Introduction

Industrial upgrading, defined as increased productivity, technological sophistication, and innovation in products and production processes, remains a difficult but core task of economic development.Footnote 1 The concept is therefore integral to many different analytic frameworks in development studies. Here we consider two: first, the “middle-income trap” (MIT), with its focus on growth slowdowns after developing countries successfully move out of the lowest income levels; and second, the literature on “global value chains” (GVC), which addresses production processes that are distributed across multiple international locations. The MIT literature grapples with industrial upgrading largely as it relates to the structural transformation required to overcome middle-income limbo. Research on GVCs, for its part, focuses more on firms or firm clusters upgrading from a given economic niche, or “linkage,” within broader economic networks.

In pursuing upgrading, both the MIT and GVC literatures underscore the role of industrial policy. Industrial policy deliberately alters the structure of the economy, whether in terms of the composition of economic activities present, how they are performed, or who performs them.Footnote 2 Examples of policy recommendations from these literatures include a variety of investments in education, training, infrastructure and research, regulatory reforms, and support for business (broadly or narrowly targeted). Crucially, both literatures consider the pathway to sustained upgrading to be largely a matter of selecting the right instrument to match the technical challenge at-hand. Yet, such a “technocratic” approach constitutes a known limitation. Critics challenge its ahistorical and decontextualized bent as limiting its practical applicability. They also highlight the constraints of an approach that portrays policies as one-shot solutions, since it undermines local problem-solving capacity to respond to uncertain circumstances.Footnote 3

This paper attempts to help fill these gaps by contributing to our understanding of the patterned relationships between institutional context, types of industrial policy interventions, and the economic upgrading problems to which they are best suited. To start, we observe that when governments engage in industrial policymaking, they tend to make policy choices that are in historical continuity with previous interventions. This suggests that the view of policymaking as a technical matter of matching a general set of policies with a given economic goal or niche needs to better account for institutional “path dependence.”Footnote 4 We propose that distinct local policy “styles” can heavily influence industrial policy selection and design. Local officials’ policy styles vary in their overarching goals, policy instruments, and the roles they set for the state and the private sector. These established, or “sticky,” policy styles set officials’ apertures much more narrowly than the menu of upgrading policies the MIT and GVC literatures would suggest.

The observation of industrial policy styles draws from an empirical analysis of policymaking in two Mexican states which stand out for growth in sectors with relatively high technological sophistication, Jalisco and Querétaro. We examine each state’s approach to industrial policy in two industries that were successively focal in local economic upgrading: electronics (1980s-1990s) and information and communications technology (ICT) (2000s–2010s) in Jalisco, and automotive (1980s–1990s) and aerospace (2000s–2010s) in Querétaro. We find that each state remained consistent in its policy approach to these industries despite periodic economic crises and changes in ruling parties, illustrating entrenched path dependence.

In Jalisco, officials consistently applied a “Business-guided” industrial policy style across its lead industries, notwithstanding their sector-level differences. This policy style prizes the overarching goal of increased investment and competition, and pursues it through the reduction of entry barriers for firms. It positions state actors as responsive to the demands of business as the lead policy actors. Businesses’ policy proposals often combine more “passive” approaches that focus on public sector changes, such as tax reductions, with “active” ones that attempt to change firm behavior, such as the channeling of resources to firms with attached conditions.Footnote 5 They may also favor “horizontal” investments, such as the provision of basic infrastructure. Given the absence of strong state guidance, most Business-guided policies lack significant staying power, with new administrations introducing their own policies deriving largely from the same model.

By contrast, in Querétaro what has prevailed across its lead industries is a “State-guided” industrial policy style, in which the state government promotes dynamic comparative advantage by shifting the behavior of firms and nurturing industry-specific learning. This style elevates the role of the subnational state as a leader in establishing the long-term direction of a given industry. The state embraces a “participatory” approachFootnote 6 as it convenes actors from the private sector, as well as other institutional realms. Together, they design and implement mostly “active” industrial policiesFootnote 7 and public goods, such as publicly-funded industry consortia, institutions that support firm learning in technical standards and advanced production processes, and specialized training programs. As state-led initiatives, these interventions often outlive individual administrations.

In narrowing the types of tools industrial policymakers employ, these divergent policy styles tend to encourage some types of industrial upgrading more than others. The case studies suggest that the Business-guided style often promotes more diversification across product types and industries (product and intersectoral upgrading). Its policy instruments, designed to reduce entry barriers, spawn myriad new, often small firms alongside large multinational subsidiaries, all usually engaged in production of novel goods and services. For its part, the State-guided style tends to favor upgrading within a given production process or product type (process and functional upgrading).Footnote 8 Its interventions support enhanced firm-level technological sophistication, productivity and capacity to move up within existing value chains by becoming more competitive and acquiring a larger range of functions.

The upgrading records of the studied industries in Jalisco and Querétaro illustrate this association between local policy styles and patterns of industrial upgrading. In Jalisco, the Business-guided agenda of entry barrier reduction through deregulation, tax reduction, horizontal infrastructure investment, and firm-level cash grants elicited a proliferation of novel products in its electronics and ICT industries, as well as more widespread forays into different product categories and sub-industries (e.g., media, financial services). At the same time, upgrading of specific production processes or movement into new production segments within the value chains proved less forthcoming. Meanwhile, Querétaro’s State-guided industrial policy style, with its emphasis on industry-specific learning through close state-business coordination and investment in tailored public goods spurred substantial process and functional upgrading. Firms became highly proficient in targeted product lines and marched upward in the value-added linkages of a given product. But that specific focus carried its own costs, such as narrower firm and product diversity.

These observations, while contributing to the GVC literature, also advance our understanding of the practical challenges preventing an escape from the “middle-income trap.” Today, states face a shifting landscape of value chains as they attempt to strategically move towards higher incomes and technological sophistication. The relevant, largely technocratic MIT and GVC literatures offer policymakers a wide array of tools with which to approach this complex landscape. However, under conditions of local policy style stickiness, these governments are likely to either selectively import or interpret the recommendations from a specific slant, in ways that may undermine the standard technical logic assumed in academic research. This policy stickiness represents a type of local “blind spot” which, when combined with the evidence that a given policy style may favor some types of upgrading over others, should be factored into our understanding of how local institutions impact structural transformation.

Literature review

The notion of a middle-income “trap” is rooted in the observation that, after successfully diversifying their economies and raising output, many developing countries experience a growth and productivity slowdown once at a “middle” tier of average national income.Footnote 9 At this stage, the sources of economic growth shift from diversification to more coordination-intensive efforts to achieve higher productivity, technological sophistication, and innovation.Footnote 10 Much of the MIT literature suggests that policymakers must select policies that address these changing conditions by promoting more local innovation, human capital, and specialization within industries.Footnote 11

Through its emphasis on industrial upgrading, the Global Value Chains (GVC) literature overlaps with this MIT scholarship. GVC research begins with the observation that, through international processes of economic globalization, production systems have become more dispersed across national boundaries, with local linkages connecting into and governed by international networks. Echoing the World Systems Theory research that inspired it, the GVC literature further claims that, in these distributed production systems, tasks with lower value-added tend to fall to developing countries.Footnote 12 At the same time, the GVC literature distinguishes itself by positing that these international systems of production also offer numerous opportunities to “upgrade,” or shift into linkages with higher value-added and greater specialization and technological sophistication.Footnote 13

While MIT research tends to focus on larger-scale units (i.e., from industries up to the national economy) with GVC studies generally taking a more micro and meso view (i.e., from firms to industries), the two literatures share important assumptions. Beyond taking an interest in industry-level change, and focusing on industrial upgrading as a key outcome, both adopt a fairly open-ended, voluntaristic and technocratic view of the relevant tools encourage industrial upgrading. In this view, officials match a given industrial upgrading problem to solutions from a wide-ranging menu of horizontal (economy-wide) and vertical (industry-specific) interventions in education, worker training, infrastructure, regulatory frameworks, subsidies, and firm-level support.Footnote 14 The main constraints lie in availability of resources and/or overall state capacity.

Though enticingly parsimonious, this technocratic view ignores other ways in which a given institutional context may influence the selection of policy goals and the tools. As a result, its treatment of the main policy problem as one of identifying a technically appropriate approach to a given industrial upgrading goal leaves significant explanatory gaps.Footnote 15 We examine below how local policy environments influence officials’ selection from some subset of the broader policy menu. We posit that accounting for locally predominant “sticky” industrial policy styles and how they influence ongoing processes of policy selection more effectively connects the contributions of the MIT and GVC literatures to policy practice.

Sticky industrial policy styles

The idea that policymaking involves self-reinforcing, inertial tendencies is well-established in institutional analysis. Much has been written about the concept of “path dependence,” which suggests that institutional rules, norms, and practices forestall change, even when it would be optimizing or welfare-enhancing. Two main reasons account for this apparent paradox: first, it is costly and difficult to alter institutions; and second, the stability of existing institutional structures and routines carries its own rewards, even if those rules and norms precipitate non-optimal decisions.Footnote 16 Paul Pierson (Reference Pierson2000) elaborates on this formulation by noting that established institutional models help actors to avoid the costs associated with building new institutions, capitalize on the efficiencies of their own prior learning, coordinate more effectively with others, and avoid anticipated sanction for deviating from the prevailing patterns and norms. This means that actors may preserve their institutions even in instances where they generate policies that seem to provide inferior payoffs.Footnote 17

We consider the phenomenon of path dependence as it relates to industrial policy, which is designed to shift the structures of economies.Footnote 18 The notion that industrial policy takes local forms through the imprinting influence of stable, but not static institutional structures was addressed in some well-known predecessors of what is now frequently referred to as “comparative capitalism.”Footnote 19 This earlier generation of comparative research focused on the role of institutions in shaping policymaking in ways that economic factors or prevalent political dynamics, such as ruling parties or civic action, could not explain. The research showed how longstanding institutional structures and capacities, as well as patterns of inter-institutional relations, shape actors’ understandings of feasible and desirable policy goals, as well as the relevant policies to pursue them.Footnote 20

This study aligns with this tradition of historical-institutional analysis of economic and industrial policy, albeit with one key departure and some specific areas of emphasis. We depart from much of the previous research by shifting the level of analysis from national to subnational, state-level institutions. Although the aforementioned studies all emphasize the national political economy as the key arena in which key institutional factors form and exert influence, important strands of research examine how subnational institutions also impact patterns of governance, policy formulation, and the formation and behavior of firms in the marketplace.Footnote 21

We further focus on the kind policy variation that is most relevant to our empirical cases, which demonstrate two policy “styles” with distinct overarching goals, policy instruments, and assumed roles and relationships between the state and private sector. Consistent with previous institutional analysis, these industrial policy styles have a tendency to become “sticky” and resistant to change. First is the Business-guided industrial policy style, wherein the state, embracing the premise that markets supply the necessary information to efficiently allocate resources, transfers policy design and implementation leadership to business actors. Yet, this devolution of policymaking authority to the private sector does not mean that state intervention is eschewed altogether. To the contrary, the style offers ample room for “open-market industrial policy,” as long as it is for the sake of supporting competition and investment by reducing entry barriers for firms.Footnote 22 Policies often tend toward the more “passive”Footnote 23 end of the spectrum, including tax reductions, deregulation and investment in broadly horizontal interventions, such as the provision of basic infrastructure benefiting more than one sector.Footnote 24 But some proposals also embrace “active” policies, such as those encouraging support with conditions (e.g., information sharing) for individual firms entering the market.Footnote 25 Given the absence of an activist state approach, these industrial policies, both passive and active, are often short-lived, shifting with changing administrations.

The second “State-guided” industrial policy style places more weight on the prerogatives of the state, in part because it assumes that market failure is possible and business actors lack necessary information or knowledge. But the state does not “go it alone”: though it sets overarching policy objectives, it also takes an organizing role in setting a “participatory”Footnote 26 agenda with other actors, especially businesses and their associations. The orienting goal of collaboration is to shift local comparative advantage, often through the creation of tailored public goods (e.g., research and technical institutions, training programs) to enable industry-specific learning processes. These are often “active” policiesFootnote 27 insofar as they demand that business reveal information about firm capabilities and needs to policymakers. Further, because these state-convened initiatives prioritize industry-level shifts in competency by supporting learning processes, policies tend to require longer timelines and the formation of new organizations for their implementation, making them more likely to outlive individual administrations.Footnote 28 As the next section shows, these divergent Business-guided and State-guided policy styles also differentially affect patterns of economic change.

Industrial policy styles and upgrading patterns

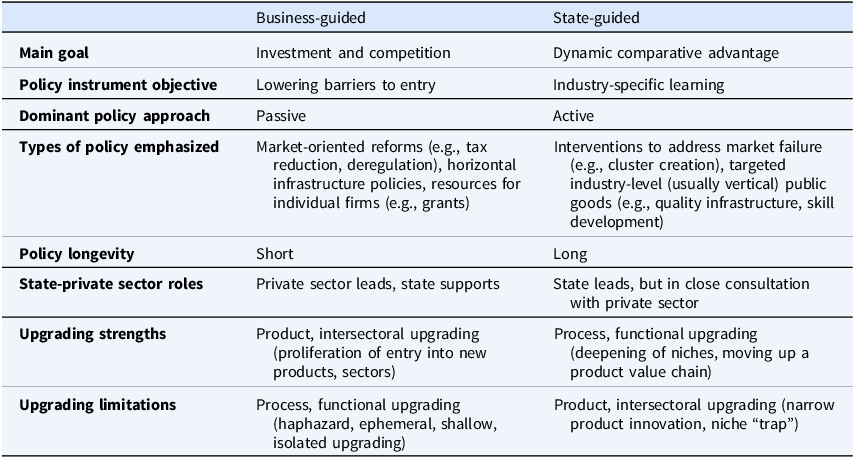

Policy styles vary in their consequences for industrial upgrading. Given the styles’ stickiness, these differences accumulate as the same approach is repeatedly deployed over time, reinforcing firm- and industry-level features, and in turn, influencing the types of economic impacts likely to be achieved. Table 1 illustrates the divergent industrial upgrading results of the Business-guided and State-guided policy styles.

Table 1. The two policy styles

The Business-guided policy style lowers entry barriers, supporting the creation of a wide variety of firms by reducing startup and operating costs. For instance, deregulatory schemes eliminate so-called “red tape” by cutting bureaucratic rules, laws and procedures with which firms must comply. Fiscal reforms lower firm tax payments. Targeted land concessions, subsidies (some with conditions) and grants lessen capital pressures on firms. Horizontal infrastructure investment enhances cheap access to indispensable services (e.g., transportation, electricity). These and other “let a thousand flowers bloom” policies spawn a profusion of entrants into new product and sectoral categories, emphasizing “product” (i.e., making more sophisticated products within a sector) and “intersectoral” (i.e., moving into new sectors) upgrading.Footnote 29

At the same time, the Business-guided policy style does not explicitly address how these firms can consolidate their gains after initial entry, whether by “scaling up,” learning how to improve a given part of the production process, or moving into a new linkage for the same product. As a result, the myriad emerging firms tend to compete more haphazardly. New, smaller entrants, which constitute the majority, are often ephemeral. For their part, the larger, usually multinational participants, internalize and silo the costs and benefits of their private innovation (e.g., R&D) initiatives.

By contrast, the State-guided policy style supports firms largely within the scope of one industry by deploying the state’s leadership and coordinating role to share information and invest in public goods such as training programs (e.g., universities) and “quality infrastructure” (e.g., metrology, standard-setting, testing centers). The jointly developed public goods allow a broader array of firms—relative to Jalisco’s siloed innovation within a select minority of firms—to enhance their technological sophistication, productivity, and innovative capacity. They offer tools that advance firm competitiveness largely by moving up within existing value chains via more “process” (i.e., enhanced efficiency and productivity in a given part of the production process) and “functional” (i.e., acquisition of skills and know-how to carry out more functions within a single product chain) upgrading.Footnote 30

Yet, this State-guided style’s repertoire tends to neglect the focus on entry barriers found in the alternative Business-guided style. Officials eschew, and even explicitly belittle, the deployment of deregulatory schemes, tax cuts, land grants and subsidies, among others, to attract investment. The absence of these industrial policy instruments, in turn, limits the growth of firm populations and lowers diversification of competencies across products and sectors.

Research design and methods

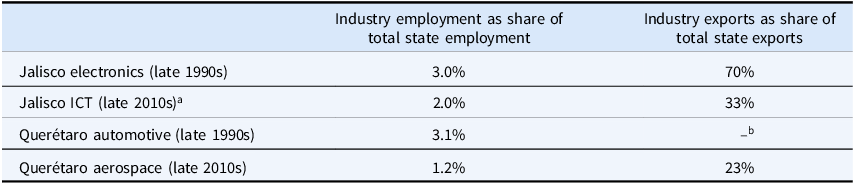

To evaluate the argument of sticky industrial policy styles and their consequences for industrial upgrading in a middle-income context, we employ a two-step subnational comparative approach in Mexico. First, we select two states: Jalisco and Querétaro. Second, within each state we choose two manufacturing industries integrated into GVCs that served as engines of development in consecutive time periods of roughly twenty years. In Jalisco, we examine electronics (1980s–1990s) and information communication technology (ICT) (2000s–2010s), while in Querétaro we focus on automotive (1980s–1990s) and aerospace (2000s–2010s) (see Table 2).Footnote 31 This subnational, industry-level setup increases the range of empirical variation available to investigate upgrading mechanisms.Footnote 32 It also allows us to account for alternative explanations for our observed state-level variation in upgrading patterns, namely strong product and inter-chain upgrading in Jalisco’s two industries, and robust process and functional upgrading in Queretaro’s.

Table 2. Industry employment and exportsFootnote 33

a Because of its intersectoral nature, ICT estimates include employees and sales cutting across different economic activities.

b Automotive accounted for 20.2% of all value added in manufacturing in Querétaro in 2008 (INEGI in Daville-Landero Reference Daville-Landero2012)

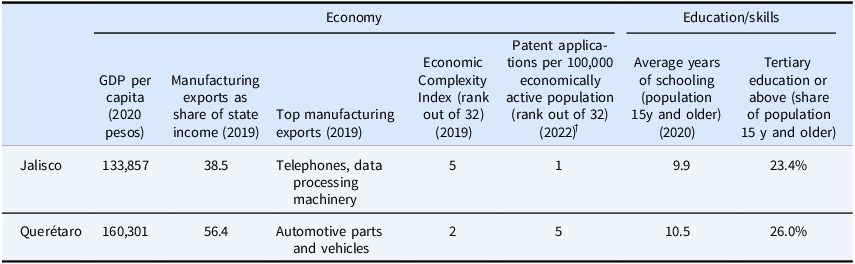

Jalisco and Querétaro merit comparison because they rank highly among Mexican states in terms of key outcomes for the middle-income trap, including more technology- and skill-intensive exports, economic complexity (which measures both the level of diversification and the uniqueness of the items produced in an economy), and patenting activity. Comparing these two states also facilitates an accounting for alternative explanations at the state level, such as economic structures and political trajectories. As Table 3 shows, despite their size difference, Jalisco and Querétaro show some notable similarities across relevant factors. These include not only their shared location in the central Bajío region, but also their middle-income status, presence of a significant export manufacturing sector, and relatively skilled labor force. Politically, the two states have followed parallel paths. After decades of Partido Revolucionario Institucional (PRI) rule, both transitioned to Partido Acción Nacional (PAN) governorships in the mid-1990s. Since then, both have mostly elected governors either from this center-right political party or the PRI. Crucially, in both states the dominant industrial policy models remained distinctive and consistent even across party alternations. These commonalities suggest that the observed variation cannot be readily accounted for by geographic, socio-economic, demographic, political and industrial conditions.

Table 3. Socio-economic conditions in Jalisco and Querétaro, MexicoFootnote 34

The cross-industry comparisons challenge arguments proposing a relationship between sector-level structures, on the one hand, and upgrading patterns on the other. For one, the literature shows that the 1980s and 1990s brought common processes of globalization and de-verticalization in automotive and electronics GVCs, leading to the institutionalization of modular governance modes in both.Footnote 35 Similar processes unfolded in aerospace and ICT GVCs during the 2000s and 2010s, with relational governance modes arising in the two global networks.Footnote 36 Furthermore, both industries offer a broad spectrum of potential niches with varying entry barriers for suppliers. Indeed, more marginal low-tier subcontractors as well as highly sophisticated, skill- and design-intensive Tier 1 suppliers have been observed in both industries in Mexico.Footnote 37 It is therefore difficult to attribute the differences in upgrading patterns observed between the two states to the structural characteristics of their main high-tech industries.

In addition to addressing alternative accounts, the within and cross-state comparisons of this research highlight both the salience of sticky industrial policies, and their consequences for industrial upgrading. First, the within state, longitudinal comparison shows the consistent application of the industrial policy style over time, as well as its distinctive consequences for upgrading, in each state’s two industries. Second, the cross-state comparison underscores the enduring variation in both policy and upgrading patterns between the states during the same time periods in comparable industries (i.e., Jalisco electronics vs. Querétaro automotive in the 1980s and 1990s, and Jalisco ICT vs. Querétaro aerospace in the 2000s and 2010s).

Data collection and analysis

We visited Querétaro (2019) and Jalisco (2022), conducting over two dozen interviews with various actors from the state government, academia and industry, and visiting R&D centers and universities. Using company directories from business associations in the studied industries, as well as news clippings and firm websites, we also compiled a firm-level dataset for each industry. The dataset includes information on firm founding years, headquarter location, employment, products and buyers. Although directories, clippings and websites should not be considered fully representative—they likely over-represent larger firms—we complemented this information with interviews and document reviews focused on the status of smaller firms in these sectors. In this paper’s analyses, we use the firm database primarily to corroborate industry- and state-level patterns related to firm age and origins, as well as forms of specialization in the value chain. Furthermore, we collected organizational documents from various agencies, associations and research centers, reviewed local newspaper reports, and accessed government documents from local archives. Lastly, we benefitted from material included in previously published industry- and state-level studies. With this evidence, we constructed industry-level historical narratives which established the role of sticky industrial policy styles, and their upgrading consequences in the two states.

Industrial policy styles and industrial upgrading in jalisco and querétaro

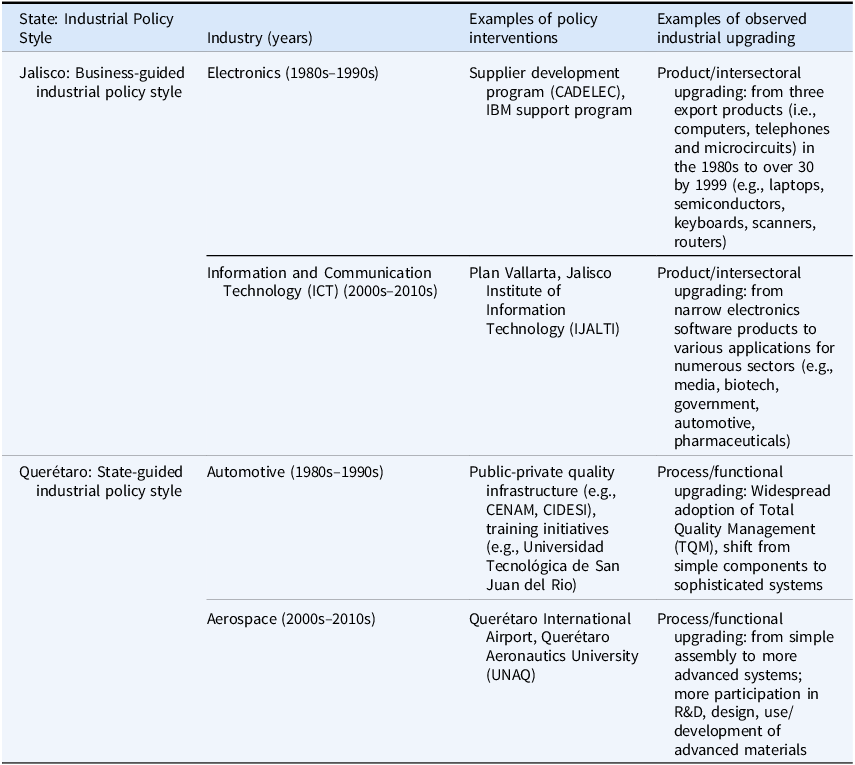

Table 4 summarizes the main empirical findings of this study. Unlike the conventional expectation of policy selection as a technical match to emergent upgrading challenges, it suggests that since the 1980s, sticky State-guided and Business-guided industrial policies have prevailed in Querétaro and Jalisco, respectively. Moreover, it shows how the upgrading patterns of the studied industries in both states reflect the consistent influence of those distinct policy styles.

Table 4. State industrial policy styles and industrial upgrading

Jalisco

When surveying Jalisco’s industrial policies since the 1980s, it is hard to avoid the conclusion that its state officials, regardless of their political party, are largely responsive to the demands of business actors. Policy design, and often implementation, rests with private sector formal and informal organizations, of which Jalisco boasts many. And even the public offices that support these business-led efforts are frequently staffed by key advocates from within the business organizations. As the following industry cases show, what arises from this private sector leadership are Business-guided policy interventions that prioritize the reduction of entry barriers.

Electronics industry (1980s-1990s)

During the last two decades of the 20th century, electronics rose to become one of Jalisco’s leading industries. In the late 1990s, it employed over 76,000 workers and accounted for roughly three-fourths of the total value of the state’s exports, its high-tech activity spanning across a range of various products.Footnote 38 Almost all this production took place under the auspices of subsidiaries of multinational firms (OEMs), such as Hewlett Packard, Motorola, Kodak and IBM, who had arrived in the capital city of Guadalajara starting in the 1960s. However, following global restructuring trends in the electronics value chain, these foreign OEMs increasingly attracted their Contract Manufacturers (CMs) to the region during the 1980s and 1990s.Footnote 39

In parallel, rapid product and intersectoral upgrading unfolded in the industry, often through OEMs’, and later CMs’, diversification into higher value-added goods. Thus, the industry transitioned from three main export product areas largely involving low-cost assembly (computers, telephones and microcircuits) in 1980, to over 30 products incorporating varying levels of local design (e.g., laptops, semiconductors, keyboards, scanners, routers) by 2000.Footnote 40 This innovation occurred at the level of individual firms, as OEMs and CMs brought their specialized know-how with them or founded over 30 corporate R&D centers in Jalisco to pursue product innovation.Footnote 41 For instance, Hewlett Packard introduced touchscreen production to Guadalajara, and established an R&D center that designed memory and other components and circuits for minicomputers, while IBM’s Guadalajara Programming Lab (GPL) experimented with software development. Toward the end of the period, the arrival of TD Com and Freescale vaulted Jalisco to the top echelons of semiconductor design and production in Latin America.Footnote 42

However, Jalisco’s electronics sector was less effective in building industry-wide specialized skills within existing production processes,Footnote 43 or in eliciting a broad-based movement up to higher value-added functions within supply chains. This was especially the case for local firms, which received “scarce spillovers” due to a “lack of competitiveness.”Footnote 44 What emerged was a thin crust of firms displaying more dynamic intersectoral and product upgrading—usually OEMs or CMs from countries like the United States, Germany, Taiwan, Canada, Japan and Switzerland, according to our dataset, which includes 26 such subsidiaries. This thin crust sat atop a much larger, more static base of simpler, largely Mexican, assembly manufacturers employing most of the industry’s local labor.

What kept Jalisco’s upgrading pattern so narrowly defined? In many ways, this Bajío state held significant potential for a much broader upgrading pattern. Its technically advanced computer industry was the envy of Latin America, with a network of experienced, though perhaps not highly innovative, local suppliers. Its large universities produced high-quality engineers. The state also offered a sizeable base for potential domestic investment, given Guadalajara’s stature as one of Mexico’s largest, most cosmopolitan cities. Further, during the 1980s and 1990s, the lead firms of the electronics GVC in which Jalisco’s producers participated were both globalizing and deverticalizing production, generating ample opportunities for process and functional upgrading.Footnote 45 Indeed, Ernst (Reference Ernst2003), among others, documented process and functional upgrading examples in the electronics industries of Taiwan, Korea, India, China, Singapore and Malaysia during this time. Querétaro’s automotive producers, integrated into a GVC that was undergoing a parallel process of globalization and de-verticalization, further illustrate this potential: they excelled at process and functional upgrading. Therefore, it is difficult to explain the bias toward product and intersectoral upgrading among Jalisco’s electronics firms by looking at the state’s industrial legacies and knowledge and skill resources, or at the structural and governance features of the GVC. Instead, we must take local policy into account.

Under Jalisco’s Business-guided policy style, competition and investment attraction were promoted through business-led efforts to lower entry barriers. As Palacios Lara (Reference Palacios Lara2008, 34) notes, the most powerful business associations, including the Coordinating Committee of the Jalisco Chambers of Industry (CCIJ) and the Western Headquarters of the National Chamber of the Electronics, Telecommunications and Informatics Industry (CANIETI Occidente), “proposed policies, programs and incentive schemes… [G]overnment played a role as facilitator and promoter instead of regulating or generating public policy.”Footnote 46 The mostly passive policy approach that arose usually addressed basic bottlenecks and infrastructure needs, supported individual firms, and favored deregulation and reduced taxes.Footnote 47

The application of this policy style elicited, above all, a rapid entry of a variety of firms of various sizes and capacities, most prominently OEMs and later, CMs. Some of them deepened their local investments into new activities, and pursued fully private product innovation initiatives in Guadalajara. At the same time, policy did much less to address the competitiveness of the industry’s production processes at the international level, or its positioning within a given product’s international supply chain. Moreover, because of the absence of active state leadership, most of these industrial policies lacked significant staying power, shifting with the winds of state administrations, which can each serve only one six-year term in Mexico. This combination generated minimal learning and diffusion beyond the confines of the individual OEMs and CMs. That, in turn, undermined industry competitiveness (to the point of the disappearance of multiple waves, or generations, of local suppliers) and local firm integration into higher stages of GVCs.

Consider two examples of this policy style (see Table 4). First is one of the most impactful policy shifts of the 1980s, the IBM deregulatory scheme. An ISI-inspired federal Computer Program (Programa de Computadoras) required OEMs to partner with local firms holding majority ownership shares. However, in 1985 IBM negotiated with Mexican federal authorities for an exemption from this rule for a new plant in Jalisco.Footnote 48 Two main points concern the state-level analysis: first, there is no evidence that Jalisco’s state government participated in this negotiation, instead maintaining its usual hands-off approach. And second, despite dissent among local industry competitors regarding such changes to the “rules of the game,”Footnote 49 IBM received support and guidance from local private sector actors in Jalisco, reflecting business’ policy leadership.Footnote 50 Ultimately, the negotiation allowed IBM full ownership of its subsidiary, thereby ensuring its investment in the state, in exchange for commitments on the percent of its output to be exported, the local content share, and investment in a research and training center for semiconductor technology. Yet, in later deals modeled after the IBM scheme, federal policymakers, with state official acquiescence, abandoned even those conditions. For instance, HP obtained a concession for 100% owned subsidiary without special domestic content, R&D or training requirements. Policymakers thus prioritized new subsidiary creation, and the development of new product lines, by lowering entry barriers through deregulation.

An organization known as the Electronics Production Chain (CADELEC) provides a second example of Jalisco’s Business-guided policy style. It illustrates how the biases embedded in this policy style eclipsed explicit intentions to foster process and functional upgrading in the electronics industry. CADELEC emerged in the late 1990s following conversations among large OEMs (e.g., IBM, Intel, Hewlett Packard, Jabil) participating in CANIETI Occidente, the CCIJ and other business associations. It received funding from CANIETI Occidente, the United Nations Development Programme, the Jalisco state government, and two federal agencies to strengthen the supplier base by matching locally-based producers with the large OEMs. However, instead of the intensive knowledge-sharing and monitoring that may raise productivity and skills, CADELEC’s interventions at the firm level mostly centered on simplifying and sharing information on basic entry requirements. As an experienced engineer who participated in CADELEC explained, “We certified local producers as suppliers for large OEMs. But these were not major certifications. Rather, we taught suppliers how to generate business quotes and present their numbers to OEMs. These were basic things…”Footnote 51 Beyond these firm-level interventions, CADELEC emphasized other functions geared toward lowering entry barriers, such as advising foreign firms on how to receive benefits from different levels of government, and hosting industry-level conferences and networking workshops.Footnote 52 Through these functions, the program reinforced the broader upgrading patterns associated with the industry’s business-guided industrial policy style: strong product and intersectoral upgrading.

Information and communications technology (ICT) industry (2000s–2010s)

A shock in the early 2000s, largely due to China’s ascension to the World Trade Organization and a recession in the United States, disrupted Jalisco’s electronics sector. Local actors responded by looking for more secure, stable economic niches, including software development and other forms of information communication technology (ICT). This new GVC opened pathways to a potentially diverse array of products and skill sets. Given software-related services’ potential interface with almost any other industry, it also offered numerous new demand markets—a marked contrast with the much narrower buyer base of the electronics industry. Yet, despite key differences with the electronics industry, the new ICT industry in Jalisco has shared a common upgrading pattern with its predecessor.

That pattern involves strong product and intersectoral upgrading. In response to the opportunities offered by the emerging GVC, a heterogeneous population of ICT firms proliferated in Jalisco in the 2000s and 2010s. Our database, which includes a sample of 50 firms, illustrates this finding: almost all of them were founded between 2000 and 2019. They range in size from large MNCs such as Oracle, Tata Consulting Services, and Intel, to smaller Mexican startups including Interlatin and Sigtao Software. Some firms (e.g., Nxp, Contapqi, Emergys Mexico, Persistent Systems, Pace Paragon, Ad Web Solutions) provide generalist business support software, IT services, cybersecurity, cloud and web services for clients across various sectors, such as government, healthcare, aviation, insurance, entertainment and finance. There are also IT offices for large MNCs (e.g., Baxter, AstraZeneca), and specialized corporate R&D centers (e.g., Continental, Bosch). Lastly, the sample includes various MNCs (e.g., Intel, IBM, c3.AI, Nextiva) involved in software design, advanced research, and AI development.

As with electronics, process and functional upgrading is much less prevalent. Many ICT firms, especially the smaller local ones, face substantial difficulties in turning their product innovations or intersectoral shifts into sustainable business models that allow them to scale up and become a longstanding presence in the industry. Not only do we observe high turnover of firms (in our sample, less than half of ICT firms were in operation in Jalisco before 2015),Footnote 53 but in addition, exceedingly few local startups are able to grow significantly. If they do, large MNCs usually buy them. Thus, product and intersectoral innovations are rarely complemented by deepening investments in these initial forays.

This relative absence of process and functional upgrading in Jalisco is surprising given both observations from other ICT cases in Mexico, as well as the comparison with Querétaro’s aerospace industry. First, in studying Mexico’s ICT industry, Brown-Grossman and Dominguez-Villalobos (Reference Brown-Grossman and Domínguez-Villalobos2012) observe a variety of different upgrading paths. Some involve the type of product upgrading observed in Jalisco (e.g., Softek). Yet, others demonstrate process and functional upgrading, including Scio (from the state of Michoacan), which provides customization for firms requiring cloud-based services, or Qualtop (from Mexico City), which builds on its competencies in certifications and quality standards to serve as a consultant for other software firms seeking to reduce errors in their products. Second is the comparison with Queretaro’s aerospace producers: in the 2000s and 2010s, both the ICT and aerospace GVCs shifted toward relational governance modes, and drew on comparable labor skills and supplier customization capabilities.Footnote 54 However, in contrast to Jalisco’s ICT sector, Queretaro’s aerospace producers excelled at process and functional upgrading. Thus, there is little indication that the structural characteristics of the ICT GVC account for the observed upgrading pattern in Jalisco.

Instead, this upgrading pattern is consistent with Jalisco’s persistent Business-guided policy style. As in the electronics sector, business actors have led in the development of ICT-related policies, with a primary objective of promoting investment and competition by reducing entry barriers. The state government has always followed “behind, coordinating or supporting the business associations, but never carrying the baton…”Footnote 55 The organizations, plans, policies and programs arising from such efforts are numerous. Among the organizations are the cabinet-level Secretary for Innovation, Science and Technology, the Council for Science and Technology (COECYTJAL), the Competitiveness Council, and the Mexico Innovation and Design Center (MIND). Plans spurred by this policy style include the 2013–2033 Plan and Jalisco Innovation Agenda 2015. Lastly, PROSOFTJAL, Technopolis, Multimedia and Animation Software Park in Chapala, Centro de Software, New Media City, and Guadalajara Design Center (GDC) illustrate the style’s programs and initiatives. Despite their number, all these instruments share a common concern with building some necessary basic infrastructure (e.g., incubators), supporting individual firms, especially small ones entering the market (e.g., competitive grants), and eliminating costly regulations and taxes. They have facilitated the rapid growth of the state’s total number of ICT firms and products. And they have been promulgated under state-level administrations of different political parties.

However, investment in more tailored public goods has mostly been absent,Footnote 56 with in-house corporate private R&D and innovation centers prevailing instead.Footnote 57 Without public investment, the diffusion of knowledge across firms, deepening of expertise beyond initial entry, and scaling up remain limited for most. Moreover, perhaps even more so than in the electronics industry, the policies for the ICT industry, devoid of state leadership, have generally proven short-lived. Initiatives such as CIPIS, Technopolis and the Multimedia and Animation Software Park in Chapala failed to even survive past the initial stages. The relative absence of public sector leadership in Jalisco can also be seen in the state’s own economic policy priorities, which shift frequently and receive only tenuous support.Footnote 58 For instance, the Secretary of Innovation, Science and Technology, ostensibly created as the key state public agency to support the industry, lacked a budget in its first year. And to this day, its physical office is provided by a subsidiary of a private business association, the CCIJ.Footnote 59

Two initiatives further illustrate this Business-guided style in the ICT industry (see Table 4). The Plan Vallarta, an overall policy agenda generated by individual business actors and adopted by the state government, constitutes one of the first ICT programs. It grew out of ongoing discussions in the late 1990s among a group of electronics industry managers and leaders from major firms (e.g., IBM, HP), local business associations (e.g., CANIETI Occidente), and a large university’s business development office (the local campus of ITESM, also known as Monterrey Tech). After securing support from the state’s Secretary of Economic Promotion and the Governor’s Office, this group procured the services of a private consulting firm to produce a diagnostic report with industry-level recommendations. They presented it at a conference in the Jalisco town of Puerto Vallarta, leading to the “Plan Vallarta” title. The plan highlighted a fairly broad range of commonly-employed Business-guided ideas to lower entry barriers, including increased export promotion, labor market flexibilization and small firm support.Footnote 60 It would go on to deeply influence ICT policymaking in the state. For instance, in 2000 the state government created a proposed Council for Science and Technology (COECYTJAL), placing as its director one of the members of the original group. Further, COECYTJAL’s best-known program, PROSOFT, followed the Business-guided style by providing individual grants to support firm creation, encouraging product and intersectoral upgrading.

In 2002, public-private collaboration led to the creation of a second illustrative example, the Jalisco Institute of Information Technology (IJALTI). Like the Plan Vallarta, IJALTI bears the markings of the Business-guided industrial policy style. While formally a public-private organization, leadership resides with business, insofar as the state government holds only a minority of the votes in its board. The director is also a private sector representative. Furthermore, the organization’s history reflects some of the policy discontinuities characteristic of Jalisco’s policy style: a year after its creation, IJALTI closed due to internal disagreements among board members, only to reopen in 2004 with less public and more private sector influence. Lastly, in a field interview, its current director explained some of IJALTI’s main efforts, most of them more conducive to firm entry and product and intersectoral upgrading than process or functional upgrading. Indeed, one of IJALTI’s key functions is to provide foreign firms with their human resource requirements to facilitate their arrival. For instance, when CISCO established a facility in Jalisco, IJALTI supplied the 150 engineers that they required by “merging 5 or 10 small local companies.”Footnote 61

Querétaro

In contrast to Jalisco’s Business-guided industrial policy style, under Querétaro’s State-guided policy the state government takes the initiative to choose the industries and key goals on which to focus. It then works collaboratively with private sector and other institutional actors (e.g., organized labor, higher education) to design and implement interventions focused on enhancing industry-wide dynamic comparative advantage. These interventions are usually supported with public resources and available for a wide array of firms. They tend to display significant staying power, given their development as long-term projects which often operate through a separate state-created organizational entity.

Automotive industry (1980s-1990s)

Throughout the 1980s and 1990s, Querétaro led the Bajío automotive industry’s development. Building on the state’s prior experience in the metal-mechanic industry, this automotive sector grew rapidly by specializing in auto-parts production. Already by 1988, the state’s auto supplier industry included at least 260 firms, employed more than 5,000 relatively high-skilled workers, and accounted for over a third of the Bajío’s total automotive production.Footnote 62 Standout firms were mostly Tier 1 suppliers, such as Tremec, Kostal, Dana and Clarion.

Driving this performance was the auto-parts suppliers’ process and functional upgrading, initially triggered by the extensive adoption Total Quality Management (TQM) practices. Originally introduced during the 1980s by auto-parts firms organized in the National Chamber of Processing Industries (CANACINTRA) (e.g., Tremec, Singer), TQM became prevalent among the state’s automotive sector throughout the 1990s.Footnote 63 It came paired with higher workforce skill levels and specialization, as workers received targeted training in Querétaro and abroad. It also raised wages: in the late 1980s, expenditures per worker in the industry exceeded the regional and national averages by 16% and 6%, respectively.Footnote 64 Additionally, TQM bolstered production process innovations through an expanding network of local process-focused R&D, testing, standards, metrology and training centers.Footnote 65 As our firm-level data suggests, this quality infrastructure supported the industry’s gradual functional upgrading from production of simpler components (e.g., components of transmissions) to more sophisticated systems (e.g., transmission, steering, braking, suspension, air, electrical systems).

However, while the automotive industry in Querétaro excelled at process and functional upgrading in auto-part production, its ability to move into new product lines or different but related sectors with higher value-added lagged. For one, the industry failed to transition into final automotive assembly.Footnote 66 The activity unfolding in neighboring states at the time brings this constrained product upgrading into greater relief. Auto industries in Aguascalientes, San Luis Potosi and, especially, Guanajuato, began growing in the 1990s, and boomed in the 2000s, driven by the arrival of final assemblers (e.g., General Motors in Silao, Guanajuato; Nissan in Aguascalientes). Firm-level incentives consistent with a Business-guided policy style (e.g., free or subsidized land, tax breaks, basic infrastructure provision) attracted these assemblers to those states. The assemblers not only raised the value-added of these neighboring industries’ output, but also drew in Tier 1 suppliers which might have otherwise located in Querétaro, thereby challenging its regional dominance in the industry.

The Queretaro automotive industry’s limited product and intersectoral upgrading is also perplexing given the patterns observed in Jalisco’s electronics industry at the time. As noted, much like Jalisco’s electronics industry, Queretaro’s automotive producers participated in a GVC undergoing an accelerated process of production globalization and de-verticalization in the 1980s and 1990s. Automotive lead firms were selling or spinning off much of their manufacturing infrastructure and outsourcing an increasing share of component design and production to Tier 1 suppliers.Footnote 67 Yet, the upgrading patterns of these leading industries in the two studied Mexican states diverged.

Our observations suggest that the State-guided policy style better fits the observations of Queretaro’s automotive industry results. In consultation with organized business, labor and representatives from academic institutions, successive state governments invested heavily in public goods that supported TQM and other process-oriented innovations, especially through skill development and quality infrastructure. At the same time, officials’ attachment to those State-guided policies placed them in a policy arena distant from the bidding contests, deregulatory schemes and costly subsidies that were necessary to bring large final assembly facilities. Interviewees often suggested that Querétaro would never compete for investment by cutting taxes and offering free land.Footnote 68 The stickiness of this approach rendered Querétaro unable to attract a large final assembler to the state—a marked contrast with the assembler boom unfolding across Querétaro’s neighbors by the late 1990s.

Two major areas of intervention further illustrate the role of the State-guided policy style in fostering the local process and functional upgrading pattern (see Table 4). First is labor upskilling. As Kahn (Reference Kahn2019) describes, state actors repurposed a tripartite state-business-labor commission created in the early 1980s to smooth management-labor relations in a time of economic tumult.Footnote 69 In its new incarnation, the commission led initiatives to raise the industry’s levels of productivity and specialization. Actively seeking federal support and responding to the demands of the commission’s labor and business representatives, the Palacios administration (PRI, 1985–1991) created the groundbreaking Science and Technology Council of Querétaro (CONCYTEQ), a public institution serving multiple industries, in 1986. From its origins, CONCYTEQ “included a program to match job seekers with appropriate employers and scholarships that allowed nearly 500 workers to participate in technical skills courses” (ibid, 105). In later years, the state, business, labor and, eventually, academia would continue to collaborate in this manner through the creation of a variety of auto worker training programs, including those offered by the public Universidad Tecnológica de Querétaro (UTEQ) and Universidad Tecnológica de San Juan del Rio (UTSJR). They would also attract prestigious universities, such as the Universidad Nacional Autónoma de México (UNAM) campus in Juriquilla, and CINVESTAV-IPN, an academic institute focused on materials research and engineering. All of these would supply the skilled workforce for broad process and functional upgrading.

The State-guided policy style is also evident in Querétaro’s investments in quality infrastructure institutions. Through the same consultative mechanisms used in the worker training programs, state officials and leaders from industry, labor and academia built a variety of public and public-private research, standards, testing, quality and metrology centers conducive to process and functional improvements. Some, such as the aforementioned CONCYTEQ, the National Science and Technology Council (CONACYT)-affiliated Advanced Technology Center (CIATEQ) and the Engineering and Industrial Development Center (CIDESI), concentrated on process-oriented R&D. In field research visits to these facilities, administrators explained that they largely respond to businesses requests for technical assistance to improve production processes, especially in areas such as product reliability, integration of the newest technologies, or production process speed and/or safety.Footnote 70 Other centers, such as the IMT (Mexican Institute for Transportation) and the National Metrology Center (CENAM) placed greater emphasis on metrology and standard-setting for the industry. Together, they comprise a formidable research network supporting the industry’s process and functional upgrading. Their basis in public sector funding and coordination also provides a stark contrast to the reliance of the electronics and ICT industries in Jalisco on in-house corporate R&D centers.

Aerospace industry (2000s–2010s)

Spawned by the 2006 recruitment of Bombardier Aerospace, a prominent producer of small and medium-sized aircraft, Querétaro’s aerospace industry quickly leapt ahead of other, more established regional aerospace clusters to be designated by the Mexican federal government as one of two “strategic poles for innovation”Footnote 71 because of its high level of productive and technological upgrading and specialization. Today, the industry’s firms perform sophisticated functions across an array of product subsystems.Footnote 72 In our firm-level dataset, at least three, in addition to Bombardier, are world-leading Original Equipment Manufacturers (OEMs); while over thirty are Tier 1, 2 and 3 suppliers, and Maintenance, Repair and Operations (MRO) providers.Footnote 73 Given this composition, Hernández Chavarria (Reference Hernández Chavarria2011, 243) concludes that “Querétaro has the first and only aerospace cluster in Mexico that is similar to successful models such as Toulouse, Wichita, Montreal, [and] Seattle.”

The large firms in this aerospace industry excel at process and functional upgrading. They employ a workforce of relatively high skill, ranging from trained assemblers to engineers with post-graduate degrees. These workers at OEMs, their suppliers and MRO providers moved up in rapid fashion from performing simple operations, such as wire harness assembly, to producing complex components and systems, such as fuselages, wings and landing gear. Their work is supported by over a dozen private and public R&D centers, which also draw upon a pool of skilled local personnel. The upshot is a high production efficiency that has led OEMs to transfer production lines (e.g., the Q400 and Global Express jet models) from places like Japan and Canada to Querétaro.

Nonetheless, product and intersectoral upgrading has proven more elusive. While the firms in this industry may require higher skill levels than basic assembly, much of the labor still involves assembly operations using imported components. Further, though the R&D ecosystem is significant, it largely offers firms iterative improvements to existing goods and production systems, rather than new products.

This absence of product and intersectoral upgrading is hard to reconcile with arguments focused on GVC structural conditions, given observations from comparable industries. For example, the Queretaro aerospace industry’s upgrading pattern is distinctive even for that industry in other Mexican states. This is clear when comparing our data on Querétaro to empirical surveys of another major Mexican aerospace cluster in the state of Baja California,Footnote 74 which describe contrary upgrading results. There, product upgrading prevails, as firms focus on basic parts including radio frequency modules, electrical support components, insulating parts and rotors, stators and armor. These products, though not necessarily offering high value-added, must meet various quality and certification requirements. More generally, McGuire (Reference McGuire2014) cites the kind of upgrading others observe in Baja as the norm for Mexico’s aerospace industry. This highlights the distinctiveness of Querétaro’s emphasis on process and functional upgrading as opposed to the more prevalent (in Mexico, at least) product upgrading.

If Querétaro’s aerospace industry shows puzzling upgrading patterns relative to other clusters in the same industry, it is nevertheless of a kind with Querétaro’s automotive industry, its predecessor as a lead industry in the state. As in the state’s automotive industry, the State-guided policy style helps make sense of what transpired in the state’s aerospace cluster. State officials from different governorships and political parties, in consultation with business and academia, largely repurposed the institutional apparatus they employed with the automotive sector for this new industry. The state government led the way in creating crucial public goods to support the industry’s emergence and development, most notably the international airport, an industry-specific university and other quality infrastructure. These investments supplied the industry with skilled labor, customized support to enhance its production processes, and through a combination of these, local capacity to integrate more sophisticated portions of the production process.

Querétaro’s use of its international airport as a site for workforce training and industry support is representative of its longstanding State-guided bent (see Table 4). Its development was contentious, as local business deemed it costly and irrelevant to their needs. However, Bombardier’s intent to build a new production facility in Mexico justified the pursuit of this large-scale public work ex-post. While it was created by the Loyola administration (1997–2003), the more pro-business Garrido administration (2003-2009) connected this resource to Bombardier’s public search and formulated a pitch rooted in the state’s State-guided playbook: it placed the new airport at the center of the proposal and focused on its use as a site for a new, publicly-funded customized training institution. The administration’s ability to credibly promise a strong training program drew from the state government’s history of coordination with higher education in the automotive industry. Based on the proposal, Bombardier selected Querétaro, with an initial investment of $200 million and a commitment to create 1,500 jobs over several years.Footnote 75 For its part, the state followed through with its promise to establish the Querétaro Aeronautics University (UNAQ), located adjacent to its international airport.

Over the next few years, the Garrido and subsequent administrations deployed this model of public-private cooperation for workforce training to attract leading aerospace firms, including the Safran Group (France) and Aernnova Aerospace (Spain). It engendered not only a new aerospace industry cluster, but also an associated public-private network for skill development, including industry-specific offerings in numerous other training institutions, such as the Colegio Nacional de Educación Profesional (CONALEP), Colegio de Estudios Científicos y Tecnológicos del Estado de Querétaro (CECyTEQ), Instituto Tecnológico de Querétaro (ITQ), Universidad Autónoma de Querétaro (UAQ) and Universidad Politécnica de Querétaro (UPQ). In its contributions to more efficient production in a growing range of increasingly sophisticated activities for the same products, it supported process and functional upgrading in the industry, with the large transnational firms shifting more steps of their production processes to Querétaro.

This State-guided approach to worker training and local upgrading was also linked directly into Querétaro’s propinquity to use public leadership to develop capacity in industry-level quality infrastructure. Across state-level administrations, the public sector consistently promoted new labs, centers and agencies, many of which exclusively served the needs of aerospace firms. These institutions, several of them public-private initiatives, far outnumber those found in other states.Footnote 76 They include the GE-IQ—GE’s “most important aviation engineering center outside the United States”Footnote 77 —and LabTA, a joint project of the state’s three national science labs. They also encompass the National Center for Aeronautical Technology (CENTA), Aerospace Research and Innovation Network of Querétaro (RIIAQ), Querétaro Research and Technical Assistance Center (CIATEQ), Center for Advanced Engineering in Turbo Machinery (CIAT), Center for Aeronautical Industry Development (CEDIA), Applied Science and Advanced Technology Research Center (CICATA-IPM), and Center for Applied Physics and Advanced Technology (CFATA-UNAM).Footnote 78 The research conducted in these centers is largely geared toward gradual improvements in production systems and goods (e.g., a more heat-tolerant chemical treatment, or a more automated, ergonomic workstation to increase production efficiency and safety) that contribute to process upgrading.

However, as with the automotive sector, the aerospace industry’s achievements in production efficiency and new functions are not matched by product and intersectoral upgrading. State-level economic development agencies collaborated with the CEDIA, an aerospace industry-promoting institution whose core members are universities, to support the integration of local firms as suppliers into the aerospace cluster. This supplier development program trained firms to meet product and process standards, especially through certifications. Yet its results were disappointing insofar as many participating firms failed to secure supplier contracts—even when buyers offered them. That was due to a lack of capital to cover the risks of what often constituted a move into a new product or industry. Thus, the strong State-guided emphasis on firm-level learning seemed to come at the expense of explicit considerations of costs and other barriers to entry that are of more central concern in Jalisco’s Business-guided policy approach.

Discussion and conclusion

The industry cases in Queretaro and Jalisco challenge the technocratic view of policy selection found in the MIT and GVC literatures. Each state consistently employed a distinct industrial policy style, drawing from a limited subset of the broader policy menus prescribed by MIT and GVC scholars. In both industries in each state, selected policies responded neither to changing market conditions, industry-level goals, or ideological shifts across ruling parties. Nor did policymakers follow a clear policy learning trajectory over time. Indeed, when presented with new obstacles, project failures, or plateaus in industry-level progress, these policymakers rarely reconsidered their styles. Rather, they usually found new applications for largely the same policy tools.

The mere existence of such distinct and sticky state-level policy styles is in many ways surprising. Many middle-income countries, and Mexico in particular, afford limited autonomy to the subnational level.Footnote 79 Whatever narrow space for policy differentiation exists is often hampered by the relatively short tenures of state-level bureaucrats, who are subject to the sweeping appointment powers of governors elected to one six-year term.Footnote 80 Insofar as Mexico presents conditions hostile to persistent local differentiation, it comprises an extreme case through which to examine the possible scope for variation at the local level. Given the strong and consequential state-level policy style differences, there is reason to believe they may be more striking where there are less constraints on local autonomy.

Further, not only were the distinct policy styles in Jalisco and Querétaro highly persistent, but they also appear to have been biased toward distinctive upgrading patterns. The Jaliscan Business-guided style’s focus on lowering entry barriers was associated with a greater emphasis on broad, diversifying upgrading efforts into what the GVC literature terms product and intersectoral upgrading. While process upgrading was possible in Jalisco, especially within the boundaries of certain OEMs and CMs, it was more the exception. Meanwhile, Querétaro’s State-guided policies spurred much less diversification across products and sectors. What prevailed instead was enhanced process and functional upgrading within existing product categories and value chains.

These observations suggest at least two extensions to existing MIT and GVC research. First, adopting some sensitivity to how local institutional contexts affect policy selection is important to contextualizing and understanding uptake of the literature’s broad range of policy recommendations. Such calibration begins by taking stock of the local industrial policy style to select a consistent subset of industrial upgrading policies. This paper observes only two such styles, but others may exist. Second, there is the observation of a patterned relationship between an industrial policy style and the prevalence of some types of upgrading over others. This hypothesis should be tested and expanded upon through a broader sample of cases.

The structure of this study—four industries across two Mexican states—brings limitations further research should address. Beyond the range of industrial policy styles considered, future work could probe the dynamics of stability and change in a given policy style. Our own preliminary research into a longer time duration in Jalisco and Querétaro suggests that their respective industrial policy styles predate the 1980s, raising questions both about their origins and the sources of their durability. Even if, as both the data and theory indicate, the benefits of maintaining a local policy model increase actors’ status quo bias, future research should also consider the conditions under which actors come to question the benefits of institutional continuity. Such research would ideally be supported with data on processes of policy formulation and debate during times of continuity as well as reform.

Further investigation could also suggest ways to compensate for a given policy style’s limitations. For example, the lack of local firm entry into Querétaro’s aerospace supply chain despite successful tutelage in process and functional upgrading seems noteworthy. Previous research observing these limitations suggests that, through tutelage, firms acquire knowledge necessary to become suppliers, but still face major barriers in terms of credit and available capital. In this case, perhaps more attention to proposals from a different industrial policy model—or an adaptation of policy ideas to better fit with the predominant approach—could help fill some of these gaps.

This should not be taken to suggest that every place is confined strictly to the boundaries of its dominant approach. Instead, scholars must recognize the interactions between a given industrial policy style and the broader policy menus presented by MIT and GVC research. It may be fruitful to consider how to import policy measures or features normally associated with one policy style more effectively into another. For example, what happens when one extends the average career tenure or policy autonomy of bureaucrats working in an institutional context that has traditionally been Business-guided? This manner of shifting individual dimensions within a policy style may offer practical ways of increasing policy options while being sensitive to local institutional legacies.

Ultimately, the integration of a local industrial policy style offers ways to think more precisely about how a general set of policy recommendations meshes with different local contexts. This does not imply that governments should, based on local legacies, choose to work only on some tasks of development. Rather, it can render more concrete and actionable what it means for different places to play to their strengths and make explicit their blind spots. In this way, researchers and practitioners can identify more effective avenues to find a “fit” between local skills and capacities and external market environments.