Even though monetary sovereignty remains an important reference point in both academic discourse and international politics, it has throughout the past decades repeatedly been declared dead (Strange Reference Strange1996; Cohen Reference Cohen1998). There are good reasons for this. Creeping dollarization subjects states across the world to monetary and financial decisions made in the United States (Cohen Reference Cohen2015; Fritz, de Paula, and Prates Reference Fritz, de Paula and Prates2018). Local financial systems depend increasingly on globally active megabanks, asset managers, and hedge funds (Braun Reference Braun2022; Naqvi Reference Naqvi2019). Governments face global bond markets and the realpolitik of the IMF and the World Bank (Roos Reference Roos2019). Regulators and supervisors across the globe struggle with cryptocurrencies, stable coins, and shadow banking instruments (Fama, Fumagalli, and Lucarelli Reference Fama, Fumagalli and Lucarelli2019; Viñuela, Sapena, and Wandosell Reference Viñuela, Sapena and Wandosell2020). Meanwhile, even local banks in low-income countries seek to comply with some version of the standards set at Basel’s Bank for International Settlements (Jones Reference Jones2020). Lacking the ability to control money within their borders, states have increasing difficulties raising taxes and funding critical expenditures (Binder Reference Binder2019; Palan, Murphy, and Chavagneux Reference Palan, Murphy and Chavagneux2013; Zucman Reference Zucman2015). In what sense, if any, can states still be described as monetary sovereigns? (Pistor Reference Pistor2017; cf. Zimmermann Reference Zimmermann2013)

Today, the concept of monetary sovereignty is typically used in a Westphalian sense to denote the ability of states to issue and regulate their own currency. This understanding continues to be the default use of the term by central bankers and economists (De Grauwe Reference De Grauwe2012; King Reference King2016) and in fields ranging from modern monetary theory (Kelton Reference Kelton2020) to international political economy (Mabbett and Schelkle Reference Mabbett and Schelkle2015) and international monetary law (Lastra Reference Lastra2015; Proctor Reference Proctor2012; Zimmermann Reference Zimmermann2013). As we argue in this article, the Westphalian conception of monetary sovereignty rests on an outdated understanding of the global monetary system and the position of states in it. This makes it unsuitable for the realities of financial globalization.

Building on foundational work in International Political Economy (IPE) (Cohen Reference Cohen1998, Reference Cohen2015; Strange Reference Strange1996), recent scholarship on the monetary system has raised new challenges for the nation state-centric focus of the Westphalian conception. For one, scholars increasingly highlight the crucial role of private money forms (Braun, Krampf, and Murau Reference Braun, Krampf and Murau2021; Gabor Reference Gabor2016; Gabor and Ban Reference Gabor and Ban2016; Gabor and Vestergaard Reference Gabor and Vestergaard2016; Hockett and Omarova 2017; Mehrling Reference Mehrling2011, Reference Mehrling2015, Reference Mehrling2016; Murau Reference Murau2017a; Pozsar Reference Pozsar2014; Tooze Reference Tooze2018; van ’t Klooster 2022). In fact, public money forms, whose issuance is under the direct control of states, are only a small part of the global money supply. The larger share is made up of private credit money forms such as bank deposits and various forms of unregulated deposit substitutes, often termed “shadow money”. This scholarship also casts further doubt on the Westphalian idea of states as equal constitutive building blocks of the international monetary system (Aldasoro and Ehlers Reference Aldasoro and Ehlers2018; Avdjiev, McCauley, and Shin Reference Avdjiev, McCauley and Shin2015; He and McCauley Reference He and McCauley2012; Ito and McCauley Reference Ito and McCauley2018). Instead, the existing global financial system leaves money creation largely to private financial institutions that issue money “offshore”, using some of the world’s most important units of account, e.g., the U.S. dollar (USD), outside of the jurisdiction to which this unit of account is legally connected (e.g., the United States).

Since the Westphalian conception rests on an inadequate understanding of money, it fails as a normative conception of sovereignty. The conception focuses on the legal competences of the state, which sovereign states are meant to exercise without interference from other states. But should issuing and regulating a currency without interference matter so much? Although a national currency can indeed be an immense source of geopolitical power, the mere ability to issue a currency is by no means a guarantee for such power. Indeed, the existing literature on state sovereignty increasingly recognizes the conceptual limitations of conceptions of state sovereignty that focus on absence of interference (Dietsch Reference Dietsch2011, Reference Dietsch2015; Jackson Reference Jackson1992; Ronzoni Reference Ronzoni2009, Reference Ronzoni2012; Viehoff Reference Viehoff2018). For this reason, political theorists have sought to rethink the concept to highlight its effective dimensions. Effective conceptions understand sovereignty as the ability of states to make meaningful choices and achieve their ends (Ronzoni Reference Ronzoni2012, 574). We turn to the monetary realm to develop an account of effective monetary sovereignty.

Rather than giving up on the concept of monetary sovereignty altogether, we reject the Westphalian conception and propose an alternative. The concept of monetary sovereignty is the general idea as it is widely used in economic and political discourse, while a conception is a particular way of defining the concept that distinguishes it from other conceptions (Rawls Reference Rawls1999). We propose an effective conception of monetary sovereignty that is distinct from the Westphalian conception. It focuses on what states are able to do within the constraints set by the global credit money system.

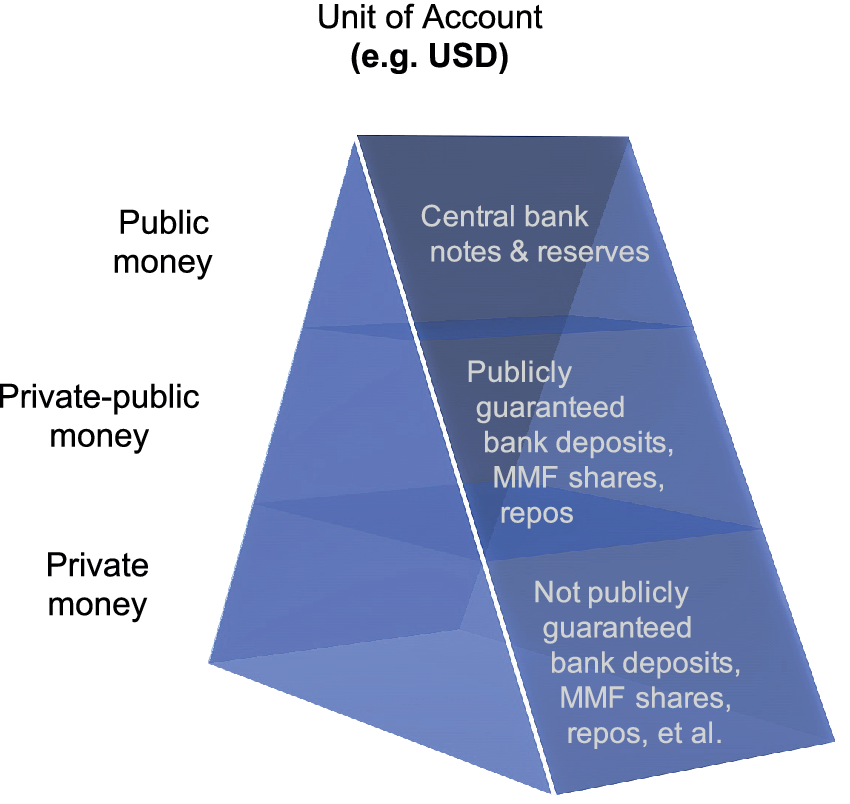

In developing a new conception of monetary sovereignty, we understand the modern credit money system as composed of a public, a private-public, and a private money segment. The agency of the state—what we describe as monetary governance—takes different forms in relation to these three segments. States can control public money through central bank design but can only exercise more arms’-length influence over private money creation. The private-public segment of the credit money system consists in the regulated banking sector, which is subject to public guarantees and has access to monetary policy operations. The pure private segment consists of money creation that takes place outside the states’ regulatory reach without public guarantees. It confronts states with a challenge of management, rather than regulation. In managing pure private money, states can seek to accommodate private money into the regulated banking system, issue an outright ban, or opt for a laissez-faire approach. Building on these observations, we understand monetary sovereignty in terms of monetary governance, which encompasses not only the issuance of public money forms, but also governance of regulated banks and unregulated money forms, onshore and offshore (see figure 1).

Figure 1 Monetary sovereignty and the three dimensions of monetary governance

In putting forward this new conception of monetary sovereignty, we contribute not only to IPE scholarship but also to the emerging normative literature on the global monetary system (Bruin et al. Reference Bruin, Herzog, O’Neill, Sandberg and Zalta2018; Cordelli and Levy Reference Cordelli and Levy2021; Herzog Reference Herzog2021; A. James Reference James2012; Meyer Reference Meyer2021; Viehoff Reference Viehoff2018; Wiedenbrüg Reference Wiedenbrüg2021; Wollner Reference Wollner2018). As we show, understanding when states are able to achieve their economic policy objectives is crucial for determining what states in a vastly unequal and opaque monetary order owe to each other as a matter of justice. States may give up their national currencies while gaining effective monetary sovereignty. States can also have duties to limit their sovereignty understood in a Westphalian sense for other states to retain effective sovereignty (Ronzoni Reference Ronzoni2009, Reference Ronzoni2012). Accordingly, the conception of effective monetary sovereignty helps advance normative political theory on the financial system.

The remainder of the article is organised as follows. We first introduce our conceptual framework, which offers an account of the global credit money system and its relation to the state that will guide the analysis. Next, we build on that account to argue against the Westphalian conception. We then develop the conception of effective monetary sovereignty.

A Global Credit Money Perspective on the State

The past decades have seen scholars move away from the intuitive assumption that states are the crucial building blocks of the international monetary system. Although it was always recognized that states impact each other, these interrelations were often conceptualized in terms of self-contained monetary systems, whose operation is assumed to be under the control of the state. Long after the Bretton Woods System ended, the international dimension of the monetary system was theorized in terms of cross-border money flows, primarily by managing the conversion of national moneys through exchange rate arrangements. This line of thought shaped the Mundell-Fleming model (Fleming Reference Fleming1962; Mundell Reference Mundell1963), which is the basis for influential analytical frameworks such as the macroeconomic trilemma (or “impossible trinity”) (Frieden Reference Frieden2015). According to the trilemma, states can only choose two of the following three policy objectives: fixed exchange rates, international capital mobility, and an autonomous monetary policy.

IPE scholars have done a lot to challenge the Mundell-Fleming perspective on the international monetary system. A first generation of IPE scholarship on international money has taken a step away from the Mundell-Fleming model by noting that the idea of “one nation, one currency” is an empirical chimera as national moneys are widely used in other countries (Cohen Reference Cohen1998; Helleiner Reference Helleiner1994). In their view, today’s global monetary system is shaped by currency competition (Cohen Reference Cohen1998, Reference Cohen2015; Strange Reference Strange1996). States compete internationally to foster widespread usage of instruments denominated in their national unit of account. Those states that succeed acquire a powerful tool of economic policy. For those states that fail, the money within their territory becomes subject to foreign rules. Key examples are the “dollarized” economies in the Global South, for instance in Latin America. This original critique of IPE stresses the cross-border usage of national currencies but still regards the creation of money as a national domain. Money creation is assumed to happen within the nation state, by the nation state, and still primarily for the nation state.

A new generation of IPE scholarship on international money—often operating in the context of “critical macro-finance” (Dutta et al. Reference Dutta, Kremers, Pape and Petry2020; Gabor Reference Gabor2020)—makes a second step away from the Mundell-Fleming world and emphasizes both the role of autonomous private money creation and of money creation that takes place offshore, outside of a state’s territory (Binder Reference Binder2019; Braun, Krampf, and Murau Reference Braun, Krampf and Murau2021; Gabor Reference Gabor2016; Gabor and Ban Reference Gabor and Ban2016; Gabor and Vestergaard Reference Gabor and Vestergaard2016; Mehrling Reference Mehrling2011, Reference Mehrling2015, Reference Mehrling2016; Murau Reference Murau2017a; Murau and Pforr Reference Murau and Pforr2020; Tooze Reference Tooze2018). In this literature, the monetary system is understood as a global payments system in which all money is credit money, whether physically printed or not. Money creation takes place when a private or public institution expands its balance sheet and issues a new monetary instrument, e.g., a deposit, against a loan or bond. Offshore money creation denotes that private institutions use a national unit of account, say the USD, to create USD-denominated money outside of the United States. Through these analytical moves, the recent scholarship acknowledges what the Bank for International Settlements has called the end of the “triple coincidence” when the monetary area, economic area, and decision-making area all coincided with a state’s territory (Avdjiev, McCauley, and Shin Reference Avdjiev, McCauley and Shin2015).

As we decouple the analysis of global money from nation-state centric categories, it is an open question what the remaining role of the state is vis-à-vis the global monetary system, and if and how it is possible to maintain ideas of states’ monetary sovereignty under such perspective. To explore this question, we present a conceptual framework that systematically introduces the key concepts used in current IPE scholarship on international money, explains how they are interrelated, and highlights four crucial features of the state in the global monetary system.

The first feature is the state’s role as a provider of units of account. A unit of account is a metric for denominating contractual obligations, which both public and private institutions use to denominate monetary instruments. For instance, the USD is the United States’ unit of account, the British pound (GBP) that of the United Kingdom, and the euro (EUR) that of the European monetary union. In common parlance, the United States are said to issue “the U.S. dollar”. Such phrasing tends to overstate the case. First and foremost, the USD is nothing that would physically exist. As a unit of account, it is merely a benchmark that is required to denominate assets and liabilities. Hence, a more exact wording would be to speak of USD-denominated instruments, some of which are issued by banks and other private financial institutions, and say that the U.S. Federal Reserve issues “USD-denominated currency”. Alfred Mitchell-Innes (Reference Mitchell-Innes1914, 151) states this crucial fact in saying that “the eye has never seen and the hand has never touched a dollar. All that we can touch or see is a promise to pay or satisfy a debt due for an amount called a dollar.”

It is, however, by no means necessary that the units of account used in the global payment system are provided by states. Rather, this is an empirical fact of our age that emerged from a specific historical trajectory (Helleiner Reference Helleiner2003). Private units of accounts are competing with the state prerogative, even though they have not reached a systemic role. Among those are cryptocurrencies such as bitcoin or tether, which fluctuate against state-based units of account (Hayes Reference Hayes2021). The planned idea for a Facebook currency called libra would have been a similar case, based on the introduction of its own non-state unit of account (Libra Association Members 2018). Central bankers justify current initiatives for the introduction of central bank digital currencies (CBDCs) as defending the traditional monetary prerogative of the state (Brooks Reference Brooks2021).

The second role of states in our framework is that they take over various functions in relation to the issuance of money. Rather than simply creating money themselves as assumed in the Mundell-Fleming world, states provide a “monetary jurisdiction” (Awrey Reference Awrey2017) as a legal space within which different institutions create different types of money, denominated in the state’s unit of account. We distinguish three segments of the money supply, in relation to each of which the state’s role takes different shapes.

First, public money is money issued directly by an institution that represents the state. The main instruments that correspond to the category of public money are central bank notes (or currency) and central bank deposits (or reserves). Today, public money is typically issued by an independent central bank, which uses the issuance of new money to pursue macroeconomic objectives outlined in a legal mandate (Garriga Reference Garriga2016; Lastra Reference Lastra2015). The introduction of a CBDC would add an additional instrument to the public money supply.

Second, private-public money is created by private institutions but guaranteed via explicit or implicit backstops by public institutions such as the central bank, the treasury, or off-balance-sheet fiscal agencies (Guter-Sandu and Murau Reference Guter-Sandu and Murau2022). Even though the direct control of money creation is in private hands, issuance of private-public money forms takes place in the context of a strict regulatory framework provided by the state. Issuers will often need a banking license, but also receive access to last -resort credit from the central bank and to deposit insurance that protects the customers of the issuer against default. Together, the guarantees serve to make private-public moneys for most economic purposes identical to public money forms. Straightforward examples of private-public money are insured bank deposits but the category also includes instruments such as overnight repos and shares of government money market funds if they are subject to public guarantees (Pozsar Reference Pozsar2014).

Third, private money forms are issued by private institutions but do not have any public guarantees. These money forms need not be used as a means of payment themselves but are often merely convertible into means of payment instantly at face value. Monetary history has witnessed multiple shadow money instruments come and go, for example, country bank notes in the eighteenth and nineteenth centuries, trust deposits in the nineteenth and twentieth centuries, as well as money market fund (MMF) shares, repurchase agreements (repos), and asset-backed commercial papers (ABCPs) in the twentieth and twenty-first centuries (Kindleberger and Aliber Reference Kindleberger and Aliber2005). Definitions of what counts as private money or shadow money vary (Gabor and Vestergaard Reference Gabor and Vestergaard2016; Pozsar Reference Pozsar2014; Ricks Reference Ricks2016), which is hardly surprising as the opacity of those instruments is often part of their issuers’ business strategy. Currently, scholars widely discuss if cryptocurrencies, in particular stable coins, are money and belong to this category (Fama, Fumagalli, and Lucarelli Reference Fama, Fumagalli and Lucarelli2019).

Since the money supply in a monetary jurisdiction is a mix of different types of money, the state has a different role in relation to each. Figure 2 represents this public-private hybridity of the monetary system as a hierarchical three-layered pyramid structure.

Figure 2 Public, private-public, and private money segments

From the conceptual perspective that we outline here, the defining feature that makes these instruments “money”—in contrast to other instruments denominated in the national unit of account such as stocks or bonds—is that they maintain a one-to-one exchange rate with each other (i.e., they trade at par). You can easily transfer one USD note (public money) into a bank deposit (private-public money) by paying it into your bank account and then shifting it into an uninsured money market fund (private money), or vice versa. This often conceals important differences between these instruments (Gabor and Vestergaard Reference Gabor and Vestergaard2016).

The public and private-public money forms we use today often originated as private money. They became systemically relevant over time, were subject to a bank run in a systemic financial crisis, and had to be turned into private-public money to prevent the monetary system from collapsing—a recurring process that Murau (Reference Murau2017b) calls “private credit money accommodation” (see figure 3). Today’s central bank notes, or currency, originated as private credit money in the seventeenth and eighteenth centuries, were “accommodated” in 1797 when the English Bank Restriction Act stopped gold convertibility and introduced a public guarantee for par clearance. The 1844 Bank Charter Act made them public money. Bank deposits are even older instruments that were turned into private credit money after the 1844 Act. In the United States, bank deposits were accommodated in 1933 when Franklin D. Roosevelt announced a 100% guarantee to end the Great Depression. MMF shares and overnight repos developed as “shadow money” in the 1970s and were accommodated in the 2007–2009 Financial Crisis through the emergency interventions of the Federal Reserve and the U.S. Treasury (Murau Reference Murau2017b; Wullweber Reference Wullweber2020). Accordingly, a money form is not firmly tied to one segment. Instead, private initiative can lead to the emergence of new money forms and state interventions can shift money forms around between the segments. Hence, states are not in the position to fully determine the structural setup of the money supply in their monetary jurisdiction but do have means to influence it.

Figure 3 Mobility of money forms between segments

The third feature of states in our framework is that they have some discretion over the degree of financial openness of their monetary jurisdiction. This is the underlying prerequisite for financial globalization, which not only pertains to capital account liberalization but crucially to the permission of offshore money creation (Braun, Krampf, and Murau Reference Braun, Krampf and Murau2021). The depiction of figures 2 and 3 assume that the public, private-public, and private forms of money are created in the monetary jurisdiction of a state, using that state’s unit of account as measure for denomination. This is the assumption that money creation occurs onshore. By contrast, offshore money creation takes place if institutions legally located in the monetary jurisdiction of one state issue monetary instruments denominated in another state’s unit of account.

For example, a French bank in London can make a USD loan to a Chinese borrower and—in the course of this—create USD-denominated deposits outside of the United States. This form of offshore money creation began in the 1950s on the Euro-currency markets (Helleiner Reference Helleiner1994), with the strong endorsement of the nexus between the City of London, the UK Treasury, and the Bank of England (Burn Reference Burn1999, Reference Burn2006). With the end of the state-centric Bretton Woods System, the private Euro-currency markets attained an increasingly important role. From 1974, the Eurodollar market—the Euro-currency markets’ core component—went global and became the backbone of the privatized international monetary system, centered around offshore USD creation (Braun, Krampf, and Murau Reference Braun, Krampf and Murau2021).

Not all credit money created offshore falls into the category of private money without public backstops. Through so-called swap lines, some central banks provide de facto backstops for credit money denominated in their unit of account in other monetary jurisdictions. The Federal Reserve and the ECB allow other central banks to provide USD and EUR-denominated credit money to their domestic banking sectors. In this way, both central banks have effectively put other central banks in the position to create public money in a foreign unit of account. This enables them to provide liquidity backstops to banks creating offshore bank deposits in their respective monetary jurisdictions, which then makes these deposits part of the private-public money segment. Other arrangements for backstopping banks are central banks’ foreign exchange reserves, regional financing arrangements, and IMF credit lines. In these different ways, states are able to provide support to offshore money creation in units of account for which they do not issue public money (Denbee, Jung, and Paternò Reference Denbee, Jung and Paternò2016; Mehrling Reference Mehrling2015; Murau Reference Murau2018).

Figure 4 integrates the onshore-offshore antagonism in our visualizations. The left part of the pyramid (dark blue) indicates the monetary jurisdiction, which is connected to the state’s unit of account. The right part (light blue) summarizes all other monetary jurisdictions, within which the unit of account is used for offshore money creation. Taken together, the whole pyramid visualizes the monetary area of the given unit of account.

Figure 4 Three segments and the onshore-offshore antagonism

The fourth and final feature of states in our conceptual framework is their hierarchical positioning towards each other in the international system. States occupy different positions in the international hierarchy of money, which gives them greater policy space, and strive to improve their relative positions. This approach draws on an understanding of the international monetary system as the entirety of monetary areas based on states’ units of account (Ito and McCauley Reference Ito and McCauley2018). Where the Mundell-Fleming model adopts a bottom-up view according to which all states are essentially equal building blocks, the recent IPE scholarship shows that states have a hierarchical relationship to each other that largely depends on the status of “their” unit of account in the international hierarchy of money.

The notion that the international monetary system is hierarchical is not new to scholars of IPE. In fact, notions of hierarchy have famously been used by first-generation IPE scholars on international money such as Strange (Reference Strange1971) and Cohen (Reference Cohen1998) who attribute a different status to different currencies, for instance top currency, patrician currency, elite currency, plebeian currency, permeated currency, quasi-currency, and pseudo-currency. These scholars, however, remain to a certain extent in the framework of the Mundell-Fleming model and assume that within the group of principally equal states, some issue a more important currency than others. In our framework, the international hierarchy is mainly a hierarchy of units of account, depending on the volume of their onshore and offshore usage. This determines the hierarchical position of the monetary area, which in turn shapes the position of the state in the international hierarchy, which again has substantial political implications for that state’s policy space.

On all accounts, the unit of account at the apex of the international hierarchy is the USD. It has the most sizeable offshore component, which extends the scope of its monetary area far beyond the U.S. monetary jurisdiction. Granting a paramount global role to the U.S. state and its institutions, it pushes all other monetary jurisdictions into a peripheral position to the US (McCauley Reference McCauley2020). However, a point of contestation is how the international hierarchy takes shape below the apex. Traditional measures include the volume of currencies held in central banks’ FX reserves (Eichengreen, Mehl, and Chiţu Reference Eichengreen, Mehl and Chiţu2017) or the shares of turnover in FX transactions (Fritz, de Paula, and Prates Reference Fritz, de Paula and Prates2018).

To depict the international hierarchy, figure 5 presents an idealized, incomplete sketch of the international hierarchy of monetary areas, using a variety of different units of account as examples. Following Murau, Pape and Pforr (Reference Murau, Pape and Pforr2021), it orders jurisdictions with the international hierarchy in terms of access to the key currency in today’s Offshore USD System. The highest layer is occupied by the USD. In the second layer, we find the euro area, which has the second largest offshore component after the USD, as well as Japan and the United Kingdom. Central banks in these monetary jurisdictions do not issue USD-denominated instruments themselves, but have access to the permanent unlimited USD swap lines of the Federal Reserve. On the level below, we find monetary jurisdictions such as Denmark, Australia, Brazil and South Korea, which have temporary limited USD swap lines. Most jurisdictions lack any access to swap lines and are situated in the lowest layer of this hierarchy.

Figure 5 The hierarchy of the Offshore USD-System

The international hierarchy of money is not static; the relative importance of units of account and states is in permanent flux. The United States attained its dominant role in the interwar years when the British Empire lost its monetary hegemony (Harris Reference Harris2021). The euro started as an attempt to establish a monetary counterweight to the USD, aiming to improve Europe’s position in the international hierarchy (COM 1990). Its introduction has indeed had a major effect on the composition of the international hierarchy. Our figure also depicts Chinese efforts to further increase the offshore use of the renminbi (“RMB internationalization”) as the political attempt of the government in Beijing to promote China’s role in the world (Eichengreen and Kawai Reference Eichengreen and Kawai2015) and eventually position itself as a competing monetary bloc outside of the U.S.-dominated Offshore USD System (Murau, Rini, and Haas Reference Murau, Rini and Haas2020).

In sum, we conceptualize the international monetary system as a doubly hierarchical construct in which states provide the major units of account that are used to create different types of public, private-public, and private money—both onshore and offshore, and embedded in a multi-layered international hierarchical structure. This raises the question whether and how states can still have monetary sovereignty, which is the topic to which we now turn.

Beyond Westphalian Monetary Sovereignty

Today, the concept of monetary sovereignty is predominantly used following a conception that we refer to as Westphalian. According to the Westphalian conception, monetary sovereignty consists in the ability of states to issue and regulate their own currency. Using the conceptual framework developed earlier, we raise four objections to the Westphalian conception. This allows us to then propose an alternative understanding of sovereignty.

The concept of monetary sovereignty is closely connected with the broader notion of state sovereignty. Although the concept has historically been used in a wide range of divergent senses (Loick Reference Loick2019; Philpott Reference Philpott and Klosko2011), it has often been taken to involve issuing a national currency (Proctor Reference Proctor2012). The sixteenth-century thinker Jean Bodin, who introduced the concept, explicitly names the ability to coin money as one of the defining aspects of sovereignty (Bodin Reference Bodin and McRae1961). The concept of sovereignty that today informs international law is a conception of state sovereignty that focuses on the right of states to exercise power over a territory without interference from other states. Originating in the nineteenth century it is widely referred to as “Westphalian” after the seventeenth century treaty that ended the Thirty Years’ War.

In the monetary realm, international law defines monetary sovereignty as the right of states to make decisions with regard to their national currency. The legal principle of monetary sovereignty originates in a 1929 ruling of the Permanent Court of International Justice. In the so-called Serbian Loans Case, the court stated that “it is indeed a generally accepted principle that a state is entitled to regulate its own currency.” Theorists of sovereignty have explored this principle by distinguishing an internal and an external dimension (Proctor Reference Proctor2012, para. 19.02-8; Zimmermann Reference Zimmermann2013). Internally, monetary sovereignty refers to the right of a state to issue a national currency, regulate its use within the territory, and use monetary policy to achieve domestic policy objectives; externally, it refers to the ability to set the exchange rates. Used in this way, the Westphalian conception is informed by a vision of money closely connected to territory. It envisages a world where three features of states coincide: authority over the issuance of money, jurisdiction over a territory, and the use of money within that territory.

Outside a narrow legal context, the concept of monetary sovereignty typically denotes that a state issues a national currency that is widely used within its territory (De Grauwe Reference De Grauwe2012; King Reference King2016; Lastra Reference Lastra2015; Mabbett and Schelkle Reference Mabbett and Schelkle2015; Mitchell, Wray, and Watts Reference Mitchell, Wray and Watts2019; Proctor Reference Proctor2012; Zimmermann Reference Zimmermann2013). Despite its widespread use, we argue that the Westphalian conception is not a particularly useful way to think about monetary sovereignty. We raise four objections.

Our first objection of the Westphalian conception is the narrow conception of the monetary system that informs it—it is focused on the public onshore segment of the monetary system. Today’s international monetary system is hierarchical and dominated by private money forms. The most important and hierarchically highest currencies also have a sizable offshore component and more prolific private-public and private money segments at the expense of the public money segment. Monetary jurisdictions that have high volumes of onshore public money forms exist at the very periphery of the global system. Bangladesh, for instance, has a proportionally large public money segment (Bangladesh Bank 2021). At the same time, there is no or very limited offshore Taka creation. The focus on public money is least accurate exactly when it comes to the world’s key currency. Within the United States’ monetary jurisdiction, the public money segment is relatively small compared to the private-public and the private segments. Within the private-public and private segments, moreover, the volume of USD issued offshore is larger than the volume of onshore USDs (Aldasoro and Ehlers Reference Aldasoro and Ehlers2018). No adequate conception of monetary sovereignty can omit these key segments of the money supply.

Second, the Westphalian conception obscures the very different positions of states within the global credit money system (Alami et al. Reference Alami, Alves, Bonizzi, Kaltenbrunner, Koddenbrock, Kvangraven and Powell2021; Cohen Reference Cohen2015; Fritz, de Paula, and Prates Reference Fritz, de Paula and Prates2018; Jones Reference Jones2020; Pistor Reference Pistor2017). Although both the United States and Bangladesh issue a national currency for use within the state’s territory—i.e., are equally sovereign in the Westphalian sense—they take up very different positions in the international hierarchy of money. Since Bangladesh is highly reliant on the USD for trade and finance, it seeks to stabilize market fluctuations of its exchange rate (a so-called “managed float”). Its monetary policy is constrained by this objective, but monetary policy is only part of the story. As its domestic firms borrow in USD, its economy is structurally dependent on foreign lenders (Iqbal Reference Iqbal2019). The key role of the USD in the global credit money system gives the U.S. banking system a key edge over competitors and the Fed a powerful voice in shaping global banking regulation at the Basel Committee and other global regulatory fora. Bangladesh finds crucial parts of its banking system outside of its jurisdiction and is unrepresented in deliberation on global banking regulation. To stabilize its currency, Bangladesh holds a record of 46.4 billion USD in low-yielding currency reserves, while paying over 8% interest on its sovereign bonds (Bangladesh Bank 2019, 2021). The currency reserves are largely held in USD-denominated sovereign bonds. The functional role of U.S. government debt as currency reserves and private sector collateral allows the United States to fund historically unprecedented debt levels at much lower rates. Where the existing monetary system allows the United States to achieve a range of economic policy objectives, the same is not true for Bangladesh. However, from a Westphalian perspective, both states are equally sovereign.

Third, as a consequence of its neglect of private and offshore money, the Westphalian conception overstates the importance of the ability of states to issue a national currency. This becomes clear if we look at one of the most important developments in the international monetary system in recent decades, namely the introduction of the European monetary union. According to the Westphalian conception, all countries that have joined the euro have given up their monetary sovereignty. To see that this is too simplistic, compare a euro area country such as the Netherlands with an opt-out country such as Denmark. In joining the euro, the Netherlands gave up its national currency, the guilder, and no longer sets its own monetary policy. Instead, monetary policy is made by the Governing Council of the European Central Bank (ECB), where Dutch interests are represented by its central bank governor. Membership in the European monetary union clearly affects how states pursue their domestic economic policy objectives, but that does not mean that they are more constrained than countries whose currency is pegged to the euro. The Danish krone is pegged to the euro at a fixed exchange rate, which precludes its use for pursuing an independent monetary policy (Wood Reference Wood2018). The Dutch banking system benefits from membership in the monetary union and Dutch banks continue to be important players in the global credit money system. There is of course a longstanding debate over whether a monetary union is actually the right choice for any given state (Gadha et al. Reference Gadha, Kaboub, Koddenbrock, Mahmoud and Sylla2021; Mody Reference Mody2018; Pigeaud and Sylla Reference Pigeaud and Sylla2021). However, despite lacking Westphalian monetary sovereignty, it is far from clear that the Netherlands is placed less favourably in the global monetary system than Denmark (Verdun Reference Verdun2022).

This brings us to our final objection to the Westphalian conception, which is that it is too restrictive in its vision of what constitutes good economic policy. An adequate conception of monetary sovereignty should be compatible with a range of broader empirical and normative background assumptions. Similar to concepts such as “freedom” and “well-being”, the question of what constitutes “sovereignty” is itself a legitimate topic of political disagreement. Using it almost synonymously with specific policy prescriptions obfuscates the difference between monetary sovereignty and particular policies that contribute to it. Proponents of modern monetary theory, for example, have claimed that states only have monetary sovereignty if they meet all of three conditions: First, they issue a national currency in which they collect taxes, whose exchange rate is, second, floating and non-convertible, and, third, they have no foreign-currency denominated debt (Mitchell, Wray, and Watts Reference Mitchell, Wray and Watts2019). To define it in this way reduces monetary sovereignty to a set of contested policy prescriptions, thereby seemingly resolving genuine political disagreement on a conceptual level (Bonizzi, Kaltenbrunner, and Michell Reference Bonizzi, Kaltenbrunner and Michell2019). A less prescriptive conception invites more sustained debate over what actually improves the position of states in relation to money.

Together, these four objections demonstrate that the Westphalian conception is simply inadequate. It is not a useful way to think about how the global monetary system helps or hinders states. As it does not track any weighty interests, it is of little help in exploring the rights and duties of states in the global monetary order. Consider the assertion that states should protect their own and respect other state’s monetary sovereignty. Relying on the Westphalian conception, that claim may require too much from states. Sometimes states have to take measures to regulate the economy that are required as a matter of justice but limit their autonomy with regard to their national currencies. Respecting Westphalian sovereignty may also require too little. Westphalian monetary sovereignty may fail to provide states with the actual ability to govern money within their territory. Since it does not refer to something that should matter much to states, the Westphalian conception easily leads moral reflection astray and is to be abandoned.

Should that observation lead us to declare the death of monetary sovereignty altogether, as Strange (Reference Strange1996) and Cohen (Reference Cohen1998) have suggested? We think that its widespread use in academic discourse and international politics should lead us to rethink rather than abandon the concept. In fact, turning to the literature on political sovereignty, it is clear that the Westphalian conception is not the only way of defining monetary sovereignty. Political theorists have long challenged Westphalian conceptions of state sovereignty as a normative benchmark for international relations (Dietsch Reference Dietsch2011, Reference Dietsch2015; Jackson Reference Jackson1992; Ronzoni Reference Ronzoni2009, Reference Ronzoni2012). These authors, too, have raised the worry that a narrow focus on non-interference is both too demanding and not demanding enough. It is too demanding in that it sees treaties in which states give up selected legal competences as reducing sovereignty, even where these treaties improve the capacities and resources available to states to achieve their domestic policy objectives (Ronzoni Reference Ronzoni2012). It is not demanding enough since it requires little more from other states than the absence of interference (Jackson Reference Jackson1992, 40–47). States can retain the legal competences to issue and enforce regulation while lacking the capacities and resources to achieve their domestic policy objectives. A thoroughly unjust order of weak states can respect national borders.

The theory of political sovereignty has therefore undergone a substantial change, moving beyond the Westphalian conceptions of state sovereignty to a conception of effective sovereignty. Political theorists have argued for a renewed focus on the policy options that are available to states and the outcomes that they can achieve (Dietsch Reference Dietsch2011, Reference Dietsch2015; Jackson Reference Jackson1992; Ronzoni Reference Ronzoni2009, Reference Ronzoni2012). Invoking the classic distinction of Isaiah Berlin between negative and positive liberty (Berlin Reference Berlin1969; Jackson Reference Jackson1992), they reject the legal conception’s focus on non-interference and instead highlight the importance of normatively valuable outcomes that states can achieve. Understood in a “positive” or “effective” sense, sovereignty is then taken to refer to “the substantive problem-solving capacity of states and to their ability to make meaningful and genuinely discretionary choices on a range of issues” (Ronzoni Reference Ronzoni2012, 574). A similar turn, however, has not taken place regarding the concept of monetary sovereignty, which reflects the modest size of the existing normative literature on the state in relation to the global monetary system (Bruin et al. Reference Bruin, Herzog, O’Neill, Sandberg and Zalta2018; Dietsch Reference Dietsch2021; Herzog Reference Herzog2019; A. James Reference James2012; Reddy Reference Reddy2003; Viehoff Reference Viehoff2018). We therefore propose to make this overdue turn in our understanding of monetary sovereignty and move from the Westphalian conception to a conception of effective monetary sovereignty.

Effective Monetary Sovereignty

Rather than focusing on the issuance of national currencies and the absence of foreign interference, effective monetary sovereignty concerns what states are able to achieve within the confines of the global credit money system. We define effective monetary sovereignty as the state’s ability to use its tools for monetary governance to achieve its economic policy objectives.

Since we propose a conception of monetary sovereignty and not an empirical benchmark or policy prescription, our account does not imply any particular vision of how states should govern their monetary systems. What objectives states pursue is their decision to make. In the postwar era of “embedded liberalism,” states often subordinated their economic policy to full employment, while post-1980s monetary orthodoxy emphasized price stability and economic growth as overriding concerns (Blyth Reference Blyth2002; COM 1990; Monnet Reference Monnet2018). Today, policymakers are increasingly concerned about financial stability, climate change, and biodiversity loss (Paterson Reference Paterson2021; Smoleńska and van ’t Klooster Reference Smoleńska and van ’t Klooster2022). Effective monetary sovereignty concerns the state’s ability to set its economic policy objectives and govern money accordingly.

How the state governs money takes different shapes in relation to the three segments of money within its monetary jurisdiction (see figure 6). The Westphalian conception of monetary sovereignty is focused on public money forms, which are indeed directly issued by public institutions. In this sphere, monetary governance involves direct control over the issuance of money. The private-public segment consists in money issued by banks and other private institutions within a strict public legal framework. Bank deposits and other means of payment benefit from public guarantees but are subject to strict regulation. A distinct private segment escapes the strict regulatory regime for banks but is still subject to its own regulatory framework. Here, effective monetary sovereignty is limited to efforts to manage the money supply.

Figure 6 Monetary governance and the three segments of the money supply

Effective monetary sovereignty fits the existing hybrid monetary system, in which central banks issue public money as a low-risk instrument, while more risky lending is left to private institutions. Such a hybrid monetary system, if it functions well, combines the advantages of various public and private arrangements (Hockett and Omarova Reference Hockett and Omarova2017). Full reserve banking and sovereign money proposals reject hybridity in favor of a purely public monetary system (Jackson and Dyson Reference Jackson and Dyson2012; Weber Reference Weber2018), while free bankers favor an entirely privatized system (Hayek Reference Hayek1976). Among those who support a hybrid system, there remains a broad range of options from financial systems subject to strict credit controls (Bezemer et al. Reference Bezemer, Ryan-Collins, van Lerven and Zhang2021; Monnet Reference Monnet2018) to the laissez-faire approaches associated with pre-crisis Basel II regulation (Tarullo Reference Tarullo2008). Our conception of monetary sovereignty is compatible with these different approaches to monetary governance.

Although there is no a priori connection between our conception and any particular segment, monetary sovereignty manifests itself in very distinct ways in the individual segments of the credit money system. To flesh out what it means for states to make their own economic policy within the constraints set by the global credit money system, we will now analyze the different ways in which states can govern money.

Controlling Issuance of Public Money

A state’s key discretionary choices for issuing public money concern the status and the design of its central bank—its institutional organization, mandate, and permissible operations (van ’t Klooster Reference van ’t Klooster, Bellamy and King2022). The design of the central bank determines who decides what regarding public money creation, and hence determines the size and accessibility of the pure public money segment within a monetary jurisdiction. The setup of the public segment is also a powerful lever to shape the private-public and private segments, as we will see in more detail later.

From the standpoint of effective monetary sovereignty, there is no obviously correct way to design the political structures for public money creation. Despite considerable harmonization since the 1980s, the institutional organization, mandates, and actual operations of central banks continue to differ quite substantially (Johnson Reference Johnson2016; Lastra Reference Lastra2015). First, concerning formal organization, a state makes choices with regard to its role as state bank and bankers’ bank (Conti-Brown Reference Conti-Brown2016), its level of democratic accountability and independence from government interference (van ’t Klooster Reference van ’t Klooster2020; Tucker Reference Tucker2018), as well as the scope of international monetary cooperation (H. James Reference James2012). Second, concerning the mandate, central banks have historically been closely connected to government expenditures, in particular war finance, converting notes, and managing international trade for foreign exchange conversion. In the era of embedded liberalism, central banks were given numerous economic policy tasks but since 1980 their primary responsibility has increasingly narrowed to maintaining price stability (Garriga Reference Garriga2016). Third, concerning actual instruments, the way in which central banks create money has evolved considerably over time (Bindseil Reference Bindseil2004; van ’t Klooster and Fontan Reference van ’t Klooster and Fontan2020), as has the degree of coordination with fiscal authorities (Monnet Reference Monnet2021).

In light of the constraints that states face individually, effective monetary sovereignty can be increased by sharing governance structures for controlling public money (Cohen Reference Cohen1998, ch. 4). From a perspective of Westphalian monetary sovereignty, membership in a monetary union is often seen as involving a dramatic loss of control over public money issuance (Proctor Reference Proctor2012). However, it is a contested question how membership in a monetary union impacts the state’s ability to achieve its economic policy objectives (Gadha et al. Reference Gadha, Kaboub, Koddenbrock, Mahmoud and Sylla2021; Pigeaud and Sylla Reference Pigeaud and Sylla2021; Viehoff Reference Viehoff2018). A more modest loss of unilateral control over money occurs when central banks provide swap lines to each other. The Federal Reserve and the ECB have allowed other states to issue public money offshore, which allows them to backstop offshore money within their monetary jurisdiction. This has been seen to erode Westphalian monetary sovereignty because it challenges the central bank’s role as monopoly issuer of the currency (Destais Reference Destais2016). Yet, from a perspective of effective sovereignty, swap lines have contributed to achieving economic policy objectives in stabilizing the global credit money system during the crisis. The conception of monetary sovereignty that we propose is compatible with such different views on the objectives of economic policy and how to achieve them.

Regulating Private-Public Money

The Westphalian conception of monetary sovereignty focuses on what states can do without interference from other states. States are thought of as sovereign as long as they can regulate financial institutions domiciled within their territory. In this regard, the Westphalian conception has a narrow territorial focus that abstracts from what economic policy objectives states can achieve by regulating private money.

For private-public money, effective monetary sovereignty consists in the ability of states to design the public-private segment in their monetary jurisdiction. In principle, this applies to both onshore money denominated in that state’s unit of account and offshore money denominated in other units of account. We distinguish two means for states to do this: first, regulating the regulated banking sector; and second, designing their monetary policy framework.

Banking regulation determines under what conditions banks and other financial institutions are allowed to issue new credit money. One crucial objective of banking regulation has traditionally been financial stability: preventing the default of individual banks as well as banking crises (Ricks Reference Ricks2016; Tarullo Reference Tarullo2008). To this end, states seek to regulate the financial risks that banks are allowed to take. In the post-war era, states regulated bank deposit creation through detailed prescriptions (Bezemer et al. Reference Bezemer, Ryan-Collins, van Lerven and Zhang2021; Monnet Reference Monnet2018). Since the 1980s, banking supervision has become more hands-off, leaving money creation to be guided primarily by the profit motive. The post-2008 macroprudential turn has led new concerns about cyclicality and environmental sustainability to once again inform banking governance (van ’t Klooster Reference van ’t Klooster2021; Thiemann Reference Thiemann2019). Effective monetary sovereignty depends on what states can actually achieve but is compatible with each of these objectives.

Since a state’s monetary jurisdiction and the monetary area often do not overlap, the ability of states to regulate banks is constrained by competitive dynamics and the prominence of cross-border transactions (Palan, Murphy, and Chavagneux Reference Palan, Murphy and Chavagneux2013; Zucman Reference Zucman2015). Offshore money constitutes a powerful challenge to the ability of states to achieve their economic policy objectives. The offshore space has become a venue not only to escape financial regulation but also to avoid taxes and to launder money. For states whose citizens and firms use such services, offshore finance undermines their monetary sovereignty (Binder Reference Binder2019).

To deal with these challenges, states coordinate their regulatory activities in global fora such as the G20, the Basel Committee on Banking Supervision, and the Financial Stability Board (Brummer Reference Brummer2015). While the coordination of banking regulation may involve giving up national discretion, it can improve the ability of the state to achieve the objectives of regulation. The same is true for giving up control over the regulation of cross-border financial flows (Dietsch Reference Dietsch2015). States that are not part of the exclusive fora of banking regulators are largely rule-takers (Jones Reference Jones2020). States who rely on finance provided outside its monetary jurisdiction lack the ability to apply its rules to begin with. Being integrated in such international regulatory bodies and influencing their policies increases a state’s effective monetary sovereignty.

The second way in which states exercise control over their banking system is through monetary policy. By changing the conditions under which banks have access to central bank credit, states have considerable sway over bank lending. The ways in which states have sought to steer the creation of private-public money within their monetary jurisdiction have varied considerably over time (Bindseil Reference Bindseil2004; van ’t Klooster and Fontan Reference van ’t Klooster and Fontan2020). In the 1990s, central banks converged on the use of short-term interest rates as the most important monetary policy tool. Banks’ reliance on central bank refinancing operations makes this tool particularly effective for the regulated banking system, even if its effects reverberate through the entire financial system. More recently, central banks have turned to a host of unconventional monetary policy tools, such as large-scale financial asset purchases (so-called Quantitative Easing), to influence non-bank segments of their financial system directly (Musthaq Reference Musthaq2021). Central bank swap lines are a starting point for more international coordination of monetary policy, which may help states regain effective monetary sovereignty vis-à-vis offshore money creation.

Effective monetary sovereignty in this field means having the ability to flexibly adapt the monetary policy strategy to a changing macro-financial environment. States that cannot use their monetary policy for these purposes, or whose banking system relies on a unit of account for which they do not control monetary policy to begin with, are limited in their monetary sovereignty.

Managing Private Money

Private moneys are monetary instruments whose issuers lack access to public backstops and usually fall outside the strict regulatory framework applied to banks. Although such issuers are subject to only modest regulation and are less responsive to monetary policy, states retain the ability to manage private money forms. Being able do so is today a crucial part of monetary sovereignty.

The normative assessment of the private money segment differs profoundly. From the perspective of critics, the emergence of new private money forms is an important driver of financial instability (Pistor Reference Pistor2017; Ricks Reference Ricks2016). During an extended economic upturn, the financial system will tend to issue new money forms that fund increasingly speculative investments (Kindleberger and Aliber Reference Kindleberger and Aliber2005; Minsky Reference Minsky2008). In a panic, financial markets lose confidence in these instruments, which often forces governments to integrate them into the private-public segment (Murau Reference Murau2017b). This means that the most aggressive private issuers acquire new on-balance-sheet credit money balances that public authorities are forced to guarantee. In this way, unregulated private money can undermine monetary sovereignty by forcing onto states unwanted monetary instruments.

A more optimistic perspective sees the private money segment as a legitimate source of funding for risky, potentially path-breaking investments and financial innovation. Historical experience shows that the prevalence of shadow money instruments in one form or another is a recurring byproduct of capitalist development (Schumpeter Reference Schumpeter1912). It is here where the largest fluctuations over the financial cycle take place, and where transformational changes of the financial and the real economy often materialize. As private money is often backed by sovereign debt it also facilitates states in funding their expenditures.

It is hard to determine ex ante which instruments are likely to develop into private money and what their connection to economic policy objectives will be. This poses a specific challenge to states for dealing with them. In the run up to the 2007–2008 financial crisis, various instruments of the shadow banking system—often termed “shadow money” (Pozsar Reference Pozsar2014)—became part of the private money supply. While the regulatory community initially perceived them as beneficial, they turned out to be an important driver of the crisis. The past years have seen a rampant proliferation of assets based on the blockchain technology. So far, as we saw, these instruments have as a rule failed to stabilize their value sufficiently to serve as money for a state-issued unit of account.

Accordingly, states face difficult choices in how to maintain their monetary sovereignty in the face of new private moneys (Hayes Reference Hayes2021; Murau Reference Murau2017a; Viñuela, Sapena, and Wandosell Reference Viñuela, Sapena and Wandosell2020). One policy is to pursue a ban of private money forms, forcing non-bank financial institutions to give up par clearance or prohibit their operations entirely (Bindseil, Papsdorf, and Schaaf Reference Bindseil, Papsdorf and Schaaf2022). Similarly, recent proposals for CDBCs are sometimes presented as a means to outcompete private cryptocurrencies (Brooks Reference Brooks2021). In contrast, a policy of accommodation provides private instruments with liquidity backstops on the central bank’s balance sheet or measures for solvency insurance. Instead of fighting back, states can also accept and even foster a purely private segment within their domestic monetary jurisdiction. Acknowledging is not the same as ignoring and involves monitoring risks and vulnerabilities emerging out of an expanding private money supply. Monetary sovereignty then manifests itself in a laissez-faire approach that leaves shadow money creation to itself. What is crucial from a perspective of effective sovereignty is that these choices are made in accordance with the state’s political procedures in ways that support its objectives.

Conclusion

We have proposed a conception of monetary sovereignty that fits the reality of today’s global credit money system. We propose thinking of monetary sovereignty as the ability of states to use tools for monetary governance to achieve their economic policy objectives. Monetary governance involves the control of pure public money, regulation of private-public money, and management of private money within the state’s monetary jurisdiction.

By rethinking monetary sovereignty, we address the four objections to the Westphalian conception that we outlined. First, where the Westphalian conception is focused on central banks issuing public money, effective monetary sovereignty emphasizes monetary governance across all three segments of the monetary system. Second, instead of the Westphalian vision of a monetary system of equal sovereign states, the effective conception focuses on what states can do. It thereby highlights the privilege of a few states and the woes of others. Through a detailed study of effective monetary sovereignty, we get a better understanding of how states are doing and what they might owe to each other. Third, as it does not privilege public money, the effective conception is able to acknowledge the complex trade-offs involved in membership in a monetary union. Finally, unlike the Westphalian conception, our approach does not prescribe any particular economic policy goals. For these reasons, the effective conception makes monetary sovereignty an adequate concept for reflecting on the state’s position in today’s global credit money system.

A reconsideration of monetary sovereignty should pave the way for more quantitative and qualitative enquiry into what states can effectively do in the face of financial globalization. This applies at least to three different avenues of future research.

First, we need a much better understanding of the real constraints that states face in governing money. The Westphalian world is one where sovereignty can be read off the legal competences of the state and the way these are constrained by international treaties. However, if monetary sovereignty is understood in terms of national currencies, then all states that issue and regulate one are equally sovereign. Conversely, if monetary sovereignty means having control over money creation within a territory, no state—not even the United States—has any monetary sovereignty to speak of. Our conception broadens the focus of how money shapes what states can do but understanding the constraints of states requires detailed economics and institutional analysis. Moving the focus to effective sovereignty helps make sense of crucial differences between Bangladesh, Denmark, and the United States, which are all monetary sovereigns in a Westphalian sense. It also raises new comparative questions about a country like the Netherlands that gave up its national currency but gained a prominent role in governing a global currency.

Second, rather than focusing on a status that states may or may not have, effective monetary sovereignty requires us to think about monetary governance and how it allows states to achieve their objectives. An adequate comparison of individual states requires considering all three segments of the domestic monetary system—how do cryptocurrencies and other shadow money forms constrain states? Due to the reality of offshore money creation, no state faces an easy choice between giving up fixed exchange rates or retaining an independent monetary policy. An individual state’s arrangement often cannot be chosen unilaterally: Global banking competition constrains the ability of states to effectively regulate their banking system, for which the Basel Committee and other transnational regulatory bodies provide only an imperfect fix. States in the periphery of the global credit money system often deal with a domestic economy where citizens save, borrow, and transact using a foreign unit of account. Going forward, states face the epochal challenge of decarbonizing their economy, while adapting their society to an increasingly derailed climate. Some states are better off than others but each state faces its own challenges. No state, not even the United States, has complete monetary sovereignty. To study monetary sovereignty empirically, research should not just consider legal constraints that result from other states and international treaties, but also those resulting from domestic institutions and market forces.

Finally, the study of effective monetary sovereignty raises new normative questions. Since states face trade-offs, determining what constitutes an increase in monetary sovereignty is in part a function of weighing policy priorities. The study of monetary sovereignty thus unavoidably confronts researchers with the question of what policies states should—and should be able to—pursue. Judgment comes in when drawing on that evidence to say that one state is better placed in the global credit money system than another. In this regard, the study of monetary sovereignty provides a more fine-grained account of how states are doing than a simple hierarchy of currencies. An obvious next step would be the design of a monetary sovereignty index.

Acknowledgments

Earlier versions of this article were presented at the 60th Annual Convention of the International Studies Association (ISA) in Toronto in March 2019 and at the Prospects of Money workshop at the Hamburger Institut für Sozialforschung in January 2020. The authors would like to thank all participants for their valuable feedback. Moreover, they are grateful to Benjamin Braun, Nik de Boer, Armin Haas, Elizaveta Kuznetsova, Perry Mehrling, Marco Meyer, John Morris, Fabian Pape, Eniola Soyemi, and Anahí Wiedenbrüg, who have read and commented on this article at various stages. Steffen Murau acknowledges funding from the German Academic Exchange Service (DAAD) and Deutsche Forschungsgemeinschaft (DFG), project number 415922179. Jens van ’t Klooster received support from the Dutch Research Council (NWO) under Grant 406.18.FT.014 and the Research Foundation–Flanders (FWO) under Grant 1227920N. The authors’ names are listed in alphabetical order.