China emerged as a global economic power under a system of state capitalism, a 21st-century addition to the taxonomy of the varieties of capitalism.Footnote 1 No variety of capitalism is static, however, and Chinese state capitalism appears to be transitioning towards a technology-assisted variant that we call “surveillance state capitalism.” The mechanism driving the emergence of this variant is China's corporate social credit system (qiye shehui xinyong tixi 企业社会信用体系) (CSCS) a data-driven project to evaluate the “trustworthiness” (xinyong 信用) of all business entities registered in the country. Running parallel to similar social credit evaluation systems for individuals, social organizations and even local governments,Footnote 2 the CSCS is linked to a regime of rewards and punishments for compliant and non-compliant firms. It was originally conceived as a self-enforcing mechanism to discipline market behaviour in the absence of a functional legal system in the period of economic transition; today, the CSCS represents a strategy of data-based monitoring to calibrate regulatory scrutiny and market access for all companies in China.Footnote 3

Striking in its ambition, the social credit system is “a complex, sweeping, government-wide initiative that reaches into every sector of the economy and touches on such issues as data collection, corporate regulation, finance, consumer advocacy, and geopolitics.”Footnote 4 The social credit system, of which its corporate component is a central but relatively understudied element, is an attempt to use data as the basis of a new operating system for society underpinned by notions of socialist legality rooted in compliance with state-led norms, detached from Western rule-of-law ideologies and practices.Footnote 5

The national and local infrastructure for CSCS is still far from complete, and the role the system will come to play in the Chinese political economy is an open question. To gain initial insight into the operation and potential implications of the CSCS, we provide the first empirical analysis of CSCS scores from Zhejiang province, as the Zhejiang provincial government is to date the only local government to publish the scores of locally registered firms. Several findings are noteworthy. We find no significant evidence that more profitable firms or firms with better governance (proxied by more independent boards of directors) receive higher overall scores. However, highly leveraged firms, subject to higher default risks, are associated with lower total scores. Perhaps most importantly, we find that, all else being equal, politically connected firms receive higher overall scores in Zhejiang than unconnected firms. The channel for this result is a “social responsibility” category that valorizes awards from the government and contributions to causes sanctioned by the Chinese Communist Party (CCP). This finding underscores the potential of the CSCS to incentivize corporate fealty to the CCP's industrial and social policies. While our results, based on the scores from a single province, have clear limitations, they provide an early window into the design characteristics, operation and potential implications of the CSCS for the country as a whole.

The paper proceeds as follows. The following section describes the principal features of the CSCS and situates them at the intersection of three contemporary phenomena in the global political economy: Chinese state capitalism, the surveillance state and surveillance capitalism. The subsequent section discusses the national administration of the CSCS and its local implementation in Zhejiang province. The penultimate section presents an empirical analysis of the scoring system in Zhejiang. The final section explores the potential implications of the CSCS for the Chinese political economy and corporate governance.

Corporate Social Credit and Surveillance State Capitalism

Overview

The CSCS is a programme to amass data on regulatory compliance, inspections, payments of taxes and court judgments, and civic conduct of business entities, and to generate publicly available social credit profiles that can be used by government agencies and market participants. “Social credit” in this context connotes “trustworthiness” or “compliance with obligations,” rather than loyalty to the CCP,Footnote 6 but the line between law and politics in China is blurred by the omnipresence of the CCP in all institutions and facets of society. Conceptually, the CSCS represents a market access regime in which only trustworthy enterprises participate, and trustworthiness is determined on the basis of data amassed and analysed by the party-state.Footnote 7

Planning for a comprehensive social credit programme to supplement China's weak legal system began in the 1990s, to address widespread fraud and corporate malfeasance as the country transitioned from central planning to a fledgling market economy.Footnote 8 Those efforts culminated in 2014 with the release of the Planning Outline for the Construction of a Social Credit System (2014–2020) (Shehui xinyong tixi jianshe guihua gangyao [2014–2020] 社会信用体系建设规划纲要[2014–2020]) (hereafter the 2014 Planning Outline), a comprehensive programme to evaluate the social credit of individuals, businesses, government entities and other organizations. Different rating standards and rules published by the local governments will be applied to each of the target groups. Today, the social credit system is also the centrepiece of China's digital governance strategy, marking a shift towards a self-regulating marketplace – that is, one in which actors are coerced and/or incentivized to conform their behaviour to norms established by the party-state beyond the ordinary channels of law and regulation.

The CSCS has two principal features. The first is nationwide data collection covering every company registered in China.Footnote 9 The data are drawn from a wide range of regulatory agencies, central and local governments, the judiciary and private platforms. Two basic types of information will be collected in the CSCS when it is fully operational: (1) public credit information, which is generated by a company's interactions with governmental organs and regulatory agencies, such as fines, judgments and business licenses; and (2) market credit information, which is generated by a company's interactions with other market actors, such as consumer complaints and data generated by credit rating agencies and industry associations. This information will be compiled in a social credit file tied to a Unified Social Credit Identifier, which is issued to every business entity. The data will be used in local-government-administered scoring systems, most of which are still under construction, to produce a searchable public credit score for every enterprise registered in the locality – from large, publicly listed firms to the corner barbershop.

The second principal element of the CSCS is a regime of rewards and punishments (in the form of “redlists” and “blacklists”) maintained by government agencies.Footnote 10 Some lists have broad reach, such as failure to satisfy court judgments, while others apply only to specific sectors of the economy, such as food or medicine.Footnote 11 Agencies at the national level stipulate the criteria for inclusion in a redlist or blacklist, but an entity is placed on a list by the local branch of the agency where the entity is registered. An entity's inclusion on a redlist or blacklist becomes part of its CSCS file and is a matter of public record. Blacklist and redlist information is centralized and may trigger rewards or punishments by other agencies – the “joint rewards and punishments mechanism” (lianhe jiangcheng jizhi 联合奖惩机制), increasing the system's behaviour-modification potential.Footnote 12

Inclusion in a redlist can confer a variety of benefits, ranging from expansion of access to loans to a reduction in the frequency of inspections. Redlisting also raises the entity's CSCS score in the locally administered system, which increases opportunities in public procurement processes and access to financing, particularly for small and medium-sized entities. Inclusion in a blacklist triggers market barriers such as restrictions on obtaining government approvals, greater frequency of inspections, and prohibitions on obtaining credit or issuing stock. Blacklisting also lowers an entity's CSCS score in the locally administered system. When an entity is placed on a blacklist, its legal representative and those individuals directly responsible for the infraction will also be blacklisted.Footnote 13 In some situations, the CSCS will require that businesses monitor the social credit files of their suppliers and business partners.Footnote 14

The CSCS is not only directed at monitoring and modifying the behaviour of market actors. It is also a major advance in Beijing's long-standing objective of using technology to increase the efficiency and scalability of government processes. In its Guiding Opinions on Accelerating the Construction of a Social Credit System and Building a New Credit-based Supervisory Mechanism (Guanyu jiakuai tuijin shehui xinyong tixi jianshe goujian yi xinyong wei jichu de xinxing jianguan jizhi de zhidao yijian 关于加快推进社会信用体系建设构建以信用为基础的新型监管机制的指导意见) (hereafter the 2019 Guiding Opinions), the State Council depicted social credit as the basis for government supervision over market entities and called for the building of “credit-score-based supervision” (xinyong fenji fenlei jianguan 信用分级分类监管). Based on the ratings given in accordance with the public credit scores, highly rated companies will be subject to less supervision; low-rated companies will be warned and subject to heightened supervision by local government agencies. In this sense, the CSCS is an advanced incarnation of nascent regulatory technology or “regtech” initiatives around the world, in which analogue-era regulatory strategies are shifted to digital and computational models.Footnote 15

Towards surveillance state capitalism?

The preceding overview of the CSCS raises questions about its potential impact on the Chinese political economy. As previously noted, it was envisioned as a means of building trust among economic actors and improving market performance through enhanced corporate compliance and law enforcement. In this respect, the CSCS resembles an enhanced version of existing credit rating systems and nascent regtech initiatives found throughout market economies. But when situated in existing, CCP-centric corporate governance institutions and practices, and given the pervasive efforts of the CCP to inculcate fealty to its political objectives and eliminate regime threats, the CSCS begins to look like a means of fusing Chinese state capitalism with the surveillance state. If this outcome is realized, CSCS will lead China's transition to what we call surveillance state capitalism.

The current form of Chinese state capitalism is broadly characterized by a combination of capitalist institutions – corporations and markets – and pervasive party-state influence over the financial system and business sector,Footnote 16 both through formal mechanisms such as state-owned enterprises (SOEs) and CCP committees internal to large firms, and through informal channels of persuasion and coercion facilitated by the CCP's supra-legal status in the political economy.Footnote 17 The CSCS is potentially a powerful means of tightening the party-state's monitoring of all companies in China, regardless of their ownership structure, by leveraging the power of data collection and analysis.

The CSCS would not be possible without the ability to collect and analyze enormous amounts of data generated by the interactions of businesses with regulators, courts and other market participants. Before the full-blown emergence of the modern surveillance state, scholars noted that authoritarian regimes faced difficulties in collecting information due to the lack of an independent press and civil society organizations.Footnote 18 Indeed, although China under the CCP has a long history of politically motivated surveillance, until relatively recently the effort was decidedly low tech, relying primarily on a network of local informants in neighbourhoods, schools and workplaces. The advent of AI, biometric identification systems and the digitization of policing and other government procedures has dramatically altered the capacity of authoritarian regimes to monitor and influence the behaviour of their populations in real time.

Beijing has long pursued the goal of assembling a vast, sophisticated network of interrelated technologies to predict, identify and neutralize perceived threats to the regime before they materialize.Footnote 19 Human Rights Watch concludes that the “Chinese government is perfecting a system of social control that is both all-encompassing and highly individualized, using a mix of mechanisms to impose varying levels of supervision and constraint on people depending on their perceived threat to the state.”Footnote 20

China's big tech companies have served as proving grounds for the government's efforts to connect huge, disparate data sets.Footnote 21 Huawei, Alibaba, Tencent and other Chinese companies have collaborated in the creation of a meta-database (the National “Internet + Monitoring” System guojia “hulianwang + jianguan” xitong 国家“互联网+监管”系统) that integrates monitoring and credit information on companies from a wide range of government, commercial and e-commerce sources.Footnote 22 More recently, at the request of Beijing, Ant Group, the financial services affiliate of Alibaba under the control of Jack Ma 马云, contributed its data on consumer loans and personal credit to a new credit scoring joint venture with SOEs.Footnote 23

The goal of obtaining massive surveillance capacity on market behaviour to generate inputs for the CSCS has obvious parallels to what has come to be known as surveillance capitalism, which may loosely be defined as the use of data on human behaviour as raw material for a new form of market exchange.Footnote 24 In surveillance capitalism, the “behavioural surplus” generated by user interactions with a platform or app is claimed as the property of private firms for the generation of profits; and thus, the power over this data is held in the first instance not by the state, but by “surveillance capitalists” such as Facebook and Alibaba.Footnote 25

In developing the CSCS, the Chinese government has embraced the basic logic of surveillance capitalism,Footnote 26 but turned that logic on its head. The data used in the CSCS is not principally accumulated by private companies but by government organs at the national and local level, as business entities interact with regulatory agencies and the courts. More importantly, in the CSCS, data generated by human behaviour (conducted via business organizations) is not commodified for private profit; rather, it is amassed and analysed in service of the party-state's interests – market surveillance and behaviour modification in conformity with its policy objectives.Footnote 27 It is a striking manifestation of the Chinese leadership's Schumpeterian confidence in the ability of a rational bureaucracy to assess market competence.

Thus, conceptually, the CSCS is much more than an automated version of a credit rating agency such as Moody's or S&P. It is an enormously ambitious regtech approach to improved corporate compliance and governmental supervision, filling enforcement gaps in the Chinese legal system and shortcomings in regulatory capacity. If its potential is fully realized – a significant “if,” given the demands the system will place on accurate data collection and its effective centralization and downstream use by local governments – the CSCS will supply a technological solution to existing limitations on party-state control over the corporate sectorFootnote 28 and propel the emergence of a powerful, data-driven variant of Chinese state capitalism. The role the CSCS will ultimately play in China, however, depends on its implementation at both the national and local levels, the subject to which we now turn.

Administration and Implementation of the CSCS

The CSCS is administered at the central level by the National Development and Reform Commission (NDRC), a powerful state planning agency, and the People's Bank of China, the central bank. The State Administration for Market Regulation, an antitrust authority, is also involved, as it collects a large amount of data on enterprises and maintains a “heavily distrusted entities list” (yanzhong weifa shixin mingdan 严重违法失信名单), which is fed into the sanctioning mechanism of the CSCS. An inter-ministerial conference composed of numerous government agencies and Party bodies coordinates the sharing of information and imposition of sanctions.Footnote 29

Publication of the 2014 Planning Outline touched off a “waterfall effect” of government agency involvement in the CSCS at descending levels of government.Footnote 30 But the CSCS in operation today is not a unified, standardized system. Overarching design features such as grading and punishment systems and policies on technical issues such as the scope of data collection and storage are established at the national level.Footnote 31 Each provincial, city and district government is responsible for setting up a CSCS to score firms registered in its locality. A digitized evaluation system to generate a score for each registered enterprise will eventually be established locally throughout the country.Footnote 32

Implementation of the CSCS at the local level is most advanced in Zhejiang province. Zhejiang is one of the most economically developed coastal provinces and home to a thriving private sector, including Alibaba Group. Zhejiang is also a frontrunner in building the assessment model for public credit, which is the core of an enterprise's overall social credit assessment, and the only province that has made the public credit scores publicly available thus far.Footnote 33 As of June 2021, the Zhejiang government had completed public credit assessments for 3 million business enterprises.Footnote 34

According to the Guidelines for the Evaluation of the Public Credit of Five Types of Subjects in Zhejiang Province (2020 Version) (Zhejiang sheng wulei zhuti gonggong xinyong pingjia zhiyin [2020 ban] 浙江省五类主体公共信用评价指引[2020版]) (hereafter the 2020 Zhejiang Guidelines), the enterprise public credit scores are evaluated under three levels of indicators (see the Appendix for Zhejiang province's evaluation and scoring system). The first-level indicators include the following five components: Basic Data, Finance and Taxation, Governance, Compliance and Social Responsibility. The 2020 Zhejiang Guidelines assign different weights to each component, following industry practice and expert recommendations. The total possible score is 1,000, of which Basic Data accounts for 80 points (8 per cent of the total), Finance and Taxation 195 points (19.5 per cent), Governance 90 points (9 per cent), Compliance 450 points (45 per cent), and Social Responsibility 185 points (18.5 per cent). Second- and third-level indicators break down those components and scores into more fine-grained subsets. As noted above, public credit information refers to the data or information collected by government bodies or legally authorized administrative bodies in the performance of their duties or in the process of providing public services.Footnote 35 The scores, therefore, do not currently contain market credit information generated by consumers, industry associations, etc. or information voluntarily provided by the enterprises, such as financial and management performance. The Appendix shows the content and weighting of data for all three levels of indicators.

The Basic Data indicator aggregates information on key corporate personnel and the business itself to determine if dishonest acts or abnormal operations have occurred. Points are deducted if an enterprise's directors, actual controllers or other key personnel are listed as having committed serious dishonest acts by any government agency, or if they have failed to satisfy a court judgment. Finance and Taxation aggregates information on the creditworthiness of the enterprise. Points are deducted if the enterprise failed to pay debts, social insurance fees or taxes. Governance aggregates information related to an enterprise's product quality, safety record and environmental compliance. Points are deducted for poor inspection results and accidents. The Compliance indicator aggregates information on an enterprise's record of compliance with a wide range of agencies and judicial authorities, with deductions for administrative penalties, criminal conduct and other enforcement actions. Social Responsibility aggregates information on redlisting, awards from government organs and charitable donations. Unlike the format of the other indicators, in which points are deducted from the base score to penalize bad conduct, in the Social Responsibility category the base score is zero and points are added for good behaviour.

To gain insights into the implementation of the CSCS in Zhejiang province, we collected publicly available scores on the Zhejiang provincial government website as of 1 July 2021. All 531 A-share listed companies headquartered in Zhejiang are included in our sample. According to the 2020 Zhejiang Guidelines, scores range from 0 to 1,000 and on this basis enterprises are rated as “excellent” (greater than or equal to 850), “good” (800–849), “average” (750–799), “fair” (700–749) or “poor” (less than 700). Table 1 and Figure 1 present the distribution of ratings and scores.

Table 1. Distribution of Ratings and Scores

Figure 1. Kernel Density Plot of Public Credit Scores

Notes: Kernel = epanechnikov, bandwidth = 5.0000.

As is evident from Table 1, ratings are not equally distributed. Of all the firms, 74.2 per cent are rated “excellent,” while only about 2 per cent are rated “fair” or “poor.” Overall, around 90 per cent of the firms are rated “excellent” or “good.” The high average ratings may be indicative of the comparatively high quality of listed firms in this economically developed region of China, or may signal poor-quality data in the system. Further analysis will have to await publication of scores over time in Zhejiang or in other provinces. As mentioned, the NDRC established the new credit-score-based supervision linking a firm's performance in the public credit rating system to the intensity of regulatory oversight. Following the national policy, Zhejiang has strengthened supervision of firms rated “fair” and “poor” as well as those included in a national blacklist.Footnote 36

While no firm received a perfect score, the average score of 864.39 carries an “excellent” rating. The summary statistics in Table 1 and the Kernel density estimation plot in Figure 1 provide additional information about variations in scoring. The total scores range from 541 to 935 and the distribution concentrates and peaks between 850 and 900. The distributions of the first four categories as shown in Figure 1 are skewed towards the maximum scores. The only exception is the Social Responsibility category, where the distribution peaks between 50 and 75 (out of 185) and scores show the largest variation. The empirical analysis in the next part will underscore the significance of high variability in Social Responsibility scores.

For additional perspective on the distribution of scores and what might be thought of as the “future payoff opportunity” for firms with respect to each indicator, we calculated the mean score for all firms as a percentage of total points possible with respect to each first- and second-level indicator. As shown in Figure 2, the mean scores for the first four first-level indicators are all above 96 per cent. The mean score for Basic Data is 99.34 per cent, potentially calling into question its usefulness in the Zhejiang CSCS, at least at this early stage of implementation. The mean score of first-level indicators is lowest for Social Responsibility, at 38.25 per cent. This suggests the largest future payoff to effort may be found in actions such as donations, volunteer work and obtaining awards from the government. Perhaps not coincidentally, these are precisely the areas of emphasis in President Xi Jinping's current campaign to reduce income inequality, promote pro-social contributions by wealthy individuals and private corporations and increase loyalty to the Party.

Figure 2. Mean Scores (Percentage) of First- and Second-level Indicators

Figure 2 also shows differences in mean scores in percentage terms for second-level indicators. Firms obtained the lowest mean scores for Honesty Record (58.29 per cent) – which adds points for government awards and redlisting – and Charity (1.25 per cent). Charity aggregates information on volunteer services in Party-sanctioned activities and donations to social organizations recognized by the party-state. Since 88 per cent of our sample firms are not SOEs, the low mean score for volunteer services probably results from low levels of participation in CCP-sanctioned activities. Looking forward, the opportunity to gain points in the Social Responsibility category by participating in Party-endorsed activities may nudge non-state firms to demonstrate greater fealty towards the CCP.

Focusing on the nuances of the scoring system in this way highlights the potential of the CSCS to tighten linkages between the corporate sector and the party-state and to modify corporate behaviour consistent with CCP policy objectives. To delve deeper into the operation and potential of the CSCS, we now turn to a more rigorous analysis of the early scores in Zhejiang province.

Empirical Analysis of Zhejiang Public Credit Scores

The CSCS is a first-of-its-kind comprehensive, data-based corporate scoring system implemented in the world's second largest economy. Investigating the determinants of scores in the CSCS is therefore important as a matter of theory – to test the understanding of what market “trustworthiness” means in China – and practice – to provide insights into the potential effects of the CSCS on firm behaviour and economic performance. Previous literature on corporate governance and compliance as well as Chinese state capitalism suggest four factors that may be influential in determining a firm's corporate social credit score: corporate governance, financial condition, state ownership and Party fealty, and political connections.

Corporate Governance: The CSCS is a means of evaluating a firm's legal compliance and market conduct. Firms with better corporate governance may be expected to receive higher CSCS scores, owing to more robust compliance programmes or heightened board sensitivity to legal risk. Introducing independent directors to boards has been the long-standing focus of major corporate governance reforms in Asia, and the percentage of independent directors on a company's board is one of the key indicators used in corporate governance assessments globally. For our regression model, we use the percentage of independent directors on the board to proxy for the quality of corporate governance.

Financial Condition: Since the CSCS measures creditworthiness (or “trustworthiness”), a firm's financial condition might also be expected to affect its social credit score. All else being equal, more highly leveraged and less profitable firms have a higher probability of defaulting on debts and potentially less capacity to satisfy judicial awards and administrative penalties. We use leverage ratio and return on assets to assess a firm's financial condition.

State Ownership and Party Fealty: Notwithstanding the ostensibly neutral quality of the CSCS, the policy context in which it has been developed is obviously relevant to its implementation. As outlined above, the CSCS is part of a sweeping project to combine surveillance of regime threats with enhancement of government functions. As such, it is plausible that direct connections to the party-state in the form of state equity ownership and overt signals of fealty to the CCP would be associated with higher social credit scores. We use a combination of variables to test the degree to which party-state linkages affect credit scores: (1) a firm's status as an SOE or privately owned enterprise (POE), (2) the state's percentage equity ownership in a firm, and (3) whether a firm has adopted charter amendments in response to a corporate “Party-building” (dangjian 党建) policy launched by the CCP in 2015.Footnote 37

Political Connections: Examining only formal linkages between enterprises and the party-state may be misleading. Previous literature has indicated that state equity ownership is an imperfect measure of the degree to which a firm accedes to government and Party policy, and the line between SOEs and POEs is blurred in China.Footnote 38 Political connections are important to private firm growth in China and serve as a form of protection for large Chinese firms in a weak-rule-of-law environment.Footnote 39 Prior studies have documented the link between political connections and a host of economic, legal and political outcomes, including the likelihood of listing shares on a Chinese stock exchange in an initial public offering,Footnote 40 accessing external financeFootnote 41 and formally acceding to Party policy.Footnote 42 Politically connected firms may obtain higher social credit scores because they are more likely to be redlisted or because they receive greater protection against adverse administrative and judicial actions than unconnected firms.

We ran ordinary least squares (OLS) regressions on public credit scores published by the Zhejiang government and measured the effect of the above independent variables on total scores. We estimated the following OLS regression specifications:

$$Scores_i = \alpha _i + \beta _1\;\;PercentageIndependentDirectors_{i\;} + \beta _2Leverage_{i\;} + \beta _3ROA_{i\;} + \beta _4SOE_{i\;} + { + } \beta _5\;PercentageStateShareholding_{i\;} + \beta _6PartyBuildingReform_{i\;} + \beta _7PoliticalConnections_{i\;} + X_{\;i} + \varepsilon _i$$

$$Scores_i = \alpha _i + \beta _1\;\;PercentageIndependentDirectors_{i\;} + \beta _2Leverage_{i\;} + \beta _3ROA_{i\;} + \beta _4SOE_{i\;} + { + } \beta _5\;PercentageStateShareholding_{i\;} + \beta _6PartyBuildingReform_{i\;} + \beta _7PoliticalConnections_{i\;} + X_{\;i} + \varepsilon _i$$Scores are the public credit scores of the sample firms in Zhejiang derived from the comprehensive public credit assessment based on government records. X i represents three control variables: Firm Size (log of a firm's total assets), Firm Age and Book-to-Market Ratio. The existing literature shows that larger firms are more likely to be politically connected; therefore, we include Firm Size as a control variable to test the effect of political connections on CSCS scores. We obtained data on the percentage of independent directors on the board (Percentage Independent Directors), Leverage, return on assets (ROA), SOE dummy and percentage of shares owned by the state and state-owned legal person shares (Percentage State Shareholding) from the China Stock Market and Accounting Research Database (CSMAR) and the Wind Economic Database (WIND). The Independent Directors variable is defined by Chinese securities law and regulations. The Party-building Reform variable evaluates the extent to which a firm is susceptible to CCP influence. Since 2015, the CCP has engaged in the Party-building reform, whereby SOEs are required to make their internal Party committee an official governance organization. Some non-SOEs have also voluntarily adopted Party-building provisions in their corporate charters.Footnote 43 The dummy variable, which identifies firms that responded earlier to the CCP's call to formalize the role of the Party in their governance, equals one if a firm had amended its corporate charter to include Party-building provisions before 31 December 2018 and zero otherwise.Footnote 44 The Political Connections variable assesses whether any director or chief executive officer (CEO) of a firm is connected with the government or CCP, such that the individual may be able to exert political influence. To assess whether a given firm is politically connected, we follow existing literature and identify formal Party or government positions held by corporate executives.Footnote 45 We obtained data on the government or Party-related positions held by each director and CEO from CSMAR. There are six main levels in the Chinese bureaucracy: ministry (bu 部), department (ju 局), division (chu 处), section (ke 科), staff member (keyuan 科员) and clerk (banshiyuan 办事员). We coded a director or CEO as politically connected if he or she has served in certain government or Party positions at or above the division level. We then constructed a dummy variable, Political Connections, that equals one if a firm has at least one politically connected director or CEO, and zero otherwise. As a robustness check, we constructed two other measures: a dummy variable of directors (not including the CEO) having political connections and the percentage of directors having political connections (see the Online Supplementary Materials). Since the CSMAR data on top executive employment is only available up to March 2018, we only included 414 Zhejiang sample firms listed on stock exchanges before March 2018 in the regression analysis. To avoid the influence of outliers, we winsorized financial variables (Leverage, ROA, Firm Size, and Book-to-Market Ratio) at 0.5 per cent.

Table 2 shows the summary statistics of all variables. On average, 37 per cent of the directors in the sample firms are independent – just over the minimum threshold of one-third set by the China Securities Regulatory Commission. Only 15 per cent of the sample firms are SOEs and the average state shareholding in sample firms is only 1 per cent. This is consistent with the general perception that Zhejiang is a powerhouse for private and small and medium-sized enterprises. However, one-quarter of the firms have amended their corporate charters in compliance with the Party-building policy and 54 per cent of sample firms have at least one politically connected director or CEO. SOE status is (not surprisingly) correlated with state shareholding percentage, firm size, firm age and book-to-market ratio. However, all variables passed the generally accepted VIF test for multicollinearity (see Online Supplementary Material).

Table 2. Summary Statistics

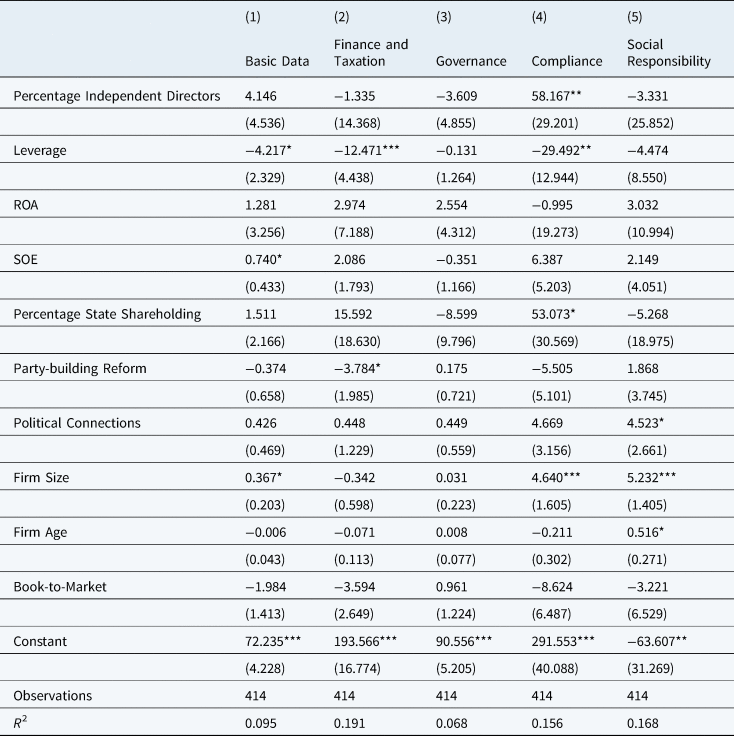

We ran regressions on the total scores and sub-scores of first-level indicators respectively. Table 3 shows the OLS regression results on the total scores. Models (1) to (4) examine the relationship between credit scores and corporate governance, financial condition, state ownership and Party fealty, and political connections indicators, respectively. Model (5) examines these factors together.

Table 3. OLS Regression on the Determinants of Corporate Social Credit Scores

Notes: Robust standard errors in parentheses. All models include industry and city fixed effects.

*p < 0.10, ** p < 0.05, *** p < 0.01

These results are contrary to some plausible conjectures based on the design and context of the CSCS and consistent with others. Contrary to expectations, the quality of corporate governance, at least as proxied by the percentage of independent directors, is not correlated with higher total scores. Nor are formal connections to the party-state in the form of status as an SOE, state equity ownership, or signalling of fealty to the CCP. Although SOE is positively correlated with scores in Model (3), the significance of the result disappears when controlling for other variables in Model (5). Consistent with expectations, leverage is negatively associated with scores as it may be associated with higher rates of default and non-performance of other obligations which are a major focus of the CSCS. The result remains after controlling for other variables in Model (5) (significant at the 5 per cent level in both models). A 1 per cent increase in leverage ratio decreases scores by 50.785. By contrast, profitability is not significantly associated with higher scores. This may be a natural result of a system designed to measure legal compliance rather than financial performance. But this result may raise questions about the impact of the CSCS on the Chinese economy: will it lead corporate managers to focus on maximizing scores in ways that harm their financial performance?

Most importantly, consistent with findings in other areas of the Chinese economy, political connections matter in the CSCS: Political Connections is significantly associated with higher scores in Model (4) (significant at the 5 per cent level) and the result remains robust after controlling for other variables in Model (5). (Also consistent with prior literature, a politically connected private firm may have more influence with the state than an SOE whose only connection to the state is via equity ownership.) In unreported regressions, the positive correlation holds when using a dummy variable of directors (without the CEO) having political connections (significant at the 5 per cent level) and the percentage of directors having political connections (significant at the 10 per cent level) (see Online Supplementary Material). Despite the fact that “trustworthiness” has no overt political connotations in the CSCS, it is significant (if not surprising) that politically connected firms have advantages in a scoring system designed by the party-state to serve its interests. As demonstrated in the summary statistics discussed above, the payoff to effort is high under the Social Responsibility indicator, where scores can be boosted by participating in activities endorsed in CCP policy and garnering awards from the government.

To obtain a finer-grained understanding of the association between CSCS scores and our variables of interest, we ran a regression on the sub-scores in each first-level indicator.Footnote 46 Table 4 shows the regression results. SOEs score higher under the Basic Data indicator, which measures the trustworthiness of key corporate personnel and the operation of a business. Percentage of State Shareholding is significantly correlated with scores in the Compliance indicator. A 1 per cent increase in the percentage of state shareholding increases Compliance scores by 53.073. Even though party-state control variables are not correlated with total scores, the regression results in sub-scores suggest that firms with formal linkages to the party-state have moderately better compliance records. (This may be due to superior compliance functions in firms with more state shareholding, or the difficulty of sanctioning firms connected to the state.) Percentage Independent Directors is also associated with higher Compliance scores. A 1 per cent increase in the percentage of independent directors increases Compliance scores by 58.167, statistically significant at the 5 per cent level. (More independent boards may produce superior compliance records, consistent with our conjecture above. Less plausibly, firms with good compliance programmes require higher percentages of independent directors.) Amplifying the results in Table 3, Leverage is negatively correlated with each of the Basic Data, Finance and Taxation and Compliance categories, suggesting that the overall scores of more heavily indebted firms are dragged down by a range of credit history and compliance problems. ROA is again uncorrelated with scores.

Table 4. OLS Regression on the Determinants of First-level Sub-scores

Notes: Robust standard errors in parentheses. All models include industry and city fixed effects.

*p < 0.10, ** p < 0.05, *** p < 0.01

Consistent with the analysis above, Political Connections is positively correlated only with the sub-score for Social Responsibility. Thus, our findings indicate that politically connected firms receive higher total CSCS scores by accumulating soft merits from party-state organs; we find no evidence that such firms have better compliance records or other indications of superior “trustworthiness” as market actors.Footnote 47 Whether the high payoff potential of political connections in the Social Responsibility category is a bug or a design feature of the CSCS remains to be seen. It will be important to analyze whether political connectedness is a channel for higher scores in other provinces and throughout the CSCS over time.

To test the robustness of our results, we conducted several alternative (unreported) regressions. First, to address the concern that scores are skewed towards the high end, we ran an OLS regression against the log of the scores as the dependent variable and found results similar to those reported in Table 3. Second, since the scores are capped at 1,000 points, we ran additional Tobit and Fractional Response Logit regressions to address the concern that the dependent variables are possibly censored or measured within a bounded range. The results of these regressions are similar to the OLS results, with Leverage negatively and Political Connections positively correlated with the scores (see the Online Supplementary Materials).

Implications and Questions

The long-standing objective of ensuring market behaviour deemed trustworthy by the party-state is an increasingly prominent feature of Chinese state capitalism. As enormous wealth and data have been accumulated by private firms outside the direct control of the state, demands for political conformity in corporate governance and regulatory compliance have increased. The most recent manifestations of this trend are the government's regulatory crackdown on many of China's leading big data firms and the state's investment in “special management shares” (teshu guanli gu 特殊管理股) with veto rights and board representation in major internet content companies.

This paper provides early evidence suggesting that the CSCS, as a data-driven system of evaluation, rewards and punishments for every company in the country, is not simply a credit rating system or law enforcement mechanism, as it has generally been portrayed. Rather, the CSCS is a policy channellingFootnote 48 tool of potentially far-reaching significance. As CCP policy priorities change over time, the CSCS scoring system can be readily adjusted by local governments to incentivize and reward policy compliance and political conformity. Consider, for example, the potential of the “social responsibility” category to shape corporate behaviour going forward. Our findings indicate a high payoff potential in the CSCS scoring system for corporate managers who prioritize CCP policy compliance and local government ingratiation over profit maximization.Footnote 49

To be sure, the scoring platform's malleability could potentially be a strength as well as a hazard, producing salutary incentive effects on corporate behaviour. For example, compliance with additional regulatory regimes, such as those for the capital and labour markets, could be subject to scoring. Perhaps most promising would be the incorporation of meaningful environmental, social and governance (ESG) metrics into the CSCS scoring system. In the best possible scenario, the CSCS will induce more scrupulous regulatory compliance and corporate creditworthiness, generating economic benefits for the country as a whole, consistent with one academic hypothesis.Footnote 50

But several more problematic potential consequences of the CSCS are also apparent. For example, scoring systems may be corrupted by powerfully connected companies, or by local government officials in order to raise the scores of local companies (and thereby enhance their own career progression). Another possibility is that the CSCS will be used as a means of ensuring that all market actors comply with Beijing's prevailing industrial policy and political agenda. Even if the CSCS is not taken to an Orwellian extreme, it could prompt a revival of the impulse towards central planning, as the system harnesses the technological means to overcome many of the information and incentive problems that doomed this approach to economic management long ago. China's CSCS strategists will need to take care, lest their scoring systems nudge Chinese companies into competitive dead ends or serve as an unproductive distraction to managers. Finally, if the benefits of political connections via the “social responsibility” channel are replicated throughout the country, foreign registered firms may face additional disadvantages in Chinese markets.

Our results, based on the initial scores in a single province, have clear limitations; a more complete picture of the CSCS must await publication and analysis of scores in other provinces and accumulation of data over time. It is too early to determine exactly how effectively the CSCS will be implemented nationwide, let alone how it will evolve over time and the role it will play in the Chinese political economy. As more data become available, future research can be done to evaluate how corporations respond to this form of monitoring and evaluation. For example, how will firms respond to blacklisting – is it a death knell or an impetus to reform? Will companies game the CSCS system by “managing what gets measured” so as to obtain “excellent” ratings? How effectively will CSCS scores predict significant corporate outcomes, such as bankruptcies or compliance-related scandals?

Despite the early stage of our research, we believe analysis of the first available CSCS scores has raised some meaningful questions and opened new avenues of inquiry at what may be the dawn of Chinese surveillance state capitalism.

Acknowledgements

We thank Yun-chien Chang, Yu-Jie Chen, Colleen Honigsberg, Wendy Leutert, Julian Nyarko and participants at the Global Corporate Governance Colloquium of the European Corporate Governance Institute; Stanford Public Policy Workshop; Faculty Workshop at Washington University in St Louis, School of Law; Conference on Empirical Legal Studies in Asia; Asia Pacific Research Center of the Freeman Spogli Institute; Asian Law Scholars Workshop; and Social Credit Workshop for helpful comments on earlier drafts.

Funding information

Lauren Yu-Hsin Lin received funding from the Research Grants Council of the Hong Kong Special Administrative Region, China, Project No. CityU11605722.

Competing interests

None.

Supplementary material

The supplementary material for this article can be found at https://doi.org/10.1017/S030574102300067X.

Lauren Yu-Hsin Lin is a Visiting Professor of Law, Washington University in St. Louis, School of Law; Associate Professor, City University of Hong Kong, School of Law; and a Member of the European Corporate Governance Institute.

Curtis J. Milhaupt is the William F. Baxter-Visa International Professor of Law, Stanford Law School; Senior Fellow, by courtesy, Freeman Spogli Institute for International Studies, Stanford University; and a Member of the European Corporate Governance Institute.

Appendix: Summary of Zhejiang Province Indicators for Public Credit Evaluation of Enterprises