Introduction

Governments like the United States have adopted innovative strategies to make their sanctions more effective.Footnote 1 While scholars have mostly focused on the role played by sanctions design elements, such as the severity, scope, and degree of multilateral participation, the role played by sanctions enforcement has received increasing attention.Footnote 2 Government agencies responsible for implementing sanctions, like the US Department of the Treasury's Office of Foreign Assets Control (OFAC), have limited resources to devote to promoting sanctions compliance and punishing sanctions violators. Enforcement bodies also face constraints on how aggressively they can punish their domestic firms compared to foreign violators without causing a backlash or undermining their country's economic competitiveness.Footnote 3 In this study, we explore how agencies like OFAC can leverage their discretion in penalizing violations by making more prominent examples out of enforcement actions capable of being more effective deterrents.

We argue that OFAC's sanctions enforcement strategy exploits firms’ sensitivity to damage to their reputations coupled with cognitive heuristics that influence the deterrent value of enforcement actions. Corporate respondents to compliance surveys consistently prioritize protecting their firm's reputation over potential regulatory and governmental fines.Footnote 4 Naming-and-shaming tactics have proved effective in a variety of contexts in international relations, including against companies that violate international norms and regulations.Footnote 5 The reputational stigma associated with a sanctions enforcement action imposes significant additional costs on violators beyond the monetary fines they are assessed. All else being equal, high-profile companies should experience greater costs associated with reputational harm when they are subject to sanctions enforcement actions than less prominent companies.

Our theory builds on insights into cognitive heuristics that sanctions enforcement strategies can exploit. Cognitive heuristics are mental shortcuts that help individuals simplify decisions when confronted with complex choices and limited information.Footnote 6 Early and Preble argue that availability bias and probability neglect help explain why OFAC's “whale-hunting” sanctions enforcement strategy, which involves imposing smaller numbers of massive penalties, has been more effective at promoting sanctions compliance than the previous “fishing” strategy employed by earlier administrations in catching larger numbers of smaller violations.Footnote 7 The availability bias heuristic refers to individuals’ tendency to rely on recent examples and information that immediately comes to mind in making decisions.Footnote 8 Probability neglect refers to the tendency of decision makers to disregard information regarding the probability of an event occurring when confronted with uncertainty or fear, especially in the case of very low-probability but high-consequence occurrences.Footnote 9 When firms witness even small numbers of companies being struck with massive penalties for violating sanctions, those heuristics suggest they will behave in a more risk-averse way to avoid a similar fate—which the evidence bears out.Footnote 10

We theorize that OFAC's sanctions enforcement strategy exploits how the availability bias and probability neglect heuristic affect firms’ decision-making by imposing larger fines for sanctions violations on high-profile companies, whose punishments cause more reputational harm and are more memorable. By “making an example” out of high-profile firms, OFAC increases the deterrent value of the limited number of sanctions enforcement it takes. Just as OFAC realized that imposing massive penalties can scare other companies into complying with sanctions,Footnote 11 we argue that its penalization strategy reflects the fact that significant penalties imposed on high-profile companies garner more attention than those imposed on lesser-known companies. Even if OFAC takes only 15–20 enforcement actions each year, this strategy helps ensure that firms’ leaders are aware of recent examples of other firms being hit with substantial penalties for violations when they assess their own compliance with US sanctions. We also theorize that OFAC will impose even larger-magnitude penalties on foreign firms based on their profiles to make up for the comparative difficulty of generating domestic media attention to cases involving foreign violators. We hypothesize that OFAC should impose significantly larger sanctions enforcement fines on high-profile sanctions violators than on lower-profile violators and that the magnitude of the effect will be larger for foreign firms than for US-based firms.

We conceptualize “high-profile companies” as constituting large, publicly traded firms with recognizable brands, such as Amazon, Apple, Bank of America, and eBay. Most companies matching this profile employ thousands of workers, generate significant annual revenue, and are likely to be publicly traded with reporting obligations to shareholders and regulators. Being “high-profile” is difficult to conceptualize along a singular dimension, and we do not think that OFAC has adopted any standard operating procedures to do so. Recognizing how general our concept is, we adopt a multifaceted strategy of operationalizing “high-profile” through exploratory factor analysis that emphasizes the size and information available about companies (public listing), whether they are externally identified as prominent by being listed as a Fortune Global 500 company, and whether firms have prominent corporate brands. Invoking these three distinct ways of capturing whether a firm subject to an OFAC enforcement action is “high-profile” provides a robust means of operationalizing our status-based independent variable.

We test our theory by analyzing the public sanctions enforcement actions that OFAC took against 207 corporate entities from 2010 to 2021 using the OFAC Enforcement Action Data Set.Footnote 12 The United States imposes more economic sanctions than any other sender in the world, and it is an outlier in terms of how much it invests in sanctions implementation and enforcement.Footnote 13 No other sanctions enforcement body in the world wields as much global influence as OFAC, making it a critical case for understanding a sender state's investment in sanctions enforcement.

Analyzing the size of the financial penalties imposed by OFAC, we find that the average penalty imposed by OFAC increases as the profile of an apparent sanctions-violating firm becomes higher. Penalties imposed on domestic firms are, on average, 5.2 times greater from the lowest profile to the highest profile. Penalties levied on the highest-profile foreign firms are, on average, more than eighteen times greater than those levied on the lowest-profile foreign firms. The effects are strongest when firms embody all three of the categories that make up our factor variable. We also explore our theory's assertions about the media attention generated by OFAC's enforcement actions by comparing how corporate profile and nationality affected the negative publicity that firms experienced based on their penalties. Those cases offer strong support for our explanation of why OFAC consistently imposes higher penalties on high-profile and foreign companies to maximize the deterrent effects of those enforcement actions.

Our study makes several important contributions to the literature on economic sanctions and the strategies that governments can adopt to influence corporate behavior for foreign policy purposes. First, our results contribute to a growing body of research demonstrating the critical role played by sanctions enforcement in understanding the way these policies work.Footnote 14 We add to this research by demonstrating how enforcement bodies adopt innovative strategies to increase the costs imposed by enforcement actions and their ability to deter other violators. Our study also makes a novel contribution to the literature on naming and shaming by showing that regulatory bodies employ marketing savvy in using those tactics to promote compliance. Our study specifically extends explanations of OFAC's sanctions enforcement strategyFootnote 15 and the consequences of OFAC's enforcement actionsFootnote 16 by explaining how and why OFAC considers firm-level characteristics of sanctions violators in maximizing the deterrent effects of its enforcement actions. As our analysis reveals, OFAC exploits the reputational concerns of companies and heuristics affecting the deterrent effects of enforcement actions in determining how much it penalizes firms for their sanctions violations. OFAC's innovative enforcement approaches have helped it overcome political and resource constraints to become an incredibly powerful regulatory body both at home and abroad.

Sanctions enforcement, evasion, and effectiveness

Economic sanctions are foreign policy instruments that seek to compel or constrain a target by restricting their ability to conduct economic transactions with other parties. Despite being used predominantly by great powers like the United States, imposed economic sanctions often fail to achieve their objectives.Footnote 17 Scholars have uncovered myriad factors that contribute to sanctions’ success,Footnote 18 but an increasing amount of attention has been given to how sender states enforce their sanctions and targets seek to evade them.Footnote 19 This approach emphasizes the challenge of translating the intended costs of sanctions “on paper” into actual disruptions and costs experienced by the target.

The literature on sanctions evasion and enforcement helps explain the challenges faced by senders in imposing sanctions and targets in evading sanctions and how firms respond to the disruptions, restrictions, and opportunities that sanctions may create for them. Compared to threatening or using military force, imposing economic sanctions involves a different set of complex challenges. Commercially oriented economic sanctions work by seeking to restrict the economic transactions conducted by firms and individuals—both domestically and sometimes abroad—with the sanctions’ target. Target governments and their constituents seek to evade sanctions or create new sanctions-busting relationships in ways that undercut sender governments’ efforts to disrupt commerce with them. Research has found that target states forge new trade, aid, and investment relationships with third-party governments and markets to help them survive sanctions.Footnote 20 Sender governments must craft policies capable of imposing meaningful, effective restrictions. They must then communicate those policies to the parties they have jurisdiction over and educate them on how to comply. Lastly, senders must enforce their sanctions by monitoring compliance with them and imposing penalties for noncompliance.Footnote 21 Maximizing sanctions’ impact requires sender governments to make significant investments to influence the behavior of the private sector, by imposing costs on target states for failing to comply.

Individual firms, whether they are in sender, target, or third-party states, face a set of disruptions, risks, and opportunities as a result of sanctions.Footnote 22 Sanctions are designed to disrupt targets’ otherwise profitable commercial transactions with external parties and introduce greater uncertainty into doing business with them. Along those lines, WebbFootnote 23 finds that firms that have commercial interests in sanctioned countries experience greater volatility in their stock prices. Senders can design sanctions to affect only their own constituents or include extraterritorial provisions designed to impose disruptions and restrictions on third-party states’ constituents whose governments are not part of sanctioning efforts against the target.

Sanctions create market distortions in doing business with targeted actors, as they deny the targets access to segments of import, export, or financial markets and create additional risks and uncertainty for doing business with sanctioned parties. Firms that are subject to the legal jurisdiction of senders’ sanctions must decide whether to comply with sanctions and how much to invest in compliance efforts, or whether to defy them and seek to profit from the opportunities they create.Footnote 24 If we assume that firms are profit motivated, their responses to sanctions will depend on how they weight the prospective risks versus rewards that sanctions create for their business activities and their underlying tolerance for risks.

Firms and sanctions enforcement strategies

The bodies responsible for imposing sanctions within sender governments, like OFAC and the United Kingdom's Office of Financial Sanctions Implementation, have expansive responsibilities and limited budgets, forcing them to make efficient, strategic investments in sanctions enforcement efforts. Enforcement bodies seek to influence the behavior of private sector actors by detecting and punishing violations. Enforcement bodies can influence the perceived risks of failing to comply with sanctions by virtue of the frequency and severity of the punishments they impose on sanctions violators.Footnote 25 Taking sanctions enforcement actions fulfills numerous objectives. First, it forces individual sanctions violators to come into compliance. Second, it raises broader awareness about sanctions compliance obligations. Lastly, enforcement deters other parties from violating sanctions who wish to avoid the punishment and shaming competitors may have incurred.Footnote 26 Research on the enforcement of US sanctions suggests that “whale-hunting” sanctions enforcement strategies that involve pursuing small numbers of cases likely to generate substantial fines will be much more effective at promoting compliance than dragnet “fishing” strategies catching a lot of small-time violators.Footnote 27

Whale-hunting strategies work better because the massive penalties they yield constitute memorable, fear-evoking events that are more likely to influence how firms perceive and manage risks associated with sanctions. Surveys of compliance professionals consistently report that compliance departments serve two critical functions: avoidance of fines from regulatory authorities, which can have tangible impacts on a firm's profitability, and brand preservation.Footnote 28 The immense fines levied on ABN Amro in 2006 ($52 million) and Lloyds TSB in 2009 ($268 million), according to a retired risk officer at National Australia Bank, “got people's attention. The amount of money that Lloyd's set aside [and then paid] was riveting.”Footnote 29

The availability heuristic accounts for the fact that decision makers do not engage in exhaustive searches for potentially relevant information that will help them make choices. Instead, they rely on information that comes more readily to mind or is most easily available to them. For example, the staggering penalties imposed on two multinational financial firms increased perceptions of what US regulators did to enforce US sanctions programs. Recent, relevant prominent events or experiences can have a disproportionate influence on decision makers’ choices.Footnote 30 The heuristic of probability neglect also accounts for the way that strong emotions can lead decision makers to overweight threats associated with low-probability but high-consequence events.Footnote 31 Both heuristics help explain why OFAC's strategy of pursuing complex cases against major sanctions violators, resulting in massive penalties during the Barack Obama administration, dramatically increased how seriously the private sector viewed the risks associated with US sanctions.Footnote 32 Those prominent enforcement actions stuck in the minds of and instilled fear in compliance officers and risk managers. Despite publishing a far more limited number of enforcement actions per year, OFAC's strategy of focusing on major cases proved far more effective at promoting sanctions compliance.

Corporate reputation and regulatory naming and shaming

For most firms, building up and maintaining the reputation of their brand is an essential part of their business strategy. Corporate brands are valuable assets. According to Arvidsson,Footnote 33 “the substance of brand value lies in consumer attention. It is what consumers think off or do with the brand that is the source of its value.” Corporations like Apple invest significant effort in cultivating their brand images and raising awareness of them. High-profile companies, especially those publicly traded on stock markets, seek to avoid negative press and publicity that could harm their reputation in ways that discourage investors and alienate consumers. The more prominent a firm's profile is, the more costly scandals or regulatory violations may be to their brand and reputation. Regulatory enforcement actions can tarnish the brands and reputations of corporate violators, and larger firms, especially those with prominent profiles, have more to lose from the negative publicity such incidents generate.

Within international relations, there is a burgeoning literature on the use of naming-and-shaming tactics. While the use of these tactics by nonstate actors has received significant attention,Footnote 34 regulatory agencies and international institutions can also employ them.Footnote 35 Yadin defines regulatory shaming as “the publication of negative information by administrative agencies concerning private regulated bodies, mostly corporations, in order to further public-interest goals.”Footnote 36 Not all governments publicize penalties related to civil infractions involving sanctions, and some governments do it selectively, like the Netherlands.Footnote 37

The ability of a regulatory body to engage in naming and/or shaming of violators can be viewed as a policy choice that affects the scope and strength of its enforcement powers. Direct forms of government naming and shaming entail announcing or publicizing the identities of parties that violated the law and their transgressions.Footnote 38 Releasing the names of parties that violate laws and their punishments promotes transparency, regulatory accountability, and more informed consumer choice.Footnote 39 According to van Erp, “Naming offenders may not only increase the cost of sanctions by adding the financial costs of stakeholder reactions, but also by adding nonfinancial reputation damage.”Footnote 40 Providing greater transparency about violations and punishments handed out to parties for legal-regulatory violations enhances the penalties they experience. OFAC has publicly posted information about the identity of the parties it takes enforcement actions against, the nature of their violations, and size of the penalties imposed on them since 2003.

To protect their financial assets and brands, companies have increasingly adopted risk management strategies designed to protect firms from running afoul of laws and regulations and other potential scandals. Relevant to sanctions, for example, many major companies have compliance departments that are responsible for ensuring that firms comply with government regulations pertaining to anti–money laundering (AML) policies, export controls, counterterrorism financing policies, and sanctions. Governments like the United States increasingly expect firms to have dedicated policies and procedures to ensure compliance with AML, export controls, and sanctions and employ more advanced risk-based analyses to prevent violations.Footnote 41 To avoid both financial penalties and reputational harm, many firms make significant investments in complying with governmental policies designed to prevent transnational crime and protect against national security threats. In sum, both firmsFootnote 42 and US regulators are aware of how much firms value their reputations. Regulatory authorities can enhance their ability to penalize violators beyond just monetary fines with strategies that disseminate information about violators and the nature of their violations.

Why corporate profiles shape OFAC's strategy in penalizing violations

Naming and shaming have been part of OFAC's sanctions enforcement strategy since the early 2000s, but the agency's tactics have evolved. In 2003, OFAC began publishing all sanctions enforcement actions it undertook in response to a legal effort to make the agency's activities more transparent. The early case summaries published by OFAC contained little information beyond the names of the parties being penalized, the fines they received, and bare-bones descriptions of their violations.Footnote 43 At least initially, OFAC's commitment to naming violators appeared to be perfunctory and involved the bare minimum amount of effort.

To overcome the challenges it faced in imposing meaningful financial penalties, officials at the Department of the Treasury began to think more innovatively about how to convince firms to quit undercutting US sanctions in the mid-2000s. Stuart Levey, former under secretary of the treasury for terrorism and financial intelligence, is credited with developing a new strategy for convincing banks to curtail their transactions with Iran by appealing to concerns about their reputation instead monetary fines.Footnote 44 Even though OFAC had not yet been empowered with the ability to impose massive fines on foreign banks, Levey realized that banks’ reputations could be significantly harmed by revelations that they were financing illicit terrorist activities or weapons development programs that violated US sanctions. Leveraging those insights, Levey proactively sought to persuade financial institutions to stop servicing Iran. As Secretary of State Condoleezza Rice described the strategy for engaging the private sector, “This really relies on the kind of self-interest—to protect their reputation and protect their investment.”Footnote 45 By threatening to shame banks for their sanctions-busting activities, Levey appeared to have gained some traction in convincing them to curtail their financial relationships with Iran without having to use severe penalties.

Once empowered with the ability to impose more significant financial penalties in 2009, OFAC integrated what it had learned about firms’ concerns about their reputations into its sanctions enforcement strategy. We assert that OFAC realized that high-profile firms—large, publicly traded companies with well-known brands—could serve as more prominent, memorable examples of companies being caught for violating sanctions than smaller, relatively unknown companies. For example, OFAC has penalized a host of prominent companies in recent years including Microsoft, Wells Fargo, Berkshire Hathaway, and Amazon. The attention generated by OFAC enforcement actions can dominate the news cycle surrounding companies, creating bad press and harming their reputations. Given the prominence of these companies, the reputational damage done by the negative publicity generated by OFAC enforcement actions should be greater than penalties experienced by lower-profile firms. Even so, can the bad press from sanctions violations actually affect firms’ bottom lines? Initial evidence suggests that, in fact, it does. Examining the stock prices of firms punished by OFAC for sanctions and AML violations, Gowin et al. find that firms subject to OFAC enforcement actions have lower stock valuations the following quarter than nonpunished firms.Footnote 46

Consistent with the availability heuristic, we argue that corporate leaders responsible for their firm's exposure to sanctions risks will be more risk averse when they can readily think of other firms they are familiar with being punished for violating sanctions. High-profile companies also have the most to lose by having their reputations tarnished by sanctions enforcement actions. All else being equal, the reputational costs associated with being punished for sanctions violations will be magnified for companies that have prominent brands and whose value is significantly derived from them. In the case of firms with prominent brands, especially brands that rely on trustworthiness and credibility as part of their reputation, being associated with sanctions violations could result in millions or even tens of millions of dollars in damages beyond the financial penalties imposed. Cases in which well-known firms experience substantial reputational harm as result of being subject to sanctions enforcement actions will be especially powerful deterrents.

The fines imposed by OFAC need to be sufficiently large to capture the media and other firms’ attention if they are also going to succeed in levying substantial reputational damages. Small penalties do not appear to be effective at deterring future violations by other partiesFootnote 47 and are more likely to be ignored by the media. OFAC has incentives to be more aggressive in imposing, on average, larger financial penalties for sanctions violations in cases most likely to generate greater amounts of publicity and higher reputational costs that the negative publicity may generate, magnifying the costs violators experience. A seven-digit fine imposed on a brand-name company may result in eight-figure damages to its brand. Imposing larger fines on companies with prominent brands serves to magnify the total costs they experience. Given that firms want to protect their reputations and brand values,Footnote 48 significant reputational damages inflicted by sanctions enforcement actions can be just as impactful as large fines in deterring companies from violating US sanctions. Drawing on the logic of probability neglect, the scandal and negative publicity generated by sanctions enforcement actions against high-profile companies likely generates fear-based overreactions among other firms to the potential risks of violating sanctions.

Punishing high-profile companies provides OFAC with opportunities to promote compliance across industries and sectors. Many of these companies, especially those that are publicly traded, provide information to the Securities and Exchange Commission and other federal (and state) regulators. A host of media companies and financial watchdogs also report on those companies and other high-value or prominently branded companies. Enforcement actions that target these high-profile firms should draw significant attention not only to the infractions committed but also to the need for increased compliance commitments, especially among competing firms in similar industries and sectors. The additional publicity generated by punishing high-profile as opposed to low-profile firms provides OFAC with the ability to magnify the impact and attention paid to its enforcement actions. Indeed, OFAC's statutory guidelines for determining the size of penalties empowers its officials to consider the deterrent effects that their enforcement actions will have.Footnote 49 The profile of violators would make sense as a factor in determining which cases OFAC will most want to make a memorable example of via a large, attention-catching penalty.

Given that OFAC issues only a small number of civil enforcement actions per year (a minuscule number relative to the size of the US economy and the number of parties it sanctions worldwide), OFAC needs to maximize the impact of those cases it pursues. We argue that OFAC selectively imposes larger penalties on high-profile firms because drawing greater attention to those enforcement actions helps keep sanctions-related compliance concerns in the minds of firms’ compliance and risk managers and leadership teams.Footnote 50 Evidence of this mindset can be found in compliance surveys within the last decade.Footnote 51 The combination of larger financial penalties and greater reputational harm arguably produces a similar deterrent effect as whale-hunting cases that involve massive fines imposed on foreign firms, yet without creating as much potential backlash as imposing massive fines would have domestically. Indeed, OFAC should not have to make the fines nearly as large to be memorable in the minds of decision makers in US firms when violations involve well-known, high-profile US companies.

Alternatively, one could argue that OFAC imposes greater penalties on larger companies simply because more severe penalties are needed to change such firms’ behavior, as small fines are unlikely to impact their bottom lines. We find that logic unconvincing, though, as the penalties imposed on many of the largest companies in our sample still only represent a fraction of their earnings—especially in sanctions enforcement cases targeting US firms. We acknowledge that OFAC officials do not want to impose penalties so severe that they would put violators out of business.Footnote 52 OFAC does use the potential size of its penalties as leverage to encourage companies to self-report violations, cooperate with investigations, and compel companies to invest in their future sanctions compliance programs, all of which provide reductions in the final penalty levied by OFAC. If OFAC only relies on company size to calibrate the severity of its penalties, however, we would not expect being a publicly traded company or having a prominent brand to matter.

We posit that OFAC seeks to harness the negative publicity generated by enforcement actions to impose reputational costs on violators and to enhance the enforcement actions’ deterrent effects. The size of the penalties is one established dimension for attracting attention to enforcement actions;Footnote 53 the profile of the violators, we argue, is another. The fear generated by OFAC's largest fines imposed on prominent companies is based on firms perceiving what an enormous fine would do to their business and the damage it could do to their reputation. Probability neglect explains how the fear generated by such cases can motivate firms to try to mitigate the potential risks of running afoul of sanctions even if their actual probability of being put in the crosshairs of an OFAC enforcement action is exceedingly low. OFAC's severe enforcement actions would not have the potent deterrent effects that have been observed if firms only expected that violations would be met with a carefully calibrated fine that would garner no negative attention. Our argument is that OFAC officials are also cognizant that big companies can survive larger fines, but their strategic logic is shaped by their understanding that the publicity generated by imposing larger fines on high-profile companies will inflict greater reputational damage and have more potent deterrent effects. Substantial penalties imposed on companies with well-known brands will garner more attention than small fines imposed on relatively unknown firms, and those cases will be more memorable. Publicly traded firms are subject to greater transparency and reporting requirements and have broader constituencies that pay attention to their activities and performance. Enforcement actions involving publicly traded firms will thus have a wider set of stakeholders with salient interests in those cases, and reporters will have wider audiences for stories about them than enforcement actions involving privately owned firms. Indeed, the negative publicity that OFAC's enforcement actions cast on firms damages their reputations and appears to be linked to lingering harm to their public stock values.Footnote 54 Our theory explains how OFAC can exercise its discretion in maximizing the deterrent effects of the penalties imposed as part of its enforcement actions.

Our approach of codifying multiple dimensions of corporate profiles provides leverage in evaluating our theory versus an alternative only-size-matters explanation. If OFAC calibrates its penalties only based on the size of corporate violators, we would not expect other aspects of their profiles, such as brand awareness and public versus private ownership, to influence the size of OFAC's penalties and only corporate size to matter. Instead, we argue that the size of companies, their ownership status, and their brand awareness all play complementary roles in influencing the profile that makes them better suited for OFAC to make a memorable example of with steeper penalties. This gives rise to the following hypothesis:

Firm profile hypothesis (H1): The size of OFAC's financial penalties for sanctions violations will be greater for high-profile firms than for firms with lower profiles.

OFAC exercises restraint when penalizing US-owned firms and US-based foreign subsidiaries for violating US sanctions programs compared to foreign-based firms. Data on US sanctions enforcement actions from 2003 to 2021 reveal that the civil penalties imposed by OFAC on domestic sanctions violators represented, on average, 0.67 percent ($546,000 versus $81 million in 2021 US dollars) of the average penalty imposed on foreign sanctions violators.Footnote 55 US firms can employ lobbyists and make campaign donations to presidential and congressional candidates, giving firms counterleverage in protesting and complaining about punishments deemed too harsh. Second, while OFAC wants to obtain compliance with US sanctions, it does not want to impair US-based firms with massive penalties or harm US economic competitiveness. Foreign firms are thus more attractive targets to make an example out of, as they have fewer domestic political constituencies to protect them and imposing significant fines on them does not result in undercutting the competitiveness of US firms.Footnote 56 We argue that differences in OFAC's ability to generate publicity from enforcement actions against domestic versus foreign violators provides a complementary reason why OFAC imposes such larger penalties on foreign violators.

The sanctions enforcement actions that OFAC imposed on US-based financial services provider Bank of America in 2014 illustrate how the agency treats American firms differently. In a similar period, OFAC issued record-shattering fines running into hundreds of millions of dollars against European banks such as ING Bank N.V. (2012), HSBC (2012), and Clearstream Banking S.A. (2014)—and a fine of more than a billion dollars (in 2021 dollars) against BNP Paribas (2014). Although Bank of America had carried out hundreds of sanctions-violating transactions, some egregious, OFAC only imposed a $18.5 million fine (in current US dollars) on the company.Footnote 57 Compared to the fines levied on rival banks in Europe and the annual revenues of Bank of America, the monetary fine was “chump change” in comparison.Footnote 58 Yet, for a US company, the fine was the second largest that OFAC had doled out to date against a US financial institution.Footnote 59 At the time, Forbes ranked the value of Bank of America's brand as $8.3 billion.Footnote 60 For a financial services provider relying on trust and credibility among customers and investors, the reputational costs of being subject to a prominent domestic sanctions enforcement action by OFAC likely far outstripped the monetary fine. OFAC demonstrated that US financial institutions could face significant costs for violating US sanctions, but it did so by utilizing a very different strategy than it employed against comparable foreign banks.

The profile of sanctions violators (and whether they are US- or foreign-based firms) may influence OFAC's penalization strategy for maximizing the deterrent value of its enforcement actions. To maximize the impact of sanctions enforcement actions against high-profile foreign companies, OFAC may have to impose much larger fines on them to generate the same level of domestic publicity as fines on a comparable US company. Following this logic, OFAC's issuing a significant fine on a high-profile US firm would yield much more domestic media attention than a similarly sized fine on a high-profile foreign company. For a sanctions enforcement action against a foreign company to gain international and US media attention, we expect the fine would have to be substantial. Therefore, OFAC would have incentives to impose even larger fines on high-profile foreign firms to ensure that such cases attract media attention, enhancing their deterrent effects both at home and abroad. Importantly, we expect the effects of profile to have a positive effect on penalty size for both domestic and foreign firms—the effect will just be greater for foreign firms. Thus, we pose the following hypothesis to account for the role of violators’ nationality within our analysis:

Nationality interaction hypothesis (H2): The positive effect of firms’ profiles on the size of OFAC's financial penalties will be greater when violators are foreign-based companies compared to US ones.

Data and methodology

We evaluate our theory by conducting a quantitative test of our hypothesis concerning OFAC's penalization strategy and two comparative analyses of the media attention generated by the enforcement actions taken against domestic and foreign firms. Case summaries of OFAC's sanctions enforcement actions are publicly available on the Department of the Treasury's website and have been compiled into a database by Early and Preble.Footnote 61 Our analysis focuses on enforcement actions against 207 firms published between 2010 to 2021: 154 US firms or foreign subsidiaries operating in the United States and 53 foreign firms or US subsidiaries operating outside the United States.Footnote 62 Enforcement actions may contain one or more violations of US sanctions regulations and programs, although any penalties imposed are based on aggregate violations. They are also adjusted based on the egregiousness of the violations and whether the entity in question cooperated and/or voluntarily disclosed the violations. The dataset contains a number of variables that have been previously employed in analyses of OFAC enforcement actions.Footnote 63 Penalty Amount (adjusted to 2021 US dollars) serves as our dependent variable.

(De)constructing a company's profile

Our Profile construct seeks to capture different dimensions of being a “high-profile” company through three distinct components: being Publicly Traded, having a prominent global Brand, and/or being listed as a Fortune 500 Company (US or global). We employ exploratory factor analysis using a polychoric correlation matrix because of the binary nature of our components. We then utilize the principal component and oblique rotation method based on promax without Kaiser normalization to create this construct, which we call Profile.Footnote 64

This construct captures the intensity of a firm's public profile across firm qualities through three components. To capture whether a company is publicly traded or private, we used Bloomberg.com and NASDAQ to conduct searches on the 207 firms listed along with companies’ websites and the Wall Street Journal archives.Footnote 65 In our sample of enforcement actions involving 207 firms, 105 are publicly traded firms, traded whereas 118 are private firms. We seek to capture the size and high-profile status of companies by using one of the most well-known public lists of the world's largest firms.Footnote 66 Our Fortune 500 Company variable captures whether a firm is categorized on a yearly basis as a Fortune Global 500Footnote 67 company using Fortune magazine's publicly available database.Footnote 68 That publication ranks companies based on their total revenues and serves as proxy for capturing firms’ profiles based on their size and status. Our last component, Brand, utilizes the CoreBrand 1000 listing from Tenet Partners, which involves proprietary survey data from 10,000 “opinion elites” to capture brand status across industries and sectors.Footnote 69 To be considered a prominent brand, survey respondents must be favorable toward the brand and have familiarity with the brand. There are 44 prominent brands in our sample of 207 firms. We create a factor variable to account for the variation in the intensity of a firm's profile. Because not all publicly traded firms are brands or Fortune 500 firms, we seek to track whether two or more combinations of our profile variables impact the size and severity of fines. We theorize that firms that embody all three of the qualities used to measure a firm's profile will result in firms facing the largest penalties from OFAC. Figure 1 depicts the distribution of our status-based factors that contribute to how we identify which companies have more prominent profiles, broken down by their location in or outside of the United States. The Profile construct ranges from 0 to 1.06. A value of 0 means that a firm embodies none of the characteristics listed here, while 1.06 means that a firm is a publicly traded Fortune 500 company with a prominent brand.

Figure 1. The distribution of firms’ profile status by location.

Key variables of interest

To account for OFAC's differing incentives and constraints in punishing domestic versus foreign firms, we code enforcement actions based on the location where the corporate violation occurred. Entities coded as “foreign” refer to foreign and US-based subsidiaries operating outside the United States. Domestic entities refer to US-headquartered firms and foreign subsidiaries operating within the United States. As OFAC developed its enforcement action processes, it also began to list the location of the parent company's headquarters on their enforcement actions where appropriate. Along the lines of our hypothesis, we interact the Foreign and Profile variables in our models.

We control for additional factors that could impact the size of the penalties that OFAC imposes according to past research.Footnote 70 Our first additional factor is whether enforcement actions involved violations deemed by OFAC to be egregious in nature. The perceived severity of violations significantly increases the fines that OFAC can impose on firms violating US economic sanctions across a range of factors.Footnote 71 Our variable has three categories to account for the severity of the violations: egregious, non-egregious, and unknown. The second factor, voluntary self-disclosure, is a further determinant of the size of the penalty. Firms that bring their infractions to OFAC's attention directly may receive substantial discounts on the statutory maximum that OFAC may impose. We also control for sector by differentiating between firms in the financial services industry and all other firms. Nearly all record-setting fines levied by OFAC have been directed at banks and other financial services firms.Footnote 72 Lastly, we control for changes in US administration, using dates of presidential succession and accession to code Administration. While enforcement actions published in the first year of a new administration involve holdover investigations, it is impossible to determine the start date of any enforcement action from the narratives provided. Summary statistics for our variables are available in the online appendix, Section VII (Table A4).

To test whether higher-profile firms incur higher fines than lower-profile firms, we employ a generalized linear model with a gamma log link using Penalty Amount as the dependent variable. For robustness, we also evaluate our results using ordinary least squares (OLS) and a logarithmic transformation of our Penalty Amount dependent variable to account for the variable's skewness involving “whale-hunting” penalties.

Results

Table 1 displays the results of a generalized linear model with a gamma log link (Model 1) across four models with robust standard errors to understand enforcement trends from 2010 to 2021. Models 1 and 2 include only our highlighted theoretical variables of interest. Model 3 includes all study and control variables, while Model 4 includes an interaction effect between the firm's Profile and whether it is a foreign or domestic firm. We also provide a replication of the analysis using OLS with robust standard errors in the online appendix (Section II, Table A1). Because of the interactions present in the regressions, the coefficients should be interpreted carefully, and the discussion should move beyond the results table with the help of visualizations to “provide a substantively meaningful description of the marginal effects . . . and the uncertainty with which they are estimated.”Footnote 73 The lack of statistical significance of the interaction does not negate the presence of potential conditionality between the variables in the interaction.Footnote 74 While the interaction is not statistically significant, this is likely due to the lack of statistical difference in mean of the firm profile across foreign and domestic firms.Footnote 75 However, because prior work has identified differences in how penalties are levied on foreign and domestic firms, we retain the interaction.

Table 1. Analyzing the impact of firm profile on OFAC penalties (2010–21)

Notes: The Obama administration serves as the reference category for US Administration. Non-egregious serves as the reference category for the Egregious variable, which has three levels: non-egregious, egregious, and unknown designations. Robust standard errors in parentheses.

*p < .05.

Model 3 provides confirmation of our firm profile hypothesis (H1), showing that higher-profile firms receive higher penalties from OFAC. For every 0.01 increase in the profile of a firm, the fine increases, on average, by $417,000. As a firm's profile increases by possessing more factors within the Profile component, the size of the fine increases significantly. Previous research has revealed that foreign firms incur more significant penalties than domestic ones, which our findings reinforce.Footnote 76 Models 2 and 3 indicate that firms’ nationality still exercises independent, positive effects on the size of OFAC penalties when the Profile variable is included.

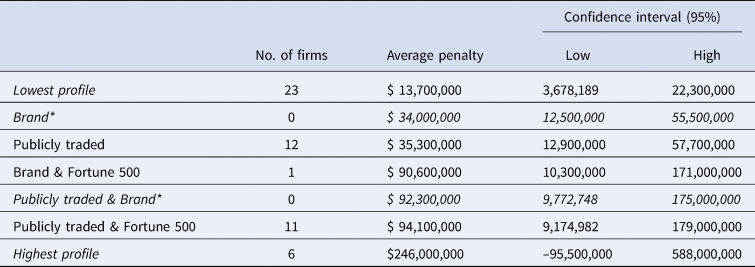

Drawing on Model 4, Figure 2 along with Tables 2a–2b provide support for our second hypothesis that OFAC will impose larger-magnitude penalties on foreign firms based on their profile scores relative to domestic firms. The tables provide evidence that the profile of a firm leads to increases in the size of the OFAC penalties for both foreign and domestic firms—the positive impact of Profile is substantially stronger, though, on the penalties assessed on foreign firms. This effect is not statistically significant for the highest-profile foreign firms, as the confidence intervals overlap with zero.Footnote 77 Penalties for domestic firms that are brands or publicly traded increase more than 50 percent over firms with the lowest profiles. Domestic firms that are both brands and publicly traded see their fines, on average, double over those of firms with the lowest profile. The highest-profile domestic firms, Fortune 500 companies that are brands and publicly traded, receive fines that are, on average, nearly six times larger than those firms with low profiles. Figure 2 shows that the effects are statistically significant and substantively significant across most of the range of our profile variable, except for foreign firms with the highest profile when the confidence intervals cross zero after the firm's Profile score surpasses 0.8. The prominence of foreign firms’ profiles is correlated with tens of millions of dollars-worth of higher penalties, illustrating that OFAC's efforts to make deterrent examples out of such cases entail much larger penalties than comparable fines on US companies.

Figure 2. Range of OFAC penalties across increases in a firm's profile for foreign and domestic firms (95% confidence interval). Note that the scales on the y-axes have different ranges. A combined figure can be found in the online appendix, Section I (Figure A1).

Table 2. Average OFAC penalties across profile variable

Table 2a. Domestic firms. The lowest-profile firms are those that are neither publicly traded, brands, nor Fortune 500 companies. The highest-profile firms are publicly traded, brands, and Fortune 500 companies. Starred categories are not currently represented in the sample data, but companies fitting those profiles could be subject to enforcement actions in the future.

Table 2b. Foreign firms. The lowest-profile firms are not publicly traded, prominent brands, or Fortune 500 companies. The highest-profile firms are publicly traded Fortune 500 companies with prominent brands. Starred categories are not currently represented in the sample data, but companies fitting those profiles could be subject to enforcement actions in the future.

As a robustness check, we also evaluated the impact of looking at our three profile dimensions with and without interactions (see the online appendix, Section VI, Tables A3-1 and A3-2). With the exception of foreign companies with prominent brands (for which there are only seven in the data), the marginal effects we estimate are statistically significant across the profile types (prominent brands, Fortune 500 companies, and publicly traded). Furthermore, we continue to find strong results that an increased profile leads to higher fines, on average, for both foreign and domestic firms. However, we think that our multifactor coding of high-profile status better captures our complex concept and is best suited for testing our hypotheses. Combined, these analyses demonstrate that the only-size-matters alternative explanation of OFAC's enforcement strategy does not explain the patterns we observe in the data.

Our models yield some additional interesting results. The variable for whether apparent sanctions violators were in the financial sector is statistically insignificant in Table 1 and in Table A3-1 in the online appendix.Footnote 78 Given that foreign banks received some highest-ever fines imposed by OFAC, it is notable that a firm's location has a more robust impact on the size of OFAC's penalties than it being in the financial sector. Because OFAC penalties are assessed by the quantity of offending transactions, financial services firms often face higher fines simply because of the sheer quantity of violations that may be discovered across several years and multiple sanctions programs. While financial services firms account for 34 percent of the observations in the data, penalties levied on US-based financial services firms are, on average, 54 percent lower than those imposed on US-based firms in other sectors. Foreign financial firms, on the other hand, receive fines that are, on average, six times larger than foreign firms of other sectors.

Lastly, our findings about the characteristics of violations yielded consistent findings in the analyses.Footnote 79 Our models indicate that OFAC imposed much higher financial penalties for cases involving egregious violations, which we fully expected. Whether firms voluntarily self-disclosed their violations was not associated with firms receiving lower fines, however. Given our understanding of how OFAC exercises discretion in taking enforcement actions, the latter could be due to selection effects and cooperation with investigations. Anecdotal evidence suggests that when firms voluntarily self-disclose minor infractions to OFAC and take remedial steps, they are not subject to public enforcement actions.Footnote 80 Instead, only more severe violations in which voluntary self-disclosure occurred have resulted in public enforcement actions.

Do OFAC cases involving high-profile and domestic firms get more attention?

Our theory asserts that penalties imposed on firms with high-profile reputations will engender more media attention than penalties on low-profile companies, which is an implication that our quantitative analyses do not test. It also asserts that OFAC enforcement actions against US-based sanctions violators generate publicity more readily than enforcement actions against foreign violators. Those implications deserve future evaluation in dedicated empirical studies. As a first cut, though, we examine our theory's logic by considering two case comparisons involving differences in profile and nationality on media attention generated from OFAC enforcement actions.

First, we evaluate the difference in media attention attributed to one of the lowest-profile US firms, Generali Global Assistance (Profile = 0) and one of the highest-profile US firms, Berkshire Hathaway, Inc. (Profile = 1.06), in our sample. Other than that difference, we selected these two cases because they are very similar: both enforcement actions were announced by OFAC in the same month, both received comparably sized fines, both cases involved egregious violations that were voluntarily self-disclosed, and the offending transactions involved similar amounts of money. As the comparison demonstrates, OFAC penalized Berkshire Hathaway's infractions more severely, and that enforcement action generated substantially more media attention.

In October 2020, OFAC levied penalties on Generali Global Assistance and Warren Buffet's Berkshire Hathaway. Generali Global Assistance was fined $5.86 million, whereas Berkshire Hathaway's fine was slightly smaller at $4.14 million. Generali Global Assistance allegedly violated the Cuba sanctions regime, whereas Berkshire Hathaway, through a subsidiary, allegedly violated the Iran sanctions regime. In the Generali Global Assistance case, the offending transactions amounted to just under $290,000 but involved a much larger number of individual violations. The offending transactions conducted by Berkshire Hathaway's subsidiary amounted to just under $400,000. OFAC deemed both firms’ violations egregious, given the behavior by individuals within both firms of attempting to circumvent US sanctions regimes,Footnote 81 but both parties voluntarily self-disclosed their violations.

We observe some significant differences in OFAC's behavior in the fines that it imposed on both firms as well as the media attention that the enforcement actions generated. While Berkshire's final settlement was lower, its base penalty per violation was roughly $128,000, whereas Generali Global Assistance's base penalty per violation was $33,000—a quarter of the per-violation cost paid by Berkshire Hathaway. OFAC thus made Berkshire Hathaway pay a higher cost per violation than Generali Global Assistance, which is consistent with our theory's logic of which types of firms OFAC seeks to penalize more based on the attention the enforcement actions could generate.

While OFAC's overarching settlement with Berkshire Hathaway was $1.7 million lower than the agreed to settlement with Generali Global Assistance, the media attention generated by the enforcement action against Berkshire Hathaway was substantially greater. Using LexisNexis, we conducted a search of all relevant news articles that included the company's name cited in the OFAC enforcement action (excluding corporation designations such as LLC or Inc.) and the term “OFAC” or “Office of Foreign Assets Control.” We restricted the date range of our search to a month before the publication of the enforcement action and one month after the publication of the enforcement action. For Berkshire Hathaway's violation, our search looked for relevant news articles related to any OFAC investigation or notice of the infraction between 12 September and 12 November. We searched a month before the publication of the enforcement action in case the OFAC investigation had been previously reported in a corporate annual report or in filings to the SEC.

Figure 3 compares the frequency of media mentions between the two firms penalized by OFAC, with Berkshire Hathaway receiving significantly greater media coverage than Generali Global Assistance. News articles in outlets such as the Wall Street Journal and Reuters reported that Berkshire Hathaway had no comment, and it has made none to date. No press releases were issued about Berkshire Hathaway's infraction on its web site either. Generali Global Assistance, on the other hand, made statements to the media in relation to OFAC's enforcement action. In a 1 October Wall Street Journal report on the company's fine, a Generali spokesperson responded that the company “has worked diligently with OFAC to provide detailed information about these prior practices and has made a substantial investment of time and resources to further improve its sanctions compliance program.”Footnote 82 Despite Generali Global Assistance being more proactive in responding to the media attention generated by its OFAC enforcement action, far more media attention was devoted to Berkshire Hathaway's infraction. Our theory explains that this was due to Berkshire Hathaway being a far more high-profile company, which led its sanctions enforcement case to attract more media attention than a comparable case involving a lower-profile company. OFAC's decision to make Berkshire Hathaway pay more per infraction also helped turn the enforcement action into a more noteworthy news event.

Figure 3. Number of news reports published about Berkshire Hathaway, Inc., and Generali Global Assistance after the publication of civil enforcement actions by OFAC.

Our second case comparison explores the differences in media attention generated by OFAC enforcement actions in 2017 against Exxon (Profile = 1.06), a US-based multinational firm, and CSE Global/CSE Transtel (Profile = 0.35), a Singaporean company. The Singaporean company's fine was significantly higher at $12 million and entailed 104 apparent violations that caused six financial services providers to conduct unauthorized financial transactions between the United States and Iran.Footnote 83 The actions were considered egregious and were not voluntarily disclosed. Exxon's OFAC penalty, on the other hand, was the result of merely signing eight legal contracts with an individual whose property and interests in Russia and Ukraine were blocked (although no property or interests were transferred between parties). OFAC assigned a monetary value of the signature on the eight contracts at $2 million, which it considered to be a provision of services to a blocked person.Footnote 84

As Figure 4 illustrates, the media attention devoted to Exxon's enforcement action was magnitudes greater than CSE's case produced. Exxon's Profile score is much higher than CSE's, consistent with our first hypothesis's expectations. Yet the penalty Exxon faced was one-sixth the size of CSE's, and Exxon's violations were minor in comparison to CSE's. Indeed, Exxon decided to challenge OFAC's penalty in court given the trivial consequences associated with its violations, which rarely occurs. While many of the articles uncovered in our search highlight Exxon's challenge to OFAC's actions, nearly all the articles surveyed draw attention to the conduct that led to the imposition of the initial civil enforcement action and the actual court case did not occur until two years later.Footnote 85 The initial prospect of court proceedings alone is insufficient to explain that attention gap.Footnote 86 In 2014, for example, US-based Epsilon Electronics Inc. challenged its OFAC penalty levied for violations of Iran sanctions involving a fine nearly two times greater than Exxon's. Yet, this lower-profile company (Profile = 0) received very little media attention when its enforcement action was published, and the subsequent legal case proceeded through the courts. Most media discussions of Epsilon Electronics, Inc., involve its initial filing and appeal with 22 mentions between 2015–22 on its case filings and appeal, while Exxon's 730 media mentions occurred over a span of thirty days before and after the publication of OFAC's enforcement action. At least in English-language media, the second case comparison illustrates that OFAC can generate greater publicity from penalizing high-profile US firms with medium-sized fines than it can from cases involving foreign firms with larger penalties. This suggests that OFAC needs to impose much larger penalties on high-profile foreign firms to generate significant attention, which is what our empirical analyses find above. These case comparisons help explain why OFAC has incentives to penalize higher-profile and foreign firms more in order to enhance the deterrent effects of those enforcement actions.

Figure 4. Number of news reports published about Exxon (July 2017) and CSE Global/CSE Transtel (July 2017) after the publication of civil enforcement actions by OFAC.

Conclusion

In this study, we argue that OFAC sought to enhance the effectiveness of its sanctions enforcement actions by imposing larger financial penalties on high-profile companies. Our theory explains the incentives that OFAC had to make examples out of higher-profile corporate sanctions violators by penalizing them more. As we argue, high-profile sanctions violators will experience greater reputational damage because their enforcement actions generate more publicity. Drawing insights from several heuristics, we also explain that OFAC had incentives to maximize the attention given to enforcement actions involving prominent companies whose punishments would be both the most memorable and likely to deter violations by others. Given that OFAC only has the resources to engage in a limited number of significant enforcement actions, adopting a penalization strategy that maximizes the impact of its cases can help OFAC be more effective at deterring sanctions violations. We hypothesized that, on average, OFAC should impose larger fines on high-profile sanctions violators and that the magnitude of that effect would be larger for foreign than domestic firms. Our statistical analysis of OFAC's contemporary sanctions enforcement actions revealed that, on average, being a high-profile company is positively correlated with receiving larger financial penalties from OFAC for US-based and foreign firms alike. As hypothesized, the magnitude of the effect was significantly greater for foreign firms.

Leveraging companies’ concerns about their reputations coincides with OFAC's recent outreach encouraging companies to bolster their sanctions compliance programs.Footnote 87 OFAC's policy of naming sanctions violators more prominently on its website further signals how the agency has sought to increase the reputational damages associated with violating US sanctions. By exercising discretionary authority to impose larger penalties on higher-profile companies, OFAC appears to exploit firms’ sensitivity to negative publicity, their protectiveness of brand value and favorability, and their overall vulnerability to reputational harm. Given that OFAC has restrained itself from imposing massive penalties on US sanctions violators, seeking to maximize the attention given to enforcement actions involving high-profile US firms with larger-sized fines seems like an effective alternative. In the case of foreign sanctions violations, OFAC both can impose larger penalties but may need larger penalties to generate similar media attention as enforcement actions involving US companies do. Using enforcement actions as a tool for imposing reputational costs on companies accomplishes a similar goal to whale-hunting by creating both memorable examples of punishments for violating sanctions and fears of tarnishing a firm's brand without the massive penalties likely to send companies to lobbyists and members of Congress for help. OFAC's strategy has enabled it to be highly effective in recent years at promoting compliance with US sanctions.

Our research has limitations that future work could build upon in furthering our understanding of the strategies employed by OFAC in implementing and enforcing US sanctions. While our empirical and case comparisons provide evidence that OFAC is imposing greater penalties on high-profile firms, additional elite interviews are needed to understand the internal rational or standard operating procedures employed by OFAC officials. OFAC has traditionally been quite circumspect about its internal decision-making, but understanding the perspectives of OFAC decision makers would provide additional support for our arguments. Second, additional research could build upon our case analyses to explore factors that affect how much publicity OFAC enforcement actions for sanctions violations generate. According to our logic here and other works,Footnote 88 enforcement actions that target high-profile companies, involve US violators, and entail larger fines should garner greater media attention. This is something that a future study could quantitatively test. Lastly, our analysis did not account for potential selection effects associated with sanctions violations OFAC learns about and pursues versus those potential violations that do not lead to public enforcement actions. OFAC has refused requests to release such data, but interviews with current or former officials could yield insights into which discovered infractions are punished. Our analysis may need to be revisited if future studies identify a selection effect involving firms’ profiles that influences their likelihood of being punished for violations. Many aspects of the consequences that sanctions enforcement actions have remain unknown. Gaining a better understanding of how the targets of sanctions enforcement actions, other firms, the media, and consumers respond to OFAC punishments can shed light on how US sanctions can be made more effective and, potentially, help prevent and reduce the adverse side effects of economic sanctions.

Acknowledgments

The authors wish to thank Jack Zhang and the KU Trade War Lab for providing feedback on our initial draft and Navin Bapat and Dursun Peksen for their insightful comments at the International Studies Association Meeting in 2022. We also benefited from feedback provided at the 2023 GIGA-hosted workshop “Sanctions in the 21st Century: Current Debates and Future Trajectories.” Lastly, our anonymous reviewers provided great suggestions that substantially improved the final manuscript.

Competing interests

The authors declare none.

Supplementary material

To view supplementary material for this article, please visit https://doi.org/10.1017/bap.2023.22