DISCUSSION POINTS

-

• The electricityFootnote * market, which is unnecessarily complex, is fundamentally only suited for a small club of fuel-conversion electricity providers, not the large number of providers, the public engagement, or the renewable electricity generation required in the 21st century.

-

• Subsidies build infrastructure and a choice has to be made to steer subsidies toward the renewable energy future to give clear signals to investors and to avoid paralysis. Photovoltaic (PV) still requires subsidies, not because it is not competitive, but because the infrastructure needs to be changed from a fossil fuel-based to a renewable energy-based one.

-

• Renewables are part of the solution to improving the grid and making it more resilient.

Introduction

When all 196 of the world's countries signed the Paris Agreement in December 2015, they fixed the first universal intention to hold global warming well below 2 °C, and to pursue efforts to keep it within 1.5 °C, a diplomatic achievement. The plans to limit climate change, the ‘Intended Nationally Determined Contributions’ (INDCs), submitted by each country to date, however, fall short of this goal. While the INDCs would improve on current policies (which will lead to a warming in the range of 3.3–3.9 °C), they will limit the warming to only 2.4–2.7 °C, significantly warmer than the 1.5–2 °C limit Footnote † . 1 The Paris Agreement now has set the stage for action on climate change, and the process of working out specific plans to meet these targets still lies ahead. Fossil fuel combustion is responsible for 85% of global anthropogenic CO2 emissions. 2 Estimates of these greenhouse gas (GHG) emissions by sector assign about 72% to the energy sector (of which 44% is in electricity & heat, 19% in manufacturing & construction, 18% in transport, 12% in other fuel combustion, and 7% in fugitive emissions). Therefore, a focus on renewable energy is a key element in plans that address climate change. 2

What is the status quo and how much investment in renewables is required to satisfy the Paris intention to keep the global warming well below 2 °C? The status quo is a situation of increasing renewable energy investments and installations. Despite unusually low oil prices in 2015 (only ∼ $50 per barrel after a price level of > $100 between 2011 and 2015), the investments in renewable energy in 2015 amounted to a record $329 billion, with 64 GW of wind and 57 GW of solar having been installed globally last year. Reference MacDonald3 While this sounds impressive, the current rate of renewable investments are still not enough to keep global warming well below 2 °C. An analysis by the International Renewable Energy Agency (IRENA) reveals that achieving this goal requires annual investments of $500 billion until 2020, growing to $900 billion between 2020 and 2030. 2

Over the past forty years, the electrical energy supply has expanded by a factor of ∼4 (from ∼6000 TWh in 1973 to ∼23000 TWh in 2013). Still predominant, fossil fuels were used to generate 77% of the electricity mix in 2014, essentially the same share (78%) they contributed in 1973, four decades earlier. In 2014, renewables accounted for 23% of the electricity supply, of which hydro contributed 17% and all other renewable sources together contributed about 6%. Fig. 1 shows a comparison between 2013 and 1973. The relative amount of coal generation has actually increased. 5 The fastest-growing fossil fuel in 2013 was low priced coal, and coal-fired generation increased in all regions of the globe. 6 Nuclear power reached its peak contribution of 17.6% in 1996, and has been on the decline since then. Reference Schneider and Froggatt7

Figure 1. World electricity generation by technology, 1973 and 2013. 5

To limit the global warming to below 2 °C, the energy supply, not only electrical energy but also heat and transport, needs to be substantially decarbonized. According to IRENA's analysis, the renewable share of the total final energy consumption needs to double from a 2010 baseline of 18% to 36% in 2030. This corresponds to renewable energy technologies generating a third of all energy: 44% in power, 38% in buildings, 26% in industry, and 17% in transport. 2,8

Because renewable electricity generation by PVs is an important element in decarbonizing the electricity supply, the discussion of the economics and the social costs and benefits associated with PVs can be expected to intensify. There have been conflicting views as to the policy support new PV installations should receive. The sudden changes in support policies in Europe, for example, have caused markets there to stall. (In this article, the installed capacity in Watt-peak (Wp) will be used to characterize the size of a PV system.) The growth in European Union (EU) installations dropped from ∼20 GWp added in 2011 to only about 7 GWp in 2014. 9 With increasing manufacturing volumes, PV manufacturers have been able to reduce the cost of production, allowing the price of PV panels to be reduced by a factor of 4 (from ∼2 €/Wp to ∼0.5 €/Wp) between 2010 and 2015. Reference Mayer10 Nevertheless, many PV manufacturers are struggling, and PV manufacturing in Europe has almost been eradicated. The aim of this article is to delve into economic and social issues that frame the competitiveness of PV as compared with fossil fuel/nuclear generated electricity.

The cost of a kWh generated by a PV system is often compared to the price of electricity from the grid, when in actuality these two quantities are like apples and oranges. Policy support and subsidies, as discussed in the preceding Viewpoint article, also complicate a comparison between fossil fuel and PV electricity. Furthermore, the valuation that the energy market ascribes to a kWh of electricity is also geared to the cost structure of fossil fuel power plants, in contrast to the cost structure of renewables. Electricity prices, the energy market and subsidies are discussed in the first section. Another way of comparing the cost of a PV-generated kWh to a kWh generated by other technologies is to calculate the levelized cost of electricity (LCOE). This is an estimate of all the costs that a system is likely to incur over its lifetime, divided by all the kWh it is expected to generate, and is discussed in section “The levelized cost of electricity”. Another life-cycle based metric, the energy return on (energy) investment (EROI), which estimates the energy delivered divided by the energy needed to deliver it, and claims to signal the social worth of an energy technology, is critically discussed in section “The energy return on investment”. The costs associated with environmental damage and health care, climate change and water depletion, among others, which follow as a consequence of electricity generation are also real costs paid by society through taxes and insurance. Even though these are not part of the electricity price, they are part of the ‘true cost’ of an electricity generating technology. Section “Figuring in the environmental and social impacts into the ‘true cost’ of electric energy” presents a life-cycle assessment of the environmental and health impacts of conventional electricity as compared to PV electricity. Increasing the amount of renewables on the grid requires some adjustments. Section “Grid investments” looks at some of the issues associated with investments to the transmission and distribution electricity grid, which are required anyway in both the US and Europe, due to an aging infrastructure and discusses the need for electrical energy storage, to accompany PV-generated electricity. The social and economic consequences of increasing PV installations, in terms of creating jobs, stimulating regional value in an economy, and motivating citizens to actively engage with their energy consumption patterns is discussed in section “Economic and social consequences and opportunities”.

Electricity prices, the energy market and subsidies

To make a level comparison between PV and fossil fuel electricity, it is necessary to look at the interplay between costs, prices, the market, and subsidies. Most often the first point of comparison is the retail price of residential grid electricity, so it is instructive to understand what this price does and does not include.

In Europe, the US, and many other countries, the price of grid electricity includes components that reflect charges for electricity generation and distribution, energy taxes, and value-added tax (VAT) (Fig. 2). The component for electricity generation (referred to as energy in Fig. 2) is composed of the wholesale electricity price, which is determined on the energy market, as well as a margin on behalf of the retailer. Reference Linden, Kalantzis, Maincent and Pienkowski11 In contrast, distribution tariffs, energy taxes and VAT are determined through national fiscal and regulatory processes. Reference Dromacque, Bogacka, Ebnet and Szabó12 It is a complicated compromise between the desire to create a market for electricity services, while still trying to cover the ‘public service obligation’ to ensure that all segments of the society have access to electricity.

Figure 2. Residential electricity prices in selected European cities and EU average electricity price, from February 2015, showing break-down of component charges. Reference Dromacque, Bogacka, Ebnet and Szabó12

The wholesale electricity price covers only the ‘marginal costs’ of generating electricity. These are the short-run variable operating costs, i.e., primarily the fuel costs. Capital costs and other fixed costs (e.g., costs for building the power stations) are not covered in the marginal cost. Renewable energy technologies such as wind and solar have no fuel costs and are considered to have zero marginal costs.

The electricity market protocol is to fill demand giving priority to the generation with the least marginal costs up to the most expensive, i.e., according to the so called ‘merit order’. A particular electricity plant, however, will not be able to cover its fixed generating costs when it sells electricity and sets the market price. It must passively wait until a more expensive electricity plant is setting the price, which it will also receive for its electricity, allowing it to cover its fixed costs. The competition over the marginal costs can be seen as an artificial competition if it covers only a minor fraction of the total costs. Conventional electric power generators (‘generators’) have adapted this system so that plants with the lowest fuel costs and the highest capital costs (nuclear) are the first to be brought on-line, and those with the highest fuel costs and lowest capital costs (gas) are the last to be brought on-line. It is the composition of the club of electrical power generators, ordered by their specific marginal costs, that determines the ability of an electric plant to passively recover its capital costs.

Designed around the 20th century plant technology and utility monopoly structure, this system of electricity allocation makes sense if the public has already subsidized the electric plants, and the variable fuel costs outweigh the fixed costs. Reference Keay13 It works when demand is growing at a predictable rate ensuring that all the generators in the club will surely sell electricity, and the chance that new electric power generators will come on line is practically zero. The flip side is, however, that the addition of new members, especially those with marginal costs ranging across the lower end of the spectrum, will jeopardize the ability of market players to recoup their fixed costs and their addition is therefore opposed. This is why priority connection of renewables was required by law to enable their participation in the market.

Since a competitive system is defined as one in which any independent provider is free to participate and sell at a fair price offer, the electricity market system is not competitive. In addition, the trading price is not a ‘fair price’ as it is only a partial recompense: the fixed costs are passively obtained through the make-up of the club.

The addition of plants with low or no marginal costs, like wind and solar, causes the wholesale price to be low. However, the consumer, who pays ever rising retail electricity prices, does not experience any relief from the lower wholesale price. It's worth noting that one of the promises when the electricity market was created was that it would benefit consumers. Reference Spence14 EU-28 retail prices have steadily risen by more than 30% since 2007, during which time the tax components have increased by more than 8% per year on average for households and industry. Reference Linden, Kalantzis, Maincent and Pienkowski11,15

While the energy portion of the retail price of electricity is determined on the market, regulators determine the larger share of the price which covers taxes and network charges. These latter charges are intended to cover mainly the distribution and transmission system operators' (SOs') capital expenditure, which reflects the particular design of their portion of the network, but also includes operational and maintenance costs, and costs related to electricity losses in the system.

Current electricity pricing mechanisms are not working well, as evidenced by the recent spate of electricity tariff deficits in European countries. The number of countries facing an electricity tariff deficit increased from four in 2007 (relating to 26% of electricity consumed in the EU-28) to eleven in 2012 (61% of the EU-28 electricity). A recently published study by the European Commission (EC) explains that debts have accumulated in the electricity sector, most often in the regulated segments, but also in the competitive segments. Reference Linden, Kalantzis, Maincent and Pienkowski11 The debts are due to inadequate pricing, lower demand, the increase of generators with low marginal costs, and the price of crude oil. Reference Linden, Kalantzis, Maincent and Pienkowski11

In Spain, for example, an electricity tariff deficit, estimated at some EUR 30 billion (3% of Gross Domestic Product (GDP)) arose between 2000 and 2013. Reference Linden, Kalantzis, Maincent and Pienkowski11 Policy support for all renewable energy technologies was responsible for about a quarter of the entire amount, but it took the blame for the entire mismanagement of the energy system. Among the contracts the Spanish underwrote for renewable energy were those for PV projects signed in the years 2004–2008 when PV system costs were significantly higher (i.e., in the range of €0.23–0.44/kWh). It's worth noting that had the ‘early’ systems not been subsidized, the less expensive systems could never have been developed. Already by the end of 2011, prices for PV electricity had dropped to €0.124/kWh, below the residential retail price of €0.142/kWh for grid electricity. While investment in renewable generation has positive consequences (see section “Economic and social consequences and opportunities”), the mismanagement and/or failings of the current energy system has created deficits that continue to persist.

The lion's share of Spain's deficit originated through regulation that kept retail electricity prices, including for industrial customers, artificially low for over a decade. Other contributors to the debt were transmission and distribution costs, “extra-peninsular costs”—compensation for higher electricity costs in (Baleares, Canary Islands etc.), annuities to cover the tariff deficit in the previous years and other costs. The aim was to contain inflation, protect consumers, and maintain the competitiveness of the Spanish industry. Unfortunately, it caused Spanish utilities to accumulate significant debt, which the government subsequently socialized and took on as a sovereign debt. Faced with declining demand for electricity (due to economic conditions), and an excess in generating capacity along with a mounting sovereign debt, Spain decided to halt new investments in renewable generation. The incorrect notion, however, that the debt is entirely due to investments in early ‘expensive’ renewable energy systems led to renewable energy, and PVs in particular, to becoming in effect a scapegoat for the failings of the energy system in Spain. Reference Couture16

The failures of the energy market appeared when the club of generators grew and the incumbent generators could no longer recover their capital costs. A solution often proposed by the incumbents is in the form of a ‘capacity market’. Not a real market, but rather an administrative device to work out the extra costs electricity customers should pay to subsidize the ‘stranded’ (unrecoverable) capital costs so that fossil fuel plants remain on-line. Varieties of these aid mechanisms are used in Finland, Greece, Ireland, Italy, Poland, Spain, and Sweden. 17 The EC is concerned that capacity mechanisms contradict the aim of phasing out fossil fuel subsidies, and has launched an inquiry into the distorting effect they have on competition or trade. 18 For end consumers, capacity mechanisms mean an additional rise in the price of electricity. Reference Meulemeester19

Benefits to the retail customer from the current electricity market are not clear. The retail customer does not realize any benefit from low energy market prices and has minimal engagement with the market. In contrast to 20 years ago, the consumer now has the possibility to switch between energy retailers, saving on average about €100 per year. However, with switching rates of only around 10%, the majority are not engaged. 20 The EC recognizes that the redesign of the energy market must focus on the integration not only of renewable energy to meet climate goals, but also on consumers, if demand is to become more flexible. 21 The EC states that self-consumption of electricity (generated by consumers for their own use) should be allowed, even though Spain's recent punitive tax on PV systems discourages exactly this. In addition to taxing self-consumption, the ‘sun tax’ also forbids that PV systems below 100 kW should receive any monetary compensation for electricity injected on the grid. Reference Roselund22 The abrupt changes in the Spanish support for PV systems has meant that many Spanish PV investments in installations and/or manufacturing made about a decade ago have since been lost. Reference Nielsen23

In the US, community-owned electric utilities (covering 14% of the US electricity supply) have reported that electricity markets are not providing competitive prices for the consumer. The rules in these regional markets are heavily skewed toward the interests of large transmission and generation asset owners. Reference Anderson24 The report finds that charges are not cost-based, and competition is hindered by the incumbents' use of market power to fight the entry of new generators into the market. Reference Caplan and Brobeck25 Monitoring the market is difficult due to complexity in the pricing resulting from using capacity, ancillary and energy markets, as well as financial products, and is compounded by the participation of financial entities that do not buy or sell power, but trade only in virtual products. Indeed, gaming and systematic manipulation is a concern. Reference Anderson24,Reference Evans26 Following up on the US General Accounting Office's recommendation that the electricity regulators take this issue on, these public power utilities are sounding the alarm that excessive profiteering in the regional markets has led to unfair electricity prices, harming customers. Reference Caplan and Brobeck25 They estimate that consumers may have paid an excess $12 billion in 2011 to generating companies that do not face genuine market competition. Reference Caplan and Brobeck25

In the EU, instances of abuse in the electricity market have also been cataloged in which firms use their market power to prevent competitors from accessing the market, or to extract benefits from competitors, customers, or consumers beyond a competitive level. Reference Klotz27 The EU created a pan European agency, ACER, to supervise energy markets in 2011, but it has had limited success in enforcing the rules due to a lack of funding and adequate support from national regulators. Reference MacDonald28 The issues with abuse highlight that the complexity and intransparency of the electricity markets do not serve the public at large.

One question that is frequently asked is why, if the cost (LCOE, see section “The levelized cost of electricity”) of PV systems is so competitive, are subsidies and/or policy support needed for renewable electricity installations? The long answer is that the current infrastructure was subsidized over many years and tailored to the incumbent technologies. 29 Infrastructure here not only refers to the physical infrastructure, but also to the regulatory, political and economic framework that serves institutions, such as the energy market, the utility regulatory system, and the power, grid, and other massive projects built with government funds. The short answer is that the electricity market does not work.

As explained above, close inspection of the electricity price reveals that regulation and energy market design really determine the price, not the market fundamentals of supply and demand. Due to the noncompetitive foundation of the electricity market, incumbent generators see their profitability threatened by, and therefore oppose, the addition of more electricity providers. Therefore, there has had to be some sort of policy action to introduce renewable energy generation into the grid. Germany pioneered the application of the feed-in-tariff (FIT), the most successful policy support mechanism to date.

As of the beginning of 2015, Germany had the largest installed capacity of PVs (∼38 GWp) of any country. The successful policy responsible for this is the Energie Einspeise Gesetz (EEG) law that was implemented as early as 2000. It set up a FIT to allow investors a reasonable return on investment, even on relatively young technologies. Reference Wirth30 The EEG law mandated that renewables should have priority connection to the grid, and that a FIT will be paid by the electricity transmission system operator to the PV owner for the renewable electricity injected onto the grid. A levy for the EEG is added on to the price of electricity, which is paid by all electricity users, except large industrial users operating in trade-sensitive industries, who are exempt from paying.

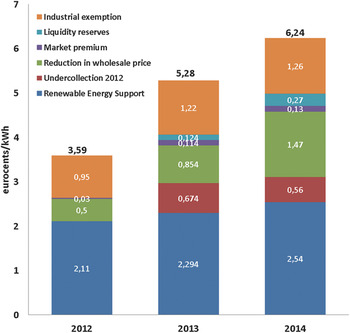

The EEG levy increased from 2012 to 2014, with the dominating components: the ‘renewable energy support’, the ‘reduction in the wholesale price’, and the ‘industrial exemption’ (Fig. 3). Figure 4 shows a schematic which illustrates how the EEG works. The EEG levy is the amount of support for renewables divided over all electricity customers. The ordinary customer pays their fair share (‘Renewable Energy Support’ in Fig. 3; arrow 1 in Fig. 4). The energy intensive industrial customers who are operating in trade-sensitive industries are considered privileged and are exempt from paying any support for renewable energy. So the ordinary customer also covers their share (‘Industrial exemption’ in Fig. 3; arrow 2 in Fig. 4). The transmission and distribution SOs receive these payments and use it to pay renewable energy installations a tariff in return for renewable electricity feed-in (arrow 3 in Fig. 4). This compensates them for the money they have invested in their renewable energy system. All the renewable energy that is not immediately consumed must be sold on the energy market. But because the energy market operates according to marginal costs, the presence of renewables (at zero marginal cost) systematically lowers the wholesale price of electricity as discussed above. Because the SOs cannot recoup the money paid to the renewable installations from the energy market, the ordinary customer is also requested to cover the difference (‘Reduction in wholesale price’ in Fig. 3; arrow 6 in Fig. 4).

Figure 3. German renewable levy (nominal amounts). Reference Weiss31

Figure 4. The EEG surcharge to cover the support of renewable energy systems is divided over all electricity users. The ordinary customer pays their fair share, as shown by arrow 1. Privileged electricity customers are exempt, and so their share is also paid by the ordinary electricity customer, arrow 2. The Transmission & Distribution SOs pay (arrow 3) renewable installations for the renewable electricity injected onto the grid, according to ‘FIT’ prescribed by the EEG law. This renewable electricity is then sold (arrow 4) on the energy market, which systematically lowers the wholesale electricity price. Because the wholesale electricity price reflects only the ‘marginal’ cost of electricity, the SO does not recoup the amount paid out in FIT payments, and requires additional compensation. This is also charged to the ordinary electricity customer (arrow 6).

Since many privileged industrial electricity customers can often buy direct from the wholesale market, they can enjoy the effects of the reduction of the wholesale electricity price provided by renewables, without having to pay any contribution. The renewable policy certainly has not made German industry less competitive. Reference Weiss31

The levy is now about 6 eurocents/kWh, and represents about 20% of the total electricity rate for residential customers, which is above 30 eurocents/kWh. It is worth noting that while the EEG levy has contributed to the increase in the retail electricity price over the period from 2000 to 2013, the rise in fossil fuel prices over this period contributed even more. 32 If the market functioned to actually cover the cost of producing energy, and if the privileged customers would pay their share of the costs, the burden on the ordinary customer could be about half the current amount.

One can wonder how the renewable electricity, even if it is priced at zero marginal cost, could have such a significant effect as to halve the wholesale electricity price, when the total renewable generation provides a relatively modest contribution to the total demand (∼20%). An empirical analysis of the German Austrian day-ahead EPEX electricity market shows how the effect of renewables is amplified on the market. German policy mandates that renewable electricity supported by a FIT must be traded on the electricity market. It is also such that roughly 60% of all electricity is allocated through bilateral contracts, not on the market. Consequently, a bit less than half the electricity traded on EPEX is renewable energy. Although all renewable generated electricity contributed about a fifth of the combined German–Austrian total demand, it constituted about 40% of the traded electricity volume in the corresponding EPEX market. If all electricity were traded on the market the decline in wholesale price would be less for 20% renewable generation. Reference Hildmann, Ulbig and Andersson33 Eventhough greater penetrations of renewables inevitably depress the wholesale price in the current market design, the amplification has exacerbated the increase in the EEG levy component that addresses the ‘reduction in wholesale price’ (Fig. 3).

The EEG, which has been so successful in stimulating the development of PV technology also stimulated cost-effective manufacturing. Even from the beginning, a gradual decrease in the tariff was foreseen with the increasing penetration of renewables. This ‘tariff degression’ was built in to stimulate and coincide with the lowering of PV module costs as greater volumes are produced by the industry (i.e., the industry's ‘learning curve’). Hermann Scheer, one of the architects of the EEG, wrote before he died in 2010 that there was a need to change the focus of the EEG from introducing renewable energy into the power market, to adapting the power market to the needs of renewable energy. Reference Scheer34 However, this approach has not been taken, to date, and abrupt, draconian measures have been implemented since 2012 to curb the renewable installations because conventional power plants are suffering from the low energy market prices. The attack on renewable subsidies (i.e., the EEG) has resulted in a stagnation of the market, if not a complete destruction of the business case for adding renewable generation to the system in Germany. Reference Wirth30,Reference Grossi35

Because the EEG law in Germany opened up the market for renewables and financed the demand for the early technology to grow, it is generally tallied as a subsidy. The point is sometimes made that technically this policy support is not a subsidy, primarily because it is not financed with public money, but rather through a surcharge to electricity users. This may be splitting hairs because the fraction of the public that does not use electricity must be very small indeed. One important difference of the surcharge to most subsidies, however, is that it is transparent and shows up on the electricity bill, in contrast to the many opaque ways (e.g., through tax breaks) that fossil fuel companies receive subsidies (as detailed in the preceding Viewpoint article). The second important difference is that while most energy subsidies persist for decades, the EEG surcharge was designed to gradually decrease until the price of renewable electricity converged to the price of conventional electricity when it would be phased out. Gradual changes are important to allow investors to operate with some certainty.

The abrupt changes in the policy support for renewables, in many European countries, have created overcapacities, tripping up many manufacturers, adding pressure for them to quit manufacturing in Europe. The many policy revisions created uncertainty for investors, especially consumers, resulting in a sharp decline in European installations. As highlighted by the EC, integrating the consumer into the energy transition is key to its success. 36 Unfortunately, both opting for ‘green’ electricity tariffs and/or installing a PV system may frustrate the participation of consumers. The European Consumer Organization (BEUC) has analyzed the current situation for small-scale renewable PV self-generation in EU Member States, identifying barriers and recommending solutions. Reference Mühlenhoff37 As 80% of EU households are in regions where generation of a kWh of electricity with an unsubsidized solar PV rooftop system is cheaper (as evidenced by LCOE calculations, as explained below) than buying a kWh at the national retail electricity price, consumers should not be discouraged from participating in the energy transition through self-generation. Reference Huld, Jäger Waldau, Ossenbrink, Szabo and Dun38

The barriers for self-generation in Europe identified by BEUC include discouragement of consumers to invest through short-term, unstable, even retroactive policies and through administrative barriers, meant for regulating big utilities, that disproportionately increase costs of private self-generation projects. Consumers are hampered by a lack of structured information on their options. Finally, consumers face high financial risks related to difficulty of access to capital and long amortization, complicated by a lack of adequate remuneration schemes for their excess renewable electricity fed onto the grid. To put consumers on a fairer footing, long-term policies need to be put in place that guarantee priority grid access. Consumers' investments in self-generation should not be restricted by limitations on network capacities nor blocked with prohibitive measures to limit grid access and use. They should be able to rely on fair remuneration for the electricity they generate and feed into the grid. Reference Mühlenhoff37 They should not be expected, as is the case with Spain's ‘sun-tax’, to receive little or no compensation for the electricity they feed onto the grid, while paying for electricity generated by incumbents. Furthermore, they should not have to bear taxes or fees meant to help maintain the incumbents' business models and market positions. The club of generators needs to change if the energy transition will indeed happen. Interestingly, the measures that need to be taken to ensure fairness to consumers are the main ideas present in the EEG.

The inadequacy of the current system to cope with lower demand, more renewable electricity generation and increased customer engagement is revealing that the fundamental design of the energy market is incompatible with 21st century requirements. Reference Keay13

In the US, the federal solar Investment Tax Credit (ITC) has been critically important for increasing residential and commercial PV installations. It was extended at the end of 2015 for an additional 5 years. 39 The US Solar Energy Industry Association engaged Bloomberg New Energy Finance to analyze the effect of the solar ITC on installed PV capacity. The extension is expected to lead to an increase of 25 GW over the next five years. 39 State and local incentives, separate from the federal subsidy for PVs, are listed in the Database of State Incentives for Renewables & Efficiency (DSIRE). 40

Policy intervention with subsidies has been justified either to nurture the development of new promising technologies, or to support activities considered to provide more value to the public than the private sector is willing to pay. Reference Pfund and Healey41 A historical perspective gives a good idea of the energy infrastructure paid for with government funding and the duration of a subsidy is an important signal to investors. Taking a snapshot of the subsidies per year divided by the kWh of energy produced does not communicate the extent of the subsidized infrastructure, nor does it align the history of the technologies under comparison in terms of technology maturation. Figure 5 shows comparisons of historical and recent subsidies for fossil fuel and renewable energy technologies. The annualized US fossil fuel and nuclear subsidies, received over nine or six decades respectively, continue to dwarf the annualized subsidies for more recent renewable technologies (Fig. 5(a)). Reference Pfund and Healey41 The 2013 global consumer subsidies for fossil fuels are estimated to be about half a trillion US dollars, while those for all renewable technologies are only about a fifth of that amount, as depicted in Fig. 5(b). Reference Bárány and Grigonytė42 Figure 5(c) gives a breakdown of the consumer subsidies by fuel. The consequences of using the fuel, especially the environmental impacts, also have a pricetag and are generally paid for with public funds. The International Monetary Fund (IMF) figures these externalities (added to their consumer subsidies) as ‘post-tax’ subsidies which they estimate was a staggering $4.9 trillion (6.5% of global GDP) in 2013, and is projected to be $5.3 trillion (6.5% of global GDP) in 2015, as shown in Fig. 5(d). Reference Coady, Parry, Sears and Shang43 Producer subsidies, yet another category of subsidies, which are looked at in the preceding Viewpoint article, are not included in these estimates. Whether one looks at the amount of subsidies provided in a given year, or the more relevant historical annual subsidies, fossil fuels received, and continue to receive, much more substantial subsidies than all renewable technologies taken together. Reference Bárány and Grigonytė42

Figure 5. (a): Annual average US subsidies over historical subsidy periods; (b): Renewable and fossil fuel consumer subsidies for 2013; (c): ‘Pretax’ (Consumer) fossil fuel energy subsidies 2011–2015; (d): ‘Post-tax’ (Consumer + taxes & externalities) fossil fuel subsidies. Reference Pfund and Healey41,Reference Bárány and Grigonytė42,Reference Coady, Parry, Sears and Shang43

The total subsidy amount for fossil fuels in 2013, found by adding producer subsidies to post-tax subsidies, is in the range of $US 5.5–$US 6 trillion dollars. It is worth repeating that the global renewable consumer subsidies were only 22% of the consumer subsidies for fossil fuels, and the total renewable subsidies (US$ 120 billion) were only about 2% of the total fossil fuel subsidies in 2013. 44 The subsidies for fossil fuel electricity generation are currently unjustified, as it is neither a new promising technology, nor has more value than the private sector is willing to pay. On the contrary, the environmental damages quantified by the IMF signify that they cause more damage than can be sustained.

The political decisions that bring new generators on line with subsidies are not always in the consumers' interest. A notable example is the Hinkley nuclear plant in the UK. Since 1998, the British government has cultivated plans for a new nuclear reactor, stating at the outset that nuclear power would be funded by the private sector, and would compete with other generation on equal terms. Reference Schneider and Froggatt7,Reference Pickard45 The original idea was that nuclear could be built for less than US$1000/kW, a price expected to make nuclear competitive with natural gas generation, but by 2006 it was already clear that that was unrealistic. Reference Schneider and Froggatt7

Nevertheless, the UK took the optimistic view that a few “enabling” measures such as making suitable sites available, overseeing an assessment of the technical design through the Generic Design Appraisal (GDA) process, and putting a cap on the cost of radioactive waste disposal would bring the technology in line. The site issue was solved by considering sites previously used in nuclear generation. Electricite de France (EDF) purchased British Energy, including 8 nuclear plant sites in 2008.

Originally, various consortia involving EDF, Centrica (a British energy company), two leading German electric utilities (RWE and E.ON), the Spanish electric utility, Iberdrola, the French GDF Suez, and Scottish and Southern energy (SSE) were participating. The exiting of SSE in 2011, RWE and E.ON Footnote ‡ in 2012, Centrica in 2013 and Iberdrola and GDF Suez in 2014 left a cool air of hesitation to commit any more resources before Hinkley was demonstrably underway. Toshiba Westinghouse bought in, but put its participation on hold. Areva and the Chinese companies, Chinese National Nuclear Corporation (CNNC) and China General Nuclear (CGN), were persuaded in the meantime by EDF to join its project, but by 2015 Areva's participation looked insecure. Reference Schneider and Froggatt7 Areva, with operations from uranium mining to treating nuclear waste, needs a cash injection of about US$7 billion. The wisdom of EDF's offer to support Areva's reactors unit has been questioned due to France's stretched public finances and the long-terms risks associated with Areva's unfinished, terminally delayed, and over-budgeted reactor projects in Finland and France. Reference Ecorcheville46 Even EDF's fleet of aging nuclear plants are struggling to compete against the lower wholesale prices due to renewables, cheap coal and weak demand. Reference Patel47

In 2013, despite promises that nuclear power would not receive subsidies, and that the development would result from competition of developers and technologies, the UK government signed a contract with the only consortium still standing, EDF, CNNC, CGN, and Areva. Although prices competitive with other forms of generation were 5.3–7.5 US¢/kWh (£31–44/MWh) at that time, the contract guarantees a wholesale price of 16 US¢/kWh (£92.50/MWh), for 35 years, the most expensive power on system, and more than double the 2013 wholesale electricity price. The contract was indexed to inflation and included government loan guarantees covering about 70% of the expected construction cost. Reference Schneider and Froggatt7 These large subsidies prompted a state-aid inquiry by the EC. At the end of 2013, the Energy Act was passed in the UK, writing into law billions of pounds of subsidies for low carbon energy, including nuclear power. The state-aid inquiry was concluded almost a year later, with the UK having achieved EC legal approval for support for Hinkley Point. Reference Pickard45 Austria and Luxembourg are currently appealing the decision countering that the £17.6bn in subsidies for Hinkley Point are not compatible with EU state aid rules. Reference Buckworth, Borovas and Webber48,Reference Neslen49

The design chosen for Hinkley is the European Pressure Reactor (EPR) design, identical to the one used in EDF's flagship Flamanville project in Normandy which has been plagued by delays and escalating costs. In April, 2015, a potentially catastrophic mistake in a crucial part of the nuclear reactor in Flamanville was discovered, which may seriously affect the future of the reactors planned for Hinkley Point. Found to have critically defective steel, the Flamanville ‘pressure vessel’ is identical to the one already manufactured for Hinkley Point. Mounting costs and additional delays of several years can result. Reference Lichfield50 In June, 2015, a leaked report from France's nuclear safety watchdog highlighting faults in Flamanville's cooling system, added to the insecurity over the adequacy of the EPR design at Hinkley. Reference Pickard45

The Hinkley delays have led to 400 workers being laid off in April 2015. Reference Pickard51,Reference Chu52 In January 2016, EDF announced it would be laying off 4000 workers over the next two years. 53 More recently, the leaders of the workers' union at EDF have warned that the Hinkley project threatens the company's future, and called for French investment into the plant to be delayed for at least two years. They cite the sudden resignation of EDF finance director Thomas Piquemal as evidence that misgivings about the project are reverberating throughout the company. Reference Willsher and Farrell54 The riskiness of the Hinkley project for EDF has been confirmed by an analyst with the investment bank, Royal Bank of Canada’s (RBC) Capital Markets, as well as by the Cour des Comptes—the French equivalent of the UK's National Audit Office. 55

Hinkley is the test case, blazing the trail of a new mini-‘nuclear renaissance’ in the UK after two decades of no nuclear construction, and it is being watched as a test case for the viability for new nuclear in Europe. The proof of the pudding is revealing that nuclear is no longer economic, nor is the technology appropriate—it is too complex and too dangerous for boiling water in a steam cycle. Reference Davies, Willsher and Farrell56

The levelized cost of electricity

Section “Electricity prices, the energy market and subsidies” shows that the retail price of grid electricity is not a good indicator of the cost of electricity generation and is therefore not an adequate benchmark for assessing the cost competitiveness of different technologies. A metric which is often used is the LCOE.

The LCOE (often expressed in $/MWh or ¢/kWh) represents the present value of the total cost of building and operating a generating plant per unit electricity produced, over an assumed financial life and duty cycle. While this metric seeks to spread or ‘levelize’ the costs of operating an electricity generating plant over the different phases of its life (i.e., construction, operation, dismantling), it is calculated differently for different technologies. Two interrelated differentiating factors are: differences in subsidies and in cost structures.

An illustration that different subsidies apply to different technologies, can be found in the case of nuclear LCOEs. Nuclear plants regularly rely on public subsidies for accident insurance and waste disposal. Because these costs are likely to be catastrophically high (as e.g., at Fukushima), nuclear is generally subsidized by government assurances, including public money to cover accidents and dealing with the radioactive waste. PV plants do not need such catastrophic insurance.

The very different cost structures of fossil fuel plants as compared to renewable plants also play a role, especially in terms of financing timetable and requirements. The latter require up-front capital expenditure to purchase the conversion equipment, short installation times (weeks to months), no fuel costs, and very little operating and maintenance costs. Fossil fuel and nuclear plants require capital over significant construction times (years), volatile fuel costs, and significant operating, maintenance, and decommissioning costs. Reference Schneider and Froggatt7

The convention of using ‘overnight costs’ in the LCOE's of nuclear and other fossil fuel plants means that the financing costs for plant construction is not included in their LCOE calculations. The use of overnight costs for fossil fuel plants, with financing costs of construction which takes years or decades, is significant ($12 billion in the US as of 2008), unlike for PV plants with their shorter installation times. Reference Shrader-Frechette57 In addition, the nuclear industry has consistently overstated the amount of electricity generated, claiming very high capacity factors (90%), despite an actual track record showing an average of 79%. If these and other real costs are included, the cost of nuclear power is roughly 6 times more expensive than indicated by conventional LCOEs. Reference Shrader-Frechette57 These cost trimmings enable a systematic under-valuation of the generation costs of these technologies, improving their competitiveness.

Within a given technology, LCOE's can also vary due to implicit assumptions about the energy produced by a system or the costs over its lifetime. In an analysis of a PV system situated in different locations, it was found that the LCOE was influenced more by financing parameters (i.e., the discount rate) than by the amount of insolation. Reference Darling, You, Veselka and Velosa58 A substantial amount of literature has arisen to discuss the methodologies and explain the sensitivities of the PV LCOE calculation, most notably to financing parameters. Reference Branker, Pathak and Pearce59 Some LCOE analyses, such as those by the investment banking firm, Lazard, are increasingly explicit about the assumptions used. 166

Lazard recently published an assessment of the levelized cost of energy for electricity generation in the US, explicitly indicating values with and without subsidies (Fig. 6). 166 The cost of providing electricity using wind or solar electricity has decreased so significantly over the past 5 years, that it is now competitive with coal and/or natural gas in some markets. The cost, after applying federal tax subsidies, of utility-scale PV falls in the range of 4.7–5.7 ¢/kWh, and for roof-top PV for an average American residential consumer in the range of 13.9–22.7 ¢/kWh. Without subsidies, utility PV costs range between 5.8 and 7.0 ¢/kWh (Fig. 6), with residential PV between 18.4 and 30 ¢/kWh. Commercial rooftop installations fall between utility and residential, at 8.6–15.3 ¢/kWh with a subsidy, and 10.9–19.3 ¢/kWh without. Subsidized wind ranges between 1.4 and 6.3 ¢/kWh, and unsubsidized wind between 3.2 and 7.7 ¢/kWh. For comparison, Lazard calculates the LCOE of natural gas (combined cycle) electric energy in the range between 5.2 and 7.8 ¢/kWh, and coal electricity between 6.5 and 15.0 ¢/kWh. 166

Figure 6. The LCOE of utility scale PV power plants have declined by 82% in 6 years. In 2015, the lower end of the LCOE range, without subsidies, was $58/MWh (5.8 cents/kWh). 166

The levelized cost of roof-top PV electricity systems (<25 kWp) in Europe, assuming fair compensation for electricity fed into the grid (‘net-metering’), but not assuming any subsidies or FIT, is equal to or less than residential electricity prices for 79.5% of Europe's population. Furthermore, a typical 20-year amortization period allows for extremely competitive electricity of about ∼4 ¢/kW h (0.04 EUR/kWh) for the rest of the systems lifetime. Reference Huld, Jäger Waldau, Ossenbrink, Szabo and Dun38

Consistent with the calculations by Lazard, utilities in US states such as Texas and California are signing deals to purchase electricity from solar farms over the next 20 years at rates as low as less than 5 ¢/kWh. More than 22 GW were installed in 2015 worldwide, up from the 14 GWp installed in 2014, which roughly doubled the utility installations in 2013. Utilities installed 23% of the total 16.3 GWp (reported here for utility scale PV plants with installed peak capacities greater than 4 MWAC) installed nationwide in the US up to 2014, and have grown rapidly worldwide (Fig. 7). Reference Cardwell60,62–64 Interestingly, utility scale installations in Europe increased for the first time in 2014 since 2011, primarily due to installations in the UK. Reference Bennett61

Figure 7. Annual installed capacity worldwide, in GWp, of utility scale PV plants >4MWAC. 64

While the LCOE of renewables is sensitive to the financing of the system, because most of the cost is in the initial capital investment, there is also a positive aspect to this. The LCOE of a PV system will change very little over its lifetime, while that of a fossil fueled system is likely to change unpredictably because of the volatility of fossil fuel costs. Indeed, as mentioned above, the price of crude oil was one of the factors in the electricity tariff deficits in Europe.

Coping with the risk of volatility in fuel prices is the new normal for all petroleum-based generation, including natural gas, but not, of course, for renewables. Reference Villar and Joutz65 Natural gas electric power generation can, during a period of low gas prices, appear to be very cost-competitive, but can be greatly affected by a spike in fuel price. The market value of crude oil is 5% of world GDP and its price can change by 50% within a matter of months, leaving few short-term options to reduce consumption. Because of widespread knock-on effects on other segments of the economy, energy price volatility is a major concern. It hurts the economy, delaying business investment, requiring costly reallocation of resources, reducing consumer expenditure, and slowing job growth. Reference Klevnäs, Stern and Frejova66 Therefore, not only would a spike in natural gas price affect the electricity price, it is likely that it will be accompanied by ripple effects slowing the economy. In contrast, once a PV system is purchased and installed, the cost price of the electricity it delivers over its lifetime of 25–30 years has been determined. It is a stable and secure economic investment. Reference Klevnäs, Stern and Frejova66

The energy return on investment

The EROI is a metric that is frequently encountered in comparisons of energy technologies, but there is at present a lack of consensus as to its usefulness. Net energy metrics, such as the EROI, claim to put the relevant information about the viability of energy technologies into a nutshell. It is interesting to open up this nut and see what is inside.

EROI quantifies the amount of energy delivered, E delivered, in relation to the energy required to deliver it, E req, (where E req is the sum of the energy for infrastructure and for processing the fuel) (Eq. (1)). The EROI does not explicitly reflect energy conversion losses (Fig. 8). The energy required by the process and infrastructure is often calculated using a life cycle assessment (LCA).

Figure 8. A schematic showing the extraction and processing of a fuel. E fuel is the energy of the primary feedstock fuel. The energies required for the infrastructure (E Inf1) and processing (E proc1) to convert it to an energy carrier, E fuel2, are no longer available for use in the next stage, fuel conversion. The conversion of the fuel to an energy carrier such as electricity involves energy for infrastructure and processing (E Inf2, E proc2), as well as conversion losses, E conv.

A primary energy source, which is energy in its natural state, is converted to secondary energy carriers through one or more process steps until it is ready for end use. While energy is never destroyed, there is always some fraction of energy, the entropy, that gets swallowed up in irreversible pathways, such as friction or waste heat. Therefore, the amount of useful energy, the exergy, becomes smaller after each process step. The exergy is an indication of energy quality. Footnote § Energy carriers of different quality need to be converted to their primary energy equivalents to be properly summed. This ‘quality challenge’ has been at the heart of many criticisms of net energy analysis [Ref. Reference Bakshi, Gutowski and Sekulić67, p. 101]. While an energy calculation appears to have a certainty as crisp and sure as gravity, the conversion of secondary energies to their primary energy equivalents can be quite ambiguous.

Primary energies for renewables and nuclear are calculated in different ways by different energy statistics sources (Internation Energy Association (IEA), Energy Information Administration (EIA), United Nations (UN), British Petroleum (BP), World Energy Council (WEC))Footnote **. The methods employ different multipliers, or ‘primary energy factors’ (equal to 1, 2.6, or 2.9), to calculate the amount of the electrical energy from the primary energy amount, and may lead to significant discrepancies in energy use data. Reference Macknick68 Caloric assumptions for the primary energies of fossil fuels may also vary between sources. Reference Macknick68 Furthermore, the simple use of the caloric content as the primary energy of a fossil fuel may easily overlook the energy required to extract, refine and transport it.

A recent study by Ecofys demonstrated that the various primary energy factors for renewable energy sources have opened up a technocratic space in which the same physical system, consisting of a mix of renewable and nonrenewable energy sources, can be characterized in significantly different ways depending on the definition of primary energy used. Specifically, they analyzed the effects of different primary energy accounting methods on the implementation of three European policy directives Footnote †† . A conclusion of this study was that an inconsistent use of primary energy factors can disguise the actual energy use such that it may even have adverse effects on reaching climate targets. Reference Surmeli-Anac, Hermelink, de Jager and Groenenberg69 In addition, they note frequent issues with primary energy factors for electricity are: scientific ambiguity, lack of consistency, and lack of transparency. Reference Surmeli-Anac, Hermelink, de Jager and Groenenberg69

Adding to the ambiguity, current EROIs are most often calculated using economic data that requires that monetary amounts be converted to a primary energy equivalent. This requires using energy intensities of economic sectors which is not very precise, as well as currency conversions which are changeable. The standard EROI (EROIst) is applied to fossil fuel extraction and covers the production phase, but not the exploration and development phases (Fig. 9) [Ref. Reference Hall, Lambert and Balogh70, p. 142]. As these latter phases are currently becoming more expensive, they are playing a decisive role in the business case for development of reserves. That these upstream supply chain links are not included weakens the ability of the EROI to reflect the viability of a fossil fuel, eventhough it may be difficult to model the exploration and development stages because they are less standardized. The EROI calculation has also been stretched over more downstream links in the supply chain, and even over a society as a whole.

Figure 9. Boundaries of the standard (EROIst), and the point of use (EROIpou) EROI analysis based on Ref. Reference Hall, Lambert and Balogh70.

Charles Hall is credited with having originated the EROI when he studied migrating fish. He compared the energy fish gained by migrating to new feeding areas to the energy expended in the migration process. Reference Murphy71,Reference Hall and Klitgaard72 These biological origins of the metric are often cited to bolster claims that the EROI is almost a rule of nature. Reference Mulder and Hagens73

Figure 10 illustrates the concept: an energy source providing 10,000 units of gross energy is accessed by the expenditure of the energy required, E req, to make it available for use. Reference Murphy71 The delivered energy, E delivered, is then used to maintain and grow the system, which is considered to be the economy. The idea is that more energy delivered is clearly better. A declining trend in the EROI of oil & gas, which slid from about 30 in 1995 to 18 in 2006, has prompted a discussion of what minimum EROI is required by society. The conspicuous threshold of 1 is often characterized as inadequate for a modern economy, which is generally perceived as requiring a glut of surplus energy. Reference Hall74

Figure 10. An explanation of the EROI concept, based on Ref. Reference Murphy71. The energy source provides a gross energy of 10,000 units in all cases. The table illustrates the calculation of EROI for different amounts of E req. The point is that if this system requires a minimum of 5000 units to maintain itself, then the minimum EROI this system can sustain is 1.

Selected EROI results for fuels and electricity from the literature are listed in Table 1. Note that it is not valid to compare an EROI for a fuel with that of an electricity generating technology because the system boundaries of the calculations embrace different supply chain links. Reference Hall, Lambert and Balogh70,Reference Brandt, Englander and Bharadwaj75,Reference Raugei, Fullana-i-Palmer and Fthenakis76

Table 1. Ranges of EROI values for fossil fuels (left) and for various electricity technologies (right), from diverse geographic locations and from the timeframe after 2000. Reference Hall, Lambert and Balogh70,Reference Brandt, Englander and Bharadwaj75,Reference Raugei, Fullana-i-Palmer and Fthenakis76

The spread of values from relatively few references is quite large. For example, the global average (2006) for oil and gas fuel is reported to have an EROI of 18, with a standard deviation of 14, from the data shown in Ref. Reference Hall, Lambert and Balogh70. There are clearly differences due to the geographic location of the extraction site but the reasons and the effects on the calculations are not elaborated. The authors concede that the statistical basis for these numbers is not (yet) solid. Reference Hall, Lambert and Balogh70,Reference Murphy71,Reference Mulder and Hagens73 The EROI result for PV electricity ranks between those for oil and coal electricity. Coal and hydro have EROIs at the top of the electricity scale. Oil sands fuel is ranked with the lowest value on the fuel list, begging the question of whether the secondary energy after processing of the oil sands would have an EROI below one.

The interpretations of the EROI values are sometimes conflicting. For example, in the case of oil sands, the low EROI was considered not to inhibit the development of oil sands. Reference Brandt, Englander and Bharadwaj75 In contrast, renewable energy is presented as an uneasy bet, questionable only because most renewable energy conversion devices are manufactured using fossil fuel electricity. Reference Hall, Lambert and Balogh70 While this is undoubtably true, the more renewable energy in society, the smaller the fraction of nonrenewable ‘support’ needed for renewable energy systems. Therefore, this point is self-defeating, and not a real criticism of renewable energy. If anything, it signals that the transition to renewables should move more quickly.

The EROI is claimed to be a ratio of the benefit (energy generated) to the cost (energy consumed) of an energy extraction or conversion process. As the EROI approaches unity, the thermodynamic and economic favorability of the process decrease. Reference Zhang and Colosi77 The proponents of the EROI, however, take the claims much further. The EROI ratio is declared to signal the environmental, as well as the energetic and economic, implications of a technology [Ref. Reference Murphy, Hall, Dale and Cleveland78, p. 1889]. EROI is claimed to be a pre-eminent indicator of the biophysical economy. Reference Murphy71,Reference Mulder and Hagens73 They allege that because every living thing must generate a great deal of surplus energy to survive, there is a law of nature which they would call the law of the minimum EROI [Ref. Reference Hall and Klitgaard72, p. 244]. And finally, they assert that the EROI is an indicator of civilization, that a higher EROI correlates with a higher standard of living and human development index (HDI). Reference Lambert, Hall, Balogh, Gupta and Arnold79

The problem with the EROI metric as a meaningful biological indicator is that it does not capture the complexity of energy use in a biological system or in a modern society. In both biology and society, energy use leads to ‘metabolic’ by-products which can be toxic. Because build-up of these by-products influence the system, biological systems typically have feed-back loops to regulate the way the system works, to avoid an over-production of energy or a build-up of by-products. An example is the human body, in which excess blood sugar can be dangerous. After increased sugar absorption in the intestine due to a big meal, insulin is secreted to activate processes to remove it from the bloodstream, and bring the system back to a balanced level. 80 Feed-back loops are hallmarks of biological systems because they are so successful in allowing organisms to function in a wide range of conditions. The EROI does not include any idea that growth must be balanced or regulated in any way. In biological systems, unregulated growth as is implied in the EROI concept, is typified by cancer.

In contrast to the pursuit of as much surplus energy as possible, nature typically keeps energy flows balanced and energy stores measured. An example is photosynthesis, the process in which plants convert sunlight into chemical energy stored as carbohydrates. The efficiency of photosynthesis as a sugar machine is not very high. The fraction of light energy converted by plants during photosynthesis into chemical energy is in the range of 0.3–4.5%. 81

Viewed from the perspective of its EROI, this inefficient sugar machine might be dismissed as inefficient. But before throwing it out, it might be wiser to change the filter through which it is being viewed. Evolved through hundreds of millions of years, plant systems interact with their environment in a multitude of ways, including the provision of habitats and food for a huge number of other life-forms and the regulation of atmospheric, water, and soil processes. When plants die, their matter decays and is recycled into a balanced and circular ‘economy’ of matter and energy. A biological model for energy in society would need to take into consideration the whole balance of the amounts of economic stimulation (e.g., employment, debt) biological impacts (e.g., health advantages, pollution) and social effects (e.g., effect on inequality, poverty, stability) that is part and parcel of the energy source. The EROI model has no way of accounting for the economic, environmental, and social consequences of the relentless pursuit of fossil fuels. Nevertheless, its proponents allege conventional fossil fuels are the most appropriate for society. Reference Pickard45,Reference Hall and Klitgaard72,Reference Hall74 Despite the claims for a biological relevance of the EROI, the logic behind it is not consistent with biological models for energy use.

Even if the EROI metric is not a biological model, it may still have the potential to indicate whether the net energy availability is a societal indicator. After all, prosperity is linked to the production of energy. Reference Hall, Lambert and Balogh70,Reference Murphy71 To calculate a societal EROI, (EROIsoc), Lambert and Hall divide the GDP (US$) by the price of energy units (US$/unit) to translate the GDP into energy units. Then, the amount of energy consumed by a country is divided by the energy content (MJ/energy unit). By dividing the nation's GDP (now in energy units) by the nation's consumption (also now in energy units), they produce a dimensionless ratio of economic activity per energy consumed. Reference Lambert, Hall, Balogh, Gupta and Arnold79 They show an overall (low resolution) trend of both EROIsoc and energy per capita that predictably correlates with various socio-economic development indicators, such as the gender inequality index and the HDI Footnote ‡‡ , for some countries. 82 A general correlation is no surprise because countries with higher GDPs are able to provide more health and educational services to their citizens than the nations with lower GDPs. This very superficial analysis, however, cannot provide more clarity on the threshold minimum EROI that is required by a modern society. Reference Lambert, Hall, Balogh, Gupta and Arnold79

The EROIsoc for Saudi Arabia (having the 14th largest GDP 83 ) is an interesting case, although not calculated by Lambert et al. Fuel prices are highly subsidized (by about 70%) in Saudi Arabia. Reference Long84 The low prices would deliver an inflated EROIsoc compared to countries that subsidize their fuels to a lesser extent. (The price of gasoline in Saudi Arabia is 10 times less than that in Germany!) 85 Unlike the predictions of Lambert et al., the inflated EROIsoc result does not correlate with a more equal society. Saudi Arabia's laws forbidding women to drive, vote, or have parental authority have contributed to Saudi Arabia's ranking in the 130th place out of 142 countries in the Gender Gap ranking of the World Economic Forum. 86 It's hard to see why the price of gasoline would be an indicative factor in deeply held, culturally perpetuated gender roles. Moreover, the price of oil is so volatile and subject not only to a range of economic but also political forces, that it is hard to imagine it in constant relationship with a host of societal factors. 87

Perhaps the real application of an EROI metric is to indicate whether an investment is a good bet. An EROI could be a first calculation before working up a more detailed business plan. If the result is less than one, a return on your investment is excluded. What about if the EROI is much greater than one? Does the EROI signal any risks the investor needs to be aware of? Because burning fossil fuels is so damaging, fossil fuel investments have a high risk of becoming stranded assets. Although coal has the highest EROI rank, its heavy contribution to climate change has made it the first fossil fuel to be targeted as an unsafe investment. The fossil fuel divestment movement along with the current market conditions for new coal plants, are sinking coal investments. A metric that directly reflects investment into the extraction of fossil fuels is the capital expenditure (capex) for development of fossil reserves. 88 Fossil reserves that require high capex for recovery are at highest risk for becoming stranded assets. Because the EROI cannot capture investment risk information, it is not really a viable investment metric.

While the EROI calculations over time have picked up a general trend that fossil fuel resources are becoming harder to extract, the information they can convey is limited. As climate change has announced itself as a more pressing planetary limit than depletion of fossil fuel resources, insight into an energy source's viability in terms of its environmental, social, and economic externalities is required. Because the EROI does not deliver this information and because it does not reflect the feedback loops and balancing mechanisms characteristic of natural systems, it does not live up to what it claims. On the contrary, it is a concept that promotes high consumption, while ignoring the consequential effects of the consumption.

Figuring in the environmental and social impacts into the ‘true cost’ of electric energy

The ‘true cost of electricity’, includes the ‘external costs’ of the electricity use, especially the environmental and health consequences of its use. The environmental impact of 1 kWh from a PV system may be compared to 1 kWh of electricity from the grid. While the PV system emits nothing during operation, energy is used in its construction: embodied energy is intrinsic in the component materials, and energy is used in the manufacture, transport, installation, and recycling over the lifetime of the PV module. Using an LCA methodology, the Simapro software (v 7.3) and the ecoinvent database (v. 2.2), the environmental impact of 1 kWh of electricity from a 14.4% efficient mid-size commercial system (12.4 kWp) was compared to 1 kWh of electricity from the European grid (Union for the Co-ordination of Transmission of Electricity (UCTE)) in 2008 (i.e., 56% coal and gas, 28% nuclear, 10% hydro and 7% renewable energy sources), 1 kWh of 100% natural gas electricity, and 1 kWh of 100% hard coal electricity. Because a major contribution to the environmental impact of PV is the electricity used to manufacture it, the 1 kWh of PV electricity was calculated to reflect a module made with 100% coal grid electricity, the UCTE mix, or just hydro and gas generated grid electricity. Reference Olson89

Emissions to the air are quantified in terms of carbon dioxide equivalents (CO2 eq) which communicates the amount of CO2 that would have the same global warming potential as the emissions under study. The emissions associated with 1 kWh from multicrystalline silicon PV modules is 19, 38, or 39 g CO2 eq, depending whether it was manufactured with hydro and gas electricity, electricity generated with the UCTE mix, or electricity generated with 100% coal. In comparison, electricity derived from burning gas (620 g CO2 eq), coal (1020 g CO2 eq), and the UCTE mix (506 g CO2 eq) are 1–2 orders of magnitude higher. A comparison of air pollutant emissions from these electricity sources is shown, normalized to 100% coal electricity, in Fig. 11. It is interesting to note that the emissions from PV modules manufactured with 100% coal electricity are double those from PV modules manufactured with hydro power and natural gas electricity, but are still 96% less than the emissions of electricity generated by coal. Therefore, modules, even if they have been manufactured using ‘dirty’ electricity, are still much more environmentally benign than coal electricity.

Figure 11. Comparison of air pollutant emissions of electricity produced by PV, natural gas, and the UCTE mix, at power plant, relevant to climate change (kg CO2 eq), human toxicity (kg 1.4 dichlorobenzene), reactive organic pollutants (kg NMVOCs), and atmospheric particulate matter loading (kg of particulate matter smaller than ∼10 μm (PM10)), normalized to the impacts of hard coal electricity. Reference Olson89

Air pollutants also contribute to human toxicity, photochemical oxidant formation, particulate matter formation, and terrestrial acidification. The human toxicity of PV electricity is dwarfed by the impacts of electricity generated with coal, or the UCTE electricity mix. The electricity from natural gas was calculated based on the natural gas supply for the European consumer in the ecoinvent database, and did not include shale gas sources. Reference Schori and Frischknecht90 The mercury emissions from coal that may be inhaled or ingested by humans causes neurological damage and are responsible for the high human toxicity impact. The reason for the high toxicity of the UCTE mix is its high content (∼30%) of nuclear generation. Nonmethane volatile organic compounds (NMVOCs) are organic compounds (e.g., benzene), often resulting from fuel combustion, that typically have compounding long-term health effects. Many are carcinogens. Particulate matter is suspended in air as an aerosol, and is associated with lung cancer and respiratory disease. Reference Hamra, Guha, Cohen, Laden, Raaschou-Nielsen, Samet, Vineis, Forastiere, Saldiva, Yorifuji and Loomis91 Emissions of sulfur oxides lead to acid rain, which affects the biology of soil and vegetation and accelerates degradation of buildings and structures.

The results for the formation of photochemical oxidants and particulates and for terrestrial acidification all follow the same pattern: the PV module made using hydro and natural gas electricity produces electricity with only ∼2–3% of the impact per kWh of coal. The PV modules made with UCTE electricity (∼50% fossil fuel) and with 100% coal electricity have twice the impact of the cleaner PV module (∼6–7.5% of coal electricity). Electricity generated with natural gas provides 60% of the GHG emissions of coal, 36% of the volatile organic compounds (VOCs), 15% of the particulates, and 14% of the acidification. UCTE electricity presents the same level of human toxicity as coal electricity, but only 50% of the GHG emissions, 42% of the VOCs, 50% of the particulates and 47% of the acidification.

An increasingly critical issue, water depletion can be characterized by the amount of the water withdrawn for use, which describes the amount removed from a water source. The act of removal may damage ecosystems, even if the water is returned or discharged after use. Water consumption is water that is not returned. In power systems, consumed water is often water that has evaporated or otherwise escaped from the controlled flow. Discharged water, after having been used in a cooling cycle, for example, is returned to the water source, but may present water quality issues. The range of the water withdrawn per megawatt-hour (MWh) generated by an electric power plant can range from almost zero for a solar PV, wind, or dry-cooled natural gas plant, to hundreds of gallons for an efficient plant using recirculating cooling, to tens of thousands of gallons for a nuclear or coal plant using once-through cooling. Reference Averyt, Fisher, Huber-Lee, Lewis, Macknick, Madden, Rogers and Tellinghuisen92 Water consumption per MWh generated can similarly range from almost zero for solar, wind, or gas plants using dry cooling, to ∼1000 gallons for coal, oil, or concentrating solar power with recirculating cooling. A separate study similarly placed the water consumption by coal, gas, and oil plants in the range from 100 to 2000 gallons/MWh. Reference Mekonnen, Gerbens-Leenes and Arjen93

In the US, for example, electricity generation accounted for more than 40% of total freshwater withdrawals in 2005, and is one of the largest consumers, losing freshwater through evaporation in the cooling process. Reference Rogers, Averyt, Clemmer, Davis, Flores-Lopez, Frumhoff, Kenney, Macknick, Madden, Meldrum, Overpeck, Sattler, Spanger-Siegfried and Yates94 Electricity generation is increasingly competing for water use in many areas in the world that have become warmer and drier due to climate change. Reference Rogers, Averyt, Clemmer, Davis, Flores-Lopez, Frumhoff, Kenney, Macknick, Madden, Meldrum, Overpeck, Sattler, Spanger-Siegfried and Yates94,Reference van Vliet95 During especially warm summers over the past decade in both the US and Europe, electric plants (fossil fuel and nuclear), that use heat as an intermediate energy carrier and therefore require cooling, were forced to reduce production because of a lack of cooling water, revealing their vulnerability for limited production in warmer conditions. By 2030, under an average economic growth scenario and if no efficiency gains are assumed, global water requirements would grow to a full 40% above the current accessible, reliable supply. 96

Even in rainy Britain, there were areas in 2012 that were suffering from drought. A recent study examines the water requirements of electricity generation in the UK, according to various generation mix scenarios. The authors find that scenarios that depend on ‘clean coal’ strategies, which employ carbon dioxide capture and storage (CCS) technology to limit CO2 emissions from thermal fossil fuel generating plants, increase water requirements by an additional 70% over those that do not. Furthermore, scenarios relying on nuclear generation may require up to 4 times more water than currently used. These additional demands will further stress scarce water resources leading to issues associated with security of supply. Reference Byers, Hall and Amezaga97 Consistent among the spate of studies is the recommendation to address the growing water scarcity issues by installing more wind and PVs, i.e., nonthermal renewable energy. Reference Mekonnen, Gerbens-Leenes and Arjen93,Reference Byers, Hall and Amezaga97,Reference Sovacool and Faeth98

The transformation of natural land, as well as the occupation of urban and agricultural land, is large for hard coal because of the mining and infrastructure. Electricity from natural gas requires about three times (282%) as much transformation of natural land as coal or UCTE electricity (110%) as a result of the requirements for gas pipelines Footnote §§ . PV requires only 15% of the natural land transformation as compared to coal Footnote §§ , 14% as compared to the UCTE electricity mix, and only 5% of the land transformation as compared to natural gas. Reference Olson89

Compared with coal electricity (per kWh), PV uses 86–89% less water, occupies or transforms over 80% less land, and presents ∼95% lower toxicity to humans; it also contributes 92–97% less to terrestrial acidification, 97–98% less to marine eutrophication, and 96–98% less to climate change. Reference Olson89

In 2011, it was estimated that the life cycle effects of coal are costing the U.S. public between a third to over one-half of a trillion dollars annually, or between 18 and 27¢/kWh (2008US$). Reference Epstein, Buonocore, Eckerle, Hendryx, Stout, Heinberg, Clapp, May, Reinhart, Ahern, Doshi and Glustrom99 Because electricity in the manufacturing of PV is a major factor in its environmental impact, the assumption of 100% coal electricity in the manufacturing can be considered a ‘worst case’. Applying the same methodology as was used in the costing of coal impacts, leads to an upper limit cost of ∼1–1.5 ¢/kWh (2008$) for PV. Using cleaner energy in the manufacturing of the PV modules translates into a negligible additional cost for the life-cycle environmental and health impact of PV.