Introduction

Social rights are one of the cornerstones of welfare states, targeting major social needs such as health, poverty and unemployment (Dean, Reference Dean2015). The intended outcome of a social program is a match between those eligible for the program and those receiving it in practice; however, this is often not the case (Currie, Reference Currie, Auerbach, Card and Quigley2006; Gal et al., Reference Gal, Eizenstadt, Benish and Holler2019). The substantial non-take-up (NTU) of social benefits, as found in many studies (e.g., Hernanz et al., Reference Hernanz, Malherbet and Pellizzari2004; Janssens & Van Mechelen, Reference Janssens and Van Mechelen2022; Ko & Moffitt, Reference Ko and Moffitt2022), contravenes the primary objectives of social security, diminishes the poverty-alleviating potential of social programs and disproportionately impacts those with the lowest incomes (Jones, Reference Jones2013; Finkelstein & Notowidigdo, Reference Finkelstein and Notowidigdo2019). Hence, as Weiss-Gal and Gal (Reference Weiss-Gal and Gal2009, p.267) state, ‘Social rights are only as good as the extent to which they are realised by those who most need them’. Low take-up rates affect the welfare of current day families but might also impact the health, education and economic outcomes of their children due to suboptimal investment (Hendren & Sprung-Keyser, Reference Hendren and Sprung-Keyser2020).

In advanced welfare states, it has been found that the rates of NTU in various social programs are notably high, ranging from over 30% to as high as 90% in programmes that involve means testing (Hernanz et al., Reference Hernanz, Malherbet and Pellizzari2004; Finn & Goodship, Reference Finn and Goodship2014; Eurofound, 2015), although some evidence attest to relatively high rates of NTU even in programmes that do not require means-tests (Vinck et al., Reference Vinck, Lebeer and Van Lancker2019). A global review conducted by Ko and Moffitt (Reference Ko and Moffitt2022) found that the issue of NTU is not limited to western industrialised nations but is a worldwide phenomenon that extends across different types of welfare and social security systems. NTU is found even in ‘passported’ benefits, which are supposed to be easier to claim (Tarshish et al., Reference Tarshish, Gal, Holler, Benish and Dahan2023).

Over the years, scholarly understanding of the take-up phenomenon has evolved from a rather static to a dynamic conceptualisation. This dynamic view recognises that claimants progress through distinct stages in a temporal sequence: the initial threshold stage, followed by the trade-off stage, and culminating in the application stage (van Oorschot, Reference van Oorschot and van Oorschot1996; Vinck et al., Reference Vinck, Lebeer and Van Lancker2019), which can be successful, require an appeal or even re-submission. Within each stage, individuals must continuously weigh evolving costs and benefits, with the balance shifting as they move through the take-up process.

Another testament to the multi-faceted nature of take-up stems from the different levels at which the process takes place beyond the client level. Lain and Julia (Reference Lain and Julia2024) identify an additional administrative (and institutional) level, and a commonly used typology adds a scheme level to identify three primary levels of NTU: scheme, administrative and client (van Oorschot, Reference van Oorschot2001, Reference Van Oorschot1991). The scheme level pertains to the design of the programs themselves, such as program rules and eligibility criteria. The administrative level involves the implementation of policy and experiences with service providers. Finally, client-level factors relate to an individual’s knowledge, social networks or psychological factors that might hinder them from fully accessing benefits, such as stigma or perceived costs associated with benefit receipt (Baumberg, Reference Baumberg2016).

As research on NTU progressed even more, models were developed to answer the main question of NTU, what factors contribute or explain NTU? Hernanz et al. (Reference Hernanz, Malherbet and Pellizzari2004) identified four main factors influencing take-up: pecuniary determinants, such as the expected amount and duration of benefits; information costs; social and psychological costs, including stigma; and process costs, such as administrative delays and uncertainty. The evidence suggests that the level of social assistance and its expected duration (Dahan & Nisan, Reference Dahan and Nisan2010; Bargain et al., Reference Bargain, Immervoll and Viitamäki2012) and high-intensity aid (Bettinger et al., Reference Bettinger, Long, Oreopoulos and Sanbonmatsu2012) appear to substantially increase the take-up of social benefits. Information costs play a significant role. Despite some mixed results (e.g., Bettinger et al., Reference Bettinger, Long, Oreopoulos and Sanbonmatsu2012), most studies confirm that information of different types (Tarshish & Holler, Reference Tarshish and Holler2023) is an effective policy tool for reducing NTU (e.g., Dahan & Nisan, 2011; Bhargava and Manoli, Reference Bhargava and Manoli2015; Finkelstein & Notowidigdo, Reference Finkelstein and Notowidigdo2019), leading us to believe that information is fundamental to take-up (Daigneault et al., Reference Daigneault, Jacob and Tereraho2012). Finally, social and psychological costs, such as the negative impact of stigma, also found to act as a welfare hindrance (Moffitt, Reference Moffitt1983; Kühner & Chou, Reference Kühner and Chou2023).

As to process costs, recent research has expanded its scope to encompass ‘the physical and administrative obstacles individuals may face when applying for a social program, which may include challenges related to form completion, travel expenses, and waiting times’ (Janssens & Van Mechelen, Reference Janssens and Van Mechelen2022, p.100). This expansion also considers other ‘channel’ factors, referred to as hassle costs, which are small contextual elements that can influence behaviour in a particular direction, guiding individuals’ actions (Baicker et al., Reference Baicker, Congdon and Mullainathan2012).

This wide interpretation of process costs is also evident in the administrative burden literature, as compliance costs, the prevalent costs of complying with the program, following administrative requirements (Moynihan et al., Reference Moynihan, Herd and Harvey2015), from the demands of completing tests, forms and documentation, as well as the time and effort required (Holler & Tarshish, Reference Holler and Tarshish2022), to complying with behavioural requirements such as mandatory work, or traveling to participate in meetings (Baekgaard et al., Reference Baekgaard, Mikkelsen, Madsen and Christensen2021). Despite this wide framework and the growing amount of research on process costs in recent years, there is an obvious lack in efforts targeting physical process costs, specifically, geographic factors contributing to administrative burden and NTU.

This issue of NTU from the lens of geographic access to social security field offices has only received little coverage in the literature. Two rare examples that explore the impact of office openings and closings on take-up are Rossin-Slater (Reference Rossin-Slater2013) that found modest increases in WIC participation with better clinic access, and Deshpande and Li (Reference Deshpande and Li2019) that showed substantial drops in disability recipients following field office closures. However, in these two papers, a traditional staggered estimation was used, and the estimated effect of geographic access is extracted using mainly closings rather than openings of field offices. Closing a field office might have a different size effect than opening one, at least in the short run, as residents have already acquired the relevant information on a certain social program, which may be used after it has closed. In this paper, we provide estimates utilising a novel estimation method that did not exist at the time of the two referenced studies, aiming to address potential biases inherent in the traditional approach. Moreover, to obtain a comparative perspective, it is necessary to broaden the scope and assess multiple social security programs.

We address this gap by examining the impact of geographic access on the take-up of the largest five social security programs in Israel. This stands in contrast to the two mentioned studies, which focused solely on a single social program. Exploring the relationship between social security geographic access and the take-up of social security benefits may shed light on the menu of policy tools and inform social security policies around the world regarding the costs and benefits of improving geographic access.

The next section presents the Israeli case of social security. Then, we focus on the theoretical background, including the expected impact of opening field offices and the alternative explanation of political favoritism. Following that, we lay out the research design and methodology, outline the results and conclude with a summary and a brief discussion of the main findings.

Social security in Israel

The National Insurance Institute (NII), Israel’s social security agency, plays a key role in addressing poverty in Israel (Dahan, Reference Dahan, Ben-Bassat, Gronau and Zussman2021), providing various social benefits worth 118 billion NIS (∼30 billion Euro) to over 3 million recipients in 2021 (Monthly Statistics, NII). Social benefits operated by the NII grant eligible households both automatic and non-automatic benefits addressing a variety of life situations, such as child allowance, general disability allowance, income support, old-age pensions, unemployment benefits and long-term care. As expected, the estimated take-up rates of automatic schemes, such as child allowance, are nearly 100% (Gottlieb, Reference Gottlieb2021). By contrast, the take-up rate is between 53% and 69% in non-automatic programs such as disability benefits, which are characterised by a higher administrative burden (Gottlieb, Reference Gottlieb2021).

Families with children automatically receive their entitled child allowance in Israel as soon as each newborn baby is registered at the hospital, except for rare cases such as mothers without bank accounts. The NII transfers the money to the mother’s bank account for each child until the age of 18 without any obvious burden caused in the process. At the other end of the spectrum, disability benefits are subjected to a demanding, complex and lengthy process that is conditional on health and economic conditions. The social programs that are conditional on health tests are so complex that some applicants are employing for-profit companies and public organisations to assist them in applying for social benefits (Gal et al., Reference Gal, Eizenstadt, Benish and Holler2019). An active claim is also essential for receiving an old-age pension with supplementary income or a long-term care allowance, but the application process is less complex than that of disability benefits. Long-term care allowance requires a health test (ADL) conducted at home or by phone in addition to the means test. The means test has a very high-income threshold, equivalent to the beginning of the top decile, and should be considered an almost universal program. A standard old-age pension (i.e., without supplementary income) is means tested between the legal retirement age and 69, but it turns universal and automatic after the age of 70. Thus, these five social security programs, which are the largest allowances, provide a continuum in terms of administrative burden that may be experienced by claimants, which could culminate with NTU.

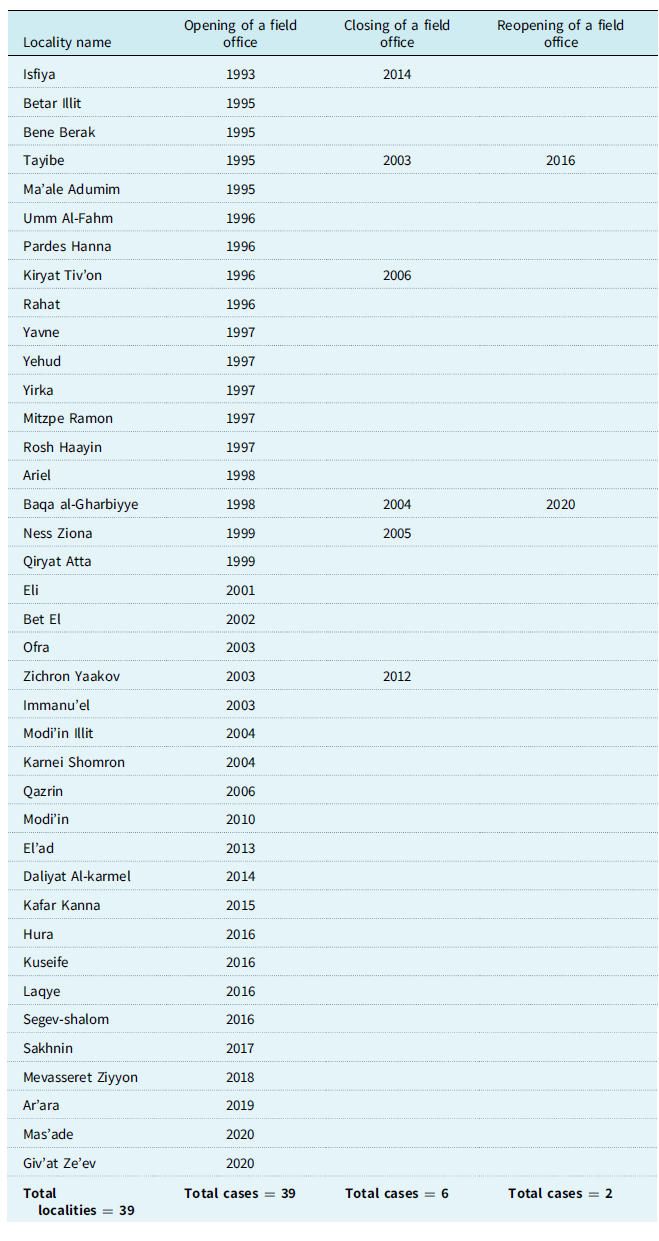

The Israeli social security is constantly expanding its online service and telephone assistance, yet over 3 million in-person visits in all of its offices were recorded in 2019. NII employs around 1,200 employees in its headquarters and an additional 3,200 employees in regional and field offices of various sizes and functions. The 23 main offices that are located in large cities provide in-person service and are responsible for all types of claims. Additionally, 15 secondary offices in medium-sized cities offer in-person service to sub-geographic areas. In addition, 48 field offices in small towns offer in-person service, but are restricted to local residents on selected days of the week, and the submitted claims are processed in the main office. During the investigated period, the geographic expansion of social security presence involved the opening of a new field office in 39 localities out of the existing 48 field offices (Table 1).

Table 1. Opening or closing of a field office, by locality and year, 1993–2021

Theoretical background

The expected effect of opening a new field office on take-up of social benefits

Geographic access, which is associated with physical presence, affects the monetary and nonmonetary costs of collecting social benefits through several channels. Opening a new field office in a certain location can affect the amount of time claimants need to submit a claim and the speed of processing that claim, if more staff are also added. Research has found that faster processing times can lead to higher rates take-up (Hernanz et al., Reference Hernanz, Malherbet and Pellizzari2004). Reducing the direct costs of travel and opportunity costs of time saved related to an application is expected to increase the take-up. A new field office may also reduce the costs of information by increasing the level of awareness and offering improved access to information on eligibility rules. Salient presence in a central location is a constant reminder of the potential eligibility for social security benefits. It has been established by now that reminders are an effective tool to promote awareness to social benefits (Linos et al., Reference Linos, Quan and Kirkman2020). As more residents exercise their entitled rights, they may share that valuable information with their neighbors and relatives, generating a social multiplier in terms of participation rate in social programs (Tarshish, Reference Tarshish2022).

The effect of field offices on take-up depends on the extent of the administrative burden associated with each social security program. The take-up in a social security program that automatically transfers benefits to recipients is not expected to change following the opening of a new field office. In contrast, expanded geographic access may affect the take-up in non-automatic programs, such as disability benefits, which require an active claim and are subject to health and economic tests. Eligible individuals who previously decided not to apply for social security benefits due to high application costs may find it worthwhile to apply after the opening of a new field office, which reduces those costs. The level of administrative burden and the associated costs in non-automatic programs create a threshold for eligible individuals that dictates who will apply. Therefore, the impact of opening field offices on the take-up of social security benefits should be positively linked to the degree of administrative burden, which influence that threshold. This is in line with ‘make administrative centers geographically accessible’, which is part of the suggested list of techniques to reduce compliance costs offered by Herd and Moynihan (Reference Herd and Moynihan2018, p.263).

We speculate that ranking the five social security programs by their degree of administrative burden would place child allowance at the lowest end due to its automatic enrollment. This would be followed by the standard old-age pension allowance due to its semi-automatic nature, then old-age pension with supplementary income and long-term care, with disability benefits exhibiting the highest administrative burden.

Thus, to the extent that opening a new field office increases the take-up of social security benefits by reducing administrative burden, we can summarise the discussion above with three hypotheses. In testing these hypotheses, we assume that the number of recipients serves as an indicator of take-up because opening a new field office does not alter the eligibility rules, which are defined by social security law.

H1: The number of recipients (our measure of take-up) of four non-automatic social security programs disability benefits, long-term care, old-age pension with supplementary income and standard old-age pension in a certain locality is expected to increase following a new field office in that locality.

H2: The number of recipients (our measure of take-up) of disability benefits and old-age pension with supplementary income is expected to increase more than long-term care and standard old-age pension in a certain locality following a new field office in that locality.

H3: The number of recipients (our measure of take-up) of child allowances in a certain locality is expected to remain the same following a new field office in that locality.

An alternative explanation: political favoritism and its impact on take-up

The three hypotheses mentioned above assume that the decision to open or close a field office is based purely on professional criteria. However, in practice, politicians in central government positions, who have oversight of social security, might favour certain localities. A long list of empirical studies shows that the electoral motivations of elected officials at the central level may account for the extra public funds channelled to certain localities with mayors of the same political party to increase the chances of winning future elections in Israel and many other developed countries (Dahan & Yakir, Reference Dahan and Yakir2022).

Politicians in Israel may exert pressure on the social security administration to open new field offices in areas governed by politicians from the same party (political alignment). Naturally, political pressure is not directly observable, and we are left with anecdotal evidence to understand the mechanisms at work. Recent example of such a political mechanism can be found in local news reports that quote Lod Mayor Yair Revivo (Lod is a city near Tel Aviv). He announced, ‘I am happy to announce that following our request, the NII has opened a new field office in our city of Lod… to save you, dear residents, time and legwork’. (Mekomonet, October 7, 2022).

This potential political favoritism could undermine the intended impact of geographic access on the take-up of social security benefits. Assuming an overall budget constraint, political favoritism may lead to misallocation in the form of too many service points and too few workers, as well as underinvestment in IT, resulting in a prolonged application process and, consequently, higher NTU. Having more social security offices with the same number of workers implies that the staff providing in-person services in a field office comes from the main office. The total productivity of the professional staff is lower because their absence from the main office outweighs the extra work in a field office due to wasted travel time and reduced work hours (a condition set by the labour union in the Israeli public sector) in the field office assuming that workers tend to live closer to their permanent place of work.

The above discussion suggests that both H1 and H2 may be altered in such a way that a new field office might not affect the take-up, or could even lead to decreased take-up for non-automatic programs. This is due to potential resource misallocation and inefficiencies resulting from politically motivated office openings. H3 should remain unaffected due to the automatic nature of child allowances. This revised perspective on our hypotheses provides a more nuanced understanding of the relationship between geographic access and social benefit take-up.

Methods

Identification strategy

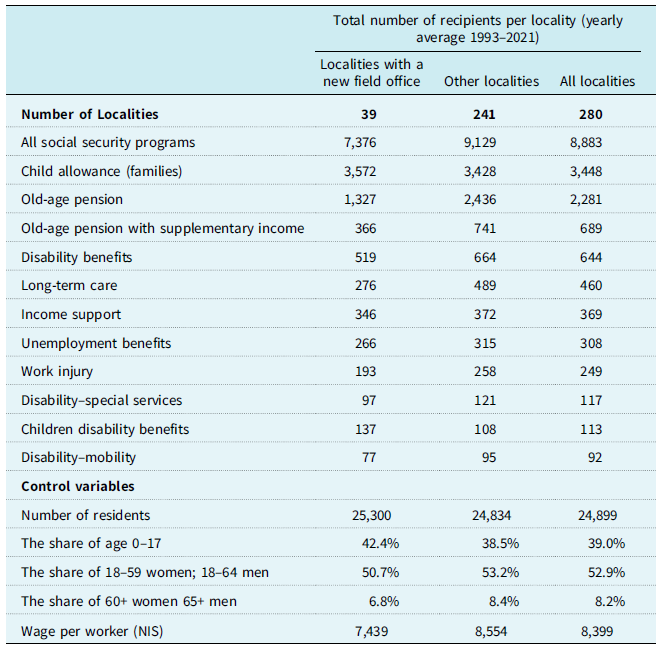

The closings and openings of social security offices in certain locations are not random but rather affected by deliberate public policy considerations, such as economic conditions, population growth and congestion in surroundings offices, which might be correlated with population characteristics that shape the take-up of social benefits. Moreover, political favoritism, as previously mentioned, can also factor into the decision-making process. Table 2 shows that localities with a new field office between years 1993 and 2021 are in inferior economic conditions compared to the Israeli average, as measured by wage per worker and the number of households receiving income support. To cope with that empirical challenge of identifying the true effect of geographic access on take-up, the number of social security recipients in a certain location before and after an opening of a new social security field office would be compared, and that comparison is restricted to locations that experienced an opening and closing. This approach refers to the traditional staggered treatment timing method or two-way fixed-effect model. The treated and the control groups are the same localities that differ in the timing of the event only. The identifying assumption will be tested in the findings section.

Table 2. Descriptive statistics, 1993–2021

According to this traditional method, the investigated population is limited to locations that experienced an opening which reduces the risk of spillover confounding effect. All other localities are excluded from the analysis. Opening a new field office may increase or decrease the working load in neighbouring offices and affect the take-up rate in untreated localities due to a slower or faster application process that artificially pushes the estimated impact towards zero.

The estimated model

To estimate the effect of geographic access on the take-up of social benefits, we use the following model:

where Yrt is the number of recipients of a certain social security program such as disability benefits (in natural logarithm) in a particular locality r in year t. The model would be estimated separately for each of the largest five social security programs. The number of recipients represents take-up because opening a new field office does not change the entitled population, which is determined by social security law.

Treatment is an indicator equal to one for all the years after the opening of a social security service point (including the year of opening) in locality r in date t and zero otherwise. Treatment is zero for all years following the closing of a social security service point (including the year of closing) in locality r in date t. For example, Treatment in the locality Tayibe gets zero in 1993–1994, one in 1995–2002, zero in 2003–2015 and one in 2016–2021.

![]() ${X_{rt}}$

is a vector of time-varying control variables, such as population size and its composition, and

${X_{rt}}$

is a vector of time-varying control variables, such as population size and its composition, and

![]() ${\gamma _r}$

and

${\gamma _r}$

and

![]() ${{\rm{\delta }}_t}$

are locality and year fixed effects. Unobserved determinants of the number of recipients of a certain social security program is represented by the error term u

rt

. The vectors β are unknown parameters that will be estimated. The estimated β should be positive and highest for disability benefits to be consistent with H1 and H2, while the estimated β in the child allowances regression should be close to zero to align with H3. The standard errors are clustered at the locality level.

${{\rm{\delta }}_t}$

are locality and year fixed effects. Unobserved determinants of the number of recipients of a certain social security program is represented by the error term u

rt

. The vectors β are unknown parameters that will be estimated. The estimated β should be positive and highest for disability benefits to be consistent with H1 and H2, while the estimated β in the child allowances regression should be close to zero to align with H3. The standard errors are clustered at the locality level.

This method involves comparing outcomes between treated and untreated localities (not yet treated) over time, where treatment is staggered across different time periods, and it relies on the parallel trends assumption, which posits that, in the absence of treatment, the treated and untreated localities would have followed the same trend over time. However, it may be violated due to unobservable time-varying factors that affect both treatment assignment and outcomes, leading to biased estimates. For example, opening a new field office in certain localities might be the result of rigorous cost benefits analysis while other openings may be driven by political favoritism leading to a bias in the estimate impact due heterogenous treatment effect. Additionally, it is plausible to expect dynamic treatment effects following the opening of a new social security field office. For example, it may take time for the full effect of the new field office on the take-up of social benefits to be realised due to the slow diffusion of information among residents (social multiplier). Thus, comparing the treated localities that differ in the time since the opening of a new field office may bias the results.

Callaway and Sant’Anna (Reference Callaway and Sant’Anna2021) propose a strategy that addresses such biases arising from violations of the parallel trends assumption. Their methodology involves using interactions between treatment status and time or other covariates as instruments for treatment status. By leveraging these interactions as instruments, the approach aims to estimate local average treatment effects, thus providing a more robust estimate of the treatment effect. We compared the treated group with the not-yet-treated group each year, assuming conditional parallel trends between the two groups, based on the covariates.

Employing this new methodology entails a cost in our empirical setting. First, this advanced method relies on the assumption that the treatment cannot be ‘turned off’, necessitating the exclusion of localities where a social security field office was closed. Second, this method requires a high number of events to obtain estimates with a high level of precision. Therefore, the advanced methodology should be viewed as a robustness check to the more traditional estimation presented above.

Data

The Israeli social security is this research’s main data source. It covers the timing and location of each new field office and the number of recipients of every social security allowance by locality. The history regarding the timing of opening a social security office is not publicly available. To fill this gap, we requested the management of the Israeli social security to provide data on the dates of openings and closings of social security offices during the period from 1993 to 2021. This period was chosen because data on the number of recipients of social security benefits by locality are available starting in 1993.

A significant and unprecedented geographic expansion is documented during the investigated period, adding 39 new field offices in cities and towns without prior social security presence, six closings and two cases of reopening (Table 1).Footnote 1 Thus, the main empirical analysis covers 39 localities over a period of 29 years, yielding a maximum of 1,131 observations. In practice, the number of observations is lower because some localities were established after 1993, and there are a few instances of missing data. Unfortunately, the Israeli social security does not publish disaggregated data on its budget, so expenditure on field offices is unknown.

Arab, Druze and disadvantaged localities have benefited more from this expanded presence. The share of Arab localities in new field offices opened in 1993–2021 is 38%, indicating a substantial increase in geographic access of social security to Arab citizens in Israel. The socio-economic index for localities with a new field office, published by the Israeli Central Bureau of Statistics, is −0.59, which is lower than the country’s mean index (set at zero by design). This indicates an improvement in geographic access for the disadvantaged population.

The Israeli social security publishes every year the number of recipients by allowance and locality for 280 localities with more than 2,000 residents, which covers 92% of the Israeli population in 2021. The data are available in digital form for the years 2002–2021 and in a non-readable PDF format for the 1993–2001 period, which had to be digitised. The data on small Jewish and Arab villages (8% of Israeli population) are not available.

This study focuses on the five largest allowances in terms of their recipients: old-age pension with and without supplementary income, disability benefits, long-term care allowance and child allowance. In certain localities, the number of recipients of other social security programs, such as unemployment benefits and income support, is too small, and the yearly change is too small to allow for meaningful estimation. In 2021, the total number of social security recipients in the five largest allowances is: around a million for standard old-age pension; 194,000 old-age pension with supplementary income; 286,000 long-term care allowance and 283,000 disability benefits and 1.2 million families received child allowance. Table 2 presents the average number of recipients per locality in the investigated group of localities and in all localities. As can be seen, the selected five allowances represent the largest social security programs in Israel. On average, the number of unemployment benefit and income support recipients may seem sufficient, but it fluctuates depending on macroeconomic conditions, such that in certain years it falls well below 100 recipients.

We assume that a change in the number of recipients (after controlling for population size and composition) following the opening of a new field office reflects a change in take-up, as this intervention does not alter the eligibility rules defined by social security law. This plausible assumption allows us to avoid computing the ratio of the eligible population to the number of recipients, which is unavailable by locality and year.

The data on time-varying control variables by locality, such as population, age composition and average wage per worker, are also taken from Israeli social security. The average number of residents in the investigated localities is larger compared to the remainder of the population in Israel, which consists of very large cities and very small towns. They are younger on average, as measured by the share of people aged 0–17 years (Table 2). The wage per worker is lower in the investigated localities compared to other localities.

Findings

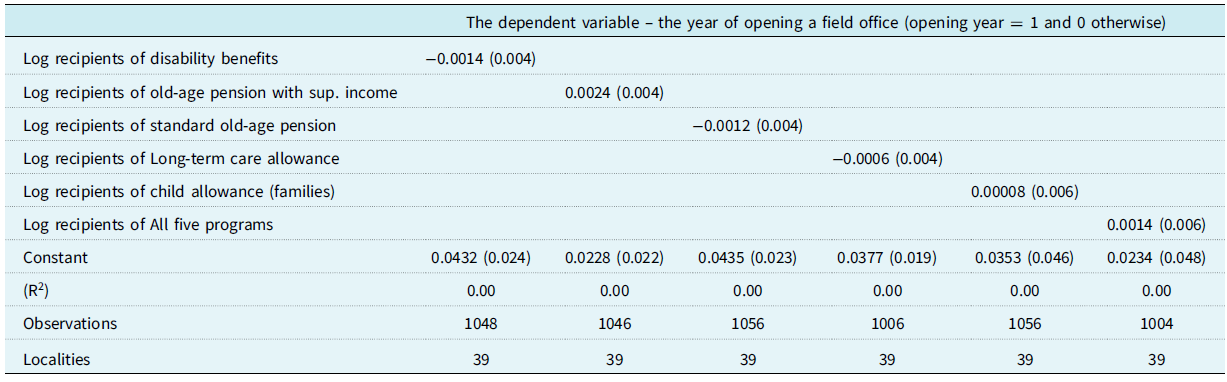

Before presenting the results, we provide support for our empirical identification. The identifying assumption is that the timing of opening a new field office is not correlated with the number of social security recipients. The results in Table 3 support this assumption. All coefficients that appear in Table 3 are insignificant implying that the number of recipients in each of the five social security benefits examined here does not predict the timing of opening a new field office.

Table 3. Predicting the timing of opening of a field office

The standard errors are reported in the parenthesis.

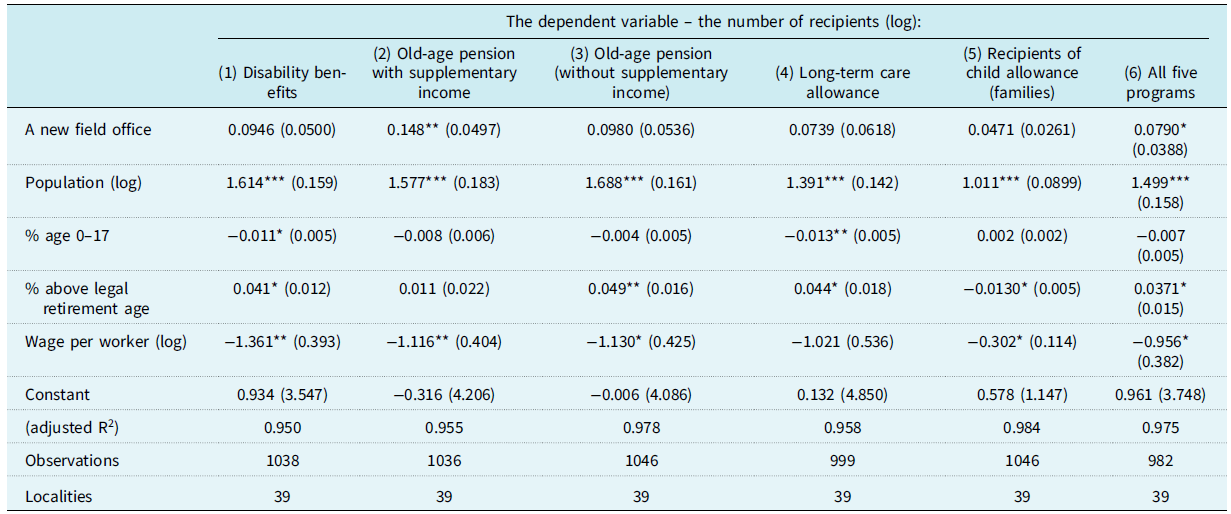

Table 4 presents the traditional estimation results based on 39 cases of new field offices in cities and towns without prior social security presence, six events of closing and two cases of reopening. Table 4 shows that opening a new field office is not associated with higher take-up of social security allowances in three out of four non-automatic programs, contrary to H1. The significant coefficient for a new field office in the regression of recipients of old-age pension with supplementary income is the only exception, which is in line with H1. The insignificant coefficient for a new field office in the regression of disability benefits, along with the previous result, implies mixed support for H2. The insignificant coefficient for a new field office in the regression of recipients of child allowances, an automatic program, is consistent with H3.

Table 4. Social security field offices and the number of recipients

Note: All regressions include locality and year fixed effects.

*, **, *** indicate the level of significance of 5%, 1% and 0.1%, respectively. Robust standard errors clustered at the locality level appear in the parentheses.

The sign of the coefficients of the time-varying control variables is generally in line with plausible predictions. The coefficient of population size is positive and significant in all regressions (Table 4). The estimated coefficients (elasticities) imply that a rise of a 1% in population associates with more than a 1% increase in the number of old-age pension and long-term care allowance recipients, which is in line with longer life expectancy. In contrast, there is a 1% increase in families receiving child allowance following a 1% rise in population. As expected, the coefficient of the share of the young population is negative in regressions of the number of social security programs for old-age recipients and positive in regressions of child allowance recipients (Table 4).

Table 4 shows that the coefficient of wage per worker is negative and significant (or nearly significant) in all regressions, but its size varies substantially depending on the type of social security program. The wage coefficient, which represents the estimated income elasticity of the number of recipients, suggests that a 1% increase in wage per worker results in a 1% or more decrease in the number of recipients of means-tested programs, such as old-age pension with supplementary income and long-term care allowances. The estimated wage coefficient for universal child allowances is considerably lower. The largest coefficient (in absolute terms) is found in regressions of disability benefits, suggesting a potential link between the labor market opportunities and the likelihood of applying for disability benefits.

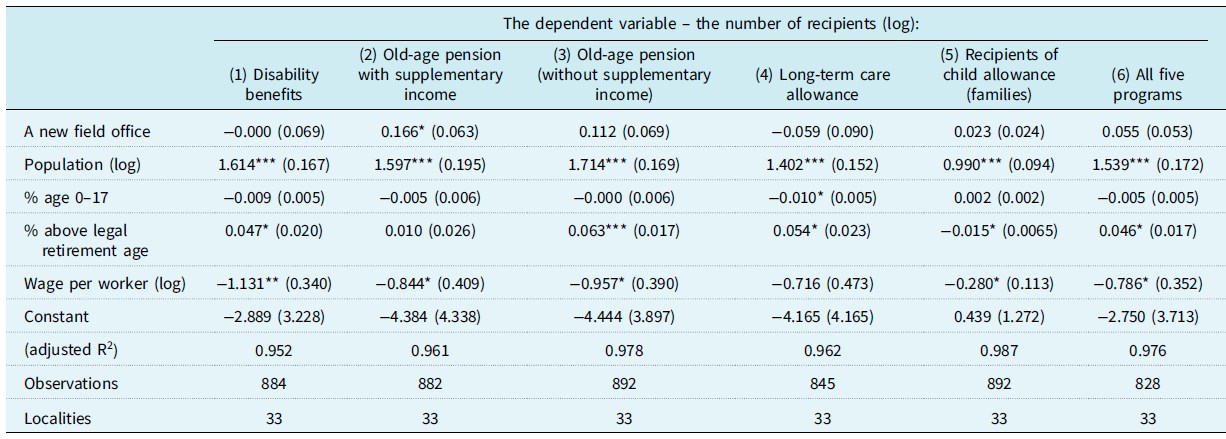

To allow for meaningful comparison between the traditional and advanced estimations (see below), Table 5 reruns the same regressions as Table 4 but excludes six localities that experienced the closing of a field office. Limiting the estimation to events of opening a new social security field office allows for potential different impacts compared to the analysis based on both openings and closings of field offices. Table 5 reveals that four out of the five estimated coefficients remain insignificant, which is consistent with Table 4. However, the sign of two of these coefficients has become negative. In addition, the coefficient of a new field office in the regression of recipients of old-age pension with supplementary income is still significant but less so.

Table 5. Social security field offices and the number of recipients, excluding localities that experience closing of a field office

Note: All regressions include locality and year fixed effects.

*, **, *** indicate the level of significance of 5%, 1% and 0.1%. Robust standard errors clustered at the locality level appear in the parentheses.

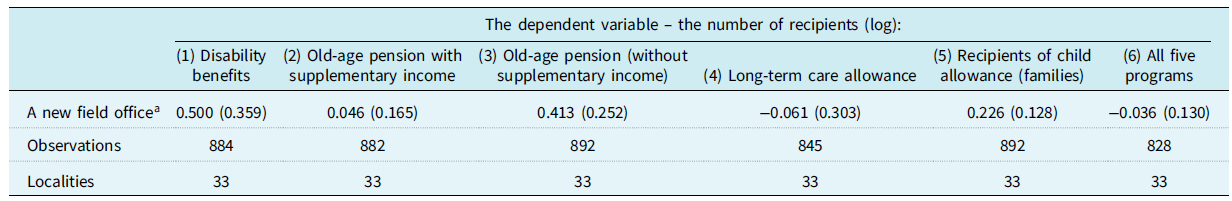

Before presenting the advanced estimation results, it should be noted that the new method suggested by Callaway and Sant’Anna (Reference Callaway and Sant’Anna2021) is based on the assumption that the treatment cannot be ‘turned off’. This implies that we must exclude the six localities that experienced the closing of a social security field office. The estimated effects of opening a new field office on the number of recipients in all five social security programs, using the Callaway and Sant’Anna method, are presented in Table 6.

Table 6. Social security field offices and the number of recipients, Callaway and Sant’Anna’s methodology

Note: The regressions above include the same list of control variables: population, the share of individuals aged 0–17 years, the share of the population above the legal retirement age and wage per worker. Additionally, localities that experience the closing of a field office are excluded from the analysis.

a Local average treatment effect (LATE).

All the estimated coefficients are insignificant after accounting for the same list of control variables as before, indicating that the physical presence of social security offices does not seem to affect take-up in both automatic and non-automatic social security programs, which is inconsistent with H1 and H2 (Table 6). Even the significance of the coefficient for a new field office in the regression of recipients of old-age pension with supplementary income becomes insignificant after transitioning from the traditional to the new estimation method. The comparison between Tables 5 and 6, both based on the same set of localities (observations), implies that the lost significance stems from the difference in the estimation methodology.

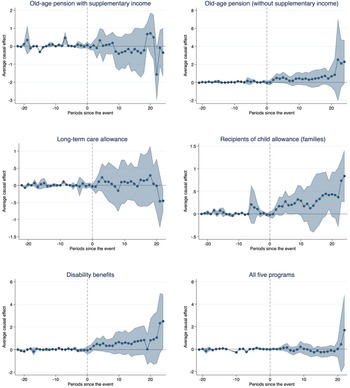

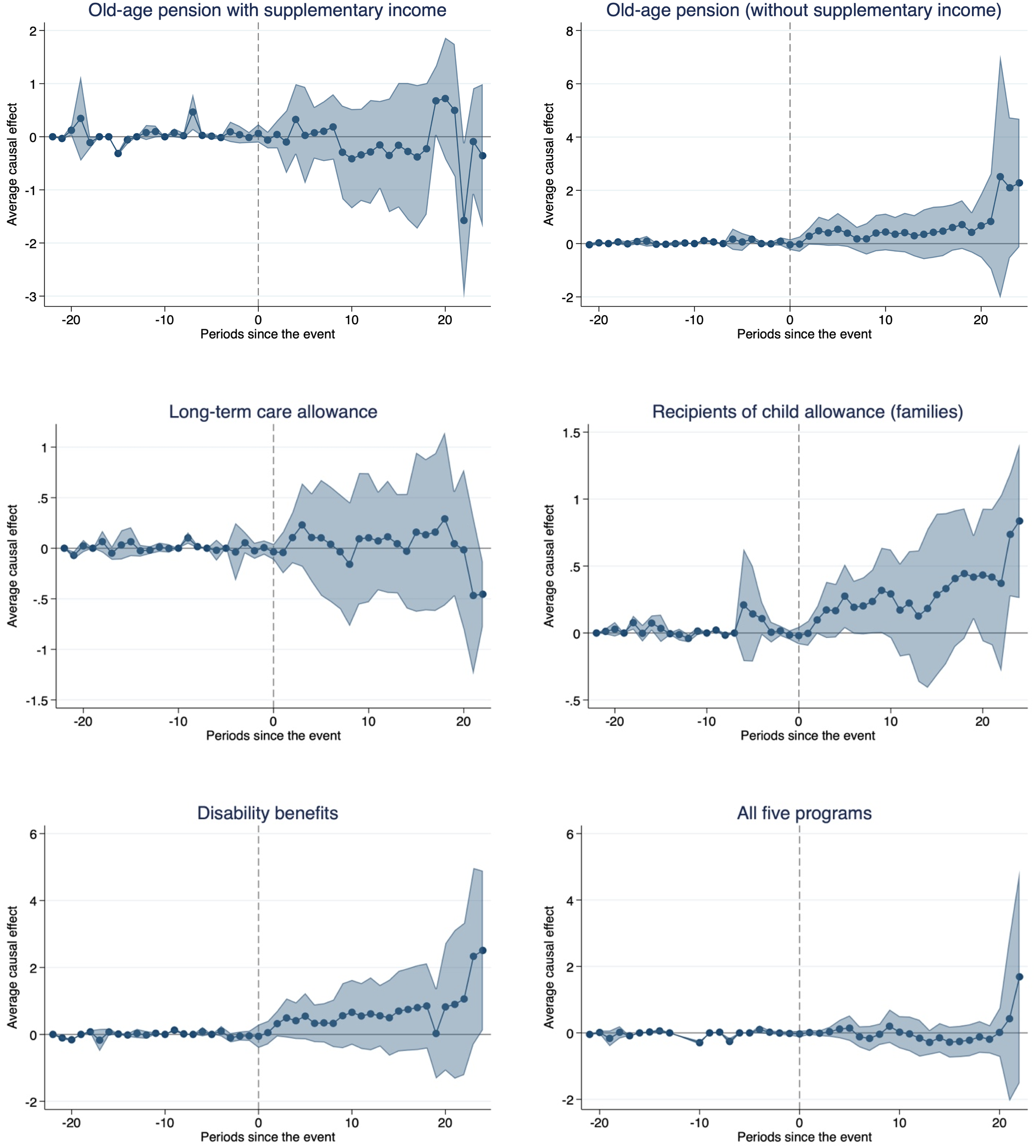

Figure 1 depicts a visualisation of the results shown in Table 6, indicating that improved geographic access to social security has no significant effect on the number of citizens collecting social benefits in any of the top five social security programs. If improved geographic access had a net positive effect on take-up, the graph would display an upward trend after the intervention, indicating a positive treatment effect. Figure 1 shows that the average effect after opening a new field office in all five programmes exhibits a wide interval around zero in almost all years, in contrast to the nearly flat and narrow interval around zero in the years before the intervention.

Figure 1. The estimated number of recipients using Callaway and Sant’Anna methodology.

Note: All regressions include the control variables that were used in Table 4’s regressions.

Discussion and conclusions

This study investigates the effect of geographic access on the take-up of the five largest social security programs in Israel. These programs vary, ranging from targeted programs with high perceived administrative burden and NTU rates, such as disability benefits, to automatic programs with modest burden and NTU, such as child allowance. The empirical analysis shows that opening a new field office does not have a robust and consistent effect on the number of recipients in all top five social security programs in Israel. While this result is expected for automatic programs such as child allowance, it is surprising for targeted programs such as disability benefits and long-term care allowances. The coefficient of a new field office in the regression of recipients of old-age pension with supplementary income is the only significant coefficient using the traditional estimation method. However, it does not remain significant and becomes insignificant after transitioning to the new estimation method. Moreover, disability benefits are associated with higher administrative burden than old-age pension with supplementary income and yet a new field office has no effect on its respective take-up.

The null impact found in the current study differs from the findings of two other studies that explored the effect of geographic access on the take-up of social programs in the United States. Rossin-Slater (Reference Rossin-Slater2013) showed that the take-up of WIC in areas with active clinics in the state of Texas was 6% higher, while Deshpande and Li’s (Reference Deshpande and Li2019) study revealed that the number of disability benefit recipients was 16% higher in places that had not experienced a field office closing. Our study employs a more recent methodology, developed after the publication of these two papers, which may be one possible explanation for the difference in findings. We have demonstrated that traditional empirical analysis tends to overstate the impact of geographic access on the take-up of a certain social security program.

The lack of significant and consistent effect of geographic access on take-up is even more surprising given that our study mostly consists of openings of new field offices. Theoretically, the impact of closing and opening new field offices may differ due to varying information diffusion, which could serve as another potential explanation for why our results differ from the two mentioned studies. As people have already obtained information from the field office in the years prior to its closure, the closing may have a limited negative effect on information costs in the short run. In contrast, the opening of a field office has a positive impact on information accessibility due to the reduced costs of collecting information at a nearby office and the constant reminder of a visible social security building.

What may account for the surprising finding of no consistent impact of geographic access on the take-up? We offer two possible explanations here. First, the insignificant effect of opening new field offices on take-up may be driven by the alternative explanation of political favoritism. Political favoritism may lead to misallocation when a new social security office is opened due to political pressure, with other inputs remaining constant, such as workers and IT resources. To the extent that more field offices result in a prolonged application time, it has a negative impact on the take-up of social security benefits, as previously demonstrated in the literature (Hernanz et al., Reference Hernanz, Malherbet and Pellizzari2004). The increased burden of waiting times is likely to have a negative psychological impact as well.

This is all the more important and common in contexts where clientelism plagues the welfare state, such as Israel (e.g., Tarshish, Reference Tarshish2017). Herd and Moynihan (Reference Herd and Moynihan2018, p.221) describe the considerable pressure certain members of Congress aggressively lobbied to locate field offices in their districts in the first years of the US social security, indicating that such behaviour is not limited to Israel or to our times. The above discussion suggests that opening a new field office due to political favoritism, without allocating the necessary resources like staffing, can backfire and actually lower take-up and undermine service delivery, contrary to intentions.

The second possible explanation may be related to the potential discouraging effect of an increased number of choices. Opening a new office raises the complexity of the application process because more alternatives (a field office, a secondary office and a main office) are available for applying for social security benefits, which may dissuade potential applicants. Hence, opening a new field office might hinder the capacity to reduce burden and NTU. This connection between state capacity and limited ability to perform burden reduction has been documented in various settings (Herd et al., Reference Herd, DeLeire, Harvey and Moynihan2013; Heinrich, Reference Heinrich2016), highlighting that ‘political choices about state capacity are can be also de facto choices about burdens’ (Moynihan, Reference Moynihan, Ladner and Sager2022, p.116).

While the second explanation implies a change in primary NTU, the first explanation also suggests a shift from primary NTU (e.g., potential claimants do not apply) to secondary NTU (e.g., claim submitted but not approved) due to a combination of political favoritism and misallocation. It highlights the effect of administrative errors (Widlak & Peeters, Reference Widlak and Peeters2020; Holler & Tarshish, Reference Holler and Tarshish2022) and burden caused by ‘information infrastructure’ (Peeters & Widlak, Reference Peeters and Widlak2023). These types of NTU (Janssens & Van Mechelen, Reference Janssens and Van Mechelen2022) and administrative burden are less researched, and the burden of their correction is incredibly high (Holler et al., Reference Holler, Tarshish and Kaplan2024).

Finally, a discussion of the limitations of the study is needed. The findings are based on 41 instances of field office openings or reopenings and six instances of closings that occurred in 39 localities between 1993 and 2021. While this number of interventions seems sufficient for the traditional method of estimation to uncover the effect of field office on take-up of social security benefits, the Callaway and Sant’Anna’s (Reference Callaway and Sant’Anna2021) methodology requires many opening events to achieve a high level of precision and confidence in the estimation results. Relatedly, according to that new method, the treatment cannot be ‘turned off’, and therefore, we excluded the observations of six localities where a field office was closed. Another important limitation is that we simply do not have data on the reasons behind new field office openings. The cause could be political, bureaucratic or other. For this reason, further research should investigate the driving force behind opening new offices to uncover the particular mechanism. More research is also needed to address other aspects of geographic access and take-up such as the physical structure of the office and the transportation to the office. Finally, research should also explore whether the effect of geographic access on take-up differs when marginalised populations seek social benefits.