Skeptics have long predicted the end of American financial leadership. Pessimistic commentary accompanied the collapse of Bretton Woods, the rise of Japan in the 1980s, the 2008 financial crisis, and the pandemic of 2020. Yet American financial power remains substantially intact, begging the question: what does it take to shift global financial leadership? To answer this question, I examine the clearest case of such a phenomenon: the Anglo-American power transition. As of 1913, Britain dominated the network of sovereign debt obligations, the most critical element of the financial system of the Pax Britannica. How did the United States supplant Britain at the heart of global finance?Footnote 1

The United States occupies a privileged position within the contemporary global financial system. Shocks to the United States impact the rest of the world, while crises in more peripheral states tend not to impact the United States.Footnote 2 The rest of the world is often forced to deal with the American capital cycle.Footnote 3 I understand this relative ability to transmit financial shocks without absorbing them from others as financial power.Footnote 4 This kind of power is best operationalized as centrality inside global networks of financial flows. The United States can influence other actors by leveraging its centrality in myriad ways, exercising financial power over others.Footnote 5 Many related benefits flow to the United States at least partly because of American centrality in global financial networks. The American dollar is the global reserve currency, allowing the United States to borrow extensively in its own currency,Footnote 6 run current account deficits without immediate adjustments,Footnote 7 and earn outsized returns on investment and the grow faster.Footnote 8 The United States has outsized influence over key institutions governing the global economy, from the IMFFootnote 9 to SWIFT.Footnote 10 Financial crises – even those originating in the United States – can paradoxically increase global reliance on Federal Reserve swap lines or IMF aid.Footnote 11

Given that the United States enjoys these privileges despite institutional deficiencies, increased debt, and declining relative economic power, we should ask ourselves: which capabilities truly underlie financial power? To some, financial power rests on conventional measures of power like GDP or military spending. In this view, a reckoning may be just around the corner.Footnote 12 Others, however, believe that American financial primacy rests on other capabilities where American decline is less evident. Some go so far as to argue that American centrality in global finance exhibits path dependence and might persist even if American capabilities erode substantially. This debate is not merely relevant to scholars of the politics of finance, but also to classic debates about when and why power transitions happen,Footnote 13 the durability and nature of world orders,Footnote 14 and interstate/group competition for power and status inside networked global structures.Footnote 15

Without examining actual financial power transitions, it is difficult to say much about how change occurs. Perhaps relative power matters, but what are the critical thresholds, and which capabilities matter most? Perhaps global financial leadership is path dependent – but just how path dependent? While a single case cannot tell us everything, it can provide valuable insights about the causal mechanisms behind financial power transitions.

In this paper, I argue that the ability of states to manage political risk for lenders abroad is an important determinant of why some states emerge and/or remain atop the global financial system. Political risk is a significant driver of investor behavior. Neoclassical economic theory predicts that foreign investment should generally flow north-south because returns are higher in the global south. Yet this has rarely been true. As LucasFootnote 16 shows in the paradox that bears his name, foreign investment stocks are predominantly north-north, as are flows most of the time.Footnote 17 One reason for this is political risk – investors and lenders will forego large returns in exchange for greater stability. Some states have institutions and capabilities that can mitigate political risks domestically, such as credible commitments to protect property rights. However, we should also consider how states exercise influence abroad on behalf of investors and lenders. I argue that a critical factor in the Anglo-American financial power transition of the early twentieth century was the decline in British power projection capabilities (and the corresponding rise of American capabilities). As British command of the commons weakened, so too did London’s role as a global financial entrepôt. Other large economies, such as Germany and the Soviet Union, failed to play a large role in global finance in part because of their lack of similar capabilities (France lies somewhat in-between). I offer evidence of the role of power projection capability by examining at the largest and most important global financial network during the critical Anglo-American transition period – the network of sovereign debt relationships.

This paper proceeds as follows. First, I discuss the literature on financial power contrasting between power as relational and power as structural. Next, I introduce a political risk framework to help understand financial power, arguing that the ability to manage political risk is a critical capability for global financial leadership. Turning to the Pax Britannica, I discuss the role of power projection capabilities in shaping the structure of global finance. I illustrate support for the theory with a Temporal Exponential Random Graph Model (TERGM) analysis of sovereign debt networks 1913–1946.

Understanding financial power

To understand financial power, a few concepts and distinctions will serve us well. There is a distinction between understandings of power as relational and structural.Footnote 18 Relational power can be understood as the possession of substantial capabilities compared to others. A great deal of the international political economy literature focuses on how tools like sanctions or debt/aid diplomacy can be used to directly or induce behavior. For instance, in Kirshner’sFootnote 19 discussion of “monetary power” he discusses how states use currency reserves to influence others, noting British vulnerability to American disapproval because of a weak reserve position during the 1956 Suez Crisis.Footnote 20 Here, power involves a very specific capability explicitly used against a specific target, for a defined aim. Scholars in this camp tend to be bearish on the future of American financial power, and bullish on the power of the BRICS, believing that growing economies can transform their economic bulk into financial clout.Footnote 21 SubramanianFootnote 22 goes so far as to begin his book with a potential scenario (in 2021) in which a Chinese-dominated IMF provides $3 trillion to the United States, imposing conditionality in the process. To varying degrees, these arguments depict global finance as a flat structure, where each actor can influence each other actor, though they may differ in power and importance.

Other explorations of financial power emphasize structural power – power that stems from one’s position inside hierarchical structures like the networks of global financial flows. Structures alter outcomes in ways that defy what we would expect just from looking at raw capabilities. Imagine that we arranged the world’s fastest runners by speed. The difference in speed between the third and fourth-fastest runner would probably be small. However, the difference in outcomes (e.g. fame, prestige, and endorsement deals) might be large due to competitions like the Olympics, which grant medals to the top three performers. Outcomes are still related to capabilities, but mediated by structures. Scholars have often described financial power in different ways. Much work has focused on monetary power, such as the American dollar’s “exorbitant privilege” – the benefits flowing to the United States because of the reserve currency status of the American dollar.Footnote 23 The United States can delay adjustments – for instance, despite persistent current account deficits, there has not been particular downward pressure on the dollar relative to other currencies.Footnote 24 The United States can borrow heavily abroad, financing periodic booms and military adventurism because of the need others have for dollars as a reserve.Footnote 25 Some have argued that the privileged access of American financial institutions to cheap credit facilitated by American financial hegemony helps US investors earn excess returns on investments, effectively borrowing in the short-term to fund long-term investments.Footnote 26 Moreover, when American financial policy has adverse consequences, the centrality of the American economy often means that this is not merely a problem for the United States, but rather one for the world.Footnote 27 For instance, consider that although the 2008 financial crisis originated in the United States, it was the Eurozone that faced a longer and deeper recession.

Some works do not only describe the ways in which America’s position in global finance provides it with advantages, but explicitly aim to model the underlying structure. Oatley et al.Footnote 28 mapped the structure of global financial flows, finding support for the idea of a US-centric global financial system. China, despite its great size and importance in global trade remained peripheral in global finance – Britain was still second. One interpretation might hold that structural power in global finance is self-reinforcing – “the dollar is widely used because it has been widely used”.Footnote 29 Yet we still might wish to know the origins of that structure. Scholars point to different factors underlying structural power. Some accounts argue that financial power lags other economic capabilities. For instance, in Wallerstein’sFootnote 30 account, agro-industrial power precedes commercial and financial power.Footnote 31 Security relationships offer another important set of explanations. Germany, Japan, and Saudi Arabia, for instance are important supporters of the dollar system, holding dollars and frequently acting in support of systemic stability (e.g. the 1985 Plaza Accord), or denominating sales of oil in dollars in the case of Saudi Arabia. In exchange, the United States provides security assistance to those states.Footnote 32

Alternately, some institutional features of states may be prerequisites for financial power. For instance, although the United States passed Britain in GDP in 1872,Footnote 33 the United States dollar played little international role before the establishment of the Federal Reserve in 1913.Footnote 34 Similarly, in his prognosis for the future of the Renminbi in the global economy, PrasadFootnote 35 suggests that Chinese financial power will depend on the policies of the Chinese government, and not just China’s economic bulk. Many of those buying into a dollar-dominated world are private actors who are unlikely to prioritize geopolitical considerations. Holders of dollar assets may simply see a deep and highly liquid American financial system which is likely to remain open. Those features of the dollar may depend on the persistence of particular institutions or policies. Some works posit that credible commitments to protect property rights and repay debt are a source of advantage in establishing the basis of financial power or in attracting capital.Footnote 36 Whatever the merits of American institutions, recent decades beg the question of whether institutional strength can really explain American financial power. From the brinkmanship of the Tea Party caucus during the debt ceiling debate, to U.S. President Donald Trump’s challenges to economic openness and democracy, to the run of large deficits since 2001, American leadership remains intact. It may be, as Winecoff and KhannaFootnote 37 argue, that the money shapes the order. The focus on the individual characteristics of leading states may also miss the fact that the global financial system is shaped by many decentralized decisions by private actors unlikely to coordinate.

Questions remain over several key points on the nature of financial power. What did the distribution of structural power in global finance look like in past eras? How distinct is structural power in global finance from other more conventional measures of relative power? Is power highly fungible, such that broad capabilities like economic size can be used to influence most international interactions, or is power siloed inside distinct domains?Footnote 38 When IR theorists assert the importance of their favorite variable, they often jump from capabilities to behavior. It can be useful to recall the classical deconstruction of power offered by Dahl.Footnote 39 For Dahl, capabilities are merely the base of power. If capabilities are to be exercised, they must be attached to some action (the means of power). Actors may differ in the extent of their power, and in the range of their power.

Most of the analysis thus far has examined fluctuations inside the contemporary global financial system. But many systems function differently in the short and long-run. For instance, complex ecological systems may be robust to shocks yet have critical tipping points that trigger systemic collapse. Some forms of power may be path-dependent, but one wonders how path dependent.

Financial power and global property rights

In this section I argue that the management of political risk is vital to financial power. Investors are unlikely to invest or lend if they fear expropriation, default, or other actions by host countries or borrowers. By signaling their willingness and ability to defend capital at home and abroad, great powers grant their investors and lenders a relative advantage over competitors. Let us first turn to the concept of political risk, and its role in determining financial flows. The political risk framework developed here should apply to both portfolio investment flows and foreign direct investment. As will be discussed later, due to data limitations, I am only able to directly test my hypotheses on portfolio investment in the interwar period though I hope future works will be able to extend this analysis.

Political risk is an important consideration for portfolio investment and sovereign lending. Consider a basic fact: the global south offers investors and lenders higher returns than the global north. However, debt defaults impose a considerable risk to lenders. If it were simply a question of maximizing returns, economic theory would expect capital to flow largely from the capital-abundant global north to the capital-scarce global south where many investment opportunities remain unexploited. However, LucasFootnote 40 reported a paradoxical trend: capital generally flows north-north. His explanation emphasized political risk – even though north-south investors earn higher returns they face novel risks. Other works agree with the notion that lenders are concerned about political risk. For instance, TomzFootnote 41 illustrates the power of reputation in sovereign lending – lenders prefer jurisdictions with a history of repayment. Shifts in the composition of government, external shocks (e.g. wars), and other forms of political risk play a substantial role in determining who can borrow, and under what terms. Lienau,Footnote 42 exploring several cases where debt repudiations went unpunished, further illustrates the extent to which reputation can be subjective, and decisions about punishment are political. For instance, American lenders after the First World War did not punish sovereign borrowers that had defaulted on debts owed to their British competitors. In other words, states may differ considerably in their ability and willingness to respond to defaults or expropriations. The problems of political risk have not gone away, either. Developing world default waves have occurred regularly over the past two centuries,Footnote 43 particularly as credit conditions shift inside more central countries within the global financial system.Footnote 44 All of this suggests that managing political risk is important for sovereign lending and portfolio investment.

What about foreign direct investment? Once again, while prospective returns are higher in the global south, the Lucas Paradox holds up there as well. Even in recent years the stock (and generally the flow) of foreign direct investment has remained overwhelmingly north-north,Footnote 45 despite the prospects of higher returns in capital-scarce economies. It is useful to consider why firms opt to use FDI over other options (e.g. contracting out).Footnote 46 In Dunning’sFootnote 47 OLI framework, firms invest abroad to exploit home country advantages, gain local advantages, and to internalize externalities such as the protection of intellectual property or tariff-hopping.Footnote 48 Thus, even the choice to use FDI itself is deeply related to fears about other actors dishonoring agreements. Consider the principal-agent problem.Footnote 49 Prospective investors have considerable leverage vis-à-vis governments before they invest (as do lenders before they lend). However, after firms have invested in a particular locale, moving becomes costly and the host country (or borrower) gains leverage. Several actions or events in host countries could undermine the profitability of an investment or a loan. Host governments can nationalize foreign-owned businesses, renege on agreements made with firms, enact unfavorable legislation, and even investor-friendly governments could lose power. Similarly, the conditions that attracted investors to a particular country might change due to wars, conflict, protectionism, piracy, or other events. Indeed, fears of expropriation are perhaps even more important for FDI flows than for portfolio flows because there are fewer exit options in the face of adverse shocks.Footnote 50 When surveyed, MNEs frequently express concern about these very risks.Footnote 51 Investing globally is also harder than investing domestically because firms must understand host country work cultures, regulations, and political systems. As a result, firms are often hesitant to invest or lend abroad. Even in the early 2000s, RugmanFootnote 52 observed that the bulk of supposedly “global” investment was largely intra-regional. However, those firms with global operations gain economies of experience from doing so, that may give them an edge over newcomers.

Great powers often intervene on behalf of investors and lenders.Footnote 53 These interventions were more overt in the nineteenth and early twentieth century. Sometimes this involved the direct use of force – when the Mexican government defaulted on its debt in 1863, French troops invaded. In numerous cases, great powers imposed “supersanctions” – revenue collection regimes or blockades – on defaulting states.Footnote 54 Supersanctions were imposed on over 40 percent of debt defaults from 1870 to 1913. As the nineteenth century wore on, borrower pledges offering valuable resources as collateral for loans became standard practice – often undermining statebuilding capacity.Footnote 55 Great power willingness to use force to defend investments abroad had a direct impact on markets. For instance, when American President Theodore Roosevelt announced the Roosevelt Corollary to the Monroe Doctrine, declaring the right of the United States to intervene in the western hemisphere, bond spreads fell across the circum-Caribbean.Footnote 56 In turn, ignoring political risk could prove disastrous – by one estimate, the 1917 Russian Revolution wiped out French investments and loans comprising a quarter of French external capital stock.Footnote 57

Instances of military and clandestine intervention on behalf of creditor or investor interests continued through the Cold War. For instance, American President Dwight Eisenhower authorized the use of force to topple Guatemalan President Jacobo Árbenz after he nationalized land belonging to the United Fruit Company.Footnote 58 Anglo-American cooperation was critical in the coup d’état launched against Iranian Prime Minister Mohammed Mossadegh in 1953 as well – a coup triggered in a large part by Iranian efforts to audit the Anglo-Iranian Oil Company.Footnote 59 Similarly, American President Richard Nixon declared his desire to “give Allende the hook” after the Chilean president rejected compensation for expropriated copper mines.Footnote 60 Two years later, Salvador Allende would be ousted in a coup. Strong reputations for intervention may allow great powers to achieve their objectives peacefully. For instance, Maurer (Reference Maurer2014: 264–312) discusses how readily the United States was able to obtain above-market compensation for US-owned oilfields following Mexico’s 1938 nationalization. Some argue that contemporary institutions formalize aspects of nineteenth century financial discipline. For instance, states facing currency crises and imminent debt defaults may turn to the IMF, which provides them with credits but imposes conditions. Conditionality serves investors well, often entailing investment-friendly policies and austerity measures aimed at generating catalytic investment. Many analyses of IMF policies note the influence of the national interests of key principals in IMF decision-making.Footnote 61 International institutions like the ICSID, too, may provide a forum to resolve disputes between MNCs and host countries peacefully. Even after countries have defaulted, the desire to regain access to global capital markets is a powerful incentive to repay.Footnote 62 Lipson (Reference Lipson1985) has also argued that as the complexity of multinational investment grew, and as developing countries abandoned laissez-faire economic models (giving states subtler means to influence foreign firms),Footnote 63 the prospects for gunboat diplomacy have waned. On the other hand, some contemporary analyses note that even today foreign direct investment flows “follow the flag”Footnote 64 and campaign donation patterns suggest support for intervention among financial firms with a north-south orientation.Footnote 65

The ability to influence political risk abroad for home country investors and lenders is vital for global entrepôts for a few reasons. Critically, these features may accentuate path dependence in financial power, while clarifying why and when transitions might occur. Imagine a world in which one country A can easily lower the political risk of its investors and lenders abroad (e.g. because it alone has naval and air power that enable it to threaten far-flung targets and cut off access to vital waterways). Firms in A would surely invest abroad more frequently, taking advantage of attractive investment opportunities that foreign firms cannot easily take. Over time, too, firms in A would develop experience and knowledge about other markets or about borrower credibility not possessed by foreign firms. Simultaneously, because flows from A are relatively large, other states may devise policies with the preferences of investors and lenders from A in mind. For instance, if investors from A strongly preferred investing in countries with a common law legal structure, such structures would be more attractive at the margins. If another country, B, with a different legal structure, emerged as a competitor with A for status as a global entrepôt, its firms would face obstacles. Indeed, firms from B might have an interest in forming links with A themselves. The ability to keep political risk low at home, too, would provide significant advantages to a state seeking status as a global entrepôt. Such a country would be able to borrow cheaply, further deepening its links to the rest of the world. Dense, highly liquid, markets could develop relatively free from the risks like default or expropriation.Footnote 66 If A’s ability to lower political risk fell, however, its financial power might evaporate rapidly as investors and lenders faced expropriation, chaos, and default abroad, and as new centers emerged as superior alternatives. Let us turn to the case of the network of international finance during the Pax Britannica (and its decline) to apply this argument about political risk management and financial power in the context of the time.

Mapping the global financial network

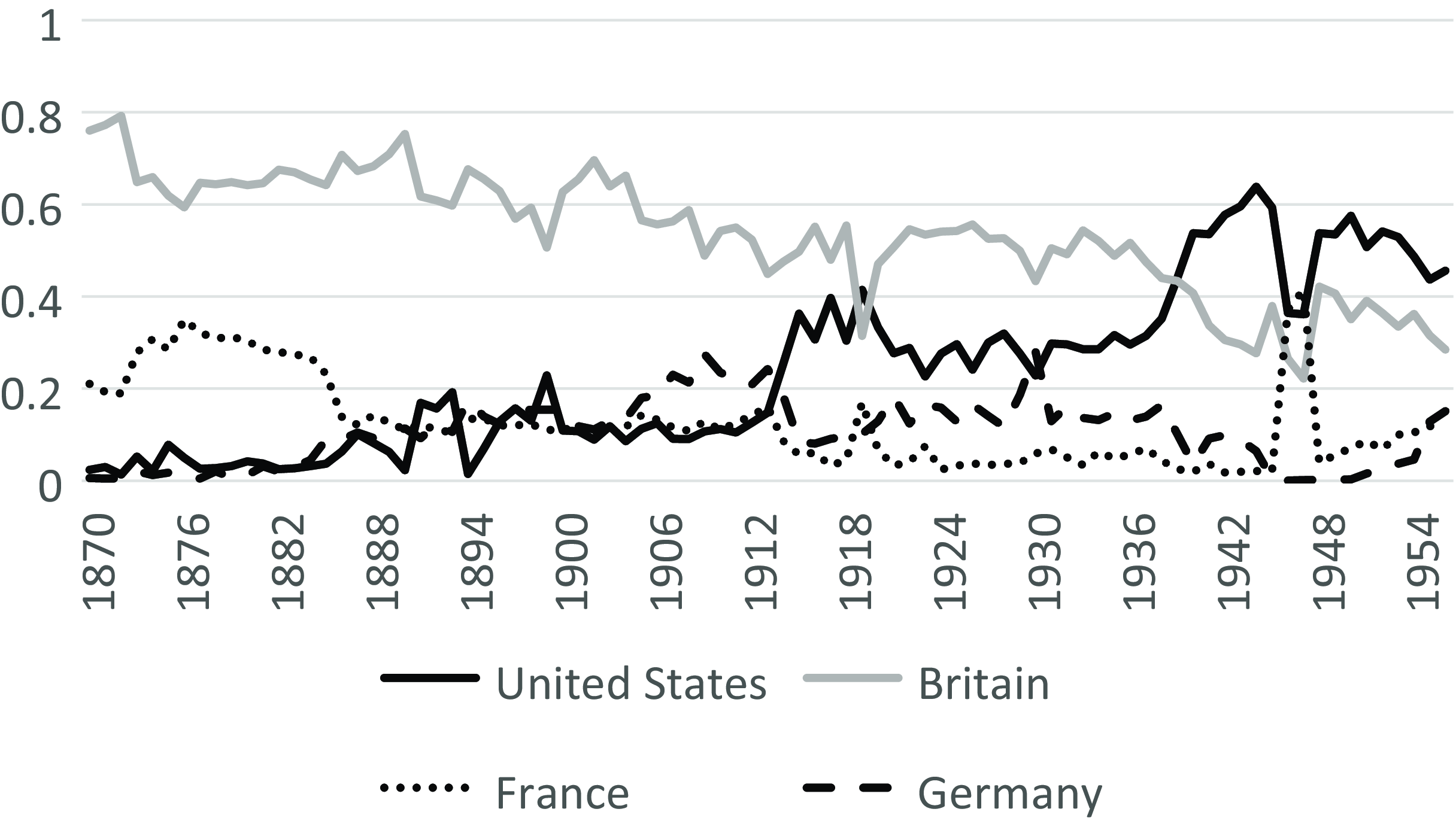

What did global finance look like during the Pax Britannica? As late as 1840, the volume of global financial activity was limited – the foreign investment stock of major capital exporters was below 3 percent of GDP.Footnote 67 However, investment surged after 1846 with the abolition of the Corn Laws in Britain – British overseas investment stock had more than quintupled by 1875. London remained central to global finance even as British industrial capacity declined.Footnote 68 On the eve of the First World War, substantial capital flows linked Britain and the rest of the world. Numerous transactions (e.g. trade acceptances markets) were profitably intermediated by British banks on sterling terms – even if the transaction involved no British firms.Footnote 69 In time, Britain’s relative advantages receded – the creation of the Federal ReserveFootnote 70 and the fiscal impact of the First World War greatly enhanced the role of the United States in global finance. Economic historians debate the precise timing of the transition. Focusing on the sterling-dollar transition, Eichengreen and FlandreauFootnote 71 argue that a dynamic picture emerged as early as the 1920s.Footnote 72 Others date the transition much laterFootnote 73 or emphasize that different capabilities tell a different story. For instance, Britain’s relative share of foreign investment capital points to British staying power into the late 1930s at least (see Figure 1).

Figure 1. Relative shares of foreign investment stock by country, 1870–1956. Source: Lee (Reference Lee2016).

A striking feature of the Pax Britannica (and its decline) was the preference of investors for portfolio investment over FDI. Estimates of the relative proportion of British portfolio investment on the eve of the war range from 65 percent to 90 percent.Footnote 74 Other countries preferred portfolio investment as well. For instance, 85 percent of French investments in Russia were sovereign bonds, with the rest a mix of shares in Russian companies and bonds of private companies.Footnote 75 Overseas investors exhibited a great appetite for bonds, buying up debt of countries, regional governments, municipalities, utilities, and railroads. Sovereign lending was particularly attractive to investors. Looking at new capital issues from New York and London 1920–1931, FishlowFootnote 76 reports that three quarters of portfolio flows were allocated to governments or public agencies. Even beyond this, much nineteenth and early twentieth century private debt (e.g. financing for large projects like railroads) was guaranteed by governments (Lewis Reference Lewis1983: 97–123). In short, sovereign debt, or sovereign-backed debt represented by far the largest proportion of financial flows during the period. Other flows, such as FDI, were important, albeit smaller in volume.

How might we understand financial power during the Pax Britannica, to capture not only the size of Britain as a global investor and lender, but also Britain’s impact on other countries? I propose a similar approach to that of Oatley et al.Footnote 77 to construct a network of financial relationships. Specifically, if Countryi relies on Countryj for a large proportionFootnote 78 of its investment capital, we might say that Countryi has a dependent relationship on Countryj. I propose representing that relationship as a directed tie from Countryi to Countryj. It is also possible for the reverse to be true – Countryj might rely on Countryi for a substantial proportion of its investment capital, which we might represent as a directed tie from Countryj to Countryi. Finally, it is also theoretically possible for two countries to rely on one another for a substantial proportion of their capital, which would be represented as a two-way tie. However, this was not common in the Pax Britannica. I understand a country as being powerful if it has many in-degrees in this network – i.e. many countries are dependent upon it for capital.

What does the network of interwar financial relationships look like? Detailed bilateral data on financial flows are not available for the full sweep of the Pax Britannica.Footnote 79 However, recent efforts to collect financial data at the instrument-level provide substantial information on most debt instruments including the amount owed, the currency, the borrower, and the market where the instrument was floated. Thus, I used instrument-level data to reconstruct the network of financial interdependence during the decline of British financial power, drawing particularly on the “Instruments of Debtstruction” dataset,Footnote 80 which contains detailed information on 3800 debt instruments issued by 18 countries and colonies from 1913 to 1946.Footnote 81 The dataset has broad coverage, including 88 percentFootnote 82 of total debt reported to the League of Nations.Footnote 83 I supplemented the data in the cases of Austria-Hungary (1913–1918), and of the Russian Empire (1913–1917).Footnote 84 The dataset includes both colonies and independent states, a useful distinction allowing us to better model intercolonial relations. That said, the sample of countries may veer toward those likely to interact with Britain as it includes much of the British Empire and excludes Mexico, Brazil, and most French colonies).Footnote 85

While the dataset focuses on sovereign debt, as established earlier, sovereign debt to governments represented the most significant flow in nineteenth century financial markets. Moreover, the definition employed by the dataset is broad, counting government-backed private debt as well. While a broader timespan than 1913–1946 would be preferable, the period covers the rise of the United States from being a net debtor, to the American triumph at Bretton Woods. Future work examining the network of FDI flows during the period would be interesting. That said, sovereign debt should represent a harder test for a political risk argument. Whereas bondholders can sell defaulted debt (albeit at a discount), the physical assets comprising FDI are less mobile, and more vulnerable to adverse shocks or policies. As a result, we might expect political risk considerations to influence FDI flows even more than portfolio investment. Nonetheless data limitations should make us cautious about drawing too many conclusions about FDI.

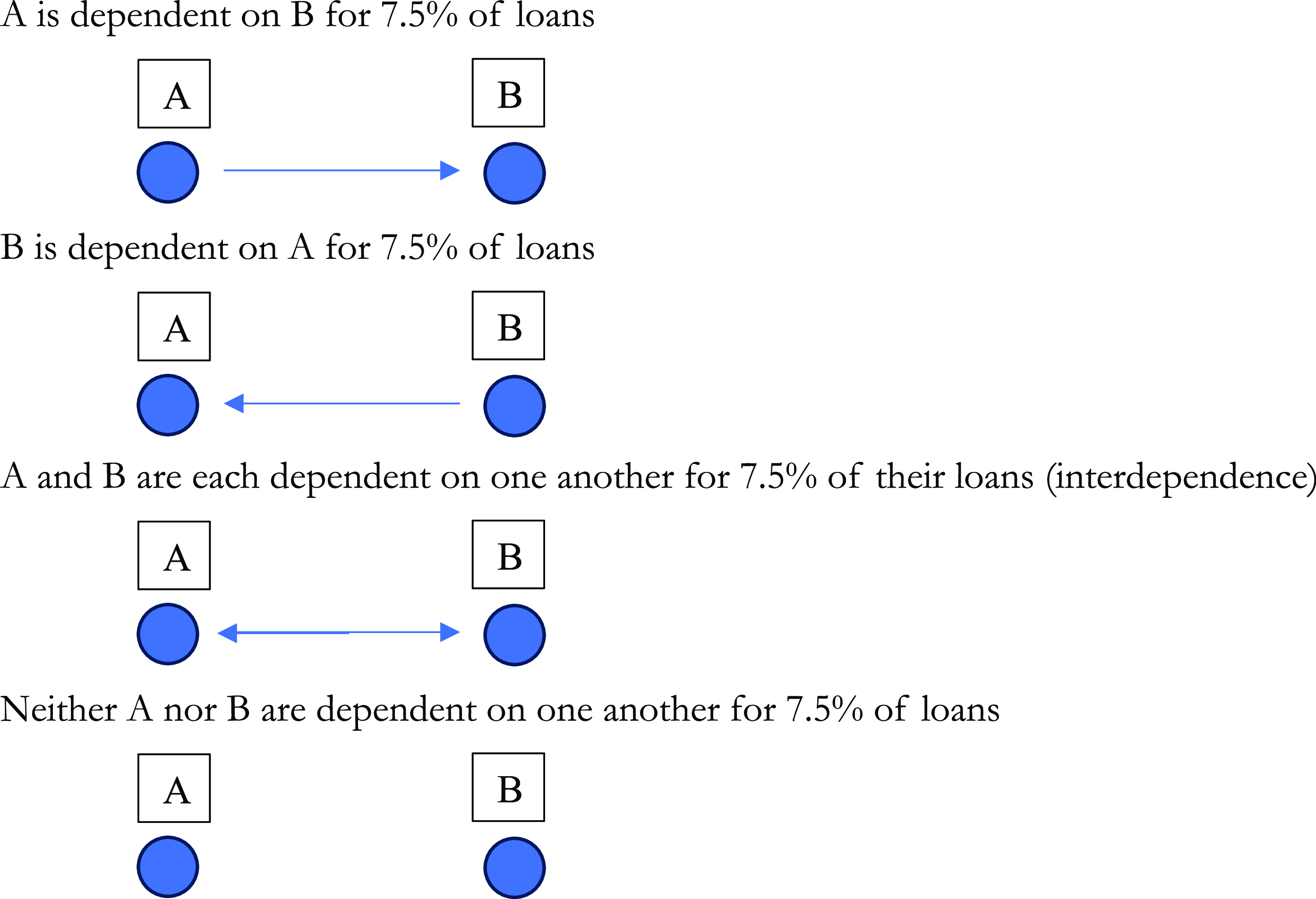

To model the structure of interwar sovereign debt markets, I constructed a directed network where nodes represented countries and edges comprised of relations of (inter)dependency. I examined the portfolio of sovereign debtFootnote 86 for each country and considered a country to be dependent on another (i.e. to have a directed tie with that country) if at least 7.5 percent of their sovereign debt portfolio flowed from that country. For instance, if Canada’s sovereign debt was 75 percent domestic, 25 percent British, and 5 percent American, Canada would have a directed tie to Britain but not to the United States. Countries could theoretically have mutual ties, however, there were no instances of this occurring in the data. Figure 2 summarizes the potential relationships between different countries in the network. The threshold of 7.5 percent is both consistent with other works, and represents a substantial link for most countries.Footnote 87

Figure 2. Summarizing potential ties in the interwar sovereign debt network.

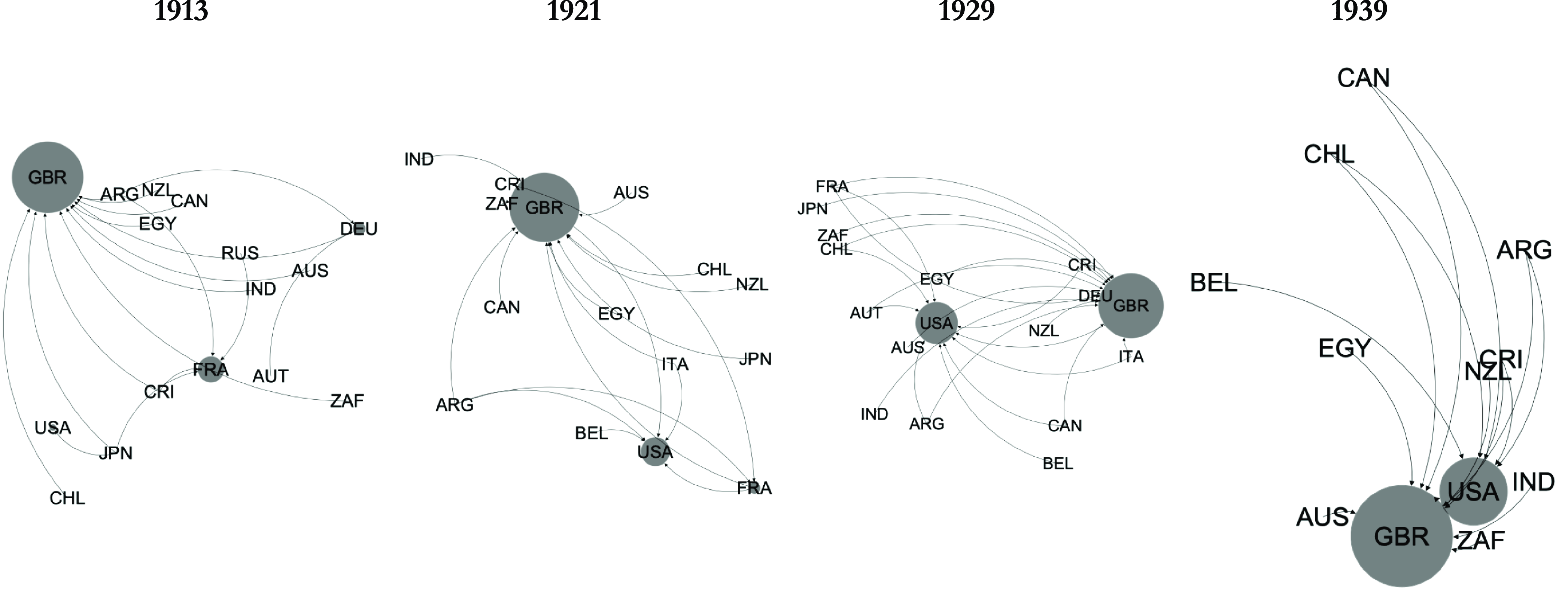

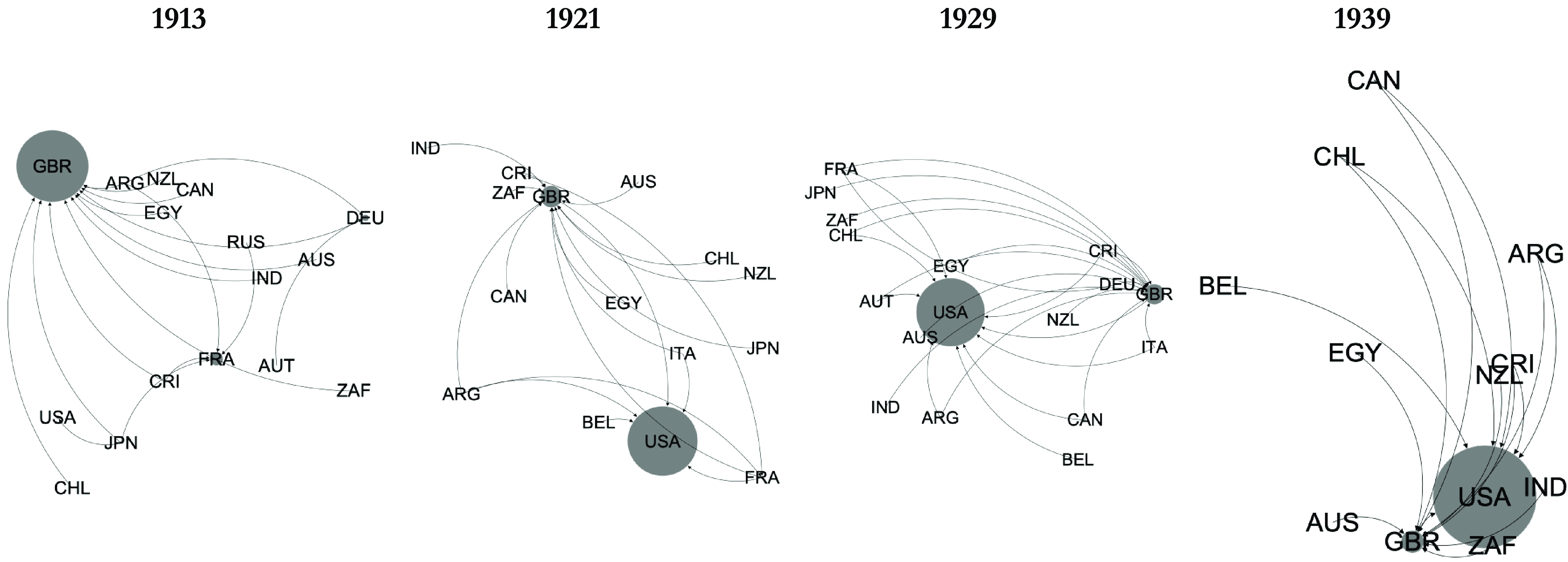

How did the network evolve over time? Importance in networks is often measured by centrality – how important is a particular node to the network. Different centrality measures are better suited to different tasks. For instance, Oatley et al.Footnote 88 discuss betweenness centrality (the number of shortest paths between all actors in a system going through a particular node) as one way to represent American financial power.Footnote 89 Betweenness centrality is a good measure of the importance of a particular node in a network of flows. However, my model does not measure flows directly, but rather relations of (inter)dependency.Footnote 90 Descriptively, we can look at the evolution of indegree centrality and eigenvector centrality – do nodes have many indegrees (i.e. many other countries in dependent relationships), and are nodes connected to other important nodes in the network, respectively.Footnote 91 The indegree centrality plots illustrate a steady rise by the United States, which reached near-parity with Britain by the late 1920s and 1930s (see Figure 3). The rise of the United States in terms of eigenvector centrality is also clear – particularly given the emergence of the United States as a critical lender to Britain and France during the First World War (see Figure 4). Another feature of the data is the gradual dissolution of the network itself. Over time, network density fell, reaching particularly low levels by the end of the Second World War as international lending waned. Though beyond the scope of this paper, scholars would do well to consider how to interpret shifts in centrality and structural power alongside shifts in the importance of a given network. Let us turn now to the question of analysis, exploring the argument that power projection was an important element of financial power.

Figure 3. Indegree centrality in the sovereign debt interdependency network, 1913–1946.

Figure 4. Eigenvector centrality in the sovereign debt interdependency network, 1913–1946.

Theory: power projection and political risk

It is difficult to project force over long distances. As supply trains grow longer and logistical challenges intensify, force diminishes.Footnote 92 However, despite the “blocking power of water”,Footnote 93 some states have specialized in power projection capabilities, such as blue-water navies and strategic air power.Footnote 94 Global powers with at least some relative power projection capabilities are substantially more likely to engage in long-distance militarized interstate disputes.Footnote 95 To protect property over long distances, great powers need the ability to project power. Strong navies and air forces enable long-distance intervention and enable states to make credible threats against others. The development of extensive basing networks, similarly, allow refueling of ships, while tropical medicine and vaccination lowered the cost of power projection across diverse environments.Footnote 96 In his account of efforts to exert force in the defense of property rights, LipsonFootnote 97 argues that global property rights protection was strongest in precisely those eras where naval power was most greatly concentrated – during the period prior to the First World War, and again in the immediate postwar period. Instead, when capabilities became more diffuse, expropriation became more common.

Naval and air power has tended to be concentrated in a single state. The Netherlands (seventeenth century), Britain (eighteenth and long nineteenth century), and the United States (twentieth and twenty-first century) are prototypical examples.Footnote 98 Power projection capabilities are concentrated because their development is not only resource-intensive, but also requires cutting-edge technology not available to all states. Moreover, such capabilities are not complementary to other forms of military power. French and German grand strategists in the nineteenth century agonized over the relative importance of land power versus sea power. This is not simply about the allocation of scarce resources, but also one of doctrinal or even ideological choices. For instance, the decision to emphasize tactical bombers to aid land armies versus strategic bombers able to strike distant targets was one of land power versus power projection. Accordingly, many have argued that naval and land powers represent ideal types on opposite ends of a spectrum, reflecting competing orientations toward territorial control and global positional strength.Footnote 99

Power projection capacity enables states to protect distant property, enhances influence, and facilitates coalition-building. Global trade largely takes place by sea (as did most flows of communication before the twentieth century). The oceans are not an undifferentiated mass, rather, they have bottlenecks and chokepoints (e.g. the Dardanelles Straits). States can potentially control access to global markets by occupying critical points in maritime trade. While some states (especially Genoa, Venice, Portugal, and eighteenth Century Britain) employed mercantilist strategies that leveraged control over trade routes to charge monopoly prices, the Dutch, British (in the 19C), and Americans instead promoted relatively open seas. The result was the development of a rich global commons over which they, as the premier naval power, exercised what PosenFootnote 100 called “command of the commons.”

Command of the Commons was vital for British financial power. So long as a single power could cut off other states from the global commons, they would be difficult to challenge, and attractive as allies and trade partners. Indeed, contrary to the predictions of balance of power theory, in every major war, the leading naval power has been able to assemble robust coalitions of allies.Footnote 101 This feature made London attractive as a global entrepôt (i.e. an economy upon whom many others were dependent for capital flows) because it was unlikely to be cut off from trade by rivals. Instead, rivals like Germany found themselves isolated from global markets during both world wars. The decline of British preponderance at sea gave aspirants an opportunity to create their own blocs outside the control of the dominant global power. Such aspirants, too, may be able to mitigate political risk faced by their investors by showing the flag. To sum up, while countries with strong power projection capabilities may also tend to be capital exporters, their ability to intervene across a broad geographical space means that they are less likely to have any one singularly important overseas market. On the other hand, they are likely to be important sources of capital for a wide array of economies, including smaller ones. Thus, I hypothesize that:

Hypothesis 1: Countries with strong power projection capabilities are more likely to have indegree ties than others in the network of financial interdependency.

British naval power lowered political risk to British assets globally, by enabling Britain to credibly threaten to intervene against default or expropriation. The fact that British investors could lend and invest with less risk than others furthered the creation of an extensive network of financial linkages dependent on Britain. These features helped Britain overcome the Lucas Paradox to an unprecedented degree.Footnote 102 On the eve of the First World War about 42 percent of British foreign investment stock was north-south – and many of the most important northern destinations (e.g. Argentina, Canada, Australia, and the United States) had only recently developed in part because of British capital.Footnote 103

A key factor in the loss of British financial leadership was the loss of Britain’s edge in the management of political risk: the United States surpassed British power projection capabilities, and from the 1944 Bretton Woods conference to the British humiliation in the 1956 Suez Crisis, London’s position in global finance waned enormously. This did not necessarily end Britain’s status in global finance – indeed, London would develop the Eurodollar markets, and played an important role in the rebirth of global finance.Footnote 104 However, while the Eurodollar enhanced the relevance of London, it also entailed the abandonment of a sterling world such as had existed in 1913.

Data and model

In this section I describe how I tested the hypotheses about the role of power projection in financial power using a TERGM model. Common statistical analysis techniques in international relations (e.g. OLS) assume that units are independent and identically distributed. This assumption is likely to be untrue for dyads of countries.Footnote 105 For instance, the Canada-US dyad is surely influenced by actions in the Canada-Britain dyad because they contain the same country. Social network analysis techniques allow us to assess the importance of endogenous structures that are common in networks. For instance, consider the notion that “the dollar is widely used because the dollar is widely used”Footnote 106 – this could be interpreted as statement about the tendency of financial transactions toward popularity (i.e. a few nodes possess most of the in-degrees) or sociality (i.e. a few nodes possess most of the out-degrees).Footnote 107 If we do not model these tendencies, we risk misinterpreting the data.

Social network data does more than describe. A TERGM allows us to analyze how different variables influenced network structure over time. Like an ERGM, a TERGM estimates the probability of a given observed network, given an entire set of networks that could have been observed.Footnote 108 Common estimation techniques include Markov Chain Monte Carlo (MCMC) methods that simulate networks to make estimates, and Maximum Penalized Likelihood Estimation, which uses bootstrapping to downward biases in standard errors.Footnote 109 While MCMC estimation is unbiased when samples are large, and able to converge, it is computationally demanding, and models may not mix appropriately. MPLE is a consistent estimator, is computationally faster, and able to accommodate large networks. The key problem with MPLE models is that they have severe downward biases in estimations of uncertainty, however, the bootstrapping technique developed by Desmarais and CranmerFootnote 110 addresses the problem. Given my large sample size, I opted for an MPLE approach.Footnote 111 ERGM/TERGM models enable the analysis of how node-level variables, edge-level variables,Footnote 112 and endogenous structures that exist in social network data might influence financial interdependence. Many dyadic analyses in international relations model these relationships as if each dyad is entirely independent when that assumption is inappropriate.

I created a TERGM model of the financial interdependence network described earlier in the paper. As mentioned above, the financial interdependence network is a directed network of 18 countries over 34 years (1913–1946). To test my hypothesis, and effectively control for relevant factors, I included different types of variables in the model. Some variables were modeled at the node level because they were attributes of countries or colonies. Because the network was directed, I could specify whether a variable predicted indegrees or outdegrees. Given that I modeled indegrees to represent dependence on another country for loans, variables that are related with greater indegree ties should predict greater financial power. Other variables were collected at the edge level – they referred to interactions between nodes. First, in order to test H1, the hypothesis that strong power projection capabilities predict greater numbers of indegrees, I collected data on relative naval and air power strength from Lee and ThompsonFootnote 113 for each node. The variable was coded as predicting indegree ties.

I also controlled for different factors that might also influence financial (inter)dependence. It is possible that British colonies and dominions were less likely to have indegree ties because they developed inside a political structure where a capital-rich metropole had both privileged access and political control over them.Footnote 114 Nodes that were either British colonies or dominions were coded with a 1 during all years they were inside the empire. The dominions were removed after the 1931 Statute of Westminster, largely granting them full legal independence. Egypt was a colony as well, although its formal status changed over time. As with power projection, this variable was coded as predicting indegree ties, with the expectation that British colonies would have fewer indegree ties.

It is also possible that liberal states were more likely to be connected to others. LiberalFootnote 115 states are uniquely good at making credible commitments to protect property rights and honor commitments to repay debt.Footnote 116 They have institutions that generate checks and balances, facilitate political compromise (which creditor interests can use to defend their property), and can delegate authority to third parties such as courts.Footnote 117 Liberal institutions offer firms clear rules and transparent processes for dispute-resolution and have norms of non-discrimination against foreigners. It is plausible, then, that liberal states will both be more attractive to investors, but also that they can develop the dense and complex market institutions to support outward lending. To measure liberalism I used data from the Varieties of Democracy Project and modeled the variable as predicting greater ties of either type.Footnote 118

I also collected data on the relative GDP of each node to capture the idea that large economies might be more likely to have many countries with dependent relationships on them (i.e. many indegrees).Footnote 119 Many contemporary analyses of the rise of China have assumed that Chinese growth will translate into other forms of influence. If indeed the Anglo-American transition followed the same path, we should see evidence that American financial power tracked the growth of relative American GDP in our model.

Next, I considered the role of alliances between states with a network variable indicating whether countries had a defense pact. Allied states might be more likely to lend to one another and thus would have greater overall ties. I based alliance data on the Correlates of War Formal Alliances Dataset v. 4.1.Footnote 120

Finally, I controlled for the effects of war using two different variables. I included a variable for whether a node was a participant in one of the world wars (coded as 1 for any year that the state was involved in the First or Second World War).Footnote 121 Participation in the war could conceivably impact both the need for borrowing but might disrupt the financial ties between one node and others. I also included an edge level variable for whether any two nodes were at war with one another, with the expectation that countries are unlikely to lend to wartime rivals.

Finally, to take full advantage of the network structure of the data, I modeled the endogenous structures likely to appear in a network of financial interdependence. I anticipated that the network would exhibit popularity. A few major financial centers are likely to attract a disproportionate share of in-degrees (i.e. many economies will be dependent on a relatively small set of lenders). I measured this tendency by including the geometrically weighted in-degrees as a regressor. Geometric weighting helps address the problem of model degeneracy that is common in ERGM/TERGM analysis.Footnote 122 Similarly, financial markets might exhibit sociality – a few economies might have a disproportionate share of out-degrees because they have features that enable (or impel) them to borrow extensively and widely. To model sociality, I included the geometrically weighted number of out-degrees. If the geometrically weighted in-degree or out-degree terms were statistically significant and negative, this would indicate preferential popularity and sociality, respectively, as hypothesized. Finally, I included a term for mutual ties, which I anticipate will have a negative sign. The network of financial interdependence is likely to involve fewer cases of reciprocal ties than would occur by chance because of the tendency for states to specialize as lenders or borrowers, although theoretically mutual ties are possible within the data (i.e. two countries each lending 7.5 percent of their portfolio of loans to one another). Finally, I included a stability memory term to account for the effects of past edges (or non-edges) on future ones.Footnote 123

Results

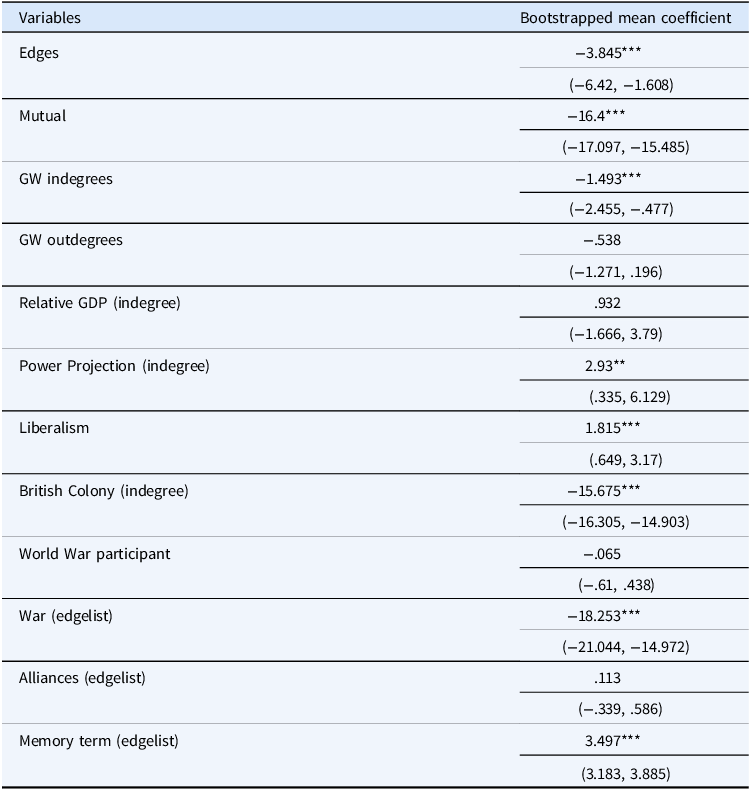

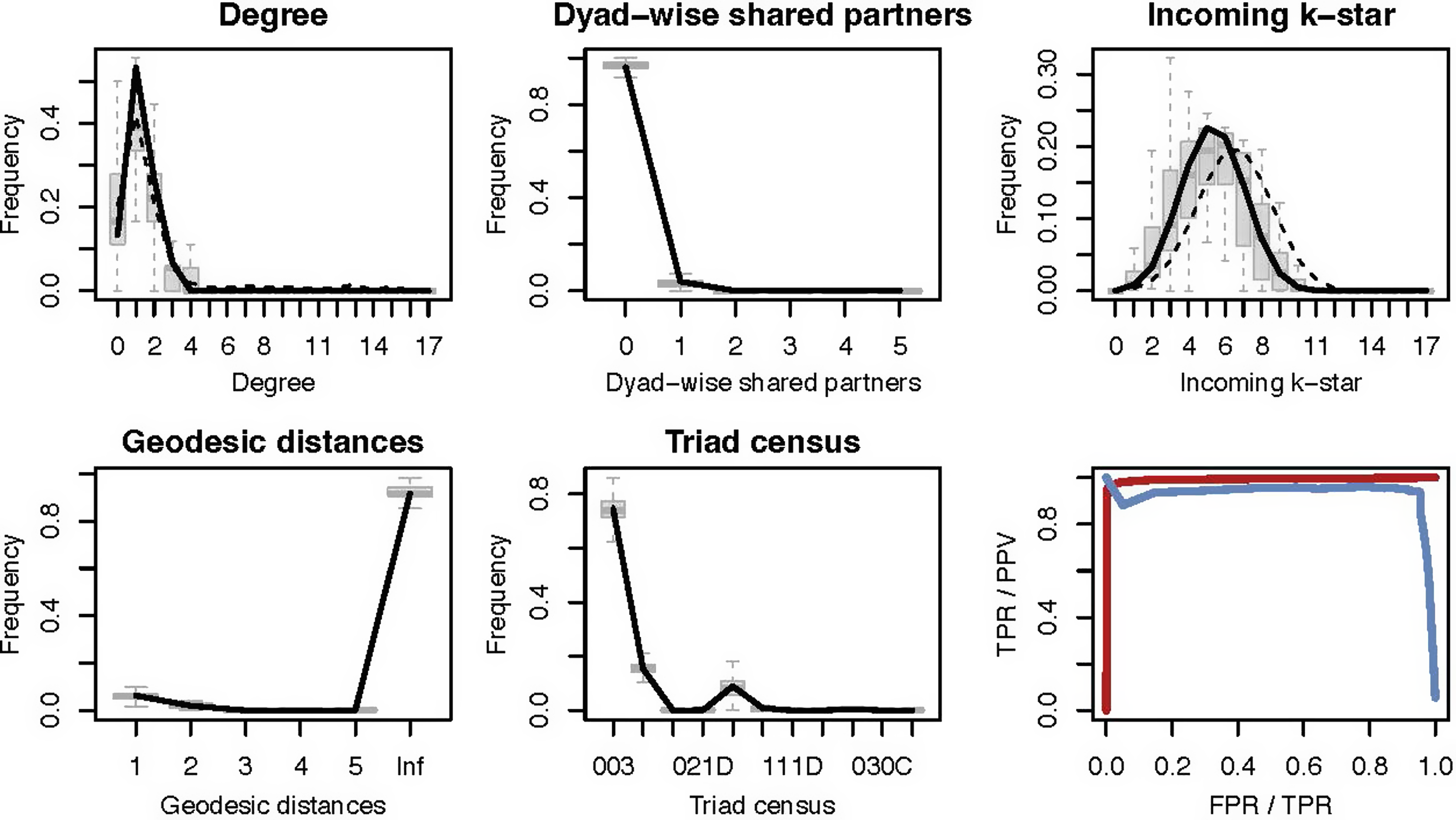

The results reported in Table 1 provide strong support for the hypothesis of this paper – nodes with greater power projection capabilities had a greater probability of indegree ties – i.e. more countries were dependent upon them for substantial loans. A node with 100 percent of power projection capabilities would be 18.73 times more likely to have an indegree tie than one with 0 percent of power projection capabilities.Footnote 124 Other factors also had a significant effect on the number of inward ties as well. British colonies were much less likely than other dyads to have indegree ties, in fact this effect was nearly prohibitive. Relative GDP, however, did not predict greater indegree ties, in contrast with the notion that large economies will necessarily become major financial hubs. Some of the endogenous network variables also exhibited statistical significance. Geometrically weighted indegrees were negative and statistically significant, consistent with a popularity effect – i.e. a general tendency in the model was the clustering of inward ties around particular nodes, rather than inward ties being widely distributed. In contrast, there was not a similar tendency toward sociality, for outward ties to be clustered in a few highly “social” nodes. There was also a tendency away from reciprocity as indicated by the statistically significant sign on the mutual term. To some extent this may reflect the period, during which there was a stronger distinction between capital exporting and other countries. Some variables also predicted greater or fewer ties with other states. Liberal nodes were more likely to have ties of any kind with other nodes, a result that was statistically significant. Strongly liberal states were 6.142 times more likely to have ties to other nodes than strongly illiberal ones. When nodes were at war with one another, conversely, they had substantially fewer ties, a result that was strongly significant – nodes at war were .000000012 times as likely to have ties as those at peace. In contrast, participation in a world war and alliances did not have statistically significant effects. Finally, the memory term was statistically significant and positive, illustrating how past iterations of the network were likely to persist. Overall, the model exhibited a good fit across all diagnostics (see Figure 5).

Table 1. TERGM of financial interdependence, 1913–1946

95% Confidence intervals in parentheses.

***p < 0.01, **p < 0.05, *p < 0.1.

Figure 5. Model fit.

Discussion and conclusion

This paper has illustrated support for myriad factors as potentially explaining the financial power transitions. Countries with strong power projection capabilities were more likely to develop networks of other states dependent upon them for finance. This paper has explained this outcome by pointing to political risk management as the key reason, although further work may be necessary to test causal relationships. In contrast, mere economic size did not consistently predict the financial power of countries – many large economies like the United States in 1913, or the Soviet Union exhibited relatively limited financial power, while Britain’s position in global finance endured even as the overall British economy lagged its competitors. In contrast to notions of a multipolar financial order, financial dependencies tended to cluster as illustrated by the geometrically weighted indegree variable – global financial power is not likely to be diffuse, but rather, there are benefits to clustering in one place. The British Empire, for its part, may have pushed a large part of the world into a dependent relationship with the metropole, with colonies dependent on London for finance (in turn, enhancing the depth of British financial markets), but not connected to states outside the empire. Overall, liberal states were generally more connected to the rest of the world than other states, both as borrowers and as lenders. There was also evidence of a measure of path dependence – British financial power persisted in part because it had existed in the past as exemplified by the significance of the memory term. Future research might expand on these efforts, by collecting data on the FDI flow network, extending the data further out, or providing more direct causal evidence on the political risk mechanism behind the power projection-financial power connection.

What of the relational vs. structural power debate? While British financial leadership does not appear to have depended on British economic size (much in contrast to contemporary predictions that China will be a leading player in global finance if it becomes the largest economy), British financial leadership hinged in part on particular capabilities (e.g. the British navy). On the other hand, endogenous network structures also clearly exhibited important pressure on the network, and past structures tended to persist. Thus, it is conceivable that an “unfit” leader might continue in their role for a long time, not because of any innate capabilities, but merely because financial networks cluster, and disruptions are costly. Some complexities of the story merit further attention, too. The Anglo-American transition occurred alongside a breakdown in the international financial system that saw network density decline overall. What does competition for financial leadership look like in an era of deglobalization?

What are the implications of this paper for the durability of American financial leadership today? While the Pax Americana and Pax Britannica have some differences,Footnote 125 they also have some similarities: they are liberal states that dominated power projection capabilities. Although the United States has no formal empire, it may derive some benefits of one (e.g. basing networks) and intercedes successfully on behalf of investor interests around the world.Footnote 126 The United States maintains some critical advantages even as China and Russia seek to establish alternatives to American-led institutions (e.g. SWIFT). Chinese power projection capabilities still lag the United States. Given the considerable expansion of Chinese overseas lending, this could represent a considerable vulnerability for China (and heightened great power competition might make it generally easier for states to expropriate FDI and default on debt). At the same time new technologies such as drones and guided missiles could potentially yield rapid shifts in such capabilities. Dramatic events such as the Ukrainian sinking of the Moskva, or attacks on Red Sea shipping by Houthi rebels may portent such shifts. This paper’s findings on the effects of liberalism highlight another potential issue for China. It may be difficult for China to reassure investors that their property is secure in China, because of the lack of constraints on the Chinese state. And it is liberal states that are more likely to integrate financially.

Supplementary material

The supplementary material for this article can be found at https://doi.org/10.1017/bap.2024.5.