Introduction

Enterprise bribery is the rent-seeking behavior of enterprises, in which offers, promises, or gifts (e.g., a kickback) to government officials or business partners are leveraged to obtain help or facilities (Xu, Zhou, & Du, Reference Xu, Zhou and Du2019; Zhou, Wang, Xu, & Xie, Reference Zhou, Wang, Xu and Xie2022). Despite the important efforts exerted by many organizations to combat enterprise bribery (Lee, Paik, Vance, Li, & Groves, Reference Lee, Paik, Vance, Li and Groves2022), it remains a widespread worldwide phenomenon (Eddleston, Banalieva, & Verbeke, Reference Eddleston, Banalieva and Verbeke2020; Fan, Tao, Oehmichen, & Van Ees, Reference Fan, Tao, Oehmichen and Van Ees2023), and the cost of bribery is estimated to be 2% of the global economy or $1.5 to $2 trillion annually (Zhou et al., Reference Zhou, Wang, Xu and Xie2022). Given the prevalence and harmfulness of enterprise bribery, scholars have been examining its determinants to better combat this practice, especially in emerging economies (Jiang & Min, Reference Jiang and Min2022; Nguyen, Reference Nguyen2020). Numerous studies have shown that differences in formal institutions (e.g., laws and regulations) can lead firms to exhibit heterogeneous bribery behavior across different countries or regions of the same country (Alon & Hageman, Reference Alon and Hageman2017; Cieślik & Goczek, Reference Cieślik and Goczek2022; Cuervo-Cazurra, Reference Cuervo-Cazurra2008; Xu et al., Reference Xu, Zhou and Du2019; Yi, Teng, & Meng, Reference Yi, Teng and Meng2018). Unlike developed economies, emerging economies, including China, have formal institutions that are still in the process of being refined (Ren, Zhong, & Wan, Reference Ren, Zhong and Wan2022a; Zhang, Zhao, & Zhang, Reference Zhang, Zhao and Zhang2016), allowing the informal institutional environment to have a more direct and far-reaching impact on firm decisions (Qian, Wu, Hall, & Pauly, Reference Qian, Wu, Hall and Pauly2021). In light of this, a growing body of research highlights that the informal institutional environment at the national level (e.g., dominant culture) plays an important role in predicting enterprise bribery, particularly in emerging economies (Godinez & Liu, Reference Godinez and Liu2018; Jensen, Li, & Rahman, Reference Jensen, Li and Rahman2010; Lee, Oh, & Eden, Reference Lee, Oh and Eden2010; Lee & Guven, Reference Lee and Guven2013; Schram, Zheng, & Zhuravleva, Reference Schram, Zheng and Zhuravleva2022).

According to social norms theory, individuals behave in a way that conforms to the norms of the group that they associate with or the group around them (Blay, Gooden, Mellon, & Stevens, Reference Blay, Gooden, Mellon and Stevens2018; Hu, Lian, & Zhou, Reference Hu, Lian and Zhou2019). As an important social norm and subculture, local gambling culture reflects a philosophy and way of life that is collectively unique to a region (Christensen, Jones, & Kenchington, Reference Christensen, Jones and Kenchington2018; Qian et al., Reference Qian, Wu, Hall and Pauly2021) and exerts a unique and far-reaching impact on the thinking patterns and behavioral tendencies of the individuals living within it (Alharbi, Atawnah, Ali, & Eshraghi, Reference Alharbi, Atawnah, Ali and Eshraghi2023; Christensen et al., Reference Christensen, Jones and Kenchington2018; Tong, Wu, & Zhang, Reference Tong, Wu and Zhang2023). If decision-makers are surrounded by a large number of people who prefer gambling activities, their perceptions and behaviors tend to be influenced by the crowd's gambling culture, even if they are not directly involved in gambling activities (Callen & Fang, Reference Callen and Fang2020; Ji, Quan, Yin, & Yuan, Reference Ji, Quan, Yin and Yuan2021). At the firm level, previous research suggests that local gambling culture subsequently influences strategic enterprise choices by changing the psychological and behavioral tendencies of relevant decision-makers (Alharbi et al., Reference Alharbi, Atawnah, Ali and Eshraghi2023; Chen, Podolski, Rhee, & Veeraraghavan, Reference Chen, Podolski, Rhee and Veeraraghavan2014; Qian et al., Reference Qian, Wu, Hall and Pauly2021). Since enterprise bribery, as an important corporate decision, is subject to the psychology and behavioral tendencies of decision-makers (Connelly, Shi, & Zyung, Reference Connelly, Shi and Zyung2017; Fan et al., Reference Fan, Tao, Oehmichen and Van Ees2023), local gambling culture can influence involvement in enterprise bribery. Nevertheless, research has yet to provide theoretical and empirical evidence for how and when local gambling culture influences enterprise bribery.

To fill these research gaps, we explore whether and when local gambling culture affects involvement in enterprise bribery based on social norms theory. Important to note is that due to data availability, in this study, gambling culture refers to the unintended consequences of government-permitted lottery sales in an area and does not include the gambling culture that arises from the prevalence of illegal gambling. Based on social norms theory (Blay et al., Reference Blay, Gooden, Mellon and Stevens2018; Hu et al., Reference Hu, Lian and Zhou2019), we argue that the prevalence of a local gambling culture reinforces speculative psychology, which is aimed at obtaining a substantial return for little or no effort (Beber & Fabbri, Reference Beber and Fabbri2012), of decision-makers. This in turn leads such decision-makers to promote more actively enterprise involvement in bribery. In addition, social norms theory suggests that the impact of region-specific norms on individuals is not homogeneous (Chantziaras, Dedoulis, Grougiou, & Leventis, Reference Chantziaras, Dedoulis, Grougiou and Leventis2020; Guiso, Sapienza, & Zingales, Reference Guiso, Sapienza and Zingales2006; Zolotoy, Sullivan, & Martin, Reference Zolotoy, O Sullivan and Martin2018) because the degree to which different individuals are embedded in a particular society may vary greatly. In light of this, we further argue that it is necessary to explore the moderating role of gender and overseas study or work experience (returnee) on the influence of gambling culture on key decision-makers to clarify the heterogeneity between local gambling culture and involvement in enterprise bribery.

These two aspects are important because they reflect how the influence of the local gambling culture on the psychology and behavioral tendencies of decision-makers is conditioned by their innate or acquired attributes. On the one hand, on the whole, women are naturally more inclined to avoid speculative and gambling activities than men (Czibor et al., Reference Czibor, Szabo, Jones, Zsido, Paal, Szijjarto, Carre and Bereczkei2017; Latvala, Castrén, Alho, & Salonen, Reference Latvala, Castrén, Alho and Salonen2018). These characteristics make women less likely than men to internalize the social norms associated with the local gambling culture. In addition, in terms of acquired aspects, returnee decision-makers can leave the local geographical area and social norms behind for longer periods. At the same time, returnee decision-makers usually internalize overseas social norms to better adapt to the overseas environment (Han, Jennings, Liu, & Jennings, Reference Han, Jennings, Liu and Jennings2019; Ren, Zeng, & Zhong, Reference Ren, Zeng and Zhong2023). These factors result in the psychology and behavioral tendencies of returnee decision-makers being less influenced by local social norms (e.g., local gambling culture) than those of nonreturnee decision-makers. Based on these insights, we argue that the influence of the local gambling culture on the chairperson's speculative psychology is weakened when they are either female or returnees, which in turn weakens the positive influence of the local gambling culture on involvement in enterprise bribery.

China provides a particularly suitable scenario for testing these theoretical views. First, Chinese people are happy to participate in gambling activities because their culture admires superheroes and luck (Ji et al., Reference Ji, Quan, Yin and Yuan2021; Qian et al., Reference Qian, Wu, Hall and Pauly2021). In addition, most extant studies have used the ratio of Catholics to Protestants as a proxy variable for the local gambling culture, which is an approach that enables these studies to confound the potential impact of religious traditions (Callen & Fang, Reference Callen and Fang2020). China's unique cultural context allows us to accurately capture the economic consequences of the local gambling culture. This is because most Chinese people are not religious. For example, based on data on religious beliefs obtained from the 2015 Chinese General Social Survey (CGSS), we perform statistics on the religious beliefs of the respondents: out of the 10,815 surveyed samples, approximately 89.1% of Chinese people do not believe in any religion. Second, although the Chinese government has made many efforts to curb enterprise bribery, it is still prevalent in China (Ren, Zhong, & Wan, Reference Ren, Zhong and Wan2022b; Zhong, Ren, & Wu, Reference Zhong, Ren and Wu2022). Therefore, scholars are responsible for helping Chinese society curb enterprise bribery by assisting in forming a better understanding of the determinants of enterprise bribery. Third, unlike in other countries, the board chairperson plays a very important role in Chinese companies and has more decision-making power than CEOs (Ghorbani, Xie, Jin, & Wang, Reference Ghorbani, Xie, Jin and Wang2023; Jiang, Shi, & Zheng, Reference Jiang, Shi and Zheng2020). In China, the chairperson has the overall responsibility for the operation of the company, and all major decisions must be approved by the chairperson, which is the equivalent of the CEO role in a developed economy (Huang & Ho, Reference Huang and Ho2023; Xu, Xu, Chan, & Li, Reference Xu, Xu, Chan and Li2021). Based on the empirical data of privately listed companies in China from 2010 to 2020, we obtained strong empirical evidence to support most of our arguments.

We contribute to the literature on local gambling cultures, enterprise bribery, and strategic leaders. First, we enrich the growing literature on involvement in enterprise bribery from the perspective of informal institutional characteristics (Godinez & Liu, Reference Godinez and Liu2018; Lee & Guven, Reference Lee and Guven2013; Schopohl, Urquhart, & Zhang, Reference Schopohl, Urquhart and Zhang2021). In this study, we show for the first time that local gambling culture, as an important subculture, is an effective predictor of involvement in enterprise bribery. Second, we extend the literature on the economic consequences of local gambling culture (Adhikari & Agrawal, Reference Adhikari and Agrawal2016; Callen & Fang, Reference Callen and Fang2020; Christensen et al., Reference Christensen, Jones and Kenchington2018) by highlighting the impact of the local gambling culture on enterprise engagement in bribery activities with strong negative externalities. Finally, we introduce chairperson characteristics to clarify the boundary conditions under which local gambling culture influences involvement in enterprise bribery. In doing so, we enrich the literature on strategic leaders, which calls for scholarly attention to explore the chairperson's critical role in shaping firms' strategic choices (Jiang et al., Reference Jiang, Shi and Zheng2020; Li, Reference Li2022).

Theoretical Background and Hypotheses Development

As bribery has far-reaching negative effects on both countries and enterprises (Jiang & Min, Reference Jiang and Min2022; Xu et al., Reference Xu, Zhou and Du2019; Zhou et al., Reference Zhou, Wang, Xu and Xie2022), its reduction is essential for long-term survival and development (Godinez & Liu, Reference Godinez and Liu2018; Krammer, Reference Krammer2019). Scholars have examined the antecedents of enterprise bribery from multiple perspectives to determine how to discourage this behavior (Jensen et al., Reference Jensen, Li and Rahman2010; Ren et al., Reference Ren, Zhong and Wan2022b; Xu et al., Reference Xu, Zhou and Du2019). One enduring stream of research argues that institutional environment plays a very important role in understanding enterprise bribery activities because every organization is embedded in a specific institutional environment (Alon & Hageman, Reference Alon and Hageman2017; Chadee, Roxas, & Kouznetsov, Reference Chadee, Roxas and Kouznetsov2021; Keig, Brouthers, & Marshall, Reference Keig, Brouthers and Marshall2015; Lu, Choi, Jiménez, & Bayraktar, Reference Lu, Choi, Jiménez and Bayraktar2023).

Studies have also shown that enterprises’ formal institutional environment is important in predicting their bribery activities. Cuervo-Cazurra (Reference Cuervo-Cazurra2008) showed that laws within a country related to combating bribery abroad increase the cost of the bribes paid by firms, thus causing them to be more sensitive to bribery and encouraging them to reduce their investments in corrupt countries. Alon and Hageman (Reference Alon and Hageman2017) argued that formal rules (e.g., rule-based trust) shape the choice of direct taxation and bribery by firms operating in transition economies. They find that the stronger the formal rules are, the more firms tend to choose direct taxation over bribery. Yi et al. (Reference Yi, Teng and Meng2018) found that competition from other multinational and local firms forces foreign affiliates to bribe government officials to seek competitive advantages and improve performance. However, the presence of formal institutions weakens this relationship. Xu et al. (Reference Xu, Zhou and Du2019) showed that the higher the level of legal development in a region is, the lower the likelihood of enterprise bribery. Cieślik and Goczek (Reference Cieślik and Goczek2022) found that complex and time-consuming administrative procedures increase the likelihood of enterprise bribery.

Other scholars have noted that the informal institutional environment at the national level significantly affects enterprise bribery. Lee et al. (Reference Lee, Oh and Eden2010) found that the more prevalent bribery in a firm's environment is, the more likely is the firm to pay bribes to government officials. Jensen et al. (Reference Jensen, Li and Rahman2010) examined the determinants of enterprises' reporting of their bribery activities and found that in countries lacking freedom of the press, firms are less likely to accurately report their bribery practices. Godinez and Liu (Reference Godinez and Liu2018) showed that firms are less likely to engage in bribery in their host country when the level of bribery in the region in which they are located is lower than that in the host country. Finally, the influence of social culture – an important informal institutional factor – on enterprise bribery has received the attention of several scholars (Lee & Guven, Reference Lee and Guven2013; Schopohl et al., Reference Schopohl, Urquhart and Zhang2021). Lee and Guven (Reference Lee and Guven2013) found that the stronger a country's male-dominant culture is, the more likely its citizens are to rationalize bribery. Schram et al. (Reference Schram, Zheng and Zhuravleva2022) recently showed that the involvement of individuals in bribery is strongly influenced by culture at the national level.

A growing body of research suggests that the local gambling culture within a country has a more direct and far-reaching impact on the cognitive dispositions and behavioral patterns of the decision-makers living within it than the dominant culture at the national level (Callen & Fang, Reference Callen and Fang2020; Chen et al., Reference Chen, Podolski, Rhee and Veeraraghavan2014; Qian et al., Reference Qian, Wu, Hall and Pauly2021). For example, local gambling culture has been found to have a significant impact on enterprise innovation, mergers and acquisitions, and other activities (Chen et al., Reference Chen, Podolski, Rhee and Veeraraghavan2014; Doukas & Zhang, Reference Doukas and Zhang2013; Tong et al., Reference Tong, Wu and Zhang2023). However, few studies have examined the impact of local gambling cultures on enterprise bribery activities. To contribute to this stream of literature, based on social norms theory, we attempt to link local gambling culture to enterprise bribery, which is an important but unresolved issue.

Local Gambling Culture and Enterprise Bribery

According to social norms theory, the behavioral norms of associated or surrounding groups in areas where decision-makers reside have a significant impact on their behavioral tendencies (Chantziaras et al., Reference Chantziaras, Dedoulis, Grougiou and Leventis2020; Guiso et al., Reference Guiso, Sapienza and Zingales2006; Zolotoy et al., Reference Zolotoy, O Sullivan and Martin2018). If decision-makers live in an environment with a large number of people who favor gambling activities, even if they do not themselves engage in gambling activities, their psychology and behavioral tendencies are influenced by those within the gambling community (Alharbi, Atawnah, Al Mamun, & Ali, Reference Alharbi, Atawnah, Al Mamun and Ali2022; Chen et al., Reference Chen, Podolski, Rhee and Veeraraghavan2014). This is because decision-makers' perceptions and behaviors consciously or unconsciously conform to the shared perceptions and values of their environment (Blay et al., Reference Blay, Gooden, Mellon and Stevens2018; Qian et al., Reference Qian, Wu, Hall and Pauly2021; Tong et al., Reference Tong, Wu and Zhang2023). Otherwise, decision-makers' social legitimacy would be questioned, thus preventing them from enjoying the benefits of membership in the society and even subjecting them to the sanctions of social exclusion (Guiso et al., Reference Guiso, Sapienza and Zingales2006; Hu et al., Reference Hu, Lian and Zhou2019). Thus, through conscious and unconscious mechanisms, the local gambling culture can shape the psychology and behavioral tendencies of individuals living or working in an area (Alharbi et al., Reference Alharbi, Atawnah, Al Mamun and Ali2022). Based on social norms theory, we argue that local gambling culture can facilitate involvement in enterprise bribery.

Gambling is rooted in the human psychology of speculation and is a classic speculative activity (Prieto Ursua & Uribelarrea, Reference Prieto Ursua and Uribelarrea1998). This is because people who engage in gambling hope for quick and large monetary returns for very small investments, although the likelihood of this becoming a reality is low. Therefore, the more prevalent the gambling culture in an area is, the more prevalent the speculative psychology among the groups living in that area (Alharbi et al., Reference Alharbi, Atawnah, Ali and Eshraghi2023; Callen & Fang, Reference Callen and Fang2020; Ji et al., Reference Ji, Quan, Yin and Yuan2021). In particular, when decision-makers live or work in areas where a gambling culture prevails, even if they do not directly engage in gambling activities themselves, their perceptions and behaviors consciously or unconsciously conform to the group norms of their environment (Guiso et al., Reference Guiso, Sapienza and Zingales2006; Lee, Pantzalis, & Park, Reference Lee, Pantzalis and Park2019). More precisely, in areas where a gambling culture is prevalent, if decision-makers do not develop a speculative psychology or similar patterns of behavior, they have difficulty integrating into the area and are denied the benefits of membership in the community – they are even subjected to sanctions of social exclusion. In short, a local gambling culture can reinforce decision-makers' speculative psychology. Prior research has provided supporting evidence (Callen & Fang, Reference Callen and Fang2020; Christensen et al., Reference Christensen, Jones and Kenchington2018; Ji et al., Reference Ji, Quan, Yin and Yuan2021) for this dynamic. For example, Christensen et al. (Reference Christensen, Jones and Kenchington2018) find that a stronger local gambling culture causes decision-makers to be more active in implementing financial misreporting.

Bribes can help enterprises gain preferential treatment from government officials, business partners, disadvantaged competitors, and other parties (Xu et al., Reference Xu, Zhou and Du2019; Zhong, Ren, & Wu, Reference Zhong, Ren and Wu2022), thereby providing opportunities for them to improve their short-term performance (Ren et al., Reference Ren, Zhong and Wan2022b; Wan, Xie, Li, & Jiang, Reference Wan, Xie, Li and Jiang2022; Zhou et al., Reference Zhou, Wang, Xu and Xie2022). However, enterprise bribery can negatively impact other businesses and societies (Jiang & Min, Reference Jiang and Min2022; Nguyen, Reference Nguyen2020). When bribery is discovered, enterprises and decision-makers are subject to social censure and legal penalties. In view of this, studies have generally concluded that decision-makers are unlikely to engage in speculative activities such as bribery unless they perceive that its benefits outweigh its costs (Fan et al., Reference Fan, Tao, Oehmichen and Van Ees2023; Mishina, Dykes, Block, & Pollock, Reference Mishina, Dykes, Block and Pollock2010; Xu et al., Reference Xu, Zhou and Du2019). Speculative psychology, however, can cause decision-makers to underestimate the costs and overestimate the potential benefits of bribery activities. Simultaneously, speculative psychology can lead decision-makers to act in a more short-term manner and initiate rent-seeking behaviors. Therefore, decision-makers with speculative psychology are likely to actively promote enterprise involvement in bribery activities (Fan et al., Reference Fan, Tao, Oehmichen and Van Ees2023). Taken together, the above points suggest that the local gambling culture enhances the speculative psychology of decision-makers, which in turn promotes their active involvement in bribery.

Accordingly, we propose the following hypothesis:

Hypothesis 1 (H1): Local gambling culture positively affects enterprise bribery.

The Moderating Role of Female and Returnee Chairpersons

Social norms theory suggests that the social norms of an area have a significant impact on the psychology and behavioral tendencies of individuals living in that area (Blay et al., Reference Blay, Gooden, Mellon and Stevens2018; Hu et al., Reference Hu, Lian and Zhou2019). However, we cannot expect that the social norms of a region have the same effect on everyone in that region. There are at least two reasons for this expectation. First, some individuals may, by nature (e.g., gender), be naturally insensitive to or have difficulty identifying with and internalizing certain regional social norms. Second, a portion of individuals may be exposed to social norms in more than one region as a result of their acquired experiences (e.g., overseas experience). This, in turn, can weaken the influence of region-specific social norms on an individual's psychology and behavioral tendencies. In view of this, we also argue that the impact of the local gambling culture on involvement in enterprise bribery is not homogeneous and that decision-makers' gender and overseas experience play an important role. To obtain more refined insights, we discuss the moderating roles of gender and overseas experience in detail in the following.

Previous research has shown important differences between the nature of males and females (Czibor et al., Reference Czibor, Szabo, Jones, Zsido, Paal, Szijjarto, Carre and Bereczkei2017). In general, males display risk-taking, self-confidence, and opportunism (Czibor et al., Reference Czibor, Szabo, Jones, Zsido, Paal, Szijjarto, Carre and Bereczkei2017). Gambling activities are consistent with men's risk-taking and thrill-seeking traits (Latvala et al., Reference Latvala, Castrén, Alho and Salonen2018; Sundqvist & Rosendahl, Reference Sundqvist and Rosendahl2019); therefore, male chairpersons are likely to endorse or even actively conform to the local gambling culture and social norms (e.g., speculative) associated with it. This implies that the local gambling culture creates a stronger speculative psychology in male chairpersons that, in turn, enables it to exert a stronger positive influence on involvement in enterprise bribery. In contrast, women in general exhibit a risk-averse, less speculative, more fragile, and sensitive nature (Rivas, Reference Rivas2013; Zhang, Ma, Chen, & Lan, Reference Zhang, Ma, Chen and Lan2023). Obviously, these natures are somewhat the opposite of the risk-taking, speculative attributes that gambling activities bear (Latvala et al., Reference Latvala, Castrén, Alho and Salonen2018). As a result, female chairpersons are likely to ignore or exclude local gambling culture and the social norms associated with it. In other words, female chairpersons are unlikely to internalize the social norms (e.g., speculative) associated with the local gambling culture into their own psychology and behavioral tendencies. This means that the local gambling culture is unlikely to lead to speculative psychology among female chairpersons. This situation ultimately translates into a weakening of the positive impact of the local gambling culture on involvement in enterprise bribery in firms controlled by female chairpersons.

Therefore, we propose the following:

Hypothesis 2a (H2a): Female chairpersons weaken the positive influence of the local gambling culture on enterprise bribery.

A returnee chairperson is one with overseas study or work experience (Zhang, Zhou, & Lyles, Reference Zhang, Zhou and Lyles2023). This implies that returnee chairpersons spent time away from the local geographic area and its corresponding social norms. Therefore, the duration of influence of the local gambling culture on the psychological and behavioral tendencies of returnee chairpersons may be relatively low compared to that of nonreturnee chairpersons. This in turn reduces the impact of the local gambling culture on the speculative psychology of returnee chairpersons and results in the culture having a weaker impact only on enterprise bribery.

In addition, inefficient systems and vague regulations have led to widespread speculation in emerging economies (Jiang & Min, Reference Jiang and Min2022). For example, although enterprise bribery is widespread in China, few companies are severely punished for paying bribes (Ren et al., Reference Ren, Zhong and Wan2022b; Xu et al., Reference Xu, Zhou and Du2019; Zhong, Ren, & Wu, Reference Zhong, Ren and Wu2022). As a result, it is unlikely that nonreturnee chairpersons will develop psychological and behavioral tendencies to avoid speculative activities. This means that when nonreturnee chairpersons work in areas where a gambling culture is prevalent, they may naturally and comfortably internalize the social norms associated with this culture into their psychological and behavioral tendencies. This, in turn, enables the local gambling culture to have a stronger influence on the speculative psychology of nonreturnee chairpersons, resulting in more involvement in enterprise bribery. In contrast, the data show that the majority of returnees to emerging economies have worked in or studied in developed economies (e.g., North America, Europe, and Oceania) (Han et al., Reference Han, Jennings, Liu and Jennings2019; Ren et al., Reference Ren, Zeng and Zhong2023). Meanwhile, developed economies have very mature and well-established laws and regulations and strong enforcement mechanisms (Ren et al., Reference Ren, Zeng and Zhong2023; Zhou et al., Reference Zhou, Wang, Xu and Xie2022). Speculation does occur in these areas; however, once discovered, the entities or individuals involved are subject to severe penalties (e.g., imprisonment or large fines). To better adapt to the overseas environment, returnee chairpersons may develop a psychological and behavioral tendency toward avoiding speculative activities (Han et al., Reference Han, Jennings, Liu and Jennings2019). Because the culture of gambling and its associated norms are in conflict with long-held values and morals, even if returnee chairpersons return to areas where a gambling culture is prevalent, they are less likely or slower to internalize in their own psychology and behavioral tendencies the social norms associated with the local gambling culture. This, in turn, reduces the impact of the local gambling culture on the speculative psychology of returnee chairpersons and results in the culture exerting only a weak, positive influence on enterprise bribery.

Therefore, we propose the following:

Hypothesis 2b (H2b): Returnee chairpersons weaken the positive influence of the local gambling culture on enterprise bribery.

Methods

Sample and Data

We use privately listed Chinese A-share companies covering a period ranging from 2010 to 2020 as the research sample. To promote the reliability of the findings, we process the initial data as follows: (1) We exclude samples with missing hospitality expense data; (2) Listed companies with gearing ratios of more than one and those with special treatment status were excluded because their financial data showed abnormal conditions (Ren et al., Reference Ren, Zhong and Wan2022b); (3) We exclude financial companies (Xu et al., Reference Xu, Zhou and Du2019) because their financial statements differ significantly from those of other industries; and (4) Samples with missing data were excluded (Zhong, Ren, & Song, Reference Zhong, Ren and Song2022). After completing the aforementioned filtering steps, 2,637 listed companies with 15,036 firm-year data points were retained. To reduce the effect of outliers, continuous variables were winsorized at the 1 and 99% levels. The data used were from the China Stock Market and Accounting Research database (CSMAR), the official website of the Chinese Ministry of Finance, and the China Population and Employment Statistics Yearbook.

Two issues need to be clarified. The first is the selection of the sample period. Before 2010, there were more missing values in the hospitality data of listed companies (Tian & Fan, Reference Tian and Fan2018). Therefore, following Tian and Fan (Reference Tian and Fan2018), we use 2010 as the starting year of the sample to ensure data availability. Second, state-owned enterprises (SOEs) are excluded for two reasons. First, in SOEs, high hospitality expenses may reflect public spending rather than bribery. Thus, it is difficult to distinguish bribery expenditures from hospitality expenses. Second, the SOE hospitality data were subjected to policy shocks during the sample period. On December 4, 2012, the Political Bureau of the CPC Central Committee adopted eight rules requiring government departments (including SOEs) to be diligent and frugal and to eliminate extravagance. The implementation of the Eight Rules has had a significant impact on SOE hospitality expenditures. Given the noise contained in SOEs' hospitality data, we exclude them from the sample. It should be noted that we examine the impact of China's eight regulations on SOEs’ hospitality expenses in 2012 through a difference-in-difference model. The unreported empirical results show that the implementation of the Eight Rules in China in 2012 significantly affected the hospitality expenses of SOEs. Therefore, it is reasonable to exclude the sample of SOEs.

Measurements

Dependent variables: Enterprise bribery (BRIBERY)

Bribery is inherently hidden, and no firm is willing to disclose such information, which makes it difficult to empirically validate large samples (e.g., it is difficult to obtain data on enterprise bribery) (Jiang & Min, Reference Jiang and Min2022; Zhong, Ren, & Wu, Reference Zhong, Ren and Wu2022; Zhou et al., Reference Zhou, Wang, Xu and Xie2022). Based on the operational reality of Chinese companies, Cai, Fang, and Xu (Reference Cai, Fang and Xu2011) developed a new indicator to measure Chinese companies' bribery expenses, namely, hospitality expenses. According to China's accounting system, hospitality is a secondary account under the administrative expenses account used to charge reasonable entertainment expenses incurred in the production and operation of enterprises. Because of information asymmetry, many Chinese companies account for bribery expenses as hospitality expenses (Jiang & Min, Reference Jiang and Min2022; Ren et al., Reference Ren, Zhong and Wan2022b). Hospitality expenses include costs for catering, entertainment, travel, and other activities, and for cigarettes, food, and gifts. However, the accounting system does not clearly regulate the objects of enterprise hospitality and thus cannot define the actual use of hospitality expenses. Relevant news reports and bribery cases have shown a significant association between hospitality and enterprise bribery (Xu et al., Reference Xu, Zhou and Du2019; Zhou et al., Reference Zhou, Wang, Xu and Xie2022). Second, in Chinese enterprise accounting practices, hospitality expenses incurred for any purpose can be reimbursed in the name of a normal business. Bribery expenses can also be expressed as hospitality expenses through false or fictitious invoices. Therefore, hospitality expenses in China are typically used by companies to account for bribery expenses (Cai et al., Reference Cai, Fang and Xu2011; Jiang & Min, Reference Jiang and Min2022; Ren et al., Reference Ren, Zhong and Wan2022b).

Therefore, we construct proxies for enterprise bribery based on hospitality expense data (Xu et al., Reference Xu, Zhou and Du2019; Zhou et al., Reference Zhou, Wang, Xu and Xie2022). To exclude normal hospitality expenses, following Xu et al. (Reference Xu, Zhou and Du2019) and Zhou et al. (Reference Zhou, Wang, Xu and Xie2022), we construct an excess hospitality indicator (EC_AB) to measure enterprise bribery. By regressing model (1), we obtain the estimated residuals, which are indicators of abnormal hospitality (EC_AB). EC is hospitality/firm revenue multiplied by 100, EXEC_PAY is measured as the total executive compensation of the top three executives, ACCRCV is measured as accounts receivable divided by operating revenue, ACCPAY is measured as accounts payable divided by operating revenue, BOARD is measured as the number of board members, SIZE is measured as the natural logarithm of total assets, EC_IND is measured as the EC industry average of EC, and EC_YEAR is measured as the EC annual average. The larger EC_AB is, the higher are the enterprise bribery expenses.

Independent variable: Local gambling culture (GAMBLE)

Referring to Ji et al. (Reference Ji, Quan, Yin and Yuan2021), we use per capita lottery sales/per capita disposable income (i.e., actual gambling activity per capita) in different Chinese provinces to measure the local gambling culture. Lottery tickets are the only legal gambling channel in mainland China. Therefore, lottery sales data are a good indicator of a region's gambling culture. GAMBLE is calculated as the natural logarithm of lottery sales per capita/disposable income per capita for the province in which the listed company is located. The larger the value of GAMBLE is, the stronger is the local gambling culture. Lottery sales data for each province are obtained from the official website of the Chinese Ministry of Finance. Data on provincial populations are obtained from the China Population and Employment Statistics Yearbook, and data on per capita disposable incomes by province are obtained from the CSMAR database.

Moderating variables

To test H2a and H2b, the following moderating variables are constructed: (1) Female chairperson (FEMALE) is measured as follows: when the company's president is female, FEMALE equals 1; otherwise, it equals 0 (Ellwood & Garcia-Lacalle, Reference Ellwood and Garcia-Lacalle2015). (2) Returnee chairperson (OVERSEA): This variable is set to 1 when the chairperson of the company has overseas (study or work) experience and to 0 otherwise (Zhang, Zhou et al., Reference Zhang, Zhou and Lyles2023). The data on the chairperson's overseas experience come from the CSMAR database. Overseas experience includes overseas study experience and overseas work experience.

Control variables

We control for several variables to improve the validity of the empirical model. First, we control for some basic firm characteristics (Jiang & Min, Reference Jiang and Min2022; Nguyen, Reference Nguyen2020; Ren et al., Reference Ren, Zhong and Wan2022b). We control for return on assets (ROA) (net profit/total assets) (the higher the ROA is, the weaker is the enterprise bribery incentive), debt to asset ratio (LEV) (total liabilities/total assets), and percentage of fixed assets (PPETA) (fixed assets divided by total assets). High levels of LEV and PPETA increase enterprise bribery costs and reduce enterprise bribery incentives. We also control for firm size (SIZE) (the natural logarithm of total assets). The larger the enterprise is, the more attention it receives and the less space it has to engage in bribery. Second, the better the quality of enterprise governance is, the lower is the incentive for firms to engage in bribery (Ren et al., Reference Ren, Zhong and Wan2022b; Xu et al., Reference Xu, Zhou and Du2019). Therefore, we control for a range of enterprise governance factors, including top shareholders (TOP1) (number of shares held by top shareholder/total number of shares in the firm), board size (BOARD) (number of board members), executive shareholding (ESH) (number of executive shares/total number of shares in the firm), and dual CEO/chair (DUAL) (set to 1 if the chairperson and CEO are the same person and to 0 otherwise). Finally, we control for the GDP growth rate (RGDP) (the GDP growth rate of that province) in the province where the listed firm is located (Alon & Hageman, Reference Alon and Hageman2017; Lee & Guven, Reference Lee and Guven2013). To control for year and industry effects, we include industry- and year-fixed effects in the model (Xu et al., Reference Xu, Zhou and Du2019).

Model Setting

Continuing from the previous study (Callen & Fang, Reference Callen and Fang2020; Christensen et al., Reference Christensen, Jones and Kenchington2018; Tong et al., Reference Tong, Wu and Zhang2023), we use pooled regression and control for industry- and year-fixed effects to test our theoretical hypotheses. To test H1, we construct the following benchmark regression:

where the dependent variable is enterprise bribery (EC_AB), the independent variable GAMBLE is the local gambling culture, and CONTROL is the control variable. In addition, we control for industry- and year-fixed effects and focus on the regression coefficient of GAMBLE. Based on H1, we expect the regression coefficient of GAMBLE to be significantly positive; that is, a local gambling culture has a positive effect on enterprise bribery.

To test H2a and H2b, we introduce the interaction term GAMBLE×M in addition to the baseline regression (Model (2)) and construct Model (3), where M is the moderating variable of the chairperson's gender (FEMALE) and overseas experience (OVERSEA). We focus on the interaction term and expect the regression coefficient of the interaction term to be significantly negative; that is, the positive effect of the local gambling culture on enterprise bribery is attenuated when the chairperson of the firm is female or when the chairperson has overseas experience.

Results

From Table 1, we can see that the mean value of GAMBLE is −4.828, which corresponds to 0.83407% of the per capita disposable income spent on lottery tickets. Because the remaining variables were not found to be abnormal, we do not elaborate on them in detail.

Table 1. Descriptive statistics results

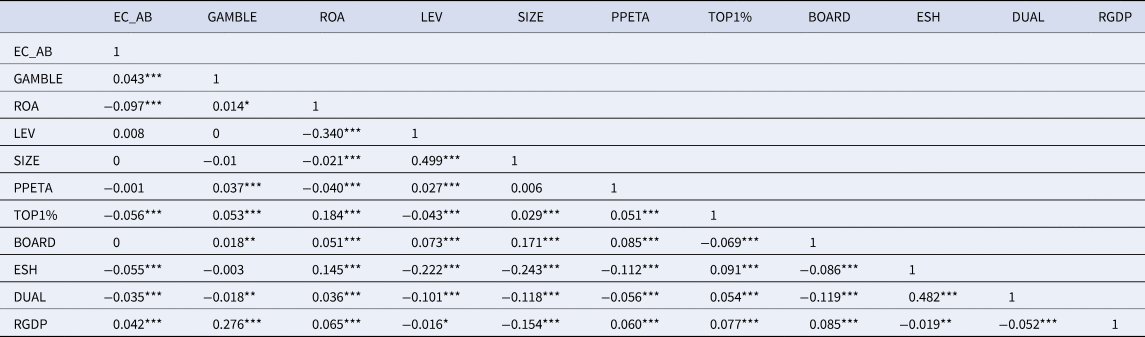

As shown in Table 2, GAMBLE and EC_AB are positively correlated at the 1% level. We also perform a variance inflation factor (VIF) diagnostic for all variables, which shows an average VIF of 3.04, indicating that multicollinearity does not pose a substantial threat to the empirical results.

Table 2. Correlation matrix

Notes: ***, **, and * denote 1%, 5%, and 10% significance levels, respectively.

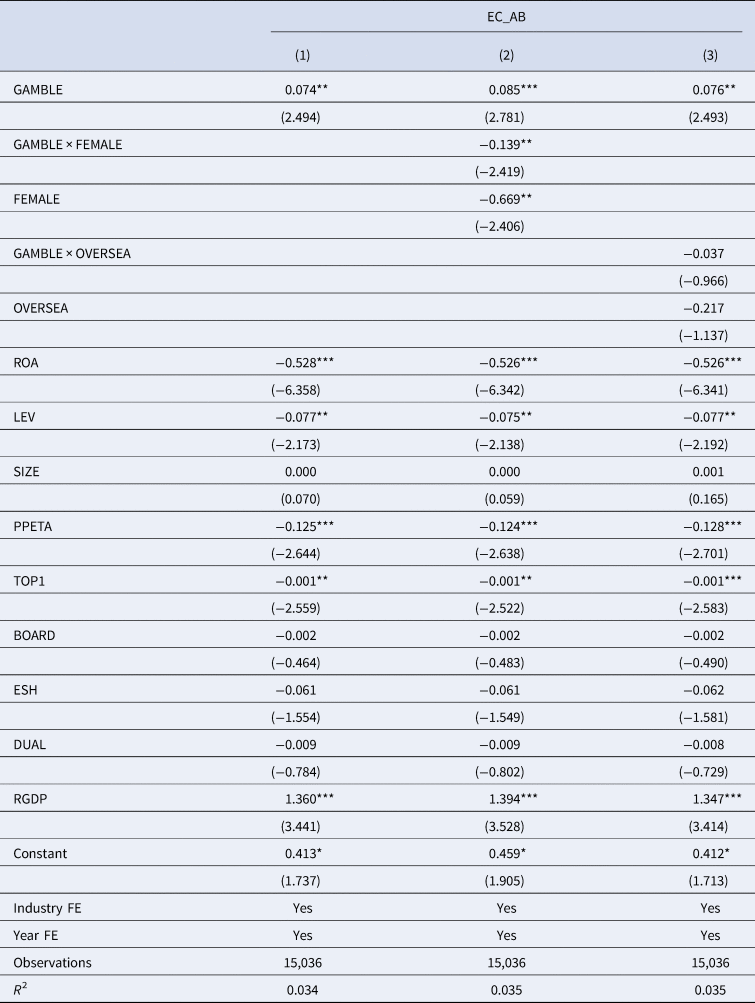

Model (1) in Table 3 reports the empirical results of the effect of local gambling culture on enterprise bribery expenditures. The empirical results show that the regression coefficient of GAMBLE is significantly positive, at least at the 5% level (beta = 0.074, p < 0.05), indicating that local gambling culture has a positive effect on enterprise bribery expenditures. The coefficient estimates in Model (1) indicate that a one-standard-deviation increase in GAMBLE is associated with a 6.55% increase (=0.074 × 0.291/0.329) in the standard deviation of EC_AB. These empirical results are consistent with the expectation of H1. Therefore, H1 is supported.

Table 3. Results of empirical tests (tests for H1, H2a, and H2b)

Notes: ***, **, and * denote 1%, 5%, and 10% significance levels, respectively, with robust t-values in parentheses.

To test H2a, we introduce an interaction term based on the baseline regression to test the moderating effect of female chairpersons. The empirical results are presented for Model (2) of Table 3. The empirical results show that the regression coefficient of the interaction term GAMBLE × FEMALE is significantly negative (beta = −0.139, p < 0.05). These test results suggest that the positive effect of the local gambling culture on bribery spending is attenuated when a firm's president is female. The empirical results were consistent with expectations, and H2a was verified.

To test H2b, we introduce an interaction term based on the baseline regression to examine the moderating effect of the returnee chairperson. Column (3) of Table 3 presents the empirical results. The empirical results show that the regression coefficient of the interaction term, GAMBLE × OVERSEA, is not significant. Therefore, H2b is not supported.

Robustness and Alternative Explanatory Tests

Various measures are taken to ensure the credibility of our conclusions. First, we use the residual method for robustness testing to exclude the interference of omitted variables from macro factors. In the baseline regressions, we control for disposable income per capita and the GDP growth rate of the host province. Next, we exclude the effects of macro factors. In this regard, we regress GAMBLE on disposable income per capita and the GDP growth rate and obtain the residual (GAMBLE_RES), which is the portion of the gambling culture that macroregional factors cannot explain. We rerun the regression analysis including GAMBLE_RES as the new independent variable. The empirical results are presented in Columns (1) to (3) of Panel A in Table 4. The findings do not change substantially.

Table 4. Robustness tests: Multiple tests

Notes: ***, **, and * denote 1%, 5%, and 10% significance levels, respectively, with robust t-values in parentheses.

Second, following Ji et al. (Reference Ji, Quan, Yin and Yuan2021), we use the propensity score matching (PSM) method for robustness testing. One potential concern is that there may be systematic differences between firms in regions with stronger and weaker gambling cultures. In this regard, we use propensity score matching (PSM) to match firms with strong GAMBLE to other firms with similar characteristics but weaker GAMBLE. This is done as follows. First, samples with a GAMBLE value above 75% (i.e., the top 25%) are classified as those with stronger GAMBLE, and those with a GAMBLE value below 50% are classified as those with weaker GAMBLE. Based on the first 25% and last 50% of the sample, the initial PSM sample was formed. Second, all microlevel control variables were used as variables affecting firm characteristics, and one-to-one nearest-neighbor, no-replay matching is performed to obtain a matching sample based on the PSM method. A regression analysis is performed on the sample obtained from PSM matching. The empirical results are presented in Columns (4) to (6) of Panel A in Table 4, and the findings remain unchanged.

Third, the test was rerun using the Fama–MacBeth regression (Fama & MacBeth, Reference Fama and MacBeth1973). There may be a time-series trend between local gambling culture and enterprise bribery expenditures. Therefore, referring to Callen and Fang (Reference Callen and Fang2020), we retest the Fama and MacBeth (Reference Fama and MacBeth1973) method. Columns (1) to (3) of Panel B in Table 4 present the empirical results, which remain unchanged.

Fourth, to further rule out the effect of reverse causation, we reexamine the dependent variable with a one-year lag. The empirical results are presented in Columns (4) through (6) of Panel B of Table 4 and show that our conclusions remain robust.

Fifth, the instrumental variable method is used for reexamination. We run a two-stage least squares (2SLS) model using the three-year lagged value of GAMBLE as its instrument. The selection of this instrumental variable is in line with the work of Chen et al. (Reference Chen, Podolski, Rhee and Veeraraghavan2014) and Callen and Fang (Reference Callen and Fang2020). The rationalization of GAMBLE(-3) as an instrumental variable can be found in Callen and Fang (Reference Callen and Fang2020).

Table 5 presents the results. Model (1) is used to calculate the first-stage regression results. This result shows that the instrumental variable and local gambling culture are positively correlated and that the F-statistic of the weak instrumental variable is much larger than 10, which is consistent with the empirical rule and rejects the original hypothesis of the existence of a weak instrumental variable. Model (2) presents the results of the second stage. These results show that the regression coefficient of GAMBLE is significantly positive, and the study findings remain unchanged.

Table 5. Robustness tests: Regression results for instrumental variables

Notes: ***, **, and * denote 1%, 5%, and 10% significance levels, respectively, with robust t-values in parentheses.

Sixth, to better mitigate concerns over omitted variable bias, we adopt the Oster (Reference Oster2019) estimation technique. The result indicates that if omitted variables lead to biased estimations, the omitted variables should be approximately 17.91249 times more important than the currently observed control variables. Thus, omitted variables are unlikely to significantly impact our main results (Oster, Reference Oster2019).

Seventh, with reference to the Huang and Ho (Reference Huang and Ho2023) approach, we employ a placebo test to exclude the interference of omitted variables. The placebo test is performed as follows. First, the independent variable GAMBLE (i.e., the dummy independent variable) is randomly assigned to each sample, and the regression analysis is rerun. Next, the procedure is repeated 500 times (Huang & Ho, Reference Huang and Ho2023). The results of the placebo test show that the mean value of the regression coefficient of the fictitious independent variable GAMBLE is 0.0003825, which is close to zero in the 500 regressions. The mean value of the t value is 0.0433418; i.e., this value shows that the regression coefficient of the fictitious independent variable is not significant. The results of the placebo test verify the robustness of the findings of this study.

Eighth, excluding alternative explanations, lottery sales represent locally charitable behavior. We use lottery sales volume as a measure of the local gambling culture (Ji et al., Reference Ji, Quan, Yin and Yuan2021; Tong et al., Reference Tong, Wu and Zhang2023). In this regard, the central assumption is that local per capita lottery sales represent the local gambling culture. However, in China, lotteries are public goods created by the state to raise social welfare funds and promote social welfare development. Thus, per capita lottery sales may measure local gambling culture and charitable behavior. In this regard, one potential concern is that lottery sales represent a local philanthropic climate and thus lead companies to make more charitable donations. Simultaneously, enterprise charitable giving has a reputation-enhancing insurance function (Kang, Germann, & Grewal, Reference Kang, Germann and Grewal2016), i.e., it reduces the negative impact of exposure to enterprise bribery. Thus, firms are bolder in their bribery activities. To rule out this alternative explanation, we directly examine the effect of per capita lottery sales on enterprises' charitable giving. To this end, we construct two measures of enterprise charitable giving: (1) LNDONATE, measured as the natural logarithm of (1 + enterprise charitable giving), and (2) DONATE_S, measured as enterprise charitable giving/operating revenue. The results are presented for Models (1) and (2) in Table 6. The control variables are consistent with the baseline regression and are used to control for industry- and year-fixed effects. The empirical results indicate that per capita lottery sales do not significantly affect enterprises' charitable giving. Therefore, lottery sales do not represent local charitable behavior, and the empirical results do not support this alternative explanation. This test also suggests that decision-makers' tendencies toward disregarding social welfare may act as a transmission mechanism between local gambling culture and enterprise bribery.

Table 6. Alternative explanatory tests

Notes: ***, **, and * denote 1%, 5%, and 10% significance levels, respectively, with robust t-values in parentheses.

Ninth, Chinese lotteries include welfare and sports lotteries; thus, based on the different types of lotteries, we construct the following indicators: (1) GAMBLE_WEL, which is the natural logarithm of the value of welfare lottery sales per capita/per capita disposable income in the province, and (2) GAMBLE_SPO, which is the natural logarithm of sports lottery sales per capita/per capita disposable income in the province. The empirical results are presented for Models (3) and (4) in Table 6. The empirical results indicate that the regression coefficient of GAMBLE_WEL is not significant. Correspondingly, the regression coefficient of GAMBLE_SPO is significantly positive.

This result indicates that local gambling culture, based on welfare lottery data, has no significant effect on bribery expenditures. In contrast, a local gambling culture based on sports lottery data significantly affects bribery expenditures. This empirical finding somewhat supports our theory that the local gambling culture increases the involvement of firms in bribery by enhancing the speculative psychology of decision-makers. Welfare lottery funds are mainly used for the welfare of elderly individuals, disabled individuals, children, and greater society. A large proportion of people purchase welfare lottery tickets out of concern and care for vulnerable groups. Therefore, the sale of welfare lottery tickets in a region is unlikely to lead to a speculative atmosphere in the region and, thus, unlikely to lead to speculative psychology among people living in that area. In contrast, sports lotteries are issued to raise funds for the development of sports and they include products with strong gambling and speculative attributes, such as soccer lotteries, baseball lotteries, and horse racing lotteries. Consequently, when a large number of sports lotteries are sold in an area, the area is likely to generate a speculative atmosphere, which creates a speculative psychology in the people living in it and ultimately affects enterprises' involvement in bribery.

Finally, to further test whether local gambling culture reinforces the speculative psychology of decision-makers, we examine the effect of the local gambling culture on firm innovation. If the effect of the local gambling culture is speculative, then decision-makers affected by local gambling culture are more likely to avoid engaging in R&D activities that only pay off in the long run. In this regard, we construct a measure of firm innovation (LNPATENT) as the natural logarithm of 1 + the number of patent applications in the year. The empirical results are presented in Column (5) of Table 6. These empirical results suggest that local gambling culture has a negative impact on firm innovation, thus indirectly verifying the explanatory mechanism behind our baseline hypothesis.

Discussion

Based on social norms theory, we examine how local gambling culture influences enterprise bribery, which is an important but underexplored area of research. Based on empirical data on privately listed Chinese companies from 2010 to 2020, we propose that local gambling culture promotes enterprise bribery activities. We attribute this relationship to the fact that a local gambling culture enhances decision-makers' psychology for speculation, which leads them to actively promote their enterprises' involvement in bribery activities. After conducting various robustness tests and excluding alternative explanations, the positive effect of the local gambling culture on enterprise bribery activities remained supported. In addition, we find that the local gambling culture, based on welfare lottery data, has no significant effect on enterprises’ bribery involvement. In contrast, a local gambling culture based on sports lottery data significantly affects enterprises’ bribery involvement. Finally, we find that female chairpersons weakened the positive effects of the local gambling culture on enterprise bribery activities.

It is important to note that the empirical test results indicate that a returnee chairperson does not moderate the relationship between local gambling culture and enterprise bribery. One possible reason for this is that our data on chairperson's overseas experience are derived from the CSMAR. However, the CSMAR fails to distinguish between the length of time a chairperson spends studying or working overseas. For example, if a chairperson had a short overseas study trip of three months, they are also listed by the CSMAR as having overseas study or work experience. In fact, when a chairperson has only a short period of overseas work or study experience, the norms or values of the overseas group are not strong enough to exert an influence; that is, they are unlikely to develop a tendency to avoid speculative behavior. This has resulted in overseas experience being inadequate to counteract the influence of the local gambling culture on the chairperson's speculative psychology.

Theoretical Contributions

First, this study is the first to show that local gambling culture constitutes an important informal institutional factor that effectively predicts enterprise bribery, thus complementing the literature that focuses on the antecedents of enterprise bribery from an institutional environmental perspective (Cieślik & Goczek, Reference Cieślik and Goczek2022; Schram et al., Reference Schram, Zheng and Zhuravleva2022; Xu et al., Reference Xu, Zhou and Du2019). Scholars have focused on the critical role played by multiple institutional factors in predicting enterprises' bribery activities. For example, laws (Cuervo-Cazurra, Reference Cuervo-Cazurra2008), rules-based trust (Alon & Hageman, Reference Alon and Hageman2017), and dominant culture (Lee & Guven, Reference Lee and Guven2013) have all been found to significantly impact enterprise bribery activities. However, few studies have focused on the impact of subcultures in different regions of the country on enterprise bribery activities. To expand and supplement the literature on enterprise bribery, we provide the first theoretical and empirical evidence that shows how local gambling culture – an informal institutional factor − promotes enterprise bribery. Therefore, this study contributes to the comprehensive understanding of the reasons underlying enterprise involvement in bribery from the perspectives of informal institutions and culture (Godinez & Liu, Reference Godinez and Liu2018; Lee & Guven, Reference Lee and Guven2013; Schopohl et al., Reference Schopohl, Urquhart and Zhang2021).

Second, in this study, we extend the literature on the economic consequences of the local gambling culture by highlighting its effects that cause firms to engage in bribery activities with strong negative externalities. Previous studies have focused on the impact of the local gambling culture on enterprises’ financial and innovation decisions (Adhikari & Agrawal, Reference Adhikari and Agrawal2016; Alharbi et al., Reference Alharbi, Atawnah, Al Mamun and Ali2022; Christensen et al., Reference Christensen, Jones and Kenchington2018). Compared with these decisions, enterprise bribery has strong negative social externalities that seriously undermine social welfare (Jiang & Min, Reference Jiang and Min2022; Xu et al., Reference Xu, Zhou and Du2019). To the best of our knowledge, this study is the first to assess the direct link between local gambling culture and enterprise bribery, which represents a far-reaching but pervasive nonmarket strategic behavior in China (Zhong, Ren, & Wu, Reference Zhong, Ren and Wu2022; Zhou et al., Reference Zhou, Wang, Xu and Xie2022). Our empirical evidence suggests that the literature may underestimate the serious negative consequences associated with the local gambling culture. In doing so, we improve our understanding of the economic consequences of local gambling culture from a nonmarket strategy perspective.

Finally, we extend the literature on the situational boundaries of the local gambling culture–firm strategy choice relationship. The influence of local gambling culture on firms’ strategic choices has attracted increasing attention (Chen et al., Reference Chen, Podolski, Rhee and Veeraraghavan2014; Doukas & Zhang, Reference Doukas and Zhang2013; Tong et al., Reference Tong, Wu and Zhang2023); however, the relevant studies have not explored the contextual boundaries of these relationships and the understanding of how key decision-makers change such relationships is significantly lacking. As the local gambling cultures serve to influence enterprises' strategic choices by changing the perceptions and behavioral tendencies of enterprise decision-makers (Alharbi et al., Reference Alharbi, Atawnah, Al Mamun and Ali2022; Qian et al., Reference Qian, Wu, Hall and Pauly2021), it is important to include these key decision-makers in the research framework. In this study, we provide solid empirical evidence that female chairpersons limit the influence of the local gambling culture on enterprise bribery, thus deepening our understanding of when the local gambling culture is more likely to influence enterprises’ strategic choices. In the process, we also expand our theory of social norms. Our theoretical and empirical evidence insightfully suggests that innate attributes are an important weighting factor that influences whether individuals internalize particular social norms. In addition, the existing strategic leadership literature focuses on CEOs, ignoring the fact that chairpersons often play a more important role in emerging economies than do CEOs in addressing strategic enterprise issues (Ghorbani et al., Reference Ghorbani, Xie, Jin and Wang2023; Jiang et al., Reference Jiang, Shi and Zheng2020; Li, Reference Li2022). We expand the literature on strategic leadership by drawing attention to the important role of chairpersons in an enterprise's strategic decisions, particularly bribery decisions. To our knowledge, this study is one of the few to examine the role of female chairpersons in enterprise bribery practices.

Practical Implications

As mentioned, enterprise bribery is widespread in many parts of the world and seriously damages both economic growth and social welfare. Therefore, detecting and containing enterprise bribery is a key issue faced by investors and regulators. In this study, we suggest that regulators should keep a close eye on companies in their regions with a strong appetite for gambling because they are more prone to bribery. As Zhou et al. (Reference Zhou, Wang, Xu and Xie2022) revealed, bribery in China can seriously damage long-term enterprise value. Therefore, investors should be cautious when investing in such companies.

In addition, although various countries' governments seek to obtain funds by actively promoting legal gambling activities to improve social livelihoods and welfare, the prevalence of gambling activities may enhance the local gambling culture, thus resulting in unexpected adverse consequences that seriously damage the overall welfare of society. One such example is the induction of bribery by an enterprise. Therefore, policy-makers should be aware that gambling can be a double-edged sword and take appropriate measures to prevent its potential negative consequences. Finally, we show that female chairpersons can dampen the impact of the local gambling culture on involvements in enterprise bribery. Therefore, the shareholders of companies in areas with a prevalent gambling culture can better protect their long-term value by employing women as chairpersons to discourage enterprise bribery.

Limitations and Implications for Future Research

This study has several limitations that should be addressed and refined in future research. First, the study's most important limitation concerns the measure of enterprise bribery. Admittedly, our measurement of enterprise bribery is in line with the practice of top academic studies (Cai et al., Reference Cai, Fang and Xu2011; Xu et al., Reference Xu, Zhou and Du2019; Zhou et al., Reference Zhou, Wang, Xu and Xie2022); however, it is difficult to deny that this approach carries noise. For example, although we take measures to exclude normal hospitality expenses, these efforts are imperfect. Therefore, we emphasize the need for future research to develop more objective and accurate bribery measures.

Second, due to data limitations, we do not consider illegal gambling activities when measuring the local gambling culture. We do not believe that this shortcoming threatens the credibility of our findings. Because the empirical context of this study is China, which strictly controls illegal gambling, even when illegal gambling activities occur in China, the locations in which they are conducted are often very hidden and cannot be discussed publicly. This means that illegal gambling activities in China may only affect a small number of people in society and thus influence even fewer corporate decision-makers. Nonetheless, we encourage future research to revise or validate the findings of this study by adopting better and more valid indicators for measuring local gambling culture.

Third, we do not directly test the theoretical mechanisms behind the mechanism hypothesis. Therefore, we encourage future research to obtain data through a questionnaire approach and, on this basis, directly test the role of decision-makers' speculative psychology as an underlying mechanism between local gambling culture and enterprise bribery. In addition to female and returnee chairpersons, future research could introduce other chairperson characteristics to further clarify the situational boundaries of the local gambling culture that influence enterprise bribery.

Finally, due to data unavailability, we are unable to explore whether the local gambling culture causes decision-makers to prefer local over nonlocal bribery. We encourage future research to explore this topic to provide a better understanding of the negative spillover effects of the local gambling culture. In fact, even if firms do not have business activities outside their home provinces, regulators, and other stakeholders may still be farther away that could be targets for bribery.

Acknowledgements

We appreciate the help and hard work of Editor-in Chief Xiao-Ping Chen, Deputy Editor Jianjun Zhang, and Senior Editor Jun Xia. Meanwhile, we are also grateful to the three anonymous reviewers for their insightful comments and suggestions. This work is supported by the National Natural Science Foundation Project of China (Grant No.72202043; Grant No. 71902040).

Data Availability Statement

Data available within the article or its supplementary materials.

Xi Zhong (zhongxi@gdut.edu.cn) is an associate professor at the School of Management, Guangdong University of Technology. His research lies at the intersection of business ethics, performance feedback, and digital transformation. He has over 100 academic articles in various scholarly journals including Journal of Business Ethics, Journal of Business Research, Technovation, Industrial Marketing Management, R&D Management, Asia Pacific Journal of Management, European Management Review, Management and Organization Review, and other Chinese academic journals.

Can Huang (huangcan@gdut.edu.cn) is an associate professor at the School of Management, Guangdong University of Technology. He received his PhD in Finance from Sun Yat-Sen University in 2016. His research focuses on corporate finance. His work has been published in Corporate Governance: An International Review, International Review of Economics & Finance, Accounting & Finance, Management and Organization Review, as well as a number of prestigious academic journals in China.

Ge Ren (hrenge@yeah.net) is a doctoral student at the School of Business Administration, South China University of Technology. Her research lies at the intersection of ESG, corporate fraud, and innovation. She has over 20 academic articles in various scholarly journals including Technovation, Journal of Business Research, Corporate Social Responsibility and Environmental Management, Business Ethics, The Environment and Responsibility, European Journal of Innovation Management, Management and Organization Review, as well as a number of prestigious academic journals in China.