Background

The latest health reform in Turkey started in 2003 and provided changes in regulatory, finance and healthcare services. The Social Security Institution (SSI) was established as a single-payer, pooling all funds for reimbursement and risks from contributory health insurance. Access to health care and pharmaceuticals increased rapidly, and this resulted in an increase in public pharmaceutical expenditures, as well as total health expenditures. There are certain indicators that show the positive impact of Universal Health Coverage (UHC) to public health (Reference Atun1;2).

Orphan drugs are intended to use for diagnosis, prevention, or treatment of rare diseases, which are diseases affecting less than 1 in 2,000 persons (3). New medicines, including biotech and/or orphan drugs, have played a significant role in this increase and are now one of the biggest challenges that the decision-makers face.

In order to address these rising costs and create an alternative access mechanism to medicines, SSI was authorized in the Social Security and General Health Insurance Law in 2014 to develop alternative reimbursement models. Since the start of the development of these alternative reimbursement models for high-volume or expensive medicines, an Alternative Reimbursement Commission, which has members from different Ministries (4), has been responsible for their management. This Commission mostly negotiates with companies mainly based on budget impact, volume, and clinical outcomes, and has the right to define public or confidential discount rates and sign agreements based on volume or total cost (budget cap) (Reference Gursoy5). It is expected that the number of new products which are going to be evaluated by this Commission will increase in upcoming years.

Simultaneously, on top of these increasing expenditures within the frame of licensed and marketed medicines, it seems that the costs of medicines used without a formal license and marketing status also have reached significant levels. This burden to the health system is a somewhat unique feature for the Turkish reimbursement process and is called "Medicines Brought From Abroad" (MBFA). MBFA is used for unlicensed medicines and medicines that are licensed molecules but not on the market for various reasons (e.g., temporally drug shortage). The Ministry of Health (MoH) is responsible for defining the use of conditions and SSI is responsible for reimbursement conditions. Although designed with good intentions to serve public health and individual patients, MBFA has become one of the access pathways in current practice.

In this study, we aimed to quantify and evaluate the impact of MBFA on the reimbursement and pricing of pharmaceuticals within the Turkish healthcare system. Subsequently, we contributed to possible future solutions for MBFA, which may lead to a more sustainable and effective reimbursement and pricing for new and expensive products in Turkey.

Our study is the first study aimed to find out the impact of direct import medicines in the Turkish pharmaceutical market.

General Description of the Reimbursement System and a Specific Description of the MBFA Process

The general reimbursement system in Turkey is based on a positive list where pharmaceutical companies can apply for reimbursement to SSI, once marketing authorization is granted, and the Turkish Medicines and Medical Devices Agency defined the prices on different levels, such as reference price, wholesaler, and pharmacy sales price. A reimbursement decision is the responsibility of the inter-ministerial Medicines Reimbursement Commission (MRC). Companies submit a dossier to the Medical and Economic Evaluation Commission (MEEC) that contains general information, clinical data, literature review, and a pharmacoeconomic evaluation (Reference Gürsoy6). Since September 2014, SSI is authorized to propose alternative reimbursement models; the Alternative Reimbursement Commission (ARC) is responsible for evaluating and dealing with companies. The ARC aims to ensure sustainable and fair access for high-priced medicines and negotiates with companies to reach an agreement on cost or volume for the specific drug. SSI made market access agreements for twenty-three medicines until the end of 2017, and over fifteen of them were used for cancer or orphan indication through alternative models, starting from 2016 (7;Reference Altun8). During the study period, the ARC also considered alternative reimbursement agreements for the products, which are currently on the MBFA list. The regulation for the MBFA is described in the “Circular and Guideline to Use and Supply of Medicines From Abroad.” The MBFA list includes reimbursed and non-reimbursed products which are not available on the market for various reasons. The MBFA Guideline aims to regulate the use of those medicines on the basis of the medical, ethical, legal, and rational use of products with scientific data, and has been prepared in order to determine the principles and procedures of this process (9–11).

Figure 1 shows the main components for medicines reimbursement in Turkey. The most common process is that licensed and marketed products obtain reimbursement through SSI MRC and listed in Appendix 4/A. There is also the alternative reimbursement system in which the public reimbursement discount and price are hidden, or a confidential agreement between SSI and the company is made. Alternative reimbursement can be based on additional discount, the confidential discount, pay-back, volume-based, and total number of patient-based or specific conditions would be included. This decision is given by the SSI ARC. Finally, products without marketing authorization or currently not available on the market may be reimbursed through SSI Health Services Pricing Commission (HSPC) decision and listed in Appendix 4/C.

Figure 1. Main mechanisms for “medicines” reimbursement in Turkey (Reference Altun8).

The MBFA reimbursement process starts with the reimbursement application of the SSI or Turkish Pharmacist Association (TPA). A specific commission of SSI (SSI) titled “Medical and Economic Evaluation Commission for Medicines Bringing From Abroad” (MEEC-MBFA) evaluates submission based on public health need (unmet need) of the product. Alternative access agreements or general reimbursement conditions may be considered for the specific submission, and HSPC gives the final decision for reimbursement. This way of reimbursement differs from general reimbursement conditions; the reimbursement price is defined in the Euro currency based on the direct import price of the products from other countries. MEEC-MBFA has the right to define specific use of conditions, and Turkish Medicines and Medical Devices Agency (TMMDA) approval may be necessary for each patient. Products that obtain reimbursement through MBFA are always listed in the Reimbursement List of Health Implementation Guideline titled "Appendix 4/C.”

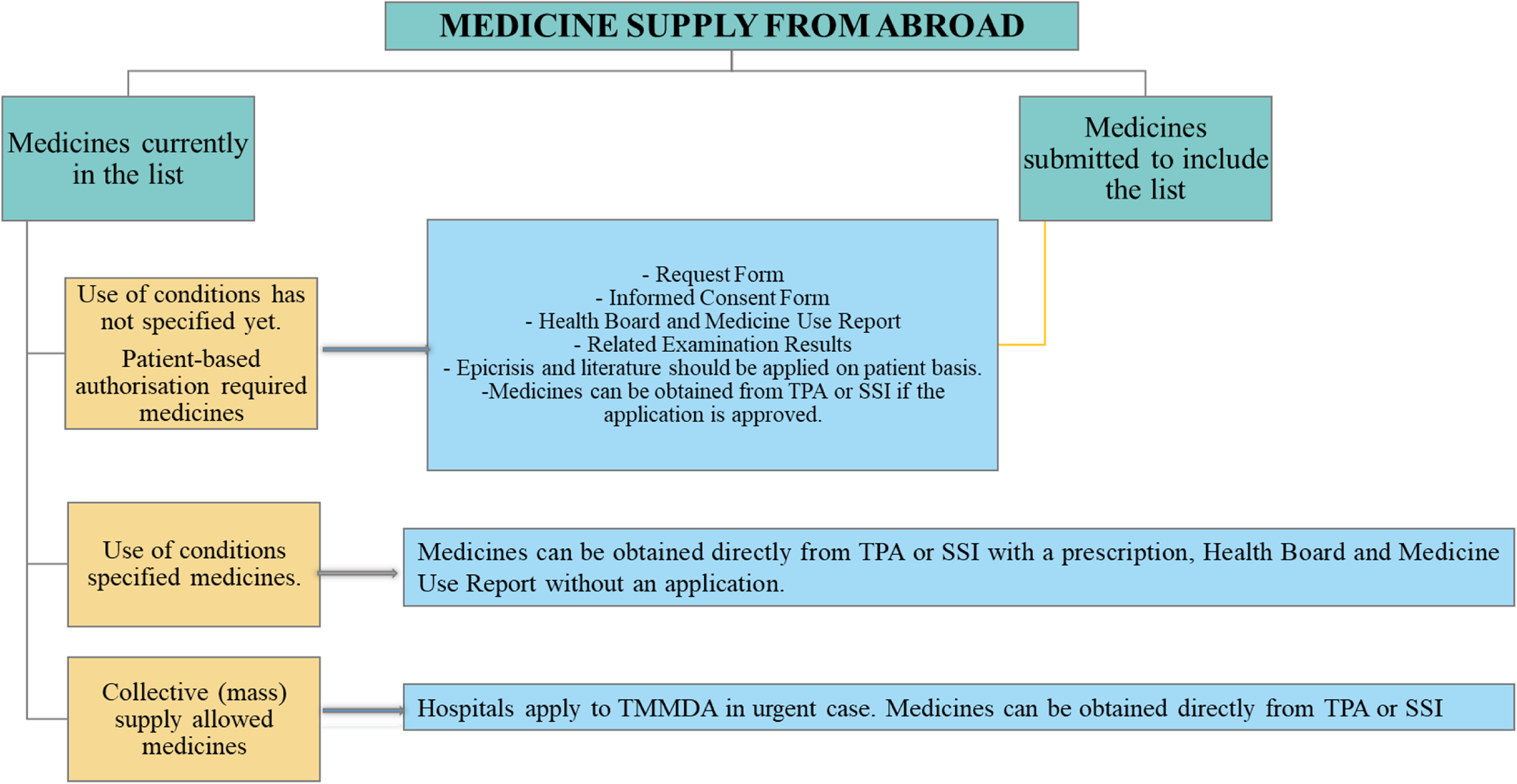

It is a standard policy that medicines can only be placed on the market after marketing authorization has been granted by the Turkish Medicines and Medical Devices Agency. However, the MBFA path enables access to certain medicines with a high medical need without marketing authorization or with an obtained marketing authorization, but not a commercially available form. The law allows for the import and supply of unlicensed medicines subject to certain conditions in order to cover the specific unmet medical needs. The MBFA pathway is not intended to provide access to medicines that are regularly and actively marketed in Turkey. Patient-based specific processes apply for medicines that are brought from abroad, summarized in Figure 2.

Figure 2. Process of medicines supply from abroad.

The MBFA system is different from compassionate use, but can classify under the Named-Patient Program that is granted in response to requests by physicians on behalf of specific or “named patients” (Reference Jandl, Tus and Kordic12). A similar program is available in France since 1992 and is titled as “The Temporary Utilization Program (ATU).” It is developed for a similar reason, to improve early access to medicines which are authorized abroad (Reference Degrassat-Théas, Paubel, Parent de Curzon, Le Pen and Sinègre13).

Similarly, the United Kingdom Government launched the Early Access to Medicines Scheme (EAMS) to provide patient access to new medicines before marketing authorization. EAMS is a voluntary scheme, and the manufacturer provides medicine free of charge. All submissions are evaluated by the UK Medicines and Healthcare products Regulatory Agency (MHRA) and usually ends after the marketing authorization of the product (Reference Macaulay14). The MBFA system differs from the UK system due to different coverage mechanisms.

Methods

We were able to collect and present data starting from 2011. However, due to gaps of detailed data and lists on the data between the years 2015 and 2017, we focused on the data period between 1 January 2017 and 31 December 2017 for the MBFA market and list of products (11). We reviewed the general reimbursement legislations of SSI (9); the guideline on MBFA published by the Turkish Medicines and Medical Devices Agency (TMMDA) (Reference Gürsoy6;9–11), the list of MBFA published by TMMDA and the SSI reimbursement list, and Imported Reimbursed Medicine List (IRML) (Appendix 4/C) to describe the current supply mechanism of medicines and, in particular, the role of MBFA. We quantified medicines covered by the MBFA system, sales data of these products from the TPA, and price data from the SSI Appendix 4/C reimbursed products to list. We analyzed in more detail the top 100 and top 10 high-cost medicines (Supplementary Table 1: The Characteristics of the MBFA List) and assessed their impact of the overall costs for pharmaceuticals in Turkey. Also, the Guideline of Medicine Supply from Abroad and the Use of Conditions (GMSAUG) has been evaluated, both on eligibility criteria and procedures. MBFA data presented in our study consist of published data by the TPA for the study period, and IQVIA data given for domestic pharmaceutical market size from the beginning of the healthcare reforms started until the study year 2018, which does not include imported medicines listed in Appendix 4/C.

We categorized the MFBA medicines in the following categories:

(1) without a marketing authorization and a license application,

(2) without a marketing authorization but with a license application,

(3) with marketing authorization but no application for reimbursement,

(4) with marketing authorization but currently under evaluation for reimbursement, and

(5) with marketing authorization for a while, but not available in the Turkish market.

Results

Total Public Pharmaceutical Expenditure and Share of Medicines Brought from Abroad

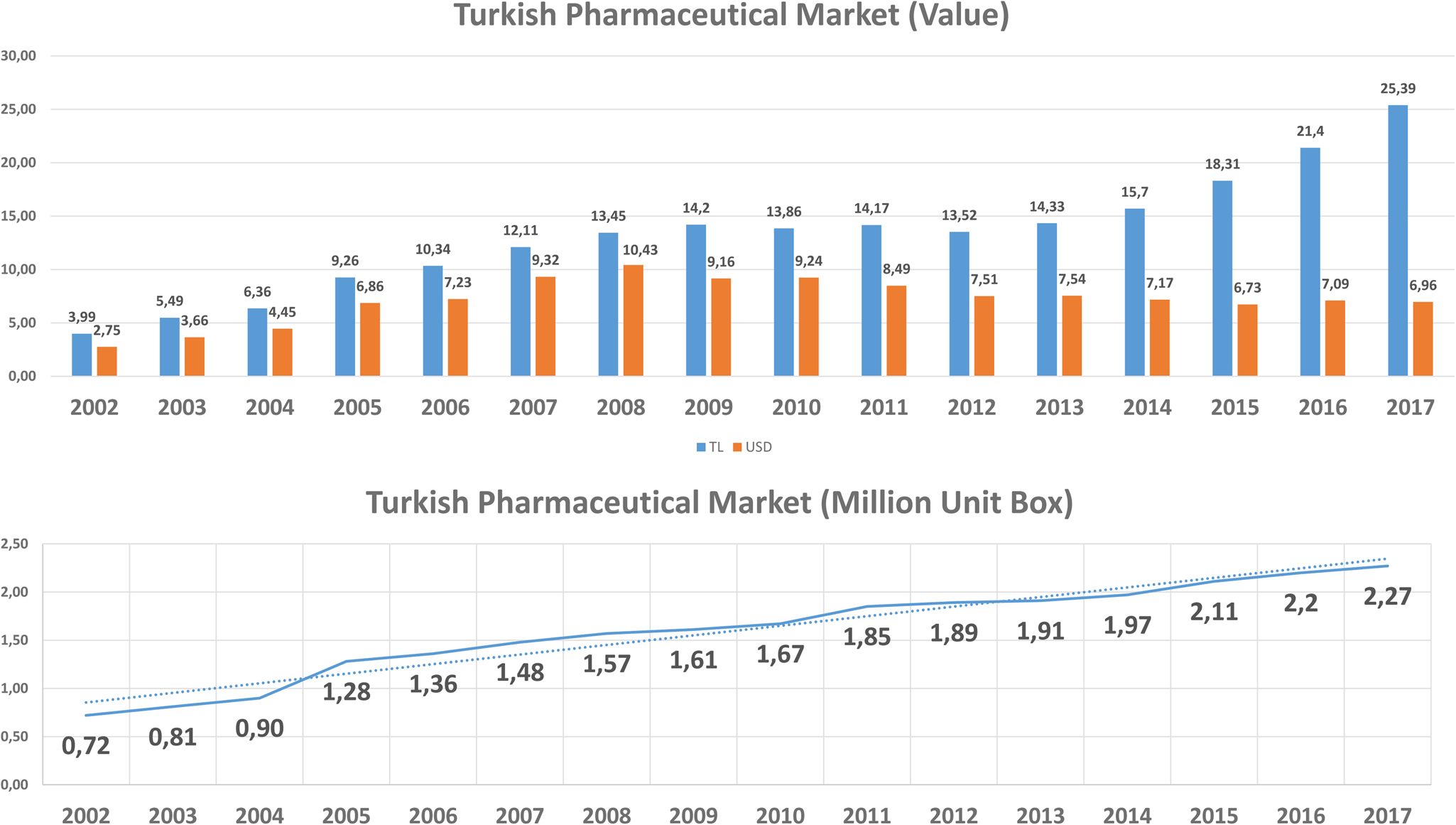

According to the IQVIA Turkey (IMS-Health) hospital and pharmacy sales data, the costs of pharmaceuticals increased with more than 700 percent from 4 billion Turkish Lira (TL) (USD 2.75 billion) in 2002 to 32.05 billion TL (USD 6.65 billion) in 2018 (15), and biotechnological medicines budget impact was about $1.1 billion (Figure 3). Based on the SSI reimbursement list for marketed products in Turkey, the number of reimbursed products was 8.393, and the number of reimbursed medicines brought from abroad was 378 by the end of 2018. It should be noted that the increase in TL is much more prominent than the increase in USD because of the significant change in the exchange rate of TL in recent years (16). According to IQVIA (15) data, we assumed that cost per unit pharmaceuticals did not change significantly.

Figure 3. Costs of pharmaceuticals in Turkey.

We assessed the number of MBFA medicines in the following categories (Supplementary Table 2: List of the Products). The MBFA list shows that most of the products had no marketing authorization or were submitted for marketing authorization during the study period. Fifty-five medicines obtained marketing authorization before 2012 and still not available in the market.

Finally, our results indicate that ninety-nine products were removed from the MBFA list in the last 3 years at the study time (2015–17) with the result of marketing authorization and/or reimbursement approval.

Costs Over the Years for MBFA Medicines

The MBFA list issued by SSI (titled Appendix 4/C) consisted of 358 molecules by October 2017 (17), while the MBFA list consists of 554 products, this means some molecules have different forms and/or some products brought from abroad are not reimbursed by SSI. Some of the new products or new oncology products, included in the list of Appendix 4/C, may in general be the reimbursement process or the alternative reimbursement process. Total costs of the MBFA medicines brought via the TPA (excluding the cost of medicines brought via SSI) reached about 1.9 billion TL ($520 million), which takes 7.5 percent of the total public pharmaceutical expenditure for 2017 (18). This shows that unlicensed or licensed but not marketed medicines took approximately 8 percent of the public pharmaceutical expenditure in Turkey for the year 2017. Even though the number of medicines remains low, mainly due to the first ten most expensive medicines, which are unlicensed or nonmarketed licensed medicines and the cost of those medicines took 78.5 percent of the total MBFA budget. From the total cost for MFBA ($520 million), approximately 85.000 patients have benefited. However, only less than ten percent of these patients received the first ten most expensive drugs. In this case, the amount paid to the first ten most expensive medicines constitutes 78.5 percent of the total MBFA budget (Figure 4).

Figure 4. Costs and sales for MBFA medicines.

Top 100 MFBA Medicines for the Years 2015–17

Ninety-eight percent costs of the MBFA medicines could be assigned to the first 100 medicines, and 20 of them were already licensed. Eleven of the top 100 medicines were biotechnological medicines, and only 3 of them were licensed. Two of those are different doses of nivolumab (available on the market in December 2017), and the other eculizumab, were not on the market although they have been licensed. Forty-two of the 100 medicines may be described as an orphan drug, and 16 of them had an orphan oncology indication. The total financial burden of these forty-two orphan drugs in the MBFA list was approximately 427 million USD in 2017, accounting for 81 percent of the total MBFA costs. Thirty-four of the top 100 medicines were oncology products, and the total financial burden of these medicines reached approximately $55 million in 2017. The cost of 16 orphan oncologic drugs were approximately $25 million in 2017.

Top Ten MFBA Medicines 2015–17

From those top 100 medicines, we did a more detailed assessment of the top ten medicines. Nine of the top ten medicines are orphan medicines. The total cost of the top ten medicines on Appendix 4/C list is about 408 Million USD), and only about 7.000 patients benefited. This amount represents 77 percent of all expenditures of MBFA and 5.9 percent of the total pharmaceutical budget. The cost per patient/year for those top ten medicines was about $55,661. The highest budget impact was eculizumab for PNH, which had a total budget impact of $164 million in 2017 (31 percent of total MBFA costs and 2.3 percent of overall drug costs). The other products that had a high budget impact were galsulfase, elosulfase, idursulfase nusinersen, defibrotide, and alglucosidase alfa.

Discussion and Conclusion

Our results show that a significant part of the total costs for medicines in Turkey, i.e., about 8 percent, can be attributed to MBFA medicines. These prescribed and dispensed MBFA medicines represented only 0.3 percent of the total unit sales of the market and were mostly orphan drugs. From the top ten drugs of the MBFA list in 2017, a total of nine were orphan drugs, covering 77 percent of the total MBFA costs. The most striking example was the costs for eculizumab, a monoclonal antibody to treat a rare kind of anemia (paroxysmal nocturnal hemoglobinuria). The expenditure took 31 percent of the overall MBFA budget and more than 2 percent of the overall Turkish pharmaceutical spending in 2017. These explain that MBFA becomes an alternative access pathway for certain types of medicines, including many orphan drugs.

A limitation to our study is that the SSI started to provide several medicines from abroad since the beginning of 2018 and sales data of those products are not publicly available. For this reason, our study period for MBFA is limited to the year 2017, but we extended internal market data (obtained from IQVIA) for 2018. However, we think that this does not affect the implications of our results because our study presents all available overall market data and data on MBFA products in 2017, which makes a relevant and actual comparison possible. On the other hand, we have not carried out statistical analysis regarding the percentage or price per box. We believe that this is a separate topic that should be done in another study in detail. The reasons for the pharmaceutical unit increase during the years evaluated in this study would be related to the increased access to medicines and population growth of Turkish residents (80.8 million by 2018).

Our study was also limited on showing a perspective for a specific topic and the main idea was to bring suggestions for the effective use of healthcare resources. Based on the MBFA topic, we cannot indicate that health technology assessment (HTA) could provide cheaper prices but we think that it could provide rational and sustainable decision-making.

Turkey's successful health reforms since 2002 have increased access to health care and medicines rapidly. There are indications that the extended and more comprehensive benefits package of UHC established in 2002 resulted in better health outcomes (Reference Atun1). However, during this period, as in many other countries, Turkey also faced important challenges of rationing and prioritizing, access pathway to medicines while continuing the sustainability of the public pharmaceutical budget (Reference Hasan and Babar19). Interventions such as increased public discount rates were introduced and affected the expenditure of some new and high price medicines for the last few years (Reference Atikeler and Özçelikay20). However, the MFBA budget increased, and this resulted in a significant increase of the MFBA proportion of the total drug budget.

Our analysis shows that for in total, 494 products granted reimbursement in 2016, alternative reimbursement models were used for 6 of them. By the end of 2017, alternative reimbursement models were used for twenty-four products since the beginning, and twelve of them have oncology indication (7). These numbers show us that during the study period, the number of alternative access agreements has increased for oncology products, but the total number of alternative access agreements evaluated in the Commission remained low. At the same time, the activities of the Commission bring up new questions on the evaluation of highly expensive products, including oncology, orphan, and biotechnological products, due to the high uncertainty of innovative products. Alternative access agreements mainly focus on price issues but, more specifically, can focus on evidence generation for decision-making on the evaluation of innovative therapies.

As we mentioned in our findings that access to orphan drugs increased recently, but orphan drug legislation both for regulatory and HTA has not been established yet. Lack of the legislation would be another reason for orphan drugs to use MBFA for access to the market; without HTA, general pricing and reimbursement conditions would not provide flexibility and measures to orphan drugs.

MBFA has become a specific system that provides early access to medicines in certain conditions to cover the unmet medical need of patients until the product becomes available regularly into the Turkish pharmaceutical market. On the other hand, higher prices of orphan medicinal products would be related with orphan drug exclusivity, which extent patent protection for an additional 7 years. Orphan medicines prices became a significant burden on the healthcare systems. This has also raised concerns about access to orphan medicines. The way to reach balance while providing sustainable healthcare and accessible price of medicines with incentivizing to pharmaceutical companies for developing an orphan medicinal product may be quite hard (Reference Jandl, Tus and Kordic12), but there are certain elements to help this which we have discussed in our study. Orphan drug exclusivity may be one of the reasons of the increased price of orphan medicines.

MBFA, which became one of the significant elements in the system, does not provide enough options to the Turkish Government to control or decrease the prices of these expensive pharmaceuticals. So, MBFA can be classified as a “By-Pass” mechanism, as it is becoming an alternative access method for companies with limited evaluation of their health benefit. Besides this, we should also mention that this method would help to decrease prices with competition for some specific cases.

It is also understood that Turkey ensures access to medicines for citizens and provides a solution for medicine shortage problems with direct import. We think that due to publicly available fixed pricing reimbursement discount rates and fixed lowest external reference pricing-based system, companies may have avoided applying general reimbursement. Due to public health need some products are listed in the MBFA list to provide access to patients. In the last decade, countries began to hide actual reimbursement prices, and the difference between the reference price and reimbursement price increases dramatically. While Turkey increased the access to innovative medicines, the numbers and cost of the included drugs expanded more than expected, and relevant policy changes may be introduced in the upcoming years. One of them “Alternative Reimbursement Agreements” had an essential effect in 2017, which decreased the number of medicines in the MBFA list compared with the year. It should be expected that this trend would continue in the upcoming years.

Additionally, the new law published in the Official Gazette on 5 December 2018 limits the duration of being in the MBFA list to 3 years, unless the company applies for marketing authorization and obtains license within 2 years after the application for unauthorized medicine. This regulation aims to force companies to obtain marketing authorization and controls the prices of the new drugs (15). Similar discussions are ongoing in France for the ATU program. According to Theas et al., early access program in France should be authorized for a limited period in order to prevent bypass of marketing authorization and public bodies in charge of HTA and pricing (21). There is a similar process only for orphan medicines in Poland. Orphan medicines could be reimbursed on the individual patient basis with approval from the Ministry of Health. Multi-criteria decision analysis is in use for decision-making (Reference Malinovski22). Kazakhstan has two reimbursed rare disease funds for orphan drugs (Reference Czech23).

Presently, Turkey has not established an HTA authority, however different Government bodies created internal HTA departments. Therefore, it may be argued that Turkey needs to create a separate HTA evaluation process in order to provide sustainable access to medicines in the future. Such an organization could also assess in more detail to which extent criteria such as budget impact and cost-effectiveness should be used as the main assessment criteria for reimbursement and pricing. There are concerns that oncological and orphan drug data on comparative effectiveness and quality of life are not sufficiently measured in order to determine their value. Our study only focused on reimbursed medicines; therefore, HTA would also help to assure budget optimization and advantage for providing access to new medicines with a significant health gain.

We suggest that the list for Medicines Brought from Abroad should be considered as conditional and temporary reimbursement for products, and it is expected that these products should be listed in the reimbursement list (Appendix 4/A) later. Due to budget and uncertainty, the total cost of Appendix 4/C products is increasing, which we can classify as “By-Pass” situation as it is becoming an alternative access method for companies that would result with higher prices. Initially, the MBFA list was created to ensure the availability of cheap and/or old molecules with public health needs for therapies at the beginning. However, we identified that the list became one of the major ways for new products to enter the market. On the other hand, due to reimbursement price uncertainty around the world, this method may provide a cheaper option for the payer. Payer also would get a chance to identify new molecules earlier with horizon-scanning and perform HTA before the product enters the market.

Therefore, a part of MBFA is an alternative access mechanism for Turkey to reimburse expensive medicines, including orphan drugs. Although we understand that to reimburse and set prices for drugs rationally, a mechanism such as the MBFA is a fast option to enable access to drugs that are needed in small population and severely diseased patients for a country that is developing their methods for HTA. However, it should be temporary, and the access to these drugs can be guaranteed more consistently through a regular Committee such as the Alternative Reimbursement Committee. This Committee should preferably be supported by an independent HTA organization that conducts HTA studies on a product basis with real-world evidence and includes additional measures such as value-based pricing to ensure better decision-making process for the future (Reference Kleijnen, Lipska and Leonardo Alves T, Meijboom K, Elsada A, Vervölgyi V.24;Reference Pavlovic25). That process certainly helps to continue fair, transparent, and sustainable access to medicines and may improve the efficient use of healthcare resources in the future (Reference Angelis26).

Supplementary material

The supplementary material for this article can be found at https://doi.org/10.1017/S0266462320000872.

Funding

This research received no specific grant from any funding agency, commercial or not-for-profit sectors.