Article contents

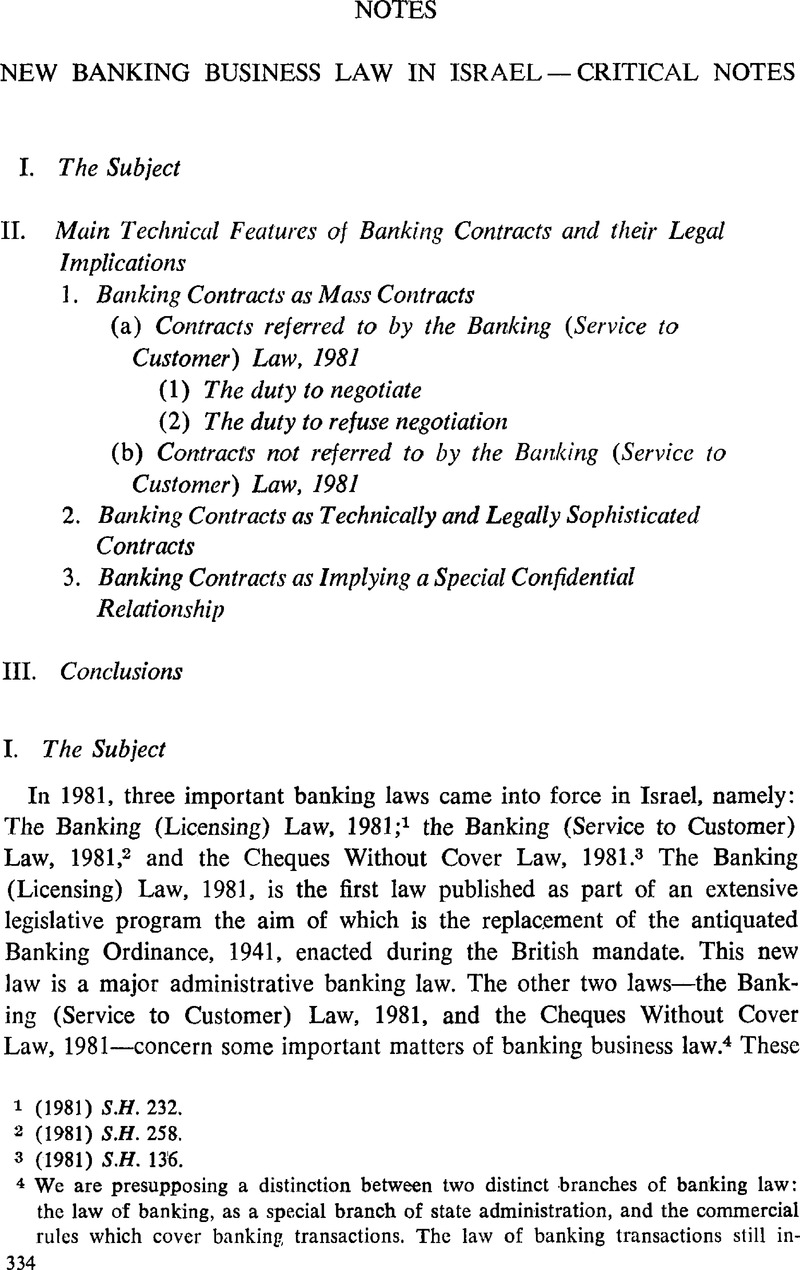

New Banking Business Law in Israel—Critical Notes

Published online by Cambridge University Press: 12 February 2016

Abstract

- Type

- Notes

- Information

- Copyright

- Copyright © Cambridge University Press and The Faculty of Law, The Hebrew University of Jerusalem 1982

References

1 (1981) S.H. 232.

2 (1981) S.H. 258.

3 (1981) S.H. 136.

4 We are presupposing a distinction between two distinct branches of banking law: the law of banking, as a special branch of state administration, and the commercial rules which cover banking transactions. The law of banking transactions still ineludes two different kinds of rules: rules covering the bank-customer relationship in general, and those which govern the various banking transactions in particular. From this point of view, the Banking (Service to Customer) Law, 1981, is basically a general commercial banking law; the Cheques Without Cover Law, 1981, relating to a major incident which may occur in the conduct of a banking account, may be considered as specific commercial banking law.

5 The full English texts of the Banking (Service to Customer) Law, 1981, and Cheques Without Cover Law, 1981, appear at the end of this article.

6 (1981) S.H. 128.

7 I discussed the above phenomenon, its causes and main consequences in my doctoral thesis, The Juridical Nature of the Bank-Depositor Relationship (Jerusalem, 1977) 17 ff.

8 For the purpose of the above comments we prefer the legal concept of “banking contract” usually adopted in Continental countries, to the more technical term “banking business” or “banking transaction” generally accepted in Common Law countries.

9 27 L.S.I. 117.

10 18 L.S.I. 51. While this article was already at the press the Standard Contracts Law, 1964, was repealed by the Standard Contracts Law, 1982 ((1982) S.H. 8). The main purpose of the new law clearly consists in protecting customers from conditions in standard contracts which are likely to prejudice customers, or to confer an unfair advantage upon the supplier. See in particular secs. 1, 3 and 4.

11 See sec. 15. For example, sec. 15 (1) relates to clauses of exclusion of liability by considering as a restrictive term a term which “excludes or limits any liability of the supplier towards the customer, whether contractual or legal, which would have existed but for such term”.

12 See see. 14.

13 2 L.S.I. [N.V.] 198.

14 The main provision is sec. 36, which states:

“Subject to the provisions of this article, a copy of an entry in a banker's book shall in all legal proceedings be received as prima facie evidence of such entry and of the matters, transactions or accounts recorded therein”. Sec. 37 indicates the conditions for a copy on an entry in a banker's book to receive the above treatment, and sec. 35 defines a “banker's book”.

These provisions are of English influence. See the Bankers' Books Evidence Act 1879, secs. 3, 4 and 5.

15 In England, for example, see Chorley, “The Law of Banking as it Affects the Ordinary Business Customer”, (1960) J. Bus. L. 40, who writes:

“The first thing to say is that most of banking law is not a separate field in itself, but only a selection of rules from the general law which happen to affect banking; and the effect of this is that decisions on banking matters are made difficult by the fact that the courts have to bear in mind not only the special needs of the case, but also the broader requirements of the law in general, as for instance the law of contract.” In France, see, for example: Rodière, R. and Rives-Lange, J.-L., Droit Bancaire (Paris, 3rd ed., 1980) 72 ff.Google Scholar; Ripert, G. and Roblot, R., Traité Élémentaire de Droit Commercial, vol. II, (Paris, 9th ed., 1981) 283 ff.Google Scholar Italy and some socialist countries, as Hungary and Czechoslovakia, arc exceptions, since some degree of codification in banking law was achieved in those countries. In Italy, see arts. 1834 to 1860 of the Civil Code of 1942. On the situation in socialist countries, see Meznerics, I., Law of Banking in East-West Trade (Budapest, 1973) at 28, 29.Google Scholar

16 See examples at p. 336 next to notes 11 and 12.

17 See Ben-Oliel, R., “Banking Liability and Risk in Opening an Account” (1982) 12 Mishpatim 60.Google Scholar In that article we contended that a banking account is usually opened under the rules of an invitation to deal. In our opinion the above conclusion is applicable, mutatis mutandis, to the process of making most banking contracts.

18 See ibid., at 63 ff.

19 According to sec. 2 (a) of the above law, those services are as follows: the acceptance of monetary deposits in Israeli currency or in foreign currency; the opening of a current account in Israeli currency from which monies may be drawn on demand by cheque; the sale of banker's cheques in Israeli currency and in foreign currency; the doing of an act which according to the Currency Control Law, 1978, and the permits thereunder, may only be done through an authorized dealer.

The obligation for banks to grant the above services is justified by the legislature as being the result of the monopoly conferred upon banking corporations to grant those services. See commentary to sec. 2 of the Banking (Service to Customer) Bill, in (1980) H.H. 106.

20 32 L.S.I. 134.

21 See sec. 2 (d) of the Banking (Service to Customer) Law, 1981. See comment in n. 23.

22 The above is the situation in socialist countries. See I. Meznerics, supra, n. 15 at 34 ff.

23 The concept of “reasonable cause” is certainly a broad, vague concept which may include, in our opinion, reasonable objective and reasonable subjective causes. A reasonable subjective case is a well-founded intuition or suspicion by the banker of the potential customer. In France, for example, C. Garalda, when considering the opening of an account, in “Les Refus du Banquier” (1962) 12 J.C.P.I. wrote: Le refus de la banque peut être sur des craintes, sur une suspicion peut-être légitime mais intuitive. Le Runch du banquier lui laisse percevoir intuitivement un risque non susceptible d'être caractérisé. Des informations confidentielles ne peuvent pas parfois être dévoilées”. This opinion may well apply to the making of most banking contracts.

24 See sec. 2 (b) of the Banking (Service to Customer) Law, 1981.

25 See sec. 7 of the Banking (Service to Customer) Law 1981. Note that sec. 7 applies to every banking contract performed by every kind of banking corporation and not only to those contracts indicated in sec. 2 (a).

26 See sec. 12 (b).

27 See sec. 15.

28 See sec. 10.

29 See sec. 11.

30 See sec. 12 (a).

31 See sec. 12 (b).

32 See sec. 12 (c).

33 Sec sec. 16.

34 We discussed extensively the above matter in our study “Banking Liability and Risk in Opening an Account”, supra, n. 17.

35 See R. Ben-Oliel, supra, n. 17 at 69 ff. and 96 ff.

36 Execution (Amendment) Law, 1968 (23 L.S.I. 19) and see sec. 81A of the Execution Law, 1967 (21 L.S.I. 112).

37 L.S.I. (Special Volume), Penal Law, 5737–1977, sec. 432.

38 See foreword to the Cheques Without Cover Bill, 1980, (1980) H.H. 250.

39 In France, see Law no. 75–4 of January 3, 1975, particularly arts. 65–2, 73 and 74.

40 See that sec. 1. of the Cheques Without Cover Law, 1981, in defining a “dishonoured cheque” admits other reasons for such a qualification beyond lack of funds or of a credit agreement between the bank and the customer. From the commentary to sec. 1 of the proposal for the above law ((1980) H.H. 250, 251) we learn that the purpose of the legislature was to consider that “also when a drawer stops a cheque drawn on an account without funds, this cheque still shall be considered as a dishonoured cheque for the purpose of this law”. This legal position may lead to very strange results. Suppose, for example, that a customer draws a cheque on his account when, wrongly but in good faith, he thinks that he has on deposit sufficient funds to cover the cheque. After discovering his error, the customer stops the payment of the cheque and arranges payment of his creditor by other means.

41 See sec. 2 (a) of the Cheques Without Cover Law, 1981. See Regulations on Cheques Without Cover, 1981, regs. 6 and 7, (1981) K.T. 1576. Recently, the Minister of Justice conferred upon soldiers a beneficial treatment in the Regulations on Cheques Without Cover (Exceptions to the Application of the Law-Emergency Service) 1982, ((1982) K.T. 1378).

42 See sec. 4 (a).

43 See sec. 4 (b).

44 See sec. 2 (C).

45 See definition of aggravating circumstances in sec. 3.

46 See sec. 3 (a) (2).

47 See secs. 3 (a) (1), 4 (b) and 5 (a).

48 See secs. 3 (a) (1), 4 (b) and 5 (a).

49 See sec. 19 (a).

50 See sec. 19 (b).

51 See sec. 13.

52 See sec. 19 (d).

53 See sec. 18.

54 See sec. 8.

55 See supra, n. 40.

56 The customer is only permitted to appeal to the court from the decision that restricted him. See: sec. 10 of the Law under discussion; Regulations on Cheques Without Cover (Procedure), 1981, ((1981) K.T. 370); Regulations on Cheques Without Cover (Procedure) (Amendment), 1982, ((1982) K.T. 1347).

57 See sec. 12 (b) of the Contracts (General Part) Law, 1973 (27 L.S.I. 117).

58 See p. 340 of this paper.

59 On the above phenomenon and its legal implications see, for example, Ben-Oliel, R. “Elements for a Legal Definition of Commercial Banking: A Comparative View” (1981) 16 Is.L.R. 499.Google Scholar

60 (1975) (II) 29 P.D. 208.

61 [1974] 3 All E.R. 757.

62 Supra, n. 60 at 211.

63 (1975) (I) 29 P.D. 313.

64 Ibid., at 315, 316.

65 (1978) (II) 32 P.D. 785.

66 (1977) 88 P.M. 124, 126.

67 Ibid. at 126. See also the decision of the Supreme Court, supra n. 65, at 787.

68 Ibid., at 128.

69 19 L.S.I. 58.

70 See sec. 8 (b).

71 See, for example, the leading case, Samuel Sharon v. Esther Levuv (1974) (II) 28 P.D. 673. See also my comments in “Joint Bank Accounts — A Critical Survey”, (1980) 10 Mishpatim 439, 449 ff. (in Hebrew).

72 See criticism of the Supreme Court decision in Ben-Oliel, R., “Transfer of Property Through a Joint Account” (1980) 33 HaPraklit 172Google Scholar (in Hebrew). See also Yadin, U., “A New View on Joint Bank Accounts” (1981) 33 HaPraklit 572Google Scholar (in Hebrew).

73 See R. Ben-Oliel, Ibid., at 180.

74 Gavalda, C. and Stoufflet, J., in Droit de la Banque (Paris, 1974), write at pp. 405, 406Google Scholar:

“Il est même contestable qu'aux contrats bancaires s'attache un devoir général de conseil au profit des clients. On peut tout au contraire affirmer l'existence d'un principe de non ingérence du banquier dans les affaires de ses clients à raison desquelles il n'assume pas de responsabilité. Ce principe que la jurisprudence paraît bien reconnaître implicitement et même explicitement dans certaines décisions récentes, s'accompagne toutefois d'un certain nombre de tempéraments liés à la nature des opérations ou fondés sur les usages ou la convention et qui tous illustrent, une fois de plus, la profonde originalité de l'activité bancaire”.

75 Sec. 12 (a) of the Contracts (General Part) Law, 1973, states: “In negotiating a contract, a person shall act in customary manner and in good faith”.

76 Sec. 39 of the Contracts (General Part) Law 1973, states: “An obligation or right arising out of a contract shall be fulfilled or exercised in customary manner and in good faith”.

77 Sec. 15 of the Contracts (General Part) Law, 5733–1973, states: “A person who has entered into a contract in consequence of a mistake resulting from deceit practised upon him by the other party or a person acting on his behalf may rescind the contract. For this purpose, “deceit” includes the non-disclosure of facts which according to law, custom or the circumstances the other party should have disclosed”.

78 See sec. 5 (a) (1) of the Banking (Service to Customer) Law, 1981.

79 See ibid., sec. 5 (b).

80 See Ibid., sec. 3(1).

81 See Ibid., sec. 3 (7). See similar provisions to sec. 3(1) and 3(7) of the Banking (Service to Customer) Law, 1981 in sec. 2(a)(1) (14) of the Consumer Protection Law, 1981 (English text in (1981) 16 Is.L.R. 516).

82 See sec. 15 of the Contracts (General Part) Law, 1973, at supra n. 77. Sec commentary on this provision by Zeltner, Z., The Law of Contracts in the State of Israel (Tel-Aviv, 1974) p. 197 ff.Google Scholar; Shalev, G., Defects in the Formation of Contract, Tedeschi, G. ed. (Jerusalem, 1981, in Hebrew), 61 ff.Google Scholar

83 See sec. 3 of the Banking (Service to Customer) Law, 1981. See analysis of this provision in R. Ben-Oliel, “Banking Liability and Risk in Opening an Account”, supra, n. 17, p. 73 ff.

84 See penalties described at p. 340 of this paper.

85 See a discussion on the position of the Israeli courts on the above issue in R. Ben-Oliel, supra, n. 71 at 445 if.

86 See Ayala Seli by her Parents, her Natural Guardians v. The Estate of Carl Shafer by his Executor, supra, n. 65, described at p. 348 of this paper. See also Shahar v. Schorr (1982) (II) 36 P.D. 281, 291.

87 For example, the Banking Ordinance (Amendment No. 11) Law, 1976 (30 L.S.I. 232), added to the principal law a provision concerning the regime of a “survivor ship clause”. Under the new order, after the death of one account holder the bank is permitted to pay the fund on deposit to the surviving partner to a joint account, but this without conferring to the survivor property rights in the fund. Because this legal provision stood in contradiction to the terms of “survivorship clauses” introduced in some banking forms, which conferred upon survivors in a joint account property rights to the money, banks were well advised in informing their clientele of the promulgation of the new law. See comments on this issue in R. Ben-Oliel, supra, n. 71 at 462 ff.

88 See sec. 19.

89 The bank-customer relationship is commonly defined as a debtor-creditor relationship and not a trusteeship or fiduciary relation. See, for example, Paget's Law of Banking (London, 8th ed., 1972) 84 ff. Chorley in Law of Banking, (London, 6th ed., 1974) clearly writes, at 19 that “to have held that the banker was a trustee of the moneys deposited with him would have killed the business of hanking…”.

90 See, for example: Sealy, L.S., “Fiduciary Relationships” (1962) Camb. L.J. 69CrossRefGoogle Scholar; Sealy, L.S., “Some Principles of Fiduciary Obligation” (1963) Camb. L.J. 119CrossRefGoogle Scholar; “Special Problems of Banks” (Panel discussion) (1975) 31 Bus. Law. 241; F.R.R., comment on “Banking” (1978) J. Bus L. 177; Tettenborn, A., “The Fiduciary Duties of Banks”, (1980) J. Bus L. 10.Google Scholar On inequality of bargaining power and undue influence see, for example, Lloyds Bank Ltd. v. Bundy, supra, n. 61. In Israel, extortion and undue influence exercised by banks on customers were the object of special treatment in sec. 4 of the Banking (Service to Customer) Law, 1981.

91 Palmieri, A., “Nuove Brecce nel Segreto Bancario?” (1981) 34 Banca Borsa e Titoli di Credito 77Google Scholar, following G. Molle, indicates the Trapezitica oration written by Tsocrates between 393 and 391 B.C. as the first document referring to banking secrecy.

92 Switzerland and Lebanon are usually indicated as exceptions to the above rule. In the United States several statutes deal with aspects of secrecy, such as: the Internal Revenue Code, 1954, as amended; the Bank Secrecy Act, 1970; the Right to Financial Privacy Act, 1978; and the Fair Credit Reporting Act. However, these statutes mainly deal with the privacy rights of individuals in regard to the state and are not particularly concerned with the banking duty of confidentiality towards customers. For a general view on American statutory law see “Bank Secrecy, Financial Privacy and Related Restrictions” (panel discussion) (1979) 7 Int. Bus. Law 259, 281 ff.

93 In England, for example, the banking duty of secrecy is traditionally seen as an implied term of the Contract between customer and bank. See, for example, the lead ing case Tournier v. National Provincial and Union Bank of England [1924] 1 K.B. 461. The same line is followed by other common law countries, such as Australia, New Zealand and the United States. On the situation in these countries see “Bank Secrecy, Financial Privacy and Related Restrictions”, supra, n. 92 at 272, 277, 281.

94 This happens, for example, in the Netherlands and France. In these countries, arts. 272 and 378 of the respective Penal Codes are usually seen as the main source of the above duty. On the situation in the Netherlands, see, for example, Mastropasqua, S., The Banking System in the Countries of the EEC — Institutional and Structural Aspects (Alphen aan den Rijn, The Netherlands, 1978) 14, 15.Google Scholar In France see, for example, R. Rodière and J.-L. Rives-Lange, supra, n. 15 at 81.

95 supra, n. 6.

96 For example, in Tournier v. National Provincial and Union Bank of England, supra, n. 93, Atkin L. J., after discussing the concept of an implied term in a bank customer relationship, said (at 483): “Is there any term as to secrecy to be implied from the relation of banker and customer? I have myself no doubt that there is”.

97 supra, n. 93.

98 In the Tournier case, Bankes L.J., at 471, 472, said: “At the present day I think it may be asserted with confidence that the duty is a legal one arising out of contract…”.

99 See dictum of Atkin L.J. in the Tournier case, supra, n. 96. Sec the Protection of Privacy Law, 1981, sec. 2 (8).

100 Atkin L.J. said (at 484): “I come to the conclusion that one of the implied terms of the contract is that the bank enter into a qualified obligation with their customer to abstain from disclosing information as to his affairs without his consent’ See main qualifications indicated in case law and in the Protection of Privacy Law, 1981, as pointed out in the following footnotes.

101 See dictum of Bankes L.J. at 473.

See the Protection of Privacy Law, 1981 sec. 18 (2) (b). Under the Privacy Law not every disclosure under law, or according to other qualifications, is justified. Disclosure is only permitted where made in good faith (sec. 18 (2)). The Law establishes in sec. 20 (a) a presumption of good faith where disclosure is made under the circumstances permitted by law and “did not exceed the limits reasonably imposed by the circumstances”; additionally, sec. 20 (b) accepts a presumption of lack of good faith where disclosure is consciously made “in a way which exceeds the reasonable limits of disclosure in those cases in which disclosure is legally permitted” (Unofficial translation).

102 See Tournier case, dictum of Bankes L.J. at 473. See Protection of Privacy Law, 1981, sec. 18 (3).

103 See dictum of Bankes L.J. at 473. See Protection of Privacy Law, 1981, sec. 18 (2) (c).

104 See dictum of Bankes L.J. at 473. See Protection of Privacy Law, 1981, secs. 1 and 3 (2).

105 Supra, n. 93 at 481.

106 Op. cit., at 473.

107 Op. cit., at 485.

108 Supra, n. 89 at 174.

109 Bankes L.J., supra, n. 93 at 474, said: “I cannot think that the duty of nondisclosure is confined to information derived from the customer himself or from his account”.

110 Atkin L.J., op. cit., at 485, said: ‘I further think that the Obligation extends to information obtained from other sources than the customer's actual account, if the occasion upon which the information was obtained arose out of the banking relations of the bank and its customers—for example, with a view to assisting the bank in conducting the customer's business, or in coming to decisions as to its treatment of its customers”.

111 Supra, n. 93 at 481.

112 Ibid., at 482.

113 see sec. 2 (9). On the concept of “person” for the purpose of sec. 2 see comments on p. 354 of this paper.

- 1

- Cited by