1. INTRODUCTION

Spain has suffered from chronic budget deficits due to insufficient taxation brought about by opposition to fiscal reforms. To finance these deficits, the governments issued public debt and turned to the bankers. The poor reputation of the Spanish Treasury under the Ancien Régime for defaulting on loans continued through to the period of liberalism. During the first half of the 19th century, public debt prices plummeted to the level of junk bonds. Only bankers and speculators financed the State through advances that offered high returns, together with additional business granted by the Treasury. The wars exacerbated the budget deficits, hindering responsible debt management. The governments thus turned to more unconventional practices, such as fiscal dominance to ensure the banks’ voluntary cooperation in financing the State. When this was not enough, they resorted to financial repression, a standard practice during the 20th century, which compelled banks to underwrite public debt. These practices had a significant effect on monetary policy, banking operations and banking crises (Álvarez-Nogal and Comín Reference Alvarez-Nogal and Comín2015; Comín Reference Comín1988, Reference Comín2016). Fiscal dominance consisted of the successive implementation of banking legislation establishing the type of banks that could be created, permitted and compulsory operations for each type, as well as the configuration of the banking market, which determined the different forms of competition between the different institutions (different types of banks, savings banks, credit cooperatives, etc.)Footnote 1 . Until the financial deregulation of the 1970s, banking legislation limited business competition between the different types of banking institutions, although they engaged in fierce political rivalry in terms of influence peddling to sway legislative decisions in their favour and thus boost their share of the market.

Given the relative backwardness of its public financing and the financial system, a focus on the State-banks relationship in Spain can provide an interesting perspective on this relationship in other peripheral countriesFootnote 2 . The changing banking regulation reveals the conflicts of interest stemming from the twofold role — political and financial — of regulators, as well as the link between public and private financingFootnote 3 . In addition, the «deadly embrace» between the banks and the State helped to bring about twin crises in banking and public debt. Large amounts of public debt held by banks represented a twofold risk for the national economy, given that a sovereign debt crisis could result in failure of the banks, and any State bailout would be financed through the issuing of more debt, which would push its price down, thus worsening the market value of bank portfolios given that a substantial part consisted of government bonds.

The structure of the banking systems is more influenced at an institutional level than by market mechanisms (Calomiris and Haber Reference Cameron2014). In banking activities, political agreements have a greater impact on property rights than in other sectors. Regulation determines banking concentration (the type of market) and the way market failures, caused by information asymmetry and moral hazard, are resolved. In this regard, some authors point out that the more the funding of the Treasury depends on the banks (because the country has not implemented financial revolution or undertaken responsible management of the public debt), the greater the intervention of the banks in passing regulation favourable to the sector (Dickson Reference Dickson1967; Calomiris and Haber Reference Cameron2014; Dyson Reference Dyson2014; Hager Reference Hager2016). This perspective on banking regulation is in line with the theory of regulatory capture by the banks being regulatedFootnote 4 . The effect of public indebtedness on the banking sector is a global historical phenomenon, confirmed by the recent economic recession. Specialised literature has highlighted its effects in three areas: lending activities and the value and composition of bank assets; bank profit-and-loss statements; and the design of macro-prudential policies (Blundell-Wignall and Slovik Reference Blundell-Wignall and Slovik2011; Candelon and Palm Reference Candelon and Palm2010; Baldacci et al. Reference Baldacci, Gupta and Mulas-Granados2013; Bofondi et al. Reference Bofondi, Carpinelli and Sette2013).

The recent rise in sovereign risk in advanced economies has piqued the interest of economists, not only in the historical causes behind the public debt crises (Stasavage Reference Stasavage2003; Tomz Reference Tomz2007; Reinhart and Rogoff Reference Reinhart and Rogoff2009; Dincecco Reference Dincecco2011; Tunçer 2015), but also in the origin of the banking systems, particularly their institutional design. The formation and evolution of different financial systems has not occurred uniformly, rather their diversity stems from the institutional particularities of each countryFootnote 5 . The structure of the financial system is a result of political decisions concerning the banking sector, both public and private, associated with maintaining financial stability and with the emergence of new business opportunities. Recent literature has closely focussed on two issues: (1) the long-term relationship between public debt cycles and credit cycles; (2) the mechanisms for the transmission of effects and contagion between the two. The historical relationship between public-finance management and banking activities is therefore reflected in the historical evolution of public credit, the types of financial repression and the degree of similarity between the series of public debt and bank credit evolution (Toniolo and Ganugi Reference Toniolo and Ganugi.1992; Jordà et al. Reference Jordà, Schularick and Taylor2010, Reference Jordà, Schularick and Taylor2013; Reinhart and Rogoff Reference Reinhart and Rogoff2011; Reinhart and Sbrancia Reference Reinhart and Sbrancia2011; Reinhart et al. Reference Reinhart, Reinhart and Rogoff2012; Conti and Della Torre Reference Conti and Della Torre2015). On the one hand, Stasavage’s hypothesis holds that institutions are a necessary but not sufficient condition for responsible debt management and thus for preventing debt crises, calling into question the theory of Dincecco (Reference Dincecco2011), which is based on institutional changes (the establishment of parliament and national bank). On the other, Stasavage (Reference Stasavage2003) and Tomz (Reference Tomz2007) point out that responsible public debt management requires that debt holders control the government and parliament, or at least exert a strong influence upon them. But institutions alone cannot ensure responsible debt management, unless they are accompanied by political democratisation and historical, economic and ideological changes. Third, Reinhart and Rogoff (Reference Reinhart and Rogoff2009, pp. 73-75; 162-173) highlight three fiscal impacts of banking crises: the costs of bailing out banks, the shortfall in public revenues due to the financial and economic crisis, and the increase in public expenditure due to fiscal stimulus packages that increase the real debt stock, eventually producing a public debt crisis. Reinhart and Rogoff (Reference Reinhart and Rogoff2009, pp. 75-76; 118-136) also explain the relationship between bank activities and domestic public debt defaults caused by inflation resulting from budget-deficit monetisation. The institutionalisation of public debt (underwritten by banks), financial repression and inflation as a means of funding public finances have been studied by Conti and Della Torre (Reference Conti and Della Torre2015), Sbrancia (Reference Sbrancia2011) and Reinhart and Sbrancia (Reference Reinhart and Sbrancia2011).

This paper analyses the relationship between the banks and the State in contemporary Spain and the effects thereof. The foundations of that relationship were laid in the banking sector financing of the State, which is evaluated in terms of the proportion of public debt held by the banks and other credit institutions in their securities portfolios, along with the total outstanding public debt. The data shown provide new historical evidence of banking activities in addition to confirming the following initial hypotheses: First, that public and private banks held ample public debt portfolios on their balance sheets, showing themselves to be carrying the weight of the State funding. Second, public debt was, in general, profitable for the banking sector given that, in addition to the financial returns, the ties with the State that were built around the public debt gave bankers significant influence when it came to economic policy. This first section of the paper sets out the aims and the hypotheses. The second section analyses a new data series on the historical evolution of outstanding public debt and debt held by banks, demonstrating their ever more important role in State financing. The original data are provided in a Statistical Appendix at the end of the work. The third section concludes that one of the consequences of the State’s embracing of the banking sector in Spain was the connection between the sovereign debt and banking crises. The final section briefly sets out the conclusions.

2. BANKS’ PUBLIC DEBT PORTFOLIOS: A QUANTITATIVE INDICATOR OF THE INTENSITY OF THE «EMBRACE».

Data on the historical evolution of outstanding public debt and public debt held in the banks’ portfolios are analysed: on the one hand, in levels, measured in pesetas; and on the other, in relative terms, measured as outstanding public debt in relation to GDP, and the public debt held in the banks’ portfolios relative to all their other activities. Sections 2.1 and 2.2 provide graphical and statistical analysis of the data.

2.1 The Evolution of Outstanding Debt and the Debt Portfolio of Banks 1850-2015

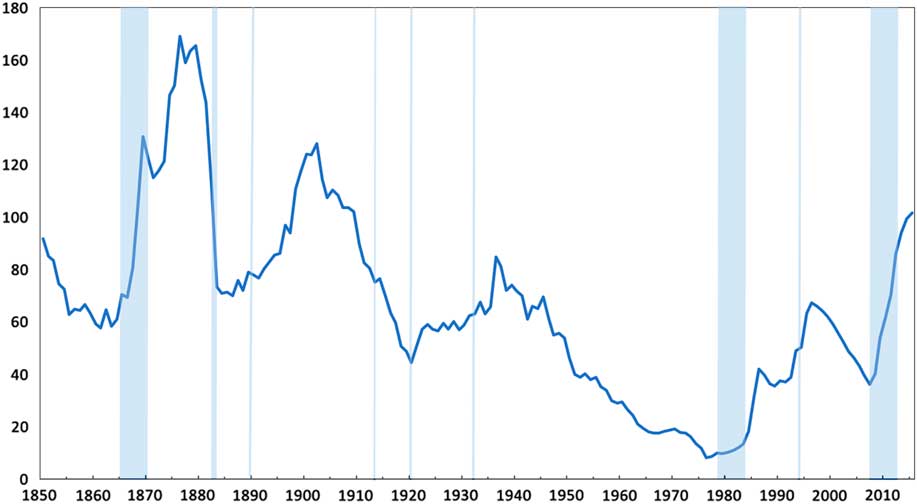

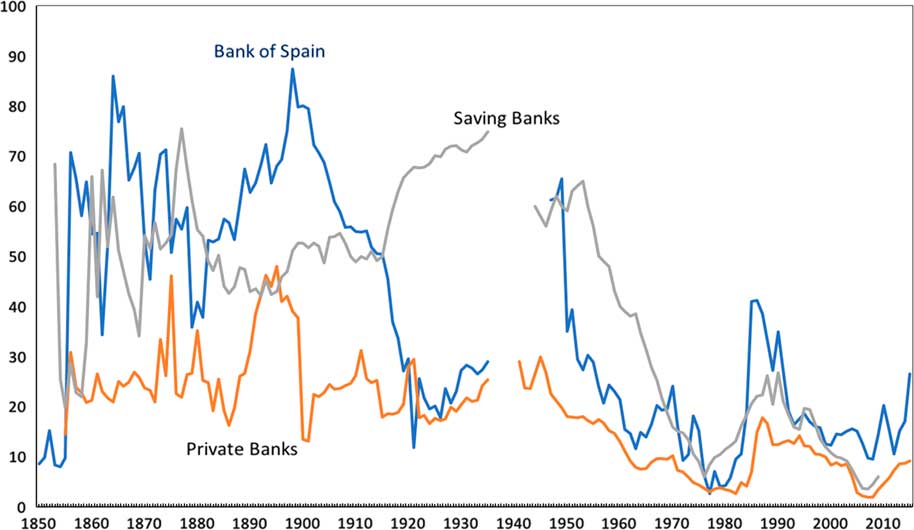

A comparison of the outstanding public debt-to-GDP ratio with the public debt banks portfolio as a percentage of total bank assets (Bank of Spain, private banks and savings banks) reveals two basic characteristics (Figures 1 and 2).

FIGURE 1 OUTSTANDING PUBLIC DEBT-TO-GDP RATIO (PERCENTAGES) Note: Shaded lines indicate banking crises. Source: Statistical Appendix.

FIGURE 2 PUBLIC DEBT BANKS’ PORTFOLIO AS A PERCENTAGE OF TOTAL BANKS ASSETS Source: Statistical Appendix.

First, in certain periods there are similarities between the evolution of the public debt-to-GDP ratio and the banks debt portfolio as a percentage of bank assets. On the one hand, certain public debt crises (maximum levels of the public debt-to-GDP ratio) coincided with the simultaneous peaks of the public debt portfolio as a share of total bank assets, particularly in the Bank of Spain and, to a lesser degree, in the rest. This occurred in the 1870s, 1890s, 1940s, 1980s and 2010s (Table 1). It is notable that in some years the maximum levels of the public debt portfolio of the Bank of Spain preceded the maximum levels of outstanding public debt, probably because the Bank of Spain portfolio includes advances to the Treasury, the fall of which were accompanied by increases in the amount of public debt issued to repay them. Another feature was the downward trend of both the public debt-to-GDP ratio and the public debt-to-bank assets ratio between 1940 and 1974. The first fell because of the lower budget deficits, once the effects of the Spanish Civil war had been overcome, but above all because of GDP growth and inflation. The fall of debt in banks portfolios was because the growth of banking activity surpassed the evolution of its investments in public debt. The final noteworthy feature is that in periods with an active public debt market, the public debt-to-GDP ratio greatly surpassed the public debt portfolio to total banks assets ratio (1850-1936 and 1990-2015), while, during periods of severe financial repression, when there was no free-trading public debt market, as was the case between 1940 and 1989, the two ratios were more similar.

TABLE 1 CORRELATION COEFFICIENTS BETWEEN OUTSTANDING PUBLIC DEBT AND PUBLIC DEBT HELD IN BANK PORTFOLIOS; (I) IN LEVELS (PESETAS) AND (II) IN RATIOS (DEBT/GDP AND PORTFOLIO DEBT/BANKING ASSETS)

Note: Table 1 shows two correlations: the first is the correlation between the level or volume of outstanding public debt and the public debt held by banks; and the second is the correlation between the public debt-to-GDP ratio and portfolio debt-to-banking assets ratio. The first is more appropriate since it indicates that when the outstanding debt grew, the debt held in the banks’ portfolio rose proportionately, which is why the correlations are so high. It is important to note that the correlation between levels is the one that is relevant to the initial hypothesis, which maintains that the banking sector was essential for the financing of budget deficits. As such, high levels of public debt were held by the banks, and this represented a high percentage of outstanding public debt. This implies that when the outstanding debt increased, the debt held by the banks also increased, resulting in a high correlation. This correlation in levels shows the high degree of institutionalisation of public debt in the banking sector. Another hypothesis is that when the banking system expanded, private banks and savings banks joined the business of public debt purchasing, thus leaving a less central role for the Bank of Spain. A secondary hypothesis is that when the ratio of public debt to GDP grew, so did the public debt held by banks as a percentage of their total assets. This last hypothesis is weaker, since GDP and banking assets are variables that have different determinants and are not directly related to the relationship between the state and the banks. The correlation between the ratios is smaller because it involves two more variables (GDP and banking assets) that are more independent of one other. However, by the time the banking system was well developed (with the Bank of Spain playing a less central role) a relationship between the growth of GDP and the increase in banking assets appears (it should be noted, though, that in the well-developed banking system this relationship is not likely to be proportional, because it is also affected by banking regulation). This dissonance is more evident for the 19th century because there was only one bank (the Bank of Spain) whose total assets and debt portfolio did not depend on GDP but rather on the decisions of the bank managers and the government. In addition, when comparing the public debt-to-GDP ratio and the banks debt portfolio as a percentage of bank assets, Table 1 shows negative values for two periods: 1870-1880, for the Bank of Spain; and 1940-1950, for Savings Banks. This is due to fluctuations in the Bank of Spain’s accounting in the 1870s following its acquisitions of regional issuing banks. The same happened with the savings banks during the 1940s, as their records were altered by the Spanish civil war.

1 1947-55.

Source: Statistical Appendix.

Second, public debt investment behaviour by the different banking institutions differed widely, depending on the regulations that ruled the different subsectors at that time. First, in the 19th century, the Bank of Spain was «the best friend of the government», given that the public assets (public debt bonds and advances to the Treasury) equated to between 40 per cent and 80 per cent of its total assets. The ratio of investment in public debt by the Bank of Spain varied greatly over the years. Initially, the ratio ranged widely between 8 per cent (1854) and 70 per cent (1857), due to the change of policy of the Governor of the bank: the obstructionist policy of Ramon Santillán at the Bank of Spain was followed by the unrestricted financing during the Bienio Progresista (Progressive Biennium, 1854-1856). Then, following a fall to 34 per cent (1862), the total loans of the Bank of Spain to the Treasury rose to 77 per cent of its total assets (1865) and then fell again to 71 per cent (1874). In general terms, between the 1850s and 1880s, there was a high correlation — 0.90 — between the public debt held in the Bank of Spain’s portfolio and the outstanding public debt. Conversely, the correlation was lower during the early years of the 20th century: between 1880 and 1920 it was 0.54, reaching 0.61 between 1880 and 1940. This decline in the correlation coefficient in the 20th century is partially explained by the fact that the proportion of Treasury liabilities in the Bank of Spain’s portfolio fell to 21 per cent in 1923, later recovering to 29 per cent in 1935. When the correlation is run between the public debt-to-GDP ratio and the banks’ debt portfolio as a percentage of bank assets, the results are quite similar: 0.45 for the period 1880-1920, and 0.66 for 1880-1940. The key was that the Bank of Spain left the business of financing the Spanish State to the private banks. Nevertheless, faced with the severe crises of the Spanish Treasury, the Bank of Spain returned to the role of the banker to the government: in 1949, as a result of the Spanish Civil War and the post-war years, the public debt to Bank of Spain asset ratio reached 60 per cent. With the struggles of the Franco Autarchy now behind it, the Bank of Spain handed over its public debt investment duties to the saving banks and private banks, who begrudgingly accepted their new role given the low bond returns. The difficulties of the Treasury in the transition to democracy compelled the government once again to turn to the Bank of Spain, which increased its public financing from 15 per cent to 41 per cent, between 1975 and 1986. In fact, in the second half of the 20th century, the correlation between the outstanding debt and that of the Bank of Spain rose to 0.83 for the years 1940-1975, and 0.89 for the period 1975-2015. This correlation coefficient reached 0.97 during the 1970-1980 fiscal crisis (see Table 1).

Second, the private banks’ investment in public debt was relatively homogeneous. During the 19th century, the banking and debt crises caused the investments in public debt by the issuing banks and credit societies to fluctuate greatly. Two critical stages particularly stand out. First, investments in public debt in relation to banks’ assets in the 1860s and 1870s (25per cent to 35 per cent of assets), peaking in 1874 (40 per cent to 45 per cent) and coinciding with the banking and sovereign crisesFootnote 6 . Although the banking data for these years are less robust than those for later years, it can be noted that the correlation coefficients between the debt held by private banks and the outstanding public debt were lower than those estimated for the Bank of Spain, namely 0.46 for the period 1850-1880. Second, in the sovereign debt crisis of 1895-1899, the banking sector took part in financing the war in Cuba, with maximum levels of the public debt-to-banks asset ratio reaching between 41 per cent and 48 per cent. Following these two difficult periods, investment in public debt by the banks fell to minimum levels. The first time, banking crises reduced the size of the banking sector and the purchase of public debt, with the ratio falling to 16 per cent in 1886. The second time, in 1902, the public debt-to-total banks asset ratio fell to 13 per cent, coinciding with changes to the Bank of SpainFootnote 7 .

In the 20th century, private banks maintained a public debt/total assets ratio below that of the previous century. During the critical stages of the Treasury, this ratio stood at around 30 per cent (1911, 1921, 1941 and 1945), less than those of the century before. With the rapid growth in private bank assets, their investment in public debt fell to lows of 16 per cent. Despite the growth of the public debt portfolio of private banks during the 1920s, in 1935, it stood at only 25.4 per cent of assets. In any case, the growth of the public portfolio of private banks was greater than that of its credits, and grew in parallel to the loans of the Bank of Spain to the public sector, although it never achieved the same ratio. Thus, the correlation between private bank holdings of public debt and outstanding public debt grew in the decades surrounding the turn of the 20th century: it was 0.42 in the period 1880-1920, reaching 0.87 in 1880-1940. That increase in the correlation coefficient was the result of the institutionalisation of the public debt in the banking sector during the 1920s and 1930s. Following the Spanish Civil War, the public debt maintained by private banks fell, in line with the ratios of the Bank of Spain and of Spanish savings banks, and with the public debt-to-GDP ratio. The elimination of the automatic pledging mechanism of the public debt and the rise of the banks compulsory investment ratio did not manage to slow down the fall of the debt-to-asset ratio, due to the greater growth of the bank balance sheets, reaching 7.6 per cent in 1965. It later rose again to 10.6 per cent in 1972, before falling even more sharply during the decline of the Franco regime with a low of 2.6 per cent in 1982. Between 1940 and 1975, the correlation coefficients between public debt held by private banks and outstanding public debt were 0.97 and 0.99, depending on whether the comparisons are made in pesetas or in ratios, respectively.

The financial system reforms of the 1970s affected the composition of bank portfolios. Until 1980, all debt portfolios of banks and savings banks continued to be for public financing (and eligible corporate securities in the Spanish savings banks). Conversely, since 1981, the issuing of monetary assets disrupted banks’ investment in public bonds. The relative position of the public debt portfolio once again began to rise, this time to 18 per cent in 1987 (correlation coefficient of 0.993 for the period 1977-1985). Since then, until the early part of the 21st century, private banks’ investment in public debt has fallen, equating to only 1.8 per cent of its assets in 2008. There are three main factors to explain this: the growth of financial business, leaning more towards loan investment, the entry of Spain into international financial markets, with the resulting placing of public bonds in the hands of non-residents and the financial disintermediation, which gave rise to a strong demand for public debt from mutual funds. Furthermore, the 1988 stock market reform was a strong incentive for the banking sector to purchase securities, which in turn led to increased activity in investment vehicles divested from the public sector. Nevertheless, because of the recent financial crisis, the involvement of banks in public debt investment has once again grown. Indeed, the fiscal and debt crisis saw an 8.5 per cent rise in public bonds investment by banks and Spanish savings banks in 2013. This increase in the debt portfolio of private banks and savings banks during the financial and fiscal crisis that began in 2008 shows the scope of State-banking sector embraces during the crises, as they are institutions that manage to maintain each other. Undoubtedly, the greatest risk from loans to the private sector during the crisis can explain the intake of public debt by the banks. But this was also influenced by the massive injection of liquidity to the banks by the European Central Bank (ECB). The relative decline that later occurred was compensated by increased financing by the Bank of Spain, which once again, through the ECB, returned to acquiring public debt, now through the secondary market (Figure 4).

Third, public debt investment by the Spanish savings banks was at the mercy of regulation, as they were always closely audited. To protect the savings of the popular classes, initially in the 1833 Savings Banks Decree, savings banks were forbidden by the liberal governments from investing in public debt. Following the public debt restructuring by Bravo Murillo, Ministry of Finance (1851), in the 19th century, savings banks maintained greater sovereign debt investment in relation to their assets compared to private banks, except during the public debt crises (the Progressive Biennium, 1854-1856, Democratic Sexennium, 1868-1874 and the war in Cuba, 1895-1898). Prior to the 1851 debt rescheduling, Spanish public debt had been a high-risk asset. Between 1851 and 1854, Spanish savings banks held on to a small percentage of public debt (between 15 per cent and 25 per cent of their assets). The creation of the Caja General de Depósitos or CGD (General Government Depository) (Titos Reference Titos1979; Gonzalo Reference Gonzalo1981) caused this figure to rise to 65 per cent in 1859. It then fell to 34 per cent in 1866, due to the economic crisis and the shutting down of the CGD. There is no robust data available for the savings banks at that time, which explains the low correlation coefficient between the public debt-to-GDP ratio and the saving banks’ debt portfolio-to-assets ratio: 0.47 for the period 1850-1880. The public debt held by the Spanish savings banks reached an historic high of 75 per cent in 1877, due to the fiscal crisis of the State and the solution arrived at for the CGD deposits, which were exchanged for debt. After falling to 40 per cent, the public debt-to-asset ratio of the savings banks stood at over 50 per cent between 1898 and 1907 due to the war in Cuba. Furthermore, the savings banks were more interested in accumulating public securities over this period because the Montes de Piedad had stopped channelling most of their acquired savings and had diversified their investments, especially in debt, which was already much less risky. Since 1915, savings bank investment in public debt increased much quicker than the deposits of its clients, reaching a public debt-to-asset ratio of 67 per cent in 1918, rising to 75 per cent in 1935. Prior to 1929, investments by savings banks were voluntary and were affected by the aversion to risk of their senior executives. And the financial repression of the Savings Bank Statutes was unnecessary at that time, because the compulsory investment ratio was lower. In any case, in the first third of the 20th century, savings banks investments in public debt in relation to total assets rose more when compared to private banks (Titos Reference Titos1991; Martínez-Soto Reference Martínez-Soto2000; Martínez-Soto and Cuevas Reference Martínez-Soto and Cuevas2004; Comín Reference Comín2007, Reference Comín2008, Reference Comín2011). The result of these increasing public debt investments was higher correlation coefficients between the public debt and the debt held by the savings banks: 0.91 for the period 1880-1940, and 0.93 for 1920-1940.

In the post-war period, the debt-to-asset ratio of savings banks fell to 60 per cent in 1944. Although it rose again to 65 per cent 1953, as of this year, the ratio began its protracted decline to 6 per cent in 1976. The fall was in line with the Bank of Spain ratio but more pronounced than that of the private banks, which fell to 3.7 per cent in 1976, but which started at much lower initial levels. Savings banks invested a greater share of their assets than the Bank of Spain and private banks, due to the peculiarities of the regulations that governed them. This fall was due to the large rise of assets of the savings banks and the insufficient issuing of public debt-to-cover the compulsory investment ratios, which had to be covered by eligible securities from public and private corporations. In addition to the acquisition of public debt, were the other enforced investments due to the investment ratio of savings banks in eligible private securities in enforced loans to the agricultural sector and othersFootnote 8 . As was the case with private banks, the correlation coefficients for the years 1940-1975 rose to 0.84 and 0.98, depending on whether the comparisons are made in terms of ratios (GDP and saving banks’ assets) or absolute values (in pesetas), respectively.

Following the financial deregulation in 1976 and the operational alignment of the savings banks and private banks in 1977, the public debt-to-asset ratio of the savings banks progressed at the same rate as that of the banking sector, just a few percentage points higher with a figure of 26.2 per cent in the savings banks and 16.5 per cent in the private banks in 1988. Only in 1990 did we begin to see this gap between them decrease and in 2007, it reached its lowest levels with 3.5 per cent in savings banks, 2.0 per cent in private banks. The greater management autonomy after the 1988 LORCA (Organic Law for the Regulation of Savings Banks) enabled Spanish savings banks in the 1990s to increase their share of public sector financing. This marked an historic change if you compare it to the interventionism of the sector since 1853.

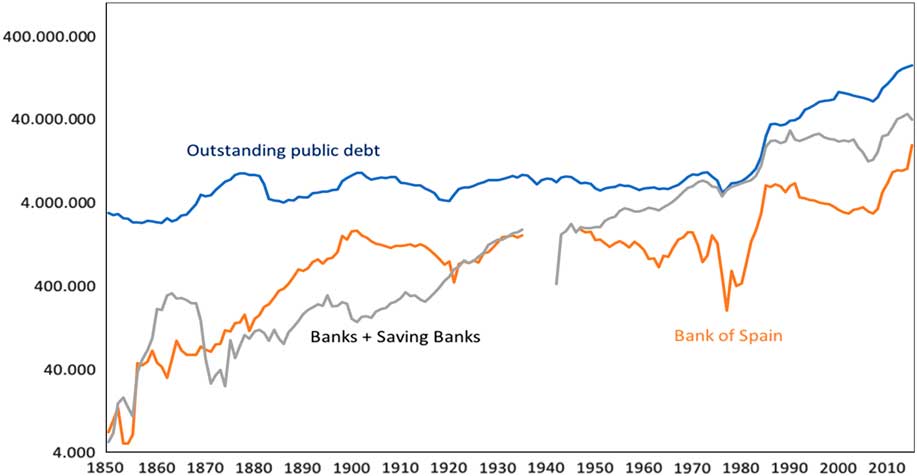

2.2 Banks, the Primary Holders of Public Debt

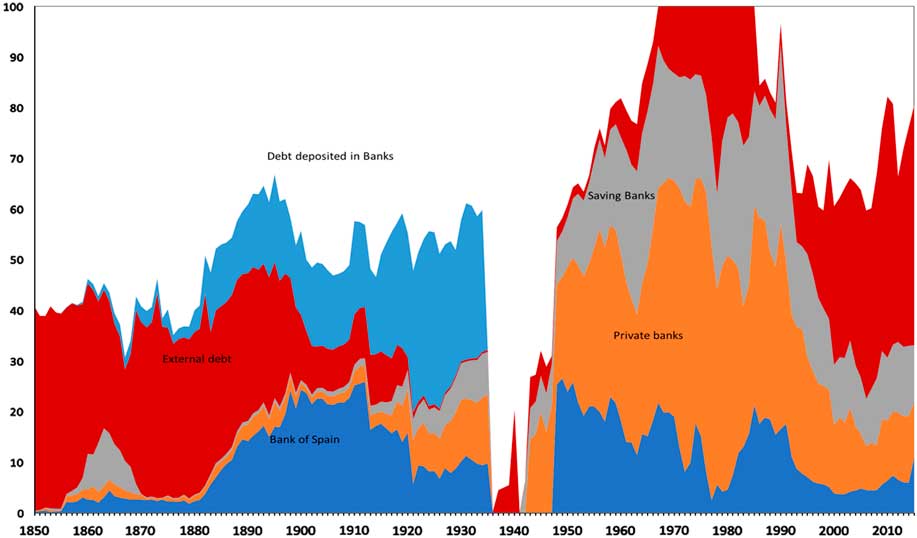

The ownership structure of outstanding public debt confirms that the banking system (savings banks and banks combined) together with the Bank of Spain were the primary holders (Figures 3 and 4)Footnote 9 . Although the relative importance of private and public banks changed over the years, the important point was that the combined contribution of the banking system increased. In the long term, there is very high correlation between outstanding public debt and that held by the Bank of Spain, and also between public debt and that held by the rest of the banking system (private banks and savings banks): 0.93 and 0.97, respectively, for the whole period, 1850-2015.

FIGURE 3 OUTSTANDING PUBLIC DEBT AND PUBLIC DEBT HELD IN BANKS’ PORTFOLIOS (MILLIONS CONSTANT PESETAS 2008) Source: Statistical Appendix.

FIGURE 4 STRUCTURE OF PUBLIC DEBT HOLDERS (AS A PERCENTAGE OF OUTSTANDING PUBLIC DEBT) Source: Statistical Appendix.

First, the embrace of the State with public banking was more pronounced between 1850 and 1921, while after 1940 private banks and savings banks played the role of primary banker of the Treasury. In fact, the Bank of Spain was the largest lender to the State between 1874 and 1920. Indeed, during the 19th century, private banks only surpassed the contribution of the Bank of Spain to financing the Treasury during the brief period when the CGD was operational. During the inter-war period, private banks and savings banks jointly conceded a similar volume of debt to the Treasury as that of the central bank. Finally, after 1940, the Bank of Spain never surpassed the holdings of public debt by private banks even though in the Spanish fiscal crises (1937-1940, 1977-1985 and 2007-2015), the former increased its portfolio of public assets more than the latter.

Second, the amount of financing regularly provided to the Treasury by the banking system varied, and can be divided into four periods that are marked by two major cycles. The first stage of the first cycle was in the 19th century, all the way up to 1887, when the overall public debt held in bank portfolios did not surpass the 16 per cent threshold; not even in the years when the CGD was operational. This can primarily be explained by the underdevelopment of the banking system. Furthermore, institutional financing came from the national and/or official (Banco de San Fernando and later the Bank of Spain) and from the CGD. The second stage was between 1888 and 1935, when public debt held by the banks was between 16 per cent and 32 per cent. During both periods, the remainder of state financing, therefore, had to come, on the one hand, from foreign investors, and on the other, from Spanish merchants, bankers and savers.

Indeed, on the one hand, external public debt was important and was in the hands of foreign holders, until after 1883, when Spanish investors began to acquire it. Figure 4 shows the importance of external debt during the second half of the 19th century, with levels fluctuating depending on the measures implemented by the different Spanish Ministers of Finance, to such an extent that between 1850 and 1867, external debt had fallen from 40 per cent to just 18 per cent of the total; then, between 1868 and 1874, it reached its highest levels of 40.4 per cent. Its final fall, between 1883 and 1898, can be explained by the fact that foreign investors went through the sharp depreciation of the peseta, not linked to the gold standard, and that foreign bankers channelled their investments towards different countries and different business sectors. This lack of interest of foreign capital in acquiring Spanish assets — foreign investment at the start of the 20th century was mainly for municipal public services — meant that no more external debt was issued, reducing its overall percentage. Since 1883, external debt fell into Spanish hands, given that Spanish business owners purchased it to fend off the effects of the depreciation of the peseta. The affidavit by Villaverde and the repurchasing of external debt by Spanish investors using foreign currency acquired in the First World War, reduced external debt to levels of under 1 per cent by around 1920.

Furthermore, given that the combined public debt held by formal banking institutions and foreign holders totalled between 40 per cent and 50 per cent of outstanding public debt during the second half of the 19th century, the rest of the public debt had to have been in the hands of Spanish private individuals, merchants, bankers, insurance companies, non-banking corporations, town and city halls, and other charitiesFootnote 10 . One part of this public debt held by private individuals and non-financial institutions had to be deposited in the private banks, which, second only to the Bank of Spain, as of 1860 provided a new function, namely the custody and safeguard of private clients’ securities; logically, they were entered as off-balance sheet itemsFootnote 11 . In this way, banking institutions acted as indirect participants albeit actively involved in the stock market through the operations involving listed securitiesFootnote 12 . Given the narrowness of the stock market between 1829 and 1987, the role of the bank in the issuance and underwriting of government and corporate industrial bonds had to have been very significantFootnote 13 . The public debt deposited in private banksFootnote 14 experienced steady growth between 1880 and 1930, thanks to the expansion in both size and territory of private banks.

During the second cycle (starting in 1948) of note within the structure of the debt holders, as maintained earlier, was the predominance of the bank financing of the State during the Franco regime and the democracy. This cycle began with the third period, between 1948 and 1995, when the public debt in the hands of the banking sector surpassed the 50 per cent mark, reaching maximum levels of 92 per cent in both 1967 and 1990. If external public debt is added into the equation, between 1967 and 1990, banks and international organisations practically made up 100 per cent of the financing of the Spanish State. Following the Spanish Civil War, the constitution of the securities portfolios (public and private) was one of the most complicated and urgent tasks of banking industry. The explanation was simple. Banks had to juggle the regulatory constraints with the search for profitable and secure investment in an economic climate marked by the scarce demand for private credit, and this only began to change in the 1960s. Furthermore, the public debt portfolio contributed a significant part of the operating profits of private banks. This context conditioned the policy of each private bank when it came to pledging part of the public debt in its portfolio in the bank of Spain in order to get liquidity to increase its credit to the general public. The tendency continued to grow between 1945 and 1958: as a consequence, the monetised debt to outstanding debt ratio rose from 3.7 per cent to 23 per cent. The consequence was that if in 1941 private banks held 26 per cent of outstanding public debt, it rose to 31 per cent in 1955 and 35 per cent in 1959. As for the savings banks, in 1961 they held more than 46 billion pesetas of public funds and large quantities of quality industrial stock, which meant that the savings banks absorbed 46 per cent of the public debt issued in 1959, rising to 65.5 per cent by 1960, but only 3.2 per cent of the total amount of the public funds portfolio was pledgeable debt.

Although as of 1991, the amount of public debt in the hands of the banks fell, the fourth period began in 2000, when public debt held by the banks normally stood at over 30 per cent, with a minimum of 22.5 per cent in 2006. If we then add the public debt held for non-residents to the banks, combined they represented between 60 per cent and 80 per cent of the total outstanding public debt as of 2000. The entry of Spain into the European Economic Community, the European Monetary System, and lastly the Eurozone had a decisive effect on the Spanish public debt responsible management and in the setting up of a modern public debt market. All this attracted the new institutional investors on Spanish public debt such as investment funds, in addition to non-resident investors. On the one hand, as of 1995, Spanish credit institutions earnestly began to lose their market share of public debt due to the growth of the investment funds, which increased their participation, rising from 11 per cent to 28 per cent of outstanding public debt. Furthermore, after 1999, and coinciding with the entry of the single currency, non-residents entered the Spanish government debt market, holding 40 per cent of outstanding debt by 2001. In the 21st century, therefore, the structure of the holders of Spanish public debt was close to meeting the aims of the Treasury: non-resident investors (39.4 per cent), credit institutions, savings banks and banks (37.7 per cent) and the remainder to national non-financial investors.

3. CONSEQUENCES OF THE DEADLY EMBRACE: THE CONNECTION BETWEEN PUBLIC DEBT AND BANKING CRISES

The financial crises in contemporary Spain followed the same international trends as far as characteristics, timelines and frequency are concernedFootnote 15 . Most banking crises were fragmentary, with systematic crises occurring much less frequently. At the heart of them all, however, was a combination of three different factors: poor bank management, misconceived regulations and their coinciding with economic downturns, which damaged the bank balance sheets (Martín-Aceña Reference Martín-Aceña2013; Martín-Aceña and Nogues-Marco Reference Martín-Aceña, Martínez-Ruiz and Pons2013). The public debt crises in Spain also followed international trends, although they occurred more frequently, and had two primary causes in the following two cycles: first, the funding of wars and fiscal imprudence between 1783 and the Franco regime; second, the development and the policies of the Welfare State during the two economic downturns of the new democracy (Comín Reference Comín2013, Reference Comín2016). The findings of this paper enable us to argue that there is a certain link between banking crises and public debt crises due to the abundant and continued funding by the banking sector to offset the government budget deficits. This banking sector-State connection explains the subsequent regulations that led to the creation of a fragile banking system that was prone to fiscal, financial and economic crisesFootnote 16 . Conclusions concerning connections between fiscal and banking crises can be grouped into different phases (Table 2).

TABLE 2 MAIN BANKING AND DEBT CRISES IN SPAIN, 19TH TO 21ST CENTURIES

Source: Comín (Reference Comín2013, Reference Comín2016) for debt crisis, and Martín-Aceña (Reference Martín-Aceña2013), Betrán et al. (Reference Betran, Martin-Aceña and Pons2012) and Sudrià (Reference Sudrià2014) for banking crisis.

The first phase, between 1780 and 1848, coincided with the bankruptcy of the Ancien Régime and the crises of the first banks (national and private): The Banco Nacional de San Carlos and the Banco de Isabel II, which were bailed out, absorbed and merged with the Banco Español de San Fernando. The 1856 banking law favoured the growth of private commercial, issuing and investment banks to finance the railways; despite not being part of their social agenda, these banks acquired a certain amount of public debt and their patrons provided major loans to the State; explicitly to ensure that new regulation favoured their banking and railway deals. The excessive risk of these deals led to the very first systemic crisis of the Spanish banking sector, while still in its very early days (Tortella Reference Tortella1973; Martín-Aceña Reference Martín-Aceña2013, p. 111; Martín-Aceña and Nogues-Marco Reference Martín-Aceña, Martínez-Ruiz and Pons2013; Tedde Reference Tedde2015; Sudrià and Blasco Reference Sudria and Blasco2016). The origins of this crisis stem from the economic crisis of 1864, which also affected government finance, and led to a public debt crisis. This banking crisis was not directly caused by the public debt crisis, as the bank debt portfolios were small. But public indebtedness was the underlying cause of the rapid systemic crisis of a very fragile banking system that had been regulated by the government and tailored to the specific interests of international financiers. These provided large loans to bail out the Treasury during the Progressive Biennium crisis in exchange for favourable railways and banking laws, but this was not in line with the broader national interests. Savings banks did not find themselves dragged into the public debt crises because they were not subject to the 1853 Decree that compelled savings banks to finance the deficit through the CGD.

During the second period, between 1882 and 1931, the cause of the banking crises can be put down to financial factors (instability of both domestic and international markets and risky banking operations), rather than to the public debt crisis. The main reason was that there had not been any suspension of payments by the Treasury, that last one having taken place between 1872 and 1874. The public debt crises during this period were swiftly resolved through the restructurings implemented successively by Camacho and then Fernández-Villaverde. Furthermore, the public debt portfolios of the private and savings banks were still hardly substantial, although these did increase between 1874 and 1935. Additionally, this period saw the groundwork of a solid association between the interests of banks and the interests of the central government finance through pledgeable debt, which benefitted both parties. Common interests were institutionalised by the 1921 Banking Act and the 1929 Savings Banks Charter (Estatuto del Ahorro). In other words, the embrace between banks and the State was brokered by the Bank of Spain. In addition to this function which favoured private banks and the Treasury, the Bank of Spain began to operate as a central bank, because of the 1921 Banking Law and of the 1913, 1914 and 1920 banking crises (the Hispano, Crédito de la Unión Minera and Barcelona banks) (Martín-Aceña Reference Martin-Aceña2001, Reference Martín-Aceña2013).

In the third period, 1936-1975, banking regulations under the governments of Franco regime included financial repression which, despite its name, did not harm the established banks, although by comparison it was detrimental to the savings banks, especially up to 1957Footnote 17 . The fiscal and banking policy of Franco managed to prevent banking crises (except for the Banco de Credito Industrial and the Matesa scandal) and public debt crises from occurring. On the one hand, interventionist regulation and financial repression greatly disrupted the banking market by abolishing the legal measures for competition between banking institutions (interest rates, the type of assets and liabilities available, the concession of banking certificates and the opening of new branches were all determined by the government)Footnote 18 . The banking system underwent a remarkable growth without banking crises because the statutory assets and liabilities interest rates provided a safe net interest margin and the government control of setting up new banks and the opening of new offices or branches greatly benefitted the well-established banks, rather more so than it did the savings banks. This state protection enabled the financial sector to prosper with no apparent crises, but under greenhouse conditions. But the downside of maintaining banking stability was, in many cases, ineffective bank management, and unorthodox (influence peddling) and illegal (bonus interest rates)Footnote 19 banking practices. Furthermore, the control of budget deficit mitigated the growth of public debt, whose size relative to GDP fell due to inflation and economic growth. Nevertheless, the collaboration between banks and State to finance the Development Plans (Planes de Desarrollo) using extra-budgetary mechanisms and financial repression certainly put an end to the public debt market, which at that time was practically non-existent.

During the fourth period, 1977-2015, Spain had to deal with a couple of twin crises: public debt and banking. The first twin crisis occurred during the transition to democracy: the 1977-1987 fiscal and public debt crisis coincided with the severe banking crisis of 1978-1985. In other words, the complementary financial system and State financing reforms were carried out in parallel, given that banks and the State had been part of the same economic policy framework under Franco. Nevertheless, exposure once again of the banks and the State funding to the markets marked a return to the fiscal and banking crises.

The banking and public debt crises were certainly triggered by the change in economic policy with the arrival of democracy: the financial deregulation and the attempt to finance the state in the market. But evidence that the ultimate cause of both crises was the burdensome legacy of the dictatorshipFootnote 20 has been underestimated. On the one hand, a very fragile banking system, part of which was unable to stand up to the banking competition amid an economic crisis. In other words, the financial deregulation initiated in 1977 triggered a financial crisis due to the fragile nature of the banking system created under Franco regime. Furthermore, it was a state financing system founded on financial repression and inflation, which together had destroyed the bond market. Indeed, the transition governments attempted to dismantle the financial-intervention mechanisms of Franco regime and the forced financing of the State as of 1977, but they were unable to do so immediately for two reasons. First, Spain did not have the necessary financial policy instruments in place to be able to deal with deregulation and the crisis. Second, the structural shortcomings inherited from the Franco regime were exacerbated by social unrest, the economic crisis, political uncertainty and the emergence of the Welfare State, which impaired bank performance and caused budget deficits to rise.

The democratic governments who decided to do away with the financial repression of Franquismo found themselves unable to finance the State in the market, despite the public debt-to-GDP ratio being at an all-time low. Democracy had to weather the financial exclusion of the State (the worst debt crisis): there was no government debt market, with no individuals or corporations willing to finance the State. Said inability to finance the State in the market explains why financial deregulation was postponed, to continue using the advances of the Bank of Spain and financial repression (Argandoña Reference Argandoña1987; Rojo Reference Rojo2002; Poveda Reference Poveda2011). The solving of this banking and economic crisis entailed, among other things, an increase in outstanding public debtFootnote 21 , further strengthening the twin crises. The delay until 1994 of a responsible public debt-management policy stemmed from the need for budget deficit financing, which was imposed on the monetary policy. The presence of fiscal measures within monetary policy continued until the convergence with the euro and the autonomy of the Bank of Spain in 1994.

The second twin crisis of Spanish democracy was triggered by the deep recession that began in 2008. The international financial crisis left the banks bereft of liquid assets, so they in turn had to restrict lending, bringing about the building crisis and the economic downturn, which led to the fall in income and a rise in unemployment. This worsened the accounts of the banks and the State. On the one hand, banks found themselves faced with a rising bad debt index, as well as a depreciating public debt portfolio. Although the 2009-2012 financial crisis, with savings banks at the forefront, but nevertheless administered and induced by the regional governments, which were bailed out by the FROB (Fund for Orderly Bank Restructuring), the whole banking sector was hit by the mortgage crisis and this led to the creation of the SAREB (Asset Management Company for Assets Arising Bank Restructuring) to clean up bank balance sheets (Maudos Reference Maudos2011; Martín-Aceña, et al. Reference Martin-Aceña and Titos2013). The State stepped in to rescue the banking institutions, issuing more debt at a time when large budget deficits stemming from the unemployment and economic crisis called for the large-scale issuing of public debt. This coincided with the onset of the public debt crisis in the Eurozone, which led to the flight of non-resident investors from Spain (Comín Reference Comín2016, pp. 297-309). On this occasion, the bank-State embrace manifested itself once again as of 2012, when the ECB provided liquidity to Spanish banks, which was used to acquire more Spanish public debt. In 2015, the ECB launched its monetary quantitative easing (QE) policy, buying up public debt in the market through the national banks. This meant that the Bank of Spain returned to financing the Spanish government, tightening the embrace. This embrace could be deadly if the ECB stopped buying up public debt, which could lead to a debt crisis, and would bring down the value of the bank portfolios, resulting in bankruptcy. This would compel the State to intervene, rescuing the banks but resulting in another series of successive debt crises.

4. Conclusions

This paper has analysed the relationship between banks and the state over the long run, quantified by the public debt portfolios of the lending institutions. Bank investment in public debt was governed by the financial regulations conceived by the different governments and regimes, regarding both the legislation that configured the banking system, and the rules that regulated the purchase (voluntarily or not) of public debt by banks. From these relationships, we have been able to establish a connection between banking and fiscal crises over said period. We have determined three periods of this bank-State financial relationship.

The first period (1783-1874) starts with the creation of the Banco Nacional de San Carlos to provide financial support to the government, and finishes with the concession of the monopoly to the Bank of Spain in 1874 on issuing banknotes. During this «learning» stage, State financing primarily came from national banks, private individuals and foreign investors. The debt portfolio jointly maintained by the private and savings banks was reduced. Within the same period, the Spanish national bank (which changed its name over the years: Banco Nacional de San Carlos, Banco Español de San Fernando and finally Banco de España) had the role of primary financier of the State, especially in periods of fiscal crisis, when there were no other lending institutions available to it; when the Spanish national bank was reluctant to collaborate after 1853, the Finance Ministers resorted to the CGD. These official banks, primarily comprising private capital, were afforded certain privileges in exchange for providing the State with advances and accepting certain statutes to regulate their activity. Conversely, private banks (issuing banks and investment banks) carried out a secondary role in State financing, due to their late development and banking regulation that directed their investments towards other sectors. This period is in keeping with Calomiris and Haber (Reference Cameron2014): the two features of the fragile debt-dependent banking systems created by the States are precisely their contribution to State financing and their insufficient provision of credit to the private sector.

In the second period (1875-1936), the embrace between private banks, savings banks and the State tightened through public debt. The predominance of the Bank of Spain in financial operations with the State continued but gradually declined. The reason was the growth of the private banks sector and the change of role of the Bank of Spain, from a direct financier of the State to a broker for private banks in negotiating the issues and subscriptions of public debt, especially following the passing of the 1921 Banking Act. As investing in public debt was profitable for private banks, their growth bolstered their demands for a greater involvement in this business. This combined well with the willingness of the Ministers of Finance to broaden their financial bases taking full advantage of the growing strength of the resources of private banks, directly negotiating the debt issues with these entities.

During the third period, the Franco regime tightened the embrace between the public sector and the banks. Extreme financial repression converted the banking system into the main provider of funds to the State. Between 1942 and 1995, the banking system held in its portfolio between 50 per cent and 92 per cent of public debt. The remainder was contributed by international organisations. During this period, there were practically no non-financial investors in public debt, neither from Spain nor from abroad. The governments of Franco turned to the banks to finance the post-civil war autarchic industrialisation and then as of 1964, the development and growth programme. Unable to turn to the equity markets, the Franco regime designed a financial repression framework to channel savings towards investments targeted by the government. In return, banks could maintain the status quo and avoid competition from the banking sector, which had practically been eliminated by the State. The interventionism of the Franco regime resulted in an inefficient and very fragile banking system, as could be seen when banking regulation changed under the new democracy.

The deregulation of the financial sector between 1976 and 1992 provided banks and savings banks with greater financial freedom. Implemented during an economic depression, deregulation caused a severe banking crisis in 1977-1985, the worst to occur in the 20th century. Furthermore, the financial exclusion experienced by the State given that nobody willingly acquired public debt, led to an institutional debt crisis, which forced the governments under the new democracy to return to the financial practices of the Franco regime. The lack of a debt market forced governments to continue to resort to the Bank of Spain and financial repression, now in the form of monetary assets brought to the banks.

Lastly, responsible debt management began to gain ground as of 1987, dispensing with financial repression, relaxing the enforced embrace between the banking sector and the State. This was reflected, as can be seen, in the relative decline of public debt held by the banks, although it continued to be one of its primary investments. The financial and debt-management reforms were parallel and complementary. The obstacles encountered prevented their consolidation until 1994, following entry into the European Monetary Union, the free movement of capital and the setting up of the European Union banks in 1992, and the monetary convergence of the Maastricht Treaty. Autonomous monetary policy was only achieved in 1994, with the granting of independence to the Bank of Spain, after the Spanish government decided to implement responsible fiscal management to join the euro.

For Spain, Europe was the solution. Entry into the European Monetary Sistem broke the long tradition of financing public debt outside the market, with two mechanisms: increasing the monetary base by the Bank of Spain, and the provision of public debt to the banks with low interest rates, thanks to the compulsory investment ratios. The gradual reduction in such compulsory ratios until their disappearance in 1992 enabled banking institutions to allocate resources, up to that time in the form of sovereign debt to other type of investments, particularly loans. This represented a milestone in monetary policy given that by lowering the reserve requirement to its technical level, meant it only had its benchmark interest rate as its instrumental variable. Since then, effective monetary policy has prevailed in financing fiscal policy, borrowing from the Bank of Spain and quantitative restrictions imposed on the finance sector. This put an end, therefore, to repressive practices and saw the start of State financing through the issuing of public debt negotiated under market conditions. That is, until the current debt crisis when the ECB began to use a new kind of financial repression; first, by offering practically free liquidity to the banks, which they then used to buy up public debt, and then through QE, which means purchasing of national public debt through the Eurosystem banks. This explains the rapid increase in the public debt held by the Bank of Spain.

SUPPLEMENTARY MATERIAL

To view supplementary material for this article, please visit https://doi.org/10.1017/S0212610917000106