Introduction

In today's knowledge economies, the success of individuals, firms, and societies increasingly depends on how much ‘knowledge‐based capital’ (OECD, 2013) they possess or command (Haskel & Westlake, Reference Haskel and Westlake2017). We can distinguish between two types of knowledge‐based capital: human capital – the knowledge (e.g. skills, expertise) that individuals acquire over the life course; and innovational capital – the knowledge that groups of individuals hold collectively (e.g. patents, organizational know‐how) (Kraft, Reference Kraft2017, pp. 19–20). Both allow individuals to (inter‐)act more efficiently and creatively and are therefore widely seen as essential for surviving and thriving in today's economy.

Against this background, investments in knowledge‐based capital should be a no‐brainer. However, the inability of private actors to fully appropriate potential payoffs leads to systematic underinvestments in knowledge‐based capital (European Commission, 2017). Governments are therefore assigned a crucial role in providing such investments by spending public resources on education, training and research and development (Fournier, Reference Fournier2016; Iversen & Soskice, Reference Iversen and Soskice2019; Mazzucato, Reference Mazzucato2019).

However, it is not just markets that often fail to make the socially optimal amount of investments. Governments often fail too. Investments increase individuals' or groups' capacity for future consumption (Beramendi et al., Reference Beramendi, Häusermann, Kitschelt, Kriesi, Beramendi, Häusermann, Kitschelt and Kriesi2015, p. 8; Kraft, Reference Kraft2017) and therefore realize a ‘collective gain’ (Hicks & Kenworthy, Reference Hicks and Kenworthy1998, p. 1632). However, they also require the conflictual (re‐)allocation of resources from present to future consumption and/or from some status groups or sectors to others (Finnegan, Reference Finnegan2022; Jacobs, Reference Jacobs2016). It is because of these intertemporal and cross‐sectional trade‐offs that investment policies are politically costly and governments generally underprovide them.

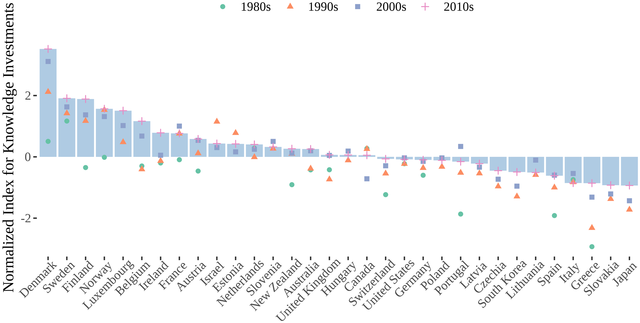

Governments, however, fail to different degrees. As Figure 1 shows, there are considerable differences in the extent to which governments are capable or willing to invest in knowledge‐based capital. This paper sets out to explain this variation. For while political scientists have made important inroads into explaining the politics of investment policies (Beramendi et al., Reference Beramendi, Häusermann, Kitschelt, Kriesi, Beramendi, Häusermann, Kitschelt and Kriesi2015; Boix, Reference Boix1997; Bremer et al., Reference Bremer, Carlo and Wansleben2021; Busemeyer, Reference Busemeyer2009; Finnegan, Reference Finnegan2022; Garritzmann & Seng, Reference Garritzmann and Seng2016; Jacques, Reference Jacques2021; Jensen, Reference Jensen2011), the literature falls short in three ways.

Figure 1. Normalized investment index (1980–2010s). Values are averaged across multiple imputations. [Colour figure can be viewed at wileyonlinelibrary.com]

First, it suffers from a ‘persistent ‘education bias’’ (Kraft, Reference Kraft2017, p. 14), i.e. it largely looks at (‘social') investment in human capital formation instead of investment in innovational (or physical) capital. I thus created an index capturing investments in individually as well as collectively held knowledge‐based capital, combining three types of investments: (1) public education spending to measure investments in individually‐held skills; (2) public spending on research and development to measure investment in collectively held knowledge; and (3) public investment in active labour market policies that may enhance both actors’ human capital and societies’ collective innovational capital.

Second, the literature has focused largely on structural and partisan factors in explaining temporal and geographic differences in investment policies. Structural accounts argue that spending patterns are the result of large‐scale economic or demographic transformations that are largely outside of political control. Partisan accounts, on the contrary, stress the importance of partisan politics and explain differences in investment spending with different priorities of governing parties. While both explanatory traditions have acknowledged the role of institutions in moderating (or superseding) the effects of structural or partisan variables (Garritzmann & Seng, Reference Garritzmann and Seng2016; Jensen, Reference Jensen2011), they have not sufficiently theorized institutional factors in their own right and have also not sufficiently theorized the importance of intertemporal, compared to cross‐sectional, trade‐offs (for exceptions, see Finnegan, Reference Finnegan2022; Jacques, Reference Jacques2021).

Building on the literature on power sharing (Jacques, Reference Jacques2021; Lindvall, Reference Lindvall2017) and cooperation‐inducing institutions (Hicks & Kenworthy, Reference Hicks and Kenworthy1998; Katzenstein, Reference Katzenstein1985; Ornston, Reference Ornston2013), I argue that corporatist institutions can be expected to alleviate not just cross‐sectional but also intertemporal trade‐offs and thus increase long‐term investments (Finnegan, Reference Finnegan2022). Specifically, I argue that corporatist institutions foster a more collaborative style of policy making as well as a sense of ‘“shared ownership” of policy problems [and a] general capacity to adapt’ (Hemerijck and Schludi, Reference Hemerijck, Schludi, Scharpf and Schmidt2001, p. 227) that allows corporatist countries to overcome the cross‐sectional and intertemporal trade‐offs associated with making policies for the long run.

Third, the literature has largely relied on time‐series‐cross‐sectional models using country‐year observations. Governments, however, do not change on a yearly basis, which results in inflated observations and incorrect estimates (Garritzmann & Seng, Reference Garritzmann and Seng2016). Following recent methodological suggestions (Garritzmann & Seng, Reference Garritzmann and Seng2020), I therefore use mixed models to analyse time‐series‐cross‐sectional data where annual observations are nested in governments which are in turn nested in countries. Moreover, the literature often uses country‐fixed effects models which –for methodological reasons – control out the between‐country effects of variables despite their substantive importance. I thus use within‐between mixed‐effects models which disentangle the within and between effects of variables (Bartels, Reference Bartels and Franzese2015; Bell et al., Reference Bell, Fairbrother and Jones2019; Bell & Jones, Reference Bell and Jones2015).Footnote 1

I find strong support for my argument that corporatist institutions, by fostering a collaborative style of policy making, are a central yet so far largely overlooked factor in explaining cross‐country variation in investment policies (again, for exceptions, see Finnegan, Reference Finnegan2022; Jacques, Reference Jacques2021). Moreover, corporatist institutions seem to moderate the relationship between deindustrialization and knowledge investments in that the impact of deindustrialization on investments varies across levels of corporatism as well as over countries more generally. I also find that austerity has a negative effect on investment spending. However, I do not find evidence that partisan factors (still) play an explanatory role, which is in line with most of the recent literature (Garritzmann & Seng, Reference Garritzmann and Seng2016; Jacques, Reference Jacques2021; Ronchi, Reference Ronchi2018). These findings matter as they highlight the importance of institutionalized compensation and collaboration between different actors in overcoming obstacles to successful long‐term policy making –obstacles that appear in similar form in climate policy making or pandemic preparedness, for example (cf. Finnegan, Reference Finnegan2022).

The paper proceeds as follows: I first demonstrate why investments in the knowledge‐based capital matter but why neither markets nor governments fully invest enough. I then show that countries nonetheless differ substantively in how much they invest in knowledge‐based capital. After discussing different explanations for why this is the case, I sketch out and substantiate my own argument, which focuses on corporatist institutions. Next, I discuss my empirical strategy and the dataset I compiled. I then present and discuss my findings. I conclude by briefly summarizing key take‐aways, discussing some limitations, and pointing to avenues for future research.

The need for knowledge investments

The last decades have witnessed dramatic growth in the economic (and social) importance of knowledge and learning (OECD, 2013; Stiglitz & Greenwald, Reference Stiglitz and Greenwald2014; Thelen, Reference Thelen2019). Knowledge‐based or intangible capital like skills, patents, know‐how, software or databases have become essential for surviving and thriving in today's economies (Haskel & Westlake, Reference Haskel and Westlake2017). This process is closely linked to the introduction of digital technologies, which tend to complement to knowledge‐based capital: they put a premium on the ability of actors, organizations and countries to access, acquire, and apply knowledge while rendering other assets and activities less valuable or redundant. This has already been true during the third industrial revolution starting in the 1970s. But it is even more true for today's fourth industrial revolution, which puts additional pressure on low‐knowledge and an additional premium on high‐knowledge assets and activities (Frey, Reference Frey2019; OECD, 2013, 2017).

In other words, digital technologies – be it those of the fourth industrial revolution which currently gathers steam, or those of the third industrial revolution which slowly runs out of it –have a tendency to make ‘highly skilled labor the main complement of capital in the production process’ (Boix, Reference Boix2019, p. 23) while rendering technological change increasingly labour‐replacing (Frey, Reference Frey2019). In such an economy, the value of knowledge – both the knowledge held by individuals and the knowledge held between them – increases dramatically (Haskel & Westlake, Reference Haskel and Westlake2017; OECD, 2013). This has implications on the individual, firm, and country levels.

Individuals may find their skills obsolete, businesses their market position upended and countries their competitive advantage deteriorating. At the same time, digital technologies also promise to massively increase societal welfare by making economies and societies vastly more efficient. Therefore, the royal road to unlocking the ‘collective gains’ (Hicks & Kenworthy, Reference Hicks and Kenworthy1998) inherent in technological change is not to halt it by increasing the relative price of capital vis‐a‐vis labour (the ‘Luddite option'). Nor it is to passively compensate its losers and thereby shore up the legitimacy of technological change (the ‘welfarist option'). Rather, the most appealing way to respond to technological change is to invest in complementary assets that allow individuals and companies to fully harness the power of digital technologies.

These investments, however, will be underprovided by markets, be it because private actors cannot exclude others from the fruits of their investment (public goods), because public benefits exceed private benefits (externalities), or because actors have myopic preferences or insufficient knowledge about the payoff of investments (uncertainty, non‐rational choices, information asymmetries). Governments – as the only actors with the necessary resources and interests – are thus called upon to invest in the public goods of advanced capitalism (Fournier, Reference Fournier2016; Iversen & Soskice, Reference Iversen and Soskice2019, p. 157).

This is particularly true for investments in knowledge‐based capital –from education and retraining to basic research and innovating funding –for which the overall benefits for society are considerably higher than the private benefits (European Commission, 2017, p. 29). R&D investments, for example, have been shown to increase long‐term growth and labour productivity (European Commission, 2017; Fournier, Reference Fournier2016) and to ‘crowd‐in and galvanize other forms of investment’ (Mazzucato, Reference Mazzucato2019, p. 3). Likewise, investments in (co‐)clustered skills are seen as central to the economic success of countries or regions (Iversen & Soskice, Reference Iversen and Soskice2019).

Such ‘soft’ investments in knowledge‐based capital – as opposed to ‘hard’ investments in physical infrastructures – have already been essential in ‘creating conditions required for the prosperity and sustainability of a “post‐industrial” or “knowledge society”’ (Streeck and Mertens, Reference Streeck and Mertens2011, p. 2; cf. Fournier, Reference Fournier2016, p. 13). Today, artificial intelligence further speeds up the ‘race between technology and education’ while making R&D capabilities both more useful and necessary. As a result, investments in knowledge‐based capital have become even more essential in the emerging digital or ‘new’ knowledge economy.

But it is not only markets that fail to invest enough. Governments often fail too. Not only is there a persistent investment gap across all advanced capitalist democracies (compared to what would be socially optimal), but the size of this gap also varies across countries (Borunsky et al., Reference Borunsky, Goranov, Rakic and Ravet2020). Figure 1 plots the dependent variable of this study: an index that captures investments in knowledge‐based capital for various countries over time (for more details, see below). We see that despite a shared emphasis by all countries on the ‘urgency for governments to be proactive’ in shaping the digital transformation (OECD, 2017, p. 22), some countries are much more proactive. We also see that some countries continued to increase their investments in knowledge‐based capital over time while others failed to do so. Finally, we see that while richer countries tend to invest more, this relationship is by no means straightforward, with many countries investing much more or much less than their similarly rich peers. This raises the puzzle of how to explain the diachronic and synchronic variations in how much countries invest in knowledge‐based capital.Footnote 2

The politics of public investments in knowledge‐based capital

The existing literature on the politics of investment policy making has focused on partisan and structural factors, and more recently also on institutional ones. Partisan accounts emphasize the role of political parties in shaping public investment. Structural accounts focus on forces that are outside the immediate control of governments like deindustrialization or independent of partisan preferences like the exigencies of the political business cycle. Institutional approaches have argued that the relationship between political agency and structural constraints is moderated by the institutional features of a polity. My own argument builds on such institutional approaches but more explicitly theorizes the role of intertemporal in addition to cross‐sectional trade‐offs.

Existing literature

Starting with Boix (Boix, Reference Boix1997), the modern literature on the politics of investment policies has focused on the role of the partisan composition of government in explaining countries’ supply‐side policies. Boix argued that because of their growth‐enhancing effects, governments are relatively unconstrained in their ability to make supply‐side investments, even in a globalized economy. But because such investments disproportionately benefit their voters, social democratic parties should favour higher levels of public investment, even at the price of higher taxes. Thus, Boix advances the two main claims of partisan accounts: that parties have an independent effect on investment policies; and that parties on the left and the right will have different effects (Busemeyer, Reference Busemeyer2009, pp. 108–109).

The more recent literature has advanced this partisan argument in several ways. For example, distinguishing between party families has been proposed as a more fine‐grained distinction than the left‐right dichotomy as there are important differences between conservative, Christian‐Democrat and liberal parties as well as between social democratic and other leftist parties (Garritzmann & Seng, Reference Garritzmann and Seng2016, p. 514). However, even that might not be sufficient as parties within the same party family often have different positions, while parties in different families have similar positions. Therefore, instead of relying on indirect assumptions about party positions, it is suggested to directly measure them using party manifestos (Garritzmann & Seng, Reference Garritzmann and Seng2016, pp. 516–517).

Structural approaches argue that it is not so much the investment preferences of political parties and their constituencies but rather broader structural trends that influence investment spending. Jensen (Reference Jensen2011) finds that it is not the partisan composition of government that explains public investments in education, but the level of deindustrialization. Streeck & Mertens (Reference Streeck and Mertens2011) argue that under austerity, the choice for investments becomes much harder as the overall amount of discretionary spending shrinks. Unless the amount of discretionary spending is increased through higher taxes, which is unlikely given broader ideological and economic constraints, ‘soft’ investments in education, R&D, active labour market policies, and families will decline (Streeck & Mertens, Reference Streeck and Mertens2011, p. 23).

Breunig and Busemeyer (Reference Breunig and Busemeyer2012) find support for this argument, finding that public investments, which are discretionary spending, are hit harder by fiscal austerity than entitlement spending. This is because politicians have lower electoral incentives and face higher political obstacles in maintaining investments. Similarly, Ronchi (Reference Ronchi2018) finds that in the aftermath of the euro crisis, the expansion of social investment policies slowed down considerably and almost stagnated, while the conflict between social investment and social consumption policies became starker. Likewise, Jacques (Reference Jacques2021) shows that governments choose the path of least resistance when implementing austerity measures. Because the benefits of investments are diffuse and become visible mostly in the future, they are least protected from fiscal consolidation.

The argument of these structural accounts is not that parties do not matter, but that their differences do not really make a difference. In other words, parties in government make policies, but these policies result not from political differences but from parties operating under tight structural constraints they have little immediate control over. These constraints can be economic or ideological but they can also be electoral.

Moving to institutional approaches, Breunig and Busemeyer (Reference Breunig and Busemeyer2012) also find that the effect of austerity on cutbacks in discretionary spending is conditional on the electoral system. In majoritarian systems, where constituencies are more concentrated, politicians have more incentives to shield discretionary spending from cutbacks, whereas in proportional systems, politicians are more likely to protect entitlement spending to avoid alienating the broad beneficiaries of these programs. Institutional factors may also supersede partisan factors over time. Garritzmann and Seng (Reference Garritzmann and Seng2016) find no partisan effect on education spending since 1995. But this does not mean that parties never mattered; it just means that they stop doing so as investment policy areas mature and institutional path dependencies start to carry more and more of the explanatory weight (cf. Beramendi et al., Reference Beramendi, Häusermann, Kitschelt, Kriesi, Beramendi, Häusermann, Kitschelt and Kriesi2015).

Argument

Importantly, these approaches tend to focus more on cross‐sectional and less on intertemporal trade‐offs. But even if we agree with Boix (Reference Boix1997) that supply‐side investments allow policymakers to sidestep cross‐sectional trade‐offs, they still face these intertemporal ones. Put differently, governments are often disincentivized from implementing investment policies not only because they cost or benefit some groups more than others in the present; but also because they imply ‘welfare trade‐offs at the expense of the present and in favour of the future’ (Jacobs, Reference Jacobs2016, p. 434). First, governments never know if future governments will commit to the same investment policies or divert resources to their own (short‐term) political ends. This is what Jacobs calls the ‘fragility of political commitments’ problem (Jacobs, Reference Jacobs2016, p. 440). It implies that governments will only invest in the long run at the short‐run expense if they can be confident that their investments will not be reverted or salvaged by future governing parties. Second, governments can never be certain that voters will adequately factor in the future benefits of investments. This is what Jacobs calls the ‘information about long‐term consequences’ problem (Jacobs, Reference Jacobs2016, pp. 439–440). It implies that politicians will bias their policies towards the short‐run to the extent that the salience of information about the short run is high and the quality of information about the long run is low.

However, the problems associated with uncertain ‘political property rights’ (Terry Moe) and incomplete markets for future‐oriented policies are not insurmountable. On the one hand, institutions that disperse and fragment power have been argued to increase investment by incentivizing politicians to maintain commitments (Jacobs, Reference Jacobs2016, p. 445; Lindvall, Reference Lindvall2017) and by diffusing the blame for short‐run costs ((Jacobs, Reference Jacobs2016), p. 444). Building on these arguments, (Jacques, Reference Jacques2021, p. 2) finds that power‐sharing institutions such as proportional electoral systems or corporatist interest group mediation can help ‘break political uncertainty about future investment by “locking in” commitments’ and thereby strengthen the capacity of governments to overcome intertemporal trade‐offs (Jacques, Reference Jacques2021, p. 2). On the other hand, ‘cooperative institutions’ that ‘promote cooperation among economic actors’ allow for credibly compensating actors for the short‐term costs of investments while credibly involving them in their long benefits (Hicks & Kenworthy, Reference Hicks and Kenworthy1998, p. 1634). And Finnegan (Reference Finnegan2022) indeed finds that proportional representation and interest group concertation increase the stringency of climate policies by lowering political costs through ensuring credible compensation.

In making the case for partisan explanations, Boix explicitly argued against the view that corporatist institutions matter for the ability of governments to invest in the supply‐side of the economy. Governments can do so ‘without the consent of organized labor’ (Boix, Reference Boix1997, p. 819). But in today's societies, there are many actors, including labour, that can raise the political costs of investments (Finnegan, Reference Finnegan2022). The promise of power‐sharing and cooperation‐inducing institutions is that they necessitate and facilitate political bargaining between winners and losers of investment policies. They also give actors a longer time horizon and a more cooperative attitude as being forced to cooperate now means that one is most likely also forced to cooperate in the future. This mitigates both the cross‐sectional and the intertemporal trade‐offs associated with long‐term policy making and thus allows for the realization of ‘collective gains’ (Hicks & Kenworthy, Reference Hicks and Kenworthy1998; Lindvall, Reference Lindvall2017).

The prime example of such a power‐sharing and cooperation‐inducing institutional arrangement is neocorporatism, understood here as the ‘institutionalized and privileged integration of organized interests in the preparation and/or implementation of public policies’ (Christiansen, Reference Christiansen, Christiansen, Elklit and Nedergaard2020, p. 161). Corporatist institutions can aid ‘compromises that are more socially acceptable (that do not provoke an adverse response from social actors) and more sustainable (that reduce the risk of policy reversals by future governments)’ (Lindvall, Reference Lindvall2017, p. 133) – and thus increase long‐term investments. If actors have the ability to veto policy change if they are not compensated, this incentivizes governments to give them a seat at the table. This, in turn, makes it less likely that social partners act confrontationally and opportunistically, not least because they know they can be vetoed themselves in the future. Over time, this leads to repeated, compromise‐oriented, and often positive‐sum interactions, which increases mutual trust and habituates actors into a collaborative mindset. I therefore hypothesize that

higher levels of corporatism lead to higher levels of investments in knowledge‐based capital (H1).

There are a number of ways to illustrate this argument. First, game‐theoretical modelling has shown that there is no trade‐off between the involvement of all social partners in the policy‐making process and the ability to non‐opportunistically adjust to external change (Tommasi et al., Reference Tommasi, Scartascini and Stein2014). This is because having more potential veto players

means not only more veto players today, but also in the future; this affects the likelihood that any current veto player is also a veto player in the future, and this might lead to different choices than if there was no tomorrow. [M]ore veto players at one point in time might [also] make deviations from cooperative equilibria less appealing and lead to more cooperative policymaking. (Tommasi et al., Reference Tommasi, Scartascini and Stein2014, p. 224)

Second, there is neocorporatist literature, old and new. Katzenstein (Reference Katzenstein1985, p. 30) famously argued that the secret behind the politico‐economic success of corporatist states is to compensate enough to maintain a political consensus but not so much as to impair economic efficiency. This allows for proactive adaption to (as opposed to resistance against) change. Ornston (Reference Ornston2012) recently took up this argument, arguing that far from inhibiting the redistribution of resources into high‐tech industries, or only being conducive to incremental innovation in low‐ and medium‐technology industries, corporatist institutions have enabled sizable investments in human and innovational capital and ‘supported unprecedented movement into new, high‐technology industries’ (Ornston, Reference Ornston2013, p. 706). This ‘creative corporatism’ relies on repurposing or converting corporatist institutions into vehicles for the ‘construction of new supply‐side resources’ (Ornston, Reference Ornston2013, p. 710). Ornston thus documents the continued success story of small corporatist states in today's knowledge economy.

The Danish reforms of the last decades can help illustrate this argument. Before the 1990s, Denmark was characterized as ‘a small state in big trouble’ (Schwartz, Reference Schwartz1994). Shortly after, it experienced an economic ‘miracle’ (Schwartz, Reference Schwartz2001), having massively expanded investments in knowledge‐based capital and successfully moved into knowledge‐intensive markets (Ornston, Reference Ornston2012, pp. 92–125). Crucial to this success story was Denmark's ability to re‐purpose its corporatist institutions to foster supply‐side investments. Denmark's ‘history of constructive collaboration (...) enabled policymakers to move beyond distributive bargaining to tackle sensitive issues such as financing, skill formation, and research’ (Ornston, Reference Ornston2012, p. 198). For example, the tripartite Zeuthen Commission ‘linked social benefit reform to active labor market expenditure and greater collaboration in training’; it thus created a ‘focal point (...) for subsequent bargaining’, which helped to mobilize a ‘broad consensus for investments in human capital’ (Ornston, Reference Ornston2012, p. 103).

I further put this argument to the test by formulating three follow‐up hypotheses. First, Katzenstein argued that the ability of corporatist states ‘to live with change’ (Katzenstein, Reference Katzenstein1985, p. 211) instead of resisting it, to equitably adjust to it instead of bitterly fighting over it was grounded not only in formal corporatist institutions but also in an informal ‘ideology of social partnership’ (Katzenstein, Reference Katzenstein1985, p. 32). For him, an important – although not sufficient –factor in bringing about this ideology was the relative ‘smallness’ of many corporatist countries. Thus, the ideology of social partnership –the ‘glue’ (Katzenstein, Reference Katzenstein2003, p. 11) behind the corporatist states’ collaborative style of policy making – was partly born out of the small European states’ perceived vulnerability to economic and political crises. Smallness, in other words, fosters a shared sense of vulnerability and lowers barriers to collective action (Katzenstein, Reference Katzenstein2003). ‘Traveling around small states’, Katzenstein (Reference Katzenstein2003, p. 11) notes, ‘is not time‐consuming. And if you give a party in the capital, you can easily invite all the important political players. This makes a difference to both politics and policy’. I thus argue that

smaller states have higher levels of investment in knowledge‐based capital (H2a).

Second, there is a question of whether one really needs a collaborative style of policy making or whether power‐sharing and the concomitant difficulty of reversing policy is enough. Following the neocorporatist literature, I argue that it is really a sense of ‘ “shared ownership” of policy problems’ (Hemerijck and Schludi, Reference Hemerijck, Schludi, Scharpf and Schmidt2001, p. 227) that provides corporatist countries with the ability to make sacrifices now to collectively benefit in the future. Ultimately, corporatism works not by locking in commitments, but by instilling a ‘culture of compromise’ that couples ‘narrowly conceived group interests with shared interpretations of the collective good’ (Katzenstein, Reference Katzenstein1985, p. 32). The alternative hypothesis, which I argue against here, is that institutional constraints themselves, by making policy reversal less likely, will lead to higher public investments. Henisz (Reference Henisz2002), for example, has argued precisely that, showing how political institutions that limit the feasibility of policy change (e.g., independent branches of government) lead to higher overall investments in infrastructure. I, however, do not expect such institutions to have an independent effect as, unlike corporatist institutions, they do not necessarily create a culture of compromise and a sense of common ownership of policy problems. I therefore posit that

higher institutional constraints on the feasibility of policy change themselves do not lead to higher levels of investment in knowledge‐based capital (H2b).

Third, in line with the Katzenstein–Ornston argument about (small) corporatist states' ‘general capacity to adapt’ (Hemerijck and Schludi, Reference Hemerijck, Schludi, Scharpf and Schmidt2001, p. 227), I argue that the existence of strong corporatist institutions should help countries to better react to technological and economic change. Jensen (Reference Jensen2011) hit on a similar point, showing that the impact of deindustrialization is conditional on a country's variety of capitalism. In coordinated market economies, where skills are more specific, deindustrialization is a greater threat to workers. And since expanding education is a promising avenue for re‐skilling, demand for it will be higher, although the precise direction of spending will differ even among coordinated market economies (Thelen, Reference Thelen2019). Similarly, I argue that corporatist countries – reinventing their corporatist institutions to meet new challenges –will tend to increase supply‐side investments in the face of deindustrialization. I therefore hypothesize that corporatism not only leads to overall higher levels of investments in knowledge‐based capital but also that

corporatism moderates the effect of deindustrialization on investment spending in that investments are decreased (increased) at low (high) levels of corporatism (H2c).

Empirical strategy and data

To test my argument – and to test it against existing explanations – I compiled a dataset for 32 advanced capitalist democracies from 1995 to 2018 and for 20 of these countries from 1981 to 2018.Footnote 3 These data are well suited to answer the question of how countries responded to the rise of the knowledge economy, which emerged in the 1980s, took off in the 1990s, and further accelerated in the 2010s.

The dependent variable of this study is an index that captures investment in human and innovational knowledge‐based capital, plotted in Figure 1. It is composed of three sub‐indicators: spending on education to measure investments in human capital, spending on R&D to measure investments in innovational capital, and spending on active labour market policies (ALMP) to measure investments in both human (retraining) and innovational capital (start‐up incentives). These spending variables are measured as a share of GDP (Streeck & Mertens, Reference Streeck and Mertens2011, pp. 6–7). The indicators were added up and normalized (for details, see online Appendix A1).

The first explanatory variable – the partisan composition of government – was operationalized in two different ways, reflecting disagreements in the literature. Indirectly, as the proportion of cabinet shares held by social‐democratic parties; and directly, as the average issue emphasis on investment issues of all cabinet parties, weighted by their respective seat shares (Garritzmann & Seng, Reference Garritzmann and Seng2016). The latter category is operationalized as the relative combined emphasis parties place on public investments in research and development, infrastructure and education and on an active, involved role of the state in the economy (for details, see online Appendix A2).

The second explanatory variable – corporatism – is constructed based on Jahn (Reference Jahn2016) index of corporatism, which takes into account the organizational structure of collective actors, the functional relationship between collective actors and the state and the scope or coverage of collective bargaining. This definition operationalizes corporatism as a politico‐economic gestalt, understanding it as both a tool for economic coordination and the integration of organized interests in policy making (Christiansen, Reference Christiansen, Christiansen, Elklit and Nedergaard2020, p. 161). However, while the paper uses the encompassing definition of corporatism, the appendix replicates the analysis with a more narrow operationalization that only takes into account corporatism's functional aspects (see online Appendix A3). Corporatism is compared to and contrasted with an institutional constraints variable which measures the feasibility of policy change, that is ‘the extent to which a change in the preferences of any one political actor may lead to a change in government policy’ (Henisz, Reference Henisz2002, p. 363). Small stateness is a dummy variable indicating whether or not a country's population is smaller than 6 million (loosely based on Katzenstein's analysis). Online Appendix B4 shows an alternative specification.

The remaining variables were measured as follows: Trade Openness is measured as the average of exports and imports as a share of GDP (Busemeyer, Reference Busemeyer2009). Deindustrialization, following Jensen (Reference Jensen2011), is measured as the share of people working in the service sector. The deficit is measured using cyclically adjusted budget deficits to control out the effect of economic conditions, with positive values indicating a surplus. The debt rule variable is collected from the corresponding IMF dataset and is a dummy variable with 1 indicating that a debt rules exist, and that there is no investment exception. EU membership and unemployment are self‐explanatory. The time dimension was modelled with cubic splines to account for non‐linear dynamics (Garritzmann & Seng, Reference Garritzmann and Seng2020)

Missing data were handled with multiple imputations whereby several complete, rectangular datasets were created with missing observations estimated from all available data. This was done using the Amelia algorithm, which explicitly takes into account the time‐series‐cross‐sectional nature of the data (Honaker & King, Reference Honaker and King2010). After running the model on each imputed dataset, results were combined using Rubin's rules whereby coefficient estimates as well as goodness‐of‐fit statistics are averaged across multiple imputations while standard errors were combined in a way that both averages uncertainty across models and accounts for disagreement in the estimated values across the models. Multiple imputations avoid the inefficiencies and potential biases associated with dropping missing values but also reflect the uncertainty that comes from using imputed missing values. Online Appendix B provides more details on the imputation process as well as diagnostics that help evaluate the validity of the imputations.

Empirically, I use within‐between mixed‐effects models (Bell et al., Reference Bell, Jones and Fairbrother2018, Reference Bell, Fairbrother and Jones2019; Bell & Jones, Reference Bell and Jones2015). This has three main advantages over standard time‐series‐cross‐section regressions on annual observational data that use country fixed effects. First, it more accurately models the nested structure of the data (Garritzmann & Seng, Reference Garritzmann and Seng2020). Governments do not change annually. Using country‐years as the unit of analysis therefore artificially inflates the number of observations, which leads to anti‐conservative estimates. An alternative would be to use cabinet terms as the unit of analysis (Garritzmann & Seng, Reference Garritzmann and Seng2016). This approach, however, ‘sacrifices’ information as many variables do indeed vary annually but have to be aggregated to the cabinet‐term level. By treating annual observations as nested in government terms which are in turn nested in countries, mixed‐effects models allow for the ‘simultaneous estimation of the effects of variables with different time intervals – that is, variables that vary annually, over several years, or not at all within countries’ (Garritzmann & Seng, Reference Garritzmann and Seng2020, p. 631).

Second, using mixed‐effects models allows for the separation of within and between effects (as well as for the inclusion of time‐constant variables). The common approach to modelling clustered time‐series‐cross‐section data is to use cluster (e.g. country) fixed effects. This neutralizes the statistical problems associated with pooling clustered data at the price of controlling out all between‐cluster variations. However, the between effects of variables are often as theoretically interesting as their within effects – and can go in a different direction (Bartels, Reference Bartels and Franzese2015). Moreover, fixed‐effects models make it impossible to estimate the effects of time‐invariant variables as all the degrees of freedom at the higher level have been consumed by the cluster dummies (Bell & Jones, Reference Bell and Jones2015, p. 139).

Standard random‐effects models, meanwhile, partition the unexplained residual variance into a higher level variance between entities and a lower level variance within these entities, assuming that higher level entities come from a single (normal) distribution which is estimated from the data. They do not, however, separate the within effect from the between effect but rather estimate a weighted average of the two, which has little substantive meaning (Bell et al., Reference Bell, Fairbrother and Jones2019, p. 1057). However, by including group‐mean centered lower level predictors (country‐averaged annual observations in this case), one can recognize the possibility of and explicitly model differences between within and between effects (Bell et al., Reference Bell, Jones and Fairbrother2018; Bell & Jones, Reference Bell and Jones2015, p. 141).

Third, within‐between mixed models have additional statistical advantages. By partially pooling information across countries, they strike a balance between fixed‐effects models, in which nothing can be known about any higher level entity (i.e. country) from knowledge about all or any of the others; and completely pooled models in which it is assumed that there are no differences between higher level entities and so knowing one means knowing all (Bell et al., 2019, p. 1061). Instead, higher level entities are treated as distinct but not completely different. In effect, the estimates for the random intercepts are shrunk towards their mean, with the most extreme (and least reliable) estimates being shrunk the most. This allows us to estimate more reliable residuals for higher level entities, estimate coefficients for higher level variables and estimate how much variance there is at different levels (Bell et al., Reference Bell, Fairbrother and Jones2019, p. 1061; Bell & Jones, Reference Bell and Jones2015, p. 144). Furthermore, mixed‐effect models allow for modelling heterogeneity in the effect of lower level variables via random slopes and cross‐level interactions. This can be used to assess whether the effect of a lower level variable X depends on a higher level variable Z, or even whether the within‐cluster effect of X depends on between‐cluster variation in X (Bartels, Reference Bartels and Franzese2015).Footnote 4

In the paper, I estimate three increasingly complex models. The first model is a three‐level random intercept model without separate within and between effects:

Variables are measured on multiple occasions (t), for multiple governments (g) and in multiple countries (c).

![]() $y_{tgc}$ is the dependent variable;

$y_{tgc}$ is the dependent variable;

![]() $x_{tgc}$ is a vector of annually observed (i.e. level‐one) variables;

$x_{tgc}$ is a vector of annually observed (i.e. level‐one) variables;

![]() $w_{gc}$ is a vector of government‐term (i.e. level‐two) variables; and

$w_{gc}$ is a vector of government‐term (i.e. level‐two) variables; and

![]() $z_$c is a vector of country‐specific (i.e. level‐three) variables. This is the fixed part of the mixed‐effects model. The random part consists of a country‐level error term (

$z_$c is a vector of country‐specific (i.e. level‐three) variables. This is the fixed part of the mixed‐effects model. The random part consists of a country‐level error term (

![]() $\nu _{00c}$), a government‐level error term (

$\nu _{00c}$), a government‐level error term (

![]() $u_{0gc}$) and an occasion‐level error term (

$u_{0gc}$) and an occasion‐level error term (

![]() $\epsilon _{tgc}$). The residuals thus capture unexplained variability at three nested levels.

$\epsilon _{tgc}$). The residuals thus capture unexplained variability at three nested levels.

The second model separates out the within and between effects but assumes homogeneous effects of the level‐one independent variables across higher level entities.

Here

![]() $\beta _{1W}$ represents the average within effect of level‐one independent variables, while

$\beta _{1W}$ represents the average within effect of level‐one independent variables, while

![]() $\beta _{2B}$ represents the between effect of level‐one independent variables. β3 represents the effect of country‐specific (time‐invariant) variables and therefore also captures a between effect (higher level variables cannot have a within effect since they do not vary over time). The separation of within and between effects is accomplished by group‐mean centering the level‐one independent variables

$\beta _{2B}$ represents the between effect of level‐one independent variables. β3 represents the effect of country‐specific (time‐invariant) variables and therefore also captures a between effect (higher level variables cannot have a within effect since they do not vary over time). The separation of within and between effects is accomplished by group‐mean centering the level‐one independent variables

![]() $x_{tgc}-\bar{x}_$c. This is similar to what fixed‐effects regressions do but allows us to additionally model the between effect by including the group mean of the level‐one covariates

$x_{tgc}-\bar{x}_$c. This is similar to what fixed‐effects regressions do but allows us to additionally model the between effect by including the group mean of the level‐one covariates

![]() $\bar{x}_$c.

$\bar{x}_$c.

The third model is equivalent to model 2 but does not assume homogeneous effects across higher level entities. It attaches a random effect not only to the intercept but also to the within slope that allows for heterogeneity in the effect of the level‐one independent variables. Including random slopes is not only substantively interesting. Simulations have shown that a failure to include random slopes when the homogeneity‐of‐effects‐across‐units assumption is violated can lead to anti‐conservative estimates of the within effects as standard errors are underestimated (Bell et al., Reference Bell, Fairbrother and Jones2019). Moreover, including cross‐level interactions between lower and higher level variables similarly leads to anti‐conservative estimates if random slopes on the lower level components of those interactions are not included (Heisig & Schaeffer, Reference Heisig and Schaeffer2019).

Findings and discussion

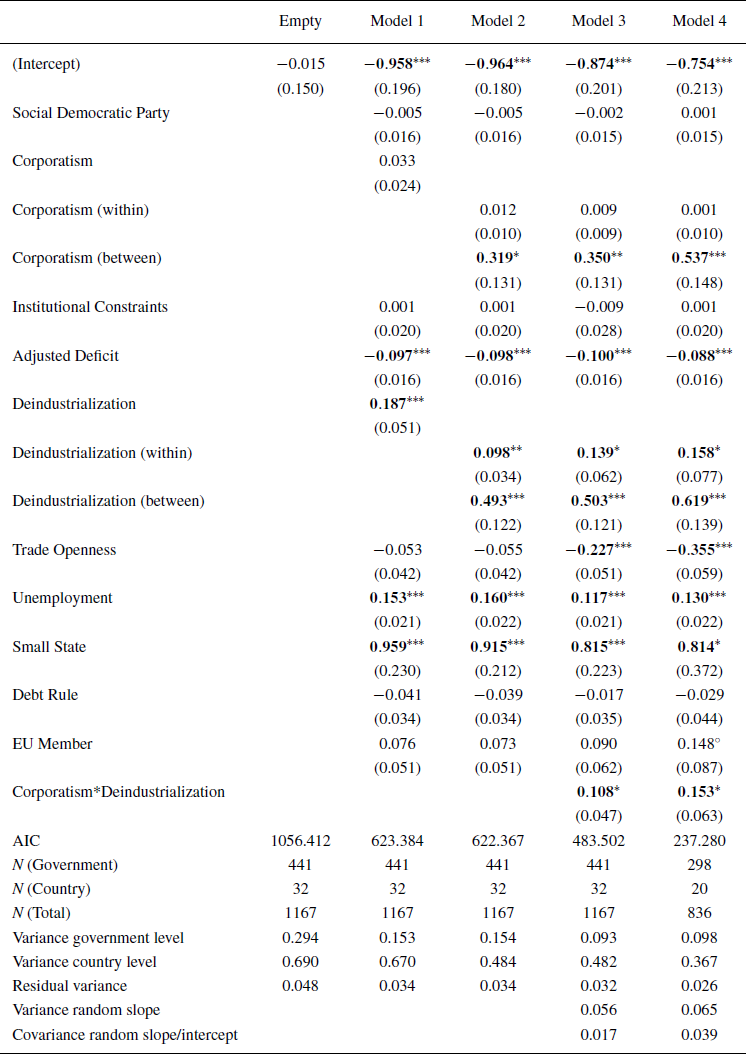

Table 1 shows the results of the different model specifications. All continuous variables are normalized to both aid model convergence and ensure better interpretability of coefficients. One advantage of mixed‐effects models is that they provide us with the basic partition of the variability in the data between different levels. For this purpose, we can estimate a three‐level random intercept model without explanatory variables. This empty model shows that the bulk of the variance stems from the country level. In other words, there is much more variance between countries than there is between governments or within countries. This is perhaps unsurprising given path‐dependencies within countries. But it also makes it all the more necessary to explicitly model between effects and group‐level variables. In a way, much of what we need to explain is why different countries invest so differently in knowledge‐based capital, more than why they – or different governments within these countries – invest more or less over time.

Table 1. Mixed‐effect models

![]() $^{***}p<0.001$

;

$^{***}p<0.001$

;

![]() $^{**}p<0.01$;

$^{**}p<0.01$;

![]() $^{*}p<0.05$;

$^{*}p<0.05$;

![]() $^{\circ }p<0.1$

$^{\circ }p<0.1$

The next step is to include explanatory variables. Model 1 does so by modelling the relationship between investments in knowledge‐based capital and the explanatory variables in a three‐level mixed effects model without separate within and between effects. A first finding is that the composition of government does not seem to have an effect on investment spending. This is true regardless of whether we measure government composition as the share of social democratic parties in government, or as the relative emphasis that government parties put on investment (see online Appendix B4 for this specification). This is consistent with the recent literature, which argues that if we accurately model partisan factors (with governments not years as the units of observation), and if we look at the more recent, institutionally denser past, we should not find (strong) partisan effects on investment spending (Garritzmann & Seng, Reference Garritzmann and Seng2016, Reference Garritzmann and Seng2020).

Moving on to the central argument of this paper, the corporatism index in model 1 shows no significant association with investment spending. However, model 2 and model 3 separate within and between effects, which were lumped together in model 1. The within‐between models reveal that the effect of corporatism is not a within but a between effect, and that this between effect is strong and highly significant. Countries that are one standard deviation more corporatist have around a third of a standard deviation more investments while becoming more corporatist does not have this effect. Importantly, while these models use the structural, functional, and scope dimensions of corporatism, the results are the same if we use the functional dimension only, i.e., the degree of concertation, which is the most important dimension for the theoretical argument (see online Appendix B4).

This is strong evidence in support of H1 on the importance of corporatist institutions for investments in knowledge‐based capital. I extensively discussed why I think this should be the case in the Argument section, building on the theoretical and empirical literature on corporatism. However, it ultimately requires detailed qualitative evidence to really understand how this works on the ground – evidence that I cannot provide here. However, by testing the follow‐up hypotheses, one can nonetheless dig slightly deeper. To start with, one can look at whether non‐corporatist institutional constraints like the number of independent branches of government or the degree of legislative fractionalization have an effect on investment spending. If this were the case, it would lend support to the power‐sharing argument and suggest that corporatism might just be another way in which the feasibility of policy change affects investment spending (cf. Henisz, Reference Henisz2002, p. 363). This, however, is not the case, even when we separate within and between effects (see online Appendix B4).

While power‐sharing institutions seem to make parties prioritize investments in their manifestos (Jacques, Reference Jacques2021), they do not increase investment spending independent of the effect of corporatism. This is evidence in favour of H2b. It is also a hint that corporatist institutions are not just about ensuring credible commitments through power sharing. Instead, the results suggest that it is the collaborative style of policy making that they induce that leads to higher investments. Investments are more likely in countries where social actors have an ‘ideology of social partnership’ (Katzenstein, Reference Katzenstein1985, p. 32) and a sense of ‘“shared ownership” of policy problems’ (Hemerijck and Schludi, Reference Hemerijck, Schludi, Scharpf and Schmidt2001, p. 227) that allow them to overcome intertemporal trade‐offs and tap into the positive‐sum potential of investment policies. If this were the case, we would also expect smallness to lead to more investments, as smallness is conducive to mutual trust and collaboration as hypothesized in H2a. And this is indeed what we find: small states tend to have much higher levels of investment compared to larger ones. However, there are no clear guidelines for how to operationalize ‘smallness’, so this finding should be interpreted with some caution (for alternative specifications, see online Appendix B4).

Another important finding relates to the way in which corporatism moderates the effect of deindustrialization on investment spending. Similar to Jensen (Reference Jensen2011), I find a sizable and highly significant effect of deindustrialization on investment spending. This is both a between effect, that is, countries that are more deindustrialized spend more on investments in knowledge‐based capital; and a within effect, that is, countries that industrialize also invest more. Crucially, as suggested by Jensen himself and as argued in the theoretical discussion of the adaptive benefits of corporatist institutions, the within effect of deindustrialization depends on institutional variables and differs across countries.

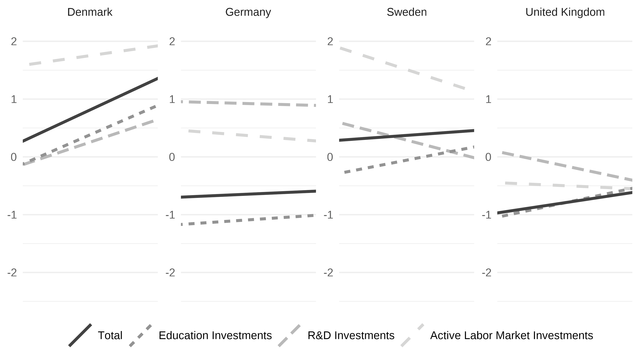

Model 3 shows an interaction effect between the within effect of deindustrialization and the between effect of corporatism. If we only focused on advanced Western democracies (for which we have longer time series), we see that this interaction effect becomes even stronger (see model 4). Figure 2, which is based on model 3, shows that an increase in deindustrialization leads to the same or even lower spending in countries with low levels of corporatism. The higher the levels of corporatism, meanwhile, the stronger the positive effect of deindustrialization on investment spending. While we need to interpret these results with some caution given the relatively low number of observations of the moderator variable (Hainmueller et al., Reference Hainmueller, Mummolo and Xu2019), they do lend further tentative support to Ornston's argument that corporatist countries can reinvent their corporatist institutions to foster supply‐side investment in the face of technological and economic change.

Figure 2. Effect of deindustrialization on investment spending conditional on the level of corporatism (based on model 3). Averaged across imputations.

Second, we can also observe the heterogeneity in responses to deindustrialization if we include random slopes for the within slope of deindustrialization. The slope standard deviation is

![]() $\sqrt 0.056 = 0.24$. Given that the average slope is 0.139, this implies that the effect of deindustrialization can be quite different from the effect in other countries. For example, in a country with the top 2.5 per cent of the country‐dependent effect, a one‐unit increase in deindustrialization is associated with a ~ 0.619 (

$\sqrt 0.056 = 0.24$. Given that the average slope is 0.139, this implies that the effect of deindustrialization can be quite different from the effect in other countries. For example, in a country with the top 2.5 per cent of the country‐dependent effect, a one‐unit increase in deindustrialization is associated with a ~ 0.619 (

![]() $0.139 + 2*0.24$) standard deviation increase in knowledge investments, while in a country with a low effect, it is associated with a ~ 0.341 standard deviation decrease.

$0.139 + 2*0.24$) standard deviation increase in knowledge investments, while in a country with a low effect, it is associated with a ~ 0.341 standard deviation decrease.

Figure 3 plots the random slopes for the selected countries for four different models with either the full investment index as the dependent variable or individual components (see online Appendix B4 for the full models and online Appendix B6 for random slopes for all countries and models). We see that while deindustrialization has led to further increases in investment spending across categories in Denmark, despite already high levels, it has led to only small increases in the United Kingdom, with decreases in R&D spending and active labour market policies being compensated by increases in education spending. Interestingly, there are also different trajectories for corporatist countries. Echoing the qualitative findings by Ibsen and Thelan (Reference Ibsen and Thelen2017), it seems that Denmark doubled down on its ‘supply‐side egalitarianism’ across all dimensions of knowledge investments while Sweden only increased its education investments and seemed to have reduced investments in R&D and active labour market policies, although from relatively high levels. Germany maintained high levels of investment in R&D, reflecting its ambitious innovation policy (Thelen, Reference Thelen2019, pp. 303–304). However, it only mildly increased its already rather low education spending. Thus, while corporatism generally leads to higher investments in knowledge‐based capital, the transition trajectories of corporatist countries into the new knowledge economy differ, depending on the coalitional dynamics within corporatist institutions (Ibsen & Thelan, Reference Ibsen and Thelen2017; Thelen, Reference Thelen2019).

Figure 3. Random slopes for deindustrialization across selected countries and different models.

It is important to note that corporatist countries are not free of conflicts, even in small states. There are diverging interests not just between but also within governments, employers, and unions (Katzenstein, Reference Katzenstein2003, p. 18; Schwartz, Reference Schwartz1994). However, the defining feature of corporatism is not the absence of interests and power, but a hybrid style of bargaining that is neither pure power nor pure persuasion (Mansbridge, Reference Mansbridge1992). In fact, the ‘shift from distributional to supply side issues’ (Thelen, Reference Thelen2014, p. 65) involved making deals –but these deals were negotiated in a collaborative mindset where actors knew that they could and had to cooperate with one another. This forces actors to seek common ground, and common ground is best found where positive‐sum, collective gains can be realized.

Danish social partners, for example, reached a compromise that involved a ‘trade‐off in which organized labour conceded cuts in the duration of unemployment support and stricter eligibility rules in return for the government's commitment to skill formation – institutionalizing a “right and obligation” to training’ (Thelen, Reference Thelen2014, p. 146). In other words, trade unions and Social Democrats agreed to liberalizing reforms ‘in return for large investments in active labour market training programs. Without this compensation mechanism, the reform would not have been possible’ (Lindvall, Reference Lindvall2017, p. 27). Corporatism thus made compromise necessary, but this compromise took an investive, future‐oriented form, with both parties having the time horizon and trust to appreciate its benefits.

In addition to confirming my argument on corporatism, my findings also show that higher cyclically adjusted budget deficits are associated with lower investment spending. The existence of a hard debt rule might also have a negative effect on investments but is not significant in most model specifications. Adverse economic conditions thus make it harder for governments to invest in the digital future. This is in line with the recent literature which finds a detrimental effect of austerity on investment spending (Bremer et al., Reference Bremer, Carlo and Wansleben2021; Breunig & Busemeyer, Reference Breunig and Busemeyer2012; Jacques, Reference Jacques2021; Ronchi, Reference Ronchi2018; Streeck & Mertens, Reference Streeck and Mertens2011). I also find that unemployment has a positive (within) effect on investment spending. This might indicate that rising unemployment levels might make policymakers more inclined to invest in knowledge‐based capital (controlling for deficits) – this is supported by the fact that the effect of unemployment on investment spending is only significant for education and ALMP (see online Appendix B4). Conversely, EU membership seems to increase R&D investments but not education or ALMP investments.

As already indicated and as online Appendix B4 further demonstrates, my main findings are robust to different model specifications.Footnote 5 They hold whether or not I include a lagged dependent variable, include GDP per capita as a control (which I did not do because of potential multicollinearity issues; see online Appendix B31), use different specifications of the dependent variable, use a different measure of the partisan variable, use different and more ‘conservative’ selections of time‐series and/or cross‐sectional units, among other things. Results also largely hold when I use only education spending or only R&D spending for my dependent variable, although there is some heterogeneity across different categories of knowledge investments, which warrants further research (see also Jacques, Reference Jacques2021) and Kraft (Reference Kraft2017) on differences between long‐term investment policies with more or less immediate, concrete, and concentrated benefits).

Conclusion

Knowledge‐based capital – be it in the form of individually held human capital or collectively held innovational capital – is often underprovided by private actors due to various kinds of market failures. Not all governments, however, are equally willing or capable of stepping in and compensating for the lack of private investments due to cross‐sectional and intertemporal trade‐offs. Against this background, this paper has addressed the question of why some governments invest more in knowledge‐based capital than others.

I have argued that in order to explain this variation, we need to take corporatism seriously. Corporatist institutions necessitate and facilitate negotiations between winners and losers of change, thus, over time, nourishing a more collaborative style of policy making. This helps countries avoid the snares of future‐oriented policy making and unlock the ‘collective gain’ (Hicks & Kenworthy, Reference Hicks and Kenworthy1998) contained in investment policies. I find strong support for the claim that corporatism, rather than being an obstacle to adaptation and change, can be harnessed for the ‘construction of new supply‐side resources’ (Ornston, Reference Ornston2013, p. 710).

This is consistent with recent findings that political trust is associated with higher support for future‐oriented social investment policies and that countries with higher levels of trust also have higher levels of social investments (Garritzmann et al., Reference Garritzmann, Neimanns and Busemeyer2021). Future research could look at how corporatism and trust co‐produce future‐oriented policies as corporatist arrangements can both create mutual trust but trust can also grease the wheels of or sustain corporatism. I also find that austerity has a negative effect on investment spending, while the partisan composition of government does not seem to have an effect (anymore) – although this might be different at the local level or under specific conditions (Bremer et al., Reference Bremer, Carlo and Wansleben2021).

In addition to its theoretical and empirical contributions to the importance of corporatism for long‐term policy making, the paper also makes a methodological contribution. Taking up and combining arguments by Bell and Jones (Reference Bell and Jones2015) and Garritzmann and Seng (Reference Garritzmann and Seng2020), the paper demonstrates the potential of using within‐between mixed‐effects models for time‐series‐cross‐sectional data. Not only do they allow for more accurate modelling of the nested structure of many comparative politics datasets. They also allow for modelling the between (and not just the within effects) of variables, the influence of time‐invariant or cluster‐level variables, and the heterogeneity of effects across higher level entities. They thus provide a viable alternative to standard fixed effects models with annual observations (Bell & Jones, Reference Bell and Jones2015; Garritzmann & Seng, Reference Garritzmann and Seng2020).

Future research should address some of the shortcomings of this paper. First, the paper remains somewhat agnostic about how exactly corporatist institutions are translated into political outcomes (cf. Finnegan, Reference Finnegan2022). While theory, quantitative and qualitative evidence from this and other studies provide first insights, it remains somewhat exactly unclear how a more collaborative style of policy making emerges from corporatist practices and how a sense of common ownership of policy problems manifests itself ‘on the ground’. In‐depth case studies are needed to illuminate these processes as well as differences among corporatist countries.

Second, the paper does not pay sufficient attention to how variables that change over time interact with country‐specific characteristics that are slow‐changing or even time‐invariant. Future studies should therefore look more systematically at heterogeneity in the effects of such transformations across countries and at the country‐level characteristics that cause this heterogeneity. Moreover, future studies should look more closely at heterogeneous effects for different types of investments, including but not limited to differences between individually and collectively held knowledge‐based capital.

Given the pressing realities of climate change, pandemic risks, and digitalization, policy making for the long term becomes ever more important. This study has shown how corporatist institutions –and the compensation and collaboration they necessitate and facilitate –might help countries better live up to these challenges and invest more in an uncertain future.

Acknowledgements

I would like to thank Dorothee Bohle, Anton Hemerijck, Olivier Jacques, Michael Kemmerling, Toon van Overbeke, Bilyana Petrova, Justin J.W. Powell, Luuk Schmitz, Jasper Simons, Dustin Voss, the participants of the EUI's Political Economy Working and of the SASE panel on long‐term policymaking, and the anonymous reviewers for very helpful and generous feedback on earlier versions of this paper.

Online Appendix

Additional supporting information may be found in the Online Appendix section at the end of the article:

Supplementary Appendix

Reproduction document