I. Introduction

As the flagship measure of the first von der Leyen Commission, the EGD adopted in December 2019,Footnote 1 comprising almost 160 legislative acts, was intended to turn the European Union (EU) into the first decarbonised (achieving carbon neutrality by 2050) and circular economy in the world aiming at zero pollution. This reform, which is both ambitious and unprecedented, was triggered by alarming reports from the IPCC, climate demonstrations as well as a new geopolitical vision seeking to free the EU from its dependence on fossil fuelsFootnote 2 and natural resources. Moreover, mirroring the objective of sustainable development enshrined in Article 3(3) and 21(2) d) TEU, the climate-environmental component of the EGD is premised on a decarbonised, circular industrial policy (growth pilar) as well as strong input from European society (social pilar). Furthermore, the strategy endorsed by the EU institutions was only further vindicated by the subsequent spike in energy prices in 2022 following the invasion of Ukraine.

At the end of 2024, the new von der Leyen Commission saw its role more in terms of implementing the 160 legislative instruments adopted during the 2019–2024 legislature rather than putting forward new legislative proposals. Lately, following the 2024 Draghi report – which underlined that excessive regulatory and administrative burden undermines the competitiveness of EU companies – and the Budapest Declaration on the New European Competitiveness Deal, the European Commission aims at simplifying and reducing sustainable finance reporting, sustainability due diligence and taxonomy requirements.

Implementing the numerous EGD legislative instruments will be a real challenge, as no one has a clear overview of these wide-ranging reforms. What is more, the administrative simplification planned in early 2025 by the Commission will complicate the implementation process. Although the various legislation is interconnected and complementary, it nevertheless pursues very different objectives, which can either reinforce or oppose one another. Against this background, four years after its adoption, one might ask whether this Deal is likely to create a new economic model, let alone a “new societal order”Footnote 3 or whether it amounts to little more than “greenwashing” of the internal market, transport, energy and common policy. The risk of greenwashing may be exacerbated by the fact that “geopolitical actors outside the EU will continue allowing their companies to operate without being held accountable for the harm they cause to the environment and the climate”.Footnote 4 The 2025 simplification “Omnibus” package aiming at cutting administrative burden is indeed a response to this concern. Whilst the answer to this question will inevitably be qualified, we shall see that traditional economic interests have largely prevailed over the fight against pollution and the ecosystemic approach, whereas nature conservation and the social pillar of sustainable development risk being the big losers of the green transition.

The article is structured as follows. First, we shall start by providing a systematic analysis of the various sectoral reforms implemented during the 2019–2024 legislature. In so doing, we shall highlight the interdependence between the various EGD objectives of climate neutrality, zero pollution, circular economy and ecological resilience. Secondly, we shall assess the added value of these new regulatory schemes. Thirdly and finally, we shall identify the challenges that the EU institutions and Member States will have to face over the course of the 2024–2029 legislature.

II. A polycentric reform

1. A bold reform in all respects

The EGD is unprecedented in the history of public policy. Although environmental policy came in through the side door of the European Economic Community (EEC) competence back in 1986, and for several decades was regarded as something of a poor sibling, in 2019 the Deal placed it centre stage within the policies being pursued by the Union. The 2019 EGD was complemented in 2021 by the Fit-for-55 programFootnote 5 that aimed to enable the EU to achieve the 55 per cent GHG emission reduction goals by 2030.Footnote 6 Aware of the intertwined nature of the climate change and the environmental crises, the European Commission adopted in 2020–2021 a flurry of strategies (industry, transport, chemicals, finance, biodiversity, forests, farm to fork, etc.) that have set bold GHG climate short-term and long-term climate change objectives, pollution abatement thresholds, and ambitious sustainable development targets. Emboldened by these announcements, the Commission proposed to EU lawmakers the adoption of almost 160 legislative acts, resulting in a legislative reform that has been producing the greatest shock wave since the creation of the single market in 1986.

The transversality of the EGD can be explained by the fact that climate change is only part of a larger megatrend of environmental degradation linked to overexploitation of natural resources.Footnote 7 Resolving such a crisis requires more than an energy transition and climate adaptation measures. Accordingly, the EGD reform has been above all polycentric: the green transition will go hand in hand with the emergence of a decarbonised and circular economy, pollution elimination, the expansion of organic farming, sustainable transport, passive buildings, as well as a genuine ecosystemic approach. Since March 2025, the EDG is likely to be flanked with a “Clean Industrial Deal”. It is also dependent on complex normative processes involving the intersection of directives, regulations, decisions and communications reflecting a plethora of policies, competence over which can vary, which in turn means that institutions act as guarantors of divergent if not antagonistic interests. It is ambitious, with all sectors of society being mobilised in the push to achieve carbon neutrality by 2050. It is costly on account of the major scale of the investments that will need to be made by both public authorities and the private sector. Finally, it has a global vocation, with the Union seeking to externalise, or even globalise, its environmental and climate ambitions.

Without presenting an endless inventory of the numerous individual legislative instruments – which would take up many pages, given the diversity and the technical complexity of the measures concerned – we shall take stock of the achievements of the EGD by focussing on a selection of emblematic regulatory measures. A number of these were adopted urgently,Footnote 8 whilst others emerged in response to regimes that had not sufficiently proven their worth.Footnote 9 Some are incremental, in particular for instance the extension of the carbon market, which has already been overhauled several times. Whereas most of the rules fleshing out the EGD simply modify other acts already in force, new regulatory techniques have emerged. Several new acts represent a break with the past: carbon neutrality required under the ECL,Footnote 10 the border adjustment measures (CBAM),Footnote 11 a new carbon market (ETS 2),Footnote 12 as well as the regulation on nature restoration.Footnote 13 Given that it is not possible to provide full details here, we will limit ourselves to outlining the key factors underpinning the various components of the EGD reform and their interactions.

2. Climate neutrality at the heart of the deal

As the fastest warming continent, Europe is already feeling the direct effects of climate change (longer and harsher heatwaves, droughts, water scarcity, wildfires, precipitations, etc.), and at an accelerating pace. Despite these challenges, the EU has not given up on its efforts since 2019. By obliging the twenty-seven Member States to achieve carbon neutrality in stages by the middle of the century (GHG emissions cut of 55 per cent 2030), the ECL, which was adopted in 2021Footnote 14 within the ambit of the Deal, requires a drastic reduction in GHG emissions in a variety of sectors such as industry, transport, energy, agriculture and the heating and cooling of buildings. The aim is to achieve negative emissions after 2050.

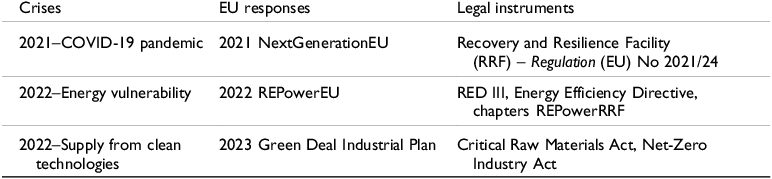

This high level of ambition is the result of several factors. The solidarity among the Member States that still remained following the pandemic Covid-19 helped to further the objective of carbon neutrality. In 2021, the EU institutions achieved a historic breakthrough on a budgetary level in enabling the Union to borrow on the international markets. The post-Covid recovery plan (NextGenerationEU) enabled significant financial resources (180 billion euros) to be freed up to boost national investments in the green transition (estimated at 40 billion euros per year). In addition, 300 billion euros were allocated under the REPowerEU plan in 2022, adopted following the invasion of Ukraine with the aim of accelerating the rollout of renewable energies such as green hydrogen, etc.Footnote 15 In an attempt to free itself from its dependence on Russian hydrocarbons, with the adoption of the RED III Directive the Union has stepped up its ambitions in the field of clean energy and in particular the development of renewable energy.Footnote 16 As the following table demonstrates, external factors (such as the pandemic and the invasion of Ukraine) have made it possible to square this circle: carbon neutrality, the energy transition, strategic autonomy and the circular economy.

3. Strengthening the EU carbon market

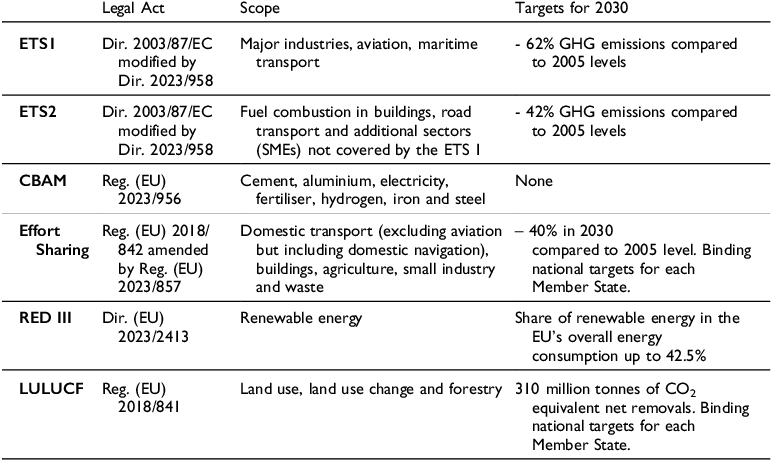

The carbon market, which at present only covers 45 per cent of GHG emissions in the EU, is regarded as the spearhead of its climate policy. Within a few years, it will end up covering 80 per cent of the EU’s GHG emissions. The ETS 1 target is to achieve a 62 per cent reduction in GHG emissions by 2030 relative to 2005 instead of the previous 43 per cent target. To achieve this target, the conditions for the free allocation of emission allowances are tightened considerably. The phasing out of the free allocation of emission allowances is made possible by the Carbon Border Adjustment Measures (CBAM) regulation that limits “carbon leakage”.Footnote 17 Thanks to CBAM, which will be fully applied from 2026, undertakings that are competing with third country undertakings will have to purchase their GHG allowances at auctionsFootnote 18 whilst importers of competitor products (cement, aluminium, electricity, fertiliser, hydrogen, iron and steel sectors) will have to cover the emissions embodied in their imported carbon-intensive products by purchasing certificates with a value equivalent to a weekly allowance average price. The phasing out of free allocation is accelerated for aviation and the linear reduction factor by which the emission ceilings decrease annually is increased (in 2024–2027 the reduction factor is of −4.3 per cent per year).Footnote 19 The scope of EU ETS 1 has been further extended to include maritime shipping. Furthermore, the obligation to use renewable and low-carbon fuels in maritime and air transport should help these sectors to reduce their environmental footprint.Footnote 20

Finally, as the icing on the cake, any undertakings marketing fuels supplied to the built environment, road transport and some other sectors, such as small industries, still covered by the Effort Sharing Regulation (ESR), will operate on a parallel carbon market (ETS2) based on the “cap-and-trade” principle. The system will be introduced gradually over the next few years. ETS2 has a GHG reduction goal of 42 per cent by 2030 compared to 2005 to be achieved by 2030.Footnote 21 Within the EU ETS2 system, not the end-consumers (building users, vehicle drivers) who are the ultimate GHG emitters, but the suppliers of fuels have an obligation to surrender allowances. As they will not be obliged to contribute to the public finances in the form of increased excise duty on energy products due to the failure to revise the directive harmonising these duties, the end-consumers will be confronted with an increase in the price of hydrocarbons from 2027 within the ambit of the ETS2.Footnote 22 These two carbon markets will be complemented by the obligation to construct passive buildings,Footnote 23 and the ban on selling vehicles with internal combustion engines by 2035, coupled with the reinforcement of CO2 emission performance standards for different categories of vehicles.Footnote 24 This will be a remarkable achievement because passenger cars and vans vehicles represent around 19 per cent whereas heavy-duty vehicles represent around 6 per cent of total CO2 emissions in the Union.Footnote 25

Given that the scope of both ETS is limited, the ESR requires a target of cutting 2005 GHG emissions levels by 40 per cent that will have to be met by 2030 throughout the EU for those sectors of the economy that do not fall within the scope of the ETS 1 carbon market: domestic transport (excluding aviation), buildings, agriculture, small industry and waste (incineration).Footnote 26 Annual emissions allocations for each Member State for the years from 2021 to 2030 are set out by Commission implementing acts. These targets vary from −50 per cent for Sweden to −10 per cent for Bulgaria.Footnote 27

4. The rise of a renewable energy-based economy

Almost three-quarters of the EU energy system relies on fossil fuels. Furthermore, oil dominates the energy mix.Footnote 28 By way of illustration, industry accounts for 25 per cent of the Union’s energy consumption which is currently supplied 91 per cent by fossil fuels.Footnote 29

In order to achieve climate neutrality by 2050, the green transition will require a renewable, decarbonised energy-based economy entailing the electrification of entire parts of the economy. This should lead to a sharp increase in electricity produced from renewables (biomass, solar, wind, hydro).Footnote 30 As a result, energy infrastructure will have to be adapted to accommodate low-carbon energy sources through the expansion of grids and energy storage facilities. Accordingly, this shift in energy production and consumption will require a deeply coordinated approach based on solidarity and strategic autonomy.Footnote 31

Due to the constant reduction in auctioned allowances, the operators of the approximately 11,000 power stations and industrial plants covered by ETS 1 will continue to invest in clean technologies in order to abate their GHG emissions. Given that the energy sector currently contributes over 75 per cent of total emissions in the EU, its decarbonisation requires structural transformation, based on phasing out fossil fuels, to be replaced by renewable and low-carbon energy sources, improving energy efficiency, all the while ensuring adequate energy supply and price affordability. Given that 75 per cent of the EU’s building stock has a poor energy performance,Footnote 32 the building sector has also been identified as a key target of the EU climate policy. Buildings are responsible for about 40 per cent of the EU’s total energy consumption and for 36 per cent of its GHG from energy.Footnote 33 Although buildings have a large untapped potential to contribute to the reduction in GHG emissions in the Union, progress on the use of renewable energy for heating and cooling has been stagnant over the last decade. The decarbonisation of heating and cooling in buildings is thus crucial to reach climate neutrality by 2050.

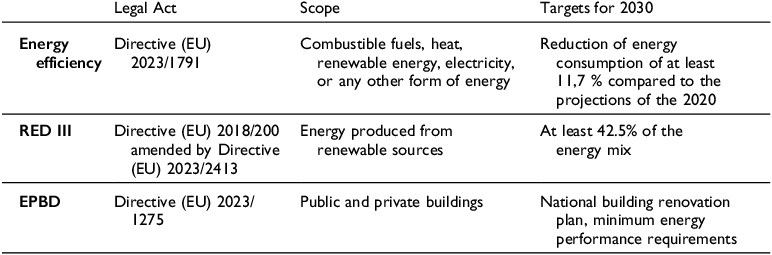

In brief, three amending directives adopted in 2023 are set to play a key role with respect to energy production and consumption. The revised Renewable Energy Directive (RED III), the amended Energy Efficiency Directive and the Energy Performance of Buildings Directive set new targets for renewables in consumption, energy efficiency that includes building renovations.Footnote 34 While hydrocarbons and gas are still the main sources of energy in 2024,Footnote 35 in virtue of RED III, the proportion of energy produced from renewable sources (wind, solar, geothermal, hydroelectric, biomass, etc.) in the Union’s gross final consumption of energy will have to reach at least 42.5 per cent, and ideally 45 per cent, of the energy mix by 2030.Footnote 36 On the other hand, the amended Energy Efficiency Directive,Footnote 37 which encompasses a swath of activities (drilling natural gas, electric appliances, etc.), sets forth the target of reducing EU final energy consumption by 11.7 per cent by 2030, compared to the projected energy use for 2030. This ambitious target is likely to reduce import energy dependency and off-set the sky-rocketing consumption linked with the digital transition.Footnote 38 In addition, the recast Energy Performance of Buildings Directive (EPBD) will increase the rate of building renovations.Footnote 39 On a final note, the directive on corporate sustainability due diligence (CSDDD) requires companies to adopt a transition plan for climate change mitigation with a view to aligning their strategy with the EU’s intermediate and 2050 climate neutrality objectives.Footnote 40

Besides, transport is responsible for more than 30 per cent of final energy consumption.Footnote 41 The Sustainable Transport Package that aimed to reduce GHG and pollutants emissions from this sector has been reinforcing the EU’s leadership in the global fight against climate change. A flurry of general EGD measures deal with transport: extension of ETS 1 to large ships of 5,000 gross tonnage and above, cancellation of the free allowances for the aviation sector, creation of ETS 2 subjecting fuel suppliers to surrender allowances, support for the most vulnerable households through the Social Fund for Climate. To supplement these measures, ambitious regulations have been enacted in 2023:

-

regulation setting stricter CO2 performance standards for cars and vans,Footnote 42

-

regulation on sustainable aviation fuels (ReFuelEU),Footnote 43

-

regulation on cleaner shipping fuels (FuelEU),Footnote 44

-

regulation on a new alternative fuels infrastructure, including improving the public charging network for electric cars.Footnote 45

Despite their highly technical nature, these new regulations should not be overlooked. The use of renewable fuels and renewable electricity in the transport sector can contribute to the decarbonisation of the Union transport sector. Given that the increasing number of electric vehiclesFootnote 46 will require the optimalisation of recharging operations, the RED III directive will increase the share of renewable electricity. Last, the Social Climate Fund, financed by the new ETS2, should improve low-emissions transport. The following table provides an overview of the two carbon markets as well as the additional rules covering installations and products not falling within the scope of these markets.

Within the space of three years, the EU energy policy has not only become more European but also more sustainable. However, one train may hide another. In order to prevent the acceleration of the energy transition from increasing the Union’s dependence on critical raw materials (rare earth metals, lithium, manganese, etc.)Footnote 47 – of which it does not have any large deposits, but which are essential in producing key technology – the Green Deal Industrial Plan, as the final plan of this reform, is set to reinforce its strategic autonomy through the development of a net-zero emissions industry and regulation of critical raw materials.

5. The last and most challenging piece of the puzzle, the Clean Industrial Deal

The energy transition, which will be indispensable in order to achieve carbon neutrality by 2050, will have to deal with geo-strategic and geo-economic tensions. The rapid transition to low-carbon technologies is expected to result in a substantial surge in demand for various raw materials.Footnote 48 Indeed, this transition will require massive use of clean technologies, the related components and critical raw materials (lithium, graphite, cobalt, nickel, manganese, etc.), which will have the effect of exacerbating the vulnerability of an EU that is already highly dependent on external markets. If the world is to reach net zero by 2050, demand for minerals for clean energy technologies will grow sixfold by 2040 compared to 2020, driven especially by electric vehicles and battery storage.Footnote 49 As such, demand for batteries for storing electricity and for sustainable transport is set to increase fourfold by 2030, and sevenfold by 2035.Footnote 50 Supply will be unable to keep up with demand, and prices will rise accordingly. Moreover, the growing exploitation of minerals and rare earth metals outside Europe will heighten environmental pressure, with mining companies having to extract increasingly large quantities of materials in order to obtain the same quantities of metal.

It comes thus as no surprise that raw materials have moved recently into the political spotlight because they are key enablers of the EU’s twin green and digital transition. As the COVID-19 crisis highlighted the dependence of the EU economy on imported raw materials and technologies, securing their supply is essential for the competitiveness of EU businesses.

The EGD strengthens the relevance of shifting the traditional industrial model into a new decarbonised and circular industrial model that reckons upon clean technologies.Footnote 51 So far, the “industrial” pillar of the EGD is implemented through two unprecedented regulations designed to counter the risk of shortages in the supply of certain raw materials and technological products, and to reduce price volatility. First of all, taking account of the primary importance of critical raw materials – non-energy and non-agricultural raw materials – for the climate and digital transitions, which are largely imported,Footnote 52 the Critical Raw Materials Act (CRM Act)Footnote 53 should enable the EU to reduce its dependence, diversify its imports and reinforce its strategic autonomy. In order to reduce vulnerabilities within the EU’s global value chains, the CRM Act aims to promote the exploitation of new deposits in the EU as a key for domestic supply. Secondly, the Net-Zero Industry Act (NZI Act)Footnote 54 aims to secure supply chains and the production of those technologies where the Chinese economy plays a major role.Footnote 55 As far as “strategic projects” for the raw materials sectorsFootnote 56 and the net-zero sectorsFootnote 57 are concerned, which have “priority status,” the EU as a whole – and not Member States individually – must achieve, according to the two Acts, a range of key targets regarding consumption for extraction, processing and recycling by 2030. Last, in order to facilitate the fulfilment of these targets, the two Acts will “rationalise” authorisation procedures by setting mandatory time limits,Footnote 58 that will come in for considerable environmental NGOs criticisms.

Clearly, these two Acts will not be enough to meet the expectations of EU undertakings facing strong international competition.Footnote 59 Considering the investment planning that will be required to achieve the energy transition, which generally covers periods longer than ten years, industry federations anticipate that their members will be unable to keep up with such a fast pace of reforms, in particular as regards the target of reducing GHG emissions by 90 per cent by 2040.Footnote 60

With the aim to increasing sustainable and resilient industrial production in Europe, the Commission 2025 Clean Industrial Deal envisions, among others, an industrial decarbonisation acceleration act, an industrial decarbonisation accelerator act, a clean industrial deal State Aid framework, an industrial decarbonisation bank, a circular economy act. This new deal aims at supporting both energy-intensive industries, which require urgent support to decarbonise, electrify, as well as the clean-tech sector, “at the heart of future competitiveness and necessary for industrial transformation, circularity and decarbonisation.”Footnote 61 At this stage, it is impossible to comment on the added value of this new deal compared with the legislative acts which we comment on in this article.

6. Circular economy: how to square the circle?

As it does not have sufficient fossil fuels and mineral resources to ensure its growth, within a world in which natural resources are becoming scarcer, the Union has every interest in becoming self-sufficient as the first decarbonised and circular economy in the world. Accordingly, the “extract–produce–discard” model, of which fast fashion and planned obsolescence are emblematic, will need to be replaced by a circular economy, spelling the end of the wasteful society.Footnote 62 This new economic model should therefore make it possible to “close the loop” by transforming residual materials into secondary raw materials. If they are forced to innovate, EU undertakings will become more competitive, as compared to their foreign competitors, which will ultimately fall victim to the poor management of natural resources. The circular economy should thus reinforce the EU’s strategic autonomy. Thanks to the EGD, a number of advances have been made in recent months in terms of foodwaste and textile recycling as well as in two sectors that consume large quantities of resources,Footnote 63 namely (waste) packagingFootnote 64 and batteries.Footnote 65 The directive on the so-called “right to repair” is likely to contribute to an increased circularity within the economy.Footnote 66 In addition, recycling, which is essential for bringing secondary raw materials to market, is set to increase as a result of restrictions on waste exports outside the EU (eg, a ban on exports of plastic waste to non-OECD countries).Footnote 67 Furthermore, a new ecodesign regulation has been adopted with a view to “improving the environmental sustainability of products … and to reduce the overall carbon footprint and environmental footprint of products over their life cycle.”Footnote 68 However, will this progress be up to the challenge posed by the transformation from an economy with a profligate approach to natural resources towards a virtuous economy?Footnote 69

7. “Zero pollution”: wishful thinking?

Although they might be less well known to the public than the reforms adopted as part of the EU energy policy, the new environmental rules that have been adopted, in line with the “zero pollution” action plan,Footnote 70 should not be underestimated. Without being exhaustive, we can mention the new rules on industrial emissions,Footnote 71 urban wastewater treatment,Footnote 72 quality of drinking water,Footnote 73 mercury,Footnote 74 and air quality,Footnote 75 coupled with the reinforcement of polluting emissions standards for cars, known as Euro 7,Footnote 76 which may significantly contribute to the improvement of ecosystems. New consumer protection rules have been adopted in order to counter the risk of greenwashing,Footnote 77 or even fraud as occurred in the Dieselgate scandal,Footnote 78 which is omnipresent and likely to manifest itself owing to the fluid nature of concepts such as “sustainable development,” “carbon neutrality” and “net zero.”

Following the initial euphoria, a feeling of disillusionment has become more widespread in 2024. On 6 February, the Commission announced the withdrawal of its proposal seeking to reduce the spraying of pesticides by halfFootnote 79 and the eagerly awaited reform of the law on chemical substances (REACH)Footnote 80 was kicked into the long grass. Furthermore, lawmakers significantly weakened the Soil Monitoring Law.Footnote 81 Although only a fraction of chemicals across European water courses is currently regulated under the EU’s Water Framework Directive (WFD),Footnote 82 the proposal of the Commission of adding some substances of known concern (PFAS (“forever chemicals”), glyphosate and pharmaceuticals) to the lists of pollutants that Member States are required to monitor in surface and groundwater and ensure that legal thresholds are not exceeded has not yet been adopted.Footnote 83 The same music was playing in 2023 when the Commission renewed its approval of the active substance Glyphosate, despite the WHO’s IARC regarding it as a class 3 carcinogen.Footnote 84

8. Nature, on the winning side or the big loser?

More species are threatened with extinction than at any time in history.Footnote 85 Whilst some animals seem to be adapting to changing conditions, the vast majority of species are unable to cope with rising temperatures and changes in precipitation patterns,Footnote 86 which are causing the weather to become less predictable and more extreme. What is more, the drastic decline in insect biomass, even in protected areas, caused by urban sprawl and agriculture intensification is altering food webs, nutrient recycling, pollination and pest control.Footnote 87

Despite five decades of nature protection policy, Europe has unfortunately not escaped this negative trend. In the EU, 81 per cent of the natural habitats included in the Natura 2000 network are deemed to be in an unfavourable condition.Footnote 88 Needless to say, ecosystems are gasping for air. Indeed, restored and diversified ecosystems could capture significant quantities of carbon, and would be more resilient to extreme climate events (flooding, drought and heatwaves). In virtue of the reformed LULUCF Regulation, for the first time a net carbon absorption target has been set for land, specifically 310 million tonnes of CO2 equivalent by 2030.Footnote 89 Increased efforts for storing CO2 should entice farmers and forest owners to store more carbon on their forests and wetlands, prioritising ecosystem-based approaches.Footnote 90 The forthcoming directive on quality of soils,Footnote 91 and the new directive on ambient air qualityFootnote 92 certainly represent clear progress for the conservation status of oligotrophic habitats. Last but not least, at the end of the previous legislature, the flagship instrument for the “biodiversity” and “farm to table” strategies,Footnote 93 the nature restoration regulation was adopted against all odds.Footnote 94 Given that its aim is to reverse the trend towards ecosystem degradation, this regulation does not lack ambition.Footnote 95

However, against the backdrop of European Parliament pre-election tensions of spring 2024, which were particularly heightened in rural areas, the proposal for a regulation on plant protection products has been put on the back burner. As regards natural habitats included within the Natura 2000 network, Member States have been encouraged, and not obligated, to increase the surface area of their sites.Footnote 96 No framework legislation on the sustainable exploitation of forests has ever been envisaged. In contrast to the various climate funds, the “Life Nature” budget is absolutely tiny: 2.14 billion euros dedicated to nature protection.Footnote 97 In addition, there is a widespread conviction that, to the delight of investors, the acceleration of investments in renewable energy will require a “predictable and simplified regulatory environment,”Footnote 98 which could lead to a decline in the level of environmental protection granted to people living near renewable energy installations as well as wild animals. For example, the strict time limits applicable to the issue of administrative authorisations provided for under the new RED III Directive do not take account of the fact that an extended period of time is required in order to assess the impact of wind turbines on migratory birdsFootnote 99 or of hydroelectric installations on ichthyofauna. From a more symbolic perspective, with Noah’s Ark on the brink of capsizing, as is shown by the acceleration in the rate of extinction of wild animal species, the protected status granted to the wolf will be watered down, a mammal that is emblematic of rewilding.Footnote 100 To make things worse, nature protection has become a scapegoat for some agricultural lobbies. As a result, greening will not feature in the Common Agricultural Policy (CAP) for the period 2023–2027, which yet again will continue to favour intensive agriculture. The EU institutions have caved in as far as environmental conditionality arrangements are concerned.Footnote 101

Absent a more ambitious and consistent regulatory approach, will these improvements be sufficient to reinforce ecosystem resilience? In a sense, the mere fact of asking this question means that we know what the answer is.

9. Shutting the door after the horse has bolted: Finance to the rescue of carbon neutrality

Considered in abstract terms, the EGD should open up major opportunities for undertakings, with the prospect of additional investments of about EUR 620 billion annually between 2023 and 2030 needed to meet the objectives of the EGD and RepowerEU.Footnote 102 However, without a unified financial framework encouraging the flow of investments into sustainable sectors,Footnote 103 investors might be unwilling to invest, and the targets of the green transitions will be “unattainable.”Footnote 104 In addition, high interest rates, high energy costs and the shortage of qualified workers are also exerting a chilling effect on private investment in the energy transition.

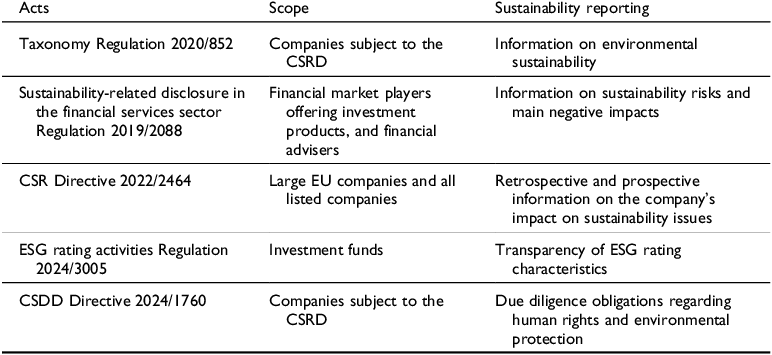

Here too, progress has been spectacular as the EU lawmaker has been adopting several instruments aimed at reorienting private financial flows towards sustainable investment. At the outset, adopted with the aim of bringing order to the sustainable investment sector, the 2021 Taxonomy RegulationFootnote 105 defines eligible investments (“construction and real estate,” “energy,” “manufacturing industry”) with reference to six environmental objectives. Its innovative nature explains both its success and its complexity. Besides, SRD Regulation (EU) 2019/2088 requires financial market participants and financial advisers which provide investment advice or insurance advice with regard to insurance-based investment products, regardless of the design of the financial product and the target market, to publish written policies on the integration of sustainability risks.Footnote 106 Furthermore, the disclosure of reliable sustainability information regarding undertakings’ activities is a prerequisite for managing their financial risks stemming from climate change, resource depletion, environmental degradation.Footnote 107 Against this backdrop, the 2022 Corporate Sustainability Reporting Directive (CSRD) requires that large undertakings and listed SMEs disclose information necessary to understand the undertaking’s impacts on sustainability matters (ie, environmental, social and governance), and information necessary to understand how sustainability matters affect the undertaking’s performance. It should make undertakings that have adapted to a low-carbon world more attractive, whilst rendering access to capital more complicated for the others.Footnote 108 Given that credit institutions, investment firms, insurance undertakings, assurance and reinsurance undertakings often use environmental, social and governance (ESG) ratings as a reference for the sustainability performance or the sustainability risks in their investment activity, ESG investment ratings has been improved at the end of 2024.Footnote 109 Last but not least, the controversial Corporate Sustainability Due Diligence Directive (CSDDD) will oblige large and listed EU companies as well as to large third country companies doing substantial business in the EUFootnote 110 to ensure that their value chains are compliant with international obligations in the area of fundamental rights and environmental law.Footnote 111 The CSDDD sets out a corporate due diligence duty to identify and prevent potential, and to bring to an end or at least minimise actual adverse human rights and environmental impacts. This duty covers a company’s own operations, the operations of its subsidiaries and its chains of activities. Due diligence under the CSDDD covers all direct and indirect business partners in the upstream part of the value chain and, to some extent, also in the downstream part. As part of their due diligence measures, companies are expected to integrate sustainability due diligence into their policies and risk management systems.

As these new obligations are procedural rather than substantive, investors are not subject to a rigid regulatory straitjacket imposing a gradual reduction in their polluting activities. The following table sets out the main information requirements under these different acts.

Following the 2024 Draghi report, the 2025 Commission Work programme called on for a simplification Omnibus package, which might have far-reaching impacts on sustainable finance reporting, sustainability due diligence and taxonomy requirements. This package consists of amendments to the CSRD, the CSDDD, different Taxonomy Disclosures Delegated ActsFootnote 112 and a proposal to amend CBAM.Footnote 113 These proposals aim at postponing the CSDDD’s transposition deadline and at simplifying and reducing companies’ reporting obligations (reducing the required frequency of the periodic monitoring exercises, limiting the due diligence steps, etc.). Under the proposed amendments to the CSRD, undertakings that have more than 1000 employees and either a turnover above EUR 50 million or a balance sheet above EUR 25 million will still be subject to mandatory reporting requirements. In contrast, undertakings with up to 1000 employees will not be subject to mandatory reporting requirements.

10. The external dimension of the EGD addressing globalisation

The EU is currently responsible for only 6.7 per cent of global GHG emissions, as a result of a long-term decreasing trend.Footnote 114 Consequently, the fact that the EU will achieve climate neutrality by 2050 is likely to have a limited effect on global phenomena, unless the EU’s efforts are followed by non-EU countries. Having refrained from taking on a political–military leadership role, as the largest trading block in the world the EU is seeking to reinforce its credibility by positioning itself at the forefront of the green transition by reducing its carbon footprint, with a particular focus on value chains for several products imported from third countries. The level of ambition of the EGD should therefore foster the global leadership position for the EU in climate and environmental matters.

Given the impossibility of concluding multilateral agreements laying down precise rules for the exploitation of natural resources (vulnerable fish stocks, tropical forests) used to produce consumer goods, the EU is taking the lead in adopting unilateral measures. Due diligence obligations have been laid down regarding the imports of products and commodities (cocoa, coffee, timber, soybean, etc.) leading to deforestation and forest degradation (EUDR)Footnote 115 and regarding major companies’ operations across their global value chains (CSDDD).Footnote 116 With respect to the climate policy, the carbon border adjustment measuresFootnote 117 aims at adjusting the common playing field and at suppressing carbon leakage with respect to different energy-intensive products (steel, cement, nickel, etc.). This regulatory approach has been criticised by many non-EU countries, which see it at best as a protectionist undertaking, and at worst as a post-colonial one. Some trade partners may challenge these measures before the WTO and thus obtain financial compensation, or authorisation to adopt countermeasures. That may be said, it might be a rough ride. Last, the European Commission did not succeed in fleshing out the EGD green requirements in the forthcoming Free Trade Agreements.Footnote 118

III. The EGD achievements (2019–2024): the successes outweigh the failures

Certain crises have actually proved to be lifesaving for Europe. The aggression in Ukraine and the effects of the COVID-19 pandemic, for example, have led to a surge in energy prices across the Union, thus highlighting the need to accelerate Europe’s drive towards energy independence.Footnote 119 By the same token, the shortage of natural resources, particularly rare earths, is forcing Europe to achieve much more ambitious levels of reuse and recycling to ensure the long-term viability of its production chains. Against this background, it is fair to say that, although the internal market rules at the heart of the economic integration project remain unchanged, the EGD has led to major advances. Overall, most of the proposals of the European Commission have been adopted, many of which were based on Article 114 TFEU. These new or recast legislative instruments integrate the ECL’s overarching goal of climate neutrality, connecting the EU climate policy with the internal market, industry, transport, finance, food and social policies.

First and foremost, the energy component of the EGD, that has been at the heart of the reform, surpassed the expectations of its framers. Thanks to the changes made in energy efficiency, in the promotion of renewable energies (RED III) and in the extension of the carbon market to the aviation sector and marine transport (ETS1) and the creation of a new market encompassing companies trading in hydrocarbons (ETS2), the energy performances of buildings, the “energy” pillar of the reform has delivered on all of its promises. The EGD breaks also with the past in embracing climate adaptation (nature restauration law, LULUCF) in addition to mitigation.Footnote 120 This is indeed the most ambitious, extensive and cohesive package of climate change legislation anywhere on the globe.Footnote 121

Regarding the legislative instruments, in several sectors, the EU lawmaker has abandoned the use of directives, which played a dominant role in environmental policy for 50 years,Footnote 122 in favour of regulations, which are directly applicable. This is particularly the case in waste management, with the replacement of the batteries and packaging and packaging waste directives by two regulations.Footnote 123 With the proliferation of regulations, centripetal forces are thus prevailing over centrifugal forces. However, in some instances there has been a mismatch between regulations and directives. For example, when it comes to due diligence, the CSDDD applies to the largest undertakings, while the EUDR lays down rules for companies importing certain commodities that cause forest degradation.

To make matters more complicated, the targets to be achieved are expressed in different ways. While most targets have to be achieved individually, some require collective action. Various scenarios therefore need to be distinguished from one another. In the area of energy efficiency, Directive 2023/1791 requires a collective effort,Footnote 124 which is mitigated by corrective measures set out in Annex I. Conversely, in the fields of nature restoration and climate neutrality, the objectives set by the EU acts must be achieved individually.Footnote 125 On another note, the ESR that establishes binding annual GHG targets from 2021 to 2030 differentiate the targets according to Gross Domestic Product (GDP) per capita. As a result, the targets range from −47 per cent for Belgium to −16.7 per cent for Croatia. Of course, it will be easier for the European Commission to verify whether a given Member State has achieved a given objective within a given timeframe than to assess whether the twenty-seven Member States have collectively achieved a single objective.

While it is certainly the energy-climate regulatory approach that stands out, with a high level of ambition dictated by the obligation to achieve climate neutrality by 2050, the fact remains that numerous directives and regulations covering other fields provide for ambitious measures. These include the extension of producer responsibility to the pharmaceuticals and cosmetics sectors for financing quaternary wastewater treatment systems,Footnote 126 higher recycling and re-use rates,Footnote 127 nature restoration measures,Footnote 128 stricter operating conditions for large industrial plants,Footnote 129 control of value chains for a gamut of products (EUDR),Footnote 130 etc. Whereas until now environmental policy, whether at international or national level, has mostly been defensive,Footnote 131 the approaches endorsed under the EGD are proactive. The implementation of the EGD will lead in any case to a major change in the history of the EU, involving the progressive incorporation of the negative externalities associated with numerous polluting substances as well as GHG into the prices of numerous goods and services in accordance with the “polluter pays” principle.Footnote 132

Despite these successes, there are several gaps. For instance, the absence of circular economy principles within the single market is likely to perpetuate a “linear economic model that is inherently unsustainable and inefficient.”Footnote 133 Given that the Climate Law does contain no phase out for fossil fuels, dominant oil and gas producers are still expected to prosper for decades during the transition, due to the volatility of prices and the concentration of production among fewer actors.Footnote 134 Whether the industry – at the source of more than 20 per cent of the GHG emissions- will take a leading position in energy and resource efficiency remains to be seen. Besides, several failures must be acknowledged: no revision of REACH and the directive on pesticide spraying, no mandatory green public procurement targets, no abolition of fuel subsidies, the abandonment of reforming the Marine Strategy Framework Directive, the absence of clear legal rules on the expansion of the Natura 2000 network, etc. In addition, the twenty-seven finance ministers have been unable to reach unanimity in accordance with Article 113 TFEU on the increase in the minimum excise duty levied on energy products used as fuels and within transportation, as well as on electricity.Footnote 135

There are also glaring inadequacies. Airlines operating intra-EU flightsFootnote 136 and shipping companies that sail ships from one European port to another will have to purchase allowances at auctions in order to cover their GHG emissions. However, flights into or out of Europe will fall under an as yet untested global scheme for offsetting CO2 emissions (CORSIA), whilst offshore ships will be covered partially and belatedly by the carbon market. In addition, a derogation from the requirement starting in 2035 to market zero-carbon-emission vehicles has been established for combustion vehicles produced in small quantities that are powered by synthetic fuel (the so-called “Ferrari” amendment).Footnote 137

In addition, there is no shortage of contradictions given the challenge in achieving zero-pollution, climate neutrality and biodiversity protection all at the same time. By way of illustration, stricter incineration standards imply higher energy consumption, which is likely to give rise to more GHG emissions. The ambition of carving out a common market for waste in line with regulations on cross-border movements of wasteFootnote 138 will increase the distances covered by fuel-powered transporters, and will therefore increase GHG emissions. The phasing out of sales of internal combustion engine (ICE) cars by 2035Footnote 139 only applies to the internal market and not to the export of ICE cars. The aspiration of achieving food security in Europe could imply that more agricultural land will be intensively exploited, which would then play a reduced role in carbon storage.Footnote 140

Last but not least, the energy transition prompted by the EGD should result in a historic caesura in the way in which Europeans produce and consume energy. Against this backdrop, as a symbol of energy independence, green hydrogen, which is set to replace natural gas,Footnote 141 continues to have Holy Grail status as production and distribution costs are still very high. The methane strategy does not address the mains sources of its emissions: agriculture and the waste sector. Finally, by moving the emphasis away from energy conservation practices, the energy pillar reflects an unshakable faith in infinite energy resource growth, decoupled from its impacts on the environment and the climate. But will this transition ever take place when, historically speaking, technological innovation never has resulted in the replacement of one source of energy with another? As a matter of fact, humanity has never consumed as much wood, coal and oil as it is doing today, and none of these energy sources are sustainable.Footnote 142 There is therefore a legitimate concern that the increase in the production of renewable energy (RED III)Footnote 143 will not be paralleled by a decline in the consumption of gas and petroleum products.

IV. Challenges in implementing the EGD (2024–2029)

Such a significant transformation of our economy and society through 160 legislative instruments raises a gamut of challenges. If the Member States are to play their part in the game (1), their various policies must be supported by an array of EU funds (2), to ensure among others a ‘just’ transition (3). On the long term, information and communications technology (ICT) will also play a role (4). What is more, climate litigation could increase pressure on national authorities (5). Finally, in terms of competitiveness, the reform is a double-edged sword (6) and there is no doubt that political pressure, both internal and external, could weaken the momentum (7).

1. Centripetal v centrifugal forces

Ultimately, the centripetal forces should prevail (uniform standards for vehicles and fuels, harmonisation of energy standards, centralisation of the carbon market). This phenomenon is underpinned by the delegated powers vested in the European Commission to define both sustainable investments as well as green hydrogen. The flip side of the coin is that the implementation of complementary yet indissociable strategies in the fields of sustainable mobility, the extensification of agriculture, waste management, nature protection, and the elimination of pollution fall under the purview of the Member States due to the simple fact that they fall under competences that have been classified as “shared” in the treaties establishing the Union.

Accordingly, the decarbonisation of the transport sector will require more than the banning of the marketing of combustion vehicles by 2050; the pursuit of national policies on alternative transportation (mass transit rail, car sharing, speed limits) and land-use planning, both of which fall under Member State competence,Footnote 144 will be indispensable. It comes as no surprise that the climate policy is divisive among Member States given that the central European countries have to carry out a great deal of effort to reduce their GHG emissions.Footnote 145

Since environmental and climate governance is multilateral, the twenty-seven Member States will be forced to bear the lion’s share of the financial costs associated with the green transition. Facing other fiscal constraints, it is to be feared that they will be moving at a senatorial pace. By way of illustration, the Member States’ progress on the circular economy is too slow to have any hope of achieving the new recycling and reuse targets.Footnote 146

Whether the traditional command and control instruments that characterise the reform will be correctly implemented by twenty-seven national authorities with diverging interests remains to be seen. There will be tensions between the ambition of the EGD and the traditional regulatory instruments. Despite the new obligations relating to environmental offences, law enforcement policy,Footnote 147 which is essential for combating burgeoning environmental crime, remains dependent on State resources and the willingness of public prosecutors to prosecute offences. To sum up, the EU’s objectives will not be achieved unless the twenty-seven Member States implement ambitious additional measures.

2. Are European funds up to the task?

It is undeniable that the green transition will be costly, particularly for clean energy and raw materials. Public and private investments, whether focussing on infrastructure (storage, interconnection, etc.) or the modernisation of the industrial base (decarbonisation of steelworks, paper mills, etc.) represent thus a massive challenge. According to several economic reports, the level of investment will need to be doubled in order to achieve a reduction of 55 per cent GHG objective set for 2030.Footnote 148 EU financial resources are not sufficient to achieve all the targets that have been set. Indeed, the EU “plastic-based own resource” (€0.8 per kilogram of non-recycled plastic packaging waste) has not worked smoothly since it was introduced in 2021Footnote 149 and it is not sure that the resources provided by the CBAM will be sufficient.

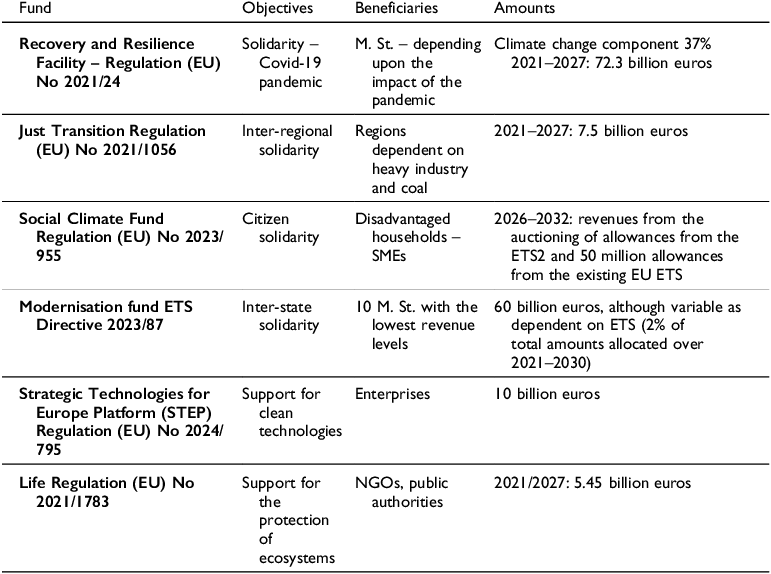

That said, the chances of success of the EGD are perhaps greater than with previous EU strategies. Whereas the Lisbon Strategy adopted in 2000 was unable to achieve its objectives due to the failure to establish a specific financial programme alongside it, the EU institutions have set up various financial schemes for implementing the EGD. These funds should support domestic policies, encourage private investors to jump on the bandwagon, but also to avoid a social divide. It is therefore necessary to juggle with different funds with varying objectives that seek to reinforce solidarity among the Member States, their regions and their citizens. To this must be added the role of the European Investment Bank, which put climate action and environmental sustainability at the heart of its activities. The following table highlights the diversity of funding sources.

At this stage, there is clearly no straight strategy for aligning and streamlining available funding in accordance with the priorities set under the various legislative instruments. Half of revenues of ETS1 (in 2023, it generated 43.6 billion euros) have to finance climate and energy policy: the Innovation Fund, the Modernisation Fund, and the Social Climate Fund. However, the resources allocated to support the just transition appear not to be commensurate with the issues at stake.Footnote 150

As these funds appear to be insufficient to successfully complete the energy transition, let alone to secure the protection of natural habitats, the Member States will have to supplement them. They will thus operate alongside State aid schemes,Footnote 151 which will undoubtedly lead the EU to loosen the budgetary constraints of the Stability and Growth Pact that are now applicable once again and which calls in principle for fiscal austerity. So far, the European Commission is willing to be more flexible when it comes to State aid,Footnote 152 at the risk of fragmenting the internal market.

3. What role for social justice?

In addition, the green transition could fall foul of other pitfalls. The objective of sustainable development is based on three pillars: economic growth, the pursuit of a high level of environmental production and the social dimension.Footnote 153 Consequently, the EDG also strives for sustainable and inclusive growth.Footnote 154 Will the “social” pillar of the Deal, which is based on an estimated 86.7-billion-euro Social Climate Fund for the period 2026–2032, be sufficient to mitigate the socio-economic impact of the energy transition on the most vulnerable households and on small and medium-sized enterprises? It is clear that this fund will not be sufficient to provide retraining for the 180,000 workers who, according to the European Commission, are set to be made redundant in the mining sector by 2030. Moreover, it would have to be quintupled in order to cover the renovation of the real estate occupied by the 35 million people comprising the most deprived segment of the population.Footnote 155 Similarly, the Just Transition Mechanism, worth 55 billion euros over the period 2021–2027,Footnote 156 will not be sufficient to enable regions dependent on fossil fuels to adapt to a decarbonised economy. By way of comparison, the 80 billion euros in transfers to the new Eastern Länder following the reunification of the two Germanies did not enable them to achieve the same level of development. In addition, the EGD could further exacerbate the polarisation between an urban population (85 per cent of Europeans in 2050) that is more attuned to the objective of carbon neutrality and rural populations that feel that they are not understood by urban elites. Accordingly, unless there is a strong social dimension, this vast regulatory project risks running aground.

Last, the gains achieved on the energy efficiencyFootnote 157 and technological progress fronts could be cancelled out by unrestrained consumption of cheaper products (rebound effect) and, as discussed below, the energy divide arising due to artificial intelligence (data storage, servers, etc.).

4. ICT, an asset or a liability for the green transition?

The European Commission takes the view that digital technologies can play a key role in achieving climate neutrality.Footnote 158 In its industrial strategy for Europe, the Commission is of the view that ICTs are closely related to the implementation of the EGD.Footnote 159 However, the question arises as to whether twining the green and digital transitions in a new geopolitical context would be such an easy task.Footnote 160 Technological progress in the digital space is a double-edged sword when it comes to climate change. On the one hand, digital technologies are likely to support the decarbonisation of the economy thanks to greater energy and resource efficiency in some sectors, and potentially serve a further role in climate change mitigation and adaptation.Footnote 161 Given the importance of consumption in the EU,Footnote 162 digital technologies are also employed to instil more transparency in markets. For instance, the EU’s digital product passport will enhance end-to-end traceability of a product throughout its value chain. Among other things, this passport is expected to enable consumers to obtain and to share information about the products life cycle, and to make better informed choices.Footnote 163

On the other hand, digital technologies are a major source of energy and water consumption.Footnote 164 The development and deployment of artificial intelligence systems, for instance, are highly resource intensive.Footnote 165 Will the increased share of renewable energy in electricity production (RED III) be able to offset the expected increase in electricity demand? Furthermore, their applications run on devices that are not compatible with a circular economy given that they contain non-renewable and non-recyclable components that can produce significant environmental damage,Footnote 166 and whose extraction is a major cause of concern in terms of sustainability.Footnote 167 In this context, EU regulations currently appears ill-suited to mitigate the adverse environmental impacts of digital technologies, unless interpreted in an exceptionally expansive manner.Footnote 168 Besides, the recently adopted rulebook for artificial intelligence systems largely limits environmental considerations to voluntary codes of conduct.Footnote 169

5. Is the green transition boosting or undermining competitiveness?

Growth in the EU has been mainly driven by services, and much less by industry. The decarbonisation process, launched by the EGD and Fit-for-55, thus represents an opportunity in terms of industrial growth for European industry. Private investment will be decisive in achieving EGD goals, as industrial investment decisions today will determine future industrial processes as well as the energy options in the future. Accordingly, the investment in clean, energy- and materials-efficient technologies should make the industry more sustainable as well as more competitive in the long run than their non-EU competitors. At the outset, the EU industry is well placed. More than a fifth of the world’s clean technologies are produced in the EU. As the EU is currently a world leader in clean technologiesFootnote 170 such as wind turbines, electrolysers, and low-carbon fuel oil, it is “well equipped to step up and seize the net-zero opportunity.”Footnote 171

It is certain that competitiveness will suffer if companies in third countries do not make the same efforts that European undertakings are obliged to make. So far, energy is the key driver of competitiveness.Footnote 172 Accordingly, the lack of competitiveness of European companies compared to US companies is particularly linked to very high electricity prices, given that the price of natural gas is four to five times higher. These high prices are mainly due to the lack of natural resources in the EU. Furthermore, the fact that energy prices are highly volatile compounds uncertainty for investors, who may prefer to import goods from third countries with lower energy prices but with a higher carbon content.

Finally, EU undertakings are likely to face significant competition from Chinese companies in clean tech and electric vehicles, thanks to a very generous industrial policy of subsidies, innovation, control of raw materials, and the ability to produce on a continental scale.Footnote 173 China has made subsidising clean tech innovation and manufacturing a priority under its Five-Year Plan.Footnote 174 By way of illustration, the ban on the sale of internal combustion vehicles has given rise to palpable tensions with China. The imposition by the European Commission, within the regulation on foreign subsidies distorting the internal market,Footnote 175 of countervailing duties should eliminate the competitive advantage enjoyed by Chinese battery electric vehicle producers. On another note, Chinese investment, particularly in Central Europe, can contribute to technological development and the creation of high skilled jobs,Footnote 176 although these investments threaten the EU’ strategic autonomy.

The EU’s claims to climate neutrality and sustainability thus clash with its roots in a globalised economy. The dilemma is as follows. First, is it technically possible to produce in Europe using only secondary raw materials produced thanks to a circular economy, without any inputs from other continents? One can imagine how difficult that would be, not least because of the slow rise of the circular economy. Secondly, can we expect European consumers to consume goods that are certainly cleaner and more environmentally friendly, but more expensive than products from countries with laxer health and environmental standards? Opinions on this matter are divided.

This leads us to ask the following questions: How can the EU protect European businesses from unfair competition while remaining open to the rest of the world? Is the EU capable of becoming a world leader while remaining competitive with less assiduous trading partners?

Mario Draghi takes the view that Europe faces a trade-off: on the one hand, it may be cheaper at first sight to import Chinese technologies in order to achieve decarbonisation targets more efficiently.Footnote 177 On the other hand, such an approach would increase the dependence of European companies on Chinese undertakings and, in the long term, threaten various companies, and indeed the automotive industry as a whole. As such, the current European dependence on fossil fuels would be substituted by another type of dependence.

The debate on competitiveness has not fallen on deaf ears. In their Antwerp Declaration, 916 signatories including industrial giants Ineos and Bayer called for action to be taken to combat “over-regulation.”Footnote 178 In the Budapest Declaration on the New European Competitiveness Deal, EU Heads of State and Government called for “a simplification revolution, ensuring a clear, simple and smart regulatory framework for businesses and drastically reducing administrative, regulatory and reporting burdens, in particular for SMEs.”

The Commission is willing to act on this shopping list of demands. In January 2025, it has set the target of cutting administrative burden by at least 25 per cent for all companies and at least 35 per cent for SMEs.Footnote 179 In February 2025, it proposed a simplification Omnibus package, which might have far reaching impacts on sustainable finance reporting, sustainability due diligence and taxonomy requirements. Whether these simplification arrangements will be up to the challenge that European companies are facing remains to be seen. In any case, it is not by simplifying or removing administrative requirements that the EU will succeed in restoring the competitiveness of European businesses. That requires much more, insofar as the problems are structural (energy price, dependency upon raw materials produced outside of Europe, etc) and not of an administrative nature. The Clean Industrial Deal will thus feature prominently in the legislature 2024–2029 as the European Commission will be working on a more ambitious industrial legislation. This raises a fundamental question. Will it be feasible to provide EU financial support to major industrial companies that is not conditioned by environmental and social requirements?

6. Is the reform sufficient to enable the Member States to comply with their human rights obligations in the realm of climate change?

Implementing a coherent climate policy is a real challenge for State authorities. In the context of climate change, the key characteristics and circumstances of the causes and the impacts of the phenomenon are significantly different than the ones of toxic pollution.Footnote 180 First, GHG emissions arise in the context of basic activities in human societies.Footnote 181 Consequently, the issue is more a question of the accumulation of GHG in the atmosphere due to mass production, globalisation and free trade, intensive agriculture, along with increased transportation by road and air, than of emissions from a limited number of industrial plants whose pollution can be easily controlled and reduced. Second, mitigation measures cannot generally be localised or limited to specific installations from which harmful effects emanate.Footnote 182 Unlike pollution control, targeted action (environmental licences, emission standards) is not an option. Third, as we know, the impacts of climate change are undeniably distant in time and space than in the case of other emissions of specific toxic pollutants. While the causal link between anthropogenic GHG emissions and the damage that will be suffered by certain categories of victims – in particular, young children and the elderly – is certain, it is nevertheless difficult to predict the extent to which one victim will be more affected than others. All in all, climate change is a challenging polycentric issue.Footnote 183 For these reasons, the individual nature of fundamental rights is not adapted to the effects of climate change, where the risk is essentially collective in nature and the causal link distended.

Although the reform prompting the green transition looks on the face of it very technocratic, human rights are nevertheless not absent. In fact, the EGD reform envisioned by the European Commission began before the judgment in KlimaSeniorinnen was handed down by the European Court of Human Rights (ECtHR) on 9 April 2024. In KlimaSeniorinnen the Court imposed a full catalogue of obligations on the Swiss Confederation in terms of programming its policy against climate change. In virtue of Article 8 ECHR,Footnote 184 the State’s “primary duty is to adopt, and to effectively apply in practice, regulations and measures capable of mitigating the existing and potentially irreversible, future effects of climate change.”Footnote 185 It follows that a State has a positive obligation to do “its part” to protect its citizens from the adverse effects of dangerous climate change. This judgment makes remarkable advances regarding the limited margin of appreciation available to the States parties to the Council of Europe in determining the general objectives of climate policy. Consequently, in order to avoid a breach of Article 8, the EU Member States will have to implement substantive measures of a preventive nature (timetable for achieving carbon neutrality, intermediate reduction targets, updating of these targets, etc.)Footnote 186 as well as procedural measures (information, participation, expertise)Footnote 187 in order to achieve “a comprehensive and profound transformation in various sectors” of our economies and ways of life.Footnote 188 Last but not least, intergenerational burden–sharing assumes particular importance both in regard to the different generations of those currently living and in regard to future generations.Footnote 189

Formal implementation of the numerous legislative instruments embodying the EGD will clearly be insufficient on the grounds that the ECtHR requires human rights to be effectively respected.Footnote 190 The ambitious objectives set out within the legislation commented on above will only be achieved if the Member States give themselves the means to do so. At this stage, it will of course be difficult to determine whether all of the targets will be achieved on time. Nonetheless, a breach of Article 8 may result from a lax or chaotic national climate policy, which may be compounded by delays in transposing the directives concerned or poor application of the various regulations. As regards the numerous infringement proceedings that have been brought before the CJEU for incorrect application of EU environmental law, there are fears that the implementation of the much more ambitious EGD reform will be fraught with pitfalls. Whatever the case may be, the Member States’ obligation to comply with the ECHR’s case law precludes any reduction of the level of protection afforded to individuals against climate risks.Footnote 191

Last but not least, the energy transition will require not only taking measures to reduce demand for fossil fuels in increasing renewables, but also require limiting the supply of fossil fuels. Although the obligations of companies to combat dangerous climate change appear to be exhaustively regulated in the EU climate legislation, the question arises as to whether there is still room left for the civil court to rule that, based on a civil liability due diligence standard, there is an additional obligation for major oil corporations to reduce their CO2 emissions. In Shell Plc, the The Hague Court of Appeal held that Articles 2 and 8 ECHR (right to life and right to privacy and the home), which a lax climate policy is likely to breach,Footnote 192 can give substance to the social standard of care.Footnote 193

7. Changing political winds

Changing political winds risk blowing the EGD off course. Turbulence at both the national and European levels is inducing national and EU decision makers alike to call into question several EGD legislative instruments. Moreover, the new US President’s approach to climate, energy and the environment is significantly at odds with the EGD’s achievements. Although this is a legal article, we cannot ignore these internal and external non-legal pressures.

At national level, the ecological transition has been criticised as being overly “punitive,” particularly by right-wing political parties. In the Netherlands, for instance, the 2019 climate agreement (Klimaatakoord) and the 2021 legislation on nitrogen pollution (Stikstofwet) provoked a veritable outcry in rural areas. In Germany and the Netherlands, the planned prohibition of gas boilers has been linked to the housing crisis and rising construction costs. In Germany and the Netherlands, the planned suppression of gas boilers has been linked by their critics to the housing crisis and rising construction costs. It comes as no surprise that, even though 2024 is the hottest year ever recorded globally,Footnote 194 the climate crisis has not been a momemtum in the June 2024 European parliamentary elections.

Some economists have recently argued that the EU should “reorient its policies to align with the new rules of the international game,” in particular by replacing legislation with incentives and subsidies, and by slowing down the imposition of new environmental and climate standards.Footnote 195 Policy statements of this type are of course taken on a political level. However, an approach of this type would of course be utterly inefficient, as it is well known that the strength of European integration since the creation of the ECSC, the EEC and Euratom has been rooted in black-letter law.

On the other hand, in the wake of the 2024 Draghi Report, the European Commission proposed in 2025 to reduce reporting requirements by 25 per cent. Against this backdrop, the EU executive proposed to EU lawmakers an “omnibus” package, which may involve revisiting existing legislation in order to reduce redundant or overlapping reporting requirements. Such a process entails the risk that entire legislative instruments may be reopened for political renegotiation.

To make matters worse, on the other side of the Atlantic Ocean, President Trump immediately set the tone in his first day in office. On 20 January 2025, the President signed a fusillade of executive orders in front of his supporters at an arena in Washington DC not only pushing oil, gas, mineral production but also revoking entire swaths of environmental, climate and energy policy. While it is not possible to draw up an exhaustive list of the decisions taken on 20 January, a few days after the devastating Los Angeles fires, it is nevertheless possible to demonstrate, in the light of a number of these executive orders, that the United States is pursuing a completely different approach from that followed by the EU under the EGD, be it in relation to climate, energy, zero pollution, nature protection or public participation.

The executive order of 20 January 2025 that aroused most discussion was the one that ordered a start to the process of withdrawing the United States, the world’s second-largest emitter behind China, from the Paris Agreement.Footnote 196 As well as sending a clear signal to the EU that the new US federal administration is unwilling to take collective action against climate change, the order also aims to cancel American contributions to international climate funding.

In addition, the blitz of January 20 executive orders seeks to overhaul the ways in which US environmental legislation must be implemented by federal agencies, although many of them are likely to be challenged in the federal courts. One striking move has been the revocation of President Carter’s order conferring on the Council of Environmental Quality the authority to issue binding regulations dictating the manner in which regulatory agencies – Environmental Protection Agency, Department of Transportation – review development projects in accordance with the Magna Carta of US environmental law, the 1969 National Environmental Policy Act (NEPA). In addition, the revocation of President Clinton’s executive order requiring federal agencies to assess environmental and health hazards in minority or low-income communitiesFootnote 197 belittles considerations of environmental justice whereas, as discussed above, the EGD entails a societal dimension.Footnote 198 Another order declares a national energy emergency with a view to facilitating the “production, transportation, refining, and generation of domestic energy resources,”Footnote 199 a move that belittles citizen engagement at the core of the Aarhus Convention. The executive order “Unleashing American Energy” aims to make the United States the “leading producer of non-fuel minerals, including rare earth minerals.”Footnote 200 In particular, this order revokesFootnote 201 President Biden’s 2021 executive order setting a target that half of all new vehicles sold in 2030 should be electric,Footnote 202 which was already far less ambitious than the EU target. Further executive orders aim to reverse Biden’s efforts to grow the US’s clean energy sector.Footnote 203 Last but not least, whilst the EU is pursuing ambitious nature restoration projects and the expansion of its Natura 2000 network, a large area of the pristine Arctic National Wildlife Refuge will be opened up to oil and gas drilling.Footnote 204

At first glance, US efforts to address climate change will be slowed at a time when urgent action is more critical than ever, and environmental protection will be significantly undermined. What therefore are the consequences for the EU? First, EU leadership at a global level in climate, clean energy as well as environmental and nature protection will be reinforced. As such, it will have to bear a large part of the burden of financing international cooperation. Secondly, while the new US political approach does not in principle call the EGD into question, it is likely to throw a spanner in the ongoing works relating to its implementation.

What will the future hold? Is the implementation of the EGD in danger of fading away in the face of these numerous political pressures? There is a question as to whether the considerable efforts made during the previous legislature are likely to be wiped out, as was seen in June 2024 with the scrapping and watering down of various CAP eco-schemes.Footnote 205 It is to be hoped that the revisions, particularly to a future “omnibus law,” will be more technical than fundamental in nature. The degree of complexity of the requirements contained in the CSRD, the CSDDD and the Taxonomy could be addressed, although without calling into question the principles underpinning these legislative instruments. But, of course, the devil, as always, is in the detail.

V. Conclusion: Blind to a paradigm shift?

Our analysis shows that the level of ambition pursued by EU institutions in areas as diverse as the carbon market, maritime and land transport, aviation, fuels, buildings, industry, hydrogen, pollution reduction, nature restoration and the fight against atmospheric pollution, waste management, is unprecedented. Considering these achievements, it is fair to say that the EU is the only international organisation to make a serious attempt at achieving a green transition. Its global climate and environmental leadership is reinforced, even more so because of the recent abdication of US federal policy. The EU cannot therefore be accused of greenwashing. Does this mean that this swath of new legislation represents a paradigm shift for European society and its economy?