1 Introduction

In the present paper, focus is on aggregated reserving making use of claim count and claim payment data, which allows for handling claim closings and re-openings. The modelling approach follows the same underlying idea as in Wahl et al. (Reference Wahl, Lindholm and Verrall2019), which introduces the so-called collective reserving model (CRM), where individual claims are modelled using discrete Poisson processes keeping track of accident year, reporting year, and payment delay in years, and which allows for multiple payments per claim. Due to this, the introduced model will be referred to as the CRMO – a CRM with openness dynamics. Further, this modelling approach is similar to the one used in, for example, Verrall et al. (Reference Verrall, Nielsen and Jessen2010) which underpins the double chain-ladder model introduced in Martinez-Miranda et al. (Reference Martinez-Miranda, Nielsen and Verrall2012). Further, by using this slightly more granular representation than the one used with the standard chain-ladder technique makes it possible to obtain separate reported, but not settled (RBNS) and incurred, but not reported (IBNR) reserves. Moreover, reserve moments can be calculated explicitly and are possible to give constructive interpretations. This will also be the case when allowing for claim closings and re-openings, although this will introduce additional dependencies. That is, starting from individual claims, it is natural that you need to keep track of claims staying open as well as those that have been closed, but could become re-opened. Examples of individual claim models with claim closings are, for example, Antonio and Plat (Reference Antonio and Plat2014), Crevecoeur and Antonio (Reference Crevecoeur and Antonio2019), Bettonville et al. (Reference Bettonville, d’Oultremont, Denuit, Trufin and Van Oirbeek2020), and Delong et al. (Reference Delong, Lindholm and Wüthrich2020), where the latter two also allow for claim re-openings. Another type of computer intensive approach is to use self-exciting processes as in Maciak et al. (Reference Maciak, Okhrin and Pešta2021). Their approach allows for re-openings, and self-exciting processes are able to capture complex dynamics and dependencies, but with the potential drawback of being more complex than standard marked point process reserving models.

Further, a discrete time setup will allow us to estimate parameters in, for example, flexible generalised linear models (GLM) using aggregated data and quasi-likelihood theory, but now having to keep track of the number of claims staying open together with the number of claims becoming re-opened. This is natural, but perhaps not ideal, since the main driver behind future payments is, reasonably, the number of open claims, regardless of whether they have been re-opened or not. With this in mind, a more restrictive version of the model is considered that allows for estimating parameters based on only knowing the number of open claims.

Moreover, the current model is an extension of the CRM from Wahl et al. (Reference Wahl, Lindholm and Verrall2019) and by re-using arguments for the CRM, it is possible to obtain consistency for normalised reserves when letting the number of contracts tend to infinity.

The modelling approach used in the current paper is a constructive one, starting from detailed claim dynamics. Another approach is to instead consider less explicit modelling, but instead allowing for flexible parametrisations using machine learning techniques. Successful examples of aggregated reserving models using machine learning techniques can be found in, for example, Gabrielli et al. (Reference Gabrielli, Richman and Wüthrich2020) where neural networks (NN) are combined with the over-dispersed Poisson (ODP) chain-ladder model and Lindholm et al. (Reference Lindholm, Lindskog and Wahl2020), which considers ODP chain-ladder type models using gradient boosting machines (GBM), as well as GBM and NN versions of CRM type models. By construction, Gabrielli et al. (Reference Gabrielli, Richman and Wüthrich2020), Lindholm et al. (Reference Lindholm, Lindskog and Wahl2020) use aggregated data, but individual claim reserving models can be found in, for example, Delong et al. (Reference Delong, Lindholm and Wüthrich2020), which uses a similar basic process approach as the CRM using NN:s, or Lopez et al. (Reference Lopez, Milhaud and Thérond2019) using trees. The present paper introduces a model that also could be parametrised using machine learning techniques. As will be seen in Section 6, however, already using a rather simple GLM formulation of the CRMO will produce predictions whose performance is comparable with aggregated machine learning reserving models based on simulated data from Gabrielli and Wüthrich (Reference Gabrielli and Wüthrich2018). This illustrates the potential benefits of modelling claim openness dynamics explicitly.

The remainder of the paper is organised as follows: Section 2 introduces data and notation, followed by Section 3, which introduces the CRMO. Section 4 discusses moment calculations, which are needed for the quasi-likelihood approach treated in Section 5, consistency of normalised reserve estimates, together with a more detailed comparison with the CRM from Wahl et al. (Reference Wahl, Lindholm and Verrall2019). Section 5 also briefly discusses how the bootstrap procedure for calculating MSEP for the CRM can be adapted to the CRMO, before moving to a number of numerical examples in Section 6 based on data generated by the individual claims history simulation machine presented in Gabrielli and Wüthrich (Reference Gabrielli and Wüthrich2018). The paper ends with a number of concluding remarks given in Section 7.

Since many of the calculations closely follow those for the CRM in Wahl et al. (Reference Wahl, Lindholm and Verrall2019), those calculations not considered essential for the exposition are omitted.

2 Data and notation

Following the notation in Wahl et al. (Reference Wahl, Lindholm and Verrall2019), let

![]() $N_{ij}$

denote the number of claims that occurred in accident year i,

$N_{ij}$

denote the number of claims that occurred in accident year i,

![]() $i=1,...,m$

and were reported j,

$i=1,...,m$

and were reported j,

![]() $j=1,\ldots, d$

years after occurring, and let

$j=1,\ldots, d$

years after occurring, and let

![]() $X_{ijk}$

denote the sum of all incremental payments from claims that incurred in year i, were reported j years after that and paid k,

$X_{ijk}$

denote the sum of all incremental payments from claims that incurred in year i, were reported j years after that and paid k,

![]() $k=1,...,\kappa$

years after being reported, where

$k=1,...,\kappa$

years after being reported, where

![]() $\kappa$

is the maximum payment delay. While it is possible to use different maximum delays for reporting claims and payments, respectively, only

$\kappa$

is the maximum payment delay. While it is possible to use different maximum delays for reporting claims and payments, respectively, only

![]() $d=\kappa=m-1$

will be considered in this paper. For more on this, see, for example, Verrall et al. (Reference Verrall, Nielsen and Jessen2010), Wahl et al. (Reference Wahl, Lindholm and Verrall2019).

$d=\kappa=m-1$

will be considered in this paper. For more on this, see, for example, Verrall et al. (Reference Verrall, Nielsen and Jessen2010), Wahl et al. (Reference Wahl, Lindholm and Verrall2019).

Further, let

![]() $N^{\textrm{open}}_{ijk}$

denote the number of claims that incurred in accident year i, were reported j years thereafter that are open at the end of the k:th year thereafter, that is open at the end of year

$N^{\textrm{open}}_{ijk}$

denote the number of claims that incurred in accident year i, were reported j years thereafter that are open at the end of the k:th year thereafter, that is open at the end of year

![]() $i + j + k$

. Thus,

$i + j + k$

. Thus,

![]() $N^{\textrm{open}}_{ijk} \leq N_{ij}$

for all

$N^{\textrm{open}}_{ijk} \leq N_{ij}$

for all

![]() $k=0,...,m-1$

. Let

$k=0,...,m-1$

. Let

![]() $N^{\textrm{stay-open}}_{ijk}$

and

$N^{\textrm{stay-open}}_{ijk}$

and

![]() $N^{\textrm{re-open}}_{ijk}$

denote the number of open claims that were and were not open in the previous year, respectively. Note that

$N^{\textrm{re-open}}_{ijk}$

denote the number of open claims that were and were not open in the previous year, respectively. Note that

Consider a setting where one has access to data from the perspective of the first day of the

![]() $m+1$

:th year. That means that all data

$m+1$

:th year. That means that all data

![]() $N_{ij}$

such that

$N_{ij}$

such that

![]() $i+j \leq m$

and all data

$i+j \leq m$

and all data

![]() $X_{ijk}$

,

$X_{ijk}$

,

![]() $N^{\textrm{open}}_{ijk}$

,

$N^{\textrm{open}}_{ijk}$

,

![]() $N^{\textrm{re-open}}_{ijk}$

,

$N^{\textrm{re-open}}_{ijk}$

,

![]() $N^{\textrm{stay-open}}_{ijk}$

such that

$N^{\textrm{stay-open}}_{ijk}$

such that

![]() $i+j+k \leq m$

is available, which can be formalised using the index set

$i+j+k \leq m$

is available, which can be formalised using the index set

as the data sets

\begin{align*}\mathcal{X}_0 &= \left\{X_{ijk} :\, (i,j,k) \in \mathcal{A}_0 \right\},\\[3pt] \mathcal{N}^{+}_0 &= \left\{N_{ij},N^{\textrm{re-open}}_{ijk},N^{\textrm{stay-open}}_{ijk} :\,(i,j,k) \in \mathcal{A}_0 \right\}.\end{align*}

\begin{align*}\mathcal{X}_0 &= \left\{X_{ijk} :\, (i,j,k) \in \mathcal{A}_0 \right\},\\[3pt] \mathcal{N}^{+}_0 &= \left\{N_{ij},N^{\textrm{re-open}}_{ijk},N^{\textrm{stay-open}}_{ijk} :\,(i,j,k) \in \mathcal{A}_0 \right\}.\end{align*}

In certain cases, we might not have access to how many of the open claims stem from re-openings or not, and in those cases

![]() $\mathcal{N}_0^+$

will have to be replaced by the less granular set

$\mathcal{N}_0^+$

will have to be replaced by the less granular set

3 Explicit modelling of closings and re-openings of claims – the CRMO model

The aim of the current paper is to introduce an extension of the CRM that was introduced in Wahl et al. (Reference Wahl, Lindholm and Verrall2019), which allows for closing and re-opening of claims, including multiple re-openings and closings per claim. This new model will be abbreviated CRMO, where “O” stands for “openness dynamics”.

Following Wahl et al. (Reference Wahl, Lindholm and Verrall2019), we let

![]() $N_{ij}$

follow an over-dispersed Poisson distribution with intensity parameter

$N_{ij}$

follow an over-dispersed Poisson distribution with intensity parameter

![]() $\nu_{ij}$

and over-dispersion parameter

$\nu_{ij}$

and over-dispersion parameter

![]() $\phi$

, that is

$\phi$

, that is

\begin{equation}\begin{split}\mathbb{E}\left[ N_{ij}\right] & = \nu_{ij}, \\[3pt] \textrm{Var}\left(N_{ij}\right)& = \phi\mathbb{E}\left[ N_{ij}\right].\end{split}\end{equation}

\begin{equation}\begin{split}\mathbb{E}\left[ N_{ij}\right] & = \nu_{ij}, \\[3pt] \textrm{Var}\left(N_{ij}\right)& = \phi\mathbb{E}\left[ N_{ij}\right].\end{split}\end{equation}

Further, note that

![]() $N^{\textrm{open}}_{ijk}$

can be expressed as a sum of boolean variables,

$N^{\textrm{open}}_{ijk}$

can be expressed as a sum of boolean variables,

\begin{equation*} N^{\textrm{open}}_{ijk} = \sum \limits_{l=1}^{N_{ij}} N^{\textrm{open}}_{ijkl},\end{equation*}

\begin{equation*} N^{\textrm{open}}_{ijk} = \sum \limits_{l=1}^{N_{ij}} N^{\textrm{open}}_{ijkl},\end{equation*}

where

![]() $N^{\textrm{open}}_{ijkl}=1$

if claim l of claims incurred in year i and reported j years after that is open at the end of the k:th year thereafter. Conditioned on

$N^{\textrm{open}}_{ijkl}=1$

if claim l of claims incurred in year i and reported j years after that is open at the end of the k:th year thereafter. Conditioned on

![]() $N^{\textrm{open}}_{i,j,k-1,l}$

, this can be viewed as a Bernoulli variable, with staying-open probability

$N^{\textrm{open}}_{i,j,k-1,l}$

, this can be viewed as a Bernoulli variable, with staying-open probability

![]() $p_{ijk}$

and re-opening probability

$p_{ijk}$

and re-opening probability

![]() $q_{ijk}$

such that for

$q_{ijk}$

such that for

![]() $k=1,...,m$

,

$k=1,...,m$

,

\begin{equation*}N^{\textrm{open}}_{ijkl}\mid N^{\textrm{open}}_{i,j,k-1,l}= \left\{\begin{array}{cll} 1, & \textrm{with probability $p_{ijk}$}, & \textrm{if } N^{\textrm{open}}_{i,j,k-1,l}=1 \\ \\[-7pt] 0, & \textrm{with probability $1-p_{ijk}$}, & \textrm{if } N^{\textrm{open}}_{i,j,k-1,l}=1 \\ \\[-7pt] 1, & \textrm{with probability $q_{ijk}$}, & \textrm{if } N^{\textrm{open}}_{i,j,k-1,l}=0 \\ \\[-7pt] 0, & \textrm{with probability $1-q_{ijk}$}, & \textrm{if } N^{\textrm{open}}_{i,j,k-1,l}=0 \\\end{array} \right. , \end{equation*}

\begin{equation*}N^{\textrm{open}}_{ijkl}\mid N^{\textrm{open}}_{i,j,k-1,l}= \left\{\begin{array}{cll} 1, & \textrm{with probability $p_{ijk}$}, & \textrm{if } N^{\textrm{open}}_{i,j,k-1,l}=1 \\ \\[-7pt] 0, & \textrm{with probability $1-p_{ijk}$}, & \textrm{if } N^{\textrm{open}}_{i,j,k-1,l}=1 \\ \\[-7pt] 1, & \textrm{with probability $q_{ijk}$}, & \textrm{if } N^{\textrm{open}}_{i,j,k-1,l}=0 \\ \\[-7pt] 0, & \textrm{with probability $1-q_{ijk}$}, & \textrm{if } N^{\textrm{open}}_{i,j,k-1,l}=0 \\\end{array} \right. , \end{equation*}

where

![]() $p_{ijk}, q_{ijk} \in [0, 1]$

. This means that

$p_{ijk}, q_{ijk} \in [0, 1]$

. This means that

![]() $N^{\textrm{open}}_{ijk}$

will be the sum of two sums of i.i.d. Bernoulli variables

$N^{\textrm{open}}_{ijk}$

will be the sum of two sums of i.i.d. Bernoulli variables

where

and

For

![]() $k=0$

, there can be no re-openings, and the distribution of the openness-booleans can instead be expressed as

$k=0$

, there can be no re-openings, and the distribution of the openness-booleans can instead be expressed as

\begin{equation*}N^{\textrm{open}}_{i,j,0,l}= \begin{cases} 1, & \textrm{with probability $p_{ij0}$} \\ \\[-7pt] 0, & \textrm{with probability $1-p_{ij0}$}\end{cases},\end{equation*}

\begin{equation*}N^{\textrm{open}}_{i,j,0,l}= \begin{cases} 1, & \textrm{with probability $p_{ij0}$} \\ \\[-7pt] 0, & \textrm{with probability $1-p_{ij0}$}\end{cases},\end{equation*}

where

![]() $p_{ij0} \in [0, 1]$

and

$p_{ij0} \in [0, 1]$

and

\begin{equation*} N^{\textrm{stay-open}}_{ij0} = N^{\textrm{open}}_{ij0} = \sum \limits_{l=1}^{N_{ij}} N^{\textrm{open}}_{i,j,0,l}.\end{equation*}

\begin{equation*} N^{\textrm{stay-open}}_{ij0} = N^{\textrm{open}}_{ij0} = \sum \limits_{l=1}^{N_{ij}} N^{\textrm{open}}_{i,j,0,l}.\end{equation*}

Thus, this construction yields the following conditional distributions

\begin{align*}N^{\textrm{stay-open}}_{ijk}\mid N^{\textrm{open}}_{i,j,k-1} \sim \textrm{Bin}\left(N^{\textrm{open}}_{i,j,k-1},p_{ijk}\right),\\ \\[-7pt] N^{\textrm{re-open}}_{ijk}\mid N_{ij}, N^{\textrm{open}}_{i,j,k-1} \sim \textrm{Bin}\left(N_{ij}-N^{\textrm{open}}_{i,j,k-1},q_{ijk}\right).\end{align*}

\begin{align*}N^{\textrm{stay-open}}_{ijk}\mid N^{\textrm{open}}_{i,j,k-1} \sim \textrm{Bin}\left(N^{\textrm{open}}_{i,j,k-1},p_{ijk}\right),\\ \\[-7pt] N^{\textrm{re-open}}_{ijk}\mid N_{ij}, N^{\textrm{open}}_{i,j,k-1} \sim \textrm{Bin}\left(N_{ij}-N^{\textrm{open}}_{i,j,k-1},q_{ijk}\right).\end{align*}

and

Continuing, every open claim is assumed to produce a number of payments following a conditional Poisson distribution. That is, let

![]() $N_{ijk}^{\textrm{paid}}$

denote the number of claims that incurred in accident year i, were reported j years thereafter, and that are paid during the k:th year thereafter, whose conditional distribution is given by

$N_{ijk}^{\textrm{paid}}$

denote the number of claims that incurred in accident year i, were reported j years thereafter, and that are paid during the k:th year thereafter, whose conditional distribution is given by

for

![]() $k \geq 1$

where

$k \geq 1$

where

![]() $\lambda_{ijk} \ge 0$

. Hence, the

$\lambda_{ijk} \ge 0$

. Hence, the

![]() $\lambda_{ijk}$

:s denote the average number of payments during year k stemming from a claim that incurred in accident year i, was reported j years after that and was open at the end of year

$\lambda_{ijk}$

:s denote the average number of payments during year k stemming from a claim that incurred in accident year i, was reported j years after that and was open at the end of year

![]() $i + j + k-1$

. For

$i + j + k-1$

. For

![]() $k = 0$

, the number of payments depends on the number of reported claims as

$k = 0$

, the number of payments depends on the number of reported claims as

This means that the interpretation of

![]() $\lambda_{ij0}$

differs slightly from that of other

$\lambda_{ij0}$

differs slightly from that of other

![]() $\lambda_{ijk}$

, as it is the expected number of payments made for a claim during the remaining calendar year after being reported.

$\lambda_{ijk}$

, as it is the expected number of payments made for a claim during the remaining calendar year after being reported.

Concerning paid amounts, let

![]() $Y_{ijkl}$

be the size of the l:th payment of the

$Y_{ijkl}$

be the size of the l:th payment of the

![]() $N^{\textrm{paid}}_{ijk}$

payments and assume that all individual payments are independent over l with moments

$N^{\textrm{paid}}_{ijk}$

payments and assume that all individual payments are independent over l with moments

\begin{align*}\mathbb{E}\left[ Y_{ijkl}\right] = \mu_{ijk} {\ \ge 0},\\ \\[-7pt] \textrm{Var}\left( Y_{ijkl} \right) = \sigma^2_{ijk} {\ \ge 0}.\end{align*}

\begin{align*}\mathbb{E}\left[ Y_{ijkl}\right] = \mu_{ijk} {\ \ge 0},\\ \\[-7pt] \textrm{Var}\left( Y_{ijkl} \right) = \sigma^2_{ijk} {\ \ge 0}.\end{align*}

Thus, finally, incremental payments

![]() $X_{ijk}$

can be written as

$X_{ijk}$

can be written as

\begin{equation*} X_{ijk} = \sum\limits_{l=1}^{N^{\textrm{paid}}_{ijk}} Y_{ijkl}.\end{equation*}

\begin{equation*} X_{ijk} = \sum\limits_{l=1}^{N^{\textrm{paid}}_{ijk}} Y_{ijkl}.\end{equation*}

Remark 1

-

(a) In order to simplify the exposition, we introduce the column vector

where \begin{equation*} \boldsymbol{\theta} = (\boldsymbol \nu, \phi, \boldsymbol{p}, \boldsymbol{q}, \boldsymbol \lambda, \boldsymbol \mu, \boldsymbol \sigma)', \end{equation*}

\begin{equation*} \boldsymbol{\theta} = (\boldsymbol \nu, \phi, \boldsymbol{p}, \boldsymbol{q}, \boldsymbol \lambda, \boldsymbol \mu, \boldsymbol \sigma)', \end{equation*}

$\boldsymbol \nu = \{\nu_{ij} : 1 \leq i \leq m, 0 \leq j < m \}$

,

$\boldsymbol \nu = \{\nu_{ij} : 1 \leq i \leq m, 0 \leq j < m \}$

,

$\boldsymbol{p} = \{p_{ijk} : (i, j, k) \in \mathcal{I}\}, \boldsymbol{q} = \{q_{ijk} : $

$\boldsymbol{p} = \{p_{ijk} : (i, j, k) \in \mathcal{I}\}, \boldsymbol{q} = \{q_{ijk} : $

$ (i, j, k) \in \mathcal{I}\}$

,

$ (i, j, k) \in \mathcal{I}\}$

,

$\boldsymbol \lambda = \{\lambda_{ijk} : (i, j, k) \in \mathcal{I}\}$

,

$\boldsymbol \lambda = \{\lambda_{ijk} : (i, j, k) \in \mathcal{I}\}$

,

$\boldsymbol \mu = \{\mu_{ijk} : (i, j, k) \in \mathcal{I}\}$

,

$\boldsymbol \mu = \{\mu_{ijk} : (i, j, k) \in \mathcal{I}\}$

,

$\boldsymbol \sigma = \{\sigma_{ijk} : (i, j, k) \in \mathcal{I}\}$

, where all

$\boldsymbol \sigma = \{\sigma_{ijk} : (i, j, k) \in \mathcal{I}\}$

, where all

$\nu_{ij}, \lambda_{ijk}, \mu_{ijk}, \sigma_{ijk} \ge 0, p_{ijk}, q_{ijk} \in [0, 1]$

, and where For practical purposes, we will, however, assume that the parametrisation of

$\nu_{ij}, \lambda_{ijk}, \mu_{ijk}, \sigma_{ijk} \ge 0, p_{ijk}, q_{ijk} \in [0, 1]$

, and where For practical purposes, we will, however, assume that the parametrisation of \begin{equation*} \mathcal{I} = \{(i, j, k) : 1 \leq i \leq m, 0 \leq j < m, 0 \leq k < m\}. \end{equation*}

\begin{equation*} \mathcal{I} = \{(i, j, k) : 1 \leq i \leq m, 0 \leq j < m, 0 \leq k < m\}. \end{equation*}

$\boldsymbol{\theta}$

is estimable based on the information contained in

$\boldsymbol{\theta}$

is estimable based on the information contained in

$\mathcal{X}_0, \mathcal{N}_0$

(or

$\mathcal{X}_0, \mathcal{N}_0$

(or

$\mathcal{N}_0^+$

), but usually without specifying this in detail. That is, for example,

$\mathcal{N}_0^+$

), but usually without specifying this in detail. That is, for example,

$\nu_{ij} \,{:\!=}\, \exp\{\alpha_i + \beta_j\}$

and similarly, which in practice will make the number of unique parameters in

$\nu_{ij} \,{:\!=}\, \exp\{\alpha_i + \beta_j\}$

and similarly, which in practice will make the number of unique parameters in

$\boldsymbol{\theta}$

considerably less than

$\boldsymbol{\theta}$

considerably less than

$O(m^3)$

. A concrete example of this is given in Section 6.

$O(m^3)$

. A concrete example of this is given in Section 6.

-

(b) The simple sequential structure defined by (3.2) can, of course, be replaced with a longer historical dependence in terms of delay. For ease of exposition and to keep calculations manageable, we will only focus on definition (3.2). Further, note that the construction above, notwithstanding the particular choice of dependence structure, is in line with how individual claim dynamics would look in a micro model. These dynamics will naturally lead to a distinction between claims staying open and becoming re-opened, even though it is the total number of open claims that is the driver behind future payments. One can, however, note that if

$p_{ijk} = q_{ijk} = \pi_{ijk}$

it follows that (3.3)which means that

$p_{ijk} = q_{ijk} = \pi_{ijk}$

it follows that (3.3)which means that \begin{align} N_{ijk}^{\textrm{open}} \mid N_{ij}, N_{i,j,k-1}^{\textrm{open}} \sim \textrm{Bin}(N_{ij}, \pi_{ijk}), \end{align}

\begin{align} N_{ijk}^{\textrm{open}} \mid N_{ij}, N_{i,j,k-1}^{\textrm{open}} \sim \textrm{Bin}(N_{ij}, \pi_{ijk}), \end{align}

$\pi_{ijk}$

corresponds to the probability that a claim is open in (i, j, k), regardless of whether it has been closed prior to k or not. Thus, it is possible to have that

$\pi_{ijk}$

corresponds to the probability that a claim is open in (i, j, k), regardless of whether it has been closed prior to k or not. Thus, it is possible to have that

$N_{i,j,k + s}^{\textrm{open}} \ge N_{ijk}^{\textrm{open}}$

for

$N_{i,j,k + s}^{\textrm{open}} \ge N_{ijk}^{\textrm{open}}$

for

$s \ge 1$

, that is, net re-openings are allowed.

$s \ge 1$

, that is, net re-openings are allowed.

-

(c) The motivation of including dynamics for closing and re-opening claims is a generalisation of the Collective Reserving Model (CRM) introduced in Wahl et al. (Reference Wahl, Lindholm and Verrall2019), and it is seen that the CRM is retrieved by setting all

$p_{ijk}$

:s equal to one. A more detailed comparison with the CRM is found in Section 5.2. Further, there are other models in the literature that only capture closing of claims, without treating re-openings, see, for example, Bettonville et al. (Reference Bettonville, d’Oultremont, Denuit, Trufin and Van Oirbeek2020) and Crevecoeur and Antonio (Reference Crevecoeur and Antonio2019).

$p_{ijk}$

:s equal to one. A more detailed comparison with the CRM is found in Section 5.2. Further, there are other models in the literature that only capture closing of claims, without treating re-openings, see, for example, Bettonville et al. (Reference Bettonville, d’Oultremont, Denuit, Trufin and Van Oirbeek2020) and Crevecoeur and Antonio (Reference Crevecoeur and Antonio2019). -

(d) As with the models discussed in Verrall et al. (Reference Verrall, Nielsen and Jessen2010), Martinez-Miranda et al. (Reference Martinez-Miranda, Nielsen, Nielsen and Verrall2011), and Wahl et al. (Reference Wahl, Lindholm and Verrall2019), the current model is defined based on individual claim dynamics. Still, due to the current Poisson assumption, under suitable conditionings, the aggregated model can be described in terms of an over-dispersed Poisson model. From this perspective, the sufficient statistics for the aggregated model tell us that no information is lost while aggregating. For more on aggregation of “micro” level information, see, for example, Huang et al. (Reference Huang, Qiu and Wu2015, Reference Huang, Wu and Zhou2016), Charpentier and Pigeon (Reference Charpentier and Pigeon2016), Lindholm and Verrall (Reference Lindholm and Verrall2020).

-

(e) Note that the above model can be expressed in terms of the hierarchical model framework presented in Crevecoeur and Antonio (Reference Crevecoeur and Antonio2019), using number of open claims as one of the layers. For the purpose of this paper, this observation does not lead to additional insights and will not be discussed further.

4 Moments

In order to be able to obtain a reserve predictor, we need to first obtain an expression for the expected value of the outstanding payments. Further, since the model structure is defined in terms of (i, j, k)-tuples, it is possible to obtain separate IBNR and RBNS reserves. Moreover, the simple model structure will allow us to obtain recursive expressions for (co)variances, which can be used in (semi-)analytical approximations of the reserve MSEP. Furthermore, due to the sequential structure defining the dynamics of the number of claim payments as a function of time, given by (3.2), it is clear that it is not meaningful to condition on more granular information than that contained in

![]() $\mathcal{N}_0$

. That is, the least granular information that does not loose information is given by (i, j, k)-level knowledge of the

$\mathcal{N}_0$

. That is, the least granular information that does not loose information is given by (i, j, k)-level knowledge of the

![]() $N_{ijk}^{\textrm{open}}$

:s, and when calculating first and second moments, the final expressions will not require (explicit) knowledge of

$N_{ijk}^{\textrm{open}}$

:s, and when calculating first and second moments, the final expressions will not require (explicit) knowledge of

![]() $N^{\textrm{stay-open}}_{ijk}$

or

$N^{\textrm{stay-open}}_{ijk}$

or

![]() $N^{\textrm{re-open}}_{ijk}$

.

$N^{\textrm{re-open}}_{ijk}$

.

The derivation of moments will make use of the standard sum representation of outstanding payments, with RBNS and IBNR reserves defined by

where

\begin{align} R^{\mathcal{R}} = \sum\limits_{i=1}^m R_i^{\mathcal{R}}, \;\;\;\; R^{\mathcal{I}} = \sum\limits_{i=1}^m R_i^{\mathcal{I}}\end{align}

\begin{align} R^{\mathcal{R}} = \sum\limits_{i=1}^m R_i^{\mathcal{R}}, \;\;\;\; R^{\mathcal{I}} = \sum\limits_{i=1}^m R_i^{\mathcal{I}}\end{align}

and

\begin{align} R_i^{\mathcal{R}} = \sum \limits_{j=1}^{m-i}R_{ij}, \;\;\;\; R_i^{\mathcal{I}} = \sum \limits_{j=I-i+1}^{m-1}R_{ij},\end{align}

\begin{align} R_i^{\mathcal{R}} = \sum \limits_{j=1}^{m-i}R_{ij}, \;\;\;\; R_i^{\mathcal{I}} = \sum \limits_{j=I-i+1}^{m-1}R_{ij},\end{align}

where

![]() $R_{ij}$

is the sum of all outstanding payments from claims stemming from accident year i with a reporting delay of j, that is,

$R_{ij}$

is the sum of all outstanding payments from claims stemming from accident year i with a reporting delay of j, that is,

\begin{align} R_{ij} = \sum \limits_{k=m-i-j+1}^{m-1} X_{ijk}.\end{align}

\begin{align} R_{ij} = \sum \limits_{k=m-i-j+1}^{m-1} X_{ijk}.\end{align}

Here one can note that the

![]() $R_{ij}$

:s are independent. This is, however, not in general the case for the

$R_{ij}$

:s are independent. This is, however, not in general the case for the

![]() $X_{ijk}$

:s. Further, let

$X_{ijk}$

:s. Further, let

![]() $\boldsymbol{\theta}$

be defined as in Remark 1, and let the theoretical reserve predictor be denoted by

$\boldsymbol{\theta}$

be defined as in Remark 1, and let the theoretical reserve predictor be denoted by

while the corresponding RBNS and IBNR estimators are denoted by

The standard computable (plug-in) reserve predictors are, hence, given by

and analogously for the RBNS and IBNR reserves. Similar estimators can be constructed for individual

![]() $R_i$

and

$R_i$

and

![]() $R_{ij}$

. The derivation of moments for outstanding payments closely follows those given in Wahl et al. (Reference Wahl, Lindholm and Verrall2019) and are based on suitable repeated conditionings that are either omitted or merely outlined.

$R_{ij}$

. The derivation of moments for outstanding payments closely follows those given in Wahl et al. (Reference Wahl, Lindholm and Verrall2019) and are based on suitable repeated conditionings that are either omitted or merely outlined.

4.1 Expected values

The expected value of

![]() $R_{ij}$

is

$R_{ij}$

is

\begin{equation*} \mathbb{E}\left[R_{ij}\mid\mathcal{N}_0\right] = \sum\limits_{k=m-i-j+1}^{m-1} \mathbb{E}\left[X_{ijk}\mid\mathcal{N}_0\right],\end{equation*}

\begin{equation*} \mathbb{E}\left[R_{ij}\mid\mathcal{N}_0\right] = \sum\limits_{k=m-i-j+1}^{m-1} \mathbb{E}\left[X_{ijk}\mid\mathcal{N}_0\right],\end{equation*}

where the expected value of the payments is obtained by repeated conditioning, and where the split into RBNS and IBNR follows from the indexation given by (4.2) and (4.3). In more detail, it follows that

for

![]() $k = 1,...,m-1$

, and

$k = 1,...,m-1$

, and

where the expected value of the number of open claims is most conveniently expressed recursively as

\begin{align} &\mathbb{E}\left[N^{\textrm{open}}_{ijk}\mid\mathcal{N}_0\right] \nonumber\\[3pt] &\quad =\begin{cases} N^{\textrm{open}}_{ijk}, & (i,j,k) \in \mathcal{A}_0 \\ \\[-7pt] \left(p_{ijk}-q_{ijk}\right)\mathbb{E}\left[N^{\textrm{open}}_{i,j,k-1}\mid\mathcal{N}_0\right] + q_{ijk} \mathbb{E}\left[N_{ij}\mid\mathcal{N}_0\right] , & (i,j,k) \notin \mathcal{A}_0 \\\end{cases} ,\end{align}

\begin{align} &\mathbb{E}\left[N^{\textrm{open}}_{ijk}\mid\mathcal{N}_0\right] \nonumber\\[3pt] &\quad =\begin{cases} N^{\textrm{open}}_{ijk}, & (i,j,k) \in \mathcal{A}_0 \\ \\[-7pt] \left(p_{ijk}-q_{ijk}\right)\mathbb{E}\left[N^{\textrm{open}}_{i,j,k-1}\mid\mathcal{N}_0\right] + q_{ijk} \mathbb{E}\left[N_{ij}\mid\mathcal{N}_0\right] , & (i,j,k) \notin \mathcal{A}_0 \\\end{cases} ,\end{align}

for

![]() $k = 1,...,m-1$

, and

$k = 1,...,m-1$

, and

where

\begin{equation*}\mathbb{E}\left[N_{ij}\mid\mathcal{N}_0\right]=\begin{cases} N_{ij}, & (i,j,0) \in \mathcal{A}_0 \\ \\[-7pt] \nu_{ij}, & (i,j,0) \notin \mathcal{A}_0 \\\end{cases}.\end{equation*}

\begin{equation*}\mathbb{E}\left[N_{ij}\mid\mathcal{N}_0\right]=\begin{cases} N_{ij}, & (i,j,0) \in \mathcal{A}_0 \\ \\[-7pt] \nu_{ij}, & (i,j,0) \notin \mathcal{A}_0 \\\end{cases}.\end{equation*}

Remark 2

-

(a) In agreement with Verrall et al. (Reference Verrall, Nielsen and Jessen2010) and Wahl et al. (Reference Wahl, Lindholm and Verrall2019), it is seen that (4.4) can be re-written in terms of

$\psi_{ijk} = \mu_{ijk}\lambda_{ijk}$

, which is a parametrisation that will be used when discussing estimation in Section 5.

$\psi_{ijk} = \mu_{ijk}\lambda_{ijk}$

, which is a parametrisation that will be used when discussing estimation in Section 5. -

(b) By using the reduced model where

$p_{ijk} = q_{ijk}$

discussed in Remark 1(b), it is seen that the expected values not in

$p_{ijk} = q_{ijk}$

discussed in Remark 1(b), it is seen that the expected values not in

$\mathcal{A}_0$

reduce to only depending on

$\mathcal{A}_0$

reduce to only depending on

$N_{ij}$

:s, as it should.

$N_{ij}$

:s, as it should.

4.2 (Co)variances

Compared with the situation in Verrall et al. (Reference Verrall, Nielsen and Jessen2010) and Wahl et al. (Reference Wahl, Lindholm and Verrall2019), the payments

![]() $X_{ijk}$

are no longer independent for equal i and j (unless all

$X_{ijk}$

are no longer independent for equal i and j (unless all

![]() $p_{ijk} \equiv 1$

, when the model coincides with the CRM), and the variance of outstanding payments must be calculated in full according to

$p_{ijk} \equiv 1$

, when the model coincides with the CRM), and the variance of outstanding payments must be calculated in full according to

\begin{align} \textrm{Var}\left(R_{ij}\mid\mathcal{N}_0 \right) = \sum\limits_{k=m-i-j+1}^{m-1}\left\{ \textrm{Var}\left( X_{ijk} \mid\mathcal{N}_0\right) + 2\sum \limits_{l=k+1}^{m-1}\textrm{Cov}\left(X_{ijk},X_{ijl}\mid\mathcal{N}_0\right) \right\},\end{align}

\begin{align} \textrm{Var}\left(R_{ij}\mid\mathcal{N}_0 \right) = \sum\limits_{k=m-i-j+1}^{m-1}\left\{ \textrm{Var}\left( X_{ijk} \mid\mathcal{N}_0\right) + 2\sum \limits_{l=k+1}^{m-1}\textrm{Cov}\left(X_{ijk},X_{ijl}\mid\mathcal{N}_0\right) \right\},\end{align}

where the split into RBNS and IBNR follows from the indexation given by (4.2) and (4.3). Still, the components of (4.6) can be represented recursively according to

\begin{align}\textrm{Var}\left(X_{ijk}\mid\mathcal{N}_0\right) & =\mu_{ijk}^2\lambda_{ijk}^2\textrm{Var}\left(N^{\textrm{open}}_{i,j,k-1}\mid\mathcal{N}_0\right) \nonumber\\[3pt] &\quad +\left(\mu_{ijk}^2+\sigma^2_{ijk}\right)\lambda_{ijk}\mathbb{E}\left[N^{\textrm{open}}_{i,j,k-1}\mid\mathcal{N}_0\right]\end{align}

\begin{align}\textrm{Var}\left(X_{ijk}\mid\mathcal{N}_0\right) & =\mu_{ijk}^2\lambda_{ijk}^2\textrm{Var}\left(N^{\textrm{open}}_{i,j,k-1}\mid\mathcal{N}_0\right) \nonumber\\[3pt] &\quad +\left(\mu_{ijk}^2+\sigma^2_{ijk}\right)\lambda_{ijk}\mathbb{E}\left[N^{\textrm{open}}_{i,j,k-1}\mid\mathcal{N}_0\right]\end{align}

for

![]() $k = 1,...,m-1$

, and

$k = 1,...,m-1$

, and

\begin{equation*}\begin{split}\textrm{Var}\left(X_{ij0}\mid\mathcal{N}_0\right) & =\mu_{ij0}^2\lambda_{ij0}^2\textrm{Var}\left(N_{ij}\mid\mathcal{N}_0\right) \\[3pt] &\quad +\left(\mu_{ij0}^2+\sigma^2_{ij0}\right)\lambda_{ij0}\mathbb{E}\left[N_{ij}\mid\mathcal{N}_0\right].\end{split}\end{equation*}

\begin{equation*}\begin{split}\textrm{Var}\left(X_{ij0}\mid\mathcal{N}_0\right) & =\mu_{ij0}^2\lambda_{ij0}^2\textrm{Var}\left(N_{ij}\mid\mathcal{N}_0\right) \\[3pt] &\quad +\left(\mu_{ij0}^2+\sigma^2_{ij0}\right)\lambda_{ij0}\mathbb{E}\left[N_{ij}\mid\mathcal{N}_0\right].\end{split}\end{equation*}

For

![]() $(i,j,k) \in \mathcal{A}_0$

,

$(i,j,k) \in \mathcal{A}_0$

,

and for

![]() $(i,j,k) \notin \mathcal{A}_0$

,

$(i,j,k) \notin \mathcal{A}_0$

,

\begin{align}\textrm{Var}\left(N^{\textrm{open}}_{ijk}\mid\mathcal{N}_0\right) = & \left(p_{ijk}-q_{ijk}\right)^2\textrm{Var}\left(N^{\textrm{open}}_{i,j,k-1}\mid\mathcal{N}_0\right) \nonumber\\[3pt] &\quad +\left(p_{ijk}\left(1-p_{ijk}\right)-q_{ijk}\left(1-q_{ijk}\right)\right)\mathbb{E}\left[N^{\textrm{open}}_{i,j,k-1}\mid\mathcal{N}_0\right] \nonumber\\[3pt] &\quad + q_{ijk}\left(1-q_{ijk}\right)\mathbb{E}\left[N_{ij}\mid\mathcal{N}_0\right] \nonumber\\[3pt] &\quad + q_{ijk}^2 \textrm{Var}\left(N_{ij}\mid\mathcal{N}_0\right) \nonumber\\[3pt] &\quad + 2\left(p_{ijk}-q_{ijk}\right)q_{ijk}\textrm{Cov}\left(N^{\textrm{open}}_{i,j,k-1},N_{ij}\mid\mathcal{N}_0\right)\end{align}

\begin{align}\textrm{Var}\left(N^{\textrm{open}}_{ijk}\mid\mathcal{N}_0\right) = & \left(p_{ijk}-q_{ijk}\right)^2\textrm{Var}\left(N^{\textrm{open}}_{i,j,k-1}\mid\mathcal{N}_0\right) \nonumber\\[3pt] &\quad +\left(p_{ijk}\left(1-p_{ijk}\right)-q_{ijk}\left(1-q_{ijk}\right)\right)\mathbb{E}\left[N^{\textrm{open}}_{i,j,k-1}\mid\mathcal{N}_0\right] \nonumber\\[3pt] &\quad + q_{ijk}\left(1-q_{ijk}\right)\mathbb{E}\left[N_{ij}\mid\mathcal{N}_0\right] \nonumber\\[3pt] &\quad + q_{ijk}^2 \textrm{Var}\left(N_{ij}\mid\mathcal{N}_0\right) \nonumber\\[3pt] &\quad + 2\left(p_{ijk}-q_{ijk}\right)q_{ijk}\textrm{Cov}\left(N^{\textrm{open}}_{i,j,k-1},N_{ij}\mid\mathcal{N}_0\right)\end{align}

for

![]() $k=1,...,m-1$

and

$k=1,...,m-1$

and

\begin{equation*}\begin{split}\textrm{Var}\left(N^{\textrm{open}}_{ij0}\mid\mathcal{N}_0\right) &= p_{ij0}\left(1-p_{ij0}\right)\mathbb{E}\left[N_{ij}\mid\mathcal{N}_0\right] \\&\quad + p_{ij0}^2 \textrm{Var}\left(N_{ij}\mid\mathcal{N}_0\right).\end{split}\end{equation*}

\begin{equation*}\begin{split}\textrm{Var}\left(N^{\textrm{open}}_{ij0}\mid\mathcal{N}_0\right) &= p_{ij0}\left(1-p_{ij0}\right)\mathbb{E}\left[N_{ij}\mid\mathcal{N}_0\right] \\&\quad + p_{ij0}^2 \textrm{Var}\left(N_{ij}\mid\mathcal{N}_0\right).\end{split}\end{equation*}

where

\begin{equation*}\begin{split}\textrm{Cov}\left(N^{\textrm{open}}_{ijk},N_{ij}\mid\mathcal{N}_0\right)= & \left(p_{ijk}-q_{ijk}\right)\textrm{Cov}\left(N_{ij},N^{\textrm{open}}_{i,j,k-1}\mid\mathcal{N}_0\right) \\&\quad +q_{ijk}\textrm{Var}\left(N_{ij}\mid\mathcal{N}_0\right)\end{split}\end{equation*}

\begin{equation*}\begin{split}\textrm{Cov}\left(N^{\textrm{open}}_{ijk},N_{ij}\mid\mathcal{N}_0\right)= & \left(p_{ijk}-q_{ijk}\right)\textrm{Cov}\left(N_{ij},N^{\textrm{open}}_{i,j,k-1}\mid\mathcal{N}_0\right) \\&\quad +q_{ijk}\textrm{Var}\left(N_{ij}\mid\mathcal{N}_0\right)\end{split}\end{equation*}

for

![]() $k=1,...,m-1$

and

$k=1,...,m-1$

and

Also,

\begin{equation*}\textrm{Var}\left(N_{ij}\mid\mathcal{N}_0\right)=\begin{cases} 0, & (i,j,0) \in \mathcal{A}_0 \\ \\[-7pt] \phi \nu_{ij}, & (i,j,0) \notin \mathcal{A}_0 \\\end{cases}.\end{equation*}

\begin{equation*}\textrm{Var}\left(N_{ij}\mid\mathcal{N}_0\right)=\begin{cases} 0, & (i,j,0) \in \mathcal{A}_0 \\ \\[-7pt] \phi \nu_{ij}, & (i,j,0) \notin \mathcal{A}_0 \\\end{cases}.\end{equation*}

As for the covariance terms of the payments, it holds that

when

![]() $k=1,...l-1$

and

$k=1,...l-1$

and

Here,

\begin{equation*}\begin{split}\textrm{Cov}\left(N^{\textrm{open}}_{ijk},N^{\textrm{open}}_{ijl}\mid\mathcal{N}_0\right) &= \left(p_{ijl}-q_{ijl}\right)\textrm{Cov}\left(N^{\textrm{open}}_{ijk},N^{\textrm{open}}_{i,j,l-1}\mid\mathcal{N}_0\right) \\[3pt]&\quad + q_{ijl}\textrm{Cov}\left(N^{\textrm{open}}_{ijk},N_{ij}\mid\mathcal{N}_0\right)\end{split}\end{equation*}

\begin{equation*}\begin{split}\textrm{Cov}\left(N^{\textrm{open}}_{ijk},N^{\textrm{open}}_{ijl}\mid\mathcal{N}_0\right) &= \left(p_{ijl}-q_{ijl}\right)\textrm{Cov}\left(N^{\textrm{open}}_{ijk},N^{\textrm{open}}_{i,j,l-1}\mid\mathcal{N}_0\right) \\[3pt]&\quad + q_{ijl}\textrm{Cov}\left(N^{\textrm{open}}_{ijk},N_{ij}\mid\mathcal{N}_0\right)\end{split}\end{equation*}

for

![]() $k=0,...,l-1$

. The derivation of the above (co)variances is again given by straightforward repeated conditioning.

$k=0,...,l-1$

. The derivation of the above (co)variances is again given by straightforward repeated conditioning.

Remark 3

-

(a) By inspecting the expressions for the (co)variances, it is clear that the corresponding quantities for the CRM are retrieved by setting all

$p_{ijk} \,{:\!=}\, 1$

. That is,

$p_{ijk} \,{:\!=}\, 1$

. That is,

$N_{ij} \equiv N^{\textrm{open}}_{ij,k}$

, for all k, and those covariance terms that are not immediately cancelled will be turned into variance terms.

$N_{ij} \equiv N^{\textrm{open}}_{ij,k}$

, for all k, and those covariance terms that are not immediately cancelled will be turned into variance terms. -

(b) For the model discussed in Remark 1(b) where

$p_{ijk} = q_{ijk}$

, the moments are simplified considerably, and all explicit dependencies between

$p_{ijk} = q_{ijk}$

, the moments are simplified considerably, and all explicit dependencies between

$N^{\textrm{open}}_{ijk}$

:s are replaced with variances only depending on

$N^{\textrm{open}}_{ijk}$

:s are replaced with variances only depending on

$N_{ij}$

:s.

$N_{ij}$

:s. -

(c) Note that

$\operatorname{Var}(X_{ijk} \mid \mathcal{N}_0) = \varphi_{ijk}\mathbb{E}[X_{ijk} \mid \mathcal{N}_0]$

for all

$\operatorname{Var}(X_{ijk} \mid \mathcal{N}_0) = \varphi_{ijk}\mathbb{E}[X_{ijk} \mid \mathcal{N}_0]$

for all

$(i,j,k) \in \mathcal{A}_0$

, where

$(i,j,k) \in \mathcal{A}_0$

, where

$\varphi_{ijk}$

is a function of

$\varphi_{ijk}$

is a function of

$\boldsymbol{\theta}$

, hence satisfying the ODP moment assumption. Moreover,

$\boldsymbol{\theta}$

, hence satisfying the ODP moment assumption. Moreover,

$\textrm{Cov}(X_{ijk}, X_{i,j,l} \mid \mathcal{N}_0) = 0$

for all

$\textrm{Cov}(X_{ijk}, X_{i,j,l} \mid \mathcal{N}_0) = 0$

for all

$k \neq l$

and

$k \neq l$

and

$(i,j,k), (i,j,l) \in \mathcal{A}_0$

, and, in particular, it holds that all

$(i,j,k), (i,j,l) \in \mathcal{A}_0$

, and, in particular, it holds that all

$X_{ijk}, X_{i,j,l}$

where

$X_{ijk}, X_{i,j,l}$

where

$k \neq l$

and

$k \neq l$

and

$(i,j,k), (i,j,l) \in \mathcal{A}_0$

are conditionally independent, given

$(i,j,k), (i,j,l) \in \mathcal{A}_0$

are conditionally independent, given

$\mathcal{N}_0$

.

$\mathcal{N}_0$

. -

(d) Analogously to the discussion in Remark 2 it is seen that (co)variance-expressions can be simplified by introducing

$\psi_{ijk} \,{:\!=}\, \mu_{ijk}\lambda_{ijk}$

.

$\psi_{ijk} \,{:\!=}\, \mu_{ijk}\lambda_{ijk}$

.

5 Estimation

The CRMO as introduced in Section 3 is very flexible and in practice we need to make assumptions concerning the parametrisation of this model. Concerning the claim occurrence part of the model, a natural way to proceed is to use the over-dispersed chain-ladder parametrisation, that is,

which corresponds to a standard over-dispersed Poisson GLM. Following this approach,

![]() $\phi$

can be estimated, as in, for example, Martinez-Miranda et al. (Reference Martinez-Miranda, Nielsen, Nielsen and Verrall2011), Eq. (11), according to

$\phi$

can be estimated, as in, for example, Martinez-Miranda et al. (Reference Martinez-Miranda, Nielsen, Nielsen and Verrall2011), Eq. (11), according to

\begin{equation*}\widehat{\phi} = \frac{1}{\frac{m(m+1)}{2}-(1+2(m-1))}\sum \limits_{(i,j) \in \mathcal{A}_0} \frac{\left(N_{ij}-\widehat{\nu}_{ij}\right)^2}{\widehat{\nu}_{ij}}.\end{equation*}

\begin{equation*}\widehat{\phi} = \frac{1}{\frac{m(m+1)}{2}-(1+2(m-1))}\sum \limits_{(i,j) \in \mathcal{A}_0} \frac{\left(N_{ij}-\widehat{\nu}_{ij}\right)^2}{\widehat{\nu}_{ij}}.\end{equation*}

Furthermore, recall that the motivation for using a quasi-likelihood approach for modelling the parameters defining the distribution of

![]() $N_{ij}$

, that is,

$N_{ij}$

, that is,

![]() $\nu_{ij}$

and

$\nu_{ij}$

and

![]() $\phi$

, relies on that all

$\phi$

, relies on that all

![]() $N_{ij}$

are independent and that

$N_{ij}$

are independent and that

and that by using the parametrisation (5.1), it is sufficient to only have observations on

![]() $\mathcal{A}_0$

and still be able to predict future claim occurrences. In Wahl et al. (Reference Wahl, Lindholm and Verrall2019), this was exploited for the payment part of the process as well, by observing that the CRM results in that

$\mathcal{A}_0$

and still be able to predict future claim occurrences. In Wahl et al. (Reference Wahl, Lindholm and Verrall2019), this was exploited for the payment part of the process as well, by observing that the CRM results in that

where

![]() $\widetilde\psi_{i,jk}, \widetilde\varphi > 0$

, and where all

$\widetilde\psi_{i,jk}, \widetilde\varphi > 0$

, and where all

![]() $X_{ijk}^{{CRM}}$

independent.

$X_{ijk}^{{CRM}}$

independent.

Remark 4

-

(a) For the numerical illustrations in Wahl et al. (Reference Wahl, Lindholm and Verrall2019), the parametrisation

$\widetilde \psi_{ijk} = \mu_{ijk} \widetilde \lambda_{ijk} = \widetilde \psi_k$

is used, based on that

$\widetilde \psi_{ijk} = \mu_{ijk} \widetilde \lambda_{ijk} = \widetilde \psi_k$

is used, based on that

$\widetilde\lambda_{ijk} = \widetilde\lambda_k$

and

$\widetilde\lambda_{ijk} = \widetilde\lambda_k$

and

$\mu_{ijk} = \mu$

. This combined with that

$\mu_{ijk} = \mu$

. This combined with that

$\sigma_{ijk}^2 = \sigma^2$

implies a constant over-dispersion parameter

$\sigma_{ijk}^2 = \sigma^2$

implies a constant over-dispersion parameter

$\widetilde\varphi$

. (Note that we do not have to introduce

$\widetilde\varphi$

. (Note that we do not have to introduce

$\widetilde \mu_{ijk}$

and

$\widetilde \mu_{ijk}$

and

$\widetilde \sigma_{ijk}$

, since these parameters will always have the same meaning for the CRMO and the CRM.) This particular choice is partly motivated by the fact that the CRM can be estimated using more aggregated

$\widetilde \sigma_{ijk}$

, since these parameters will always have the same meaning for the CRMO and the CRM.) This particular choice is partly motivated by the fact that the CRM can be estimated using more aggregated

$X_{ij}$

-data, which is not an alternative in the current paper, since we are interested in capturing the dynamics of claim closings and re-openings.

$X_{ij}$

-data, which is not an alternative in the current paper, since we are interested in capturing the dynamics of claim closings and re-openings. -

(b) In Lindholm et al. (Reference Lindholm, Lindskog and Wahl2020), it is assumed that

(5.3)which is an artificial, and in many situations unreasonable, assumption. Still, it allows us to estimate the \begin{align} \widetilde \varphi_{ijk} \,{:\!=}\, \frac{\mu_{ijk}^2 + \sigma^2_{ijk}}{\mu_{ijk}} \equiv \widetilde \varphi, \end{align}

\begin{align} \widetilde \varphi_{ijk} \,{:\!=}\, \frac{\mu_{ijk}^2 + \sigma^2_{ijk}}{\mu_{ijk}} \equiv \widetilde \varphi, \end{align}

$\widetilde\psi_{ijk}$

:s flexibly and reduces the number of parameters. Note, however, that

$\widetilde\psi_{ijk}$

:s flexibly and reduces the number of parameters. Note, however, that

$\widetilde \varphi_{ijk}$

is only a function of payment size parameters, and we could just as well assume that these are independent of (i, j, k). The practical consequences of assuming (5.3) are primarily that the model interpretation becomes less clear. This will be discussed further in Sections 6 and 7.

$\widetilde \varphi_{ijk}$

is only a function of payment size parameters, and we could just as well assume that these are independent of (i, j, k). The practical consequences of assuming (5.3) are primarily that the model interpretation becomes less clear. This will be discussed further in Sections 6 and 7.

In the current setting, for the CRMO, this relationship holds true as well, but only conditionally independent for all

![]() $(i, j, k) \in \mathcal{A}_0$

. That is,

$(i, j, k) \in \mathcal{A}_0$

. That is,

where

![]() $\psi_{ijk} = \mu_{ijk}\lambda_{ijk}$

, and where

$\psi_{ijk} = \mu_{ijk}\lambda_{ijk}$

, and where

\begin{equation*} \varphi = \frac{\mu_{ijk}^2+\sigma^2_{ijk}}{\mu_{ijk}}\end{equation*}

\begin{equation*} \varphi = \frac{\mu_{ijk}^2+\sigma^2_{ijk}}{\mu_{ijk}}\end{equation*}

which follows directly from (4.4) and (4.7) for all

![]() $X_{ijk}$

where

$X_{ijk}$

where

![]() $(i, j, k) \in \mathcal{A}_0$

, and recall from Remark 3 that these

$(i, j, k) \in \mathcal{A}_0$

, and recall from Remark 3 that these

![]() $X_{ijk}$

are conditionally independent. Moreover, as for the CRM, the functional form describing the

$X_{ijk}$

are conditionally independent. Moreover, as for the CRM, the functional form describing the

![]() $\psi_{ijk}$

:s should be possible to estimate based on data in

$\psi_{ijk}$

:s should be possible to estimate based on data in

![]() $\mathcal{A}_0$

alone and that the functional form should still allow for predictions into the future. Furthermore, concerning the estimation of

$\mathcal{A}_0$

alone and that the functional form should still allow for predictions into the future. Furthermore, concerning the estimation of

![]() $\varphi$

, this can be done analogously as for the CRM based on

$\varphi$

, this can be done analogously as for the CRM based on

![]() $X_{ijk}$

-level data by using

$X_{ijk}$

-level data by using

\begin{align}\widehat\varphi = \frac{1}{\frac{m(m+1)(m+2)}{6}-\left(1+3(m-1)\right)}\sum \limits_{(i,j,k) \in \mathcal{A}_0}\frac{\left(X_{ijk}-\widehat{\psi}_{ijk}N_{i,j,k-1}^{\textrm{open}}\right)^2}{\widehat{\psi}_{ijk}N_{i,j,k-1}^{\textrm{open}}}.\end{align}

\begin{align}\widehat\varphi = \frac{1}{\frac{m(m+1)(m+2)}{6}-\left(1+3(m-1)\right)}\sum \limits_{(i,j,k) \in \mathcal{A}_0}\frac{\left(X_{ijk}-\widehat{\psi}_{ijk}N_{i,j,k-1}^{\textrm{open}}\right)^2}{\widehat{\psi}_{ijk}N_{i,j,k-1}^{\textrm{open}}}.\end{align}

Thus, the

![]() $\psi_{ijk}$

:s and the over-dispersion parameter

$\psi_{ijk}$

:s and the over-dispersion parameter

![]() $\varphi$

can be estimated using a quasi-Poisson likelihood. Consistency of these parameter estimators follows the arguments from Wahl et al. (Reference Wahl, Lindholm and Verrall2019), Prop. 2 for the CRM.

$\varphi$

can be estimated using a quasi-Poisson likelihood. Consistency of these parameter estimators follows the arguments from Wahl et al. (Reference Wahl, Lindholm and Verrall2019), Prop. 2 for the CRM.

What remains now is to estimate the probabilities defining the dynamics for closing and re-opening of claims. In the ideal situation, one has access to the additional information

![]() $N^{\textrm{stay-open}}_{ijk}$

and

$N^{\textrm{stay-open}}_{ijk}$

and

![]() $N^{\textrm{re-open}}_{ijk}$

, and given this information, the probabilities

$N^{\textrm{re-open}}_{ijk}$

, and given this information, the probabilities

![]() $p_{ijk}$

and

$p_{ijk}$

and

![]() $q_{ijk}$

are estimated using standard binomial likelihoods. This approach guarantees consistency of the parameter estimators. In Section 6, we use GLM:s with canonical link functions. Although this modelling approach is simple, it requires a lot of data, data which are not needed for reserve prediction, see also the discussion in the first paragraph of Section 4. Another way to estimate the

$q_{ijk}$

are estimated using standard binomial likelihoods. This approach guarantees consistency of the parameter estimators. In Section 6, we use GLM:s with canonical link functions. Although this modelling approach is simple, it requires a lot of data, data which are not needed for reserve prediction, see also the discussion in the first paragraph of Section 4. Another way to estimate the

![]() $p_{ijk}$

:s and

$p_{ijk}$

:s and

![]() $q_{ijk}$

:s is to only use

$q_{ijk}$

:s is to only use

![]() $N_{ijk}^{\textrm{open}}$

-data and make the (artificial) assumption

$N_{ijk}^{\textrm{open}}$

-data and make the (artificial) assumption

![]() $p_{ijk}=q_{ijk}=\pi_{ijk}$

for all (i, j, k). While it is unlikely that the probability of a claim re-opening is equal to that of a claim staying open, the parameter

$p_{ijk}=q_{ijk}=\pi_{ijk}$

for all (i, j, k). While it is unlikely that the probability of a claim re-opening is equal to that of a claim staying open, the parameter

![]() $\pi_{ijk}$

can instead be interpreted as the probability of a claim being open k years after being reported in (i, j). Moreover, the

$\pi_{ijk}$

can instead be interpreted as the probability of a claim being open k years after being reported in (i, j). Moreover, the

![]() $\pi_{ijk}$

:s can then be estimated using, for example, standard GLM:s with canonical link functions, since the number of open claims will then be (conditionally) likelihood equivalent with

$\pi_{ijk}$

:s can then be estimated using, for example, standard GLM:s with canonical link functions, since the number of open claims will then be (conditionally) likelihood equivalent with

As commented on in Section 4, the moment expressions for

![]() $N_{ijk}^{\textrm{open}}$

will also be vastly simplified for this more restrictive model.

$N_{ijk}^{\textrm{open}}$

will also be vastly simplified for this more restrictive model.

An alternative to estimate model parameters only based on

![]() $N_{ijk}^{\textrm{open}}$

data is to treat the

$N_{ijk}^{\textrm{open}}$

data is to treat the

![]() $N^{\textrm{stay-open}}_{ijk}$

:s and

$N^{\textrm{stay-open}}_{ijk}$

:s and

![]() $N^{\textrm{re-open}}_{ijk}$

:s as missing values. This situation is straightforward to approach using the EM-algorithm, even though this approach tends to be sensitive to initial values, since the sum-of-Binomial structure will, when using more flexible parametrisations, likely lead to identification problems for the probabilities, resulting in many local maxima for the joint likelihood. Even if this approach may produce reasonable reserve predictions, this will have implications on the variance structure.

$N^{\textrm{re-open}}_{ijk}$

:s as missing values. This situation is straightforward to approach using the EM-algorithm, even though this approach tends to be sensitive to initial values, since the sum-of-Binomial structure will, when using more flexible parametrisations, likely lead to identification problems for the probabilities, resulting in many local maxima for the joint likelihood. Even if this approach may produce reasonable reserve predictions, this will have implications on the variance structure.

5.1 Comments on consistency of normalised reserves

Based on the constructive arguments that underpin both the CRM and the CRMO in terms of individual claim dynamics, it is natural to explicitly introduce accident year specific exposures

![]() $w_i$

that corresponds to the number of contracts for accident year i. That is, assume that

$w_i$

that corresponds to the number of contracts for accident year i. That is, assume that

![]() $N_{ij} \sim \operatorname{ODP}(\nu_{ij}, \phi)$

where

$N_{ij} \sim \operatorname{ODP}(\nu_{ij}, \phi)$

where

where

![]() $\overline n_{ij}(\boldsymbol{\theta}) \,{:\!=}\, \alpha_i\beta_j$

, and note that

$\overline n_{ij}(\boldsymbol{\theta}) \,{:\!=}\, \alpha_i\beta_j$

, and note that

![]() $N_{ij}$

can be expressed as

$N_{ij}$

can be expressed as

\begin{align} N_{ij} \stackrel{d}{=} \sum_{l = 1}^{w_i} \widetilde N_{ijl},\end{align}

\begin{align} N_{ij} \stackrel{d}{=} \sum_{l = 1}^{w_i} \widetilde N_{ijl},\end{align}

where all

![]() $\widetilde N_{ijl}$

are i.i.d.

$\widetilde N_{ijl}$

are i.i.d.

![]() $\operatorname{ODP}(\alpha_i \beta_j, \phi)$

. Hence, since the

$\operatorname{ODP}(\alpha_i \beta_j, \phi)$

. Hence, since the

![]() $\widehat R_{ij}$

s will be proportional to the corresponding

$\widehat R_{ij}$

s will be proportional to the corresponding

![]() $N_{ij}$

s (or expectations thereof),

$N_{ij}$

s (or expectations thereof),

![]() $\widehat R_{ij} / w_i$

can be thought of as the approximate reserve from a single contract. Thus, consistency of

$\widehat R_{ij} / w_i$

can be thought of as the approximate reserve from a single contract. Thus, consistency of

![]() $\widehat R_{ij} / w_i$

has a natural interpretation and is also treated in, for example, Huang et al. (Reference Huang, Qiu and Wu2015, Reference Huang, Wu and Zhou2016).

$\widehat R_{ij} / w_i$

has a natural interpretation and is also treated in, for example, Huang et al. (Reference Huang, Qiu and Wu2015, Reference Huang, Wu and Zhou2016).

Further, note that when letting

![]() $w_i \to \infty$

the dimension of

$w_i \to \infty$

the dimension of

![]() $\widehat{\boldsymbol{\theta}}$

is fixed. Moreover, if we assume that the parametrisation of

$\widehat{\boldsymbol{\theta}}$

is fixed. Moreover, if we assume that the parametrisation of

![]() $\boldsymbol{\theta}$

is estimable based on

$\boldsymbol{\theta}$

is estimable based on

![]() $\mathcal{X}$

and

$\mathcal{X}$

and

![]() $\mathcal{N}_0^+$

data (or assuming that

$\mathcal{N}_0^+$

data (or assuming that

![]() $p_{ijk} = q_{ijk}$

, see also Remark 1), by the arguments in Wahl et al. (Reference Wahl, Lindholm and Verrall2019), Proposition 2(ii), it follows that

$p_{ijk} = q_{ijk}$

, see also Remark 1), by the arguments in Wahl et al. (Reference Wahl, Lindholm and Verrall2019), Proposition 2(ii), it follows that

![]() $\widehat{\boldsymbol{\theta}} \to \boldsymbol{\theta}$

in probability as

$\widehat{\boldsymbol{\theta}} \to \boldsymbol{\theta}$

in probability as

![]() $w_i \to \infty$

. Next, given that the reserves can be split into an IBNR and a RBNS part, the consistency of

$w_i \to \infty$

. Next, given that the reserves can be split into an IBNR and a RBNS part, the consistency of

![]() $\widehat{\boldsymbol{\theta}}$

immediately yields that

$\widehat{\boldsymbol{\theta}}$

immediately yields that

![]() $\widehat R_{ij}^\mathcal{I} / w_i$

as

$\widehat R_{ij}^\mathcal{I} / w_i$

as

![]() $w_i \to \infty$

. Continuing with the RBNS reserves, from Section 4 for (i, j, k) such that

$w_i \to \infty$

. Continuing with the RBNS reserves, from Section 4 for (i, j, k) such that

![]() $X_{ijk}$

corresponds to an RBNS payment, it holds that

$X_{ijk}$

corresponds to an RBNS payment, it holds that

![]() $N_{ij}$

and

$N_{ij}$

and

![]() $N_{i,j,m-i-j}^\textrm{open}$

are

$N_{i,j,m-i-j}^\textrm{open}$

are

![]() $\mathcal{N}_0$

measurable, which gives us that

$\mathcal{N}_0$

measurable, which gives us that

\begin{align} h_{ijk}(\boldsymbol{\theta};\ \mathcal{N}_0) \,{:\!=}\,& \mathbb{E}[X_{ijk} \mid \mathcal{N}_0](\boldsymbol{\theta})\nonumber\\[3pt] \,{:\!=}\,& \mathbb{E}[N_{i,j,k-1}^\textrm{open} \mid \mathcal{N}_0](\boldsymbol{\theta}) \psi_{ijk}\nonumber\\[3pt] =& \psi_{ijk}N_{i,j,m-i-j}^\textrm{open} \prod\limits_{l = m-i-j +1}^{k-1}\left(p_{ijl}-q_{ijl}\right)\nonumber \\[3pt] & + \psi_{ijk}N_{ij}\sum \limits_{l=m-i-j+1}^{k-1}q_{ijl} \prod\limits_{n=l+1}^{k-1} \left(p_{ijn}-q_{ijn}\right)\end{align}

\begin{align} h_{ijk}(\boldsymbol{\theta};\ \mathcal{N}_0) \,{:\!=}\,& \mathbb{E}[X_{ijk} \mid \mathcal{N}_0](\boldsymbol{\theta})\nonumber\\[3pt] \,{:\!=}\,& \mathbb{E}[N_{i,j,k-1}^\textrm{open} \mid \mathcal{N}_0](\boldsymbol{\theta}) \psi_{ijk}\nonumber\\[3pt] =& \psi_{ijk}N_{i,j,m-i-j}^\textrm{open} \prod\limits_{l = m-i-j +1}^{k-1}\left(p_{ijl}-q_{ijl}\right)\nonumber \\[3pt] & + \psi_{ijk}N_{ij}\sum \limits_{l=m-i-j+1}^{k-1}q_{ijl} \prod\limits_{n=l+1}^{k-1} \left(p_{ijn}-q_{ijn}\right)\end{align}

by repeated conditioning using (4.5), and analogous calculations yields

\begin{align} \mathbb{E}[h_{ijk}(\boldsymbol{\theta};\ \mathcal{N}_0)] &= \mathbb{E}[N_{ij}]\left(\sum \limits_{l=1}^{k-1}q_{ijl} \prod\limits_{n=l+1}^{k-1} \left(p_{ijn}-q_{ijn}\right)+p_{ij0}\prod\limits_{l=1}^{k-1}\left(p_{ijl}-q_{ijl}\right)\right)\psi_{ijk} \nonumber\\[3pt] &= w_i \overline n_{ij}(\boldsymbol{\theta})\left(\sum \limits_{l=1}^{k-1}q_{ijl} \prod\limits_{n=l+1}^{k-1} \left(p_{ijn}-q_{ijn}\right)+p_{ij0}\prod\limits_{l=1}^{k-1}\left(p_{ijl}-q_{ijl}\right)\right)\psi_{ijk} \nonumber\\[3pt] &= w_i \overline x_{ijk}(\boldsymbol{\theta}), \end{align}

\begin{align} \mathbb{E}[h_{ijk}(\boldsymbol{\theta};\ \mathcal{N}_0)] &= \mathbb{E}[N_{ij}]\left(\sum \limits_{l=1}^{k-1}q_{ijl} \prod\limits_{n=l+1}^{k-1} \left(p_{ijn}-q_{ijn}\right)+p_{ij0}\prod\limits_{l=1}^{k-1}\left(p_{ijl}-q_{ijl}\right)\right)\psi_{ijk} \nonumber\\[3pt] &= w_i \overline n_{ij}(\boldsymbol{\theta})\left(\sum \limits_{l=1}^{k-1}q_{ijl} \prod\limits_{n=l+1}^{k-1} \left(p_{ijn}-q_{ijn}\right)+p_{ij0}\prod\limits_{l=1}^{k-1}\left(p_{ijl}-q_{ijl}\right)\right)\psi_{ijk} \nonumber\\[3pt] &= w_i \overline x_{ijk}(\boldsymbol{\theta}), \end{align}

where

\begin{equation*} \overline x_{ijk} \,{:\!=}\, \overline n_{ij}(\boldsymbol{\theta})\left(\sum \limits_{l=1}^{k-1}q_{ijl} \prod\limits_{n=l+1}^{k-1} \left(p_{ijn}-q_{ijn}\right)+p_{ij0}\prod\limits_{l=1}^{k-1}\left(p_{ijl}-q_{ijl}\right)\right)\psi_{ijk}.\end{equation*}

\begin{equation*} \overline x_{ijk} \,{:\!=}\, \overline n_{ij}(\boldsymbol{\theta})\left(\sum \limits_{l=1}^{k-1}q_{ijl} \prod\limits_{n=l+1}^{k-1} \left(p_{ijn}-q_{ijn}\right)+p_{ij0}\prod\limits_{l=1}^{k-1}\left(p_{ijl}-q_{ijl}\right)\right)\psi_{ijk}.\end{equation*}

Further, by also noting that both the expected value and variance of (5.8) conditional on

![]() $N_{ij}$

are proportional to

$N_{ij}$

are proportional to

![]() $N_{ij}$

gives us that

$N_{ij}$

gives us that

where “

![]() $\propto$

” corresponds to equality up to scaling factors (being functions only of

$\propto$

” corresponds to equality up to scaling factors (being functions only of

![]() $\boldsymbol{\theta}$

) in front of leading terms, that is

$\boldsymbol{\theta}$

) in front of leading terms, that is

where

![]() $v_{ijk}(\boldsymbol{\theta})$

is a function expressed in terms of the parameter vector

$v_{ijk}(\boldsymbol{\theta})$

is a function expressed in terms of the parameter vector

![]() $\boldsymbol{\theta}$

. Consequently, it holds that

$\boldsymbol{\theta}$

. Consequently, it holds that

that is

![]() $h_{ijk}(\boldsymbol{\theta};\ \mathcal{N}_0) / w_i \to \overline x_{ijk}(\boldsymbol{\theta})$

in probability as

$h_{ijk}(\boldsymbol{\theta};\ \mathcal{N}_0) / w_i \to \overline x_{ijk}(\boldsymbol{\theta})$

in probability as

![]() $w_i \to \infty$

.

$w_i \to \infty$

.

Further, by estimating the parameters

![]() $\boldsymbol{\theta}$

using

$\boldsymbol{\theta}$

using

![]() $\mathcal{N}_0^+$

and combining with the above it follows that

$\mathcal{N}_0^+$

and combining with the above it follows that

due to the continuous mapping theorem, and, hence,

\begin{equation*} \frac{1}{w_i}\widehat R_{ij}^{\mathcal{R}} \,{:\!=}\, \frac{1}{w_i} \sum_{k = m - i -j + 1}^{m - 1} h_{ijk}(\widehat{\boldsymbol{\theta}};\ \mathcal{N}_0) \stackrel{p}{\to} \sum_{k = m - i -j + 1}^{m - 1}\overline x_{ijk}(\boldsymbol{\theta}) \ \text{as}\ w_i \to \infty,\end{equation*}

\begin{equation*} \frac{1}{w_i}\widehat R_{ij}^{\mathcal{R}} \,{:\!=}\, \frac{1}{w_i} \sum_{k = m - i -j + 1}^{m - 1} h_{ijk}(\widehat{\boldsymbol{\theta}};\ \mathcal{N}_0) \stackrel{p}{\to} \sum_{k = m - i -j + 1}^{m - 1}\overline x_{ijk}(\boldsymbol{\theta}) \ \text{as}\ w_i \to \infty,\end{equation*}

which follows from elementary operations of convergence in probability (Cramér-Slutsky). For more details and alternative proofs, see, for example, Wahl et al. (Reference Wahl, Lindholm and Verrall2019).

Remark 5 Note that the overall consistency of

![]() $\widehat R_{ij} / w_i$

as

$\widehat R_{ij} / w_i$

as

![]() $w_i \to \infty$

is a mixture of QMLE consistency of

$w_i \to \infty$

is a mixture of QMLE consistency of

![]() $\widehat{\boldsymbol{\theta}}$

and the trivial

$\widehat{\boldsymbol{\theta}}$

and the trivial

![]() $N_{ij} / w_i$

consistency. One can, however, note that

$N_{ij} / w_i$

consistency. One can, however, note that

![]() $N_{ij} / w_i$

in light of (5.7) can be thought of as the QMLE of

$N_{ij} / w_i$

in light of (5.7) can be thought of as the QMLE of

![]() $\overline n_{ij}(\boldsymbol{\theta})$

based on the i.i.d. individual claim counts

$\overline n_{ij}(\boldsymbol{\theta})$

based on the i.i.d. individual claim counts

![]() $\widetilde N_{ijl}$

,

$\widetilde N_{ijl}$

,

![]() $l = 1, \ldots, w_i$

. Further, the interpretation of the above is that by increasing the number of underlying contracts in the portfolio, we expect that the relative reserve in each cell will converge, without letting the dimension of the observed data tend to infinity. Consequently, for sufficiently large portfolios, the influence of conditioning on actually observed claim counts instead of using conditional expected counts will diminish, which partly motivates the reasonability of using chain-ladder technique models, see Martinez-Miranda et al. (2012, Thm. 1).

$l = 1, \ldots, w_i$

. Further, the interpretation of the above is that by increasing the number of underlying contracts in the portfolio, we expect that the relative reserve in each cell will converge, without letting the dimension of the observed data tend to infinity. Consequently, for sufficiently large portfolios, the influence of conditioning on actually observed claim counts instead of using conditional expected counts will diminish, which partly motivates the reasonability of using chain-ladder technique models, see Martinez-Miranda et al. (2012, Thm. 1).

5.2 Comparison with the CRM

As already discussed in Remarks 1, 2, and 3, the CRM, as presented in Wahl et al. (Reference Wahl, Lindholm and Verrall2019), is a special case of the model introduced in the current paper, corresponding to

![]() $p_{ijk}=1$

for all combinations of i, j, k. Further, the expected value of a payment conditioned on the number of reported claims for the CRM can be expressed as

$p_{ijk}=1$

for all combinations of i, j, k. Further, the expected value of a payment conditioned on the number of reported claims for the CRM can be expressed as

for some parametrisation

![]() $\widetilde{\psi}_{i, j, k}$

, if we restrict our attention to

$\widetilde{\psi}_{i, j, k}$

, if we restrict our attention to

![]() $(i,j,k) \in \mathcal{A}_0$

(otherwise replace

$(i,j,k) \in \mathcal{A}_0$

(otherwise replace

![]() $N_{ij}$

with

$N_{ij}$

with

![]() $\nu_{ij}$

). By assuming that the true claim dynamics are given by the CRMO, one obtains

$\nu_{ij}$

). By assuming that the true claim dynamics are given by the CRMO, one obtains

\begin{align}\mathbb{E}& \left[X_{ijk} \mid N_{ij} \right] \nonumber\\&= \mu_{ijk}\lambda_{ijk}\left(\sum \limits_{l=1}^{k-1}q_{ijl} \prod\limits_{m=l+1}^{k-1} \left(p_{ijm}-q_{ijm}\right)+p_{ij0}\prod\limits_{l=1}^{k-1}\left(p_{ijl}-q_{ijl}\right)\right)N_{ij},\end{align}

\begin{align}\mathbb{E}& \left[X_{ijk} \mid N_{ij} \right] \nonumber\\&= \mu_{ijk}\lambda_{ijk}\left(\sum \limits_{l=1}^{k-1}q_{ijl} \prod\limits_{m=l+1}^{k-1} \left(p_{ijm}-q_{ijm}\right)+p_{ij0}\prod\limits_{l=1}^{k-1}\left(p_{ijl}-q_{ijl}\right)\right)N_{ij},\end{align}

which follows from repeated conditioning, see (5.9). Further, in Wahl et al. (Reference Wahl, Lindholm and Verrall2019), Lindholm et al. (Reference Lindholm, Lindskog and Wahl2020) GLM:s of the form

are used whereas in Lindholm et al. (Reference Lindholm, Lindskog and Wahl2020), machine learning algorithms are used in order to learn non-linear representations of

![]() $\widetilde{\psi}_{ijk}$

using flexible parametrisations in terms of functional forms

$\widetilde{\psi}_{ijk}$

using flexible parametrisations in terms of functional forms

![]() $\widetilde \psi(i, j, k; \boldsymbol{\theta})$

. Consequently, given that the CRMO dynamics are the correct ones, the CRM parametrisation (5.11) will likely not produce sufficient flexibility compared with (5.10). This could possibly be achieved by using machine learning techniques as those discussed in Lindholm et al. (Reference Lindholm, Lindskog and Wahl2020).

$\widetilde \psi(i, j, k; \boldsymbol{\theta})$

. Consequently, given that the CRMO dynamics are the correct ones, the CRM parametrisation (5.11) will likely not produce sufficient flexibility compared with (5.10). This could possibly be achieved by using machine learning techniques as those discussed in Lindholm et al. (Reference Lindholm, Lindskog and Wahl2020).

To conclude this far, theoretically it is possible to equate the conditional expected values of

![]() $X_{ijk}$

between the CRM and the CRMO, when conditioning on

$X_{ijk}$

between the CRM and the CRMO, when conditioning on

![]() $N_{ij}$

:s, but the computable predictors of these moments will in general not agree.

$N_{ij}$

:s, but the computable predictors of these moments will in general not agree.

Concerning higher moments, the variance of

![]() $X_{ijk}$

,

$X_{ijk}$

,

![]() $(i,j,k) \in \mathcal{A}_0$

satisfies

$(i,j,k) \in \mathcal{A}_0$

satisfies

\begin{align} \operatorname{Var}(X_{ijk} \mid N_{ij}) &= \varphi \psi_{ijk}\mathbb{E}[N^{\textrm{open}}_{i,j,k-1} \mid N_{ij}] + \psi_{ijk}^2 \operatorname{Var}(N^{\textrm{open}}_{i,j,k-1} \mid N_{ij}) \nonumber \\[3pt] &= \varphi \mathbb{E}[X_{ijk} \mid N_{ij}] + \psi_{ijk}^2 \operatorname{Var}(N^{\textrm{open}}_{i,j,k-1} \mid N_{ij}) \nonumber \\[3pt] &= \widetilde \varphi \mathbb{E}[X_{ijk} \mid N_{ij}].\end{align}

\begin{align} \operatorname{Var}(X_{ijk} \mid N_{ij}) &= \varphi \psi_{ijk}\mathbb{E}[N^{\textrm{open}}_{i,j,k-1} \mid N_{ij}] + \psi_{ijk}^2 \operatorname{Var}(N^{\textrm{open}}_{i,j,k-1} \mid N_{ij}) \nonumber \\[3pt] &= \varphi \mathbb{E}[X_{ijk} \mid N_{ij}] + \psi_{ijk}^2 \operatorname{Var}(N^{\textrm{open}}_{i,j,k-1} \mid N_{ij}) \nonumber \\[3pt] &= \widetilde \varphi \mathbb{E}[X_{ijk} \mid N_{ij}].\end{align}

Thus, if we assume that the true underlying data generating process follows the CRMO, (5.12) tells us that for

![]() $(i,j,k) \in \mathcal{A}_0$

, the ODP moment assumption will hold for the CRM as well. But, the over-dispersion parameter in the CRM, here denoted

$(i,j,k) \in \mathcal{A}_0$

, the ODP moment assumption will hold for the CRM as well. But, the over-dispersion parameter in the CRM, here denoted

![]() $\widetilde \varphi$

, will not correspond to the correct parametric relationship, since from (5.12) it is clear that

$\widetilde \varphi$

, will not correspond to the correct parametric relationship, since from (5.12) it is clear that

![]() $\widetilde \varphi$

also depends on

$\widetilde \varphi$

also depends on

![]() $p_{ijk}$

:s and

$p_{ijk}$

:s and

![]() $q_{ijk}$

:s, hence not being of the form (5.3). That is, when estimating

$q_{ijk}$

:s, hence not being of the form (5.3). That is, when estimating

![]() $\widetilde \varphi$

directly using the CRM based on data generated by the CRMO, unless there are no claim closings or re-openings, the CRM will not be consistent with the data generating process. Moreover, (5.12) also tells us that the variance of the CRMO, when only conditioning on

$\widetilde \varphi$

directly using the CRM based on data generated by the CRMO, unless there are no claim closings or re-openings, the CRM will not be consistent with the data generating process. Moreover, (5.12) also tells us that the variance of the CRMO, when only conditioning on

![]() $N_{ij}$

information, will be greater than the corresponding variance of the CRM, when using the true, unobservable, parameters. This is expected, since an additional source of variation has been introduced.

$N_{ij}$

information, will be greater than the corresponding variance of the CRM, when using the true, unobservable, parameters. This is expected, since an additional source of variation has been introduced.

Remark 6 In Wahl et al. (Reference Wahl, Lindholm and Verrall2019), the relationship between the CRM and the VNJ model is discussed w.r.t. computable reserve predictors and their corresponding variances. This comparison was possible due to that the parameter estimates in the VNJ model can be made identical to those for the CRM. This is not the case for the CRMO, and this type of comparison is, hence, omitted.

5.3 Comments on the computation of the mean squared error of prediction of reserves

The CRMO is an extension of the CRM, and consequently the basic steps in the computation of the mean squared error of prediction closely follow those from the CRM, which is described in Wahl et al. (Reference Wahl, Lindholm and Verrall2019) and Lindholm et al. (Reference Lindholm, Lindskog and Wahl2020). This procedure can be thought of as a parametric bootstrap making use of explicit moment calculations, including the process variance, and the only qualitative difference with the CRM is the introduction of claim closings and re-openings, which is only an addition of a binomial structure to the modelling. This added complexity, however, exactly follows the same procedures concerning the split in terms of RBNS and IBNR reserves and is, hence, omitted.

Alternatively, as in, for example, Buchwalder et al. (Reference Buchwalder, Bühlmann, Merz and Wüthrich2006), Diers et al. (Reference Diers, Linde and Hahn2016), Lindholm et al. (Reference Lindholm, Lindskog and Wahl2020), one could Taylor approximate the estimation error part of the MSEP calculation directly, making use of the Hessian from the QMLE-fitting. This results in a semi-analytical MSEP approximation, but since bootstrapping is straightforward (and quick), we will use the bootstrap MSEP-procedure in Section 6.

6 Numerical illustrations

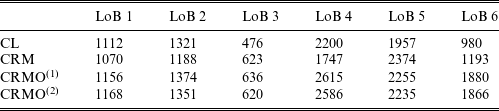

In order to illustrate the usefulness of the model in a reserving setting, the following section tests the models’ reserve prediction accuracy on simulated individual claims data from the algorithm described in Gabrielli and Wüthrich (Reference Gabrielli and Wüthrich2018), which allows us to compare reserve predictions with true simulated outcomes, that are not simulated in accordance with the assumed model structure. In particular, we will use the same simulated data set as used in Gabrielli et al. (Reference Gabrielli, Richman and Wüthrich2020) and Lindholm et al. (Reference Lindholm, Lindskog and Wahl2020), which consists of 6 individual portfolios, or Lines of Business (LoBs), each having roughly 100,000–250,000 individual claims equipped with reporting, payment and claim openness history. By using simulated data on the individual claim level, it is straightforward to aggregate data to obtain

![]() $\mathcal{X}_0$

,

$\mathcal{X}_0$

,

![]() $\mathcal{N}_0$

and

$\mathcal{N}_0$

and

![]() $\mathcal{N}_0^+$

.

$\mathcal{N}_0^+$

.

Concerning properties of the simulated data, apart from the data exploration already described for this particular simulated data set that can be found in Gabrielli and Wüthrich (Reference Gabrielli and Wüthrich2018), Gabrielli et al. (Reference Gabrielli, Richman and Wüthrich2020), Lindholm et al. (Reference Lindholm, Lindskog and Wahl2020), we briefly want to highlight additional aspects that are of interest for the CRMO.

The CRMO allows for the amount paid in a period to depend not only on accident year and reporting delay but also on payment delay. For the simulated data used in the numerical illustration, it is seen that this type of dependence is present in every LoB, see Figure 1. Further, the CRMO allows for dynamic closings and re-openings of claims. In Figure 2, the average ratio of open claims per reported claim for every year after being reported can be seen for different reporting delays for each respective LoB. As can be seen, the majority of claims close within a few years since reporting. But, interestingly, the average number of open claims are occasionally higher than in the previous development year, which is especially noticeable at

![]() $k=2$

years since reporting. This would prove a problem for a model using

$k=2$

years since reporting. This would prove a problem for a model using

![]() $q_{ijk}=0$

, that is, assuming no re-openings.

$q_{ijk}=0$

, that is, assuming no re-openings.

Figure 1: Average cumulative payment per payment delay for different reporting delays in all LoBs.

Figure 2: Average ratio of open claims to reported claims for different reporting delays in all LoBs.

Moreover, a closer look into re-openings is provided by Figure 3, which shows the average ratio of open claims that were open at the end of the previous year,

![]() $N_{ijk}^{\textrm{stay-open}}/N_{ijk}^{\textrm{open}}$