1 Introduction

In Durban, South Africa, the textile firm Crossley Carpets provides HIV/AIDS-related health care services to employees and their families.1 The firm produces hotel carpets for big chains such as the Hilton and Marriott. Its factory has an on-site clinic that employs specifically trained nurses and arranges for doctor visitations. It hands out immune boosters to employees who have contracted HIV and consults them on how to avoid the outbreak of AIDS. What is more, the clinic treats the so-called “secondary diseases” of HIV/AIDS such as tuberculosis, organizes sexual education training and awareness-raising campaigns, and distributes condoms and information pamphlets among employees. The firm also runs environmental programs high above the level of what would be legally required if environmental laws and regulations were strictly enforced in Durban. In China’s Zhejiang province, Nike, the large multinational sportswear and apparel brand, demands that its suppliers apply the minimum labor standards of the International Labour Organization (ILO) (Locke et al. Reference Locke, Qin and Brause2007; see Chapter 6 for details). The brand’s workers benefit from relatively well-paying jobs with a regular five-day work week and eight-hour days, where overtime is subject to clear procedures and extra compensation.

These corporations stand out for their responsibility vis-à-vis their workers and the local environment. They particularly stand out in the context of South Africa and China, where the state often lacks the capacity, the competence, and at times also the willingness to set and enforce rules and regulations and to provide vital services. Moreover, these corporations stand out for defying common wisdom. Firms are profit-driven while social and environmental standards are costly. Common expectation would therefore have them behave more like the multinational high-end fashion and luxury goods brand, C.2 Just like the sportswear and apparel company Nike, C has a number of suppliers in Zhejiang province. Among them is CL, a firm making leather products near the city of Tonglu. Unlike the suppliers of Nike, however, CL does not adhere to any standards of corporate social responsibility. CL is a “sweatshop” (see Chapter 6 for details). Production at CL involves chemical leather-treatment processes that expose workers to health-hazards such as fumes and gases. Working hours exceed the legal maximum and overtime is unpaid. Children as young as eight work and live in the factory far from their families, and suffer intimidation and mistreatment. The firm releases untreated chemical effluents into the river behind the factory building. C has a hands-on policy towards its suppliers. “Inspectors” (Héritier et al. Reference Héritier, Müller-Debus and Thauer2009) of C are permanently present at CL, supervising the production process. As most firms with a brand name to protect, C has an official corporate social responsibility policy. In it, C demands from its suppliers to meet minimum labor, safety, and health standards, and to protect the environment. The conditions at CL violate this policy in every way. Yet the inspectors of C at CL take no action. As long as CL meets C’s price and quality demands, they are satisfied and there is nothing to report.

The central question in this book is: why do some firms care about the wellbeing of their workers and the natural environment while others remain indifferent and are even accomplices of social and environmental exploitation? This book addresses this question by laying out a new transaction cost theory-based perspective on corporate social responsibility suggesting that internal drivers are important for our understanding of firm behavior in relation to social and environmental standards. The concept of corporate social responsibility is understood as companies caring for the wellbeing of their workers, for the natural environment, or for society in general by adhering to international standards.

What does this book mean by internal drivers? Internal – or intra-organizational – drivers are asset-specific investments within a firm. For example, when a company invests in employee skills which are otherwise hard to come by on the labor market, these skills are internal asset-specific investments. The firm is then motivated to provide social and health-related services to its employees in order to maintain their good health, thus enabling them to continue working. In South Africa, for instance, HIV/AIDS is heavily affecting the productivity of firms. Those companies that have made investments in rare skills run strong HIV/AIDS workplace programs in order to ensure they can reap the benefits of a workforce capable of fulfilling highly specific tasks. The textile firm Crossley Carpets is such a business, having invested in engineering skills specific to the processes and needs of its production. The Human Resources Director of Crossley Carpets explains: “the skills that we require here, most of them cannot be found or recruited from anywhere because we use specialized machines.” Hence, “the difficulty with respect to a high prevalence rate of HIV/AIDS is that you will be losing some very good, experienced workers that have attained these unique skills. The HIV/AIDS program is one way of trying to retain these skills.”3

This book makes four asset specificity-based arguments for internal drivers, which serve to explain four causal relationships:

(1) between a firm’s investments in rare skills – and labor-related standards and workplace programs, as in the case of Crossley Carpets. The argument in relation to the first internal driver is that asset-specific investments in unique skills motivate firms to adopt high social and labor standards (hypothesis 1);

(2) between long pay-off times of investments in production sites and technology – and environmental standards. The argument in relation to the second internal driver is that asset-specific investments in plant sites incline firms to adopt strict environmental standards (hypothesis 2);

(3) between asset-specific investments that originate from a highly regulating “home” country and are made in production sites located in a weakly regulating “host” country – and the transfer of high environmental standards from “home” to “host” country operations. The argument in relation to the third internal driver is that asset-specific investments originating from a highly regulating country cause a transfer of high standards to operations in a weakly regulating country (hypothesis 3);

(4) between dependency on brand image – and corporate social responsibility. The argument in relation to the fourth internal driver is that asset-specific investments in marketing result in a general concern for corporate social responsibility (hypothesis 4).

Intra-organizational dynamics of business social conduct have so far not been studied extensively.4 Much of the literature concentrates on external drivers of corporate social responsibility: it is the influx of foreign direct investment originating from a home country with high levels of self-regulation (Greenhill et al. Reference Greenhill, Mosley and Prakash2010; Prakash and Potoski Reference Prakash and Potoski2007; Zeng and Eastin Reference Zeng and Eastin2007) and exports to a highly regulating country, which triggers the diffusion of high standards among firms in low-regulating countries (Greenhill et al. Reference Greenhill, Mosley and Prakash2009). This so-called “California effect” (Vogel Reference Vogel1995) can also be unleashed by firms operating on high voluntary standards that lobby governments to strengthen regulation in order to keep foreign competitors operating on lower standards out of the market (Börzel et al. Reference Börzel, Héritier, Kranz, Thauer and Risse2011). Other studies point to the importance of pressure from consumers (Auld et al. Reference Auld, Bernstein and Cashore2008; Epstein Reference Epstein2008; Smith Reference Smith, Crane, Abagail, Matten, Moon and Siegel2008), NGOs (Barry et al. Reference Barry, Clay and Flynn2012; Hendry Reference Hendry2006; Schepers Reference Schepers2006), associations (Cutler et al. Reference Cutler, Haufler and Porter1999; Hall and Bierstecker Reference Hall and Bierstecker2002; Ronit and Schneider Reference Ronit and Schneider2000), and the reputation which standards provide (Abbott and Snidal Reference Abbott, Snidal, Mattli and Woods2009; Prakash and Potoski Reference Prakash and Potoski2006).

These externally oriented explanations have significantly enhanced our understanding of business behavior in relation to regulatory standards under conditions of economic globalization. Until recently, firms investing in overseas markets were considered to do so exclusively for the end of profiting from “pollution havens” and generally lax standards (Collingsworth et al. Reference Collinsworth, Goold and Harvey1994; Mani and Wheeler Reference Mani and Wheeler1998; Xing and Kolstad Reference Xing and Kolstad2002). They were thus presumed to drive states into a regulatory “race to the bottom” (Bohle Reference Bohle, Van Apeldoorn, Drahokoupil and Horn2008; Chan Reference Chan2003; Singh and Zammit Reference Singh and Zammit2004): competitive downsizing of regulation or “regulatory freeze” (Madsen Reference Madsen2009: 1298) with the intent to create comparative cost advantages. External-driver analyses showed that business does not always and does not necessarily play such a destructive role in relation to the establishment of regulatory standards. On account of external drivers, firms voluntarily adhere to high international social and environmental standards in offshore production locations (Flohr et al. Reference Flohr, Rieth, Schwindenhammer and Wolf2010; Mol Reference Mol2001; Vogel and Kagan Reference Vogel and Kagan2004), and sometimes even drive a regulatory “race to the top” in emerging markets – competitive upgrading of regulation or convergence of standards on the highest level (Blanton and Blanton Reference Blanton and Blanton2009; Börzel and Thauer Reference Börzel and Thauer2013; Prakash and Potoski Reference Prakash and Potoski2006).

However, external driver-oriented analyses have also limited our perspective, as they assume – not unlike the “race to the bottom” argument – that firms’ profit-maximization and the establishment of social and environmental standards are generally incompatible. Indeed there are many examples illustrating this assumption. The luxury goods brand C, for instance, may serve as a case in point. As mentioned, C is a firm that ignores social and environmental standards for the sake of saving costs and maximizing profits. In such cases, only strong external pressure – exerted by NGOs, consumers, or states threatening to impose stricter regulation – can possibly bring about corporate social responsibility. This is what external-driver analyses point out. But is this the whole picture?

Crossley Carpets, to mention an example of a firm that feels responsible for its workers and the environment, shows that there is more to corporate social responsibility than external pressure on business. This textile company was not facing any external pressures when it decided to confront the problem of HIV/AIDS. Neither was the firm pushed by consumers, nor forced by government, NGOs, unions, or associations. It decided to fight the disease to protect the rare skills its production depends upon. The perspective of this book, focusing on internal drivers, draws our attention to cases of intrinsic motivation. It suggests that – under the conditions specified – it is intra-organizational economic rationale that determines the choice for corporate social responsibility. This means that, unlike previously assumed, profit-orientation and the establishment of standards are not mutually incompatible. Accordingly, the perspective on internal drivers in this book provides us with a more complete picture of how, why, and when firms engage in corporate social responsibility. It also helps understand the variation in the preferences firms have in this respect: even if external pressure factors (NGO-pressure, consumer demands, private regulation set by associations or other non-state bodies) are either constant or absent, this book argues that we will see variation in the level and type of corporate social responsibility among firms on account of internal drivers.

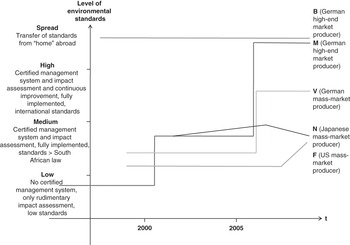

By taking into account varying preferences of firms for corporate social responsibility, this book addresses and resolves some important empirical puzzles. The South African automotive industry and its concern for environmental standards is an example of such a puzzle, as illustrated by Figure 1.1. The five car firms – each represented by one line – are structurally very similar: they originate from Germany, Japan, and the US, where environmental regulations are stricter than in South Africa.5 They are equally embedded in the web of global production and trade that characterizes the automotive industry in general. The production of these five firms in South Africa is also export-oriented to the same extent. In addition, the companies are under similar scrutiny and pressure by transnational, national, and local civil society groups and NGOs. From the perspective of external driver-based analyses of corporate social responsibility one would suspect these firms to operate on similar levels with regard to environmental standards. Yet they show remarkable differences when looked at over time. What explains these differences?

Figure 1.1 Environmental standards in the South African automotive industry over time

Internal drivers are the answer: the level of intra-organizational investments in production sites with long pay-off periods causes the different levels of environmental standards among these firms. Such investments are asset-specific and create a distinct “managerial dilemma” (Miller Reference Miller1992). While they increase production output and, thus, potentially profits, they also bear some significant risks and hazards from the perspective of management. It will be increasingly difficult to control and to incentivize the production unit to make efficient use of resources once it has received the long-term investment. Inefficient use of resources, in turn, may result in a loss of profits, however. In addition, what makes investments with long pay-off periods risky is that profits will to a large extent be dependent on cost factors beyond the control of the firm. Costs for energy, water, waste management, and transportation may rise in the future and challenge the envisioned returns of the investments made.

These are typical concerns in the face of long-term, asset-specific investments. There are ways to deal with them. A manager of a car company in South Africa, for instance, points to the necessity that “we bring the house in order before we make any such long-term investments.”6 By this he means that management in the global headquarters in Stuttgart, Germany, requires the production plant in South Africa to implement strict quality, environmental, and health-related management systems. These systems structure and regulate processes at the production site in South Africa. They allow management in Stuttgart to control and verify that the production unit is following procedures. Such measures, in turn, help to assess and control any uncertainties that may arise from fluctuating costs in the investment’s environment, such as a rise in energy, water, or waste management costs. It is for these reasons of organizational efficiency and control that the car firms in Figure 1.1 show different levels of environmental standards over time. Whenever one of the South African car firms represented in the graph receives long-term investments from global operations head office management, the branch has to demonstrate beforehand that it has increased the strictness and level of standards of its rule-based systems of management. Environmental standards and management systems are at the very core of “bringing the house in order.” They guarantee an efficient use of resources and minimize costs for utilities and services. Hence, the level of environmental standards rises each time before any such investment is made.

The empirical analysis in this book demonstrates that internal drivers solve a whole variety of such puzzles – and in very different contexts. The investigation will take the reader to automotive and textile factories in South Africa and textile manufacturers in China showing how internal drivers bring about corporate social responsibility in these distinct settings. Internal drivers explain labor, social, and health policies of firms. They also explain environmental standards, as in the puzzle of different levels of environmental policies in the South African car industry illustrated by Figure 1.1. While analytically important for our understanding of corporate social responsibility, the argument for internal drivers has some very important implications for policy-making inside and outside of firms as well: according to the arguments in this book, top managers gain rather than lose managerial freedoms when they force their companies to act in a socially responsible way following international standards. Corporate social responsibility is a means by which management can maintain its discretion and solve managerial dilemmas, for example when deciding to make long-term investments in production sites in offshore markets such as South Africa.

The findings in this book are also important for those who drive corporate social responsibility within firms, such as health, human resources, and environmental managers or union activists. Relating corporate social responsibility to economic risk minimization and efficiency concerns moves the issue closer to the center stage of intra-firm decision-making. In this way, demands for higher standards may receive greater support from top management. Beyond the firm, this book may provide external stakeholders, such as NGOs, representatives of development agencies, or government agencies, with a better understanding of what it is that drives firms in terms of corporate social responsibility. What will come to light is that not all firms are the same and thus require a varied approach in dealing with them. Firms that have internal drivers can be reliable allies in the context of joint health, social, or environmental governance projects, public–private partnerships or multi-stakeholder initiatives. However, firms that lack internal drivers will only behave responsibly if pressured to do so by external forces. These considerations should help policy-makers decide whether to pursue collaborative or conflict-oriented strategies vis-à-vis a firm. Finally, investors may wish to take note of the economic rationale for corporate social responsibility laid out in this book. It suggests that long-term investments in a company should be based on a priori proof of high social and environmental standards in relevant areas so as to guarantee that the “house is in order” and risks are minimized.

This book will first lay out in detail a theory of internal drivers. It will then demonstrate the plausibility, applicability, validity, and importance of the argument for internal drivers in different contexts and empirical settings. Chapter 2, A theory of internal drivers of corporate social responsibility, develops the key theoretical argument that intra-organizational asset-specific investments and the managerial dilemmas they give rise to cause corporate social responsibility. This chapter specifies four such dilemmas: the human resources dilemma (internal driver 1); the foreign direct investment dilemma (internal driver 2); the technological specialization dilemma (internal driver 3); and the brand reputation dilemma (internal driver 4). The theoretical analysis in this chapter specifies why and under which conditions they lead to corporate social responsibility. It also discusses the conditions under which the arguments for internal drivers apply and thus defines the limits of the theory suggested here.

Chapter 3, Corporate social responsibility: an inside-view approach and perspective, discusses the conceptual, methodological, and empirical foundations of the subsequent inquiry. It suggests looking inside the firm, but not only for the purpose of investigating internal drivers. The aim here is to observe corporate social responsibility in the behavior and practices of firms. In addition, the chapter lays out the organization of the empirical investigation and the logic according to which this book evaluates the theory of internal drivers, as well as the case selection. Moreover, it describes the institutional, policy, industry, and market contexts of the following case study analysis, which will take the reader to South African car and textile firms, as well as to textile firms in China.

Chapters 4–6 consider the theoretical arguments that have been previously construed empirically. They illustrate and test the arguments for internal drivers. Chapter 4 studies the responses of firms to the HIV/AIDS pandemic in South Africa. Taking the example of nine firms in the auto and textile industries, the analysis shows that there is an emerging diffusion of HIV/AIDS workplace programs among firms in the country – where most of the population affected by the disease does not have access to health care. However, the nine cases also illustrate significant variation: while some firms run sophisticated HIV/AIDS programs, others show such activities only to a lesser extent or do not confront the problems resulting from this disease at all. What is it that may explain these differences? First, the chapter considers external drivers such as NGO pressure and other potential explanations for corporate social responsibility one can find in the literature. It emerges that none of the established factors can sufficiently explain the nine cases. For this, one must resort to internal driver 1, the human resources dilemma, as the subsequent analysis of the cases according to paired comparisons demonstrates. What is more, the investigation shows – through the application of process-tracing methods – that internal driver 1 is not only a valid predictor of HIV/AIDS programs. The analysis shows that the theorized logic and causal mechanisms unraveled by this driver are really the ones that motivate decision-making within the nine firms.

Chapter 5 is an inquiry into environmental policies of firms in South Africa, which are only weakly regulated and rarely enforced by the state. The chapter begins with a detailed discussion of the puzzle of environmental policies of multinational car firms, as illustrated in Figure 1.1. This discussion establishes the relevance of this puzzle and shows that external factors and other explanations for corporate social responsibility highlighted in the literature fail to explain it. The analysis then considers internal drivers 2 and 3, the technological specialization and foreign direct investment dilemmas in relation to the cases of the puzzle in paired comparisons in order to resolve it. Additional within-case, process-tracing analyses show that the theorized causal mechanism relating these internal drivers to environmental policies does not only lead to valid predictions, it is also empirically sound as it reflects the decision-making processes within the featured firms. The chapter then ventures beyond the car industry and investigates South African textile firms in order to establish the general validity of the relation between asset-specific investments in production technology and environmental policies. The analysis shows that this relation is not only valid in the context of the foreign direct investment dilemma – that is, when firms are based on investments originating from a highly regulating country – but also when they originate from a weakly regulating country such as South Africa.

Chapter 6 is an evaluation of internal driver 4, the brand reputation dilemma. It begins by presenting disconfirming evidence: the South African car industry, as well as the luxury fashion goods brand C and its relation to the supplier factory CL in China, offer no recognizable evidence that asset-specific investments in marketing have a bearing on the firms’ engagement in corporate social responsibility. The chapter then turns to a consideration of cases in the South African textile industry where internal driver 4 has the expected effects, thus raising the question of what it is that accounts for this difference. An inductive investigation of cases suggests that internal driver 4 is valid only in combination with strong and recurrent NGO pressure and that, in turn, NGO pressure is only exerting effects on companies if they have internal driver 4. The remainder of the chapter assesses this inductively derived, internal–external driver nexus proposition by looking at the three US American brands Wal-Mart, Nike, and Gap and their sourcing practices in China and South Africa.

Finally, Chapter 7, Conclusion: internal drivers, corporate social responsibility, and the spread of global standards, summarizes the findings of this book and considers their importance in terms of their broader theoretical and practical implications. This discussion asks how far the arguments developed here travel, and relates these findings to debates concerned with the effects of globalization on regulation, the diffusion of policies and standards, comparative capitalism and welfare state policies, and governance in areas of limited statehood.

1 Interview with the Director of Human Resources, the Assistant to the Managing Director, the Chief Engineer, and the Environmental Manager of Crossley Carpets, September 28, 2007, Durban.

2 Firm names are abbreviated to allow for anonymity. Most firm cases in the analyses in this book will be presented in this way.

3 Interview with the Director of Human Resources of Crossley Carpets, September 28, 2007, Durban.

4 Notable exceptions are the works of Prakash (Reference Prakash2000), Gunningham et al. (Reference Gunningham, Kagan and Thornton2003), Howard-Grenville (Reference Howard-Grenville2007), Dashwood (Reference Dashwood2012) and Thauer (Reference Thauer2014). This book seeks to complement and further develop this literature; also in econometric analyses some internal factors have been featured as control variables (for example, Khanna et al. Reference Khanna, Koss, Jones and Ervin2007).

5 Barnes and Black Reference Barnes and Black2003; Black Reference Black2001; Lorentzen Reference Lorentzen2006; Lorentzen and Barnes Reference Lorentzen and Barnes2004; Meyn Reference Meyn2004. See Chapter 5 for a detailed analysis.

6 Interview with the Manager: Quality and Integrated Management Systems of M South Africa, September 23, 2008, East London.