1. Introduction

Input misallocation refers to the inefficient distribution of resources, such as labor, capital, and materials, between firms or sectors within an economy. When inputs are not allocated optimally, firms that could use them more productively may receive fewer resources, while less efficient firms may receive more than they can effectively use. This misallocation can result from market distortions that obstruct the free flow of resources to the appropriate firms. Consequently, it leads to significant losses in overall productivity and economic growth. From a macro perspective, understanding the dynamics of input misallocation is crucial because it sheds light on how distortions, such as policy interventions, market imperfections, or institutional constraints, can impact aggregate productivity. By analyzing these dynamics, researchers and policymakers can identify strategies to improve resource allocation, improve productivity, and stimulate economic growth.

In this paper, we build upon the foundational work of Hsieh and Klenow (Reference Hsieh and Klenow2009) but dig deeper into the effects of resource misallocation on aggregate total factor productivity (TFP) and revenue loss across firms. The central contribution of our research lies in the refinement of the structural model proposed by Hsieh and Klenow (HK), which allows us to provide a more precise and detailed estimation of allocation efficiency (AE), particularly when assessed through the lens of revenue output.

Although our model is grounded in the HK framework, it introduces several enhancements that address limitations in the original model. One of the key improvements is our departure from the assumption of uniform input prices across firms, which is unrealistic. By incorporating heterogeneous input prices, our model seeks to offer a more precise estimation of input misallocation and productivity dynamics. Relying on uniform input prices would overlook these essential cross-group variations. Our model includes three inputs, capital (K), labor (L), and materials (M), allowing us to capture the complexities of firm-level production processes and the inefficiencies in the allocation of these three inputs. The three-input production model is standard in structural productivity models such as Olley and Pakes (Reference Olley and Pakes1996) and many others that followed them. From an empirical model specification standpoint, incorporating

![]() $ K$

,

$ K$

,

![]() $ L$

, and

$ L$

, and

![]() $ M$

as key variables in the production function aligns with standard practices in firm-level analyses. Unlike many macroeconomic models that consider only

$ M$

as key variables in the production function aligns with standard practices in firm-level analyses. Unlike many macroeconomic models that consider only

![]() $ K$

and

$ K$

and

![]() $ L$

, the inclusion of

$ L$

, the inclusion of

![]() $ M$

addresses potential issues related to omitted variable bias. By incorporating materials (

$ M$

addresses potential issues related to omitted variable bias. By incorporating materials (

![]() $ M$

), our model provides a more accurate representation of production processes and enhances the reliability of the results. This inclusion captures a more comprehensive production structure, allowing us to account for additional sources of misallocation that influence productivity dynamics.

$ M$

), our model provides a more accurate representation of production processes and enhances the reliability of the results. This inclusion captures a more comprehensive production structure, allowing us to account for additional sources of misallocation that influence productivity dynamics.

In addition to this, we diverge from the conventional calibration methods commonly employed in the macro literature. Almost all existing papers use calibration, and these papers set some structural parameters a priori, instead of estimating them. However, the parameters used in the calibration can lead to differences in the prediction and analysis of subsequent results. Take the output substitution elasticity

![]() $\sigma _{s}$

in HK as an example. Different values of

$\sigma _{s}$

in HK as an example. Different values of

![]() $\sigma _{s}$

make the predictions of the hypothetical TFP gains of China and India significantly different. Whether the difference in the prediction results is significant is determined based on robustness checks. Calibration often relies on predefined assumptions that may not hold in all contexts, potentially leading to biased or inaccurate results. To overcome this, we adopt an econometric approach to estimate the model parameters; it is novel and has not been used before in the macro literature. Our process begins by deriving the input demand function from each firm’s optimization problem. This derivation generates the input demand functions for the three endogenous inputs, while input prices remain exogenous. We then employ firm-level data to estimate structural parameters across different manufacturing subsectors, which allows us to account for the heterogeneity in production technologies that exist between subsectors. This approach allows us to obtain more accurate estimates of firm-specific misallocations and the marginal revenue product (MRP) of inputs, independent of variations in TFP.

$\sigma _{s}$

make the predictions of the hypothetical TFP gains of China and India significantly different. Whether the difference in the prediction results is significant is determined based on robustness checks. Calibration often relies on predefined assumptions that may not hold in all contexts, potentially leading to biased or inaccurate results. To overcome this, we adopt an econometric approach to estimate the model parameters; it is novel and has not been used before in the macro literature. Our process begins by deriving the input demand function from each firm’s optimization problem. This derivation generates the input demand functions for the three endogenous inputs, while input prices remain exogenous. We then employ firm-level data to estimate structural parameters across different manufacturing subsectors, which allows us to account for the heterogeneity in production technologies that exist between subsectors. This approach allows us to obtain more accurate estimates of firm-specific misallocations and the marginal revenue product (MRP) of inputs, independent of variations in TFP.

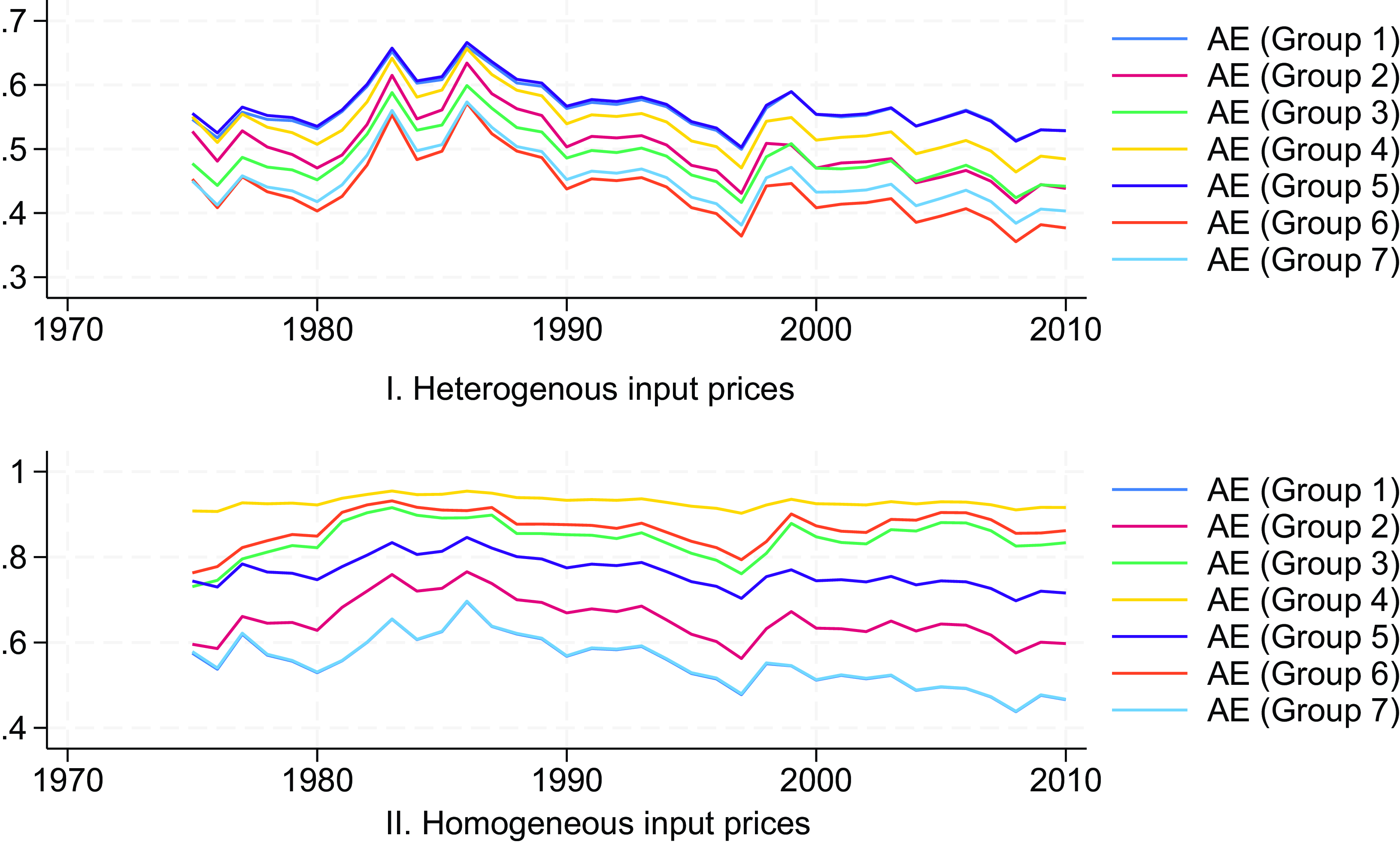

The aggregation of these firm-level estimates enables us to analyze the effects of misallocation at both the sectoral and industry levels. Our findings reveal that during the period 1975 to 2010, the average productivity growth rate, as measured by revenue-based total factor productivity (TFPR), was approximately 2.8%. However, through counterfactual analysis, we show that this growth rate could have been as high as 3.2% if resource misallocation between firms had been eliminated. This significant difference demonstrates the substantial impact that misallocation can have on overall productivity and emphasizes the potential economic gains that could be achieved through improved resource allocation.

Estimation of model parameters and AE is based on the system of input demand and the production function. The coefficients in the demand system are restricted functions of the model parameters, which poses challenges for convergence when applying maximum likelihood estimation (MLE). These challenges are aggravated by the complexity introduced by numerous constraints. To address this issue, we employ an indirect inference procedure. This approach allows us to bypass some of the difficulties associated with direct MLE. Because our model does not include exogenous variables, such as policy variables or firm-specific characteristics that could affect resource allocation or TFPR, the scope of our discussion of the empirical results is limited. Therefore, our discussion focuses mainly on the estimation methods, the prediction of the estimation results, and how our estimation method differs from existing methods. However, it is easy to generalize our model to explore more deeply the factors influencing resource allocation or policy impact. For instance, these exogenous factors can be incorporated into our model by including exogenous factors in the setting of the dynamics of TFPR in order to conduct more in-depth empirical analysis.

The main contributions of the paper are as follows. First, our model extends the HK framework by incorporating heterogeneity in input prices across firms. This extension acknowledges that firms do not operate under uniform conditions. Second, we include three distinct inputs, capital, labor, and materials, to better capture the complexities of production processes at the firm level and the resulting inefficiencies that may arise from misallocation. Third, we employ a state-of-the-art econometric approach to estimate the model parameters based on the system of input demand and the production function. We use an indirect inference procedure instead of the classical maximum likelihood method since there are numerous constraints. Conducting counterfactual analysis using our proposed analytical framework is relatively straightforward and easy to implement.

2. Relevant literature

The Hsieh and Klenow (Reference Hsieh and Klenow2009) model has been instrumental in shaping our understanding of how resource misallocation affects aggregate productivity. By quantifying productivity losses due to misallocation, particularly in China and India compared to the United States, the model has highlighted significant inefficiencies in the allocation of capital and labor within industries. Here, we consider some extensions of the HK model, evaluating their contributions to the literature and their implications for policy and future research. The purpose is not to provide a full review of the literature.

Bartelsman et al. (Reference Bartelsman, Haltiwanger and Scarpetta2013) introduce a dynamic perspective by incorporating firm turnover (entry and exit) into the analysis. It reflects the reality that inefficient firms exit the market while more productive ones enter, thus affecting aggregate productivity. These authors argue that dynamic selection plays a key role in explaining productivity differences across countries. However, they assume that the selection process is purely efficiency-driven, potentially overlooking other factors like market power or regulatory barriers that might affect firm turnover.

David et al. (Reference David, Hopenhayn and Venkateswaran2016) introduce information frictions, where firms may not fully know their productivity and therefore may not allocate resources optimally. This extension is significant because it draws attention to the role of information asymmetries in perpetuating misallocation. However, it abstracts away from how firms might endogenously invest in acquiring better information and how markets and institutions could evolve to reduce these frictions over time.

Bento and Restuccia (Reference Bento and Restuccia2017) extend the HK model by examining the impact of size-dependent policies, such as subsidies, taxes, and regulations, on resource misallocation. Bento and Restuccia argue that policies that disproportionately affect firms based on their size can distort resource allocation, thereby reducing overall productivity. They primarily focuse on policy distortions in isolation and do not fully explore how these policies interact with other forms of distortion, such as financial friction and market power.

Asker, et al. (Reference Asker, Collard-Wexler and De Loecker2014) introduce dynamic inputs and adjustment costs into the HK framework. This extension accounts for the reality that adjusting inputs, such as labor and capital, often involves costs, leading to persistent misallocation. Although this model more accurately reflects the challenges firms face in optimizing resource use, it could be criticized for its complexity, which could limit its practical application, especially in policy-making contexts where simpler models are often preferred.

Gopinath et al. (Reference Gopinath, Kalemli-Özcan, Karabarbounis and Villegas-Sanchez2017) apply the HK model to the specific context of Southern Europe, focusing on the period before and after the financial crisis. This regional application shows how financial frictions and firm-specific shocks can exacerbate capital misallocation, particularly during economic downturns. The findings, while relevant to Southern Europe, might not be directly applicable to other regions with different institutional or economic structures.

Uras and Wang (Reference Uras and Wang2024) examine how resource misallocation impacts productivity by influencing firms’ adoption of efficient production techniques. Thus, their paper extends traditional models by allowing production techniques to be endogenous, meaning that firms can adjust their production methods based on the resources available to them and the level of misallocation. This approach provides a more dynamic view of how misallocation affects productivity and development. They find that misallocation affects productivity both directly and indirectly.

Our focus, distinct from the models mentioned above, is primarily on the input allocation at the firm level, where misallocation occurs. We analyze the revenue loss resulting from misallocation at the firm level, which is then used to assess the revenue loss at more aggregate levels. between firms or across industries.

3. The model

In this section, we introduce the economic environment and show how the aggregate output reflects the cross-sector misallocation.

3.1. Aggregate economy and intermediate goods sector

In this framework, the model follows Hsieh and Klenow (Reference Hsieh and Klenow2009) and assumes a hierarchical structure. At the top level is the aggregate economy, followed by individual industries, with each industry comprising constituent firms. There is a single final good

![]() $Y$

produced/sold in a perfectly competitive final output market. There are

$Y$

produced/sold in a perfectly competitive final output market. There are

![]() $S$

industries and

$S$

industries and

![]() $M_{s}$

number of firms in each of the industries

$M_{s}$

number of firms in each of the industries

![]() $s,$

where

$s,$

where

![]() $s=1,\ldots, S$

. Assume that the production technology (aggregator function) at the top can be captured by a Cobb–Douglas function, that is,

$s=1,\ldots, S$

. Assume that the production technology (aggregator function) at the top can be captured by a Cobb–Douglas function, that is,

where

Furthermore, let

denote the constant elasticity of substitution (CES) aggregator function of

![]() $M_{s}$

differentiated products for industry

$M_{s}$

differentiated products for industry

![]() $s$

. The production technology for each differentiated product (firm technology) is

$s$

. The production technology for each differentiated product (firm technology) is

where the capital, labor, and material shares (

![]() $\alpha _{s1},\alpha _{s2},\alpha _{s3}$

) are bounded between 0 and 1 and allowed to vary by industry. Moreover,

$\alpha _{s1},\alpha _{s2},\alpha _{s3}$

) are bounded between 0 and 1 and allowed to vary by industry. Moreover,

![]() $\alpha _{s1}+\alpha _{s2}+\alpha _{s3}=1$

satisfies the constant return to scale (CRTS) production technology. The output elasticities

$\alpha _{s1}+\alpha _{s2}+\alpha _{s3}=1$

satisfies the constant return to scale (CRTS) production technology. The output elasticities

![]() $\alpha _{s1},\alpha _{s2}$

, and

$\alpha _{s1},\alpha _{s2}$

, and

![]() $\alpha _{s3}$

are sector-specific, but time-invariant and common across firms within a sector.

$\alpha _{s3}$

are sector-specific, but time-invariant and common across firms within a sector.

Let

![]() $P_{s}$

denote the price of industry output

$P_{s}$

denote the price of industry output

![]() $Y_{s}.$

The final good producer maximizes

$Y_{s}.$

The final good producer maximizes

The FOC from profit maximization of the final goods subject to (1) and (2) gives

which suggests the price of the final good is

This implies that

![]() $PY = \prod \nolimits _{s=1}^{S} \left ( \frac {P_{s} Y_s}{\theta _{s}}\right )$

. These relate the final good price and revenue to industry prices and outputs.

$PY = \prod \nolimits _{s=1}^{S} \left ( \frac {P_{s} Y_s}{\theta _{s}}\right )$

. These relate the final good price and revenue to industry prices and outputs.

Let

![]() $P_{si}$

denote the price of differentiated product

$P_{si}$

denote the price of differentiated product

![]() $Y_{si}$

. Given that the aggregate of intermediate goods of the industry

$Y_{si}$

. Given that the aggregate of intermediate goods of the industry

![]() $Y_{s}$

follows the CES assumption in (3), the demand for the differentiated output

$Y_{s}$

follows the CES assumption in (3), the demand for the differentiated output

![]() $Y_{si}$

can be derived by maximizing the industry’s profit function

$Y_{si}$

can be derived by maximizing the industry’s profit function

The FOC suggests

Thus, the output of firm

![]() $i$

of industry

$i$

of industry

![]() $s$

is

$s$

is

3.2. Firm-level economy: TFPR and TFPQ

There are three input factors (capital, labor, and materials) for producing the intermediate goods. Let the prices of capital, labor and materials be

![]() $W_{Ksi},W_{Lsi}$

, and

$W_{Ksi},W_{Lsi}$

, and

![]() $W_{Msi}$

. Because of misallocation, prices are distorted. Without any misallocations or distortions in the input prices, the first-order conditions (FOCs) of cost minimization of firm

$W_{Msi}$

. Because of misallocation, prices are distorted. Without any misallocations or distortions in the input prices, the first-order conditions (FOCs) of cost minimization of firm

![]() $i$

in industry

$i$

in industry

![]() $s$

areFootnote

1

$s$

areFootnote

1

We introduce misallocation in the above FOCs (Schmidt and Lovell (Reference Schmidt and Lovell1979)) by writing them as:

where

![]() $\zeta _{Ksi}$

and

$\zeta _{Ksi}$

and

![]() $\zeta _{Msi}$

are the misallocation terms for the input pairs

$\zeta _{Msi}$

are the misallocation terms for the input pairs

![]() $\left ( K,L\right )$

and

$\left ( K,L\right )$

and

![]() $\left ( M,L\right )$

.

$\left ( M,L\right )$

.

![]() $\zeta _{Ksi}$

and

$\zeta _{Ksi}$

and

![]() $\zeta _{Msi}$

can take positive or negative values.Footnote

2

For notational simplicity, we let

$\zeta _{Msi}$

can take positive or negative values.Footnote

2

For notational simplicity, we let

![]() $\lambda _{Ksi}=e^{\zeta _{Ksi}}$

and

$\lambda _{Ksi}=e^{\zeta _{Ksi}}$

and

![]() $\lambda _{Msi}=e^{\zeta _{Msi}}.$

Thus, the misallocation-adjusted (shadow) prices of capital and materials are

$\lambda _{Msi}=e^{\zeta _{Msi}}.$

Thus, the misallocation-adjusted (shadow) prices of capital and materials are

![]() $\lambda _{Ksi}W_{Ksi}$

and

$\lambda _{Ksi}W_{Ksi}$

and

![]() $\lambda _{Msi}W_{Msi}$

.

$\lambda _{Msi}W_{Msi}$

.

Since firms face competitive output markets,

![]() $P_{si}$

is known and the expression for

$P_{si}$

is known and the expression for

![]() $Y_{si}$

shown in (10) is determined from the optimization problem in (8). Firm

$Y_{si}$

shown in (10) is determined from the optimization problem in (8). Firm

![]() $i$

minimizes its costFootnote

3

under the misallocation-adjusted (shadow) prices of capital and materials:

$i$

minimizes its costFootnote

3

under the misallocation-adjusted (shadow) prices of capital and materials:

\begin{align} \underset {K_{si},L_{si},M_{si}}{\min }C_{si} & =\lambda _{Ksi}W_{Ksi}K_{si}+W_{Lsi}L_{si}+\lambda _{Msi}W_{Msi}M_{si} \nonumber\\[3pt] \text {s.t. }Y_{si} & =A_{si}K_{si}^{\alpha _{s1}}L_{si}^{\alpha _{s2}}M_{si}^{\alpha _{s3}}. \end{align}

\begin{align} \underset {K_{si},L_{si},M_{si}}{\min }C_{si} & =\lambda _{Ksi}W_{Ksi}K_{si}+W_{Lsi}L_{si}+\lambda _{Msi}W_{Msi}M_{si} \nonumber\\[3pt] \text {s.t. }Y_{si} & =A_{si}K_{si}^{\alpha _{s1}}L_{si}^{\alpha _{s2}}M_{si}^{\alpha _{s3}}. \end{align}

The FOCs are

and

Furthermore, if there is no misallocation, then

![]() $\lambda _{Ksi}=\lambda _{Msi}=1$

and then (12) and (13) degenerate to the standard FOCs from cost minimization problem.

$\lambda _{Ksi}=\lambda _{Msi}=1$

and then (12) and (13) degenerate to the standard FOCs from cost minimization problem.

Note that the maximization problem of the industry

![]() $s$

in (8) and its FOC in (9) imply that the MRPs of the three inputs are

$s$

in (8) and its FOC in (9) imply that the MRPs of the three inputs are

The marginal revenue of capital is proportional to the revenue-capital ratio. Similar properties hold for the marginal revenues of labor and materials. Moreover, the producer

![]() $i^{\prime }$

s optimization behavior should satisfy that the marginal revenue of an input equals the marginal cost of the input, that is,

$i^{\prime }$

s optimization behavior should satisfy that the marginal revenue of an input equals the marginal cost of the input, that is,

Foster et al. (Reference Foster, Haltiwanger and Syverson2008) stress the distinction between physical productivity (TFPQ) and revenue productivity (TFPR) because when industry deflators are used, differences in firm-specific prices show up in the customary measure of plant TFP. Therefore, similar to HK (2009), we define the physical productivity TFPQ as

and define the revenue productivity TFPR as

Using (9), one can rewrite

![]() $TFPQ_{si}$

as

$TFPQ_{si}$

as

where

![]() $\kappa _{s}=\left ( P_{s}Y_{s}^{\frac {1}{\sigma _{s}}}\right ) ^{\frac {\sigma _{s}}{\sigma _{s}-1}}$

, which is a sector-specific constant.

$\kappa _{s}=\left ( P_{s}Y_{s}^{\frac {1}{\sigma _{s}}}\right ) ^{\frac {\sigma _{s}}{\sigma _{s}-1}}$

, which is a sector-specific constant.

Using (16a)–(16c) and (18), the

![]() $TFPR_{si}$

can also be represented as

$TFPR_{si}$

can also be represented as

\begin{align} TFPR_{si} & =\frac {\sigma _{s}}{\sigma _{s}-1}\left ( \frac {MRPK_{si}}{\alpha _{s1}}\right ) ^{\alpha _{s1}}\left ( \frac {MRPL_{si}}{\alpha _{s2}}\right ) ^{\alpha _{s2}}\left ( \frac {MRPM_{si}}{\alpha _{s3}}\right ) ^{\alpha _{s3}} \nonumber\\[3pt] & =\frac {\sigma _{s}}{\sigma _{s}-1}\left ( \frac {W_{Ksi}}{\alpha _{s1}}\right ) ^{\alpha _{s1}}\left ( \frac {W_{Lsi}}{\alpha _{s2}}\right ) ^{\alpha _{s2}}\left ( \frac {W_{Msi}}{\alpha _{s3}}\right ) ^{\alpha _{s3}}\lambda _{Ksi}^{\alpha _{s1}}\lambda _{Msi}^{\alpha _{s3}} \nonumber\\[3pt] & =\lambda _{Ksi}^{\alpha _{s1}}\lambda _{Msi}^{\alpha _{s3}}TFPR_{si}^{\ast },\end{align}

\begin{align} TFPR_{si} & =\frac {\sigma _{s}}{\sigma _{s}-1}\left ( \frac {MRPK_{si}}{\alpha _{s1}}\right ) ^{\alpha _{s1}}\left ( \frac {MRPL_{si}}{\alpha _{s2}}\right ) ^{\alpha _{s2}}\left ( \frac {MRPM_{si}}{\alpha _{s3}}\right ) ^{\alpha _{s3}} \nonumber\\[3pt] & =\frac {\sigma _{s}}{\sigma _{s}-1}\left ( \frac {W_{Ksi}}{\alpha _{s1}}\right ) ^{\alpha _{s1}}\left ( \frac {W_{Lsi}}{\alpha _{s2}}\right ) ^{\alpha _{s2}}\left ( \frac {W_{Msi}}{\alpha _{s3}}\right ) ^{\alpha _{s3}}\lambda _{Ksi}^{\alpha _{s1}}\lambda _{Msi}^{\alpha _{s3}} \nonumber\\[3pt] & =\lambda _{Ksi}^{\alpha _{s1}}\lambda _{Msi}^{\alpha _{s3}}TFPR_{si}^{\ast },\end{align}

where

![]() $TFPR_{si}^{\ast }=\frac {\sigma _{s}}{\sigma _{s}-1}\left ( \frac {W_{Ksi}}{\alpha _{s1}}\right ) ^{\alpha _{s1}}\left ( \frac {W_{Lsi}}{\alpha _{s2}}\right ) ^{\alpha _{s2}}\left ( \frac {W_{Msi}}{\alpha _{s3}}\right ) ^{\alpha _{s3}}$

denotes the efficient TFPR when there is no allocation inefficiency, that is,

$TFPR_{si}^{\ast }=\frac {\sigma _{s}}{\sigma _{s}-1}\left ( \frac {W_{Ksi}}{\alpha _{s1}}\right ) ^{\alpha _{s1}}\left ( \frac {W_{Lsi}}{\alpha _{s2}}\right ) ^{\alpha _{s2}}\left ( \frac {W_{Msi}}{\alpha _{s3}}\right ) ^{\alpha _{s3}}$

denotes the efficient TFPR when there is no allocation inefficiency, that is,

![]() $\lambda _{Ksi}=\lambda _{Msi}=1.$

Misallocation of inputs causes the MRPs of capital and materials to deviate from their respective input prices,

$\lambda _{Ksi}=\lambda _{Msi}=1.$

Misallocation of inputs causes the MRPs of capital and materials to deviate from their respective input prices,

![]() $W_{Ksi}$

and

$W_{Ksi}$

and

![]() $W_{Msi}$

, leading to a discrepancy between the observed

$W_{Msi}$

, leading to a discrepancy between the observed

![]() $TFPR_{si}$

and its efficient benchmark,

$TFPR_{si}$

and its efficient benchmark,

![]() $TFPR_{si}^{*}$

.

$TFPR_{si}^{*}$

.

3.3. Aggregation

To derive the impact of misallocation for the industry as a whole, we use the results from the individual firm in section 3.2. Now we show how the aggregate TFPR reflects cross-sector distortions as well as the individual sectors’ TFPR.

Using (16a)–(16c), the industry-specific aggregate inputs are

where

\begin{align} \overline {MRPK}_{s} & =\left ({\sum \nolimits _{i=1}^{M_{s}}}\frac {P_{si}Y_{si}}{P_{s}Y_{s}}\frac {1}{\lambda _{Ksi}W_{Ksi}}\right ) ^{-1}\nonumber \\ \overline {MRPL}_{s} & =\left ({\sum \nolimits _{i=1}^{M_{s}}}\frac {P_{si}Y_{si}}{P_{s}Y_{s}}\frac {1}{W_{Lsi}}\right ) ^{-1}\\ \overline {MRPM}_{s} & =\left ({\sum \nolimits _{i=1}^{M_{s}}} \frac {P_{si}Y_{si}}{P_{s}Y_{s}}\frac {1}{\lambda _{Msi}W_{Msi}}\right ) ^{-1}\nonumber \end{align}

\begin{align} \overline {MRPK}_{s} & =\left ({\sum \nolimits _{i=1}^{M_{s}}}\frac {P_{si}Y_{si}}{P_{s}Y_{s}}\frac {1}{\lambda _{Ksi}W_{Ksi}}\right ) ^{-1}\nonumber \\ \overline {MRPL}_{s} & =\left ({\sum \nolimits _{i=1}^{M_{s}}}\frac {P_{si}Y_{si}}{P_{s}Y_{s}}\frac {1}{W_{Lsi}}\right ) ^{-1}\\ \overline {MRPM}_{s} & =\left ({\sum \nolimits _{i=1}^{M_{s}}} \frac {P_{si}Y_{si}}{P_{s}Y_{s}}\frac {1}{\lambda _{Msi}W_{Msi}}\right ) ^{-1}\nonumber \end{align}

are the weighted harmonic averages of the marginal products of capital, labor, and materials. The last equality is due to the result

which can be shown using (3), (6), and (9).

If there is no input misallocation for all firms in industry

![]() $s$

, then

$s$

, then

![]() $\lambda _{Ksi}=1$

and

$\lambda _{Ksi}=1$

and

![]() $\lambda _{Msi}=1$

for all

$\lambda _{Msi}=1$

for all

![]() $i$

,

$i$

,

![]() $s$

. Let

$s$

. Let

![]() $\overline {MRPK}_{s}^{\ast }=\left ( {\sum \nolimits _{i=1}^{M_{s}}} \frac {P_{si}Y_{si}}{P_{s}Y_{s}}\frac {1}{W_{Ksi}}\right ) ^{-1}$

and

$\overline {MRPK}_{s}^{\ast }=\left ( {\sum \nolimits _{i=1}^{M_{s}}} \frac {P_{si}Y_{si}}{P_{s}Y_{s}}\frac {1}{W_{Ksi}}\right ) ^{-1}$

and

![]() $\overline {MRPM}_{s}^{\ast }=\left ( {\sum \nolimits _{i=1}^{M_{s}}} \frac {P_{si}Y_{si}}{P_{s}Y_{s}}\frac {1}{W_{Msi}}\right ) ^{-1}$

denote the average optimal marginal product of capital and materials, then

$\overline {MRPM}_{s}^{\ast }=\left ( {\sum \nolimits _{i=1}^{M_{s}}} \frac {P_{si}Y_{si}}{P_{s}Y_{s}}\frac {1}{W_{Msi}}\right ) ^{-1}$

denote the average optimal marginal product of capital and materials, then

give a measure of the effect of input misallocation on MRP.

![]() $\gamma _{K,s} = \gamma _{M,s} =1$

if all inputs are allocated in an optimal way.

$\gamma _{K,s} = \gamma _{M,s} =1$

if all inputs are allocated in an optimal way.

Using equations (20)–(22), the aggregate industry inputs can be written as

where

\begin{align} \omega _{K,s} & =\frac {\theta _{s}\alpha _{s1}\frac {\sigma _{s}-1}{\sigma _{s}}/\overline {MRPK}_{s}}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}} \theta _{s^{\prime }}\alpha _{s^{\prime }1}\frac {\sigma _{s}^{\prime }-1}{\sigma _{s^{\prime }}}/\overline {MRPK}_{s^{\prime }}}=\frac {\frac {\theta _{s}\alpha _{s1}}{\gamma _{K,s}}\frac {\sigma _{s}-1}{\sigma _{s}}/\overline {MRPK}_{s}^{\ast }}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}}\frac {\theta _{s^{\prime }}\alpha _{s^{\prime }}}{\gamma _{K,s^{\prime }}}\frac {\sigma _{s}^{\prime }-1}{\sigma _{s^{\prime }}}/\overline {MRPK}_{s^{\prime }}^{\ast }}\text { }\nonumber \\ \omega _{L,s} & =\frac {\theta _{s}\alpha _{s2}\frac {\sigma _{s}-1}{\sigma _{s}}/\overline {MRPL}_{s}}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}}\theta _{s^{\prime }}\alpha _{s^{\prime }2}\frac {\sigma _{s}^{\prime }-1} {\sigma _{s^{\prime }}}/\overline {MRPL}_{s^{\prime }}}\text { }\\ \omega _{M,s} & =\frac {\theta _{s}\alpha _{s3}\frac {\sigma _{s}-1}{\sigma _{s}}/\overline {MRPM}_{s}}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}}\theta _{s^{\prime }}\alpha _{s^{\prime }3}\frac {\sigma _{s}^{\prime }-1} {\sigma _{s^{\prime }}}/\overline {MRPM}_{s^{\prime }}}=\frac {\frac {\theta _{s}\alpha _{s3}}{\gamma _{M,s}}\frac {\sigma _{s}-1}{\sigma _{s}}/\overline {MRPM}_{s}^{\ast }}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}}\frac {\theta _{s^{\prime }}\alpha _{s^{\prime }3}}{\gamma _{M,s^{\prime }}} \frac {\sigma _{s}^{\prime }-1}{\sigma _{s^{\prime }}}/\overline {MRPM}_{s^{\prime }}^{\ast }}\nonumber \end{align}

\begin{align} \omega _{K,s} & =\frac {\theta _{s}\alpha _{s1}\frac {\sigma _{s}-1}{\sigma _{s}}/\overline {MRPK}_{s}}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}} \theta _{s^{\prime }}\alpha _{s^{\prime }1}\frac {\sigma _{s}^{\prime }-1}{\sigma _{s^{\prime }}}/\overline {MRPK}_{s^{\prime }}}=\frac {\frac {\theta _{s}\alpha _{s1}}{\gamma _{K,s}}\frac {\sigma _{s}-1}{\sigma _{s}}/\overline {MRPK}_{s}^{\ast }}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}}\frac {\theta _{s^{\prime }}\alpha _{s^{\prime }}}{\gamma _{K,s^{\prime }}}\frac {\sigma _{s}^{\prime }-1}{\sigma _{s^{\prime }}}/\overline {MRPK}_{s^{\prime }}^{\ast }}\text { }\nonumber \\ \omega _{L,s} & =\frac {\theta _{s}\alpha _{s2}\frac {\sigma _{s}-1}{\sigma _{s}}/\overline {MRPL}_{s}}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}}\theta _{s^{\prime }}\alpha _{s^{\prime }2}\frac {\sigma _{s}^{\prime }-1} {\sigma _{s^{\prime }}}/\overline {MRPL}_{s^{\prime }}}\text { }\\ \omega _{M,s} & =\frac {\theta _{s}\alpha _{s3}\frac {\sigma _{s}-1}{\sigma _{s}}/\overline {MRPM}_{s}}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}}\theta _{s^{\prime }}\alpha _{s^{\prime }3}\frac {\sigma _{s}^{\prime }-1} {\sigma _{s^{\prime }}}/\overline {MRPM}_{s^{\prime }}}=\frac {\frac {\theta _{s}\alpha _{s3}}{\gamma _{M,s}}\frac {\sigma _{s}-1}{\sigma _{s}}/\overline {MRPM}_{s}^{\ast }}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}}\frac {\theta _{s^{\prime }}\alpha _{s^{\prime }3}}{\gamma _{M,s^{\prime }}} \frac {\sigma _{s}^{\prime }-1}{\sigma _{s^{\prime }}}/\overline {MRPM}_{s^{\prime }}^{\ast }}\nonumber \end{align}

are the input allocation weights. If there is no allocation distortion between sectors, then the optimal input allocation weights should be

\begin{align} \omega _{K,s}^{\ast } & =\frac {\theta _{s}\alpha _{s1}\frac {\sigma _{s}-1}{\sigma _{s}}/\,\overline {MRPK}_{s}^{\ast }}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}} \theta _{s^{\prime }}\alpha _{s^{\prime }}\frac {\sigma _{s}^{\prime }-1}{\sigma _{s^{\prime }}}/\,\overline {MRPK}_{s^{\prime }}^{\ast }}\text { }\nonumber \\ \omega _{L,s}^{\ast } & =\frac {\theta _{s}\alpha _{s2}\frac {\sigma _{s}-1}{\sigma _{s}}/\,\overline {MRPL}_{s}}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}} \theta _{s^{\prime }}\alpha _{s^{\prime }2}\frac {\sigma _{s}^{\prime }-1}{\sigma _{s^{\prime }}}/\,\overline {MRPL}_{s^{\prime }}}\text { }\\ \omega _{M,s}^{\ast } & =\frac {\theta _{s}\alpha _{s3}\frac {\sigma _{s}-1}{\sigma _{s}}/\,\overline {MRPM}_{s}^{\ast }}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}}\theta _{s^{\prime }}\alpha _{s^{\prime }3}\frac {\sigma _{s}^{\prime }-1}{\sigma _{s^{\prime }}}/\,\overline {MRPM}_{s^{\prime }}^{\ast }}.\nonumber \end{align}

\begin{align} \omega _{K,s}^{\ast } & =\frac {\theta _{s}\alpha _{s1}\frac {\sigma _{s}-1}{\sigma _{s}}/\,\overline {MRPK}_{s}^{\ast }}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}} \theta _{s^{\prime }}\alpha _{s^{\prime }}\frac {\sigma _{s}^{\prime }-1}{\sigma _{s^{\prime }}}/\,\overline {MRPK}_{s^{\prime }}^{\ast }}\text { }\nonumber \\ \omega _{L,s}^{\ast } & =\frac {\theta _{s}\alpha _{s2}\frac {\sigma _{s}-1}{\sigma _{s}}/\,\overline {MRPL}_{s}}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}} \theta _{s^{\prime }}\alpha _{s^{\prime }2}\frac {\sigma _{s}^{\prime }-1}{\sigma _{s^{\prime }}}/\,\overline {MRPL}_{s^{\prime }}}\text { }\\ \omega _{M,s}^{\ast } & =\frac {\theta _{s}\alpha _{s3}\frac {\sigma _{s}-1}{\sigma _{s}}/\,\overline {MRPM}_{s}^{\ast }}{{\sum \nolimits _{s^{\prime }=1}^{M_{s^{\prime }}}}\theta _{s^{\prime }}\alpha _{s^{\prime }3}\frac {\sigma _{s}^{\prime }-1}{\sigma _{s^{\prime }}}/\,\overline {MRPM}_{s^{\prime }}^{\ast }}.\nonumber \end{align}

The industry-specific TFPR is

\begin{align} TFPR_{s} & =\frac {P_{s}Y_{s}}{K_{s}^{\alpha _{s1}}L_{s}^{\alpha _{s2}}M_{s}^{\alpha _{s3}}}\nonumber \\ & =\frac {\sigma _{s}}{\sigma _{s}-1}\left ( \frac {\overline {MRPK}_{s}}{\alpha _{s1}}\right ) ^{\alpha _{s1}}\left ( \frac {\overline {MRPL}_{s}}{\alpha _{s2}}\right ) ^{\alpha _{s2}}\left ( \frac {\overline {MRPLM}_{s}}{\alpha _{s3}}\right ) ^{\alpha _{s3}} \end{align}

\begin{align} TFPR_{s} & =\frac {P_{s}Y_{s}}{K_{s}^{\alpha _{s1}}L_{s}^{\alpha _{s2}}M_{s}^{\alpha _{s3}}}\nonumber \\ & =\frac {\sigma _{s}}{\sigma _{s}-1}\left ( \frac {\overline {MRPK}_{s}}{\alpha _{s1}}\right ) ^{\alpha _{s1}}\left ( \frac {\overline {MRPL}_{s}}{\alpha _{s2}}\right ) ^{\alpha _{s2}}\left ( \frac {\overline {MRPLM}_{s}}{\alpha _{s3}}\right ) ^{\alpha _{s3}} \end{align}

Therefore, it follows that

where

![]() $TFPR_{s}^{\ast }=\frac {\sigma _{s}}{\sigma _{s}-1}\left ( \frac {\overline {MRPK}_{s}^{\ast }}{\alpha _{s1}}\right ) ^{\alpha _{s1}}\left ( \frac {\overline {MRPL}_{s}^{\ast }}{\alpha _{s2}}\right ) ^{\alpha _{s2}}\left ( \frac {\overline {MRPM}_{s}^{\ast }}{\alpha _{s3}}\right ) ^{\alpha _{s3}}.$

$TFPR_{s}^{\ast }=\frac {\sigma _{s}}{\sigma _{s}-1}\left ( \frac {\overline {MRPK}_{s}^{\ast }}{\alpha _{s1}}\right ) ^{\alpha _{s1}}\left ( \frac {\overline {MRPL}_{s}^{\ast }}{\alpha _{s2}}\right ) ^{\alpha _{s2}}\left ( \frac {\overline {MRPM}_{s}^{\ast }}{\alpha _{s3}}\right ) ^{\alpha _{s3}}.$

Using (20)–(22), it can be shown the industry-specific

![]() $TFPQ_{s}$

is

$TFPQ_{s}$

is

\begin{align*} TFPQ_{s} & =\frac {Y_{s}}{K_{s}^{\alpha _{s1}}L_{s}^{\alpha _{s2}}M_{s}^{\alpha _{s3}}} \\ & =\left [{\sum \nolimits _{i=1}^{M_{s}}} \left ( TFPQ_{si}\frac {P_{si}Y_{si}}{P_{s}Y_{s}}\frac {\overline {TFPR}_{s}}{TFPR_{si}}\right ) ^{\frac {\sigma _{s}-1}{\sigma _{s}}}\right ] ^{\frac {\sigma _{s}}{\sigma _{s}-1}}. \end{align*}

\begin{align*} TFPQ_{s} & =\frac {Y_{s}}{K_{s}^{\alpha _{s1}}L_{s}^{\alpha _{s2}}M_{s}^{\alpha _{s3}}} \\ & =\left [{\sum \nolimits _{i=1}^{M_{s}}} \left ( TFPQ_{si}\frac {P_{si}Y_{si}}{P_{s}Y_{s}}\frac {\overline {TFPR}_{s}}{TFPR_{si}}\right ) ^{\frac {\sigma _{s}-1}{\sigma _{s}}}\right ] ^{\frac {\sigma _{s}}{\sigma _{s}-1}}. \end{align*}

The revenue output of sector

![]() $s$

is

$s$

is

\begin{align} P_{s}Y_{s} & =TFPQ_{s}K_{s}^{\alpha _{s1}}L_{s}^{\alpha _{s2}}M_{s}^{\alpha _{s3}}\nonumber \\ & =\left [ \left ( \omega _{K,s}^{\ast }K\right ) ^{\alpha _{s1}}\left ( \omega _{L,s}^{\ast }L\right ) ^{\alpha _{s2}}\left ( \omega _{M,s}^{\ast }M\right ) ^{\alpha _{s3}}TFPR_{s}^{\ast }\right ] \gamma _{K,s}^{\alpha _{s1}}\gamma _{M,s}^{\alpha _{s3}}\left ( \frac {\omega _{K,s}}{\omega _{K,s}^{\ast }}\right ) ^{\alpha _{s1}}\left ( \frac {\omega _{M,s}}{\omega _{M,s}^{\ast }}\right ) ^{\alpha _{s3}}\nonumber \\ & =P_{s}Y_{s}^{\ast }\gamma _{K,s}^{\alpha _{s1}}\gamma _{M,s}^{\alpha _{s3}}\left ( \frac {\omega _{K,s}}{\omega _{K,s}^{\ast }}\right ) ^{\alpha _{s1}}\left ( \frac {\omega _{M,s}}{\omega _{M,s}^{\ast }}\right ) ^{\alpha _{s3}}, \end{align}

\begin{align} P_{s}Y_{s} & =TFPQ_{s}K_{s}^{\alpha _{s1}}L_{s}^{\alpha _{s2}}M_{s}^{\alpha _{s3}}\nonumber \\ & =\left [ \left ( \omega _{K,s}^{\ast }K\right ) ^{\alpha _{s1}}\left ( \omega _{L,s}^{\ast }L\right ) ^{\alpha _{s2}}\left ( \omega _{M,s}^{\ast }M\right ) ^{\alpha _{s3}}TFPR_{s}^{\ast }\right ] \gamma _{K,s}^{\alpha _{s1}}\gamma _{M,s}^{\alpha _{s3}}\left ( \frac {\omega _{K,s}}{\omega _{K,s}^{\ast }}\right ) ^{\alpha _{s1}}\left ( \frac {\omega _{M,s}}{\omega _{M,s}^{\ast }}\right ) ^{\alpha _{s3}}\nonumber \\ & =P_{s}Y_{s}^{\ast }\gamma _{K,s}^{\alpha _{s1}}\gamma _{M,s}^{\alpha _{s3}}\left ( \frac {\omega _{K,s}}{\omega _{K,s}^{\ast }}\right ) ^{\alpha _{s1}}\left ( \frac {\omega _{M,s}}{\omega _{M,s}^{\ast }}\right ) ^{\alpha _{s3}}, \end{align}

where

![]() $P_{s}Y_{s}^{\ast }=\left ( \omega _{K,s}^{\ast }K\right ) ^{\alpha _{s1}}\left ( \omega _{L,s}^{\ast }L\right ) ^{\alpha _{s2}} \left ( \omega _{M,s}^{\ast }M\right ) ^{\alpha _{s3}}TFPR_{s}^{\ast }$

represents the revenue output when the inputs are allocated optimally. Therefore, the sector-specific AE can be measured by

$P_{s}Y_{s}^{\ast }=\left ( \omega _{K,s}^{\ast }K\right ) ^{\alpha _{s1}}\left ( \omega _{L,s}^{\ast }L\right ) ^{\alpha _{s2}} \left ( \omega _{M,s}^{\ast }M\right ) ^{\alpha _{s3}}TFPR_{s}^{\ast }$

represents the revenue output when the inputs are allocated optimally. Therefore, the sector-specific AE can be measured by

Therefore,

![]() $(1 - AE_s) \times 100\%$

represents the percentage revenue loss resulting from input misallocation.

$(1 - AE_s) \times 100\%$

represents the percentage revenue loss resulting from input misallocation.

Now, consider the aggregate production function

\begin{align} Y & = {\prod \nolimits _{s=1}^{S}} \left ( TFPQ_{s}K_{s}^{\alpha _{s1}}L_{s}^{\alpha _{s2}}M_{s}^{\alpha _{s3}}\right ) ^{\theta _{s}}\nonumber \\ & =K^{\alpha _{1}}L^{\alpha _{2}}M^{\alpha _{3}}\times {\prod \nolimits _{s=1}^{S}} \left [ TFPQ_{s}\omega _{K,s}^{\alpha _{s1}}\omega _{L,s}^{\alpha _{s2}}\omega _{M,s}^{\alpha _{s3}}\right ] ^{\theta _{s}}, \end{align}

\begin{align} Y & = {\prod \nolimits _{s=1}^{S}} \left ( TFPQ_{s}K_{s}^{\alpha _{s1}}L_{s}^{\alpha _{s2}}M_{s}^{\alpha _{s3}}\right ) ^{\theta _{s}}\nonumber \\ & =K^{\alpha _{1}}L^{\alpha _{2}}M^{\alpha _{3}}\times {\prod \nolimits _{s=1}^{S}} \left [ TFPQ_{s}\omega _{K,s}^{\alpha _{s1}}\omega _{L,s}^{\alpha _{s2}}\omega _{M,s}^{\alpha _{s3}}\right ] ^{\theta _{s}}, \end{align}

where

![]() $\alpha _{1}=\sum _{s=1}^{S}\alpha _{s1}\theta _{s},$

$\alpha _{1}=\sum _{s=1}^{S}\alpha _{s1}\theta _{s},$

![]() $\alpha _{2}=\sum _{s=1}^{S}\alpha _{s2}\theta _{s}$

, and

$\alpha _{2}=\sum _{s=1}^{S}\alpha _{s2}\theta _{s}$

, and

![]() $\alpha _{3}=\sum _{s=1}^{S}\alpha _{s3}\theta _{s}.$

It follows from (31) that the overall

$\alpha _{3}=\sum _{s=1}^{S}\alpha _{s3}\theta _{s}.$

It follows from (31) that the overall

![]() $TFPQ$

can be defined as

$TFPQ$

can be defined as

Since

![]() $TFPQ_{si}=\frac {1}{\kappa _{s}}\left ( TFPR_{si}\right ) ^{\frac {\sigma _{s}}{\sigma _{s}-1}}\left ( K_{si}^{\alpha _{s1}}L_{si}^{\alpha _{s2}}M_{si}^{\alpha _{s3}}\right ) ^{\frac {1}{\sigma _{s}-1}}$

, where

$TFPQ_{si}=\frac {1}{\kappa _{s}}\left ( TFPR_{si}\right ) ^{\frac {\sigma _{s}}{\sigma _{s}-1}}\left ( K_{si}^{\alpha _{s1}}L_{si}^{\alpha _{s2}}M_{si}^{\alpha _{s3}}\right ) ^{\frac {1}{\sigma _{s}-1}}$

, where

![]() $\kappa _{s}=\left ( P_{s}Y_{s}^{\frac {1}{\sigma _{s}}}\right ) ^{\frac {\sigma _{s}}{\sigma _{s}-1}}$

cannot be observed or estimated from the data, it is infeasible to estimate

$\kappa _{s}=\left ( P_{s}Y_{s}^{\frac {1}{\sigma _{s}}}\right ) ^{\frac {\sigma _{s}}{\sigma _{s}-1}}$

cannot be observed or estimated from the data, it is infeasible to estimate

![]() $TFPQ_{si}$

and

$TFPQ_{si}$

and

![]() $TFPQ_{s}.$

Therefore, we estimate the TFPR instead. The aggregate TFPR is defined as

$TFPQ_{s}.$

Therefore, we estimate the TFPR instead. The aggregate TFPR is defined as

Since the aggregate revenue output is the sum of revenue output of each sector, we have

\begin{align*} PY & = {\sum \nolimits _{s=1}^{S}} P_{s}Y_{s}\\ & =K^{\alpha _{1}}L^{\alpha _{2}}M^{\alpha _{3}} \left ({\sum \nolimits _{s=1}^{S}} TFPR_{s}\frac {K^{\alpha _{s1}}L^{\alpha _{s2}}M^{\alpha _{s3}}}{K^{\alpha _{1}}L^{\alpha _{2}}M^{\alpha _{3}}}\omega _{K,s}^{\alpha _{s1}}\omega _{L,s}^{\alpha _{s2}}\omega _{M,s}^{\alpha _{s3}}\right ), \end{align*}

\begin{align*} PY & = {\sum \nolimits _{s=1}^{S}} P_{s}Y_{s}\\ & =K^{\alpha _{1}}L^{\alpha _{2}}M^{\alpha _{3}} \left ({\sum \nolimits _{s=1}^{S}} TFPR_{s}\frac {K^{\alpha _{s1}}L^{\alpha _{s2}}M^{\alpha _{s3}}}{K^{\alpha _{1}}L^{\alpha _{2}}M^{\alpha _{3}}}\omega _{K,s}^{\alpha _{s1}}\omega _{L,s}^{\alpha _{s2}}\omega _{M,s}^{\alpha _{s3}}\right ), \end{align*}

where the expression in the parentheses is the aggregate TFPR.

Using (29), the aggregate revenue output can be represented as

\begin{align*} PY & = {\sum \nolimits _{s=1}^{S}} K^{\alpha _{s1}}L^{\alpha _{s2}}M^{\alpha _{s3}}TFPR_{s}\omega _{K,s}^{\alpha _{s1}}\omega _{L,s}^{\alpha _{s2}}\omega _{M,s}^{\alpha _{s3}},\\ & = {\sum \nolimits _{s=1}^{S}} P_{s}Y_{s}^{\ast }\cdot \gamma _{K,s}^{\alpha _{s1}}\gamma _{M,s}^{\alpha _{s3}}\cdot \left ( \frac {\omega _{K,s}}{\omega _{K,s}^{\ast }}\right ) ^{\alpha _{s1}}\left ( \frac {\omega _{M,s}}{\omega _{M,s}^{\ast }}\right ) ^{\alpha _{s3}}. \end{align*}

\begin{align*} PY & = {\sum \nolimits _{s=1}^{S}} K^{\alpha _{s1}}L^{\alpha _{s2}}M^{\alpha _{s3}}TFPR_{s}\omega _{K,s}^{\alpha _{s1}}\omega _{L,s}^{\alpha _{s2}}\omega _{M,s}^{\alpha _{s3}},\\ & = {\sum \nolimits _{s=1}^{S}} P_{s}Y_{s}^{\ast }\cdot \gamma _{K,s}^{\alpha _{s1}}\gamma _{M,s}^{\alpha _{s3}}\cdot \left ( \frac {\omega _{K,s}}{\omega _{K,s}^{\ast }}\right ) ^{\alpha _{s1}}\left ( \frac {\omega _{M,s}}{\omega _{M,s}^{\ast }}\right ) ^{\alpha _{s3}}. \end{align*}

The last factor involving

![]() $\omega$

captures the degree of misallocation between industries, while

$\omega$

captures the degree of misallocation between industries, while

![]() $\gamma _{K,s}^{\alpha _{s1}}\gamma _{M,s}^{\alpha _{s3}}$

represents the distortion of MRPs due to misallocation within each industry.

$\gamma _{K,s}^{\alpha _{s1}}\gamma _{M,s}^{\alpha _{s3}}$

represents the distortion of MRPs due to misallocation within each industry.

The aggregate AE can be measured as

where

![]() $PY^{\ast }={\sum \nolimits _{s=1}^{S}} P_{s}Y_{s}^{\ast }$

represents the aggregate revenue output when the input factors are optimally allocated. When there is no allocation inefficiency,

$PY^{\ast }={\sum \nolimits _{s=1}^{S}} P_{s}Y_{s}^{\ast }$

represents the aggregate revenue output when the input factors are optimally allocated. When there is no allocation inefficiency,

![]() $\overline {MRPK}_{s}=\overline {MRPK}_{s}^{\ast }$

and

$\overline {MRPK}_{s}=\overline {MRPK}_{s}^{\ast }$

and

![]() $\overline {MRPM}_{s}=\overline {MRPM}_{s}^{\ast },$

which suggests

$\overline {MRPM}_{s}=\overline {MRPM}_{s}^{\ast },$

which suggests

![]() $\gamma _{K,s}^{\alpha _{s1}}=\gamma _{M,s}^{\alpha _{s3}}=1,$

and the input allocation weights for each group satisfy

$\gamma _{K,s}^{\alpha _{s1}}=\gamma _{M,s}^{\alpha _{s3}}=1,$

and the input allocation weights for each group satisfy

![]() $\omega _{K,s}=\omega _{K,s}^{\ast }$

and

$\omega _{K,s}=\omega _{K,s}^{\ast }$

and

![]() $\omega _{M,s}=\omega _{M,s}^{\ast }$

for all

$\omega _{M,s}=\omega _{M,s}^{\ast }$

for all

![]() $s$

. Therefore,

$s$

. Therefore,

![]() $(1 - AE) \times 100\%$

represents the percentage of aggregate revenue loss resulting from the misallocation of inputs.

$(1 - AE) \times 100\%$

represents the percentage of aggregate revenue loss resulting from the misallocation of inputs.

4. Econometric model

4.1. The structural model

In order to estimate the structure model in section 3 using empirical data, we impose some assumptions about the random components. Estimation of the model parameters and AE can be based on the system of input demand and the production function. Since our focus is on panel data, we introduce the subscript

![]() $t$

into our econometric model and let

$t$

into our econometric model and let

![]() $i$

and

$i$

and

![]() $s$

denote firm and sector, respectively. Since we observe the revenue output

$s$

denote firm and sector, respectively. Since we observe the revenue output

![]() $P_{si}Y_{si}$

empirically, we rewrite the industry-specific production functionFootnote

4

as

$P_{si}Y_{si}$

empirically, we rewrite the industry-specific production functionFootnote

4

as

where

![]() $Z_{sit}=P_{sit}A_{sit}=TFPR_{sit}.$

$Z_{sit}=P_{sit}A_{sit}=TFPR_{sit}.$

Using (4), (12), and (13), we can obtain the nonlinear system of equations

It is worth mentioning that the input demands

![]() $\ln L_{sit},$

$\ln L_{sit},$

![]() $\ln K_{sit}$

, and

$\ln K_{sit}$

, and

![]() $\ln M_{sit}$

are endogenous and

$\ln M_{sit}$

are endogenous and

![]() $\ln R_{sit},$

$\ln R_{sit},$

![]() $\ln (W_{Ksit}/W_{Lsit}),$

and

$\ln (W_{Ksit}/W_{Lsit}),$

and

![]() $\ln (W_{Msit}/W_{Lsit})$

are exogenous in the individual’s optimization problem. To estimate the model, we impose the following assumptions:

$\ln (W_{Msit}/W_{Lsit})$

are exogenous in the individual’s optimization problem. To estimate the model, we impose the following assumptions:

-

[A1]: The misallocation terms

$\zeta _{Ksit} = \ln \lambda _{Ksi}$

and

$\zeta _{Ksit} = \ln \lambda _{Ksi}$

and

$\zeta _{Msit} = \ln \lambda _{Msi}$

for the input pairs

$\zeta _{Msit} = \ln \lambda _{Msi}$

for the input pairs

$\left ( K,L\right )$

and

$\left ( K,L\right )$

and

$\left ( M,L\right )$

are i.i.d. random variables and are allowed to take both positive and negative values (over- and under-utilization of inputs). The means of

$\left ( M,L\right )$

are i.i.d. random variables and are allowed to take both positive and negative values (over- and under-utilization of inputs). The means of

$\zeta _{Ksit}$

and

$\zeta _{Ksit}$

and

$\zeta _{Msit}$

are assumed to be zero.Footnote

5

$\zeta _{Msit}$

are assumed to be zero.Footnote

5

-

[A2]: The logarithm of TFPR is

$\ln Z_{sit}=\ln z_{s0}+v_{sit},$

where

$\ln Z_{sit}=\ln z_{s0}+v_{sit},$

where

$\ln z_{s0}$

is a sector-specific constant. Moreover, the random component

$\ln z_{s0}$

is a sector-specific constant. Moreover, the random component

$v_{sit}$

satisfies: (i) The random component

$v_{sit}$

satisfies: (i) The random component

$v_{sit}=\rho _{s}v_{sit-1}+e_{sit}$

follows an AR(1) process that captures the dynamic adjustment of the TFPR. The AR coefficient satisfies

$v_{sit}=\rho _{s}v_{sit-1}+e_{sit}$

follows an AR(1) process that captures the dynamic adjustment of the TFPR. The AR coefficient satisfies

$|\rho _{s}|\lt 1$

, and

$|\rho _{s}|\lt 1$

, and

$e_{sit}$

is random. (ii) The logarithm of revenue,

$e_{sit}$

is random. (ii) The logarithm of revenue,

$\ln R_{sit}$

, is correlated with the random component

$\ln R_{sit}$

, is correlated with the random component

$e_{sit},$

where

$e_{sit},$

where

$e_{sit}=\phi (\ln R_{sit}-\overline {\ln R}_{s})+e_{sit}^{\ast }$

and

$e_{sit}=\phi (\ln R_{sit}-\overline {\ln R}_{s})+e_{sit}^{\ast }$

and

$e_{sit}^{\ast }$

represents white noise.

$e_{sit}^{\ast }$

represents white noise. -

[A3]: The input system contains three random components and is denoted as

$\xi _{sit}=\left ( \zeta _{Ksit},\zeta _{Msit},e_{sit}^{\ast } \right ) ^{\prime },$

which follows

$\xi _{sit}=\left ( \zeta _{Ksit},\zeta _{Msit},e_{sit}^{\ast } \right ) ^{\prime },$

which follows

$N(O_{3},\Sigma _{s}),$

where

$N(O_{3},\Sigma _{s}),$

where

$\Sigma _{s}=$

diagonal

$\Sigma _{s}=$

diagonal

$\left ( \sigma _{Ks}^{2},\text { }\sigma _{Ms}^{2},\text { }\sigma _{es}^{2}\right ) .$

$\left ( \sigma _{Ks}^{2},\text { }\sigma _{Ms}^{2},\text { }\sigma _{es}^{2}\right ) .$

Assumption [A2](i) specifies the dynamics of TFPR in (35). Assumption [A2](ii) captures the endogeneity of

![]() $\ln R$

, which implies that Cov

$\ln R$

, which implies that Cov

![]() $(e_{sit},\ln R_{sit})$

$(e_{sit},\ln R_{sit})$

![]() $=$

$=$

![]() $\phi \sigma _{\ln R}^{2},$

where

$\phi \sigma _{\ln R}^{2},$

where

![]() $\sigma _{\ln R}^{2}=$

Var

$\sigma _{\ln R}^{2}=$

Var

![]() $(\ln R_{sit}),$

and their correlation coefficient is Corr

$(\ln R_{sit}),$

and their correlation coefficient is Corr

![]() $(e_{sit},\ln R_{sit})=\phi /\sqrt {\phi ^{2}+\left ( \sigma _{e^{\ast }}^{2}/\sigma _{\ln R}^{2}\right ) },$

which is bounded between 0 and 1. If

$(e_{sit},\ln R_{sit})=\phi /\sqrt {\phi ^{2}+\left ( \sigma _{e^{\ast }}^{2}/\sigma _{\ln R}^{2}\right ) },$

which is bounded between 0 and 1. If

![]() $\phi =0,$

then Corr

$\phi =0,$

then Corr

![]() $(e_{sit},\ln R_{sit})=0$

, which suggests

$(e_{sit},\ln R_{sit})=0$

, which suggests

![]() $\ln R_{sit}$

is exogenous. The endogeneity of

$\ln R_{sit}$

is exogenous. The endogeneity of

![]() $\ln R_{sit}$

can be tested by the estimate of

$\ln R_{sit}$

can be tested by the estimate of

![]() $\phi$

.

$\phi$

.

Let

![]() $c_{s1}=\ln \left ( \alpha _{s2}/\alpha _{s1}\right ), c_{s3}=\ln \left ( \alpha _{s2}/\alpha _{s3}\right ), c_{s0} =\ln z_{s0}$

, so

$c_{s1}=\ln \left ( \alpha _{s2}/\alpha _{s1}\right ), c_{s3}=\ln \left ( \alpha _{s2}/\alpha _{s3}\right ), c_{s0} =\ln z_{s0}$

, so

![]() $\ln Z_{sit}=c_{0}+v_{sit}$

. After imposing the CRTS restriction

$\ln Z_{sit}=c_{0}+v_{sit}$

. After imposing the CRTS restriction

![]() $\alpha _{s1}+\alpha _{s2}+\alpha _{s3}=1,$

one can use equations (33)–(35) to solve the input demand functions as functions of the exogenous variables:

$\alpha _{s1}+\alpha _{s2}+\alpha _{s3}=1,$

one can use equations (33)–(35) to solve the input demand functions as functions of the exogenous variables:

where

![]() $a_{Ls}=\alpha _{s1}c_{s1}+\alpha _{s3}c_{s3}-c_{s0},$

$a_{Ls}=\alpha _{s1}c_{s1}+\alpha _{s3}c_{s3}-c_{s0},$

![]() $a_{Ks}=\alpha _{s3}c_{s3}-c_{s1}\left ( \alpha _{s2}+\alpha _{s3}\right ) -c_{s0},$

$a_{Ks}=\alpha _{s3}c_{s3}-c_{s1}\left ( \alpha _{s2}+\alpha _{s3}\right ) -c_{s0},$

![]() $a_{Ms}=\alpha _{s1}c_{s1}-c_{s3}\left ( \alpha _{s1}+\alpha _{s2}\right ) -c_{s0}.$

Moreover, the composite errors

$a_{Ms}=\alpha _{s1}c_{s1}-c_{s3}\left ( \alpha _{s1}+\alpha _{s2}\right ) -c_{s0}.$

Moreover, the composite errors

![]() $\varepsilon _{Lsit}=\alpha _{s1}\zeta _{Ksit}+\alpha _{s3}\zeta _{Msit}-v_{sit},$

$\varepsilon _{Lsit}=\alpha _{s1}\zeta _{Ksit}+\alpha _{s3}\zeta _{Msit}-v_{sit},$

![]() $\varepsilon _{Ksit}=\alpha _{s3}\zeta _{Msit}-\left ( \alpha _{s2}+\alpha _{s3}\right ) \zeta _{Ksit}-v_{sit},$

and

$\varepsilon _{Ksit}=\alpha _{s3}\zeta _{Msit}-\left ( \alpha _{s2}+\alpha _{s3}\right ) \zeta _{Ksit}-v_{sit},$

and

![]() $\varepsilon _{Msit}=\alpha _{s1}\zeta _{Ksit}-\left ( \alpha _{s1}+\alpha _{s2}\right ) \zeta _{Msit}-v_{sit}$

are linear combinations of

$\varepsilon _{Msit}=\alpha _{s1}\zeta _{Ksit}-\left ( \alpha _{s1}+\alpha _{s2}\right ) \zeta _{Msit}-v_{sit}$

are linear combinations of

![]() $\zeta _{Msit},$

$\zeta _{Msit},$

![]() $\zeta _{Ksit}$

and

$\zeta _{Ksit}$

and

![]() $v_{sit}.$

It follows that

$v_{sit}.$

It follows that

![]() $\varepsilon _{Lsit},\varepsilon _{Ksit}$

and

$\varepsilon _{Lsit},\varepsilon _{Ksit}$

and

![]() $\varepsilon _{Msit}$

are correlated with each other and also across time since

$\varepsilon _{Msit}$

are correlated with each other and also across time since

![]() $v_{sit}$

follows an AR(1) process.

$v_{sit}$

follows an AR(1) process.

In the system (36)–(38), the intercepts

![]() $a_{Ls},$

$a_{Ls},$

![]() $a_{Ks},$

and

$a_{Ks},$

and

![]() $a_{Ms}$

are functions of the structural parameters and so are the slope coefficients. Since all coefficients of the demand system in (36)–(38) are restricted as functions of the model parameters, it is difficult to achieve convergence when using the MLE. Therefore, we use an indirect inference approach to estimate the model.

$a_{Ms}$

are functions of the structural parameters and so are the slope coefficients. Since all coefficients of the demand system in (36)–(38) are restricted as functions of the model parameters, it is difficult to achieve convergence when using the MLE. Therefore, we use an indirect inference approach to estimate the model.

Let

![]() $\ln \mathbb {I}_{sit}=\left ( \ln L_{sit},\ln K_{sit},\ln M_{sit}\right ) ^{\prime },$

$\ln \mathbb {I}_{sit}=\left ( \ln L_{sit},\ln K_{sit},\ln M_{sit}\right ) ^{\prime },$

![]() $\ln \mathbb {X}_{sit}=\left ( \ln R_{sit},\ln \frac {W_{Ksit}}{W_{Lsit}},\ln \frac {W_{Msit}}{W_{Lsit}}\right ) ^{\prime }$

,

$\ln \mathbb {X}_{sit}=\left ( \ln R_{sit},\ln \frac {W_{Ksit}}{W_{Lsit}},\ln \frac {W_{Msit}}{W_{Lsit}}\right ) ^{\prime }$

,

![]() $\varepsilon _{sit}=\left ( \varepsilon _{Lsit}, \right.$

$\varepsilon _{sit}=\left ( \varepsilon _{Lsit}, \right.$

![]() $ \left. \varepsilon _{Ksit},\varepsilon _{Msit}\right ) ^{\prime },$

and

$ \left. \varepsilon _{Ksit},\varepsilon _{Msit}\right ) ^{\prime },$

and

![]() $\zeta _{sit}=(\zeta _{Ksit},\zeta _{Msit},e_{sit})^{\prime }.$

Then the matrix form of the structure model in (36)–(38) can be written as

$\zeta _{sit}=(\zeta _{Ksit},\zeta _{Msit},e_{sit})^{\prime }.$

Then the matrix form of the structure model in (36)–(38) can be written as

where

\begin{align*} \Gamma _{s}=\left ( \begin{array} [c]{c@{\quad}c@{\quad}c}1 & \alpha _{s1} & \alpha _{s3}\\ 1 & -\left ( \alpha _{s2}+\alpha _{s3}\right ) & \alpha s_{3}\\ 1 & \alpha _{s2} & -\left ( \alpha _{s1}+\alpha _{s2}\right ) \end{array} \right ) \text {, } \Upsilon _{s}=\left ( \begin{array} [c]{c@{\quad}c@{\quad}c}\alpha _{s1} & \alpha _{s3} & -1\\ -\left ( \alpha _{s2}+\alpha _{s3}\right ) & \alpha _{s3} & -1\\ \alpha _{s1} & -\left ( \alpha _{s1}+\alpha _{s2}\right ) & -1 \end{array} \right ), \end{align*}

\begin{align*} \Gamma _{s}=\left ( \begin{array} [c]{c@{\quad}c@{\quad}c}1 & \alpha _{s1} & \alpha _{s3}\\ 1 & -\left ( \alpha _{s2}+\alpha _{s3}\right ) & \alpha s_{3}\\ 1 & \alpha _{s2} & -\left ( \alpha _{s1}+\alpha _{s2}\right ) \end{array} \right ) \text {, } \Upsilon _{s}=\left ( \begin{array} [c]{c@{\quad}c@{\quad}c}\alpha _{s1} & \alpha _{s3} & -1\\ -\left ( \alpha _{s2}+\alpha _{s3}\right ) & \alpha _{s3} & -1\\ \alpha _{s1} & -\left ( \alpha _{s1}+\alpha _{s2}\right ) & -1 \end{array} \right ), \end{align*}

and

![]() $a_{s}=\left ( a_{Ls},a_{Ks},a_{Ms}\right ) ^{\prime }$

is a vector of constants, whose elements are nonlinear functions of the parameters

$a_{s}=\left ( a_{Ls},a_{Ks},a_{Ms}\right ) ^{\prime }$

is a vector of constants, whose elements are nonlinear functions of the parameters

![]() $\alpha _{s1},$

$\alpha _{s1},$

![]() $\alpha _{s2},$

$\alpha _{s2},$

![]() $\alpha _{s3}.$

Moreover, the unconditional variance matrix of

$\alpha _{s3}.$

Moreover, the unconditional variance matrix of

![]() $\varepsilon _{sit}$

is

$\varepsilon _{sit}$

is

where

![]() $E_{3}=\ell _{3}\ell _{3}^{\prime }$

. The unconditional covariance matrix of

$E_{3}=\ell _{3}\ell _{3}^{\prime }$

. The unconditional covariance matrix of

![]() $\varepsilon _{sit}$

and

$\varepsilon _{sit}$

and

![]() $\varepsilon _{si(t-1)}$

is

$\varepsilon _{si(t-1)}$

is

Let

![]() $\Theta _{s}=\left ( \ln A_{0},\alpha _{s1},\alpha _{s2},\sigma _{Ks}^{2},\sigma _{Ms}^{2},\sigma _{es}^{2},\rho _{s}\right )$

denote the vector of the parameters in (36)–(38). Then the coefficients in (39), (40), and (41) give enough conditions for identifying

$\Theta _{s}=\left ( \ln A_{0},\alpha _{s1},\alpha _{s2},\sigma _{Ks}^{2},\sigma _{Ms}^{2},\sigma _{es}^{2},\rho _{s}\right )$

denote the vector of the parameters in (36)–(38). Then the coefficients in (39), (40), and (41) give enough conditions for identifying

![]() $\Theta _{s}$

.

$\Theta _{s}$

.

The remaining parameter to be estimated is the parameter

![]() $\sigma _{s}$

contained in the CES aggregate output function. Define

$\sigma _{s}$

contained in the CES aggregate output function. Define

![]() $S_{K,si}=\frac {W_{Ksi}K_{si}}{P_{si}Y_{si}}$

,

$S_{K,si}=\frac {W_{Ksi}K_{si}}{P_{si}Y_{si}}$

,

![]() $S_{L,si}=\frac {W_{Lsi}L_{si}}{P_{si}Y_{si}}$

, and

$S_{L,si}=\frac {W_{Lsi}L_{si}}{P_{si}Y_{si}}$

, and

![]() $S_{M,si}=\frac {W_{Msi}M_{si}}{P_{si}Y_{si}}$

. After taking into account the randomness of the data, equations (16a)–(16c) suggest the following moment conditions :

$S_{M,si}=\frac {W_{Msi}M_{si}}{P_{si}Y_{si}}$

. After taking into account the randomness of the data, equations (16a)–(16c) suggest the following moment conditions :

which can be used to identify

![]() $\sigma _{s}$

. For simplicity, denote the sample counterpart of (42a)–(42c) as

$\sigma _{s}$

. For simplicity, denote the sample counterpart of (42a)–(42c) as

\begin{align} \mathfrak {m}_{s}=m(S_{K,sit},S_{L,sit},S_{M,sit};\,\, \sigma _{s},\alpha _{s1},\alpha _{s2},\alpha _{s3})=\left ( \begin{array} [c]{l}\frac {1}{N_{T,s}}\sum _{i,t}e^{\widehat {\zeta }_{Ksit}}S_{K,sit}-\alpha _{s1}\frac {\sigma _{s}-1}{\sigma _{s}}\\ \frac {1}{N_{T,s}}\sum _{i,t}S_{L,sit}-\alpha _{s2}\frac {\sigma _{s}-1}{\sigma _{s}}\\ \frac {1}{N_{T,s}}\sum _{i,t}e^{\widehat {\zeta }_{Msit}}S_{M,sit}-\alpha _{s3}\frac {\sigma _{s}-1}{\sigma _{s}}\end{array} \right ), \end{align}

\begin{align} \mathfrak {m}_{s}=m(S_{K,sit},S_{L,sit},S_{M,sit};\,\, \sigma _{s},\alpha _{s1},\alpha _{s2},\alpha _{s3})=\left ( \begin{array} [c]{l}\frac {1}{N_{T,s}}\sum _{i,t}e^{\widehat {\zeta }_{Ksit}}S_{K,sit}-\alpha _{s1}\frac {\sigma _{s}-1}{\sigma _{s}}\\ \frac {1}{N_{T,s}}\sum _{i,t}S_{L,sit}-\alpha _{s2}\frac {\sigma _{s}-1}{\sigma _{s}}\\ \frac {1}{N_{T,s}}\sum _{i,t}e^{\widehat {\zeta }_{Msit}}S_{M,sit}-\alpha _{s3}\frac {\sigma _{s}-1}{\sigma _{s}}\end{array} \right ), \end{align}

where

![]() $\widehat {\zeta }_{Ksit}$

and

$\widehat {\zeta }_{Ksit}$

and

![]() $\widehat {\zeta }_{Msit}$

are functions of

$\widehat {\zeta }_{Msit}$

are functions of

![]() $\Theta _{s}$

and can be predicted using (33) and (34) and

$\Theta _{s}$

and can be predicted using (33) and (34) and

![]() $N_{T,s}$

represent the total number of observations in industry

$N_{T,s}$

represent the total number of observations in industry

![]() $s$

. Therefore, the estimates of

$s$

. Therefore, the estimates of

![]() $\Theta$

and

$\Theta$

and

![]() $\sigma _{s}$

can be identified using (39), (40), (41), and (43). We have an overidentified system.

$\sigma _{s}$

can be identified using (39), (40), (41), and (43). We have an overidentified system.

4.2. Estimation procedure

Since all coefficients in the structural model given in (36)–(38) are restricted and functions of the parameters, achieving convergence when using MLE may be difficult. We suggest using indirect inference (II) estimation to estimate the model instead. See Gourieroux et al. (Reference Gourieroux, Monfort and Renault1993) for more details. The II estimation identifies the model parameters through the estimates of an instrument model. We now briefly introduce how to implement this method in estimating the structural model.

To implement the II approach, we consider an approximation of the structure model and refer to it as the instrument model. Although the estimates of the instrument model may be biased, these estimates provide a link to the model parameters and are used as the identification conditions. One can then use simulations performed under the initial model to correct for the asymptotic estimation bias from the instrument model. The II approach replaces the model with an approximated one that is easier to handle or estimate when an initial model leads to a complicated or intractable likelihood function.

Let

![]() $\Psi _{s}=(\Theta _{s},\sigma _{s})$

denote the whole set of parameters contained in the system and moments and

$\Psi _{s}=(\Theta _{s},\sigma _{s})$

denote the whole set of parameters contained in the system and moments and

![]() $\mathbb {B}(\Psi )$

denote the set of binding functions, then

$\mathbb {B}(\Psi )$

denote the set of binding functions, then

where

![]() $\mathbb {B}\,:\,\Theta _{\Psi }\rightarrow \Theta _{\mathbb {A}}$

represents the binding function, which maps the structure parameters (

$\mathbb {B}\,:\,\Theta _{\Psi }\rightarrow \Theta _{\mathbb {A}}$

represents the binding function, which maps the structure parameters (

![]() $\Theta _{\Psi }$

) to the parameters in the instrument modeland moments (

$\Theta _{\Psi }$

) to the parameters in the instrument modeland moments (

![]() $\Theta _{\mathbb {A}}$

). For the indirect inference estimation, it is required that the dimension of the binding functions be greater than the dimension of the structure parameters so that the structure parameters are identified. Below, we briefly describe the estimation procedure:

$\Theta _{\mathbb {A}}$

). For the indirect inference estimation, it is required that the dimension of the binding functions be greater than the dimension of the structure parameters so that the structure parameters are identified. Below, we briefly describe the estimation procedure:

-

Step 1: Given the approximate or instrumental model, we estimate

$\Theta _{s}$

by seemingly unrelated regressions (SUR) for the system in (36)–(38) using the observed data and estimate

$\Theta _{s}$

by seemingly unrelated regressions (SUR) for the system in (36)–(38) using the observed data and estimate

$\sigma _{s}$

using the moments in (42a)–(42c). Letdenote the estimates.

$\sigma _{s}$

using the moments in (42a)–(42c). Letdenote the estimates. \begin{equation*} \widehat {\mathbb {A}}=\mathbb {B}(\Psi _{s,0})=\left ( \widehat {a}_{s},\widehat {\Gamma }_{s},\widehat {\Upsilon }_{s},\widehat {\rho }_{s},\widehat {\mathfrak {m}}_{s}\right ) \end{equation*}

\begin{equation*} \widehat {\mathbb {A}}=\mathbb {B}(\Psi _{s,0})=\left ( \widehat {a}_{s},\widehat {\Gamma }_{s},\widehat {\Upsilon }_{s},\widehat {\rho }_{s},\widehat {\mathfrak {m}}_{s}\right ) \end{equation*}

-

Step 2: For a given

$\Theta _{s},$

we can simulate values of the endogenous variable

$\Theta _{s},$

we can simulate values of the endogenous variable

$\left \{ \mathbb {I}_{sit}^{\mathbf {h}}(\Theta _{s})\right \} _{i,t}$

using the model given in (36)–(38). In other words, given the model specification and a value of the parameter

$\left \{ \mathbb {I}_{sit}^{\mathbf {h}}(\Theta _{s})\right \} _{i,t}$

using the model given in (36)–(38). In other words, given the model specification and a value of the parameter

$\Theta _{s},$

one can draw

$\Theta _{s},$

one can draw

$\zeta _{sit}$

from their distributions and then generate the simulated

$\zeta _{sit}$

from their distributions and then generate the simulated

$\left \{ \mathbb {I}_{sit}^{\mathbf {h}}(\Theta _{s})\right \} _{i,t}$

conditional on the exogenous variables

$\left \{ \mathbb {I}_{sit}^{\mathbf {h}}(\Theta _{s})\right \} _{i,t}$

conditional on the exogenous variables

$\ln X_{sit}.$

The estimator of

$\ln X_{sit}.$

The estimator of

$\mathbb {A}$

in the

$\mathbb {A}$

in the

$\mathbf {h}$

th replication is denoted asWith the simulated data

$\mathbf {h}$

th replication is denoted asWith the simulated data \begin{equation*} \widehat {\mathbb {A}}_{s}^{\mathbf {h}}=\mathbb {B}\left ( \Psi _{s}^{^{\mathbf {h}}}\right ) =\left ( \widehat {a}_{s}^{\mathbf {h}},\widehat {\Gamma }_{s}^{\mathbf {h}},\widehat {\Upsilon }_{s}^{\mathbf {h}},\widehat {\rho }_{s}^{\mathbf {h}},\widehat {\mathfrak {m}}_{s}^{\mathbf {h}}\right ) ^{\prime }. \end{equation*}

\begin{equation*} \widehat {\mathbb {A}}_{s}^{\mathbf {h}}=\mathbb {B}\left ( \Psi _{s}^{^{\mathbf {h}}}\right ) =\left ( \widehat {a}_{s}^{\mathbf {h}},\widehat {\Gamma }_{s}^{\mathbf {h}},\widehat {\Upsilon }_{s}^{\mathbf {h}},\widehat {\rho }_{s}^{\mathbf {h}},\widehat {\mathfrak {m}}_{s}^{\mathbf {h}}\right ) ^{\prime }. \end{equation*}

$\left \{ \mathbb {I}_{sit}^{\mathbf {h}}(\Theta _{s})\right \} _{i,t}$

, one can then replicate such simulations

$\left \{ \mathbb {I}_{sit}^{\mathbf {h}}(\Theta _{s})\right \} _{i,t}$

, one can then replicate such simulations

$\mathbf {H}$

times and estimate the parameter

$\mathbf {H}$

times and estimate the parameter

$\mathbb {A}$

each time given

$\mathbb {A}$

each time given

$\Psi .$

$\Psi .$

-

Step 3: In this step, we match the estimate of

$\mathbb {A}$

from the instrument model based on the real data and the estimates of

$\mathbb {A}$

from the instrument model based on the real data and the estimates of

$\mathbb {A}$

from the simulated data. The II estimator of

$\mathbb {A}$

from the simulated data. The II estimator of

$\Psi$

is defined as the one that has the minimum distance between the estimates of the binding functions from the real data and simulated data, that is,

$\Psi$

is defined as the one that has the minimum distance between the estimates of the binding functions from the real data and simulated data, that is, \begin{equation*} \widehat {\Psi }=\arg \min _{\Psi }\text { }\left ( \widehat {\mathbb {A}}-\frac {1}{\mathbf {H}} {\sum \limits _{\mathbf {h}=1}^{\mathbf {H}}} \mathbb {B}^{\mathbf {h}}\left ( \Psi _{s}^{^{\mathbf {h}}}\right ) \right )^{\prime }\Omega \left ( \widehat {\mathbb {A}}-\frac {1}{\mathbf {H}} {\sum \limits _{\mathbf {h}=1}^{\mathbf {H}}} \mathbb {B}^{\mathbf {h}}\left ( \Psi _{s}^{^{\mathbf {h}}}\right ) \right ), \end{equation*}

\begin{equation*} \widehat {\Psi }=\arg \min _{\Psi }\text { }\left ( \widehat {\mathbb {A}}-\frac {1}{\mathbf {H}} {\sum \limits _{\mathbf {h}=1}^{\mathbf {H}}} \mathbb {B}^{\mathbf {h}}\left ( \Psi _{s}^{^{\mathbf {h}}}\right ) \right )^{\prime }\Omega \left ( \widehat {\mathbb {A}}-\frac {1}{\mathbf {H}} {\sum \limits _{\mathbf {h}=1}^{\mathbf {H}}} \mathbb {B}^{\mathbf {h}}\left ( \Psi _{s}^{^{\mathbf {h}}}\right ) \right ), \end{equation*}

where

![]() $\Omega$

is a non-negative symmetric matrix.

$\Omega$

is a non-negative symmetric matrix.

For simplicity, we choose the weighting matrix

![]() $\Omega$

as a diagonal matrix, which assigns a value of 1 for each element of the binding function. In order to identify the parameter

$\Omega$

as a diagonal matrix, which assigns a value of 1 for each element of the binding function. In order to identify the parameter

![]() $\Psi, $

it is required that the binding function

$\Psi, $

it is required that the binding function

![]() $\mathbb {B}\left ( \cdot \,\right )$

be a function of the true parameter

$\mathbb {B}\left ( \cdot \,\right )$

be a function of the true parameter

![]() $\Psi$

and the dimension of the auxiliary parameter

$\Psi$

and the dimension of the auxiliary parameter

![]() $\mathbb {A}$

must be greater than or equal to the dimension of

$\mathbb {A}$

must be greater than or equal to the dimension of

![]() $\Psi$

.

$\Psi$

.

5. An empirical application

In this section, we demonstrate our model using US manufacturing data collected from Compustat. The firm-level panel data cover the period from 1975 to 2010. We excluded firms with fewer than five periods of observations, resulting in a final sample of 55,518 observations. We divide the sub-industries of the manufacturing industry into seven major categories, summarized in Table 1. The classification of sub-industries into these groups is based on the North American Industry Classification System (NAICS) and considers similarities in production processes, input requirements, and output characteristics. For example, Group 1 includes industries such as food, textiles, and wood manufacturing, which are characterized by shared production techniques and material usage. In contrast, Group 2 comprises capital-intensive industries like petroleum, chemicals, and plastics, which rely on complex chemical processes. Each group is formed by aggregating subsectors with similar economic and technological characteristics. This classification facilitates a coherent analysis of input misallocation and productivity dynamics across distinct industry types. By grouping industries with comparable production functions and cost structures, the analysis can better capture heterogeneity, providing deeper insights into the impact of misallocation both within and across industries.

Table 1. Group classification by the North American Industry Classification System (NAICS)

The sample statistics of the inputs, revenue output, and inputs prices are summarized in Table 2. The input prices used in our analysis are computed as follows. The price of labor is calculated by dividing the total payroll by employment, while the capital price is represented by the rental rate. The material price is derived by dividing the material expenses by the total material deflator, where the material expenses are defined as the costs excluding payroll and capital, adjusted for inflation. Table 2 shows a significant variation in input prices across the seven groups, particularly in labor and material prices. These differences reflect heterogeneity in industry characteristics, cost structures, and potentially regional or firm-specific factors that influence input costs. For example, the mean price of material is substantially higher in Group 5, which includes the computer and manufacturing of electronic products, likely due to the specialized materials required in this sector. Similarly, the variability in labor prices across groups indicates differences in labor intensity and skill requirements among industries.

Table 2. Sample statistics of the seven groups of the manufacturing industry

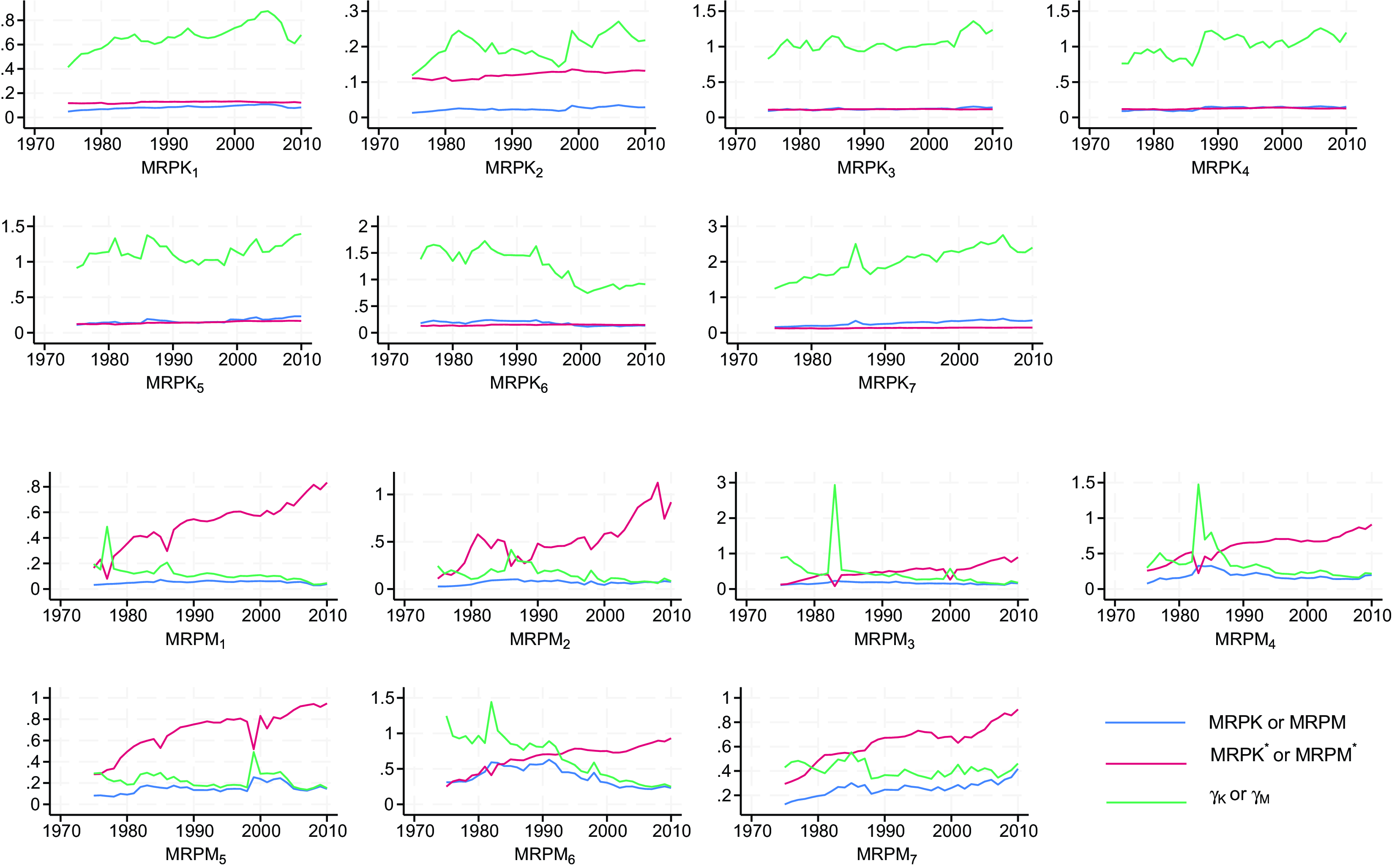

Using the manufacturing firm-level data, we use an II approach to estimate the system of structure model given in (36)–(38) for each group. Once we obtain the estimates of group-specific structure parameters, we can then estimate the firm-specific misallocation terms

![]() $\lambda _{Ksit}$

and

$\lambda _{Ksit}$

and

![]() $\lambda _{Msit}$

using (12) and (13), and the firm-specific MRP of inputs using (16a)–(16c). The group-specific MRP of inputs and the efficient MRPs when there is no misallocation can be estimated by (23). With these estimates, we then compute the input allocation weights

$\lambda _{Msit}$

using (12) and (13), and the firm-specific MRP of inputs using (16a)–(16c). The group-specific MRP of inputs and the efficient MRPs when there is no misallocation can be estimated by (23). With these estimates, we then compute the input allocation weights

![]() $\omega _{K,sit}, \omega _{L,sit}$

and

$\omega _{K,sit}, \omega _{L,sit}$

and

![]() $\omega _{M,sit}$

and the efficient weights

$\omega _{M,sit}$

and the efficient weights

![]() $\omega _{K,sit}^{*}, \omega _{L,sit}^{*}$

and

$\omega _{K,sit}^{*}, \omega _{L,sit}^{*}$

and

![]() $\omega _{M,sit}^{*}$

using (25) and (26). The sector-specific and aggregate AE can be evaluated using (30) and (32).

$\omega _{M,sit}^{*}$

using (25) and (26). The sector-specific and aggregate AE can be evaluated using (30) and (32).

To examine the differences in model estimation results under the assumptions of heterogeneous and homogeneous input prices, we use the average input prices for each group at each time point as the homogeneous input prices. These averages are then utilized to generate input price ratios for estimation. The results from both scenarios are summarized in Table 3.

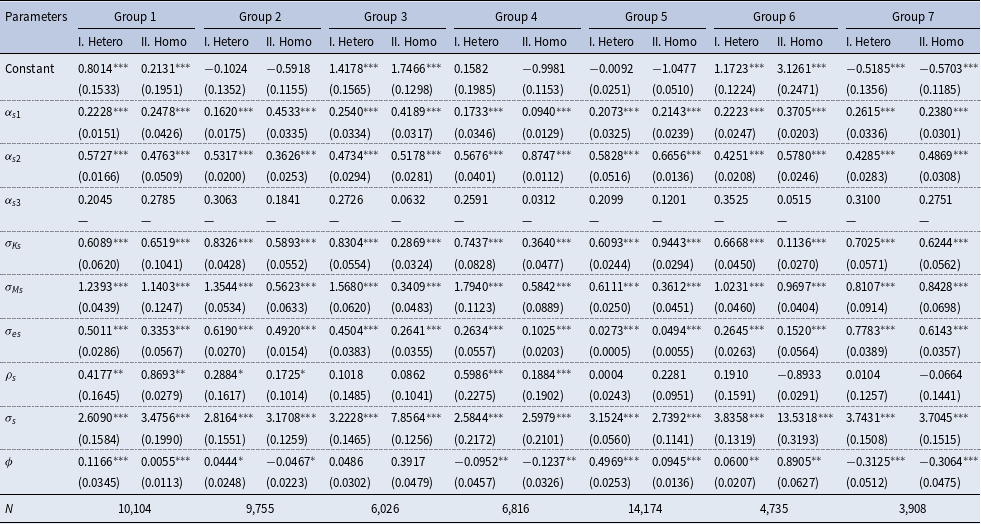

Table 3. Estimation results for each group

Note: ***, **, and * denote 1%, 5%, and 10% level of significance, respectively. Numbers in parentheses are the bootstrapped standard errors based on 200 replications.

A comparison of the input–output elasticities across groups reveals notable differences between the heterogeneous and homogeneous input price models. Specifically, Groups 2, 3, 4, and 6 exhibit more pronounced discrepancies in the estimated elasticities, suggesting that these groups are particularly sensitive to the assumption of input price heterogeneity.

Our discussion will primarily focus on the estimation results derived from the heterogeneous input price model, as it better reflects the underlying variations in input costs across industries and provides a more nuanced understanding of input–output relationships.

This table presents a detailed overview of the key parameters and outcomes derived from our model for all the groups under consideration. Each column of the table corresponds to a specific group, while each row highlights the estimated values for various parameters such as the elasticity of substitution, MRP of inputs, and the degree of misallocation for capital, labor, and materials. Thus, Table 3 provides a straightforward and brief overview of the impact and contribution of various industry groups to input misallocation. This comprehensive analysis is crucial for pinpointing sectors that could gain the most from better resource distribution and for directing future policy measures to boost productivity.

Our estimates of the parameter

![]() $\sigma _{s}$

in the CES aggregate production function, as specified in equation (3), range from 2.61 to 3.74 for Groups 1 to 7. This parameter,

$\sigma _{s}$

in the CES aggregate production function, as specified in equation (3), range from 2.61 to 3.74 for Groups 1 to 7. This parameter,

![]() $\sigma _{s}$

, represents the elasticity of substitution between differentiated outputs within an industry.

$\sigma _{s}$

, represents the elasticity of substitution between differentiated outputs within an industry.

In previous studies, this parameter has often been set to specific values based on either empirical findings or theoretical assumptions. For example, Hsieh and Klenow (Reference Hsieh and Klenow2009) set

![]() $\sigma _{s}$

at 3 in their paper on misallocation and manufacturing TFP in China and India. Similarly, Gopinath et al. (Reference Gopinath, Kalemli-Özcan, Karabarbounis and Villegas-Sanchez2017) used the same value of 3 in their analysis of capital distribution and productivity in Southern Europe. More recently, Bils et al. (Reference Bils, Klenow and Ruane2021) set

$\sigma _{s}$

at 3 in their paper on misallocation and manufacturing TFP in China and India. Similarly, Gopinath et al. (Reference Gopinath, Kalemli-Özcan, Karabarbounis and Villegas-Sanchez2017) used the same value of 3 in their analysis of capital distribution and productivity in Southern Europe. More recently, Bils et al. (Reference Bils, Klenow and Ruane2021) set

![]() $\sigma _{s}$

at a slightly higher value of 4 in their study of factor shares and productivity.

$\sigma _{s}$

at a slightly higher value of 4 in their study of factor shares and productivity.

According to Hsieh and Klenow (Reference Hsieh and Klenow2009), the estimated TFP gains from reallocation are highly sensitive to this elasticity

![]() $\sigma _{s}$

. They found that China’s hypothetical TFP gain in 2005 increases from 87% under

$\sigma _{s}$

. They found that China’s hypothetical TFP gain in 2005 increases from 87% under

![]() $\sigma _{s} =3$