Introduction

In the past, developing new antibiotics appeared to be the easiest solution to overcome resistant pathogens. As certain antibiotics became less effective against evolving bacteria, treatment for infections could be supplemented or replaced by newer generations of the same antibiotic or by a new, more effective class of antibiotic. The world saw a boom in new antibiotics and classes between 1940 and 1990 as pharmaceutical companies leveraged scientific breakthroughs and were rewarded with high-value patents (Pew Charitable Trusts, Reference Trusts2016; Silver, Reference Silver2011). However, due to a combination of financial, regulatory, and scientific barriers to continued development of new antibiotics, the focus of research and development (R&D) shifted away to other therapeutic areas (Renwick & Mossialos, Reference Renwick and Mossialos2018). In 1990, there were 18 major pharmaceutical companies active in antibiotic R&D, but today there are only eight (Access to Medicine Foundation, 2018; Butler, Blaskovich & Cooper, 2013). Since then, the number of new antibiotics marketed each decade has significantly decreased and no novel classes of antibiotics with distinct chemical structures have been developed (Pew Charitable Trusts, Reference Trusts2016) (Figure 6.1). This void in discovery and development has meant that the antibiotic pipeline is frighteningly thin relative to the unrelenting advance of antibiotic resistance.

Figure 6.1 Number of new classes of antibiotic discovered or patented each decade.

The global community is beginning to accept the severity of antibiotic resistance and is scrambling to make up for lost time in antibiotic R&D. Promisingly, numerous major international and national initiatives have been started in recent years to help fund, coordinate, and incentivize antibiotic R&D programmes (Simpkin et al., Reference Simpkin, Renwick and Kelly2017). With the recent flurry of action it is important, however, to take stock and assess the current state of the global market for antibiotics and antibiotic innovation, in order to identify any necessary policy adjustments. To this end, this chapter aims to identify progress and assess the challenges in fostering antibiotic R&D, as well as highlighting some key policy gaps that must be addressed.

The antibiotic pipeline

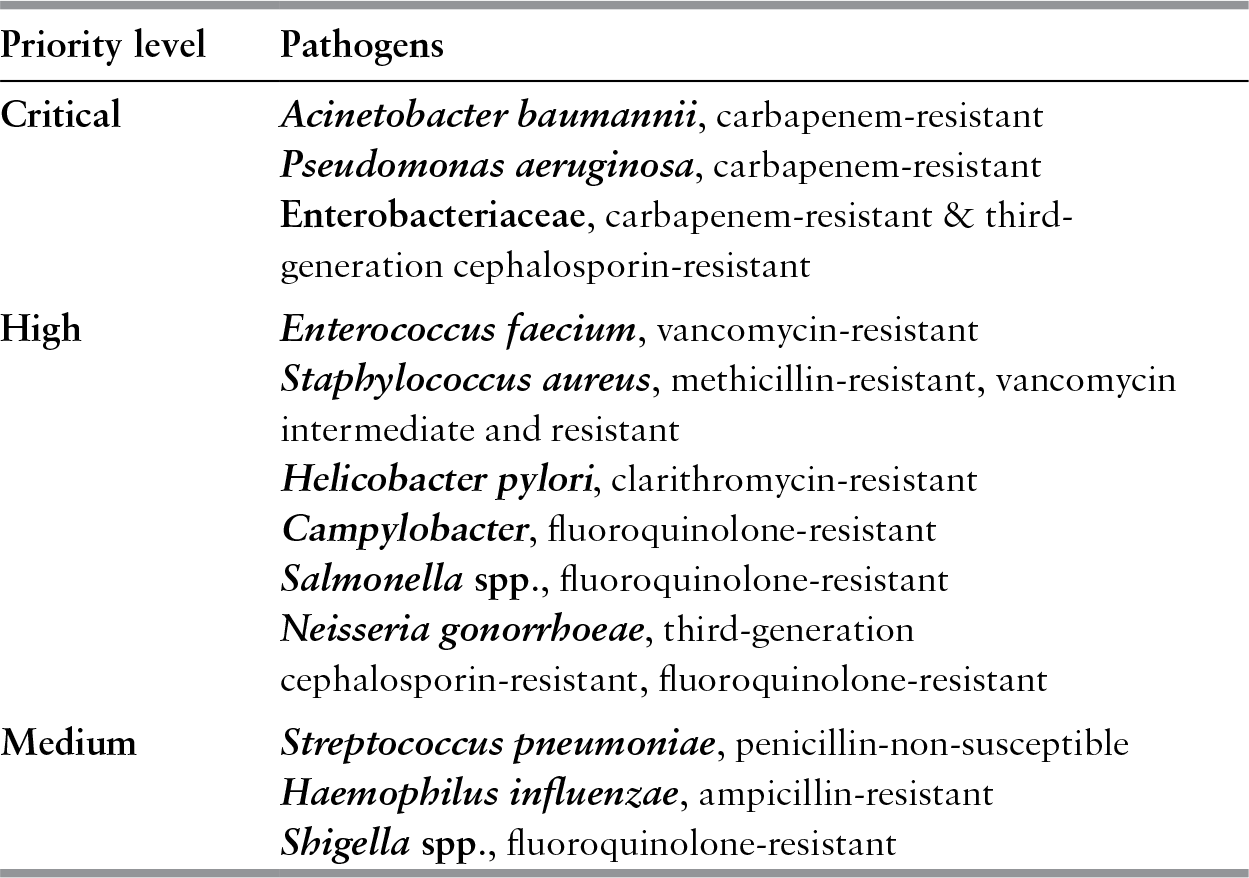

Although the antibiotic pipeline is improving, it is not nearly robust enough to match clinical need and respond to the rising rates of resistance in deadly pathogens. In early 2017, the World Health Organization (WHO) (2017a) published a priority pathogens list (PPL), which outlines the antibiotic-resistant bacteria that pose the greatest threat to global public health (Table 6.1). This list aims to guide antibiotic R&D based on medical need as opposed to the economic factors that have traditionally directed antibiotic investment. At the top of this list, categorized as “critical”, are the Gram-negative, carbapenem-resistant strains of Acinetobacter baumannii, Pseudomonas aeruginosa, and the Enterobacteriaceae family. In 2013, the US Centers for Disease Control and Prevention (CDC) published a US-focused urgent threats list for antibiotic resistance, which highlighted many of the same pathogens (US CDC, 2013).

Table 6.1 WHO Priority Pathogens List (PPL): Global priority list of antibiotic-resistant bacteria to guide research, discovery, and development of new antibiotics

| Priority level | Pathogens |

|---|---|

| Critical | Acinetobacter baumannii, carbapenem-resistant |

| Pseudomonas aeruginosa, carbapenem-resistant | |

| Enterobacteriaceae, carbapenem-resistant & third-generation cephalosporin-resistant | |

| High | Enterococcus faecium, vancomycin-resistant |

| Staphylococcus aureus, methicillin-resistant, vancomycin intermediate and resistant | |

| Helicobacter pylori, clarithromycin-resistant | |

| Campylobacter, fluoroquinolone-resistant | |

| Salmonella spp., fluoroquinolone-resistant | |

| Neisseria gonorrhoeae, third-generation cephalosporin-resistant, fluoroquinolone-resistant | |

| Medium | Streptococcus pneumoniae, penicillin-non-susceptible |

| Haemophilus influenzae, ampicillin-resistant | |

| Shigella spp., fluoroquinolone-resistant |

In September 2017, the WHO published an in-depth analysis of the global development pipeline for antibacterial agents (World Health Organization, Reference Organization2017b). The report shows how 32 antibiotic therapies that are active or possibly active against a PPL pathogen are the subject of clinical trials: 14 in phase I clinical trials, 8 in phase II, and 10 in phase III (Figure 6.2). Based on optimistic clinical trial attrition rates, the report estimates that the entire pipeline could be expected to yield 10 new approvals. As with most drug developments, the R&D and market approval process is lengthy. The phase III antibiotics are three to five years from potentially reaching the market. However, the phase I and II antibiotics have development timelines of at least five to 10 years and successful progression to marketing approval is far from certain. Antibiotics in phase I clinical trials have only a 14% likelihood of reaching the market. This means that of the 10 phase I antibiotics targeting resistant Gram-negative bacteria only one or two will succeed.

Figure 6.2 The number of antibiotics in clinical development possibly active against WHO PPL pathogens (2017) and the number of alternative therapies to antibiotics in clinical development (2017).

Note: PPL: Priority Pathogens List.

A compounding problem is that most of the pipeline drugs are redevelopments of classic antibiotic compounds or are combination therapies of existing antibiotic molecules. These types of less original antibiotics are at higher risk of quickly losing effectiveness in clinical practice because of cross-resistance. According to the WHO pipeline analysis, there are eight products in development that offer innovation in terms of having at least one of the following criteria: (1) absence of cross-resistance to existing antibiotics, (2) new chemical class, (3) new target, or (4) new mechanism of action. There are only two drugs that are truly innovative across all four WHO criteria: one targets P. aeruginosa and the other Staphylococcus aureus. The WHO analysis concluded that the current antibacterial pipeline is inadequate for the soaring resistance rates (World Health Organization, Reference Organization2017b). This sentiment was echoed in the Access to Medicine Foundation’s 2018 AMR Benchmark Report, which is an independent assessment of key industry players across a spectrum of AMR priorities related to R&D, production and manufacturing, and appropriate access and stewardship (Access to Medicine Foundation, 2018). Of note, Pew Charitable Trusts conducts a concise and useful biannual antibiotic pipeline analysis and the most recent update, as of September 2018, reiterates these general findings (Pew Charitable Trusts, Reference Trusts2018).

A fledgling portfolio of alternative therapies to antibiotics is now emerging and includes vaccines, immune stimulation, bacteriophages, lysins, probiotics, antibodies and various peptides. Initially, these products would likely supplement typical antibiotic regimens as adjunctive or preventive therapies. In March 2017, a Pew Charitable Trusts analysis found that there are 30 nontraditional antibacterial therapies in the development pipeline: six in phase I clinical trials, 19 in phase II, and five in phase III trials (Figure 6.2) (Pew Charitable Trusts, Reference Trusts2017). Of these, nine products are vaccines, nine are antibodies, and the remainder are probiotics, lysins and peptide immunomodulators. However, an earlier review of these alternative treatments estimated that this pipeline will require more than £1.5 billion in sustained investment over 10 years to translate most of these projects into investable ventures and eventually marketable products (Czaplewski et al., Reference Czaplewski, Bax and Clokie2016). Another ongoing challenge with some alternative therapies, such as bacteriophages, is that there is minimal regulatory precedent for FDA and EMA licensure, making it challenging for developers and regulators to know how to proceed (Cooper, Khan Mirzaei & Nilsson, 2016).

Antibiotic R&D funding

Antibiotic development is funded by a combination of public and private investment and an increasing number of R&D projects are being funded through partnerships (Access to Medicine Foundation, 2018). As most investment data on antibiotic R&D is confidential or unpublished, it is challenging to accurately assess current trends in global funding. However, there is some available data. With regard to public funding, between 2007 and 2013, the European Union (EU) and countries in the Joint Programming Initiative on Antimicrobial Resistance (JPIAMR) invested €1.3 billion across 1 243 research projects on antibacterial resistance (Kelly et al., Reference Kelly, Zoubiane and Walsh2015). Most of this funding supported R&D for antibiotics, alternative therapies, and diagnostics. In 2016 and 2017, the US National Institutes for Health’s (NIH) budget for AMR was $420 million and $473 million, respectively – a major portion of this will have been dedicated specifically to antibiotic R&D projects (US National Institutes of Health, 2017). The Biomedical Advanced Research and Development Authority (BARDA), the largest US funding agency for antibiotic R&D outside the NIH, has an annual budget of $192 million to develop therapies treating antibiotic-resistant bacteria (US Department of Health and Human Services, 2017). These US and EU budgets are small in comparison to the public money spent on many noncommunicable diseases such as cancer, which command annual budgets in the billions in the US and EU (Eckhouse & Sullivan, Reference Eckhouse and Sullivan2006; US National Institutes of Health, 2017). Missing from this picture are the amounts of public funding by other countries with significant investments in pharmaceutical R&D, including Japan, China, India, and the Republic of Korea.

In the private sector, $1.8 billion in global venture capital was invested in antimicrobial R&D between 2004 and 2013 (Thomas & Wessel, Reference Thomas and Wessel2015). Venture capital investment dropped by 28% between the first and second halves of this 10-year time frame. There are no data available on the investments made by pharmaceutical companies in their own antibiotic projects, but it appears that internal funding of antibiotic R&D is a relatively low priority. For instance, the global number of patent applications related to antibiotic research dropped by 34.8% from 2007 to 2012, which may indicate a decreasing commercial interest in antibiotic R&D (Marks & Clerk, 2015). The WHO’s International Clinical Trials Registry Platform shows that there are only 182 active clinical trials focusing on bacterial infections other than tuberculosis, which is much less than 1% of the 67 000 clinical trials on noncommunicable diseases (O’Neill, Reference O’Neill2015b). These numbers seem to indicate that the economic case for private investment in antibiotic R&D, both external and internal to pharmaceutical companies, has not improved over the past decade. Public and nongovernmental institutions cannot entirely replace private companies in the development of novel anti-biotics. Thus, there is a need for public and philanthropic organizations to increase funding to support private companies in antibiotic R&D and implement non-monetary incentive policies that reduce barriers throughout the antibiotic development value chain.

Barriers to antibiotic R&D

The success rate of moving an antibiotic from basic research to market approval is estimated to be between 1.5% and 3.5%. This process can typically take 15 years (O’Neill, Reference O’Neill2015a). The economic, regulatory, and scientific barriers to antibiotic R&D can best be categorized based on the steps of the antibiotic value chain: initial research, preclinical trials, clinical trials, market approval, and, finally, commercialization (Chorzelski et al., Reference Chorzelski, Grosch and Rentmeister2015). These barriers are important to consider when designing and targeting future incentives to support antibiotic R&D.

The basic and discovery research behind understanding and identifying new molecules for candidate drugs has been scientifically challenging. Bacteria, particularly Gram-negative varieties, have proven highly resilient to recent experimental mechanisms of destruction (Pew Charitable Trusts, Reference Trusts2016). In addition, scientific expertise in this area is currently lacking and is still recovering from the discovery void that began in 1990 (Silver, Reference Silver2011). The preclinical stage is ominously referred to as the “valley of death” (So et al., Reference So and Ruiz-Esparza2012). Discovery research has predominantly been tackled by academics funded by the public sector, while clinical trials have been the domain of private pharmaceutical companies, thus leaving a gap in funding and appropriate actors to move from one to the other.

Antibiotic clinical trials are costly, estimated at roughly $130 million to take a drug candidate through Phases I to III. Many drug candidates will be discarded on the way, at a financial loss. The average cost of post-approval follow-on trials can amount to an additional $146 million (O’Neill, Reference O’Neill2015a). These costs and uncertainties are often prohibitively high for small and medium enterprises (SMEs) (Renwick, Brogan & Mossialos, Reference Renwick, Simpkin and Mossialos2016). Despite the challenge of economies of scale, SMEs represent approximately 85% of the share of antibiotics in clinical development (Chorzelski et al., Reference Chorzelski, Grosch and Rentmeister2015). An added practical challenge is that recruiting patients with acute bacterial infections for clinical trials is logistically difficult due to the short treatment windows and lack of rapid point-of-care diagnostic tools to identify potential participants.

Market approval of new antibiotics is necessary for ensuring the drug’s quality, safety and efficacy. However, there are procedural differences between drug regulatory agencies in approving antibiotics that make global licensing unduly time-consuming and expensive (Renwick, Simpkin & Mossialos, Reference Renwick, Simpkin and Mossialos2016). These differences relate to patient selection criteria, definitions of clinical end-points, specification of statistical parameters, and rules regarding expedited approvals (Chorzelski et al., Reference Chorzelski, Grosch and Rentmeister2015).

Finally, the economic reward for commercializing a new antibiotic is minimal or negative relative to other therapeutic areas, such as neurologic or cardiovascular drugs (So et al., Reference So, Gupta and Brahmachari2011). At present, novel antibiotics are not destined to generate significant revenue even with their immense public health value. Potential sales volumes are restricted by short treatment durations and hospital stewardship programmes that limit access. In addition, the large overlap in clinical application of newly patented antibiotics with existing generic alternatives places downward pressure on prices (Renwick, Simpkin & Mossialos, Reference Renwick, Simpkin and Mossialos2016).

Incentivizing antibiotic innovation

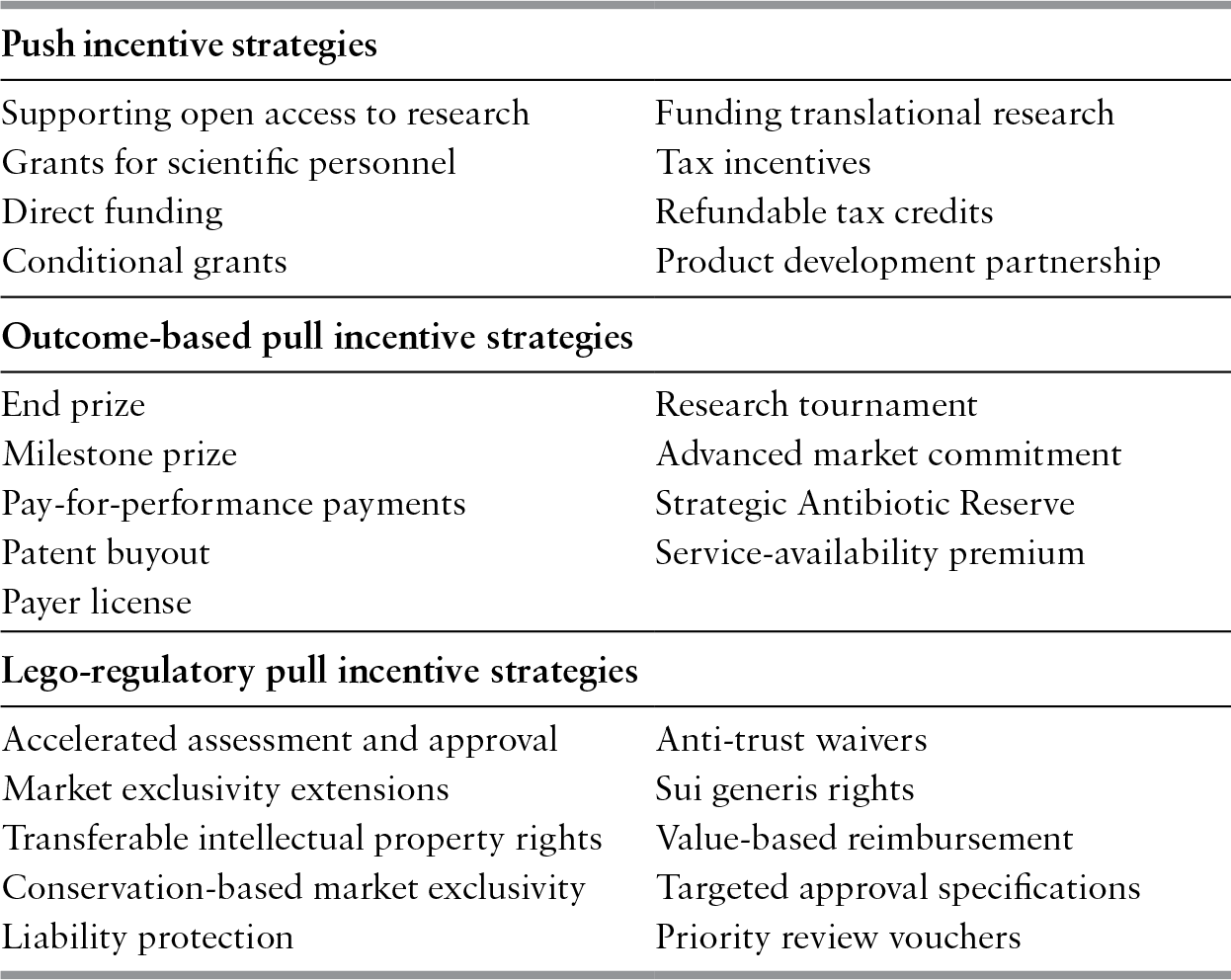

A significant amount of research has explored the policy proposals for minimizing these barriers and incentivizing companies to pursue R&D in the antibiotic field. Push and pull incentives are broadly used to classify the two main types of mechanisms for supporting antibiotic R&D (Mossialos et al., Reference Mossialos, Morel and Edwards2010). Push incentives reduce the cost of researching and developing new antibiotics. Examples of push incentives include research grants, access to shared resources, and product development partnerships to split R&D costs (Table 6.2). Pull mechanisms increase the potential revenue of a successfully marketed antibiotic. This may be through outcome-based rewards that directly increase revenue such as monetary prizes, reimbursement premiums, advanced market commitments to purchase the drug, and patent buyouts by governments. If large enough, outcome-based pull rewards could replace the traditional revenue stream generated by the sales volumes of a licensed antibiotic. This concept is referred to as “delinkage” since the antibiotic’s revenue would be delinked or decoupled from its sales, thus removing the incentive to promote the drug’s use (Rex & Outterson, Reference Rex and Outterson2016). Alternatively, pull mechanisms may be legal or regulatory, providing incentives such as accelerated procedures for marketing approval or extensions to the patent period. Different push and pull mechanisms have unique advantages and disadvantages and experts generally agree that a combination of both types is necessary to provide effective incentives for R&D. As of 2015, there were 47 different incentives available or proposed for antibiotic developers that ranged from simple push or pull mechanisms to complex hybrid models (Renwick, Brogan & Mossialos, Reference Renwick, Simpkin and Mossialos2016).

| Push incentive strategies | |

|---|---|

| Supporting open access to research | Funding translational research |

| Grants for scientific personnel | Tax incentives |

| Direct funding | Refundable tax credits |

| Conditional grants | Product development partnership |

| Outcome-based pull incentive strategies | |

|---|---|

| End prize | Research tournament |

| Milestone prize | Advanced market commitment |

| Pay-for-performance payments | Strategic Antibiotic Reserve |

| Patent buyout | Service-availability premium |

| Payer license | |

| Lego-regulatory pull incentive strategies | |

|---|---|

| Accelerated assessment and approval | Anti-trust waivers |

| Market exclusivity extensions | Sui generis rights |

| Transferable intellectual property rights | Value-based reimbursement |

| Conservation-based market exclusivity | Targeted approval specifications |

| Liability protection | Priority review vouchers |

Designing a global incentive package for stimulating antibiotic innovation is a complex task with numerous variables. Policy-makers need a methodology for selecting a complete and realistic set of incentives from the surfeit of candidates. In 2015, the authors of this chapter published a possible framework to help policy-makers with this challenge (Renwick, Brogan & Mossialos, Reference Renwick, Simpkin and Mossialos2016) (Figure 6.3). The framework has three consecutive phases. The first phase involves fashioning a core incentive package targeting the economic criteria necessary for rebalancing the market. This core incentive package must:

Figure 6.3 Framework for developing a holistic incentive package for antibiotic development.

Note: NPV: net present value; SME: Small–medium sized enterprise.

1) improve the profitability of developing and commercializing a novel antibiotic;

2) make market participation feasible for SMEs;

3) encourage investment by large pharmaceutical companies;

4) facilitate cooperation across all stakeholders including patients, academics, policy-makers, regulators, and industry.

The second step requires adjusting the core incentive package to address public health goals pertaining to sustainability and patient access to new antibiotics. The final step considers the implementation and operational practicalities that are specific to national context.

Key initiatives incentivizing antibiotic R&D

A 2016 review found that there are 58 active initiatives directly incentivizing the development of antibiotics at global, EU, and national levels, including in the UK, France, Germany, Netherlands, Sweden, the USA, and Canada (Renwick, Simpkin & Mossialos, Reference Renwick, Simpkin and Mossialos2016). These initiatives are programmes that employ one or more push or pull incentive mechanism. An added nine initiatives were identified as offering indirect incentives through economic and policy research or the coordination of strategic actions on AMR. The number of active initiatives in this field continues to rise and several programmes have been initiated since this review was conducted. The following section describes the main antibiotic R&D initiatives at multilateral and EU levels, as well as key initiatives from the USA and the UK, who are leaders at the national level in this field.

Multilateral initiatives

The international community has come together to create several multilateral initiatives including the Joint Programming Initiative on Antimicrobial Resistance (JPIAMR), the Global Antibiotic Research and Development Partnership (GARDP), the Combating Antibiotic Resistant Bacteria Biopharmaceutical Accelerator (CARB-X), the European and Developing Countries Clinical Trial Partnership (EDCTP), and the Global Antimicrobial Resistance Innovation Fund (GAMRIF).

The JPIAMR is comprised of 26 countries with the purpose of coordinating the national funding of its members towards specific AMR research projects, some of which target issues pertaining to R&D. To date, the initiative has funded six joint research calls using a budget of €67 million (Joint Programming Initiative on Antimicrobial Resistance, 2018). Their funding is push-based and is almost exclusively directed towards academic research of basic and preclinical science (Renwick, Simpkin & Mossialos, Reference Renwick, Simpkin and Mossialos2016).

GARDP is a non-profit initiative that is jointly managed by the Drugs for Neglected Diseases Initiative and the WHO. The GARDP’s strategic objective is to develop treatments that target the WHO priority pathogens, address diseases and syndromes with the greatest medical need, and help neglected patient populations. As of September 2017, GARDP had secured over €56 million in seed funding of their ultimate funding goal of €270 million (Global Antibiotic Research and Development Partnership, 2017). This initiative is unique in its offering of both push and pull incentives to antibiotic R&D projects, with the possibility of delinking antibiotics that are developed and marketed with the help of GARDP (Renwick, Simpkin & Mossialos, Reference Renwick, Simpkin and Mossialos2016; Global Antibiotic Research and Development Partnership, 2017).

CARB-X is a transatlantic public–private partnership that aims to accelerate basic science and preclinical R&D for a large portfolio of antibiotics, rapid diagnostic tools, and other antimicrobial products. CARB-X has a $505 million investment plan until 2021 with funding support from BARDA, the US National Institute of Allergy and Infectious Diseases (NIAID), the UK’s Wellcome Trust, GAMRIF, and the Bill & Melinda Gates Foundation (CARB-X, 2018). Several private partners provide expert scientific and commercial support to their projects. While leadership has initially been in the USA and the UK, this partnership has the capacity to accept additional international partners. As of 2018, CARB-X has accepted 33 projects with a total funding of $91.1 million (CARB-X, 2018). CARB-X projects receive initial push funding with scientific and business guidance. Successful projects can unlock additional funding by reaching certain development milestones. For instance, the initial portfolio of companies and research teams has the potential to access $96.5 million in milestone-based financing (CARB-X, 2018). The CARB-X portfolio will focus on R&D of therapies targeting the pathogens on the CDC’s AMR threat list or WHO PPL.

The EDCTP is a public–private partnership that brings together European countries, sub-Saharan African countries, and the pharmaceutical industry to facilitate clinical trials on therapies treating poverty-related communicable diseases that bear the greatest health burden in sub-Saharan Africa. These infections include HIV/AIDS, tuberculosis, malaria, and many neglected infectious diseases. The EDCTP is now in its second decade of operation (2014–2024). From 2014 to 2016, it funded five clinical projects on neglected infectious diseases with a budget of €5.34 million, most of which was directed towards developing new diagnostics (European and Developing Countries Clinical Trials Partnership, 2017).

Lastly, GAMRIF is a new international R&D investment fund spearheaded by the UK Government following recommendations from the UK Review on AMR. The fund supports public and private AMR research ventures that have struggled to attain funding through traditional financing avenues (Simpkin et al., Reference Simpkin, Renwick and Kelly2017). The UK Government has committed £50 million from 2017 to 2021 to GAMRIF (UK Government, Reference Government2016b). As part of a new UK–China research partnership, the Chinese government along with support of private businesses have added a further £10 million to the fund (UK Government, Reference Government2016a). In 2018, GAMRIF contributed £20 million to CARB-X for developing vaccines and antibiotic alternatives to treat resistant bacterial infections, as well as £1 million to GARDP for development of an antibiotic for drug-resistant gonorrhoea (UK Government, Reference Government2018).

EU initiatives

The EU has been a leader in initiating policy action to revitalize the antibiotic market. The key EU initiatives fostering antibiotic R&D are the European Commission’s Directorate-General for Research and Innovation (DG-RTD), the Innovative Medicine’s Initiative (IMI), and the InnovFin Infectious Diseases Facility (InnovFin ID).

The DG-RTD partially administers and funds two of the largest antibiotic R&D funding programmes, the EDCTP and the IMI. Beyond these specific programmes, it provides funding support to numerous smaller R&D projects. Between 2007 and 2013, the DG-RTD gave €235.6 million in direct funding for European antibiotics and diagnostics R&D projects, which were separate from the IMI and EDCTP (Kelly et al., Reference Kelly, Zoubiane and Walsh2015). This funding is primarily push-based via direct project funding, research grants, and fellowships. It specifically offers funding opportunities to SMEs undertaking antibiotic R&D through the SME Instrument (Renwick, Simpkin & Mossialos, Reference Renwick, Simpkin and Mossialos2016). In addition, the DG-RTD has created the Horizon 2020 Better Use of Antibiotics Prize, a €1 million market entry reward for creating a rapid point-of-care diagnostic tool for suspected upper respiratory infections (European Commission, Reference Commission2015).

The IMI is a public–private partnership between the EU and the European Federation of Pharmaceutical Industries and Associations (EFPIA). It has a subsidiary public–private partnership called the New Drugs for Bad Bugs (ND4BB) programme, which is dedicated to the discovery and development of novel antibiotics for humans. Funding for the ND4BB programme is split between the EU and EFPIA and totals €700 million (Innovative Medicines Initiative, Reference Initiativen.d.). There are seven core projects, which offer push-based support to most aspects of the anti-biotic value chain: TRANSLOCATION and ENABLE assist early drug discovery, COMBACTE supports clinical development of antibiotics for Gram-positive bacteria, COMBACTE-CARE, COMBACTE-MAGNET and iABC facilitate clinical development of antibiotics for Gram-negative bacteria, and DRIVE-AB explores economic solutions to stimulating antibiotic R&D in a sustainable manner. DRIVE-AB’s final report with recommendations was published in early 2018 (DRIVE-AB, 2018).

InnovFin ID is a financial risk-sharing programme for ventures in the clinical development phase for a novel drug, vaccine, or diagnostic device that tackles an infectious disease. It is jointly governed by the European Commission and the European Investment Bank (EIB). InnovFin ID offers loans ranging from €7.5 million to €75 million, which are only repaid if the project successfully results in a marketable product. These loans are available to non-profit and for-profit ventures alike (European Investment Bank, Reference Bankn.d.). In autumn 2017, Da Volterra, a small biopharmaceutical firm, entered a €20 million financial agreement with the EIB to support clinical development of their antibiotic portfolio (European Investment Bank, Reference Bank2017).

US initiatives

There are two US governmental bodies that run programmes to incentivize antibiotic R&D. The first is the NIAID, a research institute within the NIH responsible for conducting basic science and applied research in the field of infectious, immunological, and allergic diseases. The NIAID’s AMR portfolio runs from basic science projects to clinical trials for antibiotic therapies, rapid point-of-care diagnostic tools, and vaccines for resistant bacterial infections. The NIH-wide funding for combating AMR in 2017 is $473 million (US National Institutes of Health, 2017). The NIAID supports the Antibiotic Resistant Leadership Group, which is an academic team that prioritizes, designs, and executes clinical research on antibiotic resistance. Additionally, the NIAID is a partner of CARB-X. NIAID’s antibiotic R&D incentivization is primarily through direct project funding and research grants (Renwick, Simpkin & Mossialos, Reference Renwick, Simpkin and Mossialos2016).

The second is BARDA, which is an organization within the Office of the Assistant Secretary for Preparedness and Response in the Department of Health and Human Services. BARDA is responsible for facilitating R&D and public purchasing of critical drugs, vaccines, and diagnostic tools intended for public health emergencies. BARDA’s Broad Spectrum Antimicrobials Program had a 2017 budget of $192 million specifically for establishing public–private partnerships that develop novel anti-biotic products (US Department of Health and Human Services, 2017). BARDA currently has at least seven different antibiotic R&D public– private partnerships with both large pharmaceutical companies, such as GSK, Pfizer and Roche, as well as several SMEs (Access to Medicine Foundation, 2018). BARDA is unique in that it offers ongoing push funding and guidance to all its partners, as well as the possibility for pull-based purchasing commitments for select marketable antibiotics. Jointly offered by the NIH and BARDA, the Antimicrobial Resistance Diagnostic Challenge offers a $20 million market entry reward to a developer of a rapid point-of-care diagnostic test that can aid in identifying antibiotic-resistant pathogens (US National Institutes of Health, 2016).

The Bill & Melinda Gates Foundation has been a key funder and partner of AMR initiatives that benefit low- and middle-income countries (LMICs), where the health burden of antibiotic resistance is greatest. The Bill & Melinda Gates Foundation has at least eight active R&D antimicrobial partnership projects for treating bacteria, tuberculosis, HIV, and malaria (Access to Medicine Foundation, 2018). Notably, in 2018, the Foundation committed $25 million to CARB-X (CARB-X, 2018a; 2018b).

UK initiatives

The majority of the UK-based antibiotic R&D initiatives were operated through the UK Research Councils, now brought together under the umbrella of UK Research and Innovation. These initiatives include the Cross-Research Council AMR Initiative, the Newton Fund, and the Global Challenge Research Fund. The Cross-Research Council AMR Initiative promotes a multidisciplinary approach to tackling AMR and offers a range of individual and collaborative grants to academic institutions. The initiative aims to break down research silos and involve LMICs in AMR research. To date, this initiative has committed approximately £50 million towards various AMR projects that target the earliest stages of the antibiotic value chain (UK Medical Research Council, 2016; Simpkin et al., Reference Simpkin, Renwick and Kelly2017). The Newton Fund aims to strengthen scientific research partnerships between the UK and LMICs. The UK Research Councils alongside government agencies from China, India, and South Africa have pooled approximately £13.5 million in the Newton Fund for collaborative academic research on AMR (Newton Fund, n.d.; Simpkin et al., Reference Simpkin, Renwick and Kelly2017). Finally, the recently established Global Challenge Research Fund is a £1.5 billion fund that will strive to address a multitude of challenges faced by LMICs. AMR is one of the key issues proposed for action through this fund (Research Councils UK, n.d.).

The UK National Institute for Health Research (NIHR) is another UK agency that offers support for antibiotic R&D. The NIHR’s Biomedical Research Centres and Health Protection Research Units have started a variety of programmes conducting basic science research that could lay the groundwork for antibiotic development (UK National Institute for Health Research, n.d.).

The Wellcome Trust has been an early champion for combating AMR and has financed numerous international antibiotic R&D initiatives. The Trust funded and hosted the Review on AMR, which led to the establishment of GAMRIF. Additionally, the Trust is a major funder of CARB-X and GARDP. As of 2018, the Wellcome Trust is a partner in at least 11 active public–private R&D projects for therapies targeting resistant bacteria, HIV and malaria (Access to Medicine Foundation, 2018).

Regulatory initiatives

Most antimicrobial agents are authorized in Europe through the centralized procedure of the European Medicines Agency (EMA) (Mossialos et al., Reference Mossialos, Morel and Edwards2010; Renwick, Simpkin & Mossialos, Reference Renwick, Simpkin and Mossialos2016). The EMA supports antibiotic developers through the licensing process by offering scientific advice and protocol assistance. Antibiotics can be assessed by the EMA via an expedited pathway to speed up possible market entry. Additionally, antibiotics that address unmet medical need may be granted conditional market authorization. These antibiotics are approved under weaker criteria for quality, safety, and efficacy to hasten patient access, but have much narrower indications for use and are reserved for those individuals without other treatment options. Some antibiotics against rare pathogens may also be eligible to receive orphan drug designation and an associated market exclusivity extension.

The US Food and Drug Administration (FDA) offers similar incentives to antibiotic developers through the Qualified Infectious Diseases Products (QIDP) designation and the Limited Population Antibacterial Drug (LPAD) designation (Renwick, Simpkin & Mossialos, Reference Renwick, Simpkin and Mossialos2016). Novel antibiotics that qualify for QIDP status receive regulatory guidance from the FDA, priority review, and fast track consideration when being assessed for market approval. Certain QIDP antibiotics may also be eligible for a market exclusivity extension of five years. Antibiotics that target rare and deadly pathogens could be eligible for LPAD designation, which permits a streamlined and conditional approval process so that patients lacking appropriate treatment can receive early access to a promising novel antibiotic. Analogous to the EMA’s conditional market authorization process, antibiotics with LPAD designation are studied using smaller clinical populations and would only be approved for a narrow indication limited to the in-need patient cohort. The FDA also has an orphan drug licensing programme that offers market exclusivity extensions among some other benefits (Mossialos et al., Reference Mossialos, Morel and Edwards2010).

The Transatlantic Task Force on Antimicrobial Resistance (TATFAR) is an international partnership bringing together health policy and regulatory agencies from the EU, the USA, Norway and Canada. TATFAR’s key goal is knowledge exchange and coordination across the various partner agencies (Renwick, Simpkin & Mossialos, Reference Renwick, Simpkin and Mossialos2016). Through TATFAR, the EMA and the FDA have been working collaboratively to improve and align the market authorization processes for antibiotics in Europe and the USAFootnote *. Since late 2016, the EMA and the FDA have been working with the Japanese Pharmaceuticals and Medical Devices Agency (PMDA) to encourage and accelerate development of novel antibiotics. These agencies have recently agreed to harmonize their data requirements for certain aspects of clinical trials for new antibiotics (European Medicines Agency, Reference Agency2016).

Next steps in global antibiotic development incentivization

The extensive array of antibiotic R&D incentives is commendable, and strides have been made towards reviving the antibiotics pipeline. However, the current incentive package has major gaps and deficiencies that inhibit the transition from basic science research all the way to bedside access. The end goal should be a continuum of incentivization that reflects the economic need, cost distribution, and barriers of the entire antibiotic value chain. Different types of incentives are better suited for tackling different stages of this value chain (Figure 6.4). To achieve this continuum, there is a need to adjust push incentivization to increase funding of preclinical and clinical development, support global regulatory harmonization and provide added legal or regulatory incentives to facilitate market approval. There is also a need to introduce a variety of outcome-based pull incentives to ensure the commercialization and distribution of licensed antibiotics. These incentive changes must involve inter-initiative coordination and be made within the context of broader public health goals related to sustainability, patient access, and medical need.

Figure 6.4 Continuum of incentivization across the antibiotic value chain

Push incentives, such as grants for researchers and direct project funding, are best used to facilitate the earlier stages of R&D from basic science up to clinical development. Most push funding for antibiotic R&D is directed towards basic antimicrobial science and less so towards clinical development. An estimated 86% of European national-level public funding of antibiotics was in this category (Kelly et al., Reference Kelly, Zoubiane and Walsh2015). The JPIAMR, DG-RTD, CARB-X, NIAID, UK Research and Innovation, and NIHR, preferentially fund antimicrobial basic science. While early-stage push funding of antimicrobial science is integral to the R&D process, there is a need for more late-stage push funding of preclinical and clinical trials to help translate scientific innovation into marketable products. The overemphasis on early-stage push funding reflects the fact that basic science lends itself more easily to being partitioned into projects requiring smaller individual monetary commitments than clinical trials do. In addition, public funders can more easily justify supporting nonprofit academic work. Basic science is largely the domain of academia and, as a result, private companies often do not benefit from early-stage push funding. Yet clinical trials, which are usually operated by private companies, are by far the most expensive aspect of R&D (O’Neill, Reference O’Neill2015a). SMEs are the most impacted by the lack of late-stage push funding as they often struggle to raise the capital necessary for clinical trials (Renwick, Brogan & Mossialos, Reference Renwick, Simpkin and Mossialos2016).

As more drug candidates transition to clinical development, early-stage push funding could be pooled and reallocated to late-stage push funding to ensure viable antibiotics make it to the market approval stage. In addition, programmes such as BARDA and the IMI’s COMBACTE, which specifically fund clinical trials, could be further expanded. As demonstrated in the WHO pipeline analysis, most antibiotics and alternative therapies are in phase I clinical trials and could immediately benefit from late-stage push funding (World Health Organization, Reference Organization2017b). It will be important to balance this shorter-term strategy with the need to maintain a steady inflow of novel drug candidates identified through early discovery programmes.

Lego-regulatory (legal or regulatory) pull incentives, like those offered by the EMA and FDA, are most effective at facilitating progress through the market approval stage. Both the EMA and FDA offer several incentives that decrease the approval timeline for antibiotics: regulatory guidance, expedited pathways, and conditional market authorization. The primary value of these incentives comes from indirectly increasing the effective patent period of the antibiotic since it reaches the market earlier (Mossialos et al., Reference Mossialos, Morel and Edwards2010). But, there is a balance to be struck between speeding up the approval process and ensuring that licensed drugs meet standards for quality, safety, and efficacy (Renwick, Simpkin & Mossialos, Reference Renwick, Simpkin and Mossialos2016). It is unlikely that these regulatory processes can be shortened any further without sacrificing regulatory standards. In addition, many of the pipeline antibiotics are not expected to be high-volume products and therefore adding to their effective patent period does not translate into meaningful revenue. Market exclusivity extensions suffer from this same problem. Therefore, it may be worthwhile to explore alternative incentives that allow priority review (e.g. priority review vouchers (PRVs)) or market exclusivity extensions (e.g. transferable intellectual property rights (TIPRs)) to be transferred from an approved antibiotic to another product in the developer’s portfolio that would benefit more from the longer effective patent period (Ferraro, Towse & Mestre-Ferrandiz, Reference Ferraro, Towse and Mestre-Ferrandiz2017). Incentives such as PRVs and TIPRs could provide a market incentive to license new antibiotics without requiring upfront government funding. However, it is important to be aware that PRVs and TIPRs do not incentivize antibiotic commercialization and they could have broader pharmaceutical market consequences (Mossialos et al., Reference Mossialos, Morel and Edwards2010; Ferraro, Towse & Mestre-Ferrandiz, Reference Ferraro, Towse and Mestre-Ferrandiz2017).

Harmonization between the EMA and the FDA’s market approval requirements has been a step towards lowering market approval costs and time. However, the EMA and FDA regulatory processes are relatively similar unlike the Japanese PMDA or Chinese Food and Drug Administration. Harmonization efforts among these agencies will prove more challenging but could further relieve companies of duplicative regulatory approval costs. Including the PMDA in TATFAR was a laudable starting-point.

Push funding and legal or regulatory incentives can drive viable antibiotics to licensing; however, they are weak incentives for the commercialization and distribution of the product. Net profits from sales of an innovative new antibiotic are perceived to be limited for several reasons, especially when compared to therapeutic areas with the highest sales revenues; for example, oncologic, anti-diabetic, and anti-rheumatic drugs (EvaluatePharma, 2017). A novel antibiotic would be reserved as a last resort or may only target a rare resistant pathogen, which restricts potential sales revenue. High product prices are unlikely to compensate for low sales volume because of the considerable overlap in effectiveness between existing antibiotics. Also, future rapid-point-of-care diagnostic tools could cut into the revenue potential for newly marketed antibiotics (Outterson et al., Reference Outterson, Powers and Daniel2015). Therefore, large outcome-based pull incentives are necessary in the absence of a viable market. Pull incentives have the added benefit of potentially allowing SMEs to secure venture capital for clinical trials. However, pull incentives for antibiotics have been mostly absent from current funding initiatives. The only outcome-based pull incentives currently available are relatively limited advanced market commitments (AMCs) offered by BARDA and GARDP for certain low-volume antibiotics (Simpkin et al., Reference Simpkin, Renwick and Kelly2017).

Market entry rewards (MERs) have repeatedly been recommended by major reports and journal articles as an effective pull incentive for antibiotic commercialization (Ferraro, Towse & Mestre-Ferrandiz, Reference Ferraro, Towse and Mestre-Ferrandiz2017; Rex & Outterson, 2017; Simpkin et al., Reference Simpkin, Renwick and Kelly2017; O’Neill, Reference O’Neill2016; Renwick, Simpkin & Mossialos, Reference Renwick, Simpkin and Mossialos2016; Chorzelski et al., Reference Chorzelski, Grosch and Rentmeister2015). A MER is a financial prize for the successful development and licensure of an innovative antibiotic. To receive the prize, a developer must ensure that the antibiotic meets predefined product criteria and adheres to postmarket authorization conditions related to sustainability and patient access as specified by the payer. It is expected that a MER would need to be approximately $1–2 billion per first-entrant novel antibiotic to entice developers to invest in R&D and gamble on inventive antibiotic projects (DRIVE-AB, 2018). Practically, a prize of this size might be paid out as instalments over five to seven years. This would create a guaranteed revenue stream for the developer, spread out payer expenditures, and provide the payer with leverage if the developer chose to deviate from the agreed MER conditions. MERs can also be designed to have varying degrees of delinkage. Delinkage, in the context of a MER, refers to how much of a MER winner’s revenue can be generated from sales volume (Rex & Outterson, Reference Rex and Outterson2016). A fully-delinked MER would pay for the antibiotic patent or licence in return for access to the drug at the cost of production. A partially delinked MER would still allow developers to generate some revenue from antibiotic sales. A fully delinked MER would thus need to be much larger than a partially delinked MER. Numerous other design variations, stipulations, and augmentations can be applied to the basic MER model to achieve various market goals. However, this is beyond the scope of this chapter. Both the 2018 DRIVE-AB final report and the 2017 Office of Health Economics report offer in-depth discussion of and recommendations for MER design and costing (DRIVE-AB, 2018; Ferraro, Towse & Mestre-Ferrandiz, Reference Ferraro, Towse and Mestre-Ferrandiz2017).

The key barrier to implementing a MER programme is the cost. With the 10-year goal of bringing 10 to 15 novel antibiotics to market, a MER programme is estimated to cost between $10 and $30 billion (DRIVE-AB, 2018; Ferraro et al., Reference Ferraro, Towse and Mestre-Ferrandiz2017; O’Neill, Reference O’Neill2015a). Such a MER programme would provide large payouts of $1–2 billion for first entrants and increasingly smaller prizes for follow-up therapeutic products. A MER fund of this scale can only be practically achieved by pooling financial commitments from numerous countries and institutions into a ring-fenced endowment. For a MER programme to effectively pull antibiotics to the market, it is important that developers perceive this fund to be guaranteed by participating governments and protected from other public expenditures. This type of international fund for MERs has been recommended by various journal articles and international reports, such as the UK’s AMR review, the Boston Consulting Group’s report for the GUARD initiative, and DRIVE-AB (DRIVE-AB, 2018; Hoffman et al., Reference Hoffman, Caleo and Daulaire2015; Renwick, Brogan & Mossialos, Reference Renwick, Simpkin and Mossialos2016; Rex & Outterson, Reference Rex and Outterson2016; Stern et al., Reference Stern, Chorzelski and Franken2017; O’Neill, Reference O’Neill2016). Despite the abundance of expert literature calling for an international MER programme, no nation has been willing to take the lead in establishing such a global fund or make a firm financial commitment. This inaction stems from the large sums involved, insufficient political support, the complexity of coordinated action, and a lack of capacity and expertise to implement such a scheme. In lieu of a global MER programme, alternative outcomebased pull incentives could be applied such as corporate tax incentives, value-based pricing and reimbursement strategies, and national AMCs for bulk purchasing (Renwick, Simpkin & Mossialos, Reference Renwick, Simpkin and Mossialos2016). These strategies are generally weaker incentives but do not require the same upfront financial commitment as a MER programme and thus may be more politically palatable.

Global cooperation and communication will be essential to creating the described continuum of antibiotic incentivization. Presently, national governments, global institutions, nongovernmental organizations, and industry are independently investing their resources in antibiotic R&D projects and funding programmes (Renwick, Simpkin & Mossialos, Reference Renwick, Simpkin and Mossialos2016). This is partially responsible for the current mismatched and incomplete global incentives. In addition, many of the antibiotic R&D initiatives operate in isolation from other initiatives despite their commonalities. There is a clear risk of duplicating efforts with initiatives that have similar mandates and receive interweaving funding from different payers. Therefore, there is a need for a global governing body that can coordinate antibiotic R&D incentive programmes at an international level and guide their operation at national levels. This global governing body could establish a unified direction for international antibiotic R&D incentives and guide incentive programmes towards achieving a more balanced global R&D incentive profile. Having such an entity would also help ensure that broader AMR goals related to global sustainability, patient access, and medical need are reinforced by the individual incentives.

Other recent reports such as the UK Review on Antimicrobial Resistance (O’Neill, Reference O’Neill2016) have also referred to the need for a global body to coordinate, prioritize and mobilize resources for fighting AMR without defining how this might be established and what form it might take. The most concrete proposal emerged from the G20 summit in Hamburg in 2017 where G20 leaders called for “a new international R&D Collaboration Hub to maximize the impact of existing and new antimicrobial basic and clinical research initiatives as well as product development” (G20 Leaders’ Declaration, 2017). The Global Antimicrobial Resistance Collaboration Hub is now being established in Germany with support from the Bill and Melinda Gates Foundation and the Wellcome Trust but requires political and financial support from many countries if it is to become an effective international instrument against AMR. It is intended that the Hub will coordinate efforts to promote antimicrobial research and encourage global involvement and investment and that its scope will include all stages of the antimicrobial development pipeline, as well as vaccines, alternative therapies and new diagnostic tools. It will be open to all countries and to nongovernment donors. Members will be expected to release additional investment in national and/or international research, but there will not be a set tariff for involvement.

Conclusion

Adding innovative antibiotics to the treatment arsenal is a critical aspect to addressing the AMR crisis. Incentives are necessary for overcoming the multitude of scientific, regulatory, and economic barriers that impede progress through the entire antibiotic value chain. Over recent years, many international, European, and national-level incentive programmes have been implemented to foster the antibiotic value chain. These have helped to lift the clinical pipeline for antibiotics out of dormancy. However, the recent progress in R&D is not nearly sufficient to counteract the rapid advancement of resistance rates. The current global incentive package could be improved by ensuring that a continuum of incentives is offered to developers, reflecting the economic need, cost distribution, and barriers of the antibiotic value chain. A global governing body that provides overarching guidance to international and national-level incentive programmes will be necessary to achieving such a continuum and the establishment of the Global Antimicrobial Resistance Collaboration Hub is a promising initiative to make such a governing body a reality.