Introduction

As poverty persists in advanced welfare states some are advocating a radical change in approach. Long dismissed as utopian, a basic income (BI) as a potentially ironclad protection against financial poverty has gained more traction.

This paper examines what would happen if we introduced various versions of a BI in Belgium and the Netherlands, ranging from a modest one complementing most existing provisions to a generous one replacing many existing provisions. Could a BI reduce or even eliminate poverty? What would a BI do for the people who are financially worst off? Who would gain and who would lose? We thus specifically explore how a BI can be designed to reduce poverty. Obviously, this is only one of many goals motivating a BI (i.e. promotion of freedom and empowerment, simplification of the system, etc.).

Using microsimulation analysis, we examine in detail a range of BI schemes and compare their potential impact in Belgium and the Netherlands, countries that share important characteristics but also differ significantly in other respects, notably their tax-benefit systems and labour market institutions. This analysis is relevant to BI debates worldwide.

In contrast to common claims, it is not simply so that the higher the BI the ‘better’ the distributional consequences are, especially if income inequality and poverty reduction are goals. A low, ‘partial’ BI may make more sense than a fully fledged one that replaces most of what exists.

The exact specification of a BI matters a lot. Which parts of the existing tax-benefit system are maintained, and which are abolished, modified or replaced? Is a BI made taxable? Are amounts of other benefits affected by the BI? Such issues hardly feature in many BI debates, but, as we show, they are utterly important for outcomes.

Context matters, too. The impact of a BI, be it a low or a high one, depends on the characteristics of the existing system that it is (partially) replacing or complementing. Likewise, the socio-economic composition of the population may also matter, e.g. whether or not many people work, and in what kind of jobs they work. This, again, is a point that is often overlooked in BI debates where it is often assumed that the impact would be rather similar across countries, existing systems and settings. That is not the case at all.

Our analysis thus demonstrates that implementing a BI is far more complicated than many people, especially BI advocates, seem to realise. More importantly, this paper offers a framework for understanding, interpreting, and contextualising the potential outcomes of a BI. We bring our analysis to the level of fine-grained design, fostering an in-depth understanding of what implementing a BI would actually involve. The cross-country perspective adds a layer of richness here. Accordingly, the paper adds to the literature on antipoverty policies in advanced economies, especially the contentious potential of a BI in this respect. The analysis presented here is also highly relevant to the rapidly growing literature on public support for and the political feasibility of BI. Our results show there may well be a vast difference between what people imagine or suspect a BI would bring – for themselves and society as a whole – and what it would likely do in practice. The distributional outcomes of BI are in fact strongly dependent on usually unspecified design choices in opinion research.

The hidden part of the basic income iceberg

A considerable amount of literature has emerged on BI. Previous literature has mainly discussed the normative desirability (e.g. Bidadanure, Reference Bidadanure2019; Birnbaum & De Wispelaere, Reference Birnbaum and De Wispelaere2020; Van Parijs & Vanderborght, Reference Van Parijs and Vanderborght2017) and political feasibility of BI (e.g. De Wispelaere, Reference De Wispelaere2016; Martinelli & Pearce, Reference Martinelli and Pearce2019; McDowell, Reference McDowell2023; Perkiö, Reference Perkiö2020). Others used survey data to explore public opinions and attitudes towards BI and found quite substantial support levels among the population (e.g. Laenen et al., Reference Laenen, Van Hootegem and Rossetti2022; Parolin & Siöland, Reference Parolin and Siöland2020; Rincón et al., Reference Rincón, Vlandas and Hiilamo2022; Roosma & van Oorschot, Reference Roosma and van Oorschot2020; Stadelmann-Steffen & Dermont, Reference Stadelmann-Steffen and Dermont2020; Vlandas, Reference Vlandas2021). At the same time, in-depth interviews reveal that people still strongly adhere to the traditional deservingness criteria of control, need, and reciprocity (Rossetti et al., Reference Rossetti, Roosma, Laenen and Abts2020). Support among unions and organised labour, on the contrary, remains lukewarm (Cigna, Reference Cigna2022; Vanderborght, Reference Vanderborght2006).

There have also been several lines of empirical research on the possible impact of BI, particularly on poverty and employment. Researchers have, for example, looked at lottery winners to see what happens if people suddenly get free and unconditional money (e.g. Marx & Peeters, Reference Marx and Peeters2008; Picchio et al., Reference Picchio, Suetens and van Ours2018). A number of BI pilots have also been launched (e.g. Calnitsky & Latner, Reference Calnitsky and Latner2017; García, Reference García2022; Kangas et al., Reference Kangas, Jauhiainen, Simanainen and Ylikännö2021; Muffels, Reference Muffels, Laenen, Meuleman, Otto, Roosma and Van Lancker2021). Still, as insightful as these experiments are, they essentially run on money falling from the sky and do not tell us much about what it could do for poverty at the scale of an entire economy.

In the past years, microsimulation studies have entered the debate, seeking to provide an answer to this question. Microsimulation models have a long history in ex-ante policy analysis. They can reveal in detail the possible distributional and revenue implications both of current and alternative policies and cast light on the best approaches to policy design. This makes them fit to explore the trade-offs that arise from a BI, especially seeing it has not yet been implemented anywhere at the national level. Table 1 gives an overview of recent studies simulating a BI. There is some evidence that a higher BI tends to perform better in terms of poverty and inequality reduction, but overall, available results suggest a wide variety of potential outcomes, adding fuel to ongoing debates regarding its effectiveness and desirability as a policy reform.

Table 1. Selection of recent microsimulation studies on BI

We argue that the lack of consistency in expected outcomes can be ascribed to the multidimensionality of the ‘basic income’ concept. Although there may be a consensus on the core principles underlying a BI, its actual implementation can take on various forms and adaptations. Table 1 clearly conveys how every study seems to assume a different scheme, making the comparability of the results hard. For that reason, universal BI should be rather understood as a myriad of schemes that differ substantially along a range of policy dimensions than as one uniform policy. Key design dimensions include coverage, adequacy, uniformity, financing, integration, and accumulation. These dimensions interact in complex ways. Every choice matters, down to the very last policy detail. Moreover, BI schemes that are similar in level and design can still produce divergent outcomes depending on the country-specific context, especially the interplay with the tax-benefit system in place.

In this regard, it raises concerns that BI debates tend to focus on a limited set of issues only. Who is entitled? How high is the BI? But these issues merely constitute the proverbial tip of the iceberg, giving the illusion of a disarmingly simple idea. There is much more hidden under the sea line, notably all the policy choices that must be made (as visualised in Figure 1). Those choices go beyond the mere size of the benefit amount. Unless one is advocating the elimination of the entire existing tax-benefit system, it is especially important to consider which parts of the system remain, and how the BI will then interact with the remaining policies.

Figure 1. The basic income iceberg metaphor.

Throughout this paper, we establish that recognising the multidimensionality of the BI concept is crucial for understanding its vast and far from uniform range of potential outcomes. We empirically illustrate how the level of income provided, the design of the reform and the country-specific context in which it is implemented all determine the impact a BI can have on poverty and inequality. Rather than making sweeping claims either in favour of or against a BI, we demonstrate here that outcomes are strongly contingent upon these factors. This nuance is currently lacking in the BI debate, including much of the academic debate.

In doing so, we build on the work of the authors in Table 1, such as Browne and Immervoll (Reference Browne and Immervoll2017) and Martinelli (Reference Martinelli2020), to a certain extent replicating and validating their findings. Yet, our study differs substantially from what has been done so far in several aspects. To the best of our knowledge, the study conducted by Browne and Immervoll marked the first effort in exploring the outcomes of a BI in a cross-nationally comparative context. Our study serves as a useful complement and extension to their work. Although Browne and Immervoll’s scenarios were informative, they were for example not fully comparable as they depended upon the guaranteed minimum income (GMI) in each country included in their study. In contrast, our scenarios are designed to be fully comparable across countries, facilitating a more robust analysis of the impact of a BI in different contexts. Furthermore, while Browne and Immervoll’s focus primarily centred on describing the patterns of winners and losers, our study sheds light on the impact of a BI on poverty and inequality. Our study further distinguishes itself by focusing on different countries, namely Belgium and the Netherlands, two interesting contrasting cases. The paper by Martinelli, on the other hand, deals with analysing the critical factor determining the potential impact of a BI in a single-country setting. In this regard, our paper aligns well with Martinelli’s work, as we also delve into the intricacies of implementing a BI. Martinelli describes and illustrates the broad trade-offs in BI policy design with regard to the objectives it serves, being affordability, adequacy, and the advantages of a radically simplified welfare system. Our study goes further and demonstrates that even seemingly minor choices can significantly influence the poverty and inequality impact of a BI. As to the remaining literature, most studies emphasise only the generosity of the BI amount provided, while (probably inadvertently) overlooking the importance of design and national context. So while previous research has explored various aspects of BI, our study is the first to bring together how level, design, and context all shape the effectiveness and redistributive outcomes of a BI.

Modelling basic income

We use tax-benefit microsimulation modelling to explore the costs and outcomes of introducing a BI in the Netherlands and Belgium. Essentially, this type of modelling combines data on household incomes and characteristics across the population with the tax-benefit policy rules and can be used to answer what-if questions (e.g. in the case of a BI).

We utilise the tax-benefit microsimulation EUROMOD. EUROMOD calculates for all EU member states, in a comparable manner, the effect of cash benefits, direct taxes, and social insurance contributions on household incomes in line with national tax-benefit rules in place. Accordingly, we can compare net disposable incomes of households across the different policy scenarios with and without a BI in place. The baseline scenario corresponds to prevailing policies in 2019 (i.e. status quo), and the hypothetical BI scenarios are described in more detail in the next section.

We make use of both model family and empirical microsimulation modelling. While most studies either focus on one approach or the other, we choose to combine the strengths of both. For our distributional analyses, we make use of representative household survey data, notably the European Union Statistics on Income and Living Conditions (EU-SILC) from the year 2019 (Belgium) and 2018 (Netherlands), which were the most recent available datasets at the time of the analysis. In order to compare the pure institutional architecture of tax-benefit systems across countries and illustrate how policies interact with each other, we use hypothetical household data. The HHoT tool of EUROMOD allows to simulate how the tax-benefit system works for a selection of well-defined households, while having full control over the characteristics of interest.

EUROMOD is a static microsimulation model, in the sense that it assumes that the characteristics of individual decision units do not change over time. This makes the model mainly useful for the analysis of so-called first-order effects, which capture the estimated direct (or day-after) impact of a policy reform on, for example, poverty and inequality levels. Policy reforms can, however, also influence an individual’s behaviour (so-called second-order effects). The latter have a rather indirect character and play an important role in the BI debate. Such second-order estimations are not included in EUROMOD, but behavioural models in the context of such a wide-ranging reform as a BI should be handled with caution anyway, as estimates of labour supply responses are in the first place intended to deal with marginal policy changes. In addition, existing empirical evidence about the relationship between BI and labour supply points to very little change in people’s labour market behaviour (see de Paz-Báñez et al., Reference de Paz-Báñez, Asensio-Coto, Sánchez-López and Aceytuno2020).

Non-take-up of public provisions is a serious problem in contemporary welfare states (see e.g. Bargain et al., Reference Bargain, Immervoll and Viitamäki2012; Janssens & Van Mechelen, Reference Janssens and Van Mechelen2022), to which a BI could provide an answer. EUROMOD however does not (sufficiently) account for non-take-up. So instead, we have to assume full take-up of benefits and allowances.

Hypothetical basic income scenarios

We simulate six counterfactual BI scenarios in Belgium and the Netherlands. The scenarios not only differ in terms of generosity, but also in terms of design/funding mechanism. The scope of our exercise is limited to non-elderly individuals. The provisions of benefits for those above the statutory retirement age are assumed to remain in place unchanged such that their incomes will not be directly affected by the BI reforms.

The most typical BI proposals intend to replace all social programs, including their multitude of benefit types and eligibility rules, with a BI – pursuing the objective of simplifying the system. In that case, the amount granted should be generous enough to satisfy an individual’s basic needs. In recent years, a case has been made for a partial as opposed to a full BI scheme, as it might be more practical and politically feasible. When it is a complement to rather than a substitute for existing social assistance and other social benefits, a lower BI could act as a solid foundation underpinning the income distribution. However, a partial BI would not address the problems of a means-tested system (i.e. complexity, administrative burden, lack of knowledge, stigma, and insecurity).

Three levels of generosity

We consider three benefit levels, ranging from a modest partial to a generous full BI, to capture the effect of generosity. To make the scenarios comparable across countries, we fix the BI amount as a percentage of median income. The monthly median incomes in Belgium and the Netherlands are close to each other, being €2,048 and €2,059, respectively, resulting in similar BI levels. For the lowest level of generosity, we simulate a BI equal to 10% of median income for all working-age adults, i.e. €205 per month in both countries (see Table 2). Inspired by the OECD equivalence scale, we grant every child (below 18 years old) a BI equal to 30% of the adult amount, which is 60 euros per month. For the medium amount, we raise the BI to 30% of median income, which corresponds to €615, resp. €618 for all Belgian, resp. Dutch working-age adults, and €185 per month for each child. For the most generous BI, we further increase the amount until the level of the poverty line, i.e. 60% of median income. This adds up to an amount of €1,230, resp. €1,235 per month in Belgium, resp. in the Netherlands. Every child in its turn receives a BI of €370 per month.

Table 2. Overview of (monthly) BI amounts

Variation by design

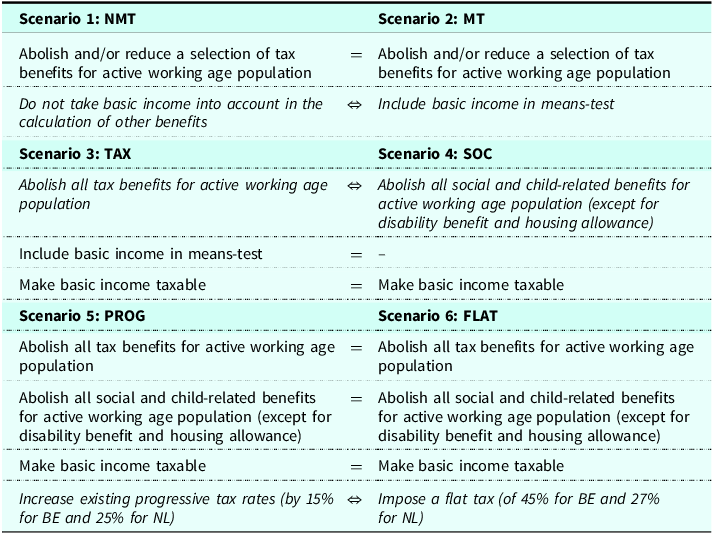

The exact form a BI should take, on the contrary, is generally ignored and/or overlooked. There are many design features to take into consideration to make the reform (quasi) budget-neutral – which is a necessity given the considerable total cost of BI. First, one has to decide which existing measures will be abolished in order to maintain budget neutrality. As the level of generosity increases, more existing benefits have to be abolished. We start with abolishing benefits that most closely align with the BI philosophy. With increasing generosity, additional design choices have to be made. We focus on three crucial design features and develop two alternative scenarios for each of these features that can be considered as two opposed options. At the lowest level of generosity, we explore the choice between including the BI in the means-test or not. At the medium level, we investigate the effect of the funding source by varying between abolishing tax advantages or social benefits. At the highest level of generosity, we explore the impact of the accompanying tax system, either progressive or flat.

We now describe the design features of the different scenarios in more detail.

Design choice I: are other benefit amounts affected by the basic income?

The lowest BI amount can be financed by abolishing and/or reducing some of the existing tax benefits for working-age individuals. We abolish the tax-free base allowance in Belgium and the general tax credit in the Netherlands, which already come close to the idea of a BI. Additionally, in Belgium, we also remove the so-called marital quotient such that spouses are assessed fully independent, in line with the individual nature of a BI. Finally, the tax deduction of professional expenses in Belgium and the work tax credits in the Netherlands – both comprehensive tax advantages for employees/self-employed of which a large share of the population benefits – are capped. The social protection system, on the other hand, is fully maintained. This implies one has to decide how the newly introduced BI is going to interact with the set of policies still in place: will the amounts of other, especially means-tested, benefits be affected by a BI? Hence, in the first scenario (further called ‘NMT’) we do not take BI into account in the social assistance means-test, while in the second scenario (called ‘MT’) we do include it.

Design choice II: which parts of the existing tax-benefit system are (not) maintained?

At the medium level of generosity, we identify two broad options: cutting either tax expenditures or social expenditures. In the third scenario (further called ‘TAX’), we abolish all existing tax benefits for households below pension age, building on the ‘low generosity’ MT scenario. In the fourth scenario (called ‘SOC’), we alternatively abolish all child-related benefits and a selection of social benefits (social assistance, unemployment benefits, survivor benefits, and early retirement benefits). Disability and housing benefits are left unaffected, as these are intended to compensate for specific needs or circumstances. Within the tax relief scheme, now only the tax-free allowance or equivalent zero-rate tax band is removed, all other tax advantages remain in place. Finally, in both alternative scenarios, we need to make the BI taxable in order to be budget neutral. This can have two implications for government revenues. First of all, revenue from personal income taxes will increase due to higher taxable incomes. Second, if social insurance contributions are also calculated on taxable incomes, these revenues will increase as well.

Design choice III: accompanied by a flat or progressive tax?

For the most generous amount, we build further on the previous steps. We abolish the existing tax benefits, child-related benefits, and social benefits, as well as make BI taxable. In order to compensate for the remaining deficit, we also have to raise personal income taxes. Again, there are several possibilities. We could simply increase existing progressive tax rates, which will be the case in the fifth scenario (further called ‘PROG’). As such, personal income taxes would have to be raised by 14% in Belgium and 27% in the Netherlands. This means that the highest tax bracket would increase from 50% to 57% in Belgium and from 52% to 66% in the Netherlands (see appendix for full tax schedule). Or, following the proposal by Atkinson (Reference Atkinson1995), we couple a BI with a flat tax in the last scenario (called ‘FLAT’). That way, excessive labour supply inefficiencies could be avoided. If we would fully replace the existing income taxation scheme, this BI reform in Belgium would require a flat tax of 45%. In the Netherlands, a flat tax of 27% would suffice. Table 3 provides an overview of the differences in design between the scenarios.

Table 3. Overview of BI schemes

In total, we thus simulate six distinct BI scenarios at three levels of generosity, which evidently come with a price tag attached. There is no set cost of BI; it all depends on how generous the scheme is. If all individuals below the statutory retirement age received a monthly BI, the annual cost would reach 18 billion euro (BE) / 28 billion euro (NL) in the lowest scenario and 115 billion euro (BE) / 172 billion euro (NL) in the highest scenario. Table 4 provides a step-by-step overview of the different levers we pull to achieve budget-neutrality.

Table 4. Overview of (1) total cost for each scenario and (2) budgetary resources to achieve budget-neutrality

Note: Budgetary savings are not always identical to the reported budgets in the appendix because interaction effects are taken into account and the elderly are still eligible for all previously existing benefits. Source: Own calculations based on EUROMOD and micro-data from EU-SILC.

Impact on income, poverty, and inequality

We now turn to the outcomes of the various simulated BI scenarios. First, we present the aggregate effects on poverty and inequality for the entire population using microdata, our main outcome of interest. We also document the pattern of winners and losers, as an indication of the political feasibility of the proposed reforms.

A higher basic income does not necessarily yield more poverty reduction

Table 5 summarises the poverty and inequality levels in the different BI scenarios. To assess the impact of a BI on income inequality, we present the GINI coefficient, a widely used statistical measure of inequality. In the baseline scenario, inequality is slightly higher in the Netherlands (0.2593) compared to Belgium (0.2178). To measure the effect of a BI on poverty, we make use of two common relative poverty measures from the Foster-Greer-Thorbecke family of poverty indices: the poverty headcount (FGT0) and the poverty gap (FGT1). The poverty headcount, also referred to as the poverty risk, measures the proportion of the population living below the poverty line (i.e. incidence). The poverty gap presents the ratio to which incomes on average fall below the poverty line (i.e. intensity). Following the official definition used by the European Union, we set the poverty line at 60% of national median equivalised disposable income. Further, the poverty line of the baseline is also used to calculate poverty levels under the reform scenarios. Keeping the poverty line fixed allows for a straightforward interpretation of the differences in poverty rates between baseline and reforms. This is important when the aim is to assess the effectiveness of policy interventions to reduce poverty. We also test statistical significance across the different scenarios. Significant differences are denoted with a * (p < 0.05), implying that the BI reform has significantly increased or decreased poverty and/or inequality compared to the baseline. Note, however, that the baseline EUROMOD results can slightly differ from Eurostat statistics calculated directly from the EU-SILC. This underestimation is largely due to the assumption of full tax compliance and take-up of benefits (Maier et al., Reference Maier, Ricci, Almeida, Christl, Cruces, De Poli, Grünberger, Hernández, Hufkens, Hupteva, Ivaškaitė-Tamošiūnė, Jędrych, Mazzon, Palma, Papini, Picos, Tumino and Vázquez2022). The estimates presented here can thus also be interpreted as the “de jure” effects.

Table 5. Poverty and inequality levels in the different BI scenarios

Source: Own calculations based on EUROMOD and micro-data from EU-SILC.

A first observation is that a more generous BI does not necessarily yield more poverty and inequality reduction, especially in comparison to the size of the reform. This holds for both countries. A BI equal to the poverty line – as shown in the last two scenarios – would reduce the share of the population below the poverty line in Belgium by less than a third at best. In the Netherlands, less than a quarter of the population would escape poverty. The poverty gap would barely decrease compared to the other scenarios. As the fiscal cost of such a BI reform would equal almost 90% of the total government tax revenue or a quarter of GDP, it is doubtful whether a full BI scheme is the most cost-efficient way of addressing poverty and inequality. A lower, partial BI seems to make more sense than a fully fledged one.

Apart from the level of payment, the design specifics and the nature of the funding mechanism also appear to be major determinants of the effect on poverty and inequality. Hence, the poverty-reducing impact of a more generous BI is not necessarily larger compared to schemes that are less generous. Not including BI in the calculation of other benefits (NMT) for example ensures a significant reduction. When a means-test applies (MT), a BI could still alleviate poverty and inequality, but to a lesser extent. There is also a marked difference in the funding mechanism used. A BI funded by replacing existing social protection arrangements (SOC) would increase poverty and inequality without exception. Replacing tax benefits with a BI (TAX) on the other hand would enhance redistribution and structurally lower poverty rates. Also, the tax structure matters. In Belgium, a BI accompanied by a flat tax (FLAT) would be overall somewhat less redistributive compared to a progressive tax (PROG). In the Netherlands, the combination of a BI and a flat tax would lead to a sharp rise in poverty risk from 11.6% to 17.9%, while income inequality would increase from 0.2593 to 0.3117. The antipoverty effect of a BI will thus also be highly dependent on the choices made by policymakers.

A second observation is that a similar BI scheme would have a larger effect on poverty in Belgium compared to the Netherlands, and this consistently for each scenario where poverty is reduced. On average, the Netherlands can only reach two third of the poverty reduction achieved in Belgium. But if poverty were to increase, as is the case in scenarios 4 and 6, the rise would be larger in the Netherlands than in Belgium. In the Netherlands, a BI – or at least the schemes simulated here – thus seems to have a lower potential for reducing poverty, but a higher potential for increasing poverty. It clearly shows that the context in which a BI would be implemented can significantly alter the effectiveness of a BI.

A last interesting observation is that the patterns of both poverty indicators do not always coincide. In the Netherlands, for example, the poverty risk declines most strongly in the fifth scenario. This scenario nevertheless does not secure the lowest poverty gap. Similarly, in Belgium, the scenarios with the biggest impact on the poverty risk and poverty gap are not the same. The indicator of interest thus also matters.

A considerable share of the population would still lose out financially from a basic income

Next, we turn to the pattern of winners and losers. Winners (losers) are defined as those who experience a gain (loss) in their household net disposable income as a result of introducing a BI. And that depends in turn on whether the BI amount surpasses the loss of social benefits and/or the increased tax burden or not.

We find different patterns of winners and losers across scenarios and countries (see Figure 2). Overall, there seem to be more winners when the benefit amount is higher. However, we also see that the pattern of winners and losers becomes more polarised in the higher BI scenarios: the more generous a BI, the higher the share of the population that will substantially benefit from such a reform, but also the higher the share that will heavily lose out financially. Considering that people weigh losses more heavily than gains (Kahneman & Tversky, Reference Kahneman and Tversky1979; Pierson, Reference Pierson2000), this calls into question the political feasibility of this type of reform. Comparing between countries, we see that in Belgium all but one scenario would result in more people losing out from a BI than gaining. Even in the highest BI scenario, still slightly over half of the persons of working age would see their incomes go down. While for the Netherlands we find the opposite trend: four out of six scenarios would benefit the greater part of the population. This indicates that in Belgium the introduction of a BI will have a stronger effect on poverty, but at the expense of a larger share of the population losing out. There thus appears to be a trade-off between social desirability and political feasibility.

Figure 2. Winners and losers expressed as % from active working-age population.

Understanding the results

The previous graphs and tables revealed relatively diverging patterns, both across countries and proposals. In this section, we attempt to understand exactly why the various BI scenarios have such different implications for household incomes across countries. Model family simulations can help explain in more depth how a BI would affect a low-income household. We show a selection of illustrative graphs depicting the impact on a hypothetical couple with two children, the most common family type. Other model family types can be found in the appendix. Figure 3 and following decompose the net disposable income of a couple with two children, aged 7 and 14. The labour market status of the breadwinner ranges from jobless to full-time employed at the minimum wage, while the partner is always assumed to be inactive. The black line represents the total monthly income that corresponds to x hours of work. We also include the poverty line, defined as 60 % of the national median disposable income, to assess income adequacy.

Figure 3. Net disposable income of a low-income couple with two children under the current system.

No uniform effects across countries: context matters

In section ‘Impact on income, poverty and inequality’, we observed that the effects of BI – even if the scheme is similar in terms of generosity and design – seem to vary substantially across countries. A BI thus strongly interacts with the national context, which makes sense seeing that it would not exist in a vacuum. The country-specific context relates to several dimensions, such as the socio-economic characteristics of the population and the underlying tax-benefit system. In the case of Belgium and the Netherlands, differences in the existing tax-benefit system are the major driving force of cross-country differences in poverty reduction (see below). Differences in socio-economic characteristics mainly relate to labour market characteristics, with far more part-time workers in the Netherlands, while Belgium has more jobless households. Other socio-economic characteristics of the Dutch and Belgian population are quite similar (see Table A4 in the appendix).

The baseline models in Figure 3 (and appendix, Figures A2–A5) show that in Belgium a jobless household, that has no other sources of income to revert to, will inevitably be at risk of poverty. Even a minimum wage job does not lift this household above the poverty line. In the Netherlands also, this household is below the poverty line, though the gap is much smaller because of higher minimum income protection levels in the form of substantially higher means-tested benefits. For single persons, the Netherlands is able to lift working and non-working people above the poverty line. This illustrates that the Netherlands is one of the few countries providing at least parts of its population with an income above the poverty threshold (Frazer & Marlier, Reference Frazer and Marlier2016; Marchal & Siöland, Reference Marchal and Siöland2019). They not only have more generous benefits but also numerous selective allowances, such as housing benefits and a care allowance to help low-income households cover their private health insurance premium.

Other elements of the tax-benefit system also differ considerably between Belgium and the Netherlands and explain different outcomes. For example, substantially more social insurance contributions are levied in the Netherlands as seen in Figure 3. Besides the common employee contributions to unemployment insurance, all income taxpayers in the Netherlands, including benefit recipients, contribute to national insurances (de Vos, Reference de Vos2022). They are calculated based on taxable income. Making a BI taxable in the Netherlands will not only increase income taxes for households but also social insurance contributions (see next section), which will dampen the effect of a BI on their incomes.

Overall, the Dutch approach can be summarised as ‘targeting within universalism’: relatively generous universal benefits and services are supplemented by a range of income and household conditional supplements (Aerts et al., Reference Aerts, Marx and Parolin2022; Van Lancker & Van Mechelen, Reference Van Lancker and Van Mechelen2015). Consequently, half of Dutch social spending goes to the bottom three deciles (see appendix, Figure A1). The Belgian tax-benefit system, in contrast, is less targeted at low incomes (OECD, 2019). Tax benefits there are more middle-class biased, in part compensating for high marginal tax rates kicking in at relatively low earned incomes (see appendix, Table A5). Ultimately, when moving from a more targeted tax-benefit system – as the Dutch one – to a universal program, the income gains from BI are thus likely to be insufficiently widespread among low-income households to substantially decrease poverty (Browne & Immervoll, Reference Browne and Immervoll2017). Accordingly, winners will be less concentrated among the lowest income deciles in the Netherlands, but more evenly spread across the population, explaining their ratio of winners to losers, as seen in Figure 2. In contrast, when moving from a relatively less targeted tax-benefit system – as the Belgian one – to a universal program, the income gains from BI will be more strongly concentrated among the most vulnerable, resulting in a bigger impact on poverty, as shown in Table 5. The non-negligible interaction with national context adds a layer of complexity to any international discussion of basic income.

The same level of basic income but an alternative design will have a different impact

We also observed that, apart from the level of payment, the design specifics and the nature of the funding mechanism strongly determine the impact a BI can have on poverty and inequality. To better grasp the significance of design, we illustrate in Figures 4 to 6 how the different BI schemes would impact the income position of the same model family.

Figure 4. Income effect of including a BI in the means-test or not (low BI scenario).

Figure 5. Income effect of the funding source for a BI (medium BI scenario).

Figure 6. Income effect of coupling a BI with a progressive or flat tax (high BI scenario).

Figure 4 clearly illustrates why the impact on poverty is larger when BI is not included in the means-test as compared to including it, and also why the poverty reduction in Table 5 was larger for Belgium as compared to the Netherlands. When not included in the means-test, social assistance recipients receive a BI fully on top of their original benefits, entailing a stronger increase for low incomes than would be the case when BI is part of the means-test for allocating other benefits. This design choice necessitates a lower budget allocated towards means-tested benefits, but also means that many welfare recipients would see their incomes rather unaffected. It is also noteworthy that in Belgium means-tested benefits are tapered away at a much lower income level compared to the Netherlands.

Table 5 shows that a BI funded by replacing existing social protection arrangements would increase poverty without exception. Figure 5 (right panel) shows that this type of reform would indeed mainly lower the incomes of those with no or a part-time job, pushing them further below the poverty line. A jobless couple with two children for example that previously received means-tested and child-related benefits equal to about €2000 now has to make ends meet with only a BI of about €1500. This is not surprising: the resources that were initially targeted towards low incomes are now redistributed equally among the population. When a BI is funded by abolishing tax benefits, it creates a universal layer on top of the current social protection system. In that case, that same jobless couple will now still receive means-tested and child-related benefits on top of their basic income of €1500 (see left panel of Figure 5). They do have to pay slightly more taxes due to the abolition of all tax credits and deductions. However, since tax advantages typically tend to benefit those with higher incomes, low-income households are not as affected by this withdrawal. Replacing tax benefits with a universal BI thus implies a pro-poor redistribution and a decrease in poverty. This is more pronounced in Belgium than in the Netherlands, due to the difference in the distribution of tax versus social benefits and the substantial increase in social insurance contributions (see previous section).

We not only find that the way taxes are designed to fund the BI matters for poverty outcomes (see Table 5), but that the impact differs between both countries. This mainly relates to the fact that the Netherlands has a more progressive income tax system than Belgium. Figure 6 shows that replacing this more progressive system with a flat tax would greatly reduce incomes at the bottom as they would be taxed at a higher rate and thus pay substantially more taxes (right panel).

Conclusion

Taking a BI seriously as a policy option requires that we consider carefully how we could really implement it. This paper debunks the proclaimed simplicity of a BI. We show that implementing a BI is far more complicated than many people, especially BI advocates, seem to realise. Our analysis sparks three key take-away messages.

First, a Basic Income is never simple – it requires many choices. The exact specification of the BI matters a great deal. Which parts of the existing tax/benefit system are maintained? What is abolished, modified, or replaced? Is a BI made taxable? Is eligibility for other benefits affected by a BI, for example through a means-test? These choices are best made with a specific purpose in mind. A BI can serve many end goals, which may well be incompatible.

Second, those choices matter, even apparently ‘minor’ choices matter. Depending on how exactly a BI is specified, the effects may vary a lot. The level of the BI is only one choice that needs to be made. Strikingly, a higher BI will not necessarily always have ‘better’ distributional consequences, especially if poverty reduction is the goal. But besides the amount of the BI, we have demonstrated that many other design features matter just as much. When a BI would be implemented as a wholesale replacement of existing social protection arrangements, poverty would increase without exception. Alternatively, replacing tax allowances – which tend to benefit those with higher incomes – with a BI would reduce poverty rates (as probably would be even more the case with more targeted benefits). Whether or not a BI is included in the means-test of other benefits also matters for the poverty reduction that can be achieved. Also, the tax structure matters: a BI accompanied by a flat tax would be overall far less redistributive compared to a progressive tax. Our analysis thus highlights the importance of scheme design in developing a BI policy.

Third, the implications of those choices will vary across different national contexts. Using the cases of Belgium and the Netherlands, we show that a BI would produce far from uniform effects in the two countries. That is because there are important differences in their socio-economic and institutional context. As existing benefits are more strongly targeted towards low-income households in the Netherlands than in Belgium, the introduction of a BI would benefit lower-income households less in the Netherlands.

De Wispelaere and Stirton (Reference De Wispelaere and Stirton2004) have it right when they state, ‘There is no such thing as a preferred basic income scheme independent of the overall institutional and policy context’. A BI scheme that reduces poverty and inequality in one country, will not necessarily have a similar impact in another country. A BI income can potentially help to reduce poverty, but always at a high budgetary cost and with significant shares of the population incurring significant losses, which matters for political feasibility. Yet a miracle remedy for persistent poverty BI is unlikely to be, even when set at a very high level. Its heralded simplicity seems vastly overestimated. BI has something of a treacherous iceberg. Below that gleaming, appealing tip of simplicity, there is a murky mass of complex choices to be made and interactions to be accounted for. What you get may be very different from what you wish for.

Supplementary material

The supplementary material for this article can be found at https://doi.org/10.1017/S0047279423000582.

Acknowledgements

Financial support from the Research Foundation Flanders, PhD Fellowship 11C7524N, and from BELSPO, contract N° B2/191/P3/BABEL, is gratefully acknowledged. The authors would like to thank the participants at the 20th annual ESPAnet conference and at the BABEL Mid-Term conference for their comments and suggestions.

Competing interests

The authors declare none.