Mr K. McInally, F.F.A.: Good afternoon, everyone. Welcome to this webinar by the Institute and Faculty Actuaries (IFoA) on Collective Defined Contribution (CDC) Design Principles. This has been hosted by the CDC Working Party. My name is Keith McInally. I am a Pensions and Investment Actuary at Aberdeen Investments. I work on investment solutions for pension scheme clients. I have also a background in consultancy where I have provided both actuarial and investment advice to pension scheme clients.

Mr J. Franklin-Adams, F.I.A.: My name is James Franklin-Adams. I work at Aon where I am a Pensions Actuary. I have been looking at CDC schemes or similar arrangements for about 10 years.

Mr McInally: First a quick agenda for the session today. I will introduce the working party and then set the scene with the current UK retirement landscape. Then we will discuss what CDC is. Do not worry if you are less familiar with the topic - we will start from the basics. We are going to get into the details of some of the key areas of design that should be considered for a CDC scheme, as well as seven key principles for design that we have come up with as a working party, which we believe provides a useful framework for considering CDC. We will finish with a couple of case studies to bring to life some of these design aspects and also to link them with the new legislation that is coming for multi-employer CDC schemes in the UK.

CDC is very topical at the moment so the timing for this webinar is good. We have seen the launch of the Royal Mail CDC scheme last month for over 100,000 staff. CDC is a reality now in the UK. There is also a recent consultation that has been released by the Department of Work and Pensions (DWP) on extending legislation to allow multi-employer CDC schemes in the UK. CDC is gaining momentum in the UK and has the potential to change the pension landscape over the coming years. The first thing to say is that this is good news for actuaries. Actuaries are very well placed to, and will play a vital role in, establishing CDC schemes and will be involved in the ongoing running of CDC schemes.

The CDC Working Party has been around for quite a long time now. We have 13 members from a range of backgrounds. These members include pension professionals, investment professionals, and insurance experts. It has been great to be part of the Working Party, coming together to share ideas. It feels like we are at the forefront of considering CDC for the UK.

We recently published a paper called “The Route to Effective Scheme Design,” which is available on the IFoA’s virtual learning environment. If today piques your interest, please download and read the paper and reach out if you have any questions.

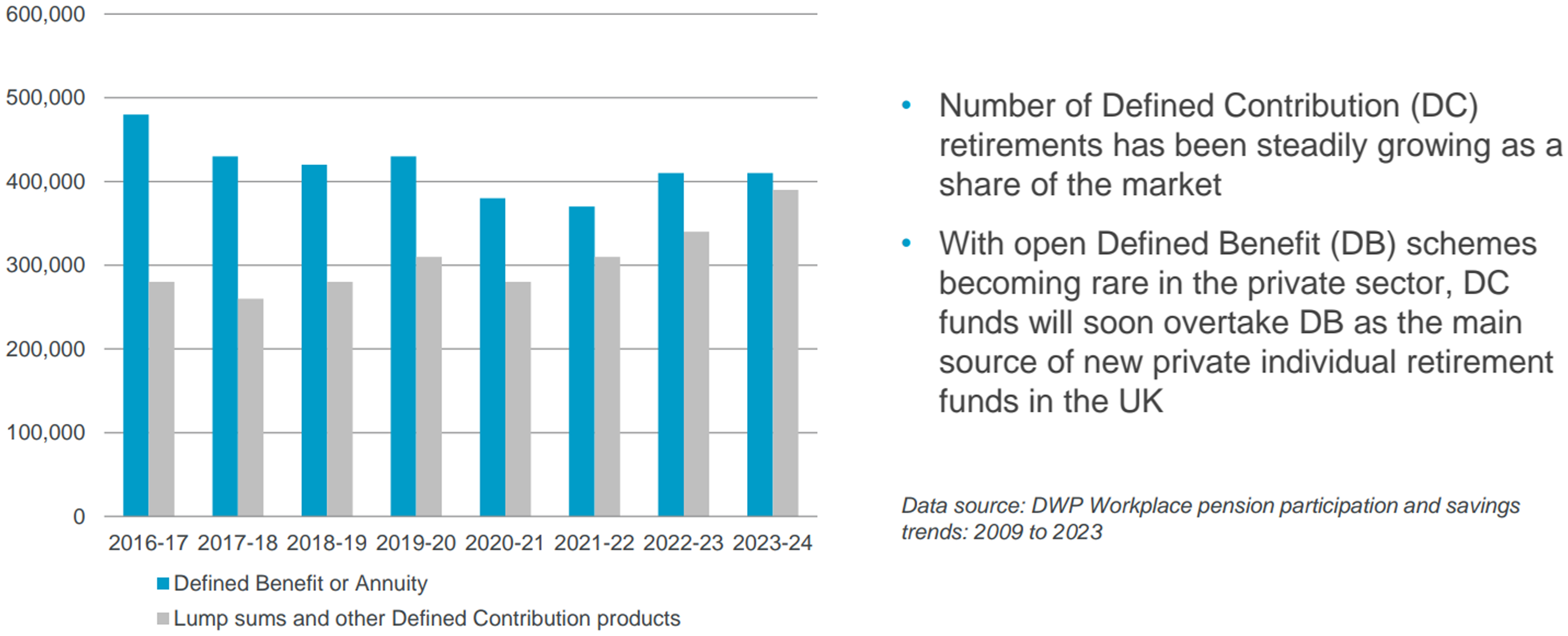

First, a quick summary of the UK retirement landscape in Figure 1.

Figure 1. The UK retirement landscape.

Figure 1 will be familiar to a lot of people. With open-defined benefit (DB) schemes becoming rare in the private sector, defined contribution (DC) funds will soon overtake DB as the main source of new private individual retirement funds in the UK. Figure 1 is from the DWP. It shows people who are retiring and taking a pension for the first time and the balance between those taking DB pensions and those taking income from DC schemes.

You can see that, perhaps next year or the year after, it will flip, and DC will overtake DB. The change is happening slowly. The vast majority, about 95% of individuals in receipt of pensions in the UK, are in receipt of a DB pension or an annuity. But this is going to change significantly over the coming decades. If private sector pension arrangements do not evolve, then in future people will be retiring with just a DC pot, which is not really a pension at all, plus the State pension. This creates challenges that have been well documented.

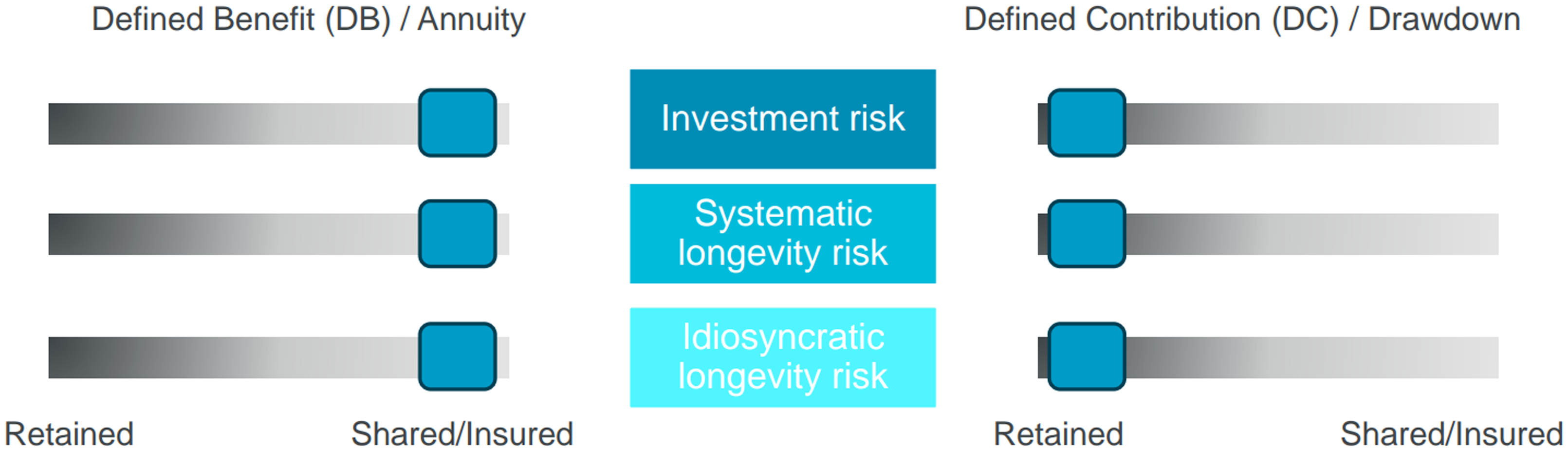

The change from DB to DC schemes creates a significant change in where the risk sits.

The key risks in Figure 2 are investment risk and longevity risk. You can split longevity risk into idiosyncratic risk, which corresponds to you as an individual and the uncertainty of how long you are going to live; versus systematic risk, which corresponds to trends in life expectancy and the uncertainty of future improvements in life expectancy that will affect the whole population.

Figure 2. Current retirement solutions.

In DB arrangements, none of that risk sits with the member. It sits with the scheme and ultimately with the sponsoring employer that bears the risk for poor investment performance or increases in life expectancy. DB is great from a member’s perspective. They are receiving a guaranteed pension in retirement until death. There is no risk to the individual arising from living longer than expected.

Having all the risk with the employer was ultimately one of the downfalls of DB and led to the closure of many schemes. Contrast this with DC, which arguably is the opposite end of the scale, where all the risk sits with the individual - the investment and the longevity risk. It does not, by default, provide an income for life. There is an upside if things go well, but it does create much more uncertainty in terms of retirement outcome for an individual. In addition, DC has more complex financial decisions that are placed on the individual. What do they do at retirement with their pot of money – purchase an annuity or use drawdown? If they use drawdown, what investment strategy should they implement and how much is a sustainable withdrawal rate?

These shortcomings of current DC arrangements then beg the question of whether there is an alternative? Can we do better? Not necessarily placing risk back with an employer, which is unlikely to be palatable for many employers, but which can overcome some of the shortcomings in other ways, by pooling risk across the membership and alleviating some of the complex financial decisions for the member. With that idea comes CDC, and I will pass over now to James (Franklin-Adams) to explain a bit more about what CDC is.

Mr Franklin-Adams: What is a collective defined contribution, or CDC, scheme? The clue is in the name. The contributions are fixed at outset. That is one of the main factors that is attractive to employers. Employers know how much money they are going to put in. They cannot be asked for any deficit contributions in the future, but they can tell their employees, like they could in DB, what pension they are accruing which will be paid until they die. But it is going to be a target pension, rather than a guaranteed pension. It is a pension that may go up or down each year, and that will depend on scheme experience and, in particular, investment performance. Because of this uncertainty, communication is key so that members understand the variability of their benefits. It should help that members will see that variability every year because almost every year the actual investment returns will be different from the expected returns. The members will see their pensions fluctuate differently from what they were told the previous year. They should come to expect variations.

Currently, the draft regulations that DWP is consulting on are for whole-life CDC pension schemes. These are pension schemes where members accrue benefits while working, during their employment. Those regulations should come into place in late 2026, or at least the scheme should be ready to run at that point, with The Pension Regulator’s (TPR’s) guidance. Once whole-life schemes are in place, hopefully, DWP will then instigate decumulation-only schemes.

Decumulation-only CDC schemes are purchased at retirement as an alternative to annuities or drawdown. They are not suitable for everyone, in particular, due to the volatility of the target pension. Many people might still prefer annuities or drawdown. Furthermore, people who accrue CDC pension benefits while working will still be able to transfer out before they retire, in order to switch into drawdown or annuities if they prefer, as long as they do that before retirement.

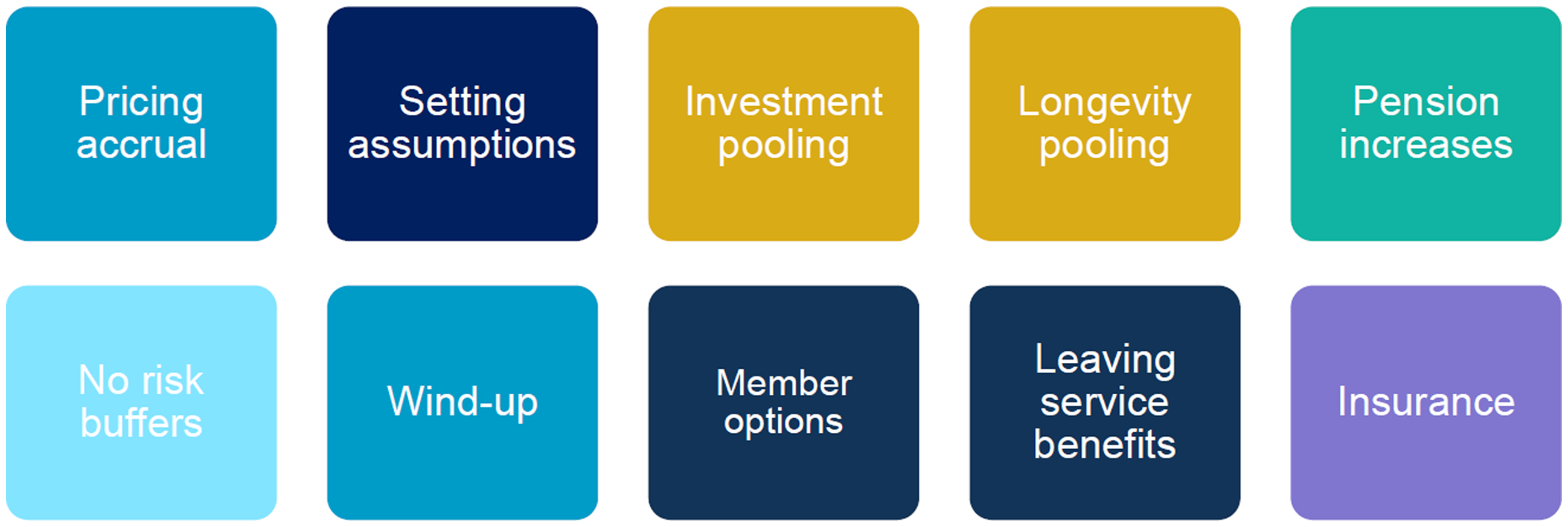

We now move on to look at some of the key areas of design, shown in Figure 3.

Figure 3. 10 key areas of scheme design.

Pricing accrual

In a multi-employer scheme, the cost of accrual must be equal to the contributions paid. This is crucial and can either be at an individual level or at an employer level. This ensures there are no cross-subsidies.

No cross-subsidies and fairness are the fundamentals of CDC schemes. In a single-employer scheme like the Royal Mail, there is more scope for flexibility because all the money stays with the one employer’s employees. But with a multi-employer scheme, there are lots of employers and individuals, so we need to make sure that there are not any cross-subsidies between those employers. Otherwise, employers and individuals will be discouraged if there is a chance of them subsidising other people.

Setting assumptions

Best estimates are required for all assumptions, otherwise those dastardly cross-subsidies will occur. If we have prudent assumptions, which are tempting to use for cautious actuaries, this could result in early joiners paying more than they should for their benefits. They would get lower benefits and that would be unfair. Why would people join early into a CDC scheme? We do not want that.

This is also why we do not build up any risk buffers. No risk buffers mean we need to have a plan for winding up as members’ funds should not be used to wind up as this would reduce their benefits. We need to have the wind-up plan in place at outset. Ideally, the plan would be straightforward enough that if your scheme does not get big enough, or it is not working very well and the sponsoring employer decides to wind it up, then that CDC scheme would merge into another CDC scheme, and members would get similar target benefits to what they have already accrued. Alternatively, if there is not a good CDC scheme in place, then they might have to transfer into a DC scheme, drawdown or annuities.

Investment pooling

In theory, each individual could have their own investment strategy. However, to price accrual properly, this investment strategy would have to be set at outset and not change thereafter, which would defeat much of the purpose of everyone having their own investment strategy. In practice, investment strategy is likely to be age-dependent, but otherwise the same for everyone in the scheme. This will enable long-term investment strategies, which can include infrastructure and other productive types of financing, which is one of the reasons the government likes CDC schemes.

Longevity pooling

Longevity pooling will enable CDC pensions to be paid for the rest of the members’ lives. Schemes will need to decide how much underwriting to do because, as ever, cross-subsidies need to be avoided. The underwriting needs to be done either at an employer level or at an individual level, and that will be in the scheme design.

Pension increases

This is the clever, crucial method by which scheme performance is smoothed over the lifetime of members. DWP are saying that the regulations are going to insist that pension increases must be at least Consumer Price Index (CPI) at inception. If investment performance is worse than expected, future pension increases will be decreased. If investment performance is better than expected, future pension increases are re-set at a higher level. If investment performance is consistently poor, then all future pension increases can disappear. If we then continue to have poor investment performance cuts can be made to the benefits paid. For instance, a 15% cut once all future pension increases have been removed would see a £1,000 pension reduce to £850.

At the other extreme, if investment performance is much better than expected, you could see pension increases going up repeatedly. The draft regulations say that once pension increases get beyond CPI plus 2% you are allowed to include in your design one-off increases that can be applied, so that you do not end up in the situation where your pension increases might be, say, CPI plus 4%. Instead, members can get one-off increases to their pensions (not one-off payments).

Member options

When considering the usual member options that can be offered to employers and/or individuals, such as contingent spouse’s pensions, lump sums on early death, early retirement, or late retirement, you won’t be surprised to hear me say that these options should be cost-neutral, so they are fair to all members. Furthermore, the scheme design needs to be completely transparent. Everybody needs to know what the scheme design is. It is going to be published.

Leaving service benefits

Benefits can accrue over very short service periods when people leave employment quickly, which can have its problems. You can be left with a lot of very small benefits. Royal Mail got around this by having a waiting period before employees could join. Other scheme designs might be similar.

Insurance

Generally, in a CDC pension scheme, you do not want insurance, but it is possible. If you think it would help the scheme, particularly in early years, you might want to have insurance.

That covers the key points. I’ll pass it back to Keith (McInally).

Mr McInally: The paper goes into detail on those ten different aspects of the design that were just discussed. When we were drafting the paper, it was before the draft regulations came out for the multi-employer aspects. The result is that it won’t be possible to implement some of the options mentioned in the paper through the multi-employer regulations.

Figure 4. Design principles.

As well as considering the ten areas of design, we came up with seven design principles that we believe apply and are helpful when considering each aspect of the design, as shown in Figure 4.

-

1. Ensure there are clear design objectives from the start. What is the employer or the provider looking to achieve? Who are the stakeholders involved and what are the drivers? Is it to try to achieve higher pensions for people? Is it a pension adequacy problem, or is it about more stable income for life? Is it around the complex decision-making and taking that requirement away from the members? That will have a big impact on the design.

-

2. Keep it simple. One of the biggest challenges with CDC is communication with members. Understanding that they are getting a pension for life is a very positive message but it is vital to ensure that the message comes with the appropriate caveats: that your pension can go down as well as up and that the level of pension you will receive is variable. When you go into some of the design aspects, again from the actuarial mindset, you can quickly go down a rabbit hole of increasingly complex design ideas that are actuarially fair to all parties, but become much more difficult to explain. That is going to be the biggest balancing act for people who are considering the design of CDC schemes – balancing simplicity with design aspects that you would ideally like to incorporate.

-

3. Compare the design with existing pension options. It is a very significant project to design and launch a new CDC scheme. It needs to be materially better than what is available through existing arrangements, be they DB or DC.

-

4. You will have to make compromises. There is no perfect solution.

-

There are always going to be trade-offs. There is no blueprint for the perfect CDC solution. We see that from experience in other countries as well. Understanding that you will have to make compromises is key.

-

5. Designing cross-subsidies. Cross-subsidies always come up in the discussion of CDCs. It is important to understand where there are cross-subsidies, who is impacted, and under what scenarios the cross-subsidies occur. It may be that having cross-subsidies allows a simpler design which can outweigh the cons of having them.

-

6. and 7. These are linked and they concern the sustainability of a CDC scheme design. With any design aspect, you need to make sure that it is going to stand the test of time. Scenario testing and stochastic analysis will likely be appropriate to make sure that, even with changes in market conditions, longevity assumptions and age profile of the scheme, the CDC scheme will still operate as expected.

Moving on to the case studies now, we have three to help bring it to life and look at some of the different aspects. The first case study, shown in Figure 5, goes into a bit more detail on pricing accrual.

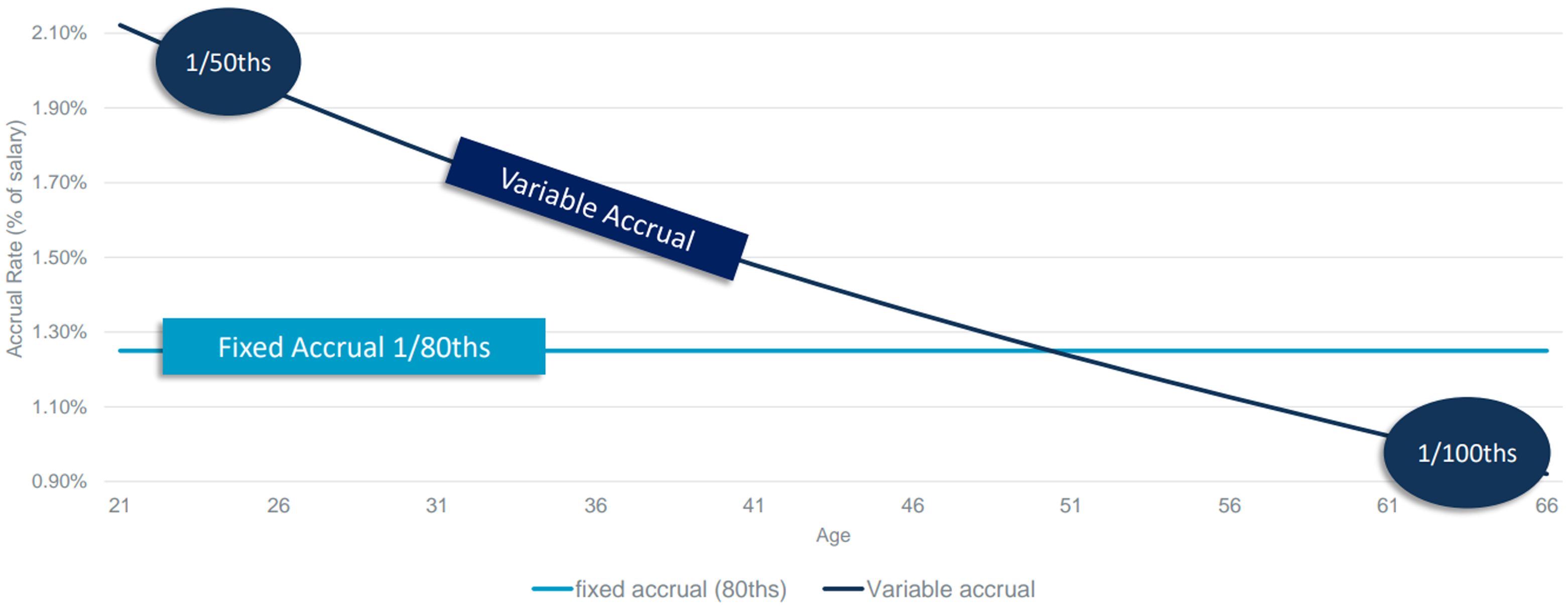

Figure 5. Case study 1 – pricing accrual.

Traditionally, DB schemes had fixed accrual. A sixtieth or an eightieth of your salary would be accrued every year for your contributions, irrespective of age. This is one approach that you can look at in a CDC scheme design and is indeed what was implemented by Royal Mail. It is arguably simple to communicate and provides more certainty over the expected level of pension that a member will have at the point of retirement. If you work for 40 years, you may expect a pension at retirement that is around half of your career average salary, with indexation to allow for the impacts of inflation. Assuming you make the same contributions every year irrespective of age, this is an example of a deliberate cross-subsidy because the cost of accrual for a younger member is lower than that of an older member who is closer to retirement. The younger member has longer until he is going to receive the pension and so there is more discounting in the calculation.

Another way to look at it is to say what would be actuarially equivalent in terms of accrual. You could have a variable accrual framework where each year, for the same contributions, you have a different accrual rate where the actuarial value of that accrual is equal to the contributions paid. The results are quite stark and shown in the chart. Younger people in this example might accrue a fiftieth, or 2%, of their salary for their contributions; whereas for the same contributions for someone in their sixties, they would only accrue 1%, so half that the amount. In the actuarial community, we can understand that and see how it is actuarially fair. It is a level of complexity in the design. And it may be viewed through some lenses as unfair. If you have two employees at the same company and one older employee is getting less pension accrual than a younger person, that might be seen as unfair.

This does link to the multi-employer legislation. There are new aspects to the multi-employer legislation around accrual and the actuarial equivalence test.

Each year, you are going to need to ensure that the cost of accrual is equal to the contributions paid either at the member level or the overall employer level. If you do the calculations at an individual member level you are likely to have this age-dependent accrual rate to be able to satisfy the test. If you do the test at the overall employer level, this might help facilitate smoother, more fixed accrual rates with some cross-subsidies.

This is still a very live issue, but it is likely that the new actuarial equivalence test could lead to accrual rates also changing over time with changes in market conditions. The test is done every year, so it is likely to be based on up-to-date assumptions about expected return on assets, longevity assumptions, and the current pension increase level of the scheme, to ensure that the accrual equals the contributions; a fair value for the accrual.

Even if you set an age-dependent accrual rate, say one-fiftieth for the youngest workers and one hundredth for the oldest workers, you may need to then change this over time, perhaps even every year, to reflect any changes in the cost of accrual. This adds another level of complexity to the design that needs to be worked through and understood and arguably creates more uncertainty for the members in terms of what their expected pension will be at retirement.

Mr Franklin-Adams: Can I add a couple of comments and ask you a question on case study 1? You have mentioned the cross-subsidies, which I always try to avoid because that is not fair. Rather than call them cross-subsidies, in the Royal Mail case, where accrual is at a rate of one-eightieth, I would prefer to say that the employer contributions are targeted at different rates for different members. Royal Mail pays 13.6% and the employees pay 6%. Of that, Royal Mail is targeting far more to older members. Would it be fair to say they are targeting about 20% of older members and only 6% of younger members?

Mr McInally: I agree with that. Younger members in a variable accrual scheme are effectively getting double the accrual of older members.

Mr Franklin-Adams: It is arguable whether that is fair or not. Royal Mail have addressed that, haven’t they?

Mr McInally: There is a good rationale for it because they typically have people who will work for a long period of time with Royal Mail, so will be part of the scheme throughout their working life and will get the average. The benefit of the simplicity of the design and its communication are key for them.

Mr Franklin-Adams: It can get quite complicated if we start discussing what the contributions are over time. For example, if the Royal Mail scheme has bad experience, then pension increases will become much lower than the CPI plus 1% per year as targeted at the outset. In such circumstances, the cost of the benefits being accrued would have decreased due to the lower pension increases. This means that only a portion of Royal Mail’s contributions are going towards current accrual with the remaining contributions going to the general asset fund which will have the effect of increasing the pension increases on past accrual as well as to current accrual.

Mr McInally: That’s right. A fundamental part of CDC is that the pension increase change is the variable and is smoothed over the whole life. If the pension increases must fall to CPI minus 1% then in a simple design all the benefits, both past and any new accrual, have an expectation of receiving CPI minus 1% increases. The actuarial value of new accrual with CPI minus 1% increases is going to be less than that with CPI plus 1% increases. However, if the contributions and accrual are both fixed, then you arguably pay too much in such circumstances, so the additional contributions in a fixed accrual pension scheme go towards benefits already accrued.

Mr Franklin-Adams: That does have advantages in the Royal Mail scheme, which makes their pension increases less volatile than in other CDC pension schemes. You can only do that in a single-employer scheme.

Mr McInally: It seems like the policy intent is to ensure that, in a multi-employer scheme, there is no cross-subsidy between employers at the point that contributions are made. Employers want to be confident that, if they are making a contribution in that year, the benefits that members are accruing fairly reflect that contribution. You would not want a design where the employer could figure out that the accrual was less than what they were contributing, and you get strange dynamics where employers would then pull out and join something else. It does need to be fair for a multi-employer scheme.

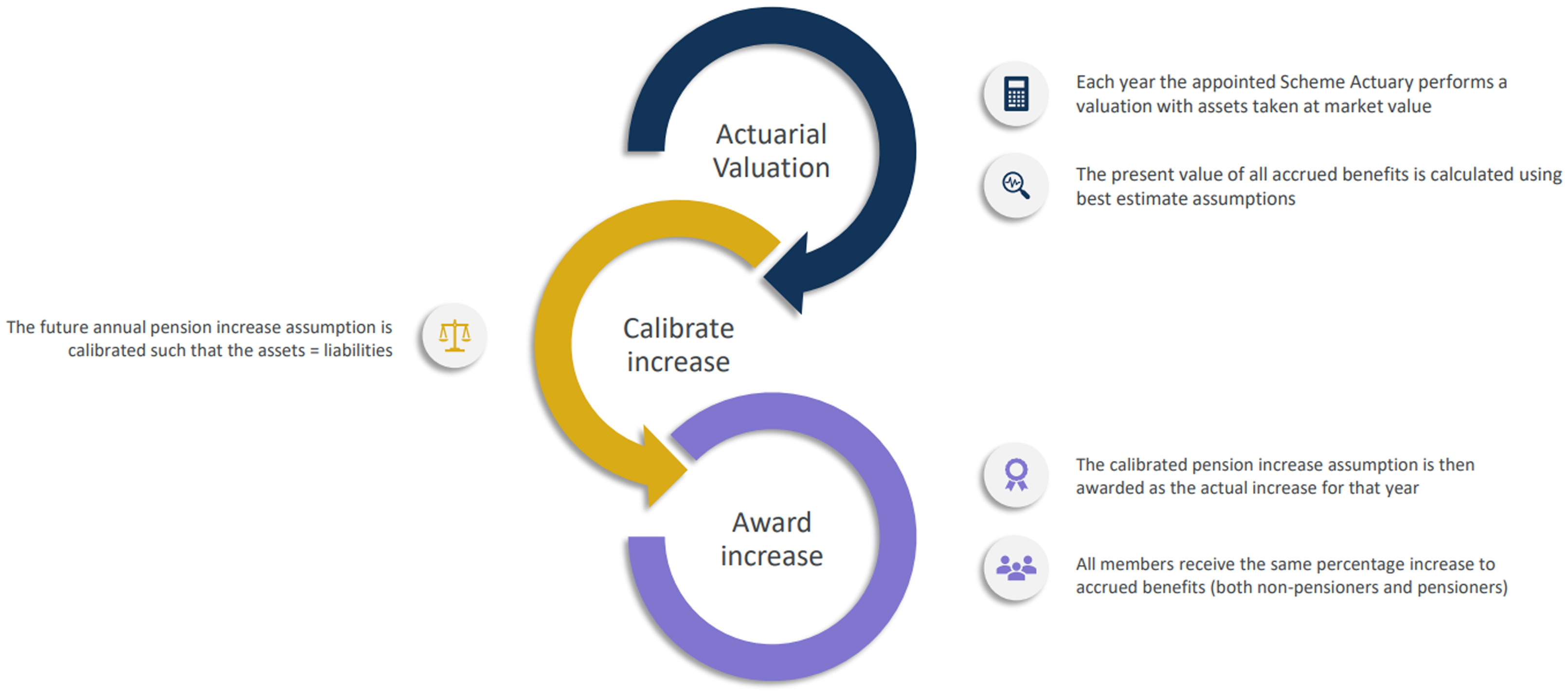

Mr Franklin-Adams: Case study 2 in Figure 6 discusses how the pension increase calculation changes every year. Actuarial valuations are carried out every year by the scheme actuary, like a traditional DB valuation except more often. The value of all the benefits accrued is calculated as is usually done, although using best estimate assumptions. Then you need to ensure that the asset value equals the liabilities. The way you do that is to vary expected future pension increases. You move the expected future pension increases up or down to tweak the level of the liabilities so that they equal the asset value. From that valuation, you get the level of all expected future pension increases. If you start at CPI, you might end up at CPI plus 0.5%, say. CPI plus 0.5% would be the pension increase that is paid that year and also the target for all future pension increases. All members get the same adjustment to all their accrued benefits.

Figure 6. Case study 2 – pension increase calculation.

Actuarial valuations take place every year, but the deadline is 10 months instead of 15 months. The aim is to ensure that the pension increase happens before the next valuation date. It could be just one day in advance, but if carrying out annual valuations hopefully this can become quite slick, and it will happen much more quickly and enable an earlier date for the pension increase.

One complication that we have thought about is that if every member is receiving the same increase, then it is straightforward, and every member will get the same pension increase afterwards. However, there are ongoing discussions about whether some schemes will be allowed to have different pension increases for different members. A new employer might join, and they would start again at CPI, even though the employers who joined a couple of years ago might have joined at CPI, but have moved to CPI minus 1%. The new employers would start at a different rate to the one that the current employers are receiving. The adjustments would be harder to work out, but you would have the same adjustment, plus or minus 1% say, to all members of the pension scheme.

Mr McInally: We have talked about benefit cuts, which require a different calculation with consequences.

Mr Franklin-Adams: Let’s look at the scenario where CPI is expected to be 2.5% say, but CPI minus 3% is needed to make the scheme 100% funded. You would have pension increases at CPI minus 2.5% and then cut benefits. This is because you are not allowed to go below 0% of expected future pension increases according to the current draft regulations. So, everyone would have to have a benefit cut such that the scheme becomes exactly 100% funded after the cut, with zero future pension increases. If that cut is big, then you might spread it over 3 years, say. I believe that if it is more than 5%, you are allowed to spread it over a number of years, but you cannot backload the spread of cuts over the three years. For example, the first cut must be the biggest or at least equal to the others.

Mr McInally: We did a lot of thinking for the paper before the new regulations came out. It is clear in the regulations for single-employer and multi-employer schemes that the smoothing of pension increases happens over the remaining life of the current members. That then creates the dynamic whereby if you have a very young membership then you have a lot longer for the smoothing. You can have big fluctuations in your assets, and you do not need to change the pension increase substantially. If you have an older workforce, you have less time to smooth it. There is a theoretical design where you have a fixed term for smoothing, over the next 10 years say, and then you get back to a central CPI benefit after 10 years. But that does not seem to be permissible under the draft regulations.

Another point is on the benefit cut methodology, which seems very prescriptive in the legislation. It is the intention that there is a prescribed approach for how, if there needs to be a cut, it must be calculated and applied.

Mr Franklin-Adams: There could have been other design options, but the DWP seem to have chosen what they think is the best design. Most schemes will look similar, other than in investment strategy. The schemes will be selling themselves on cost, as is typical, governance and on what their investment strategy is. The riskier the investment strategy, the higher the starting pension, but riskier assets mean more volatility in those target pensions. It is going to be a balance between those. It will be interesting to see how the market develops and what employers and individuals want in decumulation-only CDC.

Mr McInally: The intention that CDC schemes need to target inflation-linked benefits is clear. There are authorisation criteria where you need to demonstrate that you are designing the scheme with the expectation that you can target at least CPI-linked benefits. However, the test only needs to be done at the initial authorisation stage. You do need some flexibility such that, if investment performance is poor, you cut the pension increase assumption. It might go from CPI to CPI minus 0.5%, say. There is an interesting dynamic there because now the scheme is no longer expecting to provide fully inflation-linked benefits. So, while there is a clear intention to set up schemes initially to have inflation-linked benefits, over a potentially long period of time we could have schemes that depart materially from that intention. That is still permissible in the design.

Mr Franklin-Adams: You could have “Jimmy’s Dodgy Pension” which has been around 10 years and has done badly, competing with the healthily-performing “Keith’s Perfect Pension.” You would have thought that Jimmy’s Dodgy Pension, having done badly over a number of years, should be at a disadvantage; but actually, it will be able to offer much higher benefits for a given cost because it has low or zero pension increases.

Mr McInally: The schemes are going to be very similar. If you have multiple multi-employer schemes that are competing for new employers, the design is quite constrained. The investment strategy is a key thing that you can change, but if you have had poor investment performance, with transparency that will be clear. That is probably going to hinder schemes from gaining traction with new employers versus the upside of being able to offer you a higher pension for a given cost.

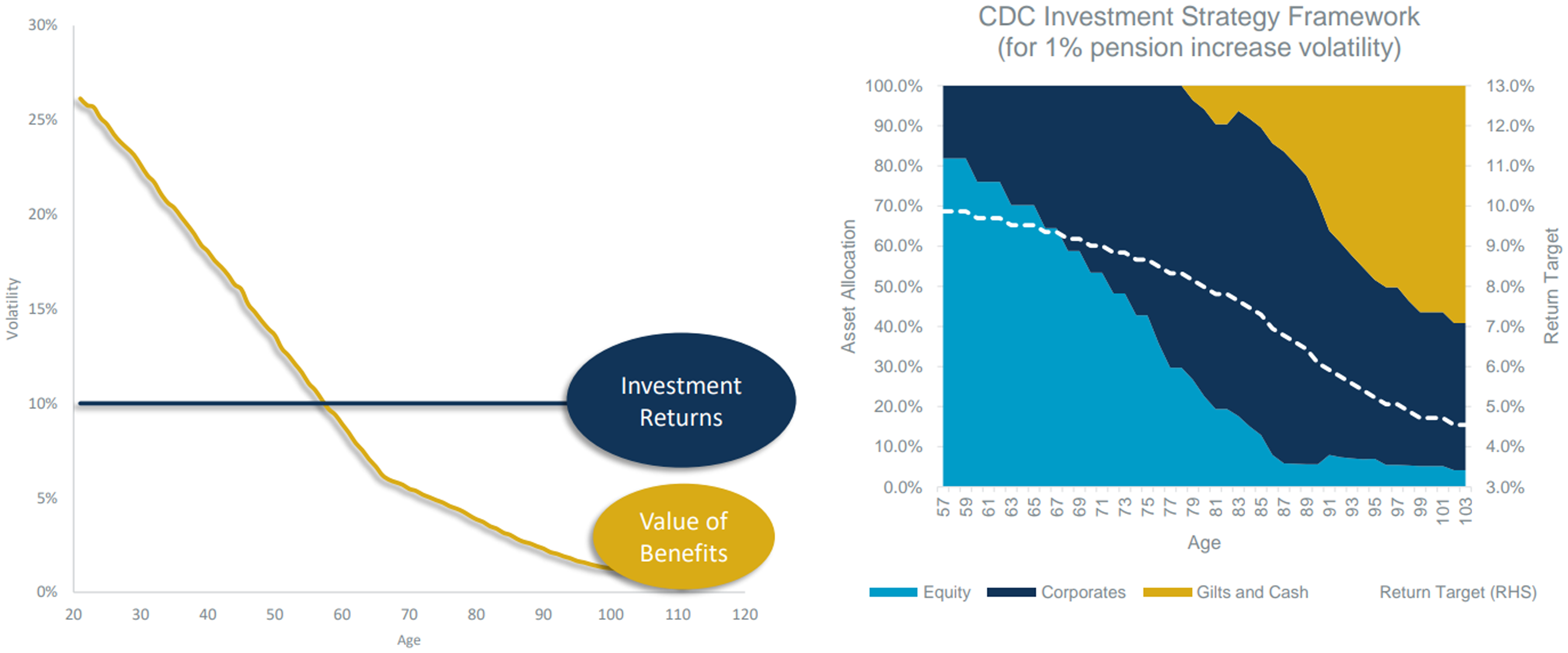

Case study 3 in Figure 7 is on investment pooling. I think investment pooling is less well understood than some of the other aspects of CDC. There are two aspects of investment pooling. The first is easy to understand. In a CDC scheme, you are pooling all the contributions together. Effectively you have a single pot with an overall investment strategy and hence you get economies of scale. Big CDC schemes will be able to command very attractive asset management fees and low costs. Long term, these schemes are going to be around for a very long time. They are going to grow into billions of pounds.

Figure 7. Case study 3 – investment pooling.

The other aspect of investment pooling in CDC is how asset returns are distributed across the membership. What happens if you have positive or negative investment performance versus expected? If performance is higher than you expect, this will translate into an increase in the annual pension increase. Similarly, if performance is poor, you reduce the pension increase.

If you change the pension increase and the expectation for all future years, this has a bigger impact on the value of pension for a younger member than for an older member. You can envisage a pensioner in their nineties who perhaps only has a few years left of expected payments. A change to the future pension increase of 1% is not going to have much of an impact on the value of their benefits. Contrast that with a 21-year-old who has just joined. The scheme change is going to have a much bigger impact on them because it is a 1% difference in pension increase for every future year. Bear in mind that it applies to all members irrespective of age, pre- and post-retirement. They are getting increases on their accrued pension before retirement as well. This dynamic is basically how investment returns are being shared. Younger members are taking more of the upside in the good years, but also more of the downside in bad years. You can translate that into volatility. On the left-hand side of Figure 7, we have an example where, if the investment strategy was targeting a volatility of 10% per annum, if everyone had an individual pot of money DC, everyone’s volatility would be 10%. But under a CDC scheme where everyone has a target pension with the pension increase adjustment mechanism, then the actuarial value of their pension has volatility every year as that pension increase changes. For the younger members, it is much more volatile than for the older members.

It is important to understand the consequences of investment pooling, which is acting as intended as part of a CDC scheme design. The aim will be to provide as stable as possible pension increases and stable but high income for a member throughout their life.

You can reverse the thought process and use it to infer an appropriate investment strategy for a CDC scheme to target different levels of pension increase volatility. This is some new analysis that we have been working on and which we will be putting into a paper soon. The chart on the right-hand side of Figure 7 has some initial results, which show you can effectively have a higher allocation to equities when you are younger, which reduces over time. This could provide a framework for a CDC scheme setting an appropriate investment strategy, which reflected the volatility of the benefits each year.

One of the selling points of CDCs is that they can facilitate higher allocations to growth assets for longer because you are pooling the risk, as demonstrated in our analysis. The equity allocation stays relatively high at a retirement age of, say, 65; but also over the next 10 years, and does not reduce significantly until members are into their 70s and 80s. That journey is likely to be higher growth and higher return generating than an individual would typically employ within a DC strategy.

So, what are the next steps for the working party? We are responding to the DWP consultation on the draft regulations for multi-employer CDC. It is due in the middle of November. We are planning some further thought leadership with a focus on investments. We also have in the diary an in-person session at the IFoA’s pension seminar day in May 2025.

Mr Franklin-Adams (starting the Q&A session): Are there caps as to how much the annual income could rise or fall, or is it purely down to the performance of the investments? For example, in a really bad year, could the members’ income go down, say, 50%?

Mr McInally: The simple answer is there is no minimum or maximum in terms of how much. We do have the dynamic that James (Franklin-Adams) spoke about where, if there is a benefit cut, you can smooth it over a three-year period. When you look at a typical age profile of what you would expect for a CDC scheme, it does give you quite a long period for smoothing those returns. If you had a 20-year duration of your liabilities, and you have a 20% fall in your assets, you only need to do a 1% per year change in the pension increase to offset that. A 50% cut in benefits is almost impossible due to the smoothing mechanism. Never say never though.

Mr Franklin-Adams: In theory, it is possible. You would spread it over three years if it happened. Hopefully, there would be a good performance in one of those years, so you could remove some of that future cut. Bad performance does go straight to the members. It is DC, like we said at the beginning. There are no extra contributions that can come in from somewhere else. That would be mirrored in a DC pot if the same happened.

Question: Do Royal Mail tell employees they get 13% employer contributions, or do they say it varies by age?

Mr Franklin-Adams: I imagine that Royal Mail says that they contribute 13.6% of pay. They are not specific about how it is applied across the members.

Question: What sort of notice does a member get for a cut in benefits?

Mr McInally: We have been discussing this because the actuarial valuation happens every year. You need to wait until the actuarial valuation is complete to get the results and see what pension increase you can award, and that might result in a benefit cut. You do not have very long until you must do the next valuation, depending on how long the valuation takes you to complete. I have not seen any wording around the notice period that you have to give for a benefit cut.

Mr Franklin-Adams: A valuation will occur at least within 10 months of the valuation date. It could be as little as two months, but hopefully, the valuations will be completed much earlier than the 10-month’ deadline and so you might get more than two months’ notice.

Question: Have you completed indicative back testing to show how volatile pension increases may be?

Mr Franklin-Adams: This was done for Royal Mail. The Royal Mail example only showed that, during the depression in the 1930s, there were a couple of cuts in succession at that point. However, as we discussed earlier, Royal Mail is a unique case and is less volatile than others. When we design other schemes, I am sure the people who design them will do back testing to test how volatile they are, but it will vary a lot depending on the design and the investment risk taken by the particular schemes.

Mc McInally: The analysis that we are looking at is the volatility of the pension increase, which will very much depend on the investment strategy. You could get some schemes that have more aggressive investment strategies with more volatility in the level of pension increases than others. That is a design choice. We have been looking at a design where you have a 1% annual volatility in the pension increase. That means that if you start at 3%, one standard deviation corresponds to 4% and 2%. You can infer an investment strategy from that, which seems reasonable to me, with high allocations to growth assets in the early years and de-risking to bonds post-retirement. It is very much a design choice.

Question: Are CDC schemes expected to be regulated by TPR or FCA?

Mr Franklin-Adams: These schemes will be under TPR, so we expect them to be trust-based. They might sit well alongside DC master trusts.

Question: Where benefits are reduced because of significantly poor performance, will the pensions paid to pensioners be adjusted as well?

Mr Franklin-Adams: Yes, all pensions are adjusted in exactly the same way.

Question: If members are told that the employer contributes at 13% for a young member, would the member’s annual statement not show that the actual rate is below 13%?

Mr Franklin-Adams: I think this is to do with the Royal Mail scheme. Members will, on their annual benefit statement, get their one eightieths and that is what will be shown. There won’t be anything about how those contributions achieved that amount.

Question: How does this link in with DC Master Trusts?

Mr McInally: There are DC Master trust providers that are thinking about CDC and how they might incorporate it as a different scheme or section. They are well-placed to be working on this and have the platforms to be able to do it. It also plays into the decumulation CDC market, which is the next phase hopefully for the DWP; with legislation to allow DC master trusts or other DC schemes to have a CDC option post-retirement, where DC pots are converted into target pensions at the point of retirement. Then that is pooled across the membership.

Question: Have many people joined the Royal Mail Collective Pension Plan?

Mr Franklin-Adams: We do not know how many Royal Mail opt-outs there have been. Their other option is to go into a DC scheme with lower contributions. I doubt there will be many opt-outs.

Last question: For multi-employer CDC, how would employer-level underwriting operate?

Mr McInally: That is up to the scheme design. It should be fair at an employer level.