Emerging countries are among the largest mineral producers in the world and, in many cases, the mining sector represents a notable share of their economies. Considering their large mineral reserves and the increasing number of explorations underway, emerging countries’ role in the mining sector is expected to rise.Footnote 1 In the past, the mining sector has not always been seen as an “engine of growth” despite its economic significance in emerging countries. Early analysts of economic development expected manufacturing to play a much larger role in promoting fast development (Reference PrebischPrebisch, 1950). However, today there are signs that this may be changing. The mining sector is increasingly organized along “value chains” with a global span. Mining companies tend to outsource their intermediate inputs and services to a larger extent than in the past, and scientific and technological developments are pervasive in the industry. Importantly, the increasing sophistication of mining technologies is placing more emphasis on the technological contribution of companies, which are not themselves miners but which are nonetheless important links in the supply chain for mining. This potentially opens a window of opportunity for the structural transformation of emerging economies endowed with natural resources, and the scope for entering more knowledge-intensive and promising activities (Reference AndersenAnderson, 2012; Reference Marin, Navas-Aleman and PerezMarin et al, 2015; Reference Katz and PietrobelliKatz and Pietrobelli 2018; Reference Pietrobelli, Marin and OlivariPietrobelli et al., 2018).

This chapter discusses the innovation processes that are developing in the mining sector of emerging countries, and uses the global value chains (GVC) approach to analyze the potential available to local firms. The focus is clearly on all forms of innovation, not only those eventually subject to patenting. These include innovations in products and processes, but also in business, marketing and organizational models and practices. Moreover, the remarkable innovation that may powerfully develop through the interaction and linkages between mining companies, their suppliers and other organizations active in the innovation ecosystem, cannot be underplayed.

After briefly reviewing the relative importance of the mining sector in emerging countries – and in particular Latin America – we discuss the potential of innovation to contribute to economic development in this sector. To illustrate the types of innovation implemented, we refer to specific examples of Latin American suppliers in mining value chains. However, in developing this argument, we cannot forget that in most of Latin American mining there is insufficient supply of local knowledge. For instance, indicators of R&D expenditures and researchers involved in the Chilean mining industry show a significant lag with respect to countries like Australia (Reference Meller and ParodiMeller and Parodi, 2017). Multinational mining companies have not traditionally conducted intensive R&D activities near their operations (Reference Pietrobelli, Marin and OlivariPietrobelli et al., 2018), local universities tend to specialize in scientific topics that are not directly linked to the mining industry (Reference Confraria and VargasConfraria and Vargas, 2019), while the majority of local METS firms lack the capabilities to actively participate in innovative projects. There are still several good examples of very innovative suppliers, but their success is limited in scale and is not shared by all suppliers. In Section 4.1 we stress the importance of mining activities in emerging countries; Section 4.2 discusses mining innovation focusing on its role in emerging countries; Section 4.3 suggests how global mining value chains could affect emerging countries, looking at some specific examples from the Latin American region; Section 4.4 discusses some policy experiences related to mining innovation in Latin America; Section 4.5 concludes.

4.1 Importance of Mining Activities in Emerging Countries

The mining sector greatly contributes to the economies of emerging countries, in particular in Latin America and sub-Saharan Africa. Table 1 (upper part) shows the proportion of ores and metals in merchandise exports along with rents from natural resources by income level and by geographical regions. This confirms that natural resources are more important among lower-income countries from Middle East and North Africa (MENA), sub-Saharan Africa and Latin America and Caribbean (LAC) regions. LAC and sub-Saharan Africa are most dependent on ores and minerals, whilst the MENA region’s main natural resources are oil and natural gas. In Latin America, despite a decline over the last decade, natural resources still represent a large share of GDP and exports (Table 4.1).

Table 4.1 Natural resources matter for GDP and trade for emerging and Latin American countries

| Indicators | Year | Level of income | Regions* | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Low | L- Mid | Upper | High | EAsia&P | E&CAsia | LAC | MENA | SubAfrica | ||

| Ores & metals exports (% of merchandise exports) | 2006 | – | 6.36 | 4.87 | 4.05 | 3.60 | 3.80 | 11.55 | 1.35 | 14.60 |

| 2016 | – | 4.09 | 4.23 | 3.98 | 4.23 | 3.16 | 11.31 | 2.27 | – | |

| Total natural resources rents (% of GDP) | 2006 | 15.72 | 8.5 | 9.64 | 1.98 | 2.57 | 1.98 | 7.35 | 31.91 | 16.21 |

| 2016 | 12.14 | 3.05 | 3.24 | 1.14 | 1.15 | 1.25 | 3.26 | 16.80 | 8.31 | |

| Indicators | Year | Latin American countries | |||||

|---|---|---|---|---|---|---|---|

| Argentina | Bolivia | Brazil | Chile | Colombia | Peru | ||

| Ores & metals exports (% of merchandise exports) | 2006 | 4.28 | 22.73 | 10.81 | 63.12 | 2.47 | 57.07 |

| 2016 | 3.34 | 36.55 | 10.47 | 51.32 | 1.22 | 52.34 | |

| Total natural resources rents (% of GDP) | 2006 | 5.92 | 16.33 | 4.89 | 21.42 | 7.02 | 13.04 |

| 2016 | 1.3 | 6.01 | 3.09 | 10.50 | 3.54 | 7.65 | |

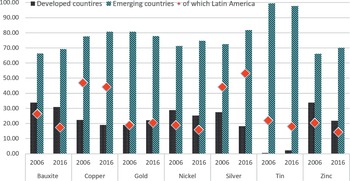

This general trend of the continued importance of mining resources is likely to persist, as reserves for key minerals are mainly present in emerging countries, and notably in Latin America (Figure 4.1 and US Geological Survey, 2015). Indeed, the share of production from developing countries has been increasing in the last decade (Figure 4.2).

Figure 4.1 Reserves of key minerals by countries’ income level (2015, %).

Note: The rest follows the IMF definitions.

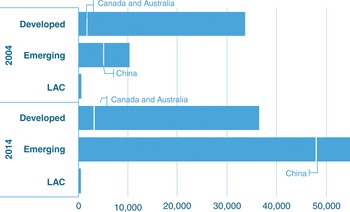

The reserves of minerals and the proportion of mineral production do not correlate with the innovation patterns than can be observed in patent data (see Figure 4.3). This is particularly true for Latin American countries that only represent a minor fraction of the mining patents, while developed economies are very active in this domain. Emerging countries as whole have seen a remarkable increase in the number of mining patents over the last decade, but most of this increase is due to China’s spectacular surge in this period.

Figure 4.3 Number of mining patent familiesFootnote 3, by country of origin (2004, 2014).

Note: The rest follows the IMF definitions.

Companies from developed countries are also disproportionally represented in the sample of larger and more international firms in the mining GVC (Figure 4.4).Footnote 2 However, companies from emerging countries have seen their participation increase in the past decade. LAC firms have grown in share in the mining segment, while other emerging economies – particularly China – have grown outstandingly in proportion of the mining equipment, technology and services (METS) segment. The increase of the Chinese METS companies correlates with a similarly impressive growth in patents. LAC companies’ patenting remains very modest in both GVC segments. In 2004, LAC mining companies accounted for almost 3 percent of patenting activity, which is related to the patenting activities of large mining companies like Codelco and Vale.

Figure 4.4 Mining GVC firms and patents by type of firm and region (2004, 2014)

Note: % at the top of the bars represent the proportion of patents by LAC. Region determined by country of origin. Emerging countries exclude LAC. Detailed figures refer to LAC share.

4.2 Innovation in the Mining Sector

We adopt here a broad definition of innovation that includes technological and non-technological innovation to understand the mining sector. This includes a wide range of new products, processes, marketing methods, business models, organizational structures and new sourcing methods. Today, extending mining global value chains involves high tech equipment and service activities that require local specific knowledge and knowhow, opening up opportunities for local suppliers to upgrade their capabilities.

It is generally acknowledged that the mining sector has the following characteristics: (1) it is capital intensive, (2) miners are price takers, and (3) mining creates intense local interactions and impacts. These features greatly influence the patterns of innovation for mining companies and suppliers due to the several reasons underlined in other chapters of this volume.

First, in most cases, the capital-intensive feature of mining implies large investments upfront.Footnote 4 This self-selects those who can invest in starting a mine, limiting them to large private or public corporations. The large-scale investment is usually followed by large-scale operations whose profits tend to rely on economies of scale. These conditions limit the type of suppliers to those who can respond to large-scale demand. The large scale and long time span of operation also contribute to risk averse and conservative technology choices. The life cycle of mines – typically 20 to 30 years – further slows technological change as the change must coincide with the mine’s investment cycle. The mining companies’ time lag in taking up new technologies has been estimated as 13 years on average (Reference Barnett and LopezBarnett and Lopez, 2012). In other words, technological innovation in this sector has many restrictions due to the way business functions.

Second, the price of mineral products is determined by the global market as these are undifferentiated commodities. The mining companies, therefore, are price takers. This condition makes research and development (R&D) for adding value to product highly irrelevant because the price does not reflect the efforts exerted. On the other hand, innovation could be important for cost reductions of the production process, the only factor under firms’ control, especially in times of decline in global prices. Some initial evidence appears to suggest that innovation occurs in such circumstances, often in the form of better organization of works, production processes and expanding domestic backward linkages to compensate for loss of profit (Reference Confraria and VargasCalzada and Iizuka, 2019).

Improvement in production processes is mainly achieved through collaboration with external actors, often including different types of METS firms. This appears to occur in areas such as the following: (1) acquisition of technology embodied in machinery from large multinational firms (Reference Lee and ProwseLee and Prowse, 2014; Reference KaplanKaplan, 2012); (2) outsourcing (i.e. R&D spin-off) in finding fully disclosed problems with high-tech suppliers and start-ups; (3) open source collaboration, involving tech start-ups, research centers, universities and industrial organizations for finding short-term specific solutions; and (4) collaborative ventures for R&D long-term solutions, involving suppliers, universities, research centers and other mining firms (e.g. Komatsu and five research centers in Australia with Rio Tinto).

Moreover, innovation in the mining sector often faces some restrictions due to the physical infrastructure of the mine (e.g. scale of architecture, width of corridors, layout and technological level of equipment installed etc.) designed at the start of the mine’s life cycle, that can set certain limits to how many changes can be introduced at a later stage (Reference CalzadaCalzada, 2018).

Third, mining activities have intense socio-economic and environmental impacts on local and regional communities. As the mines are usually located in sparsely populated regions, the large-scale operation of mining activities can create both positive and negative disruptions (Reference Katz and PietrobelliKatz and Pietrobelli, 2018). The absence of appropriate regulatory measures, policies and especially institutional capabilities may cause negative impacts for the local society. This may subsequently hamper the sustainable operation of the mine. On the other hand, mining activities can generate positive outcomes insofar as they are coordinated and well integrated into the local and regional economies. Collaborative relations between miners, suppliers and other knowledge-related organizations can be achieved more easily where there is a clear and coherent regional development plan. One of the important contributions of mining activities is the generation of employment and the creation of entrepreneurial activities. As mining industries have the tendency to use the METS sector for various purposes, linking mining operations to local suppliers can encourage industrial activities and upgrade their capacities. In this context, interactions with other local actors such as R&D centers, universities, financial institutions and firms become critical. In countries like Australia and Canada, industrial associations provide various forms of support in building innovation ecosystems and promoting linkages and technological and managerial capabilities (see Chapters 11 and 12).

Innovation in the Mining Sector in Emerging Countries

The mining sector can offer new opportunities for the development of resource-rich countries via generating employment and economic activities, as well as foreign direct investment, as can be seen from the successful examples of Australia and Canada. However, it is still an open question whether it is possible to develop mining engineering, technology and services domestically in emerging countries, in light of the special characteristics of innovation.

Earlier examination of the characteristics of innovation in the mining sector revealed that this sector has both favorable and unfavorable characteristics for emerging countries. The favorable characteristics include the requirement of close collaboration between mining companies and their local suppliers in solving location-specific productive issues. Moreover, the speed of technological adoption is slow, with a focus on incremental improvements of the processes and organization of production. Local specific knowledge (i.e. geological conditions, access to public utilities, presence of indigenous population) has a special value to solve location-specific problems that may directly or indirectly affect the productive process. These characteristics could, in principle, favor firms in emerging countries because they allow learning through interaction, catching up and substantial non-technological innovation.

On the other hand, there are some features of the mining sector that could hinder firms from taking full advantage of innovation in emerging countries. The main factors include the following: (i) the large size/scale required for supplies and services, with this size asymmetry affecting the negotiation process between mining and METS companies; (ii) the large financial requirements to finance large-scale exploration and exploitation investments upfront; and (iii) the complexity of some technical problems which may require highly technical knowledge and expertise with sophisticated capital equipment and machinery. The poor access to financial resources, know-how, technical expertise and negotiation power that characterizes many firms in emerging countries, together with the difficulty of coordinating efforts and setting up collective actions, make it hard to generate innovation and benefit from it in the mining sector.

4.3 Lessons from Latin American Case Studies of Innovations in Mining Value Chains

Traditional development and innovation literature has often given a pessimistic picture of the development impact of natural resources and mining (Reference HirschmanHirschman, 1958; Reference PrebischPrebisch, 1950). Such an opinion has been based on various explanations, arguing that mining is often an “enclave”, that large mining operations tend to be controlled by multinational corporations which perform little local innovation and govern their value chains hierarchically to the disadvantage of local suppliers, or that natural resources would induce “Dutch disease” imbalances and rent seeking (Reference Corden and NearyCorden and Neary, 1982; Reference VenablesVenables, 2016). However, in recent years, mining companies have increasingly organized their activities along global value chains and this may offer the advantage of strengthening linkages among firms and other actors, and avoid the “enclave” pattern that used to prevail in the past.

Global Value Chains

The term “global value chain” refers to the full range of activities that firms and workers carry out to bring a product or service from its conception to its end use, recycling or re-use. These activities include design, production, processing, assembly, distribution, maintenance, disposal/recycling, marketing, finance and consumer services. In a global value-chain setting, these functions are distributed among many firms in different countries. In this context, “lead firms” are groups of firms that operate at particular functional positions along the chain and that are able to shape who does what along the chain, at what price, using what standards, to which specifications, and delivering at what point in time (Reference Gereffi, Humphrey and SturgeonGereffi et al., 2005; Reference Ponte and SturgeonPonte and Sturgeon 2014).

Understanding the opportunities and drawbacks that suppliers may suffer from integration into a GVC requires knowledge of how GVCs are governed through a specific division of labor between lead firms and other actors, and how governance arises and is managed (Reference Gibbon, Bair and PonteGibbon et al., 2008). For example, it has been noted that a more hierarchical governance of GVCs in Latin America has hindered innovation and upgrading processes in suppliers (Reference Giuliani, Pietrobelli and RabellottiGiuliani et al., 2005; Reference Pietrobelli and RabellottiPietrobelli and Rabellotti, 2007). The concept of GVC governance is based on the observation that value chains are rarely coordinated spontaneously through market exchanges (Reference Gereffi, Humphrey and SturgeonGereffi et al., 2005; Reference Gibbon, Bair and PonteGibbon et al., 2008). Instead, they are governed as a result of strategies and decision-making by specific actors, the lead firms that manage access to final markets globally, but also at regional and national/local levels. Examining GVC governance then means studying the content and the management of these decisions across all suppliers and sub-suppliers, the strategies behind the decisions taken, the management methods chosen to implement them, and the systems through which their outcomes are monitored and implemented (Reference Ponte and SturgeonPonte and Sturgeon, 2014).

Furthermore, from a broader perspective, mining GVC governance is also shaped by actors that do not directly produce, transform, handle or trade products and services – such as civil society organizations, social movements, consumer groups, networks of experts and policymakers (Reference Katz and PietrobelliKatz and Pietrobelli, 2018).

Involvement in GVCs can offer opportunities for the suppliers to innovate. In the mining sector, a new context is emerging, which is opening new opportunities for innovation and fruitful linkages between lead firms and METS firms which did not exist before (Reference PérezPerez, 2010; Reference AndersenAndersen, 2012; Reference Marin, Navas-Aleman and PerezMarin et al., 2015). These new opportunities are associated with a larger and more diversified demand for natural resources, new knowledge and technology advances applicable to these sectors and outsourcing along GVCs, together with the search for local technological solutions and an increasing pressure to innovate to reduce environmental impact (Reference DantasDantas, 2011; Reference Iizuka and KatzIizuka and Katz, 2015; Reference Morris, Kaplinsky and KaplanMorris et al., 2012).

The results from a variety of new studies in the emerging countries of Latin America (Reference Pietrobelli, Marin and OlivariPietrobelli et al., 2018) indeed confirm these ideas and suggest that some local METS firms carry out important innovative activities. They have developed advanced levels of innovation capabilities, reflected in patents, new product developments, international awards, exports of goods, services and technology, and technologies in use. However, this same evidence reveals that local suppliers’ innovative activity has not emerged out of rich linkages between the suppliers and the mining companies, as sometimes happens in GVCs (Reference Pietrobelli and RabellottiPietrobelli and Rabellotti, 2011). Large mining companies have rarely built formal long-term linkages and commit themselves to joint innovation with local suppliers (Reference MolinaMolina, 2018; Reference StubrinStubrin, 2018). Instead, they tended to rely on established suppliers, and when new technological challenges emerged, they relied either on solutions coming from headquarters based abroad, or on their first-tier suppliers. In other words, value chains with the typical characteristics of mining GVCs, may have governance structures that could to some degree generate a market failure for innovation. This is particularly true in emerging countries where the local and national innovation system may not provide the underlying knowledge base for the suppliers to “upgrade” into the possible technological opportunities.

In spite of these difficulties, a new potential for innovation in mining providers is apparent, and derives from demand for innovation coming from large mining companies and often related to local specific contexts. Moreover, such potential also derives from the supply side, in terms of technological opportunities related to the use and the recombination of technologies from different domains, and from the active attitude of local innovative suppliers investing in capabilities (Reference Morrison, Pietrobelli and RabellottiMorrison et al., 2008).

The key for emerging countries with an active mining sector lies in successfully upgrading and diversifying economic activities. The upgrading in GVC entails three possible avenues (Reference Gereffi, Humphrey and SturgeonGereffi et al., 2005): (1) product and process upgrading at the same stage of the chain; (2) functional upgrading, moving to higher value-added position in the chain; and (3) moving to different chains using the knowledge and capabilities acquired in a GVC. This means that overcoming obstacles and making full use of favorable characteristics of innovation in the mining sector can be a springboard for development. Collaborative innovation systems are essential to strengthen knowledge flows, fix information asymmetries and encourage interactive and continuous learning (Reference Lundvall and LundvallLundvall, 2010; Lema et al., 2018). The selected examples analyzed in the following section reveal that some opportunities are indeed emerging, and this is relevant for many other countries in Africa and Latin America with abundant mineral resources.

Incentives to Innovation Coming from Demand

Upgrading GVCs requires active investments in innovation by firms, which are usually driven by adequate incentives. Chapter 1 explained how some of the incentives for innovation in mining and METS companies come from specific demands, such as, for example, the decreasing productivity of existing mines. In Peru, for instance, due to the depletion of clean deposits (deposits with low levels of impurities), mining companies are dealing with deposits of copper, silver and gold which need to be increasingly cleaned. Moreover, mining activity in both Peru and Chile is performed at high altitudes. The La Rinconada mine, in Puno, at 5,100 meters above sea level, is the highest in the world (Reference Molina, Olivari and PietrobelliMolina et al., 2016) and similar conditions prevail in Chile. Existing equipment and solutions underperform, and there is a need to adapt them or develop new ones tailored to local conditions. Similarly, in Brazil, most of the activity has been moved to deeper mines, where the treatment of the mineral is more complex (Reference Figueiredo and PianaFiguereido and Piana, 2016). These conditions pose pressing demands for innovation.

Additional demands for innovation come from the social and environmental challenges faced by mining companies. Local communities are concerned with livelihood security, environmental degradation and the perception that the wealth created is not fairly shared. Governments react by introducing more stringent environmental regulations and requiring some local involvement in decision-making (Reference Katz and PietrobelliKatz and Pietrobelli, 2018). Again, the demand for innovative solutions and sustainable methods of production is rising fast (see Chapter 6).

The very hierarchical structure of the mining GVCs analyzed, being characterized by important power and resources asymmetry (Reference Arias, Atienza and CadenmatoriArias et al., 2014; Reference Pietrobelli, Marin and OlivariPietrobelli et al., 2018), is posing substantial problems for the upgrading of local suppliers.Footnote 5 We identified linkages with extremely poor potential to encourage innovation in mining GVCs: large mining companies are in general quite resistant to trying new solutions that have not been tested worldwide. They demand successful pre-testing conducted in several mines before even trying it, particularly when the solution comes from domestic suppliers (Reference Pietrobelli, Marin and OlivariPietrobelli et al., 2018). In Peru, it has been detected that the communication channels with the lead mining firm are only available for METS firms that are already working with the mining company (Reference MolinaMolina, 2018). It is the suppliers themselves that incur the transaction costs needed to approach the mining companies and offer their services, and often lack these capabilities, even though this is intrinsically different from lacking purely technological capabilities.

In sum, at least for Chile and Peru, our results from case studies (Reference Pietrobelli, Marin and OlivariPietrobelli et al., 2018) confirm that exchanges of information within the mining GVCs happen, but they are mainly informal and mostly focused on the identification of the problem, rather than on finding a solution. Indeed, few exchanges were reported during the R&D stage. The experience of Brazil seems to suggest partly different conclusions. Reference Figueiredo and PianaFigueiredo and Piana (2016 and Reference Figueiredo and Piana2018) found evidence of rich “learning linkages” between Vale and its suppliers, as well as between Vale, some Brazilian universities, and sometimes firms from different industries (e.g. Petrobras). They report that from 2009 to 2012 Vale developed 161 R&D projects with universities (151 of them from Brazil) with an estimated value of about USD 88.8 million. In some instances, it appears that Vale encouraged the development of learning linkages between other MNC subsidiaries and local mining suppliers, for example, with regard to the development of belts to transport iron ore (Reference Figueiredo and PianaFigueiredo and Piana, 2016: 140). Important learning linkages also occurred with public R&D centres and sectorial institutions, for instance, with the Mineral Resources Research Company (CPRM), a government organization that seeks to generate and disseminate geological and hydrogeological knowledge in Brazil (Reference Figueiredo and PianaFiguereido and Piana, 2018). Chapter 8 deepens the analysis of innovation practices in Brazil with a focus on the role of Vale.

Incentives to Innovation Coming from the Supply Side

Incentives to innovation may also come from the supply side (i.e. the new availability of scientific discoveries, new technologies and equipment, new forms of organization). Existing studies have documented how recent advances in knowledge have opened new technological opportunities also for the mining industry (Reference Pietrobelli, Marin and OlivariPietrobelli et al., 2018, and the studies contained in the same special issue). These are related to the massive advances in information and communication technologies (ICT), computer vision systems, satellite and other remote sensing applications, and advances in molecular and synthetic biology for bioleaching and bioremediation for copper and gold. Such supply-side incentives seem to be more effective in mining GVCs. In what follows, we will see some examples of this emerging tendency.

In Chile, the company Micomo developed highly innovative monitoring technologies through optical fiber that help extraction processes, and obtained two patents and one international award (Reference StubrinStubrin, 2018). Power Train technologies entered the market with new remote-control systems for trucks that operate at very high temperatures, required for performing mining at high altitudes. High Service from Chile obtained three patents related to remote monitoring and wireless communication which allows predicting wear points for key equipment and in this way anticipate replacements and avoid having to stop operations, which can cost the company around USD 150 thousand per hour. Geoambiente, from Brazil, entered the mining GVC developing sophisticated geological maps, sensors and radar images that help in the exploration phases, predicting contents of minerals and areas of erosion and are useful to monitor environmental impact (Reference Figueiredo and PianaFigueiredo and Piana, 2018). The innovativeness of the company made it the largest Google partner in Brazil and helped it diversify into markets and countries beyond mining.

Another important area of new knowledge opportunity that companies are exploiting is new materials. Neptuno from Chile, for instance, developed pumps for one of the biggest open-pit mines in the world and adapted them to operate at 4,500 metres above sea level by improving materials, incorporating superior alloys and advanced engineering thermoplastic and extending the life of pumps. This gained Neptuno ten national and three international awards. One company from Brazil became a supplier of Vale developing new metal alloys, with longer durability at high temperatures (Reference Figueiredo and PianaFigueiredo and Piana, 2018). Using the same kind of opportunities, Verti from Brazil developed dust suppressants that use glycerine left over from biodiesel plants, and new technological routes to recycle materials and to treat wastewater. Aplik from Chile has entered the mining GVC exploiting the technological opportunity offered by robotics. One of the main innovations of the company is a new tool for controlling irrigation at key parts of the exploitation process, helping to detect failures through irrigation maps and an alarm system. This new system is in the process of being patented and has received several national and one international awards (Reference StubrinStubrin, 2018).

The application of biotechnology is making the mining process more efficient and cleaner. Aguamarina is a pioneering Chilean company that managed to enter the value chain by developing first bioleaching (i.e. the extraction of metals from their ores through the use of living organisms), and then expanded into new product lines, all biotechnology-based solutions for mining companies. The main areas of activity of Aguamarina are biolixiviation, biocorrosion, bioremediation, bioreactors, water treatment and dust control (Reference Benavente and GoyaBenavente and Goya, 2011). For example, Aguamarina created unique solutions for dust control based on bacteria and microalgae. This was a new solution for a long-standing and crucial problem as mining operations create enormous amounts of dust that affect the environment, the maintenance of the machinery and even the health of mine workers and inhabitants of nearby communities. The company obtained three patents in the United States, and won five national awards.

The integration of different areas of knowledge also creates opportunities for the development of completely new or adapted products. Neptuno develops novel, innovative pumps combining knowledge about new materials, chemistry, engineering and 3D printing; Innovaxxion developed the new technology known as Earless – which reduces scrap waste in the copper mining process from 20 percent to 10 percent – by integrating knowledge about mechanical engineering, robotics and electrical engineering; Aplik integrates knowledge about electronics, informatics, mechanics and metallurgy; Geoambiente’s unique results derive from combining traditional knowledge about geology with new knowledge related to communication.

Sometimes the integration of different areas of knowledge is useful to improve and upgrade existing tools and machinery. For example, Exsa in Peru, combining knowledge about engineering, explosives, new materials and chemistry developed a new method of rock fragmentation (Quantex) that generates savings of up to 20 percent of total costs and has positive environmental impact. The technology has been patented in Peru and the United States (Reference Molina, Olivari and PietrobelliMolina et al., 2016). Resemin developed special jumbos for narrow veins, and for coping with the extreme environmental conditions of underground mining in Peru by combining different elements of knowledge about metalworking, geology, engineering and IT (Reference MolinaMolina, 2018). Some of the jumbos developed by the company, like the Muki, are now patented in the United States.Footnote 6 Although the largest mining suppliers have developed drilling jumbos to operate in these veins, they have faced limitations to run in sections of 1.8 m width or less; this has never been the top priority for these suppliers. Narrow veins is an important niche market that Resemin took advantage of when they introduced the Muki. This also meant increased mining productivity, drilling a 2.4 m. hole in 40 seconds, unlike traditional methods which take 7 minutes, and mechanization in tunnels, which improves safety of the operators (Reference MolinaMolina, 2018).

One important result that emerges from studies such as those reported here is that technological opportunities appear to have been exploited mainly in areas where more experienced multinational suppliers did not have the incentive or could not meet the challenge.

Local Suppliers Strategies and Capabilities

Although new demands for innovative solutions as well as technological opportunities are emerging in mining value chains, this potential appears to have been exploited only by a handful of local firms that developed strong scientific and technological capabilities and opened specific channels of communication with lead firms and large first-tier providers. In other words, firm-level strategies to develop capabilities also play a central role.

In Reference Pietrobelli and OlivariPietrobelli and Olivari (2018), all the firms interviewed share a characteristic of substantial levels of investment in advanced levels of scientific and technological capabilities. They all perform R&D and carry out other high-level search and innovation efforts. Many suppliers from Chile invest on average almost one quarter of their sales on innovative activities and employ good shares of their total employees in R&D (Reference StubrinStubrin, 2018). In Peru, the interviewed firms – in different mining suppliers’ sectors – declared that they employ between 3 and 4 percent of their total labor force in R&D (Reference Molina, Olivari and PietrobelliMolina et al., 2016).

Neptuno Pumps invested heavily in the capabilities to adapt pumps to specific geographical conditions, and thereby allowed energy savings of up to US$ 650,000 a year. A similar case is that of Power Train Technologies, which develops and sells diesel engines and other engines adapted for trucks that operate at high altitudes and in extreme weather conditions. As pointed out by the company managers, engines developed by large MNCs do not work in these conditions, and the MNC would not find it profitable to invest and adapt its engines. The engines adapted by the local Chilean supplier managed to deliver a product that saves up to 10 percent in fuel consumption, improves performance and reduces carbon prints.

One of the most successful upgrading firms is Resemin, a leading global supplier of drilling equipment in the underground mining equipment sector in Peru (Reference Bamber, Fernandez-Stark and GereffiBamber et al., 2016, box 4). The company’s upgrading trajectory began as parts supplier, shifting to parts manufacturer, followed by final equipment production, using reverse engineering and finally own engineering for new equipment design. The specific conditions of mining in certain areas of Peru, where veins are very narrow and the climatic conditions extreme, favored Resemin upgrading processes.

Drillco Tools develops percussion hammers and drills specially adapted to the type of rock where they are used. In the early 1990s, the company developed customized products required to enter the GVC. Interestingly, the company started adapting products to the specific conditions of Chile, but currently, and with the same approach, it sells hammers and drills through its subsidiaries in Brazil, the United States, Peru, Italy and South Africa (Reference StubrinStubrin, 2018). The firm exports 77 percent of its production, and offers an interesting case of upgrading into different GVCs in different countries. Linkages with clients to understand the specific requirements prevailing in each location were crucial.

In sum, there are many examples of mining suppliers in emerging economies that reached remarkable levels of innovative technological capabilities. However, many of them had to overcome the difficult challenge of managing their integration into the GVC and of creating their own markets to take full advantage of the innovations developed. This includes not only the creation of new technology but also the establishment of the conditions for the transaction (the contracts and agreement on the value of the innovation, on the rules of the game, on the distribution of benefits). This is specific to mining as well as other sectors where the availability of new knowledge and technologies from other sectors, and new forms of organization in value chains, are transforming the nature of business. This is true, for example, for precision farming and for seed production in several middle-income countries (Reference Lachman and LópezLachmann and Lopez, 2018). However, this process appears to be still emergent in many instances, and often hindered by the hierarchical and conservative governance of the GVCs discussed.

In conclusion, new opportunities for innovation are emerging in the mining sector. Some may be patentable, but many others are not, and they are more related to the organization of the business and of the network of transactions with different actors along the value chain. Technology opportunities coming from both demand and supply, and especially the latter, are very strong and related to basic science. Such opportunities call for advanced firm-level capabilities that are not only technological but also related to value chain integration and to the creation of a new market (Reference Marin, Dantas and ObayaMarin et al., 2016). Groups of innovative suppliers are emerging in Latin America. However, hierarchical value chains dominated by few large firms and the resulting poor linkages often block the diffusion of innovations and hinder suppliers’ development. This often prevents innovation and success from spreading to a larger number of local companies.

Many research challenges remain open and deserve attention in the future. Thus, the capabilities complementary to production and necessary for market access and GVC integration need to be better understood. Similarly, the role of the various tiers of suppliers and their relationships with other local providers deserves future research. The role of public policies also needs to be explored in much greater details in a context characterized by remarkable uncertainties and by the coexistence of many actors with different and sometimes potentially clashing interests. These include civil society and the long-term interests of sustainability and environmentally sound management of the resource, lead-firms and their tiers of suppliers, and the inter-generational distribution of costs and opportunities deriving from the mining industry.

4.4 Implications and Selected Policy Experiences in Latin America’s Mining Sector

The innovation cases developed by suppliers presented in Section 4.3 have been an exception rather than the rule in the mining industry in LAC. Since these examples showcase the potential benefits for domestic suppliers of more innovation in the industry, some mining countries have made attempts to accelerate innovation by establishing programs to support innovation in mining suppliers. In this section, we focus on the lessons learned from one of the most famous examples of this type of initiative: The World Class Suppliers (WCS) program in Chile.

The WCS program was designed to try to alleviate the transaction costs and market failures that hinder the development of the innovation market. On the one hand, large mining companies know their operational problems but codifying them into terms that can be understood by external parties is a costly endeavor, which may not necessarily be always profitable. On the other hand, even when some of the operational problems are codified, potential suppliers who may have the capacity to solve them may not know of these opportunities or efforts to find these new opportunities may be too costly. Furthermore, the tacit knowledge component of each operational problem gives rise to asymmetries of information between the mining companies and suppliers. The latter is exacerbated when suppliers are providing a service (Reference RubalcabaRubalcaba, 2015). The program is built around the effort made by mining companies to codify part of their operational problems and make them accessible to potential suppliers. On top of that, the platform through which the program is organized also allows suppliers to reduce their transaction costs, since they do not need to rely only on their resources to approach mining companies and establish a new commercial relationship.

The World Class Suppliers (WCS) Program in Chile

The WCS program is a public–private initiative, launched in the late 2000s, whose primary objective is to promote the technological development of knowledge-intensive mining suppliers (KIMS) through increasing the demand for innovations and promoting internationalization. This initiative was developed entirely by the private sector. Indeed, the multinational company BHP Billiton created this program in 2008 and two years later Codelco, the state-owned and largest copper mining company in Chile, joined the program.

The program works as follows (Reference NavarroNavarro, 2018). The mining companies participating in the program identify a list of operational problems suitable to be solved by a subcontractor. The list of problems is filtered by considering criteria relevant to the performance of mining companies, such as the potential economic gains, expected timeframe, and perceived risks of new solutions, but also potential benefits to suppliers, such as scalability of the potential solution and suitability of that solution to be cocreated with the mining company. The final projects portfolio is uploaded to a website, managed by the local think-tank Fundación Chile, including a detailed description of the magnitude and characteristics of each of the operational challenges. Select companies are invited to apply, but the list of challenges remains open to all potentially interested suppliers.

Proposal submissions are collected and prescreened by the mining company and by Fundación Chile, which plays the role of an honest broker of the scheme. The preselection process is mostly based on the estimated capabilities of applicant firms, and the mining company manages the final list of proposals. When minimum criteria are met, the mining company selects a “winner” and the process of negotiation of a contract begins. Although the detail of the contracts of the selected projects are kept private, because they are co-innovation projects, mining companies are expected to provide access to facilities and non-pecuniary resources during project development. Besides bringing its resources to the project, the selected supplier may also apply to public financial support. Specifically, the Chilean Development Agency, CORFO, favors mining suppliers participating in the program when these companies apply to innovation support schemes. A critical characteristic of the program is that it is expected that the selected supplier retains ownership of any intellectual property created during the project, thereby, facilitating the supplier’s development through commercializing and exploiting the new (protected) knowledge.

The implementation of the projects typically lasts between 15 and 27 months (Fundación Chile, 2012). Completed projects lead suppliers to receive technical assistance on commercialization of the recently developed innovation. The mining company provides the financing for this consultancy, while domestic accelerators and business consultants offer their services.

Although the program lacks a proper impact evaluation, some detailed results have been examined by Reference NavarroNavarro (2018). Between 2009 and 2016, 92 projects were assigned to 75 suppliers.Footnote 7 The estimated pool of mining suppliers in the country ranges between 4,500 and 6,000 (Comisión Nacional de Productividad, 2017). Thirty-one of the 75 suppliers participating in the program had applied for patents before participating in the program (Reference NavarroNavarro 2018). This high rate of patent-active firms contrasts with the 10 percent of the product innovative companies that file for patents in the rest of the Chilean economy.Footnote 8 Even within the subsample of experienced patenting companies, merely one of every five companies filed for new patents after the completion of the projects. Although only indicative, the latter reflects the non-patentable nature of a not-trivial share of the operational challenges of large mining companies.Footnote 9

Analysis and Performance

The results of the program suggest that addressing these market failures has had some impact on a select group of suppliers. Nevertheless, the complex interaction between buyers and suppliers in the mining GVC is the subject of other market mechanisms that can be more of a deterrent to the development of domestic knowledge-intensive mining suppliers (Reference Urzúa, Wood, Iizuka, Vargas and BaumannUrzúa et al., 2017). One of the main issues however, remains the insufficient supply of local knowledge. R&D expenditures and researchers involved in the Chilean mining industry show a significant lag with respect to countries like Australia (Reference Meller and ParodiMeller and Parodi, 2017), there appears to be low involvement of multinational mining companies in R&D activities near their operations (Reference Pietrobelli, Marin and OlivariPietrobelli et al., 2018), and local universities do not contribute to a large extent to the industry (Reference Confraria and VargasConfraria and Vargas, 2019). These “symptoms” may be linked to business environment conditions that require interventions that go beyond a single program to be adequately addressed. For instance, the bias of mining multinationals toward conducting R&D in home countries is a response to efficiency in knowledge management and returns on investments. This type of company conducts R&D in host countries only when there are opportunities to increase their corporate knowledge from these external sources (Reference Belderbos, Leten and SuzukiBelderbos, Leten and Suzuki, 2013; Reference Belderbos, Lykogianni and VeugelersBelderbos, Lykogianni and Veugelers, 2008). The lack of incentives in academia to engage in industry research may also be linked to the rewards scheme of the academic system for researchers in local universities. Finally, capabilities failure in domestic suppliers limits the number of companies that would be able to engage in innovative projects that could eventually lead to knowledge-driven growth.

Although the WCS program has allowed, to a certain extent, the demand for innovations to increase, the relatively small number and size of the projects contracted under the program suggest the existence of other restrictions to innovation on the demand side. We speculate that this may be explained by the existence of principal-agent problems inside the large mining companies. While the WCS program responds mainly to a need for corporate social responsibility, and is managed by the corresponding departments, procurement decision-making is driven by operational optimization, considering risk management and efficiency. Therefore, the procurement incentives of large mining companies are not necessarily aligned with the program (Reference Meller and ParodiMeller and Parodi, 2017).

In brief, the WCS program was an innovative initiative to lessen the asymmetries of information between mining suppliers and large mining companies, driven by the operational problems of the latter. Some results show that indeed certain companies benefited from the interaction, but generally the scheme has done little to accelerate the growth of domestic METS firms or the industry. Some other constraints in the market hinder the intensity of the collaborations between mining companies and suppliers, and the number and capacities of the latter. As Reference Meller and ParodiMeller and Parodi (2017) remark, regardless of the design and effectiveness of the WCS program, the size of the interventions is not commensurate with the magnitude of the challenge it is seeking to address.

New Policies

Since implementing WCS-type programs is not a sufficient condition to make an impact at a more aggregate level, the Chilean government developed a new initiative to leverage the mining industry to develop knowledge-intensive companies. Backed by the learning process on WCS programs and previous national- and regional-scale policies like the Cluster Development Program and the Regional Development Agencies in the 2000s (Reference Bravo-Ortega and MuñozBravo-Ortega and Muñoz, 2018), the Chilean government launched the Alta LeyFootnote 10 program in 2015.

Alta Ley is a smart specialization strategy program (Reference ForayForay, 2017), led by the public sector through CORFO, the Ministry of Economy and the Ministry of Mining. Besides focusing on promoting the development of the METS sector, this program also targets productivity increase in the industry. The board of the program is made up of members of the public sector, NGOs and universities, and more importantly, the private sector. The latter is represented by the major mining companies of the country and representatives of the mining suppliers’ industry associations.

The primary function of the program is to coordinate efforts to match the supply of knowledge with the specific knowledge solutions demanded in the industry. Mining firms demand knowledge and technological solutions that are not always necessarily provided by other firms in the industry. The expansion of the WCS program aims at better matchmaking between demand and supply of mining-related knowledge. Alta Ley impacts the supply of knowledge by facilitating coordination between different industry stakeholders to increase the size and efficiency of public and club goods in the industry (Reference Castillo, Correa, Dini and KatzCastillo et al., 2018).Footnote 11 On the demand side, the Alta Ley program identified the five main drivers of innovation for the industry.Footnote 12 The strategy is reflected in roadmaps that would guide the decision-making of stakeholders participating in the initiative. The implementation is made through programs designed by the Alta Ley program team. The financing comes from competitive applications to public sources.Footnote 13 One of the six programs currently implemented is the Expande program, which is the continuation of the WCS program (Reference Meller and ParodiMeller and Parodi, 2017).

The Expande program is based on the WCS program and inspired by the open innovation strategy concept (Reference ChesbroughChesbrough, 2003) (see Chapter 9). Therefore, its operational mechanism goes beyond producing a bilateral transaction between a single innovation provider and the mining industry. Indeed, the main difference with the WCS program is that METS firms are also allowed to provide solutions to operational problems that have not been previously codified by any large mining company. On top of that, the main players of the industry are participating in the initiative and signaling the main productive challenges of the mining sector for the coming decades, and it also opens the supply side of innovation to new actors like universities, research centers and companies not previously working with the mining industry. Fundación Chile maintains the role of a broker but its performance becomes more critical, participating more actively in the production of information and matchmaking between mining and METS companies. Fundación Chile measures and surveys the local technical capacities that may be useful for the industry, while also translating the operational challenges of the industry to project-type potential suppliers. Since the Expande program has only been implemented for a short period of time, is it not possible to assess its outcome. However, at least in principle, by acting on both the supply and demand sides of innovation we should expect more projects than in the WCS program. However, there is no signal so far that the size of the program has been increased in a significant way, nor that the procurement policies of the large mining companies have been affected in any way.

Although Alta Ley has existed for a short time, from its design we may consider it a step forward toward solving the shortage of knowledge supply to the industry. Allowing coordination between large mining companies and signaling the main challenges of the industry to other actors of the system is expected to lower barriers to collaborative R&D and decrease the uncertainty of innovation investment decisions for the rest of the actors of the system. At the same time, better coordination between private companies and the government may increase the efficiency of the provision of knowledge and other public goods to the industry. The technological roadmaps are expected to align private and public research and innovation investments toward the leading technologies and operational challenges of the industry as a whole. Their scope and magnitude is expected to be large enough to increase knowledge investments and eventually, promote innovation to a significant extent.

In sum, as we notice the positive and original policy developments, it remains to be seen if the new public–private collaborative approach through smart specialization strategies succeeds in easing the primary constraints to get more intense and stronger interactions between domestic METS and large mining companies. Efforts like the WCS program, although valuable on its own as an innovative approach to connect mining companies with new suppliers, are not enough to lead the way toward a larger METS sector. We argue that the size of the industry and the potential gains require investments of a higher order of magnitude.

4.5 Conclusion

This chapter tries to broaden the scope and understanding of innovation in the mining sector, with a focus on emerging countries based on the experience of Latin America. The central underlying idea is that today innovation can foster growth of many countries endowed with natural resource in new ways that were not considered or not available in the past. New opportunities for innovation are emerging in the mining sector. Some may be patentable, but many others are not, and they are more related to the organization of the business and of the network of transactions with different actors along the value chain. Innovation may powerfully develop through the interaction and linkages between mining companies, their suppliers and other organizations active in the innovation system. Moreover, the new features of scientific knowledge applied to the mining sector (e.g. ICT, new materials, biotechnology) open new opportunities for new suppliers from emerging countries to enter and add value in mining GVCs.

In this chapter, we analyzed how some successful examples prove that these developments are real and offer new opportunities that were hard to visualize before. However, this does not reduce the role of public policies; indeed it promotes the need to rethink and innovate policy approaches, as the brief policy review revealed. Mining cannot become a true engine of growth for emerging economies unless linkages within mining value chains and beyond are enhanced and the system that produces the required advanced knowledge and capabilities is strengthened.