I. Introduction

Product ratings have the ability to reduce information asymmetries for experience goods. They represent a credible signal of quality and positively affect consumer choices and product sales (e.g., Chevalier and Mayzlin, Reference Chevalier and Mayzlin2006; Cox and Kaimann, Reference Cox and Kaimann2015; Frick and Kaimann, Reference Frick and Kaimann2017). As a result, the impact of ratings is significant in the wine market, especially because the intangible product characteristics of wines are difficult to evaluate before they are consumed. Product reviews and ratings from specialized guides and magazines bridge this information gap by conducting a quality assessment of professional wine critics, ranking wines on a quantitative scale according to their sensory quality (De Mets et al., Reference De Mets, Goos, Hertog, Peeters, Lammertyn and Nicolaï2017). Thus, reviews are the most critical information source that influences which wines consumers choose (Williamson et al., Reference Williamson, Lockshin, Francis and Loose2016), as consumers trust these professional evaluations (Storchmann, Reference Storchmann2012).

Professional critics constantly need to handle many information signals—such as prices, brands, or tens to hundreds of reviews—so they need to screen for relevance and evaluate reliability separately and jointly. Prior studies have analyzed the relationship between expert ratings and wine prices. Oczkowski and Pawsey (Reference Oczkowski and Pawsey2019) found that expert ratings are essential in explaining wine prices. The results suggest that winemakers should monitor and consider expert opinions when assessing wine prices. Masset, Weisskopf, and Cossutta (Reference Masset, Weisskopf and Cossutta2015) examined the ratings of 12 influential wine critics on the Bordeaux en primeur market over the vintages from 2003–2012. They observed that wine experts have significantly different rating approaches and influences on prices and suggest that Robert Parker and Jean-Marc Quarin have the highest influence on wine prices, with a 10% increase in their scores leading to a price increase of around 7%. Mastrobuoni, Peracchi, and Tetenov (Reference Mastrobuoni, Peracchi and Tetenov2014) used an experimental design to show the signaling effects of prices on consumers’ wine choices. They discovered a nonlinear price-quality relationship in a sample of wine ratings, indicating that prices are an important signal of quality. Almenberg and Dreber (Reference Almenberg and Dreber2011) demonstrate that prices serve as a quality signal and influence consumers’ expectations. Finally, Schamel and Ros (Reference Schamel and Ros2021) use Italian (Friulian) wine data and show that current quality assessments and individual reputations from past awards determine wine prices.

Based on the findings of these studies, we conjecture that there is a signaling effect of prices and ratings related to expert reviews, wine prices, and additional observable signals of product quality in the wine market. Despite significant efforts in the well-developed literature that identifies the impact of evaluations and market prices in the wine market, there is still a need for a detailed examination of the dynamic relationship between evaluations and prices, accounting for the timing of the reviews, ratings, and prices over several years. Thus, there is still no clear picture of the dynamic interrelationships between ratings and prices.

In this paper, we first examine the impact of past assessments on future market prices. In this context, we recognize that ratings have an essential influence on the reputation of individual wines (e.g., Landon and Smith, Reference Landon and Smith1997, Reference Landon and Smith1998; Frick and Simmons, Reference Frick and Simmons2013). In this, we follow Frick and Simmons (Reference Frick and Simmons2013) and control individual and collective reputations. Since ratings can be used to control the individual reputation of wines, we are also able to control the collective reputation, including the wine region or country of origin. In this way, we are able to mitigate the risk of biased estimations. At the same time, since ratings signal the quality of a product, we are interested in how the product quality of the analyzed wines evolves. This provides insight into the long-term motivation of winemakers to either hold the quality of the product at a constant level or even improve it (for better or worse). Second, we are interested in looking at reviewer attitudes to gain more insight into the consistency of professional evaluations (e.g., Frick, Reference Frick2020). Here, we reflect on the reviewers’ behavior, in that previous reviews may impact their current reviews. Consequently, we aim to enhance the current research by comprehensively analyzing the dynamic relationship between professional ratings and wine prices. Specifically, we are interested in the following:

(1) How are ratings and prices related?

(2) Is there a consistency among the reviews that drives current ratings?

We aim to shed light on the dimensions of ratings by focusing on the rating system provided by Wine Enthusiast Magazine, one of the seven most influential U.S. wine magazines (Storchmann, Reference Storchmann2012), which publishes the points of professional critics and ratings on the product quality of beverages such as spirits, beer, ciders, and wines.

There are several ways in which our study contributes to the current literature. First, we analyze how wine prices are associated with product characteristics and former expert reviews. Second, we shed light on the reviewer's behavior by analyzing possible behavioral consistency. Furthermore, we provide a comprehensive explanation by including worldwide well-known wine regions (ranging from classic European growing regions such as Italy, France, and Spain to growing regions in the United States and Australia) and grape varieties to explain the relationship between wine prices and professional ratings, and avoid product quality biases.

The present research is organized as follows. Section II presents the current state of research and our hypotheses. Section III introduces the data and model. Section IV provides the empirical results, and Section V summarizes the findings and provides possible limitations and outlooks.

II. Literature review and hypotheses

Information asymmetry (Nelson, Reference Nelson1970; Akerlof, Reference Akerlof1970) between wine producers and consumers is one of the industry-specific challenges of the wine industry as a market for experience goods. In this context, wine prices mainly signal quality (Schnabel and Storchmann, Reference Schnabel and Storchmann2010; Mastrobuoni, Peracchi, and Tetenov, Reference Mastrobuoni, Peracchi and Tetenov2014). Thus, a comprehensive research question arises about how wine prices are constituted and what determinants can define future market wine prices. The research in the last decades has mainly concentrated on hedonic price models and has used numerous empirical and experimental studies to investigate various categories of wine price determinants (Outreville and Le Fur, Reference Outreville and Le Fur2020). These studies have created a consensus regarding the most considerable dimensions that explain wine prices (e.g., Ling and Lockshin (Reference Ling and Lockshin2003) for Australian wines; Benfratello, Piacenza, and Sacchetto (Reference Benfratello, Piacenza and Sacchetto2009) for Italian wines; Ferro and Amaro (Reference Ferro and Amaro2018) for top-quality wines) and have outlined wine price determinants as objective characteristics such as sensory qualities (e.g., Schamel, Reference Schamel2000; Lecocq and Visser, Reference Lecocq and Visser2006), wine producer sizes or regions (e.g., Horowitz and Lockshin, Reference Horowitz and Lockshin2002; Oczkowski Reference Oczkowski2016a), grape varieties, climate and weather characteristics (e.g., Ashenfelter, Reference Ashenfelter2010; Ashenfelter and Storchmann, Reference Ashenfelter and Storchmann2016; Oczkowski Reference Oczkowski2016b), and reputation (e.g., Landon and Smith, Reference Landon and Smith1997; Cardebat and Figuet, Reference Cardebat and Figuet2004; Schamel, Reference Schamel2009; Frick and Simmons, Reference Frick and Simmons2013; Oczkowski, Reference Oczkowski2018). In addition, subjective measures, including taste reviews and expert quality ratings, have also been highlighted (e.g., Cardebat, Figuet, and Paroissien, Reference Cardebat, Figuet and Paroissien2014; Ashton, Reference Ashton2016; Oczkowski and Pawsey, Reference Oczkowski and Pawsey2019).

In particular, a growing body of studies has examined the relationship between professional expert ratings and wine pricing to various extents. For instance, they show the influence of expert opinions on the demand and sales of wines (e.g., Hilger, Rafert, and Villas-Boas, Reference Hilger, Rafert and Villas-Boas2011; Friberg and Grönqvist, Reference Friberg and Grönqvist2012), the respective impact of consumer evaluations (word of mouth), and expert opinions on wine prices (e.g., Oczkowski and Pawsey, Reference Oczkowski and Pawsey2019), the impact of detailed expert evaluations from wine “gurus” Robert Parker (e.g., Ashton, Reference Ashton2016) or Jean-Marc Quarin—both considered the most influential wine critics related to price increase (Masset, Weisskopf, and Cossutta, Reference Masset, Weisskopf and Cossutta2015)—or the relationship of hedonic wine price models and quality ratings (Oczkowski and Doucouliagos, Reference Oczkowski and Doucouliagos2015).

Horowitz and Lockshin (Reference Horowitz and Lockshin2002) have shown the positive correlation of ratings with price, the rating of the winery, and the winery's size and region using quality ratings from expert critic James Halliday as the dependent variable in eight equations for eight wine varieties from Australia. Current studies reflect the various “guru” scoring systems and evaluation procedures, such as blind tastings (e.g., Cicchetti, Reference Cicchetti2004; Cicchetti and Cicchetti, Reference Cicchetti and Cicchetti2009). In the research from recent years, the analysis of the possible influence of wine expert “guru” ratings on wine prices is particularly interesting (e.g., Jones and Storchmann, Reference Jones and Storchmann2001; Ashenfelter and Jones, Reference Ashenfelter and Jones2013; Ali, Lecocq, and Visser, Reference Ali, Lecocq and Visser2010). Gibbs, Tapia, and Warzynski (Reference Gibbs, Tapia and Warzynski2009) have presented a model to test the impact of Robert Parker ratings on wine prices. They found a strong relationship between the prices and ratings of wines, especially for wine categories of higher quality. Ashton (Reference Ashton2012) demonstrates the statistically significant impact and value of expert reviews by influential wine experts Robert Parker and Jancis Robinson on Bordeaux wine prices. Moreover, producers of Bordeaux wines use these expert opinions as guides for future pricing. These findings demonstrate that the quality reviews of experts have a high impact on price-setting dynamics. Dubois and Nauges (Reference Dubois and Nauges2010) also demonstrate the positive influence of wine scores by experts on wine prices, especially for Bordeaux “en primeur” wines.

In the digital age, professional online rating platforms and websites such as Wine Enthusiast are possible sources of product information and expert evaluations. The ease of access via the Internet and the provided detailed expert opinions can offer prospective buyers an initial impulse for their purchase decision. Several studies have examined the influence of these platforms explicitly on wine prices (e.g., Ali and Nauges, Reference Ali and Nauges2007; Dubois and Nauges, Reference Dubois and Nauges2010). For instance, Arias-Bolzmann et al. (Reference Arias-Bolzmann, Sak, Musalem, Lodish, Báez and De Sousa2003) examined the wine country, variety, and professional critics at Wine Spectator Magazine as factors that influence wine prices. They found that an increase of five points in the quality rating indicates a 30% increase in the wine price. Therefore, to obtain higher wine prices, wine producers should invest in improving the quality of their wines. Kwak, Nam, and Hong (Reference Kwak, Nam and Hong2021) pointed out that expert rating platforms such as Wine Spectator or Wine Enthusiast affect prices to a similar extent as the expert ratings from the renowned wine guru Robert Parker.

Hilger, Rafert, and Villas-Boas (Reference Hilger, Rafert and Villas-Boas2011) conducted a field experiment in the California retail wine market to address how expert opinion influences the demand for wine. Their findings have exposed expert ratings as a quality indexing signal for consumers, as wine sales with expert information increase by about 25% on average. They have found a decrease in demand for low-scored wines while the demand for average- and higher-scored wines increases. Similar results were found by Friberg and Grönqvist (Reference Friberg and Grönqvist2012), using the Swedish wine market as an example. They have shown that quality reviews generate an increased demand of 6% one week after the publication of the review, with a significant effect over 20 weeks. In comparison, a bad review has zero impact on demand. Further, the impact of positive reviews is higher for higher-priced bottles.

This result contrasts with the findings of Thrane (Reference Thrane2019), who found that consumers in the higher-priced segment tend to use wine price levels as quality indexing information and pay less attention to quality or peer-recommended reviews. Additionally, Thrane (Reference Thrane2019) has examined how expert opinions and peer recommendations influence the customer's buying decision in an experimental setting, especially for red wine. Thus, typical for Norwegian red wine, customers favor wines with high-quality reviews instead of wines with satisfactory reviews. Customers prefer wines that peers recommend, while the effect of excellent reviews is more significant for non-recommended wines.

Villas-Boas, Bonnet, and Hilger (Reference Villas-Boas, Bonnet and Hilger2021) have demonstrated that expert opinions have positive effects on both the consumer's willingness to pay and the product's price, especially positive ratings. Conducting a field experiment in Northern California retail wine markets between 2003 and 2006, they found that an increase in rating scores by one score point increases retail prices by 0.5 to 0.7 cents. Accordingly, consumers are willing to pay 20 to 60 cents more for wines with an average rating of 83 score points. Therefore, they show a direct relationship between the ratings and prices of wines in consumer markets. Professional evaluations seem to be strongly associated with wine prices. These findings are also supported by Oczkowski and Pawsey (Reference Oczkowski and Pawsey2019), who investigate the impact of user-generated online consumer and expert ratings on Australian wine prices. They discovered that expert ratings are essential in explaining wine prices. However, consumer reviews are more suitable for explaining price variances than expert reviews. At the same time, they highlight that expert reviews have “unique power” (Oczkowski and Pawsey, Reference Oczkowski and Pawsey2019, p. 27) in explaining wine prices, so wine producers should consider both rating systems in pricing. In the present studies, individual and prominent wine-growing regions and countries from Europe to the United States and Australia are covered and examined as examples. Based on the available results, we assume that the significant positive effect of expert opinions and wine prices can be shown independently of the country, region, or growing area. These arguments lead us to develop our first hypothesis, namely

Hypothesis 1: Expert ratings determine wine prices. While positive ratings increase prices, negative ratings decrease wine prices.

In the wine industry, reputation includes individual and collective reputation (e.g., Landon and Smith, Reference Landon and Smith1997; Schamel, Reference Schamel2009; Frick and Simmons, Reference Frick and Simmons2013). Schamel (Reference Schamel2002) analyzed the existing link between wine prices and the reputation of a wine producer. Frick (Reference Frick2020) demonstrated how expert opinions affect the reputation of wineries and how changes in the editorship of renowned wine guides could alter the ratings of wineries. Besides this market-influencing potential and the possible impact on wine prices and market performance of the wineries, current studies have also shed light on the composition of expert knowledge (e.g., Ashton, Reference Ashton2017) and the consistency of (star) expert ratings across various wine products and rating platforms (e.g., Marks, Reference Marks2015; Ashton, Reference Ashton2012, Reference Ashton2013; Oczkowski, Reference Oczkowski2017). In this context, several studies have investigated the consistency of raters in different settings (e.g., Hodgson, Reference Hodgson2008, Reference Hodgson2009; Cao and Stokes, Reference Cao and Stokes2012; Gergaud, Ginsburgh, and Moreno-Ternero, Reference Gergaud, Ginsburgh and Moreno-Ternero2021). Stuen, Miller, and Stone (Reference Stuen, Miller and Stone2015) have displayed the consent of wine critics for rated wines from Washington and California.

Further, Bodington (Reference Bodington2020) has shown that a small number of analyzed experts (nearly 10% of the sample) rate inconsistently. Based on these results, it can be assumed that reviewers stick to their previous evaluations. Collectively, these arguments lead to the development of our second hypothesis, namely

Hypothesis 2: Professional critics evolve a review consistency that drives current ratings.

III. Data and model

The dataset consists of wine reviews collected from The Wine Enthusiast Magazine, Footnote 1 containing detailed information about the country, description, winery, designation, rating points, reviews, price, province, regions, reviewer name, and title of each reviewed bottle. The magazine focuses on wine and beverage journalism, has a total readership of 4.1 million people, and is recognized as one of the seven most influential wine magazines in the United States (Storchmann, Reference Storchmann2012).

The Wine Enthusiast Magazine reviews wines and spirits available for sale in the United States according to a prescribed schedule. The wine must be the final product, be of the current vintage, and have approved labeling and packaging. If vintners are interested in submitting samples for review and publication, they must send their pre-selected samples directly to the magazine in line with the publication's guide tasting schedule. Products are blind-tasted in peer-group flights of five to eight samples. However, reviewers may know general information, such as the vintage, variety, or appellation, but never the producer or retail price of any given selection. The professional rating system is held by a network of experts allocated as primary reviewers for certain wine regions, which positions them as experts with specific knowledge of the wine regions. According to this point system, each wine is rated on a scale ranging from 80 (lowest quality evaluation) to 100 (highest rating and level of quality).

Nevertheless, vintners select themselves in the review process and will not randomly choose their products for tasting. Instead, they choose products of the highest quality. Therefore, the submission for rating represents a pre-selection stage in which producers decide whether and which products are included for revision. Accordingly, some wines were probably not surveyed in particular years, so we do not include those wines in our observed sample.

We obtained data on 8,444 wines and their ratings of various vintages between 1998 and 2017, resulting in a sample of 13,911 observations. We primarily focus our study on three wine colors (i.e., red, white, and rosé) and the relationship between the ratings from professional reviewers, the given wine prices, and the product quality characteristics. Summary statistics for variables used in the empirical analysis can be found in Table 1. Although similar variables capture rating and review characteristics, the level of correlation between all variables used in the estimations remains modest (see Table 2). Nonetheless, we centered all rating measures on reducing multicollinearity. Additionally, we used the logarithm of all monetary measures to correct the skewed distribution.

Table 1. Descriptive statistics

Table 2. Pairwise correlations

*** p<0.01, ** p<0.05, * p<0.1

One way to test the influence of wine prices on the reviews of wine experts would be to specify a single-equation reputation model of wine prices in terms of its drivers (e.g., wine color, wine-growing country) and expert evaluations. However, such a model specification would not capture the dynamic interrelationships among the various chains of valuation mechanisms. Therefore, a single-equation approach would lead to biased estimates of the influence of various drivers of wine expert reviews and prices. Following Lee (Reference Lee2007), we use a two-stage least squares (2SLS) regression analysis (see Figure 1). The first-stage equation has wine expert ratings as the dependent variable, and the second has wine prices as the dependent variable. We consider wine ratings an endogenous variable for the expected dynamic relationship between prices and expert ratings. Therefore, our model includes wine quality indicators such as rating, winery, and region (Horowitz and Lockshin, Reference Horowitz and Lockshin2002).

Figure 1. Conceptual framework.

Equation (1) specifies the experts’ ratings as a function of former wine ratings for wine i at t − 1 and t − 2, the wine color, and product quality controls:

where Ratings reflect how professional critics have reviewed their wine after a professional wine tasting on a scale from 80 to 100, thus representing the average weighted critic's rating score. In the dynamic model framework, former ratings predict current wine evaluations. In addition, lagged explanatory variables remain commonly used in empirical studies with observational data to address endogeneity concerns (Bellemare, Masaki, and Pepinsky, Reference Bellemare, Masaki and Pepinsky2017). We therefore include the time-lagged values (t − 1) and (t − 2) of experts’ ratings.

Wine Color controls for possible experts’ preferences for specific types of wine grapes. According to Cardebat and Livat (Reference Cardebat and Livat2016), prominent expert judges prefer wines from particular regions, exemplary of Bordeaux's fine wines. Consequently, taste favorites tend to weigh the expert ratings. Considering these results, we expect red and white wines to be rated better than rosé wines due to individual preferences, being the more popular wines in the market, which results in higher market demand. Thus, we assume that the respective sorts of wine (i.e., red, white, and rosé) react differently to prices and ratings. The vector Product Quality Controls consist of Country, Province, Winery, Variety, and Reviewer and represents the originating country and growing area of wine i. Consequently, the vector controls the influence of product-inherent characteristics on wine ratings.

Equation (2) specifies the wine prices as a function of given expert ratings, wine color, wine-growing country, wine-growing province, manufacturing winery, and wine category:

where Price contains the wine prices given by the individual winemaker of wine i at time t. The variable Wine Color controls the aforementioned type of grape. The variables Country, Province, Winery, and Category represent the vector Wine Controls and, thus, the originating country and growing area of wine i. Consequently, the second stage estimates a classic hedonic price function.

Specifically, the first stage estimations allow us to test hypothesis H2, and the second stage allows for testing hypothesis H1. The following section presents the results and alternate model specifications as a robustness check.

IV. Results

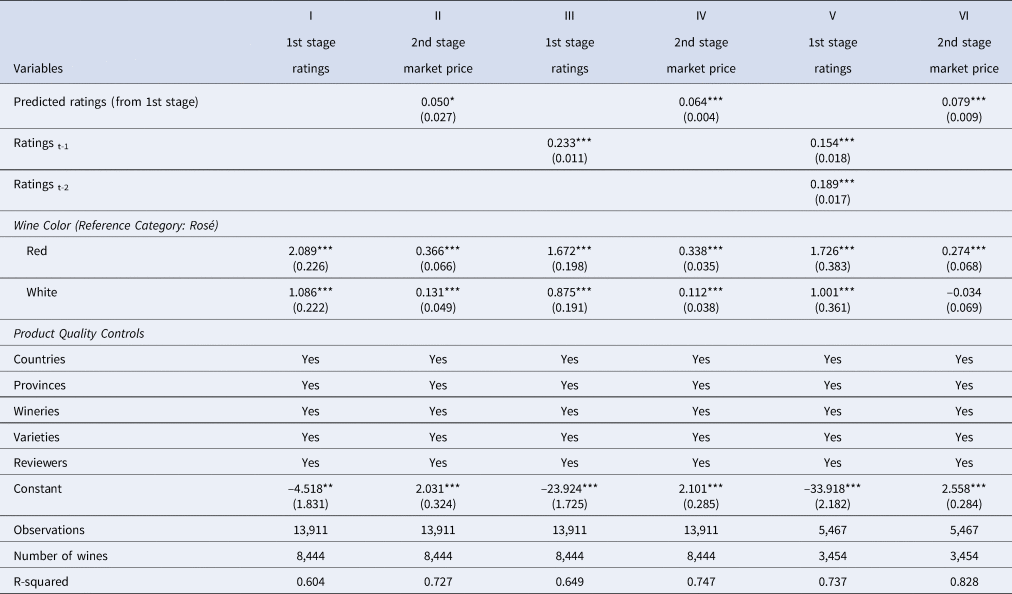

Table 3 estimates the relationship between wine ratings, wine prices, and wine colors. Two-stage least squares random-effects estimations represent the models outlined in Equations (1) and (2). The table presents regression outputs from six different model specifications, indicating remarkably consistent findings among model specifications. The presence of significant outliers (i.e., wines with above-average prices) might skew our results. To address this possibility, we winsorized and trimmed our data at the 99th percentile. However, the results obtained using the winsorized and trimmed dataset are consistent with and robust to the original dataset's standard estimations. As a result, we conclude that the results from our initial analysis are unlikely to have been affected by the presence of significant outliers.

Table 3. Regression results

Robust standard errors are in parentheses. *** p<0.01, ** p<0.05, * p<0.1

The mean comparison test shows that the wine colors are significantly different. Trimming and winsorizing wine prices at the 99th percentile show consistent and robust estimation results.

Regarding H1, the coefficient estimates related to the relationship between expert ratings and wine prices suggest that wine ratings are positively and significantly associated with wine prices. Increasing the expert ratings score by one unit increases the average wine price by approximately 8% (see Model VI); all other variables are constant. We therefore find empirical evidence supporting H1 independent of wine allocation or region, given that expert ratings drive wine prices. This finding is consistent with studies from Hilger, Rafert, and Villas-Boas (Reference Hilger, Rafert and Villas-Boas2011), Friberg and Grönqvist (Reference Friberg and Grönqvist2012), and Oczkowski and Pawsey (Reference Oczkowski and Pawsey2019).

Like Gibbs et al. (Reference Gibbs, Tapia and Warzynski2009), we control the reputation of the wineries over the years, which is potentially related to the wine prices in H2. We find a similar relationship when the lagged product ratings are considered in Models III and V. If the wine reviewers have increased their wine rating by one unit in the last review period, we would expect the current rating score to change by 0.233 points. The influence of the former rating diminishes over time, as we expect the current rating score of the observed wine to be changed by 0.189 rating points if we consider the second last review period as well. This finding aligns with Oczkowski (Reference Oczkowski2018), who shows that the most considerable lagged impact on the price of reviews occurs at approximately two years. In summary, we find empirical evidence suggesting that the professional critics of Wine Enthusiast Magazine exhibit a review consistency that drives current ratings.

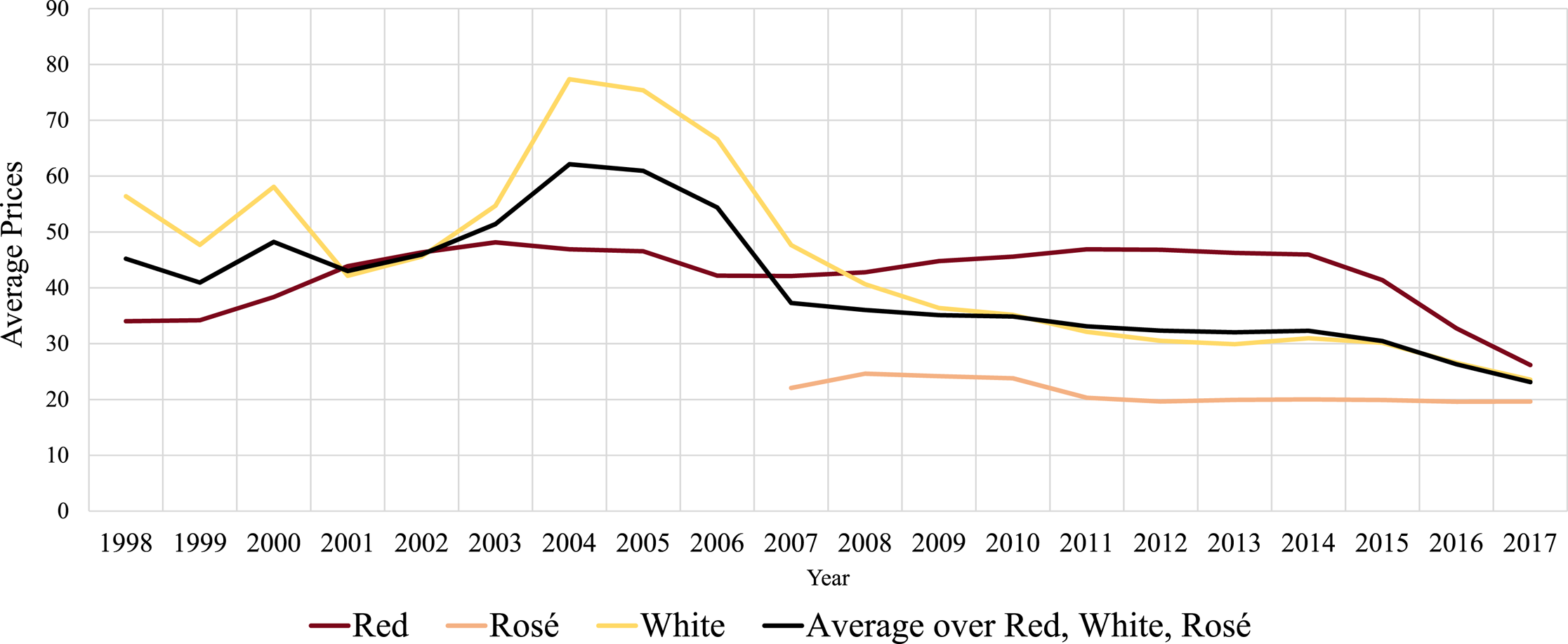

In addition to considering the variables relating explicitly to our research hypotheses, we also include wine colors as product-specific characteristic controls. The coefficient estimates of wine colors suggest that red and white wines receive significantly higher ratings and market prices than rosé wines. As shown in Figure 2, this relationship is not due to skewed distributions toward specific wine colors. The kernel density estimations of ratings and prices over wine colors show an almost normal distribution across all wine varieties. However, considering Figures 3 and 4 and the moving average distributions of ratings and prices over the years for the different wine colors, we show that although the ratings for red and white wines have always been higher, the prices for all wine colors have leveled off over time. A convergence trend for ratings and prices over the wine colors can also be seen. This trend could be the first explanation for the opposing effects of wine colors on ratings and prices.

Figure 2. Kernel density estimations of ratings and prices over wine colors.

Figure 3. Moving average rating distribution over the years by wine colors.

Figure 4. Average price distribution over the years by wine colors.

Overall, our results shed considerable light on the dynamics and relationships between expert ratings and market prices in the wine market. Our findings lead us to accept all stated hypotheses for the significant relationships between wine ratings and prices and the presence of review patterns over time.

V. Conclusion

The wine market satisfies the assumptions of an experience-goods market with prevailing information asymmetries between winemakers and consumers. Our findings extend the wine literature, which has only partially examined the relationship between wine expert ratings (e.g., Villas-Boas, Bonnet, and Hilger, Reference Villas-Boas, Bonnet and Hilger2021) and wine prices (Ferro and Amaro, Reference Ferro and Amaro2018). Furthermore, our study is one of the pioneering studies that examines the dynamic relationships between expert ratings and wine market prices. Thereby, this study not only adds to the research on the correlation of ratings with prices (e.g., Horowitz and Lockshin, Reference Horowitz and Lockshin2002) but also to the research of recent years regarding the possible impact of wine expert “guru” ratings on wine prices (e.g., Ashenfelter and Jones, Reference Ashenfelter and Jones2013; Ali, Lecocq, and Visser, Reference Ali, Lecocq and Visser2010). We also show that wine reviewers follow a unique review behavior across all wine colors, which is significantly consistent with their past wine reviews. Therefore, we shed light on understanding product signals in the wine market with a study focusing on the relationship between ratings and prices.

Moreover, this study also has clear implications for wineries and winemakers, as expert ratings are critical sources of information for assessing and setting wine market prices (see Oczkowski and Pawsey, Reference Oczkowski and Pawsey2019). The observed reviewer behavior may have strategic implications for vintners regarding their product and pricing strategies. Winemakers are probably well advised to submit their products during regular review periods and vintages and to align their pricing strategy with review outcomes, considering that higher rating points increase market prices (e.g., Arias-Bolzmann et al., Reference Arias-Bolzmann, Sak, Musalem, Lodish, Báez and De Sousa2003).

Much research on wine expert ratings and prices has focused on country-specific and regional analyses of wine markets (Oczkowski Reference Oczkowski2016b). For example, Ling and Lockshin (Reference Ling and Lockshin2003) have studied the relationship between expert ratings and prices for Australian wines; Benfratello, Piacenza, and Sacchetto (Reference Benfratello, Piacenza and Sacchetto2009) for Italian wines; Friberg and Grönqvist (Reference Friberg and Grönqvist2012) for the Swedish wine market; and Thrane (Reference Thrane2019) for the Norwegian market. Another essential contribution of this article is a more comprehensive approach by including well-known worldwide wine regions, allocations, and grape varieties to explain the relationship between wine prices and professional ratings. In particular, this research is one of the few studies empirically examining various sorts of wine originating from different wine regions, ranging from classic European growing regions such as Italy, France, and Spain to growing regions in the United States and Australia.

Consistent with the potential signaling roles of expert ratings and market prices in the wine market, our empirical findings also receive support from anecdotal market evidence. Wineries and distributors still await scores with anticipation. Both continue proclaiming and leveraging them in their advertising and selling endeavors (Bonné, Reference Bonné2017). The following quotation from the editor-in-chief of “Wine & Spirits magazine” echoes this sentiment:

When Parker first used the 100-point scale, it was as disruptive as the new wine apps—gutting the notion that a label marked grand cru or premier cru was a reliable reason to pay more for a wine. As an advocate for pleasure, Parker pointed out the bad apples in the French hierarchy, of which there were plenty, and his scale gave market access to garagistes who had no pedigree to offer, but were certainly delicious (consider Le Pin) (Greene, Reference Greene2017).

Finally, we examined two examples of potential signals in the wine market. Although our hypothesized findings are consistent with information asymmetry and signaling theory implications (see Nelson, Reference Nelson1970; Akerlof, Reference Akerlof1970), we also recognize and acknowledge alternative signals of quality (e.g., sensory qualities, grape varieties, and climate and weather characteristics) in the experience goods market for wines. It would be an exciting problem for further research to use revealed market data to empirically analyze the dynamic interaction between similar signals. Another worthwhile area for further research would be to examine how consumers process information from external market signals. Despite this, as noted previously, our study contributes to the existing empirical literature (e.g., Oczkowski and Doucouliagos, Reference Oczkowski and Doucouliagos2015) that attempts to understand the dynamics of the wine market.

Acknowledgments

The authors thank the editor, Karl Storchmann, and an anonymous reviewer for their constructive comments and valuable feedback. This work was partially supported by the German Research Foundation (DFG) within the Collaborative Research Centre On-The-Fly Computing (GZ: SFB 901/3) under project number 160364472.