1. Introduction

Global government debt is on a remarkably upward trajectory in recent years, with the ratio of government debt to Gross Domestic Product (GDP) in major economies approaching historical peak since 1960 (Reinhart and Rogoff, Reference Reinhart and Rogoff2011; Yared, Reference Yared2019), posing a significant threat to long-term economic stability and growth. (Reinhart et al. Reference Reinhart, Reinhart and Rogoff2012; Eberhardt and Presbitero, Reference Eberhardt and Presbitero2015). As a fast-developing economy, China has also witnessed a substantial rise in government debt, as evidenced by Figure 1 (Bai et al. Reference Bai, Hsieh and Song2016; Huang et al. Reference Huang, Pagano and Panizza2020; Chen et al. Reference Chen, He and Liu2020). However, unlike advanced economies, the surge in government debt in China is primarily driven by local governments rather than the central government. Despite the Budget Law’s prohibition on official government debt, local prefectures are still able to issue “de facto” debts by establishing local government financing vehicles (LGFVs)Footnote 1 to fund stimulus spending (Bai et al. Reference Bai, Hsieh and Song2016).

Figure 1. Investment rate and the ratio of local government financing vehicle (LGFV) Debts to GDP.

Notes: The investment rate is the ratio of the gross fixed capital formation to GDP. The gross fixed capital formation series and GDP series are from China National Bureau of Statistics. Total LGFV debts series is aggregated from the total debt, which consists of outstanding bank loans, outstanding bonds and various payables, of LGFVs issuing municipal corporate bonds by the end each year. Firm-level LGFV debt data were drawn from WIND.

The rise in local government debt can potentially be attributed to the unique political bureaucratic system. Career promotions for local officials are primarily determined by central government directives rather than electoral processes, and are intricately linked to the economic performance of their respective regions. This “economic tournament,” in which local officials are incentivized to prioritize economic growth (Li and Zhou, Reference Li and Zhou2005; Xiong, Reference Xiong2019). This competition leads local officials to adopt expansionary fiscal policies, especially amidst adverse economic shocks, in pursuit of favorable economic outcomes.

Similar to many other countries, one of the adverse economic shocks experienced in China in the past decade has stemmed from the stringent enforcement of environmental regulations (Greenstone et al. Reference Greenstone, List and Syverson2012; Martin et al. Reference Martin2014; Chen et al. Reference Chen, Li and Lu2018; Cui et al. Reference Cui, Wang, Zhang and Zheng2021). Since 2006, the attainment of local environmental targets established by higher-level governments has, in addition to the promotion of economic growth, become another prerequisite for the promotion of local officials.Footnote 2 In this context, the goal of this paper is to investigate how environmental policies affect local government debt when local officials face the (potentially conflicting) dual tasks of protecting the environment and promoting local economic growth. Answering this question offers a new perspective of debt accumulation under the global emphasize on environmental protection when economic development or stabilization is still pursued by the government, thereby enhancing our understanding of the costs associated with environmental regulations originating from the (potential) policy-induced over-accumulation of debt.

While we describe environmental regulations as adverse economic shocks in this paper, we do not, by any means, indicate that they are socially bad. In fact, the vast environmental economics literature has rigorously estimated the health benefits of pollution control (Chay and Greenstone, Reference Chay and Greenstone2003; Greenstone and Hanna, 2011; Tanaka, Reference Tanaka2015, to name a few). Our focus on the cost implications of these regulations is intended to highlight areas where there remains potential to reduce policy costs.

We approach the research question by first setting up a theoretical model based on Xiong (Reference Xiong2019) to elucidate the effects of environmental policy on local government debt accumulation within China’s distinct bureaucratic context. In the model, we distinguish between two types of local officials: “benevolent” and “politically incentivized”. The former group optimally determines the debt amount to maximize social welfare by equating the marginal social benefits with the marginal social costs associated with debt expansion, wherein the benefits come from short-term GDP stabilization and the costs come from a higher debt repayment in the future. A growing number of theoretical studies, however, have shown that government officials are far from being benevolent: they document “political budget cycles” related to the tenures of officials who are present-biased towards public spending (Alesina and Tabellini, Reference Alesina and Tabellini1990; Yared, Reference Yared2010). Such “present bias” can have various origins but the implications are similar: it creates a wedge between the incentives of the benevolent officials and the officials with their private career incentives. These “politically incentivized” local officials’ objective may then deviate from benevolent social planning: there is also an additional marginal private benefits of issuing debt for the purpose of achieving a promotion; thus, they tend to over-issue LGFV debts.

The primary conclusion drawn from the model is that both benevolent officials and those motivated by private career incentives are inclined to issue more debt in response to the economic downturn caused by the stringent enforcement of environmental policies; however, the latter group is more prone to excessive debt accumulation due to the presence of a private “promotion benefit” in addition to the social benefits of issuing debt.

Guided by the theoretical model, we then proceed to empirically test these implications by exploring the Air Pollution Prevention and Control Action Plan (hereafter, “the Action Plan”) in China as a natural experiment. Unsurprisingly, the policy resulted in a significant contraction in local industrial business, consequently reducing local tax revenues and adversely affecting economic growth. Meanwhile, local governments’ land financing income, one of the most important sources of off-balance-sheet local government income, did not change significantly in response to the Action Plan. Consistent with the predictions of our theoretical model, Chinese local governments inevitably increased their debt levels to stabilize local economy under shocks. Given their constrained capacity to run budget deficits, as discussed earlier, local officials resorted to off-balance-sheet debts for fiscal stimulus (Bai et al. Reference Bai, Hsieh and Song2016). Our empirical results indicate that, on average, a one-standard-deviation increase in the tightness of the Action Plan resulted in approximately a 5% rise in the annual issuance of less-regulated off-balance-sheet LGFV debts. Our findings elucidate how a policy shock that aims to enhance environmental quality can affect government leverage, which, in turn, increases the costs of environmental policies.

The results above confirm the first part of the theoretical implications but have not differentiated between debt-sourcing behaviors of benevolent local governors and those motivated by private career incentives under the Action Plan. To illustrate the latter implication, we collect data from 2011 to 2017 on prefecture-level local officials and further categorize LGFV debts into “other payables” and “non-other payables,” with the former presenting higher risk. As expected, LGFV debts sourced from higher-risk channels increased more significantly in prefectures with more “politically incentivized” local officials after the implementation of the Action Plan. Therefore, we demonstrate that political fiscal cycles, driven by local officials’ concerns regarding their political careers, incentivize deviations from the socially optimal debt accumulation under environmental policies. These results also empirically validate the prediction of macro-political models, indicating that the absence of fiscal rules, in conjunction with present-biased governance – particularly in the context of economic tournament among local governors – may lead to welfare loss through excessive debt accumulation risk. Finally, consistent with the predictions of fiscal policy theories that long-run level of debt depends on initial debt conditions (Lucas et al., Reference Lucas, Robert and Nancy1983), we also find evidence of path dependence in local government responses to the Action Plan that accelerates risk accumulation and may further increase the costs of environmental policies.

China is currently on a fast-track of “going green” but still keeps a moderate high economic growth rate. Overall, our findings suggest that local officials in China resort to issuing debts to mitigate economic slowdowns caused by tightening environmental regulations, which, however, may create future financial risk when interacting with social-economic and political conditions. An emerging body of literature emphasizes the need to design fiscal rules that mitigate debt over-accumulation (Halac and Yared, Reference Halac and Yared2022). Our findings underscore the necessity for enhanced coordination between fiscal and environmental policies in China, particularly in light of the prevailing strength of political forces and the increasing stringency of environmental protection measures.

The remainder of the paper proceeds as follows. Section 2 places our study in the broad literature. Section 3 derives testable hypotheses from a theoretical model. Section 4 briefly introduces the institutional background. Data, the construction of key variables, and the empirical methodology are presented in Section 5. Section 6 presents the estimation results and Section 7 concludes the paper.

2. Literature review

This paper relates to the extant literature in three aspects. First, there is a growing body of literature focusing on local government debt in China. Bai et al. (Reference Bai, Hsieh and Song2016) document the evolution of LGFV debts since the global financial crisis. Xiong (Reference Xiong2019) theoretically explains the local government debt over-accumulation by building a dynamic macroeconomic model with the “economic tournament” among local officials, which is empirically demonstrated by Li and Zhou (Reference Li and Zhou2005), Guo (Reference Guo2009), and Xu (2011). Several other studies examine the macroeconomic or financial effects of local government debt accumulation (Ambrose et al. Reference Ambrose, Deng and Wu2015; Huang et al. Reference Huang, Pagano and Panizza2020; Chen et al. Reference Chen, He and Liu2020).

Our paper fits into to these literatures by embedding environmental policy into this “tournament” framework and analyzing the effects of environmental policy on local government debt accumulation within China’s distinctive political system theoretically and empirically. The focus on the relationship between environmental policy and government debt is both new and important. The potential risk under the country’s promise to transit into a green economy cannot be ignored given its reliance on government debt to stabilize local economy.

Second, in this vein, our paper also contributes to a large body of literature on the benefit-cost of environmental policies. Most micro-level studies in this literature investigate the costs of environmental regulations separately from the potential welfare effects induced by government’s reaction to these regulations. For example, the literature has examined the negative impacts of the policies on firm behavior, productivity and employment (Greenstone, Reference Greenstone2002; Greenstone et al. Reference Greenstone, List and Syverson2012; Yamazaki, Reference Yamazaki2022; He et al. Reference He, Wang and Zhang2020; Fan et al. Reference Fan, Zivin, Kou, Liu and Wang2019; Fan et al. Reference Fan, Ge, Li and Zhao2021; Mao et al. Reference Mao, Wang and Yin2022; Walker, Reference Walker2011; Walker, Reference Walker2013). The “double dividend” literature initiated by Bovenberg and De Mooij (Reference Bovenberg and De Mooij1994) and Goulder (Reference Goulder1995) focus on policy design: they demonstrate that government can recycle the revenue collected from environmental taxes, which helps to reduce distortive labor taxes, thereby reducing the costs of the regulations. Therefore, the role of government in their studies is policy maker, rather than entities directly affected by the policy.

Our paper fills the literature gap by explicitly considering how the response of government, as an affected party under environmental policies, may result in policy cost implications. Given the pivotal role of local governments in the Chinese economy, only Ye and Lin (Reference Ye and Lin2020) have examined how these governments respond to environmental policies through tax instruments, which create immediate distortions. In contrast, we focus on the debt instrument, which poses risks for the future rather than the present.

Third, more generally, this study also contributes to a large literature on global government debt. Reinhart and Rogoff (Reference Reinhart and Rogoff2010, Reference Reinhart and Rogoff2011) study global government debt cycles and investigate their impacts on the macroeconomy with a country-level database. Alesina and Tabellini (Reference Alesina and Tabellini1990) and Yared (Reference Yared2010) theoretically show that governments tend to have an inefficiently high level of debt when their roles depart from a “benevolent social planner.” Yared (Reference Yared2019) surveys that various political forces that results in “myopic” government with present-biased preferences in advanced economies significantly contribute to the long-run trajectory of government debt, including the increasing political polarization and heightened electoral uncertainty. Pappa (Reference Pappa2021) documents that the increase in the fiscal flexibility in EU during “Great Recession” led to a large surge in government debt.

Our paper provides empirical evidence supporting the theoretical predictions of this literature within the context of a developing country, wherein the distinct political structure can also interact with adverse economic shocks to facilitate debt accumulation. On the one hand, although the political incentive in China is distinct, its existence precisely illustrates that debt over-accumulation happens when, for example, governors are “myopic” with present-biased preferences. Our empirical analysis supports this general theory. On the other hand, traditional empirical evidence on debt accumulation is largely based on aggregate time-series data and economy-wide shocks (Marcet and Scott, Reference Marcet and Scott2009), making it difficult to tease out the effects of other aggregate concurrent events from the effects of the shock being considered. Meanwhile, it is also difficult to test how differentiated socioeconomic conditions shape the debt accumulation problem with aggregate data. Our study can address these issues by adopting micro-econometric technique.

3. A theoretical model

In this section, we establish a stylized theoretical model to analyze the impact of environmental policy on local government debt within the context of China’s unique bureaucratic system. The majority of the model’s framework is based on Xiong (Reference Xiong2019), with the novel introduction of an environmental policy component.

3.1. Model environment

An economy consists of

![]() $N$

regions, each governed by one local government and served by a representative firm. The representative firm produce output with a Cobb-Douglas technology:

$N$

regions, each governed by one local government and served by a representative firm. The representative firm produce output with a Cobb-Douglas technology:

where

![]() $A_{it}$

is local productivity,

$A_{it}$

is local productivity,

![]() $Z_{it}$

is the flow emission input for production that is controlled by central government’s environmental policy,

$Z_{it}$

is the flow emission input for production that is controlled by central government’s environmental policy,

![]() $K_{it}$

is capital used for production,

$K_{it}$

is capital used for production,

![]() $L_{it}$

is local labor input, and

$L_{it}$

is local labor input, and

![]() $G_{it}$

is infrastructure created by the local government.

$G_{it}$

is infrastructure created by the local government.

In each period, the representative firm first observes local productivity

![]() $A_{it}$

, emission

$A_{it}$

, emission

![]() $Z_{it}$

, infrastructure

$Z_{it}$

, infrastructure

![]() $G_{it},$

and then hires capital

$G_{it},$

and then hires capital

![]() $K_{it}$

, and labor

$K_{it}$

, and labor

![]() $L_{it}$

to maximize its profit:

$L_{it}$

to maximize its profit:

where

![]() $\Phi _{it}$

is the competitive wage,

$\Phi _{it}$

is the competitive wage,

![]() $R$

is the rental price of capital that equals to the interest rate.

$R$

is the rental price of capital that equals to the interest rate.

![]() $R$

is globally determined since each region is a small open economy. Suppose the labor is immobile and each region has a fixed labor supply

$R$

is globally determined since each region is a small open economy. Suppose the labor is immobile and each region has a fixed labor supply

![]() $L_{it}=1$

. The first order conditions are

$L_{it}=1$

. The first order conditions are

By substituting

![]() $K_{it}$

and

$K_{it}$

and

![]() $L_{it}$

into the production function, we have

$L_{it}$

into the production function, we have

In each region, there are overlapping generation of households, with each generation living for two periods. Each individual born at period

![]() $t$

has identical preferences given by

$t$

has identical preferences given by

where

![]() $C_{it}^{t}$

and

$C_{it}^{t}$

and

![]() $C_{it+1}^{t}$

denote consumption chosen by the individual across his/her lifetime at

$C_{it+1}^{t}$

denote consumption chosen by the individual across his/her lifetime at

![]() $t$

and

$t$

and

![]() $t+1$

.Footnote

3

The budget constraints for each individual is

$t+1$

.Footnote

3

The budget constraints for each individual is

where

![]() $S_{it}^{t}$

is individual’s saving and

$S_{it}^{t}$

is individual’s saving and

![]() $\tau$

is the tax rate on both labor and capital income.

$\tau$

is the tax rate on both labor and capital income.

Local government’s tax revenue in period

![]() $t$

is

$t$

is

which contributes to its budget at the end of period

![]() $t$

:

$t$

:

where

![]() $W_{it}$

is the budget resources owned by local government,

$W_{it}$

is the budget resources owned by local government,

![]() $\delta _{G}$

is the depreciation rate of infrastructure,

$\delta _{G}$

is the depreciation rate of infrastructure,

![]() $D_{it-1}$

is local government debt issued at

$D_{it-1}$

is local government debt issued at

![]() $t-1$

. Local governor can issue new debt

$t-1$

. Local governor can issue new debt

![]() $D_{t}$

, in addition to

$D_{t}$

, in addition to

![]() $W_{t}$

, to fund government employees’ consumption

$W_{t}$

, to fund government employees’ consumption

![]() $E_{it}^{G}$

in the current period and the infrastructure for next period

$E_{it}^{G}$

in the current period and the infrastructure for next period

![]() $G_{it+1}$

:

$G_{it+1}$

:

3.2. Role of career incentives amidst environmental regulation

There exists an agency problem between the central and local governments. We adopt the following specification of the productivity of region

![]() $i$

:

$i$

:

where

![]() $f_{t}$

denotes a countrywide common shock,

$f_{t}$

denotes a countrywide common shock,

![]() $a_{it}$

represents the local governor’s ability in developing the local economy,

$a_{it}$

represents the local governor’s ability in developing the local economy,

![]() $\varepsilon _{it}$

is an idiosyncratic noise component. These components are independent of each other, and all are not publicly observable. Central government promotes local governors based on their anticipated economic abilities. The central government forms posterior prediction on local governors’ ability based on the realized economic outcome of all local governors:

$\varepsilon _{it}$

is an idiosyncratic noise component. These components are independent of each other, and all are not publicly observable. Central government promotes local governors based on their anticipated economic abilities. The central government forms posterior prediction on local governors’ ability based on the realized economic outcome of all local governors:

To derive

![]() $\hat{a}_{it+1}$

above, we need to get an expression for

$\hat{a}_{it+1}$

above, we need to get an expression for

![]() $Y_{it+1}$

, which, in log-scale, is given by:

$Y_{it+1}$

, which, in log-scale, is given by:

Following Xiong (Reference Xiong2019), there exists a general sufficient statistic for governor’s economic ability:

The central government expects that local governor will choose

![]() $G_{it+1}$

equaling to

$G_{it+1}$

equaling to

![]() $G_{it+1}^{\mathrm{*}}$

. Hence, from the central government’s perspective in interpreting the information content of this statistics,

$G_{it+1}^{\mathrm{*}}$

. Hence, from the central government’s perspective in interpreting the information content of this statistics,

![]() $m_{it+1}$

becomes

$m_{it+1}$

becomes

Hence, the learning rule for central government becomes

From local governor’s perspective, the sufficient statistic becomes

which is increasing in local government spending

![]() $G_{it+1}$

. Under this setup, the maximization problem for the local governor becomes

$G_{it+1}$

. Under this setup, the maximization problem for the local governor becomes

where the parameter

![]() $\rho$

and

$\rho$

and

![]() $\gamma$

are weights of the households’ and government employees’ consumption assigned by local government.

$\gamma$

are weights of the households’ and government employees’ consumption assigned by local government.

![]() $\kappa _{i}$

is a function of deep parameters in the signal-noise setting derived in Xiong (Reference Xiong2019) that captures the career incentive.Footnote

4

If the local governor is benevolent,

$\kappa _{i}$

is a function of deep parameters in the signal-noise setting derived in Xiong (Reference Xiong2019) that captures the career incentive.Footnote

4

If the local governor is benevolent,

![]() $\kappa _{i}=0$

. If he/she cares about future promotion,

$\kappa _{i}=0$

. If he/she cares about future promotion,

![]() $\kappa _{i}\gt 0$

. Issuing more debt increases the likelihood of being promoted, which increases the local governor’s value function, and the strength of this “marginal private benefit” is dictated by

$\kappa _{i}\gt 0$

. Issuing more debt increases the likelihood of being promoted, which increases the local governor’s value function, and the strength of this “marginal private benefit” is dictated by

![]() $\kappa _{i}$

. This benefit is classified as “private” since it is excessively reaped by the local governor rather than the broader society. The additional term

$\kappa _{i}$

. This benefit is classified as “private” since it is excessively reaped by the local governor rather than the broader society. The additional term

![]() $\kappa _{i}[lnG_{it+1}-lnG_{it+1}^{\mathrm{*}}]$

, which captures the difference between “benevolent” and “politically incentivized” governors, remains unchanged even if households experience disutility from flow emissions

$\kappa _{i}[lnG_{it+1}-lnG_{it+1}^{\mathrm{*}}]$

, which captures the difference between “benevolent” and “politically incentivized” governors, remains unchanged even if households experience disutility from flow emissions

![]() $Z_{it}$

, and the local governor takes this into consideration.

$Z_{it}$

, and the local governor takes this into consideration.

We now formally derive our testable hypotheses. Define two ratios:

After solving the local governor’s maximization problem following the method in Xiong (Reference Xiong2019), we can haveFootnote 5

Based on this equation, we can further derive the response of

![]() $d_{it}$

to

$d_{it}$

to

![]() $g_{it+1}$

as

$g_{it+1}$

as

Given the parameter values and

![]() $\kappa _{i}\geqq 0$

, we know

$\kappa _{i}\geqq 0$

, we know

![]() $\frac{\partial d_{it}}{\partial g_{it}}\gt 0$

. If there is a persistent environment shock to restrict emission

$\frac{\partial d_{it}}{\partial g_{it}}\gt 0$

. If there is a persistent environment shock to restrict emission

![]() $Z_{it}$

, then current output

$Z_{it}$

, then current output

![]() $Y_{t}$

decreases, so does the local government budget wealth

$Y_{t}$

decreases, so does the local government budget wealth

![]() $W_{it}$

. The local governor will choose to increase infrastructure

$W_{it}$

. The local governor will choose to increase infrastructure

![]() $G_{it+1}$

in order to stabilize the economy. Hence,

$G_{it+1}$

in order to stabilize the economy. Hence,

![]() $g_{it+1}$

increases, then

$g_{it+1}$

increases, then

![]() $d_{it}$

also goes up given

$d_{it}$

also goes up given

![]() $\frac{\partial d_{it}}{\partial g_{it}}\gt 0$

. A higher

$\frac{\partial d_{it}}{\partial g_{it}}\gt 0$

. A higher

![]() $d_{it}$

implies that local governor chooses to issue more government debt

$d_{it}$

implies that local governor chooses to issue more government debt

![]() $D_{it}$

to mitigate the negative effect of environment policy on government budget. This implication holds for benevolent governor or governor with career incentive. Hence, we have the first hypothesis.

$D_{it}$

to mitigate the negative effect of environment policy on government budget. This implication holds for benevolent governor or governor with career incentive. Hence, we have the first hypothesis.

Hypothesis 1: If an environmental policy shock occurs that restricts emissions, it will lead to a decline in economic output. In response, both a benevolent governor and a governor motivated by career incentives are likely to choose to issue more debt.

Additionally, we can derive

\begin{equation*} \frac{\frac{\partial d_{it}}{\partial g_{it+1}}}{\partial \kappa _{i}}=\frac{\left(1-\beta \right)\gamma }{\left(\gamma +\kappa _{i}\right)^{2}}\left(g_{it}\right)^{-2}. \end{equation*}

\begin{equation*} \frac{\frac{\partial d_{it}}{\partial g_{it+1}}}{\partial \kappa _{i}}=\frac{\left(1-\beta \right)\gamma }{\left(\gamma +\kappa _{i}\right)^{2}}\left(g_{it}\right)^{-2}. \end{equation*}

Since the discount factor

![]() $\beta \lt 1$

,

$\beta \lt 1$

,

![]() $\frac{\frac{\partial d_{it}}{\partial g_{it+1}}}{\partial \kappa _{i}}\gt 0$

. Given the same environmental policy shock that restricts emissions and reduces economic output, a governor with greater career incentives will choose to issue more debt to counteract the economic downturn. However, if the governor is benevolent, the decision to issue debt in response to the environmental shock will not be influenced by career incentives.

$\frac{\frac{\partial d_{it}}{\partial g_{it+1}}}{\partial \kappa _{i}}\gt 0$

. Given the same environmental policy shock that restricts emissions and reduces economic output, a governor with greater career incentives will choose to issue more debt to counteract the economic downturn. However, if the governor is benevolent, the decision to issue debt in response to the environmental shock will not be influenced by career incentives.

Hypothesis 2: If a governor is benevolent, debt issuance in response to an environmental shock is not influenced by career incentives. However, if the governor has career incentives, the risk of debt accumulation (future debt repayment) in response to environmental policy increases with the strength of career incentives.

Intuitively, A benevolent local governor determines the optimal debt level by equating the marginal social benefits of debt issuance, which comes from short-term GDP stabilization, and the marginal social costs, which come from a higher debt repayment in the future.Footnote 6 A politically incentivized local governor, in contrast, additionally considers the marginal private promotion benefits in the decision-making process, resulting in excessive debt accumulation facing the economic loss brought by the environmental policy.

4. Institutional background

4.1. The action plan on air pollution prevention and control

Rapid industrialization since the Reform and Opening-up has led to both unprecedented economic growth and environmental deterioration in China. In response to environmental challenges, China passed the Environmental Protection Law in 1989 and developed a multifaceted regulatory system.Footnote 7 However, air pollution concentration still reached a record high in 2013 due to lax enforcement (Greenstone et al. Reference Greenstone, He, Li and Zou2021).

To address the serious air pollution problem, the central government announced the Action Plan, a national air quality improvement project, in September 2013.Footnote

8

Similar to previous environmental policies, the Action Plan sets air quality goals for each province. In practice, provincial governments further break their allocated targets down to prefectures in their jurisdictions. Overall, the Action Plan required nationwide particular matter (

![]() $\mathrm{PM}_{2.5}$

and

$\mathrm{PM}_{2.5}$

and

![]() $\mathrm{PM}_{10}$

) concentrations to be reduced by more than 10% by the end of 2017, compared to 2012 levels.Footnote

9

Given the spatially differentiated nature of local economic conditions, such as industrial structure and energy reliance, there was wide variation in the tightness of the Action Plan across prefectures. We discuss how we measure “tightness” in Section 5.1.

$\mathrm{PM}_{10}$

) concentrations to be reduced by more than 10% by the end of 2017, compared to 2012 levels.Footnote

9

Given the spatially differentiated nature of local economic conditions, such as industrial structure and energy reliance, there was wide variation in the tightness of the Action Plan across prefectures. We discuss how we measure “tightness” in Section 5.1.

In China, local officials are responsible for various aspects of local affairs. Since 2006, to receive a promotion, local officials have been required to meet environmental protection goals assigned by higher-level governmentsFootnote 10 and the weight of local environmental performance in the evaluation system keeps rising (Zhang and Xiong Reference Zhang and Xiong2020).Footnote 11 However, local economic growth still takes the first priority for local officials’ evaluation.Footnote 12 Therefore, local officials need to carefully balance economic growth and environmental protection under the Action Plan.

4.2. The local government financing vehicles (LGFVs)

Unlike in most western countries, China’s Budget Law imposes strict prohibitions on official local government debt, thereby constraining local governments’ capacity to promote economic growth at the local level. However, in response to the global financial crisis, the central government initiated a fiscal stimulus package valued at 4 trillion RMB in 2008, with only 1 trillion RMB came from the central government (Bai et al. Reference Bai, Hsieh and Song2016) and local governments assumed most of the debt burden.

To align with the provisions of the Budget Law, which prohibits local governments from incurring official on-balance-sheet debts, the China Banking and Insurance Regulatory Commission (CBIRC) and Ministry of Finance permit local governments to effectively issue off-balance-sheet debts by establishing local government financing vehicles (LGFVs) to fund stimulus spending (Bai et al. Reference Bai, Hsieh and Song2016; Chen et al. Reference Chen, He and Liu2020). Practically, LGFVs are registered simply as business entities, thereby excluding their debt from local governments’ balance sheets. Nonetheless, given that these LGFVs are endorsed by the local governments, their debt becomes de facto local government debt. Shown by the dashed line in Figure 1, LGFV debts expanded rapidly after 2009 and act as an important fiscal instrument for local governments.

5. Data, variable construction and empirical method

5.1. Treatment variable: Tightness of air pollution control under the action plan

In this section, we discuss how we measure prefecture-level regulation tightness under the Action Plan, which is used as the treatment variable in the regression presented in Section 5.4. In particular, this measure is intended to capture the potential burden imposed on the economy by the Action Plan.

At first glance, prefecture-specific targets to reduce

![]() $\mathrm{PM}_{2.5}$

concentration, if available,Footnote

13

appear to be good candidates for the tightness measure. However, we argue that this is not the best fit for our study for the following reasons. First, unlike pollution emissions,

$\mathrm{PM}_{2.5}$

concentration, if available,Footnote

13

appear to be good candidates for the tightness measure. However, we argue that this is not the best fit for our study for the following reasons. First, unlike pollution emissions,

![]() $\mathrm{PM}_{2.5}$

concentration measures ambient environmental qualities that are affected by not only local polluting activities but also pollutants transported from other locations by wind. Thus, a prefecture may have a high

$\mathrm{PM}_{2.5}$

concentration measures ambient environmental qualities that are affected by not only local polluting activities but also pollutants transported from other locations by wind. Thus, a prefecture may have a high

![]() $\mathrm{PM}_{2.5}$

concentration and face a high concentration reduction target even if the prefecture itself has few polluting sources. In such a case, emission reductions in other prefectures of the province needs to be required to achieve the

$\mathrm{PM}_{2.5}$

concentration and face a high concentration reduction target even if the prefecture itself has few polluting sources. In such a case, emission reductions in other prefectures of the province needs to be required to achieve the

![]() $\mathrm{PM}_{2.5}$

concentration reduction goal of this prefecture; therefore, the actual regulation tightness for this prefecture does not necessarily to be high.

$\mathrm{PM}_{2.5}$

concentration reduction goal of this prefecture; therefore, the actual regulation tightness for this prefecture does not necessarily to be high.

Second, even if

![]() $\mathrm{PM}_{2.5}$

concentration can credibly reflect local polluting activities, the targets are not good measures of regulation tightness for our purposes. If a prefecture with a higher concentration reduction target is much less reliant on pollution- or energy-intensive industries than another prefecture with a lower target, the regulation tightness, or, in other words, the economic costs of the Action Plan, might be lower for the first prefecture compared to the second.

$\mathrm{PM}_{2.5}$

concentration can credibly reflect local polluting activities, the targets are not good measures of regulation tightness for our purposes. If a prefecture with a higher concentration reduction target is much less reliant on pollution- or energy-intensive industries than another prefecture with a lower target, the regulation tightness, or, in other words, the economic costs of the Action Plan, might be lower for the first prefecture compared to the second.

An ideal solution to the first problem above is to measure regulation tightness by

![]() $\mathrm{PM}_{2.5}$

generated or emitted by polluting sources in each prefecture, rather than

$\mathrm{PM}_{2.5}$

generated or emitted by polluting sources in each prefecture, rather than

![]() $\mathrm{PM}_{2.5}$

concentrations. Unfortunately, we do not have access to this information; thus, we use information on the generation and emissions of

$\mathrm{PM}_{2.5}$

concentrations. Unfortunately, we do not have access to this information; thus, we use information on the generation and emissions of

![]() $SO_{2}$

, a major precursor of

$SO_{2}$

, a major precursor of

![]() $\mathrm{PM}_{2.5}$

(Baker et al. Reference Baker, Collins, Olivié, Cherian, Hodnebrog, Myhre and Quaas2015), as an alternative to construct the tightness measure.Footnote

14

$\mathrm{PM}_{2.5}$

(Baker et al. Reference Baker, Collins, Olivié, Cherian, Hodnebrog, Myhre and Quaas2015), as an alternative to construct the tightness measure.Footnote

14

To resolve the second problem, we incorporate a prefecture’s pollution reliance into the measurement of regulation tightness:

\begin{equation} \textit{Tight}_{i}=\underset{\textit{abatement} \textit{intensity}}{\underbrace{\frac{SO_{2}~ \textit{abatement}_{i}}{GDP_{i}}}}|_{2012}=\underset{\textit{abatement~ ratio}}{\underbrace{\frac{SO_{2}~ \textit{abatement}_{i}}{SO_{2}~ \textit{generation}_{i}}}}|_{2012}\times \underset{SO_{2}\,\textit{generation} \textit{intensity}}{\underbrace{\frac{SO_{2}~ \textit{generation}_{i}}{GDP_{i}}}|_{2012},} \end{equation}

\begin{equation} \textit{Tight}_{i}=\underset{\textit{abatement} \textit{intensity}}{\underbrace{\frac{SO_{2}~ \textit{abatement}_{i}}{GDP_{i}}}}|_{2012}=\underset{\textit{abatement~ ratio}}{\underbrace{\frac{SO_{2}~ \textit{abatement}_{i}}{SO_{2}~ \textit{generation}_{i}}}}|_{2012}\times \underset{SO_{2}\,\textit{generation} \textit{intensity}}{\underbrace{\frac{SO_{2}~ \textit{generation}_{i}}{GDP_{i}}}|_{2012},} \end{equation}

where

![]() $SO_{2}~ \textit{generation}_{i}$

is the amount of

$SO_{2}~ \textit{generation}_{i}$

is the amount of

![]() $SO_{2}$

generated by all polluting sources located in prefecture i. It is the sum of the amount of

$SO_{2}$

generated by all polluting sources located in prefecture i. It is the sum of the amount of

![]() $SO_{2}$

ultimately emitted into the atmosphere (

$SO_{2}$

ultimately emitted into the atmosphere (

![]() $SO_{2}~ \textit{emission}_{i}$

) and the portion that is abated by emission abatement technologies such as

$SO_{2}~ \textit{emission}_{i}$

) and the portion that is abated by emission abatement technologies such as

![]() $SO_{2}$

scrubbers (

$SO_{2}$

scrubbers (

![]() $SO_{2}~ \textit{abatement}_{i}$

) before the waste gas goes into the atmosphere. All variables in equation (1) are measured at the pre-policy levels in 2012. Following Liu (Reference Liu2019), to eliminate the sensitivity of the choice of regulation tightness measures, we standardize

$SO_{2}~ \textit{abatement}_{i}$

) before the waste gas goes into the atmosphere. All variables in equation (1) are measured at the pre-policy levels in 2012. Following Liu (Reference Liu2019), to eliminate the sensitivity of the choice of regulation tightness measures, we standardize

![]() $\textit{tight}_{i}$

to have mean 0 and standard deviation 1 for the ease of results interpretation.

$\textit{tight}_{i}$

to have mean 0 and standard deviation 1 for the ease of results interpretation.

Based on equation (1), regulation tightness is defined as prefecture-level

![]() $SO_{2}~$

abatement intensity in 2012, which can be decomposed to the product of the

$SO_{2}~$

abatement intensity in 2012, which can be decomposed to the product of the

![]() $SO_{2}$

abatement ratio and

$SO_{2}$

abatement ratio and

![]() $SO_{2}~$

generation intensity. To mitigate the endogeneity issues, we employ individual-level characteristics prior to the Action Plan (i.e., in 2012) to measure regulation strength each individual unit face, which is widely adopted recently in the literature (Mian and Sufi, Reference Mian and Sufi2014; Giroud and Mueller, Reference Giroud and Mueller2019; Duval et al. Reference Duval, Hong and Timmer2020; Mao et al. Reference Mao, Wang and Yin2022). A higher pre-policy abatement ratio indicates that the prefecture had already abated a large share of emissions generated from fuel combustion before the policy took effect. Therefore, the cost associated with further increasing the abatement ratio is higher.Footnote

15

Furthermore, a higher

$SO_{2}~$

generation intensity. To mitigate the endogeneity issues, we employ individual-level characteristics prior to the Action Plan (i.e., in 2012) to measure regulation strength each individual unit face, which is widely adopted recently in the literature (Mian and Sufi, Reference Mian and Sufi2014; Giroud and Mueller, Reference Giroud and Mueller2019; Duval et al. Reference Duval, Hong and Timmer2020; Mao et al. Reference Mao, Wang and Yin2022). A higher pre-policy abatement ratio indicates that the prefecture had already abated a large share of emissions generated from fuel combustion before the policy took effect. Therefore, the cost associated with further increasing the abatement ratio is higher.Footnote

15

Furthermore, a higher

![]() $SO_{2}$

generation intensity implies that the local economy relies heavily on pollution-intensive industries, so emissions reduction for the economy is also likely to be tougher. Data required to calculate the toughness measure are drawn from the City Statistical Yearbook of China.

$SO_{2}$

generation intensity implies that the local economy relies heavily on pollution-intensive industries, so emissions reduction for the economy is also likely to be tougher. Data required to calculate the toughness measure are drawn from the City Statistical Yearbook of China.

As shown in Figure 2, the geographic distribution of regulation tightness overlaps to some degree with that of the

![]() $\mathrm{PM}_{2.5}$

reduction targets set by the Action Plan. For example, the Beijing–Tianjin–Hebei area, which had the highest

$\mathrm{PM}_{2.5}$

reduction targets set by the Action Plan. For example, the Beijing–Tianjin–Hebei area, which had the highest

![]() $\mathrm{PM}_{2.5}$

concentration prior to the Action Plan and was assigned the highest

$\mathrm{PM}_{2.5}$

concentration prior to the Action Plan and was assigned the highest

![]() $\mathrm{PM}_{2.5}$

reduction targets, is also among the most tightly regulated areas, according to our tightness measure.

$\mathrm{PM}_{2.5}$

reduction targets, is also among the most tightly regulated areas, according to our tightness measure.

Figure 2. Geographic distribution of regulation tightness.

Notes: This figure plots geographic distribution of regulation tightness in 2012, prior to the implementation of the Action Plan, which is computed by equation (1) and captures the toughness of achieving

![]() $\mathrm{PM}_{2.5}$

reduction goal. The higher the intensity, the more toughness in a prefecture. There are 261 prefectures in the sample. The intensity is sorted in an ascending order, and then classified into 4 groups. The intensity increases from group 1 to group 4. There is no data if a prefecture is out of sample.

$\mathrm{PM}_{2.5}$

reduction goal. The higher the intensity, the more toughness in a prefecture. There are 261 prefectures in the sample. The intensity is sorted in an ascending order, and then classified into 4 groups. The intensity increases from group 1 to group 4. There is no data if a prefecture is out of sample.

As shown in Figure 2, Yunnan, Sichuan, and Guizhou also had the most tightly regulated prefectures, although these provinces had low

![]() $\mathrm{PM}_{2.5}$

concentration reduction targets. In particular, Qujing (in Yunnan) and Guang’an (in Sichuan) faced significant challenges because they rely heavily on the secondary industry.

$\mathrm{PM}_{2.5}$

concentration reduction targets. In particular, Qujing (in Yunnan) and Guang’an (in Sichuan) faced significant challenges because they rely heavily on the secondary industry.

A final message from Figure 2 is that there exists sufficient heterogeneity in our tightness measure even for prefectures in the same province. As we will discuss in more detail in Section 5.4, this allows us to use within-province variations to identify the responses of local governments to the Action Plan, which alleviates potential province-level selection problems that may bias empirical estimation. This is an additional benefit of using our tightness measure in lieu of the

![]() $\mathrm{PM}_{2.5}$

concentration reduction targets, which are province-specific rather than prefecture-specific.

$\mathrm{PM}_{2.5}$

concentration reduction targets, which are province-specific rather than prefecture-specific.

5.2. LGFV debts

We follow the method in Bai et al. (Reference Bai, Hsieh and Song2016) and Huang et al. (Reference Huang, Pagano and Panizza2020) to estimate the total financial liabilities and categories of LGFVs from their disclosed balance sheets that are required by bond issuance procedure. Consistent with Bai et al. (Reference Bai, Hsieh and Song2016) and Huang et al. (Reference Huang, Pagano and Panizza2020), all LGFV balance sheets were drawn from Wind Information Co. (WIND), which is the Chinese version of Bloomberg and the leading vendor of financial and economic data in China.Footnote 16 The sample covers all firms that issued MCBs from 2011 to 2017, which accounts for a majority of all LGFVs in the country.Footnote 17

The information used to construct the LGFV debt-related variables in this study include LGFV firm identity, location, total debts, and “other payables” in each year. In particular, total LGFV debts include stock of bank loans, payable bonds, obligations to goods and services suppliers, and lending from affiliated firms. Facing different lending standards and regulations, these sub-items feature different risk levels. Based on the degree of transparency and embedded risk levels, we divide them into two categories: “other payables” and “non-other payables.” Other payables mainly comprise less transparent debts from affiliated or connected firms, which require lower lending standards, regulations, and (even undetermined) maturity but higher interest rates.Footnote 18 Although this type of debt relieves the financial constraints of LGFVs (i.e., more flexible) to some extent, a higher risk in the future is imposed in exchange. Finally, we define “non-other payables” as the difference between total debts and other payables, including debt items such as bank loans and MCBs that are subject to stricter regulations and lower risks.

We aggregate the outstanding total debts and outstanding other payables of all LGFVs within each prefecture by the end of each fiscal year to get prefecture-level total LGFV debts and other payables.Footnote 19

5.3. Other prefecture-level characteristics and summary statistics

In our mechanism analysis, we additionally supplement our main dataset with prefecture-level land sales data. We use parcel-level land transaction data collected from the website of China’s Ministry of National Land and Resources to construct these variables.Footnote 20 In particular, the following information is used: land transaction date, address, buyer identity, buyer’s two-digital industry code, and sales revenue.Footnote 21 As discussed in Appendix B1, local governments categorize urban land to its usage purpose: residential, commercial or industrial. Industrial land sales only account for a small share of land sale revenue and can be supplied for other reasons, such as structural adjustment, job creation, and local tax revenue. To mitigate the influence of non-financing considerations, we only consider commercial and residential land sales conducted for financing purposes.

A key variable in our heterogeneity analysis is the strength of local officials’ political promotion incentive. We manually collected prefect-level party secretary information from 2011 to 2017, including name, age, and position starting date of the party secretary of each city for each year. The key variable is position starting date, based on which we construct a variable to capture local officials’ incentive to promote the local economy for career promotion.Footnote 22 The construction method is detailed in Section 6.4. Other prefecture-level information, such as GDP, revenue of industrial firms, tax revenue from industrial firms, total local government tax revenue, total population, and miles of paved road, are collected from the City Statistical Yearbook of China.

To make data comparable across prefectures, we exclude the data from Beijing, Shanghai, Tianjin and Chongqing, four province-level prefectures in China. We also drop prefectures in Xinjiang, Qinghai, Hainan, and Tibet from the sample since the prefectures with non-missing data is too few to generate enough variation within corresponding province.Footnote

23

Thus, the number of prefectures reduces from 336 to 301. Additionally, 40 prefectures did not report

![]() $\mathrm{SO}_{2}$

abatement in 2012, so the final sample covers 261 prefectures in total. To minimize the impact of outliers in our study, we winsorize all variables at the 2.5% and 97.5% levels.Footnote

24

Table 1 shows the summary statistics for the sampling period from 2011 to 2017. Around 80% of all observations are located within one standard deviation of the tightness of air pollution control. Approximately 57% of all observations are from 2014 to 2017 (i.e., post-Action Plan).

$\mathrm{SO}_{2}$

abatement in 2012, so the final sample covers 261 prefectures in total. To minimize the impact of outliers in our study, we winsorize all variables at the 2.5% and 97.5% levels.Footnote

24

Table 1 shows the summary statistics for the sampling period from 2011 to 2017. Around 80% of all observations are located within one standard deviation of the tightness of air pollution control. Approximately 57% of all observations are from 2014 to 2017 (i.e., post-Action Plan).

Table 1. Summary statistics

Notes: This table reports summary statistics in this study. Tight is the

![]() $\mathrm{SO}_{2}$

abatement intensity of each prefecture in 2012, which is computed by equation (1) and standardized to have mean 0 and standard deviation 1. The dummy variable “Post2013” equals 1 if year >2013 and 0 otherwise. “pdebt1113” is the ratio of LGFV debts to GDP, averaged from 2011 to 2013, which is standardized to have mean 0 and standard deviation 1. The dummy variable “HighIn” equals 1 if a party secretary is in the 2nd–4th (or 5th–8th) year of the current position, i.e., having high promotion urgency, in a given year in a given prefecture and 0 otherwise (Guo, Reference Guo2009). Total LGFV debts and other payables are aggregated from the outstanding total debt and outstanding other payables of all LGFVs within each prefecture by the end of each fiscal year, respectively. LGFV non-other payables is the difference between total debt and other payables. Monetary units are all discounted to 2010 price level. Revenue of industrial firms, GDP, tax revenue from industrial firms, total local government tax revenue, total population, nonagricultural population, and miles of paved road, are collected from the City Statistical Yearbook of China. Firm-level LGFV debt data were drawn from WIND.

$\mathrm{SO}_{2}$

abatement intensity of each prefecture in 2012, which is computed by equation (1) and standardized to have mean 0 and standard deviation 1. The dummy variable “Post2013” equals 1 if year >2013 and 0 otherwise. “pdebt1113” is the ratio of LGFV debts to GDP, averaged from 2011 to 2013, which is standardized to have mean 0 and standard deviation 1. The dummy variable “HighIn” equals 1 if a party secretary is in the 2nd–4th (or 5th–8th) year of the current position, i.e., having high promotion urgency, in a given year in a given prefecture and 0 otherwise (Guo, Reference Guo2009). Total LGFV debts and other payables are aggregated from the outstanding total debt and outstanding other payables of all LGFVs within each prefecture by the end of each fiscal year, respectively. LGFV non-other payables is the difference between total debt and other payables. Monetary units are all discounted to 2010 price level. Revenue of industrial firms, GDP, tax revenue from industrial firms, total local government tax revenue, total population, nonagricultural population, and miles of paved road, are collected from the City Statistical Yearbook of China. Firm-level LGFV debt data were drawn from WIND.

5.4. Empirical model

We adopt the standard difference-in-difference (DID) framework to identify local government responses to the Action Plan.Footnote 25 The baseline regression model is shown in equation (2):

where

![]() $y_{ijt}$

is a list of (logged) outcome variable of prefecture

$y_{ijt}$

is a list of (logged) outcome variable of prefecture

![]() $i$

in province

$i$

in province

![]() $j$

and year

$j$

and year

![]() $t$

including total LGFV debts, ratio of non-other payable debt in total LGFV debts, the amount of non-other payable debts, and the amount of other payable debts. In the mechanism analysis in Section 6.3,

$t$

including total LGFV debts, ratio of non-other payable debt in total LGFV debts, the amount of non-other payable debts, and the amount of other payable debts. In the mechanism analysis in Section 6.3,

![]() $y_{ijt}$

is replaced by local industrial revenue, GDP, taxation, and land sale income.

$y_{ijt}$

is replaced by local industrial revenue, GDP, taxation, and land sale income.

![]() $\textit{Tight}_{i}$

, as defined in Section 5.1, is a continuous variable that measures treatment intensity, or, alternatively, the tightness of the Action Plan, facing prefecture

$\textit{Tight}_{i}$

, as defined in Section 5.1, is a continuous variable that measures treatment intensity, or, alternatively, the tightness of the Action Plan, facing prefecture

![]() $i$

.

$i$

.

![]() $Post2013_{t}$

is a dummy variable that equals 1 if

$Post2013_{t}$

is a dummy variable that equals 1 if

![]() $t\gt 2013$

, and 0 otherwise.

$t\gt 2013$

, and 0 otherwise.

![]() $\beta _{1}$

is the parameter of interest, which measures the relative change in outcome variables due to the implementation of the Action Plan for prefectures facing higher treatment intensity compared to those facing lower treatment intensity. LGFV debts are possibly higher in areas with faster urbanization and economic development, where the tightness of the action plan may also be high due to the potential reliance on the dirty industry for the fast development. To control for this confounding effect, we include in

$\beta _{1}$

is the parameter of interest, which measures the relative change in outcome variables due to the implementation of the Action Plan for prefectures facing higher treatment intensity compared to those facing lower treatment intensity. LGFV debts are possibly higher in areas with faster urbanization and economic development, where the tightness of the action plan may also be high due to the potential reliance on the dirty industry for the fast development. To control for this confounding effect, we include in

![]() ${X}_{it}^{'}$

prefecture-level lagged total population (in log) and lagged miles of paved road (in log), control variables that are highly correlated with urbanization and economic development. The error terms

${X}_{it}^{'}$

prefecture-level lagged total population (in log) and lagged miles of paved road (in log), control variables that are highly correlated with urbanization and economic development. The error terms

![]() $\varepsilon _{ijt}$

are clustered at province-by-year level to account for potential correlations in the error structure.Footnote

26

$\varepsilon _{ijt}$

are clustered at province-by-year level to account for potential correlations in the error structure.Footnote

26

![]() $\delta _{i}$

is a series of prefecture fixed effects that control for the time-invariant determinants of the outcome variables.

$\delta _{i}$

is a series of prefecture fixed effects that control for the time-invariant determinants of the outcome variables.

One might argue that prefectures in the same province may share similar unobservable socioeconomic and natural conditions that simultaneously influence the outcome variables and regulation tightness, making treatment assignment endogenous. Fortunately, by construction,

![]() $\textit{Tight}_{i}$

varies across prefectures in the same province. Therefore, we include in the regression

$\textit{Tight}_{i}$

varies across prefectures in the same province. Therefore, we include in the regression

![]() $\tau _{jt}$

, a vector of province-by-year fixed effects that the impact of any time-varying concurrent policies that happen at province level, shielding our treatment effect estimation from being contaminated by these confounding policies. In other words, we are essentially utilizing within-province prefecture-level variations in treatment intensity to identify the effects of the Action Plan on the outcome variables, which allow us to eliminate the possible province-level treatment selection problem.Footnote

27

The inclusion of

$\tau _{jt}$

, a vector of province-by-year fixed effects that the impact of any time-varying concurrent policies that happen at province level, shielding our treatment effect estimation from being contaminated by these confounding policies. In other words, we are essentially utilizing within-province prefecture-level variations in treatment intensity to identify the effects of the Action Plan on the outcome variables, which allow us to eliminate the possible province-level treatment selection problem.Footnote

27

The inclusion of

![]() $\tau _{jt}$

also teases out potential confounding effects from province-level concurrent policies, such as the establishment of carbon pilots in seven provinces in 2012. In Section 6.2, we provide further evidence that that prefecture-level selection may not be a serious concern that biases our treatment effect estimation. In that section, we also try our best to directly control for potential prefecture-level sample selection issue by including the interaction between a series of pre-policy control variables and a flexible function of time as additional regressors, following Gentzkow (Reference Gentzkow2006), Chen et al. (Reference Chen, Li and Lu2018) and Gollin et al. (Reference Gollin, Hansen and Wingender2021). It turns out that the regression results remain largely unchanged.

$\tau _{jt}$

also teases out potential confounding effects from province-level concurrent policies, such as the establishment of carbon pilots in seven provinces in 2012. In Section 6.2, we provide further evidence that that prefecture-level selection may not be a serious concern that biases our treatment effect estimation. In that section, we also try our best to directly control for potential prefecture-level sample selection issue by including the interaction between a series of pre-policy control variables and a flexible function of time as additional regressors, following Gentzkow (Reference Gentzkow2006), Chen et al. (Reference Chen, Li and Lu2018) and Gollin et al. (Reference Gollin, Hansen and Wingender2021). It turns out that the regression results remain largely unchanged.

6. Results and discussions

In this section, we first present the main results of the DID estimation, followed by a series of robustness checks. The DID results document how local governments responded to strictly enforced environmental regulations by adjusting LGFV debts under the pressure of economic stabilization (Hypothesis 1). We then conduct heterogeneity analyses to show how local officials’ promotion incentives affect their debt adjustment behaviors (Hypothesis 2) and talk about potential welfare impacts.

6.1. Local government responses: LGFV debts

Table 2 reports the effects of the Action Plan on local governments’ LGFV debts adjustment behaviors. The specifications alternate based on whether control variables are included in the regressions. It turns out that the estimated treatment effects are largely robust to the inclusion of these control variables. On average, as shown by Column (2) of Table 2, a one-standard-deviation increases in treatment intensity increased LGFV debts by approximately 5%.

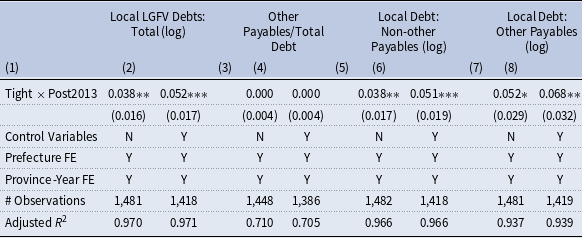

Table 2. Effects of the action plan on local local government financing vehicle (LGFV) debts

Notes: This table reports the estimated effects of the Action Plan on local LGFV debts and by debt source. We divide LGFV debts into two categories: i. non-other payable debts that includes municipal construction bonds, bank loans and other debts that are under strict supervision (Column (5) and (6)), and ii. other payables including firm-to-firm debts and other debts that are subject to looser supervision and are riskier (Column (7) and (8)). The results for the share of other payables in total LGFV debts is also reported in the Column (3) and (4). Control variables include lagged total population in log and lagged miles of paved road in log. Standard errors clustered at prefecture-by-year level are reported in parentheses. *** Significant at 1% level, ** significant at 5% level, and * significant at 10% level.

The existence of LGFVs helps explain why China has been experiencing a smooth transition toward a green economy. From this perspective, debt can act as a “economic buffer” when environmental regulations are becoming more stringent or greenhouse gas reduction policies are enacted to combat climate change in the future. This is exactly the short run benefits of debt in the theoretical model.

However, the potential adverse consequence of issuing LGFV debts to stabilize the contemporaneous economy under the pressure of environmental regulation cannot be ignored. In particular, LGFV debt expansion and the overall GDP decline across tightly regulated areas together added to the risk of the economy, such as higher debt repayment in the future and the crowding out of private firms’ investment, threatening long-term economic stability. To further investigate the structure of LGFV debt increase, we classify LGFV debts into two broad categories: less-risky “non-other payable debts” and riskier “other payable debts.”Footnote 28 The estimation results in the second panel of Table 2 indicate that the Action Plan had little impact on the share of other payable debts in total LGFV debts. Therefore, both non-other payable debts and other payable debts increased following the implementation of the Action Plan (i.e., the third and fourth panels of Table 2), and the regulation did not shift LGFV debt structure on average.

The results from this DID regression are consistent with Hypothesis 1 that local governors tend to issue more debts to mitigate the economic slowdown (shown in Section 6.3) caused by strict environmental policies, but we cannot distinguish whether they are benevolent or have private career incentives simply from the DID results. Benevolent local governments should optimize their use of LGFV debts by equalizing the marginal social benefits (i.e., GDP stabilization) and marginal social costs (i.e., debt repayment) of increasing these debts. However, as will be shown later in Section 6.4, under certain economic and political conditions, local officials might have deviated from a social planner’s optimization path, which would have exacerbated the risk associated with issuing LGFV debts.

6.2. Identification validity & robustness checks

6.2.1. Formal test of the parallel trend assumption & controlling for possible selection

As discussed in Section 5, the province-by-year fixed effects eliminate any province-level treatment intensity selection problem that might bias the estimate of

![]() $\beta _{1}$

. However, it is still possible that, within the same province, prefectures with tighter regulations are systematically different from those with looser regulations. For example, one prefecture might be more reliant on pollution-intensive industries due to greater natural resource endowment (e.g., close to a large coal mine) compared to their counterparts in the same province. If the growth patterns of resource-reliant industries differ from those of other industries even in the absence of the Action Plan, the estimate of

$\beta _{1}$

. However, it is still possible that, within the same province, prefectures with tighter regulations are systematically different from those with looser regulations. For example, one prefecture might be more reliant on pollution-intensive industries due to greater natural resource endowment (e.g., close to a large coal mine) compared to their counterparts in the same province. If the growth patterns of resource-reliant industries differ from those of other industries even in the absence of the Action Plan, the estimate of

![]() $\beta _{1}$

might also be biased. Following the literature, we use two different methods to address this concern.

$\beta _{1}$

might also be biased. Following the literature, we use two different methods to address this concern.

First, if prefectures with different regulation tightness do not differ systematically from each other, the outcome variables of prefectures with high and low treatment intensity levels should follow the same time trend prior to policy implementation. Using 2013 as the benchmark year (i.e., one year before the Action Plan took effect), we formally test the parallel trend assumption with the following even-study regression design (Jacobson et al. Reference Jacobson, LaLonde and Sullivan1993):

\begin{equation} \mathit{\log } \left(y_{ijt}\right)=\beta _{0}+\sum _{k=2011,k\neq 2013}^{2017}\beta _{k}\textit{Tight}_{i}\times Year_{k}+{X}_{it}^{'}\alpha +\delta _{i}+\tau _{jt}+\varepsilon _{ijt}, \end{equation}

\begin{equation} \mathit{\log } \left(y_{ijt}\right)=\beta _{0}+\sum _{k=2011,k\neq 2013}^{2017}\beta _{k}\textit{Tight}_{i}\times Year_{k}+{X}_{it}^{'}\alpha +\delta _{i}+\tau _{jt}+\varepsilon _{ijt}, \end{equation}

where

![]() $Year_{k}$

is a dummy variable indicating year

$Year_{k}$

is a dummy variable indicating year

![]() $k$

between 2011 and 2017. Note that

$k$

between 2011 and 2017. Note that

![]() $k$

= 2013 is excluded because it is the benchmark year.

$k$

= 2013 is excluded because it is the benchmark year.

![]() $\beta _{k}$

s for

$\beta _{k}$

s for

![]() $k\in \{2011,2012\}$

are the parameters of interest that are represents the difference in outcome variables between the more-tightly and less-tightly regulated prefectures in each year, relative to that in 2013, one year before the policy took effect. We expect these two coefficients to be statistically indifferent from 0, implying that the difference in trends of the outcome variables between the two groups of prefectures does not change over-time prior to policy implementation, which supports the parallel trends assumption and indicates that the likelihood of prefecture-level selection is small conditioning on the fixed effects and control variables included in the regression.

$k\in \{2011,2012\}$

are the parameters of interest that are represents the difference in outcome variables between the more-tightly and less-tightly regulated prefectures in each year, relative to that in 2013, one year before the policy took effect. We expect these two coefficients to be statistically indifferent from 0, implying that the difference in trends of the outcome variables between the two groups of prefectures does not change over-time prior to policy implementation, which supports the parallel trends assumption and indicates that the likelihood of prefecture-level selection is small conditioning on the fixed effects and control variables included in the regression.

The point estimates of

![]() $\beta _{k}$

s for the main outcome variables and the associated 95% confidence intervals are plotted in Figure 3. It turns out that

$\beta _{k}$

s for the main outcome variables and the associated 95% confidence intervals are plotted in Figure 3. It turns out that

![]() $\beta _{2011}$

and

$\beta _{2011}$

and

![]() $\beta _{2012}$

are not significantly different from zero and remain stable in magnitude for all dependent variables, suggesting a parallel trend in these variables among prefectures with different treatment intensity levels prior to the Action Plan implementation. The results indicate that prefecture-level selection may not be a serious concern, and the DID estimates shown in Table 2 are largely unbiased.

$\beta _{2012}$

are not significantly different from zero and remain stable in magnitude for all dependent variables, suggesting a parallel trend in these variables among prefectures with different treatment intensity levels prior to the Action Plan implementation. The results indicate that prefecture-level selection may not be a serious concern, and the DID estimates shown in Table 2 are largely unbiased.

Figure 3. Results of the parallel trends test.

Note: This figure plots the results of the parallel trends test corresponding to equation (3) for key dependent variables: logged total local government financing vehicle (LGFV) debts and the share of non-other payable debts in the total LGFV debts. The omitted base year of the test is 2013. The test is conditional on prefecture fixed effects, province-by-year fixed effects, lagged prefecture level population in log and lagged miles of paved road in log.

Another way to address this concern is to directly correct for potential differentiated pre-trends, following Gentzkow (Reference Gentzkow2006), Chen et al. (Reference Chen, Li and Lu2018) and Gollin et al. (Reference Gollin, Hansen and Wingender2021). Specifically, we add to the baseline regression an interaction term between a third-order polynomial of time and the pre-policy variables that might be correlated with the differentiated pre-trends, which flexibly controls for possibly differentiated trends in the outcome variables to isolate the treatment effect. In particular, we add

![]() $z_{ipre}\times f(t)$

into the regressions, where

$z_{ipre}\times f(t)$

into the regressions, where

![]() $z_{ipre}$

includes prefecture-level pre-policy outcome variables and the fraction of employment by the secondary industry measured in 2013. Chen et al. (Reference Chen, Li and Lu2018) argued that characteristics of the natural environment, such as terrain roughness, elevation, wind speed, temperature and precipitation, affect the concentration of pollutions and are often considered by the central government when setting local environment improvement targets. Since these factors may also be correlated with local economic development and thus, the issuance of LGFV debts; therefore, we also include the pre-policy levels of these variables in

$z_{ipre}$

includes prefecture-level pre-policy outcome variables and the fraction of employment by the secondary industry measured in 2013. Chen et al. (Reference Chen, Li and Lu2018) argued that characteristics of the natural environment, such as terrain roughness, elevation, wind speed, temperature and precipitation, affect the concentration of pollutions and are often considered by the central government when setting local environment improvement targets. Since these factors may also be correlated with local economic development and thus, the issuance of LGFV debts; therefore, we also include the pre-policy levels of these variables in

![]() $z_{ipre}$

to capture their potential impacts on city-level trends of LGFV debts. Regression results are reported in Panel B of Appendix Table C1. The estimated treatment effects are similar to those obtained without controlling for

$z_{ipre}$

to capture their potential impacts on city-level trends of LGFV debts. Regression results are reported in Panel B of Appendix Table C1. The estimated treatment effects are similar to those obtained without controlling for

![]() $z_{ipre}\times f(t)$

. This is unsurprising because, as shown in Figure 3, the parallel pre-trend assumption holds for these outcome variables.

$z_{ipre}\times f(t)$

. This is unsurprising because, as shown in Figure 3, the parallel pre-trend assumption holds for these outcome variables.

6.2.2. Teasing out the effects of confounding policies

a) Dropping observations in 2016 and 2017 from the sample

Prefecture expansion and economic development are often planned in five-year increments in China. Notably, the emphasis of different “Five-Year Plans” (hereafter, “FYP”) for the same prefecture can vary. The Action Plan was implemented from 2014 to 2017, spanning the 13rd (2011–2015) and 14th (2016–2020) FYP. It is possible that the differentiated changes in the outcome variables after 2015 for prefectures with different treatment intensity levels were partly driven by differentiated changes in development goals specified in the 14th FYP. If this is true, our estimated treatment effects would be biased.

Therefore, in another robustness check, we remove observations in 2016 and 2017 to tease out potential confounding effects of the 14th FYP. The estimated coefficients reported in Panel C of Appendix Table C1 remain largely unchanged compared to the results reported earlier in Table 2.

b) Dropping prefectures in metropolitan areas from the sample

China has three large national-level metropolitan areas: the Shanghai Metropolitan Area, the Beijing–Tianjin–Hebei Metropolitan Area, and the Guangzhou–Hongkong–Macau Metropolitan Area, whose air pollution reduction targets are much higher than the rest of prefectures. Moreover, prefectures in these metropolitan areas enjoy more support from the central government and may show different trends in local government debt and the outcome variables compared with other prefectures. To mitigate the issues about confounding factors and test whether our results are robust to the inclusion of these prefectures, we drop them from the regressions in another robustness check, and the estimation results are reported in Panel D of Appendix Table C1. Again, the estimated coefficients remain largely unchanged, possibly because the province-by-year fixed effects already capture a large fraction of such differentiated trends.

c) Dropping prefectures in provinces with pilot carbon cap-and-trade markets

Another confounding policy during this period is the establishment of pilot carbon cap and trade markets in seven provinces and cities in 2013.Footnote 29 Since all prefectures in these provinces are subject to the pilot market regulation, the inclusion of province-by-year fixed effects have already teased out the average treatment effects of this confounding policy, as discussed earlier in Section 5.4. To the extent that prefectures in the same province are affected differently by the pilot market and that the difference might be correlated with LGFV debt issuance, we drop the prefectures in these provinces from the analysis and re-run the regressions. The signs and statistical significance of the estimation results reported in Panel E of Appendix Table C1 are robust to the removal of these prefectures.

d) The No. 43 document

The State Council issued the No. 43 Document in the end of 2014 and initiated a debt swap program in 2015 to curb local government debt by swapping some LGFV debts for local government bonds. If the debt swap program in 2015 changed the stock of LGFV debts differently for prefectures with different pre-2014 SO2 abatement intensity, our estimated effects of the Action Plan on LGFV debt issuance will be contaminated.