1 Introduction

International trade has long been viewed as a source of domestic political conflict. While increasing trade leads to economic gains, these gains are not equally distributed among the members of a state's population. Trade's redistributional effects create clear winners and losers, and a large body of research in international political economy has been devoted to identifying these winners and losers and the ways in which they might impact potential trade-policy outcomes.Footnote 1

Within industries, heterogeneity in firm-level characteristics, such as size and productivity, has emerged as a robust determinant of producers’ abilities to engage foreign markets.Footnote 2 While most research has focused on exporting, other modes of internationalization—such as importing, offshoring, foreign direct investment (FDI)—follow similar patterns of engagement at the firm level.Footnote 3 Large, highly productive producers can afford to participate in these activities, while their smaller and less efficient counterparts cannot. These differences in capabilities generate political divisions over trade policy within industries, where large and highly productive firms are more likely to seek liberalization than their counterparts.

I explore the implications of firm heterogeneity for trade-policy stances at the firm level. Most existing research on the producers and trade politics focuses on policy positions revealed through costly forms of political engagement.Footnote 4 I use an original and representative survey of Japanese manufacturers to uncover patterns in latent policy stances. While industry characteristics, captured roughly by a series of comparative-advantage indicators, appear to affect policy stances, I find evidence of intra-industry divisions driven by the firm-specific characteristics fundamental to firm-heterogeneity studies. Highly productive firms are more likely to favor trade liberalization than their less-productive counterparts. Additionally, I uncover a large portion of firms where decision makers express no clear preference over trade-policy reform; these responses do not appear to be determined by firm heterogeneity. Finally, cases where respondents do not know the impact that trade liberalization would have on their business are not uncommon and are most frequently found among small producers.

2 Trade Preferences in International Political Economy

Trade-policy preferences have largely been studied at two levels in international political economy. Research on aggregated sector or factor-based cleavages has been complemented by a wide range of studies on sources of individual-level trade preferences.Footnote 5 Most work relies on predictions generated by the Stolper-Samuelson (factor) and Ricardo-Viner (sector) ideal-type models, while other efforts have sought to identify the varying levels of factor mobility that cause one configuration of preferences to dominate the other.Footnote 6 Recent research has expanded upon these factor and sector-based models to incorporate a wide range of non-income sources for preferences.Footnote 7

Over the past few years, attention has returned to the interests of producers in trade politics. Early research on this topic first uncovered the activation of firm-based attitudes from the decision makers responding to interviews, linking these to trade-policy demands.Footnote 8 This has been complemented by work focusing on firms as important players in trade politics: Strong evidence points to multinationals seeking liberalization to improve their access to lucrative foreign markets, both in goods and services trade,Footnote 9 as well as seeking protections for their investments abroad.Footnote 10 Contrastingly, some producers seek protection, either through temporary trade barriers or subsidies.Footnote 11 This protectionist stance has become the default policy position for research on producers and trade policy with the ubiquity of the ‘Protection for Sale’ framework, which has become the seminal framework for depicting producer engagement in trade politics.Footnote 12 While this framework finds strong empirical support,Footnote 13 particularly among comparative disadvantage (or import-competing) industries,Footnote 14 accounting for variations among producers within industries has led to a range of valuable extensions to the original model, including the incorporation of include heterogeneous policy positions within industries.Footnote 15 However, the focus on publicly-held trade-policy positions misses the underlying distribution of latent stances across firms, which are not as clearly defined as would be expected.

3 Firms in International Markets

The focus on micro-foundations in the study of international trade arose as a response to empirical deviations from new trade theory, leading to the development of ‘new new trade’ approaches incorporating variations at the plant or firm level.Footnote 16 These theoretical models arose from empirical regularities that became apparent with the emergence and availability of increasingly detailed data: exporters are much larger, more productive, more capital intensive, and pay higher wages than non-exporters.Footnote 17 Export engagement served as an early focal point for much interest in distinguishing between internationalizing producers and those only serving the domestic market. The latter group makes up the majority of firms: For example, only 18 percent of American manufacturers engage in exporting.Footnote 18 Among these exporters, the intensive margin of export sales varies widely across industries;Footnote 19 however, this is nothing compared to the high concentration of export sales among a small number of exporters. For example, in the United States, 1 percent of firms account for roughly 90 percent of trade by value, a figure that is similar to those observed in other countries.Footnote 20 In the case of Japan, roughly 12 percent of Japanese manufacturers were multinationals, accounting for 94 percent of exports and 80 percent of imports.Footnote 21

What is true of exporters also tends to be true of other internationalizing firms, such as those engaging in foreign direct investment (FDI), importing inputs, and offshore outsourcing, although the size and productivity premia associated with each these activities varies.Footnote 22 The largest premia are associated with FDI, due to the particularly high costs of entry, while those associated with import entry are largely comparable to export premia.Footnote 23 Ultimately, these variations in behaviors are attributed to total factor productivity (TFP), a scale-free measure of the efficiency with which producers combine their inputs to produce final products. The more efficient a producer is, the more easily it can subsume costs. TFP correlates very highly with firm size, to the extent that the two are used interchangeably in models.Footnote 24

The TFP and size premia between international firms and domestic firms is quite large. Among Japanese manufacturers, international firms are between 70 percent and nearly 400 percent larger than domestic manufacturers (depending on method of internationalization), while productivity premia typically range from 20 percent to 110 percet over domestic producers.Footnote 25 Productivity distinctions between international and domestic producers remain after controlling for economies of scale as well as the available resource that accompany firm size.Footnote 26

4 Firms and Trade-Policy Stances

A new generation of models of trade politics has emerged incorporating firm heterogeneity and its implications for trade engagement.Footnote 27 In these models, firms are differentiated within industries by productivity, which determines firms’ abilities to engage and compete in a variety of market–based activities. While high productivity allows firms to enter foreign markets, unproductive firms cannot. Accordingly, highly productive producers benefit from liberalization: Foreign markets offer profitable opportunities and liberalization reduces the operating costs associated with these markets. When foreign-market liberalization is accompanied by reciprocal actions, domestic producers face increased competition from foreign sources. This is particularly threatening for less productive domestic firms, as their reduced margins in the domestic market are not offset by the prospect of increased margins abroad. In the face of liberalization, the least productive firms may no longer find operating profitable and be forced to exit the market. While higher productivity firms also face increased import competition, their lower costs enable them to absorb these changes with relative ease. Consequently, these divergent experiences are used to predict variations in policy stances.

Prediction 1

— Highly productive firms are more likely to favor liberalization than less productive firms, even when controlling for current internationalization activities.

The opportunities that highly productive firms face in foreign markets can be addressed through a wide range of internationalization modes, from engaging in trade, to direct investment in these markets. This menu of internationalization options offers costs and benefits that vary based on the type of activity and characteristics of the foreign market targeted. Reciprocal liberalization offers increased profit opportunities for internationalizing firms. For those with global or regional production chains, cost reductions from liberalization may be multiplied several times over, as a consequence of intra-firm trade. Indirect importers and exporters stand to benefit from reduced trade barriers both through reduced costs passed through from their intermediaries and the potential for some indirectly trading firms to take advantage of lower trade costs and begin to directly importing or exporting themselves.

Prediction 2

— Current internationalizing firms should be more likely to take a pro-liberalization stance than domestic producers.

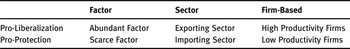

These cleavages cut across those predicted by canonical models of trade politics, which generate trade-preference divisions based on factor abundance and industry-level export proclivity as depicted in Table 1.

Table 1: Predicted Trade-Policy Cleavages

The productivity-driven political cleavage predicted by firm-based models cuts across both those predicted by factor- and sector-based models.Footnote 28 Firms are distributed by productivity within industries, resulting in intra-industry divisions over trade policy. Similarly, factors of production (such as skilled and unskilled labor) are employed by firms of all levels of productivity. Indeed, the fact that exporters employ a more-skilled workforce than domestic producers has been identified as a source of productivity differences.Footnote 29

While firm-based preferences cut across industries, they are also shaped by industry characteristics that break down in ways familiar to political economists. In advanced economies, firms in comparative-advantage industries are more likely to view trade liberalization favorably than those in comparative-disadvantage industries as a result of their industry's proclivity towards exporting.Footnote 30 For developing economies, this organization of industries breaks down in light of firm-level characteristics relating to traders.Footnote 31 However, for developed economies, it matches neatly onto patterns of product differentiation within industries.Footnote 32 Consequently, firms in comparative-advantage industries with highly differentiated products are more likely to benefit from export-market access than those in undifferentiated, or comparative-disadvantage, industries.Footnote 33

Prediction 3

— Firms in comparative-advantage industries are more likely to support liberalization than those in comparative-disadvantage industries.

When considering the policy-stance divisions between firms, it is tempting to envision a clear divide between those favoring liberalization and those preferring protection. However, trade policy is a complex issue that often overlaps with other concerns. While existing research has largely focused on costly displays of trade-policy stances,Footnote 34 it is possible that these activities over-state the salience of the issue for non-participants. While these costly signals are readily observable, they may not accurately reflect the underlying distribution of policy positions. For many producers, trade policy may not be a salient issue. Its effects may seem to be indirect or less impactful than those of other policies, or its complexity inhibits the development of directional positions. For small producers in particular, trade-policy stances should be less clear, as these firms are less likely to be able to allocate resources to understanding the effects of reform.Footnote 35

Prediction 4

— A sizable portion of firms express no clear directional trade-policy stance, either because they expect no differing effect from liberalization or because they do not know how they would be affected. Small firms will be more likely to not know what to expect from trade.

The highly productive producers that benefit from foreign-market access tend to be large, possessing the resources necessary to forecast the impact of policy reforms. Smaller and less productive firms may not be able to engage in these activities, lacking the resources to devote to analyzing a wide range of policies. Consequently, even when decision makers at firms assess the impact of trade policy on their firm's business activities, they may not have a clear set of expectations aligning to existing theoretical predictions. While we expect highly productive firms to be more likely to favor liberalization than relatively unproductive firms, a large portion of producers expect no impact with a change in trade policy, while some firms simply have no clearly formed expectations of its impact.

5 Internationalization Activities among Japanese Manufacturers

In February 2011, Megumi Naoi, Arata Kuno, Ikuo Kume and I conducted an online survey of Japanese firm executives, seeking information on their expectations of globalization's effects on their firms. The survey was administered by Teikoku Data Bank, a highly regarded credit research company,Footnote 36 whose database contains credit and financial information on 1.5 million Japanese firms. The survey was sent via email to all of the registered monitors in manufacturing and agriculture sectors, as well as five service industries.Footnote 37 These monitors are firm executives and high-ranking employees; 4,183 were surveyed. In sum, 53 percent of the monitors responded, giving us a total of 2,217 responses.Footnote 38 Nearly 1,400 of these are in the manufacturing sector.Footnote 39

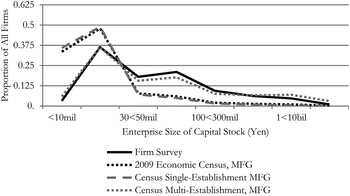

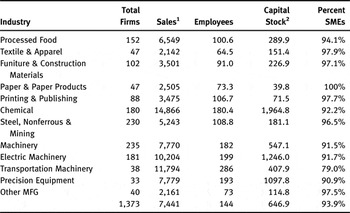

The survey's sampling frame was designed so that industries would be represented in the same proportions as in Japan's 2009 economic census; for industries with particularly high proportions of small and medium enterprises (SMEs),Footnote 40 this entailed oversampling to ensure the distribution of respondents across industries would be largely comparable to the economic census. Figure 1 illustrates the distribution of respondents across industries as a proportion of all manufacturing responses; these are compared to the distribution of firms across manufacturing industries in the economic census.

Figure 1: Firm Distribution across Industries of Survey Responses Compared to Economic Census

The overwhelming majority of respondents across all industries are SMEs, making up nearly 94 percent of firms across the manufacturing sector, closely following the composition of Japan's 2009 economic census.Footnote 41 Across industries, the proportion of SME respondents very closely matches the proportion initially sampled (see Figure A1 in the Appendix). In addition to closely matching the proportion of SMEs in the Japanese manufacturing sector, the distribution of firm sizes in terms of capital stock is closely representative of that for manufacturers in the economic census, as depicted in Figure 2. The composition of the survey sample fairly closely resembles the distribution of multi-establishment manufacturing enterprises from the economic census; very small single-establishment firms are underrepresented. This is not particularly surprising, as these firms are less likely to respond to the survey. Overall, the survey's capital-stock distribution approximates that of the economic census, exhibiting the characteristic long tail as size increases.

Figure 2: Firm-Distribution Representativeness

Foreign market engagement varies widely by industry, following commonly established patterns (Table A2 in the Appendix contains these data). As expected, trade engagement varies widely across manufacturing industries, with exporting twice as common in comparative-advantage industries as comparative-disadvantage industries (22 percent of firms to 10 percent of firms). This general pattern—greater internationalization engagement among comparative-advantage industries—holds across most forms of internationalization, although not necessarily to the same extent.

At the firm level, trading directly with foreign establishments is a rare activity; in our sample, nearly 18 percent of firms are direct exporters, while 25 percent are direct importers. Fifteen percent of firms are multinationals engaging in FDI, and 24 percent are active in offshore outsourcing. These figures are similar to those described by other studies of internationalization efforts by Japanese manufacturers using economic-census or comprehensive survey data.Footnote 42

The fixed costs of trade, including the establishment of distribution networks, vary widely by the target market.Footnote 43 Firms that cannot overcome these costs may engage a market through indirect forms of trade, in which third-party intermediaries (often multinationals or larger trading firms) provide use of their distribution networks. Consequently, the benefits and risks of intermediated trade are shared between producers and intermediaries, while the fixed costs of market entry are significantly reduced for producers engaging these intermediaries. Both indirect exporting and importing are more common than their direct counterparts, as these methods of internationalization are employed by 24 percent and 44 percent of firms, respectively. There is some overlap with direct traders, as 8.5 percent of firms are both direct and indirect exporters, while 9.5 percent are direct and indirect importers. Over 52 percent of firms in comparative-disadvantage industries indirectly import raw materials, intermediate inputs, or finished products. This provides evidence that a large portion of producers in these industries benefit from open trade, counter to Ricardo-Viner expectations.

The characteristics of internationalizing firms compared to those of domestic firms largely align with established patterns.Footnote 44 Firms that engage foreign markets are larger, more capital intensive and more productive than domestic firms. The one notable and regular exception to this is offshore outsourcing and capital intensity: It is well established that offshoring firms are less capital-intensive than their counterparts.Footnote 45

It is important to note that these different forms of internationalization are not mutually exclusive. As demonstrated in Table 2, a number of firms employ multiple methods of engaging foreign markets. The diagonal indicates the percent of firms that only engage foreign markets in the specified manner. With the exception of indirect importing, which accounts for nearly 19 percent of all respondents, it is far more common for internationalizing firms to participate in multiple forms of engagement. Participation rates for single modes of internationalization indirectly reflect the fixed costs associated with each method of entry. For example, most multinationals that engage in FDI to at least one foreign market should be able to absorb costs associated with other forms of internationalization more easily; the modes of engagement they choose will depend on the structure of costs associated with each. As a case in point, 23 percent of multinationals also engage in both direct and indirect exporting; nearly 33 percent are direct two-way traders.

Table 2: Multiple Forms of Internationalization, Percent of Respondents

These descriptive figures highlight the wide variety of market behaviors among Japanese manufacturers. They also serve to demonstrate the representativeness of these features of our survey data when compared to analyses of economic-census data and comprehensive surveys of Japanese producers. These forms of international engagement are additionally broadly similar to levels economic integration among other advanced economies.Footnote 46 The divisions between firms that possess the capabilities to participate in these modes of internationalization and those that do not, serve as the foundation for a firm-based approach to trade politics.

6 Trade-Policy Stances and Heterogeneous Firms

Just as trade and other forms of foreign-market engagement vary significantly within industries, so too do trade-policy stances. Two questions from our survey capture firm decision-makers’ expectations regarding the prospective impact of liberalizing trade-policy reforms on future business activities. The questions are framed in a prospective (rather than retrospective) manner to lead respondents to base their answer on forward-looking forecasts, rather than reflecting on previous experiences with liberalization. The effect is to shift attention away from revealed preferences towards the impact of information availability for business executives in the policy-making environment.Footnote 47 Additionally, this avoids issue linkages and framing effects from previous debates. Consequently, this creates a more focused environment for examining expectations of trade-policy's impact on future business.

The respondents were specifically directed to answer questions with respect to the impact on their business and to avoid responses based on personal ideological or political views. Established evidence shows that, when questions are framed in this manner, individuals will react positively to the framing, even when employer-specific impacts would contradict personal preferences or ideologies.Footnote 48

The survey instruments regarding trade-policy stance are included alongside a list of other policy questions.Footnote 49 The questions are framed as follows:

-

‘Please tell us how the following changes would affect your business. In answering these questions, please answer strictly in terms of impact on your business, rather than providing your personal opinions.

-

The expansion and liberalization of imports of manufactured goods.

-

The deregulation and liberalization of foreign export markets.

Respondents could choose one answer in response to each question, with five available responses:

-

Positive effects; Negative effects; No impact; Depends on division within the firm; Don't know.

The framing device targets the resulting responses to focus on the firm,Footnote 50 and on the face of things, responses tend to follow expected patterns. Export-market liberalization is much more likely to be seen as beneficial in comparative-advantage industries (38 percent of responses, compared to 22 percent in comparative-disadvantage industries). The prospect of import liberalization appears to be viewed negatively at much more similar rates across comparative-advantage industries and comparative-disadvantage industries (18 percent of responses compared 22 percent; the difference is statistically insignificant).

The responses similarly lend evidence to the importance of the differences in firms’ characteristics and behaviors within industries. Fear of trade liberalization appears to be overstated in the literature: In no industry did more than 26 percent of firms view import liberalization as having negative effects on their business. Positive responses to import liberalization range between 5 percent and 28 percent of firms, while the plurality of respondents does not expect their activities to be significantly impacted by a reduction in trade barriers. It is possible that variability in responses to the import-liberalization question could be attributed in part to its potentially vague interpretation. Imports to one firm could represent opportunity for accessing raw materials or intermediate inputs; to another firm, these may represent competition from foreign producers.

Figure 3 illustrates the breakdown of trade-policy stances by firm size. While models of firm heterogeneity and market behaviors emphasize the importance of TFP, this fundamental characteristic cannot be measured directly. Instead, it is frequently estimated with the assistance of proxy measures or indirect estimation routines. Productivity estimators range from simple linear predictors that approximate a production functionFootnote 51 to systems of equations that correct for sources of bias inherent in simpler estimators.Footnote 52 Alternatively, observable firm-level characteristics that are known to correlate highly with TFP are employed as direct proxies. The most obvious candidate in this role is firm-level revenues or net sales, due to the high empirical correlation and theoretical link between the two.Footnote 53 This fact is particularly useful in the case of cross-sectional data, where the lack of repeated observations precludes the use of sophisticated estimators.Footnote 54 In Figure 3, log-transformed sales have been divided into ten bins of equal size.Footnote 55

Figure 3: Respondents’ Trade-Policy Positions by Firm Size

To capture directional policy stances, I created a binary index, trade stance. Conceptually, trade stance indicates when respondents expect export or import liberalization to benefit (or harm) their firm. Trade stance takes a pro-trade value (one) when import (or export) liberalization is linked to positive benefits, and export (or import) liberalization is associated with positive, neutral, or variable (depends on division) influences.Footnote 56 The index takes an anti-trade value (zero) when import (or export) liberalization is tied to a negative impact, and export (or import) liberalization is connected to negative, neutral, or variable (depends on division) effects. While the probability of anti-trade stance slightly negatively correlated with firm size, likelihood of pro-trade stance increases considerably with firm size.

A large proportion of responses indicate that trade-policy reform would have no expected impact on future business interests. This is somewhat unanticipated by theory: Ricardo-Viner would predict sharp comparative–advantage-based cleavages, while firm-based theories similarly leave little room for non-directional stances. These responses make up roughly 29 percent of all responses. While bin four has the highest level of ‘no impact’ responses, there does not appear to be any relationship between firm size and the propensity to expect ‘no impact’ from trade liberalization. The prevalence of these ‘no impact’ stances across the distribution of firms potentially indicates a lack of trade-policy salience across the full range of producers. For many firms focused on the domestic market alone, trade policy may only be viewed as having indirect effects on business activities. Decisions may then be made in response to, or in anticipation of, those trends with a direct influence on business.

‘No impact’ responses may also be driven by imperfect information. Trade policy is a complex issue and a single reform can have multifarious impacts at the level of the individual firm. Combined with a fairly low salience, information may be viewed as costly, particularly given the range of alternative targets for investment of resources. Finally, the mutual ‘don't know’ responses, which, while generally rare, are more common for smaller and less productive firms than their larger and more productive counterparts. This provides some evidence supporting the argument that costly information regarding trade policy's impacts creates a barrier for producers with fewer resources to gain a sense of how they may be affected by impending trade reform.

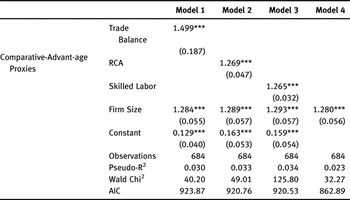

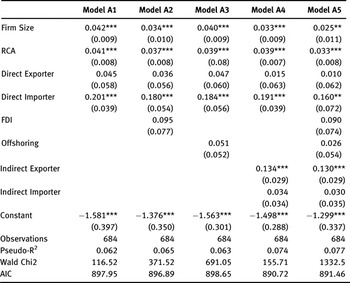

Table 3 presents some basic insight on the influence of firm heterogeneity in the formation of trade-policy stances. Models 1–3 present logit regressions with three proxies for comparative advantage. Trade balance is a simple binary indicator of comparative advantage operationalized using the average industry-level trade balance over the previous three years;Footnote 57 while this approach is clearly problematic, it provides a simple approach to capturing an industry's trade orientation and correlates highly with the other proxies.Footnote 58 RCA is a standardized measure of revealed comparative advantage, calculated through WITS and based on industry-level data from 2010. The final proxy for comparative advantage, skilled labor, consists of the standardized skilled-labor portion of employment in each industry.Footnote 59 In each of these models, an industry's comparative-advantage orientation is associated with increased likelihood of firms taking a pro-trade stance. Model 4 is a conditional logit, with each industry forming a separate group; the odds ratio for firm size remains roughly the same as in the previous models. Importantly for firm-based models of trade politics, firm size, measured as the natural logarithm of net sales, is positively associated with pro-trade stances, an effect that remains consistent across the different measures of comparative advantage. Keeping in mind the fact that firm size is a proxy for TFP, higher productivity producers are more likely than their low-productivity counterparts to favor trade liberalization.

Table 3: Industry and Firm Effects on Reciprocal Trade Stance

*** p < 0.01 **p < 0.05 *p < 0.1

Logit regressions and conditional logit run with heteroskedastically robust standard errors clustered at the industry level, with odds ratios reported.

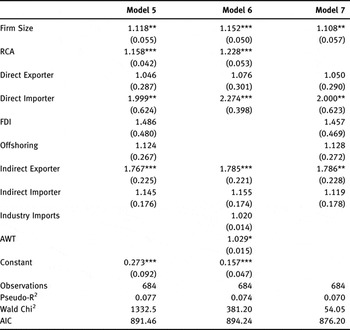

While these results provide some preliminary evidence of the relationship between firm size and trade stance, both foreign-market engagement and exposure are missing from the models. These are presented in Table 4. As demonstrated in the previous section, participation in global markets varies widely across firms and industries. Internationalizing firms, whether traders or direct investors, are intuitively likely to favor economic integration, as this would reduce costs of overseas business. When directly specifying engagement in these activities (Model 5), the effects of firm size and RCA remain positive and in the expected direction.Footnote 60 Among forms of international-market engagement, all coefficients are positive, although significance is only reached by direct importing and indirect exporting.Footnote 61 Comparable results are found when RCA is substituted for skilled labor or trade balance.

Table 4: Internationalization Activities and Reciprocal Trade Stances

*** p < 0.01 **p < 0.05 *p < 0.1

Models 4 and 5 are logit regressions; Model 6 is a conditional logit. All models are run with heteroskedastically robust standard errors clustered at the industry level, and odds ratios reported.

In addition to firm-level engagement with foreign markets, industry-level access may impact trade stance. Model 6 incorporates measures of average-weighted import tariffs (AWT) and logged industry-level imports (Industry Imports). Both measures are 2007–2009 averages calculated from industry-level WITS data. Industry-level exports are omitted, as this term correlates very highly with each of the comparative-advantage proxies.Footnote 62 Industry imports is not significantly linked to pro-trade stances, while AWT exhibits a weakly significant positive effect.Footnote 63 However, as Table A10 in the Appendix demonstrates, the relationship between both industry imports and AWT is not robust across specifications using different comparative-advantage proxies. The impact of firm size on pro-trade stances is consistent and significant across all specifications. Model 7 presents the results of a conditional logit, with firms grouped by industry; results are consistent with those of the previous models.

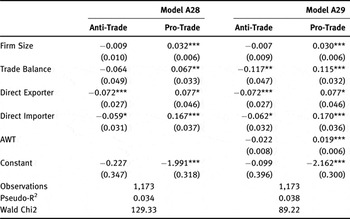

To verify the robustness of reciprocal-trade preference results in Table 4, I replicated the models with export-liberalization stances presented in Table 5. While most trade policy is conducted on a reciprocal basis—either through multilateral means or bilateral agreements—a simple test of export-liberalization stances captures the opportunities available to highly productive firms without the potentially complicating interpretation of import liberalization as applying to import competition or imported inputs. The significant positive relationship between firm size and pro-liberalization stances remains. Indirect exporters are much more likely than other firms to favor export-market liberalization, unsurprising given the likely status of many as potential direct exporters in the face of lower trade barriers. On its face, it is surprising that direct importers are so strongly linked to export-market liberalization. However, nearly 44 percent of direct importers are also direct exporters; likewise, many of the firms holding favorable export-market liberalization stances also view import liberalization favorably. Industry-level characteristics are only significant in Model 9, where RCA is included alongside industry-wide imports and AWT, but the effects are in the expected direction, with firms in comparative-advantage industries more likely to hold pro-liberalization attitudes.

Table 5: Internationalization Activities and Export-Market Liberalization Stances

*** p < 0.01 **p < 0.05 *p < 0.1

Models 8 and 9 are logit regressions; Model 10 is a conditional logit. All models are run with heteroskedastically robust standard errors clustered at the industry level, and odds ratios reported.

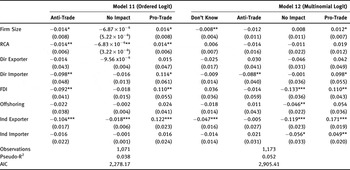

My final tests return to the set of responses to the trade-policy position question as illustrated in Figure 3. Table 6 presents these in two ways, reporting average marginal effects (AMEs).Footnote 64 Model 11 is an ordered logit, where ‘no impact’ stances have been added as an intermediate level to the original trade-stance variable, creating a three-outcome set of responses. The results here largely mirror those from the previous models. As expected, firm size is negatively associated with anti-trade stances and positively linked to pro-trade stances, although significance is reduced. RCA is significant and its coefficient is negatively signed for both anti-trade and ‘no impact’ stances, while positively signed for pro-trade stances. This corresponds with theoretical predictions on both counts: Pro-trade stances are more likely among large and productive firms and in comparative-advantage industries. The sign on RCA for ‘no impact’ stances seems to indicate the divide over trade policy is more readily apparent in comparative-advantage industries, where reallocations in response to liberalization are relatively large. Among internationalization options, effects are largely comparable to those of previous models. Unsurprisingly, direct importers are more likely to favor liberalization than other firms. Indirect exporters are more likely to favor liberalization than take protectionist or neutral stances; this is likely either driven by their sensitivity to demand fluctuations among exporting buyers or the potential opportunity to export directly in the event of reduced trade barriers. One difference that emerges is that firms engaging in FDI are much more likely to take pro-trade stances than anti-trade stances, pointing to the importance of international supply chains.

Table 6: Trade Stances with Multiple Outcomes

*** p < 0.01 **p < 0.05 *p < 0.1

Both models run with heteroskedastically robust standard errors clustered at the industry level, with average marginal effects reported.

Model 12 incorporates ‘don't know’ responses in addition to the trade-policy stances in Model 11, and is estimated as a multinomial logit, with anti-trade stance as the baseline category.Footnote 65 Firm size remains positively linked to pro-trade stances, while ‘don't know’ responses are associated with smaller firms. The latter result is unsurprising as smaller firms are more likely to lack resources to assess the impact of trade liberalization on their prospects. The range of internationalization methods largely follows the same pattern as in previous models. In general, firms serving foreign markets are more likely to take pro-trade stances and less likely to respond that they ‘don't know’ trade policy's impact on their activities.

Across a range of specifications, TFP and comparative advantage, proxied through firm size and RCA respectively, exhibit a positive impact on the prospect that firms will take pro-trade stances (Predictions 1 and 3). Engagement with foreign markets is sometimes linked with a positive effect on pro-trade stances, particularly for direct importers and indirect exporters (Prediction 2). For other forms of engagement, coefficients are generally signed in the expected direction, but are infrequently significant. This is most likely due to the fact that the survey questions on these activities did not capture variation on the intensive margin of these behaviors: Marginal participants are more likely to be dramatically impacted by policy reforms than the largest, most productive participants among whom these activities are highly concentrated. Finally, I have uncovered a group of firms for whom trade policy is not linked to a directional policy stance. Among these producers, those expecting no impact from reciprocal liberalization appear to be unrelated to firm size, while small firms are more likely than their larger counterparts to not know how they would be affected by reciprocal liberalization (Prediction 4).

7 Conclusions and Implications

Research on trade politics has largely focused on examining the sources of individual preferencesFootnote 66 over trade policy or conditions contributing to industry- or factor-based political cleavages.Footnote 67 This paper contributes to an emerging body of work focusing on the role of firms in trade politics. While the influence of producers in trade politics has long been established,Footnote 68 it is only more recently that these efforts have been put into a broader context, embedding politically active firms among those that do not involve themselves in trade politics.

Trade models with heterogeneous firms, based on extensions of the Melitz Model, can offer valuable insights to scholars interested in economic policies and their formation. By focusing on the variation in firm characteristics—in particular, productivity—that drive firm behaviors in economic markets, we can improve our understanding of the distributions of their policy stances and the nature of their participation in political markets as well. As a large body of trade research has found, high productivity firms are more likely than low productivity firms to engage foreign markets; this division of capabilities leads to heterogeneous effects from trade-policy reform. Producers that actively engage foreign markets or that could potentially do so are more likely to favor liberalization than smaller, less productive producers with prospects of serving only the domestic market.

Using a survey of Japanese manufacturers, I found evidence that this logic holds. Larger firms are more likely to favor liberalization, while smaller firms tend to prefer protection. These policy stances may be conditioned on ongoing internationalization methods; while only direct importing and indirect exporting show consistently significant influences on pro-trade stances, the lack of further significant results is likely the consequence of a lack of finer-grained data. In addition to this range of directional policy stances, a large portion of firms expect to remain unaffected by a change in trade policy; this group is not linked to size or productivity. Finally, a number of firms simply do not know how they would be impacted by trade liberalization. This category of respondents is most common among small firms that lack resources to research trade policy or its potential effects.

This is not to say that industry characteristics have been entirely subsumed by firm-oriented models. In several of the models, the comparative-advantage indicators are positively linked to pro-trade stances, indicating that characteristics intrinsic to these industries may be linked to trade-policy stances. While this paper contributes to our understanding of the distribution of trade-policy stances among firms, there is much room for further work, particularly in the study of how these stances compare to those across other issue areas, as well as what the distribution of these stances means for the policy-making process.

8 Appendix

Survey Instrument

For each of the following phenomena and/or policies, please select the respective influence of each on your firm. **Please answer strictly in terms of impact on your company/business interests, rather than providing your personal opinion.**

The expansion and further liberalization of imports on manufacturing goods (including processed foods).

Deregulation and further liberalization of foreign markets.

Potential Responses:

-

1) Would bring positive effects.

-

2) Would not have much influence.

-

3) Would bring negative effects.

-

4) Would bring positive or negative effects, depending on the division or section.

-

5) Don't know.

Trade-Stance Index

Trade Stance = 1 (pro-trade) if Import (or Export) Liberalization would bring positive effects.

And Export (or Import) Liberalization would have positive/variable/no effects.

Trade Stance = 0 (anti-trade) if Import (or Export) Liberalization would bring negative effects.

And Export (or Import) Liberalization would have negative/variable/no effects.

All Stances = 2 if Trade Stance = 1; 1 if Trade Stance = 0; 0 if Neutral or Don't Know (in other words, neutral-neutral and any responses involving a DK) = 1

Split pro/anti-trade stances are omitted (67 responses, distributed with no correlation to sales).

Figure A1: SMEs among Original Survey Sample and Respondent Sample

Survey Representativeness

Table A1: Descriptive Statistics of Survey Respondents (Industry Means of Key Characteristics)

Table A2: Internationalization by Surveyed Japanese Manufacturers

For comparison:

Kimura and Kiyota Reference Kimura and Kiyota2006: 20.3 percent exporters, 12.8 percent FDI in 2000, not limited to MFG.

Kiyota and Urata Reference Kiyota and Urata2008: 19.5 percent exporters, 19.1 percent importers, 12.5 percent direct two-way traders, 1994–2000 MFG panel.

Wakasugi and Tanaka Reference Wakasugi and Tanaka2012: 14.65 percent export to North America or Europe, 10.8 percent FDI to the same. 2005 MFG.

Tomiura et al. Reference Tomiura, Ito and Wakasugi2011: 20 percent offshore, 2006 MFG.

Table A3: Internationalization Premia, Bivariate OLS

Table A4: Internationalization Premia, Bivariate OLS with Industry Fixed Effects

Table A5: Internationalization Mode Correlations

Robustness Tests

Table A6: Internationalization Activities and Trade Stances

Table A7: Trade Stances and Internationalization, using Skilled Labor as Comparative-Advantage Proxy

Table A8: Trade Stances and Internationalization, Conditional Logits

Table A9: Trade Stances and Market Access

Table A10: Market Access, Skilled Labor

Table A11: Multinomial Trade Stances, Skilled Labor

Table A12: Multinomial Trade Stances, Trade Balance

Table A13: Trade Stances with Multiple Outcomes

Table A14: Multinomial Trade Stances, Four-Outcome Models, RCA

Table A15: Multinomial Trade Stances, Four-Outcome Models, Skilled Labor

Table A16: Multinomial Trade Stances, Four-Outcome Models, Trade Balance

Table A17: Multinomial Trade Stances, Five-Outcome Model