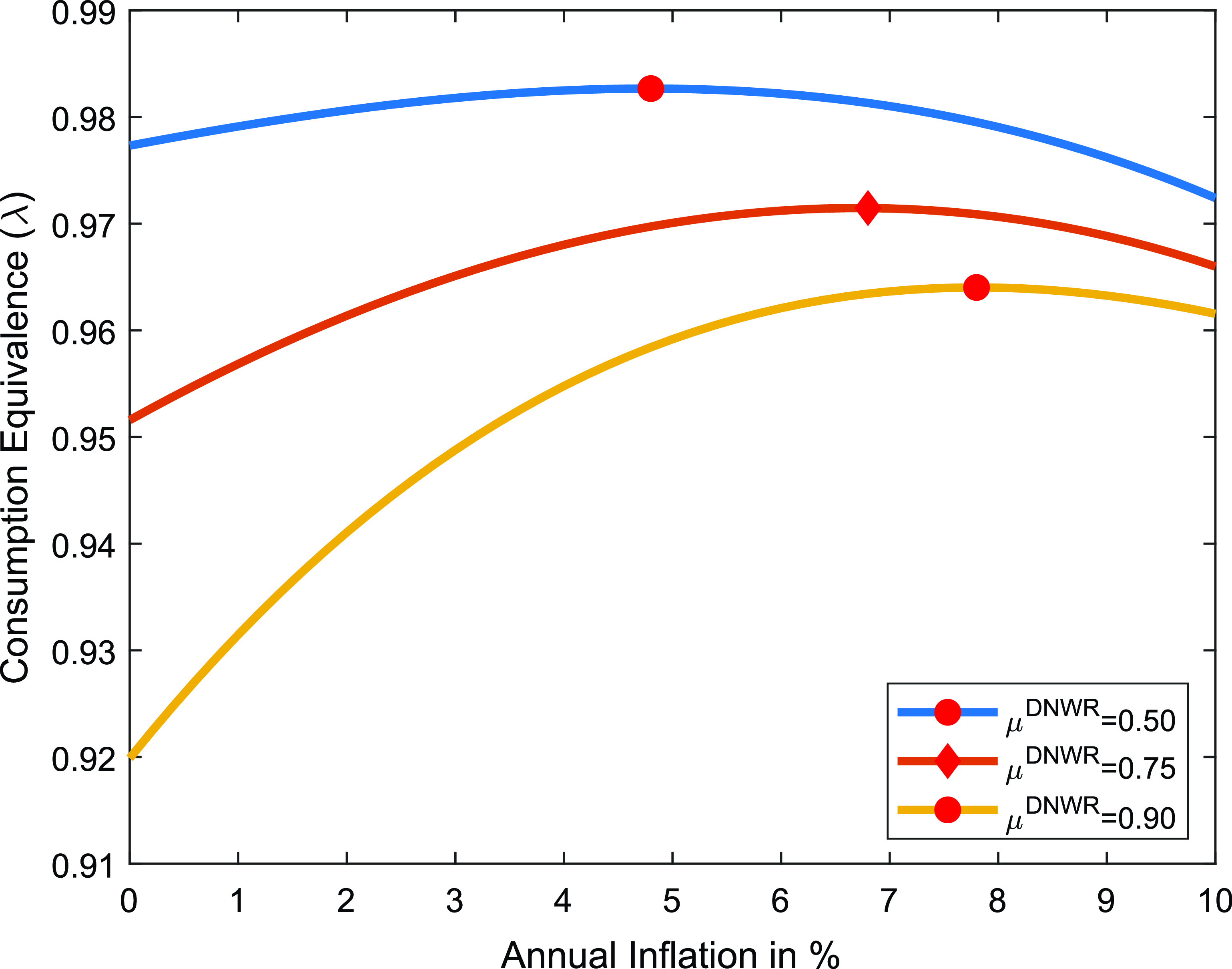

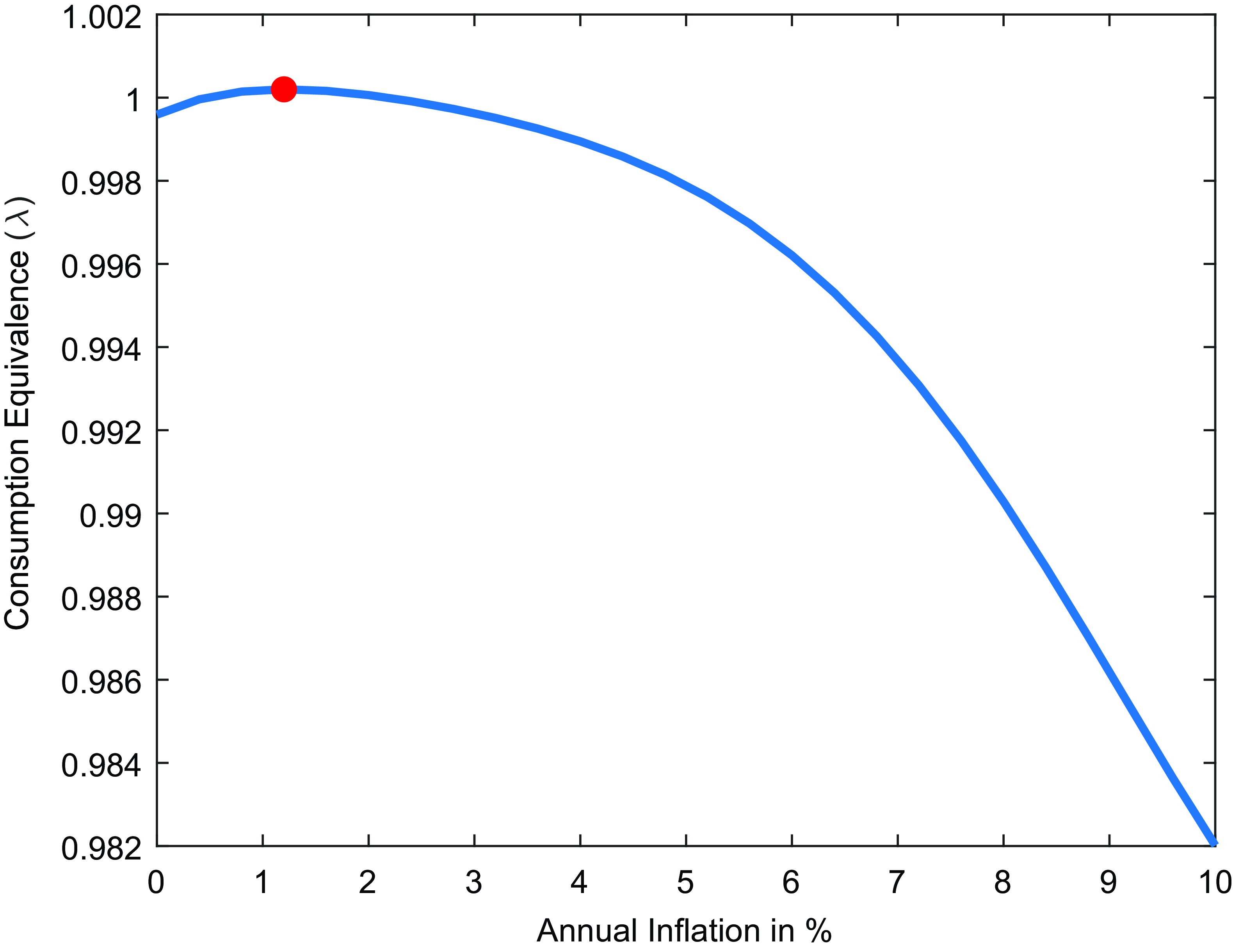

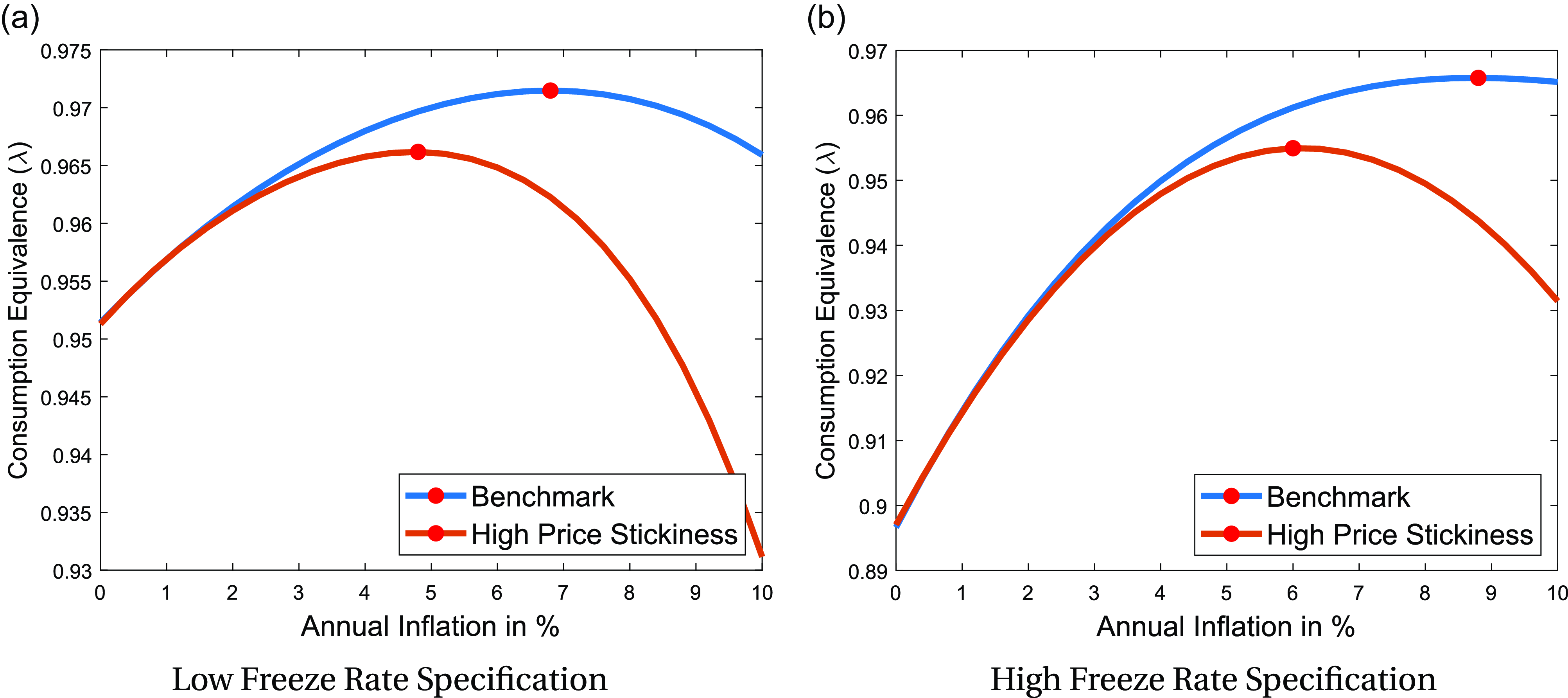

Figure 3. Welfare cost of DNWR and sticky prices at different steady-state inflation rates.

Notes: The figure plots the consumption-equivalent welfare as a function of the inflation rate, relative to welfare under completely flexible prices. Both the DNWR channel and the price stickiness channel are active in this analysis. The red circle indicates the peak of the curve. Panel (a) presents the results for the specification where the annual total wage change distribution is matched, while Panel (b) shows the results for the specification where the annual base wage change distribution is matched. This figure quantifies the trade-off between these channels and indicates that the optimal inflation target is 6.8% for the low freeze rate (11.6%) case and 8.8% for the high freeze rate (33.2%).

Combining these two channels, Figure-3 illustrates which channel dominates for each specification. With both channels active, the optimal steady-state inflation rate is found to be 6.8% when total wage change distribution is matched and found to be 8.8% when base wage change distribution is matched.Footnote 30 Figure-C8 shows that the optimal rates drop to 4.8% and 6.0%, respectively, if a higher price stickiness is assumed, with a price duration of 9 months instead of 7 months. However, since prices become more flexible with a higher inflation rate, this is not a likely scenario (Alvarez et al. Reference Alvarez, Beraja, Gonzalez-Rozada and Neumeyer2018), and thus these rates may represent the most conservative estimates in this exercise. Overall, the optimal rates in this analysis are relatively high compared to previous literature, highlighting the importance of the DNWR channel. This finding contrasts with the conclusions drawn by Coibion et al. (Reference Coibion, Gorodnichenko and Wieland2012), who, using a representative agent model, argue that DNWR occasionally binds for aggregate wages and does not play a significant role. In fact, the existence of DNWR can even be beneficial and, in some specifications, may reduce the optimal inflation target by decreasing the binding frequency of the zero lower bound (ZLB) (Billi and Galí, Reference Billi and Galí2020; Amano and Gnocchi, Reference Amano and Gnocchi2023). However, the analysis shows that when DNWR binds at the individual level, it can create significant distortions in the labor market. Consequently, reducing the binding rate of DNWR through higher inflation could lead to substantial welfare improvements. It also differs from the estimates by Fagan and Messina (Reference Fagan and Messina2009) and Mineyama (Reference Mineyama2022), which employ variants of the menu-cost model in a heterogeneous agent setting.Footnote 31 In the present model, there are always some households who are constrained by DNWR and they cannot set the optimal wages they would like to set in the absence of the DNWR constraint.Footnote 32 As a result, the DNWR channel alone significantly increases the optimal inflation rate.Footnote 33 Setting the inflation target at 6.8% instead of 2% results in a welfare gain of 1.10 percentage points in consumption equivalence, while raising the rate to 8.8% leads to a much larger gain of nearly 3.60 percentage points, which can be considered as the upper bound in this analysis.

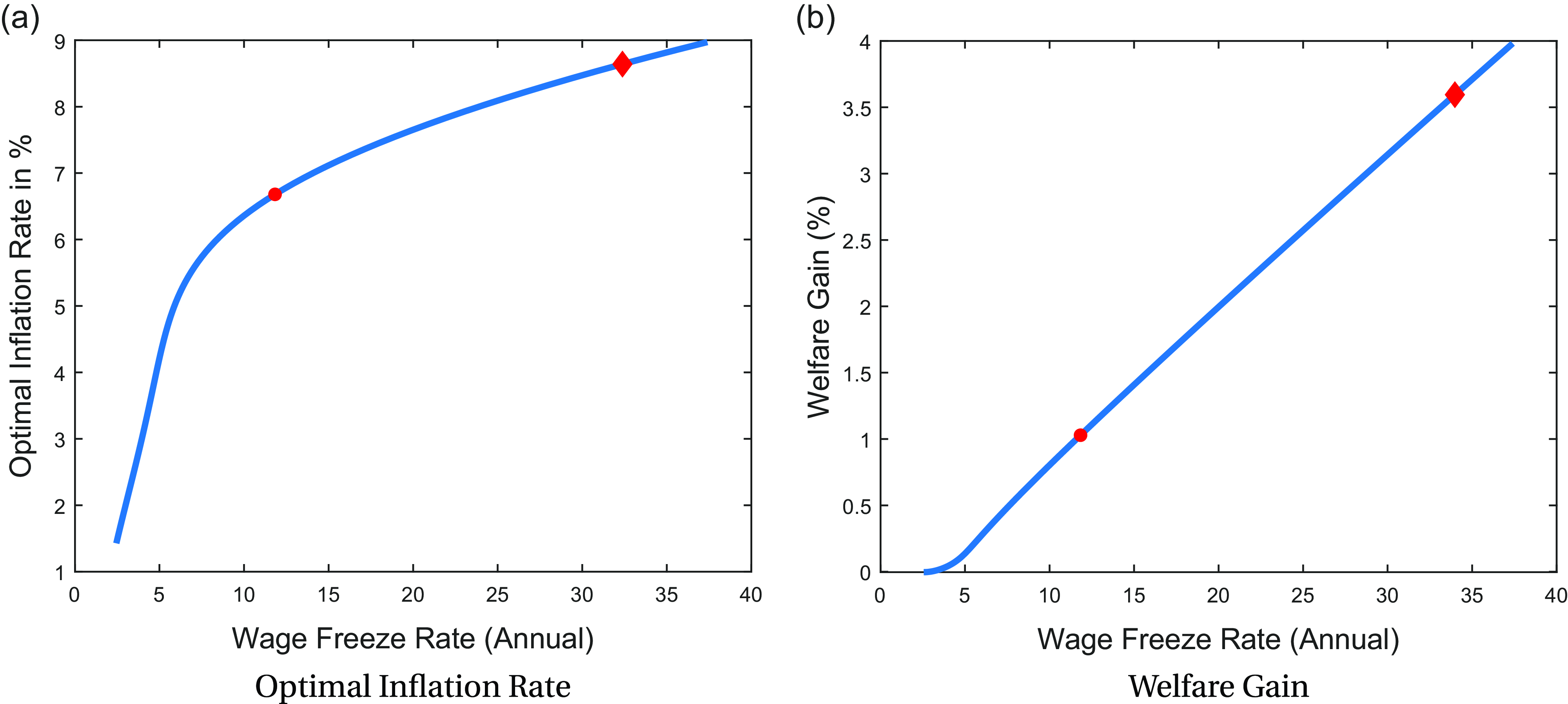

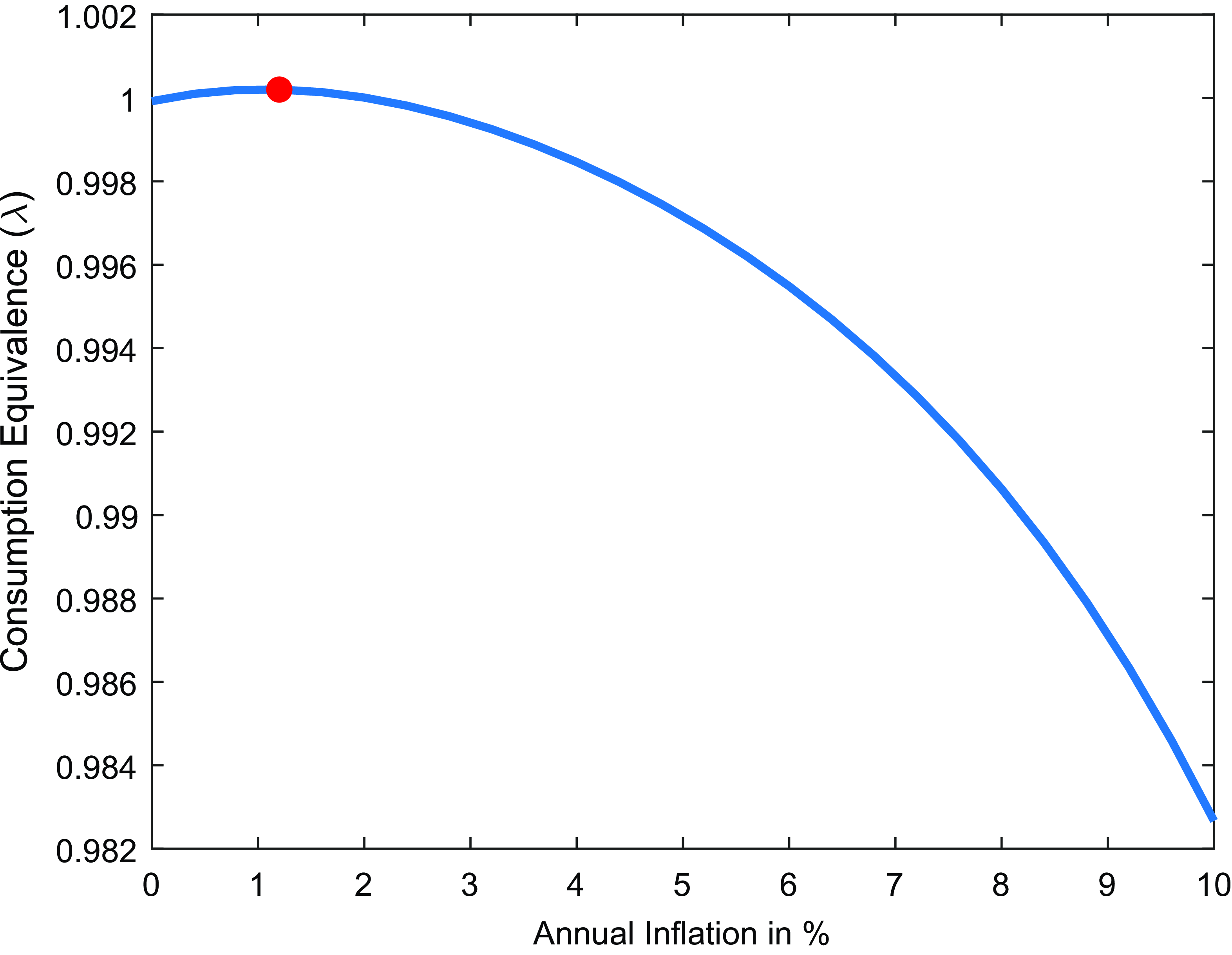

Next, Figure-4a illustrates the significance of the wage freeze rate on the optimal inflation target. When the wage freeze rate is high, reflecting the inability to adjust wages optimally, the associated welfare cost also rises. By varying the DNWR parameter, the wage freeze rate can be changed and the corresponding optimal inflation rates can be determined. As expected, with a higher DNWR parameter,

![]() $\mu ^{DNWR}$

, the wage freeze rate increases. Keeping all other parameters constant,

$\mu ^{DNWR}$

, the wage freeze rate increases. Keeping all other parameters constant,

![]() $\mu ^{DNWR}$

is calibrated to modify the wage freeze rate in the distribution, and its effect on the optimal inflation rate is documented. A higher

$\mu ^{DNWR}$

is calibrated to modify the wage freeze rate in the distribution, and its effect on the optimal inflation rate is documented. A higher

![]() $\mu ^{DNWR}$

also raises the binding rate of the DNWR constraint, resulting in greater labor market distortions and pushing the optimal inflation rate even higher.

$\mu ^{DNWR}$

also raises the binding rate of the DNWR constraint, resulting in greater labor market distortions and pushing the optimal inflation rate even higher.

Figure 4. Optimal steady state inflation and welfare gain.

Notes: The figure illustrates the optimal inflation rate as a function of the wage freeze rate and compares the welfare gain achieved by setting the inflation rate to the optimal level for each wage freeze rate against the 2% target economy. When the wage freeze rate in the wage change distribution is 11.6%, the optimal inflation rate is approximately 6.8%, with a corresponding welfare gain of 1.1%, represented by a red circle. For a wage freeze rate of 33.2%, the optimal inflation rate increases to 8.8%, with a corresponding welfare gain of 3.6%, represented by a red diamond. The parameter

![]() $\mu ^{DNWR}$

is recalibrated to adjust the wage freeze rate in the analysis.

$\mu ^{DNWR}$

is recalibrated to adjust the wage freeze rate in the analysis.

The results suggest that for extreme levels of wage freeze rates (37%), the optimal inflation target can reach as high as 9%. This indicates that when nominal wage cuts are entirely restricted (

![]() $\mu ^{DNWR} = 1$

), an optimal inflation rate of approximately 9% provides sufficient flexibility for real wage reductions when necessary. Given that empirical distributions show an annual wage freeze rate of 11.6% and a base wage freeze rate of 33.2%, the optimal inflation target should range between 6.8% and 8.8%, as indicated by the two red dots in the graph.

$\mu ^{DNWR} = 1$

), an optimal inflation rate of approximately 9% provides sufficient flexibility for real wage reductions when necessary. Given that empirical distributions show an annual wage freeze rate of 11.6% and a base wage freeze rate of 33.2%, the optimal inflation target should range between 6.8% and 8.8%, as indicated by the two red dots in the graph.

Figure-4b documents the welfare gain if the inflation target is set to the optimal level based on the economy’s wage freeze rate. It demonstrates how the optimal inflation target at different wage freeze rates improves welfare, compared to an economy with a 2% inflation target, in terms of consumption equivalence, using the optimal inflation rates documented above. If the wage freeze rate is low in an economy, the improvement in welfare from setting the inflation target to the optimal rate is minimal. However, as the wage freeze rate increases, adjusting the target to the optimal level becomes more important due to the higher welfare gains. In the case of the U.S. economy, where the wage freeze rate for the total wage changes is 11.6%, setting the inflation target to the optimal rate of 6.8% instead of 2% results in a welfare gain of 1.10 percentage points in terms of consumption equivalence. Considering the rise in wage freeze rates since the 1980s, the welfare cost of this labor market friction also increases over time if the target remains at 2%. In the case of a 33.2% wage freeze rate for the base wage change distribution, raising the target to higher levels can result in a welfare improvement exceeding 3.5 percentage points in terms of consumption equivalence, which represents a substantial welfare gain by standard measures in the literature.

5. Sensitivity analysis and robustness check

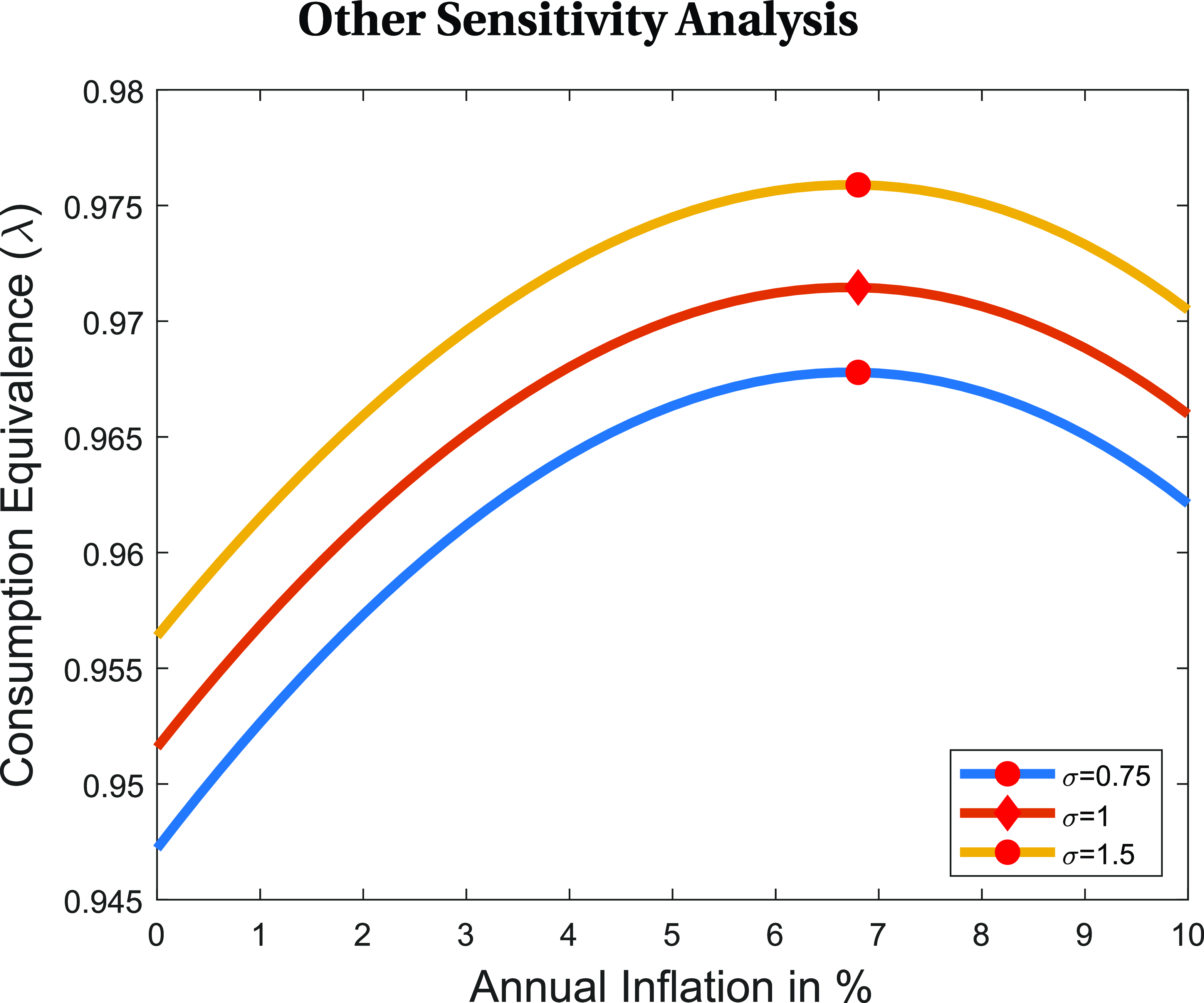

The model suggests that the steady-state inflation rate should be between 6.8% and 8.8%; however, it is essential to verify whether this result is sensitive to the calibrated parameters. Variations in parameter choices could influence the costs associated with the DNWR channel or the price stickiness channel, potentially altering the optimal inflation rate. In this section, to provide conservative estimates, I use the low freeze rate specification as the benchmark and examine all possible variations in the parameterization of the model.

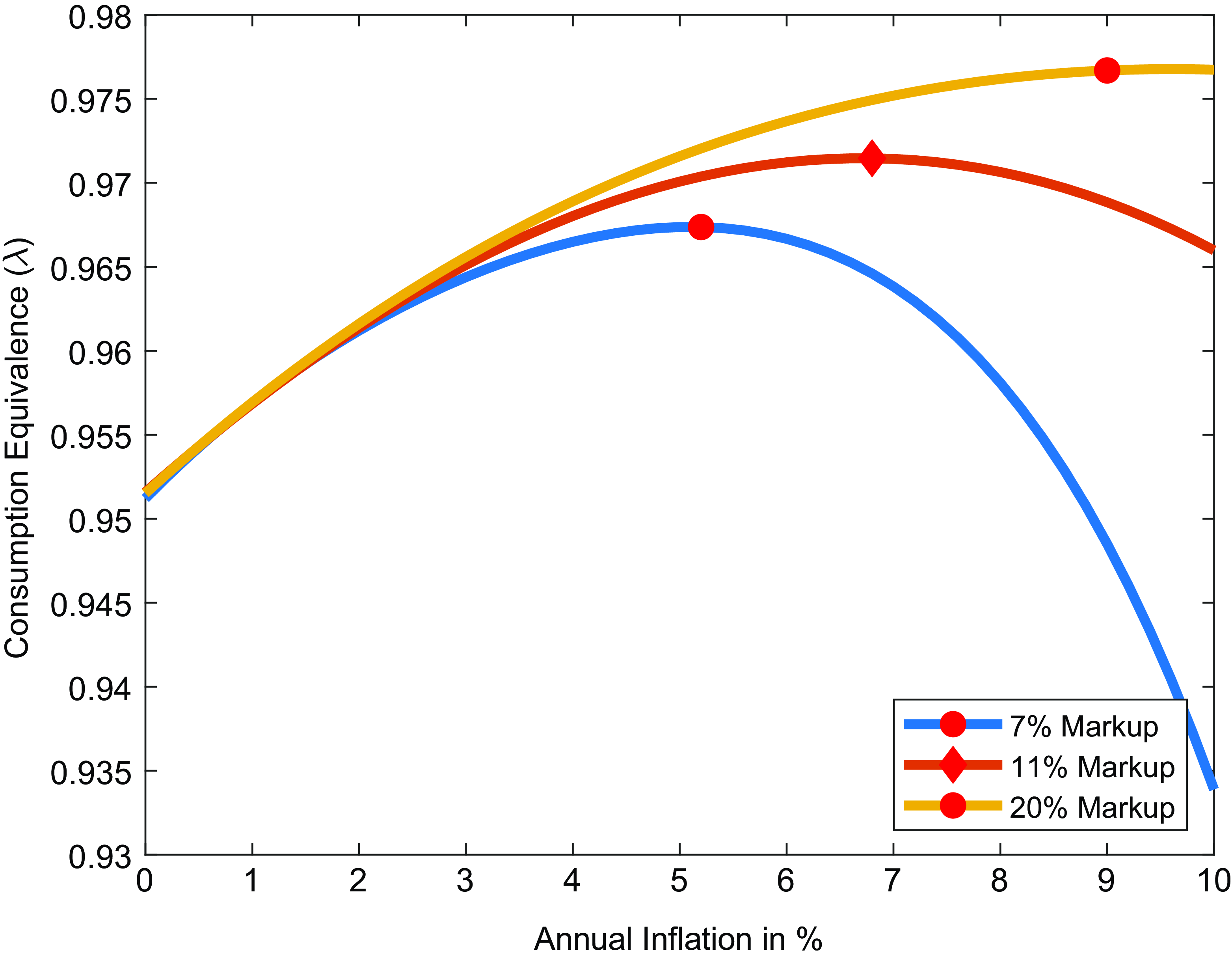

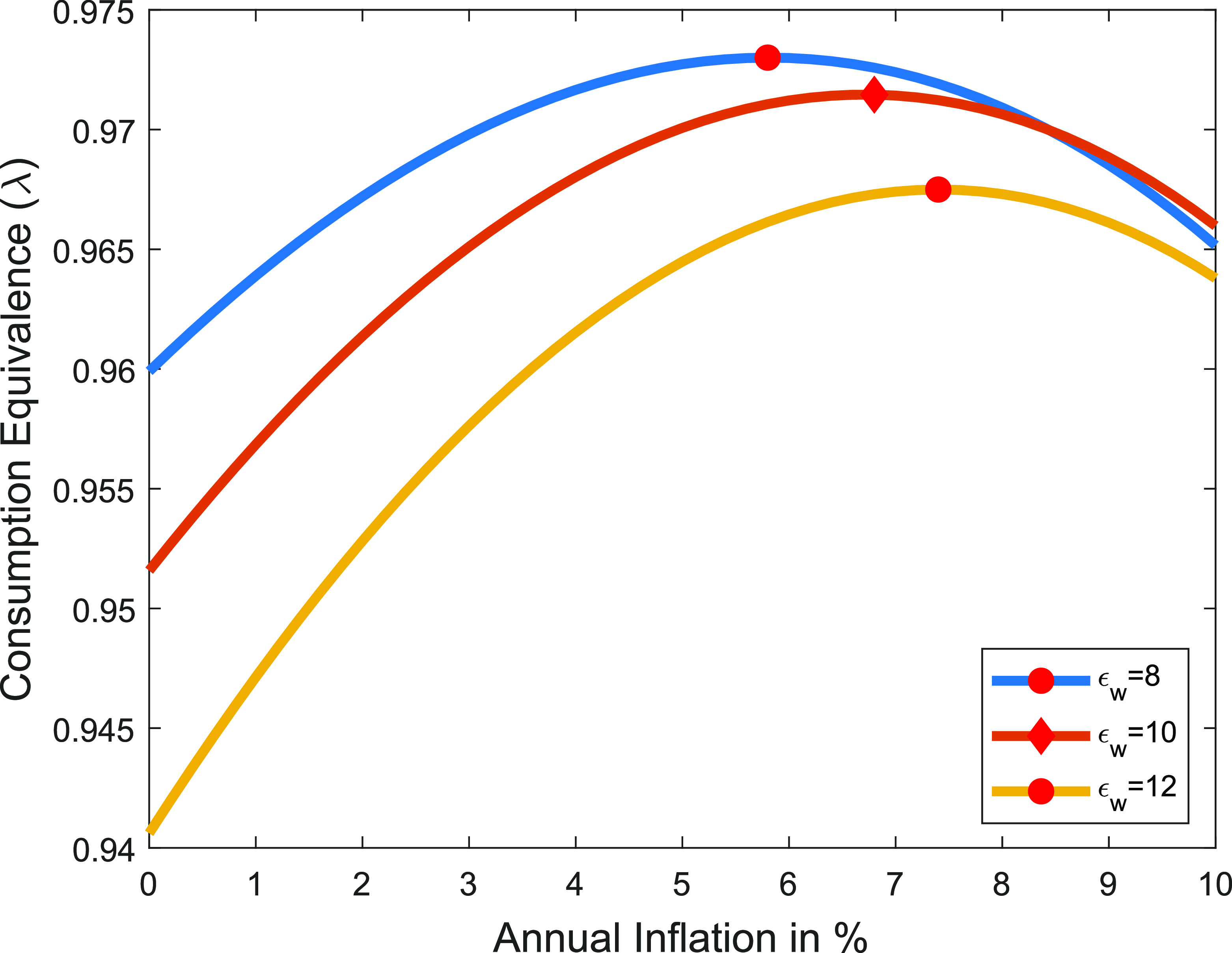

Figure 5. Optimal inflation rate, markup.

Notes: The figure plots the consumption-equivalent welfare of economies with different markup rates as a function of the inflation rate relative to welfare when prices are fully flexible. Diamond shape indicates the benchmark case.

In Figure-5, the price elasticity parameter is analyzed. I decrease the parameter to 6 such that markup has increased from 11% to 20%, which is in line with the recent literature about increasing markups (De Loecker et al. Reference De Loecker, Eeckhout and Unger2020). Consistent with the literature,Footnote 34 the welfare cost of price stickiness is higher with a higher elasticity of substitution between intermediate goods (lower markup), as demand is more elastic to price changes, increasing goods market misallocations due to price rigidity. Consequently, with a higher markup, the optimal inflation rate is higher as well. To be more conservative in estimating the optimal target, I assume an elasticity of substitution of 10 (markup of 11%) instead of 6 (markup of 20%) in the benchmark case.

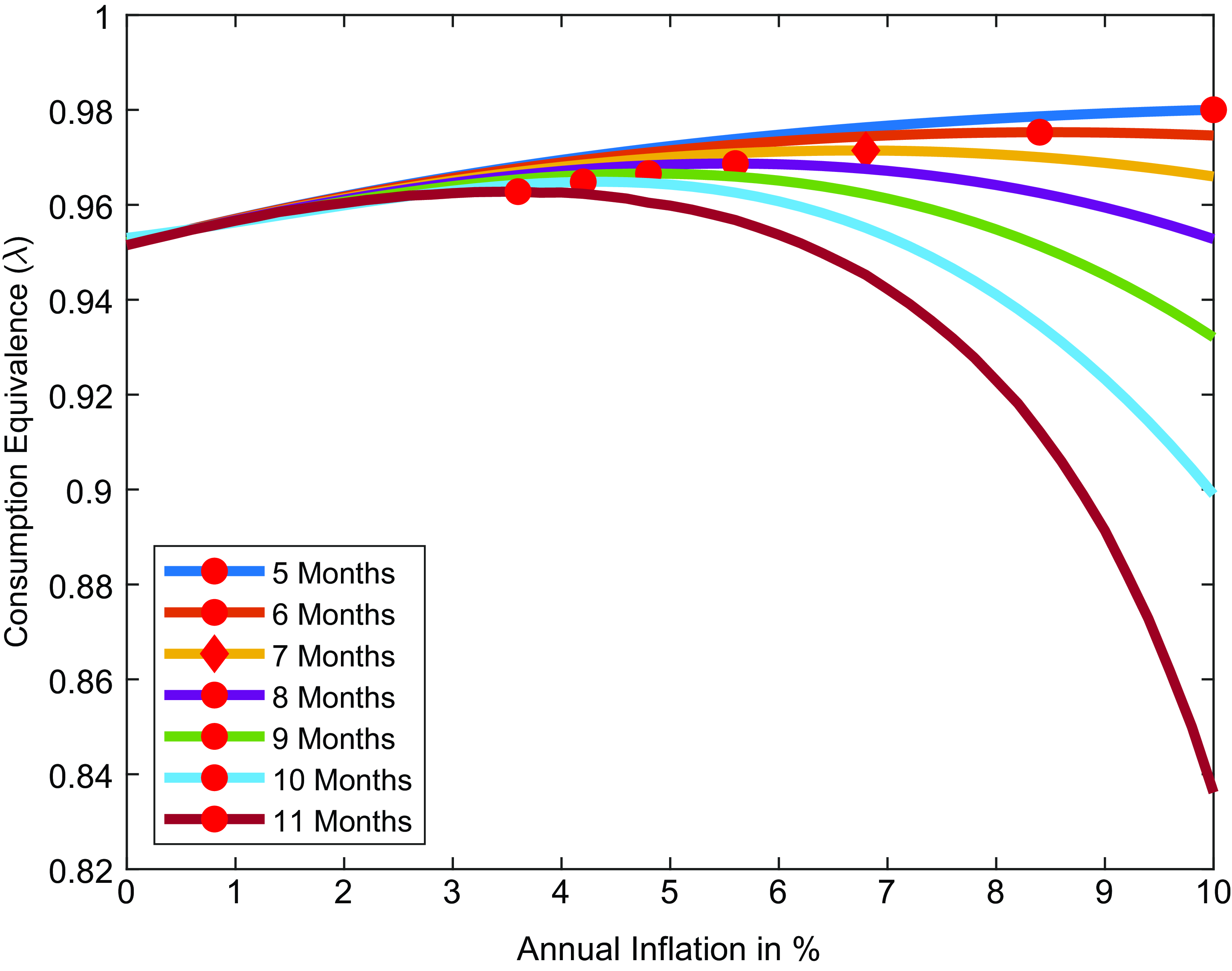

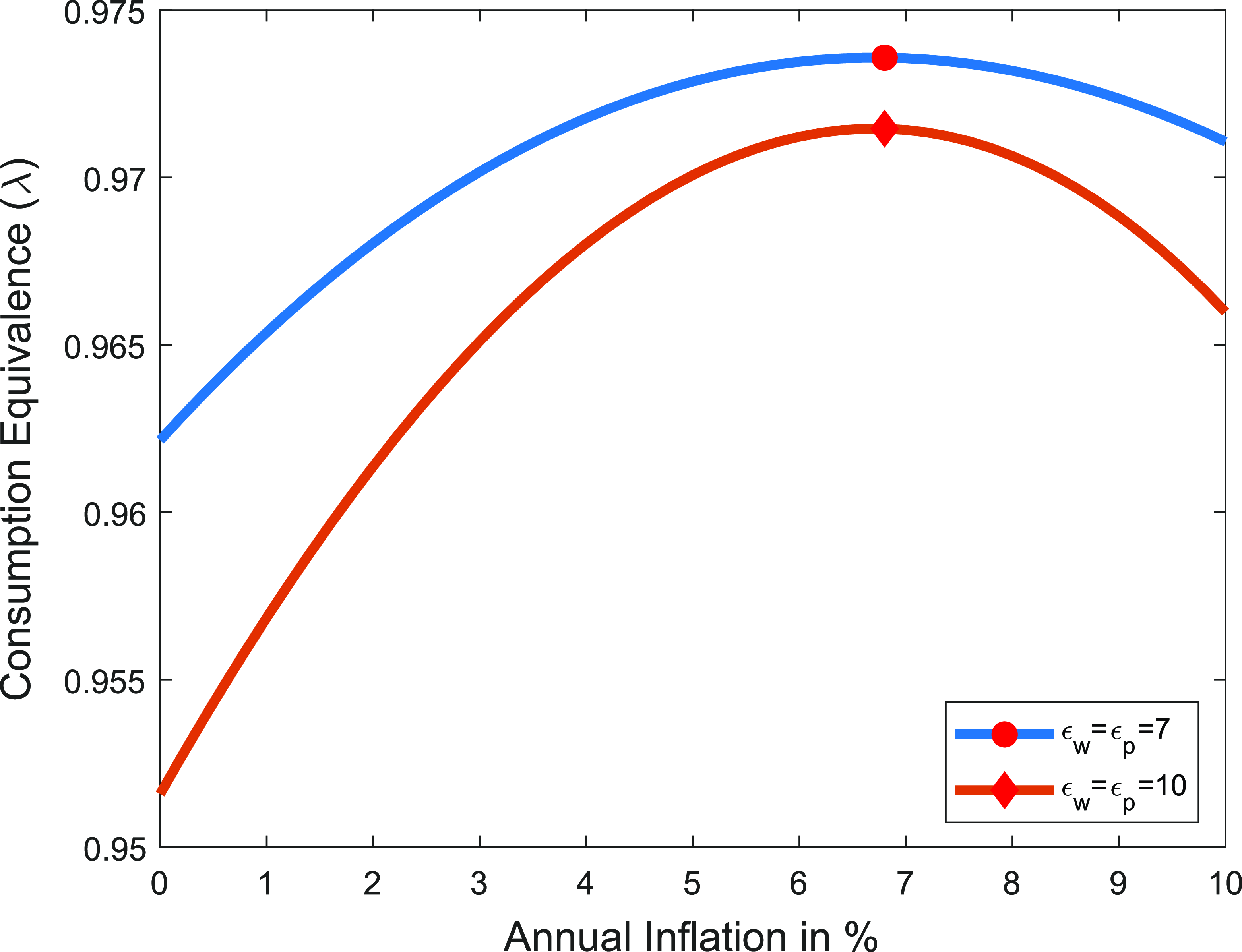

Figure 6. Optimal inflation rate, price stickiness

![]() $\mu _p$

.

$\mu _p$

.

Notes: The figure plots the consumption-equivalent welfare of economies with different price stickiness level as a function of the inflation rate relative to welfare when prices are completely flexible. Diamond shape indicates the benchmark case.

The more flexible prices are, the lower the welfare cost of inflation. As shown in Figure-6, the optimal inflation rate increases with more flexible prices, as the DNWR channel becomes dominant. Price stickiness primarily affects the price-setting decisions of firms but does not impact the wage-setting process. As a result, changes to the price stickiness parameter influence price dispersion without altering the cost associated with the wage-setting process, as seen in equations (4)–(6). When a firm resets its price, it needs to set it higher than necessary to account for the anticipated inflation over the period during which it expects to be unable to adjust the price again. This overadjustment becomes more pronounced with greater price stickiness (higher

![]() $\mu _{p}$

) and higher trend inflation, leading to increased price dispersion and a more inefficient allocation of prices. Consequently, the optimal inflation rate decreases as the stickiness parameter increases.

$\mu _{p}$

) and higher trend inflation, leading to increased price dispersion and a more inefficient allocation of prices. Consequently, the optimal inflation rate decreases as the stickiness parameter increases.

Bils and Klenow (Reference Bils and Klenow2004) estimate that firms reset prices every 4 to 5 months, suggesting that the optimal inflation rate under such conditions could be as high as 10%. On the other hand, Nakamura and Steinsson (Reference Nakamura and Steinsson2008) estimate that firms change prices every 8 to 11 months when considering regular prices, with the inclusion of product substitutions reducing the implied duration to 7 to 9 months. The 11-month duration for regular prices represents the upper bound of estimates in the literature. Even under this assumption, the optimal inflation target exceeds 3%, reaching approximately 3.6%.

However, as inflation rises, the frequency of price changes increases, as documented by Alvarez et al. (Reference Alvarez, Beraja, Gonzalez-Rozada and Neumeyer2018). This suggests that in an inflationary environment, prices are unlikely to remain highly sticky. Consequently, the cost of price dispersion associated with higher inflation is further reduced when prices change more frequently, as shown by Levin and Yun (Reference Levin and Yun2007) and Nakamura et al. (Reference Nakamura, Steinsson, Sun and Villar2018). The baseline calibration adopted here strikes a balance between the high and low-end estimates in the literature, consistent with Coibion et al. (Reference Coibion, Gorodnichenko and Wieland2012).

Figure 7. Optimal inflation rate, (Inverse) frisch elasticity

![]() $\psi$

.

$\psi$

.

Notes: The figure plots the consumption-equivalent welfare of economies with different Frisch elasticities as a function of the inflation rate relative to welfare when prices are completely flexible. Diamond shape indicates the benchmark case.

In Figure-7, I analyze variation in the levels of the (inverse) Frisch labor supply elasticity. I opt to use a conservative estimate for Frisch elasticity (

![]() $\psi =1$

) for the benchmark case but if I increase it further, the optimal inflation target increases because labor supply becomes more inelastic with respect to wage and thus the cost of DNWR is higher.Footnote

35

A higher value of

$\psi =1$

) for the benchmark case but if I increase it further, the optimal inflation target increases because labor supply becomes more inelastic with respect to wage and thus the cost of DNWR is higher.Footnote

35

A higher value of

![]() $\psi$

implies that the disutility from labor supply is more convex, leading to greater welfare losses due to inefficient wage setting.

$\psi$

implies that the disutility from labor supply is more convex, leading to greater welfare losses due to inefficient wage setting.

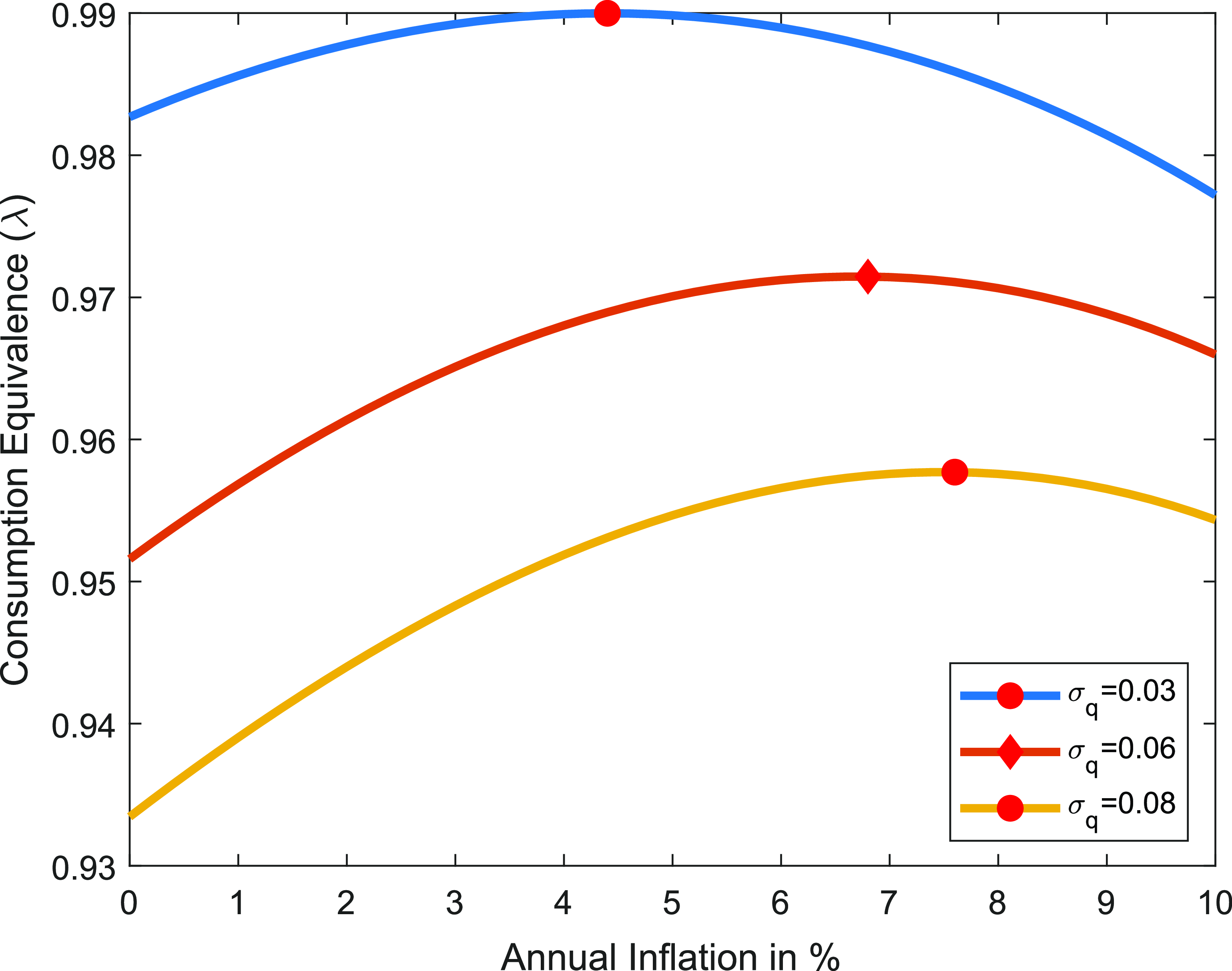

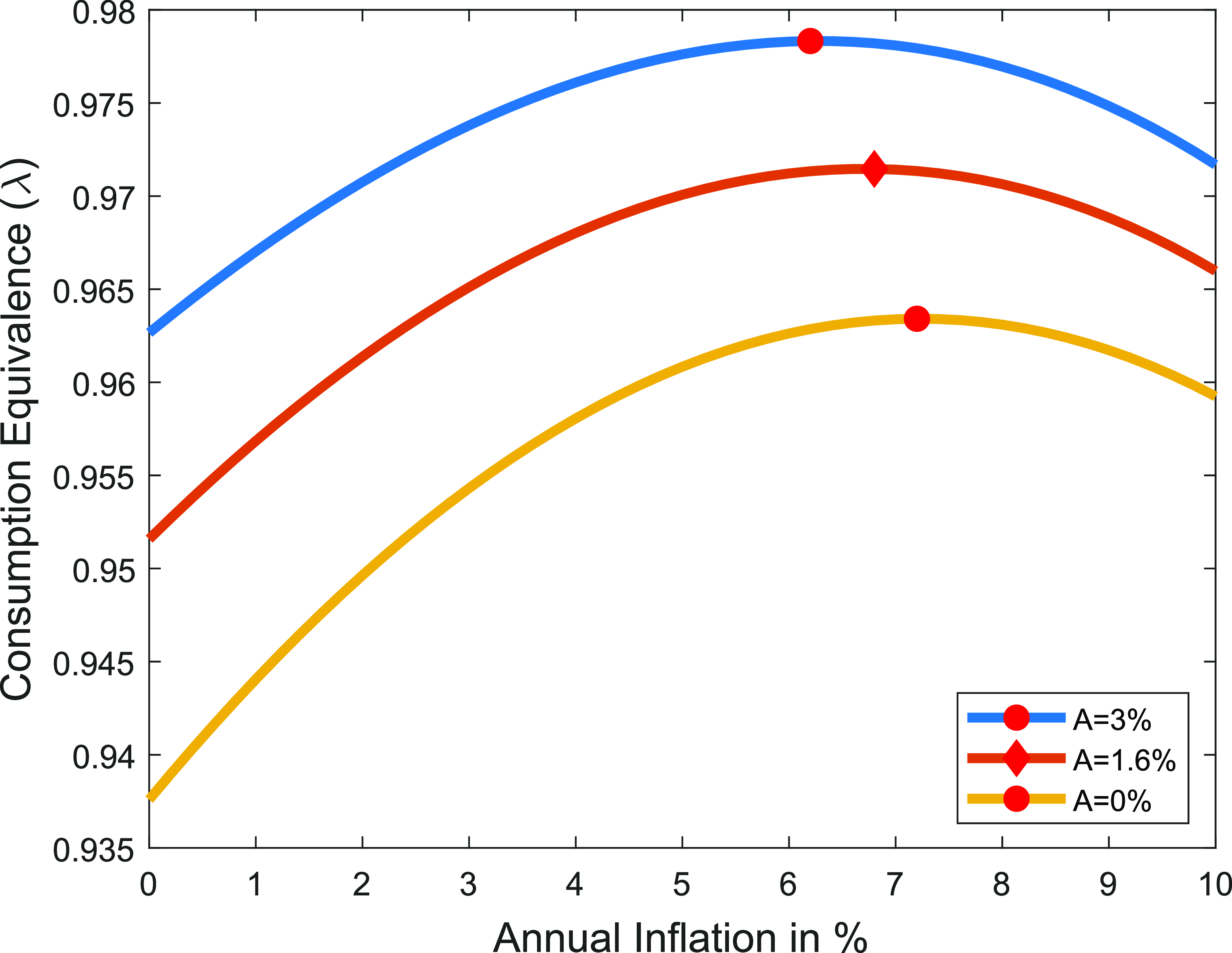

Figure 8. Optimal inflation rate, std of productivity

![]() $\sigma _{q}$

.

$\sigma _{q}$

.

Notes: The figure plots the consumption-equivalent welfare of economies with different Frisch elasticities as a function of the inflation rate relative to welfare when prices are completely flexible. Diamond shape indicates the benchmark case.

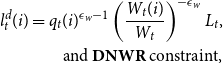

Figure 9. Optimal inflation rate, DWNR parameter

![]() $\mu ^{DNWR}$

.

$\mu ^{DNWR}$

.

Notes: The figure plots the consumption-equivalent welfare of economies with different DNWR parameter as a function of the inflation rate relative to welfare when prices are completely flexible. Diamond shape indicates the benchmark case.

Since the distortionary impact of DNWR on labor supply is more costly when the labor supply elasticity is lower, a higher value of

![]() $\psi$

–which corresponds to a lower Frisch elasticity–results in greater welfare costs associated with the DNWR channel. This shift increases the optimal inflation rate. The Frisch elasticity is a critical parameter in this analysis, and as shown in Figure-7, the main findings are robust to variations in this parameter.

$\psi$

–which corresponds to a lower Frisch elasticity–results in greater welfare costs associated with the DNWR channel. This shift increases the optimal inflation rate. The Frisch elasticity is a critical parameter in this analysis, and as shown in Figure-7, the main findings are robust to variations in this parameter.

In Figure-8, I calculate the optimal inflation rate as the standard deviation of the shock process varies. As a result, I observe a less (more) dispersed wage change distribution with a lower (higher) wage freeze rate, leading to lower (higher) welfare costs stemming from the DNWR channel. Even if the standard deviation is reduced by half, the welfare cost due to the DNWR constraint remains high: the estimated optimal trend inflation is 4.4%, significantly higher than the current target of 2%.

Finally, the parameter representing the degree of downward wage rigidity, denoted by

![]() $\mu ^{DNWR}$

, plays a crucial role in determining the welfare cost associated with such rigidity, as illustrated in Figure-9. A higher value of

$\mu ^{DNWR}$

, plays a crucial role in determining the welfare cost associated with such rigidity, as illustrated in Figure-9. A higher value of

![]() $\mu ^{DNWR}$

implies a higher wage freeze rate, resulting in a more rigidity on wages and a higher degree of distortion in the labor market. Consequently, the optimal inflation rate shifts to the right, potentially reaching as high as 8%. Since the empirical estimates show that the wage freeze rate in the U.S. is around 11.6%, the paper suggests that the inflation targeting should be set as high as 7% to promote a more flexible labor market and lower the long-run unemployment rate.Footnote

36

Even if a low level of downward rigidity is assumed, the optimal inflation target would still need to be higher than 4.5%.Footnote

37

$\mu ^{DNWR}$

implies a higher wage freeze rate, resulting in a more rigidity on wages and a higher degree of distortion in the labor market. Consequently, the optimal inflation rate shifts to the right, potentially reaching as high as 8%. Since the empirical estimates show that the wage freeze rate in the U.S. is around 11.6%, the paper suggests that the inflation targeting should be set as high as 7% to promote a more flexible labor market and lower the long-run unemployment rate.Footnote

36

Even if a low level of downward rigidity is assumed, the optimal inflation target would still need to be higher than 4.5%.Footnote

37

6. Asymmetric menu cost model

Now, instead of modeling with Calvo type wage setting process, I introduce DNWR with asymmetric menu cost pricing. For that, I focus solely on base earnings as in Grigsby et al. (Reference Grigsby, Hurst and Yildirmaz2021) and match moments accordingly. The wage-setting part of the model has been changed to integrate menu cost as follows:

Here,

![]() $w_t^*$

is the optimal real wage of households. Households are free to adjust their wages upward nominally, but they incur a utility cost

$w_t^*$

is the optimal real wage of households. Households are free to adjust their wages upward nominally, but they incur a utility cost

![]() $\Psi$

if the adjustment is nominally downward. The calibration remains the same as in the benchmark case; the only difference is that the menu cost parameter

$\Psi$

if the adjustment is nominally downward. The calibration remains the same as in the benchmark case; the only difference is that the menu cost parameter

![]() $\Psi$

is set to 1.145 to match the wage freeze rate in the base wage change distribution, replacing the

$\Psi$

is set to 1.145 to match the wage freeze rate in the base wage change distribution, replacing the

![]() $\mu ^{\text{DNWR}}$

parameter. Additionally,

$\mu ^{\text{DNWR}}$

parameter. Additionally,

![]() $\sigma _q$

is slightly adjusted to 0.063 to match the standard deviation of the distribution accurately.

$\sigma _q$

is slightly adjusted to 0.063 to match the standard deviation of the distribution accurately.