I. INTRODUCTION

The 1931 financial crisis that struck Austria and Germany as a result of the Creditanstalt bankruptcy caused tremendous problems in the international monetary system. Several European countries suffered from a shortage of gold and hard currencies, in particular those that were still paying reparations for the Great War. Their external economic relations were severely affected as they suspended debt payments and resorted to exchange controls and clearing agreements. These clearing agreements were a surprising innovation at the time. Mostly condemned by contemporary observers, bilateral clearing nevertheless inspired several economists, especially in Europe.

Edgard Milhaud (1873–1964), a French economist working as a professor of economics at the University of Geneva in Switzerland, was one of them. In 1932, he promoted a plan for international monetary cooperation and the establishment of multilateral interstate clearing in order to restore international trade. Milhaud had previously been in charge of an inquiry on production for the International Labour Organization (ILO) and was concerned by the level of unemployment. According to Milhaud, the restoration of mutual international trade was an absolute necessity in order to fight unemployment and deflation, and a new scheme involving the creation of an international compensation office was necessary to reach that goal.

The Milhaud plan first appeared in non-academic journals, such as the Journal des Nations (published in French in Geneva), before being improved and published in 1933 in the Annals of Collective Economy, a trilingual review edited by Milhaud himself.Footnote 1 Through the Annals, which devoted several issues in the 1930s to the problem of international liquidity shortage and international clearing, some updates, comments, and revisions of the plan were made available to contemporary readers by Milhaud and his circle. The plan was widely disseminated in academic and professional circles at the time. It drew the adherence of some political parties, notably in France with the influential Radical Party, which led France to raise the question of making bilateral clearings multilateral before the League of Nations (LON).

Charles Kindleberger (Reference Kindleberger1950) mentions the Milhaud plan as one of the ancestors of John Maynard Keynes’s International Clearing Union and all the subsequent proposals for international clearing (for this comparison see also Lambert Reference Lambert1963, p. 505). Kindleberger seems to have discovered Milhaud as early as the 1930s (Kindleberger Reference Kindleberger1936 and Reference Kindleberger and Harris1943) and repeatedly pointed out that Edgard Milhaud, before Keynes, had designed a proposal for a clearing union that shared many aspects of the Keynes plan. As this paper will show, Kindleberger’s argument is correct, as the Milhaud plan shares many common features with the Keynes plan, although significant discrepancies also exist between the two. With only a few exceptions, academic research on the proposals for an international clearing union has surprisingly ignored the discussion on international clearing by Milhaud. This may be due to the low impact of the Milhaud plan when it was published, despite being widely circulated and known. The 1930s were characterized much more than the subsequent decades by nationalist policies and the political context was less favorable to international talks on international monetary cooperation. The wartime negotiation of Bretton Woods had precisely the opposite context: a period favorable to international cooperation, with even officials of great powers—such as the UK—supporting proposals for international clearing.

The article will answer three research questions: (i) What were the basic principles of the Milhaud plan?; (ii) How did Milhaud’s contemporaries react to his plan, what were their alternative projects, and why has the plan been ignored by the literature on international monetary reform?; and (iii) What are the similarities between Milhaud’s plan and subsequent proposals for international monetary reform, most notably that of Keynes?

The paper starts with the presentation of the historical context surrounding the Milhaud plan (section II). The following section introduces the plan. The fourth section questions the influence of the Milhaud plan and more generally the idea of multilateral clearing, which has subsequently been promoted notably by Keynesian and post-Keynesian scholars.

II. THE GENERAL CONTEXT

Three blocs of countries emerged after the 1931 collapse of the Gold Standard. The most conservative one was the gold bloc (France, Belgium, Luxembourg, Italy, Switzerland, Poland, Netherlands), which clung to gold and was fundamentally attached to the liberal international order. However, it suffered from the problems caused by gold anchorage, including the movement of gold, as well as from the growing exchange-rate misalignment with the countries that gave up the gold standard to devalue their currency. The floating currencies bloc (including the Sterling area, the United States as of 1933) emancipated itself from the problems caused by the gold standard; however, this was at the expense of the “monetary peace” provided by the international standard (Harris Reference Harris2021). The choice to have a floating currency was both a liberal—as it avoided exchange controls—and a nationalist way to escape the international monetary crisis. The third bloc chose an illiberal way to deal with the monetary problems through exchange controls. It was mainly led by Germany and included a growing number of countries (notably Eastern Europe and Balkan countries).Footnote 2 The interrelations between these competing blocs led to a long struggle that did not leave them undamaged. The gold bloc was weakened by the Belgian franc devaluation in 1935 and collapsed in 1936 with the French franc devaluation. As we will see, the bloc that eventually dominated Europe was the exchange control bloc characterized by clearing agreements.

Although clearing was used as a form of settlement after World War I, the history of systematic clearing agreements started with the 1931 financial crisis that hurt Austria and Germany as a result of the Austrian Creditanstalt bankruptcy (Samuelson Reference Samuelson1971). Several countries suffered from a shortage of gold and hard currencies, in particular those in Central and Eastern Europe that still had to pay reparations for the Great War. Their external economic relations were severely affected, as they suspended debt payments and resorted to exchange controls. Exchange control “was introduced in many countries in order to protect an unstable currency and obtain the sums required to discharge foreign obligations” (LON 1935, p. 24). Clearing agreements followed rapidly. For the countries of Central and Eastern Europe, it was a means to control and limit imports. For the other countries—mainly creditor countries—clearing agreements were “the surest way of recovering their blocked claims and of preventing the freezing of fresh claims” (LON 1935, p. 25; see also Ritter Reference Ritter1936, p. 469). Only at a later stage did the clearings become a means of implementing military and geo-political strategies.

The mechanism of clearing can be described as follows: in each country that is part of the clearing agreement, the importer does not pay the foreign supplier directly; instead, the importer of the goods pays the corresponding amount to its national clearing office. With the amount collected from the importer, the national clearing office can pay its domestic exporters in domestic currency. The main advantage of these agreements is that there is no transfer of gold or hard currency corresponding to the flow of goods, which is the reason why clearing is sometimes compared with barter inasmuch as international currency flows are missing. The scheme above (Figure 1), drawn from the LON inquiry, compares the two methods of paying for goods. With bilateral clearing (the second method), countries A and B do not send currency flows to each other in payments of goods.Footnote 3 We observe instead in each nation a triangular relationship between the exporter, the importer, and the national compensation office. If the trade between A and B is not at equilibrium (because the value of the goods of, say, A sent to B is much higher than the value of the goods sent by B to A), there will be a positive balance recorded by A; and A should be able to use that positive balance to import from B in the next period of trade. However, this situation may result in the freezing of trade as the creditor country (A) may not want to accumulate a positive balance—potentially useless—and prefer to stop trading with B (Nyboe Andersen Reference Nyboe Andersen1946).

Figure 1. Two methods of paying for goods exchanged between two countries.

Source: LON (1935, p. 28).

Edgard Milhaud’s proposal responds to the outbreak of bilateral clearing agreements and exchange controls with a proposal to make compensation multilateral through an international clearing house. The idea was hardly new (Haines Reference Haines1943). Many contemporary observers of international monetary relations considered the creation of the Bank for International Settlements (BIS) in 1930 an important step in bringing about an international clearing house. The BIS was set up as a consequence of the 1929 Young plan. The Young plan reshaped the payment of the reparations imposed after the world war and planned to organize interallied financial settlements through the BIS. The establishment of an international clearing house was one of the initial purposes of the BIS (Dulles Reference Dulles1938, p. 291). However, the course of events prevented it from assuming its role as nationalist policies quickly took control over the process of international monetary cooperation. The BIS survived the crisis but mainly as a place for central bankers to be trained and exchange information.

The first observation made by Milhaud is that the various bilateral agreements in the world eventually prevented international trade from collapsing. Milhaud called them “[s]undry attempts to surmount the difficulties in international trade by compensating procedures” (Milhaud Reference Milhaud1933a, p. 19). Several agreements were implemented as of 1931, immediately following the crisis. Milhaud describes the example of German clearing agreements, which started in 1931 and multiplied in 1932 across Europe. The European political elites disliked these clearing agreements, even in the countries that introduced them. However, the clearings were a necessary expedient. Despite characterizing the bilateral clearings as to some extent “abominable,” Karl Ritter (Reference Ritter1936, pp. 471–472), a German diplomat, wrote that “the clearing agreements have given her [Germany] the possibility of maintaining her supply of foreign raw materials and half-finished goods in such a way that the great and complicated machinery of German production could on the whole continue to function undisturbed.” Milhaud considered the signature of various bilateral clearing agreements as a general tendency of the period. He argued that compensatory trading (or countertrade) was already an instrument frequently used to maintain and even increase exports (Milhaud Reference Milhaud1933a, p. 30). He included in his description not only German and Austrian clearing agreements but also clearing or barter transactions arranged by countries such as Brazil, Switzerland, and the United States, the latter known to be more liberal.

Even liberal countries, those without foreign exchange controls, gave in to the external pressure and eventually adopted compensation agreements during the 1930s. The main reason was that they had to cope with the exchange controls implemented by the trade partners in Germany and in Central and Eastern Europe. However, the “normal” regime of convertible currencies was still working between the countries that did not need to apply exchange controls at this time. Facing exchange-rate variations, they had struggled throughout the 1930s to support their currency by other means—other than exchange controls—especially through the Exchange Equalization Account in the UK and the Exchange Stabilization Fund in the US. These two funds aimed at stabilizing the currency’s exchange rate without involving any exchange control or centralization of trade (Cabiati Reference Cabiati1940, pp. 225–280; Schwartz Reference Schwartz1997).

As we will see below, Milhaud’s proposal offered a way to include the desirable features from the different blocs. In fact, we have: (i) an internationalist stance and an automatic mechanism (as in the gold bloc), (ii) the flexibility of the system of liquidity supply and exchange-rate determination (as in the floating bloc), and (iii) the clearing principle (as in the exchange control bloc).

III. THE MAIN FEATURES OF THE MILHAUD PLAN

An important motive for the plan was the fight against deflation, because the model creates conditions for the realization of exports and stimulates external demand. This was particularly important for agrarian peripheral countries where the depression was extremely severe. It was no coincidence that, when responding to criticism that the plan might be highly inflationary, Milhaud noted that even if there were some weak inflation, it would benefit precisely agrarian countries—they would be able to export and service their debts (Milhaud Reference Milhaud1933d, pp. 92, 108). In the same direction to overcome depression and deflation was the possibility within the plan to initiate schemes for financing large international infrastructure projects (Milhaud Reference Milhaud1933d, pp. 62–64). Milhaud’s system was supposed to come into effect as a result of an international convention (Milhaud Reference Milhaud1933d, p. 138).Footnote 4

A key issue addressed by Milhaud is that gold suffered from maldistribution, as some countries accumulated disproportionate amounts of gold (LON 1931; Harris Reference Harris2021). A problem directly related to gold maldistribution was the behavior of countries that benefitted from a strong international demand such as the United States. They implemented nationalist policies and de facto re-established trade barriers. Milhaud and his followers strongly opposed the nationalist policies of the period.Footnote 5 The consequences of these policies were a shortage of gold and hard currencies in some countries, restrictions on imports, and a fall in world trade. Milhaud began the Gold Truce (Reference Milhaud1933d) by introducing the problem of world trade in 1931 and 1932, with alarming statistics on its decline. Against the hoarding of gold, he emphasized the need to reinstate a new international means of payment, which he characterized as a round-trip ticket.Footnote 6

Milhaud considered that bilateral clearings had the advantage of preventing a worse fall in trade. Nevertheless, his plan recognizes the shortcomings of bilateral agreements. The main limitation is that country A cannot use its claim on country B to pay its debt to country C. As a result, all countries tend to seek bilateral equilibrium. Country A may reject some imports from B if it does not have anything to export to B. Therefore, bilateral clearing is essentially deflationist. By contrast, if these three countries agree to accept that A’s claim on B can be used to settle A’s debt to C, the incentives are reversed. Bilateral disequilibrium is tolerated and even encouraged. The benefits of the system increase with the number of participants. As explained by Milhaud (Reference Milhaud1933a, p. 54), “the system would gradually make its way through its inherent expansive force.”

A second limitation related to economic inefficiency resulting from bilateral clearings, which could retard economic progress, concerns misallocation issues (Milhaud Reference Milhaud1933a, p. 41):

Owing to the disadvantages likely to ensue in certain cases from a universalization of the system of bilateral compensations, we may mention the creation or the probable development in some countries of industries or undertakings having suddenly, whilst the crisis is at its height, new markets opened to them. … The world had already to sustain the burden of all the factitious industrial plants created by the autarchic currents of the war and after. To this burden are to be henceforth added the ‘compensation industries’ which the new policy, left to itself, would foster everywhere.

In line with many other internationally minded economists, Milhaud wanted to preserve the international division of labor and the efficiency gains that resulted from it.

The main elements of Milhaud’s system can be summarized as follows: (i) issuance of national purchase certificates, (ii) their compensation without the presence of an international currency unit, (iii) a two-tier payment structure, and (iv) the presence of floating exchange rates and validity period for these certificates. We will consider these in turn below.

Purchasing Certificates and the Absence of an International Currency

The international compensation scheme would use the newly created means of payment—“purchasing certificates”—to restore purchasing power without using a new unit, as the certificates would be fully covered by the domestic currency. Hence, the unit of account of the certificates would be the same as the domestic currency. It means that the Milhaud plan did not need the creation of a new and independent international unit of account.

The absence of a new currency unit may be thought-provoking for a student of international monetary reform proposals. However, it was not uncommon in other kinds of clearing schemes at the time. The clearing agreements signed by Hjalmar Schacht’s Germany, for example, did not involve any new unit of account.Footnote 7 Usually, the agreements used a national currency. Practically speaking, the goal of clearing agreements was to save international currency, not to create a new one.

On this question, it is worth remembering that the first version of the Keynes plan (8 September, 1941), entitled “Proposals for an International Currency Union,” (Keynes Reference Keynes, Johnson and Moggridge1980) involves only the creation of a new unit of account, referred to merely as “the bank money of the clearing bank,” which was conceived of as being for practical accounting purposes only in the internal accounts of the clearing bank. Only with the second draft did a named unit of account appear: the “grammor.” In the third draft, the unit is named “bancor” and it remained so until the publication of the Keynes plan as a white paper. Nonetheless, a new unit of account does not appear as the essential feature of the plan.

It is notable that in Keynes’s first draft we can recognize some aspects of the analysis calling for a sort of gold truce.

Dr Schacht stumbled in desperation on something new which had in it the germs of a good technical idea. This idea was to cut the knot by discarding the use of a currency having international validity and substitute for it what amounted to barter, not indeed between individuals, but between different economic units. In this way he was able to return to the essential character and original purpose of trade whilst discarding the apparatus which had been supposed to facilitate, but was in fact strangling it. (Keynes Reference Keynes, Johnson and Moggridge1980, p. 23)

The “apparatus” mentioned by Keynes was the gold-exchange standard based on laissez-faire. Hence, the solution was to “discard” that currency system, which was not working, and resort to “barter,” which would allow returning to the original purpose of trade.

A Two-Tier Structure of International Payment and Compensation

Michael Heilperin (Reference Heilperin1934, p. 268) explained in a text supporting Milhaud’s plan that the “mechanism consists in a differentiation effected between the interior currency of a country and the currency used for international payments.” The plan wished to make the “barter certificates” the only authorized means of payment for international trade. All foreign exchange would be the property of the National Compensation Office, which presupposes some form of exchange regulations—although Milhaud and his devotees did not mention that necessity. The centralization of payment flows also prevents undue fluctuations of exchange rates (although in Milhaud’s scheme exchange rates are not fixed nominally; see the following point on exchange rates).

Milhaud (Reference Milhaud1935, p. 18) considered that his scheme was realistic in the sense that the institutional framework needed was already in place. When he drafted his plan, the national offices necessary to carry out domestic operations already existed in twenty-five countries, covering a large part of international trade. For these countries, there was no need to create a new institution. As mentioned above, after 1931 even “liberal” countries—i.e., countries like the US or UK that were attached to “traditional” methods of international payment—had to create some institutions to carry out trade transactions with countries that blocked their claims and applied exchange controls. As explained in a document of the International Chamber of Commerce that listed the existing clearing agreements, some of them were handled by the central bank, while others were managed by a specific ad hoc institution created for that specific purpose (Chambre de commerce internationale 1936). Hence, the institutional apparatus necessary for the Milhaud plan was not perceived as a real obstacle in the 1930s. The plan does not contradict the tendencies that led to the clearing agreements; however, it overcomes the main problems resulting in the nationalist attitude underlying them: “The project has the particular advantage of being politically workable, as it falls in line with the modern scheme of barter agreements, of national currencies and other nationalistic tendencies, though in effect it leads to a deep change in this attitude. It works without making a political issue of its real international objectives” (Heilperin Reference Heilperin1934, p. 272).

The international office required to execute international payment already existed, too: according to Milhaud, it was the BIS. Milhaud thought that this institution should have the responsibility of ensuring the circulation of certificates. As mentioned above, one of its main purposes when it was created was the international clearing and settlement of international debt related to war. According to Milhaud (Reference Milhaud1935, p. 18), the Lausanne conference deprived the BIS of the power to play this role—because it terminated the reparation regime. The BIS may, however, revive it if a new consensus emerges about the necessity of international clearing: “The primary operations the Bank was intended to carry out will, owing to the results of the Lausanne Conference, become more and more restricted. It could therefore, if not without difficulty, then at least without too great a difficulty, act in the novel circumstances as the international agency for the compensating system” (Milhaud Reference Milhaud1933a, p. 54).

As Heilperin points out (Reference Heilperin1934, p. 268), the plan assumes no capital movements between countries—as a continuation of the existing controls that prevented the cross-border flows of gold and convertible currencies. Here again, there is a similarity with the Keynes plan, which assumes that there are no international flows of capital covered by the International Clearing Union (Cedrini and Fantacci Reference Cedrini, Fantacci, Rosselli, Naldi and Sanfilippo2018; Faudot Reference Faudot2021). However, the Milhaud plan is also a debt-settlement mechanism. For instance, Milhaud (Reference Milhaud1936a, pp. 305–306) explains before the French Union of Exporting Industries, France could pay its debt vis-à-vis the US through the issuance of French purchasing certificates to the US (which could be converted into goods imported from France or into touristic services for US tourists in France with “traveler’s cheques”).Footnote 8

In his presentation of the plan, Milhaud gives an example of a transaction between a wine exporter from Bordeaux (therefore French) and a Yugoslav importer. The French exporter will be paid with Yugoslav certificates—which are useless to him in France—issued by the Yugoslav Compensation Office. The French exporter will immediately deposit them in the French Compensation Office against French francs—the domestic currency—and his part in the transaction is thus completed. The French Compensation Office will then make the Yugoslav certificates available to any French importers.

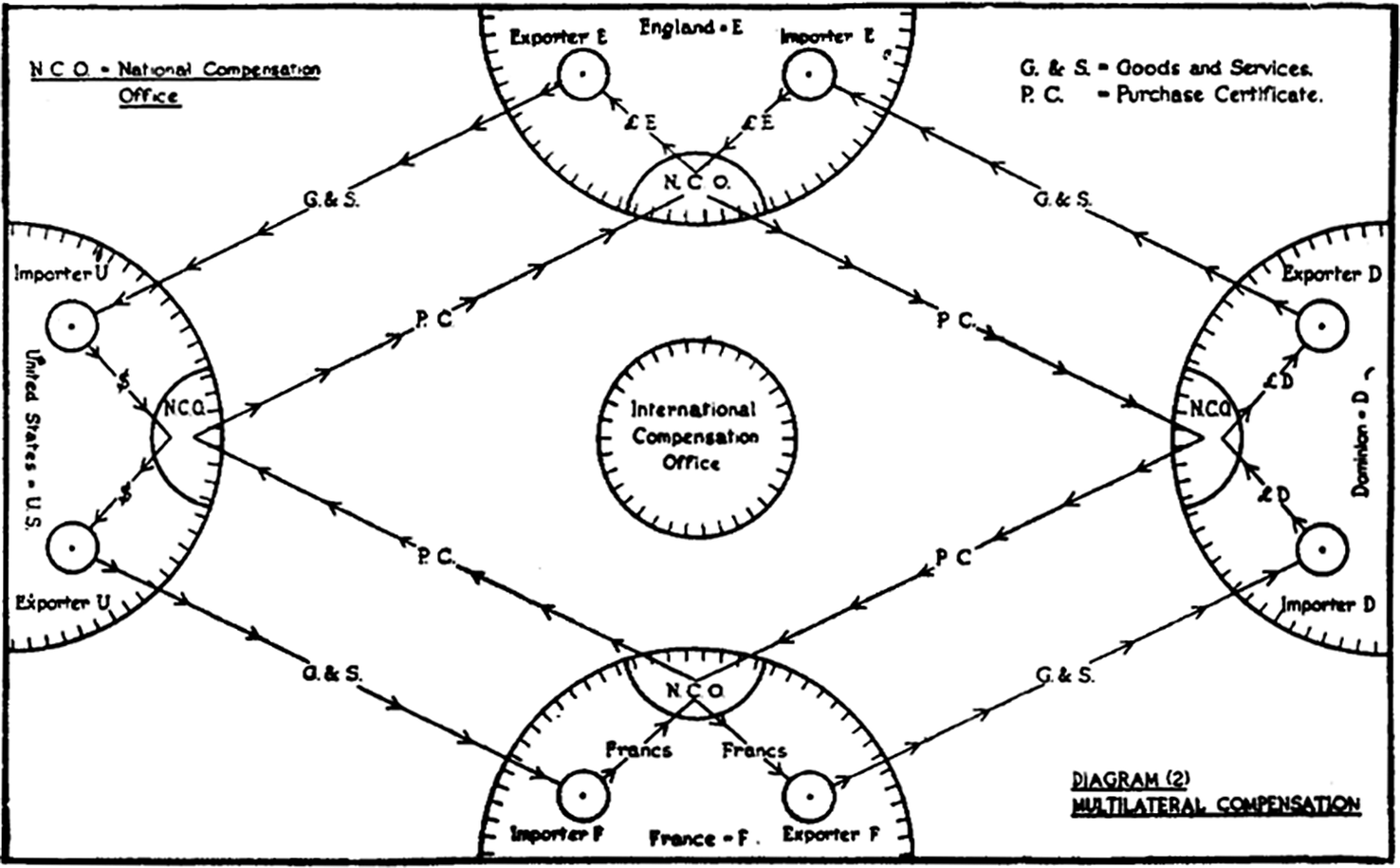

The National Compensation Office sends notifications of all transactions to the International Compensation Office, which guarantees the international circulation of the certificates. If French importers do not need Yugoslav certificates, the French Compensation Office can sell them to the International Compensation Office against certificates from other countries that will be useful to French importers. Milhaud assumes that importers elsewhere will be in need of the Yugoslav certificates for their own imports. As illustrated by Figure 2, a fundamental principle is that purchasing certificates, despite bearing the mark of their country of issue, can be used by each country participating in the exchanges. The International Compensation Office acts as an international clearing house.

Figure 2. The Milhaud plan at work with the International Compensation Office.

Source: Edridge, Upton, and Bradley (Reference Edridge, Upton and Bradley1942, p. 124).

The role of the International Compensation Office (Milhaud’s plan) is that of an auctioneer (commissaire-priseur à la Walras) that organizes the exchange of certificates at the request of the participating countries.

The Exchange Rates and the Limited Validity of the Certificates

The plan proposed that any importer can obtain certificates against national currency (banknotes). On the other hand, the exporter that receives purchasing certificates from abroad can get the equivalent amount of domestic currency, which means that the certificates are therefore substitutes for banknotes and possess precisely their value.Footnote 9 Furthermore, the plan intended to make speculation almost nil, thanks to the fact that purchasing certificates are not an interest-bearing asset and could be bought only by the National Office.

The issue of exchange rates is probably the most complex, and Milhaud devoted several sections of his plan to this question. In his plan, exchange rates fluctuate according to the purchasing power of each currency and will equilibrate the trade account: “Just like present-day currencies, indeed like the currencies of all ages, normal and abnormal, the purchasing certificates on the various countries will be quoted on the exchanges” (Milhaud Reference Milhaud1936b, p. 37).

Furthermore, according to Milhaud, the fluctuating exchange rates of the certificates do not lead to a situation of instability, as the monetary authorities still have tools to manage exchange rates.Footnote 10 “But does it follow from this that, on such a condition, the National Compensation Office will be bound to issue new certificates on the country without exercising any control, that is, to the full extent that currency is forthcoming? We do not think so” (Milhaud Reference Milhaud1933a, p. 55).

According to Milhaud, data on the issuance of certificates should be made public. This would allow the general public to be informed about the current circulation of purchasing certificates. Nevertheless, an obvious problem of Milhaud’s scheme is that exchange-rate risk is fully borne by the exporter or by the exporter’s National Compensation Office. As explained by Milhaud, assume that the Yugoslav certificates received by the French Compensation Office for the payment of Bordeaux wine suffers from exchange-rate depreciation against, for example, French certificates. The Bordeaux exporter is partly protected as it receives only French francs from the French Compensation Office. The latter bears the exchange-rate risk; however, it can exchange its Yugoslav certificates against certificates from other countries that are useful for the French importers. Milhaud proposes, therefore, that for future transactions the Bordeaux exporter should anticipate the depreciation and raise its prices in Yugoslav certificates, which may lead the Yugoslav importer to stop importing from France (Milhaud Reference Milhaud1933b, p. 88). The resulting scarcity of Yugoslav certificates will create a reverse appreciating trend. However, those principles may leave the readers puzzled. As described by Erich Roll (Reference Roll1936, p. 353) in his review of the plan, “On the question of the rates of exchange that would rule under this new system, Professor Milhaud is not very clear.”

Mr. A. Duchêne, the director of the French Compensation Office (the existing institution that had been managing compensation with Germany since 1932, and with all the countries applying bilateral clearing with France), argued in 1936 that exchange-rate risk was not a problem: several hedging instruments existed to deal with the risk, especially for forward transactions (Milhaud Reference Milhaud1936a, p. 257). Duchêne expressed a favorable stance on the Milhaud plan and was ready to implement it.

Exchange-rate fluctuation is, nevertheless, a crucial issue. Keynes’s plan was clear that exchange rates should be fixed, and therefore constraints apply to the monetary autonomy of the member countries and rules could prevail over discretion (although Keynes considered that it was probably the most difficult problem to solve in the proposal). Parities could be revised only in exceptional cases. Hence, on this point, Keynes’s plan differs from Milhaud’s plan, which is accepting of fluctuating exchange rates in line with the variations in the trade balance and currency’s purchasing power. For Milhaud, if a certificate’s exchange rate depreciates vis-à-vis other certificates, the monetary authorities and the government of the related country are expected to react through restrictive policies as in any anti-inflation strategy. As a result, the “free quotation of compensation cheques will be the surest guarantee against any excessive issue” (Milhaud Reference Milhaud1941b, p. 404). In fact, the fluctuating exchange rates of barter certificates reinstate the market clearing process that bilateral clearings with fixed rates had ruined. To a large extent, Milhaud reproduces the rules of the game and the semi-automatic adjustment of the gold standard.

According to Milhaud, the certificates should lose their purchasing power after some time if they are not used. Milhaud found inspiration in the work of Silvio Gesell (1862–1930), who supported the creation of new currency instruments with a decreasing value to increase the local exchanges. Gesell’s proposals were influential during the 1930s and convinced some economists and politicians in France, especially in the Radical Party (Blanc Reference Blanc1998; see also Noyelle Reference Noyelle1934, pp. 1651–1652). To foster and stimulate international trade, Milhaud proposed that constraints apply to holders of certificates. The certificates would be valid only for six months. As mentioned by Heilperin (Reference Heilperin1934, p. 269), the certificates lose their purchasing power at their expiration date. This was supposed to speed up transactions, discourage hoarding, and develop imports as a counterpart to exports. Incidentally, Keynes, in his plan for the negative interest rates on creditor countries’ bancor deposits, also espoused Gesell’s principle of the decreasing purchasing power of money as a driver of trade and product circulation. This is not surprising, as Keynes praised some of Gesell’s ideas in the General Theory (Keynes Reference Keynes, Johnson and Moggridge1978, pp. 353–355), although Keynes remained skeptical to some extent, writing that Gesell had neglected the issue of the liquidity preference and “has constructed only half of a theory of the rate of interest” (Keynes Reference Keynes, Johnson and Moggridge1978, p. 356).

The Premises of Endogenous Money Applied to International Trade

To those who compare clearing with primitive barter, Milhaud replies that primitive barter consists of the exchange of goods “without reference to a common standard of value,” which makes it completely different from compensation and clearing transactions that always refer to a monetary standard (Milhaud Reference Milhaud1941a, p. 375). Milhaud (Reference Milhaud1936a, p. 431) argues that the system based on his proposal would continue to use monetary instruments, both in domestic transactions—which are left unaffected—and in international transactions, which are still characterized by indirect exchanges, i.e., monetary buying and selling practices. The system maintains the advantage of the monetary economy with money as an indirect and decentralized means of exchange in the economy.

It is noteworthy that Milhaud claims that one of the main problems of the current international monetary system is that the supply of money was limiting international trade due to factors independent of the general economic development. By contrast, he wrote, payment instruments of a compensatory character form “an elastic quantity which is adaptable according to the volume of transactions to be effected by this means” (Milhaud Reference Milhaud1941a, p. 383). We can notice here the idea that international money—i.e., purchasing certificates—should be created by satisfying the needs of international trade without ex ante constraints. This appears to be a demand-led monetary emission and the compensatory office would accommodate the demand for means of payment. In this respect, the scheme seems to share another similarity with the Keynes plan, as the bancor would also be created on demand, depending on the international trade’s needs. Both were conceived of as trade finance instruments.

IV. PROMOTION AND IMPACT OF, AND REACTIONS TO, THE MILHAUD PLAN

On the intellectual front, Milhaud considered that he was not alone in offering a scheme based on compensation to boost international trade, arguing that the idea was being propagated in both academic and professional milieus. Throughout the 1930s, the Annals reprinted a series of texts written by economists abroad commenting or supporting a compensation scheme, some in response to Milhaud’s plan and some independently of Milhaud (Zander Reference Zander1933). Milhaud (Reference Milhaud1933d, pp. iv, 22–24, 47, 60) makes particular note of the “Bartex” scheme worked out by the London Chamber of Commerce in 1932. As related by Paul Einzig, another proponent of the exchange clearing system, “Indeed, it was the London Chamber of Commerce, a body consisting of practical businessmen, that was the first to realize the broader implications of the exchange clearing system” (Einzig Reference Einzig1936, p. 274). Although the initial support for exchange clearing came mainly from practical economists, the idea of clearing was gaining ground. Milhaud also emphasized that private companies already used some techniques that could be viewed as compensatory trading.

Some local experiments in the United States also inspired Milhaud. The United States, which was rich in gold, may not have felt the need to implement exchange controls and clearing agreements systematically in support of international trade. However, innovative monetary tools came from the domestic and local fronts to fight unemployment by protecting or creating additional purchasing power. Some communities launched new local currencies as well as barter practices to stimulate exchange (Champ Reference Champ2008). In 1933, the Annals of Collective Economy published an account of this new “emergency exchange organization” (Lester Reference Lester1933, p. 263) in an article entitled “A Million Men Return to Barter.” Some of these local arrangements were inspired by the ideas of Silvio Gesell.

In the introduction to “A Gold Truce,” Milhaud explains that the use of certificate issuance was supported by some leading US economists, such as Frank Graham and Irving Fisher (Fisher Reference Fisher1933), as a policy response appropriate for the local community level. Milhaud (Reference Milhaud1933d, p. 164) additionally claims that Frank Graham, from Princeton University, supported his plan in April 1933 when Graham visited Geneva. The journal Annals of Collective Economy, fully committed to supporting the Milhaud plan, devoted a whole issue (January 1934) to the famous Wörgl experiment with certificates in Austria (Von Muralt Reference Von Muralt1934). The town of Wörgl circulated in 1932 a local currency with a decreasing nominal value to accelerate the monetary circulation and boost local exchanges. Milhaud thought that those experiments that stimulated exchanges at the local level could be applied to international trade issues as, in both cases, the situation called for a response to a “hard” currency shortage and the issuance of certificates could be part of the response.

The Promotion of the Milhaud Plan

Milhaud presented his plan before the Moral and Political Sciences section of the Geneva National Institute, in 1932 (November 11), as he also did in France before the National Economic Council (Conseil économique national), and in Belgium before the European Economic Institute (Institut d’économie européenne). In France, the Radical Party first encountered the Milhaud plan at the Congress of Toulouse in 1932. Milhaud then presented his plan in person to the influential Radical Party in a four-day session, and the party eventually adopted it as a principle of its foreign policy (Milhaud Reference Milhaud1933b, p. 153; Berstein Reference Berstein1978, p. 86).

Another important meeting that applauded the plan was the “Third Week of the Currency” (“Troisième Semaine de la Monnaie”) held in Paris between May 29 and June 2, 1933. It was a meeting of experts and politicians. Milhaud participated actively with a speech (reproduced in Chabrun Reference Chabrun1935, p. 193–202) presenting the Gold Truce as well as the multilateral compensation scheme that he wanted to establish. The conference’s statement notes that “the Milhaud Plan proves to be the connecting link between the economy of yesterday and the economy of tomorrow” and the assembly of the conference gave its full support to the plan (Milhaud Reference Milhaud1949, p. 100). The meeting concluded by saying that Milhaud’s proposals should be advanced at the London conference of 1933. Lucien Lamoureux, a Radical Party deputy who became minister of Commerce and Industries in 1934, supported the Milhaud plan at the League of Nations in 1934. As a result, the latter decided to launch a Joint Committee in charge of conducting an inquiry on clearing practices.

In 1934, Milhaud (Reference Milhaud1934, p. 65) was optimistic when he explained in a short article entitled “Will Governments Heed Our Proposals at Last?” that the idea of a reorganization of trade based on international monetary reform with international compensation was making progress. More and more officials and heads of large companies in various countries were becoming convinced by the need to apply reforms along the lines of multilateral—in fact, global—clearing (Milhaud Reference Milhaud1933d, p. 38).

The League of Nations’s inquiry was made up of twenty-six questions posed to the officials of twenty-five countries (published as LON 1935). The Joint Committee received answers from twenty of them. The conclusions were mainly negative. Most often, clearing agreements were conceived of as an emergency measure. However, Milhaud (Reference Milhaud1935) embellished the conclusions in a less than accurate manner, pretending that many countries supported the idea of multilateral clearing (see Milhaud Reference Milhaud1933d, pp. 121–157). Although some of them did indeed state that a multilateral scheme would be preferable to the existing bilateral agreements, the majority of respondents did not believe that this would be possible and they desired to return to the gold exchange standard and a free international monetary system as soon as possible. Nonetheless, pockets of support remained. For example, on September 24, 1935, the delegate of Chile at the LON, supported by the Bulgarian and Latvian delegations, restated its interest in the Milhaud proposal.

In March 1935, the Action Committee for International Integral Compensation was created in Geneva. Its role was to publish articles and books on the proposed international clearing reform, inform the public, and act as a think tank for governments and their representatives. Robert Alterman, the administrator-delegate of the French Union of Exporting Industries, defended the Milhaud plan before the Congress of the International Chamber of Commerce on June 25, 1935. Eventually, a reformulation of the plan was proposed by several radical deputies before the French Parliament (notably Paul Elbel and Maurice Palmade) in March 1936 (Milhaud Reference Milhaud1936a, p. 245). The Milhaud plan also received the support of some associations of creditors interested in recovering blocked claims due to arbitrary exchange controls (Milhaud Reference Milhaud1936a, p. 410–417). We have found several of Milhaud’s works on international clearing translated into Russian, Spanish, Polish, and Italian. The Milhaud plan also generated discussions outside Europe. Michael Heilperin, who did his PhD in Geneva in the same institute as Milhaud, presented the Milhaud plan in New York in 1934 before the Commission of Inquiry on National Policy in International Economic Relations (Heilperin Reference Heilperin1934).

The Tripartite Agreement of 1936 marked a downturn in the hope for multilateral clearing reform as the agreement tried to restore a liberal order without any clearing scheme. As Milhaud (Reference Milhaud1949, p. 57) explained retrospectively:

In numerous commercial circles as well as in assemblies of economists this method [Multilateral Compensation] met with a desire to adhere to it during the great depression of the early thirties. In 1935 and 1936, it caught the attention of the Assembly of the League of Nations, which doubtless only gave up the idea of declaring itself in favor of the method in October 1936, because, on the morrow of the tripartite monetary pact between the United States, the United Kingdom and France, immediately signed by other powers, the hope was entertained of an immediate and general return to the total liberty of transactions and settlements according to the classic rule.

The Tripartite Agreement of 1936 involved not only the United Kingdom and the United States —countries that had left the gold standard in 1931 and 1933, respectively—but also France, which had just departed from it. Several smaller countries from the gold bloc joined the agreement as junior members. The members of the agreement expected that interventions by central banks (through their exchange stabilization funds) in foreign exchange markets would be sufficient to secure exchange-rate stability. If the currency of one of the three countries, e.g., the French franc, had a depreciating exchange rate compared with the daily official price in gold, the three members would support it by selling the US dollar or pound sterling, or by buying the French franc. A persistent decline in the exchange rate of the French franc could result in official devaluation the day after, and a new price in gold supported by the three countries. The principle of the agreement was to restore international monetary peace and exchange-rate stability with a “24-hour gold standard” (for a detailed account, see Harris Reference Harris2021). However, the worsening of the international situation and the preparation for war eventually opened the door to a war economy and exchange controls in Europe.

The Impact of, and Reactions to, the Milhaud Plan

The plan was commented on by a large number of economists, social scientists, and politicians. It received mixed reviews. Many commentators acknowledged that the idea of multilateral clearing was interesting and thought-provoking. However, most of them did not believe that the proposal could be useful.

In France, Bertrand Nogaro (Reference Nogaro1936) positively commented on Milhaud as an outstanding economist in the post-1931 period, although his comment mainly relates to the domestic impact of the plan. He considered that Milhaud had a consistent interpretation of the contemporary crisis, taking its international dimension into consideration. Nogaro also assumed that the creation of new purchasing certificates would contribute to fostering trade.

Several objections came from another French economist, Roger Picard (Reference Picard1933). Picard feared that the scheme would result in overissuance of certificates. This would generate shortage problems especially if the bonds were used by creditors to buy huge quantities of goods from debtor countries. Milhaud (Reference Milhaud1936a, p. 436) replied that his plan anticipated this problem by providing the necessary arrangements to be concluded between creditors and debtors, resulting in the staggered issuance of the certificates. The Milhaud plan would have the advantage of progressively freeing the claims and contributing to settling the reparations issue. Furthermore, Picard feared that overissuance would result in inflationary problems in the issuing economy. However, Milhaud (Reference Milhaud1936a, p. 451) assumed that the national compensation offices would themselves keep the issuance of certificates in check. Another of Picard’s objections was related to the limited validity of the certificates. Different purchasing certificates issued at different times would confuse the market for certificates by their different dates of issue, and those close to the expiration date would depreciate sharply. Milhaud replied with two arguments. First, it would not be a problem as the foreign exchange dealers were already used to dealing with different prices for similar assets with different validity periods. Second, banks involved in dealing with the certificates would logically distribute them in chronological order to avoid any expiration.

According to Erich Roll (Reference Roll1936), Milhaud had honorable goals, but his proposal was not relevant because it misidentified the fundamental problem as the shortage of means of payments. Milhaud accuses the creditor countries of having implemented trade barriers—through customs tariffs and other barriers—while preventing the circulation of international means of payment; hence, the shortage of means of payment for some countries that had no other choice but to resort to bilateral clearing. Roll criticizes Milhaud for showing a certain naivety in thinking that getting creditor countries to accept certificates could revive international trade and solve this problem. As Roll points out, however, if the creditor countries were willing to agree to make such a commitment, they would certainly not have put in place tariff policies and trade barriers. Roll identifies a weakness in Milhaud’s argument in that it was based on the belief that the shortage of means of payment was the main problem of the time. Roll does not seem to believe that the problem of the economic depression was essentially about international trade—it was certainly to be traced to domestic causes. Picard also developed a similar criticism (Milhaud Reference Milhaud1936a, p. 432).

In his postwar study of clearing agreements, Paul Nyboe Andersen (Reference Nyboe Andersen1946, p. 228) argues that the Milhaud plan is a proposal for the reform of the international free currency payments but certainly not an expansion of the bilateral clearing, as, according to the plan, the importers and exporters are circulating the certificates “as a cheque under the banking mechanism, and there is no current contact between the issuing compensation offices corresponding to the clearing notifications.” The certificates with decentralized issuance and the likely lack of coordination between national compensation offices thus seem at odds with the principle of clearing.

Colin Clark seemed more sympathetic towards the Milhaud plan. Clark reviewed a later Milhaud book on international compensation, published in 1937. He considered that the proposal was interesting. However, in 1937 the reform no longer seemed useful as trade was booming again: “It is also rather an unfortunately chosen time to produce a book dealing with this project at a time when world trade is booming, and indeed probably approaching a level which is not likely to be surpassed for a number of years in the near future” (Clark Reference Clark1938, p. 102).

Soviet economists did not remain indifferent to Milhaud’s ideas. For example, in his seminal book on foreign exchange restrictions and clearings, Soviet economist Lazar Frey analyzes Milhaud’s project, noting its weaknesses, both technical and ideological (Frey Reference Frey1940, pp. 182–184). According to Frey, Milhaud’s “compensatory currency, a currency of a new type” is a specific form of foreign trade banknotes, which have two peculiarities, namely that they are of a definite duration and that they can be used only in the country that issues them. This makes them similar to the models of blocked currencies (Aski marks, etc.) used in Germany. Frey also finds it problematic that Milhaud reproduces the automatism of the gold standard without gold. Milhaud, for example, believes that when a country runs a deficit, a devaluation of its notes will stimulate exports, restrict imports, and bring the trade balance back to equilibrium. According to Frey, this is naive, and could function only for a limited period (e.g., a year) because floating exchange rates will lead to severe instability, speculation, and capital flight, i.e., the need for a new currency constraint. He argues that Milhaud has confused the end and the means. The stability of exchange rates should be the goal of restoring trade and balances of payment, but under Milhaud’s scheme the equilibrium of balances of payment becomes the goal, while the exchange-rate stability is sacrificed. These are the technical criticisms. Soviet economists, in general, also made the conceptual “ideological” criticism that cooperation between capitalist countries was impossible. Each country pursues its own interest, and in this case, no country that has a strong economy and is under a free foreign exchange regime would agree to participate in Milhaud’s project. The project might function to a limited extent within countries with exchange controls, but even that is doubtful.

It is also important to consider the most fundamental dimension of the ideas put forward in Milhaud’s model: the general question of reforming exchange. In fact, in the years when Milhaud proposed his plan, there were other projects for getting out of the crisis by reforming both the mechanisms of exchange in general and international exchange in particular.Footnote 11

As for competing projects, we note that they can generally be grouped along several lines.Footnote 12 One group of authors streamlined the solution to increasing the world money supply by proposing to expand and dynamically restructure the backing of money to include different combinations of precious metals and basic resources (Georges Boris Reference Boris1931;Footnote 13 Louis Fizaine Reference Fizaine1933; Francis Delaisi Reference Delaisi1933). Others, such as Robert Eisler (Reference Eisler1932), for example, proposed an original system of synchronous and proportional increases in the money supply in all countries, through mutual lending by the respective central banks, which, in turn, through credit and open market operations (a kind of global quantitative easing), would increase public and private spending. This then would create purchasing power and melt away the gigantic unemployment.

It is worth noting Bedros Haladjian, who argues that the center of the problem of unemployment and of equilibrium is “the existing regime of international trade” (Haladjian Reference Haladjian1932, pp. 92, 106), and who proposes a reform based on international reciprocal barter (effective exchange) and a National Cartel for Foreign Trade to monitor, through planning, the harmonious relationship “between [a] country’s sales capacity and its consumption capacity” (Haladjian Reference Haladjian1932, p. 115). His solution comes close to the model of Milhaud, although it involves a higher degree of centralization and planning.

Once again, we emphasize that the above models, including Milhaud’s, searched for the solution in an institutional reform of the exchange (domestic and international), and stressed the creation of purchasing power rejecting any restrictive policy.

Influence on Keynes or on German Clearing Policies?

Keynes elaborated the “Proposals for an International Clearing Union” presented at Bretton Woods for the British delegation. The plan still has a great significance today for the Keynesian thought system (Cedrini and Fantacci Reference Cedrini, Fantacci, Rosselli, Naldi and Sanfilippo2018). Keynes’s plan endorsed many ideas supported by Milhaud. As we have already detailed them in the previous sections, we summarize them here: (i) the willingness to create endogenously a new international means of payment for the purpose of international trade; (ii) the willingness to transform bilateral clearings into a multilateral framework; (iii) the creation of an international compensation office (Milhaud) or an international clearing union (Keynes); (iv) the fact that trade payments are eventually administered by government agencies (centralization/monopoly); (v) the decreasing purchasing power of certificates (for Milhaud’s plan) and the fees on bancor balances (for Keynes’s plan).

Does this mean that Milhaud did influence Keynes? We did not find any concrete element supporting this assumption. However, one can legitimately think that Keynes could not have been ignorant of Milhaud’s proposals. Milhaud was not unknown, having been a professor of political economy since 1902 in Geneva, which was an academic stronghold where many top economists were active. Furthermore, Milhaud was very active in promoting his plan internationally both personally and through a supportive network of economists and businessmen who were highly motivated and militantly committed to the plan. As described by Clark (Reference Clark1938, p. 102), “During the last few years Professor Milhaud has been devoting an increasing amount of space to the world monetary situation, to the virtual exclusion, indeed, of all other problems.” The journal Annales de l’économie collective was published in German and English (as Annals of Collective Economy) so the plan was made available well beyond France, Belgium, and Switzerland. The plan was known in Britain: as reported in Milhaud (Reference Milhaud1936a, pp. 265–272), British businessmen also expressed their support for the Milhaud plan. Milhaud was also discussed in print by Erich Roll (twice, in Reference Roll1935 and Reference Roll1936), and by Colin Clark (Reference Clark1938), two economists living in England and under the tutelage of Keynes. Roll published his reviews in Keynes’s Economic Journal, while Colin Clark, a lecturer in Cambridge, published his review in another well-known British journal, International Affairs.

We also did not find any evidence that Milhaud directly influenced the German clearing policies.Footnote 14 Milhaud’s review was translated into German, and several German economists discussed, if not supported, his theses: in particular, Walter Zander, Ulrich von Beckerath, and Heinrich Rittershausen. However, we did not find any element confirming the idea that Milhaud inspired the Nazi plans for the monetary integration of Europe. Milhaud’s supporters in Germany were anti-Nazi. Nevertheless, Nazi officials emphasized the relevance of international clearing to unify the complex and disorganized network of bilateral clearings. As summarized by Walther Funk in the published plan for the New European Order, “Starting from the methods of bilateral trading already applied there will be a further development in the direction of multilateral trading and of the adjustment of the trade balances of individual countries, so that the various countries can engage in regulated trade relations among themselves through the medium of a clearing house” (Funk Reference Funk and Lipgens1985, p. 66).

Funk’s plan called for the multilateralization of the clearing agreements across the European continent. In practice, during the war, seventeen countries were part of the Verrechnungskasse in Berlin, which was the center of the clearing organization and acted as a European compensation office. The participating countries were allied with Germany, collaborating with the Nazi regime or occupied by the Wehrmacht.

The idea of multilateral clearing did not disappear after the war. On the contrary, it gained ground in many countries. Beyond the brief Nazi experiment of multilateral clearing with the Verrechnungskasse during the war, several multilateral clearing institutions were established in the postwar era, especially to deal with the liquidity shortage and organize trade in monetary blocs, with the notable example of the European Payments Union (EPU) in Western Europe (Mikesell Reference Mikesell1954; Faudot Reference Faudot2020). In 1949, while Western Europe and the United States were discussing the shape of the regional clearing integration of Europe, Milhaud (Reference Milhaud1949) promoted once again his plan and welcomed the nature of the discussions that would result in the EPU (1950 to 1958). However, we can observe huge discrepancies between the two systems. The EPU rested on fixed exchange rates between member countries (contrary to the Milhaud plan). Furthermore, whereas there is a gold truce in the Milhaud plan, there is not such a “truce” in the EPU: beyond a certain amount of intra-EPU payments facilitated by overdraft, the payment of intra-EPU trade should be made in gold (or in gold-convertible currencies; i.e., the US dollar). In Eastern Europe, under the leadership of the Soviet Union, the Comecon was created in 1949, and then in 1963 a multilateral payment system, at the center of which was a new monetary unit: the transferable ruble. Milhaud died a year later in 1964.

V. CONCLUDING REMARKS

The Milhaud plan is a worthy object of study as it reflects the rich thoughts and discussions on international monetary reforms occurring after the financial crisis of Europe in 1931. It includes several influential concepts such as the “melting currency” inspired by Gesell and the creation of an international compensation office. The plan also imagined a scheme with fluctuating exchange rates taking into account the evolution of currency purchasing power parity, which was not a typical feature of other clearing plans that assumed fixed parities. Despite all the efforts undertaken by Milhaud and his devotees to promote the plan, it did not receive significant support from academics. However, some notable economists have highlighted its merits. The plan had more success with some influential political parties such as the Radical Party in France, as well as among practical businessmen. The politicians and businessmen considered the plan “liberal” in the sense that the plan aims at restoring international trade, in line with the international division of labor, and without the kind of arbitrary state interference that had spread with the chaos of bilateral clearings. The compensation scheme should have limited the role of the state and aimed at supplying the means of payment necessary for international trade. Milhaud claimed to be realistic, as his plan started from the existing situation of bilateral agreements that proliferated in Europe—and beyond. The creation of an international compensation office under the aegis of the Bank for International Settlements would constitute merely an additional step consistent with the logic of clearing, so the reform was technically feasible.

Milhaud and his circle certainly contributed to the debate on international monetary organization that would become more intense during and immediately after World War Two. In this paper, we did not establish a direct link between the Milhaud Plan and the Keynes Plan, as Keynes did not refer to Milhaud. Nevertheless, we have observed suggestive similarities between the two plans. Furthermore, our research has highlighted the intellectual context that eventually led Keynes and other brilliant economists to work on the reform of the international monetary and financial system (Davidson Reference Davidson1992), which is an understudied object of research.

COMPETING INTERESTS

The author declares no competing interests exist.