Introduction

Businesses, governments and individuals are increasingly recognizing the urgency of climate change, leading to a growing net-zero ‘club’ of countries (e.g., UK 2021) and companies (e.g., BP 2020). Financial regulators are also discussing how to drive the transition to net-zero financial systems (NGFS 2021, UNFCCC 2021).

Pathways to net-zero require a portfolio of technologies, ranging from established (e.g., renewables), to emerging (e.g., inert anodes for aluminium), to negative-emission technologies such as afforestation and reforestation. Emerging technologies are needed to decarbonize heavy industrial sectors such as cement and steel, which generate nearly 20% of global emissions (de Pee et al. Reference de Pee, Pinner, Roelofsen, Somers, Speelman and Witteveen2018), yet few are available at commercial scale. This implies that such industries will need to use offsets: credits for sequestering carbon or reducing emissions. Amongst offsets, forestry activities are perhaps the most mature and readily available, with activities such as afforestation and avoided deforestation historically being regarded as viable and cost-effective options to address climate change (Eliasch Reference Eliasch2012).

This drive to net-zero, along with the large sums of money being mandated to meet the challenge, brings increased attention to offset markets. In 2020, the Taskforce on Scaling Voluntary Carbon Markets (TSVCM) released recommendations to improve the voluntary carbon trade based on a projected 15-fold scale-up in offsetting by 2030 (TSVCM 2020). However, the history of the voluntary market, inclusive of the market for forestry-related offsets via Reducing Emissions from Deforestation and Forest Degradation (REDD+), has been beset by limiting issues regarding transparency, additionality, permanence and credibility. REDD+ developed out of a contextual underpinning of payment for ecosystem services (PES) schemes that have increased in scale and scope worldwide in recent years (Ferraro Reference Ferraro2011, Kaczan et al. Reference Kaczan, Pfaff, Rodriguez and Shapiro-Garza2017). Many issues that have affected REDD+ also impact PES schemes – and indeed REDD+ could be conceived as a special type of PES scheme.

Into this mix has come an acceleration of digital technologies (McKinsey 2020), including artificial intelligence (AI), Big Data and blockchain, with the latter mushrooming in the financial services, supply-chain management (BiTA 2017) and proxy voting and elections (Broadbridge 2018). Notably, blockchain has also started to enter the climate change space, especially in the integration of renewable energy into grids (IRENA 2019), with its applications being proposed for international climate policy (Reinsberg Reference Reinsberg2021), carbon markets and offsets (Chen Reference Chen2018, Howson Reference Howson2019, Hartmann & Thomas Reference Hartmann and Thomas2020) and REDD+ (Howson et al. Reference Howson, Oakes, Baynham-Herd and Swords2019).

The advantages of the use of digital technologies are potentially multifaceted. In the context of the use of blockchain for foreign aid, Reinsberg (Reference Reinsberg2019) identified the twin benefits of validating transactions and transparency. For international climate policy, Reinsberg (Reference Reinsberg2021) highlighted areas in which blockchain could contribute via the provision of new information through blockchain prediction markets, by eliminating coordination problems between actors and via the guaranteed execution of smart contracts. We focus on the potential for blockchain to increase transparency, provide automatic validation and reduce transaction costs between buyers and sellers within REDD+ projects. By building on the existing literature regarding challenges of REDD+ (e.g., Oberhauser Reference Oberhauser2019), we analyse whether blockchain could help in solving such issues through an examination of current projects utilizing blockchain in the forestry space.

The voluntary market: growth, issues and opportunities

Carbon offsets operate in compliance and voluntary markets, with the former subject to regulation by national and international bodies. In contrast, the voluntary market is not defined by specific caps and firms are free to choose whether and in which projects they wish to invest. Even though the voluntary market has, historically, been small, it has started to grow driven by company commitments and the anticipation of future regulation (Fig. 1), and it is expected to grow over 300-fold by 2030 (Shankleman & Rathi Reference Shankleman and Rathi2021).

Fig. 1. Annual voluntary carbon offset issuances (line) and retirements (bars), 2005–2020.

Net-zero targets met through offsetting are credible only if the credits involved are valid, permanent and additional, requiring transparency regarding the nature of the project, its performance and its continuing impact. Should doubts arise, then offsets lose credibility and net-zero is undermined. What is therefore required is transparency, both for purchasers and for stakeholders (including shareholders) monitoring net-zero targets. Transparency brings credibility and helps to boost demand for offsets, helping companies and countries meet ambitious net-zero goals.

Forest carbon offsets within voluntary carbon markets

Forestry activities for offsetting include afforestation, reforestation, improved forest management and avoided deforestation and forest degradation, all grouped together into the basket of REDD+. REDD+ was institutionalized through the United Nations Framework Convention on Climate Change (UNFCCC) Conference of Parties (COP) to cover actions taken by national governments, guided by the 2013 Warsaw Framework for REDD+ (WFR).

In practice, REDD+ bifurcated into two streams: (1) national or jurisdictional programmes (e.g., in Guyana and Brazil), funded by multilateral or bilateral donors and governed by the UNFCCC; and (2) project-level activities. These two scales emerged to tackle different aspects of reducing deforestation, requiring both changes to national-level policies and local incentives and the leveraging of different sources of finance. It is the latter subnational projects that are the focus of the offset market.

Forest projects account for 38% (or almost 41.5 MtCO2e) of all voluntary offset projects in 2019, with avoided unplanned deforestation initiatives alone accounting for more than 22 megatonnes of CO2 equivalent (MtCO2e; Fig. 2). However, forest offsets suffer from challenges pertaining to verifiability, permanence, additionality and leakage (Angelsen Reference Angelsen2010), as well as insufficient financial transparency, vague and expensive standards (Laing et al. Reference Laing, Taschini and Palmer2016) and high transaction fees (Nantongo & Vatn Reference Nantongo and Vatn2019).

Fig. 2. Top 10 project types by volume and price: voluntary carbon credits, 2019.

Blockchain technology

A blockchain is a (distributed) ledger that records exchanges of ownership (via transactions) of assets in a transparent and permanent manner. Systems powered with blockchain consist of an interconnected network of nodes (computers) that interact with each other (Fig. 3a) to decide which information they receive is valid and permanently stored in the ledger. To reach such decisions, nodes strictly follow a publicly accessible set of rules, known as consensus protocols (e.g., proof of work or proof of stake, with the latter generally requiring greatly less computational power and energy).

Fig. 3. (a) A blockchain network and (b) the main content of a block in the blockchain.

When a node receives new data, it checks the data’s integrity and, if it concludes that it is valid, the data are shared across the network in the form of a block (Fig. 3b). If all nodes agree, the data are immutably stored using advanced cryptography. For each new datum stored, the updated ledger is distributed across the network, so every participant has access to the same data (Fig. 3). These processes make it extremely difficult to modify the ledger when compared to other storage methods (e.g., central or distributed databases) and thus blockchain offers advantages in terms of transparency and validity.

(De)centralization

Blockchain can either follow a centralized model where a central authority supervises the ledger’s incoming data (more suitable for international- or national-level forestry schemes) or a decentralized platform that is shared, held and updated by multiple nodes (theoretically allowing remote buyers and sellers of forest offset credits to connect; Fig. 3).

Two options are available for accessibility: a permissionless network where every node can join and a permissioned network where only nodes with special authorizations are allowed. Permissioned networks are proposed where there is a desire to decentralize control to only some degree (perhaps being more useful for government-backed forestry schemes). Permissioned networks can be further broken down into public and private permissioned networks to differentiate who can read the data on the blockchain. Alternatively, a permissionless network is suggested where an open system with maximum possible decentralization is required (e.g., allowing easier connection between remote offset buyers and sellers), offering transparency benefits as any citizen can access the information (e.g., allowing independent parties to validate offsets). In cases where the full transparency of transactions plays a key role in the application of interest, then a permissionless network is recommended.

Smart contracts

Smart contracts are programmes stored on the blockchain that are self-executed when certain conditions are met, automating standard tasks. In this way, they could serve to automatically validate contractual provisions in forest offsets that would otherwise require large amounts of manual input.

Tokens

Tokenization is the process of assigning meaning to a particular type of object or data, including assigning value to a physical coin (e.g., currency) and connecting the ownership certificate of an asset to a piece of data. In the first example, the token is interchangeable with other tokens, known as fungible tokens (FTs). People can use FTs to decentralize ownership of assets such as land, rights and shares of a company (e.g., a land block can be overlain with a system of FTs, where each token represents only a fraction of the land’s total value on the market, hence empowering the participation of smaller investors). Alternatively, non-fungible tokens (NFTs) derive their value from the unique asset they represent; they are not easily interchangeable, and their owners retain the whole value of an asset, such as a forest or tree.

Oracles

An oracle is a connection that allows data transfers from external sources to a destination blockchain-based system. Oracles work according to triggers (e.g., a transaction on the blockchain), gathering external data (e.g., satellite data on forest clearance) and placing them into transactions subsequently added to the blockchain (e.g., the purchase of a forest offset), allowing externally retrieved data to be internally read and processed (e.g., by smart contracts).

Modern technologies in forestry offset projects

The integration between carbon markets and blockchain has already begun. Forestry projects utilizing blockchain technology in their proposal and pilot stages are increasing (Table 1). This trend is unsurprising as the technology enables decentralized communication and cooperation between parties, building an infrastructure that could provide a transparent means for an automated, decentralized verification process of issuing, monitoring and even revoking credits.

Table 1. Blockchain-led carbon credit project initiatives.

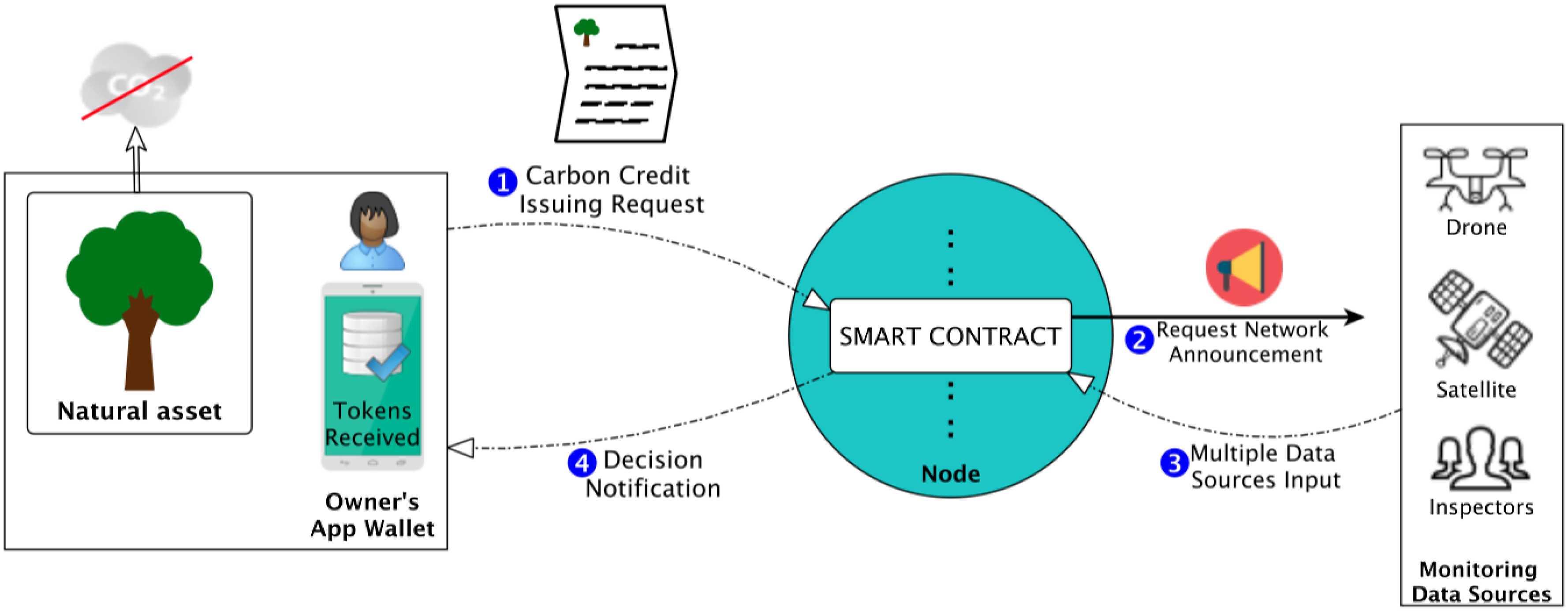

Carbon offsets generate emissions ‘savings’ through activities such as planting trees. These savings are then sold to buyers, creating a carbon market using carbon credits as its native ‘currency’. With the use of blockchain, information on what type of asset a credit represents is added to the users’ blockchain accounts (wallets) in the form of tokens (Fig. 4). Tokens can then be sold to other users, creating a market. The value of each token depends on the underlying asset (e.g., size of emissions savings). Blockchain can transparently process and securely store every token transaction. In addition, a wide range of information pertaining to the underlying asset (emissions, legal status or associated environmental and social performance) can follow the token from seller to buyer and be updated as the status of the asset changes. All initiatives in Table 1 adopt this general underlying idea of integrating carbon markets with blockchain.

Fig. 4. Issuing carbon tokens through smart contracts.

Projects using blockchain vary significantly depending on how and what technologies are used, the scale of the projects and the target groups. The largest investors, such as large corporations (e.g., Samsung), will likely invest in projects that provide legitimate and credible offsets and therefore require transparency regarding the underlying processes and the tackling of any technical issues associated with REDD+ (e.g., Veritree, Treecycle). Alternatively, others may be willing to fund offset activities irrespective of strict requirements and expectations of profiting from their investments (e.g., EcoMatcher, Forestcoin).

Treecycle is a reforestation programme with the aim of planting 10 million trees on fallow land in Paraguay (Treecycle 2019). It is not currently offering offsets but is monitoring the evolution of the market and may adjust its business model. Treecycle sells tokens, TREE, tied to actual trees, built on a proof-of-stake blockchain. The token provides holders with 40% of the net profit generated. Treecycle has also developed an additional token called TXC gifted to investors free of charge and that constitute a bonus to supplement the purchase of TREE tokens. The sale of tokens, however, is open only to investors from certain jurisdictions.

Veritree is a blockchain-based platform offering various projects having a range of impacts on climate change in locations from Nepal (habitat and soil restoration) to Madagascar (carbon sequestration with mangrove trees) and Indonesia (carbon sequestration and coastal erosion). Veritree claims to address issues pertaining to REDD+ including double-counting, additionality, permanence and transparency. However, they provide no details on how they plan to do this (potentially due to industry access), although Samsung (Sherr Reference Sherr2022) and Cardano (Malwa Reference Malwa2022) are planning to collaborate with the company.

EcoMatcher aims to tackle climate change and offset by planting new trees. Companies and consumers can ‘adopt’ either single trees or whole forests. When trees are planted, users can track their location and species as well as the CO2 emission reductions associated with their growth. Data are stored on a cloud-based platform, and while companies can purchase these data, the scheme is unlikely to be suitable for carbon offsetting by companies.

Forestcoin encourages individuals to plant trees and they receive tokens in exchange for uploaded photographs or other data of their tree-planting activities, with the tokens being able to be sold or spent at participating merchants. The environmental benefits from Forestcoin and EcoMatcher are likely to be small, and they ignore the importance of differing forest types and addressing permanence and additionality. Both Forestcoin and EcoMatcher could, however, encourage environmentally friendly behaviour and are potentially well-suited to individuals and companies wishing to become more visibly sustainable through transparent tree-planting.

Verifiability, financial transparency and transaction costs

Supply chains for forest-offset credits are often filled with intermediaries and (inter)national organizations overseeing the (re)distribution of funds (Oberhauser Reference Oberhauser2019), often retaining administrative fees and creating transaction costs and disconnects between buyers and sellers. A lack of financial transparency is coupled with insufficient standardization of the market. Currently, most credits are issued through unique processes between suppliers, making it difficult to objectively measure credit quality and leading to suggestions for voluntary markets to establish a ‘fungible currency’ with universally acceptable standards (Streck Reference Streck2020). Standards such as the Verified Carbon Standard and Gold Standard exist but are far from ubiquitous, and it is unclear how they will respond to rapid demand increases. Along with the challenge of measuring quality, checking whether contracts are fulfilled may become particularly cumbersome and require significant finance (Streck Reference Streck2020). Different approaches have been developed to bring standardization to the market, but these often rely on manual labour to verify performance. The labour involved in measuring and monitoring REDD+ (Oberhauser Reference Oberhauser2019) makes the supervision and implementation of initiatives relatively expensive, as evidenced by the average costs of forestry offsets exceeding renewable energy projects by more than three times (Fig. 2). Transparency is needed to ensure credits are verifiable and to avoid ‘double-counting’ and exploitation by ‘carbon cowboys’ seeking to gain from supplying credits of dubious quality (Maguire Reference Maguire2011).

Blockchain can ensure the efficient exchange of tokens without intermediaries, reducing inefficient use of labour and creating rapid, low-cost exchanges. Such platforms also provide an infrastructure for the development of innovative applications. For example, blockchains allow smart contracts to be deployed, enabling connection via oracles with outside data collection sources (e.g., data on forest cover, land-use changes from drones, satellites or on-the-ground verifiers; Fig. 4), as proposed by GainForest (2019). Other data concerning legal tenure and social and environmental safeguards could also be included (Veridium 2016). However, additional technology is needed to accurately combine such data, such as AI (GainForest 2019, Vlinder 2019, Pachama 2020). This approach allows the receipt of decentralized data and the use of smart algorithms to reach a conclusion on credits. If conflicts arise (e.g., one source reports ‘yes’ and another ‘no’), the system can either assign a higher weight to the more commonly accepted source or request additional data from on-the-ground inspections. The latter is a preferable approach when multiple entities with conflicted interests report conflicting data in order to minimize the possibilities of biased decisions, further conflict and collusion.

The opportunities offered by blockchain could become more attractive by adopting NFTs that are priced differently based on the carbon content of the tree. ‘Adopt a tree’-style schemes have mushroomed (e.g., Green Initiative Foundation’s projects in Indonesia) as they provide the ability and motivation for the public to be directly involved in forest protection. Blockchain-based platforms such as Forestcoin and EcoMatcher utilize this feature of the technology. Although not part of these companies’ proposals, blockchain gives users the ability to destroy or virtually lock NFTs away from the market, thereby avoiding double-counting.

Permanence, leakage and additionality

Smart contracts enabled by blockchain, used in concert with technologies such as AI, offer potential solutions to issues pertaining to permanence, leakage and additionality (Palmer Reference Palmer2011, Atmadja & Verchot Reference Atmadja and Verchot2012, Chiroleu-Assouline et al. Reference Chiroleu-Assouline, Poudou and Roussel2018). Permanence is ‘the longevity of a carbon pool and the stability of its stocks’ (Watson et al. Reference Watson, Noble, Bolin, Ravindranath, Verardo and Dokken2000). Forest carbon is inherently unstable due to reversals through forest fire or land-use changes, raising the possibility that carbon savings could be reversed, negating the validity of previously issued credits. These challenges could be mitigated through blockchain providing validated, transparent information to buyers, especially when coupled with smart contracts to provide automatic validation. Updated data on a forested area’s status, to the level of individual trees, can be associated with the token, and should the status of the carbon sequestered change, the value of the offset can adjust. If the token is sold on, then relevant information would follow it along with future changes in the information (e.g., Treecycle). The usefulness of blockchain is predicated upon there being suitable information from external sources, such as through the increasing availability of satellite data (e.g., in Brazil; Moutinho Reference Moutinho2021) along with project-level data from drones (Mitchell et al. Reference Mitchell, Rosenqvist and Mora2017).

Leakage occurs when ‘interventions to reduce carbon emissions in one place causes carbon emissions in another’ (Atmadja & Verchot Reference Atmadja and Verchot2012). Dealing with leakage is a thorny issue, with solutions focusing on buffer zones and nesting project-based approaches within country-level programmes (Atmadja & Verchot Reference Atmadja and Verchot2012, Streck Reference Streck2021). This is not an issue that can be solved using digital technologies alone. Blockchain could, however, provide a conduit for information pertaining to the problem, allowing for amendments to or revocations of credits relating to leakage (although this could also be done using non-digital techniques). For example, a smart contract could contain a provision that deforestation in a buffer zone must not rise above a threshold. By capturing and processing this information via AI or similar technologies, blockchain could amend the credit accordingly should the threshold be breached (Regen Network 2018). This process could assist in addressing issues of local leakage, but it is unlikely to address regional leakage, which requires wider policy action.

Additionality of offsets relates to whether carbon savings would have arisen anyway in the absence of projects (Valatin Reference Valatin2011). Blockchain cannot eliminate this problem, but it could provide a tool to capture and process relevant information (via smart contracts) that could validate associated credits. For example, blockchain, using oracles, could capture, process and communicate information about the prices (and thus profits) of drivers of deforestation, such as soya, beef or palm oil. Rises (or falls) in prices imply that the economic returns from deforestation are greater (or less), and thus projects are likely to be additional (or not).

Local communities’ involvement, property rights and governance

Under a decentralized blockchain model, local communities could, in theory, play bigger roles and reap greater benefits from carbon markets. There is an increasing need to design adequate requirements to ensure United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP) adoption and other related standards when developing offset projects (De la Fuente & Hajjar Reference De La Fuente and Hajjar2013, Timperley Reference Timperley2019). Such standards could be translated and programmed as conditions into smart contracts. The exact mechanism through which relevant information would be collated and added to the blockchain would vary between jurisdictions, but would likely involve some burden of proof on behalf of credit sellers that provisions regarding property rights are met, including the lack of pre-existing conflicts and the upholding of community rights.

The use of blockchain in this way cannot resolve property right issues on its own. However, it could: (1) ensure that, where conflicts occur, parties with more power cannot exploit those with fewer rights by selling credits for projects impacting them; and (2) incentivize actors to resolve conflicts in order to access finance (Regen Network 2018). Blockchain can also add the security for buyers that, should conflicts arise, credits would adjust accordingly, removing the validity of credits and ensuring that reputational risks are minimized. Blockchain’s advantages are likely to be larger where community rights are more established. In areas such as Central Africa where communities’ rights have historically been weak (Barrow et al. Reference Barrow, Kamugisha-Ruhombe, Nhantumbo, Oyono and Savadogo2016), advantages may be more on the buyer’s side, helping to either avoid buying into areas with conflicts or offering safeguards regarding their future discovery. This raises the danger that actors with greater power may be more likely to exploit the advantages of blockchain, risking further disenfranchising communities without power from the international climate change architecture.

For communities for which property rights are secure, blockchain may play an important role in their achieving easier access to buyers in the carbon market (GainForest 2019, Universal Carbon 2019, Vlinder 2019), with local communities directly selling climate services through tokens. By dealing directly with communities, buyers could connect better with projects, helping them to find those that fit their motivations. A potential concern regarding the viability of blockchain relates to the capacity of communities to engage with such technology. There is evidence that local communities may have the capacity to engage with technologies such as blockchain through devices such as smartphones. For example, in Guyana, a community-based monitoring system for REDD+ required communities to utilize Global Positioning System (GPS) software, with evaluations highlighting the capacities of the communities involved (Bellfield et al. Reference Bellfield, Sabogal, Goodman and Leggett2015). Rainforest Foundation’s Mapping For Rights project also demonstrates this capacity, with communities in the Democratic Republic of the Congo using GPS-enabled tablets to map customary lands and resources (Handja Reference Handja2014). Local community partners of Veritree are already collecting data on trees and co-benefits in real time and uploading this to investors using mobile phones. Furthermore, the adoption of mobile phones in developing countries, in conjunction with poor banking infrastructures, has been a key driver of digital payments (Ammous Reference Ammous2015, Flore Reference Flore2018). The emerging infrastructure of blockchain-based payments could be utilized and integrated with systems of payments for environmental services and other forest-offset projects.

Local community involvement raises the question of power and governance, issues that are central to the effectiveness, equity and efficiency of forest-offset activity. The increasing application of blockchain has prompted nuanced debates on the socioeconomic implications of the technology relating to the global political economy and governance (Zwitter Reference Zwitter2015, Just & Latzer Reference Just and Latzer2017, Zwitter & Hazenberg Reference Zwitter and Hazenberg2020). Existing studies suggest that blockchain may empower historically less privileged actors (e.g., cross-border remittances), with the potential to address unequal access to financial services (Ammous Reference Ammous2015, Flore Reference Flore2018) and to enhance the effectiveness of existing institutions (e.g., improving aid delivery; Reinsberg Reference Reinsberg2019). Blockchain technologies, however, could also be destructive to existing governance structures and diminish the roles of centralized authorities that traditionally underpin global governance. These divergent insights suggest that analysis from different contexts is needed in order to understand how these technologies could impact the multifaceted relationships between actors and processes at each governance level: local, national and global.

Within the forest sector, there are social contexts in which centralized actors could benefit from introducing blockchain to reduce transaction costs by facilitating direct relationships between centralized donors and the beneficiaries of REDD+ finance, automatically settling transactions and sharing information across organizations. This process could enhance the functioning of existing centralized systems, making them more efficient and increasing trust and credibility. Such a system is relevant when international organizations and donors are at the centre of REDD+. This application would benefit from permissioned blockchain, with central authorities administering systems and selecting participants (both donors and beneficiaries) and validating their behaviours. An example is the proposal of the digitization of all of Europe’s trees using a private permissioned blockchain (Bartoszek Reference Bartoszek2021). Although such a model could bring efficiencies to centralized system, it could also reinforce existing power dynamics and risk locking those without power out of these systems, thereby exacerbating those challenges that created pressures on these forests in the first place.

In contrast, for pilot and small-scale projects, and mirroring the use of blockchain in tree growth, different governance structures may be more suitable. Interaction here would need to be decentralized and most likely be beneficial if it capitalizes on the inherent decentralized features of this technology. The system should be more flexible, allowing the inclusion of various actors at different levels (mirroring the multi-level governance conceptualizations of REDD+). Such applications should utilize permissionless blockchains, facilitating access to all. Although in theory this could solve issues relating to power dynamics, this would depend on broader circumstances such as access to this technology.

Discussion

Blockchain, due to its decentralized and transparent nature, has the ability to enforce verifiable smart contracts and to provide systems for reducing transaction, monitoring and verification costs. However, questions and research gaps remain.

First, with blockchain emerging in forest-offset projects and with potentially many different options for users of such offsets, it becomes difficult to determine which companies provide credible credits. In an industry built on network effects, it is crucial that offset projects attract strong developers with adequate understanding of forestry projects and their challenges and large, capital-rich user bases.

Second, if the space becomes dominated by few players with a large number of small blockchain-based projects, important innovations would be required (e.g., the ability to seamlessly transact value across different blockchain platforms). This idea is conceptually similar to ‘linking carbon markets’ (Doda & Taschini Reference Doda and Taschini2017, Doda et al. Reference Doda, Quemin and Taschini2019). ‘Traditional’ blockchain solutions such as Cosmos (Kwon & Buchman Reference Kwon and Buchman2016), Polkadot (Wood Reference Wood2017) and Overledger (Verdian et al. Reference Verdian, Tasca, Paterson and Mondelli2018) already have this ability built into their design, allowing multiple blockchains to be connected. Future research needs to be conducted in this area in order to understand whether similar integration of various offset platforms is feasible and desirable.

Third, continued learning from pilot activities is needed regarding the usefulness of this technology, along with a deeper understanding of its technical, social and cultural barriers. NFTs and offset tokens could be accompanied by social tokens empowering local communities. This could change the relationships between forestry communities and their local economies and between forest communities and international donors and investors. Field experiments with social tokens could help with the integration of forest tokens into social aspects and with the technology/education needed for local communities. More broadly, further understanding of the preconditions for the use of blockchain is needed, including regarding the resolution of rights and the technological capacities and availabilities required.

At COP26, donors committed to deliver at least US$1.7 billion of financing to local communities. Yet there are no good mechanisms in place to deliver such funding to the ground. Blockchain, in combination with mobile phones and emerging digital payment structures, offers intriguing possibilities for donors to transfer directly to recipients while tracking funding.

Finally, despite its potential, existing blockchain technologies cannot entirely address additionality, leakage and permanence. More challenging are property rights – a major driver in deforestation (Cotula & Mayers Reference Cotula and Mayers2009, Palmer et al. Reference Palmer2010). Blockchain is only likely to be effective in geographies where property rights are clear and conflicts absent and where power dynamics are favourable to either centralized or limited decentralized approaches. The technology could, however, provide assurance to buyers that rights issues are resolved and community rights upheld, along with providing incentives for conflict resolution. The fact that benefits might not accrue to those communities involved in rights disputes or that such communities could be locked out of centralized systems, where finance may be of most use, is a downside. Further research needed on how such emerging technologies can assist in these cases.

Acknowledgements

We thank Professor Luitgard Veraart for a fruitful discussion and valuable feedback comments, the editor and three anonymous referees for their useful comments and Craig Stock for valuable research assistance and with data visualization.

Financial support

None.

Competing interests

The authors declare none.

Ethical standards

None.