Why is it so challenging to escape the middle-income trap (MIT)? This evocative concept provides a useful framework for describing the dilemmas middle-income (MI) countries face as they strive to achieve higher levels of development. Yet the concept’s strong structural bent tends to analytically foreclose alternatives for escaping it. Policymakers and communities of applied research in the Global South could move on to a promising new stage by bridging two separate strands of inquiry: the MIT framework and the evolving knowledge on how firms located in the world’s semi-periphery attain insertion into Global Value Chains (GVCs).Footnote 1 This move entails tackling MIT’s critical questions by means of a grounded, empirically driven discussion: What are the implications for sectors and firms of being located in countries trapped in the MI status? What are the distinctive challenges they face when attempting to move towards a more advantageous position in the international division of labor? Ultimately, what can governments, firms and workers in these countries do to renegotiate and reconfigure the prevailing types of insertion into GVCs?

This paper addresses these issues through a comparative study of the upgrading trajectories of four Argentine firms operating in manufacturing and natural resources-intensive sectors. Our goal is twofold. On the one hand, we aim to confront the structural pessimism of the MIT diagnosis with the GVC’s more nuanced understanding of the real-world challenges and opportunities MI countries face as they strive to diversify their economies and move toward more complex, technology- and knowledge-intensive sectors. On the other hand, we intend to explore, through a structured comparison, what lessons can be drawn from the trajectories of these firms to illuminate the experience of other MI countries facing similar challenges.

To these ends, the paper proceeds as follows. First, we recast ongoing debates on the causes and implications of the MIT by connecting them with the GVC’s fine-grained discussion of the challenges of productive upgrading from the Global South. Second, we present four case studies of relevant Argentine firms undertaking upgrading in two sectors: agrobiotechnology and auto parts manufacturing. Through this paired comparison, we aim to identify the dilemmas and obstacles faced by firms striving to improve their position in GVCs and to delve into the factors that explain their achievements and shortcomings. Finally, we draw some analytical lessons from the case studies. To that end, we inductively elaborate three ideal-typical possible trajectories, which we call subordinate, defiant, and path-breaking. For each of these trajectories we point out enabling conditions for upgrading and explore their implications for countries seeking to break out of the MIT.

Caught in the trap: analytical insights from the middle-income trap and global value chain literatures

By the end of the 1990s, the rapid industrial development of the so-called Asian Tigers (especially, South Korea and Taiwan) seemed to offer a promising model for countries in the global semi-periphery. They had succeeded in transitioning, in a matter of decades, from being assembly-driven and inward-looking economies to R&D-driven and export-oriented ones.Footnote 2 Yet, the experience of other East Asian countries, like Malaysia and Thailand, cast serious doubts as to whether that trajectory could be replicated. The middle-income status, originally thought as a step towards becoming a high-income country, came to be seen as a stable equilibrium that trapped these economies into long periods of sluggish growth and sometimes outright failure.Footnote 3

The concept of a middle-income trap gained popularity as an analytical framework for numerous studies seeking to empirically characterize this phenomenon.Footnote 4 In addition to identifying per capita income ranges characteristic of “entrapped” countries, this —mostly economic— approach argued that countries in that condition faced serious challenges for capitalizing either one of the two rapid-economic-growth trajectories that the global economy offered at the turn of the century. On the one hand, when reaching MI levels, the workforce had already secured living standards not amenable with an insertion into international markets through labor-intensive manufacturing. On the other hand, these economies lacked the institutional infrastructure, capital accumulation, economic regulations, and levels of human capital formation required for attaining specialization in the export of high-value-added and knowledge-intensive goods and services.Footnote 5

Yet, an important question remained unanswered: What were the underlying causal mechanisms that initially gave birth to, and subsequently perpetuated, the MIT? To answer this question we can resort to a larger literature drawing on different disciplinary approaches that strives to explain the economic trajectories of MI countries. Adopting a macro-level diachronic perspective, scholars have argued that economies trapped in middle-income status have undergone a detrimental historical process of structural transformation. The argument is usually backed by a comparison of the recent trajectories of East Asia and Latin America. Beginning in the 1950s, countries like South Korea successfully facilitated a rapid shift of labor from low-productivity sectors to manufacturing. Conversely, countries like Argentina failed to achieve a similar transformation.Footnote 6 These contrasting trajectories can in turn be traced back to a failed developmental blueprint in Latin America. The “easy” import substitution industrialization strategy, with its strong reliance on foreign direct investment (FDI), led to the prevalence of a non-competitive, inward-looking industry and a systemic vulnerability to negative commercial and/or financial shocks.Footnote 7

A second approach adopts a synchronic perspective. Building on the Varieties of Capitalism approach, the concepts of Hierarchical Market Economies (HMEs) and Dependent Market Economies (DMEs) aim to provide an understanding of how the structural configuration and institutional arrangements these countries came to have not only shape their current economic performance but also their long-term developmental perspectives.Footnote 8 First, these economies have a dominant presence of MNCs in most technology-intensive economic sectors, which pushes local business toward low-complexity, low-value-added activities, including non-tradable and natural resources-intensive sectors. Second, R&D investment levels are significantly lower than those observed in developed economies. The scarcity of innovative local firms reinforces dependence on FDI to produce complex goods and services, which creates a feedback effect that restricts the potential output of these economies and perpetuates their MI status.

Finally, a third approach zeroes in on the interests and strategies of collective actors to argue that coalitional dynamics typical of MIT countries are key barriers to escape the trap. These coalitional dynamics hinder the possibility of cementing a national strategy oriented towards pursuing the economic and institutional investments required to modernize these economies.Footnote 9

While offering valuable insights into the structural challenges faced at a macro-level by peripheral economies, we believe these approaches have important limitations for a more comprehensive analysis of the MIT. First, because of their emphasis on structural factors, they tend to produce descriptions and explanations that are excessively static and neglect the effects that the agency of individual actors—especially, firms’ choices and strategies—can have in the process of perpetuating or overcoming the MIT.

Second, although the mode of integration into global markets is identified as a potential obstacle for attaining higher levels of development, this is mostly considered a byproduct of national-level factors. Less attention has been paid to how international factors, such as the reorganization of production and trade at a global scale, can create conditions that either reinforce the MIT or offer new escape opportunities across regions and national boundaries.Footnote 10 In particular, the geographical fragmentation of production, due to the decoupling of design and manufacturing and the outsourcing of non-core activities by leading global firms, not only shape the playing field in which MI countries seek to participate but also configure MIT-economies internally.Footnote 11 The advent of GVCs has radically transformed traditional developmental trajectories, compressing different stages into multiple segmented and uneven insertions into the global economy. MI countries can be home to firms located in the highest or lowest segments of their respective GVCs (or even completely disconnected from GVCs), which makes it very difficult to consolidate upgrading efforts into a single national developmental strategy.Footnote 12

These limitations can be productively addressed by bridging the MIT structural perspective with the vibrant literature focused on the workings of Global Value Chains (GVC).Footnote 13 The GCV approach situates the agenda of development on a global scale by considering the relationships among the large transnational lead firms and the domestic firms located in middle- and low-income countries. These linkages provide a mechanism for upgrading, i.e., incorporating technology, increasing the efficiency of productive processes, and gaining access to international markets as skilled suppliers of GVCs’ lead companies. Furthermore, the position of a firm within a specific value chain needs not to be static. Firms may undertake a process of incremental upgrading, gradually taking on more complex tasks over time, thus gaining increasing participation in the global appropriation of benefits within the GVC.Footnote 14 A related approach, the Global Production Network (GPN), focuses on a more aggregate level, to analyze how at the subnational-level regions can develop by integrating into the global economy by means of strategic coupling to these GVC.Footnote 15 The GVC and GPN approaches thus effectively break down the overarching macro-level question of achieving higher levels of development into a multiplicity of firms’, sectors’ and regions’ deliberate efforts to scale positions within a global value chain.

Upgrading in GVC entails four main ideal types: process, product, functional and inter-chain upgrading.Footnote 16 Process upgrading improves increasing production efficiency through adopting new technologies or methods. Product and functional upgrading involves shifting up to higher-value products or functions, such as designing or branding. Inter-chain upgrading enables firms to enter new sectors by leveraging competencies gained within a value chain. The type and extent of domestic firms’ upgrading process are crucially shaped by GVCs’ specific governance patterns.Footnote 17 In producer-driven networks, the lead firm exercises tight control over every segment, often through vertical integration. On the other hand, buyer-driven networks grant autonomy to non-leading firms and coordination is achieved through the market.Footnote 18 A second, more nuanced, typology considers intermediate patterns of coordination, which in turn depend on the complexity of knowledge transferred between firms; the degree to which it can be codified; and the capabilities of non-leading firms. Asymmetrical governance patterns that characterize “captive value chains” can emerge, even without hierarchical integration, when tasks are highly codified and supplier capabilities are limited. In contrast, modular or relational value chains exhibit more balanced power dynamics between lead firms and suppliers.Footnote 19 In turn, value chains characterized by lower asymmetries provide greater avenues for upgrading, whereas those marked by hierarchical arrangements offer fewer prospects for such advancement.Footnote 20

Over time, the GVC literature has been enriched by the innovation system and technological capabilities approaches’ call for zooming out from GVC governance patterns to identify additional factors that may support upgrading efforts in MI countries. These contributions pointed out that GVC research has paid insufficient attention to the local institutional context in which domestic firms operate as well as to the deliberate efforts undertaken by these firms—and the capabilities and resources mobilized to that end—to challenge their location within the chain.Footnote 21

First, local innovation systems (LIS), in which public technology policies and organizations play a leading role, may support domestic firms’ learning and innovation processes by easing the difficulties in dealing with highly complex and codified transactions. Sectoral and intersectoral horizontal linkages among local firms can also provide key inputs and technological services for firms undertaking upgrading efforts, and therefore reduce their need to build backward and forward linkages with foreign companies.Footnote 22 Therefore, “the nature of the innovation system affects the range of possible modes of governance. (…) A well-structured and efficient innovation system can (…) enable (…) less hierarchical forms of GVC governance, [diminishing] the risk of falling into a captive relationship or being acquired by a leader.”Footnote 23 If sufficient support from the LIS is available, firms’ learning trajectory can lead to positive outcomes even within GVCs that initially do not offer high upgrading opportunities.Footnote 24

Second, in addition to enabling conditions, upgrading requires a deliberate effort by domestic firms. The technological capabilities approach calls to open the black box of domestic firms’ upgrading efforts. It identifies investment, production and linkages capabilities as necessary attributes for success, which in turn depends on firms’ previous trajectories.Footnote 25 In contexts of weak contract-enforcement institutions and narrow and inefficient markets—conditions that often prevail in MI countries—linkage capabilities (i.e., “special skills … to establish technology linkages among enterprises, between them and service suppliers, and with the science and technology infrastructure”) are often critical.Footnote 26 This approach also explicitly conceives of national trajectories of development as the aggregate results of firms’ upgrading efforts across sectors and GVCs.Footnote 27

Third, since knowledge features are at the center of technology adoption, learning and innovation processes, there are also technological and sectoral idiosyncrasies that are consequential for domestic firms’ upgrading trajectories.Footnote 28 In particular, short-cycle technologies, in which knowledge is rapidly changing and incumbents have less entrenched technology advantages, may offer more opportunities for “leap-frogging” to higher function within GVCs.Footnote 29 This may also offer novel opportunities in sectors that have traditionally been considered less likely to trigger upgrading processes, such as natural resources-intensive sectors. Domestic firms can leverage their knowledge of local conditions to produce, through backward linkages in primary sectors, knowledge-intensive and highly profitable goods and services with the potential to reach global markets. A crucial factor is the timing in which the mastering of the new technologies—as well as the business opportunities they create—occurs.Footnote 30

A final critical factor is the presence of robust state policies to support upgrading efforts by domestic firms.Footnote 31 Industrial policies can boost upgrading efforts by facilitating access to capital, providing industrial and technological services, promoting horizontal local linkages among firms, and fostering human capital development.Footnote 32 In addition to this role as facilitator, the state can be a powerful force in regulating the distribution of rents inside GVCs and enhancing the opportunities for upgrading through domestic legal frameworks and trade policies.Footnote 33 Institutional support and effective public policies at the regional level, as well as strong LIS, are also critical factors in supporting higher forms of strategic coupling in the GPN approach.Footnote 34

In short, while the MIT diagnosis puts the absence of innovative domestic firms at the center of its analysis, the GVC approach is sensitive to opportunities arising from the reconfiguration of global production. Enriched with insights from adjacent perspectives, it offers an analytical framework to investigate upgrading efforts empirically. Supportive public policies, including the national and regional innovation systems’ strength; domestic firms’ capacities and deliberate efforts to move up; as well as intrinsic features of productive knowledge and technologies are all factors that interact with GVC’s governance patterns in configuring multiple trajectories of upgrading. These factors can be consequential to overcome GVC lead firms’ preference—and sometimes deliberate efforts—to block domestic firms’ attempts to achieve higher forms of upgrading (i.e., product and functional upgrading).Footnote 35 At a more aggregated level, they may also favor higher forms of strategic coupling with GPN by specific regions within a country.Footnote 36

In the next section we apply these analytical insights to open up the black box of domestic firms’ trajectories of upgrading in countries now trapped in the MIT. To that end, we conduct four original case studies of upgrading efforts by domestic firms in Argentina’s automotive and agrobiotechnology sectors. Before turning to the cases, the next section discusses case selection, our methodological approach, and the nature of our evidence.

Case selection, methodology and data

Our case selection combines two small-N strategies. At the national level, Argentina is a typical MIT-country.Footnote 37 As such, it constitutes a most-likely case for contrasting whether MIT structural features preclude upgrading trajectories.Footnote 38 A most-likely case is one in which there is a strong presumption that an observable implication of a theory should verify. If that implication is not observed, our confidence in the alternative hypothesis strengthens—in this case, the claim that the reconfiguration of GVCs offers some opportunities for upgrading.

Within Argentina, we selected four firms located in dynamic sectors that produce high-value-added goods and services and that are intensive in R&D. In addition, the four firms have undertaken upgrading efforts with varying degrees of ambition. In selecting these firms, we thus conduct a purposive selection of cases of relative success: companies that, despite coming from a country that is affected by the MIT, score relatively high in terms of upgrading and in their capacity to enter GVCs. Adapting the language of quantitative analysis, we are selecting cases on “extreme values” of the dependent variable. Selecting cases on the dependent variable is a suitable methodological strategy to inductively identify different modes or patterns within a set of positive cases.Footnote 39 For its part, selecting “extreme” cases is an appropriate strategy for theory-building, since in such cases the relevant features of a theoretically defined phenomenon (i.e., corporate upgrading) should be more salient.Footnote 40

Since our goal is inductively understanding modes of success and within-case drivers of change, we select cases on two sectors that vary in one key variable that could have an impact in configuring firms’ trajectories: Argentina has natural comparative advantages in agriculture, whereas as a typical late-coming, MIT-country, it lacks comparative advantages in the automotive sector. Sectoral characteristics are also consequential for the type of technology and productive know-how each activity entails. By selecting two cases within each sector, we also seek to incorporate additional variation in the capacities of firms as well as in the extent and kind of support received by national and subnational institutions. In short, in the selection of firms we sought variation in the factors identified in the previous theoretical discussion.

Our small-N methodological strategy therefore does not rely on a random sampling of cases nor does it intend to attain statistical generalization. Instead, we rely on the careful reconstruction of processes using multiple sources of evidence so as to attain solid descriptive inferences as well as hypotheses about within-case causality.Footnote 41

As is usually the case with theory-generating, small-N comparative research, ours is an inductive endeavor.Footnote 42 We purposely generate hypotheses about three different trajectories of firms trying to obtain a better deal from GVCs coming from a MIT-country after looking at the evidence with the analytical toolkit previously discussed. In doing that, we follow the technological capabilities approach’s call to open the black box of MIT-country firms’ efforts to build technological and innovation capacities to challenge their position within GVCs.Footnote 43 We believe that the findings and conceptualized trajectories could travel as useful heuristics to explain similar trajectories in other MIT countries. Yet, testing the frequency of the identified trajectories within and beyond Argentina is beyond the scope of this paper.

The techniques of data collection were partly determined by our methodological approach and our object of study. Since our selected firms are not public, interviewing the key stakeholders in each firm became the main instrument for data collection. We conducted 53 semi-structured interviews distributed as follows: 24 interviews for the auto parts sector (12 for each case study), and 29 interviews for the biotech sector, including 5 with Bioceres management and 3 with BioHeuris management. We selected informants that could share first-hand knowledge of key facts and decisions configuring the trajectories of firms, prioritizing founders, CEOs, CFOs, and chief engineers and executives in charge of business development. Our interviews were conducted between 2021 and 2022 and lasted on average between 60 and 100 minutes. We supplemented interview evidence with a number of secondary sources, ranging from quantitative data from public agencies, newspaper articles, and previous scholarly studies.

Four cases of insertion into GVCs in Argentina’s automotive and agricultural biotechnology sectors

Argentina’s automotive sector

Argentina’s automotive industry is one of the most dynamic and globally integrated sectors of the country. In 2021 it was the third economic complex in terms of exporting capacity after the corn and soybean industries.Footnote 44 It is one of the segments of Argentina’s manufacturing sector that invests the most in R&D.Footnote 45 In addition, it employs around 70,000 workers (almost 6% of the country’s industrial workforce) offering comparatively high wages and demanding complex skills.Footnote 46

The origins of Argentina’s automotive sector can be traced to the early 1920s with the establishment of a series of plants dedicated to assembling imported vehicles.Footnote 47 This fostered the development of a small network of locally owned auto parts firms focused on manufacturing the spare parts required for maintaining the growing vehicle fleet. Yet it was in the 1950s and 1960s, with the implementation of a series of ISI-style policies, that the sector became one of the most important industries in Argentina.Footnote 48 Several tax and tariff benefits were offered to foreign lead firms while also incentivizing domestic auto parts companies through the imposition of local content requirements and the restriction of auto parts imports.Footnote 49 These policies increased the number of global subsidiaries operating in the country and gave birth to a new modernized segment of local auto parts firms focused on supplying components to assemblers.

Since the mid-1970s a series of transformations have taken place in the industry. First, important regulatory protections were reduced, exposing local auto parts firms to foreign competition and forcing subsidiaries to rationalize their business strategies.Footnote 50 Second, during the 1990s the government promoted the regional integration of the sector through MERCOSUR, particularly with the Brazilian market.Footnote 51 Third, at the global level the sector became structured as an extended GVC, particularly affecting local auto parts firms due to the rise of a new class of first-tier global suppliers of components.Footnote 52

In this section we seek to understand the current challenges faced by two medium-sized, Argentine auto parts firms as they seek to upgrade in an era marked by the dominance of GVCs. The automotive GVC has been characterized as a producer-driven network with strong hierarchical tendencies.Footnote 53 However, a closer look shows that there is a large array of governance patterns within this sector. Thus, the automotive global industry can be characterized as a tiered supply chain.Footnote 54 At the top, a small set of lead firms (traditionally from the industrialized core) are in charge of vehicle development and final assembly. At the bottom, a large universe of firms operate as suppliers of simple components (the so-called tiers 3 and 2). The relationship between firms at the top and at the bottom tends to assume hierarchical or captive governance patterns.Footnote 55 Lead firms are able to codify most of their own production processes and favor vertical integration with local suppliers in those places where assembly platforms are established. In this sense, tier 3 and 2 suppliers face a dilemma. The production of specific components tends to involve higher-value-added activities but remains captive of the codification carried out by lead firms; in contrast, more buyer-driven relationships arise in the segment of low-value-added and generic supplies.Footnote 56 In this sense, upgrading opportunities for actors located at the bottom of the chain tend to be scarce and driven by lean production efforts championed by lead firms.

Yet in the last decades a set of globalized tier 1 suppliers has emerged.Footnote 57 These tend to have high capacities, be internationalized and, working along lead firms, increasingly involved in the design of components. These new high scale suppliers have given birth to modular and relational governance patterns that depart from the traditional hierarchical organization of the automotive GVC. In the current structure of the automotive GVC, auto part firms compete in their attempt to reach a first-tier status, which guarantees a close relationship with the lead firms of the chain.Footnote 58

The two cases analyzed in this section show divergent types of upgrading for MI countries’ firms. While Grupo Basso was able to leverage support by the regional innovation system to undertake functional and product upgrading, thus becoming a 1st-tier provider in specific niches, Industrias Guidi was limited to process upgrading. In the latter case, productivity gains and technology incorporation were achieved at the expense of consolidating an asymmetrical and captive relationship with the lead automotive firm. We further identify a series of factors that conditioned those outcomes, including the kind of auto parts produced, the type of insertion achieved, and the support (or lack thereof) provided by the local institutional context.

Industrias Guidi (IG)

Auto parts company IG, established in the early 1960s, currently operates two plants in the Province of Buenos Aires and employs over 500 workers. In the mid-1990s a turning point took place: IG became a domestic supplier for Toyota’s subsidiary in Argentina—a MNC leading Argentina’s regional specialization in commercial motor vehicles, especially the exports of pickups. This relationship shaped IG’s insertion within the automotive GVC and the kind of upgrading it was able to pursue.

Type of product and its level of complexity

IG is specialized in the production of midsize body parts like bumpers, box front panels, and front fenders. Manufacturing these components entails performing two main industrial processes: stamping and welding. While they need workers with specific training and the use of specialized machinery, body part segments are considered to be at the lowest end of complexity within the set of components required to assemble an automobile.Footnote 59 Given that product specifications are highly codified, this pattern of specialization is not conducive to the kind of collaborative relationships that favor more symmetrical relations with the lead firm and higher types of upgrading.

Type of upgrading attained

Since the beginning of its relationship with Toyota Argentina, IG has achieved process upgrading. This process has been mostly determined by the requirements and opportunities set by the lead firm’s business strategy as a condition to stay in business. IG has not advanced to perform product and/or functional upgrading, i.e., the type of upgrading required to reap higher benefits within the GVC.

The diffusion of the Toyota Production System (TPS) is the clearest example of this pattern. The TPS is a set of norms and procedures that summarize Toyota’s famous lean, just-in-time production process (Perez Almansi Reference Perez Almansi2023). Toyota has consistently encouraged its suppliers to adopt the TPS to help these firms achieve higher efficiency and hence a reduction in the cost of components. In the case of IG, the adoption of the TPS started in 2008. The implementation of the TPS enabled IG to improve its efficiency and the quality of its output. Since its implementation in 2008, the number of parts per million that were annually found defective was reduced from 500 to 5 in 2021. Also, significant productivity gains were achieved as measured by the number of body parts welded per worker, the growth of the ratio number of hourly body parts stamped/cost of machinery and salaries, and the number of global strokes per hour performed by each stamping machine.Footnote 60

In addition, IG has modernized the machinery of its plants, which allowed the company to reach an automatization index higher than 90%—a comparatively high figure for Argentina’s auto parts firms.Footnote 61 In order to modernize the stamping line, transfer stamps were bought—by 2021 the stamping line of one of the two IG plants was completely robotized. Furthermore, IG has acquired 55 welding robots and 4 highly complex ABB robots.Footnote 62 These 4 ABB robots were loaned by Toyota Argentina so that IG could be able to produce the body parts for the latest pick up model launched by the lead firm (the 2015 Hilux).

All its positive effects notwithstanding, the implementation of the TPS and the acquisition of modern machinery followed to some extent the desire of IG to conform to the requirements of Toyota Argentina and to scale up as a trusted supplier. In particular, most of the milestones in IG’s recent process upgrading trajectory were associated with the goal of winning the bidding process for most of the body part components of the 2015 Hilux (i.e., the flagship model of Toyota Argentina). As a result, while IG has improved the efficiency and quality of its production process, it has not been able to make a leap in terms of the complexity of its goods or the functions the company performs within the automotive GVC.

Mode of insertion into the automotive GVC

IG’s upgrading trajectory has been facilitated by the particular kind of relationship that Toyota fosters with its suppliers across the world.Footnote 63 The Japanese automaker does not have a centralized purchasing division (an uncommon feature in comparison with other automotive lead firms), which has allowed its different subsidiaries to rely on local suppliers—thus avoiding importing the vast majority of auto parts, as other MNCs do. Contrasting with the short-lived market-driven relationships found in multiple nodes of the auto parts GVC, IG has built long-term cooperation with Toyota Argentina, which includes the exchange of information and technology.Footnote 64 Toyota Argentina has established channels with its suppliers for fostering capabilities acquisition in exchange for the adoption of stringent standards that delineate particular upgrading patterns, mostly focused on the organization of production.

IG’s mode of insertion into the automotive GVC thus has a number of attributes of what the literature calls a captive governance pattern. Since 1997 IG has integrated into Toyota’s Argentina business plan as a supplier; for IG, Toyota represents roughly 95% of its total sales while most of its equipment and production processes are tailored to fulfill Toyota’s requirements.Footnote 65 Governing the relationship between the two firms entails regular monitoring and control procedures. As specified by the contract, IG’s output is compared with that of other Toyota suppliers around the world and annual objectives are set in order to achieve similar productivity levels between Argentine and non-Argentine providers. In practice, IG competes not with Argentine auto parts companies but with those that serve Toyota in Thailand.

Firm’s relationship with the broader local institutional context

In its quest to respond to the demanding output goals set by the MNC, IG devised a series of creative solutions to deal with the tensions that arose in the areas of training and industrial relations at the time when IG started to apply the TPS in its plants. In these answers we see an absence of the kind of external institutional support that according to the LIS literature is a necessary condition for higher upgrading trajectories. First, IG solved worker training needs internally with the support of Toyota Argentina. Implementing the TPS required that IG trained its workers for the acquisition of new complex soft skills. This demanded hiring external instructors that worked under the supervision of Toyota Argentina’s employees in the IG plants. Since mastering new machinery was essential, IG developed novel agreements with public universities and technical schools in order to offer internships to local students that could later be hired as IG workers with the ability to operate the new equipment.Footnote 66

Second, the process of upgrading created a window of opportunity for IG to renegotiate industrial relations in its plants. The implementation of the TPS pushed the auto parts firm to negotiate with its workers the incorporation of a payment structure attached to productivity targets and polyfunctional tasks. This was discussed with union representatives at the plant level and, in practice, partially recrafted the sector-wide collective agreement that had been in place in Argentina since the mid-1970s. The requirements for becoming a Toyota’s provider thus clashed with Argentina’s typical MI prevailing labor regulations, shaped by a comparatively strong corporatist legacy, creating incentives for localized institutional change.

Grupo Basso (GB)

The Santa Fe-province, medium-sized enterprise GB is a case that illustrates a rare but feasible strategy of insertion into the automotive GVC that works around the dominant position of global lead firms to reap significant benefits at the domestic level. In its initial development in the 1960s, GB followed a trajectory that mirrored Argentina’s inwards-oriented automotive sector, focusing on supplying the local market. In the 1980s and 1990s GB moved on to an ambitious process to conquer external markets. As of the 2020s the company exports over 80% of its production to more than 30 destinations and has major global firms among its clients—including Peugeot, Fiat, General Motors, Ford, Ferrari, Mercedes Benz, and John Deere.

Type of product and its level of complexity

GB specializes in combustion engine valves, a complex component for global car manufacturers that must conform to the highest quality and performance standards.Footnote 67 The combustion engine valve market is highly segmented. GB produces over 2000 different models for four segments: aftermarket, original equipment, competition, and high-performance.Footnote 68 Some of them offer an opportunity to perform functions that go beyond the mere production of the component that originated the relationship with automakers in the first place. While the aftermarket is highly standardized and does not require complex capabilities, the original equipment and especially the competition and high-performance markets demand customization, design, and post-sale services from suppliers.Footnote 69 In these latter segments GB has found the largest profit margins and opportunities for upgrading.

Type of upgrading attained

GB has succeeded in upgrading both the functions it carries out within the chain and its products. It has steadily incorporated new functions beyond the manufacturing of engine valves—including design, marketing, logistics, and post-sale services.Footnote 70 Additionally, GB has brought increasingly more complex valves to the market, launching products such as hollow valves and non-conventional valve chrome plating.Footnote 71 In this process, GB expanded its initial operational or duplicative capabilities to invest in acquiring adaptive and innovative capabilities.Footnote 72 Incorporating new external technologies and consolidating engineering and design capacities within the firm allowed GB to optimize the production process and its valves’ performance, by choosing the most appropriate materials and treatment procedures for those materials.

Developing these capabilities pushed GB to strengthen its capacities for knowledge absorption and production. When in the mid-1990s GB’s leaders decided to venture into the European market, they set up a research laboratory with equipment and personnel that enabled the firm to produce valves that could meet the requirements of the newly gained competition and high-performance clients.Footnote 73 Over time this laboratory fostered the consolidation of linkages capabilities, by establishing a collaborative network with several local research centers and universities.Footnote 74 These partnerships strengthened GB’s capacity to bring new valves to the market and to establish the firm’s co-design and post-sale services.Footnote 75

Mode of insertion into the automotive GVC

GB’s insertion in the automotive GVC has followed a comparatively autonomous pattern shaped by the dynamics of each of the segments of the market in which the firm operates. Since the 1980s, GB has diversified its client portfolio and scaled up into those segments that are above the aftermarket in terms of complexity. A first step was acquiring the local firm that had previously built relationships with subsidiaries of lead firms, including Ford and Peugeot. This permitted GB to make its way into the original equipment market. Later, in the mid-1990s GB enlarged its client portfolio in the European and North American regions, with a special focus on the competition and high-performance segments. In 2002, as part of this expansion, Basso bought a plant in the USA.

Two different governance patterns can be identified in the segments of the market where GB has thrived—both deviating from the captive or quasi-hierarchical tendencies typical of the automotive GVC. The aftermarket segment presents the characteristics of a market-driven GVC. In contrast, the original equipment, competition, and high-performance market segments tend to foster more relational modes of governance. It is in these segments where GB has built close, horizontal relationships with its clients, supplying non-standardized products. Offering co-design services and conducting reverse engineering of components has been key for the firm’s export-oriented growth.Footnote 76 Moreover, this kind of insertion has also opened up several formal and informal channels for technological transfer from GB’s buyers. This in turn allowed the firm to manufacture valves with increasing value added and to develop a high capacity within GB to forecast and adapt to new tendencies and technological innovations taking place at the global level, which is often very hard for SMEs in MI countries.Footnote 77

Firm’s relationship with the broader local institutional context

The growth trajectory of GB was bolstered by its hometown—Rafaela—highly developed local innovation system, particularly that related to the automotive sector. This city-level ecosystem is organized around a number of government agencies and business associations that contribute with the upgrading of local firms and the strengthening of their export capacity. These public-private interactions gave birth to a sort of neo-corporatist mode of interest intermediation at the local level. In this sense, Rafaela presents the kind of feedback effects between local firms, business associations, public institutions and GVCs that is expected in the presence of a relatively well-developed LIS.

GB benefited from public support in three main areas. First, GB’s commercial expansion abroad was supported by the municipal government, which facilitated the participation of GB in international fairs. This was crucial for contacting the new clients that Basso was targeting for expansion. The local government also assisted GB in designing a novel marketing strategy to boost the reach of the company’s products outside Argentina. In both cases, it did so by working along the firm to obtain financing and technical assistance. Second, GB was able to upgrade its products and functions partially due to a series of linkages that the firm established with regional R&D public institutions. These R&D centers transferred technology that was fundamental for the development of hollow valves and permitted testing the quality of GB’s higher-end products at a relatively low cost.

Third, since the 1990s public-private coordination in Rafaela allowed local authorities to fine-tune the orientation of the local education and vocational training systems. Different from the case of IG, which solved most of its training necessities mostly in-house, these private-public initiatives facilitated GB’s capacity to solve the challenge of stably hiring highly qualified workers. The curriculum of local universities is defined in close consultation with the private sector through a series of institutionalized bodies where interest groups are represented. In 2005, a tertiary-level institute was established (ITEC) under the auspices of the city government and the Rafaelan business associations. Regular surveys are conducted to determine its training offering so as to match the changing demands of the private sector. In addition, GB has participated in an internship program especially designed for secondary-level students of technical schools willing to pursue a career in the manufacturing sector. Overall, support by the local IS has been critical in fostering GB’s product and functional upgrading.

Agricultural biotechnology in Argentina

Agricultural biotechnology has been singled out as a promising field for Argentina’s productive upgrading for many decades now.Footnote 78 This expectation is based on the comparative advantages the country has long enjoyed in the agricultural sector. Argentina is one of the main global producers and exporters of agricultural products —particularly of commercial grains.Footnote 79 The sector represents around 15% of Argentina’s GDP and almost 60% of its exports and employs 10% of its workforce. Since the 1990s, biotechnological products (mainly in the form of transgenic seeds and bio-inputs like fertilizers) have increasingly become a key input in the production of agricultural commodities. In the case of Argentina, large-scale producers of commercial grains have embraced these technologies, which had a significant impact on productivity and crop yields.Footnote 80 Adoption of GMO seeds reaches nowadays close to 100% in soy and wheat and 97% in cotton production.Footnote 81

The high expectations regarding the role biotechnology could play in Argentina’s structural transformation are also based on the long trajectory and comparative strength of the country’s public innovation system.Footnote 82 Argentina has been a regional pioneer in biotechnology since the 1980s, with academic programs hosted at public universities across the country’s main agricultural regions as well as several world-class research programs funded by the National Scientific and Technical Research Council (CONICET). The public agricultural promotion agency, National Institute of Agricultural Technology (INTA), also hosts several biotechnology-based seed improvement programs for the main commercial crops.Footnote 83 Biotechnology has also been singled out as a strategic “general purpose” technology in every science and technology policy planning adopted since the 1990s.Footnote 84 Moreover, Argentina’s science policy took since the late 1990s a “technological turn” to strengthen linkages between the public innovation system and the private sector, which especially targeted biotechnology projects.Footnote 85

This combination of market incentives and supporting policies has created a biotechnology sector that compares favorably with that of other MI countries’. Argentina has nowadays around 200 established biotechnological firms and approximately 75 startups.Footnote 86 This puts Argentina in the global top-20 in terms of the number of biotechnology firms, although still well below the four high-income countries leading the biotechnology revolution: USA, France, Spain and South Korea.Footnote 87

In spite of these positive developments, local companies have struggled to enter one of the most profitable segments of the agricultural value chain: patented GM crop events.Footnote 88 From 1996 to 2020, a total of 62 transgenic events for commercial crop production were approved in Argentina, but only 3 of them were developed and registered by local firms (Tecnoplant and Bioceres-INDEAR). The vast majority of approved events belong to a handful of large MNCs.Footnote 89 This reflects a broader structural dynamic characterizing the agricultural inputs GVC, which is dominated by a few MNCs originated in the chemical sector that expanded their market share by developing herbicide-resistant GMOs linked to a proprietary weedkiller. Starting in the 1990s, their market dominance was reinforced by a global move toward more restrictive intellectual property rights regimes.Footnote 90 And it was recently deepened by mergers that resulted in four firms controlling almost 75% of the global market —Bayer-Monsanto, ChemChina, Dow/Dupont, and BASF.Footnote 91

Dominant MNCs have been able to consolidate their position at the top of the GVC establishing a hierarchical governance pattern underpinned by the intellectual property regime born in the 90s. This configuration creates several hurdles for innovation by MI-country firms. On the one hand, a restrictive IP regime reinforces MNCs’ market power and may block the diffusion of scientific and technological knowledge beyond the incumbent firms.Footnote 92 On the other hand, market concentration creates commercial and logistical challenges for newcomers seeking to bring new technologies and products to global or local markets, since dominant firms dominate distribution channels.Footnote 93 In addition to these structural challenges there are the intrinsic challenges for innovation in biotechnology, a knowledge-intensive activity characterized by rapid technological change, high uncertainty and long maturation periods for investment in R&D. In particular, the expenditures and highly specific skills required to obtain regulatory approval of a new technology may operate as a barrier of entry harder to overcome than the scientific knowledge and lab infrastructure required to develop it. In the case of Argentina these conditions have created a clear division of labor between MNCs and local companies. Local firms have mostly specialized in developing seeds with non-transgenic techniques that, while not as profitable as GM crop events, are more accessible in terms of development and patenting.Footnote 94

Next, we study two cases of local firms aiming to scale up into the highest segment of the agricultural GVC as producers of biotechnologically improved crop seeds: a well-established conglomerate, Bioceres, and a rapidly developing startup, Bioheuris. A closer examination of the trajectory of the two firms shows clear differences in the strategy employed to accomplish such an upgrade. These not only stem from the kind of biotechnological technique chosen (transgenesis and gene editing) but also from the type of relationship they have built with other firms and their institutional context.

Bioceres

Bioceres was founded in 2001 by a group of 23 producers belonging to the most dynamic segments of Argentina’s commercial agriculture. They shared a common interest in innovations that could boost crop productivity. They were also concerned that local producers were increasingly relying on technologies owned by a few MNCs. Failing to master them could in the future reduce their autonomy and hamper their ability to access key inputs.Footnote 95 Over the years, the company developed an innovative network organization based on linkages with the public innovation system, foreign agricultural biotechnology firms, and investors. Bioceres management has been able to leverage its capabilities and those of its multiple partners to build a holding with 3 divisions that owns more than 20 companies. Listed on the Nasdaq Wall Street Technology Index as BIOX, with a market value of nearly 750 million dollars, the firm is positioned to be the next Argentine unicorn.

Type of product and its level of complexity

What sets Bioceres apart from other Argentine biotech companies is the development and deregulation for commercial use of the HB4 technology. It consists of a set of two transgenic events designed for soybean and wheat seeds that produce plants with greater tolerance to droughts, a feature of vital importance in the context of climate change. The technology was originally developed by a group of CONICET researchers working at National University of Litoral (UNL). In 2003, Bioceres signed an agreement to fund the process of obtaining regulatory approval and bringing the new technology to the market. While the patent remained property of the research group, Bioceres obtained an exclusive license for its commercial development. In turn, the dividends would be equally distributed between the firm and the two public scientific institutions that had championed its development (CONICET and UNL). The strength of the LIS was thus a crucial factor for the firm setting up a high-road upgrading strategy.

Even though the agreement proved ultimately successful, the process for obtaining approval for the HB4 technology was demanding and time-consuming.Footnote 96 It was only in 2015 that the HB4 soybean seeds received final approval regarding its biosecurity in Argentina, and it took until 2019 to get the same clearance in the USA and Brazil. Still, the Argentine Directorate of Agricultural Markets further postponed the dissemination of this technology for productive use until it received final approval from Chinese authorities—which happened in 2022. The regulatory approval of HB4 wheat crops underwent a similar trajectory, being fully commercially authorized in 2021 after a declaration of compliance by Brazilian regulators, Argentina’s main export market for this crop.

Given that its flagship product could not be readily introduced into the market for a long period, Bioceres was forced to diversify into other products. To that end, it built on the relationships it had constructed within the local biotech ecosystem by leveraging the promise of the HB4 technology´s future profits to raise capital. In 2016, Bioceres bought a controlling 50.01 percent of Rizobacter, a company specialized in soybean inoculants and fertilizers with yearly sales of USD 200 million, as well as Chemotécnica, a long-standing player in the crop protection segment. These moves boosted the firms’ credibility as a company with an actual set of commercially viable products in its portfolio, a crucial step for undertaking an IPO in the USA.Footnote 97

Type of upgrading attained

Bioceres is a success story of intersectoral upgrading. The original founders transferred the management and business skills acquired in Argentina’s large-scale commercial agriculture to an emerging sector operating in the global technological frontier. They did not seek to create value by moving forward the agricultural value chain (e.g., producing animal protein or food out of grains). Instead, they went backward seeking to gain participation in the strategic agricultural input market. The firm’s strategy thus illustrates how the growing technological- and knowledge-intensive character of natural resource-based sectors open novel opportunities for innovation through backward linkages.Footnote 98

The company has also been able to upgrade its products and its functions. First, Bioceres has developed other high-value-added biotech products like GMO carthamus (AGBM), metabolic engineering services (Inmet), and a genomic clinic (Héritas). Second, the company has started a project incubator division called Bioceres Ventures. With two investment funds, SF500 and Theo1, operating as an early stage-expansion fund and buyout fund respectively, the firm aims to become a major venture capital player in biotechnology.

Mode of insertion into the agricultural inputs GVC

Bioceres’ insertion into the agricultural inputs GVC follows a relational governance pattern. Bioceres’ original goal was to establish itself as a lead firm by upgrading into the most profitable segment of the agricultural inputs GVC—that of GMO crop events—. To achieve that, it faced three main challenges: developing the crops themselves, obtaining regulatory approval, and bringing them to global markets. Its mode of insertion is a result of the firm’s initial ambition mediated by the support as well as the obstacles it found in achieving its ultimate goal

Product development was facilitated by Argentina’s previous public investment in agricultural and life sciences. As it has been discussed, Bioceres based its business plan on a scientific development conducted at a public laboratory by a Conicet researcher. Yet, when the time came to seek regulatory approval for the technology HB4, Bioceres found that it did not have the specific skills and resources required. A common option for firms in this situation is to license the GMO crop event to a company already established in the highest node of the agricultural inputs GVC. Bioceres decided instead to associate with other biotech firms operating in Argentina’s main export markets with a proven record of obtaining approval for GM events. Thus it created Verdeca, a joint venture with US-based Arcadia Biosciences, to deregulate and commercialize the HB4 soybeans technology for the North American markets. Bioceres also signed a reciprocal agreement in regulatory matters with Beijing Dabeinong Biotechnology, a leading Chinese seed biotechnology company, to expedite the approval of HB4 soybeans in that market. A similar approach was taken with the HB4 wheat, through Trigall Genetics, a joint venture with Florimond Desprez, a leading French seeds company that operates in the UE market.

Bioceres also had to develop a commercial strategy to bring its product to agricultural producers even before the technology HB4 was approved.Footnote 99 Due to the lengthy nature of the patenting process, it is crucial to quickly generate commercial gains after the approval is granted. To that end, Verdeca signed an agreement in 2013 with Grupo Don Mario (one of the largest South American seed firms) and in 2015 with the Brazilian TMG to distribute the HB4 soybean seeds. In 2015, Verdeca established an agreement with Dow to include the HB4 technology in their Exzact gene-editing platform. That way Bioceres’s event could be accumulated to those owned by Dow to be readily distributed globally.

Bioceres’ approach of relying on strategic alliances with international partners for deregulation and commercial placement was facilitated by the symmetrical nature of these relationships, because of the complementarity of the highly specific knowledge each side of the partnership had (proprietary GM technology and expertise in regulatory matters, respectively). The support the firm had received by the LIS was highly consequential in setting the conditions for this symmetry.

Firm’s relationship with the broader local institutional context

Bioceres’s success was underpinned by the linkages it had built early on within the local public innovation system. These were crucial in developing its flagship product, the HB4 technology. Since its creation Bioceres allocated resources to monitor which innovations with commercial potential were being produced by Argentina’s public scientific system. For its part, concerned with the lack of interest public R&D institutions showed at the time on their lines of research, the CONICET team actively sought private support to put their new technology to productive use.Footnote 100 Thus, the agreement that the firm signed can be considered a positive anomaly within an institutional context that at the time struggled for routinely producing this type of collaboration.Footnote 101

Bioceres also benefited from other forms of public support for acquiring research capabilities, building infrastructure, and accessing finance. The firm’s main R&D division, the Agrobiotechnology Institute of Rosario (INDEAR), which was crucial in developing a larger portfolio of biotechnological products, was a public-private initiative launched in 2004 in alliance with Biosidus, another domestic biotechnological firm from the health sector, and CONICET. In addition, Bioceres has received support from several public funds that provide financing for R&D activities. The company was able to obtain a sizable portion of the public funds allocated to that end.Footnote 102

For the other challenges Bioceres faced, the local institutional context provided some but insufficient support. One of these challenges was gaining regulatory approval for its HB4. Argentina has a demanding regulatory framework for approving transgenic events, which lends credibility to new developments that have been able to pass it.Footnote 103 Yet, there are not well-funding public policies or advisory agencies supporting researchers or domestic firms’ patenting efforts. The firm had first to build from scratch internal capabilities to undertake this task by itself. Footnote 104 This was a building-block for the strategy already discussed of seeking regulatory approval in Argentina’s export markets by means of collaborative agreements with other international biotech and seeds firms. These agreements, in turn, boosted credibility to Bioceres’s economic promise in the eyes of local and international investors.Footnote 105

Lastly, a major challenge was securing funding for executing a long-term strategy. In overcoming it, the firm’s investment capacities proved critical. During its early years, Bioceres had resorted to successive rounds of local private equity financing.Footnote 106 By 2014, the managing team concluded that to maintain independence it had to raise capital at a scale beyond what was feasible in the shallow Argentine stock market. Therefore, it set the goal of launching an IPO in the American technological market, the milestone that in 2019 ultimately allowed Bioceres to consolidate its autonomous path.Footnote 107 Thus, in terms of later, more demanding stages of technology and product development, including obtaining regulatory approval and commercializing, support by the local institutional context was insufficient. The firm had to raise capital in international stock markets and establish alliances with leading seed firms that had the logistical networks to distribute the HB4 technology. This in turn implied partially delocalizing the firm from its Argentine origins and validating the pattern of concentration that characterizes the operation of agricultural inputs GVC.

Bioheuris

Two partners founded Bioheuris in 2016. They had worked for seed companies in R&D and regulatory issues, and sought to take advantage of the dramatic fall of development and regulatory costs that came along with the new gene-editing technology CRISPR. Bioheuris brings to the market new products with lower environmental impact through product-specific alliances with firms specialized in different segments of the agricultural inputs sector.Footnote 108 It illustrates a recent pattern in this sector in Argentina: firms that are started with a focus on a specific product (or set of products)—rather than on a scientific discovery—, exhibit comparatively weak linkages with the public sector and early on are financed by venture capital.Footnote 109 Although Bioheuris has not brought its products to the market, it has already been recognized as one of the five most important agricultural biotechnology startups in the world, with expected gains for 2027-2035 of around USD 500 million.

Type of product and its level of complexity

Bioheuris’s product development strategy combines synthetic biology to identify resistance mutations in seeds with a novel genetic edition technology to introduce them into the crop. The latter offers greater simplicity, security and lower costs than transgenesis. The CRISPR-Cas9 technology bears the promise of significantly speeding up the development of improved traits (e.g., higher yields, herbicide resistance, drought tolerance).Footnote 110 Bioheuris uses it to develop herbicide-resistant seeds (in soybean, sorghum, rice and cotton), with less toxicity and less impact on the environment.Footnote 111

Type of upgrading attained

In contrast with the cases studied above, Bioheuris is a well-funded startup that since its inception has sought to enter the highest segment of the agricultural GVC, bringing knowledge-intensive inputs to the market. Instead of pursuing intersectoral upgrading like Bioceres, this firm follows a disruptive strategy of product upgrading. In doing so, it seeks to reap the benefits of a set of favorable conditions: the early mastering of a new promising technology, Argentina’s comparatively low costs to conduct R&D and testing, and a local and global regulatory environment with low entry barriers.

Mode of insertion into the agricultural biotechnology GVC

While Bioheuris’s two founding partners worked as consultants for seed firms, a Chinese company (Rotam)—seeking information on the costs for approving herbicide-resistant seeds—approached them. This inquiry raised the founders’ awareness about the opportunity to circumvent the high costs of transgenesis by utilizing CRISPR-Cas9. This technology offers a more efficient and precise means of enhancing desired crop characteristics (Lassoued et al., Reference Lassoued, Phillips, Smyth and Hesseln2019). The resulting seeds have been legally classified as non-GMO events, skipping thereby the regulatory approval processes of conventional transgenesis (Bonny Reference Bonny2017).

Bioheuris has thus become specialized in genome-editing services, with sixteen out of its 20 employees dedicated to R&D. Typically, they work by project in alliance with three kinds of companies. First, a seed firm that provides the germplasm used as the genetic material to which the CRISPR-Cas9 technology is applied. Second, a chemical company that offers the herbicide that is paired with the improved seed. Finally, a third party provides the financial resources required.Footnote 112 According to Bioheruis’s business plan, the projected income would come both from royalties for the licensed technology incorporated in the seeds and from participating in the profits to be generated by herbicides associated with the new technologies.

The success of Bioheuris’s first experience in the market—when Argentine seed firm Santa Rosa provided the germplasm and the Chinese Rotam financed the project— opened up new project opportunities and sources of funding. More recently, Bioheuris secured agreements with major local seed firms —including Grupo Don Mario and Adecoagro—and bolstered its R&D capabilities, first by renting lab space at INDEAR in Rosario and, since 2019, by establishing a synthetic biology laboratory in the Helix Center of Saint Louis, USA, along with BioGenerator, a major biotech investment fund.

Firm’s relationship with the broader local institutional context

Bioheuris presents comparatively weak linkages with the Argentine public scientific complex and local institutions. It has advanced its business strategy primarily with the support of private partners and by succeeding in projects of seed improvement with other private firms.

Yet the local institutional context has shaped Bioheuris’s trajectory in several ways. First, the company benefited from the synergies that typically take place in its hometown Rosario, the hub where the majority of Argentina’s agricultural biotechnology and major commodity producers are located.Footnote 113 This facilitated Bioheuris’s agreements with well-established firms in this sector. Second, Bioheuris’s initial R&D facilities were built inside INDEAR, the R&D firm born out of the partnership between Bioceres and CONICET. Third, Bioheuris received financial support from several public-private institutions: an investment fund for startups, FONDCE, provided seed capital, while Aceleradora Litoral invested at early stages and later on committed an additional USD 4 million

Discussion: three paths into GVCs for middle-income-country firms and their implications for exiting the trap

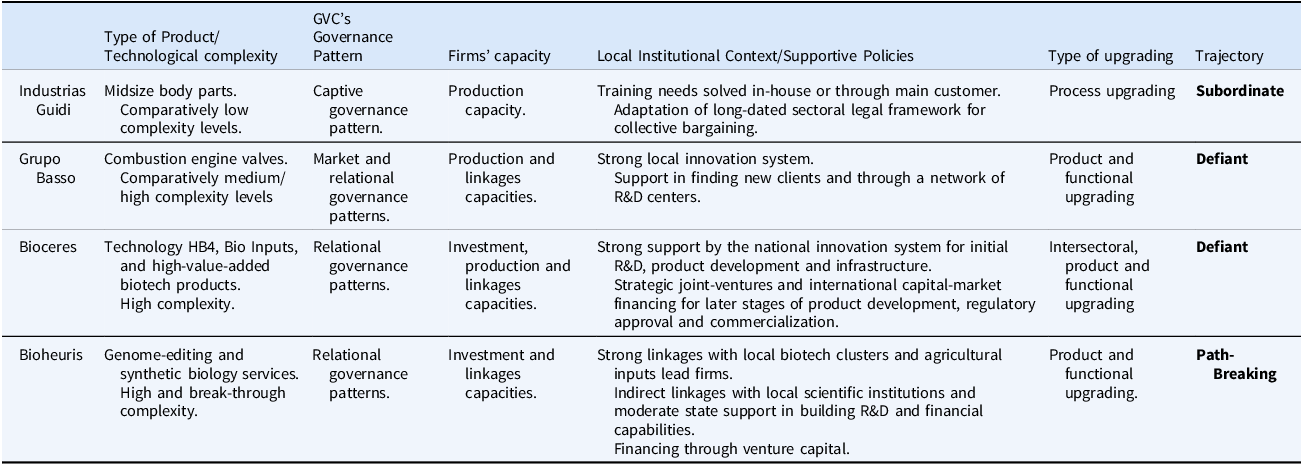

Table 1 below provides a summary of the cases, relevant factors and emerging trajectories. The columns correspond to analytical dimensions identified in the theoretical discussion section. The last column introduces novel categories for characterizing alternative modes of insertion. Our conceptualization is driven by the question of what are the consequences of each path for breaking away from the MIT. We intend to provide a typology of upgrading pathways at the firm level focused on whether they may –or may not– aggregate into a developmental trajectory. In this concluding section we conceptualize the three identified paths, pinpoint a series of factors enabling them, situate our contribution in the literature and extract some country-level and policy implications.

Table 1. Three ideal-type trajectories of upgrading: enabling factors and developmental outcomes

The first mode of insertion is a subordinate one. MI-country firms following this path build a durable relationship with a GVC leading firm by becoming a trusted supplier. Success depends on their ability to apply the leading company’s standards, which often requires process upgrading. This path thus entails an opportunity for technology incorporation and productivity gains for individual firms in the global semi-periphery. Yet, a subordinate path often leads to volatile performances—as MIT-country firms depend on a single or a few major MNC clients—and tends to hinder the most desirable types of upgrading, as opportunities remain closely tied and vulnerable to the leading firm’s business plan. Upgrading, in other words, is a mere precondition for staying in business

In a subordinate path lead firms focus on cost reduction by sponsoring suppliers’ productive process upgrading. However, lead firms rarely support—and may even disincentivize—other types of upgrading which may be conducive to higher-value appropriation within the GVC. Hence, this path may put MI-country firms in a long-term, lower value-added equilibrium. We illustrate this trajectory with the case of the Argentine auto parts firm Industrias Guidi. IG is a success story insofar as it managed to integrate into Toyota Argentina’s export-oriented strategy. Yet this subordinate insertion may endanger IG’s future if Toyota’s strategy shifts—while potentially hindering opportunities for continued, more aggressive upgrading.

In the defiant path, MIT-country firms typically find a sophisticated niche within a well-structured GVC that offers higher autonomy. The cases of auto parts manufacturer Grupo Basso and biotechnology firm Bioceres illustrate it. Following this demanding path requires solving key challenges, including overcoming regulatory barriers, accessing long-term financing and entering overseas markets. It is therefore significatively more risky and demanding in terms of firms’ capabilities than the subordinate one. The firms we studied in this path pursued different goals: GB went after a market segment where suppliers could build collaborative relationships with the lead firms, whereas Bioceres strived to become a lead firm itself.

Firms in the defiant path are challenging the default mode of insertion for MI countries. They aim to compete with established players that entered the race earlier. Therefore, success usually requires strong institutional support for product development, capital investment and conquering export markets. This upgrading trajectory thus requires more than increasing productivity and efficiency. It usually entails undertaking functional and product upgrading, when not directly leap-frogging into knowledge-intensive higher-value-added sectors.

We identified a third mode of insertion into GVCs, the path-breaking trajectory. In it, MI-country firms target a GVC segment still unstructured—with loose regulatory rules and without consolidated lead firms. Firms in this mode of insertion take advantage of a technological innovation to develop a novel product and bring it to the market. To succeed, timing of entry is crucial. The use by Bioheuris of the CRISPR-Cas9 technology to produce improved seeds illustrates it. Since identifying emerging technologies and scarce but highly profitable market opportunities is much more critical than in the subordinate and defiant paths, the path-breaking one is a more unlikely trajectory for MIT-country firms. On the other hand, the fact that the targeted segment of the GVC is unstructured reduces entrance costs and the need for direct institutional support in comparison to the defiant mode, while still allowing the level of autonomy and the more ambitious types of upgrading that characterize this last one.

What are the main factors driving each path? As the GVC literature has established, an asymmetrical hierarchical pattern of relationship between the lead firms and domestic suppliers is a main factor shaping the subordinate path of insertion.Footnote 114 In scenarios—typical of MIT countries—in which the LIS is inchoate and weak, state or other types of institutional support for upgrading is lacking and/or in which domestic firms become overdependent on a handful of MNCs, subordination is likely the default mode of insertion into GVCs.

The defiant path, instead, typically emerges in the presence of more symmetrical and relational GVC governance patterns. This second path of insertion is arguably shaped by two main factors. First, in line with the LIS literature’s core claim, MIT-country firms’ capacity to “defy” the default mode of insertion depends on the support they can draw from the institutional context that surrounds them. This can take different forms. As Grupo Basso illustrates, support can be obtained by taking advantage of public-private synergies built at the subnational level. In turn, Bioceres benefited from a state-led, large-scale developmental strategy pursued by the federal government aimed at facilitating the emergence of national champions in the agricultural biotechnology sector—in spite of the shortcomings of such strategy. Second, success in this defiant mode of insertion can also be attributed to firms’ ability to diversify and conquer export markets. The trajectories of both GB and Bioceres show that diversifying product portfolios is critical for achieving higher degrees of autonomy within GVCs and stabilizing growth over time. In these two cases, autonomy and export performance were bolstered by deliberate internationalization efforts—i.e., purchasing foreign companies or establishing joint-ventures with them.

Finally, a main driver shaping the path-breaking mode of insertion is MIT-country firms’ capacity to take advantage of radical innovation. This entails solving three challenges. First, success in this path requires firms to develop a new product at a comparatively fast pace, doing so not only before other competitors but also before global regulation is (fully) in place. Second, success depends on MIT-country firms’ capacity to access new innovative technology. This is typically achieved by establishing linkages with domestic R&D public or private ecosystems. Third, success entails that firms access external sources of funding at a timely manner. Since access to long-term investment finance is particularly hard for SMEs located in MIT countries this third challenge is difficult to solve. MIT-country firms that succeed in the path-breaking mode of insertion often do so by tapping into external sources of funding at early stages of product development.

How does the typology proposed relate to, build on and complement the existing literature? First, we provide new fine-grained empirical evidence of how the structural factors identified by the MIT literature operate at the ground level, including the dominant presence of MNCs, the difficulty to do R&D, the lack of long-term investment finance and inconsistency in productive development policies. These factors have shaped the trajectories of all four cases studied in this article. Second, at the theoretical level and in our empirical analyses we have contrasted the structural pessimism of the MIT approach with the nuanced understanding of the opportunities and challenges middle-income countries’ firms face in a world organized around Global Value Chains. Our micro-level approach brought to light important variations—both within-country and within-sector— in the capacity and degree of success of these firms when undertaking upgrading trajectories. The defiant and path-breaking modes of insertion further show the potential that MIT-country firms have to work around the obstacles identified by the MIT literature and reach high-value-added segments in their chains.

We also offer a mid-range typology of upgrading trajectories of firms from MIT countries seeking to engage and take advantage of the opportunities provided by GVC. As such, it builds on and may dialogue with other typologies that tackle similar processes at different levels of aggregation. Thus, as already discussed, we build on the GVC approach’s notion of modes of governance.Footnote 115 Yet, this is but one among other factors shaping trajectories of upgrading at the firm level. In addition, while the notion of mode of governance can accommodate more or less cooperative and enabling relationships between lead and domestic firms, it is less appropriate for tackling the case of middle-income countries’ firms that strive from day one to become a lead firm in itself.

Our typology also resonates with the GPN’s notion of modes of strategic coupling with GVC by regions from advanced and late development countries.Footnote 116 This approach recognizes, at the regional level, functional, organic and structural modes of engagement with GVC, characterized by more or less complex productive and technological tasks (in the functional vs. structural mode) and for more or less degrees of autonomy from the GVC lead firms (in the functional vs organic mode). An obvious difference with ours is the level of aggregation of the two approaches, the regional vs. firm level respectively. The evidence presented suggests that, even in the absence of a well articulated strategy, in the face of insufficient support by public policies and the local institutional context, firms in the defiant and path-breaking may resort to functional equivalents of the solutions that the policy environment fails to provide. Whether a series of successful defiant and path-breaking trajectories at the firm level can aggregate into a coherent regional-level developmental trajectory is thus an empirical question that can be better addressed with the categories proposed.

At the same time, by studying the trap at the ground level we have learned that the defiant and path-breaking trajectories share an important attribute: in order to succeed along these paths, MIT-country firms require institutional support. A macro-level implication of our study is that productive development policies in MI countries should seek to promote domestic firms to follow either of these two paths—or switching into them for firms that already achieved subordinate modes of insertion. At this point, our discussion re-encounters the classical comparative political economy literature on the key role of industrial policies for late developmental trajectories.Footnote 117

Yet, the reorganization of global production calls for revamped industrial policies. Arguably, countries will be more likely to succeed out of the MIT if their states are able to adopt and sustain over time industrial policies with at least the following focuses. First, it is crucial to revamp efforts of public-private coordination so that government and public-private institutions become better equipped to effectively identify the specific obstacles that firms face when competing in global markets—and come up with context-sensitive, tailored solutions. These arenas of public-private coordination can be useful for tackling challenges that are common to most MIT-country firms, including high regulatory barriers to enter world markets, intellectual property regimes that foreclose opportunities for late-coming firms, the lack of sufficient investment in public goods (like testing and quality facilities), and trade policies that prevent the access to key inputs and/or hinder the success of export-oriented corporate strategies.