Introduction

Corporate profitability, in today’s business world, is one of the most crucial indicators of companies’ success in the labour market. It also demonstrates the company’s capacity to utilise its resources effectively and attract investments for development and expansion. Unfortunately, Palestinian companies have suffered from weak financial performance and limited profits (Awwad Reference Awwad2024; Badwan and Awad Reference Badwan and Awad2023). Saleh and Islam (Reference Saleh and Islam2020) indicated that the ongoing political unrest and economic challenges facing Palestine negatively affect companies’ performance, and reduce their ability to achieve acceptable profits. In addition, the difficulty of accessing adequate and affordable financing can limit companies’ ability to expand their businesses and increase their profitability (Hill Reference Hill2022). Some Palestinian companies also suffer from weak leadership or lack of transparency and governance, which negatively impacts profitability and increases the risk of corruption (Haifa et al Reference Haifa, Zineb and Ziad2023). Palestinian businesses face specific profitability challenges because of their current operational difficulties. Companies operate under two main sets of obstacles, which stem from economic and political challenges (Oladele Reference Oladele2023). The profitability of Palestinian companies helps boost the local economy by creating new job opportunities (Morrar et al Reference Morrar, Yerousis, Iwidat, Shahwan, Al-Sartawi and Nour2024). Palestinian companies need profitability to maintain their operations and expand their business while supporting economic growth and bettering social and economic outcomes in Palestine.

The Palestine Exchange (PEX) operates as one of the smallest yet most important developing capital markets across the Middle East. The Palestine Capital Market Authority (PCMA) established PEX as a public shareholding company in 1995, and operations commenced in 1997. As of 2025, the exchange lists 48 companies, which are distributed across five main sectors, including banking and financial services, insurance, investment, industry, and services (Arab News 2025). The Palestinian economy benefits from PEX because it serves as a vital platform for promoting economic transparency, corporate governance, and accountability (MAS 2024). The exchange operates with a small number of listed companies, which enables researchers to study disclosure and profitability practices across almost the entire market for CSR disclosure and financial performance analysis. The exchange faces several structural and contextual barriers affecting trading operations and disclosure practices, including weak market liquidity, limited investor participation, and ongoing economic and political instability (PCMA 2024). The exchange has implemented purposeful changes to its reporting systems, which follow international standards in line with global market trends (OICEF 2023).

Although making profits is a fundamental goal for companies, there is a noticeable development in the approaches that companies adopt to achieve this goal. Today, more companies are moving towards adopting corporate social responsibility as a fundamental element of their overall plan to achieve several goals, including the continuity of companies and increasing their long term profits (Kokol Reference Kokol2023; Scamans Reference Scamans2024). Organisations that implement sustainability principles, social justice practices, and environmental practices demonstrate their dedication to protect all stakeholders, including employees, customers, and residents of their local area (Ardiansyah and Alnoor Reference Ardiansyah and Alnoor2024). Research findings show that Palestinian businesses lack strong CSRD implementation (Tarda et al Reference Tarda, Haron, Ramli and Salleh2024a; Alkhaldi Reference Alkhaldi2023; Awwad et al Reference Awwad, Alkababji and Zidan2023). According to Alkhaldi (Reference Alkhaldi2023), the Palestinian business environment faces two main challenges because companies do not interact enough with their stakeholders, including local communities and NGOs, about their social activities. The Palestinian business environment lacks both legal frameworks that enforce complete social practice disclosure and programmes that teach companies about SR disclosure requirements (Tarda et al Reference Tarda, Haron, Ramli and Salleh2024b). Hassan (Reference Hassan2023) indicated that Palestinian companies lack integration of social responsibility strategies into their daily operations. This, in turn, negatively affects their ability to make effective disclosures. The significance of social responsibility disclosure lies in a company’s ability to build sustainable relationships with society and customers and enhance trust in the market. According to Ardiansyah and Alnoor (Reference Ardiansyah and Alnoor2024), transparency about social and environmental principles and the adoption of responsible practices can have a positive impact on a company’s reputation and consumer preferences, which in turn improves and increases sales and profits (Salam and Jahed Reference Salam and Jahed2023).

The focus of this study is summarised in several issues. The first issue is the weakness and volatility of the profitability of Palestinian companies. The second is the weakness of CSRD Palestinian companies. Third, few previous studies have explored the impact of CSRD on profitability and company size. Finally, in general, there are very few studies that examined the company size as a mediator variable between CSRD and profitability, and there is a particular absence of these studies in the Middle East. The current study aims to highlight Palestinian companies’ profitability and CSRD level. Moreover, it aims to examine the correlation between the degree of CSRD and profitability and company size, and between company size and profitability of Palestinian companies. It also attempts to explore whether company size plays a mediating role in this relationship. Accordingly, the central research question guiding this article is: To what extent does the level of CSRD affect the profitability of Palestinian companies? Additionally, does CSRD affect company size? What is the nature of the relationship between company size and profitability? Does company size play a mediating role between CSRD and corporate profitability?

This paper consists of five main sections. The first section covers the literature review and hypothesis development. The second section presents the methodology, while the third section, addresses results and discussion. The fourth section presents practical and theoretical implications, and the fifth section considers limitations and future agenda.

Literature review and hypothesis development

CSRD and profitability

CSR is a company’s positive engagement with social and environmental responsibilities. This includes committing to ethical behaviour, achieving environmental sustainability, and contributing to improving the lives of local communities and wider societies (Kandpal et al Reference Kandpal, Jaswal, Santibanez Gonzalez, Agarwal, Kandpal, Jaswal, Santibanez Gonzalez and Agarwal2024). In addition, CSR is related to initiatives such as supporting social businesses, donating to charitable organisations, and adopting environment-friendly business practices (Sheehy and Farneti Reference Sheehy and Farneti2021).

Corporate disclosure of social contribution is the transparent and continuous disclosure of the efforts and activities undertaken by the company in social responsibility (Rahman et al (Reference Rahman, Tanchangya, Rahman, Aktar and Majumder2024)). The goal of proper disclosure practices is to establish trust with stakeholders and the public while showing the company’s commitment to sustainability and ethical practices. This leads to improved reputation and stronger social bonds with customers and society (Kandpal et al Reference Kandpal, Jaswal, Santibanez Gonzalez, Agarwal, Kandpal, Jaswal, Santibanez Gonzalez and Agarwal2024; Mondal and Sahu Reference Mondal and Sahu2025). The connection between CSRD and profitability exists in different ways across various businesses. Companies that disclose their social activities tend to experience better profitability (Uzliawati et al Reference Uzliawati, Taqi, Muchlish and Kalbuana2023; Li et al Reference Li, Yan and Li2025). However, the immediate assessment of CSR disclosure effects on corporate earnings faces challenges (Ortiz-Martínez et al Reference Ortiz-Martínez, Marín-Hernández and Santos-Jaén2023). The research by Xue et al (Reference Xue, Chang and Xu2023) shows that Chinese firms experience negative profitability effects from disclosure because they need to spend substantial amounts, which decreases their short-term earnings potential. Similarly, research indicates that high CSR initiatives create short-term expenses that do not produce direct financial benefits. Rather, CSR activities require organisations to spend money on workplace improvements and environmental programmes and charitable donations (Naz and Anjum Reference Naz and Anjum2023; Rohmah et al Reference Rohman, Setiawati and Trisnawati2023). These expenses create financial strain on business profits. Research shows that CSRD disclosure does not lead to improved financial results unless financial statements have similar formats, which enable investors to assess disclosed information effectively. Non-financial disclosure becomes most effective for profitability when organisations provide transparent financial reporting Thuy et al (Reference Thuy, Khuong, Canh and Liem2021).

On the other hand, by participating in social responsibility and disclosing it to the public, it is possible to enhance public confidence in the company and its products, boost its reputation, and increase consumer loyalty (Uzliawati et al Reference Uzliawati, Taqi, Muchlish and Kalbuana2023). Wang et al (Reference Wang, Gazi, Sobhani, Al Masud, Islam and Akter2023) showed that companies that adopt social responsibility are attractive to work for, which results in recruiting talent and motivating them to stay. This improves administrative and financial performance and enhances creativity and innovation within the company, contributing to a competitive advantage and economic sustainability. In addition, companies that adopt CSRD may be more attractive to investors interested in sustainability, which may provide long-term, stable investment opportunities. Ultimately, this affects the company’s profitability and progress in future (Rupanya Reference Rupanya2024). Nandini et al (Reference Nandini, Sudharani and Suresh2020) examined the impact of CSRD on the profitability of companies listed on the Bombay Stock Exchange, finding that CSRD contributes to improvement of the company’s image and enhances investor confidence, which positively impacts profitability. Stakeholder theory suggests that businesses have multiple stakeholders, including their workforce, their customers, suppliers, and their local community, each of whom may have environmental concerns (Waheed and Zhang Reference Waheed and Zhang2022). The fulfilment of stakeholder requirements leads to positive corporate reputation development and wider social backing. The approach leads to innovation and quality improvement and trust development, which results in better long-term financial performance (Alshukri et al Reference Alshukri, Seun Ojekemi, Öz and Alzubi2024). The disclosure of socially responsible practices through transparent and consistent methods helps organisations develop trust-based relationships with their stakeholders (Aldalaty and Piranej Reference Aldalaty and Piranej2024). The resultant reputation growth leads to increased customer loyalty and better market performance.

The performance and profitability of a company depend heavily on its earnings per share (EPS) metric. The calculation of EPS helps investors understand how well management performs in generating high returns from their investments (Suwarni et al Reference Suwarni and Susetyo2024). The metric enables investors to assess company performance relative to competitors, evaluate business strategy success and capital allocation effectiveness, and assess management performance in making prudent financial choices (Basvi Reference Basvi2024). The measurement of EPS is vital to drawing in new investors while strengthening their confidence in the company. The company’s ability to generate ongoing profitable results becomes more evident through EPS analysis (Suwarni and Susetyo Reference Suwarni and Susetyo2024). High EPS values result in higher stock prices, which enable companies to obtain new funding opportunities (Ibrahim Reference Ibrahim and Ibrahim2024).

Based on the existing research, this study assumes the following hypothesis:

H1: CSR disclosures have a positive and significant impact on the EPS in Palestinian companies.

CSRD and company size

Implementing and disclosing CSR practices can help reduce risk and increase company sustainability. When companies embrace social responsibility, they may avoid the risks associated with unsustainable operations and thus achieve greater growth and increase their size (Rahman et al Reference Rahman, Tanchangya, Rahman, Aktar and Majumder2024). Effective CSR disclosure can make a company more attractive to investors. Investing in social responsibility can reflect effective management and interest in non-financial issues, which can increase interest in the company by investors and thus increase the size of investments and the organisation’s assets (Uzliawati et al Reference Uzliawati, Taqi, Muchlish and Kalbuana2023; Chen et al Reference Chen, Chen, Liu and Tang2025). Celli et al (Reference Celli, Arduini and Beck2024) indicated that big companies aspire to increase their size and assets by attracting more investments through improving and disclosing social responsibility policies. Moreover, disclosure of social responsibility can strengthen relationships with customers and consumers, building a positive reputation. This enhances companies’ desire to increase the size of their assets and operations and expand their team (Uzliawati et al Reference Uzliawati, Taqi, Muchlish and Kalbuana2023; Nandi et al Reference Nandi, Agarwala and Sahu2025). By complying with CSR principles, obstacles and problems that may negatively affect the assets and financial value of the company can be reduced (Machado Reference Machado2023). Dong et al (Reference Dong, He and Chen2025) examined the impact of CSRD on firms’ export performance within the context of the Chinese economy. The results showed that CSRD plays a catalytic role in maximising economic value and enhances firms’ exports and firm size in the long run.

According to agency theory, shareholders’ inability to effectively monitor management activities results in expenses that negatively affect the company (Petrova and Andersson Reference Petrova and Andersson2024). The core principle of this theory states that management will pursue actions that benefit their own interests even though these actions may harm shareholder value (Petrova and Andersson Reference Petrova and Andersson2024). Social responsibility disclosure practices together with transparency initiatives serve as cost-reduction mechanisms for agency expenses (Hendijani and Zadeh Reference Hendijani Zadeh2021). A company that demonstrates transparency through social responsibility initiatives will gain shareholder and customer trust while minimising the chances of destructive or unethical conduct. The disclosure of social responsibility initiatives helps companies decrease agency costs while building investor and customer trust, which results in market value growth and business expansion (Tarda et al. 2024). In general, investing in and disclosing social responsibility can improve a company’s reputation, attract more investments, reduce risks, and increase efficiency and effectiveness.

These factors result in an increase in the size of the company’s assets. Therefore, this study assumes the following hypothesis:

H2: CSR disclosures have a positive and significant impact on company size in Palestinian companies.

Company size and profitability

Companies’ profitability can be affected by many internal and external factors. Borucka (Reference Borucka2023) indicated that fluctuations in supply and demand affect a company’s ability to achieve profits, as increased demand will lead to increased revenues and profits for companies. Company size is usually closely related to profitability, but this is not always constant. It varies depending on the enterprise’s strategies and the nature of industry (Jokinen Reference Jokinen2023). Zavalii et al (Reference Zavalii, Zhyhlei, Ivashko and Kornatka2025) conducted a study on advertising and marketing firms in Western Europe to analyse the impact of firm size on their financial performance. They indicated that small firms have better financial performance than large firms due to their flexibility and efficiency in managing human and intellectual capital. Bag (Reference Bag2024) indicated that large companies can achieve greater profits than small companies by exploiting the opportunities resulting from their size. Once a company becomes large, it can benefit from economies of scale that reduce production and operating costs, which increases its profitability (Roy and Roy Reference Roy and Roy2024). This allows big businesses to become better competitors as they tend to manage their resources and operations more efficiently (Oehlschläger et al Reference Oehlschläger, Haggenmüller, Herbst and Voeth2023). Big companies often possess greater negotiating power with suppliers and customers. This feature enables them to achieve better terms and greater profits (Oehlschläger et al Reference Oehlschläger, Haggenmüller, Herbst and Voeth2023).

Capital structure theory suggests that larger firms may be able to achieve greater economies of scale, which can ultimately lead to increased profitability (Brusov and Filatova Reference Brusov and Filatova2023). Economies of scale allow larger firms to benefit from reductions in production, marketing, and selling costs due to their larger scale of operations. Consequently, larger firms can be more efficient and generate more profits (Bennur and Malhotra Reference Bennur and Malhotra2023). In contrast, smaller firms may be unable to fully benefit from economies of scale and may have relatively higher fixed costs, which can negatively impact their profitability (Brusov and Filatova Reference Brusov and Filatova2023). Based on this argument, this study assumes the following hypothesis:

H3: Company size has a positive and significant impact on the EPS in Palestinian companies.

The mediating role of company size

As discussed above, the literature has studied the clear connections between CSR disclosure, profitability, and company size. However, it has ignored potential mediating factors that could create a link between CSRD and profitability. According to Safitri and Affandi (Reference Safitri and Affandi2022), price to book value is not directly impacted by the dividend policy or EPS. When company size is used as an intervening variable, it has a significant effect. However, Rosharlianti et al (Reference Rosharlianti, Annisa and Akhsani2020) indicated that company size does not mediate the relationship between profitability and CSR. This study hypothesises that company size, in particular, may act as a partial mediator in the link between CSR disclosure and profitability. Thus, business size may act as a channel for the transmission of the influence of CSRD on profitability. Therefore, CSR disclosure may affect firm profitability through company size.

H4: Company size mediates the relationship between CSR disclosure and EPS in Palestinian companies.

Methodology

Data and sample selection

The study population and sample included 48 companies listed on the Palestine Securities Exchange. This study adopted the census method for sample selection, including all companies listed on the PEX up to the date of the study. This method is appropriate in cases where the population size is relatively small, such as the PEX, as all elements of the population can be examined without the need for probability or non-probability sampling techniques. Furthermore, the inclusion of the entire market enhances the accuracy of the results and their generalisability to the entire study population. These companies are spread across the five primary industries (banking, insurance, services, industry, and investment) and provide relevant data and measurements for each of the suggested variables for the years 2012–2023. The total market value of listed Palestinian companies until 2023 is estimated at $4 to $5 billion. Over a period of 12 years, the annual reports of all companies were available on the PEX database, and all companies were listed throughout the entire period. As a result, this study has a longitudinal time horizon, and the data type is balanced panel data. The present work utilised only secondary data because they were gathered from the annual reports of Palestinian-listed firms, which can be accessed via the companies’ websites or the PEX website.

Proposed conceptual framework

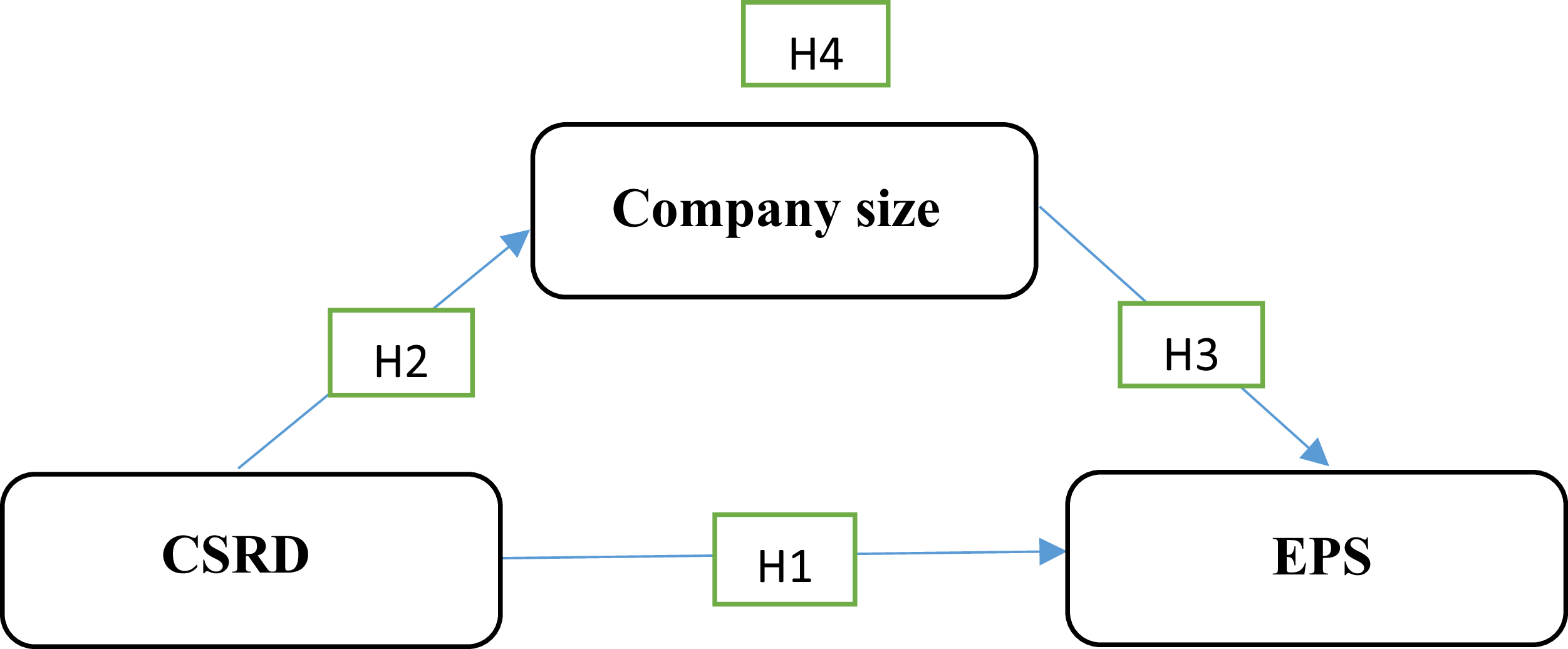

Figure 1 presents the CSRD as an independent variable, EPS as a dependent variable, and company size as a mediator variable, while leverage, type of industry, and firm age are control variables.

Figure 1. Conceptual model.

Variable definitions and measurements

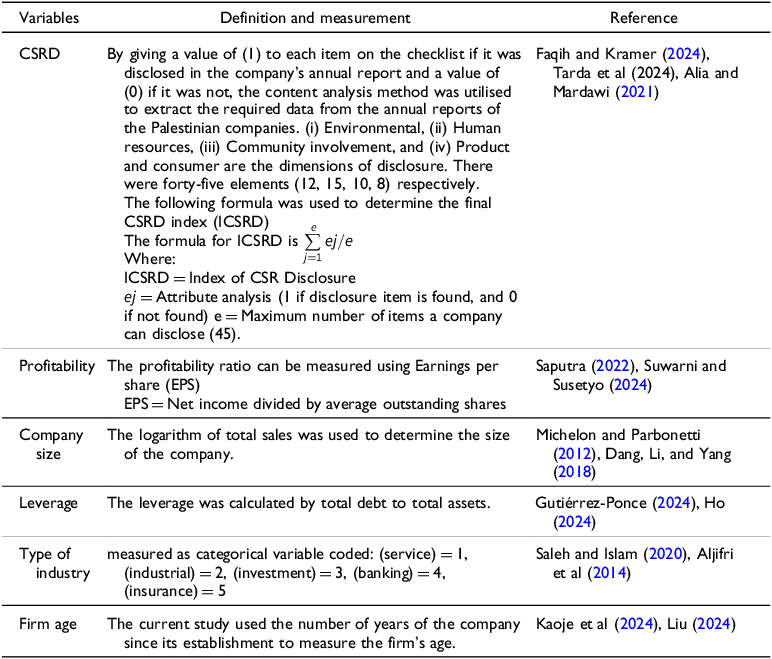

The variables of research and their measurements can be seen in Table 1.

Table 1. Variables and measurements

Data analysis

The study relies on secondary data taken from the financial statements of Palestinian companies. Data analysis and hypothesis testing were done using the statistical software programme STATA. The Ordinary Least Squares (OLS) regression estimation method – fixed and random effect model regression – as well as panel data research were used to investigate the association between the variables using the causal step technique developed by Baron and Kenny (Reference Baron and Kenny1986). The Baron and Kenny model is one of the most straightforward models in terms of analytical logic and steps. It is also suitable for simple and multiple linear regression analysis, making it more compatible with the nature of the data used in this study. Furthermore, it focuses on analysing the causal relationship between variables, which aligns with the research objective of examining the mechanism or intermediate process that influences the relationship between the independent and dependent variables. This contrasts with programmes that rely on structural equation modelling (SEM), such as AMOS or Smart PLS, which focus more on the statistical power of the model as a whole. The Baron and Kenny methodology is also more flexible in terms of sample size. It does not require a large number of participants or strong assumptions about normal distribution or variance equality, unlike some Sobel tests or SEM models. This makes it suitable for studies dealing with relatively small or medium-sized samples, as is the case in this study.

This study examines the mediating effect of firm size on the link between CSRD and EPS. Three conditions should be met to establish that a company’s size plays a mediating role, according to Baron and Kenny (Reference Baron and Kenny1986). First, the independent variable (CSRD) must have a substantial impact on the dependent variable (EPS). Second, it is anticipated that the mediator variable (company size) would be significantly impacted by the independent variable. Third, the mediator variable should be significant, and the absolute value of the regression coefficient for independent variable should decrease when both the independent and mediator variables are included in a model. The type of mediation may be identified in the third phase. Researchers state that the mediator fully or significantly mediates the relationship if the independent variable has a negligible impact on the dependent variable. Researchers claim that the mediator partially mediates the relationship if there is still a significant impact.

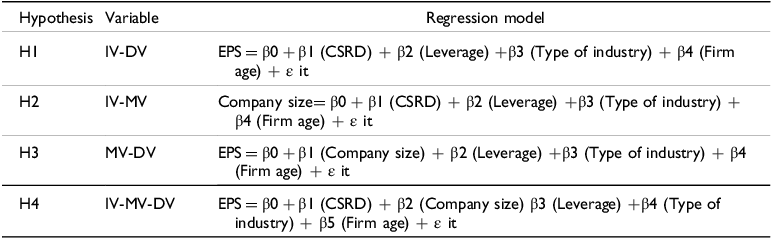

Regression model specification

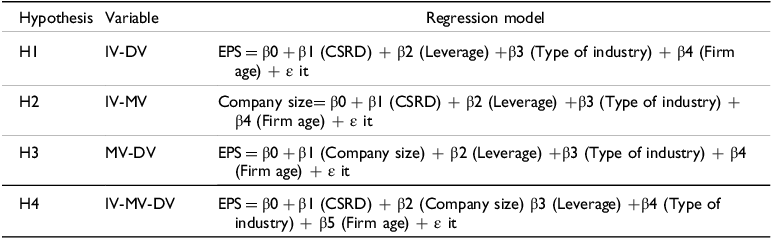

This study tested four models, as shown in Table 2:

Table 2. Regression model specification

Results and discussion

Descriptive statistics

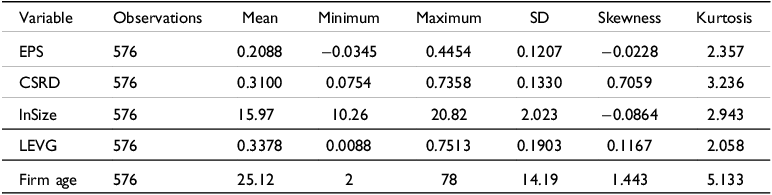

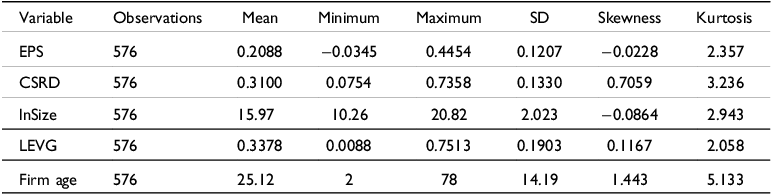

The descriptive statistics of the variables used in this investigation are shown in Table 3. The EPS values have a mean of 0.2088, a standard deviation of 0.1207, a minimum of −0.0345, and a high of 0.4454. This is considered an indicator of the volatility of the EPS during the study period (2012–2023). The EPS is low compared to other emerging countries. For example, (Azmeh and Hamada Reference Azmeh and Hamada2022) indicated that the average EPS in the UAE is 3.5. The descriptive statistics also show that the average CSR disclosure in Palestinian companies is 0.31, with a minimum of 0.0754, a maximum of 0.7358, and a standard deviation of 0.1330. This indicates that the extent of CSR disclosure is still low in comparison to some developed and developing countries. The CSRD rate is 0.98 in UK companies, 0.85 in US companies (Bhatia and Makkar Reference Bhatia and Makkar2020), and 0.50 in Jordan companies (Barakat et al Reference Barakat, López Pérez and Rodríguez Ariza2015). Notably, the degree of CSR disclosure varies greatly throughout Palestinian businesses, which could be due to different social responsibility levels and disclosure culture in Palestinian companies. Company size ranges from a minimum of 10.26 to a maximum of 20.82, with an average of 15.97 and a standard deviation of 2.023. With a minimum of 0.0088, a maximum of 0.7513, and a standard deviation of 0.1903, the average leverage is 0.3378. The age range of the companies is 25.12, with a standard deviation of 14.19 and a minimum of 2 to a maximum of 78. The distribution of the data may be inferred from the skewness and kurtosis values. Kurtosis shows the data distribution’s peakedness, whereas skewness shows the data distribution’s symmetry (Gorondutse and Hilman Reference Gorondutse and Hilman2014). This study’s skewness and kurtosis values range from 2.058 to 5.133 and −0.0864 to 1.443, respectively. The data distribution appears to be normal based on these values.

Table 3. Descriptive statistics

Notes: EPS: earning per share, CSRD: corporate social responsibility disclosure, lnSize: company size, LEVG: leverage, and Firm age: firm age.

Parametric regression assumptions

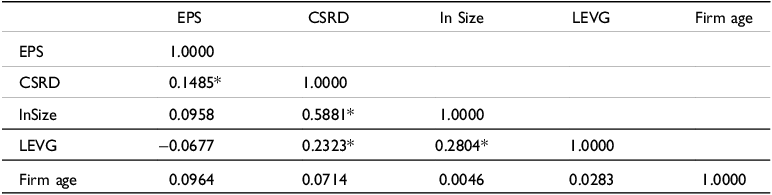

Table 4 presents the outcomes of the relationship between the research variables based on the Pearson correlation matrix. The results show that EPS is positively correlated with CSRD, age, and company size. However, it is negatively correlated with leverage. Age, leverage, and company size are all positively correlated with CSRD.

Table 4. Correlation matrix

Notes: EPS: earning per share, CSRD: corporate social responsibility disclosure, lnSize: company size, LEVG: leverage, and Firm age: firm age. Superscripts*, mean statistically significant relationship at the 0.10.

Leverage and company age also positively correlate with company size. Leverage and company age have a favourable correlation. The findings show that there are no serious multicollinearity issues. To be more precise, the research variables’ intercorrelation ranged from 0.0046 to 0. 5881. To ensure that the results are reliable, heteroscedasticity was further checked using the Breausch–Pagan/Cook–Weisberg test. The findings show that there is no heteroscedasticity in the data

![]() $(chi2\;\left( 1 \right)\; = \;1.87,\;prob\; \gt \;chi2\; = \;0.1499)$

. A simple method, the Wooldridge test, proposed by renowned econometrics scholars Semykina and Wooldridge (Reference Semykina and Wooldridge2010), detects serial correlation in a linear panel data. The P-value, according to the Wooldridge test, is 0.4211. Since the P-value exceeds the significance level, the null hypothesis is accepted. This suggests that autocorrelation is absent from our research model. To mitigate the bias caused by extreme values, the raw values of all the variables were winsorised at a rate of 1% from top to bottom.

$(chi2\;\left( 1 \right)\; = \;1.87,\;prob\; \gt \;chi2\; = \;0.1499)$

. A simple method, the Wooldridge test, proposed by renowned econometrics scholars Semykina and Wooldridge (Reference Semykina and Wooldridge2010), detects serial correlation in a linear panel data. The P-value, according to the Wooldridge test, is 0.4211. Since the P-value exceeds the significance level, the null hypothesis is accepted. This suggests that autocorrelation is absent from our research model. To mitigate the bias caused by extreme values, the raw values of all the variables were winsorised at a rate of 1% from top to bottom.

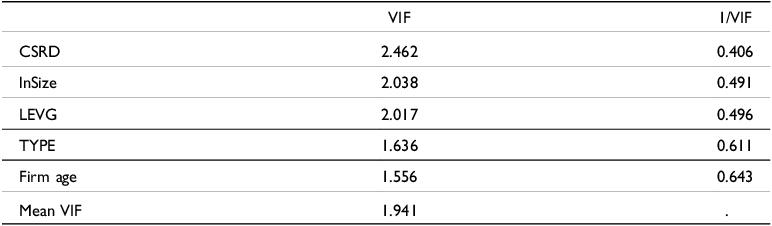

Multicollinearity assessments

Multicollinearity is an essential assessment to ensure that there is no interaction between variables from different levels of effect. In this study, collinearity must be free between the levels of independent variables. Multicollinearity is estimated by a variance inflation factor (VIF) with a margin score of 10 and a tolerance value of more than 0.1, showing that there are no multicollinearity issues (Fajaria and Isnalita Reference Fajaria and Isnalita2018). As seen in Table 5, all scores of VIF are less than 10 and have a tolerance value of more than 0.1; the model data are free of collinearity interaction.

Table 5. Variance inflation factor

Notes: CSRD: corporate social responsibility disclosure, lnSize: firm size, LEVG: leverage, TYPE: type of industry, and Firm age: firm age.

Regression analysis models

In this article, three OLS models were used for panel data regression analysis: the pooled model, the fixed-effects model, and the random-effects model. The Hausman and Breusch-Pagan Lagrangian Multiplier (LM) tests were used to identify the best model.

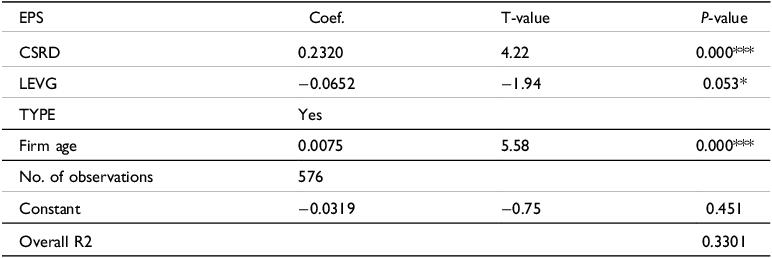

Model 1: association of CSRD and EPS (H1)

According to the Hausman test results, the P-value is 0. 000. The Breusch–Pagan LM test results show a P-value of 0.0398. The fixed-effect model is identified as the most suitable. Table 6 presents the regression result of the direct correlation between CSRD and company profitability (EPS). Table 6 shows that CSRD is positive and statistically significant with EPS at 1%, with a coefficient value of 0.23 and a corresponding t-statistic value of 4.22. H1 is therefore accepted. This result implies that in Palestinian companies registered on PEX, EPS increases with CSRD. This aligns with the stakeholder theory, which suggests that CSRD can contribute to a positive corporate reputation and broader societal support and contribute to innovation, improved quality, and increased trust, which in turn enhances the company’s long-term profitability. This result is consistent with Eberechi (Reference Eberechi2024), in that the CSRD contributes to enhancing the EPS. The control variables' outcomes are given in Table 6. At a substantial level of 10%, the leverage and EPS have a negative and significant relationship. This implies that companies’ profitability would be weakened by a high debt-to-asset ratio. This result is in line with Chauhan (Reference Chauhan2024) and Nwafor (Reference Nwafor2023). However, at the 1% significance level, there is a strong positive relationship between company age and EPS, indicating that the older the company, the higher its EPS. This result is consistent with Setyana and Nurcahyono (Reference Setyana and Nurcahyono2024) and Utami et al (Reference Utami, Elwisam and Digdowiseiso2023). Furthermore, the overall coefficient of determination (

![]() ${R^2}$

= 0.33) indicates that the independent variables in the model (CSRD, LEVG, TYPE, and Firmage) explain approximately 33% of the variation in EPS, meaning the model has moderate explanatory power. This is acceptable in management and accounting research dealing with corporate data, where high

${R^2}$

= 0.33) indicates that the independent variables in the model (CSRD, LEVG, TYPE, and Firmage) explain approximately 33% of the variation in EPS, meaning the model has moderate explanatory power. This is acceptable in management and accounting research dealing with corporate data, where high

![]() ${R^2}$

values are typically difficult to achieve due to the many factors affecting financial performance (Ozili Reference Ozili and Saliya2023).

${R^2}$

values are typically difficult to achieve due to the many factors affecting financial performance (Ozili Reference Ozili and Saliya2023).

Table 6. Results of regression model using fixed-effect estimator

Notes: EPS: earning per share, CSRD: corporate social responsibility disclosure, LEVG: leverage, TYPE: type of industry, and Firm age: firm age. Superscripts *, and *** mean statistically significant relationship at the 0.10 and 0.01 levels, respectively.

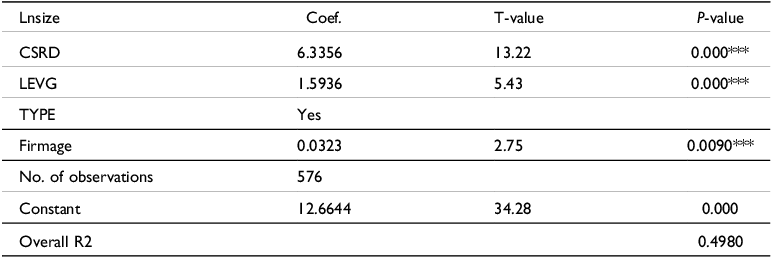

Model 2: association of CSRD and company size (H2)

The Hausman test resulted in a P-value of 0.0276. The Breusch-Pagan LM test yielded a P-value of 0.0411. The fixed-effect model is identified as the most suitable overall. Table 7 presents the regression analysis results for the direct link between CSRD and company size. With a coefficient value of 6.33 and a corresponding t-statistic value of 13.22, Table 6 shows that CSRD is positive and statistically significant with company size at the 1% level. Therefore, H2 is accepted. This result suggests that CSRD enhances the size of Palestinian companies listed on the PEX. This is consistent with the agency hypothesis, which states that CSRD can reduce agency expenses and build trust in the company, enhancing the company’s growth and market value. This conclusion validates the findings of Uzliawati et al (Reference Uzliawati, Taqi, Muchlish and Kalbuana2023) and Celli et al (Reference Celli, Arduini and Beck2024), who found that the CSRD contributes to growing the size of the company. Table 7 shows the results of the control variables. At a 1% level, there is a positive and strong link between firm age and leverage, and company size. This outcome is consistent with Liu (Reference Liu2024) and Gutiérrez-Ponce (Reference Gutiérrez-Ponce2024). The coefficient of determination,

![]() ${R^2}$

= 0.4980, shows that the independent variables explain approximately 49.8% of the variance in firm size. This value is relatively robust in the context of firm studies, indicating that the model has high explanatory power and that the included variables contribute effectively to explaining changes in firm size.

${R^2}$

= 0.4980, shows that the independent variables explain approximately 49.8% of the variance in firm size. This value is relatively robust in the context of firm studies, indicating that the model has high explanatory power and that the included variables contribute effectively to explaining changes in firm size.

Table 7. Results of regression model using fixed-effect estimator

Notes: Size: company size, CSRD: corporate social responsibility disclosure, LEVG: leverage, TYPE: type of industry, and Firm age: firm age. Superscripts *** mean statistically significant relationship at the 0.01 level.

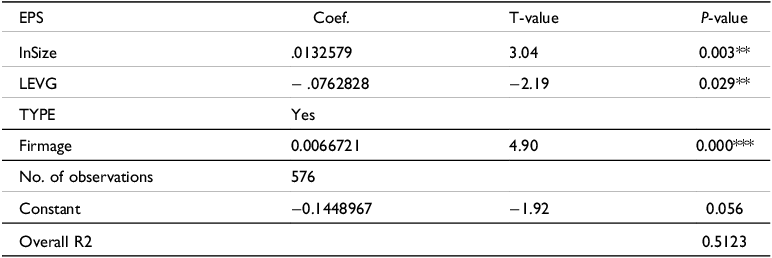

Model 3: association of Firm Size and EPS (H3)

The Hausman test yielded a P-value of 0.0001. The Breusch-Pagan LM test produced a P-value of 0.0339. The fixed-effect model is identified as the most suitable overall. Table 8 shows the findings of the regression analysis that examined the direct association between EPS and company size. Table 8, with a coefficient value of 0.0132 and a matching t-statistic value of 3.04, shows that the firm size has a positive and statistically significant relationship with EPS at the 5% level. Therefore, H3 is accepted. This finding suggests that in Palestinian companies listed on the PEX, EPS grows as company size increases. This is consistent with the capital structure hypothesis, which states that larger companies may be able to attain greater economies of scale, resulting in enhanced profitability. Furthermore, this result is consistent with the findings of Ahmed et al (Reference Ahmed, Sharif, Ali and Hágen2023). Table 8 also presents the outcomes of the control variables. At a significance threshold of 5%, the relationship between leverage and EPS is negative and significant. This suggests that a high debt-to-asset ratio would have a negative impact on EPS. This outcome is consistent with the findings of Chauhan (Reference Chauhan2024) and Nwafor (Reference Nwafor2023). At a significance level of 1%, there is a strong positive relationship between firm age and EPS, indicating that older companies tend to have higher EPS. This finding is consistent with Setyana and Nurcahyono (Reference Setyana and Nurcahyono2024) and Utami et al (Reference Utami, Elwisam and Digdowiseiso2023). The coefficient of

![]() ${R^2}$

= 0.5123 shows that the independent variables explain approximately 51% of the variance in EPS. This value is relatively robust in the context of firm studies, indicating that the model has high explanatory power and that the included variables contribute effectively to explaining changes in EPS.

${R^2}$

= 0.5123 shows that the independent variables explain approximately 51% of the variance in EPS. This value is relatively robust in the context of firm studies, indicating that the model has high explanatory power and that the included variables contribute effectively to explaining changes in EPS.

Table 8. Results of regression model using fixed-effect estimator

Notes: EPS: earning per share, lnsize: company size, LEVG: leverage, TYPE: type of industry, and Firm age: firm age. Superscripts ** and *** mean statistically significant relationship at the 0.05 and 0.01 levels, respectively.

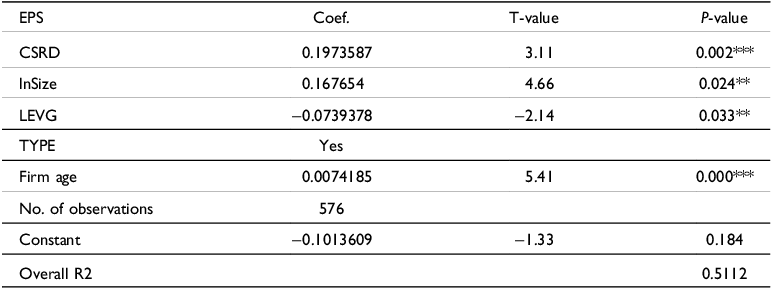

Model 4: a mediation analysis of company size between CSRD and EPS (H4)

The Hausman test reveals a P-value of 0.0000. The Breusch-Pagan LM test yielded a P-value of 0.0372. The fixed-effect model is determined to be the most appropriate overall. Based on Baron and Kenny’s (Reference Baron and Kenny1986) model, the first condition for mediation analysis has been met by looking at model one (Table 6), which shows a significant relationship between CSRD and EPS at 1%, with a coefficient value of 0.23. In addition, the second condition in mediation has been verified by looking at model two (Table 7), which shows a significant relationship between CSRD and company size at 1%, with a coefficient value of 6.33. The third requirement for mediation posits that the relationship between the company size (MV) and the EPS (DV) should remain statistically significant even after including the CSRD (IV) in a regression model. Additionally, the absolute value of the CSRD should be reduced. The results in Table 9 show that the association between firm size and EPS is significant at 5% and has a coefficient of 0.167. In addition, the absolute value (coefficient) of CSRD in Table 9 is 0.197, which is less than the absolute value of CSRD of the direct relationship in Table 6, 0.232. Therefore, the third condition has been met, and it has become clear that firm size has a mediating function in the correlation between CSRD and EPS. Therefore, (H4) is accepted. The mediation is partial because the CSRD in Table 9 – after including the mediator – is significant at 5%. The overall coefficient of determination (

![]() ${R^2}$

= 0.5112) shows that the independent variables, including the mediating variable (firm size), explain about 51.1% of the variance in EPS, a relatively high value indicating that the model has strong explanatory power in the context of firm studies.

${R^2}$

= 0.5112) shows that the independent variables, including the mediating variable (firm size), explain about 51.1% of the variance in EPS, a relatively high value indicating that the model has strong explanatory power in the context of firm studies.

Table 9. Results of regression model using fixed-effect estimator

Notes: EPS: earning per share, CSRD: corporate social responsibility disclosure, ln size: company size, LEVG: leverage, TYPE: type of industry, and Firm age: firm age. Superscripts ** and *** mean statistically significant relationship at the 0.05 and 0.01 levels, respectively.

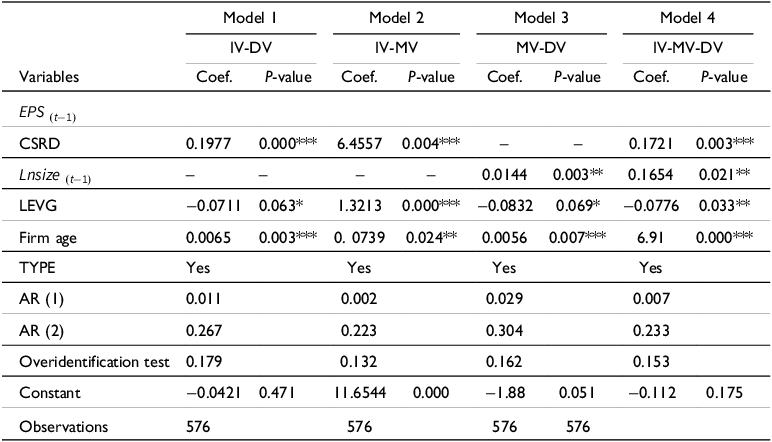

Robust regression analysis

The main analysis employed here was fixed-effects estimation. It successfully eliminates unobserved heterogeneity between the model’s different groups. To determine whether our empirical model contains endogeneity issues from many sources, the rigorous homogeneity of the explanatory variables was also tested. The present work used Durbin-Wu-Hausman assessment, a widely used test for detecting endogeneity in this context. Each explanatory variable was determined per se. The generalised method of moments (GMM) estimator was employed as a second-option method to certify the sensitivity and resilience of the findings previously mentioned. The endogeneity issue can also be resolved with this approach (Blundell and Bond Reference Blundell and Bond1998). This is because the fixed effect somewhat lessens the consequence of endogeneity (Zaid et al Reference Zaid, Wang and Abuhijleh2019). As a result, the 1-step GMM is most frequently used for this purpose.

Table 10 affirms the similarity of the outcomes of the primary analysis and GMM. However, one difference is the significance level (5%) of leverage in the main model (model 3) through fixed-effect, and significance level (1%) of firm age in the main model through fixed-effect (model 2). The two factors had statistical significance of 10% in the robust analysis. Otherwise, the outcomes for other variables were identical.

Table 10. Results of the robust regression using GMM model

Notes: This table presents the findings of multiple regression using the fixed effects model. Lnsize (t-1) and EPS (t-1) are the one-year lagged values of earnings per share. The firm size one year later, LEVG: leverage, CSRD: corporate social responsibility disclosure, Firm age: firm age, and TYPE: industrial type. A statistically significant relationship is shown by the superscripts *, **, and *** at the 0.10, 0.05, and 0.01 levels, respectively.

Practical and theoretical implications

The research outcomes in this article are significant for experts, policymakers, and forthcoming research into CSRD policies and profitability. Most research on CSRD and profitability is conducted in developed nations, whereas limited research has been carried out in regions like the Middle East, especially Palestine. Palestine’s social, economic, and security contexts are distinct from those of other nations. As a result, Palestinian companies might not be able to apply the results of research conducted in other nations or regions. The results of this study represent a fundamental practical contribution to decision-makers within Palestinian companies, and to regulatory and oversight bodies by providing practical evidence of the importance of CSRD. The research establishes that CSRD serves as both a moral and legal requirement, which directly boosts corporate profitability. Palestinian businesses should therefore implement social responsibility practices throughout their operations and marketing activities, rather than viewing them as extra expenses. The study shows that company size acts as a connecting factor between social responsibility disclosure and profitability. This requires organisations to evaluate their financial strength and operational capacity when creating disclosure systems and social responsibility initiatives. The research enables small and medium-sized enterprises to develop disclosure policies that match their available resources instead of attempting to replicate large company models without success. Furthermore, the results provide a strong justification for the PEX and the Capital Market Authority to strengthen voluntary and mandatory disclosure regulations in corporate reports, linking this to investment incentives or sustainability ratings that enhance companies’ attractiveness to investors.

On the theoretical side, this research adds to developing theories linking CSRD, profitability, and firm size. This article enhances agency theory, stakeholder theory, and capital structure theory by determining the effect of CSRD on profitability and firm size, as well as the link between company size and profitability, particularly in a volatile economic context. In addition, the study fills a clear gap in the literature in terms of geographical and institutional context, given the unconventional economic and political conditions in Palestine. Although many previous studies have limited themselves to examining the direct relationship between disclosure and profitability, this study is among the few to examine the mediating role of company size in the Palestinian and Arab contexts. This enriches researchers’ understanding of the relationship and strengthens explanatory models in this field. Further, the study presents a quantitative model supported by actual data from the Palestinian market, while simultaneously taking into account the institutional nature of Palestinian companies, filling a gap in research that often neglects the structural characteristics of the market when generalising findings. In addition, this study fills the gaps related to previous studies. Rosharlianti et al (Reference Rosharlianti, Annisa and Akhsani2020) examined firm size as a mediator between profitability and CSRD, but was limited to 38 Indonesian companies for the period 2017–2018 and for limited sectors. That study did not adequately explain the CSRD measurement and did not use the Global Reporting Initiative (GRI). In contrast, this study used firm size as a mediator variable between CSRD and profitability and included all 48 Palestinian companies listed over a 12-year period and across all sectors. It also relied on the GRI to measure CSRD.

Although this study focuses on companies listed on the PEX, its findings carry significant implications for researchers globally. The demonstrated positive relationship between CSRD, firm size, and profitability, along with the partial mediating role of firm size, provides robust empirical evidence that can be applied to various contexts beyond Palestine. For researchers studying emerging, small, or transitional markets, these results offer a model for examining how firm characteristics influence the effectiveness of CSR initiatives on financial performance. Moreover, the study contributes to the broader theoretical discourse by highlighting the mechanisms through which CSRD translates into tangible financial outcomes. Scholars can use these insights to design cross-country comparative studies, test CSR frameworks in different economic and regulatory environments, and explore the interplay between firm size, CSR practices, and profitability in diverse market settings.

Limitations and future agenda

Based on the findings of the study, it is critical to acknowledge that there are certain limitations to the research and that the findings should be interpreted cautiously. First, the study’s sample is restricted to companies that are registered on the PEX, which limits how broadly the findings can be applied to other countries. Second, the PEX’s different sectors were not distinguished in this analysis. Future research can enrich the current knowledge by distinguishing between different sectors to perform a comparative study and produce more broadly applicable conclusions. Third, this study only examined the mediating role of firm size in the relationship between CSRD and profitability. Research studies should evaluate how board size, educational background of board members, and other organisational elements influence this relationship. Future research needs to study how CSRD affects firm size while also examining how firm size impacts CSRD. Research should continue to study the connection between CSRD, profitability, and company size across various business environments to achieve better understanding of their reciprocal effects. Future research could validate the current results through alternative profitability metrics, including return on assets and return on equity, to achieve a complete evaluation of social responsibility disclosure financial effects.

Acknowledgements

Thanks to Palestine Technical University—Kadoorie for continuous support of scientific research.

Competing interests

No conflict of interest.

Dr. Omar Tarda is an Assistant Professor of Accounting in the Department of Accounting and Auditing at Palestine Technical University – Kadoorie. He holds a PhD in Accounting from Universiti Sains Islam Malaysia, focusing on the impact of corporate governance characteristics on corporate social responsibility disclosure in Palestinian companies. His research interests include corporate social responsibility (CSR) and board characteristics.