The growing global epidemic of diet-related chronic disease has provoked recommendations for the use of tax policy tools to create incentives for healthy food consumption(1–Reference Magnusson3). Diets high in meat, processed foods (often high in salt, fat and/or sugar) and refined cereals, and low consumption of whole grains, fruits and vegetables are associated with increased risk of chronic diseases such as cancer, diabetes and CVD in both high- and low/middle-income countries(Reference Popkin4–6). High levels of consumption of foods such as soft drinks and fast foods are also associated with increased disease risk(Reference Vartanian, Schwartz and Brownell7, Reference Pereira, Kartashov and Ebbeling8).

Taxes and subsidies can change the price of healthier foods relative to unhealthier foods, and thus provide incentives for a better diet(Reference Powell and Chaloupka2, Reference Thow, Jan and Leeder9). Such price changes would help to compensate for or decrease externalitiesFootnote † related to the high economic and social cost of diet-related chronic diseases by translating some of these future costs into a higher price for unhealthy food(Reference Cawley10, Reference Finkelstein, French and Variyam11). They can also reinforce consumer education by drawing the attention of discerning shoppers to unhealthy foods(Reference Cash and Lacanilao12).

However, there has been limited implementation of recommendations for specific health-related food taxes(Reference Chriqui, Eidson and Bates13). Uptake and implementation of such taxes depend on several factors; one that is often overlooked by public health nutritionists is the importance of the type of tax proposed in determining the feasibility and acceptability of proposals made to tax policy makers(Reference Thow, Quested and Juventin14). The present study examines the types of taxes that could be used to change the relative prices of foods, and their feasibility from a policy perspective, taking special account of the global tax reform agenda.

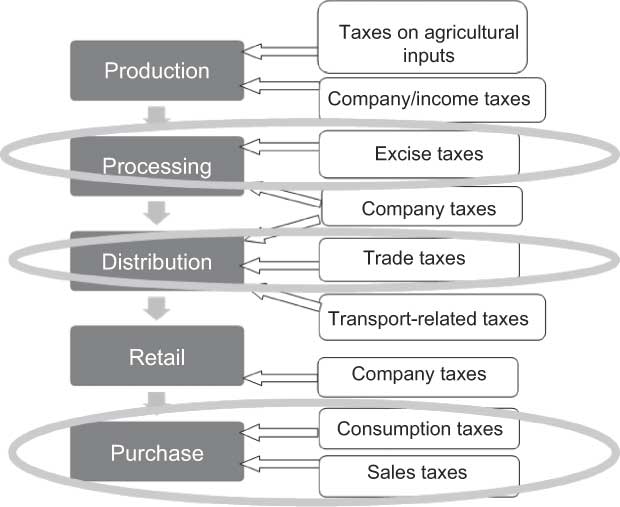

Taxes are already applied at many points in the food supply chain – e.g. to agricultural inputs, transport of food, the companies that produce, process and market food and those who consume it (Fig. 1). While governments have applied health taxes to tobacco and alcohol, food is an essential commodity that is already taxed in complicated ways. These factors make the implementation of specific food taxes designed to improve diets difficult(Reference Caraher and Cowburn15, Reference Leicester and Windmeijer16). As the aim of public health nutrition intervention is to influence consumption (quantity and type) of healthy and unhealthy foods, recommendations have focused on consumption taxes as the most direct mechanism for influencing price. These include broad-based taxes (e.g. value-added tax (VAT) and sales tax), excise taxes and trade taxes, which are applied with a high degree of specificity (Box 1). In contrast, taxes on agricultural inputs, company taxes and transport-related taxes affect a wide range of products and services, and thus cannot be targeted to specific foods.

Fig. 1 Overview of the application of the taxation system to the food supply chain. Recommendations have focused on consumption, sales, trade and excise taxes as direct influences on the purchase price of specific foods (adapted from Hawkes(Reference Hawkes17))

Box 1 Glossary of tax terms

While tax policy varies widely among countries, there is consensus regarding several future directions. The present study summarises the global tax reform agenda, which guides tax policy makers at a national level in both developed and developing countries(Reference Stewart18), especially in relation to consumption taxes. Finally, it critically assesses recent recommendations for public health nutrition taxation in the peer-reviewed and popular literature, both of which inform policy. In doing so, the present study highlights factors that may have contributed to a widespread lack of implementation of such recommendations. By aligning proposals for taxation interventions to the agenda of tax policy makers, public health nutritionists can make more feasible taxation proposals and thus increase the likelihood of their adoption(Reference Nugent and Knaul19).

Discussions about incentives for healthy eating have also included subsidies, such as tax exemptions, which fall under tax policy making (as ‘tax expenditure’), and government expenditure in the form of fund transfers, administered by specific government departments (e.g. Agriculture). As the focus of the present study is on tax policy, we include only subsidies in the form of tax exemptions and do not analyse the scope for changes to ‘fund transfer’ subsidies, such as those related to agriculture. Reductions in such subsidies might well help correct prices and the availability of heavily subsidised products. This occurred decades ago in Poland, where the reduction of subsidies to diary and meat production, together with increased availability of vegetable oils and fruit, apparently contributed to rapid and substantial reductions in CVD mortality(Reference Zatonski, McMichael and Powles20).

Method

We first summarised the priorities of the global tax reform agenda as they relate to consumption taxes. First, we performed a literature review using Business Source Premier, ProQuest, Google Scholar and International Monetary Fund (IMF) and World Bank websites, applying the terms ‘global’, ‘tax’, ‘reform’, ‘agenda’ and ‘consumption’. We then examined reference lists from relevant articles. Based on this information, we highlighted the implications for nutrition-related consumption taxes. Second, we reviewed recommendations for, and examples of, public health nutrition taxation, from 2000 onwards, to identify the types of taxes recommended. Academic databases (Medline, ProQuest and Business Source Premier) and Google Scholar were searched using the terms ‘tax’, ‘food’, ‘diet’, ‘nutrition’, ‘consumption’, ‘soft drink’, ‘obesity’ and ‘fat’, and focused on proposed mechanisms for public health nutrition taxation. These proposals were critically assessed against the global tax reform agenda.

Findings

Overarching principles for tax policy makers in reforming taxation systems

Tax instruments (and the overall tax system itself) are assessed largely by reference to the criteria of simplicity, equity and efficiency(21). ‘Simplicity’ relates to the ability of the revenue authority to administer a tax and the taxpayer to comply with the tax. In theory, the simpler the tax, the greater the certainty involved in its imposition, and, therefore, the greater the ease with which the tax can be administered and complied with.

‘Equity’ as an element of social justice and human rights has many definitions, but two varieties are of special relevance here: horizontal equity (an ethical principle that argues that persons here and now, occupying the same economic and social space, should be treated the same) and vertical equity (an argument that persons in a different social and economic context should be treated differently and, in particular, those with a greater capacity to pay should pay more tax to assist those who need affirmative support). A regressive tax is one that breaches vertical equity in that those with lower incomes pay proportionately more of their income as tax than those with higher incomes.

‘Efficiency’ requires that a tax should be neutral in the way that it affects economic behaviour (both in relation to consumer choices and productive processes). There is a loss of efficiency if a tax encourages an individual to substitute goods and services that they value less for goods and services that they value more. The costs of administering and complying with a tax involve a loss of efficiency.

These overarching principles guide tax policy makers in both tax system reform and selecting appropriate instruments for taxation, and there are important relationships between these goals. For example, simplicity in the design of a tax can lead to lower administration and compliance costs and, therefore, greater efficiency.

The global tax reform agenda: an overview

The global tax reform agenda has changed the global economy fundamentally over the past 30 years. Barriers to cross-border flows of production (such as the removal of exchange controls to facilitate flows of capital) have been demolished and goods and services have moved more easily among nations. Multinational enterprises have emerged as truly global organisations responsive to tax differentials, and this in turn has created incentives for all countries to improve their tax systems to attract and retain foreign investment. The World Trade Organization (WTO), IMF, World Bank and the Organization for Economic Cooperation and Development (OECD) have grown in power and authority. Many judge the new tax systems as more efficient than the old.

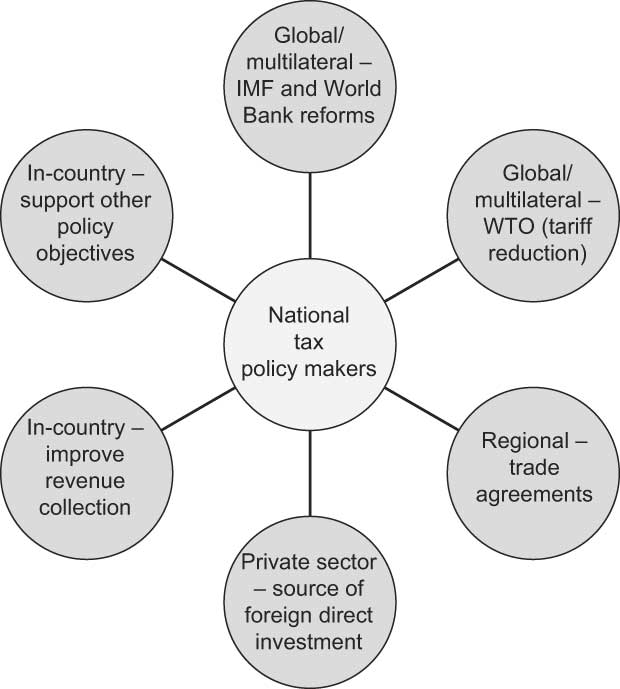

The global agenda for reform has not only informed development of tax systems to date but also continues to shape policy decisions, as tax systems are continually adjusted(Reference Stewart18, Reference Bahl and Bird22–Reference Garber24) (Fig. 2). This section provides a brief overview of the emergence of the global tax reform agenda and its main priorities.

Fig. 2 Major influences on national tax policy makers

For low-income countries, the close of the colonial era and rise of international aid for development led to pressure for the reform of inefficient, inequitable tax systems plagued by administrative problems(Reference Bahl and Bird22). In the 1980s, tax reform became part of IMF conditionalities, and the World Bank initiated research comparing the process and success of tax reform initiatives in various countries(25, Reference Abed26). These agencies have played a major role in advising low-income countries to reform their tax systems to ensure that they are commensurate with administrative capacity.

At the same time, there was a growing adoption of consumption taxes – namely VAT – among OECD countries(27). The USA is the only OECD country to still use sales tax rather than VAT(27). Consumption taxes were adopted by the IMF and later by the World Bank as a key recommendation within their structural reform packages for low-income countries(25, 28). Consumption taxes are preferred because they have a lower administrative burden and – particularly when a flat rate tax is applied to a broad base – they are an efficient way to raise revenue(Reference Cnossen29, Reference Gemmell and Morrissey30).

By the early 1990s, there was a remarkable global consensus, especially among international institutions, regarding tax reform, with the result that despite tax system differences between countries, the priorities and policy aims of tax policy makers have become similar(Reference Stewart18). Consumption taxes such as VAT or goods and services tax (GST) are now one of the main sources of revenue in most countries, replacing the existing, often ad hoc and highly complicated, taxation structures(Reference Cnossen29, Reference Thirsk31). There have also been reductions in the use of trade-related taxes, as required by policies of trade liberalisation(32); import tariffs have declined in both developed and developing countries(Reference Bahl and Bird22). ‘Tariff bands’ have come into favour, which are set rates for tariffs (e.g. 5 %, 10 % and 20 %) that are often linked to planned rate reductions (e.g. after 5 years, the 20 % band becomes 15 %, 10 % becomes 8 %, etc.)(32). The work of the WTO, which was created in 1994, has served to reinforce this aspect of the tax reform agenda. In many low-income countries, the recent adoption of a VAT or GST has been closely associated with a reduction in trade tax revenue(Reference Burns33). While the VAT is imposed on both imports and domestic production, in many low-income countries it is largely collected at the border and therefore replaces lost trade tax revenue.

Excise taxes have been used less in many countries as the tax structure has been simplified and broad-based consumption taxes introduced. However, they remain an important component of tax systems as a tool for revenue raising and correcting for externalities(Reference Bolnick and Haughton34–Reference Cnossen36).

Thus, in summary, the global priorities for tax reform are to simplify administration, minimise distortions and maximise revenue. In relation to consumption taxes, the main agenda includes implementation of broad-based, flat rate general consumption taxes, the use of specific (usually excise) taxes only to correct for negative externalities, and reductions in import taxes in line with trade liberalisation (Table 1).

Table 1 Implications of the global tax reform agenda for public health nutrition taxation

VAT, value-added tax; GST, goods and services tax; WTO, World Trade Organization.

The global tax reform agenda: implications for nutrition-related consumption taxes

There is scope within the global tax reform agenda for changes to tax systems that help to achieve health and nutrition objectives. This is partly because tax systems are constantly changing due to ongoing reform(Reference Freebairn23, Reference Gemmell and Morrissey30), and also because there is recognition by taxation specialists that the tax system plays a role in supporting other policy objectives(Reference Cnossen36, Reference James and Edwards37).

The general tax policy priorities described in the previous section suggest broad strategies that will make proposals for public health nutrition taxation interventions more feasible for tax policy makers to implement (Table 1). Public health nutritionists can contribute to simplifying tax administration by making proposals that are simple to implement and make use of existing tax policy mechanisms and tax rates. This minimises administrative costs because legislative and administrative processes for tax implementation and collection already exist, and established procedures and staff are in place for both the revenue authority and the taxpayer. In terms of maximising revenue, public health nutritionists can support the streamlining of taxes by not proposing new types of taxes or differential tax rates (e.g. special tax rates on certain foods). Again, a better option would be to examine the existing rates and types of taxes and utilise these for proposals. In doing so, it is important to reduce or limit distortions in the tax system. Further, proposals should explicitly describe the probable burden of the tax (including regressivity), as well as its benefits (i.e. reductions to the fiscal burden in the future through chronic disease prevention and additional revenue).

More specific policy directions for consumption taxes, tariffs and excise taxes are evident globally, and these also have implications for public health nutrition taxation (Table 1). The trend of general consumption taxes (sales tax and VAT) towards flat rate VAT has meant the replacement of a large number of different taxes on consumption, and limits the scope for applying widely varying rates of tax to different goods. However, it is not uncommon for VAT to have exemptions for essential foods(27), which could be extended to reduce the tax on healthy foods, or could be removed from unhealthy foods to increase taxes on these foods. The difficulty with this, though, is that it creates borders based on definitions of ‘unhealthy’ that have to be policed by the revenue authority and, from a taxpayer perspective, creates opportunities for tax evasion.

The use of specific consumption taxes (e.g. excise taxes) is decreasing as taxes are streamlined, but excise taxes remain important for correcting externalities(28, Reference Cnossen36). Proposals for excise taxes should explain the contribution of diet to poor health outcomes and clarify the role of the tax in influencing the consumption of specific foods or groups of foods, as well as raising revenue to compensate for the cost of diet-related chronic diseases(Reference Finkelstein, French and Variyam11, Reference Nugent and Knaul19, Reference Brownell and Frieden38).

As a priority of both trade liberalisation and global tax reform, the reduction of trade taxes and introduction of bound rates and tariff bands mean that there is less scope to change tariff rates in response to public health nutrition priorities. Aligning proposed tariff changes with existing tariff bands and ensuring that they remain within bound rates makes administration and implementation easier, and is more likely to be acceptable. Alternatively, as a strategy for reducing the cost of healthy foods, the reduction or removal of tariffs supports trade liberalisation, and could be a more feasible way to reduce taxes than changes to VAT. Another result of trade liberalisation is that many governments in low-income countries are actively seeking new sources of revenue as income from tariffs declines. As such, there may be increasing scope for the proposal of new taxes (e.g. excise taxes) that benefit both finance and health(Reference Burns33).

Each country also has its own priorities for tax reform. In order to develop feasible proposals, public health nutritionists need to bear in mind the current national tax structure for food and national policy directions, as well as global policy priorities. For example, while global policy directions suggest against proposing changes to the VAT, if a country has a differentiated VAT then there may be a case for applying the highest VAT rate to unhealthy foods – using the existing tax bands but still increasing the tax. Ongoing, informed consultation with national tax policy makers is essential for the development of feasible proposals.

Critical assessment of recommendations for nutrition taxation

Public health nutritionists have recommended a variety of taxes to provide incentives for healthy diets and reduce the burden of chronic disease. This section presents a review of these recommendations and critically assesses the different types of proposals against the priorities of the global tax reform agenda (Table 2). Full details of the findings of the present study are provided in the Appendix.

Table 2 Critical analysis of recommendations for use of public health nutrition taxation

VAT, value-added tax; GST, goods and services tax; WTO, World Trade Organization.

One of the most common specific recommendations was for excise taxes, particularly on soft drinks as an easily identifiable commodity that adds little or no nutritional value to the diet while being associated with a higher disease risk(Reference Brownell and Frieden38–Reference Bahl, Bird and Walker40). Excise taxes are one of the most appropriate tools for public health nutrition because their use in correcting for externalities (the basis of public health nutrition taxation) is supported in the taxation literature. However, their feasibility will depend on whether a mechanism is in place for effective excise tax collection. Linking such taxes explicitly to health goals has also been found to improve public support(Reference Leicester and Windmeijer16).

Several proposals for public health nutrition taxation have suggested changes to general consumption taxes, including increased VAT on soft drinks(Reference Gustavsen41), reduced VAT on healthy grain products(Reference Nordström and Thunström42) and increased sales tax on soft drinks and snack foods(Reference Chriqui, Eidson and Bates13, Reference Tefft43). However, the main point of introducing a VAT – and the reason for the trend towards flat rate VAT – is that through its broad base and single rate it is an efficient tax that is reasonably simple to administer. As a result, changes to VAT that lead to distortions and add administrative complexity are unlikely to be implemented.

As discussed above, the feasibility of tariff changes largely depends on whether they are consistent with the trade liberalisation agenda. Proposals for tariff increases that have been made in the Pacific (Welegtabit(Reference Welegtabit44)) are technically contrary to policies designed to reduce barriers to trade, such as the Pacific Island Countries Trade Agreement. However, if these increases are within bound rates and are non-discriminatory (see glossary), then they are feasible proposals to support public health nutrition priorities(Reference Thow45). In contrast, proposals to decrease tariffs on healthy foods(46) align with trade liberalisation priorities, and so are more feasible.

More complex proposals have included tax and subsidy packages that are revenue neutral(Reference Nordström and Thunström42, Reference Jensen and Smed47), and variable taxes based on the price change are required to reduce intake of unhealthy food to nutritional recommendations(Reference Santarossa and Mainland48). These types of proposals are unlikely to be implemented, simply because of the associated administrative complexity. However, the feasibility of these proposals could be improved by using existing types of taxes and tax rates.

Several recommendations did not describe the specific tax used or proposed(Reference Magnusson3, Reference Boizot-Szantaï and Etilé49–Reference Nestle and Jacobson57). While this strategy allows tax policy makers to select the most appropriate tool for taxation, it may reduce the likelihood of the proposal being adopted because it creates additional work for tax policy makers. While improving nutrition is a priority for health policy makers, the different priorities within finance may mean that little time is available to research and develop the details of such a proposal.

Discussion

Strategies to maximise acceptability of proposals

The implications of the global tax reform agenda for public health nutrition taxation centre on the types and rates of taxes used for intervention. First, there is little scope for use of types of taxes that are being phased out – e.g. many countries are phasing out retail sales tax with the introduction of a broad-based VAT and are reducing tariffs under trade liberalisation policies. Second, the introduction of new tax rates is contrary to the priorities of simplification and use of flat rate taxes. Public health nutritionists can improve the acceptability of their proposals for tax policy change by minimising the associated administrative burden (e.g. using existing types and rates of taxes). Excise taxes are also an appropriate mechanism for public health nutrition taxation, and proposals should clearly explain the health externality that is being corrected for. Understanding global priorities for tax reform can also highlight less obvious, more acceptable strategies that can help to achieve nutritional goals. For example, rather than proposing additional tax increases, it might be possible to remove VAT exemptions from unhealthy foods. Similarly, instead of proposing new exemptions to the VAT, tariffs on healthy foods could be reduced. Proposals should also describe the full impact of the tax, including considering the unintended and differential impacts of the tax, explicitly considering regressivity, calculating the revenue generated by the proposal and suggesting revenue-neutral options when proposing tax exemptions.

Future research, modelling and policy proposals for taxation should use potentially feasible scenarios that are consistent with the global tax reform agenda to improve the likelihood of serious consideration by tax policy makers. Proposals seen in the literature that aligned with global tax reform priorities included extending VAT to unhealthy foods that are currently exempted, decreasing tariffs on healthy foods and implementing excise taxes on specific foods to correct for externalities related to the burden of diet-related chronic disease. These proposals contribute to tax policy makers achieving their own priorities for reform, and also support population nutritional objectives. Ongoing, informed consultation with national tax policy makers will aid the development of feasible proposals. This should be supported by advocacy for (i) the significant personal, economic and social benefits of healthy eating and (ii) the benefits of a multi-dimensional approach, including taxation, to creating incentives to support healthy food choices.

The contribution of taxes to a multi-dimensional health promotion strategy might also include the use of revenue collected to support other initiatives, such as public education or social marketing of healthy foods(Reference Brownell and Frieden38, Reference Nnoaham, Sacks and Rayner62, Reference Jacobson and Brownell70, Reference Wallerstein71). This may improve public support for the taxes(Reference Leicester and Windmeijer16, Reference Brownell, Farley and Willett58), and also help to reduce regressivity (discussed below) as these initiatives may particularly benefit those with low incomes, who are often disproportionately affected by chronic disease(Reference Brownell and Frieden38). However, in terms of the global tax reform agenda, earmarking of revenue is likely to create additional administrative costs, and may reduce transparency and accountability since the tax revenue will not go through normal processes. It has also been suggested that diverting revenue may limit the sustainability of taxes, and that health promotion funds may be redirected as government priorities change(Reference Thow, Quested and Juventin14).

Taxes have been a critical component of strategies to reduce tobacco consumption and the associated burden of illness and death, and this experience has informed development of public health nutrition taxation recommendations to date(Reference Gostin56). However, in contrast to food, tobacco products are non-nutritive and relatively homogeneous, and thus a fairly straightforward candidate for excise taxation. As a result, the most pertinent application may be the use of the Framework Convention on Tobacco Control as a model for global governance in reducing diet-related chronic disease. Provision of guidelines and legislative tools for adoption by national policy makers could assist countries seeking to implement multi-dimensional policy interventions.

Challenges for public health nutritionists

A significant challenge for public health nutritionists is to assist tax policy makers to define ‘unhealthy’ foods(Reference Cash and Lacanilao72–Reference Strnad74). This will be important for tax administrators who have to monitor the border between healthy and unhealthy foods. As stated above, any borders created between taxed and untaxed goods increases the administrative and compliance costs of the tax. However, the definition of unhealthy foods is a contentious issue because of the essential nature of food, and the contribution of even the most ‘unhealthy’ food to basic nutrient requirements. It is, in fact, unhealthy diets that are related to disease, and the challenge presented is that of linking particular foods to an overall diet. Strategies employed to date have ranged from the identification of specific foods that are deemed ‘high energy low nutrient value’ foods (e.g. soft drinks), to more complicated calculations, usually taking into consideration fat, salt and sugar content. For example, researchers in the UK have used a ‘nutrient-scoring profile’ to identify a range of unhealthier foods for taxation(Reference Nnoaham, Sacks and Rayner62–Reference Marshall64). A system such as traffic light labelling could contribute to both consumer education and identification of foods that would benefit from improved economic incentives reflecting the real costs of consumption(75). The implementation of a carbon tax or another form of environmental tax on food production and processing may also result in similar health-related benefits, because of the high energy use associated with the production of livestock and highly processed food(Reference Haines, Smith and Anderson76).

In selecting foods for taxation, public health nutritionists also need to balance the (un)healthfulness of the targeted food with consumers’ likely response to its taxation, called ‘price elasticity’. Where the aim of taxation is to decrease consumption, foods for which consumer demand is likely to decline in response to a price increase (price ‘elastic’ foods) may be more appropriate to target than those that are very inelastic. Food demand is often quite unresponsive to price changes (‘inelastic’), particularly in higher-income countries. Andreyeva et al.(Reference Andreyeva, Long and Brownell77) found that while food purchases in the USA were relatively price inelastic, there was variation between food products, with demand for soft drinks, juice, meats, fruit and cereals being relatively less inelastic. However, in lower-income countries, where people tend to spend a higher proportion of their income on food, demand for some, usually non-staple, foods and beverages can be very price elastic(Reference Seale, Regmi and Bernstein78). However, there is relatively limited data on food price elasticities – further research in this area would help public health nutritionists to target food taxes more effectively.

Public health nutritionists also need to address the challenge presented by the potentially negative effect of taxation on the food industry, which has been cited as a barrier to policy implementation and sustainability(Reference Kim and Kawachi68, Reference Jacobson and Brownell70). Economic goals of government include the promotion of private sector growth as well as correcting for externalities, and one of the key aims of tax reform is to create an environment that does not discriminate unfairly against particular types of business or commodity. It has been shown that taxes on soft drinks can have negative effects on economic measures such as employment and growth of Gross Domestic Product(Reference Gabe59, 79). However, these studies do not consider the health implications of soft drink consumption, and reinforce the need for public health nutritionists to provide tax policy makers with information on the personal, social and economic costs of poor diets.

Concerns have been raised in the literature and popular press about the fact that public health nutrition taxes are regressive, in that they will place a higher relative burden on those with lower incomes, who spend a higher proportion of their income on food(Reference Caraher and Cowburn15, Reference Leicester and Windmeijer16, Reference Kim and Kawachi68); in Mexico a tax on soft drinks was rejected by the Senate due to concerns over the effect on the poor(Reference Hamm80). From a public health nutrition perspective, regressivity is a concern because of the negative effect of poverty on health overall(Reference Rose and Hatzenbuehler81). However, the extent of regressivity created by public health nutrition taxation is not clear, and some studies have suggested that the poor may in fact benefit disproportionately from the health benefits resulting from economic incentives to improve diet(Reference Leicester and Windmeijer16, Reference Nnoaham, Sacks and Rayner62, Reference Smed, Jensen and Denver69). In terms of the differential effects on consumption, Brownell et al.(Reference Brownell, Farley and Willett58) point out that in the USA both the 15–20 % drop in soft drink consumption and any associated increase in expenditure that would most likely result from a small tax is relatively minor. Raising consumer awareness of the health, consumption and expenditure effects of proposed taxes, as well as the low-cost healthy alternatives available (namely water), may help to allay concerns regarding regressivity. In addition, complementing taxes on unhealthy food with subsidies for healthy foods could help to reduce the burden on those most affected by increases in food prices. Public health nutritionists should also be mindful that similar arguments have been made against special excise taxes on alcohol and tobacco, but for both of these the public health benefits across the population have outweighed the possibly uneven financial impacts.

Conclusion

Global priorities for tax reform shape the uptake and implementation of proposals for public health nutrition taxes. By understanding this agenda, public health nutritionists can support tax policy makers to use taxes to correct for externalities caused by diet-related chronic disease. Strategies to improve the feasibility and acceptability of proposals from the perspective of tax policy makers include (i) using existing types and rates of taxes where possible, (ii) using excise taxes that specifically address externalities, (iii) avoiding differential VAT on foods and (iv) using import taxes in ways that comply with trade liberalisation priorities.

Future research and modelling studies should consider the feasibility of scenarios for public health nutrition taxation in the light of the global agenda for tax reform. There is also a need for more research into the definition of ‘unhealthy food’ for the purposes of taxation, food price elasticities, the potential for environmental/carbon taxation to contribute to public health nutrition goals and the differential effects of public health nutrition taxation on the poor.

Acknowledgements

The present study is funded through an Australian Postgraduate Award held by A.M.T. The authors declare that they have no conflicts of interest. A.M.T. conceived of the study and conducted the majority of the research, and the study will form part of her PhD thesis. P.H. and S.L. guided the development and scope of the study. L.B. provided valuable guidance regarding the global tax reform agenda. The authors thank the anonymous reviewers for their constructive comments.

Appendix

An overview of recommendations for public health nutrition taxation

VAT, value-added tax.