1. Introduction

The aim of this paper is to identify the dominating factors affecting the evolution of current UK insurance companies and pension companies’ climate risk disclosure practices. We achieve this aim by addressing the following objectives:

(i) summarise the Task Force on Climate-Related Disclosures (TCFD) (2017) reporting guidelines related to 11 specific recommended disclosures concerning the impact of climate change on governance, strategy, risk management and performance metrics of UK insurance companies and pension schemes, and provide an overview of most recent institutional developments related to their implementation;

(ii) review the relevant recent literature concerning the analysis of financial disclosures of climate change risk-related information that may bear on the topic;

(iii) analyse how recent climate risk reporting practices by a sample of 15 UK insurance companies and 15 pensions schemes have been impacted by key relevant guidelines and standards, and consider how these practices have evolved over time, to ascertain how climate change risk is being incorporated into their long-term investment decision-making;

(iv) identify what key financial risk factors and/or other organisational characteristics are most closely associated with the degree of alignment by these entities with TCFD specified recommended disclosures and their extent of engagement with more generic climate risk-related reporting; and

(v) identify and discuss examples of best practice climate risk reporting.

These topics are important because of increased regulatory and political scrutiny of the nature and extent of climate risk-related reporting practices by UK insurance companies and pension schemes. This is relevant to the UK actuarial profession because many of the recent regulatory guidelines (e.g. TCFD, 2017; the Prudential Regulation Authority (PRA), 2015, 2019) focus on the modelling and quantification of the financial impact related to various types of environmental risks – areas where actuaries have significant expertise. The research focuses on climate risk reporting obligations related to climate-related risk reporting practices of both insurance companies and pension schemes, where actuaries provide important regulatory, risk management roles and consultancy advice. Our analysis focuses both on annual reports and other public documents of the 15 largest UK insurance companies and the 15 of the largest UK pension schemes.

The scope of the analysis conducted in this research is restricted to how climate risk is reported, not how it is managed by insurance companies and pension schemes. However, more broadly, the Institute and Faculty of Actuaries (IFoA) has been active in the climate risk space with the establishment of a climate change working party focusing on a range of issues related to the management of climate risk (e.g. Institute and Faculty of Actuaries, 2015, 2018).Footnote 1 Recent developments in the regulatory and political spaces have led to calls for greater accountability related to the financial impact of climate change by UK insurance companies and pension schemes. Since many UK professional actuaries play management, advisory and regulatory roles in the financial management of these entities, this research provides insights into how their climate risk financial reporting have evolved in response to these developments.

The Climate Risk Reporting Working Party seeks to incrementally contribute to this area by analysing recent developments in the reporting of climate change by a sample of UK insurance companies and pension schemes, in response to increasing regulatory and political demands for greater accountability of these organisations related to the financial impact of risks and opportunities related to climate change.Footnote 2 This is based on an analysis of both annual reports and various other documents produced by these entities, where these are publicly available. Our analysis also differentiates between the different regulatory settings for UK insurance companies and pension schemes, in order to better understand how climate change risk exposures can be more effectively reported.

The rest of this paper is organised as follows. Section 2 outlines the regulatory background and recent developments. Section 3 provides a review of recent related literature. Section 4 identifies the research objectives to be addressed in our analysis of current climate-related disclosures of large UK insurance companies and pension schemes. Section 5 outlines the research methods used to undertake the analysis. Section 6 discusses the results of analysis of the (i) the degree of alignment of risk disclosures by these entities with specific TCFD recommendations, and (ii) more generic disclosures concerning how climate change risk was being incorporated into their long-term investment decision-making. Section 7 examines what financial risk factors and/or organisational characteristics are mostly closely related to the degree of alignment by these entities with specific TCFD (2017) recommended disclosures related to governance, strategy, risk management and performance metrics. Section 8 briefly discusses examples of good practice disclosures. Finally, Section 9 provides a conclusion and some recommendations.

2. Institutional Background

This section provides an overview of the institutional background required to understand the context of climate-related reporting practices by UK insurance companies and pension schemes. Section 2.1 briefly outlines the current UK regulatory framework related to “general purpose” risk reporting by insurance companies and pension schemes. Section 2.2 overviews recently implemented climate risk reporting guidelines. Finally, Section 2.3 discusses recent developments concerning both regulatory and political scrutiny of climate risk-related disclosures by these entities of relevance to this study.

2.1. Current UK General Purpose Risk Reporting Requirements

Since UK insurance companies and pension schemes are established as differing forms of legal entities, it should not be surprising that the existing UK legal framework that regulates risk reporting differs substantially between them. Most importantly, the PRA (2019) expects insurance companies to provide the board and relevant subcommittees with management information on their exposure to the financial risks from climate change, e.g. based on scenario analysis and the mitigating actions and associated time frame the firm proposes to take. The management information should enable the board to discuss, challenge and take decisions relating to the firm’s management of the financial risks from climate change. This section is therefore confined to a very brief overview of those regulations applicable to risk reporting in “general purpose” financial (annual) reports produced by these entities.

2.1.1. Insurance companies

Table 1 summarises the main existing regulatory framework governing risk reporting by UK insurance companies.Footnote 3

Table 1. Current UK Regulations Governing Insurance Company Risk Reporting

Source: Authors’ own analysis.

Sections 414A-414D of the Companies Act 2006 require companies to produce strategic reports as part of their annual report that includes a description of the company’s principal risks and uncertainties.Footnote 4 However, the guidance focuses on company-specific information and does not provide a standard list of items to be disclosed. The Financial Reporting Council (FRC) (2014) has since issued general principle-based guidance on the Strategic Report which includes the requirement that companies produce information related to their environmental impact when “material” (Financial Reporting Council, 2014, page 4).

The Revised Corporate Governance Code (FRC, 2015, 2018) requires that UK company annual reports must now incorporate specific statements concerning (a) a “robust assessment” about their principal risks (C2.1); (b) company management’s expectations about the future prospects of the company (C2.2); and (c) a review of the effectiveness of risk management procedures and monitoring policies (C2.3). In 2018, the FRC updated the guidance to encourage companies to “consider the broader matters that may impact the performance of the company over the longer term including the interests of wider stakeholders” (FRC, 2018).

Department of Environment, Food and Rural Affairs (DEFRA) (2019) has promulgated guidelines concerning the reporting of performance indicators by UK companies. These include both statistical-based indicators across a range of environmental areas, such as emissions, resource use as well as financial-based indicators such as environmental fines and expenditures. However, the guidance allows for considerable discretion by UK companies over the nature and extent of these performance indicators are reported by limiting its scope to only providing general principles of reporting quality, rather than specify exact key performance indicators to be reported (e.g. relevance, accuracy) (DEFRA, 2019, page 3).

Annual reports issued by publicly listed UK insurance companies must also comply with relevant International Financial Reporting Standards and International Accounting Standards issued by the International Financial Reporting Standards Board.Footnote 5 These mainly concern the financial disclosures and the recognition of financial statements that affect the form and content of annual reports and are also subject to audit by independent audit companies.Footnote 6 However, there are currently no requirements for UK auditors to explicitly consider the materiality and disclosure adequacy of climate-related risks.Footnote 7

2.1.2. Pension schemes

By contrast to insurance companies, there are no explicit requirements for reporting of climate-related risks for UK pension schemes.Footnote 8 Furthermore, general purpose reporting requirements for pension schemes is significantly more limited in scope and reports are not generally publicly available. Financial reports produced by UK pension schemes are subject to both FRS 102, effective from 2015 and to a revised Statement of Recommended Practice (SORP), effective from 2018.Footnote 9 It requires market and credit risk disclosures in relation to pension scheme investments. They are also subject to specific risk disclosure requirements of the Pensions SORP.Footnote 10 In relation to defined benefit schemes, it should be noted that the requirements of FRS 102 and the Pensions SORP confine any disclosure of long-term actuarially estimated employee benefits to a generic footnote, referring to the actuarial investigation report.Footnote 11 Thus, the financial statements of UK pension schemes are confined to a statement of net assets without showing the actuarially determined pension deficit or surplus.

2.2. Specific Guidelines on Climate-Related Risk Reporting

In addition to UK-specific codified regulatory and/or legal requirements for general purpose reporting related to climate change, voluntary accountability requirements, protocols, codes and guidance have also been promulgated. Unlike the accounting-based requirements discussed in Section 2.1, these are voluntary and therefore entirely dependent on the organisation to choose whether or not to implement them, through either separate disclosure in the annual report or in a separate sustainability report. These are summarised in Table 2 and are briefly overviewed in the remainder of this section.Footnote 12

Table 2. Voluntary Environmental Reporting Guidelines

Source: Authors’ own analysis.

The Climate Disclosure Standards Board (CDSB) (2018) has issued guidance for large companies to disclose in their annual reports for reporting environmental information and about natural capital. It provides generic purpose reporting guidelines of a reporting organisation’s natural capital dependencies, as well as environmental results, risks, opportunities, policies, strategies and targets. The reporting requirements are mainly focused on policies, strategies, risks and opportunities, as well as the firm’s environmental performance and future outlook.

By contrast, the Taskforce on Climate-related Financial Disclosures (TCFD) (2017) provides recommended guidelines concerning climate-related financial disclosures in their annual reports. It provides more detailed and specified guidance for recommended disclosures concerning the impact of climate change risk on governance, strategy, risk management and metric and targets for all multinational enterprise sectors. The recommended disclosures are to be implemented in the annual report or “filing”. The 11 specific TCFD recommended types financial disclosures are further categorised into four major areas; (i) governance (two dimensions), (ii) strategy (three dimensions), (iii) risk management (three dimensions) and (iv) metrics and targets (three dimensions). These are reported in Table A.1 in Appendix A. In 2018, a number of large financial services companies, including UK insurers and pension schemes, announced that they would implement the TCFD recommendations (Seekings, Reference Seekings2018).Footnote 13

2.3. Recent Developments

In addition to the above general guidelines, climate risk reporting practices by UK insurance companies have been influenced by a report published by the PRA (2015). This identified three main types of climate risk factors to which UK insurance companies are exposed: physical, transition and liability. It recommended that insurance companies incorporate disclosure of these risk factors within their statements of principal risks. Subsequently, the PRA (2019) undertook a review of current climate risk management practices of the UK banking and insurance sectors. It found that, “while companies are enhancing their approaches to managing the financial risks from climate change; few companies are taking a strategic approach that considers how actions today affect future financial risks” (PRA, 2019).

By contrast to the range of environmental and/or climate risk reporting regulations and guidelines applicable to UK insurance companies, there are currently no specific regulatory or voluntary requirements for UK pension schemes to report environmental risks. Moreover, there has been an ongoing debate as to whether pension scheme trustees should explicitly take account of climate change-related issues as part of their investment strategy. In 2015, the Law Commission (2015) stated that there was no reason why UK pension schemes should not take account of environmental factors as part of their fiduciary duty regarding investment policy. Additionally, there are a range of investment industry initiatives to monitor a range of “Environment, Social and Governance (ESG) factors as part of Responsible Investment Strategy, such as the Assets Owners Disclosure Project and the International Investors Group on Climate Change (IIGCC).”

Since its 11 specific climate-related disclosure recommendations were issued in 2017, the TCFD has issued two annual status reports (TCFD, 2018, 2019) concerning the degree of alignment with its recommendations. Its most recent status report, issued in June 2019, found that, based on a review of annual reports issued by large companies in 142 countries, that the average number of recommended disclosures per company has increased by 29% from 2.8 in 2016 to 3.6 in 2018.Footnote 14

There has also been increased regulatory and political scrutiny of disclosures related to climate change. In early 2018, the House of Commons Environmental Audit Committee (HCEAC) wrote to trustees of major UK pension schemes requesting information as to what actions they were taking on climate change. Subsequently the Green Finance Task Force Inquiry recommended “companies and investors” should implement the TCFD framework to “develop their financial, corporate governance and stewardship disclosures.” The HCEAC subsequently issued a report in mid-2018 (House of Commons Environmental Audit Committee, 2018) which recommended compliance with the TCFD disclosures. It identified three categories of respondentsFootnote 15 ;

(i) “more engaged” – actively managing climate risk and committed to implementing the TCFD disclosure recommendations;

(ii) “engaged” – acknowledged climate change as a risk but only as part of ESG factors, with greater caution about committing to TCFD reporting; and

(iii) “less engaged” – climate risk not considered specifically as a strategic risk and no current plans to report climate risks.

3. Literature Review

This section briefly outlines and reviews prior research related to climate-related risk reporting practices by companies.Footnote 16 Section 3.1 first discusses various theoretical perspectives concerning the costs and benefits associated with voluntary adoption of TCFD recommended disclosures by large UK insurance companies and pension schemes. Section 3.2 briefly reviews prior empirical research on this topic.

3.1. Perceived Costs and Benefits of Climate Risk Reporting

This section briefly outlines legitimacy, reputation, information asymmetry and transparency rationales for the development of sustainability reporting as identified by Herzig and Schafteller (Reference Herzig, Schaltegger, Schaltegger, Bennett and Burritt2011). Spence and Gray (Reference Spence and Gray2006) explored the motivations underlying social and environmental reporting in the UK. Perceived benefits and pressures facing UK companies ranged from business efficiency, market drivers, reputation and risk management, stakeholder management, internal champions and mimetic motivations.

An essential goal in defining strategies to disclose sustainability information is to establish, maintain or repair legitimacy (Deegan, Reference Deegan2002). This applies for the public acceptance of the company generally, as well as for the acceptance of particular management decisions and activities by the company’s key stakeholders.

Another explanatory motive underlying sustainability reporting can be the enhancement of a company’s reputation and risk management (Bebbington et al., Reference Bebbington, Larrinaga and Moneva2008). Outstanding corporate reputation is often related to higher brand value and may contribute to increasing business success (e.g. Fombrun, Reference Fombrun1996). In particular, reputation may be enhanced by reporting about successful engagement in non-market matters, i.e. in social and environmental projects that are not considered to be part of core business activities.

Reporting climate risk information may also help to reduce information asymmetry between a company and its stakeholders concerning its engagement with such issues (Schiemann & Sakhel, Reference Schiemann and Sakhel2018). Companies that are perceived as being simultaneously high performers both in the market and for society may face less friction and problems in their business relationships with suppliers, traders, public authorities and other stakeholders.

Finally, with the collection and analysis of information as well as the creation of greater transparency, sustainability reporting can support internal information and control processes (Owen & Dwyer, Reference Owen, O’Dwyer, Crane, McWilliams, Moon and Siegel2008). Reporting non-financial corporate activities signals a willingness to communicate about and deal with societal issues, and may serve to secure a continuing good relationship with the company’s stakeholders (Roberts, Reference Roberts1992; Herzig & Schafteller, Reference Herzig, Schaltegger, Schaltegger, Bennett and Burritt2011).Footnote 17

3.2. Review of Literature on Climate Risk Reporting

This section briefly outlines and reviews prior research related to climate-related risk reporting practices by companies.Footnote 18 We first review the TCFD’s (2018) own analysis of the degree of alignment by various companies with its recommended disclosures. We then briefly discuss examples of research of most relevance to our study.Footnote 19

As outlined in Section 2.3, the TCFD (2018, 2019) has published annual “status reports” which reviewed the extent of implementation of the TCFD (2017) recommended climate-related disclosures across a range of industry sectors as reported in the latest 2017 reports available at that time. It undertook a comprehensive review of the extent of global compliance with its 11 key recommended disclosures by 8 different global industry sectors, including the insurance sector and “asset owners” (which would include pension schemes).Footnote 20 The TCFD’s (2018) review methodology comprised analysis of both (a) “baseline information” on the alignment of climate-related financial disclosures (“yes” or “no”) using artificial intelligence software (“AI review”); and (b) a more disclosure practices review of 200 large companies (25 from each of the 8 groups) (“disclosure review”).Footnote 21

Due to the limited public availability of “asset owner” reports, the TCFD’s analysis was only confined to five sectors, including insurance companies. The TCFD (2018, page 20) analysis found that the 311 insurance companies report subject to the “AI review” appeared to align with the recommended disclosures less frequently than other groups, whereas the 25 insurance companies report subject to the “disclosure review” aligned with the recommended disclosure more frequently than any other groups except banks.

Masons (2018) undertook a series of interviews with key UK pension scheme trustees in the light of the HCEAC (2018) inquiry into how they are managing the risk of climate change generally. They found that trustees face a number of barriers to effective climate risk management, due to a lack of clarity of regulatory and methodological issues. However, they also found that the financial impact of climate risk was less influential in a fund’s climate risk management strategy.

Other studies have examined the propensity facing companies to engage in climate risk reporting, but have only examined this issue for non-financial companies. For example, Eccles and Krzus (Reference Eccles and Krzus2017) conducted a field experiment to evaluate climate-related risk reporting practices by the US oil and gas industry in the year prior to the publication of the TCFD (2017) recommended disclosures. They found that significant variations in reporting practices, with most disclosures occurring in voluntary sustainability reports rather than in the annual report financial filings, as recommended by the TCFD.

Ben-Amar and McIlkenny (Reference Ben-Amar and McIlkenny2015) examined the relationship between the effectiveness of corporate governance and voluntary climate change disclosures by a sample of Canadian industrial companies during 2008–2011, responding to the annual Carbon Disclosure Project (CDP) annual questionnaire. They found a significantly positive association between board effectiveness and their decision to respond to the questionnaire.

Finally, Amel-Zadeh (Reference Amel-Zadeh2019) conducted a global survey of investors and companies on the materiality of climate risk for financial reporting. Whereas the majority of investors surveyed believed that climate risk is financially material and thus heightened regulatory and litigation risk, this view was not shared by the companies surveyed. Amel-Zadeh (Reference Amel-Zadeh2019) concluded that this misalignment resulted in a lack of corporate disclosure related to climate risk.

An important issue affecting climate risk reporting practices that is not addressed specifically by the above literature concerning corporate incentives sustainability reporting generally is that UK insurance companies and pension schemes face different regulatory environments, as noted in the previous section. The UK insurance companies may choose to report on their climate risk using either (or both) “formal” reporting mechanisms (e.g. mandatory, publicly disseminated corporate annual reports) as well as other more “informal” communication devices (e.g. publicly available documents concerning “environmental responsibility”, such as a Statement of Investment Principles (SIPs), Environmental, Social and Governance (ESG) Reports, Strategic Reports or other “corporate social responsibility” or “sustainability” reports) accountability mechanisms. By contrast, UK pension schemes do not have any formal public accountability obligations concerning climate risk reporting, but is restricted to their members and to the regulator. Furthermore, they face very limited broader societal accountability for climate-related risk, depending on whether or not their trustees choose to voluntary adopt related to societal-wide “responsible investment” objectives or otherwise see it as simply generating higher long-term investment returns.

3.3. A Conceptual Framework for Analysing Climate Risk Reporting

The review of relevant prior theories identified a complex range of incentives facing organisations reporting obligations related to environmental risk. However, these are mainly limited in scale and scope to non-financial companies, and in connection with “formal” annual reporting mechanisms. By contrast, the institutional background discussed in the previous section highlights that insurance companies and pension schemes face industry-specific regulatory environments and face political and/or regulatory scrutiny concerning their broader engagement with a wider range of climate-related reporting issues. Reynolds et al. (Reference Reynolds, Blackmore and Smith2009) propose a framework for various dimensions of accountability related to environmental responsibility that can be applied to various contexts. Their framework distinguishes among a range of alternative (consequentialist – “doing what’s good”, deontological – “doing what’s right” and ecological – “being virtuous”) perspectives concerning normative, philosophical and political dimensions of accountability for environmental risk. These questions are intended to provide insights into the following issues: (a) what we can and need to take responsibility for; (b) who might do it and how; and (c) why the concept of environmental responsibility is relevant to the topic (Reynolds et al., Reference Reynolds, Blackmore and Smith2009). This general framework is summarised in Figure 1.

Figure 1. Environmental responsibility: general framework (Reynolds et al., Reference Reynolds, Blackmore and Smith2009).

We apply this general framework to insurance companies and pension schemes, respectively. A major difference between these types of organisations is that insurance companies have both formal and informal accountability relationships with a range of stakeholders. By contrast, pension schemes’ accountability for climate risk is more limited. Furthermore, climate risk reporting may be located both in the context of “formal” (via the mandatory corporate annual report) and “informal” (via publicly available documents, such as “corporate social responsibility reports”) accountability mechanisms. By contrast, UK pension schemes have more limited accountability to their members and to the regulator.Footnote 22 Furthermore, there is only very limited broader societal accountability for climate-related risk, depending on whether or not trustees choose to voluntarily adopt recommendations by ESG-oriented investors concerning “responsible investment” objectives.

4. Research Objectives

Based on the above literature review, this paper seeks to extend the findings in the existing literature by analysing the degree of alignment with TCFD recommended disclosures based on both quantitative and qualitative analysis of current reporting practices by samples of large UK insurance companies and pension schemes. Specifically, our research seeks to provide evidence on four primary research objectives related to this issue:

(i) The degree of alignment of climate-related financial disclosures contained in annual reports produced by large UK insurance companies and pension schemes with specific TCFD recommendations, as disclosed in both (a) the most recently available annual reports and (b) how these reporting practices have evolved;

(ii) More generic disclosures concerning action taken on climate risk. We establish questions related to engagement, reporting and policy, and strategic action issues associated with whether insurance firm and pension scheme long-term investment decision-making is engaged with climate change;

(iii) Examine, using more formal econometric modelling techniques, what key financial risk factors and/or organisational characteristics are most closely associated with (a) the degree of alignment with climate risk reporting practices by UK insurance companies and pension schemes with specific TCFD recommendations and (b) their level of engagement with climate risk reporting issues more generally; and

(iv) Identify and discuss examples of best practice climate risk-related reporting by UK large insurance companies and pension schemes.

The remainder of this paper is organised to answer each of these research questions. Section 5 provides empirical analysis related to research questions (i)(a) and (i)(b). Section 6 investigates further research question (ii). Section 7 provides more formal econometric model tests of research question (iii), using the statistical relationship between (a) the degree of alignment of annual reports with TCFD specified recommendations and (b) more generic climate-related financial disclosures with various financial risk and organisational characteristics. Finally, Section 8 briefly discusses some examples of best practice climate risk-related reporting practices.

5. Research Methods

This section provides a brief outline of the research methods used to address each of the research questions identified in Section 4.

5.1. Sample Selection Procedures

The sample was initially based on the 25 largest UK pension schemes, which had responded to the HCEAC (2018) request for information concerning how climate change risk was incorporated into their long-term decision-making. Because UK pension schemes are not legally obliged to publicly disclose their annual trustee reports, the analysis undertaken to address research questions (i) and (ii) was restricted to the latest trustee annual reports which have voluntarily been made publicly available. We were only able to identify trustee annual reports that were made publicly available by 15 out of the 25 largest UK pension schemes which had responded to the HCEAC (2018) request.

In order to provide comparable evidence concerning the degree of alignment with TCFD recommendations between large UK insurers and large UK pension schemes, most recent annual reports produced by the largest 15 UK insurers were used for the analysis undertaken to address research questions (i)–(iv).Footnote 23 Table B.1 in Appendix B lists the samples of UK insurance companies and pension schemes.

5.2. Data Sources

Our analysis is restricted only to the most recent publicly available primary research data sources issued by the samples of UK insurance companies and pension schemes.Footnote 24 This restriction is consistent with the approach taken by the TCFD’s (2018) analysis on the degree of alignment with TCFD recommendations. In the case of UK pension schemes, this has been supplemented by the HCEAC’s (2018) analysis of trustee responses to their inquiry.

In order to address the research question (ii), the analysis was based on all publicly available documents produced by the 25 largest UK pension schemes. These included “Statement of Investment Principles” or other publicly available documents. For the equivalent sample of UK insurance companies, all publicly available documents were analysed, including “Corporate Responsibility Reports”, “Strategic Reports”, “Sustainability Reports” or other similarly named documents provided on the corporate website.Footnote 25

In order to address question (iii), we obtained key financial risk factors from publicly available information, either directly from the sample entity publications or extracted from the ORBIS database. Research question (iv) was addressed by reference to climate risk reporting practices contained in annual reports of those UK large insurance companies and pension schemes which were most closely aligned with TCFD recommended disclosures and/or showed highest degree of engagement with more generic climate risk reporting issues.

5.3. Research Design

Our research design used to address questions (i)(a) and (b) replicates that of the TCFD’s (2018) disclosure practices review. The TCFD undertook both a manual and artificial intelligence software “AI review”). However, in reporting the results of their research, the TCFD (2018) admitted that there were significant and material discrepancies between their manual disclosure practices review and their AI review. As we do not have access to the AI software used by TCFD to perform their analysis, and in the light of these discrepancies, our analysis is based only on a manual, researcher-based analysis of the degree of alignment of annual reports with the various 11 TCFD recommendations.Footnote 26

To address research questions (ii)–(iv), we assessed the publicly available information produced by insurance companies and pension schemes based on the following three sets of general questions as an indication of the extent of action they have taken to mitigate climate risk.

1. Engagement with external organisations issues:

(i) Is the insurance company/ pension scheme a signatory of the Principles for Responsible Investment (PRI)?

(ii) Is the insurance company/pension scheme a member of the International Investors Guarantee scheme?

(iii) Is the insurance company/pension scheme a signatory of the CDP?

2. Reporting and policy issues:

(i) Does the insurance company/pension scheme maintain a responsible investment policy or similar?

(ii) Does the insurance company/pension scheme recognise climate change as a driver of long-term risk and return, as distinct from a broader definition of ESG?

(iii) Is climate risk specifically addressed in the SIPs?

(iv) Does the insurance company/pension scheme report in line with the TCFD’s recommended disclosures, or intend to do so in the near future?

3. Action taken issues:

(i) Has ESG in general impacted the insurance company’s/pension scheme’s asset allocation/stewardship approach?

(ii) Has climate risk specifically impacted the insurance company/pension scheme’s asset allocation/manager selection/stewardship approach?

In assessing this issue, we assigned a score of 2 (“positive”) if there was evidence that the insurance firm or pension scheme had positively engaged on this issue, 0 (“negative”) if they had not and 1 if there was ambiguity on their position (“neutral”).

5.4. Definition of Variables

In order to address research question (iii), we define the following definitions of key variables related to both (a) the dependent variables related to either (i) the degree of alignment with specified TCFD recommended disclosures or (ii) the extent of more generic climate change-related disclosure as discussed above and (b) independent variables related to either financial risk and/or various corporate characteristics of relevance to our research, based on our review of prior theoretical perspectives and empirical research evidence in Section 3. Table 3 defines the key variables of relevance to our study.

Table 3. Variable Definitions

In order to test whether the degree of alignment of climate risk-related disclosures with TCFD recommendations is related to information asymmetry (e.g. Clarkson et al., Reference Clarkson, Li, Richardson and Vasvari2008), we measure both liability and asset-related standard measures of financial risk. The liability risk measure (LiabRisk) is defined either by reference to the Solvency II capital adequacy ratio (for insurance companies) or the funding ratio of the actuarial valuation of assets to assessed liabilities (for pension schemes). The asset risk measure (InvRisk) is defined as the percentage of total financial investments that are invested in non-cash convertible assets, such as equities, private equity, property, derivative instruments and other “risky” asset classes).

To test the hypothesis that the degree of alignment of climate risk-related disclosures with TCFD-specific recommendations is related to either legitimisation, reputation and/or risk management issues, we measure both the total size of assets (measured in logs – LNSize) and the periodic return on total assets (ROA), respectively. We predict that, consistent with the results of prior-related research (e.g. Bebbington et al., Reference Bebbington, Larrinaga and Moneva2008), a positive relationship between the size and/or periodic return of the entity and the degree of alignment of climate risk-related disclosures with TCFD-specific recommendations.

We also include a control variable for the effectiveness of corporate governance, which we define as the percentage of outside directors on the board (OSDirect). Consistent with prior research findings (e.g. Ben-Amar & McIlkenny, Reference Ben-Amar and McIlkenny2015), we predict a positive relationship with the percentage of outside directors on the board and the degree of alignment with TCFD recommended disclosures.

Finally, in order to test the predictions of stakeholder theory, we incorporate three further variables to control for variations in the type of entity being analysed. First, we incorporate a dummy variable that delineates between either publicly listed (=1) and non-publicly listed (=0) entities for insurers, and between private sector (=1) and publicly sector sponsored pension schemes, respectively (Owner). We also include a dummy variable indicating the type of business, either general (=1) or life (=1) for insurance companies, or single (=1) or multiple (=0) employer sponsored pension scheme, respectively, incorporate line of business (BusType). Finally, we also incorporate into our pooled regression a further dummy variable to delineate between sample insurance companies (=1) and pension schemes (=0), respectively (Entity). Consistent with the predictions of stakeholder theory (e.g. Roberts, Reference Roberts1992), we predict a positive relationship between the relative degree of stakeholder engagement, as proxied by whether or not the entity is publicly listed, and multi-employer sponsored, and the degree of alignment of climate-related risk disclosures and TCFD-specific recommendations.

5.5. Econometric Models

Based on the above discussion, we predict that UK insurance companies and pension schemes are primarily motivated to align their climate-related risk disclosures with specific TCFD recommendation in order to reduce information asymmetries concerning this issue (i.e. as proxied by LiabRisk). By contrast, we predict that their propensity to demonstrate engagement with climate risk reporting issues is driven primarily by reputation and political risk management (i.e. as proxied by LNSize). We therefore develop the following multivariate Ordinary Least Squares (OLS) regression models in order to test research objectives (iii) (a) and (b), respectively;

Model 1: the degree of alignment with specified TCFD recommended disclosures;

Model 2: the extent to which entity adopts generic climate-related disclosures;

where i represents the reporting entity, t represents the years, DegAligni,t is the degree of alignment between firm disclosures and the TCFD specified disclosures, and Engagei,t is the total engagement score of the firm i at the time t related to its extent to which it adopts generic climate-related disclosures contained in its annual report of shareholders or interested parties, LiabRiski,t and LNSizei,t are the main explanatory variables, Xi,t is a vector of control variables, and ϵi,t is the random error term.

Since we do not have any economic theory as to the form and nature of the association between the independent and dependent variables defined in models (1) and (2), we assume a linear relationship and therefore follow the prior literature using standard multivariate OLS regression tests that are based on normality and independence assumptions, and separately report various robustness checks and tests to examine departures from these assumptions.

6. Analysis of Climate-Related Disclosures

This section reports a basic analysis of the key dependent variables of interest to our study based on our sample of 15 UK insurers and 15 pension schemes, with TCFD disclosures. Section 6.1 discusses the degree of alignment with specific TCFD recommendations. Section 6.2 then overviews other more generic climate-related information provided in the public domain.

6.1. Degree of Alignment with TCFD Recommendations

This section reports the degree of alignment between UK insurance and pension scheme samples with the TCFD recommended financial disclosures, both in aggregate and by type of disclosure. Our analysis is restricted to the insurance company sample only, since, to the best of our knowledge as of date of publication, none of the UK sample pension schemes has issued any publicly available trustee report beyond the initial transition year 2017–2018.Footnote 27

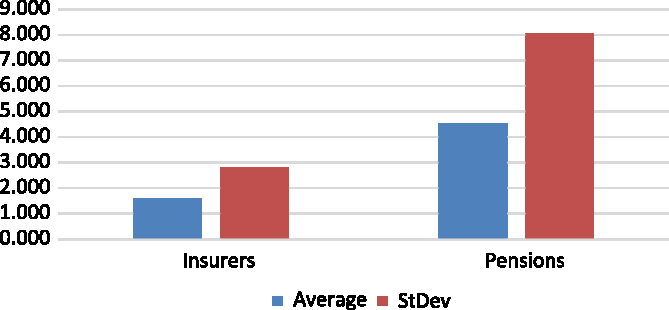

Figure 2 reports the average and standard deviation of the degree of alignment between UK insurance and pension scheme samples with all 11 TCFD disclosures.Footnote 28

Figure 2. Total TCFD alignment.

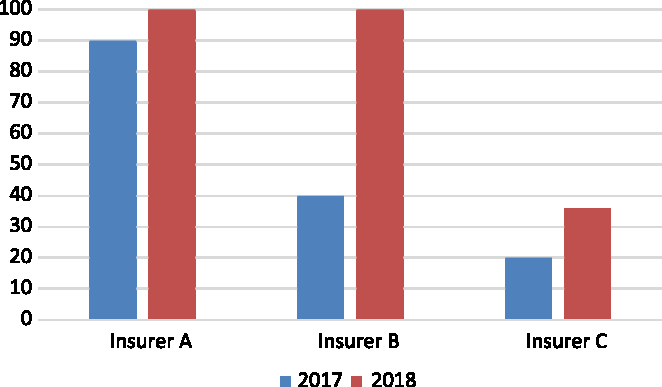

Figure 2 shows that UK sample pension scheme trustee annual reports provide a significantly greater average degree of alignment with the aggregate of the 11 TCFD recommended disclosures than equivalent UK sample insurance company annual reports. However, only 3 out of the 15 sample UK insurance companies in our sample provide any significant TCFD-related disclosures in their 2017 and 2018 annual reports. Figure 3 reports the degree of alignment between climate risk reporting practices by these companies with all 11 TCFD disclosures.Footnote 29

Figure 3. Degree of alignment with TCFD disclosures by insurance companies.

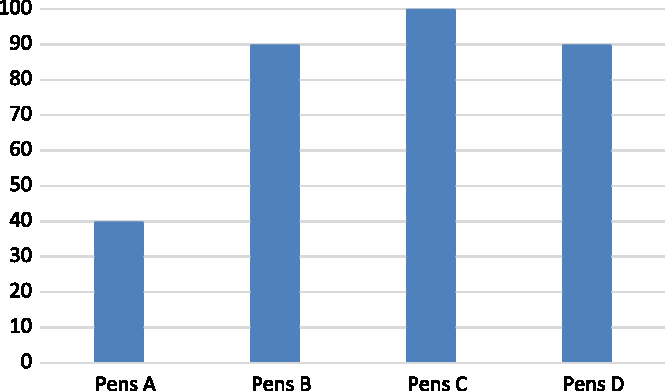

Annual reports produced by only 4 of the 11 sample UK pension schemes appeared to show any significant degree of alignment with the TCFD recommended disclosures. Figure 4 reports the degree of alignment between each of these 4 UK pension schemes with all 11 TCFD disclosures.

Figure 4. Degree of alignment with TCFD disclosures by pension schemes.

Figure 4 shows that UK sample pension scheme trustee annual reports provide a significantly greater average degree of alignment with the aggregate of the 11 TCFD recommended disclosures than equivalent UK sample insurance company annual reports.

Overall, our findings related to research question (i)(b) are equivocal. Our results were not consistent across the four dimensions of TCFD disclosures. There were increases in the degree of alignment of TCFD recommended disclosures related to risk management and metrics and targets, but not related to governance and strategic elements.

6.2. Analysis of Other Climate-Related Information

In this section, we analyse more generic disclosures provided by large UK insurance companies and pension schemes related to climate risk in order to address research question (ii). The sources for this analysis have been the publicly available SIPs, actuarial valuations, and trustee report and accounts (noting this is not readily obtainable for all schemes). We have also used the written responses each scheme submitted to the HCEAC. Our analysis initially focused on the 25 largest pension schemes which responded to the inquiry. We then replicated this analysis for the 15 largest insurance companies, using publicly available annual reports, strategic reports and/or sustainability or Corporate Social Responsibility-related reports available on the corporate website.

6.2.1. Insurers versus pension schemes

We first compare the relative percentage of total positive, neutral and negative scores of the sample insurance companies and pension schemes, based on the aggregate responses to each of the three categories of general questions outlined above.

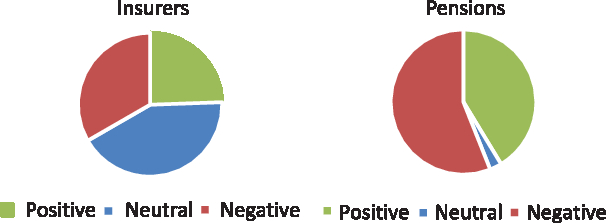

Figure 5 shows pie charts for the samples of insurance companies and pension schemes related to the two questions associated with the first “engagement” issue.

Figure 5. Engagement issues – insurers versus pension schemes.

The pie charts show that insurance companies are significantly “less negative” than pension schemes in engaging with external organisations, although the proportion of insurers positively engaged is much less than pension schemes. A significant proportion of insurers are neutral in contrast with very small proportion of pension schemes which are neutral. Less than half of the pension schemes analysed signed up with external organisations. The most signed up to the PRI and fewest signing up to the International Investors Group on Climate Change Governance Code (IIGCC). However, there is also a much higher level of neutrality on this issue for insurers (e.g. mentioning “adherence” to relevant principles rather than being “members” of the relevant organisations).

Figure 6 shows pie charts for the samples of insurance companies and pension schemes related to the four questions related to the second “reporting and policy” issue.

Figure 6. Reporting and policy issues – insurers versus pension schemes.

The pie charts show that UK pension schemes are more likely to take positive action on the reporting and policy issues than UK insurance companies. This result is consistent with the overall findings obtained from the analysis of more specific TCFD-related disclosure alignment analysis, reported in the previous section.

Over two-thirds of pension schemes maintain a responsible investment policy. The concept of Socially Responsible Investment has been around for over 15 years so this is not a surprising result. However, only six pension schemes do not distinctly recognise climate change from ESG. Approximately equal numbers of pension schemes indicated that they either do, or plan to, align their reporting with TCFD. Some comment that they want to understand more what it involves, whereas others say climate risk is one of many risks that balance against investors’ needs.

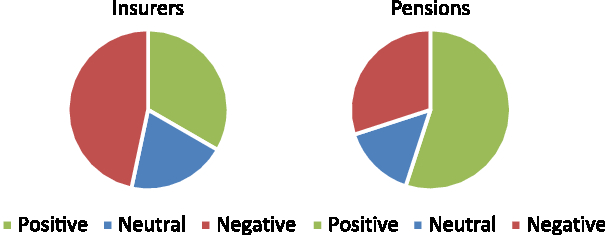

Figure 7 shows pie charts for the samples of insurance companies and pension schemes related to the four questions related to the third “action taken” issue.

Figure 7. Action taken issues – insurers versus pension schemes.

The pie charts show that UK pension schemes disclose that they are more prepared to take positive action concerning the impact of ESG/climate risk issues on their long-term asset allocation decisions than UK insurance companies. The vast majority of pension schemes confirmed (or it was self-evident) that ESG in general had impacted their scheme’s assets allocation/manager selection/stewardship. However, a little over half show climate risk specifically impacted their asset allocation/manager selection/stewardship approach. Less than half do not show it specifically impacted their approach.

Three of the pension schemes investigated scored “full marks” showing the highest level of climate risk reporting and engagement within their scheme. These schemes are government or pseudo-government schemes. The schemes that scored the worst were large organisations with shareholders, where there will inevitably be competing needs when allowing for climate risk may not be perceived to be a material risk in comparison to other risks facing the pension scheme.

6.2.2. Publishing versus non-publishing pension schemes

Our analysis of generic climate risk reporting in the previous subsection was based on the 15 largest UK pension schemes responding to the Parliamentary inquiry that voluntarily make their annual trustee report publicly available online. However, another 10 of the largest UK pension schemes which provided responses to the Parliamentary Inquiry do not publish their annual report in the public domain. We therefore undertook further analysis to compare whether the degree of engagement with climate risk in their investment decision-making is related to whether or not the 25 largest UK pension schemes do (15 schemes) or do not (10 schemes) make their annual report available in the public domain.

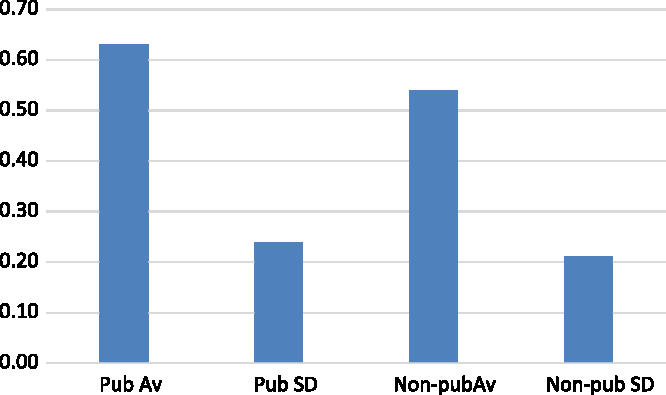

Figure 8 shows the comparative means and standard deviations of the percentage of total generic disclosures that were produced by publishing (15) versus non-publishing (10) pension schemes.

Figure 8. Generic climate disclosures – publishing versus non-publishing pension schemes.

Figure 8 shows that, on average, pension schemes which voluntarily make their annual reports available in the public domain have a significantly higher average percentage of total scores related to the various questions concerning engagement and reporting and policy issues than those which do not make their annual reports available in the public domain.

7. Determinants of TCFD Disclosures

This section reports the results of empirical tests which examine the main determinants of variations in both the degree of alignment with specific TCFD disclosure recommendations, and more generic climate-related disclosures, by the sample UK large insurance companies and pension schemes. Section 7.1 discusses the descriptive statistics for the main independent variables defined in Table 3. Section 7.2 then outlines the correlation analysis and reports the multivariate OLS regression test results used to test economic models (1) and (2) outlined in Section 5.5. Section 7.3 briefly outlines further robustness checks that were conducted to ensure the integrity of the findings reported in Section 7.2 to alternative econometric specifications.

7.1. Descriptive Statistics

Table 4 reports summary descriptive statistics for each of the main dependent and independent variables that were defined in Table 3.

Table 4 shows that, while the average degree of alignment of climate-related disclosures with specific TCFD recommendations (Deg) is significantly higher for pension schemes than it is for the sample insurance companies, average generic climate risk-related engagement (Engage) is very similar. This may reflect the higher degree of engagement by certain public sector-sponsored pension schemes, as reported in Figure 2.

The liability risk (LiabRisk) of the sample insurance companies is significantly higher than that of the sample pension schemes. This likely reflects the capital adequacy calculation under Solvency II, whereby insurance companies need to demonstrate that they have sufficient capital to cover their obligations. By contrast, many UK pension schemes are underfunded. Similarly, the average investment risk (InvRisk) of insurance companies is significantly higher than that for the sample pension schemes. This likely reflects their different risk attitude towards financial investments, as well as the well-documented “de-leveraging” of pension scheme asset allocations in recent years, following the financial crisis.

The average size (SIZE) of the sample insurance companies is significantly higher than that of the sample pension schemes. This result is likely is probably skewed by the presence of highly capitalised large publicly listed insurance companies. By contrast, the average return on assets of pension schemes is significantly higher than that of the sample insurance companies. This is most likely due to their relatively higher proportion of financial investments as a proportion of their total assets, the returns on which are measured using a consistent but more volatile fair valuation basis.

The percentage of outside directors (OSDirect) of the sample insurance companies is significantly higher than that of the sample pension schemes. This likely reflects the requirements of UK corporate law and the Corporate Governance Code that a significant proportion of UK company boards comprise of outside directors. By contrast, there are no requirements for UK pension schemes to appoint outside directors to their trustee boards, which typically comprise of employer and employee and/or pensioner appointed representatives.Footnote 30

Both of the structural control dummy variables (BusType and Owner) are similar for the sample insurance companies and pension schemes. Consequently, and notwithstanding the inconsistency in measurement bases for certain other control variables noted above, we are able to report pooled regression results in the next section.

7.2. Bivariate Correlation and Multivariate Regression Tests

Our econometric models (1) and (2) assume a standard multivariate empirical test. Therefore, in order to meet the standard independence assumptions underlying these tests, the independent (explanatory) variables need to be independent of each other, which means that factors with strong correlation are not allowed. Otherwise, the interaction between variables will lead to spurious errors in the multivariate results due to abnormal variations of the coefficient (O’Brien, Reference O’Brien2007). Therefore, a collinearity test is needed to assure that independence assumptions underlying OLS regression tests are not violated.

Table 5 reports the bivariate Pearson correlations between each of the independent variables.

For the sample insurance companies, Panel A shows that most independent variables are not collinear at a statistically significant level, except for a negative relationship between InvRisk and BusType. This is expected, since life insurance companies typically have a significantly higher proportion of financial investments in their total assets than general insurers, due to their investment-focused business model.

For the sample pension schemes, Panel B shows that only OSDirect and InvRisk are highly positively correlated. This result is not surprising either, since one would anticipate that pension schemes with a relatively high proportion of their asset allocation portfolio invested in “risky asset classes” would seek to ensure independent board monitoring of their investment activities.

Table 6 reports the OLS regression tests of the determinants of the degree of alignment of climate-related disclosures with TCFD-specific recommendations, as defined in economic model (1). We first report separate OLS regression test results for each of the sample insurance companies and pension schemes (Panels A and B). Panel C then shows pooled regression results for the combined sample.

Table 6. OLS Regression Tests – Degree of Alignment with TCFD Recommended Disclosures

Note: Variables are defined in Table 3.

Overall, the OLS regression test results regarding the degree of alignment with TCFD recommended disclosures are equivocal. On the one hand, Panel A shows that, for our sample insurance companies, the main determinants of variation in the degree of alignment with TCFD recommendations are positively related to size (LNSize) and the type of business (BusType), as their p-values are statistically significant at the 5% level (which are highlighted) and the coefficients are positive. By contrast, Panel B reports that, for our sample pension schemes, only the coefficient for financial risk (LiabRisk) is negative and statistically significant at the 5% level. When we pool the samples (Panel C), only the coefficients for LNSize (at the 1% level of significance) and BusType (at the 10% level of statistical significance) are positively and statistically significantly related to the degree of TCFD alignment.

In summary, the results of our econometric test analysis imply that information asymmetry (financial liability risk) is the main driver of TCFD alignment for sample pension schemes, consistent with our predictions. However, the results for both the sample insurance companies and the combined sample imply that variations in TCFD alignment are only consistent with an alternative reputation or political visibility explanation, as proxied by size or the reporting entity. There is also some evidence of structural variations related to the type of business. However, these results should be treated with extreme caution, since the overall F-statistic for all three models are not statistically significant. Thus, it is likely that there are either errors in variables or missing variables issues that might explain the observed cross-sectional variations.

Table 7 reports the OLS regression tests of the determinants of the extent of engagement with generic climate-related disclosure issues, as represented in economic model (2) defined in Section 5.5. Panels A and B show separate OLS regression test results for each of the sample insurance companies and pension schemes, respectively. Panel C shows the pooled regression results for the combined sample.

Table 7. OLS Regression Tests – Extent of Engagement with Climate Risk Issues

Note: Variables are defined in Table 3.

Similar to the test results reported in Table 6, there appear to be different determinants of the degree of engagement with climate risk reporting issues for UK insurance companies and pension schemes. Panel A shows that, for insurance companies, only the coefficient for board effectiveness (proxied by OSDirect) is positive and statistically significant at the 10% level. By contrast, for pension schemes, Panel B shows that the two coefficients that proxy for a reputation risk explanation (LNSize – at the 1% level and ROA – at the 10% level), as well as the coefficient for structural variable (Owner – at the 1% level), are both in the predicted direction and statistically significant. When we combine the two samples (Panel C), we find only positively and statistically significant coefficients for political visibility (LNSize) and two structural variables (Owner and Entity).

Overall, our empirical test results reported in Table 7 related to both the pension scheme and pooled samples are consistent with our prediction in economic model (2), i.e. cross-sectional variations in the observed degree of engagement with generic climate change. However, for the insurance sample, these variations are only statistically associated with board effectiveness (as proxied by OSDirect). We also find that structural variables related to ownership structure and/or business type are influential. Finally, our pooled sample results also imply that pension schemes are significantly more likely to engage with climate change reporting issues than insurance companies (Entity). Furthermore, our empirical tests results are more statistically robust. The F-model statistics of all three regressions are statistically significant at the 1% level, and the explanatory power of the regressions (adjusted R 2 statistic) is also significantly greater than those reported in Table 6.

7.3. Robustness Checks

The results reported in the previous section were based on the strong limiting assumptions of OLS regression models. Due to the limited sample size and strong econometric assumptions underlying this model, we therefore undertook various other specification checks on the data and conducted non-parametric tests. We also replaced the measurement of key variables with alternative specifications and dropped variables to see whether this would affect the overall results. We did not find any significant differences between the nature and significance of the econometric results reported in the previous section.

8. Analysis of Best Practice Climate Risk Disclosures

This section reports further analysis of examples of best practice disclosures. We first overview the form and content of the examples which align well with the TCFD disclosures by the only insurer A and pension scheme B which appeared to completely align with the TCFD recommended disclosures. For the purposes of analysis, we focus specifically on the risk management aspects of the TCFD recommended disclosures and those related to more generic climate risk-related disclosures as illustrated by insurer B and pension scheme B.Footnote 31

8.1. Examples of Good Practice – TCFD Recommended Disclosures

Table 8 shows the extract of an example insurer’s annual report concerning its TCFD disclosures related to risk management.

Table 8. Example Insurer’s 2018 TCFD Disclosure

This example insurer’s climate risk disclosure has addressed all three of the “risk factors” identified by the PRA (2015, 2019) concerning the financial risks associated with climate change related to physical, transition and liability risk factors.

Table 9 shows the extract of an example pension scheme’s annual report related to its TCFD disclosures related to risk management.

Table 9. Example Pension Scheme’s 2018 TCFD Disclosure

This disclosure is much more clearly formatted to align with the specific TCFD (2017) recommended disclosure categories related to risk management. This example pension schemes disclosure goes further by explicitly citing the relevant TCFD recommendations, together with its commentary of how it deals with the various issues.

8.2. Generic Climate Risk-Related Engagement

In this section, we review examples of what we consider to be good practice disclosures which demonstrate how our sample insurance companies and pension schemes engage with a range of broader climate-related reporting issues (as outlined in Section 5.3).

Another example insurance companies’ Annual Report extract is shown below:

We remain an active member of the ClimateWise initiative, a global network of leading insurance industry organisations, and an investor signatory to the Carbon Disclosure Project. In 2018, we again participated in the Asset Owner Disclosure Project, a survey managed by ShareAction to assess the insurance sector’s response to addressing climate risk, where we ranked 30th out of 80 in the Global Climate Insurance Index (an assessment of the 80 largest insurance companies globally) (2017: 31st). In 2018, we collaborated on enhancing industry climate-related disclosure practices and signed up to a pilot initiative sponsored by the United Nations Environment Programme to work on climate-change scenario modelling for portfolios across different asset classes.

This generic disclosure highlights the example insurer’s relatively high level of engagement with external organisations. It is one of the few UK insurance companies which explicitly recognises its responsibilities related to both the CDP and Asset Owner Disclosure Project. It also highlights its ranking in the Global Climate Insurance Index, and its collaboration with the UNEP climate change scenario modelling project.

An example of an equivalent generic disclosure related to this issue by our sample of pension schemes can be illustrated by reference to another example pension scheme’s 2018 Annual Report.

During the year in review, we were a lead participant in two thematic engagements coordinated via partners including the Principles for Responsible Investment (PRI) and the Institutional Investor Group on Climate Change (IIGCC). One engagement theme concerns cyber security risk, and 50 companies have been engaged on the subject. The other theme is climate change and is being coordinated by the Climate Action 100+ group of investors

This general disclosure provides insight into the relatively high level of engagement by the example pension scheme with a range of external organisations, such as PRI and the IIGCC. It also highlights its direct participation as a member of the Climate Action 100+ group of investors.

9. Conclusion

Climate risk reporting is an increasingly important public policy issue of concern to both the UK actuarial profession generally, and to actuarial professionals working for, or providing advice to, UK insurance companies and pension schemes. However, while increasing regulatory and political scrutiny has recently raised public awareness of the impact of climate change on their investment strategies, there is little prior systematic research on this issue related to these sectors.

This paper contributes to the existing literature by providing new evidence on current reporting practices by these important entities related to this issue. Our analysis is based on a conceptual framework towards environmental responsibility which delineates both formal accountability mechanisms and informal voluntary disclosure that address both “what matters” and “why does it matter” dimensions of the impact of climate change. We therefore examine research questions of climate risk reporting related to both examine the implementation of specific disclosure recommendations of the TCFD in annual reports, and more generic public disclosures concerning how climate change affects the investment strategy of the largest UK insurance companies and pension schemes.

The results of our analysis concerning our first research objective (i)(a), i.e. the degree of alignment of annual reports with the 11 TCFD disclosure recommendations show that there is only a limited degree of alignment with TCFD specified recommended disclosures contained in the most recently available UK insurers and pension scheme annual reports. Only a minority of entities, either large publicly listed insurance companies, or local government pension schemes, have disclosed all, or a majority, of TCFD recommendations. This finding is consistent with the TCFD’s (2018) recent analysis of the global insurance sector.

Our analysis of the evolvement of disclosure practices over time (research question (i) (b)) is limited to the sample of insurance companies only, since none of the sample UK pension schemes published annual reports for the 2 years subsequent to the issue of the TCFD recommendations. Surprisingly, we found little evidence of any change in the degree of alignment of insurance company annual reports with the TCFD recommendations.

We also analysed more generic publicly available communications produced by insurance companies and pension schemes concerning research question (ii), i.e. the degree of engagement with climate-related issues. We find that over half of all sample UK insurance companies and pension schemes considered the impact of climate change on their investment strategies. Moreover, we find that climate risk specifically, as opposed to ESG issues generally, is considered to be important. However, the incidence and nature of this vary considerably across different types of these entities concerning “engagement with outside entities”, “reporting and policy” and “action taken” issues.

We also analyse the key determinants of the degree of alignment with TCFD-specific recommended disclosures related to governance, strategy, risk management and performance metrics. We find that incentives facing sample insurance companies to align their climate-related disclosures with TCFD recommendations are related to their management of reputation risk, whereas pension schemes are related to the desire to reduce information asymmetry among their stakeholders concerning this issue. Further, consistent with a stakeholder theory explanation, find that only a minority of large, publicly listed insurance companies and large local government pension schemes are taking action to report on their actions to mitigate climate risk. We also discuss examples of best practice climate risk reporting.

These findings are subject to a number of important caveats. First, we recognise that the research methods used to score both degree of alignment with TCFD recommendations and extent of engagement with broader issues are necessarily subjective in nature. Second, we recognise that there is a lack of comparability of both climate change reporting issues between insurance companies and pension schemes given their differing types of governance and regulatory frameworks and forms of accountability relationships with their key stakeholders. Third, our empirical tests of the determinants of climate risk-related disclosures are subject to the limitations of the econometric tests used, the small sample size of insurance companies and pension schemes available for analysis, and empirical variables chosen to proxy various types of financial risks and entity characteristics. Finally, we acknowledge that implementation and recognition of the full impact of TCFD recommended disclosures concerning the impact of climate change on strategy, risk management and performance measurement are still at a relatively early stage of implementation.

Further research could usefully extend and develop the preliminary analysis that we have undertaken in a number of ways. First, our analysis of climate risk reporting has mainly been restricted to a sample of large UK insurance companies and pension schemes. It would be interesting to examine how our results compare with climate risk reporting practices of similar financial entities (e.g. banks and investment trusts) and smaller entities. Second, while our analysis provides some initial evidence as to the overall incidence and nature of how these entities identify and manage climate risk, future research could provide more detailed insight as to how climate change has impacted specific governance, strategy, risk management and performance metrics. Third, while our analysis has mainly focused on the reported impact of climate change on investment strategy, further research could be conducted on how climate change may affect strategy, internal modelling, pricing approach, reserving, underwriting, credit, market risk and capital management of these entities, which may be of greater interest to actuaries working in these domains. Fourth, future research could examine (1) the value relevance of discretionary climate risk disclosures to economic decisions made by primary stakeholder groups (e.g. investors, credit rating agencies) and (2) the disclosure effectiveness (both from a preparer’s perspective in terms of the cost of implementing TCFD recommendations, and then from a user’s perspective in terms of salience and/or information overload of alternative forms of presentation) of climate risk reporting, to individual investors and/or other interested parties.

Finally, we note a significant disconnection between the regulatory expectations of insurance companies and pension schemes regarding their accountability for climate change risk. On the one hand, the PRA’s expectations of insurance companies include developing and maintaining an appropriate approach to disclosure on and management of the financial risks, reflective of the distinctive elements of the financial risks from climate change. Insurance companies should look to evolve their disclosures to make these as insightful as possible, and in particular should ensure they reflect the companies’ evolving understanding of the financial risks from climate change. By contrast, there is relatively little specific regulatory guidance for UK pension schemes in these areas. Furthermore, the limited guidance that does exist appears to be mostly limited in scope to investment risk-related issues, whereas the liability risk implications of climate risk for pension schemes that are potentially relevant to the roles of funding actuaries (e.g. the sensitivity of the sponsor’s debt covenant to climate change risk) have received relatively little attention. This indicates that climate risk reporting needs further research and development in order to better align with both regulatory and public expectations.

Acknowledgements

We would like to thank Oscar Archer for providing research assistance, and the IFoA for providing financial assistance for this project. We are also very grateful to Paul Meins and two anonymous reviewers for detailed comments provided on earlier versions of this paper.

Disclaimer

The views expressed in this publication are those of the Climate Risk Reporting Working Party; do not represent the personal views of all authors, and not necessarily those of the Institute and Faculty of Actuaries. The Institute and Faculty of Actuaries do not endorse any of the views stated, nor any claims or representations made in this publication and accept no responsibility or liability to any person for loss or damage suffered as a consequence of their placing reliance upon any view, claim or representation made in this publication. The information and expressions of opinion contained in this publication are not intended to be a comprehensive study, nor to provide actuarial advice or advice of any nature and should not be treated as a substitute for specific advice concerning individual situations. On no account may any part of this publication be reproduced without the written permission of the Institute and Faculty of Actuaries.

Glossary of Key Terms

Appendix B

Table B.1. List of Sample UK Insurance Companies and Pension Schemes