1 Introduction

1.1 Background

1.1.1. Some UK insurers have been using economic capital models to perform their own assessment of the capital required to support their risk exposures and to assist in the management of those risks for a number of years. The implementation on 31 December 2004 of realistic reporting for some UK with-profits firms and the Individual Capital Adequacy Standards (ICAS) framework introduced a risk-sensitive approach to the determination of regulatory capital requirements for UK life insurers, supplementing the factor-based approach that applied previously under Solvency I.

1.1.2. One of the most fundamental choices to be made in the construction of any economic capital model is how to aggregate together the capital requirements for the individual risk factors and take account of the effects of diversification. The reported value of the effects of diversification is a balancing item. It depends on the final aggregate economic capital requirement and the level of granularity at which the standalone capital requirements for initial “pre-diversification” risk factors are presented, as well as assumptions made regarding the dependency between movements in those risk factors; the undertaking’s exposures to those risk factors; and how they interact to compound or reduce losses. The reported effect of diversification is therefore, taken in isolation, not necessarily a meaningful figure. Nevertheless, starting from the level at which risk factors are typically modelled separately, the effects of diversification can be very significant. Under the ICAS framework, the effect of diversification was typically one of the largest single items in the build-up of the ICA of a typical life insurer, representing a reduction of 40%–60% of the sum of individual capital requirements. For example, the KPMG LLP (2015) indicates that, for the majority of firms, the effects of diversification represented a reduction of 41%–51% in capital requirements. The survey covered 29 respondents, all of which were UK life insurers, though not all of which applied to use an Internal Model for the calculation of their solvency capital requirement (SCR) under Solvency II. However, this result is consistent with the range quoted in other industry surveys whose results are not publicly available. At the time of writing, it is not yet clear what level of granularity those firms using an Internal Model to calculate their SCR will use for the presentation of the effects of diversification in public reporting.

1.1.3. A common approach to aggregation under the ICAS framework was to calculate standalone capital requirements for individual risk factors by applying stress tests – one for each individual risk factor identified by the undertaking. These individual capital requirements were then combined using a correlation matrix to determine an aggregate capital requirement allowing for the effects of diversification. It was not uncommon to adopt a multi-tiered approach to aggregation under which subsets of risk factors within one or more categories were first aggregated to the level of that category prior to aggregation with the corresponding results for other categories.

The correlation matrix approach to capital aggregation and its limitations are well known. In particular, it is accurate if:

-

∙ the underlying multivariate distribution of risk factor changes is elliptic (e.g. if they follow a Normal, Student’s t or some other elliptic distribution), and

-

∙ the measure of economic capital available responds linearly to shocks in the risk factors and the changes in the risk factors do not interact to compound or reduce losses in economic capital.

See for example, Shaw et al. (Reference Shaw, Smith and Spivak2011).

1.1.4. It was common practice under the ICAS framework to adjust the result produced by the correlation matrix approach to allow for non-linear interactions between risks using a refinement based on a scenario. For example, under the assumptions of section 1.1.3 it is possible to determine a ‘most likely’ scenario which gives rise to a loss equal to the aggregate economic capital requirement. The scenario can be expressed in terms of a closed form formula involving matrix multiplication. The standalone stresses to each of the individual risks are scaled by a risk-specific factor (a function of the capital requirements for all risks and the entries in the row of the correlation matrix corresponding to that specific risk factor). This scenario is then run through the full actuarial model suite (or ‘heavy model’) in order to determine a scaling factor to be applied to the correlation matrix result or to simply replace it.

1.1.5. Following the implementation of Solvency II on 1 January 2016, all UK insurers which are subject to Solvency II regulations must calculate their SCR using a Standard Formula approach, or subject to supervisory approval, use results produced by an Internal Model to substitute all or part of the Standard Formula calculation. The Standard Formula approach of Solvency II uses a multi-tiered correlation matrix approach for the calculation of the SCR but, unlike under the ICAS framework, the stress tests to be applied and the correlation assumptions to be assumed are prescribed.

1.1.6. In order for an Internal Model to be used in the calculation of the SCR, the Solvency II regulations require that the model meets certain minimum standards, which are described in Articles 120–126 of the Solvency II Framework Directive (2009/138/EC). These include standards relating to the statistical quality of the model, its calibration, a requirement for independent validation and the ‘use test’, that is, that the model plays an important role in informing decisions regarding the management of risk in the business. In particular, Article 122(2) requires that the SCR must be derived, where practicable, directly from the Probability Distribution Forecast generated by the Internal Model. Article 13(38) of the Directive defines the Probability Distribution Forecast as “a mathematical function which assigns to a set of mutually exclusive future events a probability of realisation”. This is clarified in Article 228(1) of the Solvency II Delegated Regulations (2015) which states that “the exhaustive set of mutually exclusive events … shall contain a sufficient number of events to reflect the risk profile of the undertaking”. Article 234(b)(i) adds “the system for measuring diversification takes into account … any non-linear dependence and any lack of diversification under extreme scenarios”. (The full text of Articles 228 and 234 is reproduced in Appendix B.) Guidelines 24–27 of the European Insurance and Occupational Pensions Authority (EIOPA) Guidelines on the use of internal models (EIOPA, Reference Embrechts, Lindskog and McNeil2015) provide further guidance on interpretation of ‘richness of the Probability Distribution Forecast’ stressing (inter alia) that ‘the Probability Distribution Forecast should be rich enough to capture all the relevant characteristics of [an undertaking’s] risk profile’ and ensure the reliability of the estimate of adverse quantiles is not impaired, whilst ‘taking care not to introduce … unfounded richness’.

1.1.7. Some UK life insurance undertakings have taken the view that, due to the nature of their risk exposures and the Solvency II requirements for use of a “full Probability Distribution Forecast”, an aggregation approach based on a correlation matrix with scenario-based refinements would not be adequate to meet the Internal Model standards due to the limitations outlined in section 1.1.3. This has led some life insurers that use internal models to use more sophisticated approaches to the aggregation of capital requirements. The most common of these is the so-called “copula + proxy model” approach.

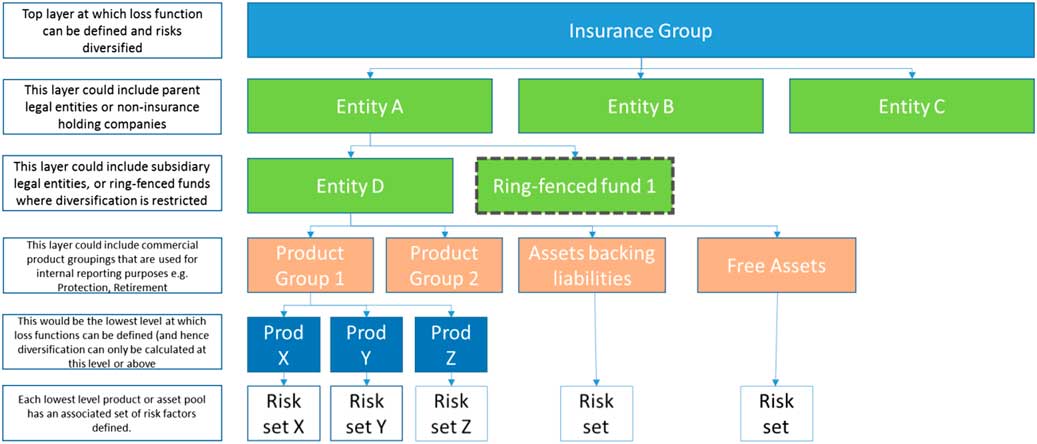

This approach is comprised of the following two components:

1.1.7.1. Multivariate risk factor model

This uses simulation techniques to generate a large number of (pseudoFootnote 1 ) random scenarios from an assumed multivariate distribution of changes in risk factors. The most common approach is to define the distribution of changes in each individual (marginal) risk factor separately (either in the form of a parametric distribution or in the form of simulated values) and to “glue” these together using a copula which defines the dependency structure.

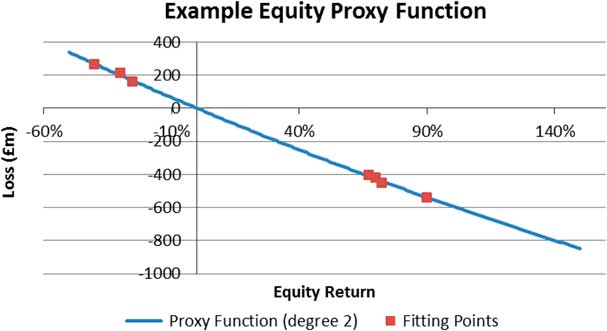

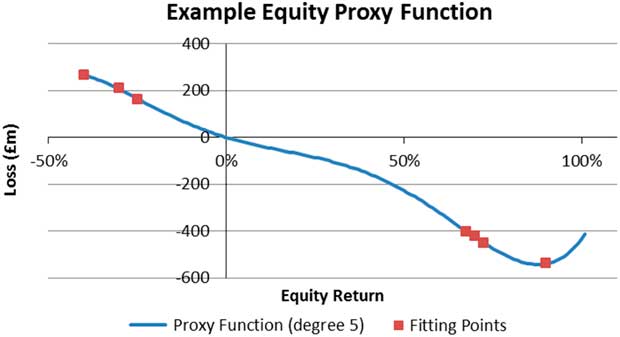

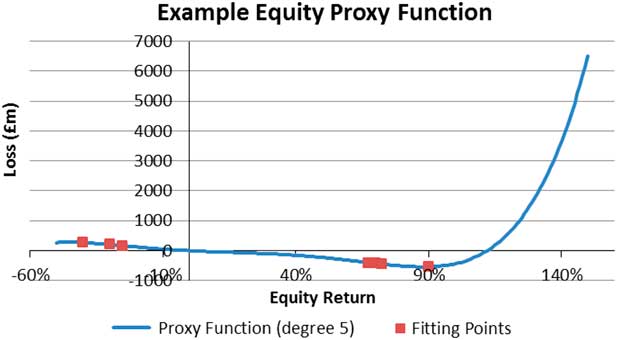

1.1.7.2. Proxy model

For many UK life insurers, it is not currently practical to revalue assets and liabilities in the large number of simulated scenarios generated in the previous step. This is because certain liabilities relating to with-profits business (such as the cost of guarantees) are usually valued using stochastic techniques. The resulting nested stochastic valuation is not currently practical due to technological limitations. Instead, a proxy model is used to approximate the profits and losses that would be produced by the “heavy” actuarial models in those scenarios. The proxy model typically consists of a number of “proxy functions” which describe the changes in values of assets and liabilities in response to changes in the risk factors. The proxy functions are defined at the level of sub-portfolios of risks (which collectively cover the whole undertaking) and are calibrated using standard fitting techniques such as least squares regression.

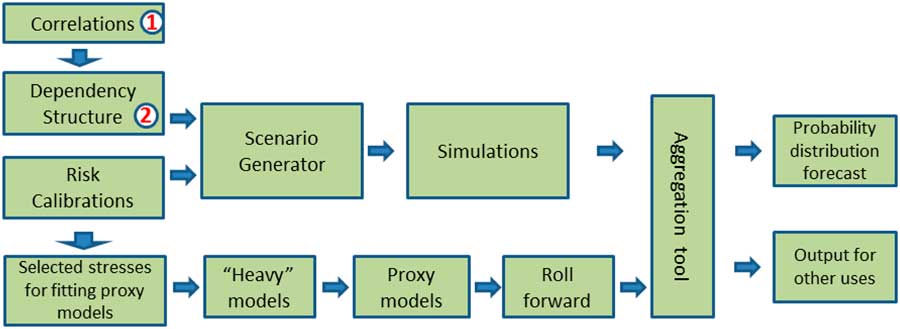

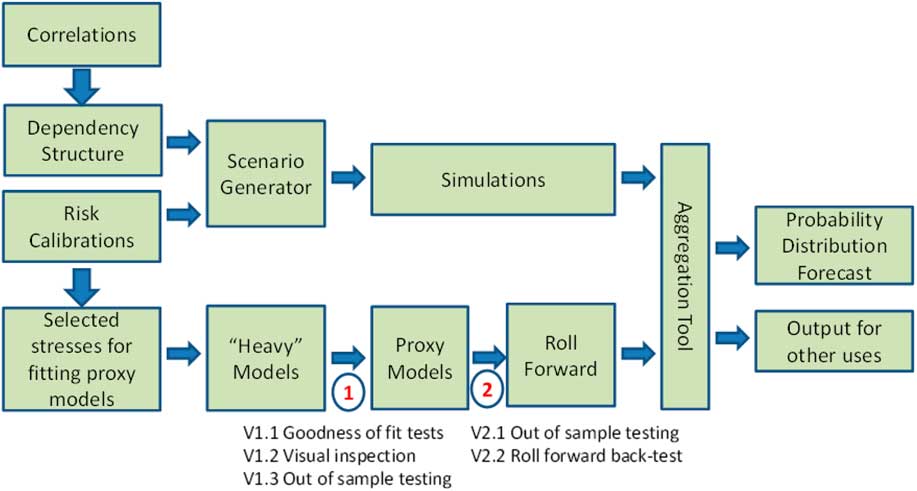

These two components combine to produce a large number of simulated values of profits and losses from which the required measure of risk can be deduced. Figure 1 provides an illustration of how the various components of the “copula + proxy model” approach fit together.

Figure 1 Overview of copula + proxy model approach

1.1.8. The aim of the proxy model is to reflect non-linear responses to changes in risk factors and the interaction between changes in risk factors. The copula-based risk factor simulation model is aimed at producing a full probability distribution forecast by generating a sufficiently large number of scenarios (rather than just a small number of stress tests) which more appropriately reflects the underlying distribution. It permits departure from the assumption of an elliptic distribution by allowing separate choices of the marginal risk factors and the dependency structure between them (i.e. the copula). For example, the copula could be chosen to explicitly include tail dependence and, at least in theory, belong to a non-elliptic family.

1.1.9. The greater complexity of such techniques, the assumptions underlying them and the financial significance of those assumptions means that they are likely to come under greater scrutiny from the users of the models, such as senior management and the Boards of the undertakings. Where the models are to be used to determine regulatory capital requirements under Solvency II, they will also be subject to scrutiny by the supervisory authorities who will expect undertakings to be able to produce evidence that the approach meets all the relevant standards of Solvency II.

1.1.10. Some of the judgements which are likely to come under particular scrutiny include:

-

∙ whether the model which describes the association or dependency between changes in risk factors and its calibration is appropriate – in particular, whether individual parameters (e.g. correlations) can be justified by reference to expert judgement and relevant data (where available) and whether the model and its parameterisation makes adequate allowance for the association between extreme changes in the risk factors (“tail dependence”);

-

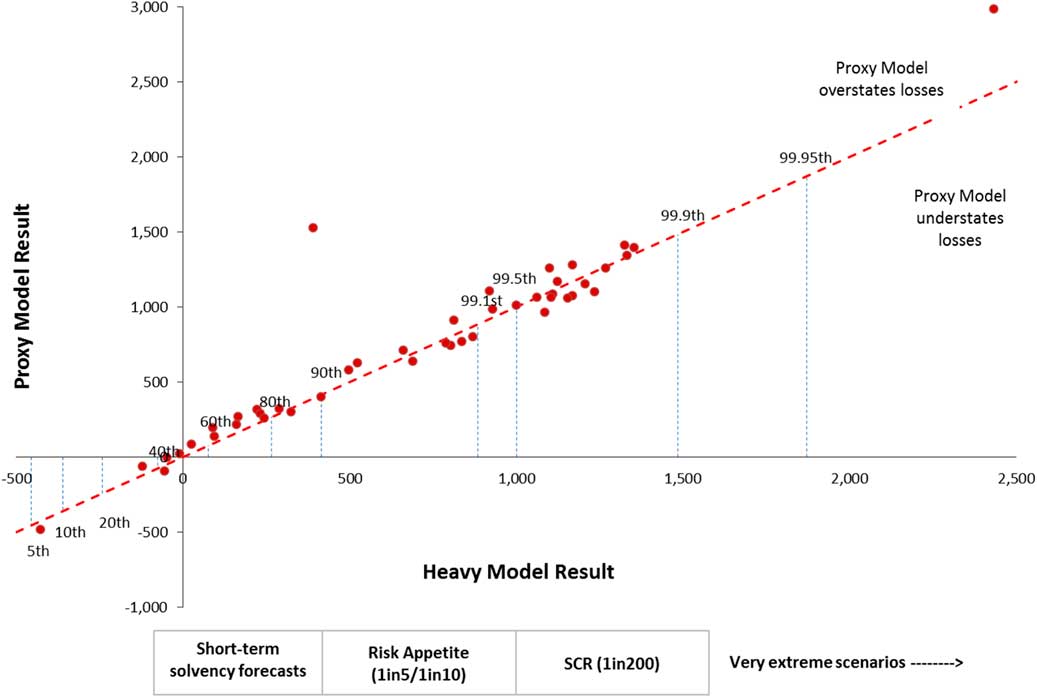

∙ whether the fitting error resulting from the use of the proxy model is material and whether appropriate adjustments are made to mitigate the effects of such errors.

1.2 Objective of the Working Party

1.2.1. The objective of the Life Aggregation and Simulations Techniques Working Party was to set out different techniques by which actuaries and insurers could assess and choose between the range of aggregation approaches available. In particular, the Working Party was asked to focus on how insurers could test, communicate and justify those choices to the various stakeholders involved.

1.2.2. The purpose of this paper is to provide UK life insurance actuaries with some examples of techniques which could be used to test and justify recommendations relating to the aggregation approach. Throughout the text we also provide some practical examples of how those techniques may be communicated effectively to stakeholders. (Readers who wish to proceed directly to these sections should refer to section 1.3.) Whilst the techniques involved are more complex than those which have been common under the ICAS framework, the Working Party believes that the underlying concepts can be explained in a manner which is accessible to financially literate stakeholders without going into unnecessary technical detail. We believe that graphical techniques can be a powerful tool in explaining and justifying the assumptions made and include some examples. We have tried to avoid discussion on the technical details and relative merits of specific techniques. However, we have included technical material or appropriate references where we believed this would provide helpful context for the reader.

1.2.3. The Working Party understands that that the “Copula and Proxy Model” method is the most common of the more sophisticated aggregation approaches used in those internal models for whose use some UK life insurers received supervisory approval in December 2015. We have therefore focussed our attention on the challenges faced by actuaries when testing, justifying and communicating choices in relation to this particular approach. We hope the paper will prove useful for actuaries involved in the preparation of internal model applications by undertakings seeking supervisory approval at a future date.

1.2.4. The paper contains examples of some techniques which the Working Party understands have been effective in practice. However, these do not necessarily represent a comprehensive set of tools, use of which will guarantee success. Other techniques may exist which are equally, if not more, effective. Actuaries should choose techniques which are most appropriate to the specific circumstances of the individual undertaking and the users of the model outputs.

1.2.5. The Prudential Regulation Authority (PRA) provided a summary of some aspects of the Quantitative Framework it used when assessing internal model applications during 2015 in two executive updates: “Solvency II: internal model and matching adjustment update” dated 9 March 2015 (PRA, 2015a) and “Reflections on the 2015 Solvency II internal model approval process” dated 15 January 2016 (PRA, 2016). This letter included an overview of the PRA’s quantitative indicators for dependencies. Actuaries involved in the recommendation of a dependency structure and its parameterisation may wish to consult this letter for more information regarding the expectations of the UK supervisory authorities.

1.3 Structure of the Paper

1.3.1. Section 2 provides an overview of the principal stakeholders, their role and interests and ways in which actuaries might approach the communication challenges.

1.3.2. Section 3 describes how the parameters of a copula may be selected using a combination of expert judgement and relevant data (where available). We discuss how the choices may be justified and tested, including the use of statistical and graphical techniques. In particular, we discuss techniques by which allowance can be made for tail dependence. We have focussed on the Gaussian and Student’s t copula as we understand these are the two copulas which have been included in internal models of UK life insurers approved to date. Readers already familiar with the concept of tail dependence may wish to proceed directly to section 3.8. Sections 3.5.1, 3.5.5, 3.6.3, 3.7.1, 3.7.2, 3.8, 3.9 and 3.10 provides some examples of how the underlying concepts and techniques may be communicated, including worked examples based on a specific data set. Section 3.15 discusses “top-down” reasonableness checks.

1.3.3. Section 4 describes the practical aspects associated with fitting and validating a proxy model. We also highlight the key challenges practitioners face in communicating their proxy model results to stakeholders such as senior management, and consider how these can be addressed in sections 4.6.9 and 4.8.

1.3.4. We have assumed that the reader is familiar with the concepts of copulas and proxy models. References to background reading material are provided in the corresponding sections. For the purposes of this paper, we have focussed on the calculation of SCR under Solvency II. The SCR is defined as the Value at Risk (VAR) of basic Own Funds at a confidence level of 99.5% over a 1-year time horizon. The considerations for other measures of economic capital requirements are similar, although the tests and standards of Solvency II may not necessarily apply. Readers should take into account the specific circumstances when applying any of the techniques discussed in this paper.

2 Stakeholders and Communication

In this section we list the principal stakeholders involved in making or reviewing decisions relating to the choice of aggregation techniques and the related assumptions, and the implications for communicating and justifying recommendations to two sets of key stakeholders: members of the Board and the supervisory authorities. Further commentary specific to the dependency structure and proxy models is included in sections 3 and 4, respectively.

2.1 Stakeholders

There are various groups of stakeholders who may be involved in the review of recommendations made regarding aggregations techniques (as well as other components of an Internal Model) and their implementation into the day to day operation of the Internal Model:

2.1.1 Boards

The Board of a company is ultimately responsible for approving the firm’s Internal Model for use. It needs to ensure that on an ongoing basis the design and operations of the Internal Model are fit for purpose; that the model appropriately reflects the company’s risk profile; the model meets the relevant tests and standards and that the output from the model is credible for use in managing the business and for regulatory purposes.

2.1.2 Supervisory authorities

The supervisory authorities will wish to be provided with evidence which demonstrates that the model meets all the relevant tests and standards of Solvency II in order that they are able to approve the model for use in calculating regulatory capital requirements.

2.1.3 Risk committees, senior management

The Board may use the output from reviews by its risk committees to inform its final decision on whether to accept the model or to require changes to it. Senior management will be users of the model in the day to day management of risk in the business and have a role in ensuring it is fit for purpose. Members of senior management will also need to have a detailed understanding of the components of the Internal Model used in their own areas of the business. Senior management may establish technical committees whose membership includes executives from different parts of the business to ensure that recommendations made to the Board on the methodology and assumptions used in the model take appropriate account of business needs in addition to being technically sound.

2.1.4 Risk management function

Under Solvency II, the risk management function is responsible for putting in place an effective risk management system to identify, measure, monitor, manage and report on the risks to which a company is exposed and their interdependencies.

Where an Internal Model has been approved by the supervisory authorities for the calculation of the SCR, the Solvency II Directive states that the risk management function is responsible for the design and implementation of that Internal Model as well as for its testing and validation. This includes the documentation of the Internal Model together with any subsequent changes made to it. The risk management function is also required to analyse the performance of the model and produce corresponding reports. These reports include informing the Board about the performance of the model, areas that need improvement and providing updates on actions aimed at improvement of previously identified weaknesses.

The risk management function is also responsible for the policies relating to the governance of the Internal Model, including the policy for changes to the Internal Model and the framework for validation of the Internal Model.

In practice, the risk management function may delegate some of the day to day activities to the actuarial function, subject to oversight by the risk management function. For example, due to the requirement of Solvency II for independent validation (see section 2.1.6), the design and implementation of the Internal Model together with responsibility for maintaining the related documentation is often delegated to the actuarial function, with oversight provided by the risk management function.

The risk management function is responsible for the developing of proposals for the validation framework for review, challenge and, ultimately, approval by the Board and for the production of regular validation reports to the Board. The resulting validation process will often include a review of the choice of copula and its parameterisation by individuals independent of the development of those proposals. It will also typically include (i) an assessment of the adequacy of the fit of the proxy model by the risk management function or (ii) the definition of a set of tests to be performed by the actuarial function to assess the fit of the proxy model and the criteria for any subsequent adjustments to model outputs with a review of the outcome by the risk management function.

2.1.5 Actuarial function

The actuarial function is often responsible for the design, maintenance, testing and day to day operation of the Internal Model under oversight of the risk management function. The actuarial function will have an interest not only in ensuring the technical soundness of the model and its compliance with the company’s own policies and the relevant regulatory tests and standards, but also that it is appropriate for use in the business. This means that the model should not only be suitable for the calculation of regulatory capital requirements, but also that it does not contain unnecessary areas of prudence which could lead to inappropriate decisions or result in unnecessary constraints on the business. The actuarial function is therefore likely to establish its own “first line” system of review which may include peer review by other technical specialists, technical review forums including other finance experts on areas such as asset liability management, tax or IFRS reporting, and final review by the Chief Actuary. The actuarial function will therefore be highly interested in both the technical soundness of the model as well as ensuring that the outputs it produces provide a realistic measure of the risks.

The actuarial function may also be responsible for maintaining the documentation of the Internal Model, subject to review and approval by the risk management function. This could include preparing papers recommending methodology and assumptions for approval by the Board, together with papers seeking approval from the Board for the results of the Internal Model, including the SCR. These papers should include an assessment of the strengths and limitations of the Internal Model, a description of the significant expert judgements and sensitivities to valid alternative assumptions. In particular, documentation provided to the Board should draw out key judgements relating to the choice of copula, its parameters, how account has been taken of tail dependence, the rationale for those judgements, the associated limitations and sensitivities to valid alternative judgements. The documentation should also draw the attention of the Board to limitations of the proxy model including fitting errors and, where applicable, how these limitations have been allowed for through adjustments to the proxy model result together with the rationale for those adjustments. These judgements should be communicated in a way which is accessible and engaging and which identifies the judgements where the Board can significantly influence the outputs of the model by choosing alternative assumptions.

2.1.6 Independent validation

The Solvency II regulations require regular validation of the Internal Model, including its specification, performance and comparison of its results against actual experience, through a validation process which is independent of those responsible for the development and operation of the model. Responsibility for the validation of the model lies with the risk management function. As indicated in section 2.1.4, the requirement for independence of validation process from those responsible from the development and operation of the Internal Model often means that the latter responsibilities are delegated to the actuarial function under oversight of the risk management function.

Personnel involved in the validation process will be interested in ensuring that the model meets all the relevant tests and standards and is suitable for use in managing the business. Personnel charged with the validation process must regularly report on the outcome of their reviews to the Board. They will therefore wish to have a good understanding of the mathematical basis for the model, detailed evidence which demonstrates that the model it meets the tests and standards of Solvency II, and that the outputs from the model provide a reasonable basis for the measurement and management of risk. They will also be interested in understanding the limitations of the model and circumstances under which it may not be effective, whether an appropriate range of alternative methods have been considered and how the limitations are mitigated.

2.1.7 Internal audit

The internal audit function is responsible for the evaluation of the adequacy and effectiveness of the company’s internal control system, including whether the actuarial function and risk management function have properly performed their respective roles. The internal audit function may therefore carry out its own testing in order to provide assurance to the Board. This could include aspects such as a review of the effectiveness of the processes and controls designed to ensure the Internal Model meets the required tests and standards, the processes around expert judgement (e.g. the selection of correlation assumptions) and whether the process for calibration and adjustment of the output from a proxy model is operated in accordance with the approved specification.

2.1.8 External advisors

Some firms may seek additional assurance from external advisors regarding the design of the model or the underlying assumptions, in particular in specialist areas where the firm feels it does not have sufficient expertise internally or where it wishes to obtain additional insight into market practice.

2.1.9 External auditors

Where the SCR is calculated using an approved Internal Model, according to PRA Consultation Paper CP 43/15 “Solvency II: external audit of the public disclosure requirement” (2015b) (the consultation on which had not been concluded at the time of writing this paper), the PRA does not intend to require the SCR to be subject to external audit. This avoids duplication of the independent validation and the PRA’s own Internal Model approval process. It is for the Boards of such firms to determine the extent of involvement of external auditors in review of the SCR. For example, the Board of some firms may determine that no further external assurance is required. Alternatively, a Board may request external auditors to perform one of a range of possible assurance exercises: (i) review and comment on specific aspects of the SCR calculation; (ii) provide a limited assurance opinion on whether specific items of the SCR have been calculated in accordance with a basis of preparation defined by the firm; or (iii) provide a reasonable assurance opinion on whether the full SCR calculation has been performed in accordance with a basis of preparation defined by the firm. In each case, the basis of preparation would be the specification of the Internal Model approved by the college of supervisors.

2.2 Communication

There is a wide range of potential audiences for communications related to the judgements involved in the aggregation of risks and the Internal Model more widely. Each of these audiences plays a different role and has different interests. In any form of communication, it is important that the communication has a clear purpose, the needs of the audience are taken into account and that essential information is not obscured by material which is not relevant to the decisions being made. The language, style and medium of communication should also be appropriate to the needs of the audience. Some audiences do not require technical details, whilst other audiences may be highly interested in the mathematical theory underlying a particular model. Some audiences may prefer detailed written documentation, whilst for others, the messages may be more effectively conveyed in the form of pictures or diagrams in a slide pack, for example. The structure of any communication is also important. The way any form of communication is organised should be logical and provide a clear path through the material presented in support of the recommendations. Different approaches are therefore needed when communicating with different audiences. It may be appropriate to have several “layers” or “strands” of documentation to meet the needs of different audiences.

The Solvency II regulations provide standards on documentation and the content which must be provided to certain stakeholders. Actuaries should also comply with the relevant professional standards in their communications, in particular with the appropriate Technical Actuarial Standards.

In the remainder of this section, we consider differences in the approach to communication to two key groups of stakeholders: members of the Board and the supervisory authorities.

2.2.1 Board members

Where the Internal Model is used for calculating the SCR under Solvency II, the Board are collectively responsible for ensuring that the Internal Model is fit for purpose and that it meets all the relevant tests and standards. They will therefore wish to make sure that it is appropriate for use in the management of risk in the business as well as for the production of regulatory capital requirements.

This does not mean that members of the Board have to be experts in the mathematics and statistics underlying the capital models. Rather they will need to understand at a high level why a particular model was selected, what that model does, its key features, its strengths and limitations, the significant judgements involved, the related uncertainties and the impacts of reasonable alternative models and assumptions so they can exercise review and challenge where appropriate.

It will therefore be important when explaining recommendations to the Board to focus on the most significant areas of judgement and to avoid technical jargon. Graphical techniques such as scatter plots, charts and histograms provide effective tools to explain and motivate choices in a compact way. Simple worked examples may also be helpful to illustrate concepts. Boards must ensure that they have sufficient understanding of the model, the underlying judgements, their limitations and the sensitivities of the outputs to valid alternative in order to form a view on whether the model is fit for purpose. The Board will also need to be involved in the design of the independent validation process and approve it for use to ensure that proposals have received an appropriate level of technical challenge.

In addition to submitting proposals for approval by the Board at a formal meeting, it will be appropriate to ensure that the Board is well informed in advance of the meeting. A series of educational events, exploring different aspects of the model, may therefore be useful to allow members to build up an understanding and have the opportunity to ask questions prior to making a decision.

Members of Boards are likely to have diverse backgrounds and experience, as well as differing levels of interest in the components of the model. It may therefore be appropriate to offer one-to-one sessions with individual members to provide an opportunity for more detailed exploration of specific areas of interest.

The membership of a Board also changes over time. Firms may therefore wish to maintain an appropriate suite of educational material which can be used to support new directors or as the basis of regular Board “refreshes”.

For the purposes of evidencing effective governance by the Board, it will be appropriate to keep a record of the review and challenge exercised by the Board and track progress against any actions. Firms may also wish to maintain a log of the educational support provided to members of the Board.

2.2.2 Supervisory authorities

Regulators will wish to ensure that the Internal Model meets all the relevant tests and standards of Solvency II prior to approval for use to calculate the SCR. They will therefore expect to be provided with documentation which demonstrates that the model meets the requirements of Articles 120–126 of the Solvency II Framework Directive (2009/138/EC) together with the related requirements of the Delegated Regulations and EIOPA Guidelines. It may therefore be useful to use a checklist or standard documentation template to verify that the documentation to be provided does evidence compliance with all the relevant standards.

The supervisory authorities will want to ensure that the undertaking has a thorough understanding of the techniques used (including the mathematical basis), their limitations and what measures the undertaking has taken to mitigate those limitations. This will include evidence of having taken account of relevant data and the application of appropriate validation tests, including statistical testing, where relevant. The supervisory authorities also have teams of technical specialists whose expertise can be drawn upon to review submissions from firms. Therefore, undertakings may expect to have to present detailed technical documentation to support their methodology.

Regulators will also expect undertakings to have identified all the choices made, the potential impact of alternatives and understand why an undertaking has chosen to go down one particular route rather than another. This includes the identification of the most significant assumptions (e.g. correlations) and a quantification of the impact on the SCR of adopting plausible alternative assumptions.

The selection of a dependency structure and the approach to calibration and adjustment of a proxy model necessarily involve expert judgement. Undertakings should be able to demonstrate that there is a robust and systematic process in place for the selection of those assumptions and their validation, including the adjustment of any assumptions or the outputs to allow for limitations of the model (e.g. the lack of tail dependence in a Gaussian copula; fitting error in a proxy model).

The supervisory authorities will also expect users of the outputs of the model to be aware of any significant limitations of the model so that appropriate account of these limitations can be taken when making decisions informed by the model. They will therefore expect documentation provided to the users to highlight such limitations.

The PRA published some principles on creating good-quality documentation in December 2013 (PRA, 2013). The PRA has also developed a Quantitative Framework which it has used in its assessment of Internal Model applications. It has released some details of the Quantitative Indicators which form part of that framework in two executive director updates dated 9 March 2015 (PRA, 2015a) and 15 January 2016 (PRA, 2016). These updates include an outline of some of the factors considered in the PRA’s assessment of dependency structures. Actuaries involved in the development of internal models may wish to refer to these documents to help understand the PRA’s expectations.

3 Calibration of Copulas and Allowance for Tail Dependence

3.1 Introduction

Most UK life assurance companies that use internal models to calculate their SCR have chosen to use a copula-based approach to aggregation according to recent industry surveys (Ernst and Young LLP, 2015; KPMG LLP, 2015; PricewaterhouseCoopers LLP, 2015; Towers Watson Limited, 2015). Of these, the majority have opted for the Gaussian model with a minority (three, according to the surveys of Towers Watson and KPMG) adopting a Student’s t copula for all or a subset of the risk factors.

The use of the Gaussian or Student’s t copula is likely to be a result of primarily practical considerations:

-

∙ Scarcity of relevant data to reliably inform the choice of a copula family;

-

∙ Transparency – elliptic copulas such as the Gaussian and Student’s t have a correlation matrix as a parameter. A correlation matrix approach to aggregation was commonly used for the Individual Capital Assessment so correlations are likely to be well understood by users of the model;

-

∙ Ease of modelling – these copulas are straightforward to simulate from using spreadsheets or statistical packages and come as standard within some proprietary aggregation tools;

-

∙ Ease of parameterisation – the large number of risk factors, particularly for a more complex group of companies – combined with the previous factors, leads to a preference for models which are no more complex and have as few parameters as is necessary to appropriately reflect the dependencies.

The choice between a Gaussian or Student’s t copula is likely to be determined by a firm’s prior beliefs regarding tail dependence and preference for modelling this explicitly using the Student’s t copula or using the simpler Gaussian copula with appropriate adjustments to the correlation parameters to make allowance for tail dependence.

In this section we assume that the choice to use either a Gaussian or a Student’s t copula has already been made (i.e. the choice of dependency structure in the box labelled ‘2’ in Figure 1). We focus on techniques that may be used to inform and justify the selection of the parameters of these two copulas (i.e. the correlations and any other parameters in the box labelled ‘1’ in Figure 1). In particular, we consider how allowance can be made in the parameterisation, explicitly or implicitly depending on the choice of model, for tail dependence.

We have assumed that the reader is familiar with the basics of copulas. There are numerous good references. McNeil et al. (Reference McNeil, Frey and Embrechts2015), Cherubini et al. (Reference Cherubini, Luciano and Vecchiato2004), Joubert & Dorey (Reference Joubert and Dorey2005), Sweeting & Fotiou (Reference Sweeting and Fotiou2013) and Shaw et al. (Reference Shaw, Smith and Spivak2011) provide accessible accounts in a finance context. Nelsen (Reference Nelsen1998) and Joe (Reference Joe2015) are standard, but more technical, reference works. The paper by Demarta & McNeil (Reference Demarta and McNeil2005) provides a comprehensive review of the Student’s t copula while the paper by Aas (Reference Aas2004) provides a practical introduction to simulation from copulas.

3.2 Overview of Section

In this section, we cover the following:

-

1. Bottom-up parameterisation:

-

a. Use of data to inform the parameterisation

-

i. Inspection of the data using graphical techniques – section 3.5.1.

-

ii. Different time periods – section 3.6.1.

-

iii. Confidence intervals – section 3.6.2.

-

-

b. Parametric fitting techniques

-

i. Method of moments (MoMs) type approaches based on first-order rank statistics – section 3.5.3.

-

ii. Maximum pseudo-likelihood (MPL) – section 3.5.4.

-

-

c. Allowing for tail dependence

-

i. Definition and communication – section 3.7.

-

ii. Coefficients of finite tail dependence – section 3.8.

-

iii. Targeting conditional probabilities – section 3.9.

-

iv. Techniques based on matching high-order rank statistics – section 3.10.

-

-

d. Overlay of expert judgement and selection of assumptions in the absence of relevant data – sections 3.12 and 3.13.

-

-

2. Adjustments for internal consistency (positive semi-definiteness (PSD)) – section 3.14.

-

3. Top-down validation – section 3.15.

We end the section by commenting briefly on techniques for testing the choice of copula.

Readers who are already familiar with the estimation of correlations and tail dependence may wish to proceed directly to section 3.8.

3.3 Relevance of Data and Statistical Techniques

Given the scarcity of data, even for pairs of market risks, one may suspect it would be a futile exercise to apply statistical techniques to whatever data are available in order to inform the choice of assumptions. Whilst the uncertainty in parameters derived using data means that the selection of copula parameters should never be a purely data-driven exercise and therefore necessarily relies on expert judgement, use of statistical techniques can help inform the choice of assumptions and support the judgements made.

The statistical quality standards of Solvency II also indicate that relevant data should be used where possible. For example, Article 231 of the Solvency II Delegated Regulations (2015) states “… no such relevant data [is] excluded from the use in the internal model without justification”. Article 234 of the Delegated Regulations requires that “the assumptions underlying the system used for measuring diversification effects are justified on an empirical basis”. Article 230(2)(c) of the Delegated Regulations states “assumptions shall only be considered realistic … where they meet all of the following conditions … insurance and reinsurance undertakings establish and maintain a written explanation of the methodology used to set those assumptions”. (See Appendix B for the full text of Article 230.)

The Working Party has interpreted these regulations as requiring an undertaking to have a documented process for the selection of the copula parameters that includes an appropriate analysis of the relevant data combined with the use of expert judgement.

3.4 Communication and Validation

When explaining statistical concepts to stakeholders as well as the selection and validation of assumptions informed by these techniques, members of the Working Party has found that visualisation techniques tend to result in the greatest level of engagement. They can be used in explaining technical terms in a way which is more readily accessible than formulae. They also provide a compact format for illustrating the choices which is straightforward to interpret. Moreover, the effect of a different set of assumptions can be illustrated by superimposition on the same chart or even using simple animation techniques (e.g. by flicking through a set of slides showing graphically how the output of the model compares to data as the parameters of the model are varied). However, one of the drawbacks of visualisation techniques is that they naturally tend to be useful only in two or three dimensions. Nevertheless, this limitation is often accepted and combined with expert judgement to choose correlation assumptions.

Where the analysis is less amenable to visualisation (e.g. parametric fitting techniques such as those described in section 3.5.5), the level of information required may vary more according to the stakeholder. Personnel responsible for independent validation and the supervisory authorities will expect documentation to evidence a detailed understanding of the technique, its strengths and its limitations, and provide sufficient evidence to demonstrate the model and assumptions meet the statistical quality standards of Solvency II. The Board is ultimately responsible for the appropriateness of the design and operations of the Internal Model. Therefore, whilst the Board and senior management do not need to be experts on the underlying mathematics, they will want to understand at a high level how a copula works; the significant choices and judgements involved in selecting and parameterising a copula (such as making allowance for tail dependence) and their implications; the impact of alternative but nonetheless reasonable assumptions and the process by which those have been validated. An explanation of a copula in terms of matching ranks of values of the marginal distributions according to an algorithm which reflects the dependency structure and illustrating this concept by means of scatter plots of the copula may be helpful (see e.g. Simulation and Aggregation Techniques Working Party, 2015). The Board and senior management may also wish to see the rationale for certain key assumptions explained at a high level, included the general reasoning and economic arguments supporting correlations (see section 3.12) and the types of real-life scenarios that can give rise to losses of similar magnitude to the SCR (see section 3.15).

In order to illustrate how the visualisation and quantitative techniques described in this section may be used in the communication and justification of assumptions, we have provided a number of worked examples of approaches which we understand have been effective in discussions with some stakeholders. The majority of these examples are based on a set of three risk factors representing monthly increases in equity values (EQ), corporate bond spreads (CR) and the first principal component of the UK nominal government bond yield curve (PC1). This data set has been chosen as it represents a set of risk factors to which most life assurance undertakings have some exposure and for which the data available are comparatively rich. A description of the data is provided in Appendix A.1.

Irrespective of the data, it is important that the choice of assumptions can be explained and justified by economic arguments or general reasoning. Such arguments form an important part of the validation of any assumption suggested by data and may be more accessible to some stakeholders.

It is common to build up the parameterisation of a copula using a “bottom-up” approach which considers relationships between pairs of risk factors. It is therefore important that the final set of assumptions is coherent and “stacks up” collectively. We discuss top-down validation in section 3.12 but note here that one of the most significant advantages of a simulation-based approach to capital aggregation is the ability to identify one or more “real life” individual scenarios giving rise to losses of magnitude similar to the SCR. These scenarios (expressed as changes in risk factors in terms which are accessible, e.g. increases in life expectancy at specific ages, reductions in interest rate at specific terms) can allow stakeholders to form a view of whether the model outcomes are consistent with the risk profile of the business and so assist in the validation of assumptions.

Finally, we observe that in the selection of copula parameters, the boundary between “calibration” and “validation” is somewhat blurred. This is because “calibration” necessarily involves the exercise of judgement, so the process of calibration itself involves thinking through the rationale and possible alternatives. For example, one could “calibrate” a correlation using a single statistical process, such as the relationship described in equation (1), use the approach described in section 3.8 to “validate” and, if appropriate, adjust the original calibration, with an overall sense check using the approach of section 3.15. Alternatively, the approach described in section 3.8 could just as well be described as one part of the calibration process.

3.5 Bottom-Up Approach to Parameter Selection

3.5.1 Data inspection

A first step in illustrating dependency is through plots of time series and scatter plots. These relatively simple charts are often the simplest and most effective tool in demonstrating evidence of association to stakeholders and motivating subsequent choices.

Scatter plots of the data can assist in:

-

∙ The identification of the presence of a relationship.

-

∙ The nature of that relationship (e.g. the sign and broad magnitude of any correlation, the extent of any symmetry or lack of it, and any clustering of extreme values that may indicate the presence of tail dependence).

-

∙ Identification of any data points, which could be outliers.

Charts of both the raw observations and pseudo-observations are useful. The pseudo-observations (defined in Appendix A.2) use a non-parametric transformation of ranks to filter out the marginal distributions and can be compared with scatter charts of standard copulas.

As noted in Shaw et al. (Reference Shaw, Smith and Spivak2011), by excluding the time dimension, scatter plots mask temporal effects which may be present in the data and which one may wish to take in account when selecting assumptions (e.g. trends or a change in regime).

Figure 2 shows a time series plot of equity returns versus increases in credit spreads. Figure 3 shows scatter plots of pairs of increases in value of our three risk factors and the corresponding pseudo-observations.

Figure 2 Monthly equity returns and increases in credit spreads over period 31 December 1996 to 31 December 2014

Figure 3 Equity returns and credit spreads raw and pseudo-observations

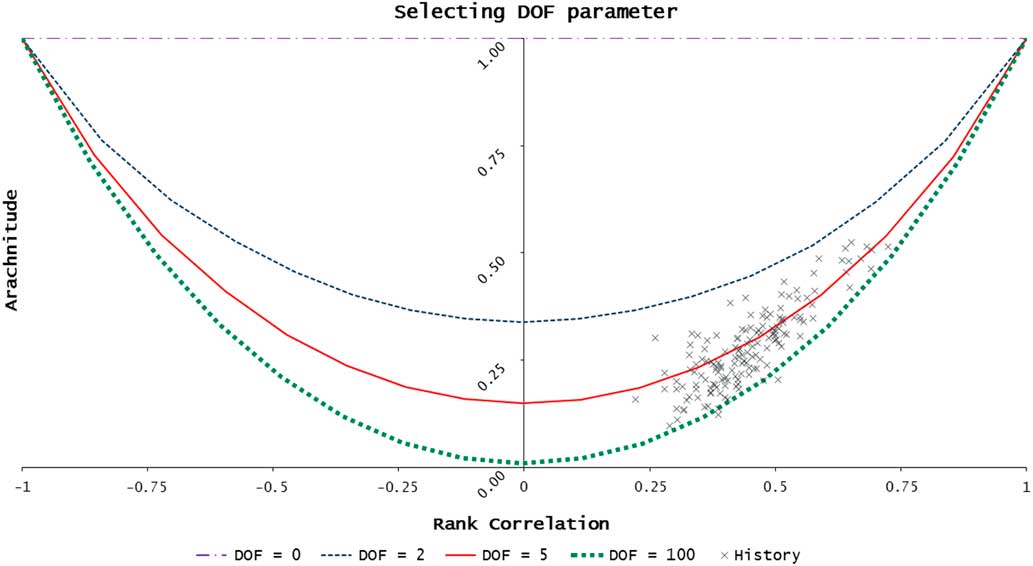

Figure 2 shows no obvious trend in the relationship between equity returns and credit spreads. There is an obvious anti-symmetry in the “peaks” with increases in credit spreads frequently being mirrored by negative equity returns. The strong negative correlation is also apparent in Figure 3. The chart of pseudo-observations for EQ/CR shows some clustering in the upper left and lower right tails along the “−45% ray” – that is, extreme falls in equity values show a greater tendency to be accompanied by extreme increases in credit spreads (and vice versa). However, it also shows some clustering along the other diagonal (the “+45% ray”) giving rise to “star” shape. This behaviour is typical of a Student’s t copula with a low degrees of freedom parameter and indicates the presence of “arachnitude” – see section 3.10.

From the charts of pseudo-observations, at least visually, the assumption of an elliptic copula for each pair does not appear unreasonable.

3.5.2 Parametric fitting techniques

There are various statistical techniques for estimation of the copula parameters which extend the MoM or maximum likelihood estimate (MLE) method that are familiar in fitting models for one-dimensional random variables. We describe these techniques briefly here. Readers are referred to standard texts, for example, section 7.5 of McNeil et al. (Reference McNeil, Frey and Embrechts2015), for further details.

3.5.3 MoMs type approaches

These are based on (first order) rank invariants of the copula such as Spearman’s rank correlation or Kendall’s τ statistic.

For the d-dimensional Gaussian copula, one can calculate Spearman’s rank correlation or Kendall’s τ for the sample data and invert to solve for the correlation parameter using the formulae below:

where, for a given pair of risk factors, ρ S is the Spearman’s rank correlation, ρ τ the Kendall’s τ statistic and ρ the corresponding parameter of the correlation matrix underlying the copula. The relationship in equation (1) is precise only for the Gaussian copula, although in practical situations, it does not appear to lead to significantly different conclusions.

The approach based on the relationship involving Kendall’s τ statistic described by equation (2) (the “inverse Kendall’s τ” technique) holds more generally for any elliptic copula such as the Student’s t copula. However, pairwise inversion of the Kendall’s τ statistic using equation (2) may not produce a PSD copula correlation matrix. It may therefore be necessary to adjust the resulting matrix using techniques such as those described in section 3.14 to obtain a PSD correlation matrix. This technique also results only in values for the correlation matrix. Other techniques such as maximum likelihood estimation or use of higher order rank statistics such as those described in section 3.10 must be used to estimate the degrees of freedom parameter.

3.5.4 Maximum likelihood approaches

There are two slightly different approaches to the estimation of copula parameters using maximum likelihood techniques:

-

(a) Inference from margins (IFM) approach – see Joe (Reference Joe2015)

This approach assumes parametric models for each of the distributions of changes in individual risk factors as well as for the copula. The usual maximum likelihood approach, given a set of sample data for changes in the risk factors, would then be to express the likelihood (or log likelihood) of the joint distribution as a function in the parameters of the copula and all the marginal distributions. This will generally result in a high-dimensional space in which to seek a solution.

The IFM approach splits this optimisation process into two separate steps:

-

∙ First, the parameters of each of the one-dimensional marginal distributions of changes in risk factors are estimated using maximum likelihood.

-

∙ The fitted parameters of the marginal distributions are then kept fixed so that the (log) likelihood function is then expressed in terms of the copula parameters only. The values of these parameters are then chosen to maximise the (log) likelihood.

The values of the copula parameters therefore depend on the models and parameters chosen for the individual risk factor distributions.

-

-

(b) MPL – see Genest & Rivest (Reference Genest, Rémillard and Beaudoin1993) and McNeil et al. (Reference McNeil, Frey and Embrechts2015)

This method avoids making assumptions about the marginal distributions by using non-parametric techniques to estimate their distributions. The sample data are replaced by the corresponding “pseudo-observations” – see Appendix A.2 for definitions. The corresponding pseudo-observations are then used as inputs to the probability density function of the copula when forming the (log) likelihood function. The resulting likelihood function then depends only on the parameters of the copula and, unlike the IFM approach, not on the assumed models and parameters of the marginal distributions. The copula parameters can then be selected using optimisation techniques.

3.5.5 Worked example

We have fitted correlation parameters (“ρ”) and degrees of freedom parameters (“Nu”) of the Gaussian and Student’s t copulas to our data set using:

-

(a) the inverse Kendall’s τ technique to estimate ρ (with MLE to estimate Nu) using the “QRM” package in R;

-

(b) the MPL method using the “copula” package of R.

In both cases, we have fitted to pairs of risk factors as well as the triple. Tables 1 to 4 show the results.

Table 1 Bivariate

Table 2 Trivariate

Table 3 Bivariate – Maximum Pseudo-Likelihood

Table 4 Trivariate – Maximum Pseudo-Likelihood

Inverse Kendall’s τ

MPL

We note the following:

-

∙ Fitting a Gaussian copula using either technique results in a correlation parameter which is appropriate to the full distribution. The resulting value of the correlation is identical to that fitted to a Student’s t model if the inverse Kendall’s τ method is used. It does not differ significantly from the corresponding parameter for a Student’s τ copula if the MPL approach is used, even where the degrees of freedom parameter is low. This suggests that, if using a Gaussian copula, further adjustments to the correlations parameter may be required to allow for the effect of tail dependence in the extreme tail – see sections 3.8 and 3.9.

-

∙ For example, for EQ/CR, both the MPL and MoM fit for the bivariate t copula produce a degrees of freedom parameter of <3. However, the correlation parameter of the bivariate Gaussian and bivariate Student’s t fitted using the MPL technique only differ by <3 percentage points (−48.8% compared to −46.5%, respectively).

-

∙ Where a Student’s t copula is fitted for each pair of risk factors separately, the degrees of freedom parameters for the different pairs vary significantly. The degrees of freedom parameter in the trivariate case (4.51) is in some sense an “average” of the three bivariate values (2.60, 9.40 and 6.08).

3.6 Estimation of Correlation Parameters in Practice

In practice, the choice of correlation parameters is not a mechanistic, data-driven process. Even where data are available (principally for market risks), one has to make a choice of the data set to use: the data series itself, the time period used and frequency at which the data are selected. Consideration must also be given to consistency with the data used for the calibration of marginal risk distributions.

In order to analyse correlations, the data for the two risk factors has to be coincident – that is, the time period and sampling frequency used must be identical. Even for pairs of market risks, the periods for which coincident data are available is relatively short. For example, the financial times stock exchange All Share Index began in 1962 and one of the most commonly used indices of credit spreads began at the end of 1996. These relatively short periods of coincident data will contain limited information about extreme events.

Different choices of data sets will generally lead to different values. For example, an analysis of the correlation between two risk factors will produce differing values over different time periods – see section 3.6.1. Any estimates produced from a finite data set will also be subject to parameter mis-estimation error.

Thus, whilst an analysis of the data which is available can assist in informing the choice of a correlation parameter, in practice it is essential to overlay this analysis with expert judgement – see section 3.12. Where there is no or extremely scanty data available, which is the case for most correlations involving non-market risks, it is essential to make use of expert judgement and general reasoning in selecting the assumption – see section 3.13.

3.6.1 Different time periods

In practice, the correlation between increases in two risk factors varies over time. Judgement is therefore required in selecting both the period of time on which the estimate is based and any allowance made for any uncertainty in the estimate. Note that the latter is a margin for prudence in the estimate of the copula parameter. In the case of a Gaussian copula, this differs conceptually from any further allowance which may be made to adjust for the absence of tail dependence, although the outcome may be similar. We discuss adjustments to the parameters of a Gaussian copula for tail dependence in sections 3.8 and 3.9.

Charts of correlations over different time periods may be helpful in illustrating the resulting uncertainty to stakeholders in a manner which is compact and amenable to explanation, for example, by pointing out the consequences of certain extreme market events. Such charts may also help identify any potential trends in correlations which the undertaking may wish to take into account when selecting assumptions.

For example, one might produce a chart showing rank correlations over different windows of time, such as:

-

(a) From a varying start date to a fixed end date (e.g. the end of the period for which data are available).

-

(b) From a fixed start date (e.g. the start of the period for which data are available) to a varying end date.

-

(c) Over a window of fixed length moving through the data period.

-

(d) Some other set of time periods chosen to test differences in behaviour.

Under (c), the length of the window could be selected using judgement as being sufficient to form a view on “short-term” correlations and give an idea of how correlations could vary between benign and stressed conditions. The choice of window is a compromise between the length of the window and the uncertainty in the resulting estimates. A longer window will result in a lower sample error but on the other hand may not pick up short-term behaviour. Modellers who use this approach may wish to assess the effect of using different window lengths, particularly where it is used to inform material assumptions.

The charts produced may also be enriched by superimposing information about confidence intervals which may be derived using techniques such as those described in section 3.6.2.

3.6.2 Confidence intervals

It may be useful to illustrate the uncertainty in-sample estimates using confidence intervals. There are a number of techniques available, for example:

-

(i) Fisher Z-transform. This uses asymptotic properties of the distribution of transformed data to provide analytic formulae for the upper and lower bounds of a confidence interval. There are various versions of the formulae, which are intended to adjust the result to allow for the finite sample size.

-

(ii) Bootstrapping. A large number of synthetic data sets is generated by re-sampling the original data with replacement. The rank correlation for each of the synthetic data sets is then calculated. This process generates a large number of simulated values of the rank correlation from which appropriate percentiles may be drawn to determine the confidence interval.

The paper by Ruscio (Reference Ruscio2008) provides a useful survey of these approaches. Functions provided in some statistical packages such as R also produce confidence intervals.

3.6.3 Graphical tools

Figure 4 is an example of a chart of type (a) described in section 3.6.1 for the Spearman’s rank correlation of our EQ/CR data set from a varying start date to a fixed end date of 31 December 2014. We have superimposed 95% confidence intervals produced using both the Fisher Z-transform (described by formula (3) of Ruscio, Reference Ruscio2008) and bootstrapping techniques (with 1,000 simulations). Visually, in this case, the confidence intervals produced by the different techniques are almost indistinguishable.

Figure 4 Equity returns and credit spreads Spearman’s rank correlation – chart of type (a); CI=confidence interval

Note that this approach provides information only about the rank correlation – a scalar statistic which is “global” – rather than relevant to a specific area of the joint distribution such as the tail. It is therefore more useful in informing one’s best estimate view of a correlation. If it is considered appropriate to include a margin for uncertainty in the correlation, one potential approach would be to use the confidence intervals as a guide to select a higher or lower value for the correlation, taking into account the exposures in the “biting scenario”. (The “biting scenario” is a scenario which, in some sense, represents the average simulated scenario which gives rise to losses equal in magnitude to the SCR. For example, some undertakings produce such a scenario by applying a smoothing process to simulated scenarios, the ranks of whose corresponding losses lie in a “window” around the SCR.)

Inspection of rolling short-term correlations such as using charts of type (c) may be useful to inform views of correlations in “stressed circumstances” and of any further allowance for tail dependence which may be appropriate. However, we note that the copula used in the calculation of the SCR (and the tail dependence embedded within it) is a static quantity. The change in correlation over time is conceptually different to tail dependence.

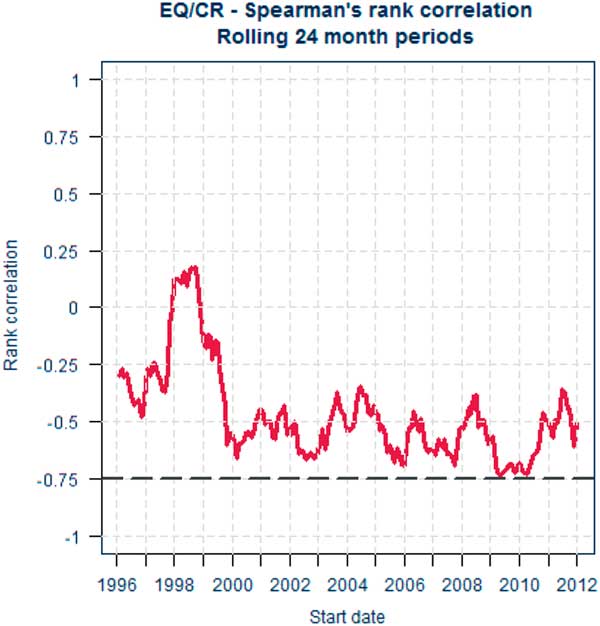

Figure 5 illustrates correlations for a rolling 24 month window for our EQ/CR data set. It shows the correlation reaching almost −75% for periods beginning in 2009 during the financial crisis.

Figure 5 Equity returns and credit spreads – correlations for rolling 24 month periods, start dates 31 December 1996 to 31 December 2012

One crude method of allowing for tail dependence would be to select an assumption based on confidence intervals or “stressed correlations” informed by charts such as Figures 4 or 5. However, as noted, these are conceptually different from tail dependence so such an approach would have to be carefully justified. Alternative approaches are discussed in sections 3.8, 3.9 and 3.10.

3.6.4 Rounding

To reflect the uncertainty in the chosen parameter values and the use of judgement, as well as for the practical reason of avoiding the frequent re-calibration of a large set of parameters, it is a common practice to round correlation assumptions according to a convention chosen by the undertaking (e.g. round to integer multiples of 10%). This rounding may lead to internal inconsistencies in the “raw” correlation matrix with adjustments required to make it PSD prior to use in simulation – see section 3.14.

The rounding convention is itself a choice which should be justified. A notch size which is too small may be spuriously accurate. On the other hand, a notch size which is too large may provide insufficient granularity and could lead to unnecessary prudence or unintended imprudence as well as inconsistencies in the raw matrix which require larger adjustments to produce a PSD matrix.

3.7 Tail Dependence

In this section, we recall the definition of the coefficients of tail dependence and its significance in terms of joint and conditional probabilities of the simultaneous occurrence of extreme events in two or more risk factors. The latter provide a route to explaining the meaning of tail dependence to stakeholders – see section 3.7.2. The approach we adopt is based on the coefficient of finite tail dependence. As we will see in section 3.8 this function can help to inform the choice of correlation parameters for a Gaussian copula. Readers who are already familiar with these concepts may wish to move directly on to section 3.8.

Definition – coefficients of finite tail dependence

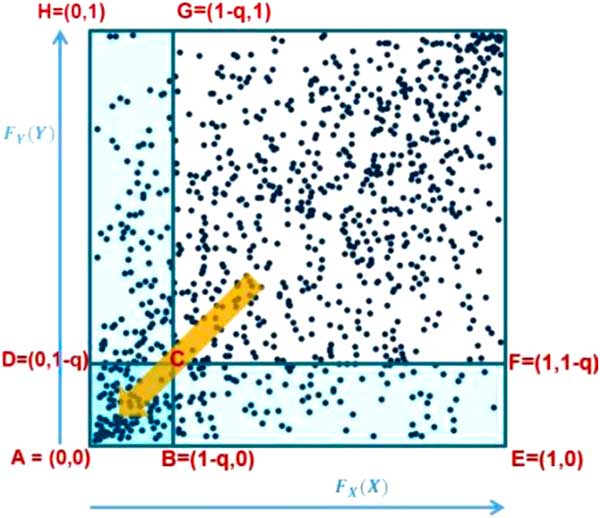

The coefficients of upper or lower finite tail dependence are functions λ U and λ L defined for q∈[0, 1] as follows:

That is the coefficient of finite upper tail dependence function λ U (q) is the probability that a value of X exceeds the q th percentile of X given that a value of Y has been observed which exceeds the q th percentile of Y. λ U (q) is a measure of the probability that X takes an extreme high value given that Y takes an extreme high value.

Similarly, λ L (q) is the probability that a value of X is less than the (1−q)th percentile of X given that a value of Y has been observed that is less than the (1−q)th percentile of Y. λ L (q) is a measure of the probability that X takes an extreme low value given that Y takes an extreme low value.

Note that both λ U (q) and λ L (q) are probabilities (not correlations) and so take values in the interval [0, 1].

Definition – coefficients of tail dependence

The coefficients of upper and lower tail dependence λ U and λ L are limiting values of coefficients of finite tail dependence given by:

We have used a slightly different definition of the coefficients of lower finite tail dependence than the conventional one to ensure that, for a radially symmetric copula (such as the Gaussian or Student’s t), values of lower and upper finite tail dependence are equal for a given value of q. This presentation will prove convenient in section 3.8 in the application of graphical methods.

3.7.1 Communicating the concept of tail dependence

Figure 6 shows a graphical method for illustrating the meaning of the coefficient of lower tail dependence.

Figure 6 Coefficient of lower (finite) tail dependence

In the diagram, the events have been expressed on a quantile (or rank) scale. The coefficient of lower finite tail dependence evaluated at q, λ L (q), is the ratio of:

-

(i) The proportion (or probability) of events in the square ABCD; to

-

(ii) The proportion (or probability) of events in the rectangle AEFD

The probability of events occurring in the rectangle AEFD is (1−q), by definition.

As the events become more extreme (i.e. q increases), the square ABCD and the rectangle AEFD shrink. The coefficient of tail dependence is the limiting value of the ratio of the proportion of events that occur in the shrinking square to the proportion of events that occur in the shrinking rectangle.

Note that the probability of events occurring in the vertical rectangle ABGH is also by definition (1−q). The definition of λ L (q) in equation (4) is therefore clearly symmetric in X and Y.

The coefficient of finite upper tail dependence, λ U (q), may be illustrated in an analogous way.

It is a standard result that the coefficients of tail dependence of a Gaussian copula are zero while those of a Student’s t copula are non-zero. For example, the coefficient of tail dependence of a bivariate Student’s t copula with correlation parameter ρ and ν degrees of freedom is given by:

where t ν+1 is the cumulative distribution function of a standard Student’s t distribution with (ν+1) degrees of freedom – see equation (7.38) of McNeil et al. (Reference McNeil, Frey and Embrechts2015).

3.7.2 Communicating the implications of tail dependence

So what does the presence of tail dependence mean in practice? The definition of the coefficient of tail dependence in terms of a limiting value makes the concept more difficult to explain to stakeholders. When explaining the implications of tail dependence to stakeholders, it may therefore be more useful to provide some simple quantitative indicators of what different copula models and parameters mean for the likelihood of “extreme events happening at the same time”, by illustrating the consequences in terms of joint exceedance probabilities or conditional probabilities. As we shall see in section 3.8 the use of conditional probabilities in the form of the coefficient of finite tail dependence provides a useful graphical tool to inform the selection or validation of parameters.

3.7.2.1 Joint exceedance probabilities

Tables 5 to 7 are based on tables 7.2 and 7.3 of McNeil et al. (Reference McNeil, Frey and Embrechts2015), although we have chosen parameters more typical of those commonly seen in a life insurance context. They show:

-

∙ A comparison of joint exceedance probabilities at differing percentiles produced by a bivariate Student’s t copula with those produced by a bivariate Gaussian copula for various correlation and degrees of freedom parameters.

-

∙ Each table shows the probabilities for the Gaussian copula and the factors by which those probabilities must be multiplied to obtain the corresponding probabilities for the Student’s t copula. For example, assuming a correlation parameter of 50%, the probability that both risk factors exceed their “1 in 100 year” values at the same time under a Student’s t copula model with 5 degrees of freedom is twice that under a Gaussian copula model. An event with a probability of 0.00129 or around 1 in 770 years under the Gaussian copula now has a probability of 1 in 385 years under the Student’s t copula. See the highlighted cells in the table.

-

∙ Looking at Table 5 for a correlation of 0%, the probability of both variables simultaneously exceeding their 95th percentiles is 0.25% under a Gaussian model. However, under a Student’s t copula with 5 degrees of freedom, the probability increases by a factor of 2.24 to 0.56%. An event with probability <1 in 200 under the Gaussian model (1 in 400) has a probability >1 in 200 under the Student’s t model (around 1 in 180).

-

∙ Tables 6 and 7 provide a comparison of joint exceedance probabilities for d-tuples of risk factors to illustrate how tail dependence influences behaviour in higher dimensions. The tables show the joint exceedance probabilities for the Gaussian copula and corresponding multiples for the Student’s t copula with various degrees of freedom. For each copula, the off-diagonal correlation parameters are all equal to the value shown. We show values for 2, 5, 10 and 25 dimensions and at the 75th and 90th percentiles (to illustrate dependence on event severity).

Table 5 Joint Exceedance Probabilities (Gaussian and Bivariate Student’s t Copula Shown as Multiples of the Gaussian)

DOF=degrees of freedom.

Table 6 Joint Exceedance Probabilities at 75th Percentile

DOF=degrees of freedom.

Table 7 Joint Exceedance Probabilities at 90th Percentile

DOF=degrees of freedom.

For example, taking 90th percentile (or “1 in 10 year” events) in each risk factor and assuming a correlation parameter of 25%, a simultaneous event in ten risk factors, each of which is at least as severe as a 1 in 10 year event, is 5.7 times more likely if they follow a Student’s t model with 5 degrees of freedom compared to a Gaussian. The equivalent multiplier for two dimensions is 1.27. See the highlighted cells in the table using 25% correlation.

The results illustrate the importance of considering tail dependence and making appropriate adjustments to the copula parameters to allow for this. As we saw in section 3.5.5, the application of standard fitting techniques can produce very similar correlation parameters for a Gaussian and Student’s t model. Yet, as shown by Tables 5 to 7, the two models can produce very different joint exceedance probabilities at extreme percentiles. When calculating the SCR or using an Internal Model to generate other outputs at extreme percentiles, it is therefore essential to consider tail dependence when selecting the parameters of the model. The selection of copula parameters necessarily involves expert judgement. We discuss some techniques for informing that judgement in the case of the Gaussian and Student’s t copula in sections 3.8, 3.9 and 3.10.

3.7.2.2 Conditional probabilities

An alternative approach to illustrating the effects of tail dependence is to show the effects on conditional probabilities (i.e. the coefficients of finite tail dependence). For example, Table 8 shows the coefficients of finite tail dependence for a bivariate Gaussian copula and bivariate Student’s t copulas with 5 and 10 degrees of freedom linking random variables X and Y with a common value of 50% for the correlation parameter. It shows that the probability of Y exceeding its 97.5th percentile value given that X has exceeded its 97.5th percentile value under the assumption of Student’s t copula with 5 degrees of freedom is 156% of that assuming a Gaussian model.

Table 8 Coefficients of Finite Tail Dependence (Bivariate Gaussian and Bivariate Student’s t Copulas, 5 and 10 Degrees of Freedom)

DOF=degrees of freedom.

Note that the ratios of the conditional probabilities of the Student’s t model to the Gaussian model in Table 8 are equal to the corresponding ratios of joint exceedance probabilities in Table 5. This is because in the conditional probabilities in numerator and denominator are both obtained by dividing the joint exceedance probability by the probability of Y exceeding the corresponding percentile – see equation (3).

From examining the ratios of joint exceedance probabilities in the tables, it is apparent that, for an equi-correlation matrix and all other things equal, the amplifying effect of tail dependence increases as:

-

∙ The percentile of the joint event increases (where the joint event is assumed to be a combination of equi-probable events in each of the risk factors).

-

∙ The correlation parameter reduces.

-

∙ The degrees of freedom parameter reduces.

-

∙ The number of dimensions increases.

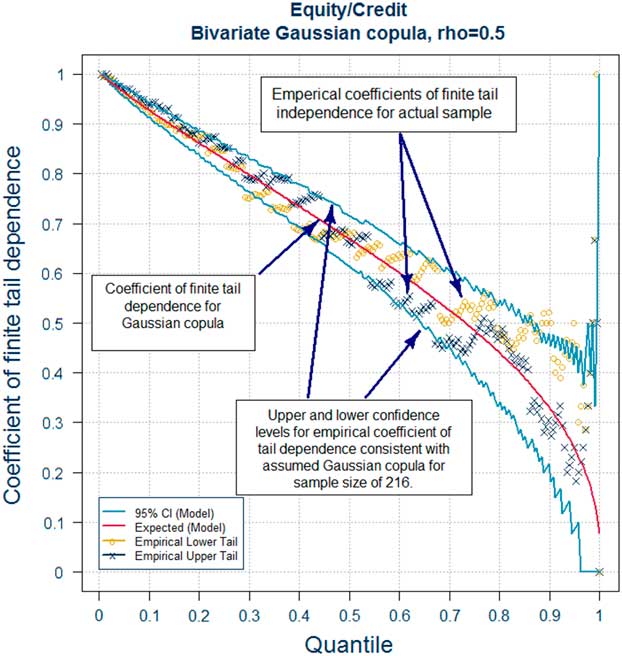

3.7.2.3 Charts of coefficients of finite tail dependence

The implications of tail dependence for conditional probabilities can be summarised compactly using simple charts showing the value of the coefficients of upper and lower tail dependence λ U and λ L as a function of the percentile q. We will see in section 3.8 that, where a Gaussian model has been chosen, such charts can provide a useful tool in explaining to stakeholders the selection of correlation assumptions and adjustments made to those parameters to allow for tail dependence.

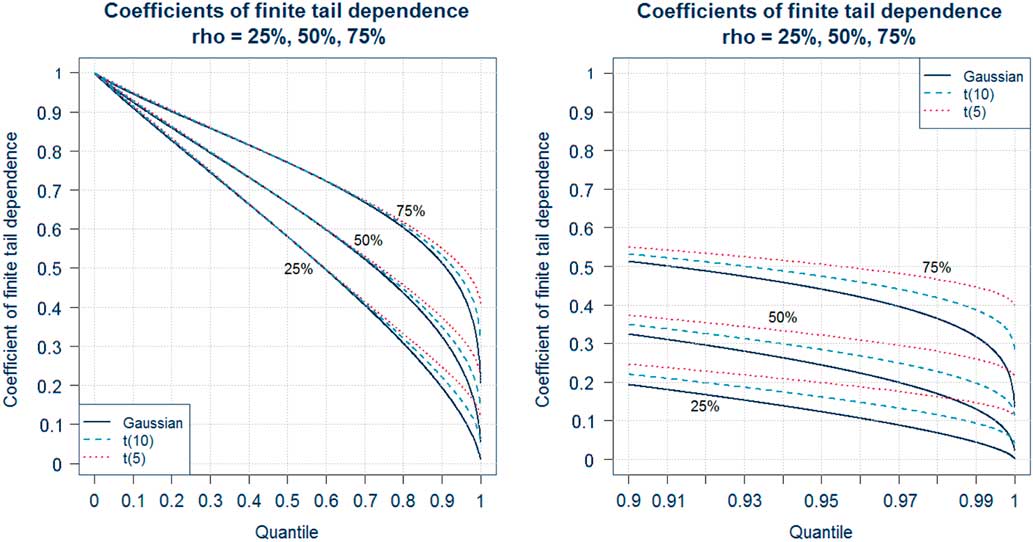

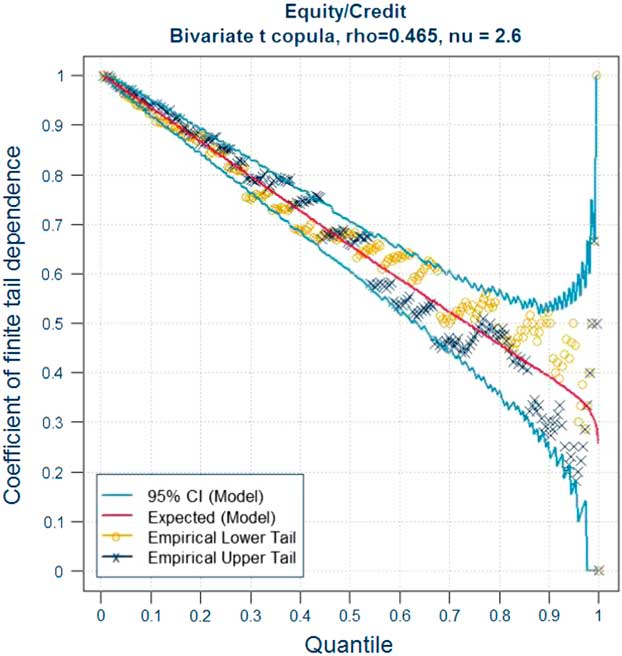

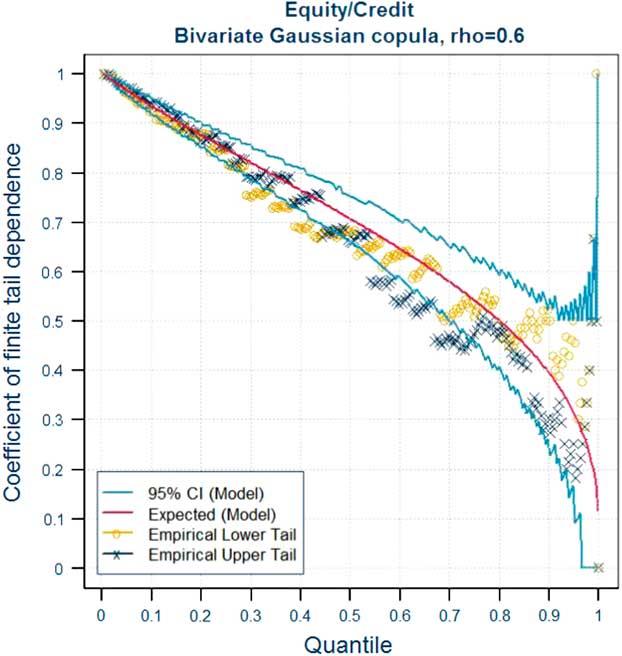

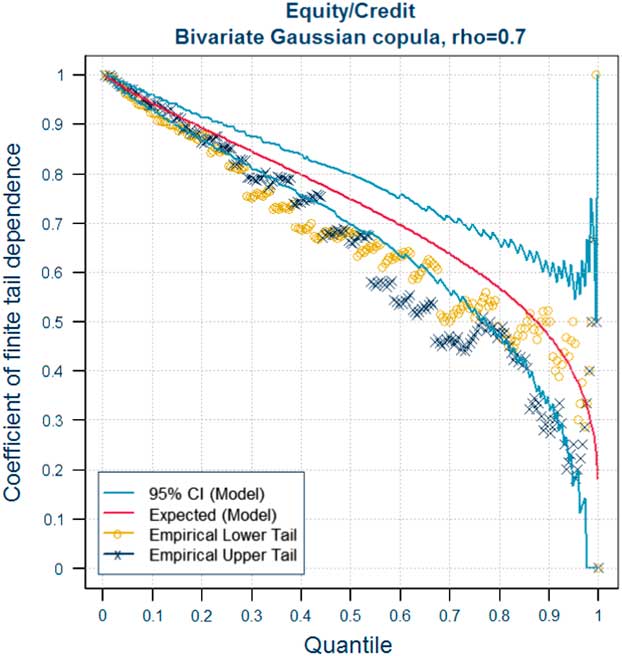

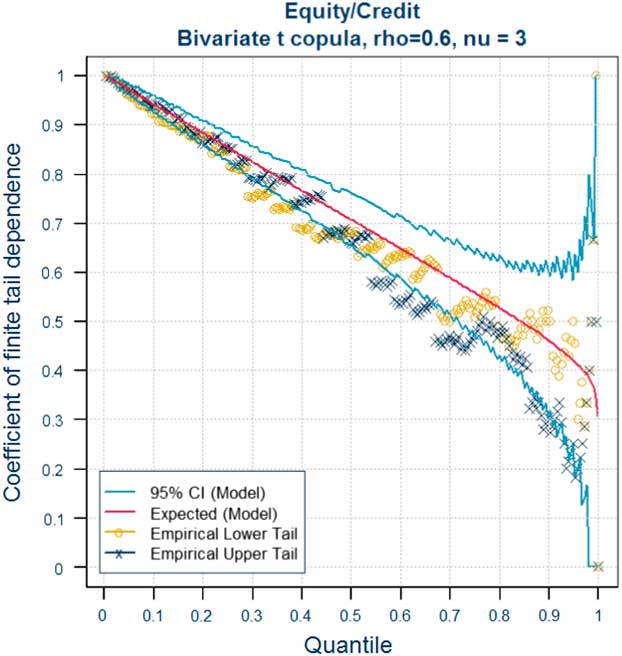

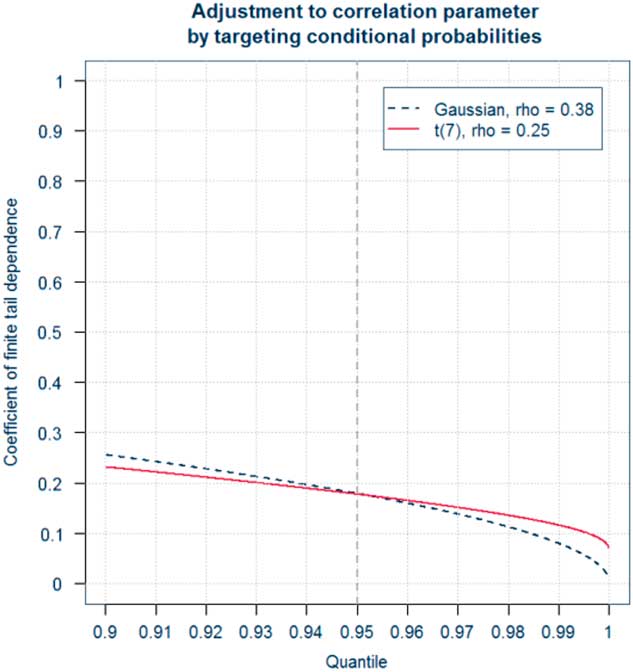

Figure 7 illustrates the behaviour of the coefficient of finite tail dependence for the bivariate Gaussian copula and bivariate Student’s t copulas with 5 and 10 degrees of freedom with correlation parameters of 25%, 50% and 75%. (The right hand plot in Figure 7 is restricted to events more extreme than the 90th percentile.) As these copulas are radially symmetric, the charts of λ U and λ L are coincident.

Figure 7 Coefficients of finite tail dependence, ρ is correlation (expanded view 90th percentile on the right)

The following is apparent from the charts:

-

∙ The correlation parameter is the principal factor that determines conditional probabilities.

-

∙ There is little difference in conditional probabilities in the body of the distribution.

-

∙ However, differences in the shape of the functions become apparent in tails. For a given correlation, the coefficient of finite tail dependence is greater for a Student’s t copula than for the Gaussian copula and increases as the degrees of freedom parameter reduces.

-

∙ The coefficients of finite tail dependence tend to zero for the Gaussian copula but to non-zero values for the Student’s t copula.

A coefficient of tail dependence of zero does not imply that extreme changes in one risk are less likely to be accompanied by extreme changes in another. In the case of the Gaussian copula, a positive correlation assumption between increases in X and increases in Y means that, on average, large increases in Y will tend to occur if a large increase in X has occurred. Recall that the conditional distribution is given by:

A large value of X results in a large value of the mean of Y|X and therefore an increased tendency for Y to take large values.