Published online by Cambridge University Press: 26 March 2020

It is generally agreed that Britain has an acute housing problem, but the nature of this problem is not always understood. For the country as a whole it is not a problem of shortage, though there is a shortage in London and the South East. In future, most new houses will not be built to add to the total stock of houses, but to replace existing houses, millions of which are more than a century old and in very poor condition.

Note (1) page 39 This figure relates to Great Britain. Unless otherwise stated, figures in this article refer to England and Wales.

Note (1) page 40 Ministry of Housing and Local Government, Slum Clearance, Cmd. 9539, 1955. The figure was described by J. B. Cullingworth (Housing Needs and Planning Policies) as ‘a gross underestimate of the problem. Though some authorities, such as Manchester and Liverpool, have included all the unfit houses in their estimates [43 per cent of all Liverpool houses and 33 per cent of those in Manchester were shown as unfit] others have lowered their sights to what can be achieved within, say, twenty years.’

Note (2) page 40 F. T. Burnett and Sheila F. Scott, ‘A Survey of Housing Conditions in the Urban Areas of England and Wales : 1960’. The Sociological Review, March 1962, page 39.

Note (1) page 41 Central Office of Information, The Housing Situation in 1960, (May 1962), table 50, page 58.

Note (2) page 41 The history of legislation for promoting the improvement of old houses is summarised in Appendix A.

Note (1) page 42 Report of Interdepartmental Committee on Rent Control, Cmd. 6621, 1945.

Note (2) page 42 J. B. Cullingworth, Housing in Transition, pages 105-6.

Note (3) page 42 About 2 per cent of privately rented houses are at present being sold to owner-occupiers each year. (Donnison, Cockburn and Corlett, Housing since the Rent Act, Occasional Papers on Social Administration No. 3, page 79.)

Note (1) page 45 Central Office of Information, The housing situation in 1960, tables 22 and 25.

Note (2) page 45 In 1962 local authorities lent £24 million on 11 thousand new houses and £60 million on 42 thousand older houses. 13 per cent of the loans were for 100 per cent of the value, a substantial part of these being made by the LCC.

Note (3) page 45 Occasional Bulletin of the Co-operative Permanent Building Society, No. 59, November 1963. The Co-operative Permanent Building Society was responsible for about 7 1/2 per cent of all house purchase loans by Building Societies in that period.

Note (4) page 45 Stanley Alderson, Britain in the Sixties : Housing, page 65.

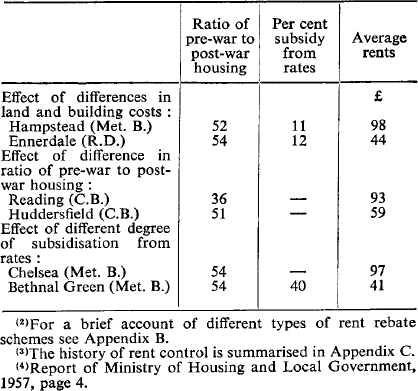

Note (1) page 46 Some examples of the effects of these differences are given below:

Note (2) page 46 For a brief account of different types of rent rebate schemes see Appendix B.

Note (3) page 46 The history of rent control is summarised in Appendix C.

Note (4) page 46 Report of Ministry of Housing and Local Government, 1957, page 4.

Note (1) page 48 It is estimated that 1963 gross values will prove to be about four times the 1939 value. (Revaluation for rates in 1963, March 1962, Cmnd. 1663, page 2.)

Note (2) page 48 The history of housing subsidies is summarised in Appendix D.

Note (3) page 48 For instance Bournemouth, with a high proportion of post-war housing but no slum problem, gets the £24 subsidy, because it balances its housing account by charging rents equal to three times the gross value; while Liverpool, with a lower proportion of post-war housing and a huge slum problem, gets only £8.

Note (4) page 48 Housing, Cmnd. 2050, page 15. ‘He has proposed that this should start with a thorough examination of the finance of local authority housing : the cost to a representative selection of authorities both of the houses they own and of those which they must build over the next seven years : the level of earnings in the different areas against which the rent- paying capacity of tenants can be judged : and what, having regard to this, the different authorities require by way of subsidy to enable them to build what houses they need to build and still to let their houses to tenants at rents which they can afford.’

Note (1) page 49 A man who invests £5,000 in shares pays income tax on the dividends he receives; and a man who invests £5,000 in a house which he lets to someone else pays income tax on the rents he receives. But a man who invests £5,000 in a house in which he himself lives now pays no tax on the income he receives (in kind) from his investment.

Note (2) page 49 Financial Statement 1963-4, 3 April, 1963, Table XI.

Note (3) page 49 Budget Speech, 3 April 1963. It is however obvious that we would not charge owner-occupiers of residential property with Schedule A income tax on the new rating valuations. We should then be suddenly trebling or quad rupling the burden of tax on many of those who pay it. This would be intolerable.’

Note (4) page 49 According to the 1962 Ministry of Labour Family Expenditure Survey, the average rateable value (1956 valuations) of owner-occupied houses in 1962 was £27 a year. If current values are four times as great then, assuming average tax rates of 5s. 6d. in the pound (the rate charged to Building Societies), the tax saving by the 6.4 million owner-occupiers would be £190 million. (This is also about four times the £48 million estimated as the loss incurred by abolishing Schedule A taxation based on 1936/7 values.)

Note (5) page 49 Hansard no. 573, 27 November 1962, col. 37.

Note (6) page 49 Another relief which is sometimes regarded as a subsidy to owner-occupiers is their right to deduct two-fifths of the premiums paid on a life endowment policy which is used to repay a mortgage on a house. This allowance, however, is not directed towards owner-occupiers as such, but towards those who are saving through the particular medium of a life insurance policy. Whether or not this particular form of saving should be singled out for favourable treatment is a separate issue from that of the subsidisation of owner- occupiers.

Note (1) page 50 P. R. Kaim-Caudle, A new look at housing subsidies, Local Government Finance, March 1964.

Note (2) page 50 Report of the National Assistance Board for 1962, page 7.

Note (1) page 51 For a discussion of the problem of the regional imbalance of employment, see ‘The Regional Problem’, National Institute Economic Review No. 25, August 1963. The effect of the distribution of industry on land prices is referred to in Appendix E, which discusses government measures which have affected land prices.

Note (1) page 52 The present value of the two series, discounted at 6 per cent per annum, is the same. The ratio of the initial rent to an equivalent constant rent varies with the rate of discount and inversely with the assumed rate of growth of prices and period of amortisation. It is more sensitive to changes in the assumed rate of growth of prices than to changes in the rate of discount or period of amortisation. A tall in the rate of discount from 6 to 5 per cent or an increase in the period of amortisation from 60 to 80 years would, ceteris paribus, reduce the starting rent (equivalent to a constant payment of £186 a year) from £110 to £102. An increase in the assumed growth rate of prices from 3 to 4 per cent would reduce it from £110 to £89.

Note (2) page 52 As they are already doing on pre-war houses.

Note (1) page 55 Circular 29/62, 30 April 1962.

Note (2) page 55 Circular 42/62, 2 August 1962.

Note (1) page 55 Table 3, page 41.

Note (2) page 55 Cmnd. 2050, May 1963.

Note (1) page 55 Society of Housing Managers, Differential rents and rent rebates, 1962.

Note (1) page 56 Houses. The next step, Cmd. 8996, November 1953.

Note (1) page 58 Report of the Royal Commission on the Distribution of the Industrial Population, Cmd. 6153, 1940.

Note (2) page 58 Report of Expert Committee on Compensation and Betterment, Cmd. 6386, 1942.

Note (1) page 59 Signposts for the Sixties.