1. Introduction

Joint transforms involving quantities associated with stopping times play a crucial role in the development of numerous risk models in actuarial science and financial mathematics. The most common stopping time in actuarial literature is the time until ruin,

![]() $\tau ,$

in a finite or infinite horizon. The ruin problem has been studied by many researchers in the last decades, providing closed-form formulae, for example, for the probability of the ultimate ruin. We refer to Willmot and Woo (Reference Willmot and Woo2017) for a recent review on ruin models.

$\tau ,$

in a finite or infinite horizon. The ruin problem has been studied by many researchers in the last decades, providing closed-form formulae, for example, for the probability of the ultimate ruin. We refer to Willmot and Woo (Reference Willmot and Woo2017) for a recent review on ruin models.

In addition to the probability of ruin, other quantities of interest in ruin theory are usually based on the surplus before ruin,

![]() $U_{\tau -},$

the deficit at ruin,

$U_{\tau -},$

the deficit at ruin,

![]() $-U_{\tau }$

, and the time until ruin,

$-U_{\tau }$

, and the time until ruin,

![]() $\tau$

. One of the most celebrated joint transforms involving these quantities was introduced by Gerber and Shiu (Reference Gerber and Shiu1998). After the publication of their work, a large number of papers appeared in the literature studying the so-called Gerber–Shiu discounted penalty function and its generalizations. The joint density of the pair

$\tau$

. One of the most celebrated joint transforms involving these quantities was introduced by Gerber and Shiu (Reference Gerber and Shiu1998). After the publication of their work, a large number of papers appeared in the literature studying the so-called Gerber–Shiu discounted penalty function and its generalizations. The joint density of the pair

![]() $(U_{\tau -},-U_{\tau })$

was also studied by Dickson (Reference Dickson1992). A simplistic assumption in these models is that the inter-claim times,

$(U_{\tau -},-U_{\tau })$

was also studied by Dickson (Reference Dickson1992). A simplistic assumption in these models is that the inter-claim times,

![]() $T$

, and claims sizes,

$T$

, and claims sizes,

![]() $X$

, are independent. In the last two decades, more realistic models involving the concept of dependence between claim sizes and inter-claim times started to attract the interest of many researchers, especially after the work of Albrecher and Boxma (Reference Albrecher and Boxma2004). There is strong real-world evidence and practical motivation for incorporating dependence (mostly positive) between inter-claim times and claim sizes in insurance risk modeling. In many instances, the magnitude of a claim tends to increase when a long time passes until it is reported, due to the accumulation of damages. For example, a vehicle that has not undergone maintenance for an extended time period may require significantly higher repair costs when eventually serviced, implying a positive dependence structure. Positive dependence also emerges in the context of catastrophic events, where shorter inter-claim times (i.e., high claim frequency after a large-scale event like a flood, earthquake, or hurricane) are usually associated with smaller individual claims (e.g., home insurance claims for minor damage). Conversely, longer waiting times may correspond to larger, isolated claims unrelated to catastrophic events. Furthermore, policyholders may intentionally delay filing a claim until the accumulated cost justifies doing so, reinforcing this dependence pattern. In this context, a large number of publications employ specific bivariate distributions that describe the dependence structure of the pair

$X$

, are independent. In the last two decades, more realistic models involving the concept of dependence between claim sizes and inter-claim times started to attract the interest of many researchers, especially after the work of Albrecher and Boxma (Reference Albrecher and Boxma2004). There is strong real-world evidence and practical motivation for incorporating dependence (mostly positive) between inter-claim times and claim sizes in insurance risk modeling. In many instances, the magnitude of a claim tends to increase when a long time passes until it is reported, due to the accumulation of damages. For example, a vehicle that has not undergone maintenance for an extended time period may require significantly higher repair costs when eventually serviced, implying a positive dependence structure. Positive dependence also emerges in the context of catastrophic events, where shorter inter-claim times (i.e., high claim frequency after a large-scale event like a flood, earthquake, or hurricane) are usually associated with smaller individual claims (e.g., home insurance claims for minor damage). Conversely, longer waiting times may correspond to larger, isolated claims unrelated to catastrophic events. Furthermore, policyholders may intentionally delay filing a claim until the accumulated cost justifies doing so, reinforcing this dependence pattern. In this context, a large number of publications employ specific bivariate distributions that describe the dependence structure of the pair

![]() $(T,X)$

. Boudreault et al. (Reference Boudreault, Cossette, Landriault and Marceau2006) considered the classical compound Poisson risk model, where the conditional distribution of the claim sizes was assumed to be a special mixture of two arbitrary distributions, and derived the Laplace transform (LT) of the Gerber–Shiu function in terms of the Dickson–Hipp operator. Albrecher and Teugels (Reference Albrecher and Teugels2006) considered several dependence structures for

$(T,X)$

. Boudreault et al. (Reference Boudreault, Cossette, Landriault and Marceau2006) considered the classical compound Poisson risk model, where the conditional distribution of the claim sizes was assumed to be a special mixture of two arbitrary distributions, and derived the Laplace transform (LT) of the Gerber–Shiu function in terms of the Dickson–Hipp operator. Albrecher and Teugels (Reference Albrecher and Teugels2006) considered several dependence structures for

![]() $(T,X)$

based on specific copulas and bivariate distributions, obtaining finite and infinite horizon ruin probabilities using Wiener–Hopf factorization. Cossette et al. (Reference Cossette, Marceau and Marri2008) derived a formula for the LT of the Gerber–Shiu discounted penalty function using a generalized FGM copula for

$(T,X)$

based on specific copulas and bivariate distributions, obtaining finite and infinite horizon ruin probabilities using Wiener–Hopf factorization. Cossette et al. (Reference Cossette, Marceau and Marri2008) derived a formula for the LT of the Gerber–Shiu discounted penalty function using a generalized FGM copula for

![]() $(T,X)$

with exponential marginals. Badescu et al. (Reference Badescu, Cheung and Landriault2009) offered explicit expressions for certain Gerber–Shiu discounted penalty functions depending only on the deficit at ruin, when the pair

$(T,X)$

with exponential marginals. Badescu et al. (Reference Badescu, Cheung and Landriault2009) offered explicit expressions for certain Gerber–Shiu discounted penalty functions depending only on the deficit at ruin, when the pair

![]() $(T,X)$

follows a bivariate phase-type distribution. Ambagaspitiya (Reference Ambagaspitiya2009) provided explicit formulae for the ultimate ruin probability using Wiener–Hopf factorization in two specific bivariate gamma distributions for

$(T,X)$

follows a bivariate phase-type distribution. Ambagaspitiya (Reference Ambagaspitiya2009) provided explicit formulae for the ultimate ruin probability using Wiener–Hopf factorization in two specific bivariate gamma distributions for

![]() $(T,X)$

. Zang et al. (Reference Zhang, Yang and Yang2012) considered finite mixtures of bivariate exponentials and derived an explicit expression for the Gerber–Shiu function. Chadjiconstantinidis and Vrontos (Reference Chadjiconstantinidis and Vrontos2014) studied the discounted joint and marginal distribution functions of

$(T,X)$

. Zang et al. (Reference Zhang, Yang and Yang2012) considered finite mixtures of bivariate exponentials and derived an explicit expression for the Gerber–Shiu function. Chadjiconstantinidis and Vrontos (Reference Chadjiconstantinidis and Vrontos2014) studied the discounted joint and marginal distribution functions of

![]() $U_{\tau -}$

and

$U_{\tau -}$

and

![]() $-U_{\tau }$

using the LT of the Gerber–Shiu function when the dependence of

$-U_{\tau }$

using the LT of the Gerber–Shiu function when the dependence of

![]() $(T,X)$

is described by the FGM copula with Erlang and exponential marginals for

$(T,X)$

is described by the FGM copula with Erlang and exponential marginals for

![]() $T$

and

$T$

and

![]() $X$

, respectively. Zhang and Li (Reference Zhang and Li2019) studied the distribution of discounted aggregate claims in a compound renewal risk model when the dependence between

$X$

, respectively. Zhang and Li (Reference Zhang and Li2019) studied the distribution of discounted aggregate claims in a compound renewal risk model when the dependence between

![]() $T$

and

$T$

and

![]() $X$

is modeled using a generalized FGM copula. More recently, Adékambi and Takouda (Reference Adékambi and Takouda2022) extended the work of Chadjiconstantinidis and Vrontos (Reference Chadjiconstantinidis and Vrontos2014) by adding a diffusion term to the surplus process, considering the same dependence structure for

$X$

is modeled using a generalized FGM copula. More recently, Adékambi and Takouda (Reference Adékambi and Takouda2022) extended the work of Chadjiconstantinidis and Vrontos (Reference Chadjiconstantinidis and Vrontos2014) by adding a diffusion term to the surplus process, considering the same dependence structure for

![]() $(T,X)$

. For a surplus process perturbed by diffusion, Li et al. (Reference Li, Sendova and Yang2024) considered a causal dependence structure between the inter-arrival time of the upcoming claim and the preceding claim size. For similar results in ruin theory involving dependence structures between the upcoming inter-claim time and the preceding claim size, see Mandjes and Boxma (Reference Mandjes and Boxma2023). For a brief overview of general bivariate distributions, we refer to Lai and Balakrishnan (Reference Lai and Balakrishnan2009).

$(T,X)$

. For a surplus process perturbed by diffusion, Li et al. (Reference Li, Sendova and Yang2024) considered a causal dependence structure between the inter-arrival time of the upcoming claim and the preceding claim size. For similar results in ruin theory involving dependence structures between the upcoming inter-claim time and the preceding claim size, see Mandjes and Boxma (Reference Mandjes and Boxma2023). For a brief overview of general bivariate distributions, we refer to Lai and Balakrishnan (Reference Lai and Balakrishnan2009).

A fruitful technique to compute quantities associated with the time until ruin is based on an appropriate change of the probability measure using likelihood ratio identities (see, for instance, Asmussen & Albrecher, Reference Asmussen and Albrecher2010). Under this new measure, which is constructed using roots of Lundberg-type equations, several quantities associated with the stopping time until ruin can alternatively be expressed via simpler formulae, for example, depending only on the distribution of the deficit at ruin. Schmidli (Reference Schmidli1995) offered approximations for ruin time probabilities employing a renewal model perturbed by diffusion via a change of measure technique. Schmidli (Reference Schmidli2010) studied the Gerber–Shiu discounted penalty function, assuming independent

![]() $T$

,

$T$

,

![]() $X$

, and managed to express this function in terms of an appropriate change of measure, without the presence of the discounted factor. Boutsikas et al. (Reference Boutsikas, Rakitzis and Antzoulakos2016) considered a Sparre-Andersen renewal risk model, with

$X$

, and managed to express this function in terms of an appropriate change of measure, without the presence of the discounted factor. Boutsikas et al. (Reference Boutsikas, Rakitzis and Antzoulakos2016) considered a Sparre-Andersen renewal risk model, with

![]() $T$

and

$T$

and

![]() $X$

independent and mixed Erlang distributed, and provided joint generating functions (GF) for the number of claims and the value of the surplus until it falls below zero or terminates above an upper safety level. These functions were expressed in terms of the distribution of the overshoot and the undershoot under an appropriately tilted measure. Boutsikas et al. (Reference Boutsikas, Economides and Vaggelatou2024) generalized the previous work incorporating a diffusion term and taking also into account the time and the total claim amount, until the double barrier stopping rule.

$X$

independent and mixed Erlang distributed, and provided joint generating functions (GF) for the number of claims and the value of the surplus until it falls below zero or terminates above an upper safety level. These functions were expressed in terms of the distribution of the overshoot and the undershoot under an appropriately tilted measure. Boutsikas et al. (Reference Boutsikas, Economides and Vaggelatou2024) generalized the previous work incorporating a diffusion term and taking also into account the time and the total claim amount, until the double barrier stopping rule.

Several generalizations of the Gerber–Shiu discounted penalty function have also been proposed in the last two decades. Cheung et al. (Reference Cheung, Landriault, Willmot and Woo2010) analyzed the Gerber–Shiu function taking into the account the surplus immediately prior to ruin, the deficit at ruin, the minimum surplus before ruin, and the surplus immediately after the second to last claim before ruin, under the presence of dependence between

![]() $T$

and

$T$

and

![]() $X$

. Frostig et al. (Reference Frostig, Pitts and Politis2012) studied an extension of the Gerber–Shiu function containing the number of claims until ruin, when the inter-claim times are Erlang distributed, independent of the claim sizes. Cossette et al. (Reference Cossette, Larrivée-Hardy, Marceau and Trufin2015) studied a generalization of the Gerber–Shiu function, including the minimum of the surplus before ruin, by employing the change of measure technique, and considered several dependent structures where the importance sampling method can be applied. For a review of Gerber–Shiu functions along with their generalizations, we refer to the recent review work of He et al. (Reference He, Kawai, Shimizu and Yamazaki2023). Moreover, many articles in the literature investigate the distribution of the number of claims until ruin, under the assumption of independence between

$X$

. Frostig et al. (Reference Frostig, Pitts and Politis2012) studied an extension of the Gerber–Shiu function containing the number of claims until ruin, when the inter-claim times are Erlang distributed, independent of the claim sizes. Cossette et al. (Reference Cossette, Larrivée-Hardy, Marceau and Trufin2015) studied a generalization of the Gerber–Shiu function, including the minimum of the surplus before ruin, by employing the change of measure technique, and considered several dependent structures where the importance sampling method can be applied. For a review of Gerber–Shiu functions along with their generalizations, we refer to the recent review work of He et al. (Reference He, Kawai, Shimizu and Yamazaki2023). Moreover, many articles in the literature investigate the distribution of the number of claims until ruin, under the assumption of independence between

![]() $(T,X)$

; see for example, Landriault et al. (Reference Landriault, Shi and Willmot2011), Frostig et al. (Reference Frostig, Pitts and Politis2012), Dickson (Reference Dickson2012), Zhao and Zhang (Reference Zhao and Zhang2013), Boutsikas et al. (Reference Boutsikas, Rakitzis and Antzoulakos2016), and Dickson (Reference Dickson2019). To the best of our knowledge, there are no published results yet for the distribution of the number of claims until ruin in the case of dependence between

$(T,X)$

; see for example, Landriault et al. (Reference Landriault, Shi and Willmot2011), Frostig et al. (Reference Frostig, Pitts and Politis2012), Dickson (Reference Dickson2012), Zhao and Zhang (Reference Zhao and Zhang2013), Boutsikas et al. (Reference Boutsikas, Rakitzis and Antzoulakos2016), and Dickson (Reference Dickson2019). To the best of our knowledge, there are no published results yet for the distribution of the number of claims until ruin in the case of dependence between

![]() $T$

,

$T$

,

![]() $X$

.

$X$

.

The aim of this paper is to propose a generalization of the Gerber–Shiu function that incorporates the number of claims until ruin in the case of dependence between the claim sizes and the inter-claim times. Using an appropriate change of measure technique, we present in Section 2 a general connection between already studied Gerber–Shiu functions and the proposed generalized one (cf. Corollary 2). We also offer a result connecting a special form of the Gerber–Shiu function with only the distribution of the deficit at ruin under the new measure (cf. Proposition 3). We further employ our general results to investigate two cases of bivariate distributions where we were able to extract closed-form formulae for the quantities of interest. More specifically, in Section 3, we employ a Downton–Moran bivariate exponential distribution to describe the dependence structure of our model, and we offer explicit formulae for some cases of the Gerber–Shiu functions that include the number of claims until ruin (cf. Proposition 6). In addition, we derive a closed formula for the defective discounted joint density of the number of claims until ruin, the deficit at ruin, and the time until ruin (cf. Proposition 9). The same is achieved for the joint density of the number of claims and the deficit at ruin (cf. Corollary 10). In Section 4, we generalize the results of the previous section by assuming that the inter-claim times and the claim sizes follow a Kibble–Moran bivariate Erlang distribution (cf. Proposition 14, Corollary 16). Finally, in the last section, we offer numerical examples in order to illustrate our main results.

2. The dependent renewal risk model

In a probability space

![]() $(\Omega ,\mathcal{F},\mathbb{P})$

, we consider the surplus process of the form

$(\Omega ,\mathcal{F},\mathbb{P})$

, we consider the surplus process of the form

\begin{equation} U_{t}\,:\!=\, u+ct-\sum _{j=1}^{N_{t}}X_{j},\,\,\,t\geq 0, \end{equation}

\begin{equation} U_{t}\,:\!=\, u+ct-\sum _{j=1}^{N_{t}}X_{j},\,\,\,t\geq 0, \end{equation}

where

![]() $u\geq 0$

denotes the initial surplus,

$u\geq 0$

denotes the initial surplus,

![]() $N=(N_{t},t\geq 0)$

is a renewal process,

$N=(N_{t},t\geq 0)$

is a renewal process,

![]() $X_{j},j=1,2,\ldots$

denote the claim sizes and

$X_{j},j=1,2,\ldots$

denote the claim sizes and

![]() $c\gt 0$

is the constant premium rate. We also denote by

$c\gt 0$

is the constant premium rate. We also denote by

![]() $T_{1},T_{2},\ldots$

the inter-claim times of the process

$T_{1},T_{2},\ldots$

the inter-claim times of the process

![]() $N,$

and by

$N,$

and by

![]() $Y_{k}\,:\!=\,\sum _{i=1}^{k}T_{i}$

the arrival time of the

$Y_{k}\,:\!=\,\sum _{i=1}^{k}T_{i}$

the arrival time of the

![]() $k$

-th claim. The non-negative random variables (RVs)

$k$

-th claim. The non-negative random variables (RVs)

![]() $T_{i}$

and

$T_{i}$

and

![]() $X_{i}$

may be dependent, while the pairs

$X_{i}$

may be dependent, while the pairs

![]() $(T_{1},X_{1})$

,

$(T_{1},X_{1})$

,

![]() $(T_{2},X_{2})$

,… are independent and identically distributed (IID) with common joint cumulative distribution function

$(T_{2},X_{2})$

,… are independent and identically distributed (IID) with common joint cumulative distribution function

![]() $F_{T,X}$

. Since the ruin event occurs only at claim arrival times

$F_{T,X}$

. Since the ruin event occurs only at claim arrival times

![]() $Y_{1},Y_{2},\ldots$

, the process

$Y_{1},Y_{2},\ldots$

, the process

![]() $(U_{t},t\geq 0)$

can be considered only at claim arrival times, and thus, for our exposition, it suffices to study the discrete time process

$(U_{t},t\geq 0)$

can be considered only at claim arrival times, and thus, for our exposition, it suffices to study the discrete time process

![]() $S=(S_{k},k=1,2,\ldots )$

, with

$S=(S_{k},k=1,2,\ldots )$

, with

\begin{equation} S_{k}\,:\!=\, U_{Y_{k}}=u+cY_{k}-\sum _{j=1}^{k}X_{j}=u+\sum _{j=1}^{k}\left (cT_{j}-X_{j}\right )=u+\sum _{j=1}^{k}Z_{j} \end{equation}

\begin{equation} S_{k}\,:\!=\, U_{Y_{k}}=u+cY_{k}-\sum _{j=1}^{k}X_{j}=u+\sum _{j=1}^{k}\left (cT_{j}-X_{j}\right )=u+\sum _{j=1}^{k}Z_{j} \end{equation}

where

![]() $Z_{j}\,:\!=\, cT_{j}-X_{j}$

, for every

$Z_{j}\,:\!=\, cT_{j}-X_{j}$

, for every

![]() $j=1,2,\ldots$

. Let

$j=1,2,\ldots$

. Let

![]() $\nu \,:\!=\,\inf \left \{ k\,:\,S_{k}\lt 0\right \}$

be the stopping time that counts the number of claims until the process

$\nu \,:\!=\,\inf \left \{ k\,:\,S_{k}\lt 0\right \}$

be the stopping time that counts the number of claims until the process

![]() $S$

drops below zero (ultimate ruin event) and

$S$

drops below zero (ultimate ruin event) and

![]() $\tau \,:\!=\, Y_{\nu }$

the total time until ruin. Obviously,

$\tau \,:\!=\, Y_{\nu }$

the total time until ruin. Obviously,

![]() $S_{\nu }=U_{\tau },\nu =N_{\tau }$

. Focusing on the process

$S_{\nu }=U_{\tau },\nu =N_{\tau }$

. Focusing on the process

![]() $S$

, we define a new measure on the measurable space

$S$

, we define a new measure on the measurable space

![]() $(\Omega ,\mathcal{F})$

, to be denoted by

$(\Omega ,\mathcal{F})$

, to be denoted by

![]() $\mathbb{P}_{h,\delta }$

, via the following martingale likelihood process

$\mathbb{P}_{h,\delta }$

, via the following martingale likelihood process

\begin{equation*} L_{k}\,:\!=\,\frac {e^{\sum _{i=1}^{k}\left (\left (ch-\delta \right )T_{i}-hX_{i}\right )}}{\mathbb{M}_{T,X}\left (ch-\delta ,-h\right )^{k}},\;\;\;k=1,2,\ldots \end{equation*}

\begin{equation*} L_{k}\,:\!=\,\frac {e^{\sum _{i=1}^{k}\left (\left (ch-\delta \right )T_{i}-hX_{i}\right )}}{\mathbb{M}_{T,X}\left (ch-\delta ,-h\right )^{k}},\;\;\;k=1,2,\ldots \end{equation*}

for two real parameters

![]() $\delta ,h$

such that

$\delta ,h$

such that

![]() $\mathbb{M}_{T,X}\left (ch-\delta ,-h\right )\lt \infty$

, where

$\mathbb{M}_{T,X}\left (ch-\delta ,-h\right )\lt \infty$

, where

![]() $\mathbb{M}_{T,X}\left (t,x\right )\,:\!=\,\mathbb{E}(e^{tT_{i}+xX_{i}})$

is the joint moment generating function (MGF) of

$\mathbb{M}_{T,X}\left (t,x\right )\,:\!=\,\mathbb{E}(e^{tT_{i}+xX_{i}})$

is the joint moment generating function (MGF) of

![]() $\left (T,X\right ).$

In particular, for every

$\left (T,X\right ).$

In particular, for every

![]() $A\in \mathcal{F}_{n}\,:\!=\,\sigma \left (\left \{ \left (T_{i},X_{i}\right ),i\leq n\right \} \right )\subseteq \mathcal{F}$

, we set

$A\in \mathcal{F}_{n}\,:\!=\,\sigma \left (\left \{ \left (T_{i},X_{i}\right ),i\leq n\right \} \right )\subseteq \mathcal{F}$

, we set

The measures

![]() $\mathbb{P}$

and

$\mathbb{P}$

and

![]() $\mathbb{P}_{h,\delta }$

are equivalent, and under

$\mathbb{P}_{h,\delta }$

are equivalent, and under

![]() $\mathbb{P}_{h,\delta }$

, the MGF of

$\mathbb{P}_{h,\delta }$

, the MGF of

![]() $Z_{1}$

is given by

$Z_{1}$

is given by

\begin{equation} \mathbb{E}_{h,\delta }\big(e^{tZ_{1}}\big)=\mathbb{E}\left (e^{t\left (cT_{1}-X_{1}\right )}\frac {e^{\left (\left (ch-\delta \right )T_{1}-hX_{1}\right )}}{\mathbb{M}_{T,X}\left (ch-\delta ,-h\right )}\right )=\frac{\mathbb{M}_{T,X}(c(t+h)-\delta ,-(t+h))}{\mathbb{M}_{T,X}(ch-\delta ,-h)}. \end{equation}

\begin{equation} \mathbb{E}_{h,\delta }\big(e^{tZ_{1}}\big)=\mathbb{E}\left (e^{t\left (cT_{1}-X_{1}\right )}\frac {e^{\left (\left (ch-\delta \right )T_{1}-hX_{1}\right )}}{\mathbb{M}_{T,X}\left (ch-\delta ,-h\right )}\right )=\frac{\mathbb{M}_{T,X}(c(t+h)-\delta ,-(t+h))}{\mathbb{M}_{T,X}(ch-\delta ,-h)}. \end{equation}

It is worth stressing that this new measure can be considered as an exponential tilting measure affecting the joint distribution of

![]() $T_{i},X_{i}$

(i.e., it is a bivariate Esscher transform), while it is easy to verify that the pairs

$T_{i},X_{i}$

(i.e., it is a bivariate Esscher transform), while it is easy to verify that the pairs

![]() $(T_{1},X_{1})$

,

$(T_{1},X_{1})$

,

![]() $(T_{2},X_{2})$

, … remain IID under

$(T_{2},X_{2})$

, … remain IID under

![]() $\mathbb{P}_{h,\delta }$

. A fundamental result of this work is the following theorem, where, by exploiting this change of measure technique, we offer an identity that can be used to generalize existing GS functions. An RV

$\mathbb{P}_{h,\delta }$

. A fundamental result of this work is the following theorem, where, by exploiting this change of measure technique, we offer an identity that can be used to generalize existing GS functions. An RV

![]() $W$

will be called

$W$

will be called

![]() $\mathcal{F}_{\nu }$

-measurable if, for every

$\mathcal{F}_{\nu }$

-measurable if, for every

![]() $k\in \mathbb{N},$

the RV

$k\in \mathbb{N},$

the RV

![]() $W1_{[\nu =k]}$

is

$W1_{[\nu =k]}$

is

![]() $\mathcal{F}_{k}$

-measurable.

$\mathcal{F}_{k}$

-measurable.

Theorem 1.

If there exists a real function

![]() $\gamma =\gamma _{z,\delta }$

such that

$\gamma =\gamma _{z,\delta }$

such that

then for every

![]() $\mathcal{F}_{\nu }$

-measurable RV

$\mathcal{F}_{\nu }$

-measurable RV

![]() $W$

, the following identity holds

$W$

, the following identity holds

for all

![]() $\gamma ,\delta ,z\in \mathcal{R}$

such that the above expectations exist.

$\gamma ,\delta ,z\in \mathcal{R}$

such that the above expectations exist.

Proof.

Let

![]() $V$

be any

$V$

be any

![]() $\mathcal{F}_{\nu }$

-measurable RV. We have that

$\mathcal{F}_{\nu }$

-measurable RV. We have that

\begin{equation*} \mathbb{E}\left(Ve^{h\left (S_{\nu }-u\right )-\delta Y_{\nu }}1_{[\nu \lt \infty ]}\right )=\sum _{k=1}^{\infty }\mathbb{E}\Big(V1_{[\nu =k]}e^{h\sum _{j=1}^{k}Z_{j}-\delta \sum _{j=1}^{k}T_{j}}\Big). \end{equation*}

\begin{equation*} \mathbb{E}\left(Ve^{h\left (S_{\nu }-u\right )-\delta Y_{\nu }}1_{[\nu \lt \infty ]}\right )=\sum _{k=1}^{\infty }\mathbb{E}\Big(V1_{[\nu =k]}e^{h\sum _{j=1}^{k}Z_{j}-\delta \sum _{j=1}^{k}T_{j}}\Big). \end{equation*}

For every

![]() $k\geq 1$

, the RV

$k\geq 1$

, the RV

![]() $V_{k}=V1_{[\nu =k]}$

is

$V_{k}=V1_{[\nu =k]}$

is

![]() $\mathcal{F}_{k}$

-measurable and therefore

$\mathcal{F}_{k}$

-measurable and therefore

\begin{equation*} \frac{\mathbb{E}\big(V1_{[\nu =k]}e^{h\sum _{j=1}^{k}Z_{j}-\delta \sum _{j=1}^{k}T_{j}}\big)}{\mathbb{M}_{T,X}\left (ch-\delta ,-h\right )^{k}}=\frac {\mathbb{E}\big(V_{k}e^{\sum _{i=1}^{k}\left (\left (ch-\delta \right )T_{i}-hX_{i}\right )}\big)}{\mathbb{M}_{T,X}(ch-\delta ,-h)^{k}}=\mathbb{E}\left (V_{k}L_{k}\right )=\mathbb{\mathbb{E}}_{h,\delta }\left (V_{k}\right ). \end{equation*}

\begin{equation*} \frac{\mathbb{E}\big(V1_{[\nu =k]}e^{h\sum _{j=1}^{k}Z_{j}-\delta \sum _{j=1}^{k}T_{j}}\big)}{\mathbb{M}_{T,X}\left (ch-\delta ,-h\right )^{k}}=\frac {\mathbb{E}\big(V_{k}e^{\sum _{i=1}^{k}\left (\left (ch-\delta \right )T_{i}-hX_{i}\right )}\big)}{\mathbb{M}_{T,X}(ch-\delta ,-h)^{k}}=\mathbb{E}\left (V_{k}L_{k}\right )=\mathbb{\mathbb{E}}_{h,\delta }\left (V_{k}\right ). \end{equation*}

Hence,

\begin{eqnarray}\mathbb{E}\left (Ve^{h\left (S_{\nu }-u\right )-\delta Y_{\nu }}1_{[\nu \lt \infty ]}\right ) & = &\sum _{k=1}^{\infty }\mathbb{E}\Big(V1_{[\nu =k]}e^{h\sum _{j=1}^{k}Z_{j}-\delta \sum _{j=1}^{k}T_{j}}\Big)\nonumber\\& =&\sum _{k=1}^{\infty }\mathbb{\mathbb{E}}_{h,\delta }\big(V1_{[\nu =k]}\mathbb{M}_{T,X}\left (ch-\delta ,-h\right )^{k}\big)\nonumber \\ & = &\mathbb{\mathbb{E}}_{h,\delta }\left (V\mathbb{M}_{T,X}\left (ch-\delta ,-h\right )^{\nu }1_{[\nu \lt \infty ]}\right ). \end{eqnarray}

\begin{eqnarray}\mathbb{E}\left (Ve^{h\left (S_{\nu }-u\right )-\delta Y_{\nu }}1_{[\nu \lt \infty ]}\right ) & = &\sum _{k=1}^{\infty }\mathbb{E}\Big(V1_{[\nu =k]}e^{h\sum _{j=1}^{k}Z_{j}-\delta \sum _{j=1}^{k}T_{j}}\Big)\nonumber\\& =&\sum _{k=1}^{\infty }\mathbb{\mathbb{E}}_{h,\delta }\big(V1_{[\nu =k]}\mathbb{M}_{T,X}\left (ch-\delta ,-h\right )^{k}\big)\nonumber \\ & = &\mathbb{\mathbb{E}}_{h,\delta }\left (V\mathbb{M}_{T,X}\left (ch-\delta ,-h\right )^{\nu }1_{[\nu \lt \infty ]}\right ). \end{eqnarray}

For

![]() $h=\gamma$

such that

$h=\gamma$

such that

![]() $z\mathbb{M}_{T,X}\left (c\gamma -\delta ,-\gamma \right )=1$

, we get

$z\mathbb{M}_{T,X}\left (c\gamma -\delta ,-\gamma \right )=1$

, we get

Applying the above to the

![]() $\mathcal{F}_{\nu }$

-measurable RV

$\mathcal{F}_{\nu }$

-measurable RV

![]() $V=z^{\nu }e^{-\gamma \left (S_{\nu }-u\right )}W$

and taking into account the fact that

$V=z^{\nu }e^{-\gamma \left (S_{\nu }-u\right )}W$

and taking into account the fact that

![]() $S_{\nu }=U_{\tau },Y_{\nu }=\tau$

and

$S_{\nu }=U_{\tau },Y_{\nu }=\tau$

and

![]() $1_{[\nu \lt \infty ]}=1_{[\tau \lt \infty ]}$

a.s., we get the desired result.

$1_{[\nu \lt \infty ]}=1_{[\tau \lt \infty ]}$

a.s., we get the desired result.

We can now exploit Theorem1 in order to reduce the form of Gerber–Shiu functions (see Gerber & Shiu, Reference Gerber and Shiu1998), which also contain the number of claims until ruin,

![]() $\nu ,$

by expressing them under the new measure

$\nu ,$

by expressing them under the new measure

![]() $\mathbb{P}_{\gamma ,\delta }$

. We offer the following corollary for any penalty function

$\mathbb{P}_{\gamma ,\delta }$

. We offer the following corollary for any penalty function

![]() $w\left (U_{\tau -},-U_{\tau }\right )$

of the surplus prior to ruin and the deficit at ruin.

$w\left (U_{\tau -},-U_{\tau }\right )$

of the surplus prior to ruin and the deficit at ruin.

Corollary 2. The generalized GS function satisfies the following identity

where

![]() $\gamma =\gamma _{z,\delta }$

is a real root of the generalized Lundberg equation (

2.4

) and

$\gamma =\gamma _{z,\delta }$

is a real root of the generalized Lundberg equation (

2.4

) and

![]() $\delta$

represents the constant discount rate.

$\delta$

represents the constant discount rate.

Proof.

Setting as

![]() $W$

the function

$W$

the function

![]() $w\left (U_{\tau -},-U_{\tau }\right )$

, which obviously is an

$w\left (U_{\tau -},-U_{\tau }\right )$

, which obviously is an

![]() $\mathcal{F}_{\nu }$

-measurable function, the formula (2.5) leads to the above identity.

$\mathcal{F}_{\nu }$

-measurable function, the formula (2.5) leads to the above identity.

The above form of the GS function (in the special case where

![]() $z=1$

) is considered by Badescu et al. (Reference Badescu, Cheung and Landriault2009) and Cossette et al. (Reference Cossette, Marceau and Marri2008).

$z=1$

) is considered by Badescu et al. (Reference Badescu, Cheung and Landriault2009) and Cossette et al. (Reference Cossette, Marceau and Marri2008).

It is worth mentioning that the above corollary could similarly be formulated employing alternative penalty functions, for example, depending on the last minimum of the surplus before ruin,

![]() $\underline {U}_{\tau -}\,:\!=\,\inf \{U_{t},t\lt \tau \}$

, the surplus on the second to last claim before ruin,

$\underline {U}_{\tau -}\,:\!=\,\inf \{U_{t},t\lt \tau \}$

, the surplus on the second to last claim before ruin,

![]() $U_{Y_{\nu -1}}$

, etc. (e.g., see Woo, Reference Woo2010). We refer to the review paper of He et al. (Reference He, Kawai, Shimizu and Yamazaki2023) for a list of cases for GS penalty functions.

$U_{Y_{\nu -1}}$

, etc. (e.g., see Woo, Reference Woo2010). We refer to the review paper of He et al. (Reference He, Kawai, Shimizu and Yamazaki2023) for a list of cases for GS penalty functions.

In what follows, we denote by

the MGF of the deficit at ruin, under the measure

![]() $\mathbb{P}_{h,\delta }$

. In the following proposition, we present an identity that enables us to explicitly express a special case of the GS function, namely, the joint GF of the number of claims until ruin, the deficit at ruin, and the time until ruin. We further denote by

$\mathbb{P}_{h,\delta }$

. In the following proposition, we present an identity that enables us to explicitly express a special case of the GS function, namely, the joint GF of the number of claims until ruin, the deficit at ruin, and the time until ruin. We further denote by

![]() $\psi _{h,\delta }\,:\!=\,\mathbb{P}_{h,\delta }\left (\tau \lt \infty \right )$

the ruin probability under

$\psi _{h,\delta }\,:\!=\,\mathbb{P}_{h,\delta }\left (\tau \lt \infty \right )$

the ruin probability under

![]() $\mathbb{P}_{h,\delta }$

.

$\mathbb{P}_{h,\delta }$

.

Proposition 3.

If there exists a real function

![]() $\gamma =\gamma _{z,\delta }$

such that

$\gamma =\gamma _{z,\delta }$

such that

![]() $z\mathbb{M}_{T,X}\left (c\gamma -\delta ,-\gamma \right )=1$

, then

$z\mathbb{M}_{T,X}\left (c\gamma -\delta ,-\gamma \right )=1$

, then

for all

![]() $s,\delta ,z\in \mathcal{R}$

such that the above expectations exist. In addition, the probability of the ultimate ruin

$s,\delta ,z\in \mathcal{R}$

such that the above expectations exist. In addition, the probability of the ultimate ruin

![]() $\psi \,:\!=\,\mathbb{P}\left (\tau \lt \infty \right )$

is given by

$\psi \,:\!=\,\mathbb{P}\left (\tau \lt \infty \right )$

is given by

where

![]() $\gamma ^{*}\,:\!=\,\gamma _{1,0}$

is a real root of the equation

$\gamma ^{*}\,:\!=\,\gamma _{1,0}$

is a real root of the equation

![]() $\mathbb{M}_{T,X}\left (c\gamma ^{*},-\gamma ^{*}\right )=1$

.

$\mathbb{M}_{T,X}\left (c\gamma ^{*},-\gamma ^{*}\right )=1$

.

Proof.

Using Theorem1 for

![]() $W=e^{-sU_{\tau }}$

, the r.h.s. of Equation (2.5) becomes

$W=e^{-sU_{\tau }}$

, the r.h.s. of Equation (2.5) becomes

\begin{align*} e^{\gamma u}\mathbb{\mathbb{E}}_{\gamma ,\delta }\left (e^{-\gamma U_{\tau }}e^{-sU_{\tau }}1_{[\tau \lt \infty ]}\right ) & =e^{\gamma u}\mathbb{\mathbb{E}}_{\gamma ,\delta }\left (\left .e^{\left (\gamma +s\right )\left (-U_{\tau }\right )}\right |\tau \lt \infty \right )\mathbb{P}_{\gamma ,\delta }\left (\tau \lt \infty \right )\\ & =\psi _{\gamma ,\delta }e^{\gamma u}\mathbb{B}_{\gamma ,\delta }\left (\gamma +s\right ), \end{align*}

\begin{align*} e^{\gamma u}\mathbb{\mathbb{E}}_{\gamma ,\delta }\left (e^{-\gamma U_{\tau }}e^{-sU_{\tau }}1_{[\tau \lt \infty ]}\right ) & =e^{\gamma u}\mathbb{\mathbb{E}}_{\gamma ,\delta }\left (\left .e^{\left (\gamma +s\right )\left (-U_{\tau }\right )}\right |\tau \lt \infty \right )\mathbb{P}_{\gamma ,\delta }\left (\tau \lt \infty \right )\\ & =\psi _{\gamma ,\delta }e^{\gamma u}\mathbb{B}_{\gamma ,\delta }\left (\gamma +s\right ), \end{align*}

which gives us the first equation. Setting

![]() $\delta =s=0$

and

$\delta =s=0$

and

![]() $z=1$

, we get the ultimate ruin probability

$z=1$

, we get the ultimate ruin probability

![]() $\psi ,$

but in this case, the change of measure parameter

$\psi ,$

but in this case, the change of measure parameter

![]() $\gamma _{1,0}$

corresponds to the solution of the equation

$\gamma _{1,0}$

corresponds to the solution of the equation

![]() $\mathbb{M}_{T,X}\left (c\gamma ,-\gamma \right )=1$

with respect to

$\mathbb{M}_{T,X}\left (c\gamma ,-\gamma \right )=1$

with respect to

![]() $\gamma$

.

$\gamma$

.

Remark 4. In the aforementioned ruin model, we have assumed, primarily for analytical tractability, that the premium collected over a time interval of length

![]() $t$

is equal to

$t$

is equal to

![]() $ct$

. Extending to a more general and realistic setup, stochastic premium income may be integrated to account for the influence of market conditions by assuming that the premium collected over the time interval

$ct$

. Extending to a more general and realistic setup, stochastic premium income may be integrated to account for the influence of market conditions by assuming that the premium collected over the time interval

![]() $[0,t]$

is equal to

$[0,t]$

is equal to

![]() $C_{t}$

, where

$C_{t}$

, where

![]() $(C_{t},t\geq 0)$

is an appropriate stochastic process with

$(C_{t},t\geq 0)$

is an appropriate stochastic process with

![]() $\mathbb{E}(C_{t})=ct,\,t\geq 0$

. To maintain the validity of our approach, this process must necessarily possess independent and identical increments (i.e., must be a Lévy process), and in addition, it must be non-decreasing a.s., ensuring that ruin can occur only upon the occurrence of a claim. Hence, the process

$\mathbb{E}(C_{t})=ct,\,t\geq 0$

. To maintain the validity of our approach, this process must necessarily possess independent and identical increments (i.e., must be a Lévy process), and in addition, it must be non-decreasing a.s., ensuring that ruin can occur only upon the occurrence of a claim. Hence, the process

![]() $(C_{t},t\geq 0)$

must be a subordinator with Lévy–Khintchine representation of the form

$(C_{t},t\geq 0)$

must be a subordinator with Lévy–Khintchine representation of the form

![]() $\mathbb{E}(e^{-sC_{t}})=e^{-\phi (s)t},s\geq 0,$

and Laplace exponent

$\mathbb{E}(e^{-sC_{t}})=e^{-\phi (s)t},s\geq 0,$

and Laplace exponent

where

![]() $a\geq 0$

is the drift coefficient and

$a\geq 0$

is the drift coefficient and

![]() $\Pi$

denotes the Lévy measure on

$\Pi$

denotes the Lévy measure on

![]() $(0,\infty )$

satisfying

$(0,\infty )$

satisfying

![]() $a+\int _{0}^{\infty }x\Pi (dx)=c\lt \infty$

. It is noteworthy that the validity of our general results (cf. Theorem1, Corollary2, Proposition3) can be confirmed even when

$a+\int _{0}^{\infty }x\Pi (dx)=c\lt \infty$

. It is noteworthy that the validity of our general results (cf. Theorem1, Corollary2, Proposition3) can be confirmed even when

![]() $(C_{t},t\geq 0)$

is a subordinator (e.g., gamma or inverse Gaussian process or compound Poisson process with positive jumps). The only modification that needs to be made is that the root

$(C_{t},t\geq 0)$

is a subordinator (e.g., gamma or inverse Gaussian process or compound Poisson process with positive jumps). The only modification that needs to be made is that the root

![]() $\gamma =\gamma _{z,\delta }$

must now satisfy the equation

$\gamma =\gamma _{z,\delta }$

must now satisfy the equation

However, in order to obtain closed-form formulae for the quantities of interest, in what follows, we proceed under our initial assumption

![]() $C_{t}=ct$

(constant, deterministic premium rate), which is also commonly adopted by most authors. The use of subordinators to incorporate stochastic premium rates will be further investigated in our future research since, under this framework, the relevant analysis becomes much more complex and may require numerical methods or approximation techniques.

$C_{t}=ct$

(constant, deterministic premium rate), which is also commonly adopted by most authors. The use of subordinators to incorporate stochastic premium rates will be further investigated in our future research since, under this framework, the relevant analysis becomes much more complex and may require numerical methods or approximation techniques.

The joint transform in Proposition 3 can now be explicitly computed when the distribution of the deficit at ruin (undershoot) under the measure

![]() $\mathbb{P}_{h,\delta }$

is known. In order to demonstrate how this approach can be used in the simplest case where

$\mathbb{P}_{h,\delta }$

is known. In order to demonstrate how this approach can be used in the simplest case where

![]() $T_{i}$

,

$T_{i}$

,

![]() $X_{i}$

are independent, we apply (2.7) in the following example to a ruin model with phase-type distributed claims that have also been studied (in a more general setup) by Frostig et al. (Reference Frostig, Pitts and Politis2012).

$X_{i}$

are independent, we apply (2.7) in the following example to a ruin model with phase-type distributed claims that have also been studied (in a more general setup) by Frostig et al. (Reference Frostig, Pitts and Politis2012).

Example.

We assume that

![]() $(N_{t},t\geq 0)$

is a Poisson process with constant intensity

$(N_{t},t\geq 0)$

is a Poisson process with constant intensity

![]() $\lambda$

, while the claim sizes,

$\lambda$

, while the claim sizes,

![]() $X_{1},X_{2},\ldots$

are IID RVs, independent of

$X_{1},X_{2},\ldots$

are IID RVs, independent of

![]() $(N_{t},t\geq 0)$

, following a phase-type distribution

$(N_{t},t\geq 0)$

, following a phase-type distribution

![]() $PH\left (\boldsymbol{\alpha },\boldsymbol{S}\right )$

, with density

$PH\left (\boldsymbol{\alpha },\boldsymbol{S}\right )$

, with density

where

![]() $\boldsymbol{\alpha }=\left (\alpha _{1},\ldots ,\alpha _{p}\right )$

is a row vector,

$\boldsymbol{\alpha }=\left (\alpha _{1},\ldots ,\alpha _{p}\right )$

is a row vector,

![]() $\textbf{1}=\left (1,\ldots ,1\right )^{\prime }$

is

$\textbf{1}=\left (1,\ldots ,1\right )^{\prime }$

is

![]() $p\times 1$

column vector, and

$p\times 1$

column vector, and

![]() $\boldsymbol{S}$

is a

$\boldsymbol{S}$

is a

![]() $p\times p$

sub-intensity matrix. We assume that there exists a real solution

$p\times p$

sub-intensity matrix. We assume that there exists a real solution

![]() $\gamma =\gamma _{z,\delta }$

of the equation

$\gamma =\gamma _{z,\delta }$

of the equation

such that the MGFs of

![]() $T_{i},X_{i}$

under

$T_{i},X_{i}$

under

![]() $\mathbb{P}_{\gamma ,\delta }$

are well defined (cf.

2.3

). Under this new measure, the inter-claim times have MGF

$\mathbb{P}_{\gamma ,\delta }$

are well defined (cf.

2.3

). Under this new measure, the inter-claim times have MGF

\begin{equation*} \mathbb{E}_{\gamma ,\delta }\big(e^{tT_{1}}\big)=\mathbb{E}\left (\frac {e^{\left (t+c\gamma -\delta \right )T_{1}}}{\mathbb{M}_{T}\left (c\gamma -\delta \right )}\right )=\frac {\frac {\lambda }{\lambda -(t+c\gamma -\delta )}}{\frac {\lambda }{\lambda -(c\gamma -\delta )}}=\frac {\lambda -c\gamma +\delta }{\lambda -c\gamma +\delta -t}, \end{equation*}

\begin{equation*} \mathbb{E}_{\gamma ,\delta }\big(e^{tT_{1}}\big)=\mathbb{E}\left (\frac {e^{\left (t+c\gamma -\delta \right )T_{1}}}{\mathbb{M}_{T}\left (c\gamma -\delta \right )}\right )=\frac {\frac {\lambda }{\lambda -(t+c\gamma -\delta )}}{\frac {\lambda }{\lambda -(c\gamma -\delta )}}=\frac {\lambda -c\gamma +\delta }{\lambda -c\gamma +\delta -t}, \end{equation*}

and therefore

![]() $T_{i}$

are exponentially distributed with parameter

$T_{i}$

are exponentially distributed with parameter

![]() $\lambda ^{*}=\lambda -c\gamma +\delta \gt 0$

. In addition, under

$\lambda ^{*}=\lambda -c\gamma +\delta \gt 0$

. In addition, under

![]() $\mathbb{P}_{\gamma ,\delta }$

, the RVs

$\mathbb{P}_{\gamma ,\delta }$

, the RVs

![]() $X_{1},X_{2},\ldots$

are again independent of

$X_{1},X_{2},\ldots$

are again independent of

![]() $T_{1},T_{2},\ldots$

following the

$T_{1},T_{2},\ldots$

following the

![]() $-\gamma$

exponentially tilted

$-\gamma$

exponentially tilted

![]() $PH\left (\boldsymbol{\alpha },\boldsymbol{S}\right )$

distribution, which is again PH. More specifically, from Lemma 5 of Asmussen et al. (Reference Asmussen, Avram and Pistorius2004), we have that

$PH\left (\boldsymbol{\alpha },\boldsymbol{S}\right )$

distribution, which is again PH. More specifically, from Lemma 5 of Asmussen et al. (Reference Asmussen, Avram and Pistorius2004), we have that

![]() $X_{i}\sim PH\left (\boldsymbol{\alpha }^{*},\boldsymbol{S}^{*}\right )$

under

$X_{i}\sim PH\left (\boldsymbol{\alpha }^{*},\boldsymbol{S}^{*}\right )$

under

![]() $\mathbb{P}_{\gamma ,\delta }$

, with

$\mathbb{P}_{\gamma ,\delta }$

, with

where

![]() $\boldsymbol{I}$

is the

$\boldsymbol{I}$

is the

![]() $p\times p$

identity matrix and

$p\times p$

identity matrix and

![]() $\boldsymbol{\Delta }$

is a

$\boldsymbol{\Delta }$

is a

![]() $p\times p$

diagonal matrix with elements on the diagonal given by

$p\times p$

diagonal matrix with elements on the diagonal given by

![]() $\left (\boldsymbol{S}-\gamma \boldsymbol{I}\right )^{-1}\boldsymbol{S}\textbf{1}$

. Since the claim sizes are phase-type distributed under the measure

$\left (\boldsymbol{S}-\gamma \boldsymbol{I}\right )^{-1}\boldsymbol{S}\textbf{1}$

. Since the claim sizes are phase-type distributed under the measure

![]() $\mathbb{P}_{\gamma ,\delta }$

, the deficit at ruin will again be phase-type distributed as described in Drekic et al. (Reference Drekic, Dickson, Stanford and Willmot2004), with the same intensity matrix

$\mathbb{P}_{\gamma ,\delta }$

, the deficit at ruin will again be phase-type distributed as described in Drekic et al. (Reference Drekic, Dickson, Stanford and Willmot2004), with the same intensity matrix

![]() $\boldsymbol{S}^{*}$

but different vector

$\boldsymbol{S}^{*}$

but different vector

![]() $\tilde {\boldsymbol{\alpha }}$

. Hence, the MGF of the deficit at ruin takes on the form

$\tilde {\boldsymbol{\alpha }}$

. Hence, the MGF of the deficit at ruin takes on the form

From Drekic et al. (Reference Drekic, Dickson, Stanford and Willmot2004), we know that

![]() $\tilde {\boldsymbol{\alpha }}$

can be written as

$\tilde {\boldsymbol{\alpha }}$

can be written as

![]() $\tilde {\boldsymbol{\alpha }}=\boldsymbol{\beta }/\psi _{\gamma ,\delta }$

where

$\tilde {\boldsymbol{\alpha }}=\boldsymbol{\beta }/\psi _{\gamma ,\delta }$

where

![]() $\boldsymbol{\beta }$

is a

$\boldsymbol{\beta }$

is a

![]() $1\times p$

known vector (see the main theorem of Drekic et al. (Reference Drekic, Dickson, Stanford and Willmot2004) along with relations (1) and (2) of that paper). Exploiting this equality, the formula in Proposition 3 now reduces to

$1\times p$

known vector (see the main theorem of Drekic et al. (Reference Drekic, Dickson, Stanford and Willmot2004) along with relations (1) and (2) of that paper). Exploiting this equality, the formula in Proposition 3 now reduces to

\begin{align*} \mathbb{E}\left (z^{\nu }e^{-sU_{\tau }-\delta \tau }1_{[\tau \lt \infty ]}\right ) & =\psi _{\gamma ,\delta }\,e^{\gamma u}\mathbb{B}_{\gamma ,\delta }\left (\gamma +s\right )=\psi _{\gamma ,\delta }\,e^{\gamma u}\tilde {\boldsymbol{\alpha }}\left ((\gamma +s)\boldsymbol{I}+\boldsymbol{S}^{*}\right )^{-1}\left (\boldsymbol{S}^{*}\textbf{1}\right )\\ & =e^{\gamma u}\boldsymbol{\beta }\left ((\gamma +s)\boldsymbol{I}+\boldsymbol{S}^{*}\right )^{-1}\boldsymbol{S}^{*}\textbf{1}. \end{align*}

\begin{align*} \mathbb{E}\left (z^{\nu }e^{-sU_{\tau }-\delta \tau }1_{[\tau \lt \infty ]}\right ) & =\psi _{\gamma ,\delta }\,e^{\gamma u}\mathbb{B}_{\gamma ,\delta }\left (\gamma +s\right )=\psi _{\gamma ,\delta }\,e^{\gamma u}\tilde {\boldsymbol{\alpha }}\left ((\gamma +s)\boldsymbol{I}+\boldsymbol{S}^{*}\right )^{-1}\left (\boldsymbol{S}^{*}\textbf{1}\right )\\ & =e^{\gamma u}\boldsymbol{\beta }\left ((\gamma +s)\boldsymbol{I}+\boldsymbol{S}^{*}\right )^{-1}\boldsymbol{S}^{*}\textbf{1}. \end{align*}

In the case when

![]() $T$

and

$T$

and

![]() $X$

are dependent, the distribution of the undershoot (deficit at ruin) is generally more complicated. Compared with the previous example, even when

$X$

are dependent, the distribution of the undershoot (deficit at ruin) is generally more complicated. Compared with the previous example, even when

![]() $X$

is phase-type distributed, there is no guarantee that the distribution of the undershoot falls within the same class. Even if this is true, the intensity matrix of the undershoot may not be the same as the intensity matrix of the claim sizes; see Sections 3 and 4. In the following two sections, we choose the joint distribution of the pair

$X$

is phase-type distributed, there is no guarantee that the distribution of the undershoot falls within the same class. Even if this is true, the intensity matrix of the undershoot may not be the same as the intensity matrix of the claim sizes; see Sections 3 and 4. In the following two sections, we choose the joint distribution of the pair

![]() $\left (T_{i},X_{i}\right )$

so that the distribution of the increments of the random walk

$\left (T_{i},X_{i}\right )$

so that the distribution of the increments of the random walk

![]() $S$

can be expressed via exponential or Erlang mixtures. Thus, by invoking the (generalized) memoryless property, we can use the fact that the distribution of the undershoot falls within the same class. Hence, we offer explicit formulae for the above general results in two cases of bivariate distributions for the pair

$S$

can be expressed via exponential or Erlang mixtures. Thus, by invoking the (generalized) memoryless property, we can use the fact that the distribution of the undershoot falls within the same class. Hence, we offer explicit formulae for the above general results in two cases of bivariate distributions for the pair

![]() $\left (T_{i},X_{i}\right )$

. In what follows, we shall investigate the case of Downton–Moran bivariate exponential distribution proposed by Downton (Reference Downton1970), and as a generalization, we shall also consider the Kibble–Moran bivariate Erlang distribution. The Downton–Moran bivariate distribution weakens the independence assumption of the Cramer–Lundberg classical risk model with exponentially distributed claim sizes, making it possible to conduct a sensitivity analysis with respect to the correlation coefficient parameter between

$\left (T_{i},X_{i}\right )$

. In what follows, we shall investigate the case of Downton–Moran bivariate exponential distribution proposed by Downton (Reference Downton1970), and as a generalization, we shall also consider the Kibble–Moran bivariate Erlang distribution. The Downton–Moran bivariate distribution weakens the independence assumption of the Cramer–Lundberg classical risk model with exponentially distributed claim sizes, making it possible to conduct a sensitivity analysis with respect to the correlation coefficient parameter between

![]() $T,X$

. The Kibble–Moran distribution further generalizes this model, allowing the use of Erlang as a marginal distribution for the inter-claim times and claim sizes. These bivariate distributions admit positive correlation between the claim sizes and the inter-claim times, which is a common scenario for insurance companies to expect bigger claim sizes in longer report periods and smaller claim sizes as the reports are more frequent (see also a brief related discussion in the introduction). Note that the Erlang model has been extensively employed by many authors (see, e.g., Dickson (Reference Dickson1998), Dickson & Hipp (Reference Dickson and Hipp2001), Li & Garrido (Reference Li and Garrido2004) in the independent case or Ambagaspitiya (Reference Ambagaspitiya2009), Chadjiconstantinidis & Vrontos (Reference Chadjiconstantinidis and Vrontos2014) for the dependent case). The Downton–Moran and Kibble–Moran distributions have the ability to model high positive correlation between

$T,X$

. The Kibble–Moran distribution further generalizes this model, allowing the use of Erlang as a marginal distribution for the inter-claim times and claim sizes. These bivariate distributions admit positive correlation between the claim sizes and the inter-claim times, which is a common scenario for insurance companies to expect bigger claim sizes in longer report periods and smaller claim sizes as the reports are more frequent (see also a brief related discussion in the introduction). Note that the Erlang model has been extensively employed by many authors (see, e.g., Dickson (Reference Dickson1998), Dickson & Hipp (Reference Dickson and Hipp2001), Li & Garrido (Reference Li and Garrido2004) in the independent case or Ambagaspitiya (Reference Ambagaspitiya2009), Chadjiconstantinidis & Vrontos (Reference Chadjiconstantinidis and Vrontos2014) for the dependent case). The Downton–Moran and Kibble–Moran distributions have the ability to model high positive correlation between

![]() $T,X$

, that is,

$T,X$

, that is,

![]() $\rho \in \left [0,1\right )$

, while other bivariate models constructed using copulas have the disadvantage of bounded range for the correlation coefficient; for example, the classical FGM copula has

$\rho \in \left [0,1\right )$

, while other bivariate models constructed using copulas have the disadvantage of bounded range for the correlation coefficient; for example, the classical FGM copula has

![]() $\rho \in \left [-1/3,1/3\right ]$

, while generalized FGM copulas can achieve a slightly wider bounded range (see, e.g., some cases in Zachariah et al. (Reference Zachariah, Arshad and Pathak2024)). An additional critical advantage of these bivariate distributions lies in the simplicity of their GF, which aligns well with our methodological framework and allows for the explicit derivation of closed-form expressions. Note that, for these bivariate distributions, closed-form formulae have been derived by Ambagaspitiya (Reference Ambagaspitiya2009) only for the ultimate ruin probability.

$\rho \in \left [-1/3,1/3\right ]$

, while generalized FGM copulas can achieve a slightly wider bounded range (see, e.g., some cases in Zachariah et al. (Reference Zachariah, Arshad and Pathak2024)). An additional critical advantage of these bivariate distributions lies in the simplicity of their GF, which aligns well with our methodological framework and allows for the explicit derivation of closed-form expressions. Note that, for these bivariate distributions, closed-form formulae have been derived by Ambagaspitiya (Reference Ambagaspitiya2009) only for the ultimate ruin probability.

3. Downton–Moran bivariate exponential analysis

We consider the Moran–Downton bivariate exponential distribution (see Downton, Reference Downton1970) for the pairs

![]() $\left (T_{i},X_{i}\right )$

, with MGF

$\left (T_{i},X_{i}\right )$

, with MGF

where

![]() $\lambda _{1},\lambda _{2}\gt 0$

and

$\lambda _{1},\lambda _{2}\gt 0$

and

![]() $\rho \in \left [0,1\right )$

. From (3.1), we see that the marginal distributions of

$\rho \in \left [0,1\right )$

. From (3.1), we see that the marginal distributions of

![]() $T_{i},X_{i}$

are exponential with parameters

$T_{i},X_{i}$

are exponential with parameters

![]() $\lambda _{1},\lambda _{2}$

, respectively . The parameter

$\lambda _{1},\lambda _{2}$

, respectively . The parameter

![]() $\rho$

is easily verified to be the correlation coefficient between

$\rho$

is easily verified to be the correlation coefficient between

![]() $T$

and

$T$

and

![]() $X$

. Using this bivariate distribution, we naturally assume positive correlation between the claim sizes and the inter-claim times in the sense that we expect bigger claim sizes in longer report periods and smaller claim sizes as the reports are more frequent. From (3.1), the MGF of the steps

$X$

. Using this bivariate distribution, we naturally assume positive correlation between the claim sizes and the inter-claim times in the sense that we expect bigger claim sizes in longer report periods and smaller claim sizes as the reports are more frequent. From (3.1), the MGF of the steps

![]() $Z_{i}\,:\!=\, cT_{i}-X_{i}$

takes on the form

$Z_{i}\,:\!=\, cT_{i}-X_{i}$

takes on the form

where

and therefore, the distribution of

![]() $Z_{i}$

is a mixture of a positive exponential distribution with parameter

$Z_{i}$

is a mixture of a positive exponential distribution with parameter

![]() $r_{2}$

and a negative exponential distribution with parameter

$r_{2}$

and a negative exponential distribution with parameter

![]() $r_{1}$

. Combining (2.3) and (3.1), we determine the MGF of

$r_{1}$

. Combining (2.3) and (3.1), we determine the MGF of

![]() $Z_{1}$

under the measure

$Z_{1}$

under the measure

![]() $\mathbb{P}_{h,\delta }$

, which is

$\mathbb{P}_{h,\delta }$

, which is

In order to compute the GS function of Proposition 3, we are in need of a real root

![]() $\gamma \,:\!=\,\gamma _{z,\delta }$

of the equation

$\gamma \,:\!=\,\gamma _{z,\delta }$

of the equation

The above equation can be simplified to the following quadratic equation

where, for every

![]() $z\in \left (0,1\right ]$

and

$z\in \left (0,1\right ]$

and

![]() $\delta \geq 0$

, there exist two real solutions

$\delta \geq 0$

, there exist two real solutions

![]() $\gamma ^{(1)},\gamma ^{(2)}$

of the form

$\gamma ^{(1)},\gamma ^{(2)}$

of the form

\begin{eqnarray} \gamma ^{(i)}&=&\frac {\lambda _{1}-c\lambda _{2}+\delta \left (1-\rho \right )+(-1)^{i}\sqrt {\left (\lambda _{1}-c\lambda _{2}+\delta \left (1-\rho \right )\right )^{2}+4c\lambda _{2}\left (1-\rho \right )\left (\delta +\left (1-z\right )\lambda _{1}\right )}}{2c\left (1-\rho \right )},\nonumber\\i&=&1,2. \end{eqnarray}

\begin{eqnarray} \gamma ^{(i)}&=&\frac {\lambda _{1}-c\lambda _{2}+\delta \left (1-\rho \right )+(-1)^{i}\sqrt {\left (\lambda _{1}-c\lambda _{2}+\delta \left (1-\rho \right )\right )^{2}+4c\lambda _{2}\left (1-\rho \right )\left (\delta +\left (1-z\right )\lambda _{1}\right )}}{2c\left (1-\rho \right )},\nonumber\\i&=&1,2. \end{eqnarray}

If

![]() $c\lambda _{2}\gt \lambda _{1}$

, the real roots

$c\lambda _{2}\gt \lambda _{1}$

, the real roots

![]() $\gamma ^{(1)},\gamma ^{(2)}$

satisfy the inequalities

$\gamma ^{(1)},\gamma ^{(2)}$

satisfy the inequalities

![]() $\gamma ^{(1)}\lt 0\leq \gamma ^{(2)}$

while

$\gamma ^{(1)}\lt 0\leq \gamma ^{(2)}$

while

![]() $\gamma ^{(2)}=0$

when

$\gamma ^{(2)}=0$

when

![]() $z=1$

and

$z=1$

and

![]() $\delta =0$

. If

$\delta =0$

. If

![]() $c\lambda _{2}\lt \lambda _{1}$

, then

$c\lambda _{2}\lt \lambda _{1}$

, then

![]() $\gamma ^{(1)}\leq 0\lt \gamma ^{(2)}$

and

$\gamma ^{(1)}\leq 0\lt \gamma ^{(2)}$

and

![]() $\gamma ^{(1)}=0$

when

$\gamma ^{(1)}=0$

when

![]() $z=1,\delta =0$

. In the last case where

$z=1,\delta =0$

. In the last case where

![]() $c\lambda _{2}=\lambda _{1}$

, we verify that

$c\lambda _{2}=\lambda _{1}$

, we verify that

![]() $\gamma ^{(1)}\leq 0\leq \gamma ^{(2)}$

with

$\gamma ^{(1)}\leq 0\leq \gamma ^{(2)}$

with

![]() $\gamma ^{(1)}=-\gamma ^{(2)}$

and

$\gamma ^{(1)}=-\gamma ^{(2)}$

and

![]() $\gamma ^{(1)}=\gamma ^{(2)}=0$

when

$\gamma ^{(1)}=\gamma ^{(2)}=0$

when

![]() $z=1,\delta =0$

. Obviously, the above cases depend on the sign of the loading factor

$z=1,\delta =0$

. Obviously, the above cases depend on the sign of the loading factor

![]() $\eta =c\mathbb{E}\left (T_{1}\right )/\mathbb{E}\left (X_{1}\right )-1=c\lambda _{2}/\lambda _{1}-1,$

since

$\eta =c\mathbb{E}\left (T_{1}\right )/\mathbb{E}\left (X_{1}\right )-1=c\lambda _{2}/\lambda _{1}-1,$

since

![]() $c\lambda _{2}\gt \lambda _{1}\Leftrightarrow \eta \gt 0$

. The condition

$c\lambda _{2}\gt \lambda _{1}\Leftrightarrow \eta \gt 0$

. The condition

![]() $\eta \gt 0$

is the net profit condition that an insurance company usually sets in order to avoid the ruin event, which is certain if

$\eta \gt 0$

is the net profit condition that an insurance company usually sets in order to avoid the ruin event, which is certain if

![]() $\eta \leq 0$

.

$\eta \leq 0$

.

By choosing the smaller root

![]() $\gamma ^{(1)}$

in (3.6) as the parameter of the tilted measure, we conveniently get that

$\gamma ^{(1)}$

in (3.6) as the parameter of the tilted measure, we conveniently get that

![]() ${{\mathbb{P}_{\gamma ^{(1)},\delta }\left (\tau \lt \infty \right )}}=1$

(cf. Lemma 5 below). Therefore, in what follows, we shall proceed our analysis with

${{\mathbb{P}_{\gamma ^{(1)},\delta }\left (\tau \lt \infty \right )}}=1$

(cf. Lemma 5 below). Therefore, in what follows, we shall proceed our analysis with

![]() $\gamma =\gamma _{z,\delta }\,:\!=\,\gamma ^{(1)}$

. The distribution, under

$\gamma =\gamma _{z,\delta }\,:\!=\,\gamma ^{(1)}$

. The distribution, under

![]() $\mathbb{P}_{\gamma ,\delta }$

, of the increments of the random walk

$\mathbb{P}_{\gamma ,\delta }$

, of the increments of the random walk

![]() $S$

is described in the next result.

$S$

is described in the next result.

Lemma 5.

For

![]() $\gamma =\gamma ^{(1)}$

given by (

3.6

), under the measure

$\gamma =\gamma ^{(1)}$

given by (

3.6

), under the measure

![]() $\mathbb{P}_{\gamma ,\delta }$

, the increments

$\mathbb{P}_{\gamma ,\delta }$

, the increments

![]() $Z_{1},Z_{2},\ldots$

are double-exponential or asymmetric Laplace (AL

$Z_{1},Z_{2},\ldots$

are double-exponential or asymmetric Laplace (AL

![]() $\left (0,\alpha ,\beta \right )$

) distributed with location parameter 0 and MGF of the form

$\left (0,\alpha ,\beta \right )$

) distributed with location parameter 0 and MGF of the form

for

![]() $t\in (-\omega _{1},\omega _{2})$

, where

$t\in (-\omega _{1},\omega _{2})$

, where

\begin{eqnarray} \alpha &=&\alpha \left (z,\delta \right )\,:\!=\,-\frac {\sqrt {\left (\lambda _{1}-c\lambda _{2}+\delta \left (1-\rho \right )\right )^{2}+4c\lambda _{2}\left (1-\rho \right )\left (\delta +\left (1-z\right )\lambda _{1}\right )}}{z\lambda _{1}\lambda _{2}},\nonumber\\[8pt]\beta &=&\beta \left (z\right )\,:\!=\,\sqrt {\frac {2c\left (1-\rho \right )}{z\lambda _{1}\lambda _{2}}}, \end{eqnarray}

\begin{eqnarray} \alpha &=&\alpha \left (z,\delta \right )\,:\!=\,-\frac {\sqrt {\left (\lambda _{1}-c\lambda _{2}+\delta \left (1-\rho \right )\right )^{2}+4c\lambda _{2}\left (1-\rho \right )\left (\delta +\left (1-z\right )\lambda _{1}\right )}}{z\lambda _{1}\lambda _{2}},\nonumber\\[8pt]\beta &=&\beta \left (z\right )\,:\!=\,\sqrt {\frac {2c\left (1-\rho \right )}{z\lambda _{1}\lambda _{2}}}, \end{eqnarray}

and

In addition,

![]() $\mathbb{P}_{\gamma ,\delta }\left (\tau \lt \infty \right )=1$

provided that

$\mathbb{P}_{\gamma ,\delta }\left (\tau \lt \infty \right )=1$

provided that

![]() $\eta \neq 0$

or

$\eta \neq 0$

or

![]() $\delta \gt 0$

or

$\delta \gt 0$

or

![]() $z\neq 1$

.

$z\neq 1$

.

Proof.

For

![]() $\gamma =\gamma ^{(1)}$

, using (3.3), we get

$\gamma =\gamma ^{(1)}$

, using (3.3), we get

\begin{align*} \mathbb{E}_{\gamma ,\delta }\left (e^{tZ_{1}}\right ) & =\frac {z\lambda _{1}\lambda _{2}}{z\lambda _{1}\lambda _{2}+\left (\lambda _{1}-c\lambda _{2}+\left (1-\rho \right )\left (\delta -2c\gamma \right )\right )t-c\left (1-\rho \right )t^{2}}\\ & =\frac {z\lambda _{1}\lambda _{2}}{z\lambda _{1}\lambda _{2}+\sqrt {\left (\lambda _{1}-c\lambda _{2}+\delta \left (1-\rho \right )\right )^{2}+4c\lambda _{2}\left (1-\rho \right )\left (\delta +\left (1-z\right )\lambda _{1}\right )}t-c\left (1-\rho \right )t^{2}}, \end{align*}

\begin{align*} \mathbb{E}_{\gamma ,\delta }\left (e^{tZ_{1}}\right ) & =\frac {z\lambda _{1}\lambda _{2}}{z\lambda _{1}\lambda _{2}+\left (\lambda _{1}-c\lambda _{2}+\left (1-\rho \right )\left (\delta -2c\gamma \right )\right )t-c\left (1-\rho \right )t^{2}}\\ & =\frac {z\lambda _{1}\lambda _{2}}{z\lambda _{1}\lambda _{2}+\sqrt {\left (\lambda _{1}-c\lambda _{2}+\delta \left (1-\rho \right )\right )^{2}+4c\lambda _{2}\left (1-\rho \right )\left (\delta +\left (1-z\right )\lambda _{1}\right )}t-c\left (1-\rho \right )t^{2}}, \end{align*}

and using the notations (3.8) for

![]() $\alpha$

and

$\alpha$

and

![]() $\beta$

, we immediately get that

$\beta$

, we immediately get that

![]() $Z_{1}\sim$

AL

$Z_{1}\sim$

AL

![]() $\left (0,\alpha ,\beta \right )$

under

$\left (0,\alpha ,\beta \right )$

under

![]() $\mathbb{P}_{\gamma ,\delta }$

. Since the increments of the random walk are AL

$\mathbb{P}_{\gamma ,\delta }$

. Since the increments of the random walk are AL

![]() $\left (0,\alpha ,\beta \right )$

distributed, then under the assumption

$\left (0,\alpha ,\beta \right )$

distributed, then under the assumption

![]() $\eta \neq 0$

or

$\eta \neq 0$

or

![]() $\delta \gt 0$

or

$\delta \gt 0$

or

![]() $z\neq 1$

, we have

$z\neq 1$

, we have

![]() $\mathbb{E}_{\gamma ,\delta }\left (Z_{1}\right )=\alpha \lt 0$

, and hence, under

$\mathbb{E}_{\gamma ,\delta }\left (Z_{1}\right )=\alpha \lt 0$

, and hence, under

![]() $\mathbb{P}_{\gamma ,\delta }$

, the process

$\mathbb{P}_{\gamma ,\delta }$

, the process

![]() $\left (S_{k},k=1,2,\ldots \right )$

has negative drift, concluding that

$\left (S_{k},k=1,2,\ldots \right )$

has negative drift, concluding that

![]() $\mathbb{P}_{\gamma ,\delta }\left (\tau \lt \infty \right )=1$

.

$\mathbb{P}_{\gamma ,\delta }\left (\tau \lt \infty \right )=1$

.

The next proposition offers an explicit formula for the joint GF of the number of claims until ruin, the deficit at ruin, and the time until ruin.

Proposition 6.

The joint GF of

![]() $\left (\nu ,-U_{\tau },\tau \right )$

, is given by

$\left (\nu ,-U_{\tau },\tau \right )$

, is given by

for every

![]() $z\in \left (0,1\right ],\delta \geq 0$

and

$z\in \left (0,1\right ],\delta \geq 0$

and

![]() $s\lt \omega _{1}-\gamma$

, where

$s\lt \omega _{1}-\gamma$

, where

![]() $\gamma =\gamma ^{(1)}$

is given by (

3.6

) and

$\gamma =\gamma ^{(1)}$

is given by (

3.6

) and

![]() $\omega _{1}$

by (

3.9

). In addition, the ruin probability is given by

$\omega _{1}$

by (

3.9

). In addition, the ruin probability is given by

where

![]() $r_{1}$

is given by (

3.2

) and

$r_{1}$

is given by (

3.2

) and

![]() $\gamma ^{*}\,:\!=\,\frac {\lambda _{1}-c\lambda _{2}-|\lambda _{1}-c\lambda _{2}|}{2c\left (1-\rho \right )}.$

$\gamma ^{*}\,:\!=\,\frac {\lambda _{1}-c\lambda _{2}-|\lambda _{1}-c\lambda _{2}|}{2c\left (1-\rho \right )}.$

Proof.

Using the representation (3.7) for the distribution of

![]() $Z_{1},Z_{2},\ldots$

, under

$Z_{1},Z_{2},\ldots$

, under

![]() $\mathbb{P}_{\gamma ,\delta }$

, it is evident that the random walk

$\mathbb{P}_{\gamma ,\delta }$

, it is evident that the random walk

![]() $S$

makes exponentially distributed negative steps (with parameter

$S$

makes exponentially distributed negative steps (with parameter

![]() $\omega _{1}$

) with probability

$\omega _{1}$

) with probability

![]() $p$

or exponentially distributed positive steps (with parameter

$p$

or exponentially distributed positive steps (with parameter

![]() $\omega _{2}$

) with probability

$\omega _{2}$

) with probability

![]() $1-p$

. Hence, from the memoryless property of the exponential distribution, the deficit at ruin will also be exponentially distributed with parameter

$1-p$

. Hence, from the memoryless property of the exponential distribution, the deficit at ruin will also be exponentially distributed with parameter

![]() $\omega _{1}$

. Therefore, we have that

$\omega _{1}$

. Therefore, we have that

The proof of (3.10) is now a straightforward application of Proposition 3 exploiting the fact

![]() $\psi _{\gamma ,\delta }=\mathbb{P}_{\gamma ,\delta }\left (\tau \lt \infty \right )=1$

(cf. Lemma 5). Finally, the relation (3.11) follows readily from (3.10) by setting

$\psi _{\gamma ,\delta }=\mathbb{P}_{\gamma ,\delta }\left (\tau \lt \infty \right )=1$

(cf. Lemma 5). Finally, the relation (3.11) follows readily from (3.10) by setting

![]() $z=1,s=0,\delta =0$

and taking also into account that, in this case,

$z=1,s=0,\delta =0$

and taking also into account that, in this case,

![]() $\omega _{1}=r_{1}+\gamma ^{*}$

.

$\omega _{1}=r_{1}+\gamma ^{*}$

.

Remark 7. If

![]() $\eta \leq 0$

, then

$\eta \leq 0$

, then

![]() $\gamma ^{*}=0$

, and hence,

$\gamma ^{*}=0$

, and hence,

![]() $\psi =1$

(cf. (3.11)). If

$\psi =1$

(cf. (3.11)). If

![]() $\eta \gt 0$

, we verify that

$\eta \gt 0$

, we verify that

![]() $\gamma ^{*}=r_{2}-r_{1}=\frac {\lambda _{1}-c\lambda _{2}}{c\left (1-\rho \right )}$

, and hence, we have

$\gamma ^{*}=r_{2}-r_{1}=\frac {\lambda _{1}-c\lambda _{2}}{c\left (1-\rho \right )}$

, and hence, we have

Note that in the last case, the formula for

![]() $\psi$

agrees with the one obtained by Ambagaspitiya (Reference Ambagaspitiya2009) using a completely different methodology.

$\psi$

agrees with the one obtained by Ambagaspitiya (Reference Ambagaspitiya2009) using a completely different methodology.

Furthermore, utilizing the explicit form of (3.10), our analysis will be focused on the (defective) joint density,

![]() $f_{\nu ,-U_{\tau },\tau }$

, of

$f_{\nu ,-U_{\tau },\tau }$

, of

![]() $\left (\nu ,-U_{\tau },\tau \right )$

. The corresponding GS function reads

$\left (\nu ,-U_{\tau },\tau \right )$

. The corresponding GS function reads

\begin{equation} \phi _{z,\delta ,s}\left (u\right )=\mathbb{E}\left (z^{\nu }e^{s\left (-U_{\tau }\right )-\delta \tau }1_{[\tau \lt \infty ]}\right )=\sum _{m=1}^{\infty }z^{m}\intop _{0}^{\infty }\intop _{0}^{\infty }e^{sy}e^{-\delta t}f_{\nu ,-U_{\tau },\tau }\left (m,y,t\right )dydt, \end{equation}

\begin{equation} \phi _{z,\delta ,s}\left (u\right )=\mathbb{E}\left (z^{\nu }e^{s\left (-U_{\tau }\right )-\delta \tau }1_{[\tau \lt \infty ]}\right )=\sum _{m=1}^{\infty }z^{m}\intop _{0}^{\infty }\intop _{0}^{\infty }e^{sy}e^{-\delta t}f_{\nu ,-U_{\tau },\tau }\left (m,y,t\right )dydt, \end{equation}

and the density

![]() $f_{\nu ,-U_{\tau },\tau }$

can be derived by the inversion of

$f_{\nu ,-U_{\tau },\tau }$

can be derived by the inversion of

![]() $\phi _{z,\delta ,s}\left (u\right )$

with respect to

$\phi _{z,\delta ,s}\left (u\right )$

with respect to

![]() $z,\delta$

and

$z,\delta$

and

![]() $s$

. In general, simultaneous inversions that involve three variables are difficult to derive analytically. As another option, the joint density of

$s$

. In general, simultaneous inversions that involve three variables are difficult to derive analytically. As another option, the joint density of

![]() $\left (\nu ,-U_{\tau },\tau \right )$

can be determined using a single variable inversion of the transform

$\left (\nu ,-U_{\tau },\tau \right )$

can be determined using a single variable inversion of the transform

\begin{equation} \ell _{\delta }\left (m,y,u\right )\,:\!=\,\intop _{0}^{\infty }e^{-\delta t}f_{\nu ,-U_{\tau },\tau }\left (m,y,t\right )dt, \end{equation}

\begin{equation} \ell _{\delta }\left (m,y,u\right )\,:\!=\,\intop _{0}^{\infty }e^{-\delta t}f_{\nu ,-U_{\tau },\tau }\left (m,y,t\right )dt, \end{equation}

where numerical inversion can be easily applied; see, for example, Abate and Whitt (Reference Abate and Whitt1992) for a detailed list of algorithms. Alternatively, for fixed discounted factor

![]() $\delta$

, the transform (3.15) can be seen as the discounted defective density of

$\delta$

, the transform (3.15) can be seen as the discounted defective density of

![]() $\left (\nu ,-U_{\tau }\right )$

with corresponding Gerber–Shiu measure

$\left (\nu ,-U_{\tau }\right )$

with corresponding Gerber–Shiu measure

which can be used to derive the distribution of the number of claims until ruin. In some cases,

![]() $\ell _{\delta }\left (m,y,u\right )$

can be expressed in terms of scale functions (see Biffis & Kyprianou, Reference Biffis and Kyprianou2010) or by renewal arguments (see Cheung & Woo, Reference Cheung and Woo2016). By utilizing the analytic formula (3.10), we shall be able to apply a straightforward approach. The inversion of (3.15) with respect to

$\ell _{\delta }\left (m,y,u\right )$

can be expressed in terms of scale functions (see Biffis & Kyprianou, Reference Biffis and Kyprianou2010) or by renewal arguments (see Cheung & Woo, Reference Cheung and Woo2016). By utilizing the analytic formula (3.10), we shall be able to apply a straightforward approach. The inversion of (3.15) with respect to

![]() $\delta$

leads to

$\delta$

leads to

![]() $f_{\nu ,-U_{\tau },\tau }$

, while setting

$f_{\nu ,-U_{\tau },\tau }$

, while setting

![]() $\delta =0$

induces the joint density of the pair

$\delta =0$

induces the joint density of the pair

![]() $\left (\nu ,-U_{\tau }\right )$

. Moreover, we can derive the (defective) probability function of the number of claims until ruin

$\left (\nu ,-U_{\tau }\right )$

. Moreover, we can derive the (defective) probability function of the number of claims until ruin

![]() $f_{\nu }\left (m\right )\,:\!=\,\mathbb{P}\left (\nu =m\right )$

from

$f_{\nu }\left (m\right )\,:\!=\,\mathbb{P}\left (\nu =m\right )$

from

![]() $f_{\nu }\left (m\right )=\intop _{0}^{\infty }\ell _{0}\left (m,y,u\right )dy$

. In order to find the LT (3.15), we present a connection between

$f_{\nu }\left (m\right )=\intop _{0}^{\infty }\ell _{0}\left (m,y,u\right )dy$

. In order to find the LT (3.15), we present a connection between

![]() $\phi _{z,\delta ,s}\left (u\right )$

and

$\phi _{z,\delta ,s}\left (u\right )$

and

![]() $\phi _{z,\delta ,s}\left (0\right )$

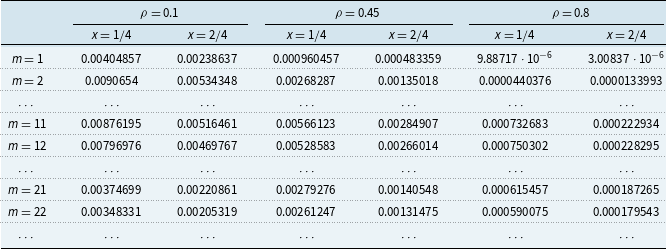

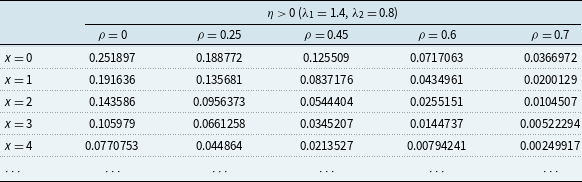

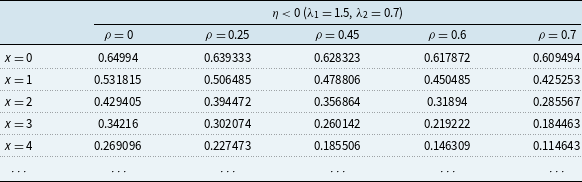

. If