Introduction

Economic development in developing countries continues to face structural constraints, with limited human capital emerging as a key bottleneck. Human capital – defined by individuals’ skills, health, and education – is a fundamental component of national wealth (Becker, Reference Becker2009). However, progress in building human capital remains limited in low-income countries, contributing to persistent disparities in per capita wealth. In 2018, wealth per capita in high-income countries was nearly 50 times greater than in low-income nations (World Bank, 2021).

Economic freedom, which reflects individuals’ ability to make economic choices free from excessive state interference, plays a crucial role in enhancing socio-economic outcomes. It is grounded in principles such as personal choice, voluntary exchange, market competition, and property rights. According to the 2024 Economic Freedom of the World report, countries with higher levels of economic freedom enjoy greater income, educational access, and quality of life, while those with lower freedom face deeper inequality and poorer health outcomes (Gwartney et al., Reference Gwartney, Lawson and Murphy2024).

This study investigates how economic freedom influences human capital accumulation in 83 developing countries. It explores key channels – such as improved investment incentives, reduced expropriation risks, and better credit access (Dawson, Reference Dawson1998; Feldmann, Reference Feldmann2021) – through which economic freedom affects education and health.

While the existing literature has made important contributions, few studies adopt a comprehensive approach that includes gender, employment status, and multiple dimensions of economic freedom. This research addresses these gaps using different econometric techniques, including quantile regression via moments, to assess both average and distributional effects.

The paper is structured as follows: Section 2 reviews the literature; Section 3 outlines the methodology and data; Section 4 presents the results; and Section 5 concludes and provides policy implications.

Literature review

Economic freedom reflects the extent to which institutional and policy frameworks allow individuals to make economic choices independently and without excessive interference (Gwartney et al., Reference Gwartney, Lawson and Murphy2024). Economic theory establishes a strong link between economic freedom and human capital development. Human capital – defined as the accumulation of skills, education, and health – is widely viewed as a foundational driver of economic growth. Economic freedom supports human capital development through three main mechanisms.

First, it increases the returns on investment in education and health. Environments with low taxation and monetary stability create favourable conditions for individuals and firms to allocate resources toward human capital accumulation (Feldmann, Reference Feldmann2025). King et al. (Reference King, Montenegro and Orazem2012) find that higher levels of economic freedom are associated with greater returns on such investments.

Second, economic freedom contributes to a more predictable and secure institutional environment. By reducing the risk of expropriation, it encourages individuals to invest in their skills and education, knowing they can retain the benefits over time (Dawson, Reference Dawson1998). It also allows markets to allocate labour more efficiently, boosting overall productivity.

Third, it facilitates the development of credit markets, which are crucial for financing health and education, especially in developing countries. Functioning credit systems reduce liquidity constraints and improve household access to essential services (Dawson, Reference Dawson1998; Feldmann, Reference Feldmann2021).

Empirical studies consistently show a positive link between economic freedom and various dimensions of human capital. In the health sector, greater economic freedom is associated with improved outcomes. Esposto and Zaleski (Reference Esposto and Zaleski1999) and Stroup (Reference Stroup2007) report higher life expectancy and lower mortality in freer economies. Economic freedom is also linked to higher childhood vaccination rates (Stroup, Reference Stroup2007), improved mental health (Callais et al., Reference Callais, Hyde, Murtazashvili and Zhou2023), and lower infant mortality, particularly in sub-Saharan Africa (Sharma, Reference Sharma2020).

In education, economic freedom has been shown to enhance literacy, school enrolment, and educational attainment (Dawson, Reference Dawson1998; Esposto and Zaleski, Reference Esposto and Zaleski1999; Stroup, Reference Stroup2007; Feldmann, Reference Feldmann2017; Dia et al., Reference Dia, Ondoa and Ouedraogo2023). Aixalá and Fabro (Reference Aixalá and Fabro2009) confirm its positive effect on global enrolment rates, while Feldmann (Reference Feldmann2025) highlights its role in improving the quality of education and aligning it with labour market needs.

Beyond health and education, economic freedom is positively associated with overall well-being (Gehring, Reference Gehring2013; Graafland, Reference Graafland2020b), higher returns on human capital (King et al., Reference King, Montenegro and Orazem2012), and stronger motivation for skill development (Feldmann, Reference Feldmann2021). These findings underscore its potential to support human capital accumulation more broadly.

Recent research has also highlighted economic freedom’s role in promoting gender equality and women’s empowerment. Kramer (Reference Kramer2024) finds that greater economic freedom reduces legal restrictions on women’s rights, particularly in employment and entrepreneurship, with stronger effects in democracies. Grier (Reference Grier2024) shows that long-term exposure to economic freedom increases female labour force participation and school enrolment. Piano and Stone (Reference Piano and Stone2024) note that women in freer economies are better able to balance family and career, contributing to reduced fertility gaps and greater autonomy. These outcomes suggest that economic freedom can play a transformative role in enhancing women’s economic inclusion.

Despite this growing body of evidence, important gaps remain. Most studies analyze the impact of economic freedom using an indicator approach, treating education and health as separate outcomes. This fragmented view fails to capture the dynamic interactions between the two and only partially reflects the broader concept of human capital. As Goldin (Reference Goldin, Diebolt and Haupert2024) argues, human capital involves investments in people – through education, training, and health – that improve productivity. This study adopts a holistic perspective, applying the monetary approach to value human capital as a productive asset (Abraham and Mallatt, Reference Abraham and Mallatt2022).

In addition, few studies have explored how economic freedom affects different population subgroups. Although some progress has been made (Feldmann, Reference Feldmann2017; Dia et al., Reference Dia, Ondoa and Ouedraogo2023), persistent gender gaps in education and health access require further investigation. Understanding how economic freedom influences human capital differently for men and women is critical for designing more inclusive development strategies.

Similarly, the effects of economic freedom on human capital may vary depending on employment status. Self-employed individuals may experience different constraints and opportunities compared to wage earners, with significant implications for labour productivity and economic development. Moreover, most existing research uses single-model methods that focus on average effects. This approach overlooks the heterogeneity of outcomes, particularly in developing countries where initial levels of human capital are often low.

This study addresses these limitations by examining the heterogeneous effects of economic freedom on human capital accumulation in 83 developing countries from 2000 to 2018. Using advanced econometric techniques – including quantile regression via moments – it analyzes how economic freedom affects different segments of the human capital distribution. By disaggregating data by gender and employment status, the study provides a more nuanced understanding of how institutional and economic conditions shape human capital outcomes.

Finally, the research investigates each of the five dimensions of economic freedom separately to determine which components are most strongly linked to human capital development. This multidimensional and inclusive approach enhances the robustness of the findings and provides actionable insights for policymakers seeking to foster inclusive, sustainable growth in developing countries.

Methodology and data

Empirical strategy

Building on previous studies that explore the relationship between economic freedom and human capital investment (Feldmann, Reference Feldmann2017, Reference Feldmann2021), the following equation is proposed to examine the effect of economic freedom (EF) on human capital (HC):

where X represents a set of control variables. Incorporating the panel structure of the data, the equation is expanded as:

where

![]() ${\alpha _0}$

is the constant term,

${\alpha _0}$

is the constant term,

![]() ${\varepsilon _{it}}$

is the error term, i indexes countries, and t represents the time period.

${\varepsilon _{it}}$

is the error term, i indexes countries, and t represents the time period.

Our dependent variable is human capital, which can be measured using three approaches: monetary, indicator-based, and cost-based (Abraham and Mallatt, Reference Abraham and Mallatt2022). The indicator approach relies on measures like years of schooling or literacy rates, while the cost approach estimates human capital based on its production costs. The monetary approach, on the other hand, evaluates human capital through its expected impact on future income. The cost-based approach measures human capital from an input perspective, whereas the income-based approach assesses it in terms of economic returns (Boarini et al., Reference Boarini, d’Ercole and Liu2012). The indicator-based approach, though widely used, captures only part of human capital, as it overlooks health factors. This study adopts the monetary approach, which is best suited for viewing human capital as an investment (Abraham and Mallatt, Reference Abraham and Mallatt2022). Human capital stock is estimated by discounting the present and future lifetime labour income, accounting for schooling and survival probabilities (Fraumeni et al., Reference Fraumeni, Christian and Samuels2017; Fraumeni and Christian, Reference Fraumeni, Christian and Fraumeni2020).

In this study, we use the logarithm of human capital, which reflects the economic value of a skilled and healthy workforce. It is measured as per capita human capital (in 2018 US dollars), capturing the present value of future earnings for the working-age population while accounting for education, health, and skills. To provide a more granular perspective, this variable is disaggregated by gender and employment status.

Data are sourced from the recent Wealth Accounts database of the World Bank (2021) to proxy human capital. Human capital is estimated using the lifetime income approach developed by Fraumeni and Jorgenson (Reference Fraumeni, Jorgenson, Lipsey and Tice1989). The World Bank applies a uniform discount rate of 4% to ensure comparability across countries within the Wealth Accounting Framework. This methodology also incorporates region- and income-specific wage growth rates to refine earnings projections. By integrating educational attainment, employment probabilities, and life expectancy, this measure offers a comprehensive and standardized assessment of human capital across different economic contexts. Human capital proxy based on the monetary approach often overestimates the value of investments in human capital through: (1) the application of too low an intertemporal discount rate and too high an expected growth rate in future income; (2) an overestimation of the return on human capital (Abraham and Mallatt, Reference Abraham and Mallatt2022). In addition, in this approach, unpaid work done in households that are not taken into account in the System of National Accounts is excluded. In spite of these limitations, the income-based measure has recently been used as a proxy for human capital in recent empirical literature (Fraumeni and Christian, Reference Fraumeni, Christian and Fraumeni2020; Fraumeni et al., Reference Fraumeni, Christian, Samuels and Fraumeni2021; Clech et al., Reference Clech, Guevara-Pérez and Urdaneta-Camacho2023; Dianda, Reference Dianda2025).

The primary independent variable, economic freedom, is drawn from the Economic Freedom of the World Index compiled by the Fraser Institute (Gwartney et al., Reference Gwartney, Lawson and Murphy2024). This index measures the extent to which a country’s institutions and policies enable its citizens to make economic choices autonomously. It is scaled from 0 (least economic freedom) to 10 (most economic freedom). The index comprises five dimensions, which are also used in robustness tests: size of government, the legal system and property rights, monetary stability, freedom to trade and invest internationally, and regulatory freedom. This measure of economic freedom is widely used in the literature and is considered to be the best proxy, as it provides a comprehensive measure of the degree to which the institutions and policies prevailing in countries are compatible with economic freedom (Gehring, Reference Gehring2013; Feldmann, Reference Feldmann2017; Graafland, Reference Graafland2020b; Berggren and Nilsson, Reference Berggren and Nilsson2021; Feldmann, Reference Feldmann2021, Reference Feldmann2024).

Although widely used, the indicator of economic freedom has limitations due to its mix of institutional measures and outcomes, introducing subjectivity (De Haan et al., Reference De Haan, Lundström and Sturm2006). However, it remains a reliable tool. In addition to the Economic Freedom of the World index (Fraser Institute), we use the Heritage Foundation index to test the robustness of our results.

Following prior studies, we incorporate five control variables. First, political freedom is a key determinant of human capital (King et al., Reference King, Montenegro and Orazem2012; Feldmann, Reference Feldmann2017). King et al. (Reference King, Montenegro and Orazem2012) argue that protecting political rights enhances human capital returns, fostering its accumulation. Political freedom also facilitates foreign direct investment (FDI) benefits (Dutta and Osei-Yeboah, Reference Dutta and Osei-Yeboah2010; Filippaios et al., Reference Filippaios, Annan-Diab, Hermidas and Theodoraki2019). We measure it using Freedom House’s average political rights and civil liberties ratings, scaled from 1 (high freedom) to 7 (low freedom). Second, financial development plays a crucial role in human capital accumulation by easing credit constraints, allowing high-potential individuals to invest in education (Levine, Reference Levine2021). We use domestic credit to the private sector (% of GDP) as a proxy of financial development to capture credit availability for human capital investments (Feldmann, Reference Feldmann2017). Third, we include GDP per capita (PPP, constant 2021 international $) in logarithm as a measure of income levels. Wealthier economies allocate more resources to education and health (Rajkumar and Swaroop, Reference Rajkumar and Swaroop2008). Fourth, we control for logarithm of natural capital per capita (in 2018 US dollars), reflecting resource availability for public human capital investments (Stijns, Reference Stijns2009). Finally, we account for FDI net inflows (% of GDP), which fosters job creation, skill development, and wage premiums for skilled workers (Liu, Reference Liu2024; Feldmann, Reference Feldmann2024). FDI encourages human capital investment by raising labour market returns for qualified workers.

Data and descriptive statistics

The data used are annual and cover 83 developing countries over the period 2000–2018, with the study period determined by data availability. Variables representing human capital and natural capital are sourced from the World Bank Wealth Accounts (World Bank, 2021). Measures of economic freedom and its components are drawn from Gwartney et al. (Reference Gwartney, Lawson and Murphy2024). All other variables are obtained from the World Development Indicators (World Bank, 2024). Table A1 in online appendix (see the link after the conclusion) provides a summary of the descriptive statistics for the main variables used in the analysis. Between 2000 and 2018, the average human capital per capita was estimated at 18,447 USD. During the same period, the average human capital per capita for women stood at 7,124 USD, compared to 11,323 USD for men, underscoring a significant gender gap in human capital. Additionally, the overall average score for economic freedom was 5.98 out of 10. Tables A2 and A3 in online appendix present the bivariate correlation analysis between variables and the variance inflation factor (VIF) test. Human capital is positively correlated with economic freedom, private credit, GDP per capita, and natural capital. However, the results indicate a negative correlation between human capital and foreign direct investment. In addition, there is no problem of multicollinearity.

Figure A4 in online appendix illustrates the correlation between the mean economic freedom and the mean overall human capital, as well as the correlation between the mean economic freedom and the mean human capital disaggregated by gender in developing countries between 2000 and 2018. It highlights a positive correlation, indicating that, during the study period, countries with greater economic freedom tended to have higher levels of overall human capital, as well as higher human capital for both men and women.

Identification strategy

Although the stationarity of the variables is not a major problem in the case of panels with large N and small T (Gujarati and Porter, Reference Gujarati and Porter2009), as is the case here, we test the stationarity of variables using Maddala and Wu (Reference Maddala and Wu1999) and Choi (Reference Choi2002). It emerges that all variables in our main regression are stationary at level. Therefore, to estimate equation (2), we use ordinary least squares (OLS). The OLS estimates are robust to heteroskedasticity given that robust standard errors are reported. However, the empirical specification of the linear model estimated via OLS is not very conservative. Therefore, we examine how estimates change in size and precision when more conservative assumptions on the standard errors are specified. For this purpose, we allow for clustering the standard errors at the country and year levels. We also add year dummies and country dummies. The country fixed effects allow to control for the impact of unobserved country-specific characteristics. These effects are useful in removing omitted factors that affect both economic freedom and human capital (Feldmann, Reference Feldmann2017). Country fixed effects allow us to take into account any country-specific features such as geography, endowments, and history that create a difference in the baseline conditions for human capital across different countries (Rodrik, Reference Rodrik2016). Likewise, we add year fixed effects to consider the impact of common shocks that affect human capital. We furthermore include conjointly years and country fixed effects to control for both common shocks and unobserved country-specific characteristics.

The OLS does not account for endogeneity issue. However, economic freedom is potentially endogenous due to reverse causality. Jones and Potrafke (Reference Jones and Potrafke2014) and Murphy and O’Reilly (Reference Murphy and O’Reilly2019) evidence that human capital is associated with stronger property rights protection and improvements in overall economic freedom. We tested the endogeneity of economic freedom using the Durbin-Wu-Hausman (Durbin, Reference Durbin1954; Wu, Reference Wu1973; Hausman, Reference Hausman1978) test for endogeneity. The P-value associated with the test is small (0.00021, less than 0.05) and the null hypothesis that economic freedom is exogenous is rejected. Economic freedom is therefore an endogenous variable. To address this issue, the study employs an instrumental variable approach: two-stage least squares (2SLS). Two types of instruments are used in the literature: internal and external instruments. The internal instruments are the lags of endogenous variables which makes it possible to solve endogeneity issues (Anderson and Hsiao, Reference Anderson and Hsiao1981; Todd and Wolpin, Reference Todd and Wolpin2003). Following the previous literature (Sharma, Reference Sharma2020; Feldmann, Reference Feldmann2025), the first and second lags of economic freedom are used as instruments. The first- and second-order lags in a country’s economic freedom affect its current degree of economic freedom, and it is through this channel alone that they affect the current stock of human capital (Feldmann, Reference Feldmann2025). Following previous studies, we also use an external instrument to address the endogeneity of economic freedom: legal origin (Berggren and Jordahl, Reference Berggren and Jordahl2006; Faria and Montesinos, Reference Faria and Montesinos2009). French legal origin is less protective of investors than German, British, or Scandinavian legal origins (La Porta et al., Reference La Porta, Lopez-de-Silanes and Shleifer2008). Legal origin is represented as a dummy variable, with 1 indicating French legal origin and 0 for other legal systems.

It should also be noted that capital accumulation is a dynamic phenomenon, since past levels of human capital affect current levels (Ouedraogo et al., Reference Ouedraogo, Tabi, Ondoa and Jiya2022). Although 2SLS solves endogeneity problems, it does not take into account the dynamic nature of human capital. We take into account the dynamic nature of human capital by using a dynamic empirical model based on two-step system–generalized method of moments (GMM) system-GMM estimator developed by Blundell and Bond (Reference Blundell and Bond1998).

The single model estimators such as OLS, 2SLS, and GMM estimate the parameters at the mean of the conditional distribution of human capital. They do not allow us to analyze the effect of independent variables on the overall distribution of human capital. As a result, these methods do not provide a more complete and nuanced picture of the heterogeneous effect of economic freedom on human capital.

To fill this gap, we use the quantiles via the moments regression method developed by Machado and Silva (Reference Machado and Silva2019). This approach offers several advantages: (1) it is robust to distributional assumptions and outliers, ensuring reliable estimates (Koenker and Bassett, Reference Koenker and Bassett1978; Hao and Naiman, Reference Hao and Naiman2007; Kudryavtsev, Reference Kudryavtsev2009); (2) it accounts for non-linearity and fixed effects issues; and (3) it accounts for endogeneity of variables and provides the estimation of conditional mean effects (scale shift and location shift) (Machado and Silva, Reference Machado and Silva2019).

The quantiles via moments estimate the conditional quantiles of HC where the distribution of HC is conditional on a set of covariates X, including economic freedom. This framework follows a location-scale variant model, allowing the estimation of both central tendency (mean effects) and dispersion (variance effects).

Accounting for the panel structure, human capital is modelled as follows:

where:

-

(1)

$\alpha, \beta, \partial {\rm{\;and\;}}\theta $

are unknown parameters to be estimated, satisfying the constraint

$\alpha, \beta, \partial {\rm{\;and\;}}\theta $

are unknown parameters to be estimated, satisfying the constraint

$P\left\{ {{\partial _i} + {N_{it}}\theta \gt 0} \right\} = 1.$

$P\left\{ {{\partial _i} + {N_{it}}\theta \gt 0} \right\} = 1.$

-

(2)

${\alpha _i}{\rm{\;and}}\;{\partial _i}$

capture individual-specific fixed effects.

${\alpha _i}{\rm{\;and}}\;{\partial _i}$

capture individual-specific fixed effects. -

(3)

$\beta $

is the location parameter that captures changes in the mean of human capital, showing how economic freedom influences average levels of human capital.

$\beta $

is the location parameter that captures changes in the mean of human capital, showing how economic freedom influences average levels of human capital. -

(4)

$\theta $

is a scale parameter, which determines how the dispersion of human capital varies in response to the explanatory variables.

$\theta $

is a scale parameter, which determines how the dispersion of human capital varies in response to the explanatory variables. -

(5) X represents location variables, which influence the central tendency of HC.

-

(6) N consists of scale variables, determining how the dispersion of HC responds to changes in explanatory variables.

By explicitly separating N from X, the model allows us to differentiate between location effects (

![]() ${X_{it}}\beta $

) and scale effects (

${X_{it}}\beta $

) and scale effects (

![]() ${N_{it}}\theta $

) and ensure flexibility in capturing nonlinear interactions. If N=X, the scale function would depend on the same variables as the location function. By allowing N to be a transformation of X (equation (4)), the model ensures that explanatory variables can affect location and scale differently.

${N_{it}}\theta $

) and ensure flexibility in capturing nonlinear interactions. If N=X, the scale function would depend on the same variables as the location function. By allowing N to be a transformation of X (equation (4)), the model ensures that explanatory variables can affect location and scale differently.

![]() ${V_{it}}$

represents the random component of the model and satisfies the following properties: (1) it is orthogonal to X

it

and normalized to meet the moment conditions specified by Machado and Silva (Reference Machado and Silva2019) and (2) it is independently and identically distributed across individuals and time periods.

${V_{it}}$

represents the random component of the model and satisfies the following properties: (1) it is orthogonal to X

it

and normalized to meet the moment conditions specified by Machado and Silva (Reference Machado and Silva2019) and (2) it is independently and identically distributed across individuals and time periods.

Considering the quantile regression form of equation (3), we express the conditional quantile function of human capital as:

where:

![]() ${Q_{HC}}\left( {\tau /{X_{it}}} \right)$

represents the τ-th quantile of human capital (

${Q_{HC}}\left( {\tau /{X_{it}}} \right)$

represents the τ-th quantile of human capital (

![]() $H{C_{it}}$

) given the set of explanatory variables

$H{C_{it}}$

) given the set of explanatory variables

![]() ${X_{it}}$

.

${X_{it}}$

.

![]() ${\alpha _i}\left( \tau \right) = {\alpha _i} + {\partial _i}\left( \tau \right)$

represents quantile-specific fixed effects, which vary across quantiles. Unlike standard least squares fixed effects, these do not induce a simple intercept shift but allow for heterogeneous impacts across different points of the conditional distribution of human capital.

${\alpha _i}\left( \tau \right) = {\alpha _i} + {\partial _i}\left( \tau \right)$

represents quantile-specific fixed effects, which vary across quantiles. Unlike standard least squares fixed effects, these do not induce a simple intercept shift but allow for heterogeneous impacts across different points of the conditional distribution of human capital.

![]() $Q{\rm{\;}}\left( \tau \right){\rm{\;}}$

denotes the τ-th sample quantile, estimated by solving the following optimization problem:

$Q{\rm{\;}}\left( \tau \right){\rm{\;}}$

denotes the τ-th sample quantile, estimated by solving the following optimization problem:

where

![]() ${\rho _\tau }{\rm{\;}}\left( A \right){\rm{\;}} = \left( {\tau - 1} \right){\rm{\;}}AI{\rm{\;}}\left\{ {{\rm{\;A}} \le 0} \right\} + \tau AI{\rm{\;}}\left\{ {{\rm{\;A}} \gt 0} \right\}$

is the check-function and

${\rho _\tau }{\rm{\;}}\left( A \right){\rm{\;}} = \left( {\tau - 1} \right){\rm{\;}}AI{\rm{\;}}\left\{ {{\rm{\;A}} \le 0} \right\} + \tau AI{\rm{\;}}\left\{ {{\rm{\;A}} \gt 0} \right\}$

is the check-function and

![]() ${R_t} = {Y_{it}} - ({\alpha _i} + {X_{it}}\beta $

).

${R_t} = {Y_{it}} - ({\alpha _i} + {X_{it}}\beta $

).

![]() $A = {R_{it}} - \left( {{\partial _i} + {N_{it}}\theta } \right)Q$

and

$A = {R_{it}} - \left( {{\partial _i} + {N_{it}}\theta } \right)Q$

and

![]() $I$

is the identity matrix.

$I$

is the identity matrix.

As a robustness test for quantile regression, we also use instrumental variables quantile regression (IVQR) introduced by Chernozhukov and Hansen (Reference Chernozhukov and Hansen2005).

The quantile estimator is obtained by solving the following optimization problem for the

![]() ${\theta ^{th}}$

quantile, (

${\theta ^{th}}$

quantile, (

![]() $0 \lt \theta \lt 1$

):

$0 \lt \theta \lt 1$

):

$$\matrix{ {min} \cr {\beta \in {R^k}}} \left[ \sum \limits_{i \in \left\{ {i:{{\boldsymbol HC}_i} \ge x_i^{\prime}\beta } \right\}} \theta \left| {{\boldsymbol HC}_i} - x_i^{\prime}\beta \right| + \sum \limits_{i \in \left\{ {{\boldsymbol HC}_i} \lt x_i^{\prime}\beta \right\}} \left( {1 - \theta} \right) \left| {{\boldsymbol HC}_i} - x_i^{\prime}\beta \right| \right]$$

$$\matrix{ {min} \cr {\beta \in {R^k}}} \left[ \sum \limits_{i \in \left\{ {i:{{\boldsymbol HC}_i} \ge x_i^{\prime}\beta } \right\}} \theta \left| {{\boldsymbol HC}_i} - x_i^{\prime}\beta \right| + \sum \limits_{i \in \left\{ {{\boldsymbol HC}_i} \lt x_i^{\prime}\beta \right\}} \left( {1 - \theta} \right) \left| {{\boldsymbol HC}_i} - x_i^{\prime}\beta \right| \right]$$

where

![]() $H{C_i}$

is the dependent variable, and

$H{C_i}$

is the dependent variable, and

![]() ${x_i}$

a vector

${x_i}$

a vector

![]() $k\;$

by 1 of explanatory variables. Quantile regressions minimise the weighted sum of the absolute deviations, obtaining in this case for the 10th, …,90th quantiles by weighting the residuals appropriately. The 50th quantile is the median effects in IVQR. The conditional quantile of

$k\;$

by 1 of explanatory variables. Quantile regressions minimise the weighted sum of the absolute deviations, obtaining in this case for the 10th, …,90th quantiles by weighting the residuals appropriately. The 50th quantile is the median effects in IVQR. The conditional quantile of

![]() ${{\boldsymbol HC}_i}$

given

${{\boldsymbol HC}_i}$

given

![]() ${x_i}$

is given by equation (9) below:

${x_i}$

is given by equation (9) below:

Empirical findings and discussion

Main findings

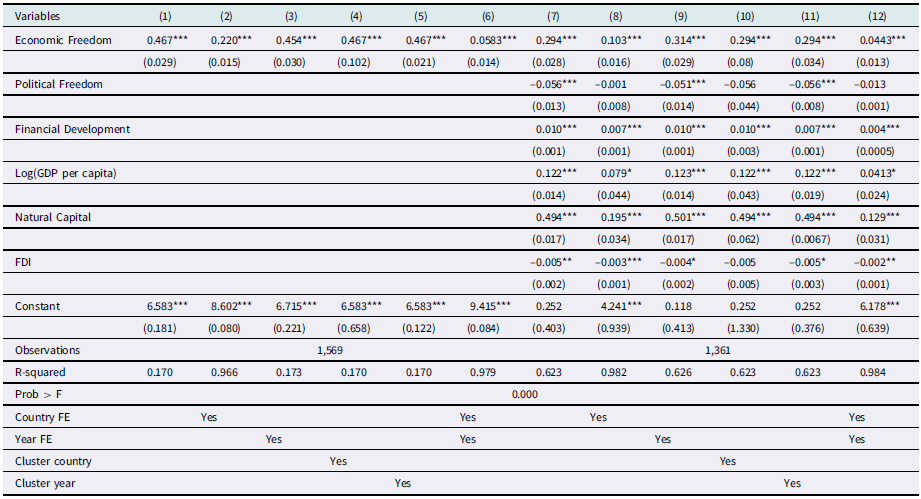

In Table 1, we report the findings from OLS estimator. In Columns 1 to 6, economic freedom is the only explanatory variable taken into account. In Columns 7 to 12, we include the control variables. As evidenced in Columns 1–3 and 7–9, the coefficient associated with economic freedom is positive and highly significant at a 1% level, whether or not control variables are included, whether or not common shocks and unobserved country-specific characteristics are taken into account. Similarly, the findings presented in Columns 4 and 5 and 10 and 11 suggest that economic freedom retains positive and significant coefficients, irrespective of whether clustering by years or countries is applied and control variables are included or not. In addition, the results from the two-way fixed effects estimator reported in Columns 6 and 12 indicate that economic freedom is positively associated with human capital accumulation in developing countries, even when controlling for common shocks and country-specific characteristics.

Table 1. Main estimates with OLS regressions

Robust standard errors in parentheses; *** P < 0.01, ** P < 0.05, * P < 0.1.

Source: Authors.

Table 2 summarizes the main findings from 2SLS and GMM regressions. The diagnostic tests are reported at the bottom of the table. In 2SLS regression, weak identification tests, including underidentification test (Kleibergen-Paap rk LM statistic), weak identification test (Cragg-Donald Wald F statistic), and overidentification test (Hansen J statistic) reveal that the internal and external instruments are strong, relevant, and valid.

Table 2. Main estimates with 2SLS and GMM regressions

Robust standard errors in parentheses; *** P < 0.01, ** P < 0.05, * P < 0.1.

SW F (First Stage) = Sanderson-Windmeijer multivariate F test of excluded instruments in the first stage regression.

Source: Authors.

Likewise, the multivariate F test of excluded instruments (Sanderson and Windmeijer, Reference Sanderson and Windmeijer2016) or test for the joint significance of the instruments in the first stage indicates that both internal and external instruments are not weak. According to the rule of thumb, F-Stat should be at least 10.

In addition, the results of the diagnostic tests in GMM regression indicate that the model is well specified. The Arellano–Bond test indicates the absence of second-order serial correlation since AR (2) P-values ≥10. Likewise, Sargan test P-values are more than 10%, suggesting that the instruments are valid. In line with the findings from OLS regression, the results from 2SLS regressions reveal that economic freedom is positively and significantly associated with human capital, whether or not common shocks are taken into account, whether or not country specificities are controlled or whether or not common shocks and country specificities are jointly taken into account. Furthermore, the coefficient of economic freedom in GMM regression is positive and significant at the 1% level. These findings indicate that freer economic institutions promote human capital accumulation in developing countries.

With regard to the control variables, in line with our theoretical expectations, we find that financial development, income level, and natural capital have a positive effect on human capital. Although the coefficient of political freedom is negative, it means that political freedom favours the accumulation of human capital since this variable is scaled from more freedom (1) to less freedom (7). Conversely, FDI hinders the accumulation of human capital. According to Feldmann (Reference Feldmann2024), foreign direct investment can be unfavourable to the accumulation of human capital. The delocalisation of unskilled labour-intensive production and assembly activities to developing countries by multinationals makes human capital accumulation less attractive. In addition, the increased availability of unskilled jobs generated by FDI and providing high remuneration is likely to encourage young people who run out of school to enter the workforce. On the other hand, more competitive foreign firms can crowd out domestic firms and reduce demand for human capital. This result supports the finding that inward FDI has a significantly negative effect on female secondary and tertiary enrolment (Wang and Zhuang, Reference Wang and Zhuang2021).

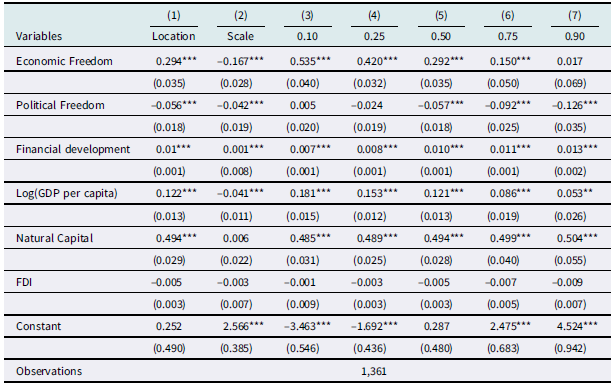

Table 3 presents the main results from quantiles via moments regression.

Table 3. Main estimates from quantiles via moments regression

Robust standard errors in parentheses; *** P < 0.01, ** P < 0.05, * P < 0.1.

Source: Authors.

As shown in Columns 1 and 2, the location-based coefficient is positive and statistically significant at the 1% level, while the scale-based parameter is negative and significant at the same level. These findings suggest that greater economic freedom not only enhances the average stock of human capital but also reduces its dispersion across observations. Furthermore, across all quantiles – except the 90th quantile – reported in Columns 3 to 7, the coefficient of economic freedom is positive and statistically significant at the 1% level. These robust results indicate that economic freedom may support human capital accumulation in developing countries, regardless of the level of human capital. Overall, they suggest a potentially important role for economic freedom in shaping human capital outcomes.

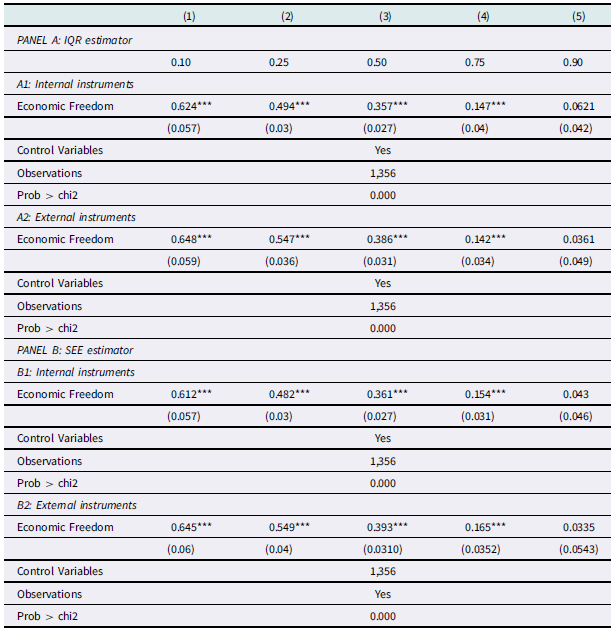

We also use IVQR. There are two IVQR estimators: the inverse quantile regression (IQR) estimator developed by Chernozhukov and Hansen (Reference Chernozhukov and Hansen2006) and the smoothed estimating equations (SEE) estimator proposed by Kaplan and Sun (Reference Kaplan and Sun2017). The presence of an indicator function in the base function makes the objective function nonconvex and nonsmooth, requiring a transformation before estimation. At the IQR level, the transformation consists of an exhaustive grid search. The SEE estimator smoothes the original estimation equation using a kernel method. The IQR estimator is characterized by its numerical stability and offers the possibility of calculating the dual confidence interval, all of which makes it robust to weak instruments. On the other hand, the SEE estimator is suitable in the presence of more than one endogenous variable, but does not guarantee robust inference to weak instruments. Given that there is currently no weak instrument test specific to IVQR, Kaplan (Reference Kaplan2022) suggests referring to the tests undertaken in 2SLS regression. We use the same instruments as in 2SLS regression. In Table 4, we report results from IVQR. In Panel A, we report the findings from IQR while Panel B gives the results from SEE estimator. The P-value associated with the Wald chi2 test is less than 1%, suggesting that the models are well specified.

Table 4. Main estimates from IVQR

Robust standard errors in parentheses; *** P < 0.01, ** P < 0.05, * P < 0.1.

Source: Authors.

We show that apart from the 90th quantile, the parameters of economic freedom are all positive and significant at 1 level in both regressions, whether the instruments are internal or external. This result supports the findings from quantiles via moments regression that whatever the level of human capital stock prevailing in the country, economic freedom is an essential ingredient in increasing that stock.

In online appendix (Table A5), we report the post-estimation test for endogenous effects in IQR, which highlights four hypotheses. The test reports Kolmogorov–Smirnov statistic and the 95% critical value for each hypothesis. The null hypothesis is rejected when the test statistic is greater than the critical value. In three of the four hypotheses (no effect, constant effect, and exogeneity) the KS statistics are above the 95% critical values. This result suggests that (1) economic freedom has some effect on human capital accumulation, (2) this effect varies across quantiles, and (3) economic freedom is endogenous. The test for dominance means that economic freedom is beneficial across quantiles.

Figure A6 in online appendix reports the estimated coefficients of economic freedom across the quantiles in the IQR (top dial) and SEE framework (bottom dial) using internal instruments (the left panel) as well as external instruments (the right panel). The dots highlight the point estimates of the effect of economic freedom on the different quantiles of human capital, and the grey boundary shows the point 95% confidence interval. The red line shows the two-stage least squares estimate, i.e. the average effect. As observed, the magnitude of the estimated coefficient for economic freedom declines as one moves from lower to higher quantiles. This pattern suggests that the association between economic freedom and human capital accumulation tends to be stronger in countries with lower levels of human capital and weaker in those with higher levels.

Globally, our findings align with theoretical predictions, which posit that economic freedom enhances returns to human capital (King et al., Reference King, Montenegro and Orazem2012) and creates an environment that enables economic agents to reap the benefits of investing in human capital (Feldmann, Reference Feldmann2017).

While the analysis confirms a positive link between economic freedom and human capital development, this relationship is not uniform across contexts. As Gehring (Reference Gehring2013) notes, the effectiveness of economic freedom depends on cultural, institutional, and social conditions that influence how individuals and businesses respond to market incentives. In societies with strong support for market values and secure property rights, economic freedom is more likely to translate into tangible gains. Conversely, in countries with institutional weaknesses or cultural resistance to market mechanisms, the benefits may be limited or slower to emerge. Social inclusiveness also matters: countries that ensure equal access to education and employment – regardless of gender, ethnicity, or social class – are better positioned to turn economic freedom into broad-based human capital development.

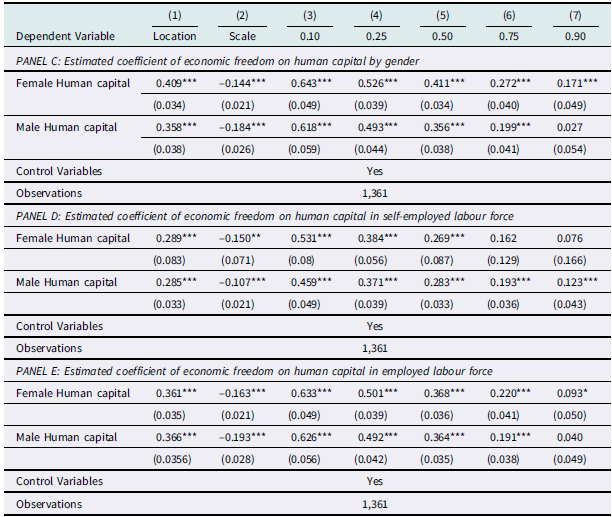

Using disaggregated data from the CWON 2021 dataset, we re-estimate our models by gender and employment status. Table 5 reports the effects of economic freedom on human capital across these groups using quantiles via moments regressions.

Table 5. Effect of economic freedom on human capital by gender

Robust standard errors in parentheses; *** P < 0.01, ** P < 0.05, * P < 0.1.

Source: Authors.

Results (Panels C–E, Columns 1–2) show a positive and significant location shift, and a negative, significant scale shift. This indicates that economic freedom raises average human capital and reduces disparities across gender and employment types. The effect is particularly strong in countries with low human capital levels.

The results show that economic freedom has a stronger positive effect on women’s human capital than on men’s, suggesting disproportionate benefits for women. This aligns with Feldmann (Reference Feldmann2025), who finds greater improvements in women’s education under freer economic conditions. However, cultural, institutional, and labour market barriers often prevent women from fully translating these gains into economic participation (Barro, Reference Barro2001; Duflo, Reference Duflo2012). Discrimination, limited mobility, and lack of childcare restrict access to formal employment. Additionally, economic freedom has a greater effect on employed individuals than on the self-employed, highlighting labour market structure as a key factor in human capital outcomes.

Robustness checks

We test the robustness of our main findings in six ways: (1) by examining the effect of components of economic freedom, (2) by including additional control variables, (3) by using lagged values of the explanatory variables, (4) by using an alternative proxy for economic freedom, (5) by using an alternative proxy for human capital, and (6) by using 3- and 5-year averages data. The findings of these tests are reported in online appendices (Tables A7–A13).

Examining the effect of components of economic freedom

The first robustness test involves disaggregating economic freedom into its five components to assess the effect of each dimension on human capital and to identify the most critical aspects of economic freedom that drive human capital accumulation. Analysis of the effect of the components of economic freedom is common in the literature (Gehring, Reference Gehring2013; Ghazalian and Amponsem, Reference Ghazalian and Amponsem2019; Ciftci and Durusu-Ciftci, Reference Ciftci and Durusu-Ciftci2022; Giorgio, Reference Giorgio2024; Lawson et al., Reference Lawson, Miozzi and Tuszynski2024). The five components include the size of government, the legal system and property rights (with gender adjustments), sound money, freedom to trade internationally, and regulation.

Following Gehring (Reference Gehring2013), we introduce the dimensions individually into the basic equation, instead of the global index. The results of the estimations are reported in Table A7. A second approach consists of introducing all the components of economic freedom jointly into the same equation to assess their relative associations with human capital, following the approach adopted by Lawson et al. (Reference Lawson, Miozzi and Tuszynski2024). While the dimensions of economic freedom are expected to ‘work together’ (Lawson, Reference Lawson2006), we acknowledge that they are also theoretically interrelated, which may raise concerns about multicollinearity and the interpretability of individual coefficients. To address this issue, we conducted a correlation analysis and applied the VIF test to the model including all five components. The results suggest that multicollinearity is not a significant concern. Nonetheless, we interpret the joint estimates with caution, recognizing that the components are not fully independent and that their inclusion in a single specification primarily serves to explore their relative empirical strength rather than to infer isolated effects. Table A7 reports the results of the estimation with all components introduced simultaneously. The location-based findings reported in Column 1 reveal that the coefficients for all five dimensions of economic freedom are positive and statistically significant at the 1% level. However, the regulation loses its significance when the components are introduced simulatively, as evidenced in the results reported in Column 1 of Table A8. This indicates that all aspects of economic freedom, except regulation, contribute to average human capital accumulation in developing countries. However, when considering the magnitude of the coefficients, the findings indicate that freedom to trade internationally appears to be the dimension most strongly associated with human capital, followed by the legal system and property rights.

As Feldmann (Reference Feldmann2025) argues, reducing barriers to international trade may contribute to human capital accumulation by being associated with increased demand for highly skilled workers in export-oriented enterprises, greater investment specialization, and enhanced economic exchange. Moreover, when fewer restrictions exist on the movement of physical and human capital, as permitted by trade freedom, individuals have stronger incentives to invest in human capital. This freedom not only allows individuals to utilize their skills in regions offering the highest returns but also enables them to repatriate the resources earned, thereby enhancing human capital development.

Similarly, robust legal systems that ensure the protection of property rights and the enforcement of contracts create an environment where individuals can fully enjoy the benefits of their investments in human capital, further incentivizing its accumulation.

Adding additional control variables

The second robustness exercise involves incorporating additional control variables. First, we include urbanization, as access to healthcare and education tends to be better in urban areas compared to rural ones (Rajkumar and Swaroop, Reference Rajkumar and Swaroop2008). Second, following Rajkumar and Swaroop (Reference Rajkumar and Swaroop2008), we account for government expenditure on health and education as a share of GDP, as such spending is generally associated with improvements in the public provision of health and education services, which may, in turn, support human capital accumulation. Personal remittances as a share of GDP are also included, given their documented association with human capital improvements in developing countries (Azizi, Reference Azizi2018). Finally, we account for gross enrolment ratio for secondary school given that the market value of labour increases with the level of education. All these variables are sourced from World Bank (2024). The results, presented in Table A9, reveal a positive and significant location shift as well as a negative and significant scale shift.

Furthermore, except for the 90th quantile, the coefficient of economic freedom is positive and significant across all quantiles. However, the magnitude of the effect decreases as we move from lower to upper quantiles. The results support the existence of a positive relationship between economic freedom and human capital, which appears more pronounced in countries with lower human capital levels.

Importantly, the inclusion of these additional control variables does not alter the core results. The robustness of our main findings is therefore upheld, indicating that economic freedom remains consistently and positively associated with human capital accumulation.

Using lagged values of the explanatory variables

The endogeneity test of Durbin-Wu-Hausman indicates that economic freedom is an endogenous variable. In the main findings, we use its lags as instruments to deal with endogeneity. Another way to address the endogeneity issue is to use the lagged values of the explanatory variables (Graafland, Reference Graafland2020a). Following the literature (Baum and Lake, Reference Baum and Lake2003; Graafland and Lous, Reference Graafland and Lous2018; Graafland, Reference Graafland2020a), we use first, second, and five-year lagged of economic freedom as strategy for solving endogeneity issues in this robustness exercise. The findings are portrayed in Table A10.

Across the distribution, except at the 90th quantile, economic freedom appears to be positively linked with higher levels of human capital in developing countries. In addition, this beneficial effect is more important in countries with low stock of human capital, supporting our main findings.

Using an alternative proxy for economic freedom data: index of economic freedom from the Heritage Foundation

We test the robustness of our baseline result by using an alternative measure of economic freedom: index of economic freedom from the Heritage Foundation. Table A11 presents the results from this regression.

The coefficient of economic freedom index in location-based findings and across the quantiles, except 10th quantile, is positive and significant at most 5%. The robustness of our main findings is therefore upheld, indicating that economic freedom remains consistently associated with human capital accumulation.

Using the Human Capital Index of the World Bank as an alternative proxy for human capital

The World Bank’s Human Capital Index is used as an alternative dependent variable for robustness. It combines health and education indicators (survival, education, and health) to approximate the contribution of education and health to the productivity of the next generation of workers (Kraay, Reference Kraay2019). It is scaled from 0 to 1, with 1 indicating the maximum level of human capital. It is available for the years 2010, 2017, and 2018 for some of the countries in our sample. Table A12 summarizes the result of this exercise.

From the table, it emerges that the coefficient of economic freedom is positive and significant across quantiles and in location-based estimate. Economic freedom therefore improves human capital whatever the level of human capital in a country. In addition, at the level of the average effect and across quantiles, the coefficient of economic freedom is higher at the level of female human capital, reinforcing our basic finding that economic freedom disproportionately benefits female human capital.

Using 3- and 5-year averages data

As a final robustness test, we divided the study period into averages of three (2000–2002, 2003–2005, 2006–2008, 2009–2011, 2012–2014, and 2015–2018) and five (2000–2004, 2005–2009, 2010–2014, 2015–2018) non-overlapping periods. The findings are portrayed in Table A13.

Consistent with our core findings, this exercise reveals that economic freedom improves the average human capital and reduces the dispersion of observed human capital across countries. This beneficial effect is more important in countries with low stock of human capital.

Conclusion and policy implications

This study provides strong evidence of a positive relationship between economic freedom and human capital accumulation in developing countries. Using data from 83 countries between 2000 and 2018 and applying various econometric techniques, the analysis confirms that institutional quality plays a crucial role in shaping education and skill outcomes (King et al., Reference King, Montenegro and Orazem2012; Feldmann, Reference Feldmann2017, Reference Feldmann2025).

The results reveal that the effects of economic freedom are not uniform. Women benefit more significantly, with economic freedom helping narrow gender gaps in education and skill acquisition (Grier, Reference Grier2024; Kramer, Reference Kramer2024). Additionally, countries with lower human capital see stronger gains, highlighting the potential of market-friendly institutions to reduce development disparities. Key dimensions driving this relationship are international trade freedom and legal systems and property rights.

Policy implications include enhancing legal frameworks, improving access to education and finance, and reducing regulatory burdens. Eliminating trade barriers can also promote knowledge diffusion and job creation in high-productivity sectors.

However, two limitations remain: the study does not control for cultural factors, and it lacks region-specific analysis. Future research should incorporate cultural indicators and regional regressions to better understand how economic freedom shapes human capital outcomes across diverse contexts.

Supplementary material: online appendix at:

(PDF) Title:Heterogeneous Effects of Economic Freedom on Human Capital in Developing Countries Journal: Journal of Institutional Economics. https://www.researchgate.net/publication/390744472_Title_Heterogeneous_Effects_of_Economic_Freedom_on_Human_Capital_in_Developing_Countries_Journal_Journal_of_Institutional_Economics

Acknowledgements

We are also very grateful to the seven anonymous reviewers for their insightful comments and suggestions.

Competing interests

None.

Funding sources

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.