1. Introduction

In recent years, governments and central banks have increasingly stressed the relevance of climate change in their respective policymaking (Dikau et al. Reference Dikau, Robins and Täger2019). In 2015, 196 national governments signed the Paris Agreement, aiming to limit global warming to 2° Celsius relative to pre-industrial levels. In the same year, Bank of England’s (BoE) Mike Carney delivered his seminal speech at Lloyd’s, where he first addressed climate change as a potential source of financial instability. Among others, this was the result of central banks’ revamped focus on their financial stability mandate following the global financial crisis (GFC), which also contributed to establish their potential role in addressing climate change (DiLeo, Reference DiLeo2023).

Carney’s argument first let central banks, traditionally focused on preserving price and financial stability, consider addressing climate change as part of their latter mandate (Batten et al. Reference Batten, Sowerbutts and Tanaka2016). Indeed, most of the climate-oriented interventions under discussion consist in a series of green constraints applicable to the monetary and macroprudential instruments already in place (Dikau and Volz, Reference Dikau and Volz2019; Bolton et al. Reference Bolton, Despres, Pereira da Silva, Samama and Svartzman2020; Masciandaro and Tarsia, Reference Masciandaro and Tarsia2021), such as countercyclical or systemic buffers, asset purchase programs, and stress testing (Battiston et al. Reference Battiston, Mandel, Monasterolo, Schütze and Visentin2017; Monnin, Reference Monnin2018a,Reference Monninb; Dikau et al. Reference Dikau, Robins and Volz2020; Bremus et al. Reference Bremus, Schütze and Zaklan2021). By incorporating climate risks, these instruments should penalize polluting sectors and, in particular, their financing capacity (Baer et al. Reference Baer, Campiglio and Deyris2021).

While this framework does not envision the introduction of new mandates or explicit targets (Dikau and Volz, Reference Dikau and Volz2021), an overlap of policy considerations can still result and lead to unintended trade-offs (Campiglio et al. Reference Campiglio, Dafermos, Monnin, Ryan-Collins, Schotten and Tanaka2018). These trade-offs would stem from setting instruments with aggregate effects based on the central bank’s desire to favor one sector over the other, potentially translating a sector-specific penalization into aggregate disturbances. Furthermore, the attempt to tilt the allocation of credit in favor of green firms would entail redistributive effects, jeopardizing central banks’ neutrality. This possibility has raised more stringent concerns than for standard monetary and prudential policies. In fact, while even these can be affected by similar problematics, those relating to climate actions would be exacerbated by the lack of an explicit mandate (Boneva et al. Reference Boneva, Ferrucci and Mongelli2022).

Political clearance thus becomes a necessary condition to act in favor of the green transition (DiLeo, Reference DiLeo2023). The nature of this clearance, supportive (DiLeo, Reference DiLeo2023) or coercive (Deyris, Reference Deyris2023), is subject to debate and mostly case-specific. In general, the redistributive aspect is particularly relevant for central banks of composite jurisdictions, like the Federal Reserve (Fed) or the European Central Bank (ECB). As brown activities may be more prominent in a sub-jurisdiction than another, constraining their financing capacity may penalize specific geographical areas, besides sectors. On the other hand, relying on political authorities for clearance may jeopardize central banks’ independence, make them prone to shifts in the political agenda (DiLeo et al. Reference DiLeo, Rudebusch and Van Klooster2023), and give rise to another series of inefficiencies.

Most of the extant literature has adopted a purely “economic” approach to investigate the potential of central banks’ climate actions. Under this view, explicit climate targets are exogenously included in the central bank’s policy rule (Chan, Reference Chan2020; Chen and Dongyang, Reference Chen and Dongyang2020), or multiple policy rules are considered in order to differentiate the central bank’s instruments on a sectorial basis (Holtemöller and Sardone, Reference Holtemöller and Sardone2022). This approach has two fallacies in terms of its (lacking) institutional framework. First, even if in economic terms this would provide relatively more efficient results, central banks’ interventions cannot be envisioned as targeting an explicit climate objective (Krogstrup and Oman, Reference Krogstrup and Oman2019) but must fall within the scope of their existing ones (Tucker, Reference Tucker2019; Moschella, Reference Moschella2024). Second, this setting neglects the clearing role of political authorities (Tucker, Reference Tucker2019), underestimating the compromises that could emerge from the principal-agent relation between the government and central bank. For both reasons, a purely economic approach risks being subject to an “institutional bias” in favor of central banks’ interventions, providing results that are economically feasible but politically unfeasible.

In this paper, we adopt a political-economy approach envisioning a principal-agent framework. This approach frames central banks’ actions to account for climate risks within their current objectives, while still highlighting the trade-offs that could result from favoring the green transition. In doing so, we acknowledge the focus on macroprudential objectives that arose in the post-GFC era and, above all, account for the relevance of political clearance of either nature. Thanks to this, we are able to investigate in a transparent way the effectiveness of central banks’ climate interventions with respect to three elements: (i) the attainment of the extant monetary and macroprudential targets, (ii) the adaptation decision of the brown sector to become green, and (iii) the resulting (re)distribution of social losses.

Specifically, we rely on a Walsh contract (Walsh, Reference Walsh1995a) to design a “green memorandum,” which the government can offer to the central bank. Henceforth, the terms “contract” and “memorandum” will be used interchangeably. Without political clearance, the central bank cannot disfavor the financing capacity of brown firms and promote the green transition. The aim of the memorandum is to provide such clearance, and to let the central bank introduce a “tilt factor” penalizing the allocation of financing to the brown sector.

Depending on the climate preferences of the government and central bank, the memorandum can be interpreted in either a “hostile” or “cooperative” fashionFootnote 1 : in the first case, it represents a tool for a climate-concerned government to bend a poorly independent central bank to its political agenda; in the second case, it is an instrument for the central bank itself to incentivize the adaptation of brown firms by “stretching” its mandates while relying on political legitimization. The memorandum thus captures the institutional dynamics between the government and central bank that can let the latter take promotional climate actions. By doing so, it unveils the underlying trade-offs, if present, and eliminates the institutional bias.

We consider a two-sector model with green and brown firms. We first show that in a no-memorandum scenario, both the government and central bank could find a green transition optimal—in other words, that brown firms become green. Given this, we then analyze how the memorandum would affect this picture. On the one hand, the government will offer it provided that brown firms can deplete social welfare. On the other hand, the central bank can evaluate it either negatively or positively, depending on how its own losses are affected. Still, we assume that the central bank anyway has to accept the memorandum if its degree of political dependence is positive. Comparing the outcomes of this scenario relative to the baseline, we highlight under which conditions, and at which costs, a politically legitimized central bank could effectively favor the green transition.

The rest of this paper is structured as follows: Section 2 reviews the related literature, also providing further details on the Walsh contract. Sections 3 and 4, respectively, present the model economy and each player’s loss function, together with the institutional relations among them. Section 5 starts the analysis and presents the baseline, no-memorandum scenario. In Section 6, we introduce the memorandum and analyze its effects in terms of central banks’ effectiveness in preserving price and financial stability, as well as promoting the green transition. The effects in terms of social welfare are presented in Section 7. Section 8 concludes.

2. Related Literature

Our paper is related and complementary to a relatively novel strand of the literature, highlighting potential trade-offs between central banks’ traditional objectives and environmental considerations (Annicchiarico et al. Reference Annicchiarico, Diluiso, Kalkuhl and Minx2021 and the references cited therein; Nakov and Thomas, Reference Nakov and Thomas2023). These papers propose a New Keynesian framework and analyze different tools through which the central bank may face environmental risks. Importantly, they are among the firsts to put the accent on the potential drawbacks this may entail, but still in a purely economic framework. By not covering the role of delegation from political authorities and the political feasibility of their results, they disregard how the political-economy dimension may add to these problematics (Masciandaro and Russo, Reference Masciandaro and Russo2024).

To include these aspects, we rather focus on a principal-agent framework based on contracts as proposed by Walsh (Reference Walsh1995a) and subsequent research (Chortareas and Miller, Reference Chortareas and Miller2003, Reference Chortareas and Miller2007). The Walsh contract enters the loss function of the central bank and “punishes” it for any deviations of the target variables from the levels preferred by the government. Therefore, the former acts as an agent of the latter (principal). The contract counterbalances the central bank’s original incentives, without the need to change them. This approach being in line with how most central banks plan to take action (Dikau et al. Reference Dikau, Robins and Täger2019; Masciandaro and Tarsia, Reference Masciandaro and Tarsia2021), we deem it particularly suitable for this subject.

The Walsh contract offers a high degree of flexibility and must not necessarily be thought of as explicit (Walsh, Reference Walsh1995b) or pecuniary. The “punishment” could represent the central banker’s disutility from having to justify his actions to the government, from a higher probability of not being renewed in office, or from unfriendly political declarations resulting in a “political stigma.” For convenience, we adopt the view of a political stigma as it can apply to both the hostile and cooperative interpretations of the contract-memorandum: regardless of why the central bank accounts for it, failing to deliver on its objectives will result in political backlashes. This is also coherent with the fact that, even though the contract is always offered to minimize the principal’s loss, it may also benefit the agent.

We also complement the strand of the literature focusing on the effects of central banks’ policies in a multi-sector economy. Specifically, this paper speaks to the work of Blinder and Gregory (Reference Blinder and Gregory1984), Duca (Reference Duca1987) and Waller (Reference Waller1992). In different versions, they propose a two-sector principal-agent model highlighting how heterogeneity between productive sectors can lead to suboptimal results if the central bank targets aggregate variables. While disturbances in their model would arise due to different wage rigidities, in ours, these would be the result of the penalization of brown financing. Therefore, even if from a theoretical perspective, this paper also contributes to the discussion about the distributive effects of central banks’ policies to favor the green transition (Fay et al. Reference Fay, Hallegatte, Vogt-Schilb, Rozenberg, Narloch and Kerr2015; Breckenfelder et al. Reference Breckenfelder, Maćkowiak, Marques-Ibanez, Olovsson, Popov, Porcellacchia and Schepens2023).

Finally, we build on Ueda and Valencia (Reference Ueda and Valencia2012) and Smets (Reference Smets2014). They update the classical Barro and Gordon (Reference Barro and Gordon1983a, Barro & Gordon Reference Barro and Gordon1983b) framework, at the basis of the Walsh model, to include the effects of macroprudential policy on output, and the role of macroprudential responsibilities in the central bank’s loss function. Traditionally, this has focused on the output gap and inflation only. In their approach, the macroprudential mandate to preserve financial stability translates into smoothing the leverage cycle, which comes on top of the other two. This novelty is particularly relevant to us, as the role of macroprudential policy in determining firms’ financing capacity is key in this framework. We further develop their model to include climate constraints and differentiate between brown and green sectors.

3. The Economy

Based on Ueda and Valencia (Reference Ueda and Valencia2012) and Smets (Reference Smets2014), we focus on three main variables: inflation, output, and leverage. The latter is our measure of financing capacity (credit) and the target of macroprudential policy. Inflation in a given period,

![]() ${\pi }$

, is proportional to the central bank’s monetary instrument m as follows:

${\pi }$

, is proportional to the central bank’s monetary instrument m as follows:

For simplicity, time subscripts are dropped.

![]() ${m}$

can be thought of as “monetary accommodation.” For instance, one may see it as the rate of money growth or a monetary aggregate. Therefore, monetary policy decisions will be goal-basedFootnote

2

.

${m}$

can be thought of as “monetary accommodation.” For instance, one may see it as the rate of money growth or a monetary aggregate. Therefore, monetary policy decisions will be goal-basedFootnote

2

.

There are initially two productive sectors: brown and green. The former is exposed to a negative climate shock, which reflects environmental risks; the latter is notFootnote 3 . Outputs of the two sectorsFootnote 4 are, respectively, given by:

These correspond to the macroprudential-augmented Lucas supply function proposed by Ueda and Valencia (Reference Ueda and Valencia2012) and Smets (Reference Smets2014), adapted to our model’s sectorial specificities:

![]() $\hat{{y}}_{{b}}$

and

$\hat{{y}}_{{b}}$

and

![]() $\hat{{y}}_{{g}}$

are the natural levels of brown and green output, respectively.

$\hat{{y}}_{{g}}$

are the natural levels of brown and green output, respectively.

![]() ${n}$

is the macroprudential instrument of the central bank, defined as “macroprudential accommodation.” It may be seen as the looseness of macroprudential supervisionFootnote

5

.

${n}$

is the macroprudential instrument of the central bank, defined as “macroprudential accommodation.” It may be seen as the looseness of macroprudential supervisionFootnote

5

.

![]() ${\pi }^{{e}}$

is the rate of inflation that in a given period the public expects to prevail in the following period. This is determined right after the public observes the central bank’s stances. Brown output is exposed to the climate shock, v

${\pi }^{{e}}$

is the rate of inflation that in a given period the public expects to prevail in the following period. This is determined right after the public observes the central bank’s stances. Brown output is exposed to the climate shock, v

![]() $\lt$

0 in line with the literature, which documents negative effects of climate change on production, while

$\lt$

0 in line with the literature, which documents negative effects of climate change on production, while

![]() ${\alpha }$

and

${\alpha }$

and

![]() ${\beta }$

are positive parameters.

${\beta }$

are positive parameters.

Firms in each sector are identical, and the total number of firms in the economy is normalized to 1. The brown sector is made of 0 ≤

![]() ${\gamma }$

≤ 1 firms. The green sector is made of 1 –

${\gamma }$

≤ 1 firms. The green sector is made of 1 –

![]() ${\gamma }$

firms. These sizes are used as weights to aggregate over sectors (Waller, Reference Waller1992). Thus, aggregate output is:

${\gamma }$

firms. These sizes are used as weights to aggregate over sectors (Waller, Reference Waller1992). Thus, aggregate output is:

Each sector’s leverage is again defined following Ueda and Valencia (Reference Ueda and Valencia2012) and Smets (Reference Smets2014):

where

![]() $\hat{{c}}_{{b}}$

and

$\hat{{c}}_{{b}}$

and

![]() $\hat{{c}}_{{g}}$

are brown and green baseline leverages. Actual leverage in either sector is then pulled down (up) by higher (lower) unexpected inflation, which reduces (increases) the debt overhang. Following the same line of reasoning, macroprudential accommodation contributes positivelyFootnote

6

. Similarly to the case of inflation, macroprudential policy decisions will also be goal-based. At the aggregate level, leverage is:

$\hat{{c}}_{{g}}$

are brown and green baseline leverages. Actual leverage in either sector is then pulled down (up) by higher (lower) unexpected inflation, which reduces (increases) the debt overhang. Following the same line of reasoning, macroprudential accommodation contributes positivelyFootnote

6

. Similarly to the case of inflation, macroprudential policy decisions will also be goal-based. At the aggregate level, leverage is:

4. Loss Functions and Institutional Framework

Each sector is assumed to suffer a loss from current inflation (either positive or negative, so that the preferred level by either sector would be null inflation), deviations of sectorial output from its natural level, and deviations of sectorial leverage from its baseline value. Therefore, sectorial loss functions are defined as follows:

The weights assigned to deviations of output and leverage relative to those of inflation,

![]() ${\lambda }$

and

${\lambda }$

and

![]() ${\phi }$

, respectively, are positive and common across sectors.

${\phi }$

, respectively, are positive and common across sectors.

The government and central bank do not share the same loss function. Therefore, whether one of the two, or both, would like to have the memorandum in place is the result of an endogenous assessmentFootnote 7 . The objective of the government in office is to minimize the social loss in a given period. Therefore, it acts as a shortsighted social plannerFootnote 8 . The central bank’s objective is to minimize its own loss in the same period, which summarizes the mandates handed over to it in an ex ante “constitutional stage”Footnote 9 . Tilting the allocation of financing in favor of the green sector does not fall within these mandates. Thus, the central bank would not do so by default. Neither the government nor the central bank is forward-looking, since it would be impossible, in a given period, to specify all the potential contingencies of subsequent periods (Lohmann, Reference Lohmann1992). Specifically: the realization of the climate shock and the adaptation decision of the brown sector cannot be anticipated.

In the social loss function, the government weighs sectorial losses by the size of each sector. The loss function of the central bank is similar to sectorial ones, except that it depends on the gaps of aggregate variables from their targets. This reflects the neutrality it must preserve. These loss functions are, respectively, defined as:

with

![]() $\hat{{y}}={\gamma }\hat{{y}}_{{b}} + (1 - {\gamma })\hat{{y}}_{{g}}$

aggregate natural output,

$\hat{{y}}={\gamma }\hat{{y}}_{{b}} + (1 - {\gamma })\hat{{y}}_{{g}}$

aggregate natural output,

![]() $\hat{{c}}={\gamma }\hat{{c}}_{{b}} + (1 - {\gamma })\hat{{c}}_{{g}}$

aggregate baseline leverage, and

$\hat{{c}}={\gamma }\hat{{c}}_{{b}} + (1 - {\gamma })\hat{{c}}_{{g}}$

aggregate baseline leverage, and

![]() ${\vartheta }$

= τ

${\vartheta }$

= τ

![]() $- {\mu }$

(

$- {\mu }$

(

![]() ${c}- \tilde{{c}}$

) the memorandum (contract) the government would offer. The central bank’s inflation, output, and leverage targets are fixed, as defined in the constitutional stage, and consist in targeting null inflation, aggregate natural output, and aggregate baseline leverage without any tilt factor. They are unbiased so that any equilibrium distortion would be due to climate considerations.

${c}- \tilde{{c}}$

) the memorandum (contract) the government would offer. The central bank’s inflation, output, and leverage targets are fixed, as defined in the constitutional stage, and consist in targeting null inflation, aggregate natural output, and aggregate baseline leverage without any tilt factor. They are unbiased so that any equilibrium distortion would be due to climate considerations.

The memorandum the government would offer,

![]() ${\vartheta }$

, will be accounted for as long as the central bank is not fully independent from the government’s preferences. Such a degree of (in)dependence is measured by the parameter

${\vartheta }$

, will be accounted for as long as the central bank is not fully independent from the government’s preferences. Such a degree of (in)dependence is measured by the parameter

![]() ${\xi } \geq$

0: the larger

${\xi } \geq$

0: the larger

![]() ${\xi }$

, the more dependent the central bank. Also this parameter is set in the constitutional stage. τ is the central bank’s participation incentive (Walsh, Reference Walsh1995a, Walsh Reference Walsh1995b). Given that the central bank accounts for the memorandum based on

${\xi }$

, the more dependent the central bank. Also this parameter is set in the constitutional stage. τ is the central bank’s participation incentive (Walsh, Reference Walsh1995a, Walsh Reference Walsh1995b). Given that the central bank accounts for the memorandum based on

![]() ${\xi }$

, we assume τ = 0Footnote

10

: this also ensures that the memorandum only affects the central bank through the potential political stigma

${\xi }$

, we assume τ = 0Footnote

10

: this also ensures that the memorandum only affects the central bank through the potential political stigma

![]() ${\mu }$

> 0.

${\mu }$

> 0.

The central bank bears the political stigma entailed by the contract for positive deviations of realized leverage

![]() ${c}$

from the “tilted” target

${c}$

from the “tilted” target

![]() $\tilde{{c}}={\gamma }(\hat{{c}}_{{b}} - {T})+ (1- {\gamma })\hat{{c}}_{{g}}$

.

$\tilde{{c}}={\gamma }(\hat{{c}}_{{b}} - {T})+ (1- {\gamma })\hat{{c}}_{{g}}$

.

![]() ${T}$

> 0 is the tilt factor: if it accounts for the memorandum, the central bank will weigh its original, unbiased leverage target,

${T}$

> 0 is the tilt factor: if it accounts for the memorandum, the central bank will weigh its original, unbiased leverage target,

![]() $\hat{{c}}$

, with its tilted counterpart,

$\hat{{c}}$

, with its tilted counterpart,

![]() $\tilde{{c}}$

. The latter should incentivize the central bank to set its monetary and macroprudential instruments in a way that penalizes brown leverage proportionally to T in the attainment of its aggregate leverage objective. This should increase the realized losses of brown firms if they decide to stay brown, thus incentivizing them to rather switch to green.

$\tilde{{c}}$

. The latter should incentivize the central bank to set its monetary and macroprudential instruments in a way that penalizes brown leverage proportionally to T in the attainment of its aggregate leverage objective. This should increase the realized losses of brown firms if they decide to stay brown, thus incentivizing them to rather switch to green.

5. Baseline Scenario

We first consider the baseline scenario where the government does not offer the memorandum, and therefore, the central bank does not apply the tilt factor to leverage. The sequence of events is important: first, the central bank sets

![]() ${m}$

and

${m}$

and

![]() ${n}$

to minimize (11) subject to (1)-(7) and

${n}$

to minimize (11) subject to (1)-(7) and

![]() ${\vartheta }$

= 0. Then, inflation expectations are formed. The brown sector observes the central bank’s stances and decides whether to pay an adaptation cost S>0 to become green. The climate shock is only observed after this. Therefore, when policymakers and brown firms solve their optimization problems, they cannot do it based on the observation of v. This reflects the extreme uncertainty, lack of data, and limited forecasting possibilities when it comes to quantifying or pricing environmental risks (Schnabel, Reference Schnabel2023)Footnote

12

, affecting both policymakers and private agents. Once the climate shock is observed, losses are realized.

${\vartheta }$

= 0. Then, inflation expectations are formed. The brown sector observes the central bank’s stances and decides whether to pay an adaptation cost S>0 to become green. The climate shock is only observed after this. Therefore, when policymakers and brown firms solve their optimization problems, they cannot do it based on the observation of v. This reflects the extreme uncertainty, lack of data, and limited forecasting possibilities when it comes to quantifying or pricing environmental risks (Schnabel, Reference Schnabel2023)Footnote

12

, affecting both policymakers and private agents. Once the climate shock is observed, losses are realized.

Given this sequence of events, in its optimization problem, the central bank takes

![]() ${\pi }^{{e}}$

and

${\pi }^{{e}}$

and

![]() ${\gamma }$

as given. Solving the system of the central bank’s response functions obtained from this problem yields:

${\gamma }$

as given. Solving the system of the central bank’s response functions obtained from this problem yields:

where

![]() ${\omega }=({\alpha }+{\beta }){h}+{q}$

,

${\omega }=({\alpha }+{\beta }){h}+{q}$

,

![]() ${h}=({\alpha }+{\beta }){k}$

,

${h}=({\alpha }+{\beta }){k}$

,

![]() ${k}={\lambda }{\phi }$

,

${k}={\lambda }{\phi }$

,

![]() ${q}={\beta }^{2}{\lambda }+{\phi }$

, and

${q}={\beta }^{2}{\lambda }+{\phi }$

, and

![]() ${x} = {\alpha }{\beta }{\lambda }$

–

${x} = {\alpha }{\beta }{\lambda }$

–

![]() ${\phi }$

. Taking expectations of (12) and solving for

${\phi }$

. Taking expectations of (12) and solving for

![]() ${\pi }^{{e}}={m}^{{e}}$

gives

${\pi }^{{e}}={m}^{{e}}$

gives

![]() ${\pi }^{{e}}$

= 0. Plugging this back into (12) and (13) gives the central bank’s instruments in equilibrium:

${\pi }^{{e}}$

= 0. Plugging this back into (12) and (13) gives the central bank’s instruments in equilibrium:

The upper flat bar denotes equilibrium values in this baseline case.

The brown sector must now decide whether to adapt. Not having observed the shock yet, brown firms’ supposed loss at this stage is equal to the one of green firms

![]() $\overline{{L}}_{{b}{,}\textit{ supposed}}= \overline{{L}}_{{g}}=0$

. This prevents them from adapting, since

$\overline{{L}}_{{b}{,}\textit{ supposed}}= \overline{{L}}_{{g}}=0$

. This prevents them from adapting, since

![]() $\overline{{L}}_{{b}{,}\textit{ supposed}}\lt \overline{{L}}_{{g}}+{S}$

. In other words, the brown sector wrongly assumes that its realized losses from staying brown will be smaller than those from becoming and being green. Thus, it decides not to adapt, making the realized equilibrium envision

$\overline{{L}}_{{b}{,}\textit{ supposed}}\lt \overline{{L}}_{{g}}+{S}$

. In other words, the brown sector wrongly assumes that its realized losses from staying brown will be smaller than those from becoming and being green. Thus, it decides not to adapt, making the realized equilibrium envision

![]() ${\gamma }$

> 0.

${\gamma }$

> 0.

At this point, the climate shock is observed and, after substituting (14), (15) and

![]() ${\pi }^{{e}}$

= 0 back into (2)–(7) and rearranging, one obtains the actual equilibrium gaps of the other key variables:

${\pi }^{{e}}$

= 0 back into (2)–(7) and rearranging, one obtains the actual equilibrium gaps of the other key variables:

Of course, the brown and aggregate output gaps will be non-null, and amount to the corresponding exposure to the climate shock, v and

![]() ${\gamma }{v}$

, respectively. The green output gap as well as all leverage gaps are instead null. Both of these outcomes result from the fact that the central bank has not been able to set its stances to counterbalance the climate shock. On the one hand, this has left the brown sector exposed to it. On the other hand, this “compartmentalization” from sector-specific sources of variability, that is, central bank’s neutrality, has prevented the central bank itself from spilling the brown sectorial disturbance over to the green sector via its policy instruments. Overall, this has made the central bank able to achieve its inflation and leverage targets, but not its output target.

${\gamma }{v}$

, respectively. The green output gap as well as all leverage gaps are instead null. Both of these outcomes result from the fact that the central bank has not been able to set its stances to counterbalance the climate shock. On the one hand, this has left the brown sector exposed to it. On the other hand, this “compartmentalization” from sector-specific sources of variability, that is, central bank’s neutrality, has prevented the central bank itself from spilling the brown sectorial disturbance over to the green sector via its policy instruments. Overall, this has made the central bank able to achieve its inflation and leverage targets, but not its output target.

It is now possible to evaluate the equilibrium social, sectorial, and central bank’s losses. By plugging (14) and (16)–(19) back into (8)–(11), one obtains:

All losses but those of the green sector depend positively on the shock. Again, the green sector is “preserved” thanks to the neutrality of central banks’ instruments.

The government will find that the adaptation of the brown sector could have been welfare-improving if

![]() ${\gamma }{S}+\overline{{L}}_{{s}}$

(

${\gamma }{S}+\overline{{L}}_{{s}}$

(

![]() ${\gamma }$

= 0) <

${\gamma }$

= 0) <

![]() $\overline{{L}}_{{s}}$

(

$\overline{{L}}_{{s}}$

(

![]() ${\gamma }$

> 0)Footnote

14

, which is verified for:

${\gamma }$

> 0)Footnote

14

, which is verified for:

If in a given period the adaptation cost is low enough, the social loss it entails will be lower than the one stemming from the climate shock. In this case, the government would be incentivized ex ante to offer the memorandum to the central bank, make it apply the tilt factor, and encourage the brown sector to switch. Given that

![]() $\overline{{L}}_{{cb}}$

(

$\overline{{L}}_{{cb}}$

(

![]() ${\gamma }$

= 0) <

${\gamma }$

= 0) <

![]() $\overline{{L}}_{{cb}}$

(

$\overline{{L}}_{{cb}}$

(

![]() ${\gamma }$

> 0), the central bank shares the government’s assessment and favorably receive the memorandum in a cooperative fashion.

${\gamma }$

> 0), the central bank shares the government’s assessment and favorably receive the memorandum in a cooperative fashion.

Consistent with the conventional wisdom in policy debates (e.g., Stern, Reference Stern2007; NGFS, 2022), it can be reasonable to assume that the central bank, society, or both realize that a nonquantifiable climate shock would come anyway, eventually affecting the losses of the players. On these grounds, the central bank may want to (or the government may want the central bank to) take preventive action to incentivize the brown sector to become green and eliminate the economy’s exposure to such a shock. This would be done by applying the tilt factor, but political clearance is needed for this. The tilt factor thus enters the picture through the memorandum.

6. Introducing the Green Memorandum

If the government offers the memorandum, the loss function of the central bank will be as in (11), with

![]() ${\vartheta } \gt$

0. Except for this, the rest of the economy and loss functions do not change relative to the baseline scenario. The sequence of events is also the same. So, even in this case, the central bank cannot account for the climate shock as its policy stances are set before this is realized. The central bank minimizes (11) with respect to its instruments and subject to the economy constraints. Solving the system of the central bank’s response functions gives:

${\vartheta } \gt$

0. Except for this, the rest of the economy and loss functions do not change relative to the baseline scenario. The sequence of events is also the same. So, even in this case, the central bank cannot account for the climate shock as its policy stances are set before this is realized. The central bank minimizes (11) with respect to its instruments and subject to the economy constraints. Solving the system of the central bank’s response functions gives:

Taking expectations of (24) and solving for expected inflation gives

![]() ${\pi }^{{e}}={m}^{{e}}={\xi }{\beta }{h}{\mu }/(2{\phi }{q})$

. Replacing this back into (24) and (25) yields:

${\pi }^{{e}}={m}^{{e}}={\xi }{\beta }{h}{\mu }/(2{\phi }{q})$

. Replacing this back into (24) and (25) yields:

The central bank’s punishment term can be deduced as in Walsh (Reference Walsh1995a) and is given by

![]() ${\mu } = 2{\gamma }{\phi }{T}{/}{\xi }.$

Of course, this is directly proportional to T and is not defined for

${\mu } = 2{\gamma }{\phi }{T}{/}{\xi }.$

Of course, this is directly proportional to T and is not defined for

![]() ${\xi }$

= 0 since the government would not offer the memorandum in the first place.

${\xi }$

= 0 since the government would not offer the memorandum in the first place.

As in the baseline scenario, the brown sector foresees to incur the same losses of the green sector, as it cannot observe the climate shock. That is,

![]() ${\check{L}}_{{b}{,}{supposed}}={\check{L}}_{{g}}={\gamma }^{2}\Omega {T}^{2}{16}$

, with

${\check{L}}_{{b}{,}{supposed}}={\check{L}}_{{g}}={\gamma }^{2}\Omega {T}^{2}{16}$

, with

![]() $\Omega ={\phi }[{\beta }^{2}{\lambda }({\omega } -{\beta }^{2}{\lambda })+ {\phi }^{2}]/{q}^{2}$

. For it to adapt, it should be verified that

$\Omega ={\phi }[{\beta }^{2}{\lambda }({\omega } -{\beta }^{2}{\lambda })+ {\phi }^{2}]/{q}^{2}$

. For it to adapt, it should be verified that

![]() ${\check{L}}_{{b}{,}{ supposed}}\gt {\check{L}}_{{g}}({\gamma }=0)+{S}$

, which is the case provided that:

${\check{L}}_{{b}{,}{ supposed}}\gt {\check{L}}_{{g}}({\gamma }=0)+{S}$

, which is the case provided that:

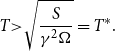

\begin{equation*}{T}{\gt }\sqrt{\frac{{S}}{{\gamma }^{{2}}{\Omega }}}={T^*}{.}\end{equation*}

\begin{equation*}{T}{\gt }\sqrt{\frac{{S}}{{\gamma }^{{2}}{\Omega }}}={T^*}{.}\end{equation*}

The tilt factor should be large enough for its implied losses to exceed those the brown sector would bear to adapt. In this scenario, the variables denoted by the upper reverse hat thus represent a candidate equilibrium, since whether the brown sector adapts or not is ambiguous.

For

![]() ${T}$

<

${T}$

<

![]() ${ T^*}$

, the brown sector would not switch, and a no-transition equilibrium would result. We would thus have

${ T^*}$

, the brown sector would not switch, and a no-transition equilibrium would result. We would thus have

![]() ${\gamma }$

> 0 with an active brown sector. The gaps for this candidate equilibrium are obtained by replacing

${\gamma }$

> 0 with an active brown sector. The gaps for this candidate equilibrium are obtained by replacing

![]() ${\mu } = 2{\gamma }{\phi }{T}{/}{\xi }$

into (26) and (27), and the resulting policy instruments with

${\mu } = 2{\gamma }{\phi }{T}{/}{\xi }$

into (26) and (27), and the resulting policy instruments with

![]() ${\pi }^{{e}} = {\xi }{\beta }{h}{\mu }/(2{\phi }{q})$

back into (2)–(7):

${\pi }^{{e}} = {\xi }{\beta }{h}{\mu }/(2{\phi }{q})$

back into (2)–(7):

The deviations implied by the shock are the same as in the baseline scenario. Those implied by the tilt factor come on top of them and are negative but for inflation. They are propagated across sectors through the central bank’s instruments, which no longer ensure neutrality. Equation (27) shows that the memorandum implies a lower degree of macroprudential accommodation than in the previous scenario. This is because the central bank now weighs its original leverage target with the tilted target introduced by the memorandum, which is lower. To counterbalance the resulting negative effect on output, the central bank sets a higher degree of monetary accommodation, as per equation (26). This results in positive inflation, a negative output gap for the green sector, and makes all the other gaps more negative. In any case, for no tilt factor, the central bank could achieve its inflation, leverage, and output targets at the same time. Giving up neutrality pushes the central bank away from its policy objectives.

Losses can be obtained following the same procedure as before. Still evaluated for

![]() ${\gamma }$

> 0, these result as follows:

${\gamma }$

> 0, these result as follows:

with Q = 2βk.

For

![]() ${T}$

>

${T}$

>

![]() ${ T^*}$

, the brown sector would switch, resulting in a transition equilibrium. The brown sector’s loss would amount to

${ T^*}$

, the brown sector would switch, resulting in a transition equilibrium. The brown sector’s loss would amount to

![]() ${\check{L}}_{{g}}$

(

${\check{L}}_{{g}}$

(

![]() ${\gamma }$

= 0) +

${\gamma }$

= 0) +

![]() ${S} = {S}$

, the one of the green sector to

${S} = {S}$

, the one of the green sector to

![]() ${\check{L}}_{{g}}$

(

${\check{L}}_{{g}}$

(

![]() ${\gamma }$

= 0) = 0. The social loss would thus be

${\gamma }$

= 0) = 0. The social loss would thus be

![]() ${\check{L}}_{{s}}$

(

${\check{L}}_{{s}}$

(

![]() ${\gamma }$

= 0) +

${\gamma }$

= 0) +

![]() ${\gamma }{S} = {\gamma }{S}$

, and the one of the central bank

${\gamma }{S} = {\gamma }{S}$

, and the one of the central bank

![]() ${\check{L}}_{{cb}}$

(

${\check{L}}_{{cb}}$

(

![]() ${\gamma }$

= 0) = 0. Either of the two equilibria is feasible. Therefore, while the central bank’s intervention allowed by the memorandum manages to introduce a transition equilibrium, not envisioned in the baseline case, this is not sufficient to ensure that such a transition equilibrium will also be the prevailing one.

${\gamma }$

= 0) = 0. Either of the two equilibria is feasible. Therefore, while the central bank’s intervention allowed by the memorandum manages to introduce a transition equilibrium, not envisioned in the baseline case, this is not sufficient to ensure that such a transition equilibrium will also be the prevailing one.

7. Social Optimality and Sectorial Trade-Offs

Ex post, whether introducing the memorandum is welfare-improving, welfare-depleting or neutral, and for whom, depends on the prevailing equilibrium and, contingent on this, how the realized climate shock interacts with the tilt factor and the adaptation cost. On the one hand, potential welfare-improving conditions emerge if the transition equilibrium materializes. On the other hand, if these conditions are not met, the memorandum would result in larger losses than without it. Overall, the memorandum thus entails a “widening” of the distribution of losses relative to the baseline scenario.

If the no-transition equilibrium (i.e., T <

![]() ${T^*}$

) materializes, losses will be affected by both the tilt factor and the climate shock. From equations (28), (29), (30), and (32), it is easy to see that the factor always increases the deviations of inflation, sectorial outputs, and leverages from their baseline values, thus resulting in larger losses for both sectors (

${T^*}$

) materializes, losses will be affected by both the tilt factor and the climate shock. From equations (28), (29), (30), and (32), it is easy to see that the factor always increases the deviations of inflation, sectorial outputs, and leverages from their baseline values, thus resulting in larger losses for both sectors (

![]() ${\check{L}}_{{b}}$

>

${\check{L}}_{{b}}$

>

![]() $\overline{{L}}_{{b}}$

and

$\overline{{L}}_{{b}}$

and

![]() ${\check{L}}_{{g}}$

>

${\check{L}}_{{g}}$

>

![]() $\overline{{L}}_{{g}}$

). As a consequence, social losses will also be larger than in the baseline scenario (

$\overline{{L}}_{{g}}$

). As a consequence, social losses will also be larger than in the baseline scenario (

![]() ${\check{L}}_{{s}}$

>

${\check{L}}_{{s}}$

>

![]() $\overline{{L}}_{{s}}$

), and the government will not find the memorandum worthy ex post. The same line of reasoning, applied to the aggregate gaps, results in

$\overline{{L}}_{{s}}$

), and the government will not find the memorandum worthy ex post. The same line of reasoning, applied to the aggregate gaps, results in

![]() ${\check{L}}_{{cb}}$

>

${\check{L}}_{{cb}}$

>

![]() $\overline{{L}}_{{cb}}$

, making the central bank share the government’s assessment.

$\overline{{L}}_{{cb}}$

, making the central bank share the government’s assessment.

If instead the transition equilibrium (i.e., T >

![]() ${T^*}$

) materializes, the dynamics of brown losses will depend on how the switching cost compares to the climate shock the brown sector would have undergone. Originally brown firms would be better-off relative to the baseline scenario if

${T^*}$

) materializes, the dynamics of brown losses will depend on how the switching cost compares to the climate shock the brown sector would have undergone. Originally brown firms would be better-off relative to the baseline scenario if

![]() ${\check{L}}_{{g}}$

(

${\check{L}}_{{g}}$

(

![]() ${\gamma }$

= 0) +

${\gamma }$

= 0) +

![]() ${S}$

<

${S}$

<

![]() $\overline{{L}}_{{b}}$

. This is verified for

$\overline{{L}}_{{b}}$

. This is verified for

![]() ${v}$

< –

${v}$

< –

![]() ${v*}$

, with:

${v*}$

, with:

In other words, for brown firms to benefit from the transition, the shock they would have undergone by staying brown should be sufficiently extreme to compensate for the adaptation cost. Since this scenario implies

![]() ${\check{L}}_{{g}}$

(

${\check{L}}_{{g}}$

(

![]() ${\gamma }$

= 0) =

${\gamma }$

= 0) =

![]() $\overline{{L}}_{{g}}$

, the condition

$\overline{{L}}_{{g}}$

, the condition

![]() ${v}$

< –

${v}$

< –

![]() ${v*}$

also ensures that the memorandum is worthy for society as a whole, that is,

${v*}$

also ensures that the memorandum is worthy for society as a whole, that is,

![]() ${\check{L}}_{{s}}$

(

${\check{L}}_{{s}}$

(

![]() ${\gamma }$

= 0) +

${\gamma }$

= 0) +

![]() ${\gamma }{S}$

<

${\gamma }{S}$

<

![]() $\overline{{L}}_{{s}}$

. This is always the case for the central bank, as

$\overline{{L}}_{{s}}$

. This is always the case for the central bank, as

![]() ${\check{L}}_{{cb}}$

(

${\check{L}}_{{cb}}$

(

![]() ${\gamma }$

= 0) <

${\gamma }$

= 0) <

![]() $\overline{{L}}_{{cb}}$

independently of the size of v.

$\overline{{L}}_{{cb}}$

independently of the size of v.

Overall, this model shows that central banks’ intervention will not necessarily result in an adaptation equilibrium. Rather, they would make it possible. For the adaptation equilibrium to prevail, the tilt factor should be effectively calibrated with respect to the adaptation cost, so as to make the losses of the brown sector larger than those it would undergo if it did not pay such a costFootnote 17 . Even in this case, though, the brown sector and society as a whole could be worse off if the realized climate shock is not extreme enough.

Therefore, just placing a very high tilt factor would not guarantee a welfare improvement even if it managed to trigger an adaptation equilibrium. On top of this, since the cost of adaptation and the size of the climate shock are outside the control of the central bank, little room is left to ensure that welfare-improving conditions are met. They could still materialize, but mostly independently of the policymaker’s actions, which makes it a problem in terms of neutrality.

Furthermore, if a no-transition equilibrium results, welfare losses will emerge due to the distortionary effects of the tilt factor, which in this case would not be compensated by the elimination of the climate shock. These issues may be particularly relevant in the case of composite jurisdictions, given that the central bank may end up penalizing given geographical areas where production is more carbon intensive, and for an uncertain outcome.

Different evaluations of such uncertainty may be one of the reasons why, for instance, the Fed retreated as regards the inclusion of climate considerations in its policies, although this is not the case for the ECB or BoE (DiLeo, Reference DiLeo2023; DiLeo et al. Reference DiLeo, Rudebusch and Van Klooster2023). As an example, the latter two have introduced a negative discrimination of brown assets in their asset-purchase programs, while the Fed categorises climate risks as sources of traditional financial risks, addressing them as such (Waller, Reference Waller2023).

Another major issue arising from this comparative framework is that, in case the central bank intervened, miscalibrations could be repeated. In other words, if in a given period introducing the memorandum and the tilt factor leads to larger losses, nothing ensures that this will be corrected in the following or later periods. This is because of the variability of the climate shock and potentially of the adaptation cost, over which the central bank has no or limited visibility. One option to address this question could be to introduce some form of “credibility dynamics” (Barro and Gordon, Reference Barro and Gordon1983b; Lohmann, Reference Lohmann1992), punishing the central bank for misestimations of the realized effects of the memorandum.

Another element to consider is that we assumed the whole brown sector could switch. In reality, though, this may not be the case. If some brown firms could not adapt, the potential disturbances of the tilt factor would be amplified. Of course, this situation could be mitigated as the understanding of environmental risks progresses, favoring a correct calibration that could lead the brown sector to adapt and forever “shield” the economy from this source of variability.

8. Conclusion

The way how central banks are planning to account for and tackle climate risks can raise questions in terms of neutrality, legitimacy, and effectiveness. Most of the literature has focused on this last point, disregarding the first two. This has resulted in overwhelming evidence in support of central bank’s interventions, which nevertheless does not account for the necessary interplay with political authorities, and the trade-offs this could imply. Such a purely economic approach could result in an institutional bias in favor of central banks’ interventions.

With this paper, we complement the extant literature proposing a comprehensive framework à la Walsh, which shows why governments and central banks may want to tackle climate risks, which conditions would determine their effectiveness, and what trade-offs could stem from the principal-agent relation between them. We propose a concrete interpretation of the Walsh contract, seen as a memorandum between the government and central bank, which introduces a tilt factor to incentivize the green transition. Through the memorandum, we unveil the potential trade-offs that central banks may face in tackling climate change while relying on the (necessary) legitimization of elected authorities. In doing so, we eliminate the institutional bias and provide an analytical framework that could be useful to interpret the actions of major central banks like the Fed or the ECB.

Our model shows that an economy’s social welfare can be harmed by the presence of a brown sector with volatile output. Therefore, a social planner may find that the adaptation of brown firms to green could be welfare-improving. This is true provided that the adaptation cost is not too high. In this case, the government and central bank may agree ex ante on the opportunity to implement the memorandum. However, a series of conditions should be respected for central banks’ interventions to be beneficial, but neither the government nor the central bank itself can ensure ex ante that they will be met ex post. Furthermore, such legitimization comes at the cost of a positive degree of the central bank’s dependence on political authority and loss of neutrality.

The central bank will not be able to attain its monetary and macroprudential objectives. This would entail the benefit of introducing a potential transition of the brown sector but also the potential of welfare distortions. In any case, this does not imply that political authorities should disregard the relevance of supporting the green transition themselves. The analysis of their autonomous role is simply outside the scope of this paper. Overall, central banks should not “rush” into the climate arena and cautiously assess the trade-offs they may end up facing. The uncertainty that these assessments would entail and that our model highlights can represent one explanation of why the Fed and the ECB have parted ways as regards “greening” central banking.

Disclaimers

Donato Masciandaro gratefully acknowledges the infrastructural and organizational help of the Bocconi Baffi Centre, which in turn used the financial support of PRIN 2022 PNRR (European Union, Next Generation EU, Mission 4, Component 1, J53D23015340001). The affiliations of the authors are valid at the time of writing. The views expressed in this paper are solely those of the authors and should not be interpreted as those of their current or previous employers.

Appendix A: How to Retrieve the Punishment Term

The punishment term of the Walsh contract is retrieved by simulating a hypothetical scenario, where the central bank acts as the government would like without the need for further incentives (Walsh, Reference Walsh1995a). In our case, this corresponds to a central bank autonomously applying the tilt factor, whose loss function is as follows:

All the variables and parameters are defined as in the main model. Of course, the contract is not present, but the central bank targets by itself the tilted leverage objective

![]() $\tilde{{c}}$

.

$\tilde{{c}}$

.

The central bank minimizes (A1) with respect to

![]() ${m}$

and

${m}$

and

![]() ${n}$

, subject to the usual constraints and sequence of events. After solving the system of the two response functions, one obtains:

${n}$

, subject to the usual constraints and sequence of events. After solving the system of the two response functions, one obtains:

with z = h +

![]() ${\beta }{\lambda }$

. Taking expectations of (A2) yields

${\beta }{\lambda }$

. Taking expectations of (A2) yields

![]() ${\pi }^{{e}}={m}^{{e}}=({\omega } - {q}){\pi }^{{e}}/{\omega }+{\gamma }{\beta }{hT}/{\omega }$

. Solving for

${\pi }^{{e}}={m}^{{e}}=({\omega } - {q}){\pi }^{{e}}/{\omega }+{\gamma }{\beta }{hT}/{\omega }$

. Solving for

![]() ${\pi }^{{e}}$

gives

${\pi }^{{e}}$

gives

![]() ${\gamma }{\beta }{hT}/{q}$

. Substituting this into (A2) and (A3) gives the game’s candidate equilibrium values for

${\gamma }{\beta }{hT}/{q}$

. Substituting this into (A2) and (A3) gives the game’s candidate equilibrium values for

![]() ${\gamma }$

> 0:

${\gamma }$

> 0:

By offering the contract, the aim of the government is to make the central bank replicate these candidate equilibrium values in the main game. To find the value of

![]() ${\mu }$

such that this is the case, it is enough to take the difference between either (A4) and (26) or (A5) and (27). After solving for

${\mu }$

such that this is the case, it is enough to take the difference between either (A4) and (26) or (A5) and (27). After solving for

![]() ${\mu }$

, both yield

${\mu }$

, both yield

![]() ${\mu } = 2{\gamma }{\phi }{T}{/}{\xi }$

.

${\mu } = 2{\gamma }{\phi }{T}{/}{\xi }$

.