INTRODUCTION

In China, corporate loans are difficult to obtain without having the ‘right connections’. The reasons why this is the case seem to be reasonably well-understood. Cross-country studies show that distinct regulatory regimes and institutional voids encourage relational lending (Faccio, Masulis, & McConnell, Reference Faccio, Masulis and McConnell2006; Faccio, Reference Faccio2010). Similar conditions characterize China's hybrid economy, where liberal markets are mixed with traditional elements of state and regulatory control (Peng, Reference Peng2001; Puffer, McCarthy, & Boisot, Reference Puffer, McCarthy and Boisot2010). Specifically, the financial market continues to be one of the least liberalized markets with wide-spread ad-hoc interventions by state and party officials[Footnote 1] (Allen, Qian, & Qian, 2011; Andersson, Burzynska, & Opper, Reference Andersson, Burzynska and Opper2016). Institutional uncertainties exacerbate the problem: corruption levels are high; accounting fraud is common (Stuart & Wang, Reference Stuart and Wang2016); legal institutions are weak (Clark, Murrel, & Whiting, Reference Clarke, Murrell, Whiting, Brandt and Rawski2008; Pei, Reference Pei2006); and judicial decisions often unpredictable (He & Ng, Reference He and Ng2017; Lubman, Reference Lubman2006). In short, creditors operate in a high-risk environment and have strong incentives to look for informal ways to secure their transactions.

In such a high-risk environment, reliance on interbank relations is a logical strategy to gather client information and thereby reduce credit risks. In China, cross-ownership ties between formally independent banking institutions provide bank officers and loan managers with readily available conduits for information exchange (in our sample, 50 of 183 banks share some ownership ties). Organizational incentives to use these channels are pronounced. Bank officers are held liable for gathering and assessing information, as well as for internal company ratings assigned in the lending process (Qian, Strahan, & Yang, Reference Qian, Strahan and Yang2015). Even if exchanged informally or ‘off-the record’, inter-bank information exchange promises valuable insights when dealing with new or risky clients. Whether or not, for example, closely connected banks offer favorable loan agreements will strongly communicate their assessment of the borrower. In this sense, companies in China become part of a network consisting of the sum of their own dyadic company-bank ties and relevant inter-bank relationships (henceforth referred to as a bank network).

We address two related questions. First, we ask how the informal network between banks influences a company's ability to secure loans. Because close ties of inter-connected actors facilitate monitoring and sanctioning of deviant behavior, and thereby help to build trust and reduce risk (Burt, Reference Burt2000; Burt & Knez, Reference Burt and Knez1995; Coleman, Reference Coleman1990), we expect close inter-bank relationships to facilitate corporate credit access. Second, we ask whether the value of informal bank networks is contingent on environmental qualities. Assuming a fluid adjustment of relational strategies in response to environmental changes (Bian & Zhang, Reference Bian and Zhang2014; Chang, Reference Chang2011), we predict that close interbank ties yield smaller benefits if environmental uncertainties are low and if trust-producing formal institutions become available.

We test these hypotheses using a panel of 515 firms listed on China's two stock exchanges in Shanghai and Shenzhen, with a total of 1,052 firm-year observations. With firms located in 30 of the country's 31 provinces (excluding only Tibet), the sample is ideal for exploring how variation in the business environment moderates the influence of informal bank networks on corporate credit access. In total, our study incorporates 7,009 major bank loans from 183 distinct banks taken out by firms between 2007 and 2012.

Two findings stand out. First, when controlling for network size, our results show that companies that receive loans from a number of closely connected banks have better access to credit than those who borrow from a selection of banks that do not have relationships. Second, we show that the advantage associated with closely connected bank networks is contingent on the quality of the institutional environment. Interactions between the network-performance association and the institutional environment have long been suspected (Barnes, Kalberg, Pan, & Leung, Reference Barnes, Kalberg, Pan and Leung2016; Brass, Galaskiewitz, Greve, & Tsai, Reference Brass, Galaskiewitz, Greve and Tsai2004; Chang, Reference Chang2011; Owen-Smith & Powell, Reference Owen-Smith, Powell, Greenwood, Oliver, Suddaby and Sahlin-Andersson2008; Powell, White, Koput, & Owen-Smith, Reference Powell, White, Koput and Owen-Smith2005). Yet the empirical literature on networks in China has largely focused on interpersonal guanxi ties (guanxi), which can be expected to respond quickly to changes in the business environment (Batjargal et al., Reference Batjargal, Hitt, Tsui, Arregle, Webb and Miller2013; Haveman, Jia, Shi, & Wang, Reference Haveman, Jia, Shi and Wang2017; Zhou, Reference Zhou2008). The present study shows a similar pattern for inter-organizational ties in the financing industry, suggesting that organizational units – even those with a long organizational legacy and close government connections – respond to dynamic shifts in the environment. Rather than remaining locked into certain styles of lending and coordination, banks rely less on informal exchange relationships in their lending decisions as uncertainties decline. Our findings corroborate theoretical arguments advocating the flexible adjustment of corporate social capital in response to environmental changes, even for large-scale organizational players (Bian & Zhang, Reference Bian and Zhang2014; Chang, Reference Chang2011). A related point worth noting is that the observed dynamism speaks against cultural explanations for network strategies. Elsewhere in the literature, there has been some suggestion that China's society may be more prone to closed networks, and that closure generally promises greater network value (Xiao & Tsui, Reference Xiao and Tsui2007; for a discussion, see Burt, Reference Burt2019). China's bank networks, at least, seem to follow environmental imperatives, rather than cultural stereotypes.

THEORETICAL BACKGROUND AND HYPOTHESES

Lending in China is a risky endeavor, as documented by high ratios of non-performing loans and low bank efficiency (Bailey, Huang, & Yang, Reference Bailey, Huang and Yang2011). This is in spite of the increasing competition in China's banking sector. Today, state-owned commercial banks represent only one of many organizational forms. Joint-stock banks and city commercial banks with minority state shares, collectively-owned rural credit cooperatives, as well as foreign-owned banks have all successfully entered the market and compete for trustworthy creditors (Andersson et al., Reference Andersson, Burzynska and Opper2016). Central problems arise from the common and widely documented practice of double bookkeeping and weak auditing standards (Stuart & Wang, Reference Stuart and Wang2016), corporate mismanagement and outright malfeasance – for instance in the form of tunneling by controlling shareholders (Jiang, Lee, & Yue, Reference Jiang, Lee and Yue2010), and a weak legal system offering insufficient protection of creditor rights. In brief, financial institutions in China have good reasons not to trust their clients and not to fully rely on formal institutional mechanisms protecting credit contracts. Here, we develop a theoretical framework to show how organizational and institutional deficiencies in China have promoted reliance on interbank networks and how the quality of the institutional environment moderates the utility of such networks on credit access. The suggested association between organizational networks and environmental uncertainties has been discussed previously (see Brass et al., Reference Brass, Galaskiewitz, Greve and Tsai2004 and Gulati, Reference Gulati1995), but we are not aware of any applications to the specific case of bank lending and credit access.

Bank Networks, Trust, and Credit Access

Coleman (Reference Coleman1990: 78) defines trust as ‘committing to an exchange before you know how the other person will reciprocate’. Due to their specific periodicity of loan payments and amortization in future periods, credit contracts are a classic example of high-risk engagements requiring a high level of trust.

How is such trust built? How can creditors trust that borrowers will use capital for the intended purpose and will invest and manage it to the best of their ability, so that future investment returns enable timely repayment of the principal and interest? How can creditors be reasonably sure that borrowers will ‘do the right thing’? Access to relevant information is essential. A company's audited financial statements and company reports provide factual data on financial health, but, even if we assume these statements are accurate, many information asymmetries remain. Specifically, ‘soft’ information, such as managerial capabilities and intentions regarding current and future business operations, remains largely unknown. Much research has focused on isolated dyads and the quality of bilateral firm–bank relationships as a trust-promoting mechanism (Uzzi, Reference Uzzi1999; Uzzi & Gillespie, Reference Uzzi and Gillespie2002), and on information communicated between interconnected firms with a formal relationship to the same bank or financial intermediary (Uzzi & Lancaster, Reference Uzzi and Lancaster2003). However, the informal exchange of information and quality signals between interconnected banks has been overlooked, with Shipilov's (Reference Shipilov2006) study on syndicated loans as a notable exception.

Interbank ties offer readily available channels to communicate quality signals regarding current and prospective borrowers. The association between interbank ties and credit access is straightforward: From the lender's perspective, a corporate actor involvement with banks I and II helps bank III assess the actor's trustworthiness and reputation, with likely effects on the structure and terms of credit agreements. From the debtor's perspective, awareness of the possibility of mutual information exchange between banks I, II, and III, combined with the potential for collective sanctioning, offers incentives to comply with contractually agreed upon terms, limits the ability to withhold valuable information on parallel loan agreements, and ultimately lowers the risk of voluntary and involuntary credit default. Therefore, the better connected the banks surrounding a borrower, the better the chances for mutual monitoring, the lower the expected default risk (voluntarily or involuntarily) and, in consequence, the better the borrower's access to credit. To analytically capture the interconnectedness of banks, we employ Burt's (Reference Burt2000: 351) definition of network closure as ‘networks in which everyone is connected such that no one can escape the notice of others, which in operational terms usually means a dense network’.

Our prediction is:

Hypothesis 1: Closure in bank networks will improve corporate credit access, holding all other factors constant.

Closure and environmental uncertainty

The environmental embeddedness of networks and related consequences for the network-performance association have been widely discussed (Brass et al., Reference Brass, Galaskiewitz, Greve and Tsai2004; Owen-Smith & Powell, Reference Owen-Smith, Powell, Greenwood, Oliver, Suddaby and Sahlin-Andersson2008). Prior research focusing on networks in non-financial markets has supported the mediating role of environmental factors for a variety of different industries (Rowley, Behrens, & Krackhardt, Reference Rowley, Behrens and Krackhardt2000), countries (Lin, Peng, Yang, & Sun, Reference Lin, Peng, Yang and Sun2009), and national institutions (Batjargal et al., Reference Batjargal, Hitt, Tsui, Arregle, Webb and Miller2013; Vasudeva, Zaheer, & Hernandez, Reference Vasudeva, Zaheer and Hernandez2013). Other studies have focused on the link between environment and emergent network styles. Beckman, Haunschild, and Phillips (Reference Beckman, Haunschild and Phillips2004), for example, find that where market uncertainty is high, large service and industrial firms are more likely to choose former partners for new alliances than new partners. In China's business context, similar theoretical arguments are made in reference to the association between distinct relational (guanxi) strategies and progress in the country's market transition (Chang, Reference Chang2011). Some argue that market liberalization will bring a decline in relational strategies (Guthrie, Reference Guthrie1998); others predict that the marketization process in itself creates new opportunities for utilization of guanxi relationships (Haveman et al., Reference Haveman, Jia, Shi and Wang2017). Keister (Reference Keister2001) observes that in China's uncertain market environment of the 1990s, business group member firms preferred trading and lending with firms or individual managers with whom they had prior contact. Bian and Zhang (Reference Bian and Zhang2014) offer yet another perspective: in their conceptual study, the authors suggest that relational strategies adapt to changes in institutional uncertainty and market competition by changing their main purpose and applicability, but not their relational nature.

There is broad agreement across these different camps that the way people build and utilize their networks is partly explained by environmental uncertainties. The question we explore here is how the utility of distinct networks responds to environmental uncertainties. Building on institutional theory and recent research on the formation and mobilization of social capital, particularly in the Chinese context, we expect the network-performance association of company specific bank networks to vary across different environments, and specifically in line with the level of institutionalization of formal rules (Bian & Zhang, Reference Bian and Zhang2014; North, 1990). Central advantages for companies of network closure are the capacity to access trustworthy information and to benefit from group monitoring and sanctions of deviant behavior. Yet, in a business environment with reliable and predictable formal institutions, trust is less dependent on network closure. As a general rule, we expect closure to be most (least) beneficial in high-risk (low-risk) environments. We highlight three mechanisms: market stability, financial market development, and the quality of legal institutions.

Market stability

The liberalization of markets in China's transition economy has led to two key changes. First, markets provide new opportunities for profitmaking. Second, they increase risk and uncertainty. Information asymmetries are common, and so organizational actors may choose to rely on relational strategies in an effort to secure information advantages and reduce perceived risks. This is a common theme, specifically in literature predicting a continuing role for relational strategies (guanxi) in China's reforming economy (Bian & Zhang, Reference Bian and Zhang2014; Chang, Reference Chang2011). The way in which markets affect relational strategies is likely to depend on a variety of factors, including industry growth, market regulation, and competitive pressure (Luo, Reference Luo2003). Correspondingly, the value of relational strategies is unlikely to be uniform across different industries and market environments. Haveman et al. (Reference Haveman, Jia, Shi and Wang2017), for instance, find that close ties between China's large listed corporations and state bureaucrats yield greater value the more liberalized the economy is (measured by the share of the country's employment and investment attributable to private firms). Li, Poppo, and Zhou (Reference Li, Poppo and Zhou2008) find the opposite effect for a sample of private firms, when using the same employment and investment measures at the provincial level.

The central question for banks is whether their debtors will survive the inherent market risks, and so be able to repay their debts. They also need to know whether their debtors will intentionally defect or act opportunistically to avoid repaying the debt. Broad measures of marketization are unlikely to be useful; instead, bankers need information on specific sales markets. High levels of short or medium-term fluctuation create high levels of uncertainty and complicate business predictions (Sutcliffe & Zaheer, Reference Sutcliffe and Zaheer1998). Importantly, volatile market environments make it difficult to identify why a company delays amortizing a loan or defaults on a loan. Managers may attribute business failure to exogenous factors outside the corporation's influence in order to hide mismanagement or outright malfeasance; or firms may simply experience short-term liquidity constraints. Thus, the value of interbank communication and information exchange should be higher in more volatile markets. In contrast, under relatively stable market conditions, interbank communication is likely to offer little additional value beyond knowledge that can be produced in-house and via bilateral communication with the debtor. We therefore predict:

Hypothesis 2: The more stable a corporation's main sales market, the smaller the credit access advantages associated with closure in its bank network.

Financial market development

Credit markets, in which customized credit agreements are used, feature multiple tools to ‘punish’ defectors: credit may become unattainable, or only available at high cost. If financial markets impose sanctions for defection, opportunism, and malfeasance in prior transactions, debtors are more likely to honor their commitments in order to avoid sanctions and secure future loans. Interbank information exchange becomes less crucial. To what extent financial intermediaries are able to collect, assess, and act on relevant information depends on the maturity and development of the financial market. Lenders in segregated markets with high opacity levels are less able to monitor the lending process than those operating in highly developed financial markets with standardized and certified market supervision procedures (Beck, Demirgüç-Kunt, & Maksimovic, Reference Beck, Demirgüç-Kunt and Maksimovic2005; Khan, He, Akram, & Sarwar, Reference Khan, He, Akram and Sarwar2017).

China's financial market continues to reflect its socialist heritage of a state-controlled banking system. Although China's four major state-owned commercial banks have been (partly) privatized and new competitors – mostly domestic shareholding banks – have entered the market, the sector suffers from inefficiencies, high overhead costs, and non-performing loans (Allen, Qian, & Qian, Reference Allen, Qian and Qian2005). These problems are closely linked with the development and enforcement of financial market rules and regulations. Allen et al. (Reference Allen, Qian and Qian2005) use a measurement score introduced by La Porta, Lopez-de-Silanes, Shleifer, and Vishny (Reference La Porta, Lopez-de-Silanes, Shleifer and Vishny1998) to show that China's investor protection, corporate governance, and accounting standards are significantly less developed than those in most of the 49 countries investigated by La Porta et al. Not only are standards lower, but the regulatory enforcement of existing standards is inconsistent. Stuart and Wang (Reference Stuart and Wang2016) use a sample of 467 private technology firms to show accounting fraud continues to be pervasive across all companies, and even more so for companies with political connections. However, regional differences exist. Specifically, the increase in banking competition and inflow of foreign banks set in motion positive technical spillover effects for domestic banks, leading to improved book-keeping and information access, a decrease in fraudulent activities, and an increase in fraud detection (Li, Makaew, & Winton, Reference Li, Makaew and Winton2018). In our sample, the municipality of Tianjin, one of the first four pilot cities to liberalize foreign bank transactions in 2001 (Li et al., Reference Li, Makaew and Winton2018), has the highest level of financial market development; the western province of Gansu has the lowest. The broad pattern of regional development in the banking sector reveals a familiar divide in China's economic reforms, which have led to pronounced development differences between coastal China and inland provinces (Qian et al., Reference Qian, Strahan and Yang2015), partly due to governmental decentralization and partly due to uneven regional liberalization and experimentation (Bian & Zhang, Reference Bian and Zhang2014).

If we are correct in assuming that environmental uncertainties affect the utility of information sharing, then closure should become less valuable as local financial markets develop and access to reliable information improves. We predict:

Hypothesis 3: The more developed the surrounding financial market environment, the smaller the credit access advantages associated with closure in a corporation's bank network.

Quality of legal institutions

Closely linked to the previous argument, we predict a similar effect for the corporate legal environment. The link between institutionalized trust and economic development is well established. Economic actors require assurance that legal rights – including contract and property rights – are protected, and that judicial authorities enforce the law in a fair, efficient, and predictable manner (Williamson, Reference Williamson1993; Zucker, Reference Zucker1986).

While China's government has promulgated a number of laws in an effort to formalize creditor rights and property rights (the Contract Law 1999; Enterprise Bankruptcy Law 2006 and Property Rights Law 2007), the subsidiary role of the judiciary vis-à-vis government and party remains problematic. Structurally, a local court is a division of the local government (He & Ng, Reference He and Ng2017), and so is dependent on local government budget allocations and staff decisions (Opper & Schwaag-Serger, Reference Opper and Schwaag-Serger2008), both of which help to ‘guide and influence’ local judges. To further complicate matters, China's legal culture differs markedly from that of the West. Civil order was traditionally based on family and local community arbitration rather than on a codified common or civil law system; similarly, business is traditionally supported by personal rather than contractual relationships (Boisot & Child, Reference Boisot and Child1996; Xin & Pearce, Reference Xin and Pearce1996). Unsurprisingly, judicial decision making in China continues to be heavily influenced by judges’ social ties (Chen, Deakin, Siems, & Wang, Reference Chen, Deakin, Siems and Wang2017; He & Ng, Reference He and Ng2017). But even absent of external influence, judicial court rulings tend to be unpredictable due to the often ambiguous character of China's laws, which leaves room for inconsistent interpretations of the same legal provisions in different rulings (Hawes, Reference Hawes2018; Lubman, Reference Lubman2006).

There are, however, marked regional differences in law enforcement. Coastal regions and cities with a strong presence of foreign and domestic private investors have been eager to improve legality, and have invested in more and better staff to accelerate judicial procedures and improve the predictability of court rulings. For instance, today there are more than 20,000 registered lawyers in Guangdong province's Pearl River Delta region, ten times as many as in Hunan province, while having a comparable population (Chen et al., Reference Chen, Deakin, Siems and Wang2017). Also notable are a number of pilot projects authorized by China's Supreme People's Court aiming to build a system of case precedents that local courts can use as ‘guidelines’ for their own rulings. The municipality of Tianjin, for instance, is part of a pilot project establishing a system built on ‘guiding cases’, which has led to greater consistency within the Tianjin court system (Hawes, Reference Hawes2018). Building on our assumption that closure in bank networks partly substitutes for lack of reliable external enforcement mechanisms, we expect that differences in legal quality should influence the value of bank networks. We predict:

Hypothesis 4: The more advanced the legal environment, the smaller the credit access advantages associated with closure in bank networks.

DATA AND METHODS

Sample

To test the predicted association between corporations’ bank networks and credit access, we compile a panel dataset of all corporations listed on China's stock exchanges in Shanghai and Shenzhen between 2007 and 2012. China's listed firms are the country's largest and most valuable and modern firms, and are in a position to ‘shop around’ for loans. This contrasts with the position of China's private unlisted companies, which are often small and medium-sized, with only limited access to bank loans (Nee & Opper, Reference Nee and Opper2012). We focus on major corporate loans (the details of which are made public through loan announcements), which are likely to require the development of specific inter-organizational relationships on either side of the credit market. We exclude small and medium-scale loans associated with standard business operations. Because this study focuses on the role of bank networks, rather than dyadic relations, we include only firm-year observations for which the corporation receives major loans from more than one bank in the year.

Data for our panel comes from four sources. First, we rely on credit data in China's Listed Firms’ Bank Loan Research Database, operated by the China Stock Market and Accounting Research (CSMAR) platform. The database contains details of all public loan announcements in listed corporations’ ad-hoc interim reports. Second, to construct information on interbank ties, we collect equity information from individual banks’ annual reports, which document the ownership structure of the 183 institutions that have issued loans to the sample firms. Third, for corporate information, including financial data, corporate equity structure, and organizational qualities, we use CSMAR's China Stock Market Financial Statements Database and China's Listed Firms’ Corporate Governance Research Database, and the China Stock Database operated by the China Center for Economic Research (CCER). Finally, we employ provincial measures that proxy the quality of a corporation's institutional and legal business environment (Wang, Yu, & Fan, Reference Wang, Yu and Fan2013).

To construct our final panel, we apply several data filters. First, we exclude financial firms due to the structure of their financial agreements, which differ from those of other firms. Second, given our interest in informal bank networks, we exclude syndicated loans. As maximum likelihood estimators perform worse with the inclusion of extreme observations, we exclude 14 observations identified by Cook's distance measure.[Footnote 2] The final sample comprises 515 publicly listed corporations, with a total of 1,052 firm-year observations. The unbalanced nature of our panel is a consequence of our focus on major lending agreements, considered ‘important company events’. It is also noteworthy that our sample population is almost evenly distributed between China's two stock exchanges, with 53 percent of the corporations listed on the Shenzhen Stock Exchange.

Between 2007 and 2012, the total number of corporations listed across both stock exchanges was 2,296. Thus, our sample includes roughly 22 percent of the total population of listed corporations. Comparison between our sample and the total population reveals only minor structural differences. In our sample, 55.4 percent of all firm-year observations relate to the manufacturing sector, compared to 58.5 percent of the total population. There is a slightly higher representation of conglomerates in our sample, 5.9 percent versus 2.5 percent in the total population. Regarding organizational features and performance measures, the sample firms are comparable in tangibility (defined as the ratio between fixed assets and total assets); on average, however, they are larger and older, involve less state ownership, and are more profitable. These differences can be expected given the nature of the loans under review here (for a detailed comparison, see the Appendix I).

Measures

We created the following variables:

Dependent variable

To measure a company's ease of access to bank loans, we employ a binary measure that equals 1 if the total amount of major loans exceeds 10 percent of the firm's total debt and is above the 15th percentile of the distribution in our sample, and 0 otherwise (Chen, Liu, & Su, Reference Chen, Liu and Su2013). To ensure the results do not hinge on the chosen cut-off point, robustness testing was also performed using 15 percent as an alternative and the 25th percentile. Consistent with prior research (e.g., Chen et al., Reference Chen, Liu and Su2013; Wu & Yue, Reference Wu and Yue2009), we operationalize credit access as a discrete variable. This strategy is common, if accessibility of external debt financing is highly constrained.

Network constraint

To measure the level of closure of the bank network surrounding each borrower, we construct a firm's network constraint (Burt, Reference Burt1992). Intuitively, network constraint increases as the number of network members decreases and as mutual connections between network members increase. Network constraint can range between zero and one, with smaller, denser networks scoring closer to one. A network constraint of 1 signal that all members are mutually connected. We assume that tie strength between our focal firm ‘ego’ (focal node) and each surrounding bank is reflected by the proportion of the firm's credit received from each of the surrounding banks. For robustness, we use a firm's number of loans received from a given bank as an alternative proxy for the strength of firm-bank relationships. The overall results remain unchanged when using this alternative proxy. The strength of interbank ties is proxied by joint ownership (see similarly, Kogut & Walker, Reference Kogut and Walker2001). Specifically, we identify whether banks providing loans to ego are related, directly or indirectly, through a common owner, and equate the tie strength between these banks with the share of common ownership in total bank equity. Our measure of interbank ties includes two types of cross-ownership: (1) direct cross-ownership by individual banks (i.e., corporate equity holdings in each other); and (2) indirect cross-ownership through common shareholders, such as bank investment funds, institutional investors, business corporations, and local and national government agencies. It is useful to clarify that cross-ownership ties establish formal property relationships between banks, yet banks still operate as independent legal persons following independent company policies and business plans. Banks with cross-ownership ties are not part of any formal alliance and interbank exchange is informal by nature.

Formally, following Burt (Reference Burt1992), we calculate:

where Cit is the network constraint of firm i in period t; p ijt is the proportion of the firm's loans received from bank j at time t; p iqt is the proportion of the firm's loans received from bank q at time t; and p qjt is the strength of the cross-ownership connection between bank q and bank j at time t. The inner summation incorporates the indirect constraint imposed on firm i through cross-ownership connections among i's banks; the more cross-ownership connections exist, the higher the constraint on i's bank network, indicating a higher degree of closure in the bank network. In the sample period, network constraint varies between 0.122 (reflecting the lowest degree of closure in bank networks) and 1 (reflecting the highest degree of closure in bank networks), with a mean value of 0.44 and standard deviation of 0.18 (see Table 1). A maximum value of 1 indicates that each bank is connected with all other banks in the ego network. The average network comprises four banks.

Table 1. Descriptive statistics and correlations

Note: * p < 0.1

To illustrate, Figure 1 compares the bank networks of two corporations, one (Company 1) representing the highest constraint and the other (Company 2) the lowest constraint in our sample. Company 1 is a privately owned manufacturer and seller of automobile parts, established in Shanghai in 1997 and subsequently listed on the Shanghai Stock Exchange (stock code 600081). In 2012, the company reported newly issued loans from two different banks: the Agricultural Bank of China and the Industrial and Commercial Bank of China. Both belong to the big four state lenders, and are characterized by a high degree of cross-shareholding. In contrast, Company 2, a Beijing-based textile manufacturer listed on the Shenzhen Stock Exchange in 1999 (stock code 000902), shows a low constraint value. In 2012, it reported newly issued loans from six banks: the Bank of Shanghai, the Bank of Ningbo, the Industrial and Commercial Bank of China, Merchants Bank, the Pudong Development Bank, and CITIC Bank. The connections between these banks are all weak: the cross-ownership link between CITIC Bank and Merchants Bank amounts to approximately 16 percent, and all other pairings of its banks have even lower (1 to 2 percent) or no cross-ownership.

Figure 1. Example of a bank network with high constraint value (Company 1) and low constraint value (Company 2) in 2012.

The comparison between companies 1 and 2 begs the question of whether companies with a high network constraint actively choose their lenders, or whether a group of banks – often state-owned – forms de-facto lending consortia around distinct firms. Having already excluded syndicated loans (which are flagged in China's Listed Firms’ Bank Loan Research Database), we have explored whether our data give any indication of such lending consortia which would conflict with our claim that bank networks operate informally. A good indicator of the answer to this question is the timing of loan agreements. Formally linked loans should be expected to be announced more or less simultaneously. However, only 10 percent of all firm-year observations in the sample feature no variation in the announcement month of loans. There is also very little correlation (-0.0362) between announcement month variation and network constraint. Furthermore, the formation of quasi-formal consortia would be likely to be stable over multiple years. However, of 263 corporations with multiple firm-year observations in our sample, all except one reported changes in their bank network composition. We are therefore confident that closure is not a reflection of quasi-formal, possibly state-orchestrated lending consortia.

Contingency measures

To test H2 to H4, we include three contingency measures that serve as proxies for the specified environmental dimensions. First, to proxy market uncertainty, we estimate the stability of the respective industry's operating income over the previous four years (market stability). Industry[Footnote 3] incomes were regressed against time, and the standard errors of the regression coefficients were divided by the mean operating income (Keats & Hitt, Reference Keats and Hitt1988). For ease of interpretation, the measure was presented in inverse form, so that higher values indicate higher market stability. We note, however, that operating income data were unavailable for some sectors (e.g., agriculture, conglomerates, culture, real estate, and transport), which causes the drop in sample size for testing of H2. As an alternative measure, our robustness tests include market uncertainty as the mean monthly stock price volatility of all sampled firms in the focal firm's industry category in the previous year (Beckman et al., Reference Beckman, Haunschild and Phillips2004). We center both variables by subtracting their respective mean to improve the interaction term's interpretability. Second, we test H3 by employing the financial services index, a provincial measure calculated bi-annually as part of China's Business Environment Index (Wang et al., Reference Wang, Yu and Fan2013). The index is constructed based on a bi-annual survey of more than 4,000 general managers from 29 provinces conducted by the China Reform Foundation, China's National Economic Research Institute (NERI), and the Chinese Entrepreneur Survey System (CESS). Survey participants are asked to assign a score from one (very bad) to five (very good) to assess several aspects of the financial environment in the local province based on their own perception. The financial services index is a proxy of formal financial market development, focusing on difficulties in obtaining bank loans and the charges for financial services. The index thereby automatically reflects the level of local financial liberalization and competition. For those years for which matching index values were not available, we employ the simple mean of the index in the last and next available years. We center the variable by subtracting its mean to improve the interaction term's interpretability. Finally, to test H4, we employ the bi-annually published provincial legal environment index (Wang et al., Reference Wang, Yu and Fan2013), which records the extent to which a sample of business managers report having confidence in and abiding by the rule of law. The score ranges from one (very bad) to five (very good), assessing the fairness of the judiciary, the efficiency of formal law enforcement, and the protection of legal contract rights (which are associated with the implementation of firm contracts, the security of personal property, and the protection of intellectual property rights).[Footnote 4] The index is comparable in design and coverage with the Rule of Law index from the Worldwide Governance Indicators (World Bank, 2018).[Footnote 5] For years without matching index values, we again employ the simple mean of the index for the last and next available years, and center the variable by subtracting its mean to improve interpretability. As a robustness check for H4, we also use the NERI marketization indices constructed by Fan, Wang, and Zhu (Reference Fan, Wang and Zhu2011).[Footnote 6]

Control variables

We introduce a vector of control variables, which covers lending conditions, a set of organizational characteristics, and financial performance measures. To differentiate between constraint and size of the bank network, we include the number of banks > 5 dummy variable, which controls for particularly large networks in which the number of banks providing credit in a given year exceeds five. This corresponds to the 75th percentile of the distribution. The results are also robust to using a dummy variable based on six (85th percentile) or seven banks (90th percentile) as cut-off points. We control whether lenders require collateral, because collateral may provide an alternative form of securing contract compliance to informal network monitoring. Firm size is measured by the log value of total assets, and state ownership is captured by the percentage of the corporation's total shares that are owned by the state. State-owned firms may benefit from privileged credit access (Cull & Xu, Reference Cull and Xu2003). Further, a corporation's age is likely to be associated with organizational risks (Freeman, Carroll, & Hannan, Reference Freeman, Carroll and Hannan1983), and therefore with credit access. Firm age is also associated with organizational differences. Firms established after the implementation of China's Company Law in 1993 are likely to have a different organizational culture to older companies that were privatized and restructured when this law was implemented. Such age effects are captured by a binary variable that takes the value 1 for corporations founded after the promulgation of the national Company Law (young firm) and 0 otherwise. As an alternative measure in robustness testing, we also use the log value of firm age, which has no substantive impact on our core findings. Furthermore, a binary variable that takes the value 1 for manufacturing companies and 0 for other kinds of companies controls for industry. Finally, we control for the location of a company's headquarters by including a binary dummy variable, taking the value 1 for companies located in coastal provinces and 0 otherwise. This serves to control for time-invariant regional factors, such as geography, and also for the long-standing preferential treatment of coastal regions.[Footnote 7] Results were the same if we include individual province fixed effects. To control for corporations’ financial health, we include the variable leverage, defined as the debt-to-assets ratio, as a proxy for firms’ probability of default (Detragiache, Garella, & Guiso, Reference Detragiache, Garella and Guiso2000), and the corporations’ return on assets (ROA). Robustness testing using return on equity produces similar results. Finally, we include the variable tangibility, defined as the ratio between fixed assets and total assets, to control for the share of a corporation's assets that can be easily repossessed by creditors in case of credit default. All performance measures are calculated based on data for the year preceding the new credit agreement.

Analytical Approach

To test whether a firm has easy access to major bank loans, we use probit panel estimations. Since our data are highly unbalanced, with many companies not having three observations within the investigation period, we use a pooled model. To address concerns of unobserved heterogeneity, we test the robustness of our findings with a random-effects panel probit model and find consistent results.[Footnote 8] The interpretation of coefficients in nonlinear models is less straightforward than in linear models, so we test the hypotheses and interpret the results in terms of the average marginal effects of the independent variables. To test H2 to H4, we introduce interaction effects between the contingency measures and constraint. As the sign and level of significance of interaction coefficients may be inaccurate in non-linear model estimations, we follow Ai and Norton (Reference Ai and Norton2003) by estimating the correct marginal effects and standard errors of interaction effects (using the command inteff in the Stata software package). Error terms are clustered at the firm level to allow for possible correlations within firms. All estimations include time-fixed effects to control for common shocks, such as policy effects.

RESULTS

Main Specification

Table 1 summarizes the descriptive statistics and correlation coefficients, combining all years of observation in our analysis. Notable is the near zero correlation between constraint and credit access. It is worth noting that the summary view of the panel period masks dramatic differences in correlation over time (with the pairwise correlation coefficient being as high as 0.23 in 2007) and across space (with highest correlations between 0.25 and 0.44 in the provinces of Guizhou, Henan, Qinghai, Shandong). These temporal and regional variations, obscured in the summary account, support our assertion that the association between informal bank networks and credit access is highly contingent on environmental factors. In the case of China, these have improved significantly between 2007 and 2011. Specifically, the average development of formal financial services has increased from 2.4 to 3.1, indicating a change from negative evaluations to neutral ones. Firms experienced higher levels of market uncertainty in 2007–2008 than in later years (the market stability measure fluctuated over the sample period between -0.19 and 0.11), while the average legal environment index has fluctuated over the period between 3.1 and 3.3, suggesting rather neutral evaluations over the sample period, with provinces such as Tianjin, Hainan, Guanxi, Chongqing, and Shaanxi experiencing the largest increases in perceived quality (0.4–0.5 points).

All pairwise correlations of our explanatory variables are moderate, which suggests no critical multicollinearity concerns. Yet our key explanatory measures are found to be highly correlated (0.67). Therefore, we include each measure in a separate model testing for the contingency effects of network closure.[Footnote 9] The variance inflation factor (VIF) of the variables (including interaction terms) has a mean of 2.46, which is well below the benchmark problematic value of 10, thus indicating no serious multicollinearity problem.

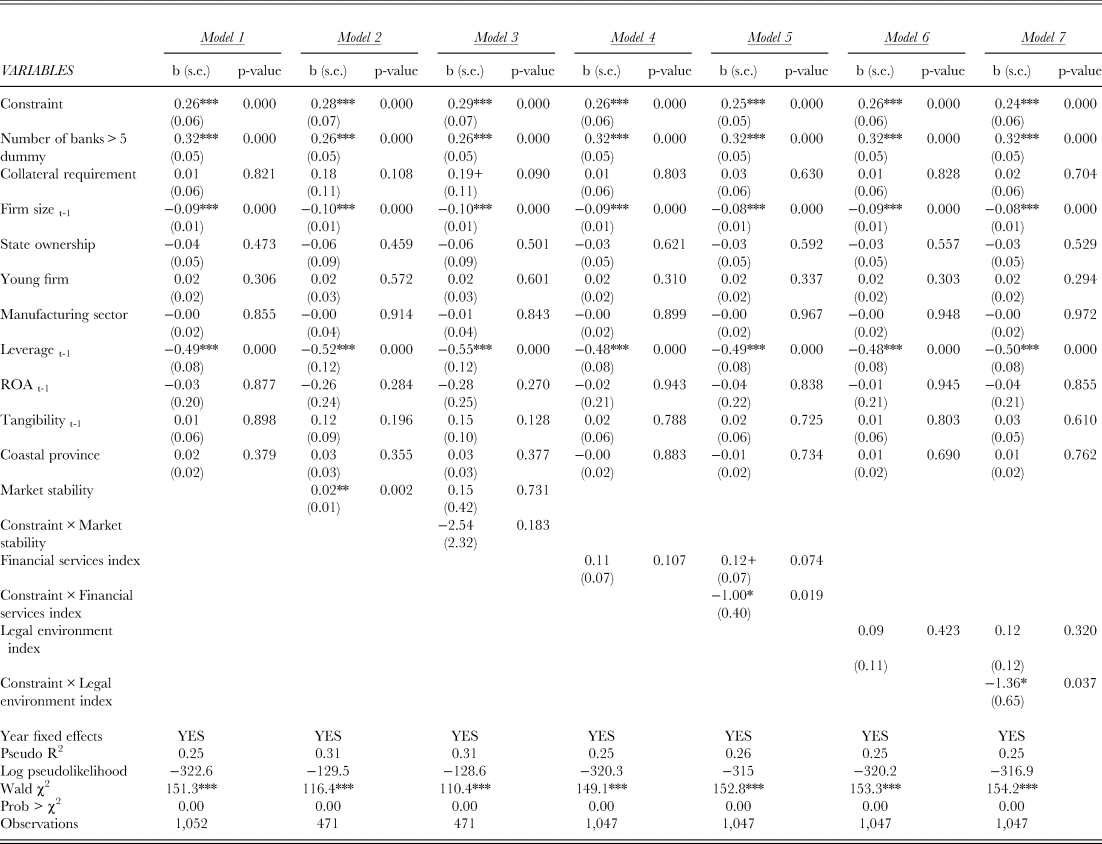

To test H1 to H4, we regress credit access on network constraint while controlling for confounding measures and potential contingency effects. For H2 to H4, we first present our findings excluding interaction effects between contingency measures and constraint (M2, M4, and M6), and then include the corresponding interaction effects (M3, M5, and M7). For ease of interpretation of the magnitude of the effects, all coefficient estimates are transformed to represent the marginal effects evaluated at the means of the independent variables from the Probit regressions. The marginal effects of dummy variables are measured as the discrete change in the expected value of the dependent variable as the dummy variable changes from 0 to 1. All models are found to be statistically significant, as detailed below.

H1, which predicts a positive association between closure in bank networks and corporate credit access, is strongly supported (β = 0.26, p = 0.000). A one standard deviation increase in network constraint increases the probability of credit access on average by 4 percentage points (M1). This result is in line with our assumption that close interbank ties and mutual information sharing help to reduce credit risks and thereby increase corporate credit access.

Examining contingency effects, specifying the interplay between bank networks and their organizational embeddedness, H2 is rejected, which predicted a smaller utility of network closure embedded in relatively stable markets. Although the interaction effect between constraint and market stability has the predicted negative sign, the result is found to be statistically insignificant (β = −2.54, p = 0.183) (M3). We note, however, that the number of available observations is fairly small in this case, which limits the likelihood of detecting a statistically significant correlation.

In contrast, we find that the interaction effect between constraint and financial services index is negative and statistically significant (see M5, β = −1.00, p = 0.019), supporting the hypothesized contingency effect of financial market development for a corporation's bank networks (H3). Closure of bank networks becomes less valuable as financial markets mature, a finding that is consistent with our claim that information access and quality improve as financial markets develop. A one standard deviation increase in the financial service index from its mean value reduced the marginal effect of closure on credit access by 19 percentage points (approximately a 90 percent decrease). Figure 2A illustrates the effect of constraint on the probability of a corporation having access to credit for provinces with different levels of financial market development: low (at the 25th percentile of the sample distribution), medium (50th percentile), and high (75th percentile). Figure 2A shows that for corporations located in provinces with a less-developed financial market, bank networks become more valuable in terms of their effect on credit access as they become more closed. Similarly, for corporations located in provinces with moderate financial market development, credit access improves with network closure, but with a smaller coefficient. In provinces with highly developed financial institutions, closure no longer offers any advantages.

Figure 2 (A) Plot of the effects of network constraint on the probability of having access to credit for different levels of financial sector development based on the financial services index: low (at 25th percentile), medium (at 50th percentile), and high (at 75th percentile). (B) Plot of the effects of network constraint on the probability of having access to credit for different levels of legal quality based on the legal environment index: low (at 25th percentile), medium (at 50th percentile) and high (at 75th percentile).

Table 2, also shows the support found for H4, which proposes that advantages in credit access associated with closure in bank networks are smaller for firms operating in regions with a relatively advanced legal environment. The interaction effect between constraint and legal environment index is negative and statistically significant (β = −1.36, p = 0.037) (M7). A one standard deviation increase in the legal environment index from its mean value is associated with a 15 percentage point (about 60 percent) decrease in the effect of closure on credit access. Figure 2B depicts this trend. For firms operating in regions with strong legal environments, highly constrained bank networks offer relatively small advantages, whereas firms surrounded by weak legal institutions benefit substantively from closure in bank networks.

Table 2. Network constraints and contingency effects on credit access

Notes: Reported coefficients reflect the average marginal effect of the independent variable across all observed values for the other variables in the model. All models consider an intercept term. Robust standard errors clustered at firm-level in parentheses. *** p < 0.001, ** p < 0.01, * p < 0.05, + p < 0.1

Regarding the control variables, we find coefficient estimates for larger bank networks to be positive and statistically significant (p = 0.000) in all model specifications, in line with earlier studies highlighting the effect of competition in the credit market (Houston & James, Reference Houston and James1996). Collateral is positive and weakly significant (p = 0.090) in only one estimation model (M3), undermining the idea that collateral provides an effective mechanism for banks to hedge against risks. However, an average company in our sample has only about 5% of the value of its loans collateralized, and it may be the case that collateral is not an important determinant for credit access among listed firms in China. Further, firm size is negatively and significantly (p = 0.000) correlated with credit access across all model specifications. Leverage accumulated in earlier periods has negative and significant (p = 0.000) effect on credit access level across all model specifications. Interestingly, the coefficient estimate for ROA is not significant in any specification. This may indicate the continuing importance of relational lending, in precedence to profitability measures, in China's credit market. However, other organizational controls, such as state ownership, firm age, and tangibility, also do not show statistically significant results, which is broadly in line with other studies on credit access (e.g., Chen, Liu, & Su, Reference Chen, Liu and Su2013; Uzzi, Reference Uzzi1999). In the present study, this may be driven by a large level of heterogeneity of banks in our sample, with different levels of lending rigidity and different priorities in lending criteria. We include loans from 183 institutions, ranging from the big four state-owned banks to local banking institutions; differences regarding the effect of internal lending regulations and company ratings are likely to be pronounced (Chen, Liu, & Su, Reference Chen, Liu and Su2013). Interestingly, the insignificant effect of state ownership suggests that, on average, political capital is less relevant for access to loans for listed firms than for private unlisted enterprises (Li et al., Reference Li, Meng, Wang and Zhou2008). Moreover, while state-owned enterprises are more likely to receive loans from the big four state banks, the association between state ownership and credit access becomes statistically insignificant when looking at a larger pool of banks (Bailey et al., Reference Bailey, Huang and Yang2011), which may also explain our results. Next, companies in the manufacturing sector are found not to be more likely to access credit than firms in other sectors, which is in line with the findings of other studies that do not find support for sectoral effects in credit access (e.g., Uzzi, Reference Uzzi1999). Finally, we find no significant effect of being located in a coastal region on credit access; this may be due to limited regional variation in credit costs and tightly regulated interest rates (Andersson et al., Reference Andersson, Burzynska and Opper2016). Chen, Liu, and Su (Reference Chen, Liu and Su2013) obtain similar results.

Lastly, we note that McFadden's pseudo R2 statistic in our models ranges between 0.25 and 0.31, which indicates a good fit (Louviere et al., Reference Louviere, Hensher and Swait2000). The improvement in pseudo R2 relative to models without interaction terms, however, is modest – as is to be expected in moderation analysis in social science research (Aiken & West, Reference Aiken and West1991). However, our graphical analysis using the extreme values of environmental uncertainties indices confirms that these interactions between network closure and environmental uncertainties have a sizeable impact on credit access. Other potential sources of variance in firm access to credit that we cannot account for in our models include individual firm preferences that are not made public as well as bank-specific priorities and differences in the way loan decisions are made.

Interplay between Network Structure and Environment

To further illustrate the effect of interactions between closure in bank networks and organizational environment, we compute the probabilities of having access to credit in four hypothetical scenarios: (1) a corporation with a high constraint (closed) bank network (value equal to 1), located in a province with the most developed financial market environment (Tianjin); (2) a corporation with a low constraint (open) bank network (value equal to 0.12), located in a province with the most developed financial market (Tianjin); (3) a corporation with a high constraint (closed) bank network (value equal to 1), located in a province with the least developed financial market environment (Gansu); and (4) a corporation with a very open bank network (value equal to 0.12), located in a province with the least developed financial market (Gansu). The values of all other variables are held at their means for the province, based on the respective network constraint level (top 10 and bottom 10 percentiles).

Table 3, panel A presents the results. If the financial market environment is weak, a corporation with a high constraint (closed) bank network has approximately twice the probability of access to credit than a corporation with low constraint (open) bank network (this difference is statistically significant at the 1 percent level). In contrast, in Tianjin – an independent municipality with highly developed financial markets due to its early adoption of reforms related to foreign banks – there is no statistically significant difference in the likelihood of credit access for corporations with high constraint (closed) bank networks and that for corporations with open bank networks. This finding corroborates the theory that the economic effect of bank networks is contingent on external uncertainties. The economic advantage of closed bank networks disappears where formal financial institutions offer a higher standard of financial accounting information and fraud detection.

Table 3. Probabilities of credit access for hypothetical cases and the corresponding confidence intervals

Notes: High constraint indicates constraint = 1; Low constraint indicates constraint = 0.12; High legal environment index indicates Tianjin Province; Low legal environment index indicates Guizhou Province. Other variables held at their local means, defined as mean values of variables in the subsample of companies belonging to either the top 10 or bottom 10 percentile of the distribution of constraint. LL indicates lower limit. UL indicates upper limit.

A similar pattern emerges when comparing the four hypothetical cases combining high/low constraints and high/low quality of legal environment, here represented by the provinces of Tianjin, as an early adopter of local legal reforms, and Guizhou (see Table 3, panel B). Where the legal environment is weak, credit access for a corporation with a maximum network constraint is 0.28 points higher than for a corporation with an open bank network (the difference is statistically significant at the 5 percent level). In contrast, if the hypothetical corporation is situated in an environment with relatively well developed legal institutions, network closure loses its economic advantage, and there is no statistically significant benefit to credit access attributable to network types.

Robustness Check

We assess the robustness of our findings as follows. First, we explore whether our results are sensitive to different measures of environmental uncertainties. We adopt market uncertainty, the NERI Marketization index and the NERI Legal environment index. All original findings are confirmed. When relying on alternative measures, which also provide a larger number of observations to test H2, the statistically insignificant effect of market stability remains, and the statistical significance of data supporting H4 are confirmed. These results support the conclusion that the value associated with closure in bank networks is smaller when environmental uncertainties are smaller. Again, market stability is shown not to have a statistically significant effect (see Supplementary Material, Table S1, M1–M3 for results).

Second, we ensure that our results are not driven by excluding corporations with only one lending relationship (and correspondingly a very high constraint). Including such observations increases the total sample to 1,845 observations, and we include a dummy variable identifying corporations with a single lending agreement. All benchmark results presented in Table 3 are confirmed, including the two contingency effects predicted by H3 and H4 (see Supplementary Material, Table S1, M4–M6).

Next, we ascertain that our findings are not dependent on the choice of cut-off point used to define credit access, our dependent variable. We re-estimate all models using the alternative cut-off point of 15 percent (see Supplementary Material, Table S1, M7–M9). All benchmark results are confirmed, further supporting the hypothesized association between closure in bank networks and the two contingency effects predicted by H3 and H4. Again, H2 is rejected.

Further, we investigate the potential issue of selection bias, as corporations with certain characteristics may be more likely to announce major bank loans than other corporations (see our discussion of the sample and in the Appendix I, Table A1, panel B). To account for this, we use a Heckman selection model (Heckprobit) to explore the robustness of our findings. Once again, we find our baseline results supported, including the two contingency effects predicted by H3 and H4. For all models, we find no evidence of sample selection bias from the likelihood ratio test; with p-values between 0.5 and 0.73, we cannot reject the null hypothesis of no correlation between the error terms of the selection model and final stage model (see results in Supplementary Material, Table S2).

Moreover, whereas we are confident that the network constraint measure is not linked to the formation of lending consortia (discussed above), we also confirm that our results are robust to inclusion of a dummy variable capturing variation in loan announcement months within a given year. This further supports our claim that network closure does not indicate de-facto ledning consortia (see results in Supplementary Material, Table S3).

An alternative explanation for the credit access-enhancing role of closure in bank networks is that banks with more interconnections are also those capable of offering larger loans. In our sample, loans from state-owned banks are, on average, larger than those from other banks. We therefore repeat our analysis using controls relating to the following characteristics of banks in an ego network: 1) whether there is at least one state-owned bank in the network; and 2) whether the bank providing the largest loan(s) amount in a network is a state-owned bank. Our results are robust to these modifications (see results in Supplementary Material, Table S4a and Table S4b).

The next robustness test controls for the effect of prior firm–bank lending relationships leading to future firm–bank ties. In our sample, approximately half of the corporations receive multiple loans within a year from at least one bank in their network. To eliminate the possibility that our network constraint measure merely captures the strength of prior lending experience between a firm and its banks, we explicitly control for the ratio of number of loans to number of banks in a network for a given year. Whereas we do find evidence that having multiple loans from individual banks in a network is positively related to credit access, closed bank networks continue to have a positive and statistically significant effect on credit access, suggesting that having multiple loans does not undermine the role of cross-ownership ties (see results in Supplementary Material, Table S5).[Footnote 10] Finally, a skeptic could contend that better access to credit enables corporations to change their network positions, rather than the other way round. To explore the direction of causality more closely, we construct alternative measures of network structure using data from two to four preceding years,[Footnote 11] thereby relating past network structure to future credit access. Our results are robust to using two, three, or four-year windows, with shorter windows generally associated with stronger effects (results for the two-year window test are in Supplementary Material, Table S6). Moreover, in the subsample of corporations that report receiving loans in multiple years, we find no evidence that access to credit affects their future network positions. It is therefore unlikely that our results are driven by reverse causality.

DISCUSSION

We present two central findings. Closure in the informal bank networks around companies in China improves companies’ ability to secure credit. Second, we show that the closure-performance association disappears as financial markets and the legal environment matures. Both findings corroborate and expand two central themes in the literature on networks in China.

First, it is well established that bank lending continues to rely on relational ties in China's partly liberalized economy. Yet the focus on relational ties in the literature was entirely on dyadic ties connecting the company with the lender, and more specifically on the political connections the borrowers can activate to influence lending decisions in the company's favor (Du, Guariglia, & Newman, Reference Du, Guariglia and Newman2015; Haveman et al., Reference Haveman, Jia, Shi and Wang2017; Li et al., Reference Li, Meng, Wang and Zhou2008; Nee & Opper, Reference Nee and Opper2010; 2012; Zhou, Reference Zhou2008). In the present study, we add to the literature showing that informal networks connecting actors in the banking sector also matter. Whereas the study of cross-organizational ties is more common in the venture capital market (e.g., Luo et al., Reference Luo, Rong, Yang, Guo and Zou2018), the banking sector remains poorly understood, partly due to the fact that information on corporate loans is much harder to obtain than information on venture capital and ‘angel’ investments. It is likely, however, that similar forms of informal network activities documented here also characterize bank networks in a variety of other transition and emerging economies. Generally, informal bank networks are likely to be relevant in any environment in which institutions cannot guarantee access to reliable information through formal means.

The latter qualification brings us to our second finding, which emphasizes the institutional contingency of the observed closure-performance association. Our main results and all robustness tests consistently find that the positive closure-performance association disappears as external safeguard mechanisms become more reliable. Both the maturity of the legal environment and financial market development reduce the value of relational information exchange within closed bank networks; market uncertainties in contrast are not found to interact with the value of informal bank networks.

Although we are, to the best of our knowledge, the first to explore the structure of inter-organizational ties between banks and their contingencies, we are not the first to identify a robust interaction between the use of relational strategies and institutional embeddedness in China's financial market. Others have focused on the social connections the borrower brings to the transaction (Haveman et al., Reference Haveman, Jia, Shi and Wang2017; Li et al., Reference Li, Meng, Wang and Zhou2008; Zhao & Lu, Reference Zhao and Lu2016). Consistent with our findings, Li et al. (Reference Li, Meng, Wang and Zhou2008) and Zhao and Lu (Reference Zhao and Lu2016) study samples of private enterprises and find that the political connections of the manager advance credit access, but the effect is reduced when markets develop (Li et al., Reference Li, Meng, Wang and Zhou2008) and the quality of intermediary institutions improve (Zhao & Lu, Reference Zhao and Lu2016).

Focusing on corporations listed on stock exchanges, Haveman et al. (Reference Haveman, Jia, Shi and Wang2017) find the opposite association: they show that gains from relational lending (here also measured by the political connections of the company management) increase, rather than decrease, with progress in national marketization. However, methodological differences are so pronounced that direct comparisons with the studies by Li et al. (Reference Li, Meng, Wang and Zhou2008) and Zhao and Lu (Reference Zhao and Lu2016) are not warranted. First, Haveman et al. (Reference Haveman, Jia, Shi and Wang2017) use a much longer observation period, taking data for listed companies for the period from 1992 to 2007, a period characterized by highly disruptive institutional changes (relating to China's progression from the initiation of its socialist market economy to the country's accession to the WTO and beyond), which may have led to high levels of uncertainty in the market (Bian & Zhang, Reference Bian and Zhang2014). Second, because regional institutional indicators are not available for their observation period, the authors had to rely on national averages of private sector activities, which are crude measures to proxy institutional quality and the perception of company specific uncertainties.

Clearly, in light of these mixed results and the lack of similar studies on inter-bank ties, replication studies are needed before it will be possible to provide definite answers to the question of how relational strategies develop dynamically over time. This is not only a task for those committed to understanding the future role of ‘guanxi’ in China's economy and relevant contingencies (Bian & Zhang, Reference Bian and Zhang2014; Chang, Reference Chang2011); the study of network contingencies is also a crucial element in advancing social network analysis as a whole. That network-performance associations depend on contingencies has long been discussed (Brass et al., Reference Brass, Galaskiewitz, Greve and Tsai2004; Burt, Reference Burt2000; Owen-Smith & Powell, Reference Owen-Smith, Powell, Greenwood, Oliver, Suddaby and Sahlin-Andersson2008), but empirical work in this area remains limited, targeting different outcomes, industries and countries (Batjargal et al., Reference Batjargal, Hitt, Tsui, Arregle, Webb and Miller2013; Lin et al., Reference Lin, Peng, Yang and Sun2009; Rowley, Behrens, & Krackhardt, Reference Rowley, Behrens and Krackhardt2000; Vasudeva et al., Reference Vasudeva, Zaheer and Hernandez2013).

The Bright and Dark Sides of Informal Bank Networks

Are bank networks good or bad? On the bright side, informal networks help banks assess information and borrower risks, which is why those borrowers surrounded by closed bank networks enjoy better access to credit than other borrowers. Further, our analysis has shown that these network effects are not driven by history or culture; neither do they reflect a distinct organizational style. They respond to institutional deficiencies making the reliable assessment of credit risks difficult or impossible. In this sense they are productive strategies, ready to vanish if formal institutions allow them to do so, but in place for as long as uncertainties are perceived to require their use.

From the company manager's perspective, closed bank network effects can be employed to the advantage of the company. Managers play an active role in selecting individual lenders that combine to form their company specific bank network. Managers in highly developed regions, for example Tianjin, should bargain for the best loan contracts independent of inter-bank ownership ties, whereas managers in institutionally less developed regions should seek out mutually connected banks, in order to facilitate the building of trust and maximize corporate credit access.

Critically, however, and this brings us to the potentially ‘dark’ side of these bank networks, the question is whether the ‘best’ companies end up with the most advantageous bank networks. If this is not the case, then we see (at least temporary) inefficiencies, and possibly even systemic risks, associated with the impact of bank networks on corporate lending in China. By affecting corporate credit access, bank networks can bias competition in the corporate sector and – in the worst case – channel credit from stronger to weaker firms. Information sharing through bank networks could theoretically also increase barriers for new entrants in the credit market and thereby reduce competition in the financial sector. One suspected factor, specifically in a banking system dominated by state-owned banks, is political interference that could help to shape informal syndicates in support of politically favored corporations. Our analysis gives no indication that this is the case. Yet, in spite of our analytical efforts to track any form of syndication, we are ultimately unable to fully rule out the possibility of political intervention in the formation of bank networks.

Limitations and Future Research Directions

This study focuses on China's largest corporations, which are listed on the stock exchanges in Shanghai and Shenzhen. Although we included a range of controls for corporate characteristics such as ownership and firm age, the firms in this study's sample are, on average, much larger and more established than non-listed firms. Therefore, before our findings can be generalized to non-listed corporations and SMEs, replication studies will be needed to explore how informal bank networks of smaller firms influence their access to credit. Our expectation is that trust-generating interbank communication may matter even more for smaller firms, as critical company information is harder to retrieve, and company and managerial reputations are not yet established. On a related point, our research focuses only on loans of a size that requires public announcement. Small-scale loans and loans designed to address short-term liquidity constraints are omitted from our analysis, partly because such data are not easily available. One could argue that as such loans are generally considered less risky, access to them may not depend to the same extent on network closure among independent lenders. However, it is clearly desirable to re-test our hypotheses for a sample of firms with smaller loan contracts. Finally, two of our environmental measures utilize data for external conditions at the provincial level. This is simply because consistent city-level data for a suitable time period are unavailable. While we agree that city-specific measures would be preferable to more closely identify the local micro-climate, it is reassuring that the intra-provincial variation in environmental uncertainties is far smaller than the inter-provincial variation. Among other factors, this is due to China's quasi-federalist structure, in which provincial governments enjoy substantial power over reform progress in general, but also, more specifically, with respect to institution-building (Montinola, Qian, & Weingast, Reference Montinola, Qian and Weingast1995). In this light, reliance on provincial data can be regarded as the best proxy available for city-level data for the type of analysis we conduct.

Whether our findings replicate in other cultural contexts and countries remains an empirical question. Therefore, quick generalizations are not warranted. Based on our findings, however, one should expect similar results, whenever mutually connected banks operate in an environment characterized by weak financial and legal institutions. Russia and India, two emerging economies with comparable cross-ownership ties between banks, for example, are characterized by similarly weak financial and legal institutions (World Bank, 2018). Therefore we expect bank networks to play a significant role in corporate credit access in these countries. In contrast, banks operating in Korea and Japan, two developed economies where cross-ownership ties are equally common, may find their institutional environment mature enough to rely less on interbank ties (World Bank, 2018).[Footnote 12] This and other predictions may prove untenable, however, due to the different governance and organizational structures present in Korea and Japan which include the dominant keiretsu and chaebol business groups (Chang & Hong, Reference Chang and Hong2000; Gedajlovic & Shapiro, Reference Gedajlovic and Shapiro2002).

CONCLUSION

Closure in bank networks matters for credit access. The important qualification is that the positive closure-performance association in the banking sector depends on institutional uncertainties in the financial market and legal environment, but is not a cultural, historic, or organizational preference.

SUPPLEMENTARY MATERIAL

The supplementary material for this article can be found at https://doi.org/10.1017/mor.2020.25.

APPENDIX I